The Price Determinants of the EU Allowance in the EU Emissions Trading Scheme

Abstract

1. Introduction

2. Literature Review

3. Theoretical Background and Carbon Price Mechanism

3.1. Theoretical Background

3.1.1. Understanding the Emissions Trading System

3.1.2. Current Status of the Global Emissions Trading System

3.1.3. The Development Background of the EU Emissions Trading System

3.2. Carbon Price Mechanism

3.2.1. Importance of the Carbon Price

3.2.2. Cap and Trade Benefits

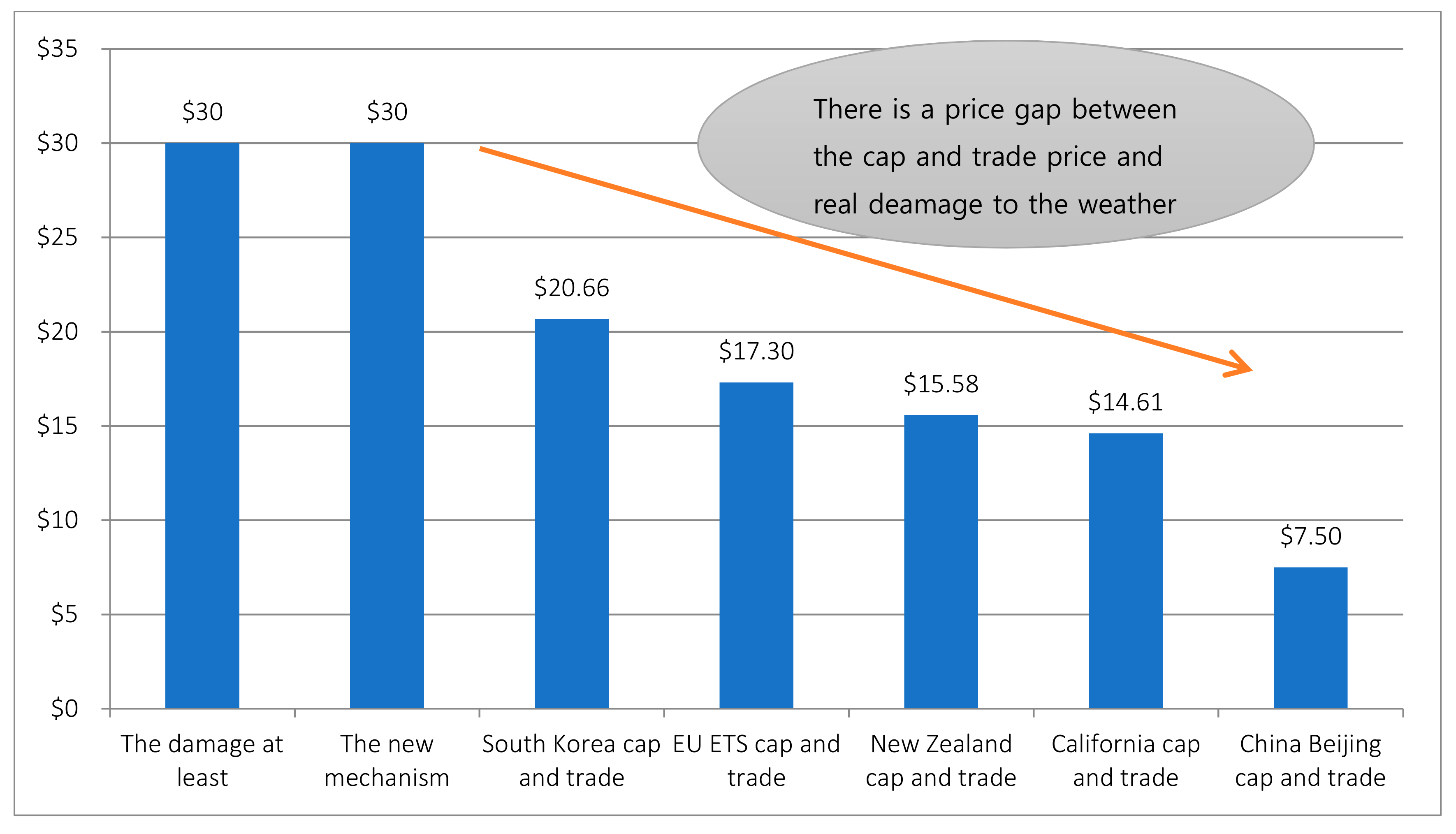

3.2.3. Global Carbon Pricing Mechanism

4. Empirical Analysis

4.1. Data and Model

