New Tool to Screen Financial Viability of Alternative Public–Private Partnership Structures for Delivery of Electric Vehicle-Charging Infrastructure

Abstract

1. Introduction

1.1. Background

1.2. Literature Review

1.3. Novelty and Key Contributions

1.4. Structure of the Paper

2. Model Description

- Revenue estimation: The model estimates the project’s revenues based on assumptions about user demand, pricing, and demand growth.

- Cost estimation: This involves estimating both initial capital expenditures (CapExs) and ongoing operational expenses (OpExs). Inputs are provided in current-year (real) USD, and the model uses escalation factors to project these costs to future years of the project’s lifespan or P3 concession term length.

- Cash flow analysis: The model then calculates detailed cash flows (nominal USD) over the project’s lifecycle. This includes projected inflows from revenues and outflows from expenses.

- Discounted Cash Flow (DCF) analysis: This step involves discounting future cash flows to the present value using a discount rate to account for the time value of money and the risk associated with the cash flows. The Net Present Value (NPV) is then calculated to assess the overall value the project will add. If the NPV is negative, a government contribution would be needed to make the project financially viable.

- Financial metrics: The model then calculates key financial metrics such as the Internal Rate of Return (IRR) and payback period to provide additional measures of the project’s financial performance.

2.1. Inputs—Constant Tab

- Inputs for capital cost estimates: Users may enter detailed information into the cells provided or may enter a total estimate. The user also enters cost allocation in the planning and construction phase as the percentages of the initial capital cost that are expended in each year of the planning and construction phase.

- Inputs for revenue estimates: Users can select a baseline (i.e., best-guess forecast), pessimistic, or optimistic scenario to develop a range. The optimistic and pessimistic scenarios will multiply baseline (best-guess) revenues by a multiple that the user inputs for each scenario. The baseline (best-guess) multiple is 1.00. The estimate of the share of charging that takes place during peak hours is entered as a percentage. The price per kWh paid by the user of the EV port during peak and non-peak hours is used along with peak-hour charging share to calculate a weighted average price. Alternatively, if data on the peak- versus non-peak-hour charging price are unavailable, a weighted average price per kWh may be input into the peak-hour price cell, with the peak-hour charging share input as 100%.

- Inputs to estimate demand: The EVCI-FAST uses a bottom-up approach to arrive at a value for total annual visits based on the user input of the estimated average charge duration per EV (hours), the occupancy per charger (average % per 24 h period), and the number of ports. Alternatively, users may conduct their own calculations and enter them into the User Override cell.

2.2. Inputs—Time Series Tab

- Input for government support: the user provides inputs for the maximum governmental reimbursement as a % of the project costs that are eligible for reimbursement by the government.

- Input for revenue structures: Two optional revenue structures may be input as applicable. These are a minimum revenue guarantee (MRG) and a revenue-sharing strategy. If an MRG is in place, then the input will be a percentage of the baseline (best-guess) forecasted revenues for the project. For example, if the MRG is 60%, this means that if the project falls short of 60% of the baseline (best-guess) forecasted revenues, the agency will pay the difference between the actual revenue and 60% of the baseline (best-guess) forecasted revenue. If a revenue-sharing strategy is in place, the user inputs the percentage of revenue retained by the private developer. The threshold that triggers the revenue-sharing mechanism is also input as a percentage of the baseline (best-guess) forecasted revenues.

2.3. Intermediate Model Outputs

- In the Cost Estimate Output section, a summary of costs is provided for the planning and construction phase and the operation phase. Note that cost estimates that are input in real USD in the Inputs—Constant tab are multiplied by escalation factors to output the values in year-of-expenditure USD in the Outputs tab.

- The Revenue Estimate Outputs show revenues from charging activity, fees, and subscriptions and any other revenues, if applicable. Note that revenues may be input in nominal USD in the Input—Time Series tab, or they may be optionally calculated by the model based on demand-related inputs that are provided in the Inputs—Constant tab. The demand-related inputs are multiplied by “constant” input growth rates provided in the Inputs—Constant tab to output the revenue estimates in year-of-expenditure USD.

- In the Government Support Output section, government subsidies under grant-based and performance-based P3s are provided. For a grant-based P3, the outputs are simply the subsidy amounts calculated over the planning and construction period and the operation period and the NPV of these subsidies. For a performance-based P3, the NPV of the availability payments is calculated as the difference between the NPV of the total revenues and the NPV of the total eligible costs. Then, this value is distributed equally over the operational years and multiplied by the future value factor calculated for each year. The future value factor is equal to 1 divided by the discount factor for each year, and the discount factor for each year is calculated as 1/(1 + r) ^n (where “r” is the discount rate and “n” is the period in years).

