1. Introduction

The use of private vehicles remains quite low, accounting for only approximately 4% to 5% of total transportation [

1]. When consumers can access more attractive pricing through sharing platforms compared to traditional methods, these platforms can disrupt conventional consumption patterns, leading to increased popularity among users. Numerous scholars have examined the business model of the sharing economy through various approaches, including qualitative interviews and quantitative analyses of consumer behavior [

1,

2,

3,

4]. Sharing represents a viable strategy to enhance the utilization of private cars, particularly with the advancement of 5G communication technology. As the 5gRTS-ET system expands across more countries and cities, coupled with a growing emphasis on environmental sustainability, the reliance on walking as a mode of transport, as discussed in this article, is expected to decline. Conversely, the use of passenger operating EVs (such as Uber and Didi) is anticipated to rise [

5], allowing individuals to serve as part-time drivers during weekends or commutes [

6,

7]. Integrating the 5gRTS-ET platform with existing charging stations and developing a new dynamic business model is crucial for adapting charging infrastructure to the operational demands of EVs under the 5gRTS-ET framework. This approach also serves as an effective means to enhance the utilization of charging point (CP) stations. The CP stations examined in this study impose high occupancy fees for connections without power output charging, rendering connection times without power output insignificant. For this reason, the definition of CP utilization rate in this article is CP Utilization/day (%) = Total Connection Duration (hours)/24 hours.

Comparison of CP in 5gRTS-ET vs. 4gRTS-ET systems as in

Table 1If every charging station integrates with the 5gRTS-ET platform, it will create a network connecting each EV, charging station, and traffic system. This integration will significantly transform the conventional business model where gasoline vehicles seek out fuel stations, as well as the traditional approach for EVs that plan their routes based on maps and calculate charging needs based on starting points or destinations. Furthermore, it will also alter the business models associated with EV sales and operations, prompting a shift in the charging station business model driven by this platform [

8]. However, changing the charging station business model presents challenges, as EVs are mobile while the map is software based, leaving only the charging stations as fixed and immovable entities. Within this platform, charging stations represent the most passive and vulnerable nodes in the system, often experiencing congestion issues [

9].

At the close of the last century, the Internet had the potential to undermine business models in sectors such as music recording and journalism; however, the Internet companies themselves struggled to establish viable business models. This phenomenon has now extended to the EV sector [

10]. The introduction of 5gRTS-ET has disrupted the existing business model of the EV industry [

11]. In both planned and perfectly competitive economies, price is the primary determinant of market dynamics. When the price exceeds the cost, producers are able to sell their products, and consumers receive goods produced by the market system. However, in a consumer society that values personalization, two-sided markets have become prevalent, where customers seek not just products but solutions to their perceived needs, which can also be influenced. In instances where enterprises must engage in activities for which the market is unprepared, the design of business models becomes crucial [

11,

12,

13]. This study effectively demonstrates the influence of technological advancements, linking the disruption of business models across various industries to the imperative for digitization and big data analytics [

13]. The disruptive technological shifts brought about by 5G have connected real-time vehicle platforms to transportation systems [

6,

14] and EV infrastructures [

15], facilitating online, real-time interconnectivity.

Currently, 5G technology is not integrated with charging stations. This is primarily due to two reasons: first, the inability to interconnect all infrastructure, even in major cities like New York [

14], and second, the lack of demand for interactions between conventional vehicles at refueling stations. The refueling process is typically brief, resulting in minimal congestion, except during the three global oil crises. In contrast, the technical limitations of EVs and their charging systems necessitate a charging duration of at least thirty minutes or more, leading to potential overcrowding during peak charging times. Consequently, access to CP within the system platform is crucial, as these points are significant variables in the decision-making models related to charging behavior [

16]. The 5gRTS-ECR network, which transitions from a static to a smart mobile service, emphasizes that the establishment and sharing of an effective innovation ecosystem within regional networks requires sustainable partnerships and collaborative strategies among key stakeholders [

17,

18]. Looking ahead, the rapid advancement and widespread adoption of generative AI have brought attention to the development of adaptive automated systems aimed at enhancing the security of cyber-physical systems through the use of large language models, thereby promoting safer applications [

19].

The inflexibility of traditional business models and their transformation processes has hindered some companies from swiftly adapting to technological advancements. The current ecological landscape has evolved, with networks playing a pivotal role. Consequently, the essence of the business model must focus on being the provider or controller of the network, leading to an increased significance of the software component in information interaction and analysis [

20]. This transition is profoundly disruptive and poised to reshape entire industries. Communication technology is a catalyst for network transformation, which in turn undermines existing business models centered around product elements within network nodes. The evolution from an initial manufacturing and sales business model to a manufacturing leasing model, followed by an intelligent network operation model [

6], ultimately culminates in the transformation of product manufacturers into service providers within the network’s economic and social framework. This shift represents a significant change in business models [

21].

The emergence of professional intelligent network operators has led to a growing acceptance of the mobile-as-a-service concept among users [

6,

22]. The introduction of non-ownership business models for EV has disrupted the previously established single information flow system [

6]. Current CP business models are unable to fully leverage the capabilities offered by this new system. Most existing business models rely on frameworks such as the Business Model Canvas (BMC) [

23], Teece’s Business Modelling Framework, or the Ecosystem Pie model [

24,

25]. However, it has been established that the rigidity of these models’ transformation mechanisms is ill suited to adapt to technological advancements. Each framework possesses distinct advantages and disadvantages; nonetheless, recent literature has innovatively integrated the BMC, Teece’s framework, and the Ecosystem Pie model. This integration proposes a novel Integral Business Modelling approach and introduces a prototype for business model verification. The effectiveness of this prototype has been validated in response to changes in the technological landscape of the CP market, specifically concerning single technology in vehicle-to-grid (V2G) systems [

20]. Similarly, innovations in 5G technology have significantly disrupted traditional charging systems and EV operating systems, including urban road network business models. Consequently, the existing business models for these systems are no longer applicable within the new 5gRTS-ET platform.

The existing charging infrastructure is characterized as a sunrise industry that struggles to generate profits, primarily due to the constraints imposed by oil prices and fuel consumption on electricity sales prices, as well as the limitations of electricity prices on operational costs. This situation presents a complex challenge [

26]. The limited availability of private parking spaces in urban areas makes public charging stations crucial for the widespread adoption of EVs. However, the initial site selection for these CP cannot adapt to urban development or the increasing number of EVs. According to data from the China EV Charging Infrastructure Promotion Alliance, the average operational time of charging stations in China in 2021 was merely 12.12%, indicating that they were utilized for less than three hours each day. Furthermore, since CP are not classified as public welfare facilities, they are not excessively constructed.

Enhancing the utilization of charging facilities and lowering the charging cost per vehicle are crucial for increasing profitability; a well-structured pricing model could potentially double cost recovery [

27]. However, the uncertainty surrounding input parameters means that the choice of pricing structure by operators can significantly influence the feasibility of profit margins [

28]. The pricing of CP lacks the capacity to impose a cost premium on suppliers (electricity prices) as a result of increased sales volume, nor can it raise prices due to monopolistic practices within charging regions. This renders the industry largely reactive, making it imperative to address the profitability of CP to facilitate the transition to EV energy. Given the fixed price range and the inability to impose cost premiums, the profit margins per unit price are inherently limited. Additionally, the financial burden of investment is substantial. Historically, policy subsidies have been utilized to encourage capital investment in new energy CP; however, with the reduction of government subsidies, the profitability of CP has become a critical factor in attracting capital investment [

29,

30,

31].

