Electric Vehicle Uptake: Understanding the Print Media’s Role in Changing Attitudes and Perceptions

Abstract

1. Introduction

2. Background

2.1. Opinion-Based versus Fact-Based: The Media’s Role in Shaping Perceptions

2.2. Information as a Driver of Consumer Choices

2.3. New Zealand Car Market and Media Readership

3. Conceptual Framework and Method

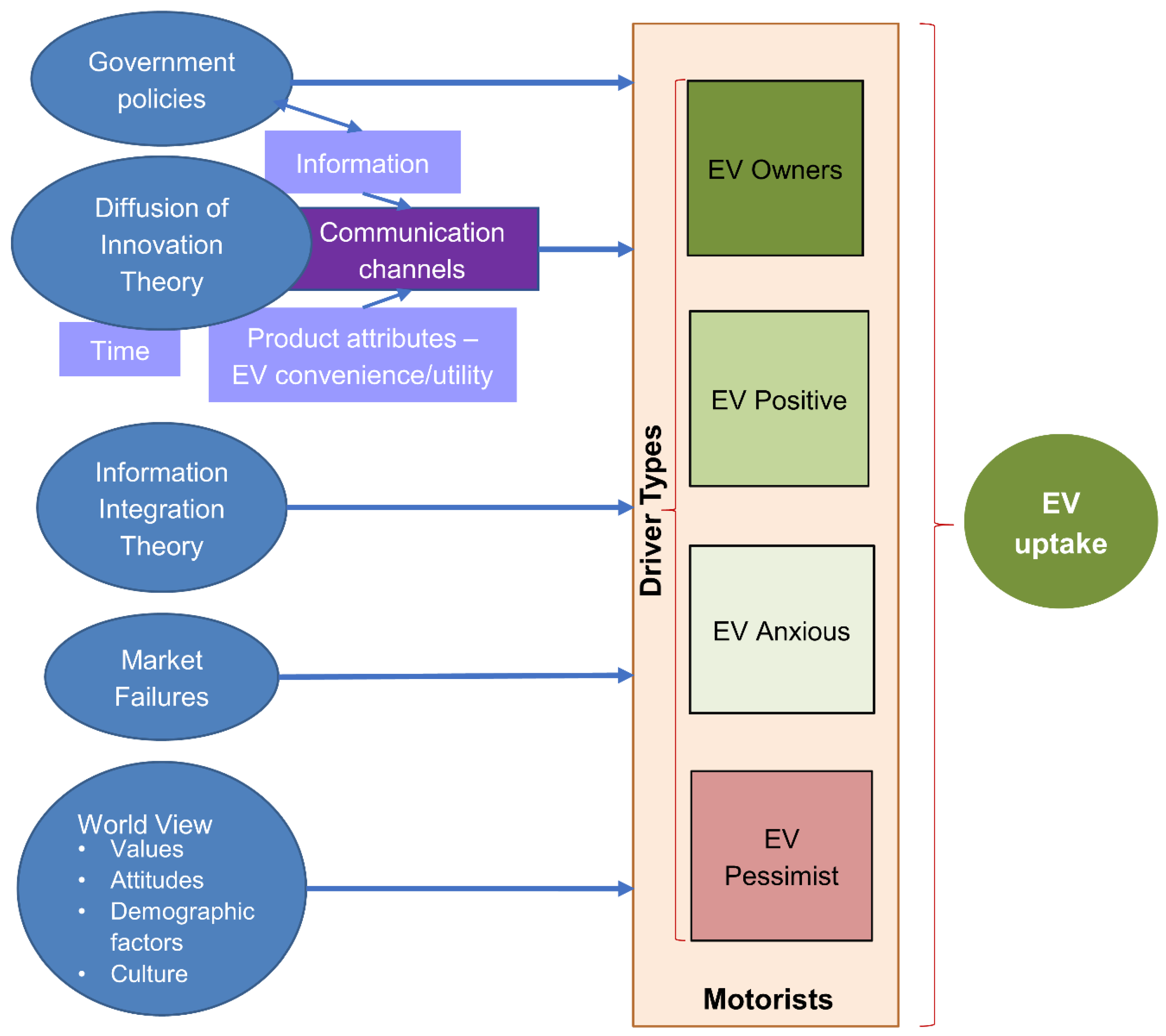

3.1. Conceptual Framework

3.2. Methodological Approach

3.2.1. Identification, Collation, and Analysis of New Zealand’s Print Media Treatment of EVs: Newspapers and Car Magazines

