1. Introduction

One of the major challenges facing the world today is how to respond to the impact of disasters from natural hazards on human economic and social development, and the key to meeting this challenge is to correctly understand and assess the long-term impact of disasters on economic growth and social welfare (Klomp, 2016 and Klomp and Valckx, 2014) [

1,

2]. For example, because people lack awareness of and assistance during and after an earthquake, one of the most serious disasters from natural hazards in the history of the United States—Hurricane Katrina—had a serious impact on the affected areas, with economic losses of up to

$200 billion with nearly 2000 deaths. This disaster has piqued the attention of the United States and the world and, to a large extent, affected US national disaster prevention and assistance measures (Burby, 2006; Elliott et al. 2006; Tierney et al. 2006; Eisenman et al. 2007) [

3,

4,

5,

6]. In recent years, due to widespread coverage by the media, the immediate impact of disasters—death, injury, and destruction—can quickly be brought to public attention. However, as time goes by and postdisaster relief programs are implemented, the long-term impacts of disasters tend to be ignored by those who are not directly affected. It is difficult to provide adequate empirical support to attract public response to future disasters; this can also have a negative effect on government policies (Barone and Mocetti, 2014) [

7]. Therefore, it is important that economists re-examine the effects of disasters on economic development by evaluating their economic impact and the effectiveness of disaster aid policies.

Starting with the groundbreaking work of Albala-Bertrand (1993), research into the direct impact of disasters on economic growth has resulted in more than 30 comparative studies that provide thousands of estimated outcomes (Klomp and Valckx, 2014) [

2,

8]. However, the existing literature has not yet reached a consensus on the relationship between disasters due to natural hazards and economic growth. On one hand, some studies suggest that disasters from natural hazards have a detrimental effect on physical capital, human capital (Human capital is the stock of knowledge, habits, social and personality attributes, including creativity, embodied in the ability to perform labor so as to produce economic value), and the institutional environment of the affected areas, resulting in significant impairment in economic growth (Rasmussen, 2004; Noy, 2009; Loayza et al. 2012; and Brollo et al. 2013) [

9,

10,

11,

12]. For example, Rasmussen (2004) used data from 1970 to 2002 gathered in the Caribbean to study the impact of natural disasters on economic growth, analyzed the short-term impact of natural disasters on economic growth in three years after the disaster, and explored the medium-term impact by dividing an interval every ten years [

9]. Moreover, as of 2002 he also studied the long-term relationship between natural disasters and economic growth, and found that natural disasters will have an adverse effect on economic growth in different periods. Using the cross-country data from 1970 to 2003, Noy (2009) studied the impact of natural disasters on the macroeconomy of developing countries and smaller economies, and found that natural disasters have a negative relationship with macroeconomic growth, but the higher literacy rate, better institutions, higher per capita income, higher degree of openness to trade, and higher levels of government spending are conducive to withstanding the initial disaster shock and preventing further spillovers into the macroeconomy [

10]. Applying a dynamic generalized method of moments panel estimator to a 1961–2005 cross-country panel dataset, Loayza et al. (2012) found that disasters do affect economic growth but not always negatively, with effects that differ across types of disasters and economic sectors [

11]. However, serious natural disasters will have a negative impact on economic growth, and the negative correlation between natural disasters and economic growth in developing countries is more significant.

Other research suggests that disasters from natural hazards do not only impede economic growth, but can also have a positive relationship with economic growth. Based on the historical data from across countries, Skidmore and Hideki (2002) examined the impact of the average level of natural disasters on economic growth and human capital from 1960 to 1990, and found that natural disasters would reduce physical capital in the short term, but would promote the accumulation of human capital in the long run, increase productivity and economic growth [

13]. Cuaresma et al. (2008) used cross-country panel dataset to study the effects of disasters on economic growth in different time ranges and found that the effects of disasters on economic growth were significantly different between 1976 and1990 and 1960 and 1990 [

14]. Using the cross-country data from 1970 and 2008, Cavallo et al. (2013) examined the short- and long-run average causal impact of catastrophic natural disasters on economic growth by combining information from comparative case studies, and found that only extremely large disasters have a negative effect on output, both in the short- and long-run, but once controlling for political changes during the sample interval, even extremely large disasters did not display any significant effect on economic growth [

15]. Therefore, in the long run, there is a positive relationship between natural disasters and economic growth. In addition, there are scholars who believe that due to differences in data selection and natural disaster types (Felbermay and Gröschl, 2014) [

16], and the impact of different disaster response systems and other factors (Barone and Mocetti, 2014) [

7], the impact on economic growth is dynamic, so there should be more focus on specific analysis.