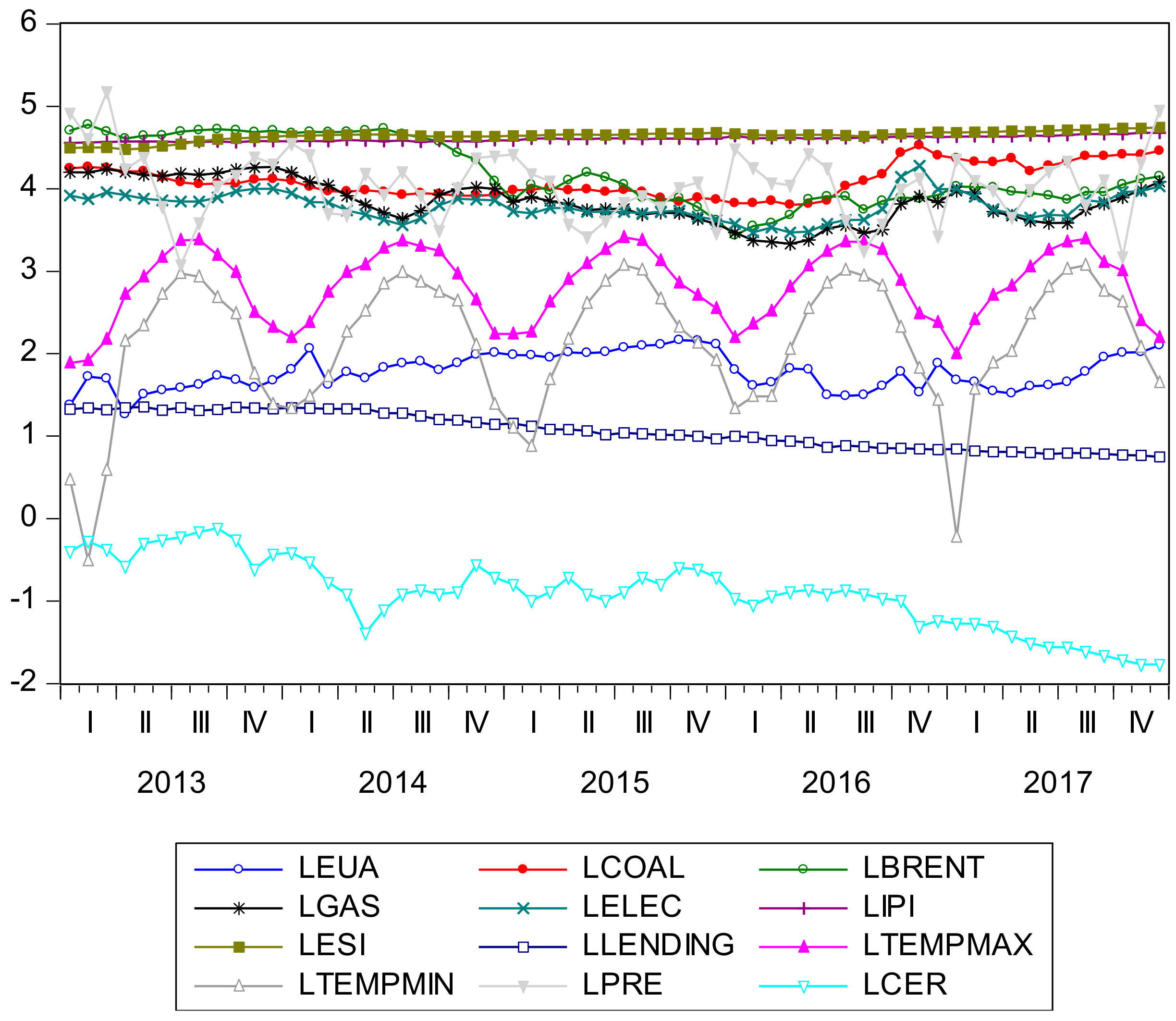

4.1.1. Variables and Data

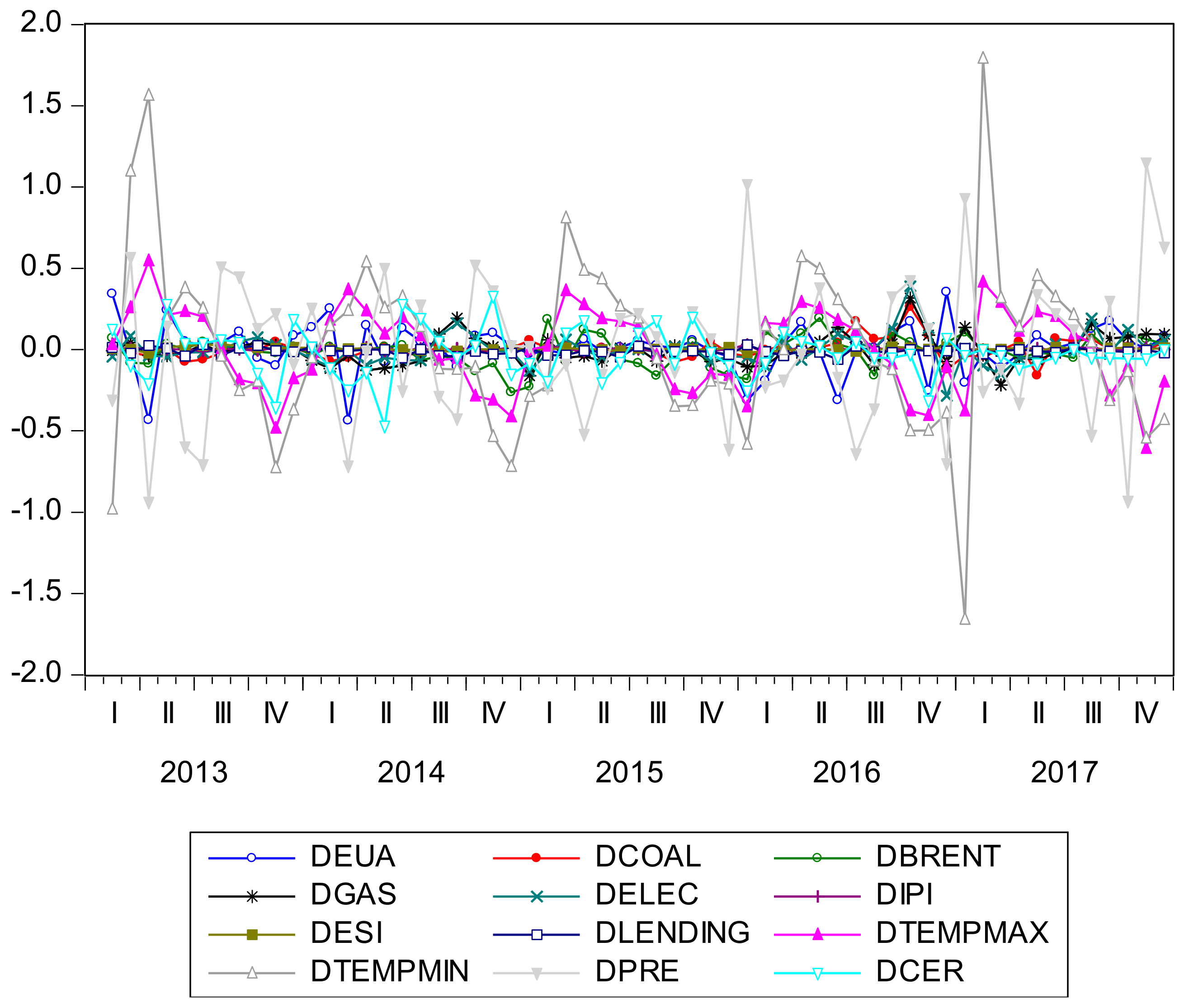

4.1.2. Data Statistics

4.1.3. VECM Model

4.2. Empirical Results

4.2.1. Lag-Order Selection Criteria

4.2.2. Unit-Root Test

4.2.3. Cointegration Test

4.2.4. Granger Causality Test

4.2.5. Estimation of the VECM and the Impulse Response Function

4.2.6. Forecast Error Variance Decomposition

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- International Carbon Action Partnership. ETS Brief#1, What Is Emission Trading? International Carbon Action Partnership: London, UK, 2015. [Google Scholar]

