1. Introduction

As a clean and renewable source of energy, hydropower (HP) is expected to play a key role in coping with the goals of climate policy and phasing-out nuclear energy, especially in mountain areas. However, HP is not undisputed. It can entail substantial impacts on the environment, economy and society, and thus on sustainable development (SD). Accordingly, HP projects and operations must increasingly be evaluated from an SD perspective. Corporate social responsibility (CSR) is the principle frequently applied in this regard. It is generally defined as the business world’s commitment and contribution to sustainable development [

1,

2]. CSR is particularly understood as “the way firms integrate their values, culture, decision making, strategy and operations in a transparent and accountable manner” [

3] (p. 5) and as a program where firms “decide voluntarily to contribute to a better society and cleaner environment” [

4] (p. 5).

Accordingly, socially responsible firms must not only ensure returns to shareholders, wages to employees and products and services to consumers. They also respond to societal concerns and values regarding the social, economic and environmental development of the system in which we are living. This implicates a shift away from the pure shareholder perspective of maximizing profits and corporate value to a broader understanding of operation that encompasses various conflicting goals and multi-stakeholder concerns. In other words, CSR implicates a welfare perspective of corporate behavior that aims at internalizing external costs and avoiding distributional conflicts on a voluntary basis [

5,

6,

7,

8]. Consequently, a welfare-economic approach is required to comprehensively address these issues and formally integrate the societal and corporate concerns of HP in the evaluation of a company’s performance and contribution to SD.

Measuring a firm’s CSR performance thus requires a translation of the normative concept of sustainable development, as originally propagated by the Brundtland Commission [

9], to the corporate level, such as to ensure that current decisions and activities do not jeopardize future generations in satisfying their own needs and wants. However, this does not make obsolete regulation and legislation about social rights and environmental standards [

4]. Rather, CSR calls for shared responsibility between the government (or the regulator) and private businesses. This directly applies to the management of water resources, which is generally regarded as a shared responsibility of public and private actors, and thus to activities in the HP industry. The latter is likewise influenced by market developments and the prevailing institutional setting in different countries [

10]. Accordingly, the CSR of hydropower companies must be evaluated and implemented in the concrete context of their economic, institutional, geographical and political spheres.

In order to cope with this challenge and to fill a gap of conceptual and theoretical research, we provide a formal approach that integrates the corporate and societal perspectives of HP activities from a welfare-economic and institutional perspective. This particularly helps to separate issues of efficiency and equity in political-economic discourses and to address distributional problems related to resource rents, royalties and taxes, which is currently a political issue in Switzerland—the so-called “water tower of Europe” [

11,

12]—where HP is a backbone of the national energy strategy and the economies of many mountain areas [

13,

14,

15,

16,

17,

18,

19,

20]. Given the federalistic organization and the specific situation with resource rights and ownership structures in the HP sector, the Swiss case is ideal to illustrate and explicitly address the various issues involved with the CSR of HP companies both in an applied and generic form.

Thus, to provide a generic approach of CSR and its application to the institutional situation in Switzerland, we proceed as follows. First, we propose in

Section 2 the extension of a welfare-economic model of CSR [

8] to the context of HP companies. Then, we present the major challenges of HP in Swiss Alpine regions in

Section 3 and the adaptation of our CSR model to HP companies in these regions in

Section 4. Building on this background, we complete our analysis by discussing implications of this microeconomic approach with regard to the current debate about royalties and governance of HP companies, first with regard to the case of Switzerland in

Section 4.2 and then with a more general discussion in

Section 5. Finally,

Section 6 concludes. Altogether, this shall support better informed decision making on both corporate and policy levels, and thus contribute to the envisaged energy transition, in Switzerland and other countries.

2. CSR of Hydropower Companies: An Analytical Framework

In a business context, social responsibility, transparency and accountability are core sustainability principles [

21] that involve the concept of CSR and the business’s commitment and contribution to SD. Regarding HP, this requires various aspects be taken into consideration. In particular, the local and national characteristics of the HP system must be addressed when evaluating the CSR performance of HP companies and their contribution to SD.

As already reported by Carroll in 1999 [

22], there is a diverse history behind the concept of CSR. It started with the concern about the social responsibility of businessmen in the 1930s and became particularly prominent with to the contemporary debates about globalization and the roles of business in society (cf. [

8]). Moreover, CSR covers a wide range of different approaches that build on different epistemological and ideological perspectives, that serve different purposes in the realms of corporate and public governance, corporate strategy etc., and that have been addressed by scholars from different disciplines and in a wide range of literature. Accordingly, there exist no comprehensive reviews on the various concepts of CSR. Rather, in addition to various handbooks on CSR, edited volumes with selected articles on theory and applications have been produced by different publishers. Those include, amongst others, a collection with contributions from the management and business ethics literature in

the Library of Corporate Responsibility [

23] and on the economics of corporate social responsibility [

24] in

The International Library of Critical Writings in Economics.

