4.1. Real-Time Transparency and Cost Savings of Manufacturing Firms

We focus on manufacturing firms, because, as described in

Section 3.2, applications of blockchain technology to the financial industry and supply chains considerably impact manufacturing industries. In particular, applications of blockchain technology to securities markets are being vigorously developed by large investment banks, such as JP Morgan and Goldman Sachs (Ryan and Donohue, 2017 [

17]; Walker and Venables, 2017 [

18]; Hallam et al., 2018 [

19]). Moreover, NASDAQ is also developing a private equity exchange platform using blockchain, the NASDAQ Linq Blockchain Ledger Technology. Supply chains as composite material and agri-food supply chains have scope to employ blockchain technology as well. These applications are expected to have major impacts on the behaviors of owners and managers working in manufacturing firms because of real-time transparency and cost savings.

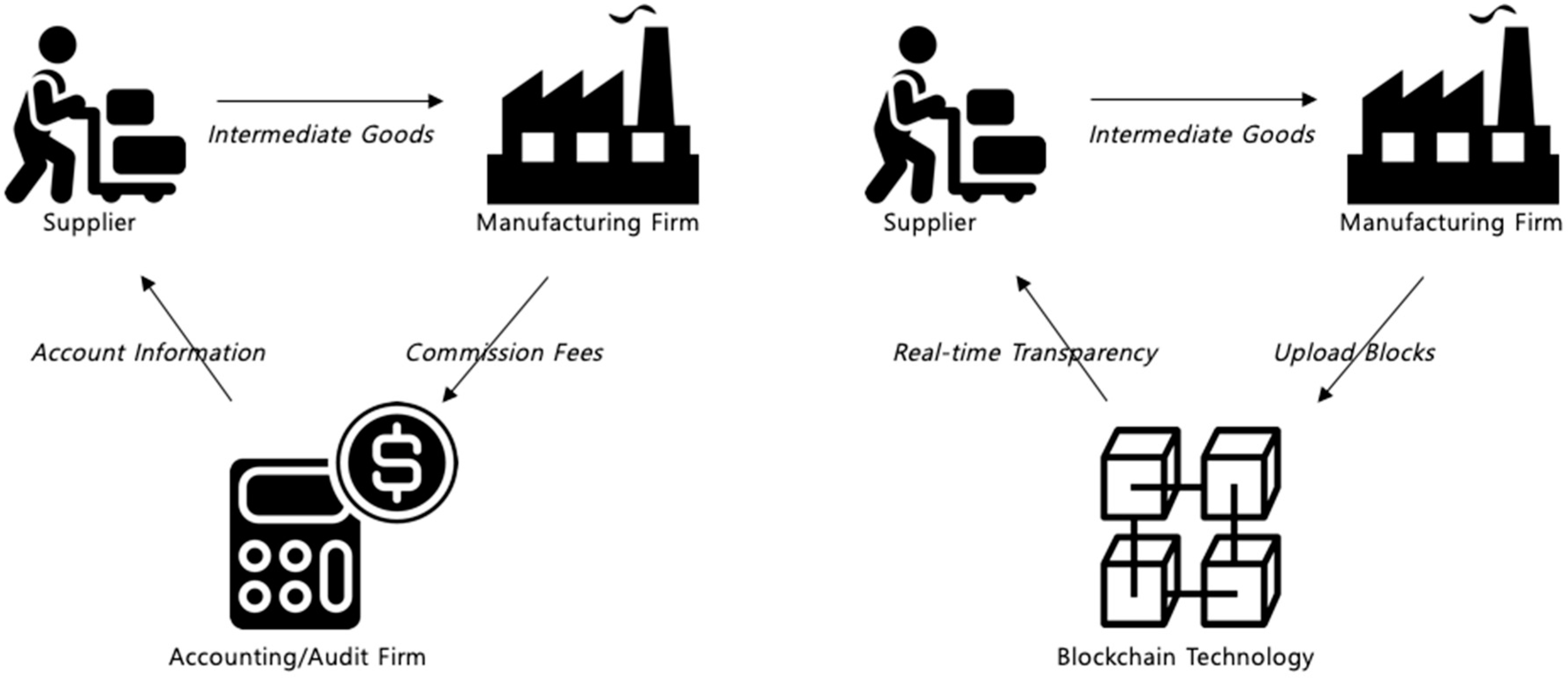

The effects of blockchain technology on the manufacturing industry primarily arise because of this technology’s influence on financial transparency and manufacturing supply chains. Real-time financial transparency allows firms using blockchain technology to reduce verification and surveillance costs. Manufacturing firms implementing blockchain technology can structure confident relationships with their counterparts, thereby eliminating the cost of trust and reducing verification costs. Verification costs are incurred because of a lack of trust between traders (Catalini and Gans, 2016 [

15]). For instance, when a manufacturing firm does business with intermediate goods suppliers, the suppliers must consider the potential of default and fraud by the manufacturing firm and require the manufacturing firm to prove that it has sufficient funds to pay for the transaction. Because of this lack of trust and the risk of default, an audit or intermediary is needed, and the manufacturing firm incurs verification costs. These costs can be estimated based on the income of the accounting industry, which is anticipated to surpass 156 billion US dollar in 2018 in the U.S. alone (“

Accounting industry in the U.S.—Statistics & Facts,”

https://www.statista.com/topics/2121/accounting-industry-in-the-us/). The effective use of blockchain technology allows a manufacturing firm to provide its true financial status (real-time accounting) to the supplier, rendering verifications by an accounting firm unnecessary. Therefore, the manufacturing firm can save a significant amount of verification costs (

Figure 1).

