Analysis of Technological Innovation Efficiency in Listed New Energy Vehicle Enterprises Under the Carbon Neutrality Framework Based on Two-Stage Dynamic Network DEA and a GRA Model

Abstract

1. Introduction

2. Materials and Methods

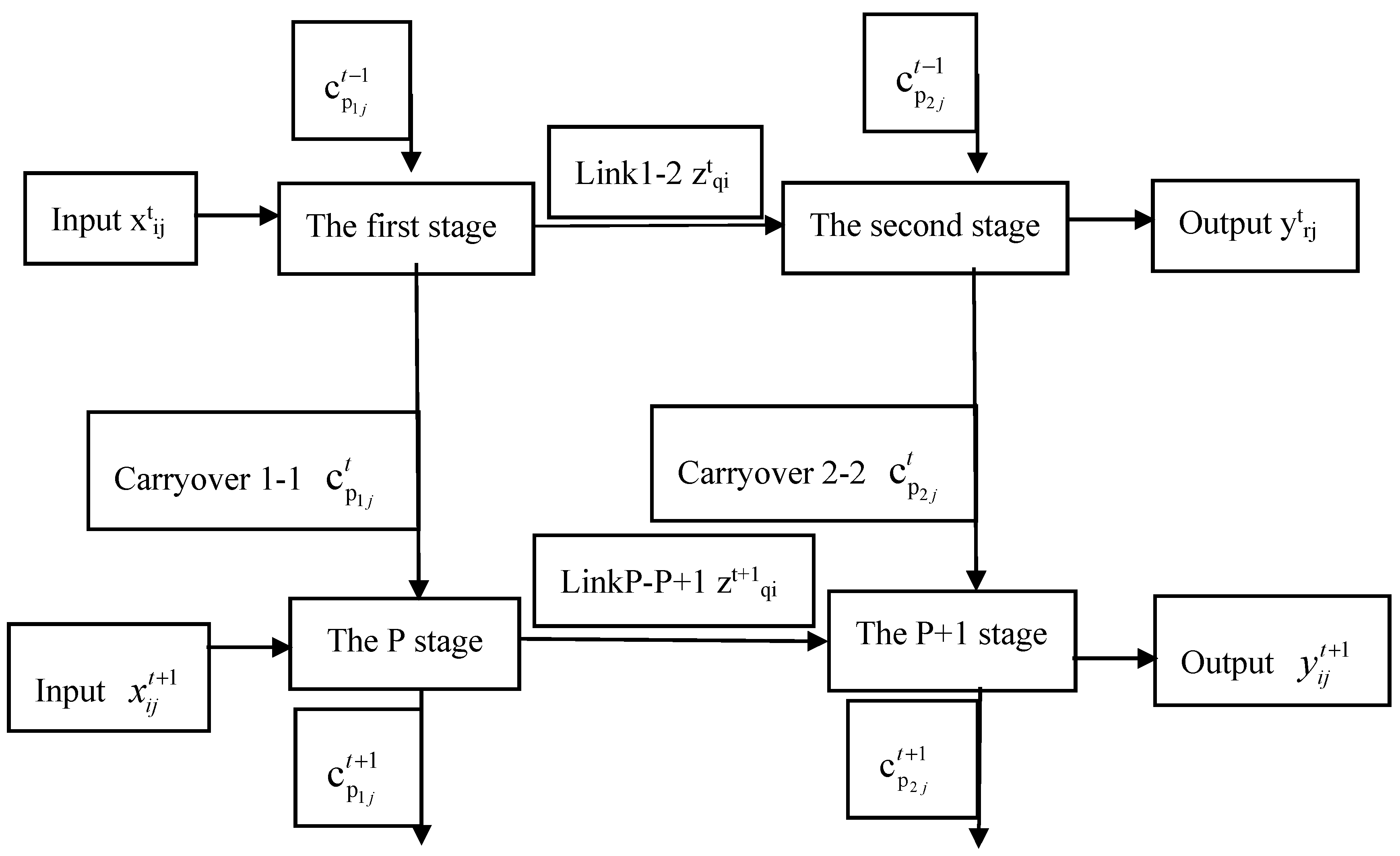

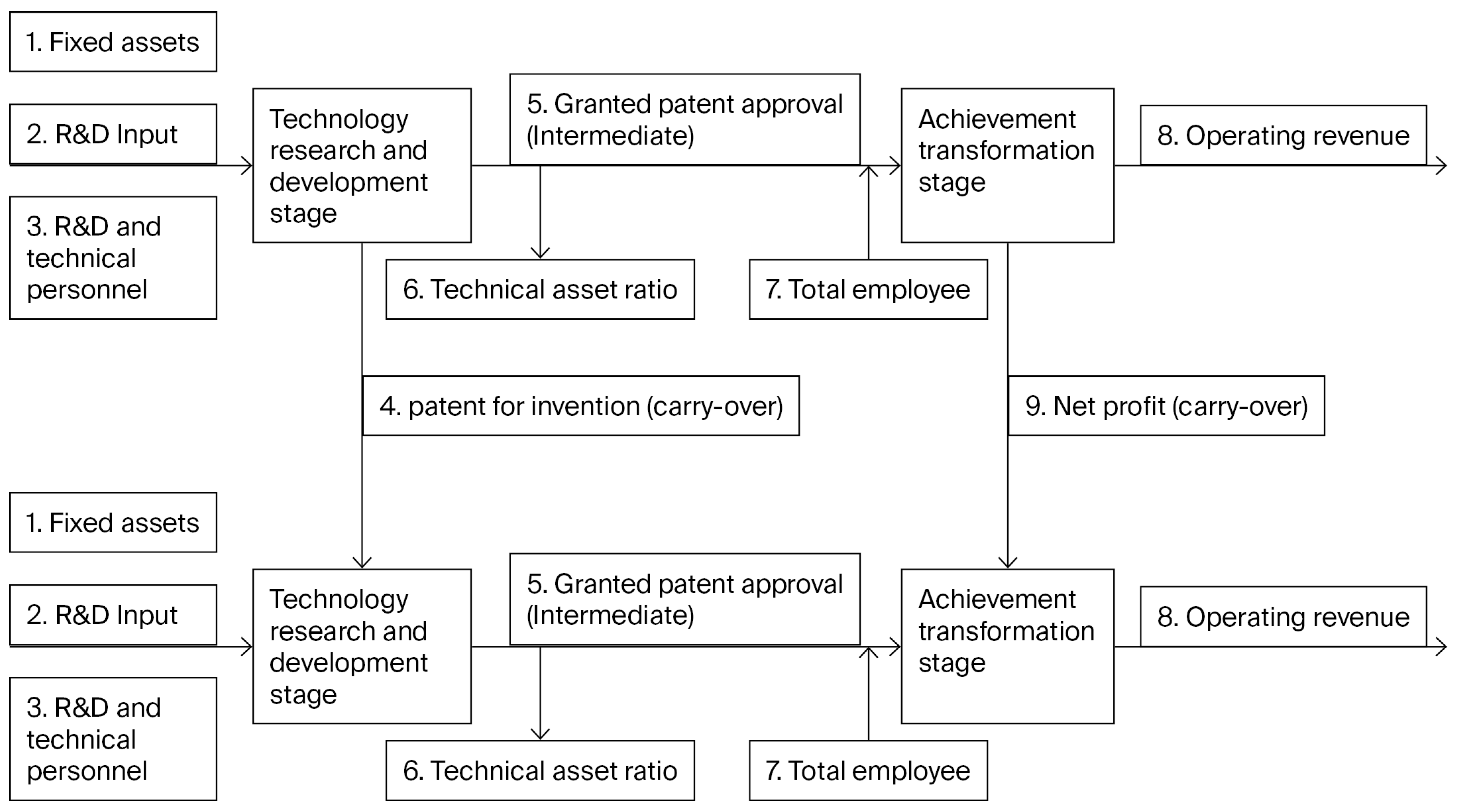

2.1. Dynamic Network DEA Model

2.2. Grey Relational Analysis

3. Results

3.1. Data Sources

3.2. Indicator Selection and Sample Data Analysis

4. Discussion

4.1. Data Processing

4.2. Grey Correlation Analysis of Factors Affecting Technological Innovation Efficiency

5. Conclusions

5.1. Conclusions

- The overall efficiency of the new energy vehicle industry is not high. The model results indicate that the industry’s overall efficiency reduced during the study period, highly related to the external environment, including policies, laws, government subsidies, environmental protection requirements, the emergence of new technologies, and policy instability and unsustainability. By the end of 2021, China had become the world’s largest producer and seller of new energy vehicles, and related technologies have continued to make progress. However, in the process of implementing relevant industrial policies, many problems have emerged, such as frequent fraudulent subsidies and the excessive dependence of enterprises on the dividends brought by industrial policies. This has led to insufficient R&D investment by the enterprises themselves, resulting in low technological innovation efficiency. Faced with these problems and the development situation of new energy vehicles, the government has decided to gradually reduce relevant policy incentives. The drastic fluctuations during the study period may be due to changes in external factors driving changes in internal factors within enterprises, for example, internal reforms, equity changes, institutional changes, and organizational changes.