In general, the research supporting a positive impact on economic growth emphasizes that large-scale, postdisaster rescue policies (postdisaster rescue policies refer to the funding from the Central Government of China was allocated to county governments in our paper) can help the affected areas to rapidly expand capital investment, improve infrastructure (Okuyama, 2003; Hallegatte and Dumas, 2009) [

17,

18], and promote technological upgrades of the facilities and equipment used in the damaged industries and enterprises (Fischer and Newell, 2008) [

19]. Further, there is also research that indicates that the role of postdisaster relief in aiding economic development depends on the efficient use of the aid funding and the rationality of the funded projects. In the context of an imperfect system design and lack of a restraint mechanism, external relief will not only fail to promote economic growth, but will boost nonproductive consumption, reduce the actual investment in public goods, exacerbate government corruption, and damage incentives. Unfortunately, all of the aforementioned can lead recipient areas into the trap of ongoing financial dependency (Boone, 1996 and Clement et al. 2012) [

20,

21]. Therefore, it is clear that the effects of postdisaster rescue policies are very different throughout the existing research. Although China is a country with some of the most devastating disasters from natural hazards and a strong national disaster relief system, most of the existing economics literature concentrates on developed countries or Africa. There are few empirical studies focus on the impact of Chinese disasters and national aid on economic growth. In domestic studies, the relationship between disasters from natural hazards and economic growth was studied by applying the single-difference method to time series or provincial data (Jia, 2013; Guo et al., 2015; and Tang et al. 2014) [

22,

23,

24]. The conclusions, however, may be subject to error in the estimated results due to the different levels of economic development in the affected areas before the disasters occurred. At the same time, in order to identify the net impact of disasters on economic growth, it is also necessary to account fully for the impact of national disaster relief (Barone and Mocetti, 2014) [

7], but current studies on economic growth in areas affected by the Wenchuan earthquake do not effectively control for this impact. Therefore, based on China’s experience with disasters, it is not only possible to improve on the existing literature related to disaster impact and economic growth, but also possible to understand and improve the country’s national disaster relief model more accurately by using a more scientific approach to study and evaluate the impact of disasters on economic growth and the effects of disaster relief policies.

The focus of our research is on the Wenchuan earthquake, the worst disaster to occur in China since the introduction of reform and the opening of economic policy. This event is studied as a quasi-natural experiment to evaluate its impact on economic growth using the Difference-in-Difference (DID) method. The findings and contributions of this research are reflected in three aspects: First, this article uses panel data from 181 cities in Sichuan province from 2003 to 2013 to scientifically evaluate the impact of the disaster on economic growth through Difference-in-Difference-Propensity Score Matching (PSM-DID). The results indicate that the earthquake was not only harmful to current economic growth, but also continues to have a significantly negative effect on regional economic growth from a long-term dynamic perspective, thereby supporting the conclusion that disasters from natural hazards have a negative impact on economic growth. Second, based on financial expenditure data from the disaster areas, a disaster relief variable has been developed and controlled for use as a variable to represent national aid. Without considering and controlling for the influence of national aid, the research results regarding the competing individual effects of the earthquake and national rescue on economic growth will be ambiguous, possibly leading to the conclusion that earthquakes do not influence economic growth. Third, the Chinese national disaster model does help to boost recovery in the affected areas; financial investment in postdisaster reconstruction, as the main objective of national aid, can effectively improve conditions in the disaster area. This will promote urbanization and private economic development, thus reducing government economic intervention and inhibiting excessive investment in fixed assets. However, national aid, which has no obvious effect on the development of tertiary industries and the accumulation of human capital, is related to bias in national rescue policies. We believe that the impact of disasters on economic structures and human capital are the most important issues to consider when providing national aid, so it is essential to promote economic development in the disaster area and to enhance the country’s disaster response capacity.

The rest of this paper is arranged as follows.

Section 2 is a review of the literature.

Section 3 introduces the data, variables, and descriptive statistics.

Section 4 discusses the empirical method and identification strategy.

Section 5 presents the results and an empirical analysis.

Section 6 outlines the robustness test.

Section 7 presents the conclusion.

2. Literature Review

How do disasters from natural hazards affect economic output and growth? What does economic theory contribute toward our understanding of the short- and long-term economic consequences of disaster shocks? For nearly half a century economists have struggled to answer these questions. In the new classical economic growth model, earthquakes are seen as having a negative impact on capital accumulation, causing economic development to deviate from its original trajectory and causing a rapid economic downturn in the short-term (Barone and Mocetti, 2014) [

7]. Based on the assumptions of the new classical theory of growth, scholars have conducted extensive studies trying to find empirical evidence to verify the adverse effects of disasters on economic development.