The analysis indicates that CP are currently undergoing a real-time interactive technological transformation across their entire operational systems, which encompasses various driving models for new technology development and a diverse range of stakeholders within the business ecosystem.

The current “business model” significantly influences the demand for and use of EV CP. Conventional business models typically emphasize hardware-focused revenue generation or fixed infrastructure deployment, often neglecting the dynamic requirements of the evolving mobility landscape. This limited perspective does not encompass the comprehensive value chain, which includes software platforms, data analytics, user experience, and efficient service delivery—elements crucial for optimizing CP utilization. Transitioning to a more integrated business model that prioritizes software-driven solutions, network connectivity, and customer-oriented services can effectively guide charging locations based on factors such as EV density, battery levels, and road conditions, thereby minimizing EV queuing times and enhancing CP utilization. For example, implementing subscription-based or usage-based pricing models enables providers to establish recurring revenue streams while encouraging customers to choose CP of this new business framework more frequently. Furthermore, incorporating CPs into larger mobility ecosystems—such as ride-sharing platforms, smart grids, or IoT-enabled services—can increase their functionality and attract a broader user base.

With the rise of ride-hailing platforms, the roles of EV users have become increasingly varied [

32]. Most existing research aimed at enhancing the utilization of charging stations focuses on the planning of CP locations and the analysis of charging behaviors, often treating the role of EV users as static or singular. This approach fails to account for the evolving nature of charging demand and user behavior resulting from shifts in EV user roles [

33,

34,

35]. For instance, the transition from private vehicle ownership to car-sharing—exacerbated by the proliferation of sharing platforms—leads to frequent changes in user roles [

29]. Additionally, some studies have explored the adjustment of charging prices to boost utilization; however, this strategy is often ineffective for EV users who are sensitive to charging times, particularly during peak operational hours [

28,

36,

37]. There is a scarcity of research examining CP utilization from the perspective of EV CP integrated into shared operation platforms, a method that can effectively address the fluctuations in charging demand and behavior associated with changing user roles. Evidence suggests that applying this approach to platforms like Uber significantly enhances vehicle usage [

36]. This paper investigates the business model of EVs and CP participating in the 5gRTS-ET platform in China, operational since 2021, while thoroughly considering the critical variables associated with the evolving roles of EV users, thereby addressing the limitations of prior studies.

This study investigates a novel business model tailored for 5gRTS-ET, aimed at addressing the challenges of charging queue management, enhancing user charging experiences, optimizing charging utilization rates, and reducing the investment return period. An empirical approach utilizing system data is employed to analyze the CP business model. Ultimately, an integrated business modeling technique is applied to perform a three-cycle modeling process for three distinct categories of EV users, each corresponding to different ecosystems, resulting in the development of dynamic business models that cater to the specific roles of various EV users [

20].