Though the principle of CSR is frequently applied in the business world, there exists no conceptual and theoretical basis that is common to the various approaches. We fill this gap by providing an analytical framework and formal approach that allows us to evaluate a company’s performance from a societal perspective of SD and that accounts for the specificities of HP operations in their socio-economic and institutional realms. Thus, our first focus is on a formal approach to elaborate an HP company’s CSR performance from a welfare-economic perspective. This relates to one stream of literature that deals with the welfare-economic foundations of CSR (e.g. [

7,

8,

25]) and that contrasts the one that is intimately linked to CSR as a strategic management approach (e.g. [

26,

27]). Our second focus is on the implications regarding the problem of water concessions and the distribution of resource rents from a CSR perspective.

2.1. CSR in a Paretean View of the Firm

We start our analysis with the understanding of “CSR as actions that appear to further some social good, beyond the interests of the firm and that which is required by law” [

6] (p. 117), as well as the claim that “socially responsible firms do try to maximize profits but at the same time try to improve the welfare of other stakeholders” [

22] (p. 385). This does not imply that a company must necessarily fulfil this normative criterion and behave in a socially responsible manner. Rather, it allows us to derive a minimum condition and formal definition of CSR from a welfare-economic perspective that corresponds to the standard problem of welfare economics—the problem of Pareto improvement for utility maximizing individuals [

28]—as applied at the firm level.

In the simplest form, this is formalized by maximizing at any time

t a firm

j’s profit

π(

xjt) as a function of its activity vector

xjt, subject to the “CSR constraint” that some suitably-defined measure of social welfare

W must not fall under the reference level

W0, which society could enjoy without the firm’s activity and which determines the bottom line for the evaluation of the company’s CSR performance. Representing social welfare

W as a function of

z(

xjt), i.e., a vector of those attributes that determine individual and social well-being and that can be positively or negatively affected by the firm’s activities

xjt. These attributes can be thought of as encompassing issues like aggregate levels of income (beyond the firm’s profit), social capital and environmental quality, as well as degrees of macroeconomic stability (cf. [

29] and

Section 2.3).

This optimization problem can be represented by the Lagrangian:

which formally expresses firm

j’s internal evaluation of its instantaneous profits and its net contribution to society, with

λjt denoting the implicit price of the CSR constraint. This is the firm’s marginal opportunity cost of its (voluntary or enforced) commitment to improving social welfare through its own choice of activity.

Moreover, as stated by Heal [

7], the role of CSR “to anticipate and minimize conflicts between corporations and society and its representatives” (p. 394). It is “a programme of actions to reduce externalized costs and to avoid distributional conflicts” (p. 387), since “almost all conflicts between corporations and society can be traced to one of these two sources—either discrepancies between private and social costs and benefits, or different perceptions of what is fair” (p. 388). Hence, CSR can help to improve corporate profits and guard against reputational risks. This coincides with Beltratti’s emphasis that CSR is positively related to the market value of firms [

22] and the findings of Minor and Morgan [

30] about the role of CSR “as a powerful form of reputation insurance” and the link between a firm’s CSR activities and its stock market price following an adverse effect.

Accordingly, firm

j’s reputation

Rjt is included in our analytical framework as an asset (reputation capital) that is self-reinforcing, i.e., increasing with external benefits and declining with negative externalities generated by the firm’s activities:

Caused by firm j’s current activities xjt, the net externalities and distributional effects, Ejt, are positive if W(z(xjt)) exceeds the bottom line W0 and negative if it is below that reference level. (Rjt) > 0 (’ > 0, ’’ < 0) is the proportional rate of state-dependent impact of the firm’s external effects upon its own reputation. Moreover, α−Ejt (α > 0) accounts for potential asymmetries between the impact of positive and negative externalities, with α > 1 giving a larger weight to the impact of negative externalities on reputation as compared to positive externalities, while the opposite applies for 0 < α < 1.

2.2. CSR, Corporate Value and Social Welfare

The firm’s reputation capital constitutes a dynamic element in our CSR framework. It accounts for the past and current externalities and spillover effects in the economic, social and ecological domains, and thus constitutes an interface to the concept of sustainable development, which is further explored below.