Rasmussen (2004) used the data from 1970 to 2002 gathered in the Caribbean to study the impact of natural disasters on economic growth, then analyzed the short-term impact of natural disasters on economic growth in three years after the disaster, and found that in the Caribbean, disasters from natural hazards can reduce the economic output of the affected area by 2.2%, and that even large-scale reconstruction fails to restore economic output to predisaster levels [

9]. Research on a sample of global emergencies indicates that serious disasters can be significantly detrimental to economic growth in the affected areas, and can even adversely affect the larger economic system, an indirect effect that makes it much more difficult to restore economic growth for years (Cavallo and Noy, 2010) [

25]. For example, floods in Europe, and hurricanes, such as Harvey and Irma in the United States, have a negative impact by reducing the earnings from corporate and individual capital investment and driving up financial costs for affected enterprises, which can adversely influence corporate production and local and distant employment, thus stunting economic growth (Leiter et al. 2009; Strobl, 2011) [

26,

27].

In addition, research done on less developed regions such as Africa suggests that disasters can harm the accumulation of human capital, which will in the long run impact economic development of the affected areas. Beegle et al. (2006), using household survey data from Tanzania, discovered that in order to counter the negative impact of agricultural disasters on household income, families will choose to have children enter the agricultural industry at an earlier age [

28]. In the meantime, the destruction of schools and other education facilities in affected areas reduces the number of education-related resources, leading to an overall decrease in average education levels (Checchi and GarcíA-Peñalosa, 2004) [

29]. Even when governments provide positive conditions for postdisaster resumption of education, population outflow from the affected areas makes it difficult to enhance levels of human capital (Donner and Rodriguez, 2008) [

30]. Moreover, the adverse effects of the disaster on human capital accumulation will trickle down to future generations (Caeuso and Miller, 2015) [

31]. Therefore, from the view of both short-term physical capital damage or long-term capital investment and human capital accumulation, the disaster will have a negative impact on economic development.

However, scholars who disagree with the strictly negative view of disasters argue that previous studies are only concerned with the negative effects of the disaster itself, and do not fully consider the role of postdisaster relief policies, especially the effects of large-scale national aid. Albala-Bertland (1993) was the first to suggest that postdisaster relief and economic recovery mechanisms can effectively reduce the negative impact of disasters on the economic system, and that disasters from natural hazards cannot adversely affect economic development [

8]. Furthermore, there are a large number of scholars who adhere to Schumpeter’s “Creative Destruction Theory”, signifying that disasters provide opportunities to adjust the levels of capital accumulation and technology (Okuyama, 2003; Fischer and Newell, 2008) [

17,

19]. Postdisaster relief will effectively increase levels of capital investment and improve infrastructure in the affected areas, while government policy support can encourage industries to adopt or develop new technologies (Hallegatte and Dumas, 2009) [

18]. The impact of the disaster on economic development can be seen as a kind of subversive form of creation (Cuaresma et al. 2008; Cavallo et al. 2013) [

14,

15]. Even with population outflow and a decline in human capital from disaster shocks, if the government is able to provide better living conditions and education resources through the provision of postdisaster national aid, the demand for an educated labor force can still be supplied. Therefore, in the long run, the quality of human capital in the affected areas can gradually be improved and not significantly reduced (Skidmore and Toya, 2002; Heylen and Pozzi, 2007) [

13,

32]. Therefore, due to the effects of postdisaster relief and economic recovery policy, the economic performance in the affected areas may be increased.

In the debate between these two arguments, one of the central questions is whether postdisaster aid can really work, thus making it necessary to recognize the role of national rescue policies when studying the impact of disasters on economic development (Barone and Mocetti, 2014) [

7]. However, many studies have not fully considered this problem because of data limitations. Even in the literature that focuses on national aid, there is no agreement on the effect it has on economic development in the affected areas. Most research suggests that national rescue does have a positive impact on physical capital investment, infrastructure construction, and public services in the affected areas, and even improves regional technical capabilities and foreign trade (Hatemi and Irandoust, 2005) [

33], but capital-based relief policies can also adversely affect the institutional environment of the recipients. Increased capital investment also means that government fiscal power is expanding, and in the absence of constraints this public sector expansion will lead to increased nonproductive consumption and the exclusion of the non-public sector (Boone, 1996 and Clement et al. 2012) [

20,

21]. In the case of disaster aid, there is a policy bias toward financial inputs that focus more on infrastructure construction and building restoration than on the economic structure and the institutional environment. This could limit the role of disaster aid policies in promoting economic development.

The research presented in this paper is directly related to two areas of research discussed in the existing literature. The first area pertains to the relationship between disasters from natural hazards and economic development. This paper attempts to study economic development in the disaster area for the five years following the 2008 Wenchuan earthquake, and provides empirical evidence to support the conclusions presented. The second area of research is related to national rescue policies. For this study, a national rescue variable, based on financial expenditure data, has been developed and employed to analyze economic development in the impacted area. At the same time, this study focuses on the effects of financial input on the major forms of disaster aid, summarizes the problems in policy performance, and offers some suggestions for policy improvements.

