Does Sustainability Engagement Affect Stock Return Volatility? Evidence from the Chinese Financial Market

Abstract

1. Introduction

2. Literature Review and Empirical Predictions

2.1. Economic Consideration of Corporate Sustainability

2.2. Institutional Background

2.3. Information Asymmetry and Stakeholder Theory

3. Sample and Methodology

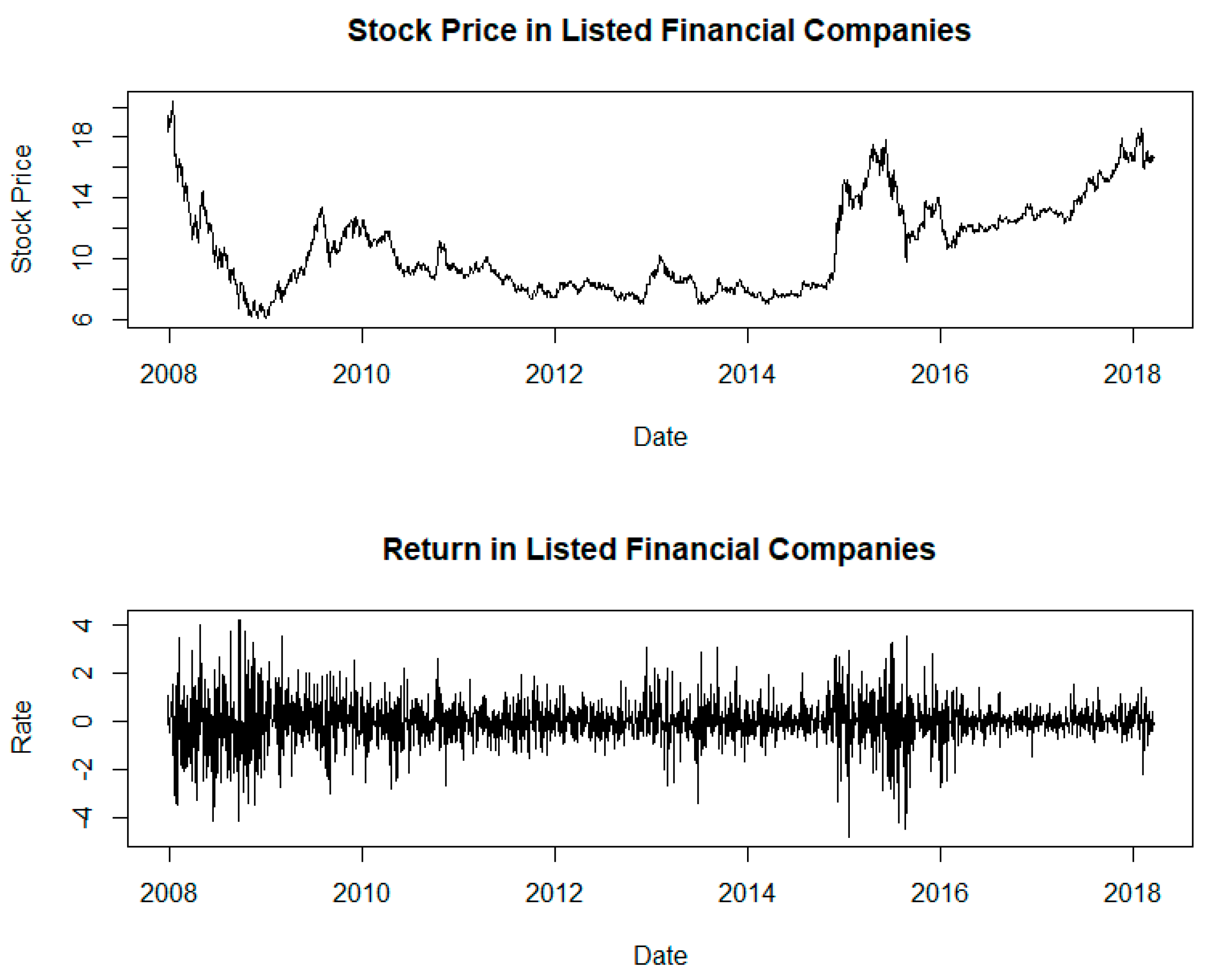

3.1. Sample and Return Series

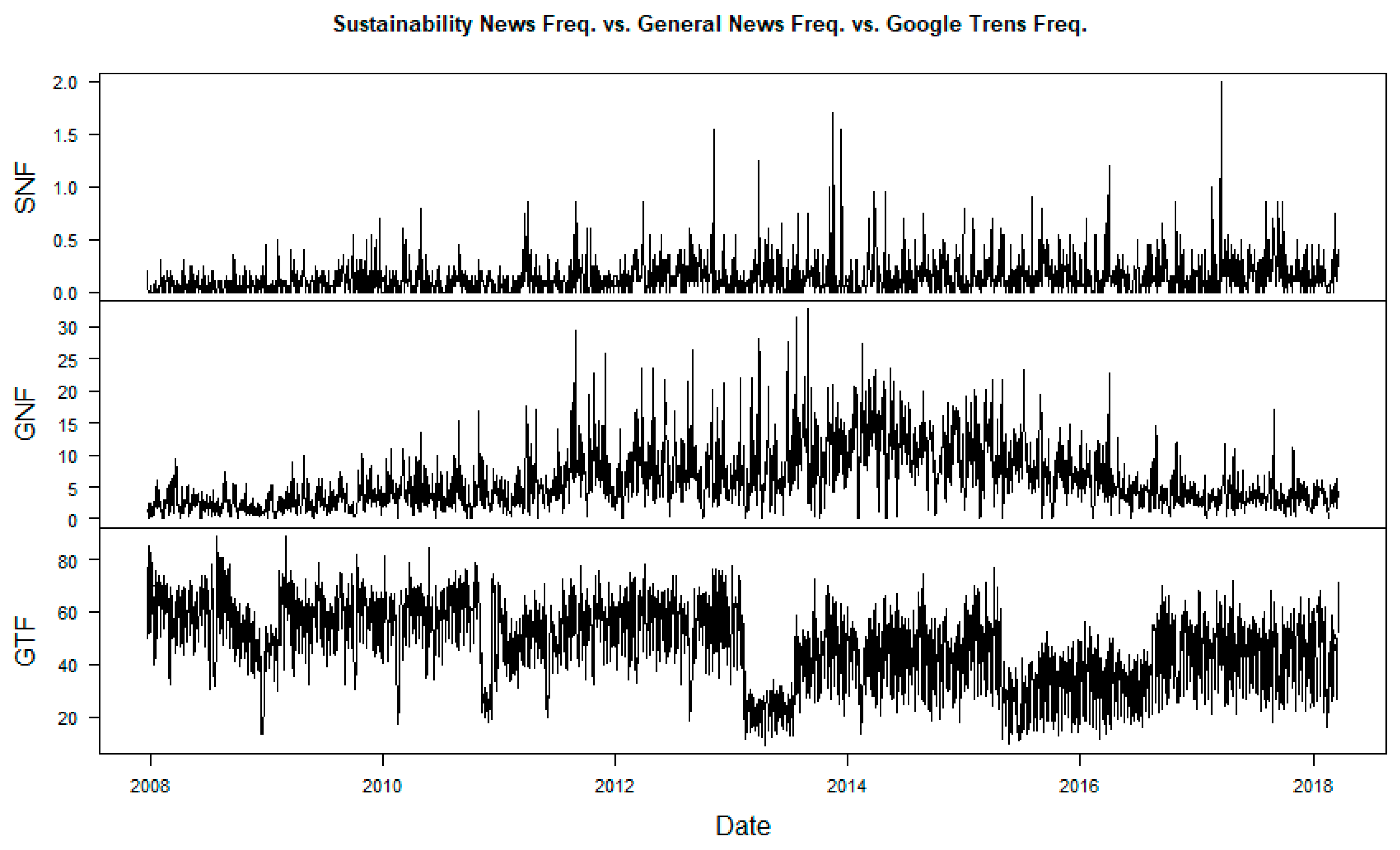

3.2. Sustainability News Information Arrival