- The comprehensive and stage efficiencies of listed new energy vehicle companies are not high. Among the 13 sample companies, only 2—Aote Xun and BYD—have a comprehensive efficiency value of 1; 3—Aote Xun, BYD, and Dongfeng Motor—have a technology research and development stage efficiency value of 1; and 4—Aote Xun, BYD, Dongfeng Motor, and Zhongtong Bus—have a results transformation stage efficiency value of 1. These companies thus exhibit technical effectiveness. At the same time, the efficiency of the technology research and development stage is higher than that of the commercial transformation stage, while the efficiency of technological innovation varies greatly depending on the nature of the enterprise. The technological innovation and stage efficiencies of state-owned enterprises are significantly higher than those of private enterprises. The main reason for this is that state-owned enterprises undertake more basic research as well as key development and technological innovation research. State-owned enterprises have become pioneers in the fields of new energy, medicine, electronic information, semiconductors, aerospace, high-speed rail, etc. These enterprises can also obtain more support from national-level policies and technologies.

- The six most important factors affecting the technological innovation efficiency of listed new energy vehicle companies are the shareholding ratio of the largest shareholder, R&D investment, the proportion of employees with a bachelor’s degree or above, management ability, return on net assets, and total asset turnover rate. On the other hand, government subsidies and total assets have a smaller impact on technological innovation efficiency.

5.2. Suggestions

- Government Level

- 2.

- Industry Level

- 3.

- Corporate Level

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Jiang, C.; Li, J.; Kou, Y.; Han, J. Government promotion subsidies, technology regulation embedding and green innovation of new energy vehicle enterprises. China Environ. Manag. 2025, 17, 55–62. [Google Scholar]

- Gao, W.; Du, X.; Liang, Q.; Sun, W. Government subsidies, market structure and collaborative innovation: Empirical evidence from the new energy vehicle industry. China Soft Sci. 2025, 5, 25–40. [Google Scholar]

- Jiang, C.; Kou, Y.; Zhang, Y. Can government procurement promote green innovation of new energy vehicle enterprises? Based on the perspective of media supervision and regulation. China Popul. Resour. Environ. 2025, 35, 14–23. [Google Scholar]

- Aigner, D.; Lovell, C.A.K.; Schmidt, P. Formulation and estimation of stochastic frontier production function models. J. Econom. 1977, 6, 21–37. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- Chung, Y.H.; Färe, R.; Grosskopf, S. Productivity and undesirable outputs: A directional distance function approach. J. Environ. Manag. 1997, 51, 229–240. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, P.W. Sensitivity analysis of efficiency scores: How to bootstrap in nonparametric frontier models. Manag. Sci. 1998, 44, 49–61. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, P.W. Estimation and inference in two-stage, semi-parametric models of production processes. J. Econom. 2007, 136, 31–64. [Google Scholar] [CrossRef]

- Battese, G.E.; Rao, D.S.P. Technology gap, efficiency, and a stochastic metafrontier function. Int. J. Bus. Econ. 2002, 1, 87–93. [Google Scholar]

- Färe, R.; Grosskopf, S. Network DEA. Socio-Econ. Plan. Sci. 2000, 34, 35–49. [Google Scholar] [CrossRef]

- Tone, K.; Tsutsui, M. Dynamic DEA: A slacks-based measure approach. Omega 2010, 38, 145–156. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Yi, L.; Tian, M.; Zou, F.; Yan, S. How does technological innovation in new energy vehicles improve regional carbon emission efficiency? An empirical analysis based on 274 cities in China. Soft Sci. 2025, 39, 89–96. [Google Scholar]

- Zhao, Q.; Chen, H.; Zhang, L. Research on the Coopetition Relationship of Technological Innovation in China’s New Energy Vehicle Industry—Based on the Lotka-Volterra Population Competition Model Analysis. Tech. Econ. 2024, 43, 47–59. [Google Scholar]