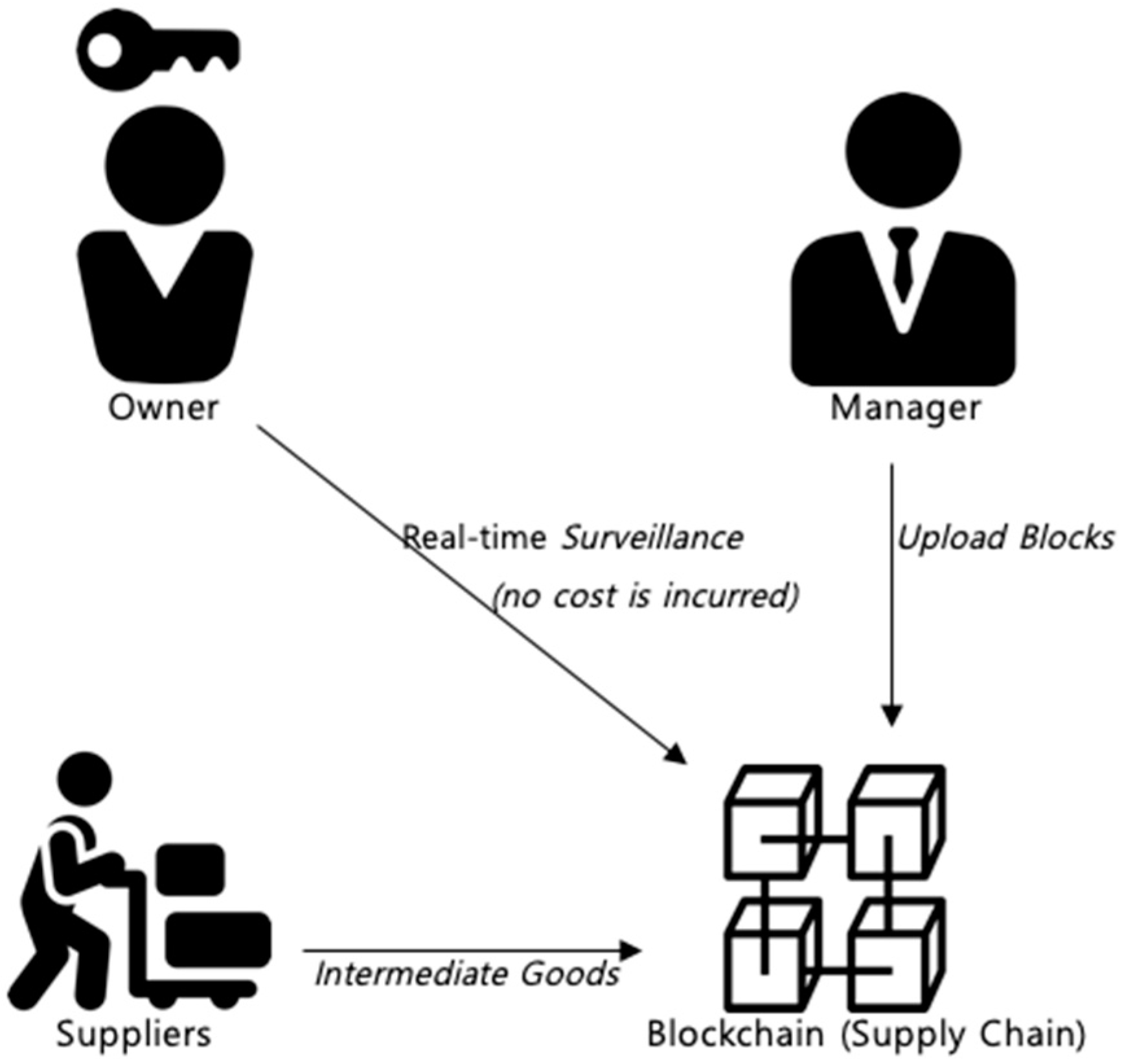

In addition, the real-time transparency of blockchain technology allows the owners of manufacturing firms to cut the surveillance costs on managers. A single shareholder (i.e., an owner) may experience difficulty steering a frim because the firm’s shares are spread among many shareholders. When a firm has many owners, shareholders’ interests generally do not coincide. Berle and Means (“

The Modern Corporation and Private Property”) explain that the problem of diverse interests among shareholders is solved according to managers’ preferences. As a result, manufacturing firms incur additional costs to supervise managers. However, these costs can be reduced through the real-time transparency of blockchain technology. In general, a firm’s transparency is divided into two components, financial transparency and corporate governance transparency (Bushman, Piotroski, and Smith, 2004 [

31]). However, a blockchain system can provide both financial (Pilkington, 2016 [

7]; Underwood, 2016 [

8]) and corporate governance transparency (Yermack, 2017 [

16]). Thus, the actions of managers can be supervised in real time. As a result, intensive surveillance is no longer needed, lowering surveillance costs. For instance, an owner of a manufacturing firm can monitor the blockchain of a supply chain to observe whether a manager is maximizing profit. She can track the amount of intermediate goods that the manager purchases to estimate the quantity that the manager is planning to produce. Thus, the owner can reduce surveillance costs (

Figure 2).

Networking costs can be saved among in-chain manufacturing firms, and the in-chain manufacturing firms with intermediate goods suppliers can develop a new market platform, where in-chain firms refer to the firms within a blockchain system. This process may produce network effects that render in-chain manufacturing firms more competitive than off-chain manufacturing firms. According to Catalini and Gans (2016) [

15], firms with blockchain technology can cut networking costs by bypassing intermediary intervention using blockchain technology participants’ new transaction platforms. Extending this argument to the manufacturing industry, manufacturing firms with blockchain technology can develop a new market platform with intermediate goods suppliers and no intermediaries. This new market platform under a blockchain system achieves lower transaction costs by bypassing intermediaries and renders the manufacturing firms within the blockchain system more competitive than the off-chain manufacturing firms. Furthermore, the manufacturing firms in the blockchain system can achieve the benefits of network effects. The more that intermediate goods suppliers engage in the blockchain system, the more that the in-chain manufacturing firms benefit from the excess market information. Thus, the manufacturing firms and their submarkets form even tighter platforms under blockchain technology.