First, we integrate the accumulation of reputation capital and other assets in our model. Thus, we shift the scope from the short to the long run, where the CSR problem is that of maximizing the firm’s net present value of profit prospects subject to the above CSR constraint. This leads to

Definition 1. CSR is “a program of action where a firm’s objective is to maximize its corporate value and, at the same time, to contribute to the improvement of social welfare” [8] (p. 521).

In this intertemporal setting, the instantaneous contribution to corporate value is represented by the current-value Hamiltonian

Hjt, with

jt and

μjt denoting the shadow prices (implicit values) and

and

the intertemporal changes of production capital and reputation, respectively:

It implies that the firm’s net revenue is either distributed in the form of dividends yjt to the shareholders or used for investments in the firm’s capital stock kjt. Together with variable inputs, the latter is employed in the generation of the firm’s current activities xjt that in turn influence the accumulation of the reputation capital Rjt.

The above function must continuously be maximized subject to the CSR constraint. Formally, this is comprehended by the extended Lagrangian:

where

denotes the shadow price of the CSR constraint of non-declining social welfare due to the firm’s activities at time

t.

Compliance with the welfare constraint implies that the negative externalities resulting from current activities would be eliminated by firms following a CSR strategy coherent with the above definition. However, this does not necessarily refer to the broader objective of SD, which goes beyond traditional conceptions of welfare economics and ethics, and is built on different epistemological foundations (cf. [

31]). Moreover, CSR does not require all firms behave in a socially responsible manner. Rather, our approach provides an analytical reference (benchmark) for the evaluation of a firm’s CSR performance and its contribution to SD.

2.3. Integrating the Firm’s and Societal Perspectives

Sustainable development (SD) is a normative concept of equality and posterity that integrates concerns across social, economic and ecological system goals [

32] and that satisfies a set of critical limits in the social, economic and ecological realms [

9]. Those have been integrated in the concept of sensible sustainability [

33] and formalized with the sustainability-based social welfare function

W0 =

W(

Y,M,S,Q|

Y0,

M0,

S0,

Q0;

Y#,

M#,

S#,

Q#) [

29]. The latter defines the reference when evaluating a company’s CSR performance from a societal perspective of SD. It depends on an economy’s aggregate income

Y, its macroeconomic performance

M (e.g., full employment, price level stability), social capital

S and environmental quality

Q. It is defined for a given state of development {

Y0,

M0,

S0,

Q0} that would be achieved without the contribution of a specific project or set of activities and accounts for critical boundaries {

Y#,

M#,

S#,

Q#} in the economic, social and environmental domains.

To be consistent with our definition of CSR, the firm must contribute with its activities to an increase in social welfare, or at least to maintain it at the current level. Thus, a firm contributes to SD if social welfare will not fall below the indifference curve given by the total differential dW = WYdY + WMdM + WSdS + WQdQ = 0, with WY, dY, etc., denoting the marginal social utilities and marginal changes of the respective variables Y, M, S and Q.

Since SD requires that social welfare must not fall under the reference level that society could enjoy without the firm’s activities (

dW ≥ 0), firm

j’s contribution to society at time

t must satisfy:

In this functional form, dYjt denotes company j’s contribution at time t to the aggregate income of an economy, and dMjt, dSjt and dQjt are the company’s contributions to macroeconomic performance (e.g., full employment, price level stability, etc.), social capital and environmental quality. The sustainability-based marginal values βM = WM/WY, βS = WS/WY and βQ = WQ/WY, respectively, represent the evaluation of tradeoffs between M, S and Q, on the one side, and the aggregate income Y, on the other, from a societal point of view. These values are essential when evaluating a company’s performance from an SD perspective.

Let us further assume, for a moment, that the firm’s total income is exclusively distributed in the form of dividends

yjt to the shareholders and labor income

ωjt to its employees, or retained for the accumulation of productive capital

. Taking furthermore into account that the firm’s current activities effect the value of its reputation capital

(see Equation (2)), we get the overall value

of the company’s contribution to society that consists of the internal value of the overall profit prospect

Hjt from a shareholder perspective (as specified in Equation (3)) plus the external value of the firm’s direct and indirect contributions to society:

Altogether, this provides us with a generic approach to CSR, which represents “the overall value of a company’s contribution to society that consists of the internal value of the overall profit from a shareholder perspective and the external value of its direct and indirect contribution to society” [

8] (p. 524). It entails, on one side, the firm’s implicit prices of capital,

jt and

μjt, that draw from the intertemporal maximization of corporate value. On the other side, it embraces the externally determined accounting prices

βM,

βS and

βQ that measure the tradeoffs between macro-economic performance, social capital and environmental quality, on one side, and aggregate income, on the other. Accordingly, they must be assessed at a societal level and account for individual preferences and critical limits of SD (cf. [

29,

34]). To this end, an integrated approach is required, which brings together a systemic view of impact assessment and its evaluation from a stakeholder perspective (cf. [

35,

36,

37]).

