Circular Economy and Sustainability in Lithium-Ion Battery Development in China and the USA

Abstract

1. Introduction

2. Global LIB Technical Evolution, Market Demand, and Supply Chains

2.1. Lithium-Ion Battery Evolution over Time

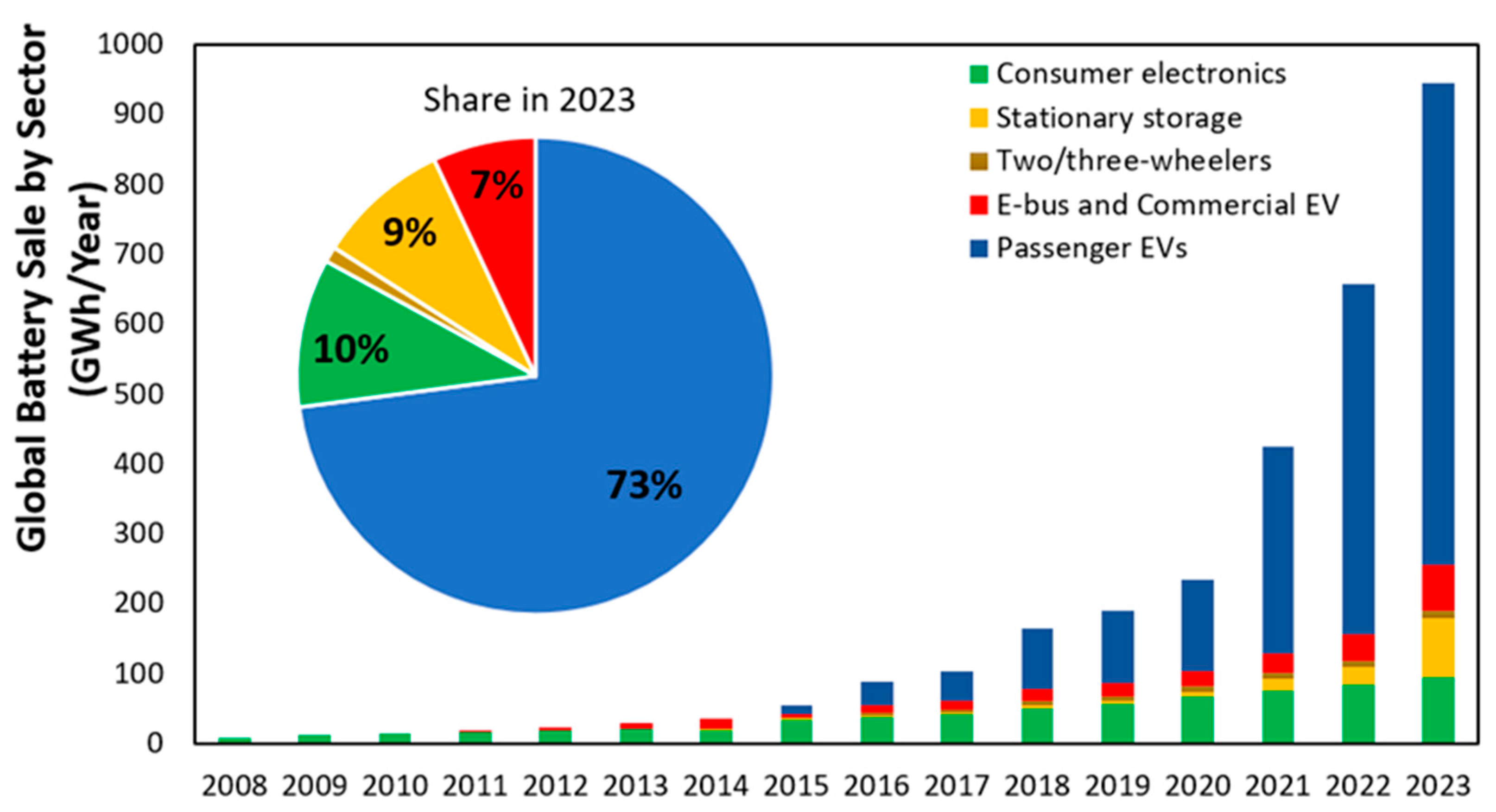

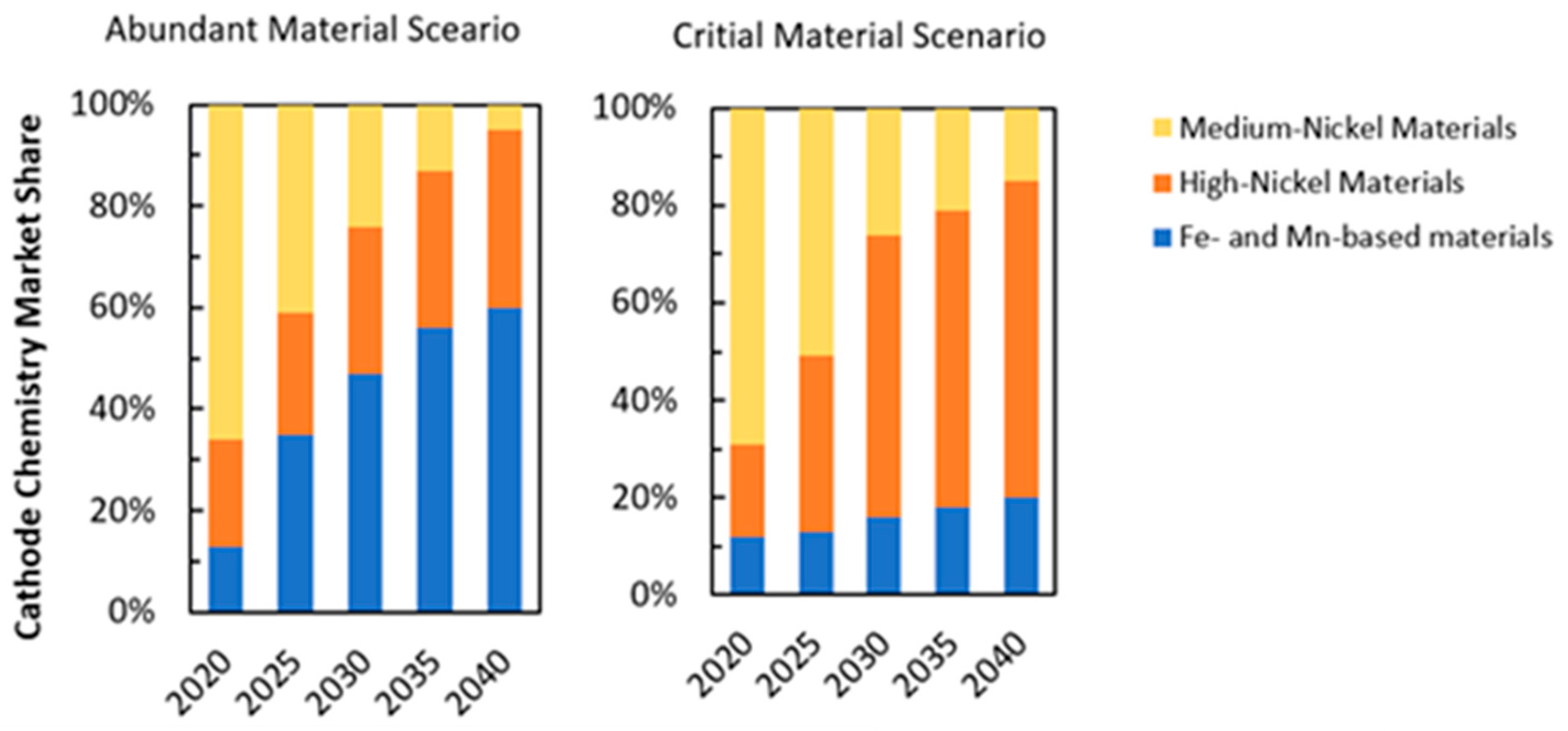

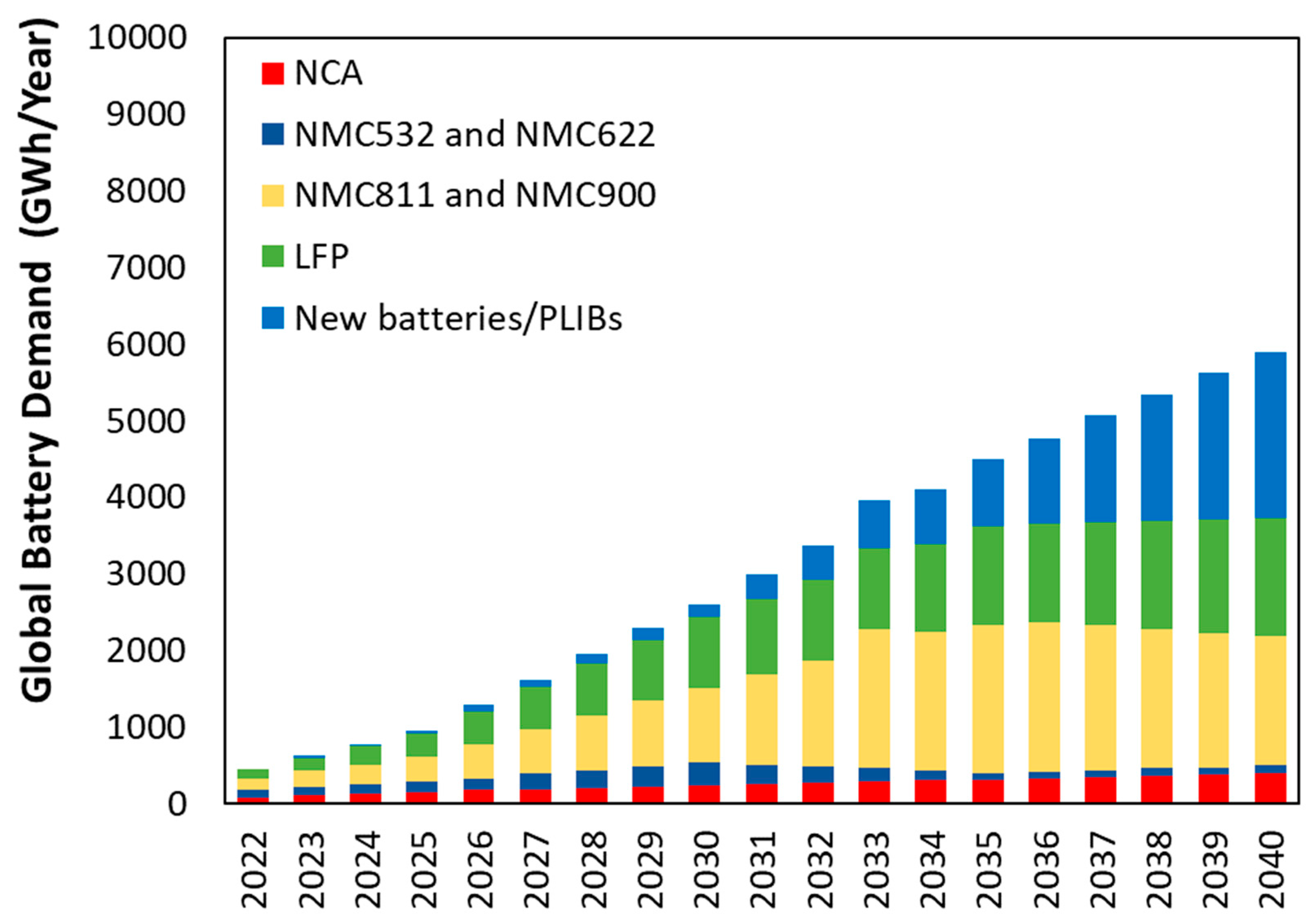

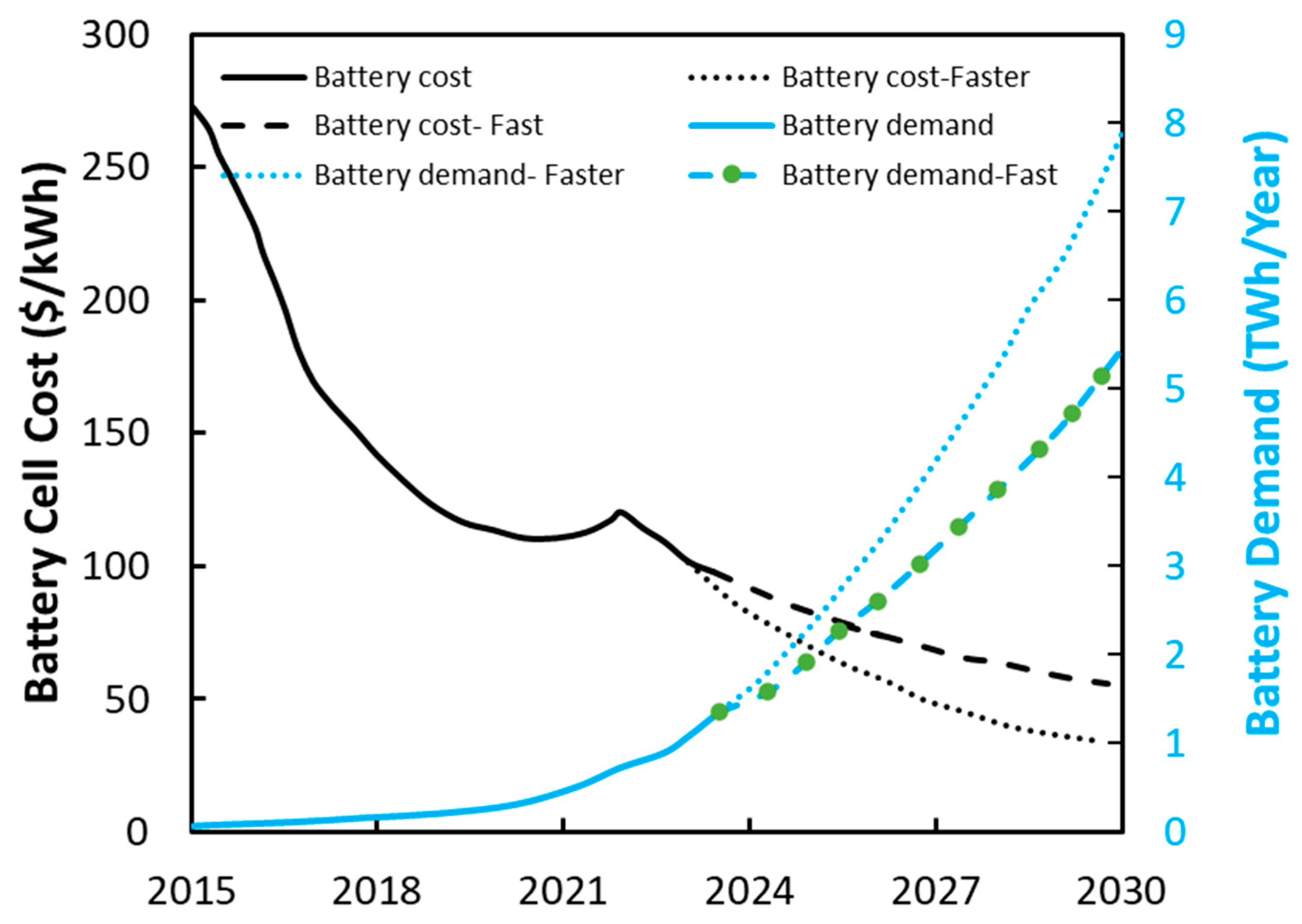

2.2. Battery Demand

2.3. Battery Materials Supply Chain

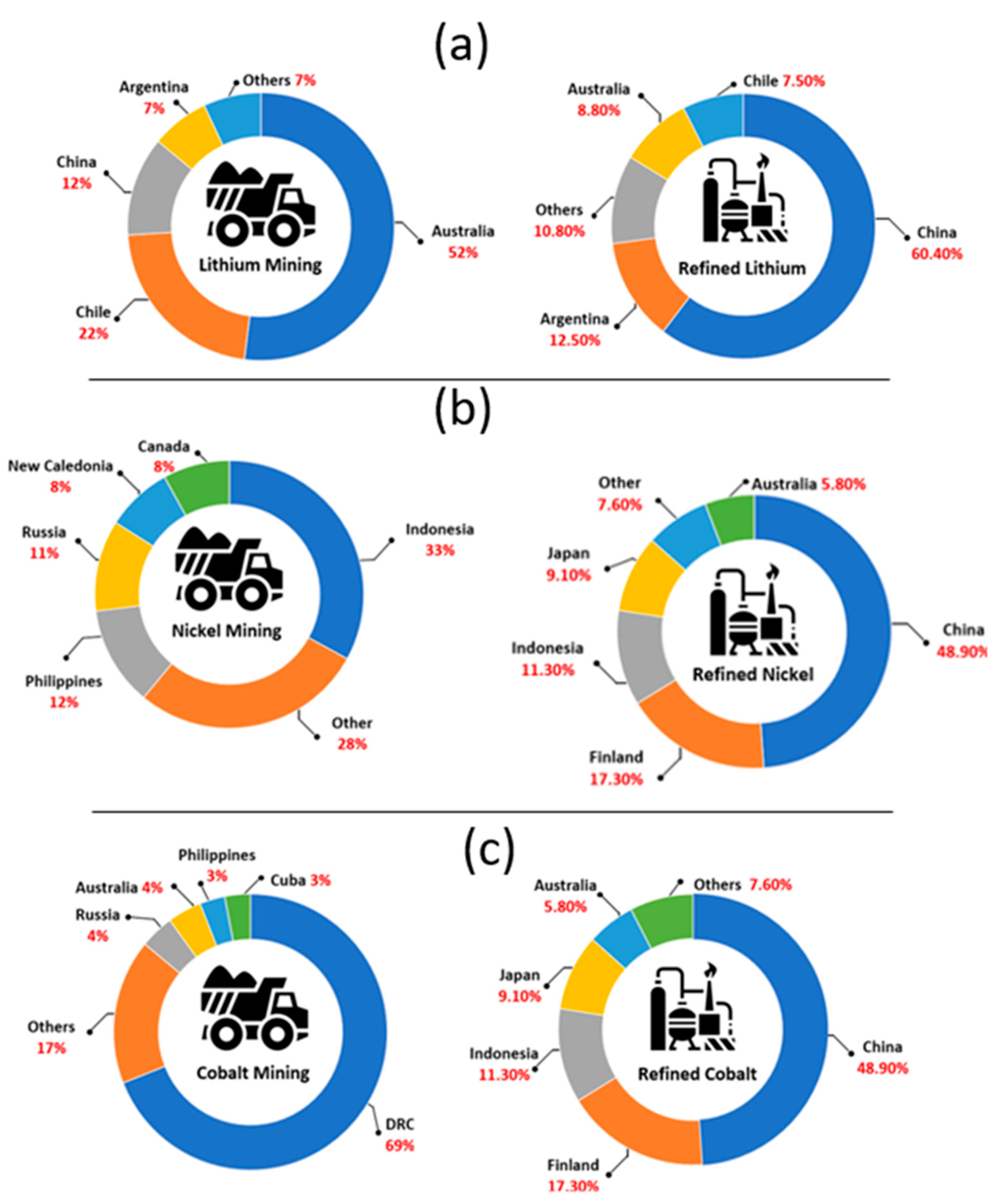

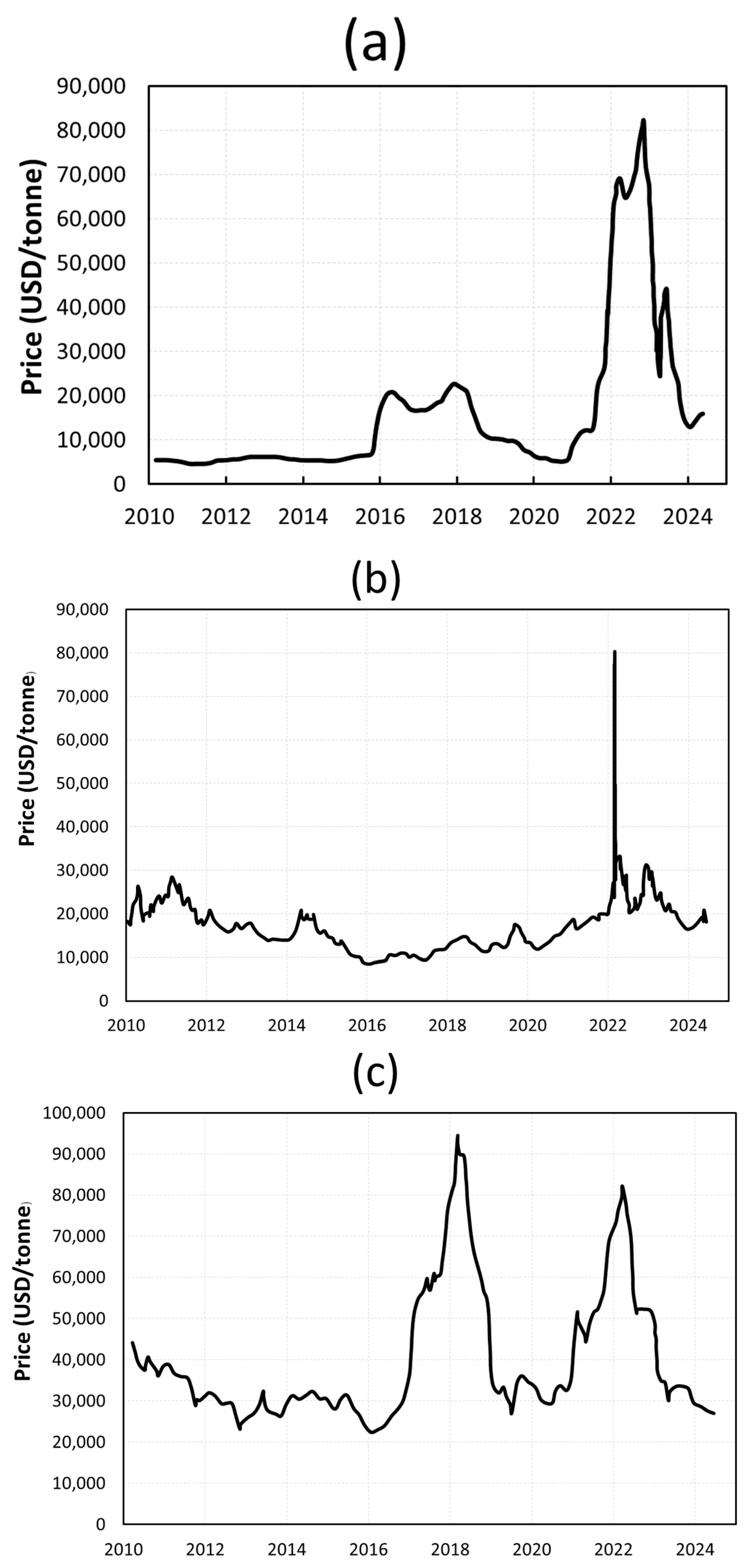

2.3.1. Lithium

2.3.2. Nickel

2.3.3. Cobalt

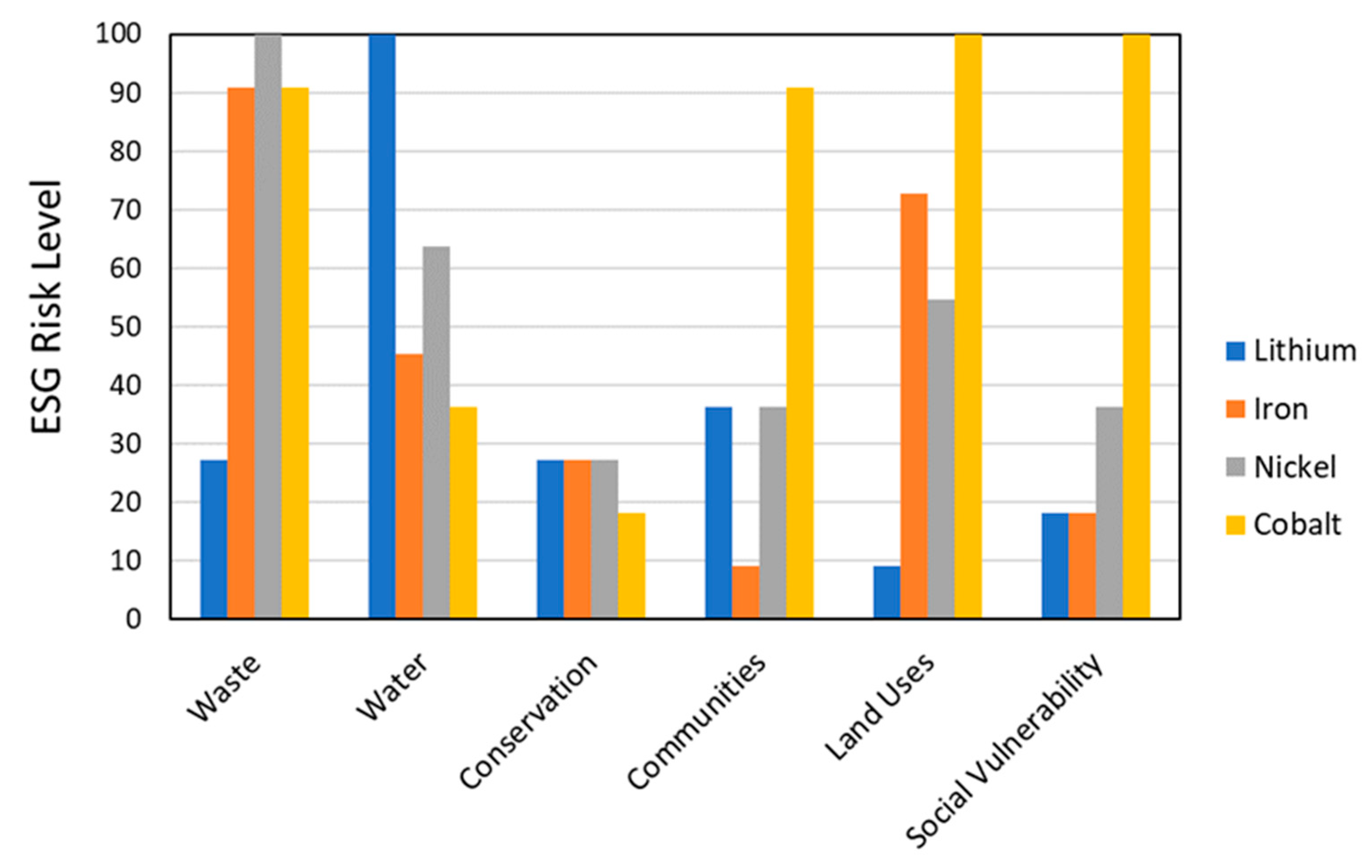

2.4. Environmental and Societal Risk

2.5. Reuse, Repurpose or Recycle Batteries

2.6. Battery Production

2.7. Battery Price Trends

3. China-US LIB Industry Strategic Comparisons

3.1. China’s Path to Battery Manufacturing Leadership

3.2. Advancing Domestic Battery Independence in the USA

4. Discussion

5. Conclusions

