Research on New Energy Vehicle Market Penetration Rate Based on Nested Multinominal Logit Model

Abstract

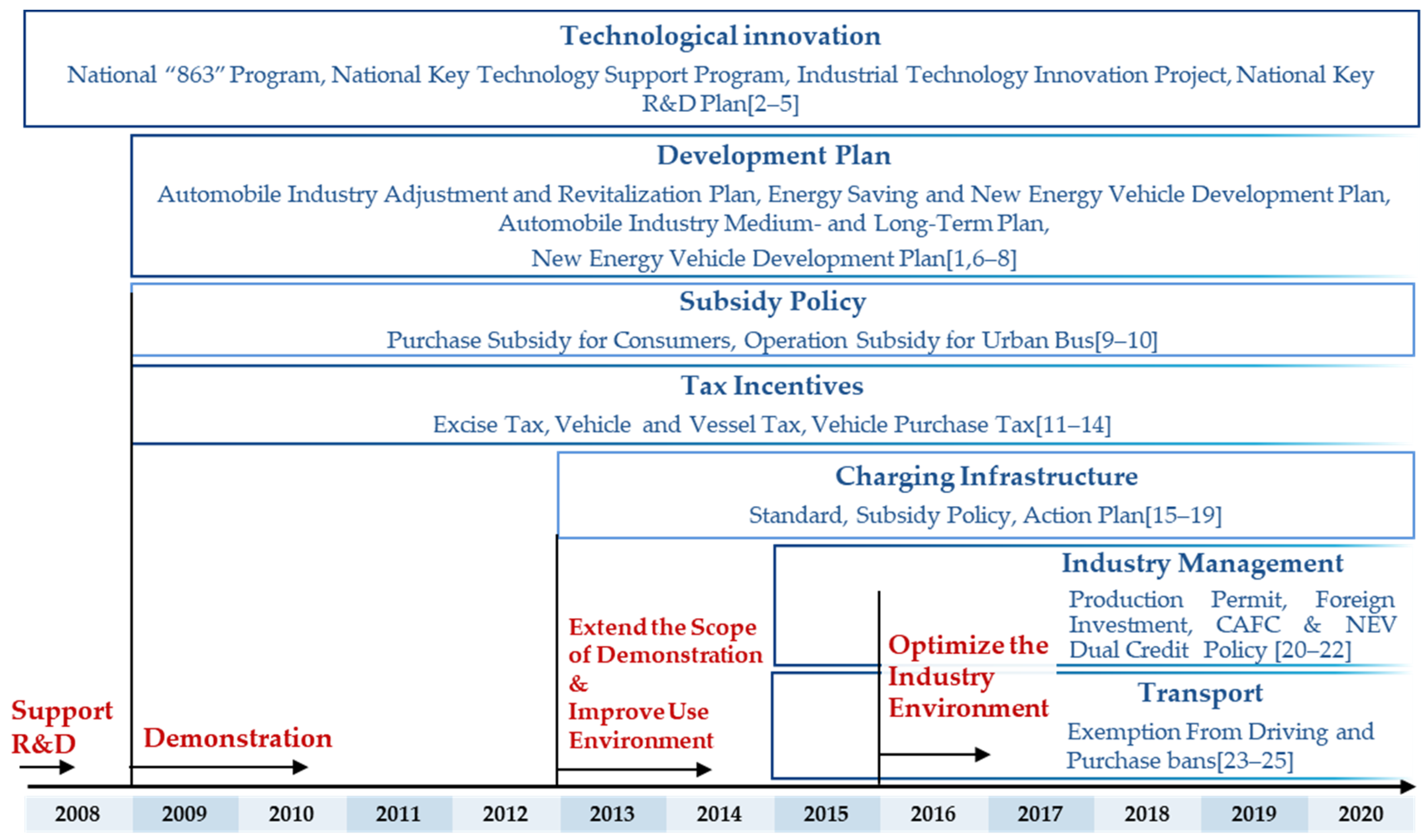

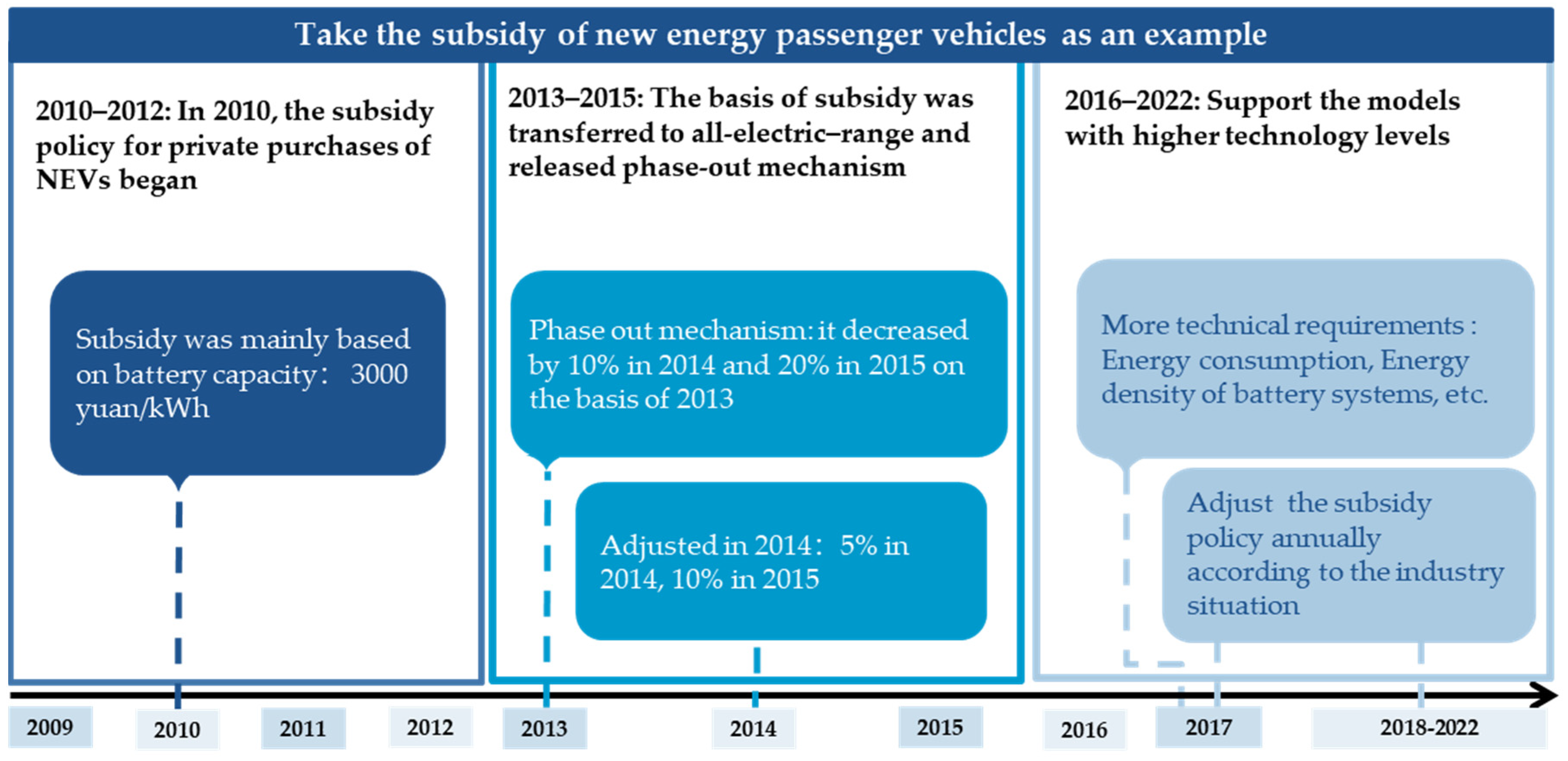

:1. Introduction

2. Research Methods

2.1. Utility Maximization

2.2. MNL Model

2.3. NMNL Model

2.4. Review of Market Forecast Models

3. Model Building

3.1. Research Ideas and Selection of Indicators

3.2. Model Building and Application

4. Research Conclusions

4.1. Assumptions of Policy Scenarios

4.2. Analysis of Model Results

4.3. Sensitivity Analysis of Influencing Factors

5. Policy Recommendations

Author Contributions

Funding

Conflicts of Interest

References

- Energy-Saving and New Energy Automobile Industry Development Plan (2012–2020). Available online: http://www.gov.cn/gongbao/content/2012/content_2182749.htm (accessed on 25 September 2021).