3.3. Other News Information Arrival

3.4. Methodology and Model Specification

4. Data Analysis and Implications

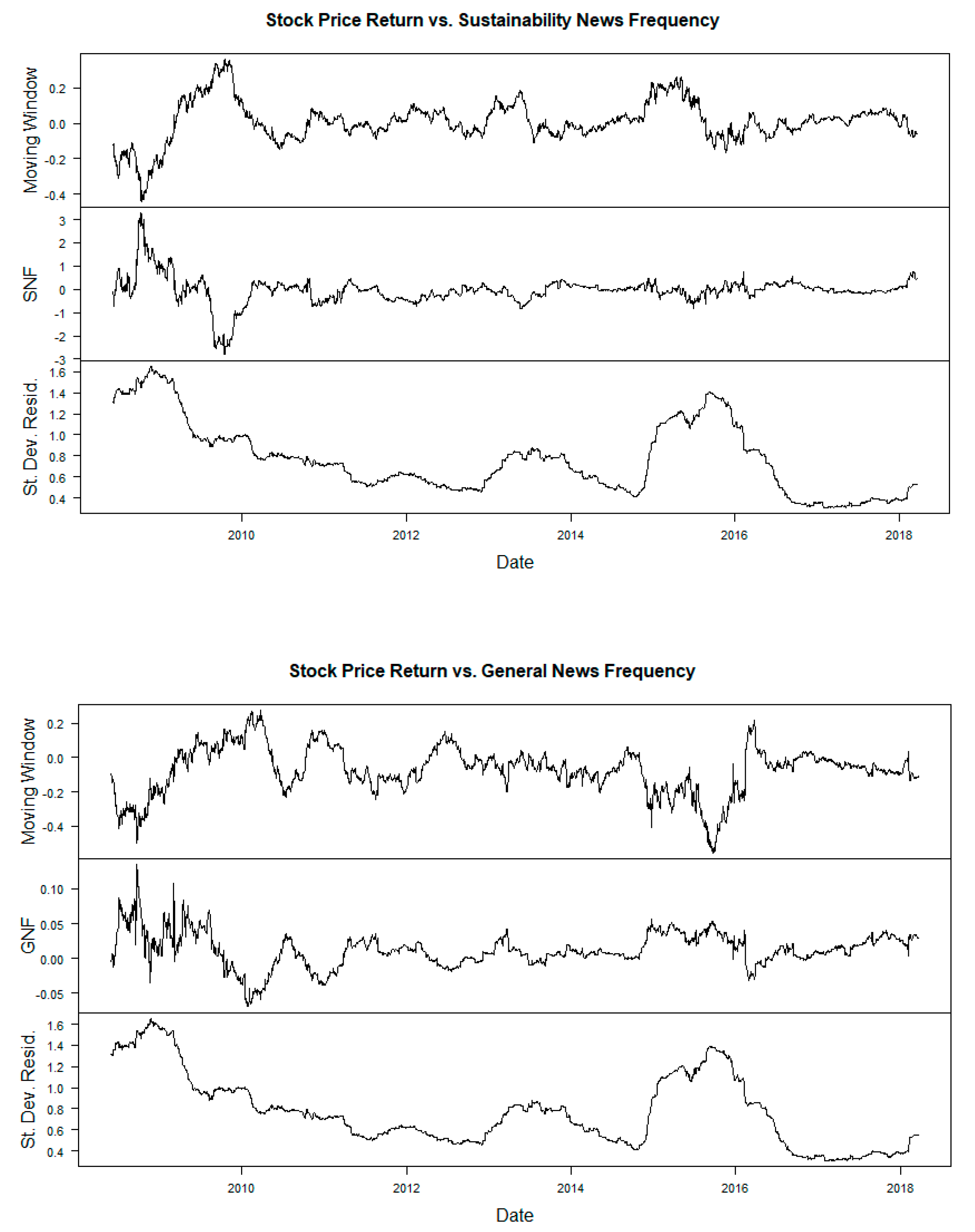

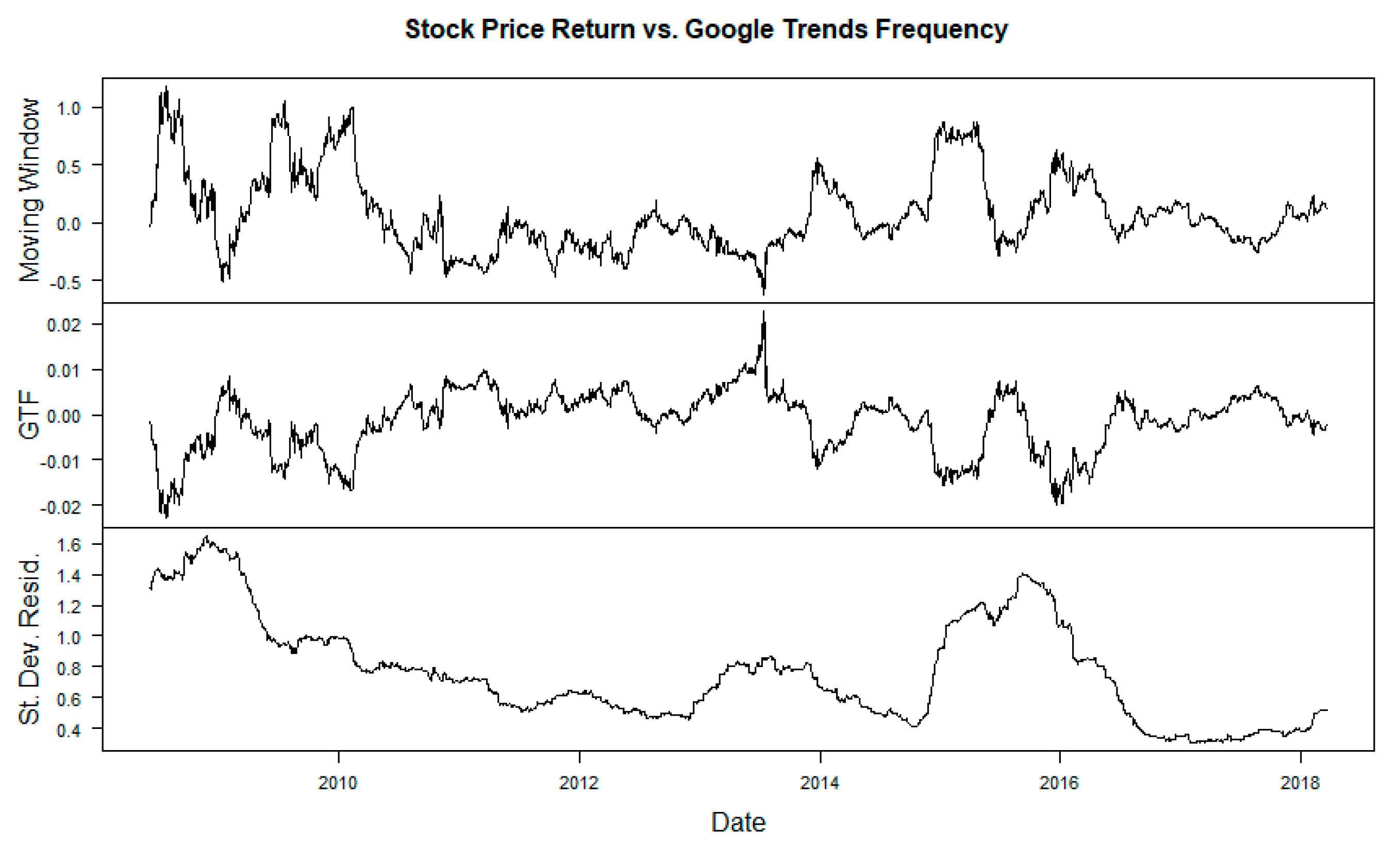

4.1. Descriptive Statistics

4.2. The EGARCH-M Framework

4.3. The FIGARCH Framework

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Date | Stock Code | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 000001 | 002142 | 600000 | 600015 | 600016 | 600036 | 601009 | 601169 | 601328 | 601601 | |

| 2007 | 352.54 | 75.511 | 914.98 | 592.34 | 918.83 | 1310.96 | 76.06 | 354.22 | 2110.44 | 322.34 |

| 2008 | 474.44 | 103.26 | 1309.43 | 731.63 | 1054.35 | 1571.79 | 93.70 | 417.02 | 2556.41 | 317.89 |

| 2009 | 587.81 | 163.35 | 1622.72 | 845.45 | 1426.39 | 2067.94 | 149.56 | 533.46 | 3309.13 | 397.18 |

| 2010 | 727.21 | 263.27 | 2191.41 | 1040.23 | 1823.73 | 2402.50 | 221.49 | 733.21 | 3951.59 | 475.71 |

| 2011 | 1258.18 | 260.50 | 2684.69 | 1244.14 | 2229.06 | 2794.97 | 281.79 | 956.49 | 4611.17 | 570.61 |

