Research on the Renewable Energy Industry Financing Efficiency Assessment and Mode Selection

Abstract

:1. Introduction

2. Literature Review

3. Methodology and Materials

3.1. Methodology

3.1.1. BC2 Model (Variable Returns to Scale) and C2R Model (Constant Returns to Scale)

3.1.2. Malmquist Index Model

3.2. Materials

3.2.1. Input Indicator

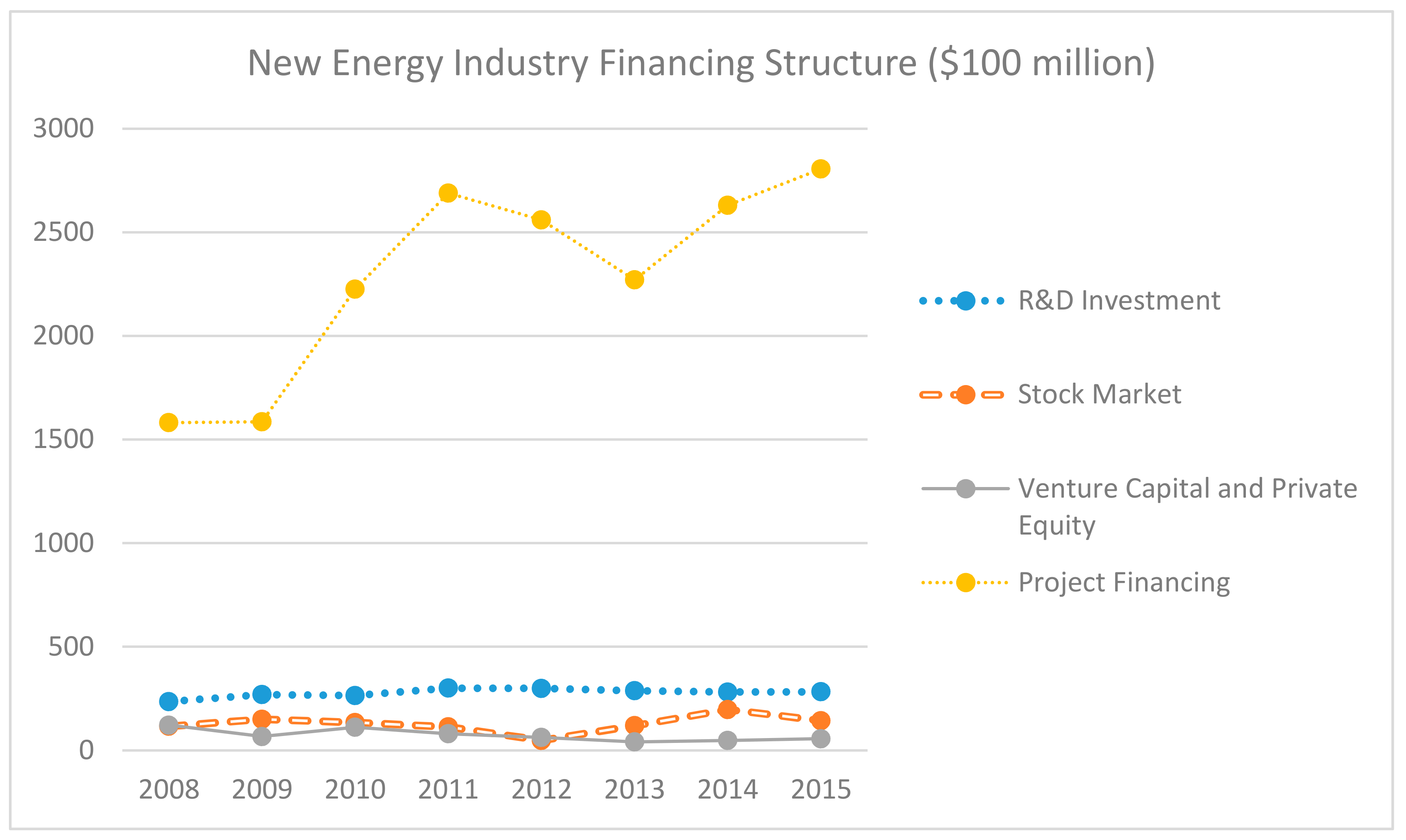

- The R&D investment can represent the government’s support for the development of the new energy industry and the financing cost of financing is very low [19]. R&D overheating will lead to overcapacity and will not play well in guiding the healthy development of the industry. The reason may be that the policy finance combines with market weakly and doesn’t play a role of policy guiding in the market vision.