- National High-Tech Research and Development Program (863 Program). Available online: http://www.most.gov.cn/ztzl/swkjjh/kjjhjj/200610/t20061021_36375.html (accessed on 25 September 2021).

- 11th Five-Year Development Outline of the National Science and Technology Support Plan. Available online: http://www.most.gov.cn/ztzl/qgkjgzhy/2007/2007syw/200702/t20070214_41340.html (accessed on 25 September 2021).

- Notice on Organizing the Development of Technological Innovation Projects in the New Energy Automobile Industry. Available online: http://www.gov.cn/gzdt/2012-10/12/content_2242395.htm (accessed on 25 September 2021).

- Interim Measures for the Administration of National Key R&D Programs. Available online: http://www.most.gov.cn/xxgk/xinxifenlei/fdzdgknr/fgzc/gfxwj/gfxwj2017/201706/t20170628_133796.html (accessed on 25 September 2021).

- Auto Industry Adjustment and Revitalization Plan. Available online: http://www.gov.cn/zwgk/2009-03/20/content_1264324.htm (accessed on 25 September 2021).

- Mid- to Long-Term Development Plan for the Automotive Industry. Available online: http://www.gov.cn/gongbao/content/2017/content_5230289.htm (accessed on 25 September 2021).

- New Energy Automobile Industry Development Plan (2021–2035). Available online: http://www.gov.cn/zhengce/content/2020-11/02/content_5556716.htm (accessed on 25 September 2021).

- Notice on Further Improving the Financial Subsidy Policy for the Promotion and Application of New Energy Vehicles. Available online: http://jjs.mof.gov.cn/zhengcefagui/202012/t20201231_3638812.htm (accessed on 25 September 2021).

- Notice on Improving the Price Subsidy Policy of Refined Oil for Urban Buses and Accelerating the Promotion and Application of New Energy Vehicles. Available online: http://www.gov.cn/xinwen/2015-05/22/content_2866789.htm (accessed on 25 September 2021).

- Notice on Adjusting and Improving the Consumption Tax Policy. Available online: http://www.chinatax.gov.cn/chinatax/n360/c612/content.html (accessed on 30 October 2021).

- Notice on Energy-Saving New Energy Vehicles and Ships Enjoying Vehicle and Ship Tax Preferential Policies. Available online: http://www.chinatax.gov.cn/n810341/n810755/c3640048/content.html (accessed on 30 October 2021).

- Announcement on the New Energy Vehicle Purchase Tax Exemption Policy. Available online: http://www.chinatax.gov.cn/chinatax/n810341/n810755/c5148808/content.html (accessed on 30 October 2021).

- Announcement on Adjusting the Technical Requirements for New Energy Vehicle Products Exempted from Vehicle Purchase Tax. Available online: https://ythxxfb.miit.gov.cn/ythzxfwpt/hlwmh/tzgg/xzxk/clsczr/art/2021/art_a77258175f0141b18e88f050546155dd.html (accessed on 30 October 2021).

- Notice on Issues Related to Electric Vehicle Electricity Price Policy. Available online: https://www.ndrc.gov.cn/fggz/tzgg/ggkx/201408/t20140806_1073810.html (accessed on 30 October 2021).

- Guidelines for the Development of Electric Vehicle Charging Infrastructure (2015–2020). Available online: http://www.gov.cn/zhengce/2015-10/09/content_5076250.htm (accessed on 30 October 2021).

- Notice on Rewards for the Construction of New Energy Vehicle Charging Facilities. Available online: http://www.gov.cn/xinwen/2014-11/26/content_2783831.htm (accessed on 30 October 2021).