| 2012 | 1606.54 | 372.70 | 3145.71 | 1488.86 | 3212.00 | 3408.09 | 343.79 | 1119.96 | 5273.37 | 681.50 |

| 2013 | 1891.74 | 462.19 | 3680.13 | 1672.44 | 3226.21 | 4016.39 | 434.05 | 1336.76 | 5960.93 | 723.53 |

| 2014 | 2186.46 | 554.11 | 4195.92 | 1851.62 | 4015.13 | 4731.82 | 573.15 | 1524.43 | 6268.29 | 825.10 |

| 2015 | 2507.145 | 716.46 | 5044.35 | 2020.60 | 4520.68 | 5474.97 | 805.02 | 1844.90 | 7155.36 | 923.84 |

| 2016 | 2953.43 | 885.02 | 5857.26 | 2356.23 | 5895.87 | 5942.31 | 1063.90 | 2116.33 | 8403.16 | 1020.69 |

| 601166 | 601939 | 601988 | 601998 | 601398 | 601628 | 600837 | 601318 | 600030 | 600369 | |

| 2007 | 851.34 | 6598.18 | 5991.22 | 1011.18 | 8683.71 | 933.70 | 95.34 | 692.22 | 189.65 | - |

| 2008 | 1020.90 | 7555.45 | 6951.68 | 1319.57 | 9757.14 | 987.49 | 74.68 | 704.56 | 206.80 | 8.02 |

| 2009 | 1332.16 | 9623.36 | 8751.94 | 1775.03 | 11,785.05 | 1226.25 | 120.73 | 935.71 | 153.17 | 14.97 |

| 2010 | 1849.67 | 10,810.32 | 10,459.87 | 2081.31 | 13,458.62 | 1410.57 | 115.41 | 1171.62 | 148.28 | 22.77 |

| 2011 | 2408.80 | 12,281.83 | 11,829.79 | 2765.88 | 15,476.86 | 1583.90 | 98.97 | 2285.42 | 168.50 | 17.76 |

| 2012 | 3250.98 | 13,972.83 | 12,680.62 | 2959.93 | 17,542.21 | 1898.91 | 126.48 | 2844.26 | 271.35 | 17.25 |

| 2013 | 3678.30 | 15,363.21 | 13,874.30 | 3641.19 | 18,917.75 | 1972.94 | 169.12 | 3360.31 | 479.62 | 29.99 |

| 2014 | 4406.40 | 16,744.09 | 15,251.38 | 4138.81 | 20,609.95 | 2246.56 | 352.62 | 4005.91 | 616.10 | 58.20 |

| 2015 | 5298.88 | 18,349.49 | 16,815.60 | 5122.29 | 22,209.78 | 2448.31 | 576.44 | 4765.15 | 597.43 | 71.74 |

| 2016 | 6085.90 | 20,963.71 | 18,148.89 | 5931.05 | 24,137.26 | 2696.95 | 560.86 | 5576.90 | 189.65 | 70.99 |

Appendix B

| Date | Stock Code | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 000001 | 002142 | 600000 | 600015 | 600016 | 600036 | 601009 | 601169 | 601328 | 601601 | |

| 2007 | 80.76 | - | 229.94 | 80.47 | 214.58 | 556.59 | 35.081 | 126.79 | 639.48 | 380.77 |

| 2008 | 2.94 | 17.00 | 75.01 | 36.28 | 76.61 | 180.14 | 15.410 | 55.49 | 236.46 | 85.62 |

| 2009 | 75.70 | 43.73 | 191.52 | 61.98 | 175.30 | 344.65 | 35.54 | 12.04 | 425.43 | 220.80 |

| 2010 | 55.03 | 35.76 | 177.78 | 54.40 | 136.66 | 291.35 | 29.51 | 71.24 | 339.02 | 207.31 |

| 2011 | 79.87 | 26.42 | 158.37 | 76.92 | 155.57 | 259.50 | 27.55 | 57.79 | 275.04 | 162.24 |

| 2012 | 82.08 | 30.74 | 185.04 | 70.89 | 219.184 | 296.70 | 27.31 | 81.84 | 358.38 | 205.41 |

| 2013 | 100.42 | 26.62 | 175.90 | 76.31 | 213.213 | 283.85 | 24.02 | 66.10 | 300.21 | 182.35 |

| 2014 | 180.97 | 51.12 | 292.67 | 119.86 | 351.531 | 413.75 | 43.49 | 115.42 | 469.83 | 290.60 |

| 2015 | 171.56 | 60.49 | 340.80 | 129.72 | 329.453 | 441.44 | 59.59 | 133.44 | 412.80 | 255.54 |

| 2016 | 156.26 | 64.89 | 350.43 | 115.94 | 317.773 | 437.77 | 65.68 | 148.42 | 402.27 | 241.77 |

| 2017 | 228.37 | 90.29 | 369.54 | 115.40 | 293.156 | 717.57 | 65.65 | 151.17 | 368.74 | 375.35 |

| 601166 | 601939 | 601988 | 601998 | 601398 | 601628 | 600837 | 601318 | 600030 | 600369 | |

| 2007 | 259.30 | 1468.28 | 1443.64 | 328.35 | 2471.79 | 1485.46 | 225.94 | 706.49 | 295.95 | 2.22 |

| 2008 | 73.00 | 875.47 | 670.58 | 131.74 | 1186.85 | 542.69 | 66.727 | 211.77 | 119.15 | 1.73 |

| 2009 | 201.55 | 1375.34 | 1051.10 | 291.58 | 1836.22 | 911.17 | 157.89 | 416.88 | 210.65 | 36.15 |

| 2010 | 144.12 | 1464.68 | 922.21 | 192.81 | 1537.88 | 643.84 | 79.32 | 479.34 | 125.22 | 27.01 |