- The Net Operating Income is simply the revenues minus the costs during the operation phase of the project.

- The results of any Optional Revenue Structures are provided annually over the scenario timeframe.

2.4. Discounted Cash Flow Analysis

- Net Present Value (NPV): The discount factor is multiplied by the free cash flows to calculate Discounted Cash Flows (i.e., present values of future cash flows), which are summed to obtain the NPV. Typically, if the NPV ≥ 0, then the project is financially viable.

- Internal Rate of Return (IRR): The IRR is the annual rate of return that an investment is expected to generate. In the AP/RR approach, due to the way availability payments are calculated (i.e., using a discount rate exactly equal to the required Internal Rate of Return), the NPV will be zero and the IRR will be equal to the input discount rate.

- Payback Period: The discounted payback period is the amount of time required to recoup the investment. If the cumulative Discounted Cash Flows are not ≥0, then the payback period is not within the period of the analysis.

- Subsidy Adjustment: For a grant-based approach, there is an additional output called the Optimal Subsidy Adjustment. If the NPV of the project is negative, even with grants provided at the maximum allowable %, then the additional subsidy that will be required for financial viability (i.e., for NPV ≥ 0) will be shown here. If the NPV is positive, the value shown here indicates the amount of payment to the private partner beyond what it would need to meet its target rate of return.

2.5. Outcomes Dashboard

3. Scenario Construction

3.1. Prototypical Project and Alternative P3 Approaches

3.2. Common Inputs for All Alternatives

- Initial capital and construction costs: A study by the Institute of Transportation Studies [9] found that a large share of project capital costs comprises site “make-ready” infrastructure costs, which vary greatly due to site-specific factors and design choices. The study found that project capital costs ranged from USD 122,000 to USD 440,000 per DCFC charging port. For the 80 DCFC ports in our hypothetical project, we estimated a total capital cost of USD 11,500,000, or an average cost of USD 143,750 per port.

- Energy costs per year: The cost of electricity for an EVCI operator varies depending on number of ports, the occupancy of the ports, and the power delivered by the port. To estimate energy costs under a pessimistic scenario, we assumed power delivery at 50 kWh for a DCFC port, a pessimistic occupancy rate of 12.5% (which equates to an occupancy rate of 25% for the baseline “best-guess” scenario), and an energy cost for the operator of USD 0.06 per kWh, representative of states with low electricity rates like Louisiana, coupled with energy cost-cutting strategies like Energy Storage Systems (ESSs), negotiations with utility providers, and, potentially, solar energy on site. With these assumptions, the annual costs were estimated as follows: 50 kWh × (8760 h per year × 0.125 occupancy) × 80 ports × USD 0.06 = USD 262,800. For simplicity, we rounded off the annual cost to USD 250,000. This estimate would increase as occupancy rates increase under less pessimistic scenarios.

- Operations and maintenance costs: According to USDOE’s Alternative Fuels Data Center [11], station owners should plan to allocate around USD 400 per charger per year for general maintenance and an additional USD 800 per charger per year for extended warranties. This amounts to a total of USD 1200 per year. However, these estimates are sourced from a January 2018 report. Adjusting for inflation using the Producer Price Index by Commodity [12], we estimated the adjusted cost at USD 1654 per DCFC port and a total of USD 132,337 for 80 ports. We used an estimate of USD 200,000 in the first operational year to account for other operational costs, such as costs for station site insurance and other general station site maintenance costs.

- Demand growth rate: The EV market is expected to grow at a compound annual growth rate of 10.49% from 2024 to 2029 according to Statista [13], whereas the International Energy Agency [14] projects that 2024 EV sales in the U.S. will increase by 20% compared to 2023. Since the former estimate is a multi-year projection, we gave more weight to that estimate when arriving at our estimate of 11.5%.

- Inflation rate: We used an estimate of 2.5% for inflation since the US inflation rate has come down to between 2% and 3% at present [15].

- Energy cost escalation: This rate was estimated at 14.3% by combining the inflation rate and the demand growth rate inputs, i.e., (1.025 × 1.115) − 1 = 0.143.

