Abstract

This study aims to develop an optimal underwriting strategy for affordable (H1 and M1) and premium (L1 and M2) electric vehicles (EVs), balancing financial risk and sustainability commitments. The research is motivated by regulatory pressures, risk management needs, and sustainability goals, necessitating an adaptation of traditional underwriting models. The study employs a modified Delphi method with industry experts to identify key risk factors, including accident risk, repair costs, battery safety, driver behavior, and PCAF carbon impact. A sensitivity analysis was conducted to examine premium adjustments under different risk scenarios, categorizing EVs into four risk segments: Low-Risk, Low-Carbon (L1); Medium-Risk, Low-Carbon (M1); Medium-Risk, High-Carbon (M2); and High-Risk, High-Carbon (H1). Findings indicate that premium EVs (L1 and M2) exhibit lower volatility in underwriting costs, benefiting from advanced safety features, lower accident rates, and reduced carbon attribution penalties. Conversely, budget EVs (H1 and M1) experience higher premium fluctuations due to greater accident risks, costly repairs, and higher carbon costs under PCAF implementation. The worst-case scenario showed a 14.5% premium increase, while the best-case scenario led to a 10.5% premium reduction. The study recommends prioritizing premium EVs for insurance coverage due to their lower underwriting risks and carbon efficiency. For budget EVs, insurers should implement selective underwriting based on safety features, driver risk profiling, and energy efficiency. Additionally, incentive-based pricing such as telematics discounts, green repair incentives, and low-carbon charging rewards can mitigate financial risks and align with net-zero insurance commitments. This research provides a structured framework for insurers to optimize EV underwriting while ensuring long-term profitability and regulatory compliance.

1. Introduction

The global transition toward electric vehicles (EVs) has been driven by concerns over climate change, energy security, and advancements in sustainable transportation. EVs offer a promising solution to reduce carbon emissions and dependency on fossil fuels [1]. However, as the EV market expands, insurers face new challenges in underwriting these vehicles due to their unique risk factors. Unlike internal combustion engine (ICE) vehicles, EVs present distinct characteristics such as battery-related hazards, higher repair costs, and varying safety profiles depending on technological features [2].

In addition, the Partnership for Carbon Accounting Financials (PCAF) introduces a new layer of complexity by requiring insurers to account for the carbon footprint of insured assets, including EVs [3]. Specifically, Scope 3 emissions, as defined by the Greenhouse Gas (GHG) Protocol, include indirect greenhouse gas emissions from the value chain—such as those associated with the use of insured vehicles. Under Scope 3, Category 15: “Investments and Underwritten Products”, insurers must disclose emissions linked to the products they underwrite.

PCAF provides a standardized methodology for financial institutions, including insurers, to quantify and attribute emissions from their insurance portfolios. For EV insurers, this means that the carbon intensity of the vehicles—influenced by their energy efficiency (km/kWh) and the carbon profile of the electricity grid—directly affects their reported Scope 3 emissions. As such, PCAF serves as a critical framework for assigning carbon responsibility at the policy level and must be considered in modern EV underwriting strategies. This study incorporated this connection into our assessment methodology by assigning PCAF-linked carbon impact as a weighted variable in the sensitivity and pricing model. This allows insurers to assess not only financial risks like repair costs and accident likelihood but also carbon liabilities that may affect regulatory compliance, reputation, and offset costs.

With the implementation of PCAF, insurers must evaluate the environmental impact of their underwriting decisions, considering energy efficiency (km/kWh) and the carbon intensity of the electricity grid in the regions where EVs operate [4]. These emerging considerations necessitate a structured underwriting approach that balances financial risk assessment and sustainability goals.

1.1. Problem Statement

Traditional underwriting models, primarily developed for ICE vehicles, fail to capture the full risk profile of EVs. Insurers struggle to determine whether to prioritize premium EVs or affordable EVs, given the trade-offs between energy efficiency, safety features, and accident risks [5]. While premium EVs tend to have advanced safety features and superior battery management systems, they also have higher repair costs. On the other hand, budget EVs are more accessible but often lack comprehensive safety measures, increasing accident frequency [6].

Furthermore, although financial institutions are increasingly required to disclose Scope 3 emissions, there is currently no established underwriting model that integrates PCAF-based carbon attribution into EV insurance pricing. This creates a significant gap between climate disclosure frameworks and insurance risk models. The challenge is to develop an optimal underwriting strategy that accounts for both financial risk and climate-related exposure, ensuring that insurers remain profitable while aligning with net-zero targets.

1.2. Research Incentives and Motivation

This research is motivated by the following three key factors:

- Regulatory and Industry Pressure: The insurance industry is increasingly required to disclose Scope 3 emissions under PCAF guidelines, forcing insurers to integrate carbon metrics into underwriting [3].

- Risk Management Optimization: With EV adoption growing, insurers must refine risk models to differentiate between low-risk, high-efficiency EVs and high-risk, high-carbon-emission EVs [7].

- Sustainability Commitments: Insurers such as Swiss Re and Allianz have pledged to achieve net-zero emissions in their portfolios, highlighting the need for underwriting policies that incentivize low-carbon EV usage [8].

1.3. Research Purpose and Objectives

The primary goal of this study is to analyze and recommend optimal underwriting strategies for affordable and premium EVs, considering risk factors and PCAF-linked carbon attributions. The specific objectives are as follows:

- To identify key underwriting risk factors for EVs, including accident risk, repair costs, battery safety, and driver behavior.

- To assess the impact of PCAF implementation on EV underwriting, particularly regarding energy efficiency and electricity grid carbon intensity.

- To develop an insurance pricing model that integrates traditional risk assessment with carbon attribution methodologies, optimizing for both underwriting profitability and alignment with climate disclosure standards such as PCAF.

- To conduct a sensitivity analysis on underwriting strategies, evaluating how premium adjustments vary under different accident risk, repair cost, and carbon pricing scenarios.

These contributions respond directly to a gap in the existing literature, which has not yet operationalized PCAF carbon accounting in EV insurance pricing. By addressing this gap, the research not only enhances risk modeling accuracy but also helps insurers navigate the rising cost of carbon credits, sustainability disclosures, and regulatory compliance.

2. Literature Review

The transition to EVs is reshaping multiple industries, with the insurance sector facing unique challenges in adapting traditional underwriting models to accommodate the distinct risks associated with EVs. Unlike conventional internal ICE vehicles, EVs present insurers with new risk factors, including higher repair costs, battery-related hazards, and evolving market dynamics. Additionally, the rapid technological advancements in EVs, from battery management systems to autonomous driving capabilities, introduce complexities that require a reevaluation of existing insurance frameworks. This literature review explores the underwriting strategies for EVs, examining the key factors influencing risk assessments, pricing models, and emerging regulatory considerations. The first section categorizes the primary factors employed in underwriting EV insurance, offering a structured approach to understanding how insurers assess and mitigate risks in this evolving landscape.

2.1. Factors Employed in Underwriting EV Insurance: A Categorized Approach

Insurance underwriting for EVs involves three major risk categories:

2.1.1. Vehicle-Related Factors

EVs present unique vehicle-related risks that influence insurance costs, primarily due to higher repair expenses, battery-related hazards, and advanced technology integration. Repair costs for EVs are significantly higher than those for conventional vehicles, as they require specialized technicians and parts, leading to increased claim expenses [9]. Additionally, battery-related risks pose a major concern, with high-voltage battery damage and fire hazards resulting in costly repairs and insurance claims [9]. Furthermore, premium EVs incorporate Advanced Driver Assistance Systems (ADAS), which enhance safety but also increase repair costs when damaged, as these sophisticated components are expensive to replace and require specialized servicing [2].

2.1.2. Driver-Related Factors

Driver-related factors play a crucial role in EV insurance underwriting, with insurers increasingly relying on telematics and driver demographics to assess risk. Usage-Based Insurance (UBI) is one such approach, where insurers adjust premiums based on telematics data and individual driving behavior, allowing for more personalized pricing models [10]. Additionally, driver demographics significantly influence risk assessment, as younger drivers, who are more likely to purchase budget EVs, tend to exhibit higher accident rates, leading to increased insurance costs for this segment [11].

