1. Introduction

Autonomous vehicles (AVs) or smart cars are one of the most trending researches in today’s automotive industry. Smart cars are also one of the greatest applications of the Internet of things (IoT) which havethe ability to send and receive data with other devices both inside and outside the car. The automation has been divided into six levels by the Society of Automotive Engineers (SAE). For levels 0 to 2, the car is controlled fully by the operator. For levels 3 and 4, the operator only controls the car when autonomous mode requests to do so. In level 5, the car is fully automated (driverless cars), and no human intervention is required. Each of these automations provides an entirely different driving experience, especially level 5, by providing a completely different architecture and interfaces as compared to the today’s cars. AV technology also aims to bring a revolution in the mobility ecosystem by reducing the number of accidents and through other benefits, e.g., increased mobility, reduced congestion, etc.

However, along with benefits, AVs also have social, environmental, economic, and security/safety impacts and issues. The safety and security of the AVs are the most critical issues, as they affect human lives directly [

1,

2]. Since 2014, AVs have already been involved in more than 30 accidents [

3]. In February 2016, an accident happened between a Google modified AV and city bus in Mountain View, California [

4]. Similarly, in May 2016, a driver was killed while driving a Tesla Model S AV when it was on autonomous mode, as autopilot could not identify the white side of the truck against the bright sky [

5]. However, the National Highway Traffic Safety Administration (NHTSA) found during the inquiry that there was no defect in the autopilot system. The Tesla smart car hadanother fatal accident in 2018 when the car hit the lane divider (stationary object) and the driver died in hospital [

6]. Similarly, in March 2018, an Uber test vehicle hit a pedestrian in Tempe, Arizona and the woman died. Tesla AV also hit two people in Indianapolis who lost their lives and the inquiry is still underway to find out whether autopilot failed again or not [

4,

5].

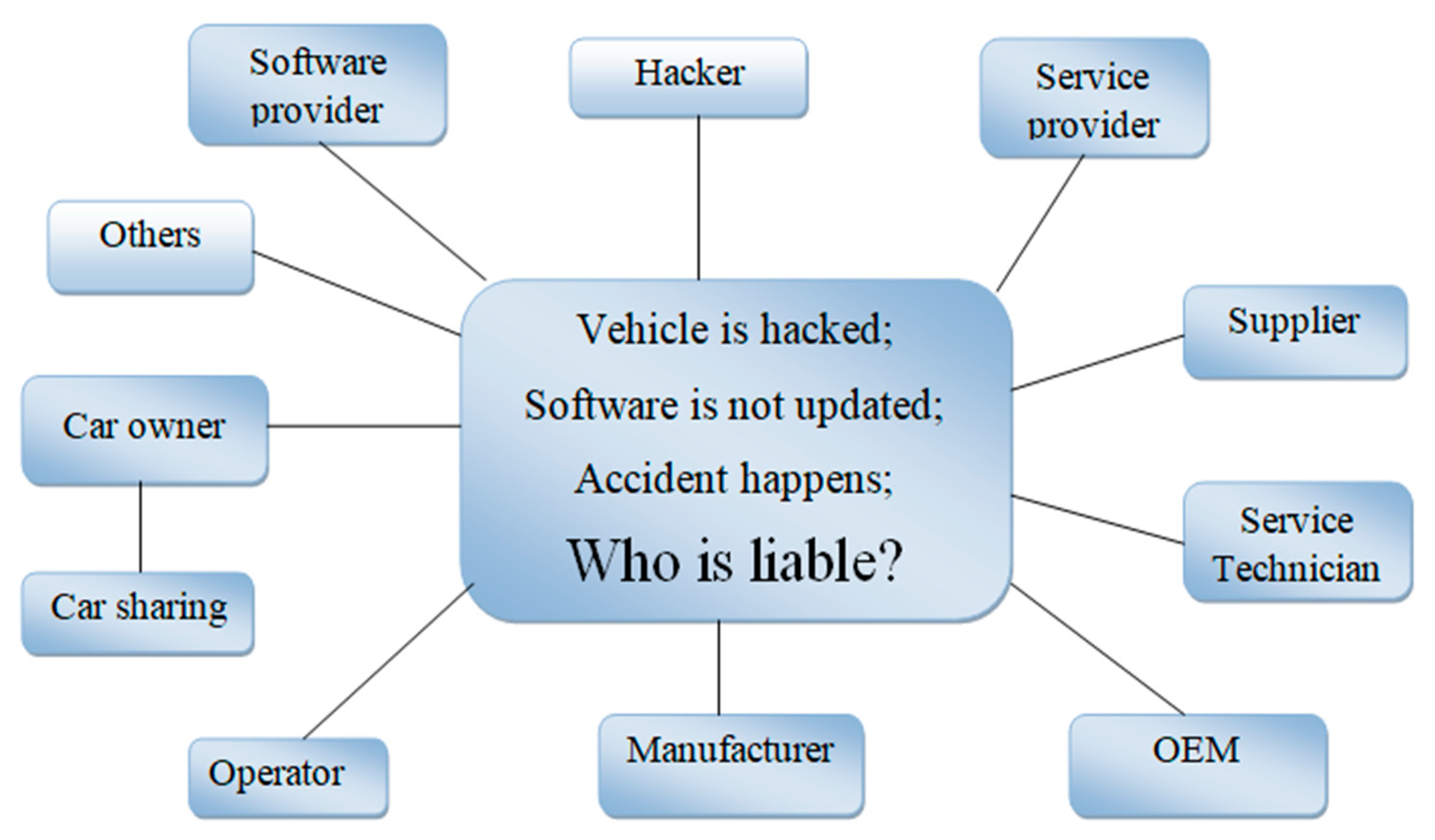

All of these accidents raised serious questions on the safety/security of the smart cars. More importantly, these accidents highlighted the lack of regulations regarding AVs, and these accidents became a touch point for liability discussions: i.e., who will be liable in case of accidents? Will it be the driver (operator) of the vehicle (being not attentive during auto mode), the owner of the vehicle, the manufacturer (product failure), network provider, hacker, original equipment manufacturer (OEM), or someone else, as shown in the

Figure 1? On the other side, if responsibility is shared, how will it be divided? [

7] Similarly, if accidents involve deaths, especially pedestrian death, then different sets of questions may arise: e.g., who will go to court? [

8]. The first known claim against a manufacturer was filed in January 2018, when the motorcyclist alleged that he got injuries after a 2016 Chevy Bolt AV hit him while traveling on a San Francisco street. However, the lawsuit was more like negligence than product failure, treating AV as a human instead of a product [

9].

The issue of liability will also be very critical in future mobility system and it will be very difficult to answer novel and challenging questions involving multiple factors, especially when the car runs entirely on software. Similarly, the liability will also affect the insurance coverage. A survey was performed by KPMG and it is shown in

Table 1 adapted from [

2]. The survey shows that ninety four percent of people consider that finding liability would be the most important component in their AV insurance coverage in future.

Asking people who will be liable in case of AV accident has no clear answer. It really depends on multiple factors, as liability is a broader concept of responsibility and usually multifaceted rather than binary. However, liability can be defined in terms of technical, legal, and moral responsibilities as shown in part 2 of

Figure 2.

