1. Introduction

The recent financial crisis showed the damage that a disordered banking failure can cause to the real economy. So far, we have seen the use of public funds to resolve troubled entities as the preferred way to deal with banking failures. This has proven to be an unsustainable strategy which entails very high costs for society [

1].

Due to the severe impact in social welfare and economic growth of the Global Financial Crisis, governments and regulatory agencies around the world began to work on a new regulatory framework designed to be more sustainable. This led to an in-depth update of the banking rules, including a review of the Basel framework with the release of Basel III [

2]. Moreover, several additional regulations such as the Total Loss Absorption Capacity [

3] or the Minimum Requirement of Eligible Liabilities [

4] were proposed. This new regulatory framework gives the necessary tools to supervisory and resolution agencies to ensure that losses arising in the banking sector will be borne by the bank’s shareholders and creditors and not by taxpayers [

5].

This article aims to obtain relevant conclusions on the current status of the literature on the topic of capital and loss absorption requirements. While the literature on capital requirements is large and provides valuable outputs on increasing the effectiveness of bank capital regulation, in this study we observe that academic literature on loss absorption requirements is still in its early stages. The paramount importance of the contributions from academia to governments and regulators for the design of an effective loss absorption framework justifies the relevance of this work.

We have chosen ProKnow-C as a methodology for this work. ProKnow-C allows one to build up a bibliographic portfolio systemizing the selection of articles and hence reducing the selection bias [

6]. Furthermore, ProKnow-C proposes to develop a bibliometric and systemic analysis with the ultimate goal of proposing a research agenda. This methodology has been increasingly used for the production of literature reviews and other exploratory and descriptive works [

7,

8]. Furthermore, this work contributes to the development of this methodology by adding a new module to the original framework. The methodological improvement proposed in this study reduces the likelihood of relevant articles being discarded or excluded from the final portfolio by using a cross-reference extension method (snowball-effect).

This study suggests that increasing banks’ loss absorption requirements could potentially have spill-over effects on the real economy. We conclude this work by providing a set of research axes to be developed in order to design a loss absorption framework tight enough to mitigate the impacts of a potential financial crisis, but without damaging ex-ante the real economy by hampering the banking sector. Therefore, the results revealed in this paper are key to the development of a more sustainable banking resolution framework.

This paper is composed of six sections including this introduction. In section two we describe the theoretical framework. Section three elaborates on the research methodology, while in section four we present the results of the bibliometric and the systemic analyses. Then the discussion section follows, and finally section six concludes.

2. Theoretical Framework

The maturity transformation risk that banks shoulder makes the banking business intrinsically risky [

9]. It is shown by the law of large numbers that banks can perform their activities of collecting short-term deposits and lending at long maturities without distortions in a stable and benign scenario [

9]. However, in moments of irrational panic, the law of large numbers fails, leading to a situation of insolvency as a result of a shortfall of liquidity, when suddenly a significant number of deposits are withdrawn at the same time—a bank run.

In order to avoid bank runs and with the ultimate goal of preserving the critical functions of banking, a safety net around the banking sector has been established. As defined by Berger et al. (1995), the term “safety net” refers to all government actions, excluding regulation and supervision, designed to enhance the safety and soundness of banks [

10].

As explored in many research papers [

11,

12,

13], the safety net leads to a moral hazard problem, incentivizing banks to bear more than a socially optimal level of risk and substantially increasing the probability of a banking crisis.

The complexities and systemic risk issues linked to banks’ defaults lead to the governments’ implicit promise of bailing out troubled entities when they become insolvent. Furthermore, the larger the banks’ total assets, generally the more difficult their liquidation, leading to the well-known problem of “Too Big To Fail” [

14]. Therefore, in addition to the safety net, the implicit promise of bailout exacerbates the moral hazard problem, increasing both banks’ risk appetite and their probability of default. Hence, this represents a major threat to the real economy and the stability of the financial system.

