Characteristics and Experiences of Ride-Hailing Drivers with Electric Vehicles

Abstract

1. Introduction

2. Materials and Methods

- Who: Who (in terms of basic demographics) is currently driving PEVs on TNCs;

- What: What PEVs they chose and how they acquired them;

- Why: Motivations to drive a PEV for ride-hailing;

- How: Ride-hail driving and PEV charging behaviors;

- What drivers say would better support the use of PEVs for ride-hailing.

3. Results

3.1. Who Is Currently Driving PEVs on TNCs

3.2. What Cars They Chose and How They Acquired Them

- BEV: Range = 50 to 300 miles; mean = 190 miles; median = 210 miles;

- PHEV: Range = 3 to 100 miles; mean = 30 miles; median = 25 miles.

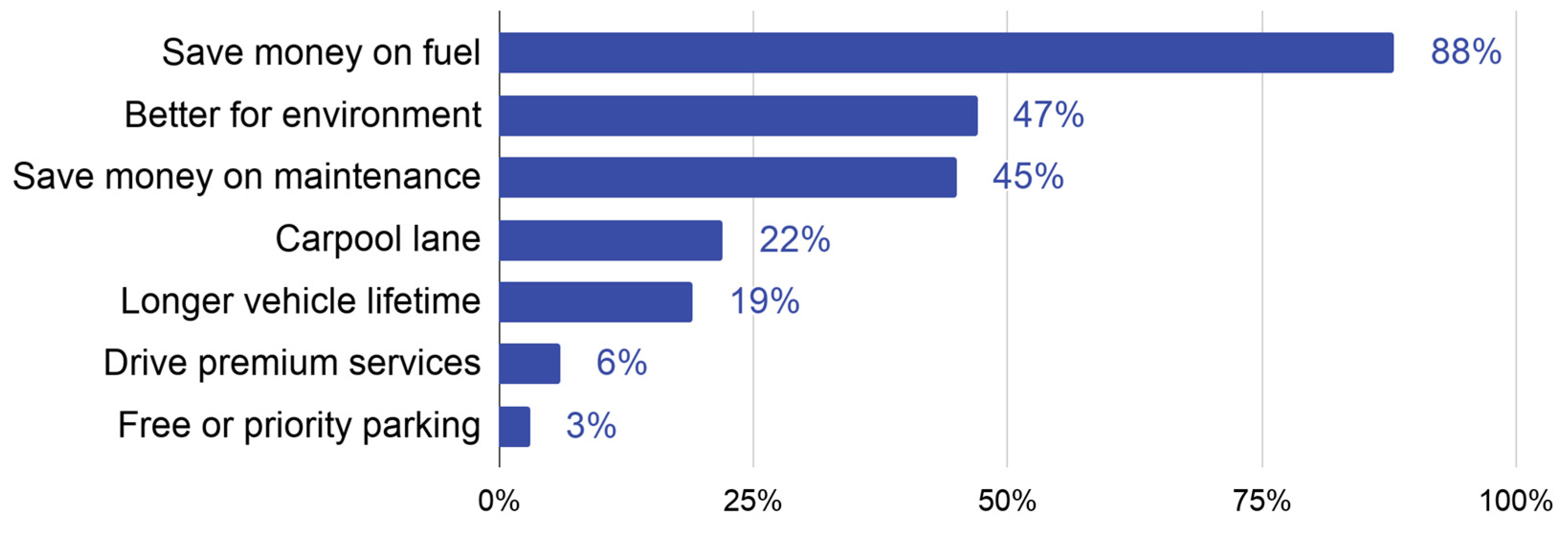

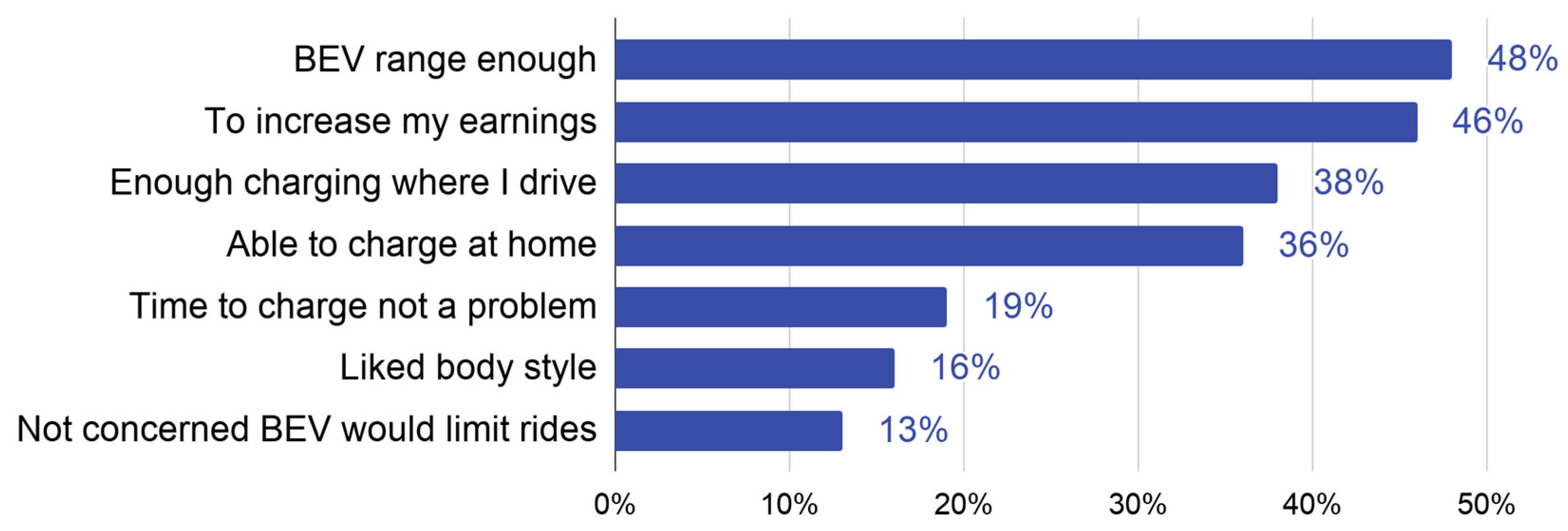

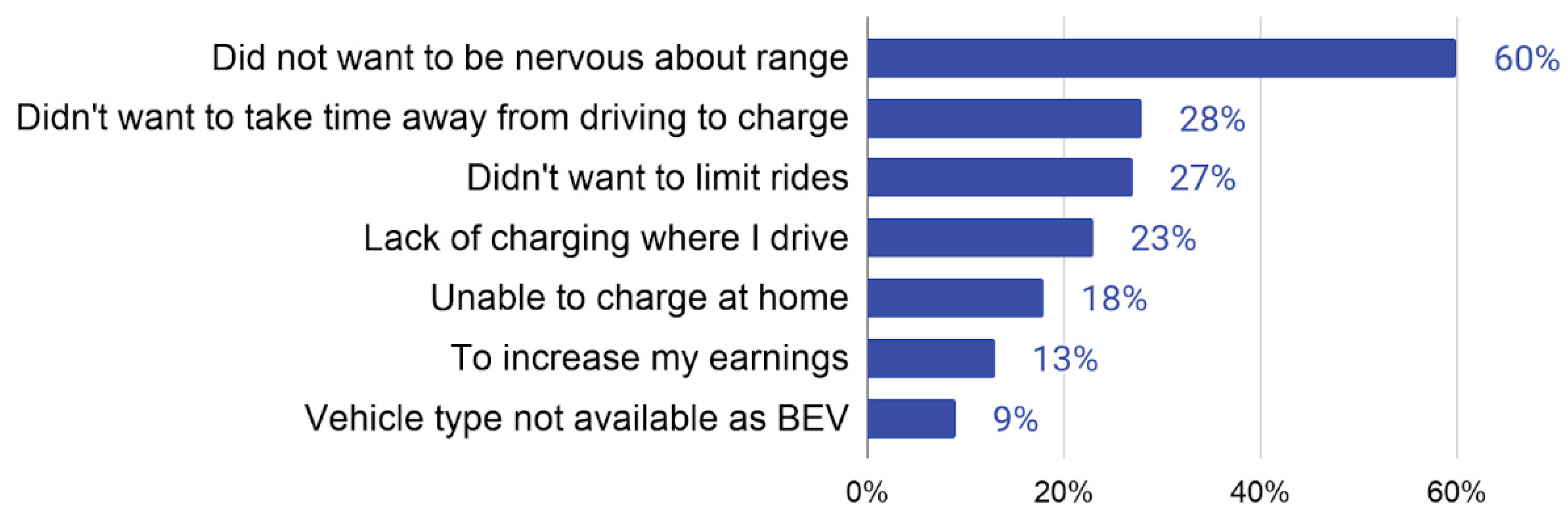

3.3. Why Drive a PEV for Ride-Hailing?

3.4. Ride-Hail Driving and Charging Behaviors

- Time to reach charger: 16–47 min;

- Time waiting in line to charge: 6–28 min;

- Time to charge: 73–176 min;

- Time to next fare: 8–42 min.

3.5. Driver Ideas to Support the Use of PEVs for Ride-Hailing

4. Discussion

- Much more likely to be male than female;

- More likely to live in a household of two or three people in a single-family home they own rather than any other building type or residential tenure;

- Very likely to be between 30 and 60 years old;