3.2.2. Survey of Car Buyers

Sampling Frame and Survey Data Collection

Questionnaires

Interviews

Market Segmentation

3.2.3. Statistical Data Analysis

Tests of Association by Driver Type

Likelihood to Buy Ratio Tests

3.3. Limitations

4. Results

4.1. Media Survey

4.2. Car Buyer Survey

4.2.1. Results of Driver Type Analysis

4.2.2. Results of Likelihood to Buy Ratio Tests

5. Discussion

5.1. Introduction

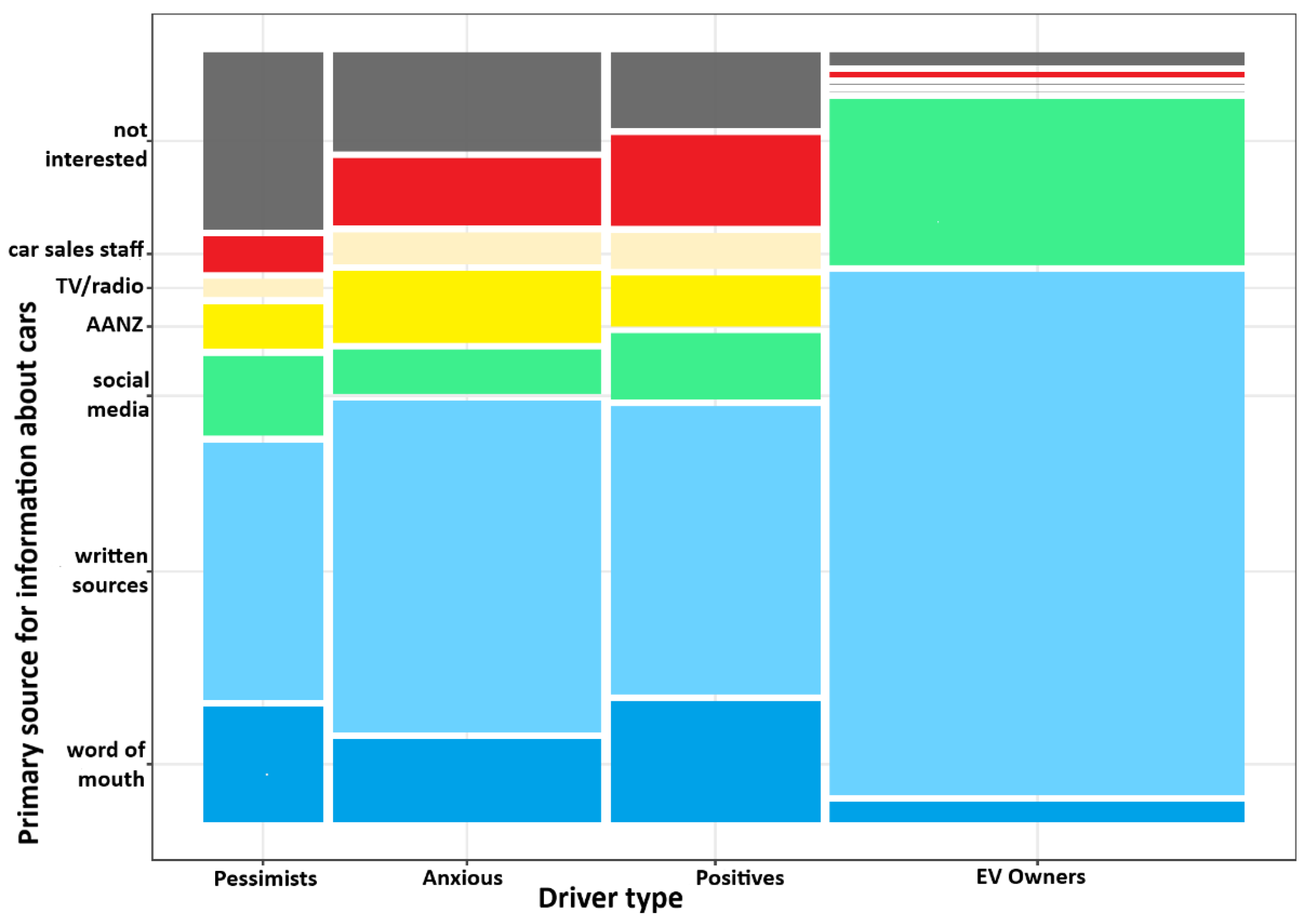

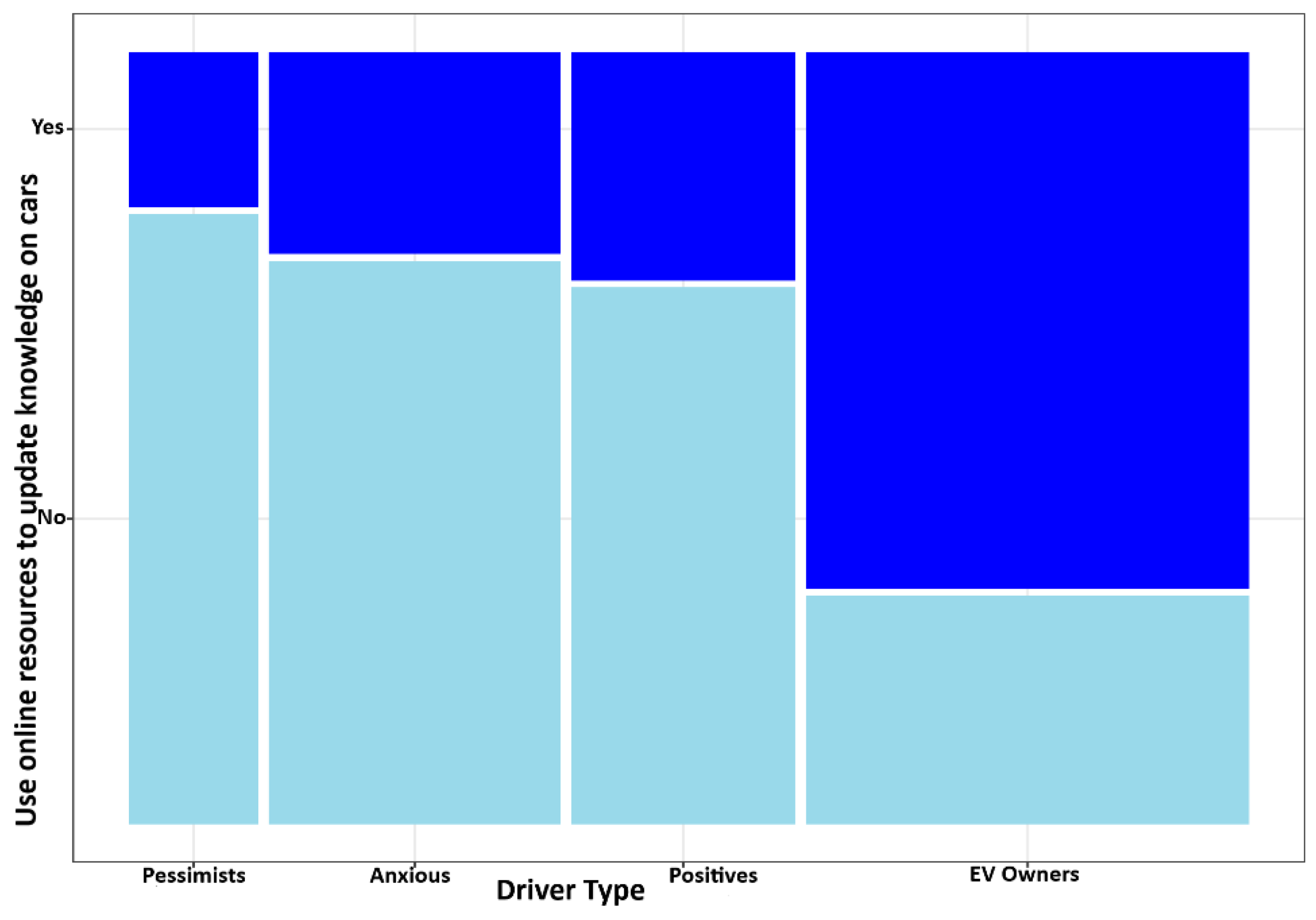

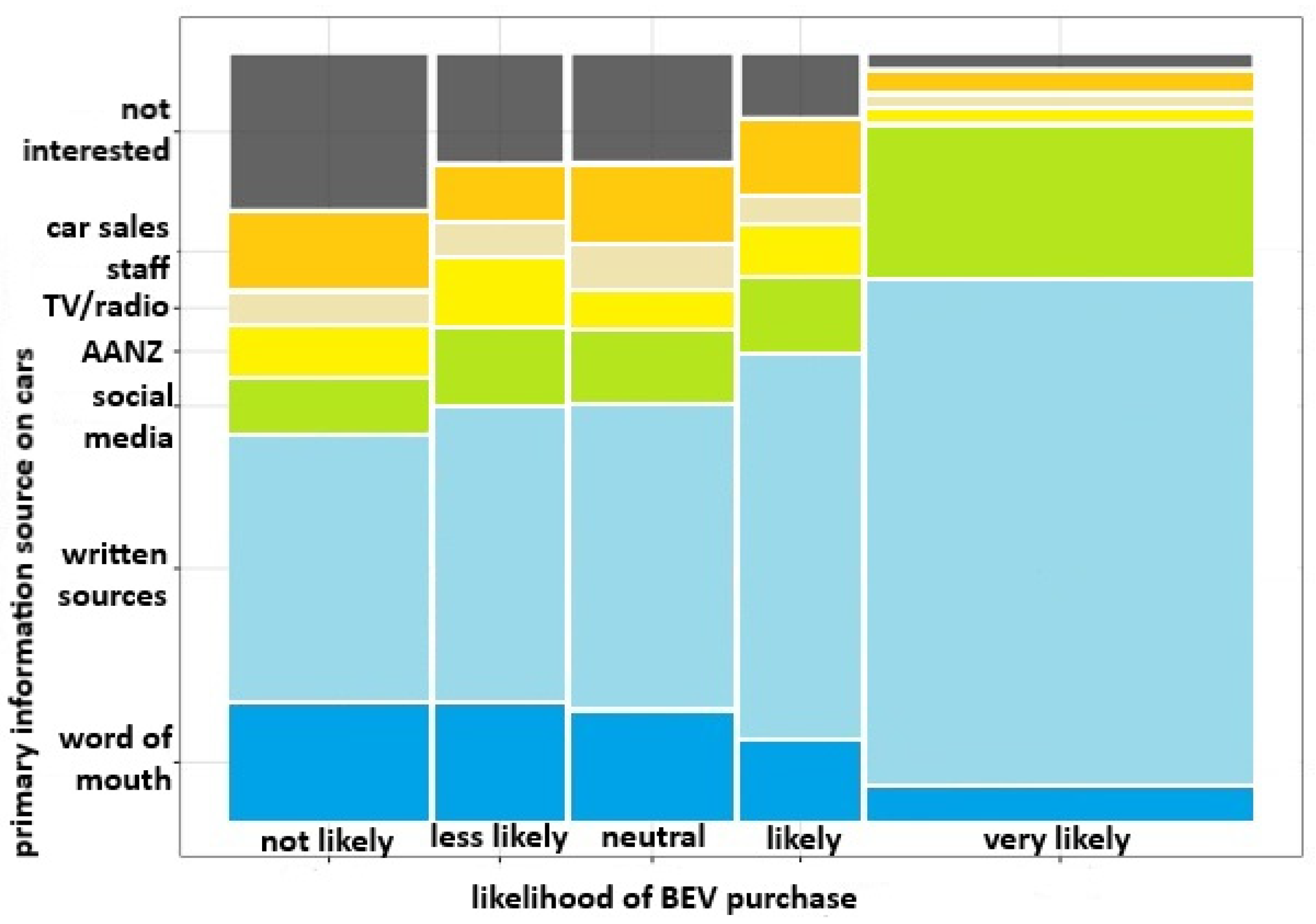

5.2. Sources of Information

5.3. Media Portrayal and Influence on Attitudes to EVs

5.4. Perceptions of EVs as Expensive

5.5. Engagement with the Media and Awareness of Initiatives and Incentives

5.6. EV Messaging

6. Policy Recommendations

- Increasing dissemination of information about EVs and their lifestyle benefits through targeted and sustained campaigns, including via the media in general news stories. Focus should be on the EV Positives, the early mainstream market, the next most likely segment to buy an EV. Governments and other stakeholders, for example, motoring organisations and manufacturers could work with the media to spread factual news to correct lack of knowledge and misinformation, provide timely updates and helping change perceptions.

- Reducing the cost differential between EVs and ICEVs. Implementation of the policies Clean Car Discount to reduce upfront EV cost, and the Clean Car Standard, to increase EV importation, and consequently model availability, at no cost to government, could achieve this goal and help counter the perception of ‘expensive’.

- Increasing funding, by all tiers of government, for expanding deployment of fast-chargers nation-wide, providing signage and special numberplates, and increasing communications about smart phone apps to locate chargers could increase EV visibility in the community helping allay anxiety about running out of charge,

- Reframing EVs’ image, indicating EVs represent the ‘good life’ by presenting value for money and they are fun, thus providing lifestyle gains for individuals, for example, there is more money to spend otherwise.

- Increasing procurement of EVs, for example, by government departments and large companies, could increase sales certainty for car dealers, increase communication via the media and employees, and increase volumes of the second-hand EV fleet through short-term turnover.

7. Final Considerations and Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- IPCC. Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change: Chapter 8 Transport. Available online: https://www.ipcc.ch/report/ar5/wg3/ (accessed on 2 February 2021).