Basel standards were designed to reduce systemic instability and bank failures. The first Basel accord was introduced in 1988 [

15] following the Herstatt Bank default in 1973 and the Savings and Loans crisis during the decade of the 1980s. However, the Basel I accord was severely criticized due to its low sensitivity towards the riskiness of the different banks’ exposures and on the possibility of inducing banks to carry out regulatory arbitrages [

16,

17]. Moreover, the possibility that Basel I triggered the credit crunch which affected the US economy during the decade of the 1990s has been discussed [

18]. As a result of the weaknesses linked to the Basel I framework, in 2004 an updated version of Basel accords, known as Basel II, was released [

19]. Basel II is structured in three main pillars: (i) Minimum capital requirements; (ii) Supervisory review; and (iii) Market discipline. However, the Global Financial Crisis unveiled the significant flaws linked to this updated regulatory framework. As a result, capital requirements are significantly strengthened in terms of both quantity and quality with the release of Basel III in 2010 [

2]. More recently, the critiques linked to the variability of advanced models when determining the capital consumption of bank’s exposures led the Basel Committee on Banking Supervision to review once again the regulatory framework and to release an updated version in late 2017 [

20].

On the back of the introduction of Basel accords, an intense debate within the academic world started. The academic literature reveals a trade-off between costs and benefits derived from imposing capital requirements to the banking sector [

21,

22,

23]. Most of the authors on the topic tend to agree with the fact that amongst the main benefits of capital requirements there are: A decrease in banks’ default probability and a reduction of costs linked to financial instability [

21,

24,

25].

On the other hand, academic literature also states that not all of the effects linked to higher capital requirements are positive. One of the main criticisms of capital requirements is the potential increase in funding costs that banks face on the back of stringent capital regulation. In turn, the increase in the banks’ cost of funding is transferred to the real economy, resulting in a slowdown of the economic growth [

25,

26,

27].

In line with the above, it is worth highlighting the work developed by Modigliani and Miller in the late 1950s, which as of today still constitutes the framework on which the cost of capital theory is based. The Modigliani-Miller theorem (M&M) points out that in a frictionless world, the design of the capital structure is irrelevant [

28]. Therefore, in line with M&M, increasing the minimum level of capital requirements should not have any effect either on banks’ performance or on the real economy. However, banks do not develop their activities in a frictionless world [

11]. As defined by Berger et al. (1995), amongst the frictions that make capital structure relevant we highlight: (i) Costs of financial distress—which are particularly relevant in the banking sector; (ii) taxation—since interest payments are tax deductible but dividends are not, making the substitution of debt by equity not optimal for shareholders; (iii) transaction costs; (iv) asymmetry of information; and (v) specific sector regulation.

Hence, since the M&M propositions seem not to fully apply to banks [

29], it is expected that forcing banks to hold a minimum level of capital above what is described as “market capital requirement” by Berger et al. (1995), could lead to side effects impacting directly both banks and the real economy.

In addition to the capital requirements, the new regulatory framework makes special mention to avoid the use of public funds to recapitalize banks. Until the Global Financial Crisis, “bailouts” were the standard method to recapitalize banks. With the new regulation in place, “bailouts” have been replaced by “bail-ins”. This means that from now on, in case of insolvency, banks’ shareholders and debt holders will be the ones in charge of absorbing any potential losses and recapitalizing the banking sector.

However, recent banking failures in Europe, such as the case of the Spanish bank Banco Popular [

30] or the precautionary recapitalization of the Italian lender Monte dei Paschi di Siena [

31], have shown that complying with capital requirements does not guarantee an orderly resolution of an entity in case of need.

In order to ensure that a bail-in is indeed credible and feasible, it is necessary to ensure that banks hold a minimum level of bail-in-able instruments easily written-down or convertible into equity. For that matter, loss absorption requirements have been proposed [

3,

4]. Loss absorption capacity ensures that resolution authorities will be able to use the banks’ own funds and certain types of liabilities to absorb losses and recapitalize the bank when the entity is deemed failing or likely to fail. This procedure should be done in an orderly manner, without contagion to other segments of the economy and with no use of public funds [

5].

Relying on this regulatory framework, this paper seeks to identify knowledge gaps in the academic literature and to propose a research agenda in order to better understand the implications of the loss absorption requirements to the real economy.

3. Methodology

The methodology chosen to perform a structured and unbiased analysis of the current status of the academic literature on the subject of capital and loss absorption requirements is ProKnow-C [

6]. An increasing use of the ProKnow-C methodology has been witnessed in several research areas, such as management of public services [

32], management and business [

33] and mobile computing [

8], amongst others. ProKnow-C is, in our view, a particularly useful method for descriptive and exploratory analyses such as literature reviews or research agendas. Next, we elaborate on the application of ProKnow-C and we extend the original method with an additional module which allows one to build-up a more comprehensive final bibliographic portfolio thanks to further exploring the papers quoted in our initial portfolio (snow-ball effect).