Figure 2 also shows the overall structure of the research. Many papers have been written in the past which discuss the liability issues related to AVs in case of accidents. These papers generally discuss one or two aspects of liability, such as legal or moral or product or insurance aspects only [

1,

2,

4,

5,

7,

8,

9,

10,

11,

12]. Therefore, the existing literature does not comprehensively discuss all kinds of liabilities and entities involved in the case of an accident. Keeping in view of this shortcoming, this research provides a comprehensive overview and analysis of all kinds of liabilities and entities and their relation with each other as shown in part 2 of

Figure 2.

The remainder of the paper is organized as follows:

Section 1 describes legal liabilities.

Section 2 describes moral liabilities.

Section 3 describes technical liabilities.

Section 4 discusses the future mobility ecosystem model.

Section 5 discusses the legal and insurance issues for different possible scenarios of accidents.

Section 6 describes the role of regulatory bodies.

Section 7 discusses the challenges/issues.

Section 8 proposes recommendations.

Section 9 describes a new proposed liability attribute model with a focus on ethical issues.

Section 10 presents the conclusion.

Part 2 discusses all liabilities. The following section describes legal liabilities.

Legal liability:Legal liabilities are very important and are related to public policies, regulations, insurance claims, and tort law, etc. Legal liabilities can be further divided into civil, criminal, and administrative (civil fines) liabilities [

1].

1.1. Civil Rules (Administrative Laws)

Administrative laws are one of the legal issues related to the AVs, i.e., certification and licensing, technical control, road traffic rules, public policies, etc. However, there are many important challenges and concerns with respect to administrative laws. The most important question is whether a special driving license is needed for autonomous driving. If yes, will it be national or international? Similarly, should AVs be allowed on every road in a country? Should there be an external indicator on the AV when it is in autonomous mode? Does an AV have to follow all traffic rules or will different rules be needed? Does an AV have to report to the authorities in case of any violation, etc.? [

1,

13]. Similarly, issues like speed, operator requirements/response in case of emergency, road infrastructure, fines, etc., need to be addressed, and new rules/regulations must be made by the administrative authorities.

1.2. Criminal Liability

Criminal liability is a form of legal liability. It deals mainly with those issues in which we have to find out who is criminally liable in case of an accident. It also deals with the issues related to cybercrime and hackers. While using AVs, there can be many different criminal liability situations, i.e., how many different kinds of crimes can be done within the perspective of AVs and who will be held responsible when the AV commits such a crime? The liable entity may also change depending on the accident circumstances, and if so, how to decide? Are there any different basic model scenarios of incidents/accidents with respect to AVs? How should the law react if the criminally liable entity is also a legal entity (auto manufacturer)? Similarly, corporate criminal liability is also important due to the fact that AVs are used to relieve the driver. However, if the driver still has to remain attentive even during autonomous mode (to take necessary actions when needed) and is not permitted to do other work such as reading a book, then the question arises: what is the purpose of an AV? [

14,

15] In the same way, the use of an AV may increase unintentional crimes such as causing someone’s death, injuries or illness, etc. Moreover, another important question is whether an AV can do a crime deliberately. Therefore, new legal rules should be defined which will take care all of the criminal liability issues. Similarly, cyber-crime is also a new major dilemma which must be taken care of by using criminal codes, regulatory standards, and technical norms [

14].

1.2.1. Issues Arising from Different Scenarios

Criminal law does not punish only those who aredoing something illegal, but also punishes those who are responsible for this crime indirectly. In December 2016, a person was killed by hitting a car coming from the front in the UK. The brake lights of the front car were not working due to an electrical fault which was known to the OEM. However, the OEM neither notified the consumer, nor did it instigate a recall [

16,

17]. Similarly, if two AVs collide with each other and all the passengers die, then it is a very complex criminal situation as towho is liable. More complex situations may also arise while using AVs, and it will be very difficult to ascertain criminal liability in such scenarios, especially when software controlled cars will be running on the road [

16]. Therefore, distinct and new criminal laws have to be made to handle different kinds of scenarios to ascertain criminal liability in such cases [

16].

1.2.2. Strict Liability

In some cases, a manufacturer can argue that the accident happened due to ahacker attack or software issues, as happened in a stock market incident in May 2010 when the clash of algorithms left a trillion dollar lost, etc. To address these situations, some people argue for strict liability rules for manufacturers in which an entity is held legally responsible for the consequences even in the absence of fault or criminal intent [

18].

1.3. Civil Liability

Civil liability can be defined under legal liability andcovers a wide range of legal issues, and it will certainly change many practices in the courts. Civil liability can be further divided into different types of liabilities as described below.

1.3.1. Operator (Driver) Liability

The operator is one of the important entities in case of any incident. In this section, we will examine four specific scenarios of the operator role to further analyze operator liability in the case of an AV accident.

a. Distracted driver:An operator who is not fully attentive is called a distracted driver, e.g., someone reading email, watching a movie, etc. In this case, the driver deliberately engages himself in other activities, relying on AV completely. However, if any accident happens and the AV does not inform the operator to take control of the car, then who is liable: i.e., the driver, or the manufacturer, as the car was on autonomous mode [

5,

19]?

b. Diminished capabilities driver:A person whose driving capabilities are diminished due to some reasons, e.g., an old human, or a person with some medical issues, etc. Now, if the car malfunctions and the driver isnot able to take control of the car at the required time (even though the car has informed) and an accident happens, who is liable: i.e., the driver or manufacturer [

5,

19]?

c. Disabled driver:A person who cannot drive because of a physical disability such as blindness, etc., and he is riding AV and an accident happens. Then, who is liable: i.e., the driver or manufacturer [

5,

19]?

d. Attentive driver:Anattentive driver is the one who does not trust the AV and watches the road and surroundings constantly and also monitors the AV. However, with the passage of time, he starts trusting theAV. However, one day he seeshis AV is drifting into the other lane while driving. Rather than taking control, he trusts the AV that it will avoid the accident by fixing itself as claimed by the manufacturer. However, an accident happens. In this case, is the driver liable for not taking control of the AV, or the manufacturer [

5,

19]? Therefore, we have to find out the capabilities of the driver as compared to the current regulations across the world where the operator is generally considered liable for any accident.

The next section describes manufacturer (product) liability.

1.3.2. Manufacturer (Product) Liability

Product liability is the main basis for manufacturer liability [

20]. A manufacturer can be sued due to manufacturing defects, design defects, and failures to warn, etc. Therefore, autonomous cars should be analyzed under each of these products liability suits as discussed below.

a. Manufacturing defects:A manufacturing defect is the case when a product does not work according to its specification, or an accident happens with an undefined reason. The claimant must prove that the product did not work according to its specifications, i.e., laser sensors do not detect surrounding vehicles, etc., regardless of negligence in the manufacturing process to win the case in the court. The claimant must also prove, though, that the product malfunctioned during proper use and the product had not been altered or misused in any manner. Manufacturing defect claims cannot be applied to the software as nothing perfect can be developed. However, courts want unique circumstances to apply manufacturing defect doctrine and do not apply it in a widespread fashion [

4,

13,

19].

b. Design defects:Design defect is a defect which is beyond the understanding of a consumer, i.e., observation/consideration. These defects are considered in the courts, only if an accident could have been avoided by the use of a better or alternative design. Design defects can be tested by consumer expectations test and the risk-utility test [

5,

19].