2.4. An Extension to Resource-Based Companies: The Case of Hydropower

When applying the concept of CSR to HP companies, one needs to extend the above framework by specifically taking into account the externalities and distributional effects going along with their activities. These effects particularly involve the distribution of water resource rents and taxes among different stakeholder groups and territorial entities, as well as the socio-economic and environmental impacts of HP undertakings.

In general, a resource rent is a surplus that results when converting a natural resource (here waterpower) into a marketable product (electricity). This rent is defined as “the difference between the price of a good produced using a natural resource and the unit cost of turning that natural resource into the good” [

38]. These costs include the payments of the capital, labor, material and other inputs that are used in the production process. What remains after these factor costs are netted out is the value of the natural resource: the waterpower. In the first instance, this value (the water resource rent) flows as an income to the holder of property or use rights on that resource: the water.

At this point, it is important to notice a fundamental difference between rent and profit. For Ricardo [

39], this distinction was of great importance since the laws that regulate the progress of rent are widely different from those that regulate the progress of profits, and they seldom operate in the same direction. Rothman [

40] adds that “rent arises when exploiting a resource that Nature has endowed with a value that is independent of any labor, capital or entrepreneurial effort applied to the resource” (p. 5). As a consequence, resource developers—HP companies in our case—do not earn rent as they earn normal profits (i.e., return on capital). Rather, Rothman further emphasizes (p. 5) that “rent is a windfall created by exploiting the bounty of Nature.” And “the owner of the natural resource is the owner of the rent.” Accordingly, capturing resource rents from the developers and delivering it back to the owners—often the public—is common practice in most resource-based industries, like oil, coal, mining, etc. [

41,

42].

Building on this background, resource rents and corporate taxes must explicitly be included in our CSR framework. It must particularly reflect the distribution of resource rents through royalties and corporate taxes. Accordingly, company

j’s net revenue (resource rent) resulting from its activities

xjt can be represented by:

with

pt denoting the price vector and

c(

xjt) the firm’s cost function. It is a function of its current activities, production and reputation capital and can be distributed among dividends

yjt to shareholders, investments

Ijt in the firm’s capital stock

kjt, royalties and taxes, Ω

jt and Ψ

jt, respectively. Moreover, as formalized in Equation (2), the firm’s activities have an impact on its reputation

Rjt. Hence, HP plant

j’s contribution to corporate value encompasses three major components:

This value goes beyond the mere market value that private investors might be interested in, unless they also care about social responsibility and social values—the issue of this contribution. The terms in the first and third bracket represent the internal value of the overall profit from a shareholder perspective (first term) and the external value of the company’s contributions to society from a stakeholder perspective (third term). As an extension to the original model (Equation (6)), the middle term (second term) encompasses the share of water rents, i.e., the royalties and taxes, paid to the “public hand”. Moreover, issues related to the fiscal incidence of these payments as well as the ownership structure of HP companies will be addressed in

Section 4 and

Section 5.

From a theoretical point of view, this implies that water rent and corporate tax payments are elements of revenue sharing among different stakeholder groups rather than cost factors. Indeed, translated from Ricardo [

39], the “produce of HP”—i.e., the value of the water that is derived from using its potential energy in electricity generation by the united application of labor and capital—is divided under the names of rents, profits and wages among the proprietors of the water, the owners of the stock of capital (the investors) and the laborers (employees) by whose industry the electricity is generated. In addition, through corporate and other taxes, some share of the revenue is generally diverted to the “public hand”. In the end, the regulation of this distribution of revenue is an issue of political economics.

Before further discussing the implications of this interpretation and applying our theoretical framework to the case of HP companies in the Swiss Alps and Swiss energy policy, we present the specific challenges the industry currently faces in Switzerland.