ProKnow-C is divided in four main steps: (1) Build-up of a bibliographic portfolio; (2) bibliometric analysis of the portfolio; (3) systematic analysis and (4) definition of a research agenda and main objectives [

34]. This paper is an example of a complete application of this research methodology to the field of banking crises resolution and the impact of new regulation on the real economy.

In order to select final constituents of the bibliographic portfolio, a threefold approach was followed, consisting of: (a) Creating a gross bibliographic portfolio; (b) filtering and obtaining a net bibliographic portfolio, and (c) applying a methodological innovation to explore cross-reference data to obtain the final bibliographic portfolio.

Figure 1 synthesizes the main steps of this methodology.

The first stage consists of creating the gross bibliographic portfolio by establishing research definitions. Therefore, at this stage we defined the initial criteria that will be used to obtain the gross stock of references (gross portfolio).

In line with ProKnow-C, the definition of the research axes and the key words linked to each one was the first step in this methodology. While in the case of capital requirements the academic literature is sizeable, this is not the case for loss absorption requirements. Regarding the latter, non-academic research has been growing substantially in the last few years, with contributions from the Financial Stability Board, the Bank for International Settlements and the European Banking Authority amongst others. However, as addressed at a later stage of this work, the existing non-academic literature is not developed enough to cover relevant topics that should be further studied from a pure academic research angle. It is worth highlighting that the current non-academic literature has been useful for this work, particularly for methodological purposes and especially to define the research axes and keywords. Capital requirements and loss absorption requirements are two concepts of paramount importance with regard to the subject under study; hence these concepts were used as research axes in our methodology. The key words related to loss absorption have been selected on the basis of relevance and frequency of use in the current non-academic literature. In the case of capital requirements, we relied on existing academic literature for choosing the key-words. Next, we show the two research axes and keywords:

The next step consisted of running Boolean searches in Web of Science and Scopus databases combining the keywords abovementioned. Initially we found 4166 results in Web of Science database and 5145 in Scopus.

Following ProKnow-C methodology, the second stage consisted of filtering the gross selection of articles (gross portfolio) in order to obtain the final bibliographic portfolio. This second stage was subdivided in six additional steps: (i) Filter duplicates; (ii) filter by publication date; (iii) filter by title; (iv) filter by abstract; (v) filter by scientific relevance; and (vi) filter by full article alignment. After performing these filters, a bibliographic portfolio of 186 articles is obtained.

The final step represents a methodological innovation that we introduce in this paper. The alternative that we propose consists of adding a cross-reference module to the original ProKnow-C framework as can be observed in

Figure 1. This methodological upgrade allows the expansion of the initial bibliographic portfolio by adding articles found within the references of the initial net portfolio. We ran this cross-reference search two times, increasing the final portfolio from 186 references to 241.

We conclude this section by mentioning the potential limitations of the portfolio obtained. The literature on the topic is extremely large, making the task of defining the boundaries of the final portfolio very difficult. Therefore, we consider that the potential authors’ biases when applying filters to the gross portfolio could have an impact on the final sample, although in a lower measure thanks to the use of ProKnow-C methodology.

5. Discussion

After the release of the Basel I accords, the frequency of articles published on the topic of bank capital regulation by prestigious journals increased dramatically.

Figure 2 shows that both the volume of publications and cites per article surged from the mid-1990s onwards. Interestingly, however, during the years before the start of the Global Financial Crisis (GFC) the number of papers on the topic declined, observing a boost just after the beginning of the crisis. At present, the interest in the subject is very high, with 19 articles in our portfolio being published in 2017, 16 articles in 2016 and 21 articles in 2015. This compares with an average number of articles published per year of 8.6 during the period from 1995 to 2014. Nonetheless, despite the increase in the frequency of publications after the GFC, we observe that the works that build-up the theoretical framework were mainly published in the period from 1988 to 2000.

In line with the above, the most relevant articles included in our portfolio by number of citations are: “A theory of bank capital” [

24] with 1363 citations, “Risk in banking and capital regulation” [

25] with 1153, “The role of capital in financial institutions” [

11] with 1037, and “The relationship between capital and earnings in banking” [

10] with 1022. Amongst the main contributions of these articles to the academic literature, we highlight: The definition of a theoretical banking framework and the definition of theoretical models justifying the existence and need of regulatory bank capital requirements.