- International Carbon Action Partnership. Emission Trading Worldwide; International Carbon Action Partnership (ICAP) Status Report; International Carbon Action Partnership: London, UK, 2018. [Google Scholar]

- International Carbon Action Partnership. ETS Brief#3, Emissions Trading at a Glance; International Carbon Action Partnership: London, UK, 2015. [Google Scholar]

- European Commission. EU ETS Handbook; European Commission: Brussels, Belgium, 2015. [Google Scholar]

- Melum, F. (Ed.) Carbon Market Monitor Decreased Uncertainty as Carbon Market Reforms Conclude; Thomson Reuters: Toronto, ON, Canada, 2018. [Google Scholar]

- Cramton, P.; Mackey, D.J.; Ockenfels, A.; Stoft, S. Global Carbon Pricing; MIT Press: Cambridge, MA, USA, 2017. [Google Scholar]

- Dai, F.; Xiong, L.; Ma, D. How to set the allowance benchmarking for cement industry in China’s carbon market: Marginal analysis and the case of the Hubei emission trading pilot. Sustainability 2017, 9, 322. [Google Scholar] [CrossRef]

- Dong, J.; Ma, Y.; Sun, H. From pilot to the national emissions trading scheme in China: International practice and domestic experiences. Sustainability 2016, 8, 522. [Google Scholar] [CrossRef]

- Ye, B.; Jiang, J.; Miao, L.; Li, J.; Peng, Y. Innovative carbon allowance allocation policy for the Shenzhen emission trading scheme in China. Sustainability 2015, 8, 3. [Google Scholar] [CrossRef]

- Christiansen, A.; Arvanitakis, A.; Tangen, K.; Hasselknippe, H. Price determinants in the EU emission trading scheme. Clim. Policy 2005, 5, 15–30. [Google Scholar] [CrossRef]

- Mansanet-Bataller, M.; Pardo, A.; Valor, E. CO₂ prices, energy and weather. Energy J. 2007, 28, 67–86. [Google Scholar] [CrossRef]

- Alberola, E.; Chevallier, J.; Cheze, B. Price drivers and structural breaks in European carbon prices 2005–2007. Energy Policy 2008, 36, 787–797. [Google Scholar] [CrossRef]

- Bunn, D.; Fezzi, C. Interaction of European Carbon Trading and Energy Prices. Fondazione Eni Enrico Mattei Working Paper 123. Available online: http://www.feem.it/Feem/Pub/Publications/WPapers/default.htm (accessed on 15 February 2018).

- Tan, X.-P.; Wang, X.-Y. Dependence changes between the carbon price and its fundamentals: A quantile regression approach. Appl. Energy 2017, 190, 306–325. [Google Scholar] [CrossRef]

- Hong, K.-H.; Jung, H.-J.; Park, M.-J. Predicting European carbon emission price movements. Carbon Manag. 2017, 8, 33–44. [Google Scholar] [CrossRef]

- Chevallier, J. Macroeconomics, finance, commodities: Interactions with carbon markets in a data-rich model. Econ. Model. 2011, 28, 557–567. [Google Scholar] [CrossRef]

- Oberndorfer, U. EU Emission allowances and the stock market: Evidence from the electricity industry. Ecol. Econ. 2009, 68, 1116–1126. [Google Scholar] [CrossRef]

- Lin, Q.-L.; Kim, T.K. A causality of the CO2 price and the stock prices of steel corporations. Korean Energy Econ. Rev. 2010, 9, 1–23. [Google Scholar]

- Moreno, B.; Silva, P. How do Spanish polluting sectors’ stock market returns react to European Union allowances prices? A panel data approach. Energy 2016, 103, 240–250. [Google Scholar] [CrossRef]

- Koch, N.; Fuss, S.; Grosjean, G.; Edenhofer, O. Causes of the EU ETS price drop: Recession, CDM, renewable policies or a bit of everything? New evidence. Energ. Policy 2014, 73, 676–685. [Google Scholar] [CrossRef]

- Benz, E.; Truck, S. Modeling the price dynamics of CO2 emission allowances. Energy Econ. 2009, 31, 4–15. [Google Scholar] [CrossRef]

- Barrieu, P.; Fehr, M. Integrated EUA and CER Price Modeling and Application for Spread Option Pricing; Centre for Climate Change Economics and Policy Working Paper; Centre for Climate Change Economics and Policy: London, UK, 2011. [Google Scholar]

- Hintermann, B. Allowance price drivers in the first phase of EU ETS. J. Environ. Econ. Manag. 2010, 59, 43–56. [Google Scholar] [CrossRef]

- Bu, G.-D.; Jeong, K.-H. The analysis of EU carbon trading and energy prices using vector error correction model. J. Korean Data Inf. Sci. Soc. 2011, 22, 401–412. [Google Scholar]

- Lee, E.-J.; Pak, M.-S. A study on the price determinants of the emission allowance in the European market: Phase 1 and 2. J. Int. Trade Econ. 2014, 10, 427–452. [Google Scholar]

- Cho, K.-J. Price determinants of European Union allowances. J. Int. Trade Econ. 2014, 10, 949–967. [Google Scholar]

- Hong, S.-M.; Paterson, G.; Mumovic, D.; Steadman, P. Improved benchmarking comparability for energy consumption in schools. Build. Res. Inf. 2014, 42, 47–61. [Google Scholar] [CrossRef]

- Republic of Korea, Ministry of Environment. After Kyoto Protocol the New Climate Regime; Paris Agreement Guidelines; Republic of Korea, Ministry of Environment: Seoul, Korea, 2016.