6. Future Directions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| APC | MPC | Grid-Scale BESS | Distributed BESS |

|---|---|---|---|

| Battery Pack | Cells | 38.0 | 18.1 |

| Packaging | 3.3 | 30.1 | |

| Thermal Management System | 4.9 | 9.0 | |

| Battery Management System | 5.2 | 9.0 | |

| Production | 21.1 | 27.3 | |

| Inverter | Printed Circuit Board Assemblies | 1.7 | 3.8 |

| Electrical Part 9 | 0.6 | 0.4 | |

| Climate Control | 0.4 | - | |

| Enclosure | 0.6 | 0.4 | |

| Production | 1.9 | 1.9 | |

| Battery Container/Housing | Battery Racks and Metal Enclosure | 15.8 | - |

| Production | 6.5 | - | |

| Steel or Iron rebar in foundation | - | Steel/Iron Product | - |

| Total | - | 100 | 100 |

References

- BNEF. RMI Analysis. Electronics Share of Addressable Market Percentage Indicative, Transport Percentage Based on 2022 EV Sales Share, Stationary Storage Defined as Sales Volume Today Divided by Peak Sales in Long Term (2050); Trains, Ships, and Airplane Total Addressable Market Sizes Illustrative; BNEF: London, UK, 2022. [Google Scholar][Green Version]