4.2. Competition between an SME Manufacturing Firm with Blockchain Technology and a Market-Dominating Manufacturing Firm without Blockchain Technology

The objective functions of firms are much disputed, but they are traditionally understood to maximize profits. However, modern corporations and stakeholders have two interest groups—owners and managers—resulting in disagreements regarding the aims of the groups. Amihud and Kamin (1979) [

32], Baumol (1977) [

33], Cyert and March (1963) [

34], Leibenstein (1979) [

35], Marris (1964) [

36], Simon (1964) [

37], Vickers (1985) [

38], and Williamson (1964) [

39] describe ways that firms can deviate from profit maximization; for example, firms often maximize total revenue instead of net profits.

Managers of a firm could prefer to maximize revenue, even if owners require to maximize profit, to reduce the risks of downturn of a profit performance in the next period or to exaggerate their resume. Nonetheless, managers of SMEs that consider blockchain technology can behave as owners prefer, that is, they can maximize profit, for two reasons. First, because the owners of SMEs recognize that they cannot compete on market shares, so they focus on maximizing profit within a given output capacity rather than maximizing revenue. More importantly, if a blockchain system is implemented, business owners can monitor managers in real time owing to the real-time transparency of the blockchain system. For example, as explained in

Section 4.1, if intermediate goods are purchased through the blockchain system, the owners can estimate managers’ planned output by monitoring the amount of intermediate goods purchased by the managers. Thus, when managers behave suspiciously, that is to maximize revenue, the owners can intercede. In contrast, the owners and managers of traditional large corporations are likely to maximize revenue for market domination (Sklivas, 1987 [

12]).

The real-time transparency of blockchain technology reduces surveillance, remittance, verification, and networking costs, as explained in the previous sections. Because of these advantages, manufacturing firms can produce at smaller marginal costs when they incorporate blockchain technology. We first analyze the effect of real-time transparency by comparing the profits of a firm before implementing blockchain technology to those after applying blockchain technology. Then, we consider cost savings. Significant lump-sum costs may be required to introduce blockchain technology to a business. However, these lump-sum costs are independent of a firm’s production decision making and, thus, do not affect the marginal cost of the firm. We consider these lump-sum costs and examine the necessary cost savings from blockchain technology to exceed the lump-sum costs of applying this technology, which could be incentives for manufacturing firms to adopt this technology.

We consider two firms competing against each other. Firm 1 is an SME manufacturing firm, and firm 2 is a market-dominating manufacturing firm. Neither firm 1 nor firm 2 employs blockchain technology initially. The game proceeds as follows. First, the owners, with perfect foresight regarding their managers, choose the optimal manager incentive variables

and

from their profit function. Next, the managers simultaneously choose their optimal quantities of production

and

. In this two-stage game, we apply backward induction to clearly show the profits and compensations of owners and managers. Thus, we analyze managers first, and then analyze owners. The inverse market demand function is given as:

where

is price,

a,

b > 0, and

is firm

’s output, for

. The owners’ objective functions are given as:

where

, for

, is profit and

, for

, is marginal cost. We also assume that,

for both firms to participate in the market. The owners, having perfect foresight of the managers’ games, consider managers’ production quantities,

and

, and maximize their profits indirectly by appropriately choosing

and

, which determine the incentives for managers. Thus, the owners’ profit functions

and

are dependent on

, and managers’ incentives are proportional to:

Here,

,

, is the managers’ compensation from the owners, for

. Manager 1 of firm 1 maximizes only profits, assuming that owner 1 sets

to induce manager 1 to maximize profits. Owner 1 prefers to maximize profits because of the characteristics of SMEs (firm 1), as explained previously. As owner 1 gives

to manager 1, manager 1’s objective is technically the same as that of owner 1: the maximization of profit (