- Höltl, A.; Macharis, C.; De Brucker, K. Pathways to decarbonise the European car fleet: A scenario analysis using the backcasting approach. Energies 2018, 11, 20. [Google Scholar] [CrossRef]

- Broadbent, G.H. Comment on “Consumer purchase intentions for electric vehicles: Is green more important than price and range? K. Degirmenci, MH Breitner Transportation Research Part D 51 (2017) 250–260”. Transp. Res. Part D Transp. Environ. 2018, 65, 849–852. [Google Scholar] [CrossRef]

- Plötz, P.; Axsen, J.; Funke, S.A.; Gnann, T. Designing car bans for sustainable transportation. Nat. Sustain. 2019, 2, 534–536. [Google Scholar] [CrossRef]

- European Commission. European Alternative Fuels Observatory: Countries. Available online: https://www.eafo.eu/ (accessed on 2 February 2021).

- Moore, G.A. Crossing the Chasm: Marketing and Selling Disruptive Products to Mainstream Customers, 3rd ed.; Harper Business New York: New York, NY, USA, 2014. [Google Scholar]

- Ford, R.; Stephenson, J.; Scott, M.; Williams, J.; Rees, D.; Wooliscroft, B. Keen on EVs: Kiwi Perspectives on Electric Vehicles, and Opportunities to Stimulate Uptake 2015, (Working Paper). Centre for Sustainability, University of Otago. Available online: http://hdl.handle.net/10523/5730 (accessed on 22 February 2021).

- Kangur, A.; Jager, W.; Verbrugge, R.; Bockarjova, M. An agent-based model for diffusion of electric vehicles. J. Environ. Psychol. 2017, 52, 166–182. [Google Scholar] [CrossRef]

- Broadbent, G.H.; Metternicht, G.; Drozdzewski, D. An Analysis of Consumer Incentives in Support of Electric Vehicle Uptake: An Australian Case Study. World Electr. Veh. J. 2019, 10, 11. [Google Scholar] [CrossRef]

- Peters, A.; de Haan, P.; Scholz, R.W. Understanding Car-Buying Behavior: Psychological Determinants of Energy Efficiency and Practical Implications. Int. J. Sustain. Transp. 2015, 9, 59–72. [Google Scholar] [CrossRef]

- Greenwald, B.C.; Stiglitz, J.E. Externalities in Economies with Imperfect Information and Incomplete Markets. Q. J. Econ. 1986, 101, 229–264. [Google Scholar] [CrossRef]

- Anderson, N.H. Integration theory and attitude change. Psychol. Rev. 1971, 78, 171–206. [Google Scholar] [CrossRef]

- Mairesse, O.; Macharis, C.; Lebeau, K.; Turcksin, L. Understanding the attitude-action gap: Functional integration of environmental aspects in car purchase intentions. Psicologica 2012, 33, 547–574. [Google Scholar]

- Krause, R.M.; Carley, S.R.; Lane, B.W.; Graham, J.D. Perception and reality: Public knowledge of plug-in electric vehicles in 21 U.S. cities. Energy Policy 2013, 63, 433–440. [Google Scholar] [CrossRef]