- Estimated EV Charge Duration: USDOT [16] indicates that the average battery electric vehicle takes 20 min to 1 h to charge with a DCFC port. We assumed an average of 30 min per charging session.

- Estimated occupancy per port: The Transportation Energy Institute [17] found that EV port utilization can range from 0.9% to 24% in the US. We estimated a utilization rate of 12.5% under the pessimistic scenario.

- Average price per kWh: EV Connect [18] indicates that DCFC charging costs for customers range from USD 0.20 to USD 0.40 per kWh. We assumed a value of USD 0.36 per kWh.

- Discount rates for P3 structures: we used a discount rate that reflects the expected market rate of return on equity, which is approximately 10% when considering historic annualized average returns of the S&P 500 index [19].

- Average energy sold per charging session: In a study of EV owners, USDOE [20] estimated that the average energy consumed per charging session was 22 kWh. We rounded this estimate up to 25 kWh per charging session.

- Term length: a term length of 5 years of operation was assumed, consistent with the relatively short lifecycle of EV-charging equipment.

3.3. Alternative Specific Inputs

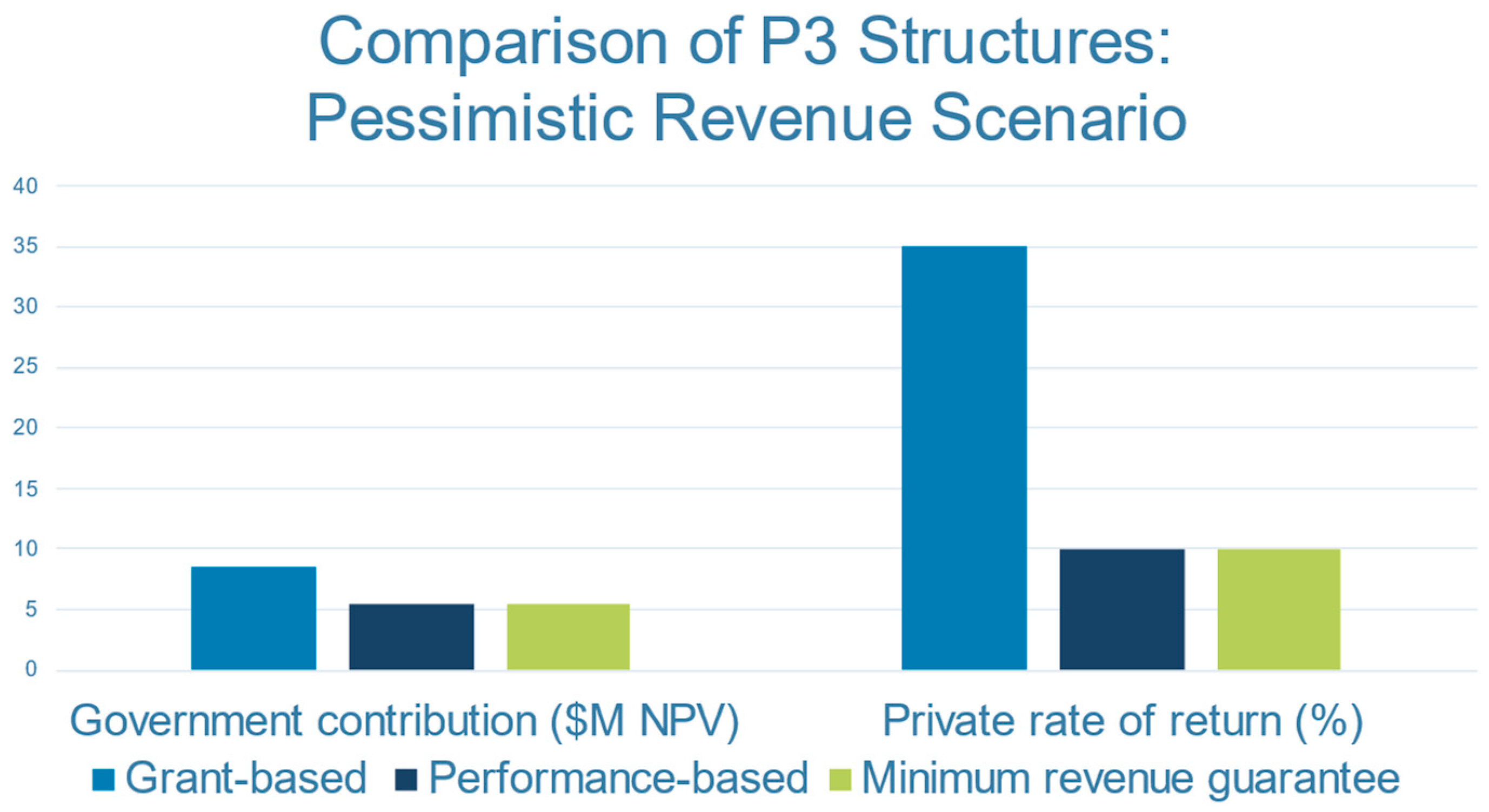

- Grant-based P3 alternative: The P3 structure scenario was set as grant-based (Inputs—Constant tab). In the same tab, the Revenue Scenario Selector was set as pessimistic. Grant-based cost reimbursement was set to 80%, which is typical of U.S. Government federal-aid projects. This was input for every year throughout the concession period (including both the planning and construction phase and operation phase) in the Inputs—Time Series tab.

- AP/RR alternative: The P3 structure scenario was set as performance-based in the Inputs—Constant tab. In the same tab, the Revenue Scenario Selector was set as pessimistic. In the Inputs—Time Series tab, revenue-sharing strategy inputs were input as follows:

- ○

- Threshold for revenues triggering the upside revenue-sharing mechanism: 60% of baseline (best-guess) forecasted revenues (i.e., 120% of the pessimistic revenue forecast);

- ○

- Proportion of revenue above the revenue cap the private developer will collect: 50%.

- MRG alternative: The P3 structure scenario was set as the minimum revenue guarantee in the Inputs—Constant tab. In the same tab, the Revenue Scenario Selector was set as pessimistic. In the Inputs—Time Series tab, revenue structure inputs were input as follows:

- ○