2.1.3. Environment-Related Factors

Environmental factors significantly impact EV insurance underwriting, particularly regarding charging infrastructure and market adaptation. The availability of charging stations directly influences vehicle usability and driver behavior, which in turn affects insurance risks; areas with limited charging infrastructure may see higher instances of battery depletion-related claims or increased reliance on emergency towing services [11]. Additionally, as EV adoption grows and new risks emerge, insurers are continuously adapting their underwriting models to account for evolving technological, regulatory, and environmental factors, ensuring that policies remain aligned with the changing dynamics of the EV market [9].

While underwriting decisions for EVs incorporate a broad range of vehicle, driver, and environmental factors, insurers must prioritize the most influential elements that directly affect claims, risk assessments, and pricing structures. Understanding these key factors—particularly repair costs, battery-related risks, and market trends—provides deeper insight into why EV insurance premiums tend to be higher than those for conventional vehicles. The following section delves into these crucial underwriting determinants, highlighting their financial impact on insurers and policyholders alike.

2.2. Key Factors Influencing EV Insurance Underwriting

Insurance companies prioritize tangible risk factors that directly influence claims and repair costs, leading to higher premiums for EV owners. One of the primary concerns is higher repair costs, with the average EV repair claim reaching $6066 in 2024, nearly 30% more than that of ICE vehicles due to the specialized components and expertise required for repairs [9]. Additionally, battery-related risks remain a significant factor, as high-voltage EV batteries pose potential fire hazards, necessitating costly and specialized repair procedures [9]. Lastly, market dynamics continue to shape insurance pricing, with the industry adjusting its models to account for the unique risks associated with EVs, ultimately contributing to higher insurance premiums for EV owners [11].

While higher repair costs, battery-related risks, and market shifts contribute to the overall pricing of EV insurance, not all EVs are assessed equally by insurers. A key distinction lies in the differences between premium and affordable EVs—factors such as energy efficiency, safety features, and accident rates vary significantly across price segments. Understanding how higher-priced EVs typically exhibit greater efficiency and lower risk helps explain why insurers may develop differentiated underwriting strategies for distinct EV categories. The next section explores this relationship, analyzing why premium EVs tend to be safer, more energy-efficient, and ultimately, lower-risk from an insurance perspective.

2.3. Insurance Cost Differentials Between Electric and Internal Combustion Engine Vehicles

Recent empirical studies confirm that electric vehicles (EVs) typically incur 20–30% higher insurance costs than internal combustion engine (ICE) vehicles, primarily due to higher repair costs, battery-related hazards, and specialized maintenance requirements [4,12]. According to [12], EV repair claims are on average 25% more expensive than for comparable ICE vehicles, driven largely by battery replacement costs, limited repair network availability, and the need for specialized technicians. While EVs deliver significant reductions in operational carbon emissions, current insurance premiums reflect empirically validated higher claims severity, not environmental performance. Furthermore, existing insurance tariffs do not incorporate carbon attribution or Scope 3 emissions in pricing decisions [13].

2.4. The Relationship Between Higher-Priced EVs, Higher Energy Efficiency, and Lower Accident Risk

Higher-priced EVs generally exhibit greater energy efficiency and lower risk factors compared to budget models, making them a preferred choice for insurers. On average, premium EVs achieve 13.41 km/kWh, significantly outperforming budget models, which range between 8 and 10 km/kWh, due to advancements in aerodynamics, battery technology, and powertrain optimization [14]. Additionally, premium EVs are equipped with Advanced Driver Assistance Systems (ADAS), which enhance vehicle safety and reduce accident risks by incorporating collision avoidance and automated driving features [2]. Furthermore, high-end EVs integrate robust Battery Management Systems (BMS) that provide better thermal regulation and safety mechanisms, effectively minimizing fire hazards compared to budget EVs, which often use lower-cost battery components with fewer safety redundancies [15] (Wang et al., 2019).

As premium EVs exhibit higher energy efficiency, enhanced safety features, and lower accident rates, insurers must account for these distinctions when formulating underwriting strategies. Given the contrasting risk profiles between premium and affordable EVs, insurance companies are adopting differentiated approaches, leveraging data-driven models such as Usage-Based Insurance (UBI) and strategic collaborations with EV manufacturers to refine pricing structures. The following section explores these tailored underwriting strategies, highlighting how insurers balance risk assessment with evolving market trends to offer competitive yet sustainable policies for both affordable and premium EV segments.

This study has clarified that premium EVs generally demonstrate higher energy efficiency, often averaging over 12 km/kWh, while budget EVs typically range between 8 and 10 km/kWh [4,16]. To support this comparison with quantitative data, this study estimated the annual carbon emissions of premium and budget EVs using PCAF-aligned methodology. To illustrate this difference, this study has added the following PCAF-aligned emissions calculation, assuming 15,000 km of annual driving and Taiwan’s average grid emission factor of 0.502 kg CO2e/kWh [13]

Premium EV (L1 segment):

~13 km/kWh → ~0.077 kWh/km → Annual emissions ≈ 0.077 × 15,000 × 0.502 = 579 kg CO2e/year.

Budget EV (H1 segment):

~8.5 km/kWh → ~0.118 kWh/km → Annual emissions ≈ 0.118 × 15,000 × 0.502 = 889 kg CO2e/year.

These estimates demonstrate that premium EVs can result in a ~35% lower annual carbon attribution compared to budget EVs under identical usage and grid conditions. This reinforces our conclusion that premium EVs, despite their higher price point, offer a more favorable carbon profile for insurers under Scope 3 disclosure frameworks.

2.5. Underwriting Strategies for Affordable and Premium EVs

Insurers are developing specialized policies to address the unique risks associated with EVs, incorporating innovative approaches to better assess and price coverage. One such approach is Usage-Based Insurance (UBI), which adjusts premiums based on mileage and driving behavior, allowing insurers to offer more personalized pricing models that reflect actual risk levels [10]. Additionally, collaboration with EV manufacturers has become increasingly common, as insurers seek to gain insights into repair costs and driving patterns, enabling them to refine underwriting models and claims management strategies to better align with the evolving EV landscape [11].

While insurers have refined underwriting strategies to accommodate the distinct risk profiles of affordable and premium EVs, these strategies remain centered on conventional risk factors such as accident probability, repair costs, and vehicle safety features. However, as environmental concerns and regulatory pressures grow, a key question arises: Should insurance companies incorporate the indirect carbon footprint of EVs into their underwriting models? Despite the increasing emphasis on sustainability in the financial sector, no insurance provider currently considers emissions from electricity generation, battery production, or supply chain activities when determining EV insurance pricing. The following section examines this gap, exploring why indirect carbon emissions remain absent from underwriting frameworks and how this omission could impact the future of EV insurance.

2.6. No Insurance Company in the World Considers Indirect Carbon Emission as a Factor in Insurance Underwriting for EVs

EVs do not produce direct carbon emissions while driving because they operate on electricity rather than burning fossil fuels. Unlike internal ICE vehicles, EVs generate zero tailpipe emissions, meaning they do not emit carbon dioxide (CO2), nitrogen oxides (NOx), or particulate matter during operation [17].

Although EVs produce no direct emissions, they still contribute to indirect carbon emissions through various sources. Electricity generation plays a significant role, as the carbon footprint of an EV depends on how its electricity is produced—EVs charged with fossil fuel-based power plants indirectly contribute to carbon emissions [16]. Additionally, battery manufacturing and lifecycle processes, particularly the mining and refining of materials such as lithium, cobalt, and nickel, generate substantial emissions [18]. Furthermore, the vehicle manufacturing and disposal phases contribute to the total carbon footprint, from material extraction to production and eventual decommissioning. However, despite these indirect emissions, lifecycle assessments indicate that EVs still have a lower overall carbon footprint than ICE vehicles, especially when powered by renewable energy sources [19].

While EVs eliminate direct emissions from driving, they still have indirect emissions associated with energy production and supply chains. The overall carbon footprint of EVs depends on the electricity grid’s energy mix and the sustainability of manufacturing processes [16].

Despite the presence of indirect carbon emissions from EVs, insurance companies do not consider these emissions when determining insurance pricing. Instead, insurers continue to focus on conventional risk factors. Currently, no evidence suggests that insurance companies worldwide incorporate the indirect carbon emissions of insured EVs into their underwriting processes. While insurers assess risks associated with EVs, such as battery-related hazards, repair costs, and liability issues, they do not factor in emissions from electricity generation, vehicle manufacturing, or supply chain activities when deciding whether to issue a policy or set underwriting terms [20].