3. Major Challenges for Hydropower in Swiss Alpine Regions

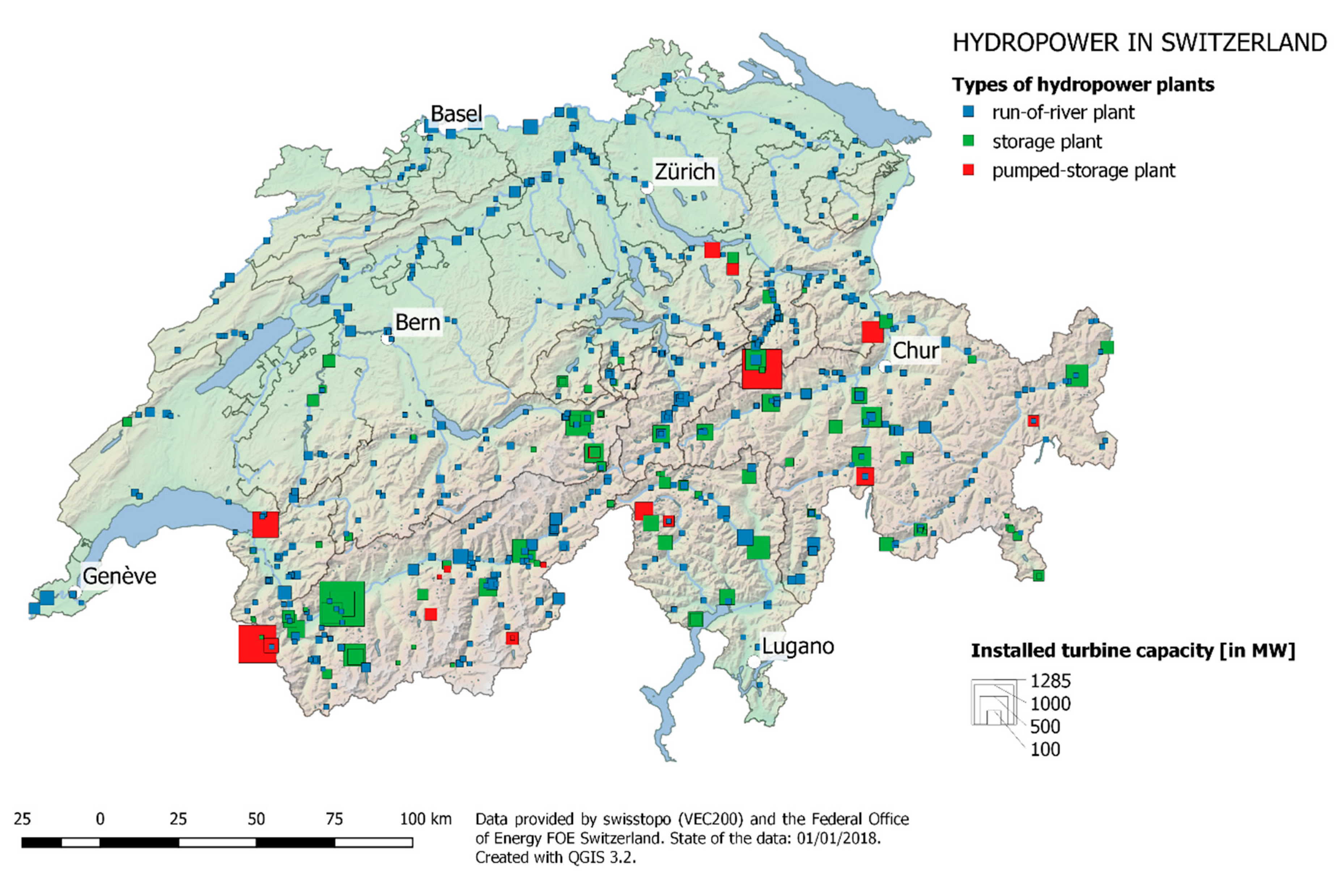

Located at the heart of the Alps, Switzerland has ideal conditions for the utilization of HP, which made it the country’s most important domestic source of renewable energy. It accounted for almost 90% of domestic electricity production at the beginning of the 1970s, while its share fell to actually about 57% following the authorization of nuclear power plants [

43]. Nonetheless, HP still constitutes the backbone of the electricity supply in Switzerland [

44]. Today, 650 HP plants exist in Switzerland (638 stations are located on Swiss territory, the rest across the border) with a capacity of at least 300 kW, each. Together, these power plants provide an installed capacity with an average production of about 36 TWh/a, of which about 48% is produced in run-of-river plants, about 48% in storage plants and some 4% in pumped-storage plants [

43,

45]. The major part of this production (64%) originates from the mountain regions in the Swiss Alps, while another important share is generated along the rivers Aare and Rhine, in the northern part of the country, as

Figure 1 and

Table A1 in the Appendix show (see also the interactive map on “Switzerland’s main hydropower plants” [

43]).