- More likely than not to have some level of collegiate education culminating in a Bachelor’s or graduate degree;

- More likely than not to have a household income less than $100,000.

- More likely to drive a PHEV than a BEV;

- Much more likely to own their PEV than to lease or rent;

- Most likely to be driving their first PEV;

- Not likely to drive any other vehicle to provide ride-hailing services.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Ward, J.W.; Michalek, J.J.; Azevedo, I.L.; Samaras, C.; Ferreira, P. Effects of on-demand ridesourcing on vehicle ownership, fuel consumption, vehicle miles traveled, and emissions per capita in US States. Transp. Res. Part C Emerg. Technol. 2019, 108, 289–301. [Google Scholar] [CrossRef]

- Wenzel, T.; Rames, C.; Kontou, E.; Henao, A. Travel and energy implications of ridesourcing service in Austin, Texas. Transp. Res. Part D Transp. Environ. 2019, 70, 18–34. [Google Scholar] [CrossRef]

- Erhardt, G.D.; Roy, S.; Cooper, D.; Sana, B.; Chen, M.; Castiglione, J. Do transportation network companies decrease or increase congestion? Sci. Adv. 2019, 5, eaau2670. [Google Scholar] [CrossRef] [PubMed]

- Henao, A.; Marshall, W.E. The impact of ride-hailing on vehicle miles traveled. Transportation 2019, 46, 2173–2194. [Google Scholar] [CrossRef]

- George, S.R.; Zafar, M. Electrifying the ride-sourcing sector in California. Calif. Public Utilities Comm. 2018. [Google Scholar]