- The development of the stock market can provide long-term financing for the development of renewable energy industry, thus promoting the long-term and healthy development. On a global scale, renewable energy industry has exposed the blind development, the problem of excess production capacity and low technical level. The problem makes investors evaluate the investment value and the tendency of raising funds through Initial Public Offerings (IPO) and then secondary is no longer overheating.

- Project financing is a type of financing that the lender provides specific project financing, has repayment for the project cash flow, and takes the project assets as collateral. It is a financing way that repays the loan with the future earnings and assets of the project. As a new mode of financing, it has great operating space in the development and utilization of renewable energy. As can be seen from Figure 2, project financing accounts for a large proportion in the financing structure and is the main financing method of renewable energy industry.

- Venture capital and private equity financing is a kind of investment that raises the capital investment for the highly uncertain high-tech enterprises or projects, expected by implementing the highest growth rate of the project, and gets ultimately higher revenues from the sale of equity through certain institutions and a certain way from various organizations and individuals.

3.2.2. Output Indicator

4. Results

4.1. Time Series Analysis

- The average value of technical efficiency between 2008 and 2015 was 1.202, the maximum value was 2.019 and the minimum value was 0.815. There existed larger fluctuation range and the total efficiency was general. From the trend of the overall financing efficiency we could find that technical efficiency and pure technical efficiency was parallel. In the decomposition of the energy industry of renewable financing efficiency, pure technical efficiency on the efficiency of the overall financing force was stronger.

- The renewable energy industry financing efficiency in 2010–2011 and 2013–2014 period was in decline, it showed a trend of different proportion of growth in the rest of the years, renewable energy industry’s overall financing efficiency was well, financing effect of four ways was remarkable.

- The technical efficiency during 2011–2011 and 2013–2015 presented the downward trend, all the rest of the year presented a rising trend. The reason may be the countries all over the world have attached great importance to the field of renewable energy power generation as industrial support, financial support, but the narrow financing channel lead to poor performance financing efficiency in individual years.

4.2. Analysis of Different Industries

- On the whole, the average value of comprehensive financing efficiency of each industry was low. The comprehensive financing efficiency of wind power industry was highest, at 0.72, but it belonged to the weak efficient state and 28% of the investment did not get valid use. Most of the year has big ameliorative space. The financing efficiency of the remaining industries was generally low, it might account for that the blind investment in the renewable energy industry led to generally input redundancy and lower output efficiency. Although renewable energy industry developed rapidly, the stronger policy driving force and poor market initiative made the overall financing efficiency lower and earnings volatility larger in the face of big policy volatility and the condition of insufficient market demand. At the same time, the average capital using efficiency and the scale efficiency had equal effect the overall financing efficiency.

- The capital using efficiency represented the maximum output at the given input when the scale was fixed. According to Table 3, it could be found that the fund using efficiency of photovoltaic industry, wind power industry, geothermal energy and ocean energy industry were generally higher, at 0.846, 0.968, 0.842, 0.968 respectively. It meant that after stripping out scale inefficiency, 15.4%, 3.2%, 15.8%, 19.8% of the fund was wasted because of mismanagement. In most years, the capital using efficiency was greater than 0.8; it indicated that the efficiency was higher, but there still existed a big room for improvement.

- The scale efficiency of the geothermal energy industry and the marine energy industry were higher, which showed that some of the inputs were not fully utilized in these years and the resource allocation were not well. Among them, there were four years of valid scale efficiency of the marine energy industry and in the position of the constant state of scale compensation. It meant that the marine energy generation had reached the largest point in this investment.