- International Carbon Action Partnership. Global Emission Trading Trend; ICAP Newsletter: London, UK, 2018; p. 17. [Google Scholar]

- International Carbon Action Partnership. ETS Brief#5, From Carbon Market to Climate Finance: Emission Trading Revenue; International Carbon Action Partnership: London, UK, 2016. [Google Scholar]

- International Carbon Action Partnership. ETS Brief#6, Allocation: How Emissions Permits Are Distributed; International Carbon Action Partnership: London, UK, 2017. [Google Scholar]

- Ha, A.-J. Global emissions trading market: Current status and its implications. Korea Deriv. Res. C 2016, 5, 7–57. [Google Scholar]

- O’Sen, N. Largest City in Europe. The World Atlas. Available online: https://www.worldatlas.com/articles/largest-cities-in-europe-by-population.html (accessed on 16 January 2018).

- Sandbag. State of the EU Emissions Trading System; EU: Brussels, Belgium, 2017. [Google Scholar]

- Lee, G.-S. Economic Information Processing; KonKuk Universtiy: Seoul, Korea, 2013; pp. 1–12. Available online: http://www.kocw.or.kr/home/search/kemView.do?kemId=865736 (accessed on 28 January 2018).

- Kim, M.-J.; Jang, K.-H. Time Series Analysis; Book, Inc.: Kyeongmun, Korea, 2002. [Google Scholar]

- Kim, K.-S. Structural Vector AutoRegression Model for Economic Forecasts Using EVIEWS; Jian Kim Fine Tech Press: Seoul, Korea, 2015. [Google Scholar]

- Boersen, A.; Scholtens, B. The relationship between European electricity markets and emission allowance futures prices in phase II of the EU (European Union) emission trading scheme. Energy 2014, 74, 585–594. [Google Scholar] [CrossRef]

- Lee, J.-W. EU-ETS carbon capture pricing factors: Focusing on short and mid term EU-ETS. Econ. Rev. 2008, 10, 4–28. [Google Scholar]

- Yang, B.; Liu, C.; Gou, Z.; Man, J.; Su, Y. How Will Policies of China’s CO2 ETS Affect its Carbon Price: Evidence from Chinese Pilot Regions. Sustainability 2018, 10, 605. [Google Scholar] [CrossRef]

- Choi, Y.; Lee, H.S. Are emissions trading policies sustainable? A study of the petrochemical industry in Korea. Sustainability 2016, 8, 1110. [Google Scholar] [CrossRef]

| Variable Classification | Variable | Variable Description | Source of Data |

|---|---|---|---|

| Price | EUA (Allowance Price) | EUA Futures Price | www.investing.com |

| Energy | COAL (Coal Price) | Australian Thermal Coal Price | www.indexmundi.com |

| BRENT (Oil Price) | Brent Futures Index | www.theice.com | |

| GAS (Natural Gas Price) | European Nature Gas Future Index | ||

| ELEC (Electricity Price) | UK Power Future Index | ||

| Economic | IPI (Industrial Production) | European Industrial Production Index | www.ecb.europa.eu |

| ESI (Economic Sentiment) | European Economic Sentiment Index | www.ec.europa.ev/eurostat | |

| Lending (Bank Lending) | Euro area Bank Lending Index | www.tradingeconomics.com | |

| Temperature (new) | TEMPMAX (Temperature Maximum) | European Average Temperature Maximum Index | www.worldweatheronline.com |

| TEMPMIN (Temperature Minimum) | European Average Temperature Minimum Index | ||

| PRE (Precipitation) | European Average Precipitation Index | ||

| Related index | CER (Certified Emission Reduction) | CER Futures Price | www.marketwatch.com |

| Variables | EUA | COAL | BRENT | GAS | ELEC | IPI | ESI | LENDING | TEMPMAX | TEMPMIN | PRE | CER |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | 6.0983 | 61.2340 | 71.7890 | 48.2921 | 44.8217 | 100.0800 | 104.1367 | 2.9760 | 18.3167 | 10.6467 | 62.0748 | 0.4432 |

| Median | 5.9350 | 57.0600 | 57.4900 | 45.9720 | 43.2300 | 100.1000 | 105.0000 | 2.8150 | 18.1000 | 9.9000 | 58.8050 | 0.4100 |

| Maximum | 8.7100 | 92.4400 | 118.5800 | 71.0260 | 72.0400 | 107.5000 | 115.1000 | 3.8700 | 30.2000 | 21.60000 | 176.9700 | 0.890000 |

| Minimum | 3.540000 | 44.90000 | 31.01000 | 27.97500 | 32.06000 | 95.20000 | 88.20000 | 2.110000 | 6.600000 | 0.600000 | 21.69000 | 0.170000 |

| Std. Dev. | 1.314278 | 12.74857 | 28.33999 | 12.48789 | 7.680847 | 3.143721 | 6.044916 | 0.632164 | 7.373824 | 6.236510 | 28.20096 | 0.182659 |

| Skewness | 0.282000 | 0.692137 | 0.412412 | 0.289248 | 0.808002 | 0.516530 | −1.072820 | 0.180262 | 0.099909 | 0.189441 | 1.654291 | 0.607750 |

| Kurtosis | 2.003380 | 2.274456 | 1.477453 | 1.964514 | 4.290711 | 2.451936 | 4.120893 | 1.461592 | 1.663493 | 1.751858 | 7.175078 | 2.708939 |

| Jarque-Bera | 3.278373 | 6.106573 | 7.496209 | 3.517219 | 10.69351 | 3.418962 | 14.65043 | 6.241694 | 4.565448 | 4.253525 | 70.94499 | 3.905387 |

| Probability | 0.194138 | 0.047204 | 0.0236 | 0.172284 | 0.004764 | 0.180960 | 0.000659 | 0.044120 | 0.102006 | 0.119223 | 0.00000 | 0.141891 |

| Sum | 365.9000 | 3674.040 | 4307.340 | 2897.526 | 2689.300 | 6004.800 | 6248.200 | 178.5600 | 1099.000 | 638.8000 | 3724.490 | 26.59000 |

| Sum Sq.Dev. | 101.9122 | 9589.034 | 47386.15 | 9200.898 | 3480.730 | 583.0960 | 2155.919 | 23.57824 | 3208.23 | 2249.749 | 46922.35 | 1.968498 |