3. Results and Discussion

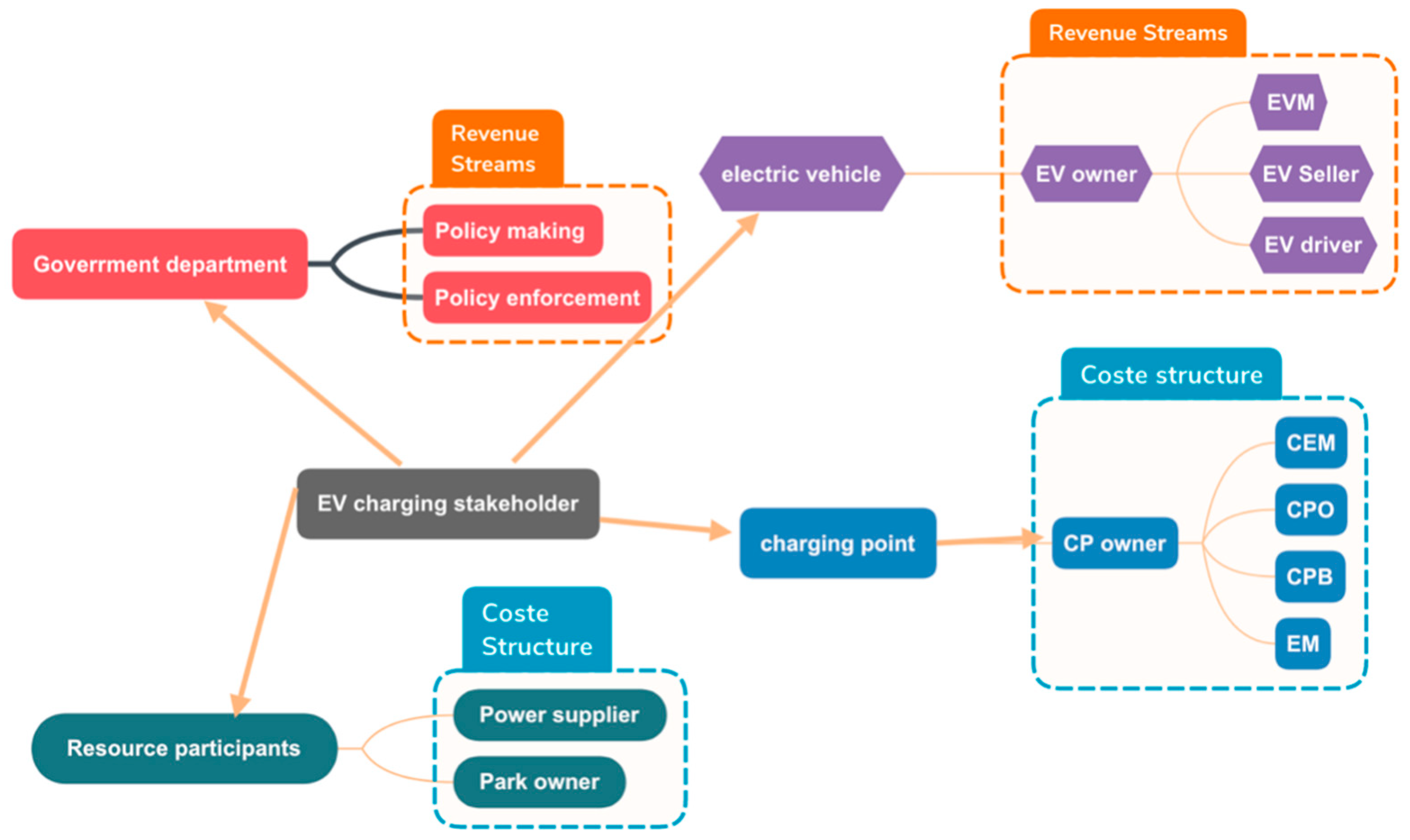

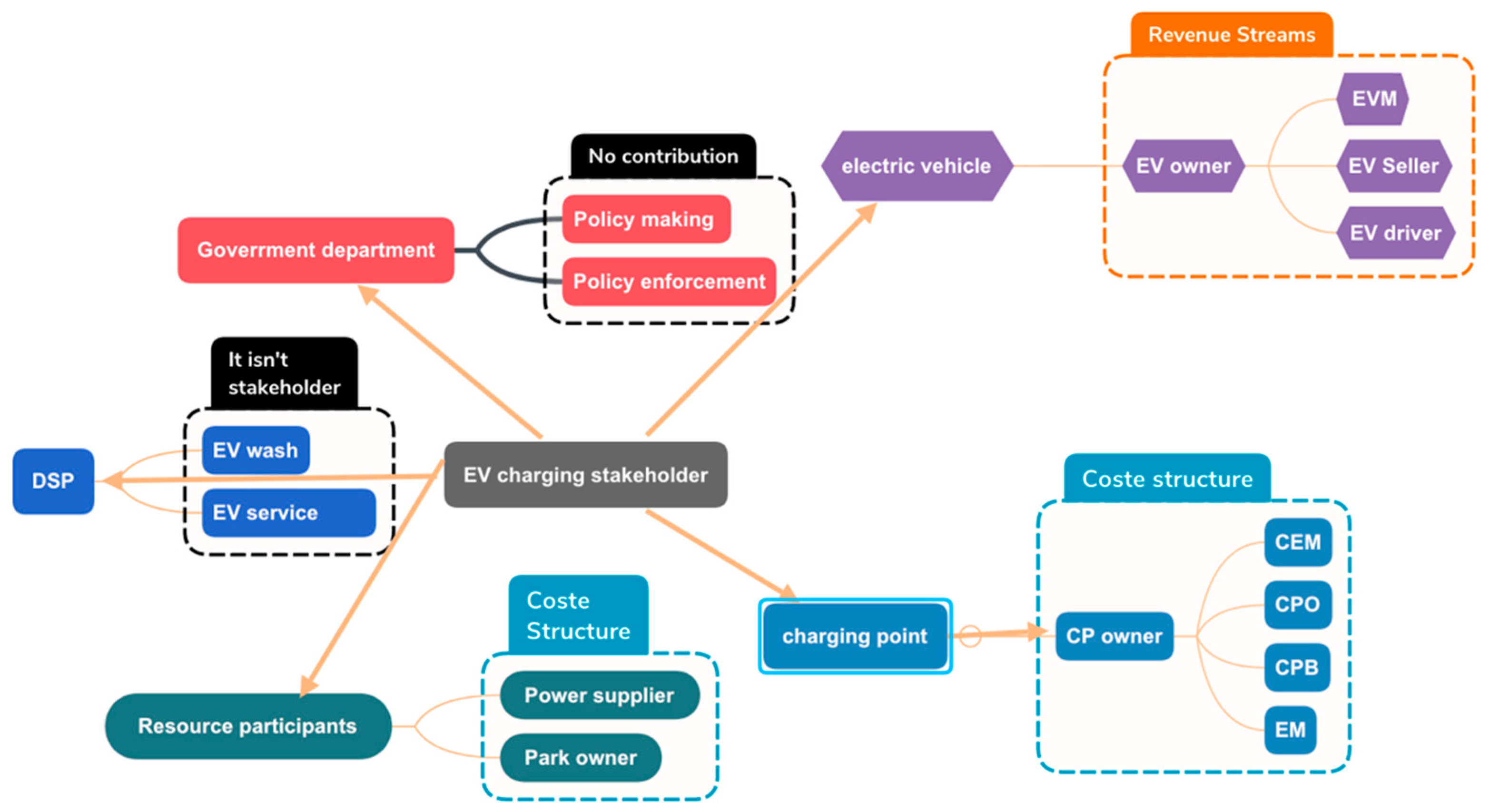

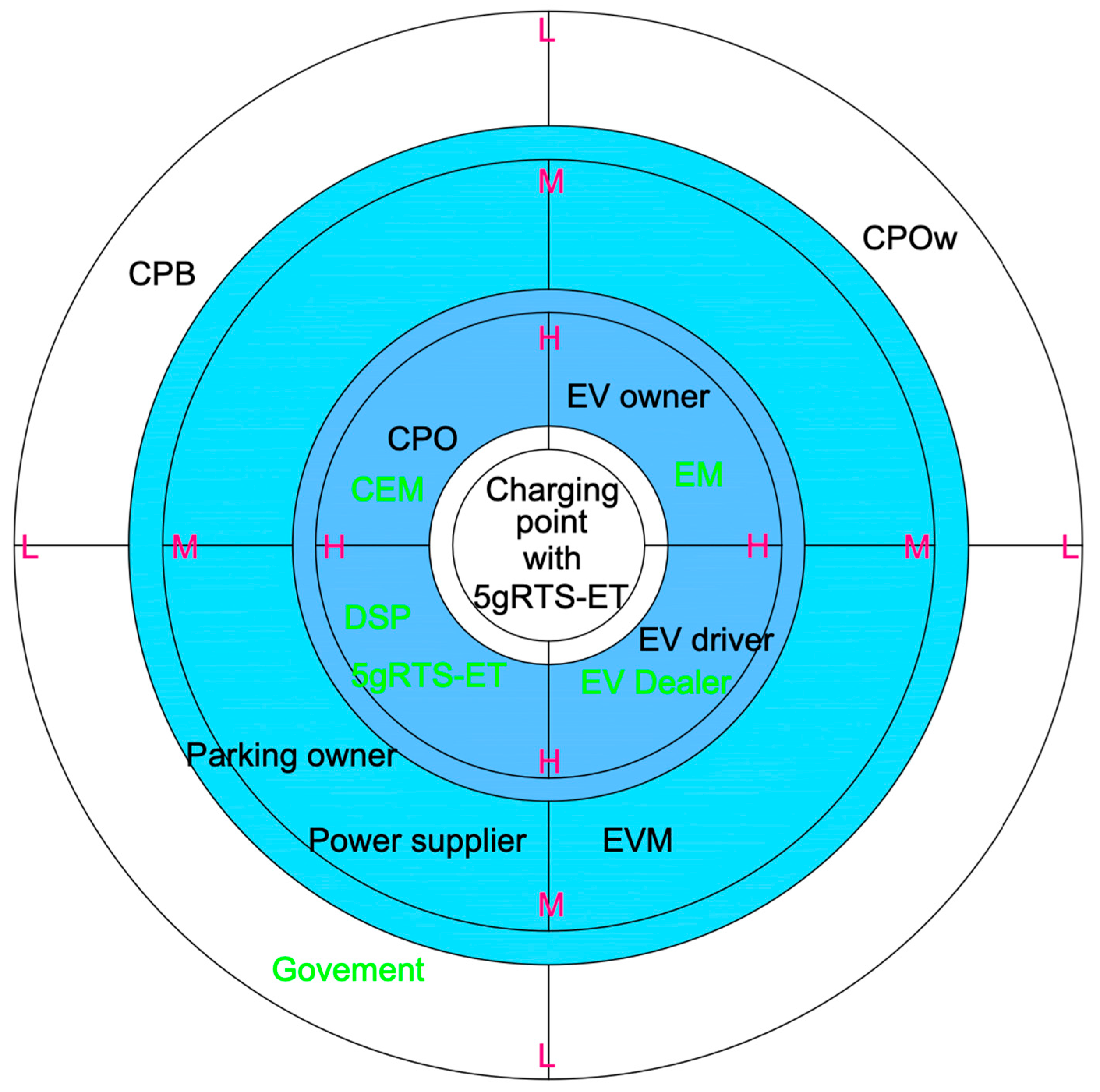

3.1. Global View: Establish a Pie Chart Model for the CP Business Ecosystem

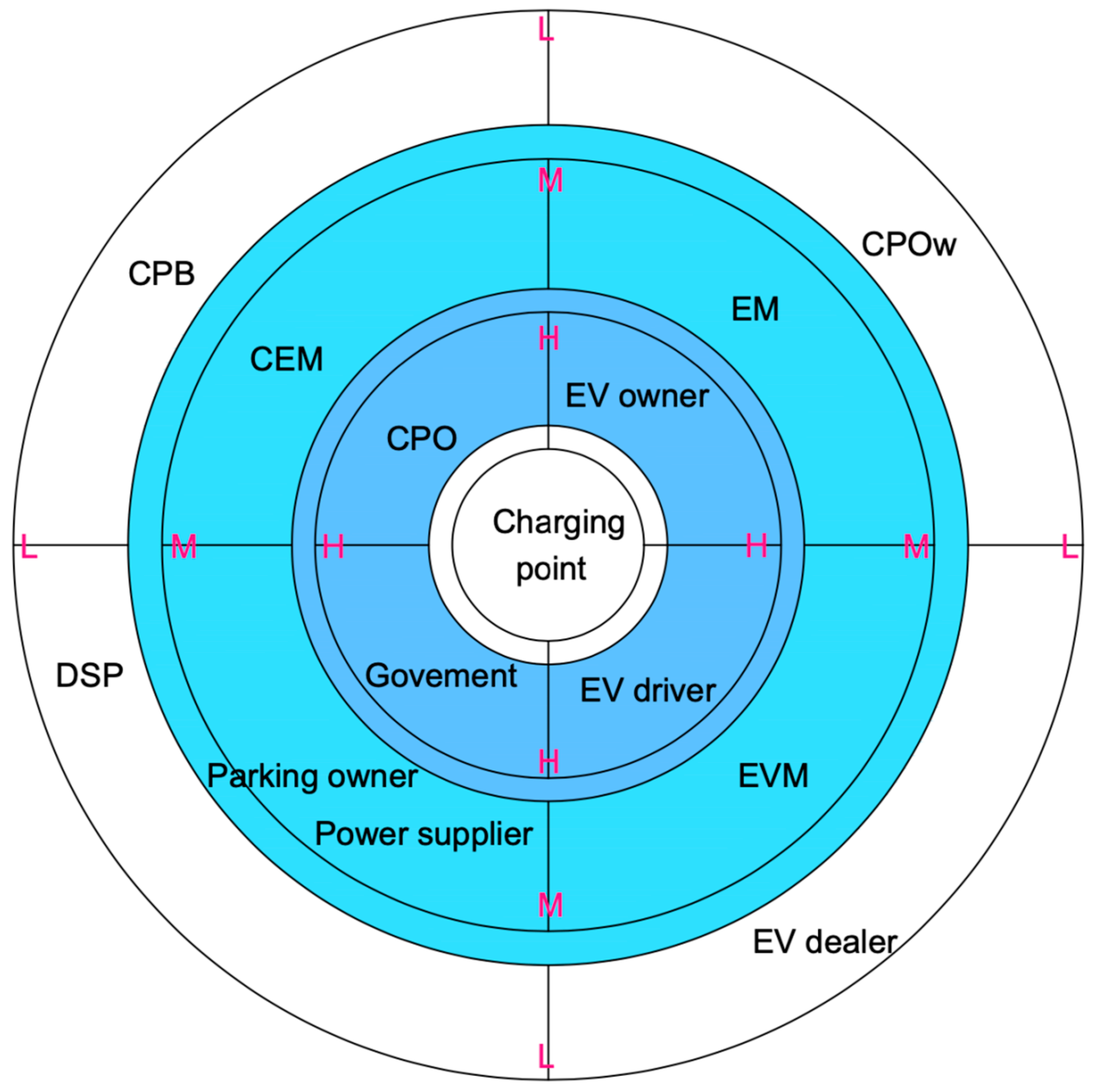

In the initial phase of the integrated business modeling approach, the CP commercial ecosystem pie chart (

Figure 6) is developed, featuring a central commercial nexus located within a high-intensity connection zone (H). This zone includes categories such as CPO, Government, EV driver, and EV owner [