- Alemi, F.; Circella, G.; Mokhtarian, P.; Handy, S. Exploring the latent constructs behind the use of ride-hailing in California. J. Choice Model. 2018, 29, 47–62. [Google Scholar] [CrossRef]

- Roni, M.S.; Yi, Z.; Smart, J.G. Optimal charging management and infrastructure planning for free-floating shared electric vehicles. Transp. Res. Part D Transp. Environ. 2019, 76, 155–175. [Google Scholar] [CrossRef]

- Sheller, M.; Urry, J. Mobilizing the new mobilities paradigm. Appl. Mobilities 2016, 1, 10–25. [Google Scholar] [CrossRef]

- Sperling, D. Three Revolutions: Steering Automated, Shared, and Electric Vehicles to a Better Future; Island Press: Washington, DC, USA, 2018. [Google Scholar]

- Jenn, A. Benefits of Electric Vehicles in Uber and Lyft Services. UC Davis: National Center for Sustainable Transportation. 2019. Available online: https://escholarship.org/uc/item/15s1h1kn (accessed on 6 April 2021).

- Kurani, K.; Hardman, S. Automakers and Policymakers May Be on a Path to Electric Vehicles; Consumers Aren’t. UC Davis Institute of Transportation Studies. 2017. Available online: https://its.ucdavis.edu/blog-post/automakers-policymakers-on-path-to-electricvehicles-consumers-are-not/ (accessed on 6 April 2021).

- Weiss, M.; Zerfass, A.; Helmers, E. Fully electric and plug-in hybrid cars: An analysis of learning rates, user costs, and costs for mitigating CO2 and air pollutant emissions. J. Clean. Prod. 2019, 212, 1478–1489. [Google Scholar] [CrossRef] [PubMed]

- Pavlenko, N.; Slowik, P.; Lutsey, N. When does electrifying shared mobility make economic sense? Int. Counc. Clean Transp. 2019. [Google Scholar]

| Category | Question Prompt | Response Options |

|---|---|---|

| Who | How old are you? | 21 to 29; 30 to 39; 40 to 49; 50 to 59; 60 to 69; 70 or older |

| What is your gender? | Female; Male; Non-binary; Prefer not to answer; Self-describe: (open) | |

| What is the highest level of formal education you personally have completed? | Less than high school; High school or GRE; Some college/no degree; Associate’s degree; Bachelor’s degree; Graduate degree | |

| What was your household’s pre-tax income from all sources for the past tax year? | Slider to select any number between $0 and $200,000 or more; No answer | |

| How would you describe the building in which you live? | Detached single family house; Duplex, row house or townhouse; Apartment or condominium; Mobile home, trailer, recreational vehicle, car, boat or other movable dwelling; Dorm room or fraternity/sorority house; Other | |

| Do you own, rent, or lease the building in which you live? | Own; Rent or lease; Employer-provided; Other | |

| How many people live in your household? | 1; 2; 3; 4; 5; 6; 7; 8 or more | |

| What | What is the PEV that you drive on Uber? | Year, Make, Model, Option |

| Do you own, lease, or rent this [PEV]? | Own, Lease, Rent, Other | |

| Is the [PEV] your first electric vehicle? | Yes, No | |

| Which came first for you, getting an electric vehicle or rideshare driving? | Electric vehicle before I drove rideshare; Rideshare driver before I got an electric vehicle; I am not sure which was first | |

| Why | Why did you choose to drive an electric vehicle for rideshare instead of a conventional gas vehicle? | Choose up to three: To save money on fuel; To save money on maintenance; Longer lifetime of the vehicle; Better for the environment; Carpool lane access; Free or priority parking; Ability to drive for premium service (e.g., Uber Select); Other: |

| Why did you choose to drive a battery electric vehicle for rideshare instead of a plug-in hybrid electric vehicle? (Chose up to three.) | Battery electric vehicle driving range long enough; I’m able to charge at home; Liked the vehicle body style; Enough charging infrastructure where I drive; Time away from driving to charge is not a problem; Not concerned about limiting the rides I could take; To increase my profits from driving on Uber; Other: | |

| Why did you choose to drive a plug-in hybrid electric vehicle for rideshare instead of a battery/all electric vehicle? (Choose up to three.) | Did not want to be nervous about range; Unable to charge vehicle at home; Vehicle body style I wanted not available in a battery electric vehicle; Lack of charging infrastructure where I drive; Didn’t want to take time away from driving to charge; Didn’t want to limit rides I could take; To increase my profits from driving on Uber; None of these; Other: | |

| When you bought/leased/rented/acquired your [PEV] did you compare all costs (purchase, fuel, maintenance, insurance, etc.) of it compared to other vehicles? | Yes; No; Don’t recall | |

| Do you compare all such costs for any car you buy or lease? | Always; Sometimes; Never | |