| 2011 | 135.05 | 1100.50 | 764.92 | 181.65 | 1436.39 | 483.21 | 60.97 | 294.82 | 107.75 | 20.04 |

| 2012 | 180.03 | 1247.06 | 803.68 | 193.08 | 1474.73 | 597.07 | 98.91 | 380.17 | 150.02 | 20.74 |

| 2013 | 193.19 | 1137.55 | 745.87 | 172.38 | 1302.25 | 455.91 | 107.33 | 369.40 | 144.90 | 23.06 |

| 2014 | 314.36 | 1290.58 | 1143.75 | 333.81 | 1682.45 | 892.52 | 218.02 | 593.40 | 361.07 | 62.91 |

| 2015 | 325.22 | 1124.09 | 1087.37 | 292.89 | 1574.85 | 745.55 | 167.12 | 658.05 | 224.93 | 55.89 |

| 2016 | 307.50 | 1336.77 | 982.49 | 283.94 | 1550.20 | 636.17 | 168.04 | 642.42 | 190.14 | 40.25 |

| 2017 | 352.95 | 14,499.25 | 1104.18 | 199.71 | 2126.29 | 577.94 | 136.35 | 1238.572 | 219.32 | 26.14 |

References

- Feldman, S.J.; Soyka, P.A.; Ameer, P.G. Does improving a firm’s environmental management system and environmental performance result in a higher stock price? J. Investig. 1997, 6, 87–97. [Google Scholar] [CrossRef]

- Godfrey, P.C. The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Acad. Manag. Rev. 2005, 30, 777–798. [Google Scholar] [CrossRef]

- Sharfman, M.P.; Fernando, C.S. Environmental risk management and the cost of capital. Strateg. Manag. J. 2008, 29, 569–592. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Ratnatunga, J.; Jones, S. An inconvenient truth about accounting: The paradigm shift required in carbon emissions reporting and assurance. In Contemporary Issues in Sustainability Accounting, Assurance and Reporting; Emerald Group Publishing: Bradford, UK, 2012; pp. 71–114. [Google Scholar]

- Dhaliwal, D.S.; Radhakrishnan, S.; Tsang, A.; Yang, Y.G. Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure. Account. Rev. 2012, 87, 723–759. [Google Scholar] [CrossRef]

- Harjoto, M.A.; Jo, H. Legal vs. Normative CSR: Differential Impact on Analyst Dispersion, Stock Return Volatility, Cost of Capital, and Firm Value. J. Bus. Ethics 2015, 128, 1–20. [Google Scholar] [CrossRef]

- Theodoulidis, B.; Diaz, D.; Crotto, F.; Rancati, E. Exploring corporate social responsibility and financial performance through stakeholder theory in the tourism industries. Tour. Manag. 2017, 62, 173–188. [Google Scholar] [CrossRef]

- Mackey, A.; Mackey, T.B.; Barney, J.B. Corporate social responsibility and firm performance: Investor preferences and corporate strategies. Acad. Manag. Rev. 2007, 32, 817–835. [Google Scholar] [CrossRef]

- Jo, H.; Na, H. Does CSR Reduce Firm Risk? Evidence from Controversial Industry Sectors. J. Bus. Ethics 2012, 110, 441–456. [Google Scholar] [CrossRef]

- Orlitzky, M. Corporate social responsibility, noise, and stock market volatility. Acad. Manag. Perspect. 2013, 27, 238–254. [Google Scholar] [CrossRef]

- Crane, A. The Oxford Handbook of Corporate Social Responsibility; Oxford Handbooks: Oxford, UK, 2008. [Google Scholar]

- Freeman, R.E. The politics of stakeholder theory: Some future directions. Bus. Ethics Q. 1994, 4, 409–421. [Google Scholar] [CrossRef]

- Ho, K.-Y.; Shi, Y.; Zhang, Z. How does news sentiment impact asset volatility? Evidence from long memory and regime-switching approaches. N. Am. J. Econ. Financ. 2013, 26, 436–456. [Google Scholar] [CrossRef]

- Ho, K.-Y.; Shi, Y.; Zhang, Z. Does news matter in China’s foreign exchange market? Chinese RMB volatility and public information arrivals. Int. Rev. Econ. Financ. 2017, 52, 302–321. [Google Scholar] [CrossRef]

- Riordan, R.; Storkenmaier, A.; Wagener, M.; Zhang, S.S. Public information arrival: Price discovery and liquidity in electronic limit order markets. J. Bank. Financ. 2013, 37, 1148–1159. [Google Scholar] [CrossRef]

- Tetlock, P.C. Does public financial news resolve asymmetric information? Rev. Financ. Stud. 2010, 23, 3520–3557. [Google Scholar] [CrossRef]

- Lu, Y.; Abeysekera, I. What do stakeholders care about? Investigating corporate social and environmental disclosure in China. J. Bus. Ethics 2017, 144, 169–184. [Google Scholar] [CrossRef]

- DesJardins, J. Corporate environmental responsibility. J. Bus. Ethics 1998, 17, 825–838. [Google Scholar] [CrossRef]

- Chow, W.S.; Chen, Y. Corporate sustainable development: Testing a new scale based on the mainland Chinese context. J. Bus. Ethics 2012, 105, 519–533. [Google Scholar] [CrossRef]

- Korhonen, J. The dominant economics paradigm and corporate social responsibility. Corp. Soc. Responsib. Environ. Manag. 2002, 9, 66–79. [Google Scholar] [CrossRef]

- Korhonen, J. Should we measure corporate social responsibility? Corp. Soc. Responsib. Environ. Manag. 2003, 10, 25–39. [Google Scholar] [CrossRef]

- Jha, A.; Cox, J. Corporate social responsibility and social capital. J. Bank. Financ. 2015, 60, 252–270. [Google Scholar] [CrossRef]

- Gao, Y. Corporate social performance in China: Evidence from large companies. J. Bus. Ethics 2009, 89, 23–35. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J.; Dou, Y. Corporate sustainability development in China: Review and analysis. Ind. Manag. Data Syst. 2015, 115, 5–40. [Google Scholar] [CrossRef]

- Chen, Y.-C.; Hung, M.; Wang, Y. The effect of mandatory CSR disclosure on firm profitability and social externalities: Evidence from China. J. Account. Econ. 2017, 65, 169–190. [Google Scholar] [CrossRef]

- The 19th National Congress of the Communist Party of China. Available online: http://www.gov.cn/zhuanti/19thcpc/baogao.htm (accessed on 16 May 2018).