). Although the assumption that

seems extreme, it is useful for the simplicity of comparing the profits of firm 1 before and after adopting blockchain technology. We also have that

because the owner of the dominant firm (firm 2) is interested in market shares, which is measured by revenue. The managers simultaneously choose their outputs knowing each other’s objective function. Therefore, taking derivatives of Equations (4) and (5) with respect to

, the reaction functions of the managers are:

The pure Nash equilibrium for each manager is:

Substituting Equations (8) and (9) into Equations (2) and (3), we obtain:

Because we assume that

, we only need to consider

. Owner 2 must choose an appropriate

to maximize firm 2’s profit. Taking the derivative of Equation (11) with respect to

produces:

Therefore, the subgame perfect Nash equilibrium of owners and managers is:

Substituting

into Equations (8) and (9), the Nash equilibrium output is:

As expected, the optimal output level of the SME that is not interested in market shares (firm 1) is relatively small compared to the optimal output level of the dominant firm (firm 2) when their marginal costs are similar, although this result can be inverted depending on their marginal cost difference. Accordingly, the subgame perfect Nash equilibrium output can be written as:

Substituting the subgame perfect Nash equilibrium output into the owner’s profit functions,

and

, gives:

For the managers,

is given as:

As in the case of the output levels, firm 1’s profit is smaller than that of firm 2 if the firms have the same marginal cost. However, because the square root of each firm’s profit is affected by its own marginal cost reduction on the order of three times (firm 1) or two times (firm 2), we can expect that blockchain technology reduces costs more effectively for firm 1 than for firm 2. It is noteworthy that even the compensation of manager 2, who has an incentive to maximize revenue, is consequentially proportional to the firm’s profit.

From now on, we assume that firm 1, the manufacturing SME, implements blockchain technology. Now, owner 1 does not have to consider incentives for manager 1 because she can supervise manager 1 in real time owing to the real-time transparency of blockchain technology. Instead, owner 1 directly sets the optimal quantity,

, in stage 1, and manager 1 merely follows by producing the planned

in stage 2. Firm 1, the SME, therefore preemptively achieves profit maximization in stage 1. However, as a market-dominating manufacturing firm, firm 2 still maximizes revenue. For firm 2, owner 2 selects an appropriate

in stage 1, and manager 2 chooses the optimal

in stage 2. Note that owner 1, with perfect foresight regarding stage 2, chooses

in stage 1 knowing the optimal

for manager 2 (

Table 1). Importantly, owner 2 cannot respond to

with

, but she responds with

in order to render a manager 2’s decision to the one owner 2 prefers, due to the lack of real-time transparency on manager 2. Meanwhile, manager 2 responds to the

that is already set by owner 1 knowing the optimal

, even though she is actually simultaneously choosing outputs with manager 1. Because of this time lag of the output decision of firm 2, firm 1 takes the advantage that is similar with being a Stackelberg leader owing to real-time transparency. We again apply backward induction by examining the manager first and then the owners.

For these reasons, in the second stage, manager 2 of firm 2 maximizes her incentive in Equation (5):

In stage 1, the owners’ profits are:

Owner 1 and owner 2 simultaneously choose

and

, respectively, to maximize their profits, which are:

Thus, firm 2 no longer has an incentive for market domination because there is no competition in the second-stage game. The owner of firm 2 therefore places the full weight on profit maximization. The optimal outputs are derived from Equations (21) and (24) by replacing

with 1:

As a result, the owners’ profits in the equilibrium are:

Therefore, if

in Equation (28) is larger than

in Equation (17), then firm 1 receives the benefits of real-time transparency and has incentives to implement blockchain technology. This condition is equivalent to:

In fact, this condition always holds when all firms can make a profit in the market. The condition is equivalent to , and this condition ensures a positive profit of firm 2, . Because , Equation (30) is always satisfied, indicating that real-time transparency offers a profit. Moreover, this positive effect of real-time transparency on profits is smaller when firm 2’s marginal cost, , is larger than firm 1’s marginal cost, . This result arises because the difference in the square roots of and is proportional to . Thus, if firm 1 already has more competitive costs, then its profit may be insensitive to real-time transparency.