- Fry, A.; Ryley, T.; Thring, R. The influence of knowledge and persuasion on the decision to adopt or reject alternative fuel vehicles. Sustainability 2018, 10, 2997. [Google Scholar] [CrossRef]

- White, L.V.; Sintov, N.D. You are what you drive: Environmentalist and social innovator symbolism drives electric vehicle adoption intentions. Transp. Res. Part A Policy Pract. 2017, 99, 94–113. [Google Scholar] [CrossRef]

- Dijk, M.; Wells, P.; Kemp, R. Will the momentum of the electric car last? Testing an hypothesis on disruptive innovation. Technol. Forecast. Soc. Chang. 2016, 105, 77–88. [Google Scholar] [CrossRef]

- Jeffres, L.W.; Neuendorf, K.; Atkin, D.J. Acquiring Knowledge from the Media in the Internet Age. Commun. Q. 2012, 60, 59–79. [Google Scholar] [CrossRef]

- Happer, C.; Philo, G. The role of the media in the construction of public belief and social change. J. Soc. Polit. Psychol. 2013, 1, 321–336. [Google Scholar] [CrossRef]

- Oppegaard, B.; Rabby, M.K. Proximity: Revealing new mobile meanings of a traditional news concept. Digit. J. 2016, 4, 621–638. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research and Applications, 6th ed.; Sage Publications, Inc.: Los Angeles, CA, USA, 2018. [Google Scholar]

- Hamborg, F.; Donnay, K.; Gipp, B. Automated identification of media bias in news articles: An interdisciplinary literature review. Int. J. Digit. Libr. 2018, 20, 391–415. [Google Scholar] [CrossRef]

- Levin, I.P.; Schneider, S.L.; Gaeth, G.J. All Frames Are Not Created Equal: A Typology and Critical Analysis of Framing Effects. Organ. Behav. Hum. Decis. Process. 1998, 76, 149–188. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263–292. [Google Scholar] [CrossRef]

- Pan, Y.; Opgenhaffen, M.; Van Gorp, B. Negotiating climate change: A frame analysis of COP21 in British, American, and Chinese news media. Public Underst. Sci. 2019, 28, 519–533. [Google Scholar] [CrossRef]

- Brüggemann, M.; Engesser, S. Beyond false balance: How interpretive journalism shapes media coverage of climate change. Glob. Environ. Chang. 2017, 42, 58–67. [Google Scholar] [CrossRef]

- Newman, T.P.; Nisbet, E.C.; Nisbet, M.C. Climate change, cultural cognition, and media effects: Worldviews drive news selectivity, biased processing, and polarized attitudes. Public Underst. Sci. 2018, 27, 985–1002. [Google Scholar] [CrossRef] [PubMed]

- Gentzkow, M.; Shapiro, J.M. What Drives Media Slant? Evidence from U.S. Daily Newspapers. Econometrica 2010, 78, 35–71. [Google Scholar] [CrossRef]

- Otto, I.M.; Donges, J.F.; Cremades, R.; Bhowmik, A.; Hewitt, R.J.; Lucht, W.; Rockström, J.; Allerberger, F.; McCaffrey, M.; Doe, S.S.P.; et al. Social tipping dynamics for stabilizing Earth’s climate by 2050. Proc. Natl. Acad. Sci. USA 2020, 117, 2354–2365. [Google Scholar] [CrossRef] [PubMed]

- Roy Morgan Research. Over 3.1 Million New Zealanders Read Newspapers. Report. 2019. Available online: http://www.roymorgan.com/findings/7862-over-3point1-million-new-zealanders-read-newspapers-201902010504 (accessed on 8 August 2021).

- Ministry of Transport NZ Vehicle Fleet Statistics. Available online: https://www.transport.govt.nz/mot-resources/vehicle-fleet-statistics/ (accessed on 9 September 2021).

- Feldman, L.; Hart, P.S.; Milosevic, T. Polarizing news? Representations of threat and efficacy in leading US newspapers’ coverage of climate change. Public Underst. Sci. 2017, 26, 481–497. [Google Scholar] [CrossRef]

- Bolsen, T.; Shapiro, M.A. The US News Media, Polarization on Climate Change, and Pathways to Effective Communication. Environ. Commun. 2018, 12, 149–163. [Google Scholar] [CrossRef]

- Carmichael, J.T.; Brulle, R.J. Elite cues, media coverage, and public concern: An integrated path analysis of public opinion on climate change, 2001–2013. Envrion. Politics 2017, 26, 232–252. [Google Scholar] [CrossRef]

- Entman, R.M. Framing bias: Media in the distribution of power. J. Commun. 2007, 57, 163–173. [Google Scholar] [CrossRef]

- Carmichael, J.T.; Brulle, R.J.; Huxster, J.K. The great divide: Understanding the role of media and other drivers of the partisan divide in public concern over climate change in the USA, 2001–2014. Clim. Chang. 2017, 141, 599–612. [Google Scholar] [CrossRef]

- Chen, Y.; Ghosh, M.; Liu, Y.; Zhao, L. Media Coverage of Climate Change and Sustainable Product Consumption: Evidence from the Hybrid Vehicle Market. J. Mark. Res. 2019, 56, 995–1011. [Google Scholar] [CrossRef]

- MacDonald, T. WSJ and Right-Wing Outlets Hype Dubious Study Criticizing Electric Vehicles. Media Matters for America. Available online: https://www.mediamatters.org/wall-street-journal/wsj-and-right-wing-outlets-hype-dubious-study-criticizing-electric-vehicles (accessed on 22 February 2021).

- Rinallo, D.; Basuroy, S. Does advertising spending influence media coverage of the advertiser? J. Mark. 2009, 73, 33–46. [Google Scholar] [CrossRef]

- Beattie, G.; Durante, R.; Knight, B.G.; Sen, A. Advertising Spending and Media Bias: Evidence from News Coverage of Car Safety Recalls. SSRN Electron. J. 2017. [Google Scholar] [CrossRef]

- Germar, M.; Albrecht, T.; Voss, A.; Mojzisch, A. Social conformity is due to biased stimulus processing: Electrophysiological and diffusion analyses. Soc. Cogn. Affect. Neurosci. 2016, 11, 1449–1459. [Google Scholar] [CrossRef] [PubMed]

- Cherchi, E. A stated choice experiment to measure the effect of informational and normative conformity in the preference for electric vehicles. Transp. Res. Part A Policy Pract. 2017, 100, 88–104. [Google Scholar] [CrossRef]

- Mallinson, D.J.; Hatemi, P.K. The effects of information and social conformity on opinion change. PLoS ONE 2018, 13, e0196600. [Google Scholar] [CrossRef] [PubMed]

- Morecroft, J.D.W. Strategic Modelling and Business Dynamics a Feedback Systems Approach, 2nd ed.; Wiley: Hoboken, NJ, USA, 2015. [Google Scholar] [CrossRef]

- Struben, J.; Sterman, J.D. Transition challenges for alternative fuel vehicle and transportation systems. Environ. Plan B Plan Des. 2008, 35, 1070–1097. [Google Scholar] [CrossRef]

- Hertzke, P.; Müller, N.; Schenk, S.; Wu, T. The Global Electric-Vehicle Market Is Amped Up and on the Rise, Report for McKinsey & Company-Center for Future Mobility. 2018. Available online: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-global-electric-vehicle-market-is-amped-up-and-on-the-rise (accessed on 5 May 2021).