- Hui, Z.; Yu, X.; Sang, X.; Zhou, D.; Wang, Q. Analysis of the impact effect of the “double-credit” policy for new energy vehicles on technological innovation of heterogeneous enterprises. Syst. Eng.-Theory Pract. 2024, 12, 1–19. [Google Scholar]

- Cheng, X.; Tang, X. Research on the Efficiency and Influencing Factors of Technological Innovation in Strategic Emerging Industries: From the Perspective of the New Energy Vehicle Industry. East China Econ. Manag. 2024, 38, 54–64. [Google Scholar]

- Shen, K.; Shi, B.; Fu, D. The impact of environmental regulations and tax incentives on the innovation efficiency of Chinese new energy vehicle enterprises. J. Beijing Inst. Technol. (Soc. Sci. Ed.) 2024, 26, 84–97. [Google Scholar]

- Tone, K.; Tsutsui, M. Dynamic DEA with network structure: A slacks-based measure approach. Omega 2014, 42, 124–131. [Google Scholar] [CrossRef]

- Yao, H.; Xu, K. Analysis of the Impact of the “Double-Credit” Policy on Technological Innovation in Upstream Enterprises of New Energy Vehicles. Econ. Issues 2024, 7, 105–111. [Google Scholar]

- Qin, S.; Xiong, Y. Can “Non-subsidy” Policies Promote the Innovation of New Energy Vehicle Enterprises?—Based on the SCP Paradigm Analysis Perspective. Sci. Sci. Technol. Manag. 2024, 45, 3–23. [Google Scholar]

- Zhou, Q.; Cheng, M.; Wu, S.; Zeng, L. Research on the collaborative construction of innovation ecosystem for new energy vehicle enterprises. Sci. Res. Manag. 2024, 45, 32–41. [Google Scholar]

- Wang, J.; Wang, W.; Liu, Y. How can new energy vehicles drive renewable energy technology innovation?—A test based on the difference-in-differences model. Ind. Econ. Res. 2024, 2, 115–129. [Google Scholar]

- Ren, X.; Sun, S.; Ma, Q.; Shao, S. New Energy Vehicle Promotion Policies, Financing Constraints and Green Technological Innovation. Manag. Rev. 2024, 36, 131–148. [Google Scholar]

- Liu, X.; Yang, P.; Ding, X. Central and Local Industrial Policy Coordination and the Development of the New Energy Vehicle Industry: From the Perspective of the Innovation Ecosystem. China Soft Sci. 2023, 11, 38–53. [Google Scholar]

- Zhai, X.; Liu, Y. Internationalization Strategy, Resource Base and Innovation Performance of New Energy Automobile Enterprises—Based on Fuzzy Set Qualitative Comparative Analysis. China Sci. Technol. Forum 2023, 10, 95–104. [Google Scholar]

- Zhang, J.; Li, X.; Ye, X.; Yin, X. Quantitative evaluation of new energy vehicle policy combination guided by meaning innovation. Sci. Sci. Manag. Sci. Technol. 2023, 44, 3–17. [Google Scholar]

- Xu, X.L.; Chen, H.H. Exploring the innovation efficiency of new energy vehicle enterprises in China. Clean Technol. Environ. Policy 2020, 22, 1671–1685. [Google Scholar] [CrossRef]

| Listed Company | Stock Code | A-Share? | Registered Company Address | Nature of Controlling Shareholders |

|---|---|---|---|---|

| Aote Xun | 002227SZ | A-share | Guangdong Province | Other |

| BYD | 002594SZ | A-share | Guangdong Province | Private enterprise |

| Dongfeng Technology | 600081SH | A-share | Shanghai | State-owned enterprise |

| Dongfeng Motor | 600006SH | A-share | Hubei Province | State-owned enterprise |

| GAC Group | 601238SH | A-share | Guangdong Province | State-owned enterprise |

| Ningbo Yunsheng | 600366SH | A-share | Zhejiang Province | Other |

| SAIC Motor | 600104SH | A-share | Shanghai | Other |

| Universal Money Tide | 000559SZ | A-share | Zhejiang Province | Private enterprise |