i. Consumer expectations test:One of the tests to analyze the design defect is the consumer expectation test. It is understood that the manufacturer will make sure that the AV is safe and the consumer will expect that the AV will work safely in autonomous mode. The court will ultimately judge what can be expected from a product by a reasonable consumer. However, when an accident happens against the consumer’s expectation, the consumer has the right to make a claim based on the consumer expectation test. For an example, if an AV moves right instead of left (software defect), then the claimant can go with the design defect claim. In this case, the expectations are simple and the court allows the consumer to go with this test, but many courts still do not recognize a design defects claim as AVs are complex. Many states in the USA are not following this test, as expecting a vehicle to run always accurately is unrealistic [

5,

13,

19].

ii. Risk-utility test:The consumer expectation test can only be applied to design defects in a few cases and most claimants have to use the risk utility test. Under this test, a claimant has to present an alternative design which would have avoided the accident, if used. Additionally, the safety benefits of the proposed altered design should be more than the cost of alteration. Unfortunately, software malfunctions will be the majority of design defects. Moreover, the cost of presenting an alternative design, i.e., qualified experts, etc., is another issue with respect to this test [

5,

13,

20].

c. Failure to warn:Warning defects are the final category of products liability. A manufacturer must inform the buyers about any hidden danger and also should provide clear cut instructions onhow to use the product safely. A failure to warn claim can be madeif the manufacturer has not informed properly. Similarly, the omission of the instructions or warnings makes the product unsafe for use. For example, the manufacturer must inform the buyer that this product may not work properly in remote areas due to anetwork error. However, many hidden dangers cannot be informed at the time of sale, which lowers the success of this type of claim [

5,

21].

Evidence issues: a big problem for plaintiffs:All of the product liability suits described above will require an expert testimony and subsequent remedial measures which will increase the cost of such kinds of claims due to the complexity of the technology. In case of design defect, the claimant has to present a better alternative design. Therefore, it will be very difficult to hold the manufacturer liable in any of these doctrines, i.e., manufacturing defects, design defects, and warning defects, except for those cases which involve more losses [

5,

13,

21].

Product Liability Defenses Applied to AVs

The manufacturer can also defend their product failure and are not defenseless as described below.

a. Comparative negligence: The manufacturer has a comparative negligence defense, arguing that theycannot be fully or partially held liable because of the negligence of the claimant. The court will analyze the claimant’s conduct when the accident happened, e.g., the operator decided not to intervene when the accident happened, etc. Similarly, a claimant reading a book is more negligent as compared to an attentive driver. The disabled driver cannot do anything, but for an attentive driver, evidence isrequired that the accident could not have been prevented even with operator intervention. However, the situation is more complex for diminished capabilities and distracted drivers. On the other hand, manufacturers cannot avoid liability by forcing anyone to be attentive [

19,

22].

b. Misuse: The Manufacturer can also use a misuse defense. A manufacturer can only warn people that an accident will happen if the product will be misused. The manufacturer is not liable for all kinds of misuses. However, reading a book is not misusing the AV [

5,

20].

c. State of the art: The state of the art defense can be used against design defect and warning defect claims. For warning defects, the manufacturer can only warn based on current technology and scientific knowledge at the time of production. Similarly, for design defect, the manufacturer can only be liable if he has not used an advanced design at the time of production to make the AV safe. A claimant can only win the claim if he proves that a better design/technology was available and was not used by the manufacturer at the time of production [

5,

22].

d. Assumption of risk: The manufacturers have to inform the buyer about the potential risk of using the product to use this defense. For example, the user must be informed that he must take control of the AV in snowy conditions. Assume that the consumer has no idea that the snow will start during the journey. Then, the snow starts during the trip, and the AV asks the operator to take control. However, whether the manufacturer can use this defense or not will depend on who is the operator at that time, as a disabled driver cannot do anything. Similarly, it depends on the capability of the diminished capability driver, whether he can take control or not. For a distracted driver, the AV can ask the driver to take control. The attentive driver should take control in such a situation. The court will decide based on all evidence and driver capabilities, whether manufacturers can use this defense or not [

5,

13,

19].

Increase in Product Liability Litigation

There will be an increase in product liability claims as consumers will insist that the accident happened due to the product failure and they did not do anything wrong. Such claims will keep on rising if the auto industry continues to develop AVs which are not advanced in terms of design, process, handling, and safety/security. Therefore, new testing measures and regulations must be made by the regulators to further verify the safety, security, and efficiency of the AVs manufactured by the auto industry.

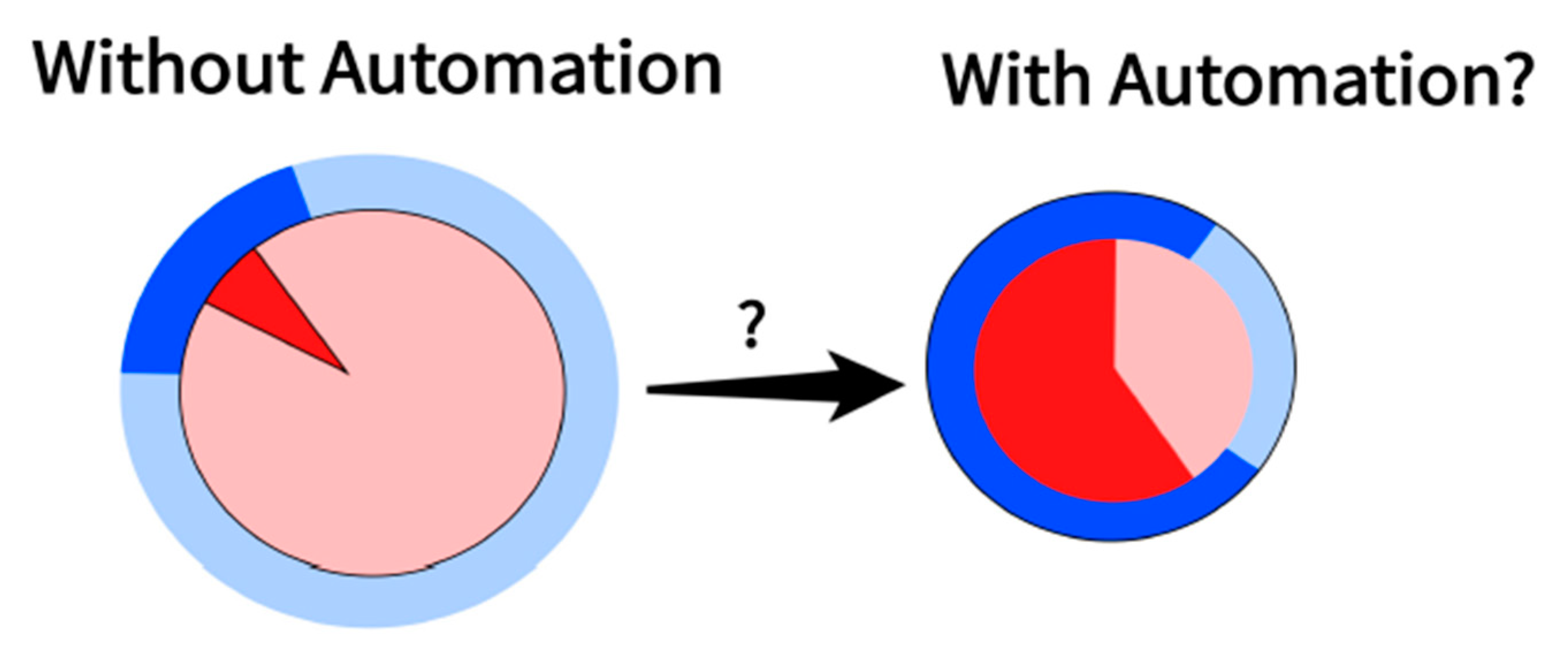

Figure 3 illustrates the accident magnitude and the accident cost effects in traditional automobiles and AVs adapted from [