- Minimum revenue guarantee private sector is eligible to receive from agency: USDOT [21] indicates that international agencies have guaranteed up to 90% of forecasted revenues for P3 projects. We therefore used 90% of the forecasted baseline “best-guess” revenues (i.e., 180% of the pessimistic revenues) because we found, through trial runs of the model, that this level would be sufficient for the project to meet the private partner’s target rate of return of 10%.

- ○

- Threshold for revenues triggering the upside revenue-sharing mechanism: 100% of forecasted baseline “best-guess” revenues.

- ○

- Proportion of revenue above the revenue cap the private developer will collect: 50%.

4. Results

5. Discussion and Value of This Research

5.1. Discussion of Results

5.2. Value of This Research

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Acronyms

| AP/RR | availability payment/revenue risk |

| DCF | Discounted Cash Flow |

| DCFC | direct-current fast charger |

| EV | electric vehicle |

| EVCI | electric vehicle-charging infrastructure |

| EVCI-FAST | Electric Vehicle-Charging Infrastructure Financial Analysis Spreadsheet Tool |

| IRR | Internal Rate Of Return |

| MRG | minimum revenue guarantee |

| NPV | Net Present Value |

| O&M | operations and maintenance |

| P3 | public–private partnership |

| USDOE | United States Department of Energy |

| USDOT | United States Department of Transportation |

References

- Federal Highway Administration. State of the Practice of Public-Private Partnerships for Electric Vehicle Charging Infrastructure. FHWA. 2024. Available online: https://www.fhwa.dot.gov/ipd/pdfs/p3/state_of_the_practice_of_p3s_for_ev_charging_infrastructure.pdf (accessed on 6 January 2025).

- Federal Highway Administration. Structuring Options for Performance-Based Contracts Under the NEVI Program: A Discussion Paper. FHWA. 2024. Available online: https://www.fhwa.dot.gov/ipd/pdfs/p3/structuring_options_for_ev_charging_infrastructure.pdf (accessed on 6 January 2025).

- Government of India. PPP Toolkit for Improving PPP Decision-Making Processes. Government of India Ministry of Finance. 2010. Available online: https://ppp.worldbank.org/public-private-partnership/library/ppp-toolkit-improving-ppp-decision-making-process (accessed on 6 January 2025).

- PPIAF. Toolkit for Public-Private Partnerships in Roads and Highways. Public-Private Infrastructure Advisory Facility. 2009. Available online: https://www.ppiaf.org/sites/ppiaf.org/files/documents/toolkits/highwaystoolkit/index.html (accessed on 6 January 2025).