3. Data, Variables, and Descriptive Statistics

Sichuan (Formerly Romanized as Szechuan or Szechwan), is a province in southwest China occupying most of the Sichuan Basin and the easternmost part of the Tibetan Plateau between the Jinsha River on the west, the Daba Mountains in the north, and the Yungui Plateau to the south. Sichuan’s capital city is Chengdu. The population of Sichuan stands at 81 million.

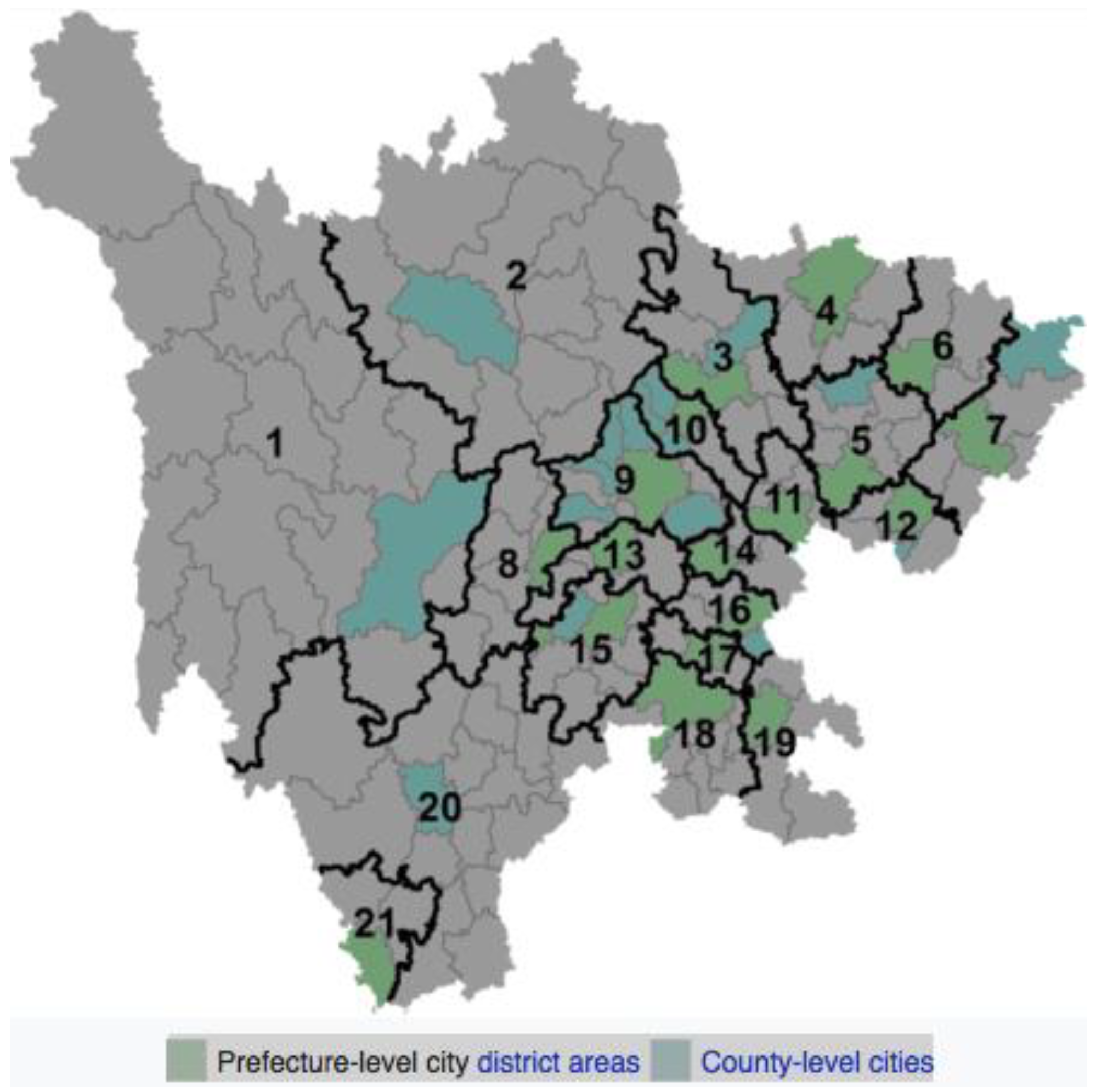

Sichuan consists of twenty-one prefecture-level divisions: eighteen prefecture-level cities (including a sub-provincial city) and three autonomous prefectures, as shown in

Figure 1. The twenty Prefectures of Sichuan are subdivided into 183 county-level divisions (53 districts, 17 county-level cities, 109 counties, and four autonomous counties).