| Observations | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 |

| Variables | DEUA | DCOAL | DBRENT | DGAS | DELEC | DIPI | DESI | DLENDING | DTEMPMAX | DTEMPMIN | DPRE | DCER |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DEUA | 1 | |||||||||||

| DCOAL | −0.0123 | 1 | ||||||||||

| DBRENT | 0.1828 | 0.0140 | 1 | |||||||||

| DGAS | −0.0002 | 0.4264 | 0.2904 | 1 | ||||||||

| DELEC | −0.0979 | 0.6142 | 0.1147 | 0.8226 | 1 | |||||||

| DIPI | −0.0168 | 0.0369 | −0.1650 | 0.1563 | 0.1632 | 1 | ||||||

| DESI | 0.4072 | 0.0211 | 0.1755 | 0.0616 | 0.0324 | −0.1160 | 1 | |||||

| DLENDING | −0.0075 | 0.0602 | −0.0684 | −0.1223 | −0.1191 | 0.0439 | 0.0113 | 1 | ||||

| DTEMPMAX | −0.0997 | −0.2234 | 0.1764 | −0.4053 | −0.2891 | −0.2111 | −0.0841 | −0.1060 | 1 | |||

| DTEMPMIN | −0.1510 | −0.1788 | 0.0287 | −0.2968 | −0.1577 | −0.1014 | −0.0954 | −0.1267 | 0.8353 | 1 | ||

| DPRE | 0.0407 | 0.0776 | −0.0762 | 0.1322 | 0.1289 | 0.2574 | 0.0133 | 0.1067 | −0.4918 | −0.3473 | 1 | |

| DCER | 0.5234 | −0.0848 | 0.0842 | 0.0151 | −0.0550 | −0.2785 | 0.1732 | −0.1451 | 0.0999 | −0.0002 | −0.0464 | 1 |

| Sequences | Issues | Analysis Methods | Using Variables |

|---|---|---|---|

| 1 | Check the correct Lag order | SIC | Natural log |

| 2 | Check the time series stationarity | Unit-root test & ADF, PP Test | Natural log & Discrete log |

| 3 | Check the cointegration | Johansen Cointegration | Natural log |

| 4 | Find out the causality | Granger Causality Test | Discrete log |

| 5 | Measure the correlation | VECM estimation & Impulse Response Function | Natural log |

| 6 | Compare the relative correlation size | Forecast Error Variance Decomposition | Natural log |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | 518.4073 | N/A | 3.12 × 10−23 | −17.76868 | −17.33856 | −17.60152 |

| 1 | 1093.468 | 887.8132 | 9.28 × 10−30 | −32.89362 | −27.30211 * | −30.72057 |

| 2 | 1280.879 | 210.4257 | 3.94 × 10−30 | −34.41679 | −23.66389 | −30.23785 |

| 3 | 1531.401 | 175.8054 * | 8.70 × 10−31 * | −38.15443 * | −22.24014 | −31.96959 * |

| ADF | PP | |||

|---|---|---|---|---|

| p-Value | t-Statistic | p-Value | t-Statistic | |

| LEUA | 0.0356 | −3.055988 | 0.0422 | −2.984378 |

| LCOAL | 0.6827 | −1.167349 | 0.7379 | −1.027621 |

| LBRENT | 0.5959 | −1.359506 | 0.5579 | −1.437604 |

| LGAS | 0.2579 | −2.068355 | 0.3568 | −1.842875 |

| LELEC | 0.0599 | −2.833176 | 0.1257 | −2.479064 |

| LIPI | 0.9961 | 0.9997 | 0.103632 | 0.9634 |

| LESI | 0.2928 | −1.984367 | 0.3421 | −1.874023 |

| LLENDING | 0.9035 | −0.389219 | 0.9718 | 0.221042 |

| LTEMPMAX | 0.00111 | −3.529973 | 0.0139 | −3.425476 |

| LTEMPMIN | 0.0000 | −5.841264 | 0.00136 | −3.433459 |

| LPRE | 0.0001 | −5.030188 | 0.0004 | −4.622699 |

| LCER | 0.7961 | −0.853044 | 0.8835 | −0.499416 |

| ADF | PP | |||

|---|---|---|---|---|

| p-Value | t-Statistic | p-Value | t-Statistic | |

| DEUA | 0.0000 | −9.758254 | 0.0000 | −10.71395 |

| DCOAL | 0.0000 | −5.584956 | 0.0000 | −5.597697 |

| DBRENT | 0.0000 | −5.961247 | 0.0000 | −5.992281 |

| DGAS | 0.0001 | −5.04162 | 0.0001 | −4.976623 |

| DELEC | 0.0000 | −5.86215 | 0.0000 | −5.86215 |

| DIPI | 0.0000 | −8.654458 | 0.0000 | −12.33428 |

| DESI | 0.0001 | −4.953879 | 0.0001 | −4.952978 |

| DLENDING | 0.0343 | −3.073978 | 0.0000 | −9.62994 |

| DTEMPMAX | 0.0000 | −8.081471 | 0.003 | −3.972452 |

| DTEMPMIN | 0.0000 | −6.295002 | 0.0000 | −6.431096 |

| DPRE | 0.0000 | −9.445539 | 0.0000 | −13.173262 |

| DCER | 0.0000 | −7.758334 | 0.0000 | −8.75748 |

| Unrestricted Cointegration Rank Test (Trace) | ||||

|---|---|---|---|---|

| Hypothesized No. of CE(s) | Eigenvalue | Trace Statistic | 0.05 Critical Value | Prob. ** |

| None * | 0.8763 | 504.6197 | 334.9837 | 0.0000 |

| At most 1 * | 0.7711 | 383.3907 | 285.1425 | 0.0000 |

| At most 2 * | 0.6785 | 297.8750 | 239.2354 | 0.0000 |

| At most 3 * | 0.6197 | 232.0668 | 197.3709 | 0.0003 |

| At most 4 * | 0.5279 | 175.9949 | 159.5297 | 0.0046 |

| At most 5 * | 0.4738 | 132.4601 | 125.6154 | 0.0179 |

| At most 6 | 0.3973 | 95.22120 | 95.75366 | 0.0544 |

| At most 7 | 0.3846 | 65.85029 | 69.81889 | 0.0995 |

| At most 8 | 0.2759 | 37.69285 | 47.85613 | 0.3156 |

| At most 9 | 0.1792 | 18.97090 | 29.79707 | 0.4950 |

| At most 10 | 0.1216 | 7.519811 | 15.49471 | 0.5181 |

| At most 11 | 5.19 × 10−5 | 0.003010 | 3.841466 | 0.9547 |

| Unrestricted Cointegration Rank Test (Maximum Eigenvalue) | ||||

|---|---|---|---|---|

| Hypothesized No. of CE(s) | Eigenvalue | Trace Statistic | 0.05 Critical Value | Prob. ** |