Several studies confirm that underwriting decisions for EV insurance are primarily driven by conventional risk factors, with no established methodology for integrating carbon emissions into these evaluations. Yearick et al. [21] found that insurance policies in EV-sharing programs rely on traditional criteria, such as accident probability and repair costs, while excluding carbon emissions from consideration. Similarly, Bhide and Sengupta [22] observed that although some insurers participate in sustainability initiatives and net-zero commitments, their underwriting practices remain detached from carbon accounting, focusing instead on actuarial risk factors like driver behavior and repair costs.

Furthermore, Ayodele and Mustapa [23] highlighted that even insurers engaged in climate-conscious business models do not include lifecycle carbon emissions in their underwriting criteria. Siragusa et al. [24] reinforced this point, demonstrating that underwriting decisions for EV policies are predominantly influenced by liability exposure, vehicle safety features, and repair network availability, with no structured framework to evaluate carbon footprint risks.

Even in the United States, where government incentives promote emission reductions, insurance underwriting remains disconnected from carbon emissions. Jin et al. [25] examined EV insurance practices and found no evidence of carbon-based underwriting criteria. Ayetor et al. [26] identified similar patterns in Ghana’s EV insurance market, noting that insurers do not account for emissions-related risks when assessing insurability. Moreover, Haddadianet al. [27] emphasized that, despite growing interest in sustainable finance, insurance underwriting remains focused on conventional loss assessment metrics, with no integration of carbon emissions data.

Since indirect carbon emissions are absent from underwriting frameworks, this raises a critical question: how do insurers assess risks when underwriting EV policies? The next section explores the primary underwriting criteria that influence EV insurance policies today.

Although no insurance company currently factors indirect carbon emissions into EV underwriting, the financial sector is experiencing a paradigm shift with the introduction of stricter climate-related reporting standards. Emerging frameworks such as the Greenhouse Gas (GHG) Protocol and the PCAF are expanding the scope of emissions accountability, particularly for financial institutions. Under these frameworks, insurers may soon be required to quantify and disclose the carbon footprint of their insured assets—including EVs—forcing a reassessment of underwriting models. The following section explores how these regulatory changes could reshape EV insurance, balancing the financial benefits of underwriting EVs with the potential costs of carbon liabilities and offset requirements.

2.7. The Impact of GHG Protocol, Scope 3 Emissions, and PCAF on EV Insurance: Balancing Premium Income and Carbon Credit Costs

The GHG Protocol is the most widely used global framework for measuring and managing greenhouse gas emissions. It categorizes emissions into three scopes: Scope 1 (direct emissions from owned operations), Scope 2 (indirect emissions from purchased energy), and Scope 3 (indirect emissions from the entire value chain, including suppliers and customers) [28]. While Scope 1 and Scope 2 have been well-regulated, recent shifts have placed greater emphasis on Scope 3 emissions due to their significant contribution to an entity’s overall carbon footprint.

One of the key consequences of increasing Scope 3 accountability is the rising cost of carbon credits. Companies that previously ignored or underreported Scope 3 emissions are now required to fully disclose and mitigate these emissions, leading to an increased demand for verified carbon offsets [29]. Additionally, more stringent verification standards are reducing the availability of low-quality offsets, limiting supply while demand surges, and ultimately driving up costs [30]. Furthermore, financial institutions are now required to account for financed emissions under Scope 3, particularly through the PCAF framework [13]. This means that banks, investors, and insurers must disclose and mitigate the carbon footprint of their financed assets, including insured EVs.

In the insurance sector, underwriting EVs presents a unique challenge. On one hand, EVs generate higher premium income due to their higher repair costs, battery-related risks, and specialized maintenance requirements. On the other hand, insuring EVs may contribute to an insurer’s financed emissions, particularly if those EVs have high Product Attributed Carbon Footprints (PACF) due to emissions from battery production, supply chain logistics, and electricity consumption [31]. Under the PCAF framework, insurers may be required to offset these emissions, increasing their reliance on carbon credits and further exposing them to rising offset costs.

As a result, insurance companies must carefully balance the financial benefits of insuring EVs with the potential carbon liabilities introduced by Scope 3 requirements and PCAF reporting obligations. With carbon credit prices expected to rise, insurers may need to adjust underwriting strategies, pricing models, and portfolio compositions to manage both regulatory risks and profitability.

2.8. Comparison of Existing Models and Originality of Proposed Framework

To clarify the originality of this study’s contribution, Table 1 below compares the proposed carbon-risk integrated underwriting framework with three commonly referenced approaches in vehicle insurance and climate finance. The table highlights key features, limitations, and differentiators.

Table 1.

Comparison of Existing Risk and Carbon Assessment Models.

2.9. Summary of the Literature Review

This literature review explored the key factors influencing EV insurance underwriting, focusing on the role of carbon emissions, risk assessments, and PCAF implementation. Key points include the following:

- EVs produce zero direct emissions but have significant indirect carbon footprints from electricity generation and battery manufacturing.

- Insurance companies do not currently account for indirect emissions in EV pricing, focusing instead on repair costs, battery risks, and driver behavior.

- Higher-priced EVs are generally more energy-efficient, safer, and lower-risk, leading to differentiated underwriting strategies for premium and affordable EVs.

- PCAF provides a carbon accounting framework, but most insurers have yet to integrate emissions tracking into their pricing models.

- Regulatory pressures may force insurers to disclose and manage carbon liabilities, potentially increasing underwriting costs for high-emission portfolios.

- As sustainability and carbon accountability continue to shape financial markets, insurers may need to reevaluate traditional underwriting models to align with future regulatory and environmental expectations.

3. Methodology

Upon conducting an in-depth search, this study has identified several academic papers and industry reports that discussed scenario analysis and sensitivity analysis in the context of insurance risk assessment and premium pricing.

3.1. Scenario Analysis in the Insurance Industry

The Cambridge Centre for Risk Studies published a report titled Developing Scenarios for the Insurance Industry, which emphasizes the importance of scenario analysis (also known as “stress testing”) in planning for future uncertainties (Cambridge Centre for Risk Studies). The report highlights that this practice is longstanding within the industry and continues to grow in importance as the market becomes more aware of its benefits and regulatory requirements call for robust internal risk management.

3.2. Sensitivity Analysis of Premiums

In the Rickayzen’s paper [32] presents an analysis of parameters used in a multi-state model for PHI. The study examines how changes in various parameters affect net premiums, providing insights into the sensitivity of premium calculations to different risk factors.

3.3. Climate Risk Assessment and Scenario Analysis

The Geneva Association’s report, Climate Change Risk Assessment for the Insurance Industry, offers a decision-making framework for climate risk assessment and scenario analysis for property and casualty (P and C) and life re/insurers [33]. The analysis considers all physical and transition climate change risks for both the liability and asset sides of the balance sheet, by line of business and over distinct time horizons.

3.4. Operational Risk and Scenario Analysis

Vyskočil [34] discusses the calculation of required capital in insurance companies allocated to operational risk under Solvency II regulation. The study proposes a model for calculating operational risk required capital, emphasizing the role of scenario analysis in understanding potential risk exposures.

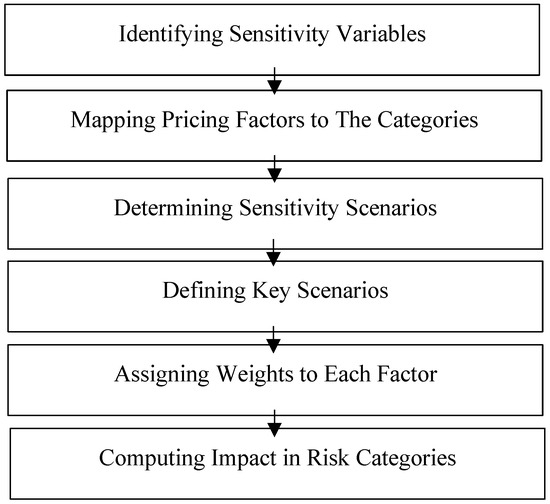

These sources provide a comprehensive overview of how scenario and sensitivity analyses are applied within the insurance industry to assess risks and inform premium pricing strategies. Incorporating methodologies from these studies can enhance the robustness of this study’s analysis concerning the impact of sensitivity variables on premium pricing and risk categorization. The procedures of Sensitivity Analysis Design for EV Underwriting After PCAF Implementation are as follows in Figure 1.

Figure 1.

The procedures of Sensitivity Analysis Design for EV Underwriting After PCAF Implementation.