20]. The intermediate strength joint (M) zone comprises CEM, Parking owner, Power supplier, EVM, and EM. Conversely, the low-intensity joint (L) zone includes DSP, EV dealer, CPOw, and CPB.

3.2. Detailed View: Three CP BMC Models

According to the second step of the integrated service modeling method, detailed BMC model views of the three CP are drawn respectively by [

20]:

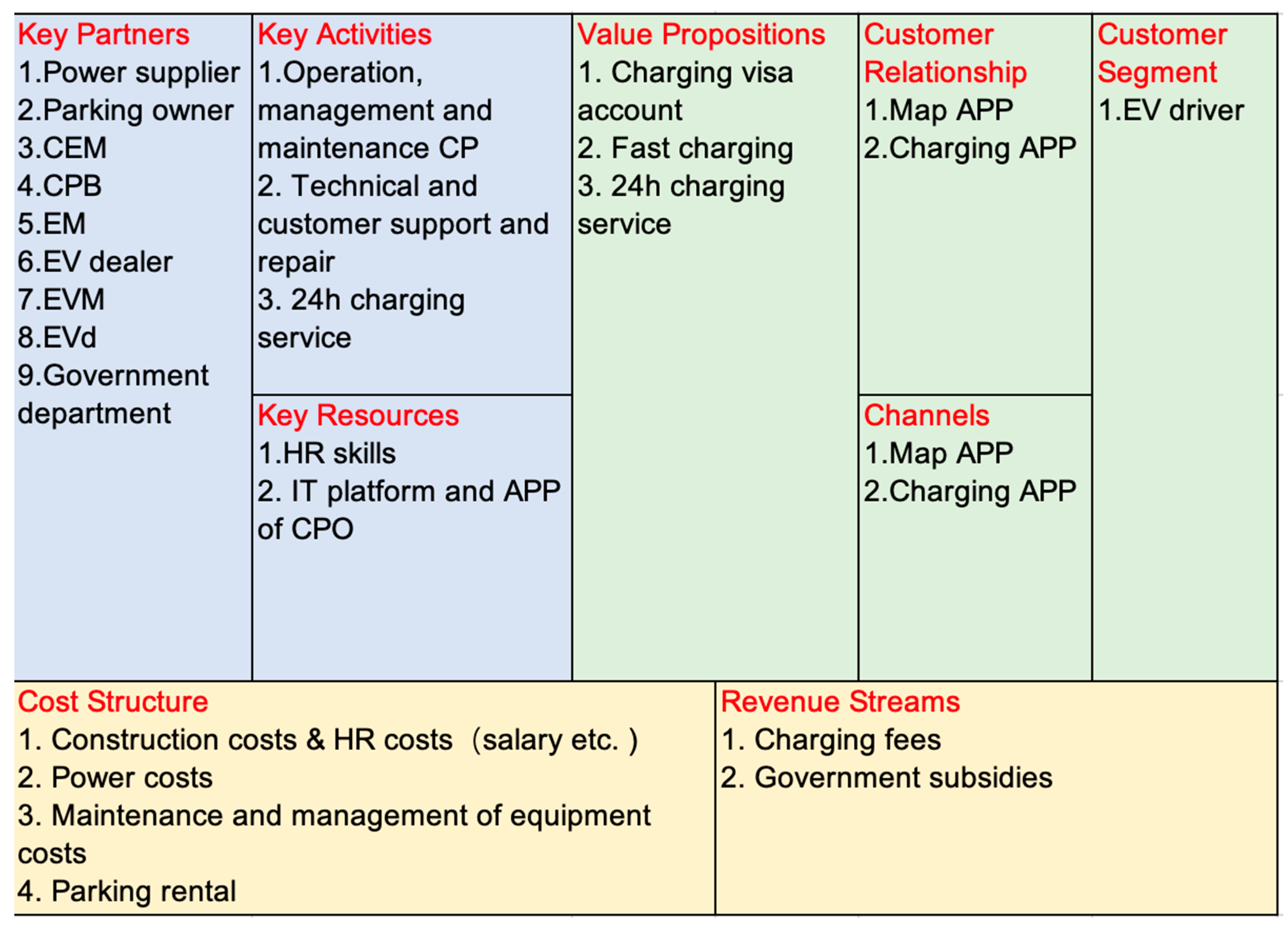

In the BMC of

Figure 7, the BMC of the Private EV CP, there is only one customer in the customer segment, namely EV drivers, which encompasses both CP members and private EV drivers who are non-members.