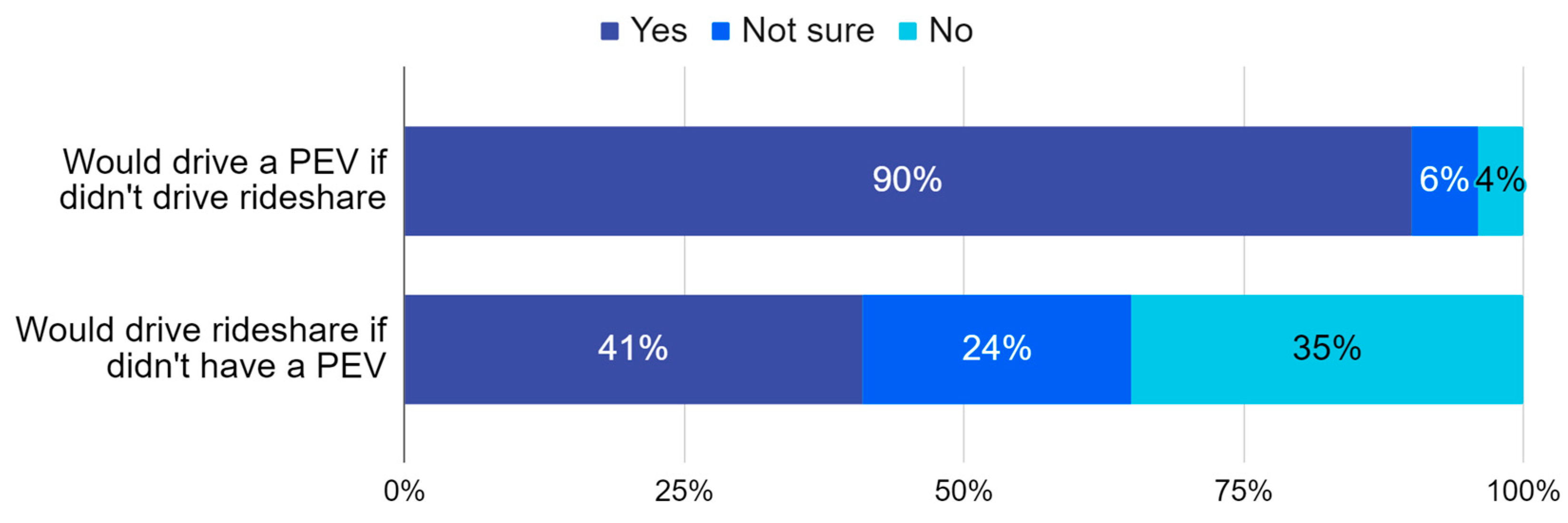

| Would you still drive for rideshare if you could only have a conventional gas vehicle? | Yes; No; Not sure | |

| Would you still drive an electric vehicle if you did not drive on rideshare networks? | Yes; No; Not sure | |

| How | Do you drive for more than one rideshare network (Uber, Lyft, or others)? | Yes; No |

| Besides your [PEV], is there any other vehicle you are presently driving on rideshare networks? | No, only my [PEV]; Yes, I sometimes drive a different vehicle for rideshare | |

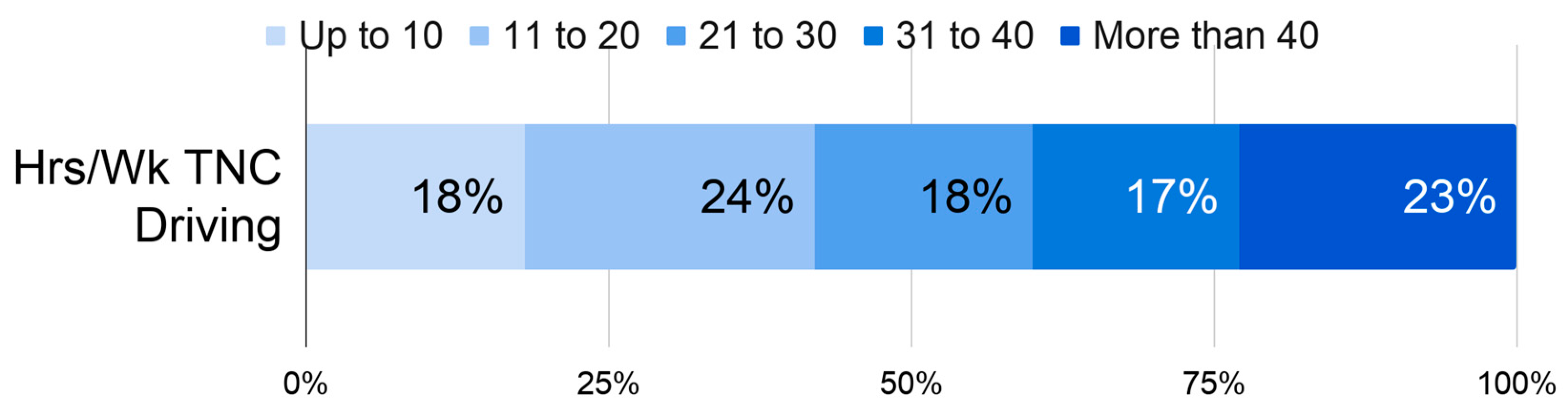

| About how many hours per week do you drive on rideshare networks (Uber, Lyft, and similar)? | Ten or fewer hours; 11–20 h; 21–30 h; 31–40 h; 41 or more hours | |