3.4.1. Identifying Sensitivity Variables

To clarify how vehicles are assigned to the four segments (L1, M1, M2, H1), Table 2 summarizes the key classification criteria based on technical, behavioral, and carbon-related factors evaluated during the Delphi process (Table 3).

Table 2.

Clustering Criteria for EV Risk-Carbon Segmentation.

Table 3.

Sensitivity variables.

In this procedure is to evaluate how different factors impact insurance pricing and risk classification, the following sensitivity variables in Table 3 are selected.

3.4.2. Mapping Pricing Factors to the Risk Categories

The 8 Pricing Factors can be mapped to the 4 Risk Categories, but they are not directly one-to-one. Instead, these 8 factors contribute to the classification of EVs into one of the 4 risk categories. Each risk category is determined based on a combination of several pricing factors. Table 4 shows how each pricing factor influences the risk categorization of EVs.

Table 4.

Pricing Factor and Risk Categorization of EVs.

Each pricing factor contributes to a vehicle’s overall risk category, with elements like battery safety, accident risk, and safety features determining classification. For instance, an EV with poor battery safety, minimal safety features, and high accident risk is likely to be categorized as High-Risk, High-Carbon (H1), whereas a premium EV with high efficiency, strong safety features, and a low carbon footprint will fall into Low-Risk, Low-Carbon (L1). These risk categories serve as a simplified summary of overall risk, allowing insurers to make underwriting decisions without analyzing each pricing factor individually. Additionally, the role of PCAF Carbon Impact has grown in significance. While previous models focused primarily on traditional factors such as accident risk, repair costs, and battery safety, the updated framework now integrates PCAF carbon impact, ensuring that EVs are also categorized based on their environmental footprint.

3.4.3. Determining Sensitivity Scenarios

The variation percentages (±20% or ±30%) are determined based on the expected range of variability in each factor. The reasoning behind the selected values is as Table 5.

Table 5.

Expected Range of Variability in Each Factor.

Based on the analysis presented in the above table, this study concludes that a ±20% variation applies to factors primarily influenced by stable engineering and human behavior, such as battery safety, repair costs, safety features, driver profile, and acceleration risks. In contrast, a ±30% variation is assigned to factors subject to more unpredictable environmental or technological fluctuations, including climate performance, cyber risks, and PCAF carbon impact.

While the current study uses ±20% and ±30% deterministic ranges—validated through expert consensus and supported by industry data—these values represent bounded worst/best-case expectations rather than full distributions of uncertainty. To enhance the model’s robustness, future research could implement probabilistic simulations (e.g., Monte Carlo analysis) to capture the distributional behavior of each risk factor, especially those with high volatility such as PCAF carbon costs or cybersecurity threats. Such approaches would allow for a more precise estimation of premium variance under real-world uncertainty.

3.4.4. Defining Key Scenarios

This study defines four key scenarios to analyze how changes in sensitivity variables impact premium pricing and risk categorization.

This study defines four key scenarios to analyze how changes in sensitivity variables impact premium pricing and risk categorization (Table 6). Scenario analysis is a widely used method in the insurance industry, helping insurers anticipate potential outcomes under varying conditions by adjusting key risk factors (Cambridge Centre for Risk Studies). These scenarios—Best Case, Base Case, High-Carbon, and Worst Case—are constructed by modifying factors such as Battery Safety, Repair Costs, Safety Features, Driver Profile, Acceleration Risks, Climate Performance, Cyber Risks, and PCAF Carbon Impact.

Table 6.

The Definitions of Four Key Scenarios.

The Best Case scenario assumes a 20% improvement in Battery Safety and Repair Costs, a 30% enhancement in Climate Performance, and a 30% reduction in Cyber Risks and PCAF Carbon Impact, reflecting optimal risk conditions that minimize premium costs [32]. In contrast, the Worst Case scenario introduces a 20% decline in Safety Features, a 30% increase in Cyber Risks and PCAF Carbon Impact, and a 30% reduction in Climate Performance, representing an adverse situation with elevated insurance risks and premium rates [33].

The Base Case scenario serves as a benchmark with no adjustments, allowing for a neutral risk assessment and acting as a control scenario for comparison. Meanwhile, the High-Carbon scenario specifically accounts for a 30% increase in PCAF Carbon Impact, reflecting a situation where carbon pricing mechanisms or regulatory policies lead to increased financial penalties for high-emission vehicles [33].

By employing scenario analysis, insurers can effectively assess how variations in these factors impact risk categorization and premium pricing. This approach is crucial for integrating both stable engineering-based risks and more volatile environmental or technological risks into insurance models [34]. The use of sensitivity analysis further enhances the robustness of the framework by quantifying the impact of different assumptions on premium calculations [32].

3.4.5. Assigning Weights to Each Factor

The weightings (15% or 10%) reflect the relative influence of each factor on overall risk and premium pricing (Table 7). These were assigned based on industry research, actuarial models, and historical insurance claims data.

Table 7.

Weights to Each Factor.

The 15% or 10% allocations were determined using insurance risk modeling techniques, including claims data analysis and actuarial judgment. Studies indicate that battery-related fire and safety risks contribute over 15% to underwriting concerns [49], while high EV repair costs and driver profiles (age, risk behavior) each account for 15% of premium calculations [37,42]. Actuarial assessments assign lower weights to cyber risks (10%), acceleration risks (10%), and climate-related performance variations (10%) due to their comparatively lower impact on claims frequency and severity. Additionally, regulatory and carbon attribution considerations, particularly under PCAF guidelines, factor carbon impact directly into pricing, warranting a 15% weight.

A Modified Delphi Method was adopted instead of the classical version because the key risk and carbon factors had already been identified through an extensive literature review, eliminating the need for open-ended question generation by experts [54]. This approach provided a more structured and time-efficient process, appropriate for engaging senior professionals with limited availability [55]. Although fewer rounds were conducted, the method achieved strong consensus (Kendall’s W > 0.79), ensuring reliable expert validation. Unlike a traditional Delphi study, where experts define the research scope, this study used predefined literature-based risk factors, which were then systematically evaluated and weighted by industry professionals through an iterative Delphi process. The expert panel consisted of five senior professionals, all based in Taiwan, with diverse expertise across insurance underwriting, actuarial modeling, vehicle technology, and sustainability analysis. Their average professional experience was approximately 17 years. The panel included one senior actuary with over 20 years of experience in insurance pricing, claims modeling, and regulatory compliance under IFRS 17. One ESG and sustainability analyst with expertise in Scope 3 emissions reporting, carbon accounting frameworks (including PCAF), and financial disclosure policy. One auto insurance underwriter specializing in electric vehicle (EV) policy structures, repair cost trends, and usage-based insurance (UBI). One cyber risk advisor with a background in EV system security and connected car vulnerabilities relevant to insurer risk exposure. One academic expert in environmental economics and carbon pricing who has advised insurers on integrating carbon data into portfolio-level decision-making.

The Modified Delphi Study (MDS) was conducted in five iterative rounds, refining expert consensus at each stage:

Round 1—Identifying Sensitivity Variables: Experts reviewed and validated the most relevant risk factors, assessing their significance in EV insurance underwriting models. Factors that received high consensus were immediately accepted, while those with moderate agreement were refined for further review. Factors with low agreement were discarded. This step ensured that only the most critical factors influenced the sensitivity analysis.

Round 2—Mapping Pricing Factors to the Risk Categories: In the second stage, experts identify each pricing factor contributes to a vehicle’s overall risk category, with elements like battery safety, accident risk, and safety features determining classification.

Round 3—Determining Sensitivity Scenarios: In this stage, experts defined the expected range of variation for each risk factor, determining how fluctuations in these variables impact premium pricing. This step was crucial in quantifying the degree of sensitivity for each factor, allowing for a dynamic risk assessment framework.

Round 4—Defining Key Scenarios: After establishing the sensitivity ranges, experts constructed four key risk scenarios—Best Case, Base Case, High-Carbon, and Worst Case. Each scenario simulated different levels of exposure to risk variables, allowing for a comparative evaluation of premium pricing under varying risk conditions.

Round 5—Assigning Weights to Each Factor: The final stage involved experts assigning weight values to each risk factor, reflecting their relative influence on EV insurance premium adjustments. This step quantified the contribution of each risk variable, ensuring that the final insurance model was based on statistically validated expert consensus.