Currently, Swiss energy policy and electricity companies face a wide range of challenges that are at the heart of the current debate about future prospects of HP and its role within the envisioned energy transition, which particularly aims at phasing out nuclear energy and thus replacing about 40% of the domestic electricity supply [

43,

44].

In particular, the Federal Council's Energy Strategy 2050 focuses on the consistent exploitation of the existing energy efficiency potentials and on the balanced use of the potentials of hydropower and new renewable energy sources [

46]. The challenge is to realize these targets, to exploit the remaining hydropower production potential of about 3.2 TWh/a [

47] and to cope with the volatility of solar and wind energy production in Europe. To this end, investments are required not only in new energy technologies (e.g., solar, wind, geothermal), but also in the construction of new HP plants, in the retrofitting (renovation and expansion) of existing ones and in the adjustment of HP operations to get higher flexibility [

48]. Especially, storage and pumped-storage plants play a key role in the supply of electricity and the stability of the international network, especially with the increasing production from intermittent energy sources, notably solar and wind energy [

13,

49,

50].

However, due to the low prices on the European electricity market and the relatively small price differentials between low and high price periods, the profitability and competitiveness of Swiss HP came under pressure. Accordingly, based on investigations with a questionnaire and a stakeholder workshop, Barry et al. [

48] identified the main challenges of Swiss HP in the domains of market development and regulatory aspects. Furthermore, Betz et al. [

13] pointed out that in order to recover their competitiveness, Swiss energy companies need (a) to reduce their cost of production and realize efficiency potentials and (b) to optimize their trading strategies under consideration of current and future market conditions. Moreover, the institutional arrangements—defined by federal and cantonal policy—are currently under reconsideration and subject to public debates. Those involve discussions about the regulation of royalties, the so-called “water fees”, and the process of granting and renewing concessions.

In Switzerland, the latter are framed by federal legislation, while the water authority and, thus, the ultimate decision about the concessioning of water resource uses are with the cantons. Moreover, the cantons have the power to fix the applied water fee rate up to the maximum that is defined by the federal authorities. The principles for determining this maximum rate are defined in the federal Water Rights Act (Wasserrechtsgesetz (WGR)). The legal maximum has been increased several times since the inception of the law in 1918, from initially 8.16-CHF/kW installed capacity to currently 110 CHF/kW; this has primarily been motivated by fiscal reasons [

16,

51,

52,

53]. In addition, the cantons have the authority to share the resource rights and thus the water fees with the municipalities and other organizations. Accordingly, in four cantons those municipalities that grant HP companies the right to use their water also participate in the water fees, and in three cantons private landowner and water cooperations receive water fees (cf.

Table 1).

Currently, the annual water fees amount to a maximum of 550 Mio CHF in Switzerland [

15,

20]. About 65% of this amount is paid in the four Alpine cantons Grisons (GR), Ticino (TI), Uri (UR) and Valais (VS) (cf.

Table A1 in the Appendix), where the water fees constitute a major source of fiscal revenue. Other important recipients of water fees are the cantons of Aargau (AG) and Bern (BE), given the large HP capacities installed in these cantons. In numerous municipalities in the Alps, the water fees constitute between 20 and 40% of the total revenues, in some even more than 40% [

18,

20].

Apart from water fees and general taxes, cantons and municipalities further benefit from HP in various forms. They charge one-time concession fees, are shareholders of HP companies and receive electricity at reduced prices or for free, which can be sold to final consumers or on the market. Finally, the local economies benefit through additional employment of local people and value-added in the local businesses.

Recognizing the related challenges, discussions have been launched in politics, the media and academia concerning the exploration of the remaining HP potential that is needed to realize the goals of the federal Energy Strategy 2050, given the current lack of profitability that hinders investors from undertaking new projects, as well as on the future design of water fees and governance structures, respectively [

10,

13,

14,

16,

51,

52,

54,

55,

56]. The solution of these problems is not straightforward, since any modification of the current system of resource rent “taxation” would have substantial consequences on public finance, especially in HP regions, and thus on the equalization payments in the respective cantons and at the federal level [

14].

Indeed, water fees and taxes of HP companies are an important source of revenue in many mountain areas. At the same time, in a situation on the electricity market with low prices and low spreads between peak and off-peak periods, the water fees constitute a substantial burden for HP companies that cannot in general cover their fixed cost. Yet, those companies are mainly owned by non-mountain cantons, who obtain the major share of profits and the remaining resource rents (after taxes and water fees). Thus, the current system of water fees serves the distribution of resource rents among mountain cantons, where most HP comes from, and the owners of the HP companies that are mainly owned by cantons located on the Central Plateau.