- Notice on the “13th Five-Year” New Energy Vehicle Charging Infrastructure Incentive Policy and Strengthen the Promotion and Application of New Energy Vehicles. Available online: http://www.gov.cn/xinwen/2016-01/20/content_5034655.htm (accessed on 30 October 2021).

- Action Plan for Improving the Charging Capability of New Energy Vehicles. Available online: http://www.gov.cn/xinwen/2018-12/10/content_5347391.htm (accessed on 30 October 2021).

- Regulations on Management of New Energy Vehicle Production Enterprises and Product Access. Available online: http://www.gov.cn/xinwen/2020-08/19/content_5535780.htm (accessed on 30 October 2021).

- Special Administrative Measures for Foreign Investment Access (Negative List) (2018 Edition). Available online: http://www.mofcom.gov.cn/article/b/f/201806/20180602760432.shtml (accessed on 1 November 2021).

- Decision on Revising the “Measures for the Parallel Management of Average Fuel Consumption of Passenger Car Companies and New Energy Vehicle Credits”. Available online: http://www.gov.cn/zhengce/zhengceku/2020-06/22/content_5521144.htm (accessed on 1 November 2021).

- Li Keqiang Presided over the Executive Meeting of the State Council. Available online: http://www.gov.cn/guowuyuan/2015-09/29/content_2940663.htm (accessed on 1 November 2021).

- Promote the Renewal and Upgrade of Key Consumer Products and Unblock Resource Recycling Implementation Plan (2019–2020). Available online: http://www.gov.cn/xinwen/2019-06/07/content_5398219.htm (accessed on 1 November 2021).

- The Traffic Management Bureau of the Ministry of Public Security Deploys the Comprehensive Promotion of Special License Plates for New Energy Vehicles. Available online: http://www.gov.cn/xinwen/2017-11/18/content_5240710.htm (accessed on 1 November 2021).

- Notice on Improving the Fiscal Subsidy Policy for the Promotion and Application of New Energy Vehicles. Available online: http://jjs.mof.gov.cn/zhengcefagui/202004/t20200423_3502975.htm (accessed on 1 November 2021).

- Koning, R.H.; Ridder, G. Discrete choice and stochastic utility maximization. Econom. J. 2003, 6, 1–27. [Google Scholar] [CrossRef] [Green Version]

- Transport Research Laboratory. D2.1. Consumer Attitudes and Behaviours Report, The Future of Transport Report. Available online: https://esc-non-prod.s3.eu-west-2.amazonaws.com/2020/12/CVEI-Consumer-attitudes-and-behaviours-report.pdf (accessed on 1 November 2021).

- Yan, S. The economic and environmental impacts of tax incentives for battery electric vehicles in Europe. Energy Policy 2018, 123, 53–63. [Google Scholar] [CrossRef]

- Di Foggia, G. Drivers and challenges of electric vehicles integration in corporate fleet: An empirical survey. Res. Transp. Bus. Manag. 2021. [Google Scholar] [CrossRef]

- Wang, N.; Tang, L.; Pan, H. A global comparison and assessment of incentive policy on electric vehicle promotion. Sustain. Cities Soc. 2019, 44, 597–603. [Google Scholar] [CrossRef]

- Nie, Y.; Ghamami, M.; Zockaie, A.; Xiao, F. Optimization of incentive polices for plug-in electric vehicles. Transp. Res. Part B Methodol. 2016, 84, 103–123. [Google Scholar] [CrossRef]

- Potoglou, D.; Kanaroglou, P.S. Household demand and willingness to pay for clean vehicles. Transp. Res. Part D Transp. Environ. 2007, 12, 264–274. [Google Scholar] [CrossRef]

- Gallagher, K.S.; Muehlegger, E. Giving green to get green? Incentives and consumer adoption of hybrid vehicle technology. J. Environ. Econ. Manag. 2011, 61, 1–15. [Google Scholar] [CrossRef]