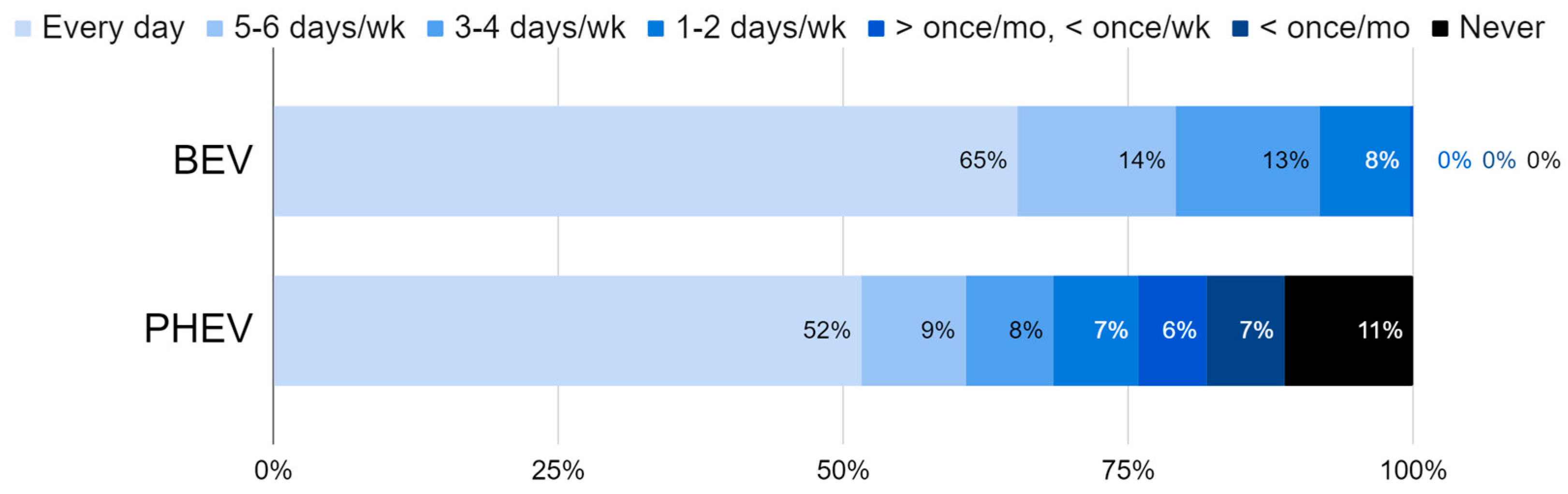

| On how many days do you charge your [PEV]? | I don’t charge my [PEV]; Less than once a month; More than once a month, but less than weekly; One or two days a week; Three or four days a week; Five or six days a week; Every day | |

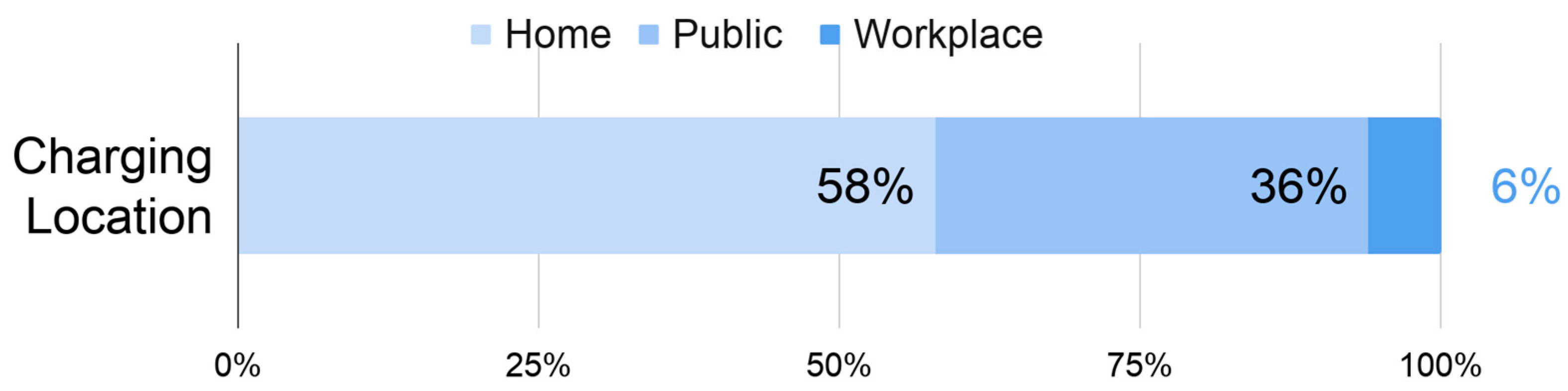

| What percent of all your charging of your [PEV] do you do at home, at public chargers, or at a workplace? | Percentage for each: home, public, workplace; totaling 100 | |

| You’ve indicated you don’t charge your [PEV] at home. Could you charge it at home if you wanted to? | Yes; No; I don’t know | |