- Duffy, M.C. Electric Railways: 1880–1990; Institution of Engineering and Technology: London, UK, 2003. [Google Scholar][Green Version]

- U.S. Department of Energy. The History of the Electric Car. In Energy; 15 September 2014. Available online: https://www.energy.gov/articles/history-electric-car (accessed on 13 September 2025).[Green Version]

- Balducci, P.; Mongird, K.; Alam, J.; Wu, D.; Fotedar, V.; Viswanathan, V.; Crawford, A.; Yuan, Y.; Labove, G.; Richards, S.; et al. Grid Modernization Projects: Economic Analysis; Final Report; U.S. Department of Energy: Washington, DC, USA, 2020.[Green Version]

- Electrification Solutions. The Global Lithium-Ion Battery Shipment Volume in 2024 Reached 1545.1 GWh. Electrification Solutions, 11 January 2025. Available online: https://electrification-solutions.com/the-global-lithium-ion-battery-shipment-volume-in-2024-reached-1545-1-gwh/ (accessed on 13 September 2025).[Green Version]

- Lopez, L. The One Crucial Industry Where China Is Crushing America in the Tech Cold War. Business Insider, 16 May 2023. Available online: https://www.businessinsider.nl/the-one-crucial-industry-where-china-is-crushing-america-in-the-tech-cold-war/ (accessed on 13 September 2025).[Green Version]

- SNE Research. Global EV Battery Market Share in 2024: CATL at 37.9%, BYD at 17.2%; China Accounts for Over 60% of Global EV Sales. SNE Research/CnEVPost, 11 February 2025. Available online: https://cnevpost.com/2025/02/11/global-ev-battery-market-share-2024/ (accessed on 13 September 2025).[Green Version]

- VVP Consult. Top 5 Financing Opportunities for Battery Companies in the U.S. LinkedIn, 28 November 2023. Available online: https://www.linkedin.com/pulse/top-5-financing-opportunities-battery-companies-united-states-sx11e/ (accessed on 13 September 2025).[Green Version]

- EnergyTrend. Tesla’s Nevada LFP Battery Factory Nears Completion, Focusing on Stationary Storage. EnergyTrend News, 30 June 2025. Available online: https://www.energytrend.com/news/20250630-49803.html (accessed on 13 September 2025).[Green Version]

- Lambert, F. Tesla Unveils Nevada LFP Battery Factory, Almost Ready for Production. Electrek, 1 July 2025. Available online: https://electrek.co/2025/07/01/tesla-unveils-lfp-battery-factory-claims-almost-ready/ (accessed on 13 September 2025).[Green Version]

- Sivaram, V.; Gordon, N.; Helmeci, D. Winning the Battery Race: How the United States Can Leapfrog China to Dominate Next-Generation Battery Technologies; Carnegie Endowment for International Peace: Washington, DC, USA, 2024. [Google Scholar][Green Version]

- Maisel, F.; Neef, C.; Marscheider-Weidemann, F.; Nissen, N.F. A forecast on future raw material demand and recycling potential of lithium-ion batteries in electric vehicles. Resour. Conserv. Recycl. 2023, 192, 106920. [Google Scholar] [CrossRef]