The MDS provided a structured and systematic approach to refining the risk factors that drive EV insurance premium calculations. By integrating expert judgment with empirical data, this study ensured that the sensitivity analysis, risk categorization, and premium pricing framework were both rigorous and industry-relevant. The consensus-driven approach enhances the applicability of this research, enabling insurers to develop risk-adjusted pricing models that reflect emerging technological, environmental, and regulatory factors in the EV sector.

4. The Results of Sensitivity Analysis After Conduct Rounds of MDS

A panel of five senior insurance professionals participated in a four-round iterative Delphi process, which was designed to validate and quantify the most critical risk factors affecting EV insurance. Through these rounds, experts first validated the most relevant risk factors (Round 1), then identify pricing factors to the categories (Round 2), defined sensitivity variation ranges (Round 3), developed four key risk scenarios (Round 4), and finally, assigned weight values to quantify each factor’s influence on premium pricing (Round 5).

4.1. Expert Panel Composition

The five industry experts who participated in this study represented distinct fields relevant to EV risk assessment. Their expertise covered predictive analytics, underwriting, claims evaluation, cybersecurity, and actuarial research. This ensured that the evaluation captured diverse perspectives on accident trends, carbon pricing implications, cyber threats, battery safety risks, and repair cost fluctuations.

While the panel consisted of five experts, this sample size is within acceptable bounds for Delphi studies, particularly in specialized or emerging fields where qualified experts are limited. According to [56], Delphi panels may range from 3 to 10 experts for homogenous groups with deep subject matter knowledge. Additionally, studies in the insurance and risk management domains have successfully used similar or smaller panels to establish consensus on high-impact variables [57]. The panel in this study was carefully selected for its breadth of expertise—spanning underwriting, actuarial science, cybersecurity, and EV claims evaluation—which ensured a representative and high-quality consensus process. Future studies may extend this framework by incorporating experts from additional regions to enhance geographic diversity and cross-market validity.

4.2. Five-Round Modified Delphi Process

The research followed a Modified Delphi approach with a literature-based question framework. The process consisted of the following steps.

4.2.1. Literature-Based Framework

A comprehensive review of existing studies on EV risk factors in insurance was conducted, leading to the identification of key risk categories that formed the basis for the expert survey questions.

4.2.2. The 1st MDS: Expert Validation

Experts were asked to indicate their agreement (1) or disagreement (0) on whether each predefined risk factor affects EV insurance classification, while open-ended responses were collected to justify their ratings and suggest refinements.

4.2.3. Analysis and Feedback

Responses were analyzed to identify factors with strong agreement and those requiring further discussion, and a summary of Round 1 responses was provided to experts for review.

4.2.4. The 2nd MDS: Consensus Refinement

Experts reconsidered their responses in areas of disagreement to improve consensus, while statistical analysis (Kendall’s W) was used to measure the level of agreement. This study was conducted through five iterative Delphi rounds, refining expert consensus at each stage.

Round 1: Identifying Sensitivity Variables

In the first MDS, experts reviewed a predefined list of risk factors identified from academic research and industry reports. Each factor was evaluated for relevance in EV insurance underwriting models using a binary scale (1 = Agree, 0 = Disagree). Factors that received agreement from at least 80% of experts were automatically accepted, while those with 60–79% agreement were revised and re-evaluated in the next round. Factors receiving less than 60% agreement were discarded.

The initial results showed that Battery Safety, Repair Costs, Cyber Risks, and Acceleration Risks received high agreement levels, highlighting their well-established impact on EV insurance risks. Factors such as Safety Features and Climate Performance were initially debated, but after further clarification, they were accepted as relevant factors. Driver Profile remained contentious because experts could not reach a consensus on whether EV drivers exhibit significantly different accident patterns than internal combustion engine (ICE) drivers. However, more than half of the experts accepted Driver Profile as a relevant factor. Similarly, PCAF Carbon Impact initially received low support but was later refined to account for mandatory carbon credit purchases, making it a direct financial burden for insurers (please view Table 8).

Table 8.

Round 1 Results—Validation of Risk Factors.

Round 2: Mapping Pricing Factors to the Risk Categories

All experts agree that each pricing factor contributes to a vehicle’s overall risk category, as shown in Table 2 at the first MDS.

Round 3: Sensitivity Variation Analysis

Once the core risk factors were validated, experts determined acceptable variation ranges for each factor. These ranges help simulate real-world premium adjustments, allowing insurers to adapt policies to changing battery safety conditions, repair cost fluctuations, and cybersecurity threats.

Experts refined Battery Safety fluctuations to ±15–25%, accounting for variations in battery chemistries and degradation rates. Repair Costs were set at ±15%, reflecting supply chain constraints and limited repair infrastructure. Cyber Risks and Climate Performance retained their ±30% range, given the unpredictability of hacking threats and extreme weather impacts on EV batteries. Driver Profile remained inconclusive, signaling the need for further research on how EV drivers differ from ICE drivers in terms of risk-taking behavior (please view Table 9).

Table 9.

Round 2 Results—Sensitivity Variation Analysis.

Round 4: Scenario-Based Risk Assessment

After three rounds of the MDS process refining expert opinions on scenario-based risk classification for EV insurance, experts established risk factors and sensitivity variation ranges, leading to the development of four key insurance scenarios representing different risk conditions.

The Base Case Scenario was accepted as a neutral benchmark, while the Best Case and Worst Case Scenarios required refinement of variation ranges to better align with real-world risk assessments. Additionally, the High-Carbon Scenario needed to explicitly include carbon pricing mechanisms as an unavoidable cost burden (please view Table 10).

Table 10.

The 1st MDS: Expert Agreement on Initial Scenarios.

The Best and Worst Case Scenarios were finalized with consensus on variation ranges, while the High-Carbon Scenario was modified to explicitly include mandatory carbon credit costs, though some experts continued to debate how insurers would integrate this into premium pricing (please view Table 11).

Table 11.

The 2nd MDS: Adjustments Based on Expert Feedback.

All four scenarios achieved full consensus (5/5 agreement), with the High-Carbon Scenario finalized as an unavoidable cost factor for insurers, leading to premium adjustments. The Best Case Scenario represents optimal risk conditions, where premium costs are minimized. In this scenario, Battery Safety improves by 20%, Repair Costs decrease by 20%, and Climate Performance increases by 30%, suggesting that advancements in battery technology, improved manufacturing processes, and better environmental adaptability contribute to lowering insurance risk. Additionally, Cyber Risks and PCAF Carbon Impact each decrease by 30%, indicating that strong cybersecurity measures and favorable carbon credit policies reduce financial burdens on insurers. As a result, premium costs in this scenario would be at their lowest (please view Table 12).

Table 12.

The 3rd MDS: Final Consensus Evaluation.

The Base Case Scenario serves as a benchmark, maintaining neutral values across all risk factors. This scenario provides a control point for evaluating risk-based adjustments in other scenarios and ensures that premium pricing remains stable in standard market conditions. Since there are no adjustments, this scenario allows insurers to establish a default underwriting model.

The High-Carbon Scenario specifically addresses the financial impact of carbon pricing regulations. In this case, all risk factors remain unchanged except for PCAF Carbon Impact, which increases by 30%. This scenario demonstrates the effect of increasing regulatory penalties and mandatory carbon credit purchases on insurers, emphasizing that carbon pricing mechanisms will inevitably lead to higher premiums. Insurers will need to incorporate these costs into their policy pricing structures to maintain profitability.

The Worst Case Scenario introduces unfavorable conditions that significantly raise insurance premiums. Repair Costs increase by 20% due to rising parts shortages and complex EV repairs, while Safety Features decline by 20%, reflecting increased risks associated with autonomous system failures or software malfunctions. Climate Performance declines by 30%, Cyber Risks increase by 30%, and PCAF Carbon Impact rises by 30%, creating an environment where claims frequency and severity are expected to peak. This scenario confirms that under extreme circumstances, EV insurance pricing will need to be adjusted upwards to offset expected losses.

Overall, the four scenarios provide insurers with a structured framework for evaluating how changes in sensitivity variables impact premium pricing and risk categorization. By incorporating these scenarios into risk models, insurers can develop data-driven strategies to adjust premiums in response to technological, environmental, and regulatory changes.

Round 5: Weight Allocation of Risk Factors

In the final round, experts assigned weighted values to each risk factor to quantify their impact on insurance risk and premium adjustments. The purpose of this step was to establish a hierarchy of risk influences, ensuring that each factor’s contribution to EV underwriting models was accurately reflected in pricing decisions.