- Struben, J. The Diffusion of Complex Market Technologies: Multifaceted Dynamics for Alternative Fuel Vehicles. In Proceedings of the 2008 Industry Studies Conference Paper, Boston, MA, USA, 1–2 May 2008; Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1135732 (accessed on 22 February 2021).

- Kristensen, F.S.; Thomassen, M.L.; Jakobsen, L.H. The Norwegian EV Initiative. Report for European Commission, Brussels. Available online: https://jiip.eu/mop/wp/wp-content/uploads/2018/09/NO_Electric-Vehicles-Initiative_SkovKristensenLaugeThomassenJakobsen.pdf (accessed on 22 February 2021).

- Figenbaum, E.; Kolbenstvedt, M.; Elvebakk, B. Electric Vehicles—Environmental, Economic and Practical Aspects—As Seen by Current and Potential Users TØI Report 1329/2014. Oslo. 2014. Available online: https://www.toi.no/getfile.php/Publikasjoner/TØIrapporter/2014/1329-2014/1329-2014-el.pdf (accessed on 22 February 2021).

- Ofcom, U.K. News Consumption in the UK, 2020. Report by Jigsaw Research for UK Office of Communication. Available online: https://www.ofcom.org.uk/home (accessed on 14 September 2021).

- Roy Morgan Research. Cross Platform Audiences. 2021. Available online: http://www.roymorgan.com/findings/8707-roy-morgan-cross-platform-audiences-march-2021-202105240628 (accessed on 9 September 2021).

- Best, A.; Holmes, B. Systems thinking, knowledge and action: Towards better models and methods. Evid. Policy A J. Res. Debate Pract. 2010, 6, 145–159. [Google Scholar] [CrossRef]

- Gardner, J.; Quezada, G.; Paevere, P. Social Study on Attitudes, Drivers and Barriers to the Uptake of Electric Vehicles, (An Electric Driveway Project Report); Commonwealth Scientific and Industrial Research Organisation (CSIRO): Canberra, Australia, 2011; Report Number: EP113815; Available online: Chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/viewer.html?pdfurl=https%3A%2F%2Fpublications.csiro.au%2Frpr%2Fdownload%3Fpid%3Dcsiro%3AEP113815%26dsid%3DDS3&clen=528259 (accessed on 22 August 2021).

- Larson, P.D.; Viáfara, J.; Parsons, R.V.; Elias, A. Consumer attitudes about electric cars: Pricing analysis and policy implications. Transp. Res. Part A Policy Pract. 2014, 69, 299–314. [Google Scholar] [CrossRef]

- Morton, C.; Anable, J.; Nelson, J.D. Consumer structure in the emerging market for electric vehicles: Identifying market segments using cluster analysis. Int. J. Sustain. Transp. 2017, 11, 443–459. [Google Scholar] [CrossRef]

- Kotler, P.; Zaltman, G. Social Marketing: An approach to planned social change. J. Mark. 1971, 35, 3–12. [Google Scholar] [CrossRef]

- Jenn, A.; Lee, J.H.; Hardman, S.; Tal, G. An in-depth examination of electric vehicle incentives: Consumer heterogeneity and changing response over time. Transp. Res. Part A Policy Pract. 2020, 132, 97–109. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations, 5th ed.; Simon and Schuster: New York, NY, USA, 2003. [Google Scholar]

- Zarazua de Rubens, G. Who will buy electric vehicles after early adopters? Using machine learning to identify the electric vehicle mainstream market. Energy 2019, 172, 243–254. [Google Scholar] [CrossRef]

- Bator, F.M. The Anatomy of Market Failures. Q. J. Econ. 1958, 72, 351–379. [Google Scholar] [CrossRef]

- Harding, R.; Hendriks, C.M.; Faruqi, M. Environmental Decision-Making: Exploring Complexity and Context; Federation Press: Sydney, Australia, 2009. [Google Scholar]

- Cresswell, J.W.; Poth, C.N. Qualitative Inquiry and Research Design, 4th ed.; Sage Publications, Inc.: Thousand Oaks, CA, USA, 2018. [Google Scholar]

- Bryman, A. Social Research Methods, 4th ed.; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Twyman, J. Getting It Right: YouGov and Online Survey Research in Britain. J. Elect. Public Opin. Parties 2008, 18, 343–354. [Google Scholar] [CrossRef]

- Brand, C.; Cluzel, C.; Anable, J. Modeling the uptake of plug-in vehicles in a heterogeneous car market using a consumer segmentation approach. Transp. Res. Part A Policy Pract. 2017, 97, 121–136. [Google Scholar] [CrossRef]

- Pearson, K.X. On the criterion that a given system of deviations from the probable in the case of a correlated system of variables is such that it can be reasonably supposed to have arisen from random sampling. London, Edinburgh. Dublin Philos. Mag. J. Sci. 1900, 50, 157–175. [Google Scholar] [CrossRef]

- Hay, I. (Ed.) Qualitative Research Methods in Human Geography, 2nd ed.; Oxford University Press: Melbourne, Australia, 2005. [Google Scholar]

- Holm, S. Board of the Foundation of the Scandinavian Journal of Statistics a Simple Sequentially Rejective Multiple Test Procedure Author(s): Sture Holm Published by: Wiley on behalf of Board of the Foundation of the Scandinavian. J. Stat. Stable U. Scand. J. Stat. 1979, 6, 65–70. [Google Scholar]

- Christensen, R.H.B. Analysis of Ordinal Data with Cumulative Link Models-Estimation with the R Package Ordinal. 2015. Available online: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/viewer.html?pdfurl=https%3A%2F%2Fcran.r-project.org%2Fweb%2Fpackages%2Fordinal%2Fvignettes%2Fclm_article.pdf&clen=351531&chunk=true (accessed on 25 May 2021).

- Liao, F.; Molin, E.; van Wee, B. Consumer preferences for electric vehicles: A literature review. Transp. Rev. 2017, 37, 252–275. [Google Scholar] [CrossRef]

- Otieno, C.; Spada, H.; Renkl, A. Effects of news frames on perceived risk, emotions, and learning. PLoS ONE 2013, 8, e79696. [Google Scholar] [CrossRef][Green Version]

- Liebrecht, C.; Hustinx, L.; van Mulken, M. The Relative Power of Negativity: The Influence of Language Intensity on Perceived Strength. J. Lang. Soc. Psychol. 2019, 38, 170–193. [Google Scholar] [CrossRef]

- Soroka, S.N. Good news and bad news: Asymmetric responses to economic information. J. Politics 2006, 68, 372–385. [Google Scholar] [CrossRef]

- Drive Electric. EV Models and Where to Buy. Available online: https://driveelectric.org.nz/individuals/ev-models-and-where-to-buy/ (accessed on 22 February 2021).