| None * | 0.8763 | 121.2290 | 76.5784 | 0.0000 |

| At most 1 * | 0.7711 | 85.5157 | 70.5351 | 0.0012 |

| At most 2 * | 0.6785 | 65.8082 | 64.5047 | 0.0373 |

| At most 3 | 0.6197 | 56.0719 | 58.4335 | 0.0840 |

| At most 4 | 0.5279 | 43.5349 | 52.3626 | 0.2978 |

| At most 5 | 0.4738 | 37.2389 | 46.2314 | 0.3274 |

| At most 6 | 0.3973 | 29.3709 | 40.0776 | 0.4659 |

| At most 7 | 0.3846 | 28.1574 | 33.8769 | 0.2063 |

| At most 8 | 0.2759 | 18.7220 | 27.5843 | 0.4363 |

| At most 9 | 0.1792 | 11.4511 | 21.1316 | 0.6023 |

| At most 10 | 0.1216 | 7.5168 | 14.2646 | 0.4299 |

| At most 11 | 0.0001 | 0.0030 | 3.8415 | 0.9547 |

| Y | DCOAL | DBRENT | DGAS | DELEC | DIPI | DESI | DLENDING | DTEMPMAX | DTEMPMIN | DPRE | DCER | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| X | ||||||||||||

| DEUA | X ⇏ Y | X ⇏ Y | X ⇏ Y ** | X ⇏ Y *** | X ⇏ Y | X ⇏ Y | X ⇏ Y | X ⇏ Y | X ⇏ Y | X ⇏ Y | X ⇏ Y | |

| DEUA | Y ⇏ X | Y ⇏ X | Y ⇏ X | Y ⇏ X | Y ⇏ X | Y⇏X | Y ⇏ X | Y ⇏ X | Y ⇏ X | Y ⇏ X | Y ⇏ X | |

| [24] Phase 1 and 2 | [25] Phase 2 | Present Study Phase 3 | |

|---|---|---|---|

| DEUA ⇒ X | DEUA2 ⇒ DCOAL2 ** DEUA2 ⇒ DPOWER2 ** | DEUA ⇒ DCER ** | DEUA ⇒ DGAS ** DEUA ⇒ DELEC *** |

| X ⇒ DEUA | DOIL1 ⇒ DEUA1 ** DGAS ⇒ DEUA *** DPOWER2 ⇒ DEUA2 ** | DCER ⇒ DEUA ** |

| Error Correction | D(LEUA) | D(LCOAL) | D(LBRENT) | D(LGAS) | D(LELEC) | D(LIPI) | D(LESI) | D(LLENDING) | D(LTEMPMAX) | D(LTEMPMIN) | D(LPRE) | D(LCER) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CoinEq1 | −0.091056 ** | −0.02909 | −0.038545 | −0.018906 | 0.0161 | 0.006234 *** | −0.011087 *** | −0.005795 | 0.066666 | 0.421580 *** | 0.276651 ** | −0.037974 |

| (0.04532) | (0.01963) | (0.02785) | (0.02674) | (0.02885) | (0.00247) | (0.0279) | (0.00524) | (0.05011) | (0.10041) | (0.12648) | (0.04828) | |

| [−2.00912] | [−0.14822] | [−1.38377] | [−0.70699] | [0.55732] | [2.52391] | [−3.97473] | [−1.10685] | [1.33048] | [4.19860] | [2.18725] | [−0.78658] | |

| D(LEUA(−1)) | −0.246435 | −0.019550 | 0.009934 | 0.197111 * | 0.190458 * | −0.007794 | 0.005463 | −0.021163 | −0.167448 | −0.825691 ** | 0.144223 | −0.174448 |

| (0.18171) | (0.07869) | (0.11168) | (0.10722) | (0.11568) | (0.00990) | (0.01118) | (0.02099) | (0.20089) | (0.40257) | (0.50711) | (0.19356) | |

| [−1.35622] | [−0.24846] | [0.08895] | [1.83844] | [1.64635] | [−0.78698] | [0.48843] | [−1.00824] | [−0.83352] | [−2.05104] | [0.28440] | [−0.90127] | |

| D(LCOAL(−1)) | −0.013725 | 0.261666 | −0.118222 | 0.012572 | 0.221321 | 0.048508 ** | −0.038056 | −0.050976 | 0.220812 | −0.248014 | −1.753526 | −0.336411 |

| (0.42726) | (0.18502) | (0.26260) | (0.25211) | (0.27202) | (0.02329) | (0.02630) | (0.04936) | (0.47237) | (0.94660) | (1.19241) | (0.45513) | |

| [−0.03212] | [1.41425] | [−0.45020] | [0.04987] | [0.81363] | [2.08314] | [−1.44713] | [−1.03282] | [0.46745] | [−0.26201] | [−1.47057] | [−0.73916] | |

| D(LBRENT(−1)) | 0.215441 | 0.140627 | 0.321829 * | 0.069447 | 0.057995 | −0.012390 | 0.008501 | −0.058681 * | 0.113594 | 0.445976 | 0.785138 | 0.038809 |

| (0.27340) | (0.11839) | (0.16803) | (0.16132) | (0.17406) | (0.01490) | (0.01683) | (0.03158) | (0.30226) | (0.60571) | (0.76300) | (0.29123) | |

| [0.78801] | [1.18780] | [1.91528] | [0.43050] | [0.33319] | [−0.83156] | [0.50519] | [−1.85804] | [0.37581] | [0.73628] | [1.02901] | [0.13326] | |

| D(LGAS(−1)) | −0.389961 | −0.046329 | −0.238205 | 0.343399 | 0.158321 | −0.001003 | 0.07493 | 0.002106 | 0.429552 | 0.155370 | −1.638213 | 0.475428 |