20]. Accident cost represents the total money spent on a vehicle in case of accidents. In

Figure 3, accident cost is represented by the light blue slice in the background, and this expense is expected to decrease in AVs in the future due to the increased safety. The dark blue slice in the background pie represents product liability (percent of expenses occurring due to product liability), and it will increase in AVs in the future. Accident magnitude (number of accidents) defines those accidents in which a vehicle component breaks or malfunctions. Accident magnitude effect is shown by light red slices in the foreground pie which shows that the number of accidents will decrease in the future in AVs due to improved safety. The darker slices (red) in the foreground pie (smaller pie) represent product failure, which shows that product failure will increase in the future and it will be the main contributor for AVs in future accidents.

As shown in the figure, product liability claims will increase in the future, and there can be two approaches to handle this situation [

23].

a. Product liability deemphasized: In this approach, the consumer is held liable for accidents even due to the product failure, i.e., strict liability. The law could exempt manufacturers from product liability for any damage that is covered under the third party regime. What if the accident happened, though, due to product failure? In order to compensate this exemption, the manufacturers will contribute a portion to the third party liability premium for each individual vehicle. This does not mean, however, that manufacturers can now even build defective vehicles. First of all, the accident record of their vehicles would be reflected in the third party liability loss cost. Secondly, product liability claims can still be filed for any injury/damage outside the scope of the third party liability regime. Finally, the recall exposure, i.e., reputational risk, would remain a potent motivation for manufacturers to avoid defects as much as possible [

17,

18].

b. Product liability further sharpened: The second approach holds manufacturer liable for any injury and damage caused by product failure. However, in this approach, the claimant has to prove that there was indeed a product defect [

19,

20].

It is not only the legal, moral, civil, driver, and criminal liabilities which will change, but insurance liability will also change with the AVs. The next section discusses the insurance liability and other related issues with respect to the AVs.

1.3.3. Insurance Liability

There will be a major change in the insurance policies and claims in the new mobile ecosystem. In AVs, the possibility of driver fault will be removed from the vast majority of accidents and the manufacturers will be needed to insure against a higher percentage of on-road accidents. Insurance mobility instead of vehicle insurance is also another consideration. Insurance companies are also expanding usage-based insurance (UBI) products, such as pay-as-you-drive (PAYD) or pay-how-you-drive (PHYD) policies. These insurance policies rely on the assessment of the driver’s real time driving behavior to determine appropriate prices. Even assuming that the OEMs and manufacturers will be largely held liable for the damage of fully automated vehicles, they will at least try to transfer the corresponding costs to the vehicle purchase price, leasing rates, or car-sharing fees or liability claims to other parties in the supply chain. As current insurance regulations are not applicable to AV vehicles in most of the cases, therefore, new liability rules should be defined for a clear role, and determining fault and compensation in the case of AV accidents [

24,

25].

Insurer’s Key Challenges

The insurer will have these challenges in the new mobility model.

a. Residual risks and new arising challenges: The AV is assumed to reduce the number of accidents. Therefore, the insurer will observe how the risk of collision has been reduced and will also see the cost of injuries and repairs. At the same time, though, new risks, e.g., cyber attacks, software/control failures, etc., will emerge. The insurer has to keep in mind these systematic risks in order to evaluate the insurability (liability) [

25,

26].

b. Identification of the customer and type of business: The key question would be who is liable for risk, especially if the accidents are mainly due to software failures. The insurer has to see how the manufacturers could be held liable in such cases and the manufacturer will try to shift the legal/financial burden to others involved in the AV business. Similarly, will the consumer be required to purchase policies to indemnify manufacturers? If pay per use bases are used, then how will the insurance be determined [

24,

26]?

c. Changes in insurance products:Due to the overlapping between human and computer control, there are many gray areas of liability and negligence which should be covered by the development of new autonomous products to meet the market’s needs. Similarly, short term policies could be applied rather than conventional policies due to the pay-per-use mode of mobility. In the same way, the experience obtained due to the current ride sharing products could be employed, and the insurers have to make sure to change and apply new policies with changing technology [

25,

26].

d. Pricing:Different factors have to be analyzed for pricing the insurance policies, i.e., level of automation, quality of implementation, and anticipated types of driving, etc. Different manufacturers will have different levels of attained technology, even for the level 5, depending on the sensor quality, software used, and other products, etc. The insurer will also have to take into account other factors such as hardware/failure rates and performance capability, software performance for different roads and weather conditions, hacking, and other security issues, etc. The pricing will also depend onhow much data can be accessed by the insurer and also how this data has been collected and statically produced [

24,

26].

e. Legislation:Legislation will have a key role towards the insurance policies in the future. Different countries have different regulations, i.e., encouraging or restraining this technology. NHTSA urges manufacturers to work closely with other stakeholders and regulators to develop a safe and reliable product, especially taking into accountthe ethical dimension or implications such as “life versus life” scenarios [

26].

f. Other issues:There will be many other issues such as the complexity of insurance policies that will increase as it willbe more difficult to find out who is liable. Similarly, finding liability will be more difficult in developing countries where there is a lack of proper legal infrastructure as it is always difficult to have uniform regulations everywhere [

27,

28].

Table 2 shows the possible changing insurance coverages with respect to time adapted from [

29]. For phase I, there will be no particular change in insurance coverage. For phase II, all the coverages will be required by the driver in manual mode, i.e., no change in product structure. However, in auto mode, product liability, collision, and medical coverage will be bought by vehicle manufacturers and network providers. For phase III, the coverages will be the same as Phase II (auto mode).

Table 3 shows claims impact management over time adapted from [

29]. The table shows that the driverless cars will be having a complete overhaul of the claim management process, as many steps will be removed due to the usage of self-diagnostic techniques, i.e., First notification of loss (FNOL), claims survey, claims estimation, etc. The table shows that in phase I, an operator will be driving the vehicle. In this case, it will take time to receive first notification of loss, to do the investigations, and settle the claims by the insurance company. There will also be the possibility of fraud due to human involvement. For phase 2, claim management will change mainly due to two reasons, i.e., to clarify whether the vehicle was in auto or manual mode, and different advanced technology measurements will be used to get accurate accident information about accident. In this case, the car might be able to send an automated first notification of loss (FNOL) report to the insurer and manufacturer along with other internal damage assessment reports using different diagnostic tools. In phase 3, everything will be same as in phase 2, expect it will always be clear that the AV was in auto mode.

The next section discusses moral liability, i.e., who should be held responsible from a moral point of view.

2. Moral (Ethical) Responsibility

The AVs are expected to take right decisions, even in extreme emergency situations. However, is this always practically achievable? Consider a situation in which an AV reaches an intersection and the traffic light is green, but unexpectedly, a walker crosses the road. What is the right decision in this case? Similarly, if the car swerves into traffic abruptly, who is liable for the consequences: i.e., owner, operator, or a software programmer sitting in his office having no idea what happened? Moreover, is it the obligation of the AV to save his operator all the time? [

30,

31].