According to Wikipedia, Sichuan has been historically known as the “Province of Abundance”. It is one of the major agricultural production bases of China. Grain, including rice and wheat, is the major product with output. Sichuan is rich in mineral resources. It has more than 132 kinds of underground mineral resources including vanadium, titanium, and lithium being the largest in China. Sichuan also possesses China’s largest proven natural gas reserves, the majority of which is transported to more developed eastern regions. Sichuan is one of the major industrial centers of China. In addition to heavy industries such as coal, energy, iron, and steel, the province has also established a light industrial sector comprising building materials, wood processing, and food and silk processing. Chengdu and Mianyang are the production centers for textiles and electronics products. Deyang, Panzhihua, and Yibin are the production centers for machinery, metallurgical industries, and wine, respectively. Besides, the auto industry is an important and key sector of the machinery industry in Sichuan. Most of the auto manufacturing companies are located in Chengdu, Mianyang, Nanchong, and Luzhou.

This paper studies the direct and dynamic effects of the Wenchuan earthquake disaster on economic growth using panel data from 181 county-level cities in Sichuan province from 2003 to 2013. In addition, based on fiscal expenditure data, national rescue variables are developed and used to analyze the effects of disaster aid on economic growth in the affected areas and to identify the specific methods used to administer this aid. The data used are from the Sichuan Statistical Yearbook and the China Statistical Yearbook of Regional Economy. The earthquake disaster area variable is set according to the 2008 Wenchuan earthquake Disaster Assessment Report that listed 39 major disaster cities, 10 heavy disaster cities and 3 Pan-Hui heavy disaster in Sichuan Province. The specific meaning and method of calculating each variable are presented in

Table 1.

In order to measure regional economic growth, following the methods utilized in existing literature, the real GDP (in log) will be considered as the dependent variable; county data for GDP is from the Sichuan Statistical Yearbook. To be able to compare the data accurately, 2003 is regarded as the base year and GDP growth rates are used to calculate the real GDP. In addition, dummy variables are set in the same manner as in the existing literature, if the county belonged to the Wenchuan earthquake disaster zone in 2008; the Wenchuan earthquake dummy variable (earthquake) is valued as 1, otherwise it is valued as 0. To test for robustness, the PSM-DID method is used to specify the county variable as the individual ID, and the Logit estimation bias score is used based on the Kernel Matching of the Propensity Score method. To control for the influence of other factors, we have a series of control variables, including government spending (gov), the level of investment in fixed assets (far), the urbanization rate (urban), the level of regional industrialization (industry), the proportion of the tertiary industry in the local economy (third industry), the number of people in schools of higher education per ten thousand people (edu), private economic development (private), regional traffic conditions (traffic), the total population at the end of the year (lnpop), and economic fluctuations (GDP).

Table 2 shows the descriptive statistics of the main variables.

It is important to note that we developed the postdisaster rescue policies variable used in this research. Much of the literature points out that disaster rescue—financed mainly by fiscal funds—will have a direct impact on economic growth, household income, and individual consumption (Barone and Mocetti, 2014; Raschky and Schwindt, 2012; Zhuo and Duan, 2012; Lu, et al. 2014) [

7,

34,

35,

36]. Further, this rescue is most often administered for some time after a disaster. When studying the disaster impact on economic growth, there may be an estimate bias if external aid variables are not effectively controlled. In the case of the Wenchuan earthquake, the central government allocated

$6018 million immediately after the disaster in 2008, and three years later, this funding reached more than