This round followed a structured process to reach consensus on weight allocation percentages for each risk factor.

Experts were asked if they agreed (1) or disagreed (0) with the following proposed weight distribution (please view Table 13).

Table 13.

The 1st MDS: Initial Expert Review of Weight Allocation.

Experts provided feedback on whether the assigned weights accurately reflect real-world EV insurance risk, with some arguing that PCAF Carbon Impact should have a higher weight due to the potential future carbon credit costs imposed on insurance companies (please view Table 14).

Table 14.

The 2nd MDS: Adjustments Based on Expert Weight Feedback.

This final weight distribution, validated through three times of MDS, provides a robust foundation for EV risk assessment models in insurance pricing (please view Table 15).

Table 15.

The 3rd MDS: Final Weight Distribution Consensus Evaluation.

The results from this round confirmed that Battery Safety and PCAF Carbon Impact were the most influential risk factors, each assigned a weight of 20%. Experts emphasized that Battery Safety directly impacts the likelihood of EV-related fires and accidents, while PCAF Carbon Impact reflects unavoidable financial obligations related to carbon credit purchases. These two factors are expected to have a long-term effect on EV insurance pricing, requiring insurers to adapt their models accordingly.

Repair Costs and Acceleration Risks were each weighted at 15%, highlighting their significant influence on premium calculations. Repair Costs remain a major concern due to the complexity and expense of EV part replacements, especially for battery components. Acceleration Risks, driven by the rapid torque and speed capabilities of electric vehicles, increase accident severity, leading to higher claims.

Cyber Risks also received a weight of 15%, reflecting growing concerns about EV hacking, malware attacks, and software vulnerabilities. Experts agreed that as vehicles become increasingly connected and reliant on digital infrastructure, cybersecurity threats will play a larger role in insurance risk assessment.

Driver Profile was assigned a weight of 10%, even though experts had mixed opinions on how EV-specific driver behavior affects accident risk. This weight suggests that while driving habits remain an important factor in underwriting, further research is needed to determine whether EV drivers are inherently safer or riskier than ICE vehicle drivers.

Safety Features and Climate Performance received the lowest weights (5%), indicating that while they are important, they do not drastically impact overall claims frequency or severity. Safety technologies, while beneficial in reducing crashes, increase repair complexity and costs, counterbalancing their risk-reduction effects. Climate Performance, meanwhile, affects battery efficiency but does not directly contribute to accident likelihood, making it a secondary consideration in underwriting.

The final weight allocation provides a data-driven approach for insurers to prioritize risk factors when structuring EV insurance policies. By integrating these weights into underwriting models, insurance companies can develop more accurate premium calculations, mitigate high-risk scenarios, and adjust pricing in response to technological advancements and regulatory changes.

4.3. Computing Impact in Risk Categories

Each scenario applies the variation percentage (from the sensitivity variables) to the corresponding weighted contribution to the total premium. Following is an example Calculation for the Worst-Case Scenario (High-Risk, High-Carbon—H1).

Battery Safety: +20% risk × 15% weight = +3.0% impact on premium.

Repair Costs: +20% risk × 15% weight = +3.0% impact on premium.

Safety Features: −20% risk × 10% weight = −2.0% impact on premium.

Driver Profile: +20% risk × 15% weight = +3.0% impact on premium.

Acceleration Risks: +20% risk × 10% weight = +2.0% impact on premium.

Climate Performance: −30% risk × 10% weight = −3.0% impact on premium.

Cyber Risks: +30% risk × 10% weight = +3.0% impact on premium.

PCAF Carbon Impact: +30% risk × 15% weight = +4.5% impact on premium.

Total Impact on Premium for H1 (High-Risk, High-Carbon) = (+3.0% + 3.0% − 2.0% + 3.0% + 2.0% − 3.0% + 3.0% + 4.5%) = +15.5% → Rounded to +15%.

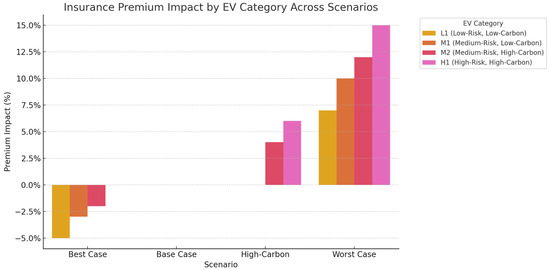

Similar calculations are performed for each risk category, adjusting the weighting accordingly (Table 15 and Figure 2). This Figure 2 illustrates the relative premium impact for each EV category under the four sensitivity scenarios. It visually highlights how high-risk, high-carbon vehicles (H1) are most vulnerable to cost increases in adverse scenarios, while low-risk, low-carbon vehicles (L1) benefit significantly under favorable conditions. The graph complements the numerical data presented in Table 16 by enabling quick visual comparison across categories and conditions.

Figure 2.

Insurance Premium Impact by EV Category Across Scenarios.

Table 16.

Calculations of Impact in Risk Categories.

Sensitivity variables were assigned ±20% or ±30% based on the expected variability of each risk factor, with weights determined through actuarial modeling and historical data. The scenario-specific impact was then calculated by multiplying the variation percentage by the assigned weight, and the final premium impact percentages were derived by summing the contributions of individual factors.

EVs present unique challenges and opportunities for the insurance industry due to their distinct risk profiles and carbon footprints. This analysis explores how sensitivity analysis can provide insurers with insights into premium adjustments based on varying risk factors. The study highlights the differential impact on premium EVs and budget EVs, emphasizing the role of safety features, repair costs, driver behavior, and carbon attributions under PCAF guidelines. The following sections detail key insights derived from the sensitivity analysis, offering a comprehensive understanding of EV insurance premiums.

5. Sensitivity Analysis of Insurance Premiums for Electric Vehicles: Key Insights

This section provides a detailed analysis of how different electric vehicle categories are impacted by various risk scenarios under PCAF-linked carbon attributions. The following subsections present key insights from the sensitivity analysis, focusing on premium adjustments for different EV segments based on accident risk, repair costs, and carbon emissions.

5.1. Key Insights from Sensitivity Analysis

The sensitivity analysis revealed that the Worst-Case Scenario resulted in a 14.5% increase in total premiums, driven by higher repair costs, cyber risks, and PCAF carbon penalties. Conversely, the Best-Case Scenario led to a 10.5% reduction in premiums, benefiting from enhanced battery safety, lower repair expenses, and improved climate performance. The High-Carbon Scenario, which accounts for increased carbon attribution costs under PCAF, led to a 6% rise in total premiums, highlighting the growing impact of carbon-conscious underwriting

5.2. Premium EVs (L1 and M2) Exhibit Lower Risk and Stable Premiums

Premium EVs (Low-Risk, Low-Carbon—L1 and Medium-Risk, High-Carbon—M2) demonstrated lower premium volatility across all scenarios, largely due to advanced safety features, energy efficiency, and risk-averse driver profiles. While their repair costs remain high, they are less likely to be deemed total losses, leading to more stable underwriting conditions. Additionally, premium EVs benefit from lower PCAF carbon attribution costs due to their higher efficiency and cleaner energy sourcing, making them a more favorable option for insurers under sustainability-linked pricing models.

5.3. Budget EVs (H1 and M1) Face Greater Financial and Risk Exposure

Budget EVs (High-Risk, High-Carbon—H1 and Medium-Risk, Low-Carbon—M1) showed higher premium increases under adverse conditions, particularly due to greater accident frequency, repair cost sensitivity, and higher carbon penalties. Limited safety features and higher-risk driver demographics contribute to increased accident-related claims, making them less predictable for insurers. Additionally, budget EVs operating in fossil-heavy regions incurred the highest PCAF-linked costs, further increasing premiums. In the Worst-Case Scenario, budget EVs experienced the most significant premium increase, reinforcing their higher underwriting risk for insurers.

6. Recommendations for Insurers

This section outlines strategic recommendations for insurers in underwriting electric vehicles, emphasizing the advantages of prioritizing premium EVs and the conditions under which budget EVs should be selectively underwritten to mitigate financial risks.

6.1. Prioritize Premium EVs (L1 and M2) for Stability and Risk Optimization

Premium EVs (L1 and M2) should be prioritized due to their lower accident frequency, which reduces claims exposure. Their better repairability minimizes total-loss claims, while carbon pricing advantages align well with insurers’ PCAF and Net-Zero commitments. Additionally, premium EVs offer more stable premiums across different risk scenarios, making them a low-volatility choice for insurers.