Value propositions of the private EV CP include 24 h service, rapid charging, which cannot be satisfied by home charging, and the provision of a Charging Visa Account, which allows users to make VIP appointments.

Information about the locations of charging stations is mainly communicated to users through map applications and charging applications, which encompass both proprietary and third-party options. All map applications rely on third-party services. Additionally, customer engagement is enhanced through online feedback mechanisms and real-time interactions via map and charging applications. From a financial standpoint, revenue streams for private EV CP consist of fees charged to EV drivers and subsidies provided by the government.

From an internal business perspective, private EV CP performs the following key activities: The operation of CP, including management and maintenance (such as opening connections, controlling all charging sessions of the network, tracking consumption per user, detecting consumption patterns, etc.), is conducted automatically by the system. Additionally, upgrades and maintenance for technologies and customers are performed.

The cost structure of a private EV CP incorporates a number of key factors, including the costs associated with the energy supply, the construction of the CP, the management and maintenance of the CP equipment, the remuneration of personnel, and the rental of parking spaces. From the perspective of the partners, the key partners of the private EV CP are the stakeholders responsible for manufacturing and installation (such as EM, EVM, and CPB), as well as the service-related parties. Additionally, key partners include the CEM, the EV Dealer and the EVd, as well as government agencies that require government subsidies to maintain operating expenses. Furthermore, energy suppliers can also be considered key partners, given that their policy support may help to secure more preferential electricity prices.

- (2)

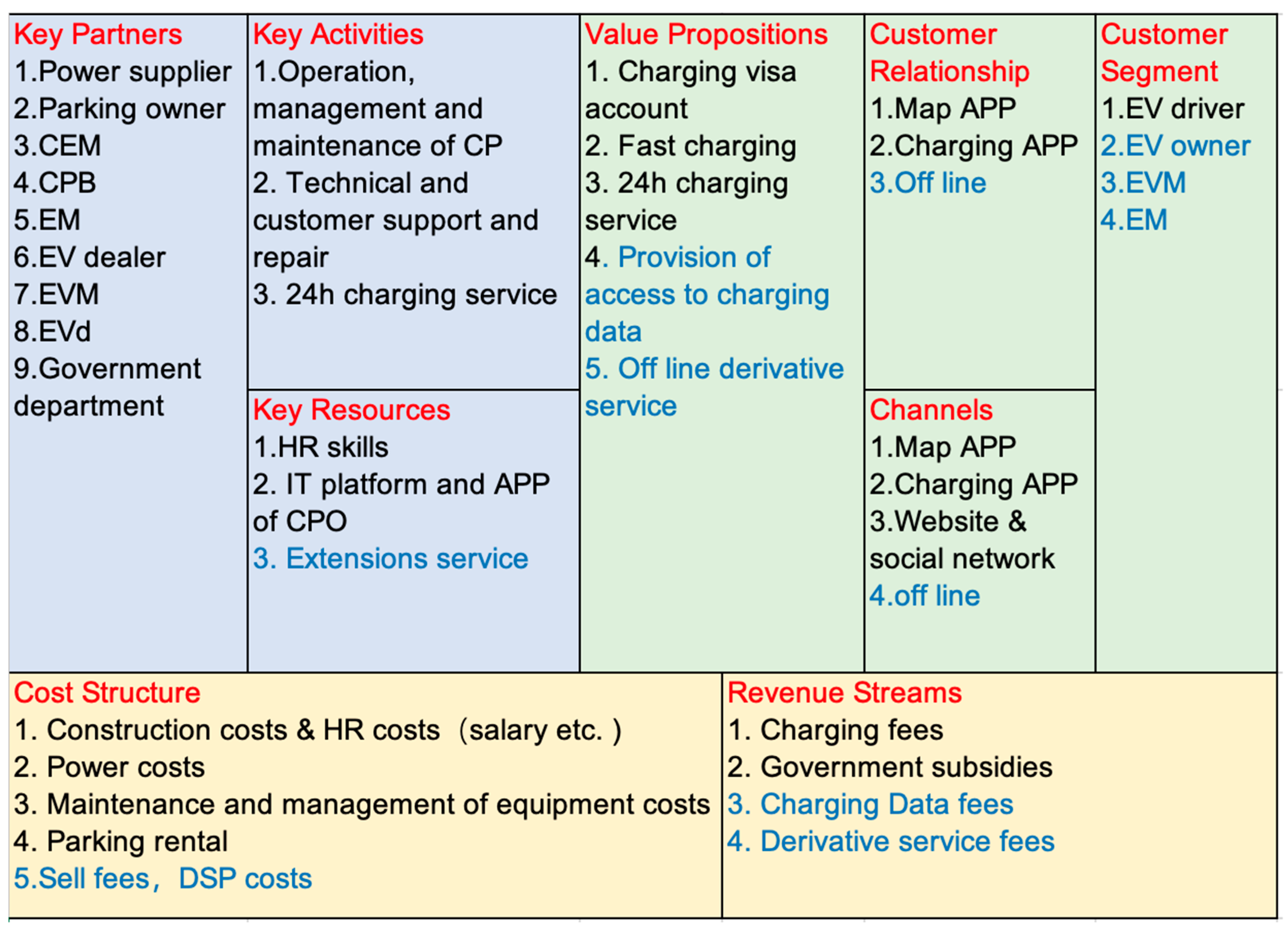

BMC of Passenger operating EV CP

Figure 8 illustrates a block diagram of the passenger operating EV CP, detailing its components. The black text denotes the private EV, while the blue text highlights a new aspect of the passenger operating EV. The description associated with the blue text indicates that the BMC for the passenger operating EV CP includes a more extensive array of detailed elements compared to that of the private EV CP. From the customer’s perspective, both the EV driver and the EV owner are considered stakeholders. The owner of an EV operating in passenger mode has the authority to select the charging location, thus positioning them as a key customer of the CP. The EV driver acts as the executor, tasked with managing customer relations and delivering a high standard of service. Additionally, the integration of the EVM and EM systems enhances the provision of data services to these devices, fostering a deeper understanding of the potential product and service needs of customers. The channel and customer relationship established between the CP and the customer also incorporates an offline function, as this customer group tends to be relatively concentrated.

Based on private EV CP, the provision of access to charging data, which can provide EVM and EM with the fee-related data they require, is incorporated into the value propositions of passenger operating EV CP. Additionally, it offers offline derivative services to customers who require access to charging facilities.

From a financial perspective, the fees charged for charging data and derivative services, which are paid by the revenue streams of passenger operating EV CP, are added to the fees charged by private EV CP. The cost structure of a passenger operating EV CP includes two more items—offline sell fees and DSP costs—than private EV CP. As for the internal business and partner, passenger operating EV CP is the same as private EV CP.

- (3)

BMC of Logistics distribution EV CP:

Figure 9 illustrates the BMC of the Logistics Distribution EV CP, wherein black text denotes the private EV component, blue text represents the passenger operating EV part, and dark red text signifies a novel element of the Logistics Distribution EV. As evidenced by the dark red text description, the Logistics Distribution EV CP exhibits a single additional value proposition, namely a dynamic price adjustment system, when compared to the Passenger Operation EV CP BMC. This is due to the fact that the Logistics Distribution EV has a price-preferred customer base, whereas the remainder can be attributed to the operational EV model.