- Manski, C.F.; Sherman, L. An empirical analysis of household choice among motor vehicles. Transp. Res. Part A Gen. 1980, 14, 349–366. [Google Scholar] [CrossRef]

- Ewing, G.O.; Sarigöllü, E. Car fuel-type choice under travel demand management and economic incentives. Transp. Res. Part D Transp. Environ. 1998, 3, 429–444. [Google Scholar] [CrossRef]

- Brownstone, D.; Bunch, D.S.; Train, K. Joint mixed logit models of stated and revealed preferences for alternative-fuel vehicles. Transp. Res. Part B Methodol. 2000, 34, 315–338. [Google Scholar] [CrossRef] [Green Version]

- Berkovec, J. Forecasting automobile demand using disaggregate choice models. Transp. Res. Part B Methodol. 1985, 19, 315–329. [Google Scholar] [CrossRef]

- Berkovec, J.; Rust, J. A nested logit model of automobile holdings for one vehicle households. Transp. Res. Part B Methodol. 1985, 19, 275–285. [Google Scholar] [CrossRef]

- Bunch, D.S.; Bradley, M.; Golob, T.F.; Kitamura, R.; Occhiuzzo, G.P. Demand for clean-fuel vehicles in California: A discrete-choice stated preference pilot project. Transp. Res. Part A Policy Pract. 1993, 27, 237–253. [Google Scholar] [CrossRef]

- Ardeshiri, A.; Rashidi, T.H. Willingness to pay for fast charging station for electric vehicles with limited market penetration making. Energy Policy 2020, 147, 111822. [Google Scholar] [CrossRef]

- Gong, S.; Ardeshiri, A.; Rashidi, T.H. Impact of government incentives on the market penetration of electric vehicles in Australia. Transp. Res. Part D Transp. Environ. 2020, 83, 102353. [Google Scholar] [CrossRef]

- Abotalebi, E.; Scott, D.M.; Ferguson, M.R. Ferguson, Why is electric vehicle uptake low in Atlantic Canada? A comparison to leading adoption provinces. J. Transp. Geogr. 2019, 74, 289–298. [Google Scholar] [CrossRef]

- Axsen, J.; Goldberg, S.; Bailey, J. How might potential future plug-in electric vehicle buyers differ from current “Pioneer” owners? Transp. Res. Part D Transp. Environ. 2016, 47, 357–370. [Google Scholar] [CrossRef]

- Ferguson, M.; Mohamed, M.; Higgins, C.D.; Abotalebi, E.; Kanaroglou, P. How open are Canadian households to electric vehicles? A national latent class choice analysis with willingness-to-pay and metropolitan characterization. Transp. Res. Part D Transp. Environ. 2018, 58, 208–224. [Google Scholar] [CrossRef]

- Kormos, C.; Axsen, J.; Long, Z.; Goldberg, S. Latent demand for zero-emissions vehicles in Canada (Part 2): Insights from a stated choice experiment. Transp. Res. Part D Transp. Environ. 2019, 67, 685–702. [Google Scholar] [CrossRef]

- Huang, Y.; Qian, L. Consumer preferences for electric vehicles in lower tier cities of China: Evidences from south Jiangsu region. Transp. Res. Part D Transp. Environ. 2018, 63, 482–497. [Google Scholar] [CrossRef]

- Ma, S.C.; Xu, J.H.; Fan, Y. Willingness to pay and preferences for alternative incentives to EV purchase subsidies: An empirical study in China. Energy Econ. 2019, 81, 197–215. [Google Scholar] [CrossRef]

- Qian, L.; Grisolía, J.M.; Soopramanien, D. The impact of service and government-policy attributes on consumer preferences for electric vehicles in China. Transp. Res. Part A Policy Pract. 2019, 122, 70–84. [Google Scholar] [CrossRef] [Green Version]

- Wang, N.; Tang, L.; Pan, H. Effectiveness of policy incentives on electric vehicle acceptance in China: A discrete choice analysis. Transp. Res. Part A Policy Pract. 2017, 105, 210–218. [Google Scholar] [CrossRef]