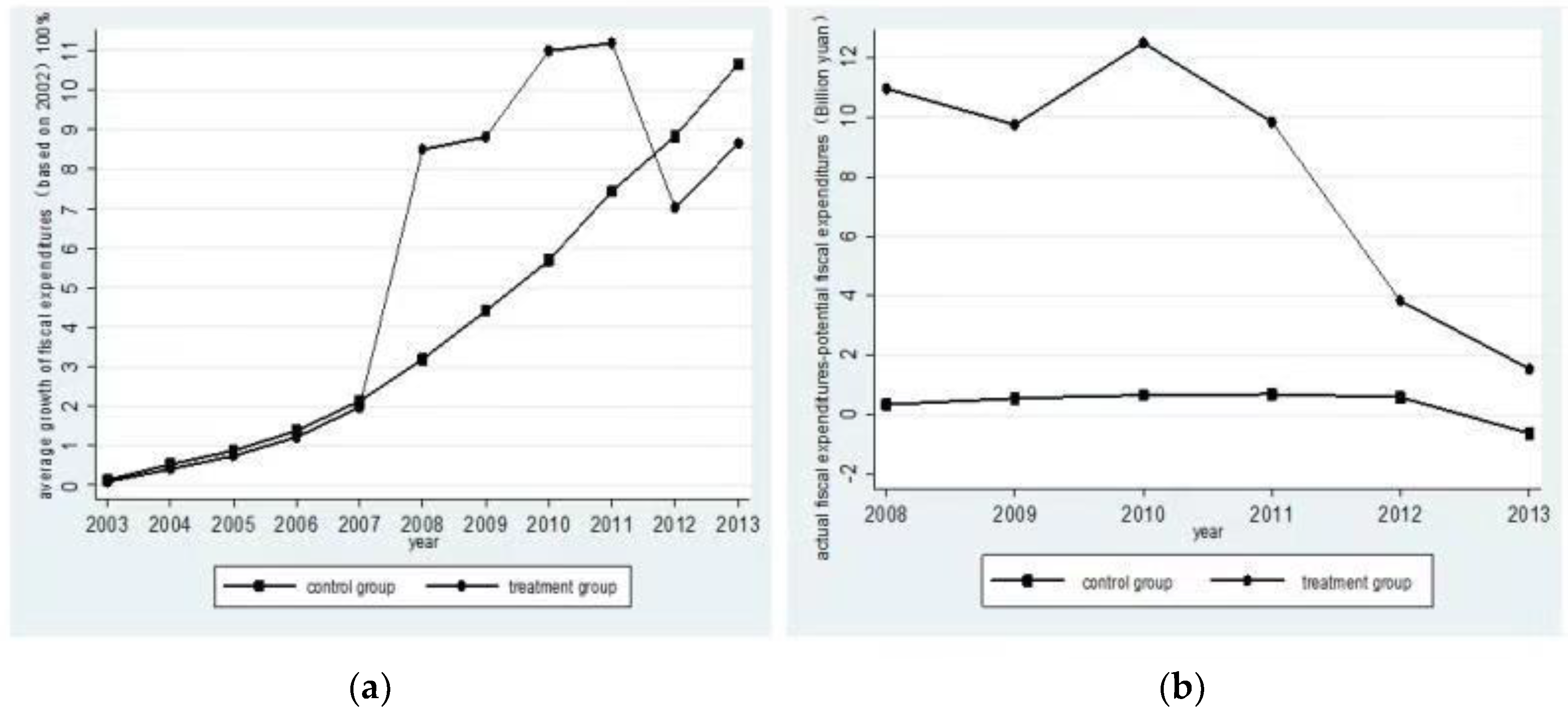

$258.6 billion. Such massive funding will inevitably influence the net effect of the disaster on economic growth. In addition, studying the impact of the national rescue on economic growth in the affected areas has more significance: by controlling the aid variables, the separate effects of the disaster and the aid on economic growth can be more clearly identified. Unfortunately, the government has so far failed to release detailed data on the disaster aid provided to the earthquake-affected cities, but in the post-Wenchuan earthquake period, national rescue has been the primary form of financial investment in China. During this period, financial expenditures across different regions effectively reflected national rescue levels for those regions and, for this reason, the national rescue variable measure is based on fiscal expenditure data. First, the average growth of fiscal expenditures in the regions is measured over the five years from 2003 to 2007 based on actual fiscal expenditures in these regions. Then, based on this growth rate, the potential fiscal expenditures of the regions from 2008 to 2013, using 2007 as the base year, are calculated. These figures reflect the potential fiscal expenditure levels based on the average growth rate in the five years before the disaster. Finally, the difference between the actual fiscal expenditures from 2008 to 2013 and the calculated potential fiscal expenditures in the affected areas can be used to identify the effect of the postdisaster rescue policies for use in this research.

Is it reasonable to use fiscal expenditures as a measure for national aid?

Figure 2a shows the growth rate of financial expenditures for the control and treatment groups based on fiscal expenditures in 2002. Noticeably, before the Wenchuan earthquake, the growth rate of the treatment group is lower than that of the control group, although both groups maintain similar growth trends. After 2008, the growth rate of fiscal expenditure for the treatment group increases rapidly, and continues to grow until the postdisaster reconstruction policy expires in 2012. This suggests that the affected areas received substantial financial support, which is consistent with national rescue policies. Therefore, we conclude that fiscal expenditures can reflect the status of national disaster aid.

Figure 2b shows the difference between actual and potential fiscal expenditures. After 2008 the real fiscal expenditure for the control group was only slightly higher than the potential spending, which was calculated based on the average growth rate of the previous five years, while the degree of difference and the trend are not obvious. For the treatment group, this difference is very significant and the trend is in line with actual national rescue policies. Therefore, we can hypothesize that the difference between the actual financial expenditure and the potential fiscal expenditure of the treatment group after 2008 does reflect the influence of the national aid. This variable is then used as a measure of national rescue policy. The descriptive statistics for the main variables are shown in

Table 2.