- Kurzweil, P.; Dietlmeier, O.K. Elektrochemische Speicher: Superkondensatoren, Batterien, Elektrolyse-Wasserstoff, Rechtliche Rahmenbedingungen, 2nd ed.; Springer Fachmedien: Wiesbaden, Germany, 2018. [Google Scholar]

- Nwanya, C.; Nzereogu, P.U.; Omah, A.D.; Ezema, F.I.; Iwuoha, E.I. Anode materials for lithium-ion batteries: A review. Appl. Surf. Sci. Adv. 2022, 9, 100233. [Google Scholar] [CrossRef]

- Murdock, E.; Toghill, K.E.; Tapia-Ruiz, N. A perspective on the sustainability of cathode materials used in lithium-ion batteries. Adv. Energy Mater. 2021, 11, 2102028. [Google Scholar] [CrossRef]

- Matos, C.T.; Mathieux, F.; Ciacci, L.; Lundhaug, M.C.; León, M.F.G.; Müller, D.B.; Dewulf, J.; Georgitzikis, K.; Huisman, J. Material system analysis: A novel multilayer system approach to correlate EU flows and stocks of Li-ion batteries and their raw materials. J. Ind. Ecol. 2022, 26, 1261–1276. [Google Scholar] [CrossRef]

- Ma, Q.; Zeng, X.-X.; Yue, J.; Yin, Y.-X.; Zuo, T.-T.; Liang, J.-Y.; Deng, Q.; Wu, X.-W.; Guo, Y.-G. Recent advances and perspectives on the design of advanced cathode materials for lithium–sulfur batteries. Adv. Energy Mater. 2019, 9, 1803854. [Google Scholar] [CrossRef]

- Ding, Y.; Cano, Z.P.; Yu, A.; Lu, J.; Chen, Z. Automotive Li-ion batteries: Current status and future perspectives. Electrochem. Energy Rev. 2019, 2, 1–28. [Google Scholar] [CrossRef]

- Metalary. Cobalt Price. Available online: https://www.metalary.com/cobalt-price (accessed on 13 September 2025).

- Metalary. Iron Price. Available online: https://www.metalary.com/iron-price/ (accessed on 13 September 2025).

- Li, W.; Erickson, E.M.; Manthiram, A. High-nickel layered oxide cathodes for lithium-based automotive batteries. Nat. Energy 2020, 5, 26–34. [Google Scholar] [CrossRef]

- Wentker, M.; Greenwood, M.; Leker, J. A techno-economic analysis of current and future lithium-ion battery recycling from EVs. Energies 2019, 12, 504. [Google Scholar] [CrossRef]

- Myung, S.T.; Maglia, F.; Park, K.-J.; Yoon, C.S.; Lamp, P.; Kim, S.-J.; Sun, Y.-K. Nickel-rich layered cathode materials for automotive lithium-ion batteries: Achievements and perspectives. ACS Energy Lett. 2017, 2, 196–223. [Google Scholar] [CrossRef]

- Placke, T.; Kloepsch, R.; Duhnen, S.; Winter, M. Lithium ion, lithium metal, and alternative rechargeable battery technologies: The odyssey for high energy density. J. Solid State Electrochem. 2017, 21, 1939–1964. [Google Scholar] [CrossRef]

- Walter, D.; Butler-Sloss, S.; Bond, K. The rise of batteries in six charts and not too many numbers. RMI, 25 January 2024. Available online: https://rmi.org/the-rise-of-batteries-in-six-charts-and-not-too-many-numbers/ (accessed on 13 September 2025).

- Ziegler, M.S.; Trancik, J.E. Re-examining rates of lithium-ion battery technology improvement and cost decline. Energy Environ. Sci. 2021, 14, 1635–1651. [Google Scholar] [CrossRef]

- BloombergNEF. Long-Term Electric Vehicle Outlook. 2023. Available online: https://about.bnef.com/electric-vehicle-outlook/ (accessed on 13 September 2025).

- Curry, C. Lithium Ion Battery Costs and Market. Bloomberg New Energy Finance, 5 July 2017. Available online: https://about.bnef.com/blog/behind-scenes-take-lithium-ion-battery-prices/ (accessed on 10 September 2025).

- Vision Mechatronics. Empowering Renewable Energy: The Role of Energy Storage Solutions. Available online: https://vmechatronics.com/blog/empowering-renewable-energy-with-energy-storage (accessed on 13 September 2025).

- BloombergNEF. Lithium-Ion Battery Price Survey. 2023. Available online: https://about.bnef.com/blog/battery-pack-prices-fall-to-an-average-of-132-kwh-but-rising-commodity-prices-start-to-bite/ (accessed on 13 September 2025).

- Precedence Research. Battery Market Size, Share, and Trends 2024 to 2034. 2024. Available online: https://www.precedenceresearch.com/battery-market (accessed on 13 September 2025).

- World Economic Forum. A Vision for a Sustainable Battery Value Chain in 2030: Unlocking the Full Potential to Power Sustainable Development and Climate Change Mitigation. 2019. Available online: https://www.weforum.org/reports/a-vision-for-a-sustainable-battery-value-chain-in-2030 (accessed on 13 September 2025).

- Degen, F.; Winter, M.; Bendig, D.; Tübke, J. Energy consumption of current and future production of lithium-ion and post lithium-ion battery cells. Nat. Energy 2023, 8, 1284–1295. [Google Scholar] [CrossRef]

- Marscheider-Weidemann, F.; Langkau, S.; Eberling, E.; Erdmann, L.; Haendel, M.; Krail, M.; Loibl, A.; Neef, C.; Neuwirth, M.; Rostek, L.; et al. Raw Materials for Emerging Technologies 2021; German Mineral Resources Agency (DERA): Berlin, Germany, 2021.

- Bhandari, N.; Cai, A.; Yuzawa, K.; Zhang, J.; Joshi, V.; Fang, F.; Lee, G.; Harada, R.; Shin, S. Batteries: The Greenflation Challenge. Goldman Sachs, 8 March 2022. Available online: https://g-city.sass.org.cn/_upload/article/files/c9/91/51a9f64f4332b0f2362886a564fc/4b6463d8-0f60-4080-b2ad-e1288346ac9c.pdf (accessed on 13 September 2025).

- Jenu, S.; Deviatkin, I.; Hentunen, A.; Myllysilta, M.; Viik, S.; Pihlatie, M. Reducing the climate change impacts of lithium-ion batteries by their cautious management through integration of stress factors and life cycle assessment. J. Energy Storage 2020, 27, 101023. [Google Scholar] [CrossRef]

- European Commission. 2030 Climate and Energy Framework. Available online: https://www.consilium.europa.eu/en/policies/climate-change/2030-climate-and-energy-framework/ (accessed on 13 September 2025).