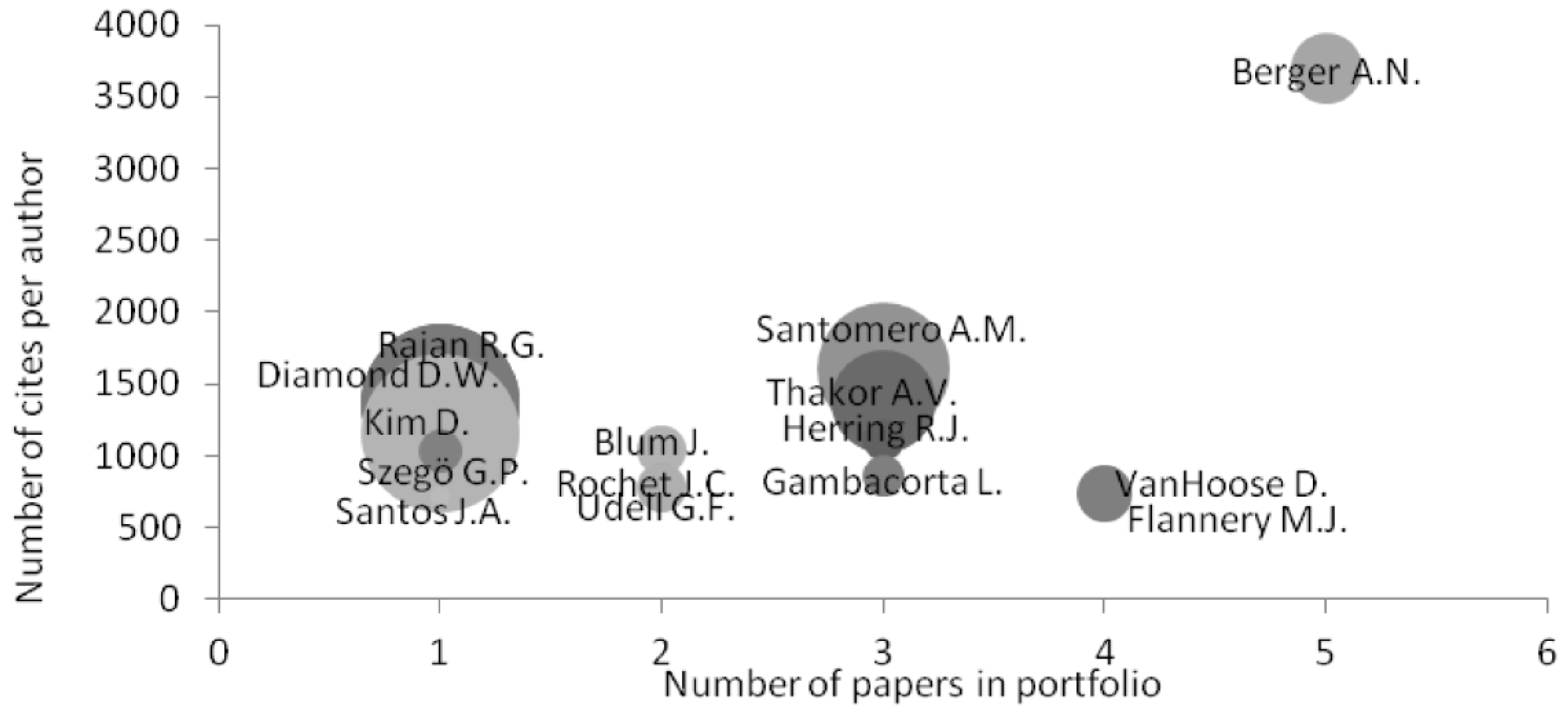

In our final portfolio we find 422 different authors, with the authors with a higher representation being Berger A.N. with five articles, followed by Evanoff D.D., Flannery M.J., Gale D., Repullo R., VanHoose D., and Wall L.D with four articles each. In terms of citations per author, the most prominent author is Berger A.N. with 3691 citations, followed by Santomero A.M. with 1607, Thakor A.V. with 1380 and Diamond and Rajan with 1363 each. In particular, the relevance ratio plotted in

Figure 2 allows us to synthesize the information on author’s relevance, showing that Berger A.N. remains the most prominent author in this area also using this bibliometric measure. Five papers from this author are included within our final bibliographic portfolio with 3691 citations in aggregate. Santomero A.M. and Thakor A.V. with three articles each, and 1607 and 1380 citations respectively follow. These authors are closely followed by D. Diamond and R. Rajan (with 1363 citations) with their work “A theory of bank capital” [

24].