Finally, the future of HP is a major challenge for SD, particularly in the Alps, where it constitutes an important local industry and major source of fiscal revenues. However, HP companies and policy also face a series of new challenges, ranging from liberalization and market conditions over the impacts of climate change to land and water resources management and the environmental impacts of HP plants: “The reorganization of power generation in Switzerland following the decision by the Swiss parliament and Federal Council to close the country’s nuclear power stations, and the attendant expansion of renewable energies, will pose major challenges to nature and the landscape” [

57]. Moreover, the renewal/reversion of water concessions and the design of future water fee systems constitute major challenges that must carefully and simultaneously be addressed on the federal, cantonal and local scales. Ultimately, this implicates new views on governance and private-public partnership, along with the integrated evaluation of corporate performances from a financial and societal perspective of SD.

5. Discussion

Building on a Paretean view of the firm and a welfare-economic perspective of SD and under consideration of the institutional settings in Switzerland with its federalistic structures, we developed in the previous sections an analytical framework, which links the concepts of SD and CSR and is adjusted to the specific requirements of evaluating the CSR performance of HP companies. Formally, we extend a welfare-economic approach of CSR to the case of HP companies and apply it to an investigation on current policy issues with a special focus on HP in Swiss Alpine regions. Building on this background, our analysis provides, at the same time, generic insights on the CSR of HP companies and for Swiss energy policy that largely relies on HP production. The question remains, to what extent the analytical framework of

Section 4 can be applied to HP companies in general, not just to the Swiss case. This is briefly discussed here, building on the theoretical and conceptual insights gained above.

First, given the most fundamental understanding of CSR as a program where firms act so as to maximize profit prospects and at the same time to improve the welfare of other stakeholders, CSR is usefully formalized as a constrained optimization problem of Pareto improvement and capital accumulation, including reputation capital. This allows us to assess the opportunity cost of a firm’s voluntary or enforced commitment to improve the well-being of other people; i.e., social welfare at large. From a theoretical point of view, the former can be seen as related to the firm’s reputation capital, whereas the latter relates to externalities and distributional concerns, and thus involves the distribution of income and assignment of property rights. Those are issues concerning the license to operate and the sharing of resource rents. Regarding HP, this is at the heart of the current discussion about HP concessions and water fees/royalties [

10,

14,

18,

54,

72,

78,

79,

80] that must also be addressed when it comes to the implementation of CSR strategies by HP companies and their respective reporting. The latter requires a comprehensive assessment of the firm’s activity and its impacts upon the social, economic and environmental systems. Moreover, it must be based on corporate and societal accounting prices to weigh those changes form a societal perspective against the financial concerns of the shareholders and other recipients of revenues from the HP company.

Second, accounting for the prevailing institutional settings and the market environment, the CSR of HP entities must be evaluated and implemented in the concrete context of the economic, institutional and geographical sphere of operation. In Switzerland, which serves here as the illustrative case of application, this context particularly involves the system of royalties (the so-called water fees) and taxes that is specific to each canton and that entails substantial financial revenue to some municipalities in Alpine regions. Thus, the case of Switzerland with its federalistic system and ownership structure in the HP industry is ideal for developing a generic model of HP CSR. It simultaneously encompasses different stakeholder groups (private and public), state levels and geographical spheres, such as formally represented in Equation (9), and thus allows us to explicitly address the key issues of the externalities and distributional impacts of HP.

When applying this model to other countries, one must simply adjust it to adequately represent the prevailing tax system and ownership structures with regard to water resources and HP companies. Measuring the CSR performance of the latter, it encompasses an HP plant’s contribution to corporate value, public revenue, as well as salaries paid and further impacts on economy, society and the environment, the main domains of SD, as presented in

Section 4 and in the literature. In order to apply this theoretical framework to concrete cases of HP firms and the evaluation of HP projects, respectively, two steps are required. First, the resource rents of that operation or project and its distribution among different stakeholders must be calculated. Second, a comprehensive sustainability assessment, using differentiated utility weights and accounting for critical limits (cf. [

29,

34]), is recommended to also include the societal impacts at large, such as discussed in

Section 2 and

Section 4.