- European Commission. 2050 Long-Term Strategy. Available online: https://climate.ec.europa.eu/eu-action/climate-strategies-targets/2050-long-term-strategy_en (accessed on 13 September 2025).

- Sommerville, R.; Zhu, P.; Rajaeifar, M.; Heidrich, O.; Goodship, V.; Kendrick, E. A qualitative assessment of lithium-ion battery recycling processes. Resour. Conserv. Recycl. 2021, 165, 105219. [Google Scholar] [CrossRef]

- Forbes. GM Plans to Phase Out Gas and Diesel Cars by 2035. 2021. Available online: https://www.wsj.com/articles/gm-sets-2035-target-to-phase-out-gas-and-diesel-powered-vehicles-globally-11611850343 (accessed on 13 September 2025).

- Reuters. VW to End Sales of Combustion Engines in Europe by 2035. 2021. Available online: https://www.reuters.com/business/autos-transportation/vw-end-sales-combustion-engines-europe-by-2035-2021-06-26/ (accessed on 13 September 2025).

- Bridge, G.; Faigen, E. Towards the lithium-ion battery production network: Thinking beyond mineral supply chains. Energy Res. Soc. Sci. 2022, 89, 102659. [Google Scholar] [CrossRef]

- Jennifer, L. Understanding Lithium Prices: Past, Present, and Future. Carbon Credits, 29 May 2024. Available online: https://carboncredits.com/understanding-lithium-prices-past-present-and-future/ (accessed on 13 September 2025).

- Carbon Publisher. The Ultimate Guide to Nickel. Carbon Credits, 24 July 2024. Available online: https://carboncredits.com/the-ultimate-guide-to-nickel/ (accessed on 13 September 2025).

- Cobalt Institute. Cobalt Market Report 2021. 2021. Available online: https://www.cobaltinstitute.org/wp-content/uploads/2022/05/FINAL_Cobalt-Market-Report-2021_Cobalt-Institute-1.pdf (accessed on 13 September 2025).

- Abuelsamid, S. Ford to Build $3.5 Billion Lithium Iron Phosphate Battery Plant in Michigan Using CATL Technology. Forbes, 13 February 2023. Available online: https://www.forbes.com/sites/samabuelsamid/2023/02/13/ford-to-build-35-billion-lithium-iron-phosphate-battery-plant-in-michigan-using-catl-technology/ (accessed on 13 September 2025).

- Lèbre, É.; Stringer, M.; Svobodova, K.; Owen, J.R.; Kemp, D.; Côte, C.; Arratia-Solar, A.; Valenta, R.K. The social and environmental complexities of extracting energy transition metals. Nat. Commun. 2020, 11, 4823. [Google Scholar] [CrossRef] [PubMed]

- Gerding, J. DRC: Why It’s Hard to Make Cobalt Mining More Transparent. DW News, 19 March 2024. Available online: https://www.dw.com/en/drc-struggles-to-make-cobalt-mining-more-transparent/a-68610784 (accessed on 13 September 2025).

- Thies, C.; Kieckhäfer, K.; Spengler, T.S.; Sodhi, M.S. Sustainable supply chain management of lithium-ion batteries. Procedia CIRP 2019, 80, 292–297. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Hook, A.; Martiskainen, M.; Brock, A.; Turnheim, B. The decarbonisation divide: Contextualizing landscapes of low-carbon exploitation and toxicity in Africa. Glob. Environ. Change 2020, 60, 102028. [Google Scholar] [CrossRef]

- Ciez, R.E.; Whitacre, J.F. Examining different recycling processes for lithium-ion batteries. Nat. Sustain. 2019, 2, 148–156. [Google Scholar] [CrossRef]

- May, V.; Kleyn, S.V.; Vekovshinina, S.A. Sustainable development of mineral resources: Current state and prospects. IOP Conf. Ser. Earth Environ. Sci. 2019, 315, 062024. [Google Scholar] [CrossRef]

- Farjana, S.H.; Huda, N.; Mahmud, M.A.P.; Saidur, R. A review on the impact of mining and mineral processing industries through life cycle assessment. J. Clean. Prod. 2019, 231, 1200–1217. [Google Scholar] [CrossRef]

- Kelly, J.C.; Dai, Q.; Wang, M. Life cycle greenhouse gas emissions of lithium-ion batteries for electric vehicles. Mitig. Adapt. Strateg. Glob. Change 2020, 25, 371–392. [Google Scholar] [CrossRef]

- Babbitt, C.W. Sustainability perspectives on lithium-ion batteries. Clean Technol. Environ. Policy 2020, 22, 1213–1214. [Google Scholar] [CrossRef]

- Islam, M.T.; Iyer-Raniga, U. Lithium-Ion Battery Recycling in the Circular Economy: A Review. Recycling 2022, 7, 33. [Google Scholar] [CrossRef]

- He, R. 2023 Motive Power Battery Overseas Market Share Battle: CATL in Pursuit, BYD Surges Ahead. SMM Li-ion Battery Materials Department . News Metal, 19 February 2024. Available online: https://news.metal.com/newscontent/102622888/2023-Motive-Power-Battery-Overseas-Market-Share-Battle:-CATL-in-Pursuit-BYD-Surges-Ahead (accessed on 13 September 2025).

- Pontes, J. Top 10 Battery Producers in the World—2023 (Provisional Data). Clean Technica, 19 January 2024. Available online: https://cleantechnica.com/2024/01/19/top-10-battery-producers-in-the-world-2023-provisional-data/ (accessed on 13 September 2025).

- BloombergNEF. Lithium-Ion Battery Pack Prices Hit Record Low of $139/kWh. BNEF, 26 November 2023. Available online: https://about.bnef.com/blog/lithium-ion-battery-pack-prices-hit-record-low-of-139-kwh/ (accessed on 13 September 2025).

- Duviter. The New Era of Chinese Manufacturing. 2024. Available online: https://ccbc.com/wp-content/uploads/2024/06/Duviter-CCBC-The-New-Era-of-Chinese-Manufacturing-June-2024.pdf (accessed on 13 September 2025).