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Orlitzky, M.; Siegel, D.S.; Waldman, D.A. Strategic corporate social responsibility and environmental sustainability. Bus. Soc. 2011, 50, 6–27. [Google Scholar] [CrossRef]

- Owen, D.L.; O’Dwyer, B. Corporate social responsibility: The reporting and assurance dimension. In The Oxford Handbook of Corporate Social Responsibility; Oxford University Press: Oxford, UK, 2008; pp. 384–409. [Google Scholar]

- Miller, E.M. Risk, uncertainty, and divergence of opinion. J. Financ. 1977, 32, 1151–1168. [Google Scholar] [CrossRef]

- Grossman, S.J.; Stiglitz, J.E. On the impossibility of informationally efficient markets. Am. Econ. Rev. 1980, 70, 393–408. [Google Scholar] [CrossRef]

- Cordeiro, J.J.; Tewari, M. Firm characteristics, industry context, and investor reactions to environmental CSR: A stakeholder theory approach. J. Bus. Ethics 2015, 130, 833–849. [Google Scholar] [CrossRef]

- Hasnas, J. The normative theories of business ethics: A guide for the perplexed. Bus. Ethics Q. 1998, 8, 19–42. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Agle, B.R.; Wood, D.J. Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Rodrigue, M. Contrasting realities: Corporate environmental disclosure and stakeholder-released information. Account. Audit. Account. J. 2014, 27, 119–149. [Google Scholar] [CrossRef]

- Chen, S.; Sun, Z.; Tang, S.; Wu, D. Government intervention and investment efficiency: Evidence from China. J. Corp. Financ. 2011, 17, 259–271. [Google Scholar] [CrossRef]

- Li, W.; Zhang, R. Corporate social responsibility, ownership structure, and political interference: Evidence from China. J. Bus. Ethics 2010, 96, 631–645. [Google Scholar] [CrossRef]

- Liu, X.; Wang, C.; Wei, Y. Causal links between foreign direct investment and trade in China. China Econ. Rev. 2001, 12, 190–202. [Google Scholar] [CrossRef]

- Kim, K.-H.; Kim, M.; Qian, C. Effects of corporate social responsibility on corporate financial performance: A competitive-action perspective. J. Manag. 2018, 44, 1097–1118. [Google Scholar] [CrossRef]

- Lins, K.V.; Servaes, H.; Tamayo, A. Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar] [CrossRef]

- McGuire, J.B.; Sundgren, A.; Schneeweis, T. Corporate social responsibility and firm financial performance. Acad. Manag. J. 1988, 31, 854–872. [Google Scholar]

- Oh, S.; Hong, A.; Hwang, J. An Analysis of CSR on Firm Financial Performance in Stakeholder Perspectives. Sustainability 2017, 9, 1023. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Luo, Y.; Xue, Q.; Han, B. How emerging market governments promote outward FDI: Experience from China. J. World Bus. 2010, 45, 68–79. [Google Scholar] [CrossRef]

- Unger, J. Bridges: Private business, the Chinese government and the rise of new associations. China Q. 1996, 147, 795–819. [Google Scholar] [CrossRef]

- Becchetti, L.; Ciciretti, R.; Hasan, I. Corporate social responsibility, stakeholder risk, and idiosyncratic volatility. J. Corp. Financ. 2015, 35, 297–309. [Google Scholar] [CrossRef]

- Tehulu, T.A. Determinants of financial sustainability of microfinance institutions in East Africa. Eur. J. Bus. Manag. 2013, 5, 152–158. [Google Scholar] [CrossRef]

- Lourenço, I.C.; Branco, M.C.; Curto, J.D.; Eugénio, T. How does the market value corporate sustainability performance? J. Bus. Ethics 2012, 108, 417–428. [Google Scholar] [CrossRef]

- Hunter, M.L.; Van Wassenhove, L.N.; Besiou, M.; Van Halderen, M. The agenda-setting power of stakeholder media. Calif. Manag. Rev. 2013, 56, 24–49. [Google Scholar] [CrossRef]

- Besiou, M.; Hunter, M.L.; Van Wassenhove, L.N. A web of watchdogs: Stakeholder media networks and agenda-setting in response to corporate initiatives. J. Bus. Ethics 2013, 118, 709–729. [Google Scholar] [CrossRef]

- Bruntland, G. World Commission on Environment and Development (WCED, 1987): Our Common Future; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Atkinson, G. Measuring corporate sustainability. J. Environ. Plan. Manag. 2000, 43, 235–252. [Google Scholar] [CrossRef]

- Inglehart, R. Public support for environmental protection: Objective problems and subjective values in 43 societies. PS Political Sci. Politics 1995, 28, 57–72. [Google Scholar] [CrossRef]

- Nghiem, L.T.; Papworth, S.K.; Lim, F.K.; Carrasco, L.R. Analysis of the capacity of Google Trends to measure interest in conservation topics and the role of online news. PLoS ONE 2016, 11, e0152802. [Google Scholar] [CrossRef] [PubMed]