4. Econometrics Model and Estimation Method

Disasters from natural hazards can be seen as external shocks that affect regional economic growth. When evaluating the impact of these shocks, it is more effective to use the DID method (Ashenfelter and Card, 1985 and Gruber and Poterba, 1994) [

37,

38]. This paper refers to the existing literature (Zhang, et al. 2015) [

39] and the Wenchuan earthquake disaster area assessment report released in 2008. During the aftermath of the Wenchuan earthquake, Sichuan province identified the 52 heavily affected areas, which included 39 major disaster cities, 10 heavy disaster cities, and three Pan-Hui heavy disaster. In this research, the sample of the serious disaster cities is the treatment group, and the sample from nondisaster areas is the control group. Data from 2003 to 2013 for 181 cities is divided into four subsamples: the treatment group before the earthquake, the treatment group after the earthquake, the control group before the earthquake, and the control group after the earthquake. To distinguish among the four groups of subsamples, two dummy variables, du and dt, were developed. In the treatment group, du is given the value 1, and in the control group, the value 0, meaning that du = 1 represents the disaster area sample and du = 0 reflects the nondisaster area sample. The variable dt = 0 represents the period before the earthquake and dt = 1 reflects the period after the earthquake. Accordingly, the benchmark regression model for the DID method is as follows

where the subscripts i and t represent i county in the t year; β

1 measures the individual effect on the disaster county, β

2 represents the time trend effect, and β

3 measures the impact of the disaster on economic growth. If the earthquake adversely affects economic development in the affected areas, the coefficient of β

3 should be significantly negative. The rescue

it term represents the amount of national rescue received for the year t in the ith county. If national rescue enhances economic development in the affected areas, β

4 should be significantly positive. X represents a series of control variables, and ε is a random error term. The dependent variable Y measures economic development in the affected cities, and the specific indicators include real GDP in log and real GDP per capita in log.

The specific parameters in the DID model are listed in

Table 3. According to model (1), for the earthquake disaster areas (the treatment group sample, du = 1), the economic growth parameters for before and after the earthquake are β

0 + β

1 and β

0 + β

1 + β

2 + β

3, respectively. The change in economic development for the affected areas before and after the earthquake is △Y

t = β

2 + β

3, which includes the combination of disaster shocks and other factors. For the nondisaster areas (the control group, du = 0), the parameters for the level of economic development before and after the earthquake are β

0 and β

0 + β

2, respectively, and ΔY

0 = β

2 is the pre- and post-earthquake change in economic growth. The change does not include the disaster impact of the earthquake on regional economic growth. Therefore, using the measured difference in economic development for the treatment group before and after the earthquake, ΔY

t = β

2 + β

3, minus the measured difference in economic development for the control group before and after the earthquake, ΔY

0 = β

2, the net effect of the earthquake disaster (ΔΔY

0 = β

3) on economic development in the affected areas can be determined. If the earthquake really reduces the level of economic growth in the affected areas, the coefficient of β

3 should be significantly negative, and if the national rescue policies improve economic growth, after controlling for the effect of the policies, the absolute value of β

3’s coefficient should increase significantly.

In addition, the impact of disasters on economic growth may have a long-term effect (Barone and Mocetti, 2014) [

7]. As time goes by the effects of the disaster on economic growth may diminish or persist in the long run; therefore, the effect on long-term economic growth will be dynamic. This means that the negative impact will gradually disappear, a situation associated with the implementation of national disaster aid and postdisaster reconstruction policies designed to enhance regional economic growth. In order to test this prediction, we transform model (1) as follows

In this model, k represents the exogenous shocks occur in the kth years after or before the Wenchuan earthquake, and thus duit × dtitk shows the annual dummy variable of the kth year for the severely affected areas. Because the Wenchuan earthquake happened in 2008 and our sample is acquired from 2003 to 2013, k = −5, −4, −3, −2, −1, 0, 1, 2, 3, 4, 5. For example, in 2006, exogenous shocks happened in the two years before the Wenchuan earthquake, therefore k = −2, and thereby the variable duit × dtit−2 = 1, while duit × dtitk(k −2) in the other years are given the value 0. As a result, coefficient bk measures the impact of the disaster on economic growth in the kth year of the earthquake. At the same time, other control variables need to be controlled during the dynamic effect test.