3.3. Transformation Mechanism: CP BMC Evolution with 5gRTS-ET

In accordance with the third step of integrated service modelling and the modifications resulting from the introduction of 5gRTS-ET CP to various elements of the BMC, the author presents a comprehensive analysis of the evolving BMC models for three CP, as follows:

- (1)

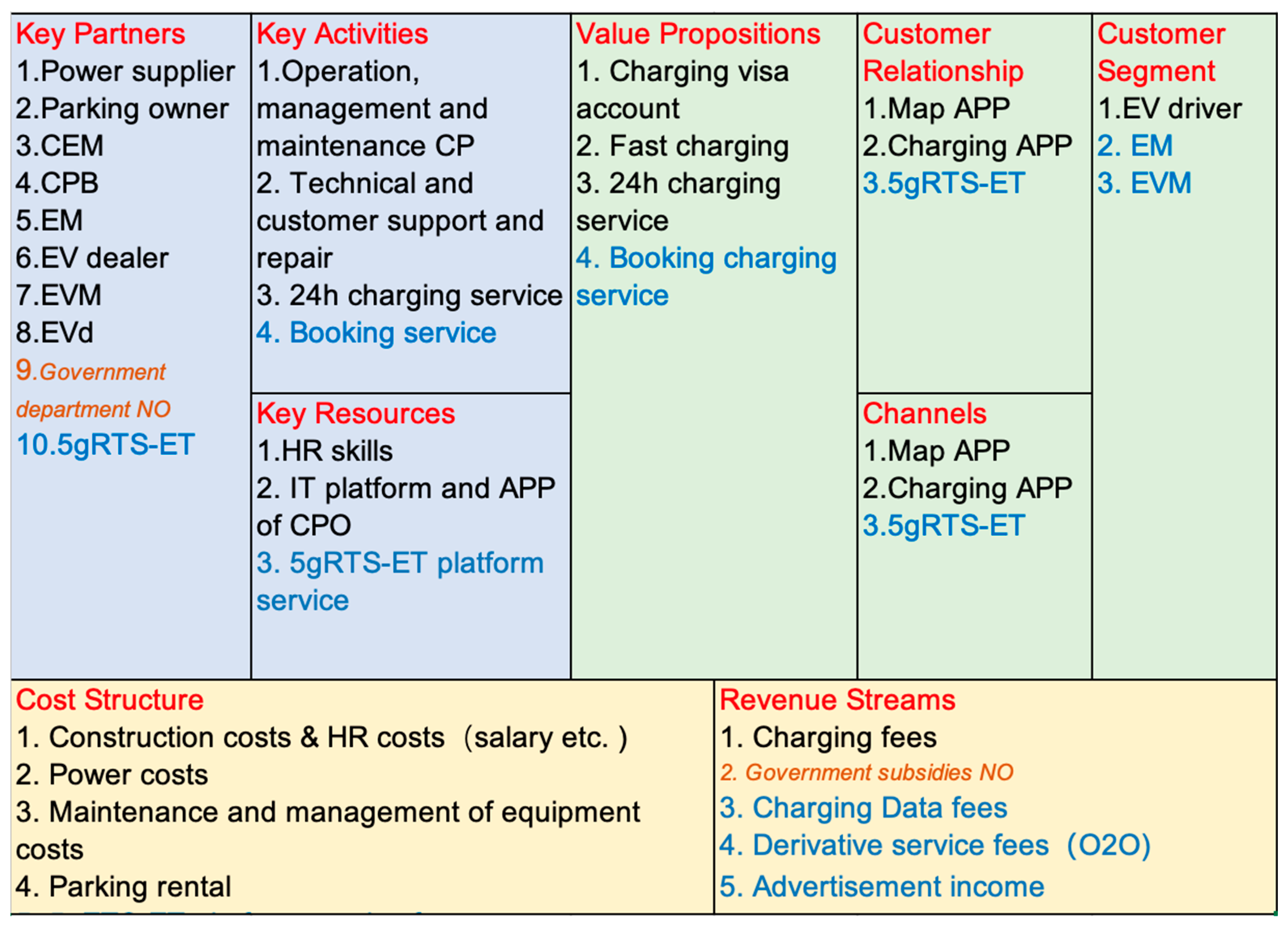

BMC of Private EV CP with the 5gRTS-ET

Figure 10 illustrates the BMC of a private EV CP with the 5gRTS-ET. The blue text denotes elements that were added after the 5gRTS-ET was joined, while the brown text represents elements that were reduced after the same integration. As can be observed from the newly incorporated elements described in blue font, the private EV CP with the 5gRTS-ET BMC has many more subdivisions than before.

From the customer perspective, in addition to the EV driver, both EM and EVM were added. This was done because CP can provide reserving charging service to both EVM and EM in order to achieve a deeper understanding of the reserving preference of their customers after joining 5gRTS-ET.

The introduction of a reserving charging service has enhanced the value propositions of private EV CP associated with the 5gRTS-ET platform. This development allows for the provision of services to EVM and EM providers based on the booking data they require, thereby fostering a deeper understanding of customer preferences. Additionally, it provides data support for the improvement and optimization of EVM and EM products and services. The integration of CP and customer relationships into the 5gRTS-ET platform has created a comprehensive system that consolidates EVs, traffic, and CP into a single, user-friendly interface, eliminating the need for users to navigate multiple applications. From a financial standpoint, the revenue streams for private EV CPs utilizing the 5gRTS-ET platform now include charging data fees and derivative service fees paid by EVM and EM providers. These derivative service fees are generated from offline transactions related to the 5gRTS-ET platform and advertisement income from its partners. Consequently, the justification for government subsidies is diminished, as each product and service is poised to achieve profitability independently.

The 5gRTS-ET platform service fees constituted a novel element of the cost structure of private EV CP with the 5gRTS-ET. From the internal business and partner perspective, both the reserving service and the 5gRTS-ET platform service were added in private EV CP with 5gRTS-ET.

- (2)