- Hackbarth, A.; Madlener, R. Willingness-to-pay for alternative fuel vehicle characteristics: A stated choice study for Germany. Transp. Res. Part A Policy Pract. 2016, 85, 89–111. [Google Scholar] [CrossRef]

- Danielis, R.; Rotaris, L.; Giansoldati, M.; Scorrano, M. Drivers’ preferences for electric cars in Italy. Evidence from a country with limited but growing electric car uptake. Transp. Res. Part A Policy Pract. 2020, 137, 79–94. [Google Scholar] [CrossRef]

- Orlov, A.; Kallbekken, S. The impact of consumer attitudes towards energy efficiency on car choice: Survey results from Norway. J. Clean. Prod. 2019, 214, 816–822. [Google Scholar] [CrossRef]

- Choi, H.; Shin, J.; Woo, J. Effect of electricity generation mix on battery electric vehicle adoption and its environmental impact. Energy Policy 2018, 121, 13–24. [Google Scholar] [CrossRef]

- Langbroek, J.H.; Franklin, J.P.; Susilo, Y.O. The effect of policy incentives on electric vehicle adoption. Energy Policy 2016, 94, 94–103. [Google Scholar] [CrossRef]

- Cirillo, C.; Liu, Y.; Maness, M. A time-dependent stated preference approach to measuring vehicle type preferences and market elasticity of conventional and green vehicles. Transp. Res. Part A Policy Pract. 2017, 100, 294–310. [Google Scholar] [CrossRef]

- Hagman, J.; Ritzén, S.; Stier, J.J.; Susilo, Y. Total cost of ownership and its potential implications for battery electric vehicle diffusion. Res. Transp. Bus. Manag. 2016, 18, 11–17. [Google Scholar] [CrossRef] [Green Version]

- Zhang, T.; Gensler, S.; Garcia, R. A Study of the Diffusion of Alternative Fuel Vehicles: An Agent-Based Modeling Approach. J. Prod. Innov. Manag. 2011, 28, 152–168. [Google Scholar] [CrossRef]

- Lévay, P.Z.; Drossinos, Y.; Thiel, C. The effect of fiscal incentives on market penetration of electric vehicles: A pairwise comparison of total cost of ownership. Energy Policy 2017, 105, 524–533. [Google Scholar] [CrossRef]

- Wong, R.C.; Szeto, W.Y.; Wong, S.C. Behavior of taxi customers in hailing vacant taxis: A nested logit model for policy analysis. J. Adv. Transp. 2016, 49, 867–883. [Google Scholar] [CrossRef] [Green Version]

- Tanaka, M.; Ida, T.; Murakami, K.; Friedman, L. Consumers’ willingness to pay for alternative fuel vehicles: A comparative discrete choice analysis between the US and Japan. Transp. Res. Part A Policy Pract. 2014, 70, 194–209. [Google Scholar] [CrossRef]

| Tax Type | Tax Rate | Exemption Policy | |

|---|---|---|---|

| Excise tax (Production/import stage) | Vehicle manufacturers/importers pay the tax at the point of production/import for onetime |

| Battery electric passenger vehicles and fuel cell passenger vehicles do not belong to the scope of excise tax |

| Purchase tax (Purchase stage) | Consumers pay the tax at the point of purchase for onetime |

| BEV, PHEV, and FCEV are exempt from purchase tax to the end of 2022 |

| Vehicle and Vessel tax (Ownership stage) | Owners of vehicle pay the tax per year |

| Battery electric passenger vehicles and fuel cell passenger vehicles do not belong to the scope of tax, and other NEVs are exempt |

| Author | Model | Country | Cost | Incentive | ||||

|---|---|---|---|---|---|---|---|---|

| Purchase Cost | Fuel Cost | Convenience Cost | Other Cost | Financial Incentive | Nonfinancial Incentive | |||