- Choi, M.J.; Torralba, A.; Willsky, A.S. Context models and out-of-context objects. Pattern Recognit. Lett. 2012, 33, 853–862. [Google Scholar] [CrossRef]

- Engle, R.F. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econ. J. Econ. Soc. 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Franses, P.H.; McAleer, M. Financial volatility: An introduction. J. Appl. Econ. 2002, 17, 419–424. [Google Scholar] [CrossRef]

- McAleer, M.; Oxley, L. The econometrics of financial time series. J. Econ. Surv. 2002, 16, 237–243. [Google Scholar] [CrossRef]

- Li, W.; Ling, S.; McAleer, M. Recent theoretical results for time series models with GARCH errors. J. Econ. Surv. 2002, 16, 245–269. [Google Scholar] [CrossRef]

- Ling, S.; McAleer, M. Necessary and sufficient moment conditions for the GARCH (r, s) and asymmetric power GARCH (r, s) models. Econ. Theory 2002, 18, 722–729. [Google Scholar] [CrossRef]

- Ling, S.; McAleer, M. Asymptotic theory for a vector ARMA-GARCH model. Econ. Theory 2003, 19, 280–310. [Google Scholar] [CrossRef]

- Asai, M.; McAleer, M.; Medeiros, M.C. Asymmetry and long memory in volatility modeling. J. Financ. Econ. 2012, 10, 495–512. [Google Scholar] [CrossRef]

- Marcucci, J. Forecasting stock market volatility with regime-switching GARCH models. Stud. Nonlinear Dyn. Econ. 2005, 9. [Google Scholar] [CrossRef]

- Franses, P.H.; Van Dijk, D. Forecasting stock market volatility using (nonlinear) GARCH models. J. Forecast. 1996, 15, 229–235. [Google Scholar] [CrossRef]

- French, K.R.; Schwert, G.W.; Stambaugh, R.F. Expected stock returns and volatility. J. Financ. Econ. 1987, 19, 3–29. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized autoregressive conditional heteroskedasticity. J. Econ. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Bollerslev, T.; Mikkelsen, H.O. Modeling and pricing long memory in stock market volatility. J. Econ. 1996, 73, 151–184. [Google Scholar] [CrossRef]

- Chan, F.; McAleer, M. Estimating smooth transition autoregressive models with GARCH errors in the presence of extreme observations and outliers. Appl. Financ. Econ. 2003, 13, 581–592. [Google Scholar] [CrossRef]

- McAleer, M.; Medeiros, M.C. A multiple regime smooth transition heterogeneous autoregressive model for long memory and asymmetries. J. Econ. 2008, 147, 104–119. [Google Scholar] [CrossRef]

- McAleer, M. Automated inference and learning in modeling financial volatility. Econ. Theory 2005, 21, 232–261. [Google Scholar] [CrossRef]

- Nelson, D.B. Conditional heteroskedasticity in asset returns: A new approach. Econ. J. Econ. Soc. 1991, 59, 347–370. [Google Scholar] [CrossRef]

- Martinet, G.G.; McAleer, M. On The Invertibility of EGARCH (p, q). Econ. Rev. 2018, 37, 824–849. [Google Scholar] [CrossRef]

- McAleer, M.; Hafner, C.M. A one line derivation of EGARCH. Econometrics 2014, 2, 92–97. [Google Scholar] [CrossRef]

- Chang, C.-L.; McAleer, M. The correct regularity condition and interpretation of asymmetry in EGARCH. Econ. Lett. 2017, 161, 52–55. [Google Scholar] [CrossRef]

- Baillie, R.T.; Bollerslev, T.; Mikkelsen, H.O. Fractionally integrated generalized autoregressive conditional heteroskedasticity. J. Econ. 1996, 74, 3–30. [Google Scholar] [CrossRef]

- Chang, C.-L.; McAleer, M.; Tansuchat, R. Modelling long memory volatility in agricultural commodity futures returns. Ann. Financ. Econ. 2012, 7, 1250010. [Google Scholar] [CrossRef]

- Shi, Y.; Ho, K.-Y. Modeling high-frequency volatility with three-state FIGARCH models. Econ. Model. 2015, 51, 473–483. [Google Scholar] [CrossRef]

- Bentes, S.R. Measuring persistence in stock market volatility using the FIGARCH approach. Phys. A Stat. Mech. Appl. 2014, 408, 190–197. [Google Scholar] [CrossRef]

- Cochran, S.J.; Mansur, I.; Odusami, B. Volatility persistence in metal returns: A FIGARCH approach. J. Econ. Bus. 2012, 64, 287–305. [Google Scholar] [CrossRef]

- Belkhouja, M.; Boutahary, M. Modeling volatility with time-varying FIGARCH models. Econ. Model. 2011, 28, 1106–1116. [Google Scholar] [CrossRef]

- Taylor, D.; Shan, Y.G. What drives the fledgling practice of social and environmental reporting by Chinese companies listed in Hong Kong? Account. Account. Perform. 2007, 13, 55. [Google Scholar]

- Mehran, H. Executive compensation structure, ownership, and firm performance. J. Financ. Econ. 1995, 38, 163–184. [Google Scholar] [CrossRef]

- Jenter, D.; Kanaan, F. CEO turnover and relative performance evaluation. J. Financ. 2015, 70, 2155–2184. [Google Scholar] [CrossRef]

- Quitzow, R. Dynamics of a policy-driven market: The co-evolution of technological innovation systems for solar photovoltaics in China and Germany. Environ. Innov. Soc. Trans. 2015, 17, 126–148. [Google Scholar] [CrossRef]