2.1. More Ethical Dilemmas

The trolley problem, i.e., an ethical thought experiment, is an ethical dilemma which has no right answer. Similarly, other different ethical dilemmas may have more complex and critical situations, as finding solutions with respect to ethics generally ends up with a dead end with no right solution. Consider a situation in which the AV is driven, and suddenly, a group of people appears in front of the car. The car is at the maximum speed limit and has no option other than to take some action, otherwise, it will hit the group of people. In one option, the AV can move towards the pedestrian way and can kill a pedestrian in order to save the group. In the second option, the AV can hit the wall on the other side, killing the passenger sitting inside. Similarly, consider another more critical ethical dilemma where the AV unexpectedly faces an obstacle. Now, if the AV hits the obstacle, no injury will happen and only liability will be applied. However, if the AV stops and a car behind hits the AV, many people may die. Now, according to the law, the AV is right and the car behind is faulty. In this case, the liability has been saved at the cost of human lives, which isnot a good outcome from a societal/moral point of view. If we ask for answers from different people as to what they would do in such situations, everybody will have a different answer, with no right solution, and all these answers will also be ethically questionable [

4,

32,

33].

2.1.1. How Should Self-Driving Cars Solve Ethical Dilemmas?

One way to deal with such situations is to implement ethical principles/theories, i.e., utilitarianism, different forms of consequentialism, or deontological ethics, etc., in the algorithms. Although it might not solve the problem accurately, at least it will provide a solution based on some rules and will move the problem towards engineering where it is implemented [

34].

2.1.2. Ethics versus Engineering Problems

An engineering problem is significantly different from any supposed ethical dilemma. The ethical dilemma is an idealized imaginary situation, having no right solution, but an engineering problem always comes up with right and wrong solutions [

35].

2.1.3. Ethics versus Decision Making

Ethical dilemmas can also be recognized/solved by using the decision making process available through advanced technology. The following question can be asked to AV developers, i.e., hardware/software engineers, management, etc.: whether the AV has a moral on its own or if it is the moral of its stakeholders/creators. Furthermore, who is responsible for the decision-making of an AV? Should these people be held strictly liable in case of an accident? Some people say that the AVs should be utilitarian, and should always save more people in case of an accident, even at the cost of the operator’s life [

36]. Therefore, it is necessary to understand how ethical issues are addressed/justified in the design and development of AVs [

36].

2.2. Automakers and Ethics

An Uber representative says that “on the same day an AV had an accident, a hundred other people also died in accidents in the USA alone. We have opened up a new can of ethical issues”. He further says that if I am driving an AV and am going to collide, should I save the people or myself? Who is going to decide this situation on our behalf? The users of the AVs also need answers tothese questions [

37].

2.3. Manufacturing AVs and Ethical Issues

Regulatory bodies should make such rules which take care of the ethical norms carefully by protecting individual rights and liberties along with the advancement in technology. The rights of anyone cannot be violated on the basis of benefiting others, and it does not matter how large it is. Moreover, in contrast to the standard trolley case, one should not always see the total loss at the end only. Instead, the risks at the time of the decision should be considered. A new safety feature favoring someone does not provide a guarantee that it will save the individual, as that person may never have any accident. Instead, the introduction of a new safety feature should reduce the chance of accidents for everyone. Therefore, an action should be judged at the moment when the decision takes place with given probabilities and preferential situations [

36,

37].

2.4. Strict Liability and Ethics

Some people argue that the operator should be held morally liable (strict liability) for accidents as he decided to use the vehicle even knowing and accepting the risks involved. This liability can be considered with two different approaches. In the first approach, the user should be held responsible for using a car and putting himself and others at risk. The second approach blames the person for any kind of accidents caused by him while driving. This approach differentiates between a person who only took the risk of driving a car, and the one who took the risk and had an accident also. It means that any use of cars, whether autonomous or human driven, is subject to moral luck. These approaches, though, also seem unrealistic, as driving an AV is lawful, but may be morally doubtful with respect to a strict liability perspective [

33,

35,

37].

Based on the above discussion, moral ethics need special consideration and the manufacturer should develop such algorithms ascan handle emergency situations with satisfactory norms.

The next section discusses technical liability.

3. Technical Liability

Many components are used in the making of AVs such as video cameras for the detection of traffic lights and moving objects, sensors for scanning, smart navigation maps, V2V communications, etc. This equipment is still not perfect, as the sensors do not work in all weathers properly, and LIDAR (light detection and ranging) has problems with bright sunlight, etc. The hardware and software technology is also not up to the standard to validate safe driving, especially for the level 5 automation. If accidents happen due to any of these technology failures, who is responsible? Should strict liability be applied to the original equipment manufacturer (OEM) of these products or should the users of these products be held liable? However, the OEMs can also claim that they build safe and advanced equipment and the product failure happened due to undefined and unexpected conditions [

12].

In the above sections, different kinds of liabilities associated with AVs have been discussed. AVs will also change the dynamics of mobility.

Part 3 discusses the future mobility model, different possible AV accident scenarios, the role of regulatory bodies, future challenges, recommendations/solutions, and the proposed model. The next section describes a future mobility system involving different stakeholders and how liability will be addressed in this system [

38,

39].

4. Future Mobility Ecosystem/Model

Social attitudes towards mobility are changing at a fairly rapid rate along with the advancement in technology bringing a paradigm shift in the mobility of humans, especially urban mobility, which is becoming more shared, electric, and autonomous [

40].Therefore, the insurance companies have to rethink their relationships with different entities, i.e., drivers, owners, manufacturers, etc. In future, four different states of mobility may emerge, as shown in

Table 4 adapted from [

40], due to the intersection of two key trends which are the emergence of AVs and shifts in mobility preferences [

40].

4.1. Future State 1

This state deals with personally owned driver driven vehicles. In this state, the vehicle owner will insure himself and the vehicle against any loss as a primary stakeholder while the manufacturer will be liable for product failure [

40,

41].

4.2. Future State 2

This state deals with shared driver driven vehicles. There can be three basic stakeholders in this mobility model, i.e., fleet (yellow cabs), auto rental companies, and ridesharing (the owner is generally the operator). For fleet and ridesharing, owners will be the primary stakeholders and comprehensive coverage will remain the norm to insure the vehicles against theft. For rental, the owner of the vehicle (Rental Company but belonging to an individual) and the operator can be the stakeholders. In this state, separate policies would be required to cover both the owner and the operator [

40].

4.3. Future State 3

Future state 3 will deal with personally owned autonomous vehicles with the possibility of multiple stakeholders, i.e., owner, manufacturer, and the entities involved in the designing, building, and maintaining of hardware/software of the autonomous system (OS). For level 5 automation, vehicle owners would require comprehensive coverage. The manufacturers/OS providers may decide the coverage similar to the product liability policies to insure against malfunctioning of hardware/software, flawed algorithms, or hacked issues, etc. [

40].

4.4. Future State 4

Future state 4 deals with shared autonomous vehicles. In this state, there will also be many stakeholders, i.e., mobility management providers (the company providing the ridesharing service), owner (may be different party), manufacturer, and the OS providers. In this case the operator/owner would also require comprehensive coverage, and other coverages will be the same as in future state 3 [

40].