4.3. Analysis of Different Financing Ways

- On the whole, the average financing efficiency of the various financing was higher. The comprehensive efficiency of R&D investment and project financing was bigger, at 0.920 and 0.920 respectively, and efficiency in most years stayed above 0.9. Stock market and venture capital and private equity financing efficiency was low and had larger fluctuation. The reason may be that the equity financing cannot match the current and future demand for project funding scale, then relying on equity financing could not fully meet the demand of funds.

- The capital using efficiency of R&D and project financing was higher, at 0.949 and 0.990 respectively; in most years, the capital using efficiency value is greater than 0.9. But there still existed room to improve. This also showed that the comprehensive financing efficiency was greatly influenced by the capital using efficiency.

- The capital scale efficiency of R&D investment, venture capital and private equity was higher. The capital scale efficiency in most years was greater than 0.9. The stock market and the scale of the project financing efficiency was low and volatile; it mainly related to renewable energy industry characteristics itself. Because the renewable energy industry management products and services had a larger initial investment and the cycle was long, it needed continue occupying the market through the expansion of the scale.

5. Discussion and Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- International Energy Agency. Available online: http://www.iea.org/ (accessed on 26 November 2017).

- Bloomberg New Energy Finance. Available online: https://about.newenergyfinance.com/about/ (accessed on 2 December 2017).

- Modiliani, F.; Miller, M.H. The Cost of Capital, Corporation Finance, and the Theory of Investment. Am. Econ. Rev. 1958, 48, 125–143. [Google Scholar]

- Li, L.B.; Liu, B.L.; Liu, W.L.; Chiu, Y.H. Efficiency evaluation of the regional high-tech industry in China: A new framework based on meta-frontier dynamic DEA analysis. Soc. Econ. Plan. Sci. 2017, 60, 24–33. [Google Scholar] [CrossRef]

- Lu, T.; Yan, B.W. The Study of the DEA Method Model for University Teaching Quality Assessment and Benefit Analysis. Phys. Proc. 2012, 5, 1187–1191. [Google Scholar] [CrossRef]

- Wu, L.; Li, H. Analysis of the development of the wind power industry in China—From the perspective of the financial support. Energy Sustain. Soc. 2017, 7, 37. [Google Scholar] [CrossRef]

- Ng, T.H.; Tao, J.Y. Bond financing for renewable energy in Asia. Energy Policy 2016, 95, 509–517. [Google Scholar] [CrossRef]

- Mazzucato, M.; Semieniuk, G. Financing renewable energy: Who is financing what and why it matters. Technol. Forecast. Soc. Chang. 2018, 127, 8–22. [Google Scholar] [CrossRef]

- Krupa, J.; Harvey, L.D.D. Renewable electricity finance in the United States: A state-of-the-art review. Energy 2017, 135, 913–929. [Google Scholar] [CrossRef]

- Jiang, X.L.; Duan, Y.C. Research on financial support system for new energy enterprises based on life cycle theory. Mod. Manag. Sci. 2016, 10, 24–26. [Google Scholar]

- Jiang, X.L.; Wang, Y.; Lyu, D.K. Financial support path analysis in the development of new energy industry. Econ. Asp. 2010, 8, 50–53. [Google Scholar]

- Kabir, E.; Kumar, P.; Adelodun, A.A.; Kim, K.H. Solar energy: Potential and future prospects. Renew. Sustain. Energy Rev. 2018, 82, 894–900. [Google Scholar] [CrossRef]

- Zeng, S.; Jiang, C.; Ma, C.; Su, B. Investment efficiency of the new energy industry in China. Energy Econ. 2017. [CrossRef]

- Deng, H. Research on Financing Efficiency of New Energy Industry in China. Master’s Thesis, South China University of Technology, Guangzhou, China, 2015. [Google Scholar]

- Zhao, B. The impact of financing method and enterprise nature on financing efficiency—Based on empirical research on China’s new energy industry. J. Commer. Econ. 2016, 17, 180–182. [Google Scholar]