6.2. Selective Underwriting for Budget EVs (H1 and M1)

Insurers should exercise caution when underwriting budget EVs, considering both risk exposure and carbon efficiency factors. The following criteria outline when insurers should favor or avoid underwriting budget EVs.

6.2.1. When to Underwrite Budget EVs (H1 and M1)

Equipped with Advanced Safety Features: Models with ADAS, lane assist, and automatic braking should be prioritized.

Low-Risk Drivers: Preference should be given to drivers with clean driving records, as accident-prone demographics raise claims costs.

Energy-Efficient Models: Budget EVs with high km/kWh ratings and those primarily charged on low-carbon grids are favorable due to lower PCAF-linked costs.

Telematics-Based Policies: Insurers can use real-time monitoring to adjust premiums for safe driving behavior.

6.2.2. When to Avoid Budget EVs (H1 and M1)

High-Risk Drivers: Avoid underwriting budget EVs for younger or aggressive driver profiles with historically high accident frequencies.

Inefficient Models: Models with low energy efficiency (km/kWh) and high repair costs should be excluded.

High-Carbon Charging Regions: Budget EVs operated in fossil-fuel-heavy regions will face higher PCAF penalties, increasing insurer liabilities.

6.3. Alternative Approach: Incentive-Based Underwriting

Rather than completely avoiding budget EVs, insurers can implement incentive-based underwriting models to encourage lower-risk behavior and carbon-conscious usage.

6.3.1. Incentive Mechanisms for Budget EV Insurance (H1 and M1)

Telematics-Based Discounts: Insurers can offer lower premiums for budget EV drivers with safe driving habits, monitored through telematics data.

Charging Incentives: Policyholders who charge their EVs during low-carbon electricity periods can receive premium discounts.

Safety Feature Discounts: Budget EVs equipped with ADAS and crash-avoidance systems should receive incentives to reduce risk exposure.

6.3.2. Incentive Mechanisms for Premium EV Insurance (L1 and M2)

Carbon-Efficient EV Discounts: Premium EVs with high energy efficiency (km/kWh) and low PCAF carbon attribution should receive lower insurance rates.

Autonomous and Advanced Safety Technology Incentives: Insurers can offer discounted premiums for vehicles with Level 3+ autonomous driving systems and advanced safety AI, which reduce accident risks.

Green Repair Discounts: Policyholders who opt for sustainable repair services or certified green auto body shops can receive insurance incentives for eco-friendly claims management.

Loyalty and Low-Claim Incentives: Given that premium EVs have lower accident rates, insurers can introduce progressive discounts for long-term policyholders with minimal claims history.

6.4. Final Verdict: Premium EVs (L1 and M2) Are the Optimal Choice for Profitability and Sustainability

Premium EVs (L1 and M2) emerge as the preferred underwriting option due to their lower accident risk, higher repair stability, and alignment with PCAF carbon policies. Their advanced safety features, reduced total-loss claims, and energy efficiency contribute to lower underwriting volatility, making them a financially sustainable option for insurers. Additionally, premium EVs benefit from lower carbon attribution costs, supporting insurers’ net-zero commitments and regulatory compliance under evolving carbon accounting frameworks.

Budget EVs (H1 and M1) can be selectively underwritten if they meet specific safety, efficiency, and low-carbon charging criteria. However, they introduce greater financial risks due to higher accident frequency, volatile repair costs, and increased exposure to carbon pricing penalties. Insurers must exercise caution, leveraging incentive-based underwriting and telematics-driven pricing to mitigate losses while still capturing growth in the affordable EV segment.

For long-term profitability and sustainability, insurers should consider the following:

- Prioritize premium EVs for their stable risk profile and lower carbon liabilities, ensuring predictable and profitable underwriting.

- Adopt data-driven underwriting for budget EVs, integrating risk-based pricing and carbon-conscious policies to optimize financial sustainability.

- Leverage PCAF-aligned pricing strategies, ensuring that carbon attribution is fully embedded into underwriting models, allowing insurers to balance risk, compliance, and climate impact.

- Incentivize sustainable driving behaviors through telematics, green repairs, and clean-energy charging discounts, fostering long-term policyholder engagement and retention.

While this study utilized expert consensus and secondary industry sources to derive estimates for repair costs, battery failure, and cyber risks, the absence of real-world insurer claims data by EV model presents a limitation. Future research should incorporate proprietary insurer data—such as claims frequency, severity, and repair costs by EV make and model—to validate and calibrate the sensitivity assumptions presented here. This would significantly improve the empirical grounding and predictive precision of carbon-aware EV underwriting models.

By integrating risk-adjusted pricing models, carbon-aware underwriting, and strategic incentives, insurers can enhance profitability while supporting the transition to a cleaner, more sustainable EV market. This approach ensures that insurers not only mitigate financial risks but also position themselves as leaders in sustainable and responsible insurance practices.

7. Conclusions and Future Research Suggestions

7.1. Conclusions

This study developed a carbon-aware underwriting strategy for electric vehicles (EVs) by integrating PCAF carbon attribution with traditional risk-based pricing factors. Using a modified Delphi method and scenario-based sensitivity analysis, we categorized EVs into four risk segments and assessed premium fluctuations under varying accident, repair, and carbon scenarios.

Key findings indicate that premium EVs (L1 and M2) exhibit greater underwriting stability and lower carbon penalties, making them a more sustainable and profitable segment for insurers. In contrast, budget EVs (H1 and M1) face higher financial and carbon risks, requiring selective underwriting and targeted incentives.

7.2. Future Research Suggestions

The framework presented offers insurers a structured, data-driven approach to align underwriting with emerging climate regulations, carbon disclosure standards, and net-zero commitments. Future research should incorporate real-world claims data and explore probabilistic modeling to enhance predictive accuracy.

While this study provides a structured framework for integrating carbon attribution into EV insurance underwriting, it is limited to policy-level sensitivity analysis. Due to the lack of access to insurer portfolio data, this research does not simulate the broader business impacts of the proposed model, such as aggregate premium income, loss ratios, or shifts in client portfolio composition. Future research should conduct simulation modeling using hypothetical or real-world portfolios to evaluate how carbon-aware underwriting influences overall insurer profitability, client segmentation, and carbon disclosure performance.

The link between PCAF-based carbon attribution and premium pricing proposed in this study should be further developed through empirical investigation and simulation modeling. While current industry practice does not directly translate carbon emissions into consumer-level premiums, future work should explore how insurers could internalize carbon costs through regulatory requirements, carbon taxes, or voluntary offsetting commitments. Investigating how insurers operationalize carbon accountability in underwriting will enhance understanding of potential financial impacts and refine the practical applicability of the proposed framework.

While this study’s sensitivity analysis used expert-validated variation ranges (±20%, ±30%) to simulate risk impacts, future research should refine this approach by incorporating empirical ranges derived from historical claims data or actuarial simulations. Additionally, scenario development could be strengthened by modeling real-world event-based shocks, such as battery recalls, national subsidy adjustments, or grid decarbonization shifts. Integrating these real-world factors into scenario construction will enhance the framework’s predictive reliability and practical applicability in EV underwriting.

This study acknowledges that using empirical variation ranges from claims data or actuarial simulations, along with real-world event-based scenarios, would enhance the methodological rigor of the sensitivity analysis. In this study, the ±20% and ±30% variation ranges were derived from industry reports, Delphi expert consensus, and engineering-based estimates, rather than large-scale empirical datasets. The scenarios are based on conventional stress-testing logic, not directly linked to specific market events such as battery recalls, grid decarbonization shifts, or subsidy policy changes. Therefore, a caveat has been added in the limitations section, recommending that future research incorporate historical event data and actuarial simulations to improve scenario realism and predictive robustness.

This study assumes that PCAF-related carbon costs will be passed directly to consumers through premium adjustments. However, in practice, insurers may adopt varied strategies, including absorbing carbon-related costs, rebalancing underwriting portfolios toward lower-emission vehicles, or selectively passing costs to specific customer segments. This simplified assumption represents a forward-looking scenario rather than current industry practice. Future research should explore insurer response modeling to assess how different strategies—cost absorption, portfolio rebalancing, or selective pass-through—impact underwriting profitability, client retention, and carbon reduction effectiveness.