All in all, the scientific relevance of the portfolio under study has proven to be high, with an average number of citations per article amounting to 131 and covering research papers from more than 400 different authors. Furthermore, the average 5-year impact factor of the portfolio is 2.08, including the Journal of Finance, the Review of Financial Studies and the American Economic Review, the three journals with a higher 5-year impact factor with 19.63, 13.38 and 10.34 respectively.

Table 1 in particular shows that the Journal of Banking and Finance is the most prominent journal with 37 articles. This is followed by the Journal of Financial Stability with 15 articles, the Journal of Financial Intermediation with 11, the Journal of Finance with nine and the Journal of Money Credit and Banking with eight. It should be noted that all these articles are classified as Q1 in the categories of Finance or Economics, with a 5-year impact factor ranging from 1.495 in the case of Journal of Financial Stability to 19.63 in the case of Journal of Finance.

As observed in

Table 2, the most frequent keywords are “Capital requirements” with 26 appearances, followed by “Bank capital” with 25 appearances and “Bank regulation” with 22. Financial crisis, Banking, Basel III, and Capital regulation are also keywords seen in the articles that compose our portfolio with a higher frequency than the average.

As per the results obtained in the systematic analysis, the literature on the topic seems to point out that the continuous failures of banking regulation to prevent financial instability events led researchers to: (i) Engage in a debate in order to reinforce the financial regulatory framework; and (ii) find theoretical explanations of why past regulations fell short to prevent banking crises [

17,

38]. Furthermore, the frequent updates on banking regulation and the wave of criticisms that tend to follow them led the academia to elaborate on the expected impacts on the economy of any regulatory change [

18,

39]. This is in line with our findings, which are synthesized in

Table 3, and where it can be seen that the most frequent types of studies involve either a theoretical-qualitative approach or an empirical-quantitative one.

In

Table 3, it can also be observed that most of the quantitative studies are related to developed economies. This can be explained since developed economies have usually been the first to force banks to comply with the latest regulatory changes, and therefore they are richer in terms of data availability. In addition, the level of detail and public disclosure of financial and regulatory data from developed economies has also contributed to the publication of further research in these regions, as we show later. Finally, we also consider that the concentration of researchers and research centers on financial stability issues in the US and Europe is also a key element that explains why most of quantitative studies are focused on developed economies [

37].

In particular, we see that only 12 articles are focused on emerging market economies. Nine of them are quantitative studies and three of them combine qualitative and quantitative approaches. Concetta Chiure et al. (2012) suggests that there is currently a gap in the academic literature regarding the implications of regulatory requirements in emerging market economies [

40]. Since the banking systems in advanced and developing economies differ, the impacts of capital requirements are also different and, therefore, it is in the interest of global financial stability to understand its impact also in developing countries [

40]. In line with this, further qualitative work applied to emerging market economies is probably needed.

On a different note, results arising from the systematic analysis reveal significant conclusions about the current status of the literature on capital and loss absorption requirements and their impacts on the real economy.