| (0.48769) | (0.21119) | (0.29974) | (0.28776) | (0.31049) | (0.02658) | (0.03002) | (0.05634) | (0.53919) | (1.08049) | (1.36106) | (0.51950) | |

| [−0.79960] | [−0.21937] | [−0.79471] | [1.19333] | [0.50990] | [−0.03774] | [0.24964] | [0.03738] | [0.79667] | [0.14380] | [−1.20363] | [0.91516] | |

| D(LELEC(−1)) | 0.206852 | 0.049393 | 0.015659 | 0.013596 | 0.130542 | 0.000634 | −0.004748 | 0.019405 | −0.781744 | 1.394452 | 2.088369 | −0.359369 |

| (0.47924) | (0.20753) | (0.29454) | (0.28278) | (0.30511) | (0.02612) | (0.02950) | (0.05536) | (0.52984) | (1.06175) | (1.33746) | (0.51049) | |

| [0.43163] | [0.23801] | [0.05316] | [0.04808] | [0.42785] | [0.02426] | [−0.16098] | [0.35053] | [−1.47544] | [1.31335] | [1.56144] | [−0.70396] | |

| D(LIPI(−1)) | −0.525554 | 0.924336 | 0.987121 | −1.465294 | −0.305560 | −0.364519 *** | 0.067914 | 0.697356 *** | 3.700777 | 8.8110889 * | 7.621193 | −1.806517 |

| (2.40413) | (1.04108) | (1.47760) | (1.41856) | (1.53060) | (0.13103) | (0.14797) | (0.27772) | (2.65796) | (5.32635) | (6.70948) | (2.56093) | |

| [−0.21860] | [0.88786] | [0.66806] | [−1.03294] | [−0.19963] | [−2.78203] | [0.45897] | [2.51104] | [1.39233] | [1.65424] | [1.13588] | [−0.70541] | |

| D(LESI(−1)) | −0.994048 | −0.513154 | 0.387759 | −0.572071 | 0.124768 | 0.285791 ** | 0.179288 | 0.725675 *** | −2.242645 | 2.401617 | 10.31127 | −2.029063 |

| (2.30974) | (1.00021) | (1.41958) | (1.36287) | (1.47051) | (0.12588) | (0.14216) | (0.26681) | (2.55361) | (5.11723) | (6.44606) | (2.46038) | |

| [−0.43037] | [−0.51305] | [0.27315] | [−0.41976] | [0.08485] | [2.27031] | [1.26115] | [2.71979] | [−0.87823] | [0.46932] | [1.59962] | [−0.82469] | |

| D(LLENDING(−1)) | −0.244991 | −0.336282 | 0.391066 | −0.380389 | −0.088921 | 0.003200 | −0.033142 | −0.275302 ** | −0.15082 | 3.264887 | 4.254464 | −1.280798 |

| (1.08889) | (0.47153) | (0.66924) | (0.64250) | (0.69325) | (0.05934) | (0.06702) | (0.12578) | (1.20386) | (2.41244) | (3.03889) | (1.15991) | |

| [−0.22499] | [−0.71317] | [0.58434] | [−0.59204] | [−0.12827] | [0.05392] | [−0.49450] | [−2.18868] | [−0.12475] | [1.35336] | [1.40001] | [−1.10422] | |

| D(LTEMPMAX(−1)) | 0.211030 | 0.003397 | 0.144242 | 0.136085 | 0.061460 | −0.019323 | 0.046989 *** | 0.014126 | 0.904233 *** | 1.236196 | −1.799758 *** | 0.125350 |

| (0.25144) | (0.10888) | (0.15453) | (0.14836) | (0.16008) | (0.01370) | (0.01548) | (0.02905) | (0.27798) | (0.55706) | (0.70171) | (0.26784) | |

| [0.83929] | [0.03120] | [0.93339] | [0.91725] | [0.38394] | [−1.41007] | [3.03631] | [0.48633] | [3.25282] | [2.21915] | [−2.56480] | [0.46801] | |

| D(LTEMPMIN(−1)) | −0.132595 | 0.007440 | −0.036958 | −0.058476 | −0.007237 | 0.004188 | −0.018677 *** | −0.003647 | −0.103932 | −0.116912 | 0.400062 | −0.024429 |

| (0.09497) | (0.04113) | (0.05837) | (0.05604) | (0.06046) | (0.00518) | (0.00585) | (0.01097) | (0.10500) | (0.21041) | (0.26504) | (0.10116) | |

| [−1.39618] | [0.18092] | [−0.63318] | [−1.04353] | [−0.11970] | [0.80905] | [−3.19519] | [−0.33242] | [−0.98986] | [−0.55565] | [1.50943] | [−0.24148] | |

| D(LPRE(−1)) | −0.039022 | 0.020735 | 0.010080 | 0.025071 | 0.024911 | −0.007271 | 0.001198 | −0.009930 | 0.227571 *** | 0.462331 *** | −0.537683 *** | 0.033971 |

| (0.05427) | (0.02350) | (0.03335) | (0.03202) | (0.03455) | (0.00296) | (0.00334) | (0.00627) | (0.06000) | (0.12023) | (0.15146) | (0.05781) | |

| [−0.71904] | [0.88228] | [0.30221] | [0.78293] | [0.72099] | [−2.45833] | [0.35870] | [−1.58391] | [3.79288] | [3.84523] | [−3.55008] | [0.58764] | |

| D(LCER(−1)) | 0.097043 | 0.020851 | −0.102998 | −0.051150 | −0.012785 | −0.0008846 | −0.006234 | 0.013348 | −0.211037 | 0.022758 | 0.200962 | 0.08337 |

| (0.17338) | (0.07508) | (0.10656) | (0.10230) | (0.11038) | (0.00945) | (0.01067) | (0.02003) | (0.19168) | (0.38411) | (0.48386) | (0.18468) | |

| [0.55973] | [0.27773] | [−0.96659] | [−0.5000] | [−0.15583] | [−0.08952] | [−0.58415] | [0.66648] | [−1.10098] | [0.05925] | [0.41553] | [0.04514] | |