- Peng, L.; Li, Y. Policy Evolution and Intensity Evaluation of the Chinese New Energy Vehicle Industry Policy: The Angle of the Dual-Credit Policy. World Electr. Veh. J. 2022, 13, 90. [Google Scholar] [CrossRef]

- Viernes, F. Oversupply, low prices for cobalt to persist in 2024 as demand slips; Commodity Insights. S&P Glob, 27 December 2023. Available online: https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/metals/122723-oversupply-low-prices-for-cobalt-to-persist-in-2024-as-demand-slips (accessed on 13 September 2025).

- Matthews, D. Global Value Chains: Cobalt in Lithium-ion Batteries for Electric Vehicles; Office of Industries Working Paper ID-067; U.S. International Trade Commission: Washington, DC, USA, 2020. Available online: https://www.usitc.gov/publications/332/working_papers/id_wp_cobalt_final_052120-compliant.pdf (accessed on 13 September 2025).

- EnergyTrend. Energy Storage Market Continues to Grow, Driven by EV and Renewable Energy Demand. EnergyTrend, 4 June 2024. Available online: https://www.energytrend.com/news/20240604-47317.html (accessed on 13 September 2025).

- The White House. FACT SHEET: President Biden Takes Action to Protect American Workers and Businesses from China’s Unfair Trade Practices. In The White House; 14 May 2024. Available online: https://bidenwhitehouse.archives.gov/briefing-room/statements-releases/2024/05/14/fact-sheet-president-biden-takes-action-to-protect-american-workers-and-businesses-from-chinas-unfair-trade-practices/ (accessed on 10 September 2025).

- Utility Dive. IRA Sets the Stage for US Energy Storage to Thrive. Utility Dive, 7 November 2022. Available online: https://www.utilitydive.com/spons/ira-sets-the-stage-for-us-energy-storage-to-thrive/635665/ (accessed on 13 September 2025).

- Mehdi, A.; Moerenhout, T. The IRA and the US Battery Supply Chain: One Year On. EnergyPolicy, 20 September 2023. Available online: https://www.energypolicy.columbia.edu/publications/the-ira-and-the-us-battery-supply-chain-one-year-on/ (accessed on 13 September 2025).

- Bloomberg Tax. What Qualifies for Business Energy Tax Credits? Bloomberg Tax, 26 January 2024. Available online: https://pro.bloombergtax.com/insights/federal-tax/business-energy-tax-credits/ (accessed on 13 September 2025).

- Internal Revenue Service (IRS). Notice 2024-41. Domestic Content Bonus Credit Amounts under the Inflation Reduction Act of 2022: Expansion of Applicable Projects for Safe Harbor in Notice 2023-38 and New Elective Safe Harbor to Determine Cost Percentages for Adjusted Percentage Rule; IRS Notices; IRS: Washington, DC, USA, 2024. Available online: https://www.irs.gov/pub/irs-drop/n-24-41.pdf (accessed on 13 September 2025).

- Lambert, F. Tesla Produces Its 100 Millionth 4680 Battery Cell: Here’s What It Means. Electrek, 16 September 2024. Available online: https://electrek.co/2024/09/16/tesla-produced-100-millionth-battery-cell-heres-what-it-means/ (accessed on 13 September 2025).

- Kim, Y. US-China EV Battery Competition and the Role of South Korea; US-Korea Energy Series—Working Paper No. 4; Energy Innovation Reform Project: Arlington, VA, USA, 2024; Available online: https://innovationreform.org/wp-content/uploads/2024/05/2024-05-Korea-Energy-EV-batteries.pdf (accessed on 13 September 2025).

- Reinsch, W.A.; Broadbent, M.; Denamiel, T.; Shammas, E. Friendshoring the Lithium-Ion Battery Supply Chain: Battery Cell Manufacturing. CSIS Report, 6 June 2024. Available online: https://www.csis.org/analysis/friendshoring-lithium-ion-battery-supply-chain-battery-cell-manufacturing (accessed on 13 September 2025).

- Mann, M.; Babinec, S.; Putsche, V. Energy Storage Grand Challenge: Energy Storage Market Report. In U.S. Department of Energy; 1 December 2020. Available online: https://www.osti.gov/servlets/purl/1908714/ (accessed on 13 September 2025).

- Roberts, D. Millions of Used Electric Car Batteries Will Help Store Energy for the Grid. Maybe. Vox, 29 August 2016. Available online: https://www.vox.com/2016/8/29/12614344/electric-car-batteries-grid-storage (accessed on 13 September 2025).

- Iloeje, C.O.; Xavier, A.S.; Graziano, D.; Atkins, J.; Sun, K.; Cresko, J.; Supekar, S.D. A systematic analysis of the costs and environmental impacts of critical materials recovery from hybrid electric vehicle batteries in the U.S. iScience 2022, 25, 104830. [Google Scholar] [CrossRef] [PubMed]

| Country | Leading Firms | Key Technologies/Chemistries | 2024 Output/Capacity (GWh) | Strategic Notes |

|---|---|---|---|---|

| China | CATL | NMC, LFP | ~586 GWh (37.9% of global EV battery market) | Vertical integration; overseas plants in Europe/Asia. |

| BYD | LFP, Blade Battery | ~266 GWh (17.2% of global EV battery market) | Strong domestic EV demand; rapid cost leadership in LFP. | |

| United States | Tesla | 4680 cylindrical cells; LFP (Nevada factory) | ~9 GWh 4680 output (2024); Nevada LFP plant 10 GWh/year (completion 2025) | Focus on vertical integration; cobalt-free chemistries; aligned with IRA/DCA incentives. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Published by MDPI on behalf of the World Electric Vehicle Association. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yousefi, D.; Soleymani, A. Circular Economy and Sustainability in Lithium-Ion Battery Development in China and the USA. World Electr. Veh. J. 2025, 16, 578. https://doi.org/10.3390/wevj16100578

Yousefi D, Soleymani A. Circular Economy and Sustainability in Lithium-Ion Battery Development in China and the USA. World Electric Vehicle Journal. 2025; 16(10):578. https://doi.org/10.3390/wevj16100578

Chicago/Turabian StyleYousefi, Daniel, and Azita Soleymani. 2025. "Circular Economy and Sustainability in Lithium-Ion Battery Development in China and the USA" World Electric Vehicle Journal 16, no. 10: 578. https://doi.org/10.3390/wevj16100578

APA StyleYousefi, D., & Soleymani, A. (2025). Circular Economy and Sustainability in Lithium-Ion Battery Development in China and the USA. World Electric Vehicle Journal, 16(10), 578. https://doi.org/10.3390/wevj16100578