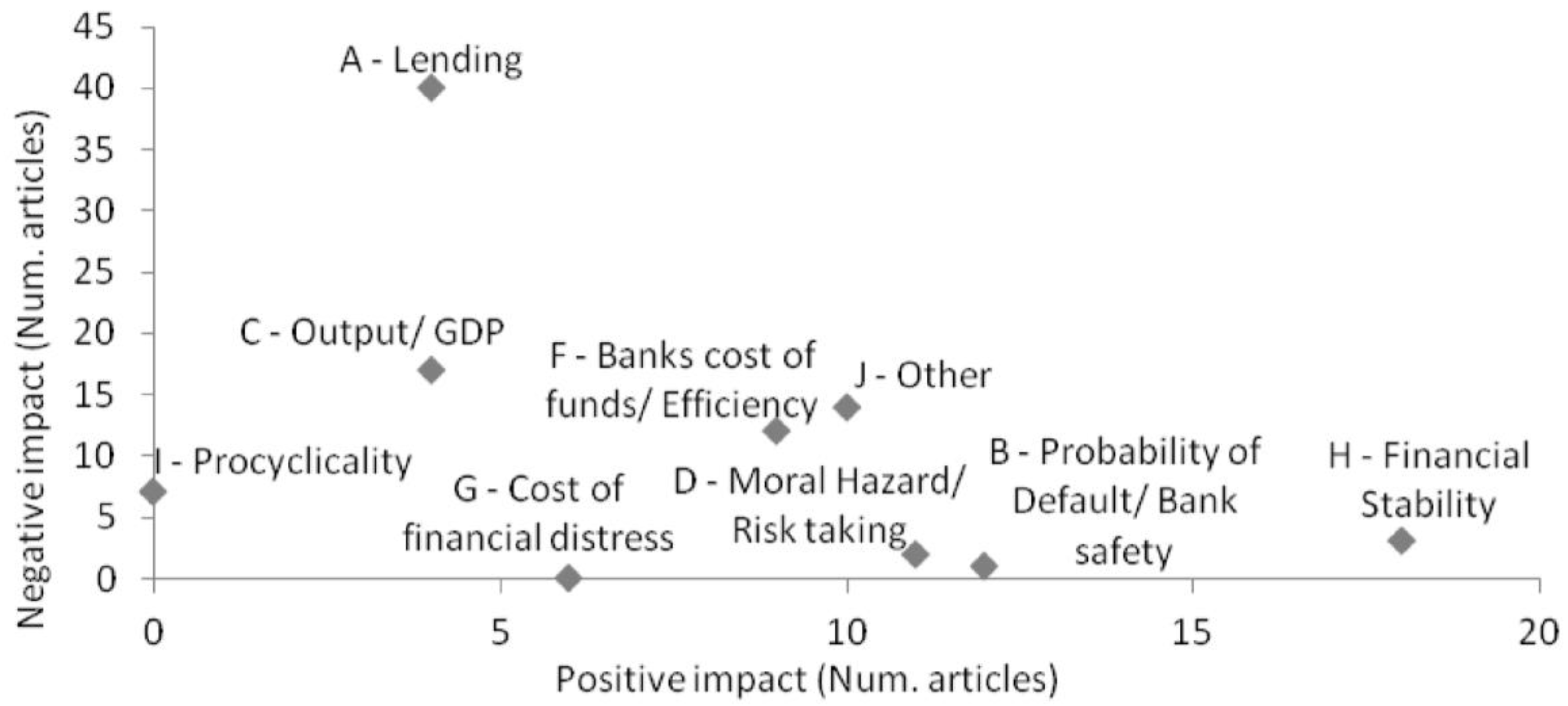

In particular, focusing first exclusively on capital requirements,

Figure 4 reveals the existence of a trade-off between their benefits and costs. Amongst the main benefits, the literature on the topic finds that capital requirements: (i) Reduce the costs of financial distress and increase the ability to force the borrower to repay or its willingness to repay [

24]; (ii) encourage additional prudence at management level reducing moral hazard [

25]; (iii) reduce the probability of banking crises and the output volatility [

41]; and (iv) increase financial stability [

23].

On the negative side, the existing literature points out that capital requirements also have significant adverse effects on the real economy, with the reduction of lending volumes being the most relevant. In particular, as much as 40 out of the 84 articles that analyze the impact of capital requirements point out that the increase in lending rates and the decline in lending volumes are direct consequences of forcing banks to hold minimum regulatory capital [

42,

43]. Other negative impacts are: (i) Distortion on banks’ loans portfolio, reduction of economic growth, and higher funding costs for banks [

25,

27].

Van den Heuvel is particularly critical of the function of capital requirements, stating that the welfare costs of capital requirements are surprisingly large [

12]. In the same tone, Baker and Wurgler suggest that capital requirements have a negative impact on investment and growth, and contribute to the development of the shadowing banking sector [

44].

However, it is worth mentioning that most authors ultimately defend the use of capital requirements in the banking industry, since according to them, after weighing social benefits and costs, strict capital requirements still remain desirable. Berger et al. (1995) are in line with this rationale, highlighting that financial innovations allowed other non-bank competitors to satisfy their credit needs. Therefore, this suggests that capital requirements’ negative effects could be less severe for the economy than initially was thought [

11]. On the negative side, however, the authors also state that risk-weighted assets’ methodology significantly affects the composition of banks’ portfolios, encouraging them to increase its holding of 0% risk-weighting assets (RWA) and declining the percentage of assets with higher RWA in their portfolios. This could lead, according to the authors, to a credit crunch.