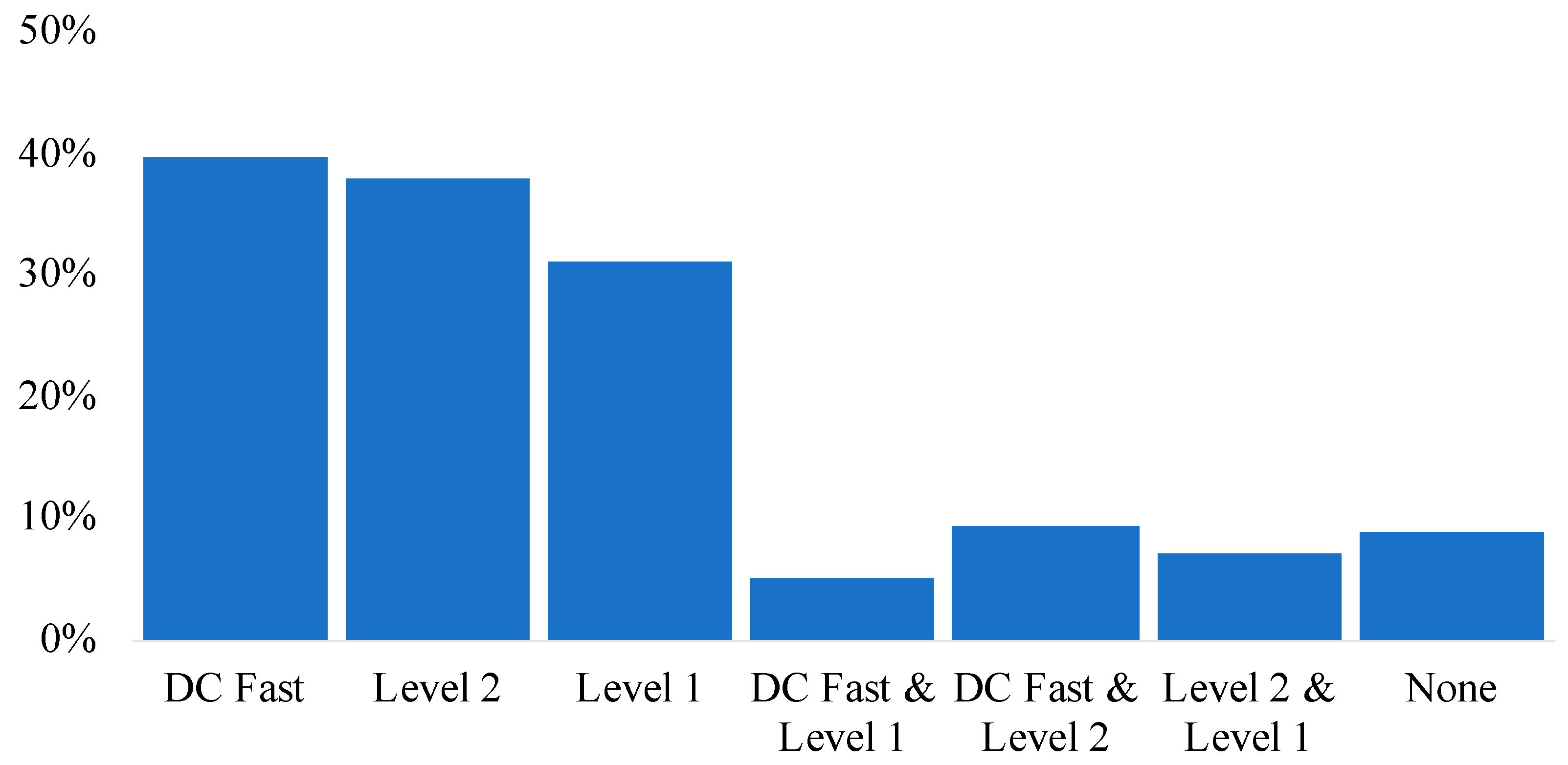

| What percent of all your charging of your [PEV] do you do at different power levels or rates? | Percentage for each: fast, level 1, and level 2 chargers; totaling 100 | |

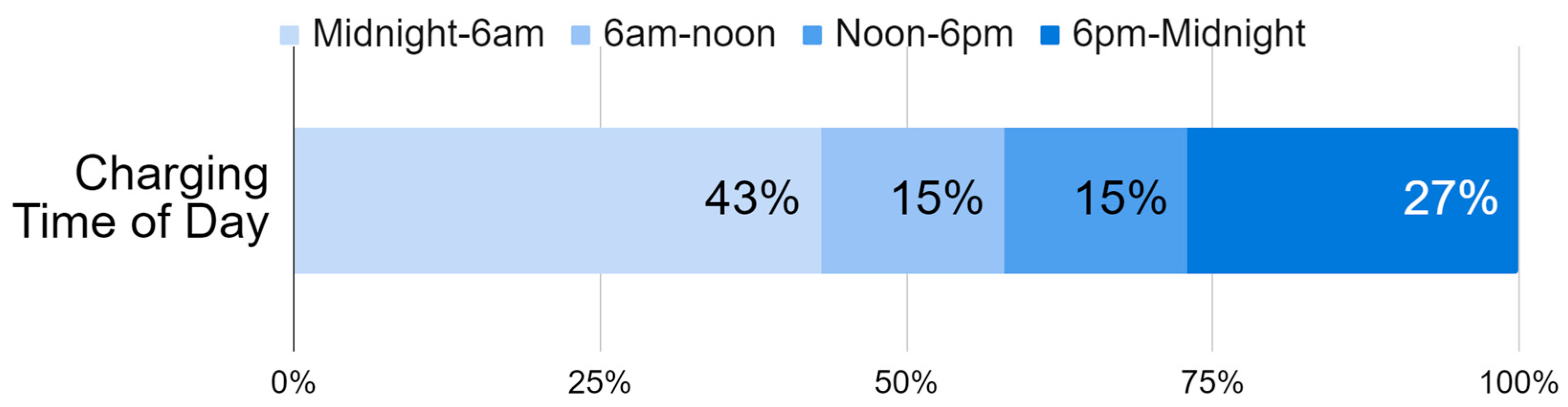

| How much of all your charging of your [PEV] do you do during different periods of the day? | Percentage for each: midnight to 6 a.m. 6 a.m. to noon, noon to 6 p.m., and 6 p.m. to midnight; totaling 100 | |

| What is the largest number of times you will charge your [PEV] during any single period of driving for ridesharing? | None; Once; Twice; Three times or more | |

| Please estimate the time it takes for each of these steps in charging your [PEV]: Time to reach charger location from the moment you decide to charge; Time waiting in line to charge; Time to actually charge your vehicle; Time to get your next ride after charging | Shortest time is about XXX minutes; Longest time is about XXX minutes | |

| Do you feel you miss out on earning opportunities because you have to charge your [PEV]? If so, how often do you feel the missed opportunity? | Not at all; Once per 15 charges or less; Once per 10 charges; Once per 5 charges or more frequent | |

| Do you do any of the following to increase your electric driving range while driving for ridesharing? | Limit top speeds; Moderate accelerations; Try to coast more to stops; Choose trips or routes where I can use less energy; Choose trips or routes where I can use more regenerative braking; Use heating or air conditioning less; Leave more room from car ahead; None of the above; Other: | |