- Mladenovic, G.; Queiroz, C. Enhancing the Financial Feasibility of PPP Projects with Hybrid Funding. In Proceedings of the International Conference on Traffic and Transport Engineering, Belgrade, Serbia, 27–28 September 2018; pp. 592–599. Available online: https://www.academia.edu/90072235/Enhancing_the_Financial_Feasibility_of_PPP_Projects_with_Hybrid_Funding (accessed on 6 January 2025).

- DeCorla-Souza, P. New Tool to Understand Value-for-Money Analysis Concepts in Evaluating Public-Private Partnership Options. Transp. Res. Rec. J. Transp. Res. Board 2014, 2450, 99–108. [Google Scholar] [CrossRef]

- National Renewable Energy Laboratory. Electric Vehicle Infrastructure Financial Analysis Scenario Tool (EVI-FAST): Spreadsheet Tool User’s Manual. 2020. Available online: https://www.nrel.gov/transportation/assets/pdfs/evi-fast-user-manual-draft-nov-2020.pdf (accessed on 6 January 2025).

- Atlas Public Policy. EV Charging Cost Calculator (v0.2). 2023. Available online: https://atlaspolicy.com/ev-charging-cost-calculator/ (accessed on 6 January 2025).

- Institute of Transportation Studies, University of California, Davis. A Study Evaluating the Total Costs of Installing DC Fast Chargers Along Major Transportation Corridors in California. 2023. Available online: https://www.sciencedirect.com/science/article/pii/S2213624X23000238 (accessed on 6 January 2025).

- Federal Highway Administration. Toolkit for Public-Private Partnerships for Electric Vehicle Charging Infrastructure: EVCI-FAST User Guide. FHWA. 2024. Available online: https://www.fhwa.dot.gov/ipd/p3/toolkit/download/Toolkit%20for%20Public-Private%20Partnerships%20for%20Electric%20Vehicle%20Charging%20Infrastructure%20-%20FAST%20User%20Guide.pdf (accessed on 6 January 2025).

- U.S. DOE Alternative Fuels Data Center. Charging Infrastructure Operation and Maintenance. Available online: https://afdc.energy.gov/fuels/electricity_infrastructure_maintenance_and_operation.html (accessed on 6 January 2025).

- Federal Reserve Bank of, St. Louis. Producer Price Index by Commodity: Repair and Maintenance Services (Partial): Commercial and Industrial Machinery and Equipment Repair and Maintenance. Available online: https://fred.stlouisfed.org/series/WPU551 (accessed on 6 January 2025).

- Statista. Electric Vehicles—United States. Available online: https://www.statista.com/outlook/mmo/electric-vehicles/united-states (accessed on 6 January 2025).

- International Energy Agency. Global EV Outlook. 2024. Available online: https://iea.blob.core.windows.net/assets/a9e3544b-0b12-4e15-b407-65f5c8ce1b5f/GlobalEVOutlook2024.pdf (accessed on 6 January 2025).

- Federal Reserve Economic Data. CPI for All Urban Consumers: Electricity in US City Average. Available online: https://fred.stlouisfed.org/series/CUSR0000SEHF01#0 (accessed on 6 January 2025).

- U.S. DOT. Charger Types and Speeds. Available online: https://www.transportation.gov/rural/ev/toolkit/ev-basics/charging-speeds#:~:text=DCFC%20equipment%20can%20charge%20a,not%20work%20with%20fast%20chargers (accessed on 6 January 2025).

- Transportation Energy Institute. Electric Vehicle Charging State of the Market Report. June 2024. Available online: https://www.transportationenergy.org/wp-content/uploads/2024/06/Tier-1-Report-JUNE-2024-FINAL.pdf (accessed on 6 January 2025).

- EV Connect. How Much Does It Cost to Charge an Electric Car at a Public Charging Station? Available online: https://www.evconnect.com/blog/ev-charging-costs-at-public-stations (accessed on 6 January 2025).

- Investopedia. S&P 500 Average Return and Historical Performance. Available online: https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp?utm_source=chatgpt.com (accessed on 6 January 2025).

- U.S. DOE. FOTW #1319, December 4, 2023: EV Charging at Paid DC Fast Charging Stations Average 42 Minutes per Session. Available online: https://www.energy.gov/eere/vehicles/articles/fotw-1319-december-4-2023-ev-charging-paid-dc-fast-charging-stations-average (accessed on 6 January 2025).