| Wolong Electric | 600580SH | A-share | Zhejiang Province | Other |

| Yutong Bus | 600066SH | A-share | Henan Province | Private enterprise |

| Changan Automobile | 000625SZ | A-share | Chongqing | State-owned enterprise |

| Great Wall Motor | 601633SH | A-share | Hebei Province | Other |

| Zhongtong Bus | 000957SZ | A-share | Shandong Province | Other |

| Technical Research and Development Stage | Intermediate Indicator | Achievement Transformation Stage | Carry-Over Indicator | |||

|---|---|---|---|---|---|---|

| Input Indicators | Output Indicators | The First Stage/The Second Stage | Input Indicators | Output Indicators | T Period– T + 1 Period | |

| DNSBM | 1. Fixed assets 2. R&D investment 3. Number of R&D personnel in the enterprise | 6. Technical asset ratio | 5. Number of patents granted | 5. Number of patents granted 7. Total number of employees | 8. Main business income of the enterprise | The first stage—4. Patent for invention (carry-over) The second stage—9. Net Profit |

| Quantity | Min | Max | Average | STDEV | |

|---|---|---|---|---|---|

| Fixed Assets | 104 | 12,070,845.400 | 83,056,007,151.500 | 11,376,251,463.406 | 16,095,434,153.687 |

| R&D Investment | 104 | 23,786,500.000 | 15,385,012,641.180 | 1,945,638,282.373 | 2,934,162,118.755 |

| Number of R&D Personnel in the Enterprise | 104 | 174.000 | 35,788.000 | 5497.817 | 7545.075 |

| Number of Valid Invention Patents | 104 | 1.000 | 1368.000 | 189.471 | 313.337 |

| Number of Patents Granted | 104 | 2.000 | 7533.000 | 1134.365 | 1479.375 |

| Technical Asset Ratio | 104 | 0.008 | 0.101 | 0.039 | 0.021 |

| Total Number of Employees | 104 | 503.000 | 229,154.000 | 33,018.390 | 52,338.917 |

| Main Business Income of the Enterprise | 104 | 251,755,817.510 | 887,626,207,288.410 | 80,999,114,958.803 | 188,041,969,449.538 |

| Net Profit | 104 | 8,779,746.740 | 48,404,663,401.860 | 5,077,189,744.771 | 10,692,756,958.145 |

| Significant Figure | 104 |

| Listed Companies | θ | Rank | θ1 | Rank | θ2 | Rank |

|---|---|---|---|---|---|---|

| Aote Xun | 1 | 1 | 1 | 1 | 1 | 1 |

| BYD | 1 | 1 | 1 | 1 | 1 | 1 |

| Dongfeng Technology | 0.688 | 7 | 0.610 | 9 | 0.629 | 9 |

| Dongfeng Motor | 0.831 | 5 | 1 | 1 | 0.939 | 6 |

| GAC Group | 0.422 | 10 | 0.776 | 8 | 1 | 1 |

| Ningbo Yunsheng | 0.933 | 3 | 0.383 | 11 | 0.638 | 8 |

| SAIC Motor | 0.692 | 6 | 0.959 | 5 | 0.602 | 11 |

| Universal Money Tide | 0.267 | 11 | 0.156 | 13 | 0.310 | 13 |

| Wolong Electric | 0.629 | 8 | 0.528 | 10 | 0.608 | 10 |

| Yutong Bus | 0.110 | 13 | 0.259 | 12 | 0.343 | 12 |

| Changan Automobile | 0.456 | 9 | 0.974 | 4 | 0.690 | 7 |

| Great Wall Motor | 0.154 | 12 | 0.844 | 7 | 0.972 | 5 |

| Zhongtong Bus | 0.933 | 4 | 0.896 | 6 | 1 | 1 |

| Average | 0.624 | 0.722 | 0.749 |

| Overall Efficiency | The First Stage | The Second Stage | ||||

|---|---|---|---|---|---|---|

| Effective Quantity | Proportion | Effective Quantity | Proportion | Effective Quantity | Proportion | |

| Effective | 2 | 15.38% | 3 | 23.08% | 4 | 30.77% |

| Invalid | 11 | 84.62% | 10 | 76.92% | 9 | 69.23% |

| Score | State-Owned Enterprises (4) | Private Enterprises (3) | Others (6) | Kruskal–Wallis H | p-Value | Effect Size (η2) | Statistical Conclusions |

|---|---|---|---|---|---|---|---|

| θ | 0.599 | 0.459 | 0.724 | 4.740 | 0.093 | 0.365 | No Significant Difference |