These future states may coexist for the next 10 to 25 years. It shows that there will be a change in different policy types, such as a reduction in the amount of driver liability and required collision coverage, while product liability insurance and shared mobility providers’ coverage will increase, etc. Therefore, the insurer will have to modify the current policies to cover the new and unique policy required by different users [

42,

43].

Table 5 adapted from [

2] shows a comparison of loss split between personal auto, commercial auto, and product liability in future. The table clearly shows that the cost of products liability will increase in future. Similarly, commercial auto, i.e., fleet, etc., usage will increase in future, which will face more losses (expenses), i.e., insurance, etc. With the increase in commercial auto, personal auto usage will decrease and will have fewer losses in future. The table shows that the overall loss will reduce in future due to the changing mobility mode.

There can also be different reasons for AV accidents in future. The next section discusses different possible scenarios of accidents along with the liability and insurance situation [

16].

5. Different Scenarios in Case of Accidents

This section discusses different scenarios for accidents with the fact that the reason of the accident is already identified.

5.1. Human Driver and Driver Error

This scenario deals with the SAE level 0 to 4 with the condition that the car is always under human control. The incident which is caused by the mistake of the operator can be categorized broadly as operator carelessness and/or operator planned action.

Third Party Insurance and Legal Liability Position

In this scenario, the insurer will compensate with respect to the innocent third party claims. If the operator does not have any insurance, then the motor insurer’s bureau (MIB) will be responsible. If an accident has been done by a planned and/or illegal action of the operator, then the motor insurer will reject the insurance cover and the operator will not be insured any more [

16]. For legal liability, the driver will be legally liable for damages and typically indemnified by their motor insurance policy for third party liability.

5.2. Human Driver and Hardware Failure

This scenario also deals with the SAE level from 0 to 4 with the condition that the car is always under human control.

Third Party Insurance and Legal Liability Position

In this case, the third party can make a claim with respect to product liability against the manufacturer and/or supplier. However, if the driver is not insured, or the car has been changed without informing the insurer, the claim may be dealt through the MIB (motor insurance bureau). For legal liability, if any original equipment provided by the OEM (original equipment manufacturer) fails, then the OEM will face the product liability claim. However, if any kind of modification has been done after the purchase, then the modified entity will be legally liable [

16].

5.3. Autonomous Mode Driving (Operator Does Not Respond to Handover Request)

Level 3 and 4 deals with this scenario. At level 3, the operator must respond to the request by vehicle in a timely manner. For level 4, though, there is no such condition and the AV should be able to drive safely by itself.

Third Party Insurance and Legal Liability Position

For level 3, the third party insurance is inconclusive in this scenario. It can be an operator fault or vehicle deficiency or the motor insurer may cover the loss. For level 4, the insurer will be liable for third party liability on a strict liability basis, if there is no negligence from the operator [

16].In the case of legal liability, the operator will be liable if he does not respond to the request in a timely manner at level 3, although it is difficult practically and depends on many other factors. This would further lead to multi-party complex litigation to resolve, but the most important question would be whether the handover function is safe or not. For level 4, it will also consider a product failure and typically the manufacturer or OEM or supplier will be legally liable.

5.4. Autonomous Mode Driving (No Software Update)

The accident happens because software has not been updated (levels 3–5 automation).

Third Party Insurance and Legal Liability Position

For levels 4 and 5, the motor insurer is strictly liable to the third party if there is any negligence from their side. For level 3, it can be an operator fault, i.e., software not updated, OEM updater fault or product deficiency, etc., or the OEM may offer third party compensation in the first instance. For legal liability, it depends on who is liable for maintaining the software of the AV [

16].

5.5. Autonomous Mode Driving (Failure because of External Infrastructure Dependency)

For levels 3 to 5, external infrastructure can be a network service provider with no network signal, and/or physical infrastructure, such as bad road conditions, etc.

5.5.1. Third Party Insurance and Legal Liability Position

For level 4 and above, the insurer is strictly liable to the third party insurance, i.e., subject to contributory negligence on their part. For level 3, it is inconclusive, i.e., an external infrastructure fault or product deficiency, etc., or the OEM may offer third party compensation in the first instance. For legal liability, it can be one or more out of OEM, supplier, service provider, or hacker, etc.

5.6. Autonomous Mode Driving (Failure to Assure Safe Driving Mode)

For levels 3 to 5, it is assumed that the AV will function properly as expected, but accidents happen [

16].

Third Party Insurance and Legal Liability Position

Third party position will be the same as described in

Section 5.5.1. For legal liability, it will depend on various factors, i.e., OEM, supplier, or manufacturer, or service provider, etc. If the vehicle was up to standard, then probably liability would not be attached to anyone, and AV will be further verified through simulations based on pre-set standards.

The next section discusses the role of regulatory bodies for regulating AVs.

6. Role of the Regulatory Bodies

6.1. National Highway Traffic Safety Administration (NHSTA)

In the US, the federal agency NHTSA is responsible for motor vehicle regulations, i.e., regulating the safety, design, and performance aspects of vehicles, etc., and states are responsible for regulating the operator and vehicle operations. In September 2017, NHTSA released new voluntary regulations for the ease of manufacturing, testing and deploying AVs while discouraging states implementing conflicting AV regulations. Similarly, NHTSA’s safety 2.0 regulations take care of levels 3 to 5 automation particularly. The regulations also encourage automakers to present a voluntary safety (self-assessment certificates) to NHSTA indicating how safety has been addressed in AVs [

4,

5].

6.2. States Conditions in USA

In the USA, at least forty one states have considered AV legislations. Out of forty one, twenty two states have approved regulations related to AVs and governors in ten states have issued executive orders. Level 5 AVs are already in service in Arizona, Florida, Michigan, and Pennsylvania. California has also allowed testing of AVs on public roads without an operator [

5,

13,

19].

Liability with Respect to Different States

Rules vary in every state with respect to AVs. California and Nevada law explicitly define the operator as liable (strict liability) for any accident, as he took the risk of using the AV. However, the question still arises that if the AV does not alert a sleeping driver or alert about any other hazard to take control, whether the driver can legally sue the manufacturer or not. At the other end, it also does not make sense to hold manufacturers liable all the time just because itsproduct did not function a hundred percent every time.

6.3. Legal Expert Opinion

Law experts say that we are at the beginning of this new technology and it seems that regulators are moving fast without properly addressing the safety issue. Arizona has allowed AV testing without defining strict rules. CanArizona or any other state be held fully or at least partially liable in case of an accident because of lenient regulations? A similar question is whether NHSTA can be held liable or not, as NHSTA has also the authority to instigate auto accidents and implement regulations. Moreover, is there any Federal or international regulations or is it all states-driven, i.e., no uniform regulations?

Table 6 adapted from [

29] shows a possible future regulatory road that may evolve throughout the various driverless car phases. In phase I, rules will be updated according to state requirements or according to the Geneva conventions along with recognizing the driverless cars. Similarly, minimum testing requirements will be defined which manufacturer have to follow while manufacturing driverless cars. For phase II, where the controlling entity can be the operator or the vehicle itself, more emphasis will be given to tariffing the vehicles, i.e., fixing premium/contributionratesso that insurance companies are able to charge premiums/contributions that can commensurate the risk profile of the consumers, etc., and motor pools will be made to share losses in case of accidents. Similarly, such regulatory bodies will be made which may solve the dispute rapidly in case of accidents. For phase III, tariffs and motor pools will be removed with a confidence on the safety/security of this new technology, and new rules/regulations will be made.