- Zheng, D. Research on Financing Efficiency of Listed Companies in China’s New Energy Industry. Master’s Thesis, South China University of Technology, Guangzhou, China, 2015. [Google Scholar]

- Zhu, Y.; Zhou, S.; Feng, Y.; Hu, Z.; Yuan, L. Influences of solar energy on the energy efficiency design index for new building ships. Int. J. Hydrogen Energy 2017, 42, 19389–19394. [Google Scholar] [CrossRef]

- Despotis, D.K.; Koronakos, G. Efficiency Assessment in Two-stage Processes: A Novel Network DEA Approach. Proc. Comput. Sci. 2014, 31, 299–307. [Google Scholar] [CrossRef]

- Serras, F.R.; Marques, A.C.; Fuinhas, J.A. Evaluating the Impact of New Renewable Energy on the Peak Load—An ARDL Approach for Portugal. Energy Proc. 2016, 106, 24–34. [Google Scholar] [CrossRef]

- Gavrila, H.; Manescu, V.; Paltanea, G.; Scutaru, G.; Peter, I. New Trends in Energy Efficient Electrical Machines. Proc. Eng. 2017, 181, 568–574. [Google Scholar] [CrossRef]

- Li, J.; Liang, X.; Reiner, D.; Gibbins, J.; Lucquiaud, M.; Chalmers, H. Financing new power plants ‘CCS Ready’ in China—A case study of Shenzhen city. Energy Proc. 2011, 4, 2572–2579. [Google Scholar] [CrossRef]

| Indicator Hierarchy | Basic Indicator | Unit |

|---|---|---|

| Input | R&D Investment | $100 million |

| Stock Market | $100 million | |

| Venture Capital and Private Equity | $100 million | |

| Project Financing | $100 million | |

| Output | Renewable Energy Generation | TWh |

| Year | Effch | Techch | Pech | Sech | Tfpch |

|---|---|---|---|---|---|

| 2008–2009 | 2.019 | 0.585 | 1.41 | 1.432 | 1.181 |

| 2009–2010 | 1.305 | 1.062 | 1.064 | 1.226 | 1.386 |

| 2010–2011 | 1.266 | 0.771 | 1.087 | 1.164 | 0.976 |

| 2011–2012 | 0.99 | 1.579 | 0.972 | 1.019 | 1.564 |

| 2012–2013 | 1.49 | 0.791 | 1.105 | 1.348 | 1.178 |

| 2013–2014 | 0.903 | 1.019 | 1.002 | 0.901 | 0.92 |

| 2014–2015 | 0.815 | 1.746 | 0.888 | 0.919 | 1.423 |

| Min | 0.815 | 0.585 | 0.888 | 0.901 | 0.92 |

| Max | 2.019 | 1.746 | 1.41 | 1.432 | 1.564 |

| Average | 1.202 | 1.009 | 1.066 | 1.128 | 1.213 |

| Industry | Photovoltaic | Wind Power | Biomass | Geothermal | Marine Energy | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | Crste | Vrste | Scale | Crste | Vrste | Scale | Crste | Vrste | Scale | Crste | Vrste | Scale | Crste | Vrste | Scale |

| 2008 | 0.174 | 0.839 | 0.207 | 0.421 | 1.000 | 0.421 | 0.080 | 0.255 | 0.315 | 1.000 | 1.000 | 1.000 | 0.392 | 1.000 | 0.392 |

| 2009 | 0.301 | 1.000 | 0.301 | 0.507 | 0.975 | 0.520 | 0.119 | 0.363 | 0.329 | 0.585 | 0.592 | 0.988 | 0.222 | 0.567 | 0.392 |

| 2010 | 0.406 | 0.848 | 0.479 | 0.509 | 0.811 | 0.628 | 0.172 | 0.353 | 0.486 | 0.621 | 1.000 | 0.621 | 0.543 | 0.754 | 0.720 |

| 2011 | 0.337 | 0.520 | 0.648 | 0.719 | 0.987 | 0.729 | 0.166 | 0.322 | 0.517 | 0.479 | 1.000 | 0.479 | 0.547 | 0.760 | 0.720 |