- Hasan, M.A.; Frame, D.J.; Chapman, R.; Archie, K.M. Costs and emissions: Comparing electric and petrol-powered cars in New Zealand. Transp. Res. Part D Transp. Environ. 2021, 90, 102671. [Google Scholar] [CrossRef]

- Mack, A. Inattentional Blindness: Looking Without Seeing. Curr. Dir. Psychol. Sci. 2003, 12, 180–184. [Google Scholar] [CrossRef]

- Westin, K.; Jansson, J.; Nordlund, A. The importance of socio-demographic characteristics, geographic setting, and attitudes for adoption of electric vehicles in Sweden. Travel Behav. Soc. 2018, 13, 118–127. [Google Scholar] [CrossRef]

- Barton, B. Electric vehicles policy announcement. N. Z. Law J. 2016, 1, 268–270. Available online: https://hdl.handle.net/10289/11146 (accessed on 25 May 2021).

- NZ Transport Agency. Clean Car Discount. Available online: https://www.nzta.govt.nz/vehicles/clean-car-programme/clean-car-discount (accessed on 8 August 2021).

- Lieven, T. Policy measures to promote electric mobility-A global perspective. Transp. Res. Part A Policy Pract. 2015, 82, 78–93. [Google Scholar] [CrossRef]

- Friis, F. An alternative explanation of the persistent low EV-uptake: The need for interventions in current norms of mobility demand. J. Transp. Geogr. 2020, 83, 102635. [Google Scholar] [CrossRef]

- Nab, M.; Jansma, S.; Gosselt, J. Tell me what is on the line and make it personal: Energizing Dutch homeowners through message framing. Energy Res. Soc. Sci. 2020, 70, 101760. [Google Scholar] [CrossRef]

- Kurani, K.S.; Caperello, N.; Tyree-Hageman, J.; Davies, J. Symbolism, signs, and accounts of electric vehicles in California. Energy Res. Soc. Sci. 2018, 46, 345–355. [Google Scholar] [CrossRef]

- European Commission, 2021. Norway Incentives Eur. Altern. Fuels Obs. Available online: https://www.eafo.eu/countries/norway/1747/incentives (accessed on 22 February 2021).

- Schmidt, B. Jacinda Ardern to Get All-Electric Audi e-Tron to Replace Diesel Fleet Car, the Driven. Available online: https://thedriven.io/2020/10/26/jacinda-ardern-to-get-all-electric-audi-e-tron-to-replace-diesel-fleet-car/ (accessed on 22 February 2021).

- Ingeborgrud, L.; Ryghaug, M. The role of practical, cognitive and symbolic factors in the successful implementation of battery electric vehicles in Norway. Transp. Res. Part A Policy Pract. 2019, 130, 507–516. [Google Scholar] [CrossRef]

- Legros, S.; Cislaghi, B. Mapping the Social-Norms Literature: An Overview of Reviews. Perspect. Psychol. Sci. 2020, 15, 62–80. [Google Scholar] [CrossRef] [PubMed]

- Nayum, A.; Klockner, C.A. A comprehensive socio-psychological approach to car type choice. J. Environ. Psychol. 2014, 40, 401–411. [Google Scholar] [CrossRef]

- Bennett, R.; Kottasz, R.; Shaw, S. Factors potentially affecting the successful promotion of electric vehicles. J. Soc. Mark. 2016, 6, 62–82. [Google Scholar] [CrossRef]

- Figenbaum, E. Perspectives on Norway’s supercharged electric vehicle policy. Environ. Innov. Soc. Transit. 2017, 25, 14–34. [Google Scholar] [CrossRef]

| Question Number | Question Text |

|---|---|

| A8 | When you are considering what to buy for your next car, how much research do you do to familiarise yourself with changes in market offerings? Choose the most appropriate response. 1: Very little, I just buy something similar to last time 2: I rely on the car sales staff at the dealership 3: I do a lot of research 4: I rely on discussions with family and friends 5: I rely on someone else to choose and buy the car 6: Other—please specify |

| A13 | From which single source do you get MOST of your information about new car models coming onto the market? Choose the source you use most often. 1: friends and family, that is by word of mouth 2: written sources: newspapers/magazines (print or online), including manufacturers websites 3: Social media (e.g., Facebook) 4: AANZ 5: Television 6: radio 7: Car sales staff 8: Other- please specify 9: I am not really interested in finding out about cars |

| A14 | Thinking of the written media (print or online) including newspapers and magazines, please indicate the sources you READ most often to update your knowledge about cars. Please select up to 3 options 1: AANZ; 2: New Zealand Herald; 3: Dominion Post; 4: The Press; 5: Otago Daily Times; 6: Waikato Times; 7: NZ Autocar; 8: Autotrader; 9: Driven NZ; 10: Stuff Motoring News; 11: International online sources; 12: Social media; 13: Other—please specify; 14: I rarely, if ever, read about cars |

| A21 | Please write down three words (or short phrases) that pop into your head that you would use to describe electric vehicles. EVs are…..[open] |

| Initiatives | The following list shows the initiatives that New Zealand has taken to increase the popularity of electric cars (EVs) 1: EV Ride and Drive events where you can see and drive EVS 2: Importation of good quality second-hand EVs from Japan and UK permitted 3: First registration tax exemption for EVs (until 2021) 4: Allowed EVs to use lanes normally reserved for buses or vehicles with multiple occupants 5: Provision of a website with lots of information about EVs, including a list of car dealers who sell EVs 6: Support for the installation of a network of fast chargers about NZ 7: Smart phone app called EV Roam to enable motorists to find EV recharger locations 8: contestable fund that offers grants to help organisations, including charities, to buy EVs or install rechargers, or other initiative to increase EV uptake 9: From 2021, the proposed clean car discount would subsidise the purchase price of cars with low emissions whereas the first registration fee of cars with high emissions would pay an additional registration fee 10: From 2021, the proposed clean car standard would require vehicle importers to reduce the average emissions of their imports by increasing the number of cleaner cars they import |

| A22 | Please choose as many of the initiatives [from 1–10 listed above] that you have heard or read about, [or], 11: I have not heard or read about any of these initiatives |

| A23 | Please choose the three most appealing to you [from 1–10 listed above] as a consumer that might help persuade you to buy an EV, [or], 11: don’t know 12: I would never buy an EV |

| A15-1 | On a scale of 1–5 where 1 represents not likely, 3 represents neutral and 5 represents very likely, how likely are you to buy a …? Fully electric car (BEV) |

| A15-2 | Plug in Hybrid (PHEV) |

| A17 | When thinking about car purchase, please consider the following qualities and indicate on a scale from 1–5 how important each factor is to you when thinking whether to go electric or not |

| A17-2 | Vehicle purchase price |

| A17-3 | Total ownership cost savings of EVs over time compared to conventional cars e.g., due to fuel cost savings |

| A17-7 | The expected life of the battery |

| A18 | How do you think, overall, are EVs portrayed in the media: 1 = very negative; 2 = negative; 3 = middle, there is a mix of positive and negative; 4 = positive; 5 = very positive; 6 = I haven’t noticed any stories in the media about electric cars |

| A24 | ICEV: Complete this statement: I would be more likely to buy an EV if…(open) EV: The main reason I bought a plug-in electric car is… (short answer) |