| θ1 | 0.840 | 0.472 | 0.768 | 6.200 | 0.045 * | 0.477 | Significant Difference |

| θ2 | 0.815 | 0.551 | 0.803 | 5.640 | 0.060 | 0.434 | Marginally Significant |

| Variable | Formula | Symbol |

|---|---|---|

| Comprehensive Technological Innovation Efficiency | Comprehensive technological innovation efficiency | θ |

| Total Assets | Total assets (CNY) | X1 |

| Shareholding Ratio of the Largest Shareholder | Shareholding ratio of the largest shareholder | X2 |

| R&D Investment | Ratio of R&D investment to main business income × 100% | X3 |

| Percentage of Employees with Bachelor’s Degree or Above | Ratio of employees with bachelor’s degree or above to total number of employees × 100% | X4 |

| Government Grants | Government subsidies (yuan) | X5 |

| Management Skills | Management expense/main business income × 100% | X6 |

| Return on Equity (ROE) | Net profit/total assets × 100% | X7 |

| Total Asset Turnover Ratio | Net operating income/average total assets × 100% | X8 |

| Variable | Quantity | Min | Max | Average | STDEV |

|---|---|---|---|---|---|

| Comprehensive Technological Innovation Efficiency | 104 | 0.110 | 1.000 | 0.624 | 0.313 |

| Total Assets | 104 | 741,926,500.000 | 849,333,279,599.190 | 80,725,528,782.239 | 157,925,660,164.157 |

| Shareholding Ratio of the Largest Shareholder | 104 | 0.211 | 0.743 | 0.468 | 0.163 |

| R&D Investment | 104 | 0.010 | 0.126 | 0.046 | 0.024 |

| Proportion of Employees with a Bachelor’s Degree or Above | 104 | 0.072 | 0.814 | 0.327 | 0.175 |

| Government Grants | 104 | 187,780.140 | 14,027,129,065.720 | 1,206,020,239.639 | 2,738,449,574.105 |

| Management Skills | 104 | 0.014 | 0.208 | 0.074 | 0.042 |

| Return on Equity (ROE) | 104 | −0.059 | 2.330 | 0.158 | 0.242 |

| Total Asset Turnover | 104 | 31.700 | 229.706 | 3.187 | 23.239 |

| Significant Figure | 104 |

| Indicator | Relevance | Sort |

|---|---|---|

| Total Assets (X1) | 0.712 | 8 |

| Shareholding Ratio of the Largest Shareholder (X2) | 0.997 | 1 |

| R&D Investment (X3) | 0.994 | 5 |

| Proportion of Employees with a Bachelor’s Degree or Above (X4) | 0.996 | 2 |

| Government Subsidies (X5) | 0.712 | 7 |

| Management Ability (X6) | 0.994 | 4 |

| Return on Equity (X7) | 0.995 | 3 |

| Total Assets Turnover Ratio (X8) | 0.977 | 6 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Published by MDPI on behalf of the World Electric Vehicle Association. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ruan, Z.; Liu, Z. Analysis of Technological Innovation Efficiency in Listed New Energy Vehicle Enterprises Under the Carbon Neutrality Framework Based on Two-Stage Dynamic Network DEA and a GRA Model. World Electr. Veh. J. 2025, 16, 635. https://doi.org/10.3390/wevj16110635

Ruan Z, Liu Z. Analysis of Technological Innovation Efficiency in Listed New Energy Vehicle Enterprises Under the Carbon Neutrality Framework Based on Two-Stage Dynamic Network DEA and a GRA Model. World Electric Vehicle Journal. 2025; 16(11):635. https://doi.org/10.3390/wevj16110635

Chicago/Turabian StyleRuan, Zhihua, and Zhikun Liu. 2025. "Analysis of Technological Innovation Efficiency in Listed New Energy Vehicle Enterprises Under the Carbon Neutrality Framework Based on Two-Stage Dynamic Network DEA and a GRA Model" World Electric Vehicle Journal 16, no. 11: 635. https://doi.org/10.3390/wevj16110635

APA StyleRuan, Z., & Liu, Z. (2025). Analysis of Technological Innovation Efficiency in Listed New Energy Vehicle Enterprises Under the Carbon Neutrality Framework Based on Two-Stage Dynamic Network DEA and a GRA Model. World Electric Vehicle Journal, 16(11), 635. https://doi.org/10.3390/wevj16110635