Assuming that their marginal costs are the same (i.e.,

) for a more precise comparison, we find that:

which is twice the original profit. Thus, the real-time transparency incentive for a profit-maximizing manufacturing SME is expected to be large enough to attract the SME to employ blockchain technology. In addition, by making preliminary production decisions utilizing real-time transparency, manufacturing SMEs can produce more outputs than before, and they can expect to earn greater profits than firm 2 can at a similar marginal cost level, which means

.

Equation (32) is notable because it yields a contradictory result to that of Fershtman (1985) [

10]. Fershtman (1985) [

10] states that the earnings of a profit-maximizing firm are half those of a compromising firm. This reverse result is driven by the effects of real-time transparency; firm 1 can receive the benefit of preemptively deciding quantity and, thus, acting similar with a Stackelberg leader. This case is analogous to Basu (1995)’s [

9] case of

, which stackelberg leader firm 1 maximizes profits through not employing a manager. However, firm 1 in our case, technically employs a manager and produces in the stage 2. With the advantage of making a preemptive output decision through the blockchain technology’s real-time transparency, SMEs can receive the benefits of becoming a leader and outperform a market-dominating firm even with a profit-maximizing strategy.

The application of blockchain technology not only provides real-time transparency to firms but also provides cost savings. Thus, as explained in

Section 3.1,

Section 3.2,

Section 3.3 and

Section 4.1, blockchain technology helps firm 1 produce at a marginal cost less than

, that is,

(

). However, developing blockchain technology in a firm may temporarily incur significant upfront costs. These upfront costs can be considered as one-time lump-sum costs. We define the expected cost savings (

cs) realized by blockchain technology as,

. Furthermore, we assume lump-sum costs (

LC) as a certain ratio of the profits of firm 1 before applying blockchain technology,

. Considering their characteristics, lump-sum costs are irrelevant to firms’ optimal quantity choices and, thus, do not affect output decision makings but do affect profits. Therefore,

, the profits of firm 1 achieved by adopting blockchain technology, are as follows:

Firm 1 has incentives to implement blockchain technology if the new profits,

, exceed the previous profits without blockchain technology,

, even after considering lump-sum costs:

This inequality provides incentives for firm 1 to implement blockchain technology if the marginal cost savings are greater than the following lower bound:

The first term of the lower bound of cost savings, , implies that as more lump-sum costs are required, greater cost savings are needed, that is, as increases, greater cost savings are required. However, if, from the first term of the lower bound of cost savings is, , the first term is non-positive, and, consequently, firm 1 has an incentive to employ blockchain technology even without any cost savings. This result arises because of the positive real-time transparency effects of Equations (30) and (31). More importantly, if is large enough that other terms besides the first term can affect Equation (35), as increases relative to , more marginal cost savings are necessary. This situation implies that because firm 1 is already receiving considerable profits (lower compared to ), it needs more lump-sum costs to have an incentive to implement blockchain technology. Furthermore, the profit from real-time transparency decreases with a larger marginal cost gap, as explained by Equation (30). As the profits of the manufacturing SME increase through the application of blockchain technology, manufacturing firms have incentives to employ blockchain technology.