An important premise of the DID method used in this research is that before the earthquake there is no systemic difference in the trend of economic growth between the affected and non-affected areas. However, in reality, the most severe earthquake effects were felt in areas with the harshest natural geography and lowest original levels of economic development, making it difficult to satisfy the common trend hypothesis required for the DID method. To solve this problem, Heckman et al. (1997, 1998) proposed using the PSM-DID method (PSM-DID is an abbreviation for ‘Propensity Score Matching with Difference-in-difference’. Standard propensity score matching was used to create a highly comparable control group) to abate the problem of invisible factors affecting treatment group variables that do not change with time, a solution which can ensure that the DID estimate can satisfy the common trend hypothesis [

40,

41]. This means that nondisaster county j in the control group should be made as similar as possible to county i of the treatment group by matching the observed variables so that X

i ≈ X

j, and then comparing these matched treatment and control groups because of their similarity in earthquake disaster possibilities.

For such a purpose, we also apply a PSM-DID approach to estimate. This approach first estimates a propensity score for all counties based on the “distance” between treatment and control cases, the estimated score is then added into the model to serve as the control function. Remarkably, for each county i in the quake-affected area, the score changes before and after the earthquake in all matched non-affected areas should be calculated. The propensity model then predicts the average treatment effect, which is equal to the score change in the affected cities before and after the earthquake minus the score change in the matched non-affected cities. While the average treatment effect can judge accurately the impact of the disaster on economic growth in affected areas.

7. Conclusions and Discussion

Disasters from natural hazards occur quite frequently in China with disaster aid as an integral part of the Government’s response. During the 2008 Wenchuan earthquake, the timely, forceful, and substantial investment by the Chinese government compelled the world to take note of “Chinese power;” however, at the same time, the Government-led aid model created a lot of controversy. This paper, analyzing the earthquake as a quasi-natural experiment, uses panel data from 181 cities in Sichuan province from 2003 to 2013, and the Difference-in-Difference method to study the effect of the disaster and national disaster aid on economic growth.

First, national disaster aid in China is normally initiated immediately after an event. If the effect of national rescue on economic growth cannot be effectively controlled in the model, the research results regarding the competing individual efforts of the disaster and national rescue will be ambiguous when using the DID method, possibly leading to the conclusion that disasters from natural hazards do not hinder economic growth. After effectively controlling for the national rescue variables, the results show that the earthquake has significantly reduced real GDP in the affected areas, a negative effect that will impact the area long after the disaster.

Second, financial assistance from the government is a major component of disaster aid in China. As a result of the Wenchuan earthquake, the central and local governments spent $258.6 billion on disaster aid and reconstruction over three years. National disaster aid variables are developed based on government expenditure data for the affected area. It is found that financial investment— the primary mechanism for providing national aid—can effectively promote economic recovery and GDP growth. This can improve traffic conditions and promote the level of urbanization and development of the private economy. Unlike the conclusions from research on African countries, we found that national disaster aid in Wenchuan reduced government economic intervention and excessive investment in fixed assets and promoted economic growth in the affected areas.

Third, disasters caused by earthquakes will adversely affect the economic structure and human capital of the affected areas. Also, national rescue is less effective in promoting tertiary industries and improving levels of human capital. Further research has found that these latter results are related to policy bias in the application of national disaster aid in China. In general, the main purpose of disaster aid has been postdisaster reconstruction and production recovery, and this is achieved through significant fiscal investment aimed at promoting the reconstruction of residential housing, improving traffic conditions, and other “hard” capital infrastructure enhancements. In contrast, it has not been effectively used to promote the development of “soft” capital or encourage environmental considerations in the reconstruction process; in effect, “the software can’t keep up with the hardware”.␆ In many areas, there are many new houses without inhabitants. National rescue policies would be improved if the focus were directed toward the people, increasing human capital investment, given that such support would encourage local residents to make better use of educational resources, thus improving the level of human capital.

Due to constraints in access to data, there are deficiencies in the research results, which need further consideration. (1) Limitations in the measurement of variables: Existing studies on disasters from natural hazards and economic growth in China have failed to effectively control for the effect of national rescue policies because of data limitations. For this research, a national rescue variable, based on fiscal expenditure data, is developed for the first time, and while this variable is relatively consistent with the Wenchuan earthquake national rescue policies, there will still be a deviation from real postdisaster aid. At the same time, the variable contains components of social assistance and foreign aid, ② but compared with the control social assistance and foreign aid variables, it still does not reflect the actual situation. In follow-up studies, additional data on social assistance and foreign aid need to be compiled, and combined with government assistance for further analysis. (2) The problem with internal conditions: Although the impact of earthquakes on economic growth can be studied as a quasi-natural experiment, we have also conducted a series of robustness tests on the common trend of the treatment and the control groups. It is also possible that the economic development conditions in the quake-affected areas are relatively poor, which will lead to estimate errors. However, due to county-level panel data limitations, we are not yet able to examine this issue more extensively. The resulting endogenous problems need to be explored and new solutions developed in follow-up research.