| 2012 | 0.483 | 0.680 | 0.710 | 0.792 | 1.000 | 0.792 | 0.414 | 0.439 | 0.942 | 0.756 | 0.929 | 0.814 | 0.793 | 0.793 | 1.000 |

| 2013 | 0.821 | 0.958 | 0.857 | 0.895 | 1.000 | 0.895 | 0.516 | 0.561 | 0.919 | 0.598 | 0.710 | 0.843 | 0.968 | 0.968 | 1.000 |

| 2014 | 0.857 | 0.918 | 0.934 | 0.916 | 0.969 | 0.946 | 0.537 | 0.601 | 0.893 | 0.609 | 0.655 | 0.930 | 0.578 | 0.578 | 1.000 |

| 2015 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.830 | 0.851 | 0.975 | 1.000 | 1.000 | 1.000 |

| Average | 0.548 | 0.846 | 0.642 | 0.720 | 0.968 | 0.741 | 0.376 | 0.487 | 0.675 | 0.685 | 0.842 | 0.831 | 0.630 | 0.802 | 0.778 |

| R&D Investment | Stock Market | Venture Capital and Private Equity | Project Financing | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | Crste | Vrste | Scale | Crste | Vrste | Scale | Crste | Vrste | Scale | Crste | Vrste | Scale |

| 2008 | 0.922 | 1.000 | 0.922 | 0.339 | 0.416 | 0.816 | 0.288 | 0.336 | 0.859 | 0.998 | 1.000 | 0.998 |

| 2009 | 0.810 | 0.877 | 0.923 | 0.264 | 0.322 | 0.819 | 0.527 | 0.611 | 0.862 | 1.000 | 1.000 | 1.000 |

| 2010 | 0.957 | 0.988 | 0.968 | 0.342 | 0.359 | 0.953 | 0.368 | 0.369 | 0.997 | 0.829 | 0.999 | 0.830 |

| 2011 | 0.923 | 0.928 | 0.994 | 0.445 | 0.981 | 0.454 | 0.559 | 0.615 | 0.908 | 0.751 | 0.989 | 0.759 |

| 2012 | 0.890 | 0.906 | 0.982 | 1.000 | 1.000 | 1.000 | 0.687 | 0.717 | 0.957 | 0.756 | 0.957 | 0.791 |

| 2013 | 0.878 | 0.907 | 0.967 | 0.285 | 0.406 | 0.950 | 1.000 | 1.000 | 1.000 | 0.810 | 0.973 | 0.832 |

| 2014 | 0.981 | 0.988 | 0.993 | 0.254 | 0.530 | 0.480 | 0.929 | 1.000 | 0.929 | 0.764 | 1.000 | 0.764 |

| 2015 | 1.000 | 1.000 | 1.000 | 0.359 | 1.000 | 0.359 | 0.819 | 1.000 | 0.819 | 0.735 | 1.000 | 0.735 |

| Average | 0.920 | 0.949 | 0.969 | 0.424 | 0.627 | 0.729 | 0.647 | 0.706 | 0.916 | 0.830 | 0.990 | 0.839 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lyu, X.; Shi, A. Research on the Renewable Energy Industry Financing Efficiency Assessment and Mode Selection. Sustainability 2018, 10, 222. https://doi.org/10.3390/su10010222

Lyu X, Shi A. Research on the Renewable Energy Industry Financing Efficiency Assessment and Mode Selection. Sustainability. 2018; 10(1):222. https://doi.org/10.3390/su10010222

Chicago/Turabian StyleLyu, Xiaohuan, and Anna Shi. 2018. "Research on the Renewable Energy Industry Financing Efficiency Assessment and Mode Selection" Sustainability 10, no. 1: 222. https://doi.org/10.3390/su10010222

APA StyleLyu, X., & Shi, A. (2018). Research on the Renewable Energy Industry Financing Efficiency Assessment and Mode Selection. Sustainability, 10(1), 222. https://doi.org/10.3390/su10010222