Even with the new regulations and defining liabilities, this technology still has many challenges/issues, as discussed in the next section.

7. Other Challenges/Issues

Different other issues are discussed below.

7.1. Holding Manufacturer Liable

The manufacturer has never had a duty to design one hundred percent safe vehicles. Automakers have different approaches with respect to strict liability. The AAJ (American Association for Justice) says that imposing a strict liability on automakers may ultimately be the most suitable approach to the liability issues. Similarly, Volvo, Google and Mercedes-Benz representative said the same thing. A Swedish automaker said that automakers are strictly liable for any accident and if we are not ready for this thing then we should not build AVs. Tesla has stated that it will accept liability only when there will be a fault in the design. The Tesla CEO asked whether Otis (Elevator Company)takes responsibility for thefailures for all the elevators around the world: no, they do not. Similarly, an auto alliance spokesperson says that the organization has no standing as to whether the industry should be held liable or not. Holding only manufacturers liable or too many regulations or strict regulation or any kind of inaction may also de-accelerate the advancement of this technology [

44].

7.2. Holding Operator Liable

Another approach is to hold the operator partially or fully liable as he took the risk of using this product. Is this morally fair? Similarly, another approach is to hold the operator liable for not taking control (negligence) of the car when requested in autonomous mode. Is this practically possible to take control in all situations? There can be many situations in which an intervention by the operator may worsen the situation. Who will be liable in such scenarios?

7.3. Accidents Due to Software Error

What will happen if a software error causes an accident, as the driver is late in updating the software and causes an accident? Finding liability due to a software error is a complex situation.

7.4. Data Protection Issues

There can be a conflict between data privacy laws and an increased amountof product liability, such as data needed by the manufacturer for its defense or other purposes versus the data privacy of the owner/operator. The GPS and navigation data generally fall under the category of personal data and are not accessible. However, thesedata arealso very necessary for a rapid and better advancement of the AVs [

45].

7.5. Liability Due to Hacker Attacks

Accidents have happened due to cyber security attacks, i.e., hackers unlocked the BMW AV remotely and 2.2 million cars were recalled; attacks on Volkswagen cars which recalled about 100 million vehicles, etc. Similarly, a recent attack on the Tesla electric car resulted in software updates for the car operating system. Therefore, if an accident happens due to cyber-attack, who is liable in such a situation? Cyber security threats have critical impacts while defining the reliability of the product, which ultimately affects the insurance policies and other regulations [

5,

46].

7.6. Operator’s Miseries in Unexpected Situations

How would AV react when there is a defect in the electrical wiring causing an entire electrical supply to collapse or a falling rock that smashes the lens of an indispensable camera? What would happen if a negative pressure hose blewout and disabled the engine control? What are the expectations from drivers in such situations, especially from lowercapability drivers [

45,

46]?

7.7. Effect on Cities and Public Rights Issues?

Asurvey shows that Arizona residents do not feel comfortable to live in a robot car test facility because of the Uber test cars in Arizona. Similarly, General Motors test cars are running on the street of California since June 2015. AV accidents are different from traditional accidents/deaths. Autonomous cars could finish people’s rights to the public streets. Eventually, if autonomous cars become widespread, certain roads might have no pedestrians, bicyclists, and human drivers so that computer cars can operate at maximum efficiency to follow regulations and avoid liabilities [

47,

48].

7.8. Revenue Issues

Government revenues will be reduced as there will be fewer fines, i.e., speeding tickets, etc., due to no human error, which will ultimately affect active regulatory developments.

7.9. Sensor Data Can Be Altered

The sensor data in AV will be used to find out who is liable. In a new mobility system, though, some parties may have unequal control over thesedata and they might change themin their favor.

7.10. Past Examples

There are examples in the past ofproduct failures, i.e., the failure of Bridgestone/Firestone tires in the late 1990s, and the violent rupture of Takata airbags in the late eighties, etc. Therefore, even when the manufacturer claims that the product is safe, accidents still happen, and people will have different perspectives, i.e., liability.

7.11. Increased Product Liability Claims

Increased product liability claims will exhaust manufacturers, and these claims would not remain beneficial, except for the lawyers involved. Moreover, smaller companies will be badly affected due to costly legislation and may be out of the technology race. This will ultimately hinder the development of the technology.

7.12. Different Regulations Problems

Geneva and Vienna conventions do not allow an AV to be on the road which does not permit an operator to take control in case of emergency. Different countries have different rules, though, or less/lenient regulations or too strict regulations, etc. There is no uniform regulation nationally and internationally for AVs which will further hinder the development of this technology.

7.13. Fair Regulations Required

Current liability regulations are uncertain. Declaring someone liable who has no control or pinpointing someone without considering all factors can also have negative impacts and can disrupt the market even before the start. Similarly, with strict and unfair regulations, this technology might not be legally, morally, economically, and politically viable. The manufacturers will not invest in the advancement of this technology, especially if they are always held liable. Therefore, there should be a regulatory system which justifies everyone [

45,

46].

7.14. Education Required for Everyone

Decisions taken by the AV may be strange for many people and thatwill be reflected in the lawsuits. Moreover, lawsuits may also be evaluated/resolved by those people who are also technically and legally not experts.

7.15. Hidden Agreements Issues

Another issue regarding claims would be whether the automakers have any kind of indemnification agreements (the situation where an entity takes care of another’s liability costs). These kinds of agreements are generally confidential.

7.16. Public Trust Issues

Most of the surveys show that the vast majority of the public does not trust this technology due to liability issues in case of accidents and with no clear regulations.Accidents are generally assessed by considering only operator negligence and product liability is only taken into account when there is a clear defect which caused the accident. Similarly, the vehicle act/performance is only considered at the time of accident, rather than considering that a better vehicle could have been designed and built.

The next section proposes recommendations/solutions based on the above discussion.

8. Recommendations/Future Work

8.1. Education on AVs

Consumers should be properly educated as tohow to use this product and what are the limitations of the AVs in order to have a safe and reliable drive. In the same way, policy makers should also educate themselves with the advancement of this technology in order to make clear, fair, and updated regulations to avoid unrealistic claims.

8.2. Setting Up New Authorities

New regulatory bodies should be made to make sure ofdifferent measures such as premarket testing and approval of AVs, forcing manufacturers to remove any failure/hazard immediately, post-sale regulation of any software changes, etc.

8.3. New Testing Measures

New testing measures should be used for testing the AVs to make themmore safe and efficient in every aspect, i.e., testing in real time environments, making it mandatory to follow the safety regulations, updating the regulations/standards continuously with the advancement in technology, recoding, collecting, and sharing data among different regulatory bodies for further analysis, etc.

8.4. Building Confidence

The technology cannot be fully and rapidly adopted by society unless all the entities (operator, owner, manufacturer, insurer, OEM, service provider, etc.) feel that they have been fairly treated in case of any accident.