| C | 0.016433 | 0.001411 | −0.010603 | −0.001009 | −0.000152 | 0.001422 | 0.003159 ** | −0.017318 *** | 0.001768 | 0.051841 | −0.003720 | −0.020630 |

| (0.02498) | (0.01082) | (0.01536) | (0.01474) | (0.01591) | (0.00136) | (0.00154) | (0.00289) | (0.02762) | (0.05535) | (0.06972) | (0.02661) | |

| [0.65773] | [0.13043] | [−0.69049] | [−0.06842] | [−0.00956] | [1.04438] | [2.05402] | [−6.02149] | [0.06400] | [0.93659] | [−0.05335] | [−0.77518] |

| Period | LEUA | LCOAL | LBRENT | LGAS | LELEC | LIPI | LESI | LLENDING | LTEMPMAX | LTEMPMIN | LPRE | LCER |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0.1503 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 2 | 0.1128 | 0.010228 | 0.002909 | −0.001906 | 0.026027 | −0.004590 | −0.002514 | 0.001016 | 0.009587 | −0.004708 | 0.004781 | 0.018265 |

| 3 | 0.1226 | 0.018332 | −0.002673 | 0.004038 | 0.026091 | 0.012923 | 0.005688 | 0.012636 | 0.007304 | 0.002375 | 0.017556 | 0.016493 |

| 4 | 0.1223 | 0.033115 | 0.010419 | 0.016110 | 0.038394 | 0.014467 | 0.012947 | 0.015878 | 0.007499 | −0.000733 | 0.015161 | 0.018367 |

| 5 | 0.1313 | 0.030091 | 0.012082 | 0.013477 | 0.036213 | 0.013069 | 0.017890 | 0.011770 | 0.012878 | −0.003199 | 0.014196 | 0.014978 |

| 6 | 0.1287 | 0.026963 | 0.011923 | 0.009453 | 0.034111 | 0.015323 | 0.015660 | 0.013488 | 0.015306 | −0.005569 | 0.018222 | 0.014144 |

| 7 | 0.1270 | 0.026395 | 0.011802 | 0.008399 | 0.034236 | 0.019598 | 0.016426 | 0.016343 | 0.015853 | −0.004163 | 0.019346 | 0.013657 |

| 8 | 0.1266 | 0.027624 | 0.012692 | 0.008637 | 0.035270 | 0.019641 | 0.018476 | 0.016527 | 0.016388 | −0.004329 | 0.018364 | 0.013380 |

| 9 | 0.1275 | 0.026430 | 0.012614 | 0.007577 | 0.034368 | 0.019317 | 0.018954 | 0.015631 | 0.017332 | −0.005146 | 0.018306 | 0.012775 |

| 10 | 0.1268 | 0.025286 | 0.012297 | 0.006434 | 0.033549 | 0.019673 | 0.018376 | 0.015859 | 0.017733 | −0.005345 | 0.018802 | 0.012502 |

| Period | S.E. | LEUA | LCOAL | LBRENT | LGAS | LELEC | LIPI | LESI | LLENDING | LTEMPMAX | LTEMPMIN | LPRE | LCER |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0.1503 | 100.0000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 2 | 0.1913 | 96.46838 | 0.285707 | 0.023113 | 0.009919 | 1.850122 | 0.057548 | 0.017256 | 0.002819 | 0.251019 | 0.060551 | 0.062420 | 0.911150 |

| 3 | 0.2317 | 93.79530 | 0.820688 | 0.029065 | 0.037129 | 2.529380 | 0.350265 | 0.072021 | 0.299315 | 0.270514 | 0.051795 | 0.616592 | 1.127934 |

| 4 | 0.269910 | 89.67312 | 2.110147 | 0.170439 | 0.383602 | 3.887620 | 0.545444 | 0.283179 | 0.566682 | 0.276573 | 0.038912 | 0.769933 | 1.294348 |

| 5 | 0.3064 | 87.96303 | 2.602275 | 0.287777 | 0.491200 | 4.414179 | 0.605276 | 0.560715 | 0.587390 | 0.391314 | 0.041101 | 0.812219 | 1.243519 |

| 6 | 0.337677 | 86.94991 | 2.779839 | 0.361569 | 0.482733 | 4.654338 | 0.704204 | 0.676660 | 0.643117 | 0.527607 | 0.061038 | 0.959832 | 1.199152 |

| 7 | 0.366054 | 86.03723 | 2.885482 | 0.411630 | 0.463437 | 4.835419 | 0.885898 | 0.777170 | 0.746598 | 0.636531 | 0.064872 | 1.096103 | 1.159628 |

| 8 | 0.392519 | 85.23020 | 3.004783 | 0.462543 | 0.451465 | 5.012767 | 1.020837 | 0.897458 | 0.826593 | 0.727903 | 0.068580 | 1.172152 | 1.124716 |

| 9 | 0.417391 | 84.70036 | 3.058336 | 0.500389 | 0.432217 | 5.111164 | 1.116989 | 0.999908 | 0.871272 | 0.816175 | 0.075850 | 1.228984 | 1.088350 |

| 10 | 0.440558 | 84.31624 | 3.074561 | 0.527060 | 0.409280 | 5.167639 | 1.202009 | 1.071493 | 0.911626 | 0.894608 | 0.082803 | 1.285254 | 1.057423 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chung, C.Y.; Jeong, M.; Young, J. The Price Determinants of the EU Allowance in the EU Emissions Trading Scheme. Sustainability 2018, 10, 4009. https://doi.org/10.3390/su10114009

Chung CY, Jeong M, Young J. The Price Determinants of the EU Allowance in the EU Emissions Trading Scheme. Sustainability. 2018; 10(11):4009. https://doi.org/10.3390/su10114009

Chicago/Turabian StyleChung, Chune Young, Minkyu Jeong, and Jason Young. 2018. "The Price Determinants of the EU Allowance in the EU Emissions Trading Scheme" Sustainability 10, no. 11: 4009. https://doi.org/10.3390/su10114009

APA StyleChung, C. Y., Jeong, M., & Young, J. (2018). The Price Determinants of the EU Allowance in the EU Emissions Trading Scheme. Sustainability, 10(11), 4009. https://doi.org/10.3390/su10114009