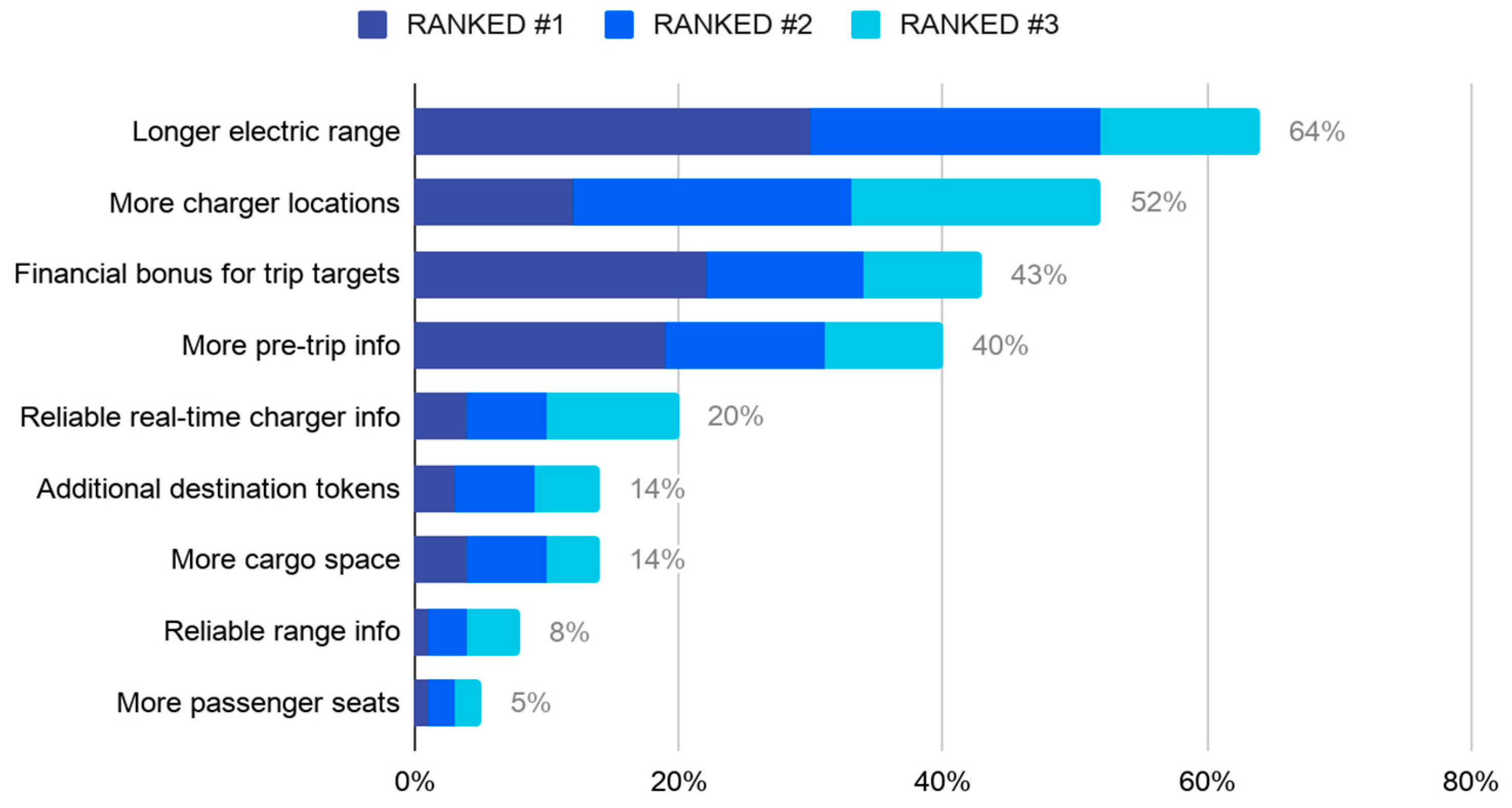

| How would you improve your experience as a rideshare driver with an electric vehicle? | Choose up to three answers: Longer electric driving range; More charger locations; Reliable real-time information about charger availability; More reliable information on vehicle driving range; Additional trip destination setting tokens to and from charging stations; More detailed trip information in advance of trip acceptance; Financial bonuses for completing complete trip target numbers; More passenger seats; More cargo space; Other: |

| Variable | Descriptive Statistics |

|---|---|

| Age | Mdn = 40 to 49 years old; 9% 21 to 29, 27% 30 to 39, 28% 40 to 49, 21% 50 to 59, 10% 60 to 69, 4% 70 or older |

| Gender | 85% Male, 13% Female, 1% Non-binary, 1% Prefer not to answer |

| Education | Mdn = Bachelor’s degree; <1% Less than high school, 9% High school or GRE, 27% Some college/no degree, 11% Associate’s degree, 34% Bachelor’s degree, 18% Graduate degree |