Our analysis also confirms that different authors seem to reach similar conclusions on most of the topics. Proof of this is that no articles are plotted in the “contradictory zone” located on the top right part of

Figure 4. The major discrepancies between the authors’ conclusions are linked to financial stability and the cost of banks’ funds and banks’ efficiency. Regarding the former, there is some controversy between authors that consider that increasing capital requirements has positive impacts on financial stability [

21,

27], while other authors highlight that increasing capital requirements could have a negative impact for the banking system as a whole [

45,

46]. All in all, we can conclude that research on capital requirements is well developed, while the main gap in the literature is linked to loss absorption requirements, as we can observe from

Table 5.

On that note, the Dodd–Frank Act signed in July 2010 opened the door to significant changes in banking regulation, particularly with regard to the procedures linked to the resolution of troubled entities [

47]. The literature on loss absorption capacity published by regulatory bodies and international organizations such as the International Monetary Fund, the Bank for International Settlements and the Financial Stability Board is at present more developed than the academic literature. In particular, on the subject of loss absorption capacity, the Financial Stability Board released the Key Attributes of Effective Resolution Regimes for Financial Institutions [

48] and the final term sheet for the Total Loss Absorption Capacity (TLAC) [

3]. In turn, in Europe a similar loss absorption requirement was proposed: The Minimum Requirement for Eligible Liabilities and Own Funds (MREL), included in the Bank Recovery and Resolution Directive [

4]. These proposals and regulatory texts were followed by different studies such as a quantitative impact of TLAC led by the FSB and the BIS [

49] and the final report on MREL published by the European Banking Authority (EBA) [

50]. The World Bank and the IMF also elaborated on the use of the bail-in policy [

51,

52]. More recently, the Single Resolution Board (SRB) and the EBA released two additional documents addressing the topic of loss absorption capacity in Europe [

53,

54]. These new developments in banking rules were also followed by academics with the release of several papers on the topic during the early days of this new regulatory framework. This proves the efforts and the paramount importance that this topic represents for academic researchers [

55,

56]. However, as this work points out, the current status of the academic literature on the topic is neither as sizeable nor as deep as it should be in order to fully understand the strengths and potential side effects of the new banking resolution framework.