- U.S. DOT. Revenue Risk Sharing for Highway Public-Private Partnership Concessions. December 2016. Available online: https://www.fhwa.dot.gov/ipd/pdfs/p3/p3-toolkit_risk_sharing_white_paper_1216.pdf (accessed on 6 January 2025).

- Huang, B.; Bai, X.; Zhou, Z.; Cui, Q.; Zhu, D.; Hu, R. Energy informatics: Fundamentals and standardization. ICT Express 2017, 3, 76–80. [Google Scholar] [CrossRef]

- Bordin, C.; Mishra, S.; Safari, A.; Eliassen, F. Educating the energy informatics specialist: Opportunities and challenges in light of research and industrial trends. SN Appl. Sci. 2021, 3, 674. [Google Scholar] [CrossRef]

| Pessimistic Revenue Scenario at 50% of Baseline (Best-Guess) Forecast | Alternative Actual Revenue Scenarios with MRG Set at 90% of Baseline (Best-Guess) Revenue Forecast | |||||

|---|---|---|---|---|---|---|

| Key Metrics | Grant-Based P3 | AP/RR * | MRG ** | Actual Revenue at 70% of Baseline (Best Guess) | Actual Revenue at 90% of Baseline (Best Guess) | Actual Revenue at 100% of Baseline (Best Guess) |

| Revenues (NPV) | USD 6,895,837 | USD 6,895,837 | USD 6,895,837 | USD 9,654,172 | USD 12,412,507 | USD 13,791,675 |

| Costs (Eligible) (NPV) | USD 12,410,777 | USD 12,410,777 | USD 12,410,777 | USD 12,816,975 | USD 13,223,172 | USD 13,426,271 |

| Returns to Agency (NPV) | USD 0 | USD 0 | USD 0 | USD 0 | USD 0 | USD 0 |

| NPV of Cash Flows | USD 3,076,796 | USD 0 | USD 1,730 | −USD 404,467 | −USD 810,665 | USD 365,404 |

| NPV of Govt. Contribution | USD 8,591,736 | USD 5,514,939 | USD 5,516,670 | USD 2,758,335 | USD 0 | USD 0 |

| Internal Rate of Return (IRR) | 35.41% | 10.00% | 10.00% | 9.05% | 8.06% | 10.84% |

| Subsidy above Amount Needed for Viability (NPV) | USD 3,076,796 | USD 0 | USD 1730 | USD 0 | USD 0 | USD 0 |

| NPV of Availability Payments/NPV of Total Eligible Costs | N.A. | 44% | N.A. | N.A. | N.A. | N.A. |