| A16 | When thinking about electric cars, which of the following statements most closely matches your thoughts about buying an EV? 1: It’s about time, why wouldn’t you 2: Yes please, it would save how much fuel? 3: Yes please, but make it a plug-in hybrid for now 4: Great idea but where would I charge it? 5 If everyone else is, then maybe…. 6: Will they save the planet? Don’t think so. 7: I would never be seen in one of those 8: I do a lot of driving, convince me 9: Don’t know |

| Media Outlet | Readership Numbers/Week | No. EV Articles Analysed | Framing % | ||

|---|---|---|---|---|---|

| + | 0 | – | |||

| Automobile Association of NZ | 416,000 a | 63 | 79 | 21 | 0 |

| NZ Herald | 1,844,000 a | 446 | 65 | 27 | 8 |

| Driven NZ (classifieds + news) | 111,000 b | 501 | 70 | 25 | 5 |

| Otago Daily Times | 253,000 a | 101 | 85 | 13 | 3 |

| The Press | 314,000 a | 387 | 71 | 22.5 | 6.5 |

| Waikato Times | 214,000 a | 246 | 58 | 38 | 4 |

| Dominion Post | 432,000 a | 424 | 61 | 34 | 5 |

| NZ Autocar magazine | 14,000 a | 332 | 84 | 11 | 5 |

| NZ Autotrader (classifieds + news) | N/A | 56 | 91 | 9 | 0 |

| Stuff Motoring c | 208,750 c | 43 | 58 | 26 | 16 |

| Question Number | Issue | n | Method | Test Statistic | df | p-Value |

|---|---|---|---|---|---|---|

| Gender | Gender | 748 | Chisq | 54.7 | 3 | <0.0001 |

| Age group 1 | Age | 749 | Chisq | 66.5 | 18 | <0.0001 |

| D6 | Education level (School/vocation/university) | 741 | Chisq | 29.7 | 6 | 0.0003 |

| D10 | Cars in household (1 or 2+) | 749 | Chisq | 39.6 | 3 | <0.0001 |

| A3 | Purchase new or used | 623 | Chisq | 3.2 | 3 | 0.3576 |

| A5 | Frequency of trips > 150 km | 749 | Chisq | 32.5 | 12 | 0.0059 |

| A6 | Amount willing to spend on car | 728 | Chisq | 50.7 | 3 | <0.0001 |

| A8 | Amount of research when buying car | 749 | Chisq | 98.6 | 3 | <0.0001 |

| A13 | Primary information source | 695 | Chisq | 189.4 | 18 | <0.0001 |

| A14_Magazines | Researches in car magazines | 749 | Chisq | 5.0 | 3 | 0.3433 |

| A14_Newspaper | Researches in newspapers | 749 | Chisq | 10.2 | 3 | 0.0676 |

| A14_Online | Researches international online or social media | 749 | Chisq | 142.8 | 3 | <0.0001 |

| A14_14 | Rarely reads about cars | 749 | Chisq | 42.6 | 3 | <0.0001 |

| A18 | Perception of media portrayal about cars | 717 | Chisq | 162.2 | 12 | <0.0001 |

| A22_11 | Have not heard of EV initiatives | 749 | Chisq | 143.9 | 3 | <0.0001 |

| P1 | 2017 Election Party vote | 583 | Chisq | 123.9 | 6 | <0.0001 |

| A23_12 a | I would never buy an EV | 749 | Chisq | 84.9 | 2 | <0.0001 |

| P4 | Household income | 676 | Chisq | 35.3 | 21 | 0.0786 |

| Word use | Negative word association with EVs | 749 | Chisq | 294.0 | 3 | <0.0001 |

| Word use | Expensive | 749 | Chisq | 76.7 | 3 | <0.0001 |

| Word use | Economical | 749 | Chisq | 79.2 | 3 | <0.0001 |

| Word use | Low-range | 749 | Chisq | 54.1 | 3 | <0.0001 |

| Word use | Ecofriendly | 749 | Chisq | 22.9 | 3 | <0.0001 |

| Word use | Fun | 749 | Chisq | 11.7 | 3 | <0.0001 |

| A15_1 | Likelihood of buying BEV | 731 | ANOVA | 22.9 | 3 | <0.0001 |

| A15_2 | Likelihood of buying PHEV | 730 | ANOVA | 33.3 | 3 | <0.0001 |

| A17_1 | Importance of vehicle range | 743 | ANOVA | 66.7 | 3 | <0.0001 |

| A17_2 | Importance of purchase price | 749 | ANOVA | 267.2 | 3 | <0.0001 |

| A17_3 | Importance of total ownership costs | 740 | ANOVA | 266.4 | 3 | <0.0001 |

| A17_4 | Importance of suitable EV model | 746 | ANOVA | 156.3 | 3 | <0.0001 |

| A17_5 | Importance of cheaper servicing costs | 709 | ANOVA | 34.9 | 3 | <0.0001 |

| A17_6 | Importance of fast charger network | 737 | ANOVA | 41.3 | 3 | <0.0001 |

| A17_7 | Importance of battery life | 740 | ANOVA | 48.2 | 3 | <0.0001 |

| A22_count | How many initiatives heard of | 749 | ANOVA | 160.5 | 3 | <0.0001 |

| Factor | EV Owners n = 305 | EV Positives n = 154 | EV Anxious n = 201 | EV Pessimists n = 89 |

|---|---|---|---|---|

| Likelihood of buying BEV (A15_1) Mean Likert Scores 1–5 | 4.82 | 3.33 | 2.5 | 1.9 |

| Likelihood of buying PHEV (A15_2) Mean Likert Scores 1–5 | 1.97 | 3.14 | 3.49 | 2.19 |

| Perception of how the media portray EVs (A18) Mean Likert Scores 1–5 | 3.05 | 3.99 | 3.78 | 3.38 |

| “I have not noticed any stories in the media about EVs” (A18_6) Percentage | 1.3% | 7.1% | 6% | 5.6% |

| “I rarely if ever read about cars” (A14_14) Percentage | 11.1% | 26% | 31.8% | 36% |

| Initiative | EV Owners | EV Positives | EV Anxious | EV Pessimists | ||||

|---|---|---|---|---|---|---|---|---|

| Aware | Desirable | Aware | Desirable | Aware | Desirable | Aware | Desirable | |

| EV Ride and Drive Events | 84.3 | 18.4 | 9.1 | 11.0 | 9.5 | 11.9 | 6.7 | 12.4 |

| Importation 2nd hand EVs | 85.6 | 40.7 | 18.8 | 36.4 | 18.4 | 36.8 | 12.4 | 24.7 |

| First registration tax exemption till 2021 | 45.2 | 14.4 | 18.8 | 29.2 | 11.9 | 24.7 | 16.9 | 15.7 |

| EV use of HOV lanes | 61.0 | 10.2 | 13.6 | 25.3 | 11.4 | 21.4 | 12.4 | 20.2 |

| Information website | 43.0 | 4.9 | 14.3 | 17.5 | 11.4 | 17.4 | 6.7 | 15.7 |

| Nation-wide fast charge network | 87.5 | 53.4 | 35.7 | 48.1 | 38.3 | 56.2 | 36.0 | 22.5 |