Altogether, a comprehensive CSR reporting as proposed in this article and formally outlined in Equation (9) can provide information to be used by HP companies, investors and regulators, as it provides detailed information about the contribution of a single HP plant and the company as a whole towards SD. This is crucial to ensure accountability and transparency in corporate reporting. This is particularly important for HP companies with shared private and public ownership and where external stakeholders grant the company the right to operate; i.e., the HP concessions. Accordingly, it also can provide valuable information to regulators, policy makers and other stakeholders.

6. Conclusion and Recommendations

Hydropower (HP) is a key to the transition of our energy systems and to sustainable development (SD) in many regions, especially in the Alps. Accordingly, the performance of HP companies must be evaluated from an SD perspective and with regard to its contribution to society. Corporate social responsibility (CSR) is the key principle for this purpose. It implies a translation of the normative framework of SD to the corporate level and must account for the impacts of an HP company or a single plant on the economy, society and environment. To this end, we provide a generic framework that formally integrates the corporate and societal perspectives of HP activities in a welfare-economic framework with externalities and distributional concerns. All in all, it integrates efficiency and equity concerns that are important when it comes to decisions about investments in HP plants from both a corporate and societal (governmental) point of view.

Moreover, our analysis reveals that the ownership structure of companies running HP plants must be taken into consideration when evaluating their CSR performance. This is formally integrated in our CSR model that accounts, in monetary terms, for the social benefits of public revenue resulting from water fees and taxes paid by the HP company, as well as the spatial impacts of the plant. In our analytical model, these impacts are captured by the social benefits generated by the HP plant on the different territorial levels; i.e., the direct and indirect financial incidence through the distribution of dividends, water fees and taxes among the different state entities in the federalistic system. This aspect is particularly important for HP companies with shared private and public ownership and where external stakeholders are also sensitive shareholders who grant the company the right to operate; i.e., the HP concessions.

Altogether, this is an issue of political economics, since it involves tradeoffs between the profitability of HP plants and the distribution of water resource rents. Hence, the discussion about water fees and the granting of HP concessions must involve a discussion about the governance and ownership structure of HP companies, as well as the fiscal incidence of these decisions, especially in mountain areas that substantially depend on water fees as an important source of revenue in their public budget. By addressing those issues, we enter the spheres of corporate and public governance, which widens our perspective to also include institutional and management aspects of corporate responsibility at large. It implicates a shift away from the pure shareholder perspective of maximizing profits and corporate value to a broader understanding of operation that encompasses various conflicting goals and multi-stakeholder concerns.

This does not make obsolete regulation and legislation about social rights and environmental standards. Rather, it calls for shared responsibility between the government and corporate enterprises. Moreover, our analysis reveals that private (corporate) and the external (societal) values must be taken into account when evaluating HP investments and the CSR performance of HP companies. Accordingly, the total value of HP encompasses (a) the internal value of the overall profit prospects from a shareholder perspective and (b) the external value of its direct and indirect contribution to society from a community and SD perspective. The latter implies externally determined accounting prices that must, in principle, express individual preferences, community values and risk premiums for the anticipation of potentially irreversible changes (critical limits) at the boundaries of the opportunity space for SD.

Building on this background, investment decisions should primarily be taken from an allocation (efficiency) perspective, rather than involve distributional concerns in the first instance. This implies that investments into retrofitting and new HP plants should be undertaken from a societal point of view as long as the total value of HP exceeds the cost of investment, even if electricity prices and the profitability of HP operations are low, as this currently is the case. As a consequence, discussions about water fees, as well as the granting of HP concessions must involve a political-economic discussion about the governance and ownership structure of HP companies, as well as investments by public entities and philanthropic investors who also care about the societal values of HP. This is justified by the fact that CSR calls for shared responsibility between the government (or the regulator) and private businesses running HP plants.

Altogether, these findings are mainly targeted at actors involved in the evaluation of HP projects and in the decision making process to further national energy strategies. Indispensable for practical implementation are adequate assessments of the water resource rents to be shared among different stakeholders and a comprehensive sustainability assessment with stakeholder involvement [

35,

36,

37,

81]. Thus, a limitation for the practical implementation of the proposed approach is the availability of those assessments. Furthermore, the successful implementation in practice relies on the commitment of project managers at HP companies, public authorities and key stakeholders in the sustainability assessment of investment projects. In the end, the commitment of the high-level management and shareholders of HP companies is required, when it comes to the implementation of CSR as a guiding and reporting principle within the frame of corporate governance. Finally, given the ownership structure of Swiss HP companies, policy makers, as well as federal and cantonal authorities could play a key role in making compulsory a comprehensive CSR assessment, as presented here, whenever it comes to a process of (re)concessioning HP plants (and other large-scale facilities for the use of renewable energies).