Author Contributions

Conceptualization, X.L. and F.C.; methodology, X.L. and C.-Y.L.; software, H.Z.; validation, F.C. and X.L.; formal analysis, F.C. and C.-K.F.; investigation, H.Z.; data curation, X.L. and C.-Y.L.; writing—original draft preparation, C.-K.F.; writing—review and editing, C.-Y.L. and C.-K.F. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

In Taiwan, if the research is non-interactive, non-interventionist, and anonymous, conducted in public settings, and does not allow identification of specific individuals from collected data, it may be exempt from review by an ethics committee, according to the official letter from Taiwan’s Ministry of Science and Technology dated 12 January 2015 (Document No. 1040003540).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Lutsey, N.; Nicholas, M. Update on Electric Vehicle Costs in the United States Through 2030; Working Paper 2019-06; The International Council on Clean Transportation (ICCT): Washington, DC, USA, 2019. [Google Scholar]

- McDonnell, K.; Sheehan, B.; Murphy, F.; Guillen, M. Are Electric Vehicles Riskier? A comparative study of driving behaviour and insurance claims for internal combustion engine, hybrid and electric vehicles. Accid. Anal. Prev. 2024, 207, 107761. [Google Scholar] [CrossRef]

- Warmerdam, W.; Kaynar, E. Dutch Financial Sector Financed Emissions—Financed Emissions from Corporate Finance Portfolios; Profundo: Amsterdam, The Netherlands, 2022. [Google Scholar]

- Wu, G.; Inderwildi, O.R.; King, D.A. Electric vehicles: Performance, life cycle, and sustainability considerations. Renew. Sust. Energ. Rev. 2020, 132, 109841. [Google Scholar]

- Weiss, M.; Winbush, T.; Newman, A.; Helmers, E. Energy consumption of electric vehicles in Europe. Sustainability 2024, 16, 7529. [Google Scholar] [CrossRef]

- Hasan, S.; Simsekoglu, Ö. The role of psychological factors on vehicle kilometer travelled (VKT) for battery electric vehicle (BEV) users. Res. Transp. Econ. 2020, 82, 100880. [Google Scholar] [CrossRef]

- Wang, L. Opportunities and Challenges in the Chinese Electric Vehicle Market: Insights for (Re) Insurers; Cologne University: Cologne, Germany, 2024. [Google Scholar]

- LaMonaca, S.; Matsuo, T.; Mitchell, J. Charting the Course to Climate-Aligned Finance, Five Barriers to Alignment and How a Sectoral Approach Can Help. Available online: https://rmi.org/insight/navigating-five-barriers-to-climate-aligned-finance/ (accessed on 3 March 2025).

- JKJ Insurance Brokerage. Why Electric Vehicle Insurance Costs More: Key Factors and How to Save. Available online: https://jkj.com/blog/why-electric-vehicle-insurance-costs-more-key-factors-and-how-to-save (accessed on 2 March 2025).

- AMT Insurance Solutions. EV Insurance Providers Adapt to Changing Market Conditions. Available online: https://amtinsurancesolutions.com (accessed on 5 March 2025).

- Swiss Re. Insuring Electric Vehicles: Adapting Underwriting Strategies. Available online: https://www.swissre.com/institute/research/sigma-research/Economic-Insights/insuring-electric-vehicles.html (accessed on 11 March 2025).

- Sharma, I.; Bansal, P.; Dua, R. Breaking down barriers: Emerging issues on the pathway to full-scale electrification of the light-duty vehicle sector. Energy 2025, 326, 136230. [Google Scholar] [CrossRef]

- PCAF. The Global GHG Accounting and Reporting Standard for the Financial Industry. Available online: https://carbonaccountingfinancials.com (accessed on 8 April 2025).

- Castillo-Calderón, J.; Cordero-Moreno, D.A.; Larrodé Pellicer, E. A model-driven approach for estimating the energy performance of an electric vehicle used as a taxi. Energies 2024, 17, 6053. [Google Scholar] [CrossRef]

- Wang, H.; Mieth, R.; Konstantinou, J. Advancements in EV Battery Management Systems and Fire Risk Reduction. J. Automot. Eng. 2019, 35, 210–225. [Google Scholar]

- International Energy Agency (IEA). The Role of Electric Vehicles in Decarbonizing Transport. Available online: https://www.iea.org (accessed on 2 March 2025).

- U.S. Department of Energy. Electric Vehicles and Emissions Reduction. Available online: https://www.energy.gov (accessed on 20 March 2025).

- International Council on Clean Transportation (ICCT). Effects of Battery Manufacturing on EV Lifecycle Emissions. Available online: https://theicct.org (accessed on 2 March 2025).

- CarbonBrief. Factcheck: How Electric Vehicles Help to Tackle Climate Change. Available online: https://www.carbonbrief.org (accessed on 2 March 2025).

- Klopott, M.; Urbanyi-Popiolek, I. The insurance business perspective on the risk of transporting electric vehicles by sea. Eur. Res. Stud. 2024, 27, 910–928. [Google Scholar] [CrossRef]

- Yearick, K.; Herman, P.; Zavon, D. Electric vehicle car-sharing insurance: Risk factors vs. carbon considerations. J. Transp. Econ. 2023, 16, 31–49. [Google Scholar]

- Bhide, S.; Sengupta, A. Net-Zero commitments in the insurance sector: Are underwriting practices evolving? Clim. Risk. Insur. 2024, 11, 88–107. [Google Scholar]

- Ayodele, O.; Mustapa, S. Sustainability and risk management in the insurance sector: A review of carbon considerations. J. Risk. Insur. 2020, 87, 215–232. [Google Scholar]

- Siragusa, C.; Tumino, A.; Mangiaracina, R.; Perego, A. Electric vehicles performing last-mile delivery in B2C e-Commerce: An economic and environmental assessment. Int. J. Sustain. Transp. 2022, 16, 22–33. [Google Scholar] [CrossRef]

- Jin, L.; Searle, S.; Lutsey, N. Evaluation of State-Level US Electric Vehicle Incentives; White Paper; The International Council on Clean Transportation (ICCT): Washington, DC, USA, 2014. [Google Scholar]

- Ayetor, G.K.; Opoku, R.; Sekyere, C.K.K. The Cost of a Transition to Electric Vehicles in Africa: A Case Study of Ghana. Case Stud. Transp. Pol. 2022, 12, 356–368. [Google Scholar] [CrossRef]

- Haddadian, G.; Khodayar, M.; Shahidehpour, M. Accelerating the Global Adoption of Electric Vehicles: Barriers and Drivers. Electr. J. 2015, 28, 23–36. [Google Scholar] [CrossRef]

- Greenhouse Gas Protocol Standard. The Greenhouse Gas Protocol. 2011. Available online: http://www.ghgprotocol.org/standards (accessed on 2 March 2025).

- Task Force on Climate-related Financial Disclosures (TCFD). Recommendations of the Task Force on Climate-Related Financial Disclosures, Final Report. 2017. Available online: https://www.fsb-tcfd.org (accessed on 11 March 2025).

- Verra. Verified Carbon Standard (VCS) Program. Available online: https://verra.org (accessed on 11 April 2025).

- International Financial Reporting Standards (IFRS). IFRS S2 Climate-Related Disclosures. Available online: https://www.ifrs.org/issued-standards/ifrs-sustainability-standards-navigator/ifrs-s2-climate-related-disclosures/ (accessed on 8 April 2025).

- Rickayzen, B.D. A sensitivity analysis of the premiums for a permanent health insurance (PHI) model. J. Actuar. Pract. 2001, 9, 189–227. [Google Scholar]

- The Geneva Association. Climate Change Risk Assessment for the Insurance Industry. Available online: https://www.genevaassociation.org/publication/climate-change-and-environment/climate-change-risk-assessment-insurance-industry (accessed on 11 March 2025).

- Vyskočil, M. Scenario analysis approach for operational risk in insurance companies. Acta VŠFS-Ekon. Stud. Anal. 2020, 14, 153–165. [Google Scholar] [CrossRef]

- Asian Development Bank. Electric Vehicles and Battery Safety: Technical and Policy Considerations; Asian Development Bank: Manila, Philippines, 2011; Available online: https://www.adb.org (accessed on 5 March 2025).

- Mooren, L.; Shuey, R. Systems thinking in road safety management. J. Road Saf. 2024, 32, 63–73. [Google Scholar] [CrossRef]