| Smart phone app for recharger locations | 27.9 | 3.6 | 20.8 | 33.1 | 17.9 | 36.8 | 12.4 | 18.0 |

| Contestable fund for EV grants | 59.7 | 13.4 | 7.8 | 11.5 | 6.5 | 7.5 | 6.7 | 4.5 |

| Proposed Clean Car Discount | 73.8 | 29.2 | 30.5 | 51.3 | 30.3 | 42.8 | 23.6 | 31.5 |

| Proposed Clean Car Standard | 49.5 | 12.5 | 24.7 | 20.8 | 21.4 | 14.9 | 13.5 | 6.7 |

| I am not aware of any initiatives | 0.7 | 35.1 | 38.3 | 41.6 | ||||

| Don’t know | 5.9 | 3.2 | 8.5 | 12.4 | ||||

| I would never buy an EV | 1.9 | 1.5 | 30.3 | |||||

| I would have bought an EV anyway | 52.1 | |||||||

| Question | n | Test Statistic | df | p-Value |

|---|---|---|---|---|

| A16_Driver Type, attitude to EVs | 731 | 409.2 | 4 | <0.0001 |

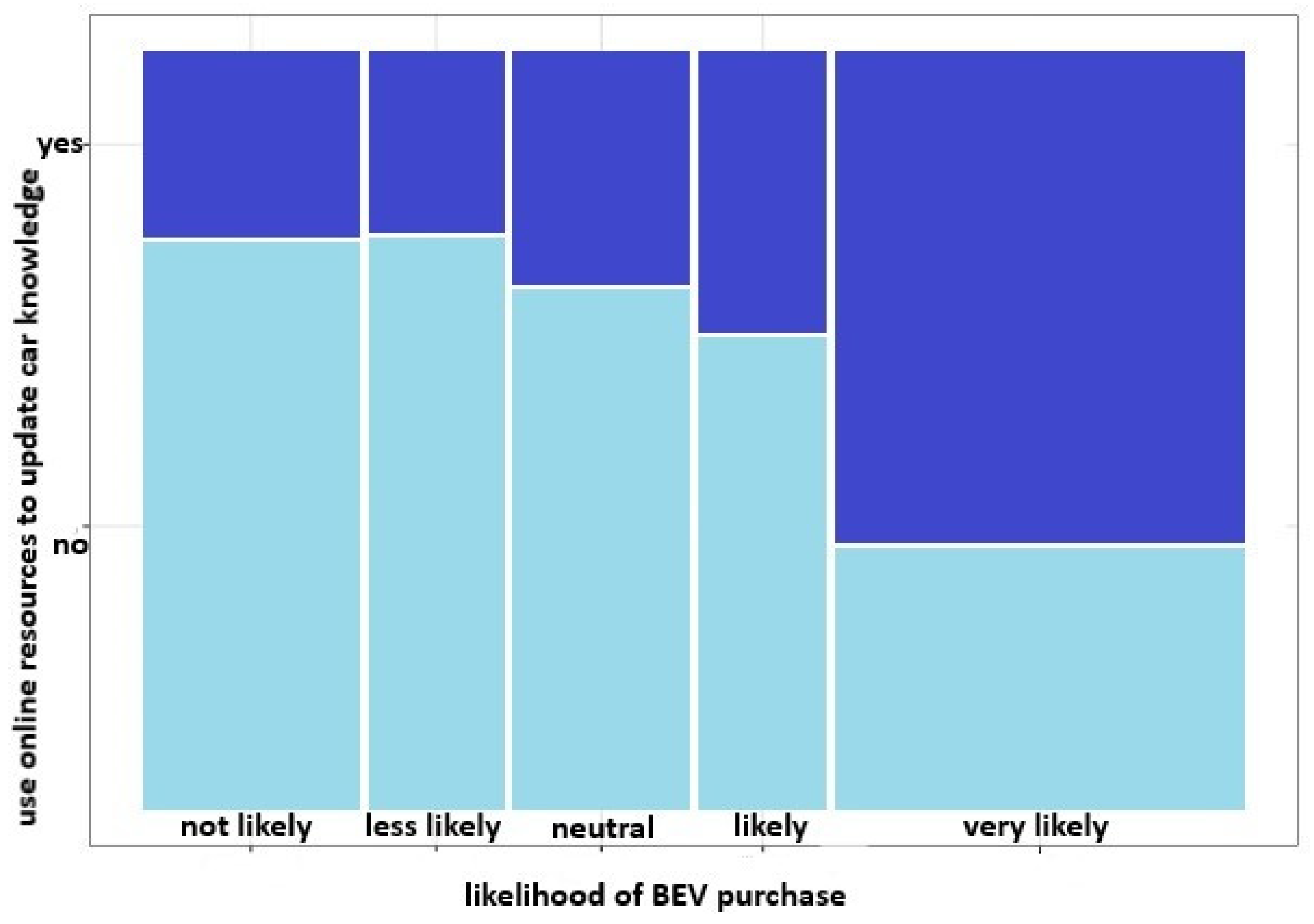

| A8_Car buyer does a lot of research or not | 861 | 78.6 | 1 | <0.0001 |

| A13_ Info source | 799 | 132.3 | 7 | <0.0001 |

| A14_Car Magazine | 861 | 0.2 | 1 | 1 |

| A14_Newspaper | 861 | 0.1 | 1 | 1 |

| A14_Online | 861 | 107.0 | 1 | <0.0001 |

| A14_14 rarely read car articles | 861 | 42.8 | 1 | <0.0001 |

| A18 Media portrayal perception | 814 | 54.7 | 5 | <0.0001 |

| A22_11 Not heard of initiatives | 861 | 170.8 | 1 | <0.0001 |

| A22_count number initiatives aware of | 861 | 313.2 | 1 | <0.0001 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Broadbent, G.H.; Wiedmann, T.O.; Metternicht, G.I. Electric Vehicle Uptake: Understanding the Print Media’s Role in Changing Attitudes and Perceptions. World Electr. Veh. J. 2021, 12, 174. https://doi.org/10.3390/wevj12040174

Broadbent GH, Wiedmann TO, Metternicht GI. Electric Vehicle Uptake: Understanding the Print Media’s Role in Changing Attitudes and Perceptions. World Electric Vehicle Journal. 2021; 12(4):174. https://doi.org/10.3390/wevj12040174

Chicago/Turabian StyleBroadbent, Gail Helen, Thomas Oliver Wiedmann, and Graciela Isabel Metternicht. 2021. "Electric Vehicle Uptake: Understanding the Print Media’s Role in Changing Attitudes and Perceptions" World Electric Vehicle Journal 12, no. 4: 174. https://doi.org/10.3390/wevj12040174

APA StyleBroadbent, G. H., Wiedmann, T. O., & Metternicht, G. I. (2021). Electric Vehicle Uptake: Understanding the Print Media’s Role in Changing Attitudes and Perceptions. World Electric Vehicle Journal, 12(4), 174. https://doi.org/10.3390/wevj12040174