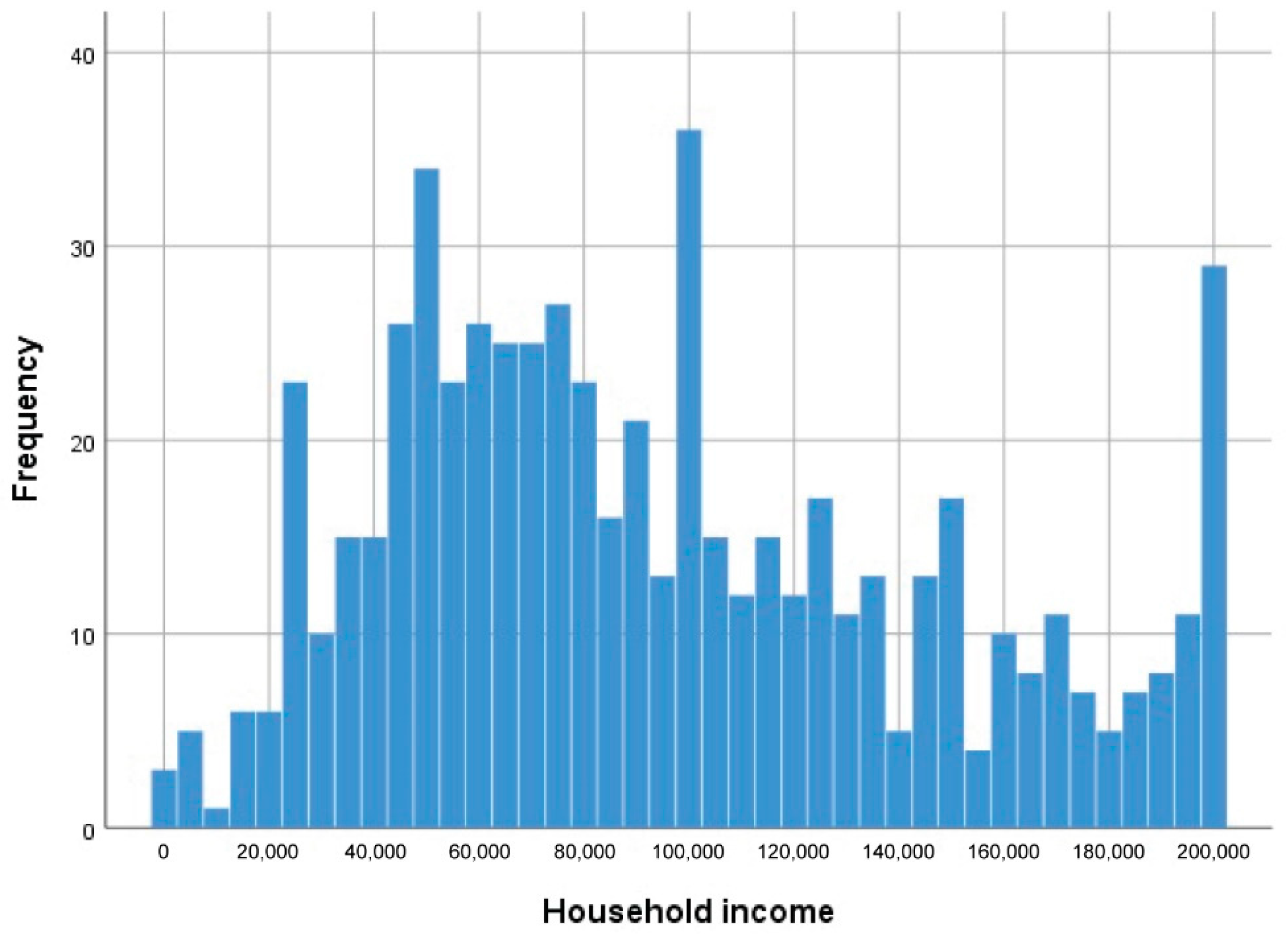

| Income | Mdn = $88,000; min = $1000, max = $200,000 or more; 22% no answer |

| Household Size | Mdn = 3; 15% 1, 31% 2, 20% 3, 18% 4, 12% 5, 3% 6, 1% 7, 1% 8 or more |

| Housing Type | 62% Detached single-family home, 24% Apartment/condo, 12% Duplex/row house/townhouse, 2.5% Mobile/dorm/other |

| Housing Tenure | 55% Own, 43% Rent, 2% Other |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sanguinetti, A.; Kurani, K. Characteristics and Experiences of Ride-Hailing Drivers with Electric Vehicles. World Electr. Veh. J. 2021, 12, 79. https://doi.org/10.3390/wevj12020079

Sanguinetti A, Kurani K. Characteristics and Experiences of Ride-Hailing Drivers with Electric Vehicles. World Electric Vehicle Journal. 2021; 12(2):79. https://doi.org/10.3390/wevj12020079

Chicago/Turabian StyleSanguinetti, Angela, and Kenneth Kurani. 2021. "Characteristics and Experiences of Ride-Hailing Drivers with Electric Vehicles" World Electric Vehicle Journal 12, no. 2: 79. https://doi.org/10.3390/wevj12020079

APA StyleSanguinetti, A., & Kurani, K. (2021). Characteristics and Experiences of Ride-Hailing Drivers with Electric Vehicles. World Electric Vehicle Journal, 12(2), 79. https://doi.org/10.3390/wevj12020079