4.3. Competition between Two Fairly Market-Dominating Manufacturing Firms, Only One of Which Uses Blockchain Technology

In this section, both firms compete for market domination because the two firms are equally large and competitive manufacturing firms. Thus,

is no longer set equal to one. Instead,

, and

still satisfies

. Thus, the owners in this game prefer managers to maximize revenues to secure a greater market share. This game follows the process described in

Section 4.2. That is, owners choose managers’ incentive variables first, with perfect foresight on managers’ strategies, and, then, the managers choose the optimal quantities. However, we again use the backward induction method for analysis and, thus, analyze managers first. We first analyze both firms without blockchain technology, and then assume that firm 1 uses blockchain technology. The owners maximize profits using the objective functions given by Equations (2) and (3), and managers of firms without blockchain technology maximize:

The reaction functions of managers are:

The pure Nash equilibrium of each managers is:

Substituting

and

into Equations (2) and (3), we obtain:

Taking the derivatives of Equations (42) and (43) with respect to

and

, respectively, gives the owners’ reaction functions, which are:

Thus, solving Equations (44) and (45) results in:

Substituting

and

into Equations (40) and (41), the subgame perfect Nash equilibrium output is:

As a result, owners’ compensations are:

The managers’ incentives are:

Because both firms use revenue maximizing incentives for managers, their profit scales are also symmetric, and their competitiveness depends on their marginal costs. Starting from this point, we again assume that firm 1 brings blockchain technology into its business. As in

Section 4.2, owner 1 of firm 1, which now has blockchain technology, chooses the optimal quantity,

, in stage 1. Then, in stage 2, manager 1 follows the decision of owner 1 because of real-time transparency. However, the difference from the setting in

Section 4.2 is that even though owner 1 prefers manager 1 to maximize revenue for market domination in this setting, because of the real-time transparency of blockchain technology, owner 1 can engage in a micro-management on manager 1, allowing her to act first on deciding a certain quantity. Thus, to gain the advantage of the faster decision making, owner 1 requires manager 1 to produce profit maximizing outputs. In the case of firm 2, owner 2 chooses the profit-maximizing

in stage 1, and manager 2 selects the revenue-maximizing

in stage 2 (the game procedure is the same as that described in

Table 1). Thus, everything we consider is the same in

Section 4.2 except for the profits of firm 1 without blockchain technology (now firm 2 is not the focus of our analysis).

Comparing Equation (28), the profits with blockchain technology, with the revenue-maximizing owner’s profits without blockchain technology, Equation (49), the profits from real-time transparency are:

Note that this condition is always satisfied as long as firm 2 remains in the market, that is, if firm 2 can earn positive profits according to Equations (29) and (50). Thus, Equation (53) shows, once again, the profits from real-time transparency. In addition, as shown in

Section 4.2, the positive effects of real-time transparency on profits decrease as the marginal cost of firm 2 increases relative to that of firm 1. That is,

. This result implies that if firm 1 is already maintaining a good competitive position compared to firm 2, the compensation from real-time transparency decreases.

If we assume that the firms have the same marginal costs (i.e.,

), the profit from real-time transparency, or the difference between

and

, becomes:

which is greater than the half of original profits. Consequently, significant profits can be obtained through the real-time transparency of blockchain technology, which can serve as an incentive to apply blockchain technology in the manufacturing industry.

Now, taking cost savings and the lump-sum costs of implementing blockchain technology into account, we define the decrease in the marginal cost due to blockchain technology as

, and lump-sum costs are again

. Recall Equation (33) for

in Equation (49):

The inequality in Equation (55) indicates firm 1’s additional profits from the marginal cost savings of blockchain technology:

The first term in Equation (56), , implies that as the lump-sum costs of applying blockchain technology increase, (i.e., as increases) more cost savings are needed to finance these costs. However, if , the first term is not positive, and, in this special case, blockchain technology may be implemented even without cost savings. This free-looking benefit is induced by the profit increase from real-time transparency, as explained in Equations (53) and (54). Note that if is large enough and if is large compared to , more marginal cost savings are needed to justify the implementation of blockchain technology because firm 1 is already enjoying considerable profits, leading to higher costs for the blockchain technology implementation. This result coincides with Equation (53). Again, the increase in the profits of the market-dominating manufacturing firm demonstrates that manufacturing firms have incentives to implement blockchain technology.