| Ardeshiri and Rashidi (2020) [41] | NMNL | Australia | √ | |||||

| Gong et al. (2020) [42] | NMNL | Australia | √ | √ | √ | √ | √ | |

| Abotalebi et al. (2019) [43] | NMNL | Canada | √ | √ | √ | √ | √ | √ |

| Axsen et al. (2016) [44] | NMNL | Canada | √ | √ | ||||

| Ferguson et al. (2018) [45] | NMNL | Canada | √ | √ | √ | √ | √ | √ |

| Kormos et al. (2019) [46] | NMNL | Canada | √ | √ | √ | |||

| Huang and Qian (2018) [47] | NL | China | √ | √ | √ | √ | √ | |

| Ma et al. (2019) [48] | MNL | China | √ | √ | √ | √ | √ | |

| Qian et al. (2019) [49] | MNL | China | √ | √ | √ | |||

| Wang et al. (2017) [50] | MNL | China | √ | √ | √ | √ | ||

| Hackbarth et al. (2016) [51] | NMNL | Germany | √ | √ | √ | √ | √ | |

| Danielis et al. (2020) [52] | MNL | Italy | √ | √ | √ | √ | √ | |

| Orlov et al. (2019) [53] | MNL | Norway | √ | √ | ||||

| Choi et al. (2018) [54] | MNL | South Korea | √ | √ | √ | |||

| Langbroek et al. (2016) [55] | MNL | Sweden | √ | √ | √ | √ | ||

| Cirillo et al. (2017) [56] | MNL | USA | √ | √ | ||||

| Policy Category | —2022 | —2024 | —2025 | —2030 | —2035 |

|---|---|---|---|---|---|

| Management | Energy consumption target setting (In 2025, 2030, and 2035, the average fuel consumption of passenger vehicles will reach 5.6 L/100 km, 4.8 L/100 km, 4.0 L/100 km) | ||||

| CAFC and NEV dual credit (NEV credits will gradually increase from 12% in 2020 to 50% in 2035, increasing by 2–3% per year) | |||||

| Subsidy | Purchase subsidy (Implemented according to the published policy, ending in 2022) | / | |||

| Taxes | Exemption from vehicle purchase tax (Exempted according to the published policy) | Concessions to vehicle purchase tax (Continue to be exempted) | Concessions to vehicle purchase tax (Vehicle purchase tax rate increases by 2% per year) | Vehicle purchase tax and consumption tax incentives based on energy efficiency indicators (Vehicle purchase tax rate will increase by 2% every year until 10%, excise tax is exempted) | Vehicle purchase tax and consumption tax incentives based on energy efficiency indicators (Start to levy excise tax on BEVs and FCEVs) |

| * Increase in fuel tax (Tax amount increased by 5%) | * Increase in fuel tax (Tax amount increased by 5%) | ||||

| Year | Non-NEV | BEV | PHEV | FCEV |

|---|---|---|---|---|

| 2020 | 93.8% | 4.9% | 1.2% | 0.0% |

| 2025 | 80.0% | 13.0% | 7.0% | 0.0% |

| 2030 | 59.1% | 29.1% | 11.8% | 0.0% |

| 2035 | 50.0% | 38.7% | 11.2% | 0.1% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, K.; Shi, H.; Liu, B.; Jian, X. Research on New Energy Vehicle Market Penetration Rate Based on Nested Multinominal Logit Model. World Electr. Veh. J. 2021, 12, 249. https://doi.org/10.3390/wevj12040249

Liu K, Shi H, Liu B, Jian X. Research on New Energy Vehicle Market Penetration Rate Based on Nested Multinominal Logit Model. World Electric Vehicle Journal. 2021; 12(4):249. https://doi.org/10.3390/wevj12040249

Chicago/Turabian StyleLiu, Kexin, Hong Shi, Bin Liu, and Xiaorong Jian. 2021. "Research on New Energy Vehicle Market Penetration Rate Based on Nested Multinominal Logit Model" World Electric Vehicle Journal 12, no. 4: 249. https://doi.org/10.3390/wevj12040249

APA StyleLiu, K., Shi, H., Liu, B., & Jian, X. (2021). Research on New Energy Vehicle Market Penetration Rate Based on Nested Multinominal Logit Model. World Electric Vehicle Journal, 12(4), 249. https://doi.org/10.3390/wevj12040249