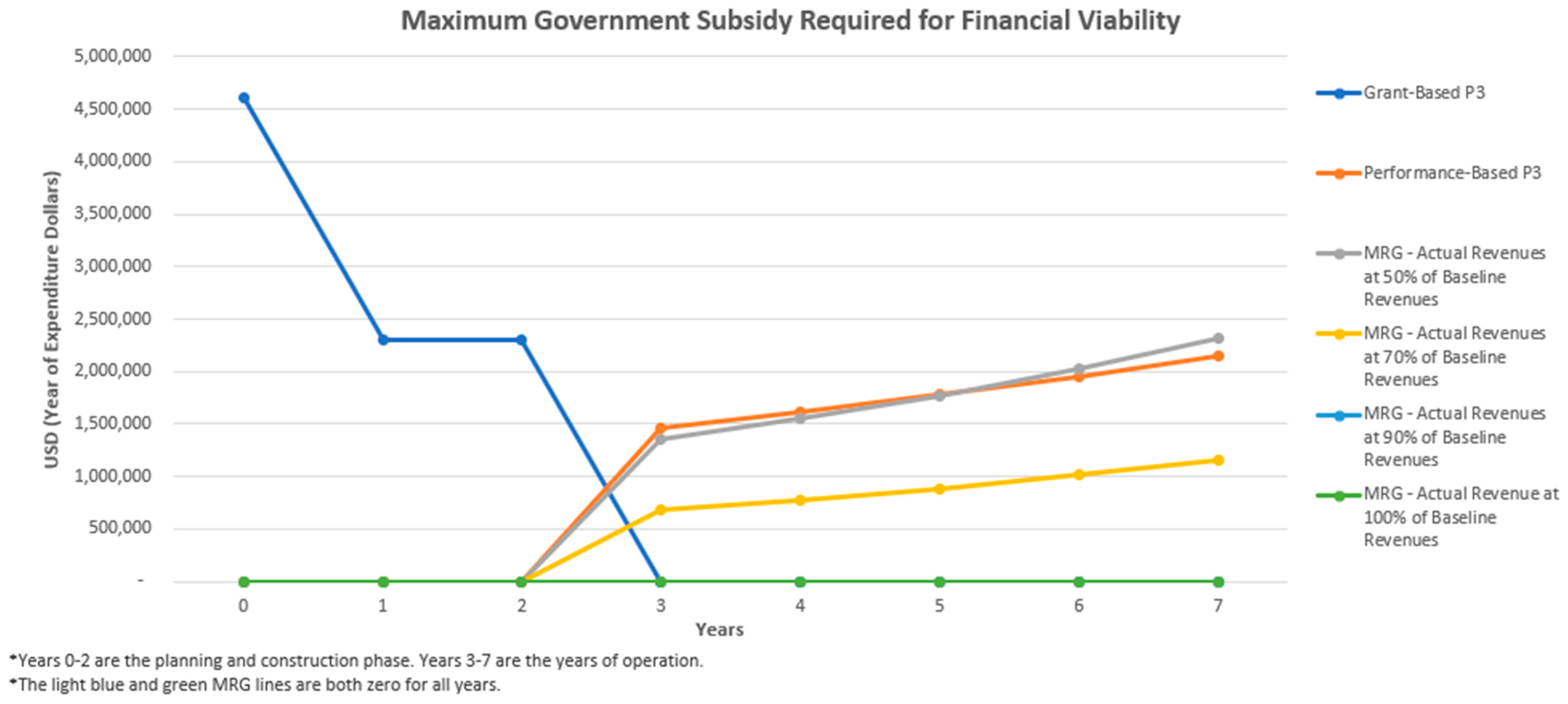

| P3 Structure | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 |

|---|---|---|---|---|---|---|---|---|

| Pessimistic Revenue Scenario (50% of Baseline Forecast) | ||||||||

| Grant-Based P3 | USD 4,600,000 | USD 2,300,000 | USD 2,300,000 | USD 0 | USD 0 | USD 0 | USD 0 | USD 0 |

| Performance-Based P3 | - | - | - | USD 1,468,077 | USD 1,614,885 | USD 1,776,373 | USD 1,954,010 | USD 2,149,411 |

| Minimum Revenue Guarantee (MRG) | - | - | USD 1,358,433 | USD 1,552,519 | USD 1,774,335 | USD 2,027,843 | USD 2,317,571 | |

| MRG Structure with MRG at 90% of Baseline Revenue Forecast | ||||||||

| Actual Revenues at 70% of Baseline | - | - | - | USD 679,216 | USD 776,260 | USD 887,168 | USD 1,013,922 | USD 1,158,786 |

| Actual Revenues at 90% of Baseline | - | - | - | USD 0 | USD 0 | USD 0 | USD 0 | USD 0 |

| Actual Revenues at 100% of Baseline Revenues | - | - | - | USD 0 | USD 0 | USD 0 | USD 0 | USD 0 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Published by MDPI on behalf of the World Electric Vehicle Association. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

DeCorla-Souza, P.; Hossain, M. New Tool to Screen Financial Viability of Alternative Public–Private Partnership Structures for Delivery of Electric Vehicle-Charging Infrastructure. World Electr. Veh. J. 2025, 16, 30. https://doi.org/10.3390/wevj16010030

DeCorla-Souza P, Hossain M. New Tool to Screen Financial Viability of Alternative Public–Private Partnership Structures for Delivery of Electric Vehicle-Charging Infrastructure. World Electric Vehicle Journal. 2025; 16(1):30. https://doi.org/10.3390/wevj16010030

Chicago/Turabian StyleDeCorla-Souza, Patrick, and Mahir Hossain. 2025. "New Tool to Screen Financial Viability of Alternative Public–Private Partnership Structures for Delivery of Electric Vehicle-Charging Infrastructure" World Electric Vehicle Journal 16, no. 1: 30. https://doi.org/10.3390/wevj16010030

APA StyleDeCorla-Souza, P., & Hossain, M. (2025). New Tool to Screen Financial Viability of Alternative Public–Private Partnership Structures for Delivery of Electric Vehicle-Charging Infrastructure. World Electric Vehicle Journal, 16(1), 30. https://doi.org/10.3390/wevj16010030