BMC of Passenger operating EV CP with the 5gRTS-ET

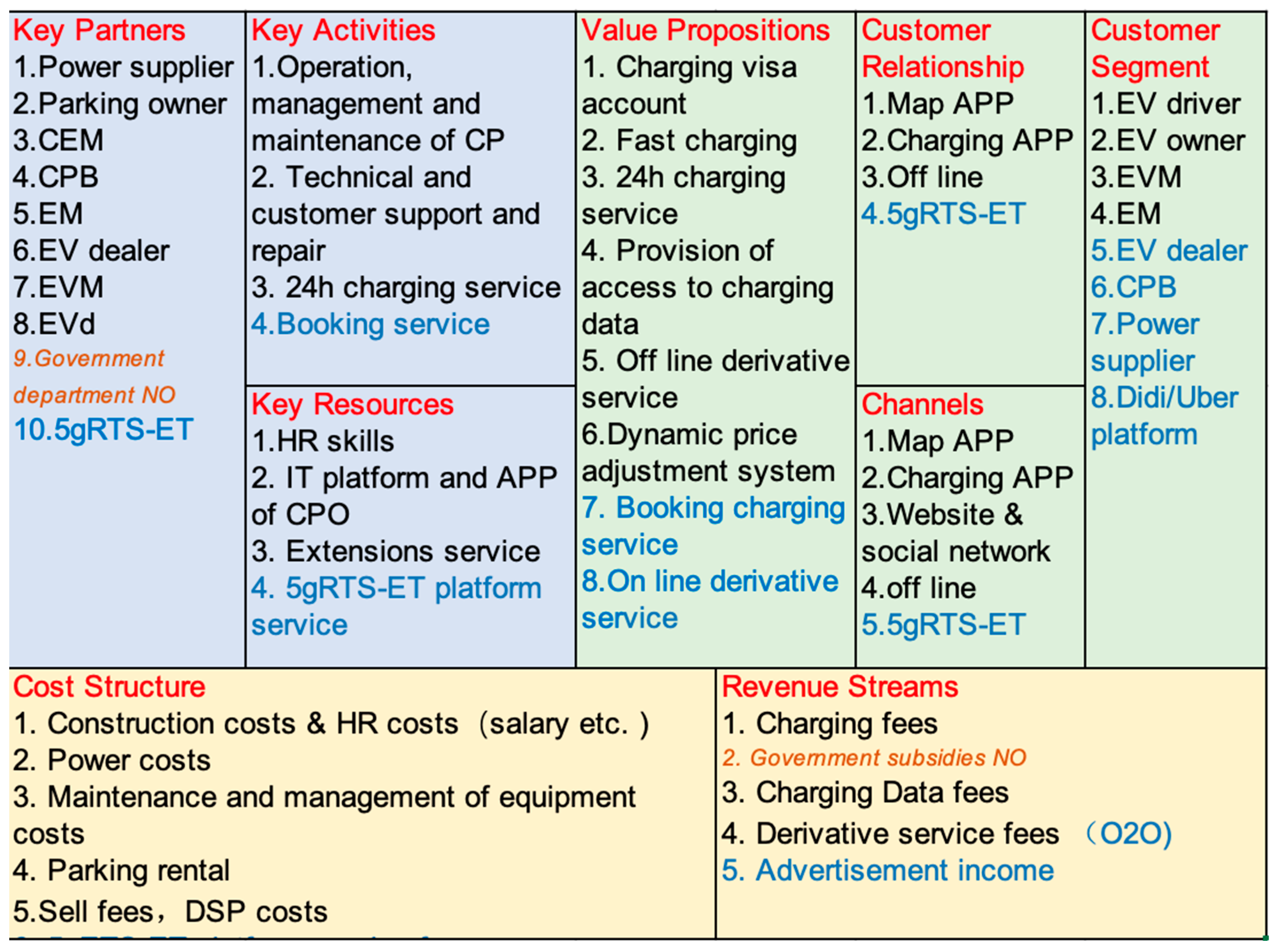

Figure 11 illustrates the BMC of a passenger operating EV CP with the 5gRTS-ET. The blue text denotes the element that was added after joining the 5gRTS-ET, while the brown text represents the element that was removed after joining the 5gRTS-ET. As can be seen from the newly added elements described in blue font, the passenger operating EV CP with the 5gRTS-ET BMC has many more subdivision elements than before.

From the customer’s perspective, four components—EV dealers, CPB, power suppliers, and the Didi/Uber platform—were integrated following the collaboration with 5gRTS-ET. This integration has enhanced the availability of charging services for new users and customers utilizing the operating platform, which includes features such as charging reservations, online derivatives, and data services. Consequently, these new users and customers on the operating platform can analyze customer data to gain insights into their behaviors and preferences. This information can then be utilized to more effectively target and promote online advertising on the platform.

With the implementation of the 5gRTS-ET platform, several value propositions were introduced for the Passenger Operating EV CP utilizing the 5gRTS-ET. These propositions encompass the reservation of charging services and the provision of an online derivative service, both designed to meet the online and offline service needs of newly targeted customer segments. To enhance the understanding of customer preferences among EV dealers, PBs, EMs, and EVMs, the platform offers data-driven insights aimed at improving their products and services. Additionally, it supplies power suppliers and ride-hailing platforms like Didi and Uber with essential data, enabling them to optimize power scheduling based on this information. The operating platform is also equipped to perform predictive analyses of customer behavior using the necessary data. Moreover, the 5gRTS-ET platform integrates with customer channels and relationships, allowing CP to interface with customers and consolidate EV, traffic, and CP data into a single, easily accessible platform through a unified login, thereby eliminating the need for users to navigate multiple applications. From a financial standpoint, the revenue streams for private EV CPs utilizing the 5gRTS-ET include charging data fees and derivative service fees from EVMs and EMs, as well as advertisement income from 5gRTS-ET partners. Consequently, the justification for government subsidies becomes irrelevant, as each product and service is poised to achieve profitability independently. 5gRTS-ET platform service fees were new in the cost structure of private EV CP with the 5gRTS-ET.

From the internal business and partner perspective, both reserving service and the 5gRTS-ET platform service were added in private EV CP with 5gRTS-ET.

- (3)

BMC of Logistics distribution EV CP with the 5gRTS-ET

Figure 12 illustrates the BMC of the Logistics Distribution EV CP with the 5gRTS-ET. The blue text denotes the element that was added after the 5gRTS-ET was joined, while the brown text represents the element that was removed after the 5gRTS-ET was joined. As can be observed, the newly added elements, described in blue and brown font, are identical to those of the passenger operating EV CP with the 5gRTS-ET BMC. This is because they are all operational EV modes.