- Foley, H. Understanding Sustainability from a Global Perspective: Exploring the Role of Education for Sustainable Development within Contemporary Education in Ireland. Ph.D. Thesis, University College Cork, Cork, Ireland, 2017. [Google Scholar]

- McAleer, M. Asymmetry and leverage in conditional volatility models. Econometrics 2014, 2, 145–150. [Google Scholar] [CrossRef]

| Var. | Mean | Std. Dev | Median | Min. | Max. | Skew. | Kuro. | Obs. |

|---|---|---|---|---|---|---|---|---|

| Panel A: Descriptive statistics of stock price return | ||||||||

| rt | −0.0018 | 0.8487 | 0.0000 | −4.7958 | 4.2516 | −0.1240 | 7.4307 | 2673 |

| Panel B: Descriptive statistics of news frequency | ||||||||

| SNFt | 0.1349 | 0.1646 | 0.1000 | 0.0000 | 2.0000 | 3.0131 | 20.3135 | 2673 |

| GNFt | 5.9828 | 4.6825 | 4.6500 | 0.0000 | 32.7500 | 1.4506 | 5.5448 | 2673 |

| GTFt | 47.7899 | 15.3058 | 49.3681 | 9.0526 | 88.9474 | −0.2663 | 2.3256 | 2673 |

| Panel C: Descriptive statistics of news variables | ||||||||

| WSNFt | 0.1468 | 0.1796 | 0.1034 | 0.0000 | 2.1997 | 3.0795 | 21.2409 | 2673 |

| WGNFt | 1.4495 | 0.9289 | 1.5369 | −2.9957 | 3.4889 | −1.0312 | 5.2408 | 2673 |

| WGTFt | 3.8585 | 0.3744 | 3.9530 | 2.2450 | 4.5300 | −1.0619 | 3.7932 | 2673 |

| Parameter | Sustainability News (WSNF) | General News (WGNF) | Google Search (WGTF) | Benchmark Model |

|---|---|---|---|---|

| b0 (constant) | 0.0558 (p = 0.0000) | 0.5667 (p = 0.0000) | 4.0442 (p = 0.0000) | 0.0209 (p = 0.1098) |

| bλ | 0.1743 (p = 0.0000) | 0.7709 (p = 0.0000) | 0.5595 (p = 0.0000) | −0.0156 (p = 0.4209) |

| b1 | 2.9819 (p = 0.0000) | 1.7560 (p = 0.0000) | 2.2062 (p = 0.0000) | − |

| (constant) | −0.1231 (p = 0.0000) | −0.2691 (p = 0.0000) | −0.5206 (p = 0.0000) | 0.0070 (p = 0.0005) |

| α | 0.1601 (p = 0.0000) | −0.1747 (p = 0.0000) | −0.3292 (p = 0.0000) | −0.0044 (p = 0.0000) |

| β | 0.9679 (p = 0.0000) | 0.6388 (p = 0.0000) | 0.8177 (p = 0.0000) | 0.9934 (p = 0.0000) |

| γ | −0.0530 (p = 0.0000) | 0.0273 (p = 0.0982) | −0.1063 (p = 0.0000) | 0.1284 (p = 0.0000) |

| Log lik. | 1081.085 | 5567.7940 | 116.5570 | −2881.932 |

| AIC | −0.8094 | 2.0984 | 0.0488 | 2.1616 |

| Parameter | Sustainability News (WSNF) | General News (WGNF) | Google Search (WGTF) | Benchmark Model |

|---|---|---|---|---|

| (constant) | 0.0066 (p = 0.0000) | 0.0055 (p = 0.0000) | 0.0092 (p = 0.0000) | 0.0224 (p = 0.1447) |

| b1 | 0.0233 (p = 0.0000) | −0.0014 (p = 0.0000) | −0.0107 (p = 0.0000) | − |

| (constant) | 0.0014 (p = 0.0000) | 0.0009 (p = 0.0000) | −0.0001 (p = 0.1679) | 0.0022 (p = 0.0082) |

| α | 0.0423 (p = 0.0000) | 0.0353 (p = 0.0000) | 0.0449 (p = 0.0000) | 0.0000 (p = 1.0000) |

| β | 0.9008 (p = 0.0000) | 0.9039 (p = 0.0000) | 0.9002 (p = 0.0000) | 0.9395 (p = 0.0000) |

| d | 0.4014 (p = 0.0000) | 0.4398 (p = 0.0982) | 0.4016 (p = 0.0000) | 0.7007 (p = 0.0000) |

| Log lik. | −4019.846 | −4036.078 | −4235.052 | −2884.184 |

| AIC | 3.0145 | 3.0266 | 3.1755 | 2.1640 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, J.; Djajadikerta, H.G.; Zhang, Z. Does Sustainability Engagement Affect Stock Return Volatility? Evidence from the Chinese Financial Market. Sustainability 2018, 10, 3361. https://doi.org/10.3390/su10103361

Zhang J, Djajadikerta HG, Zhang Z. Does Sustainability Engagement Affect Stock Return Volatility? Evidence from the Chinese Financial Market. Sustainability. 2018; 10(10):3361. https://doi.org/10.3390/su10103361

Chicago/Turabian StyleZhang, Junru, Hadrian Geri Djajadikerta, and Zhaoyong Zhang. 2018. "Does Sustainability Engagement Affect Stock Return Volatility? Evidence from the Chinese Financial Market" Sustainability 10, no. 10: 3361. https://doi.org/10.3390/su10103361

APA StyleZhang, J., Djajadikerta, H. G., & Zhang, Z. (2018). Does Sustainability Engagement Affect Stock Return Volatility? Evidence from the Chinese Financial Market. Sustainability, 10(10), 3361. https://doi.org/10.3390/su10103361