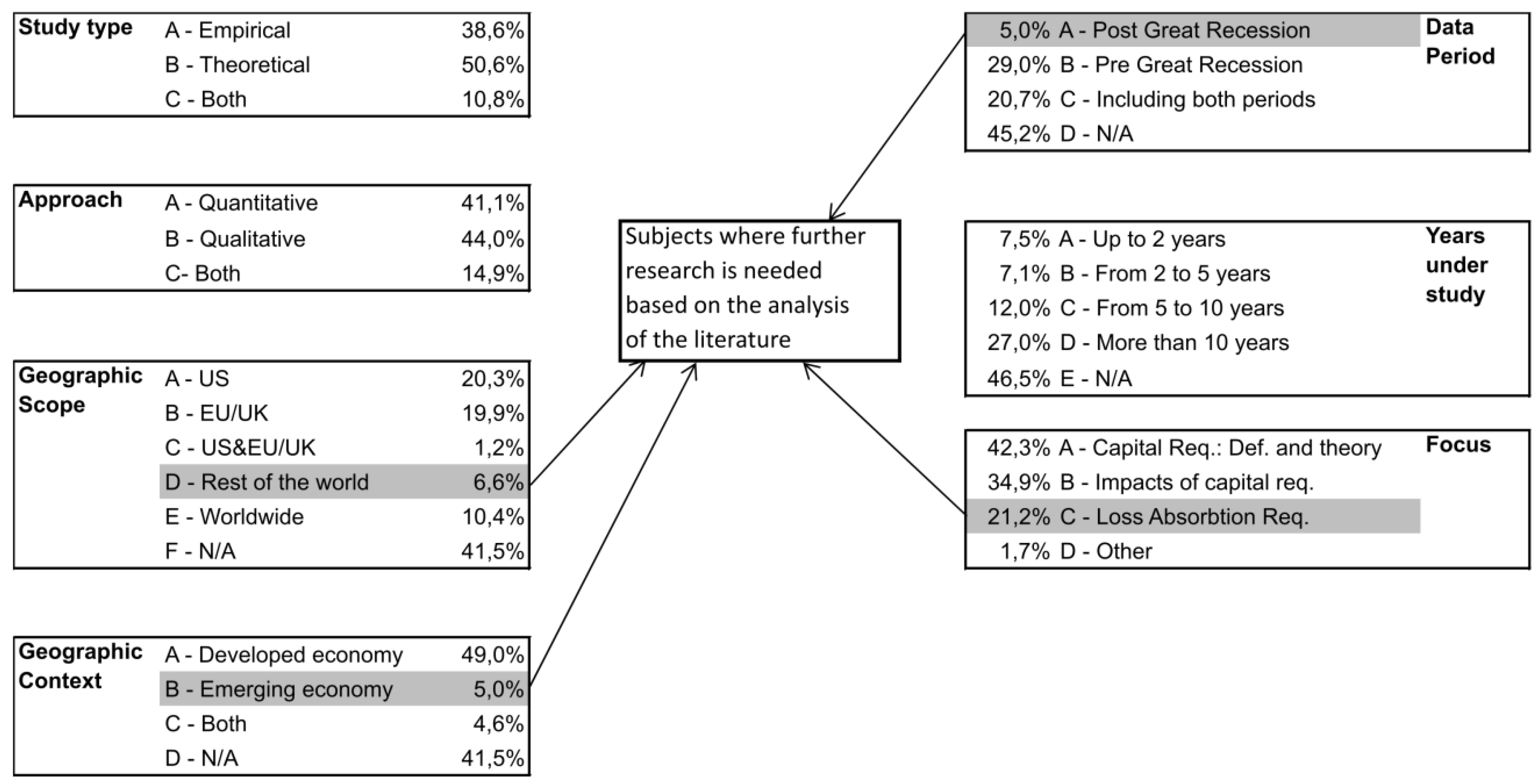

In line with this,

Table 5 sheds light on the most recurrent topics under analysis. As much as 77% of the articles included in our final portfolio elaborate on the topic of capital requirements, with 42% of those articles focused on the definition and theory of capital requirements, while 35% are focused on finding empirical evidence of the impacts of such requirements on the economy. Articles focused on loss absorption requirements analyze the topic mainly from a theoretical and conceptual point of view (21%).

From a broader perspective, and as can also be seen in

Table 5, most of the articles included in our final portfolio follow a quantitative approach or a combination of both approaches. Focusing on these articles, we find that most of them (70) use data from before the Global Financial Crisis, while just 12 references are using data obtained after 2007–2008. Interestingly, 50 articles are focused on both pre-2007 Global Financial Crisis and also the period following. Out of the articles combining data from both periods, around 75% of them follow a quantitative approach. Generally, these articles add significant value to the academic literature since they are able to calibrate the real impact of the Global Financial Crisis. Furthermore, these articles tend to also shed light on the impact of the regulatory regimes that came into force after the GFC, comparing them to the pre-crisis ones [

57,

58,

59].

In line with this point, in

Table 4 we show the type of data used in the different works. It can be observed that most of the articles that use real data obtain it from the companies’ financial statements (48 out of the total). More specifically, the sources of these data tend to be Bankscope in most of the cases, although in other cases researchers look for the information directly on the company’s annual accounts. In some cases, we also find that data is obtained as a combination of different data types. The most recurrent data combination is financial statements with macro and/or regulatory data, and can be found in 20 articles. This combination is usually enough to determine most of the relevant impacts of banking regulation in the real economy, since financial statements’ data provide balance-sheet and capital data, while macro and regulatory data provide aggregate data in terms of lending evolution, GDP, and capital requirements amongst others. We observe that 113 articles are not using any type of data. Most of these articles are theoretical, following a qualitative approach.

This work highlights several areas where further academic research is potentially needed. The main results are compiled in

Figure 5. On the one hand, only 5% of the total of articles use exclusively post-GFC data. Given the significant changes that the financial industry faced after the Global Financial Crisis, we think it is important to increase the number of analyses focusing exclusively in post-2007 data. On the other hand, with regard to geographic scope and context, we note a shortfall in articles elaborating on the impact of regulatory requirements in emerging economies.

Finally, concerning the focus of the articles, the vast majority of the academic literature is focused on capital requirements. We consider it extremely relevant to focus on loss absorption capacity in order to increase our understanding of how banks would be able to cope with future financial crises without the use of public funds to recapitalize the system. Therefore, as already pointed out above, we consider that further research on the impact of loss absorption requirements is needed.

Our initial hypothesis is that increasing banks’ loss absorption capacity could potentially have spill-over effects on the real economy. We have identified several axes where further research should be undertaken. Amongst them, we consider the following particularly relevant, as shown in

Table 6.

We would encourage other researchers to use the research axes proposed above. It is our view that analyzing and understanding the potential impacts of loss absorption requirements is an important task to be done in order to keep building-up a safe and sound financial system, able to cope with the challenges that the future will bring us.