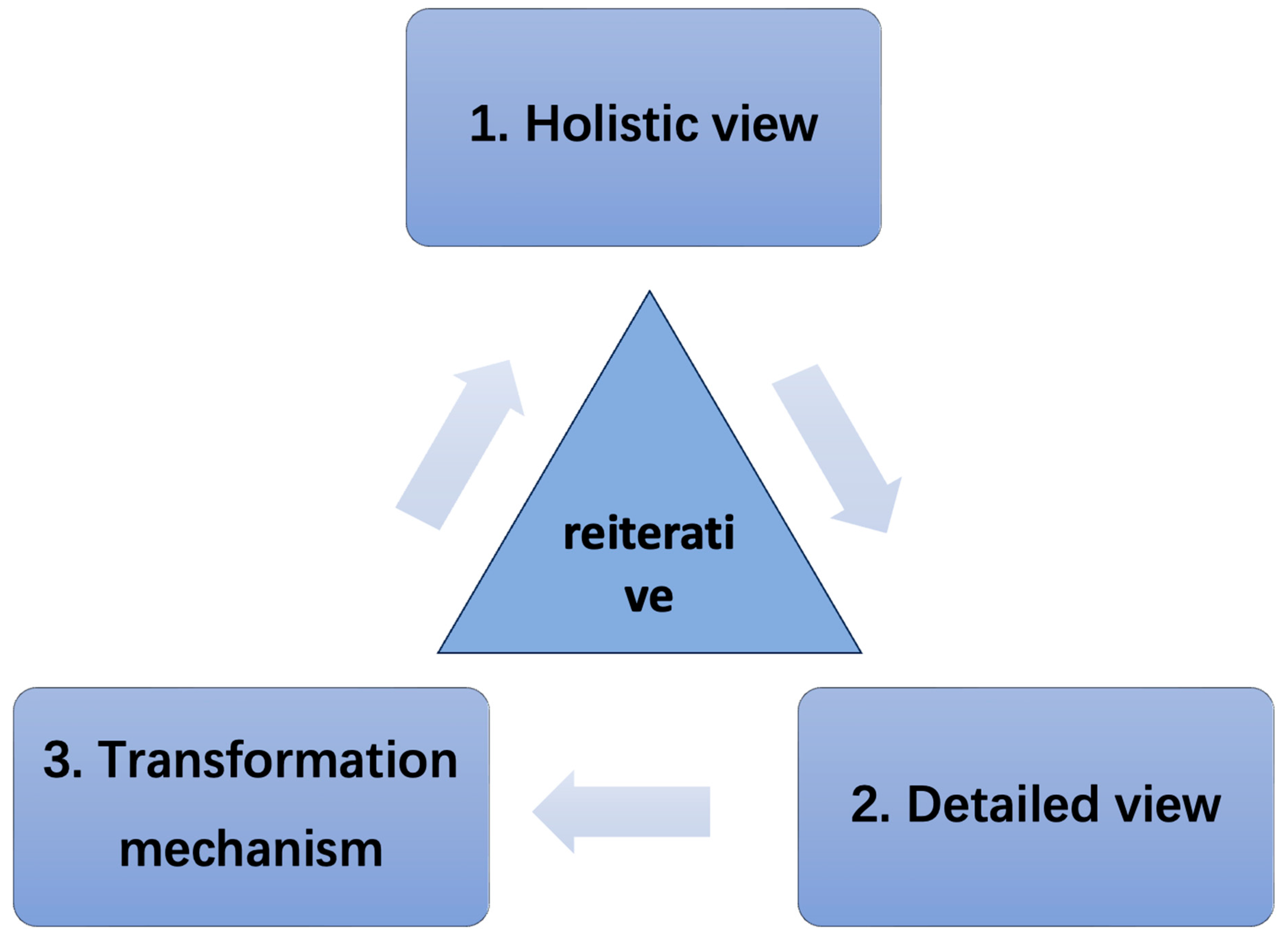

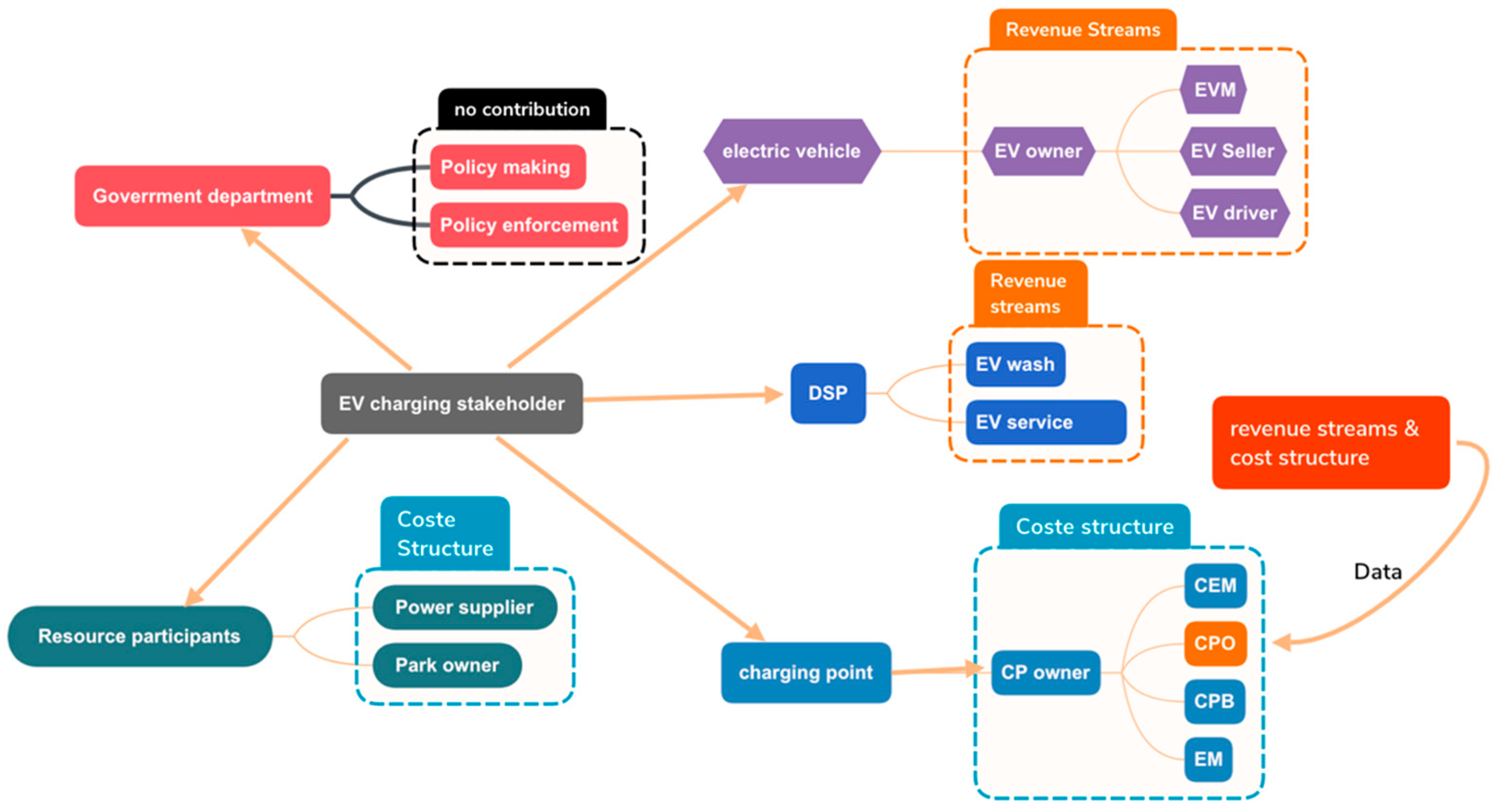

3.4. Discuss the Viability of the Business Mode

As previously outlined in the description of the integrative business modeling mechanism, the current approach to business modeling is characterized by its iterative nature. The concluding phase of the process initiates a new iteration, commencing with the first step. The initial phase of the integrative business modeling process involves adopting a holistic perspective. This discussion aims to assess the impact of integrating 5gRTS-ET into the core business models of participants on the wider EV charging business ecosystem. This integration will help stabilize the comprehensive and detailed perspectives of the established business models, making them more amenable to the introduction of new technological advancements.

The transformation of business models among key participants in EV CP (as illustrated in

Figure 10,

Figure 11 and

Figure 12) demonstrates that the incorporation of 5gRTS-ET significantly enhances the existing value proposition. The BMC incorporating 5gRTS-ET facilitates interactions among entities within the ecosystem, based on the delineation of network boundaries. The involved entities—EVM, EM, EV dealers, CPB, and power suppliers—now function as both partners and customers, marking a departure from their previous role as solely partners within the system.

In summary, the integration of CP into the 5gRTS-ET platform has transitioned the business model from a single-customer framework to a multi-customer framework. This shift has resulted in an expansion of revenue streams, with the emergence of five distinct customer types. Consequently, the CP that connect to the 5gRTS-ET platform will exert a direct and substantial influence on the CP business ecosystem. This will lead to increased revenue for CP and enhanced utilization due to the variety of CP services and the ability to cater to customer preferences. The aggregation trend of high-intensity core link areas is clearly illustrated in

Figure 13, which presents the CP Commercial Ecosystem Pie Chart with 5gRTS-ET, where the green font indicates elements that have been removed compared to

Figure 6.

In order to verify the results of the study, this study sampled the data of Nanjing city center for six months from 1 March to 31 August 2021 and extracted 8 CP from the 5gRTS-ET operating platform, with a total of 12,597,109 charging data, including the variable of CP utilization time, as shown in

Table 3.

On 1 June 2021, the charging station implemented an integrated business modeling approach, incorporated 5gRTS-ET, and introduced variable role EV user parameters, resulting in a notable enhancement in the daily charging utilization rate. The integration of the business modeling approach with 5gRTS-ET facilitates the continuous monitoring of operational data, the optimization of business models, and the operationalization of processes.