8.5. Other Insurance Options

No-fault insurance and a victim compensation fund are two good options under the current scenario. Carrying a no-fault insurance by a consumer will force all the entities to develop, design, and manufacture a safe product. In a victim compensation fund, the states or federal governments should compensate for damages just like the National childhood vaccine injury fund in the USA. Similarly, there can be a single pool compensation fund where everyone who has AV will give funds and will be compensated in case of accidents. This approach has many benefits, i.e., providing insurance to every AV, avoiding high insurance, a central pool of accident data for further analysis, less administrative work among different insurance providers, etc. Another option is that the manufacturer can include the product liability claims in the price of the car (cost benefit analysis), which is equal to indirectly buying insurance from the automaker. In this way, in case of accidents, insurance will not take a steep rise [

5].

8.6. Inclusion of Ethics

Ethics must be considered in the overall process of design, development, and implementation of AVs. Ethical dilemmas should be treated very fairly and seriously, otherwise, these dilemmas may hinder the technology and will make the things moreunclear. Strict liability should be applied to those entities who do not consider ethical issues.

8.7. New Regulations

New regulations should be made for AVs keeping in view safety and ethical issues. However, these rules should only be made, if existing rules are not applicable to AVs anymore.

8.8. Active Regulatory Process

AV technology is more advanced than the regulatory processes. Therefore, there should be smooth and proactive measures to define liability for everyone in order to maximize the efficiency, rather than something happening and then the change is done. In the same way, too much liability can also harm the products to develop and market them.

8.9. Uniform Regulations

Different regulations or having no regulations are like silent killers, even for the current liability system. For AVs to be adapted by society as early as possible, there should be a uniform kind of regulations across the world.

8.10. Comprehensive Rules and Regulations

Laws and regulations should be made which cover everything, i.e., setting standards of performance, speed, need of an operator in case of emergencies, licensing, acceptable infrastructure, fines, liabilities in case of damage to third parties or otherwise, level of allowed automation, etc., in addition to the ethical issues.

8.11. Strict Liability

The manufacturer must be held liable in cases like the Ford Pinto in which the manufacturer builds a car with design defects.

8.12. HoldingOperator Liable at Level 5 Automationis Not Applicable and Satisfactory

The liability should be more inclined towards manufacturer for level 5 automation, unless some clear evidence is favoring manufacturers.

The above discussion in all the sections clearly demonstrates that finding liability in AVs is a complex and critical matter. Moreover, the ethical aspects have critical impacts in case of AV accidents. Therefore, the next section proposes a comprehensive novel liability attribute model with a particular focus on ethics [

49].

9. Proposed New Novel Liability Attribute Model

A novel liability attribute model is shown in

Figure 4 adapted from [

49]. The proposed liability attribute model covers all entities more comprehensively as presented in [

49], and also takes into account the ethical aspects which arenot present in the previous model [

49]. All of the proposed sections have been shown in green as compared to the model proposed by [

49]. The following entities will be the key players in this model which will interact with each other.

Insurance Company: The entity which plays a key role in defining the liability is called the insurance company. It communicates with all other entities in the proposed model to find out the liable entity in case of an accident. The insurance company communicates two ways with the settling entity and ethical entity in order to define the liable entity in case of accident. It also defines/updates new rules/regulations, e.g., insurance policies, etc., based on its communication with ethical and settling entities according to the changing requirements of AV technology. The insurance company is also responsible forpaying compensationon behalf of a client.

Autonomous vehicle: AV is the prime entity which had an accident and had all the prime data, i.e., time, precise location, speed, videos, sensor information, communication with operator or other AVs, etc., for further analysis. It provides all this information to the insurance company and manufacturer. The insurance company uses this information to find out who is liable for the accident. The manufacturer uses thesedata to make safer and more advanced AVs in future.

Auto manufacturer: The manufacturer is the entity who has built the vehicle. The manufacturer acquires data from AV, witnesses, and communicates two ways with legal authorities for suggestions and future improvements. Similarly, the manufacturer also receives information from the software provider and operator in the proposed model in case of any accident which is not taken into account by the model in [

49]. The manufacturer shares all received information with the insurance company and legal authorities to define the liable entity.The manufacturer also acquires data, i.e., sensor information, communications, etc., from the AV for diagnostic and scheduling purposes on a regular basis. The manufacturer is also responsible for providing any software updates (obtained from software provider or developed by manufacturer itself) to the AV which is also not taken into account by the model proposed in [

49].

More importantly, the manufacturer communicates two ways with the ethical entity in order to make sure that ethical aspects have been taken into account in all developed algorithms (developed itself and/or by the software provider) with current legal requirements.

Witnesses: Witnesses are the vehicles involved in the accident and also vehicles within the camera range. Witness can also be nearby pedestrians or infrastructure having cameras installed. Witnesses provide information to the insurance company, OEM, and manufacturer and legal authorities. In the proposed model, witness information is also communicated with the OEM and legal authorities for improvements in the design and for finding out the liable entity in case of accident, which is not taken into account by [

49].

Service technician: Thisprovides maintenance services for the AVs. It also provides information to the insurance company as a proof in case of accident.

Service provider: Thisprovides all network services for the AVs. It also provides information to the insurance company and legal authorities as a proof in case of accident whether all of the network services were available or not (up to an accurate level) in the case of an accident. The model proposed in [

49] does not take into account this entity. However, this entity must be taken into account as it is very important for the AV to drive safely which is only possible if a consistent high quality network service is available.

Supplier: Thisprovides original equipment parts to the OEM. It provides information to the insurance company, legal authorities, and manufacturer in case of accident, i.e., whether there was any faults/problems in original parts or not, etc. The model proposed in [

47] does not take into account this entity. However, the feedback from this entity must also be taken into account in case of accident.

Software provider: The software provider is a very important entity which is also not present in [

49]. It develops, provides, and updates software services for the AVs. It also provides information to the insurance company, settling authority, and manufacturer in case of accidents. The software provider also communicates two ways with the ethical entity to verify and update the ethical aspects in software algorithms.

Original equipment manufacturer (OEM): This entity is also not taken into account by the model proposed in [

49]. Thisentity designs and builds original equipment, i.e., sensors, cameras, LIDAR, etc. It receives information from witnesses, and provides information to the insurance company in case of accident. It also communicates two ways with the settling authority in case of accident to find out the liable entity and also to improve and follow the current regulations.

Operator: The operator is the entity which we generally call driver and is not discussed in the previous model [

49]. The operator can be controlling the car or busy in some other work while the AV is in motion. Therefore, any kind of information provided by the operator is very important in case of accident. It provides information to the insurance company, settling authority, and manufacturer in case of accident. It also provides its experience on a regular basis to the manufacturer for any kind of technology improvements.

Settling authority: The settling authority is one of the key entities. The settling authority is composed of regulators, government transport agencies, police, courts, etc., and communicates with other entities as shown in the figure to analyze the proofs to find out the liable entity in case of accidents. The settling authority is also responsible formaking new regulations and updating current rules regarding AVs based on the feedback and suggestions provided by other entities. The settling authority also communicates with the ethical entity to verify and update the ethical issues taken into account in the software development of AVs.

Ethical entity: Ethical issues/dilemmas are one of the major aspects in AV accidents. Therefore, ethical aspects have been defined in the proposed model. The ethical entity has multiple roles. In case of accident, at first, it must be checked by the ethical entity whether ethical aspects were considered in the design and software (algorithms) developments or not. If ethical aspects were not taken into account, then the insurance company and settling authority should be informed about it and strict liability should be applied to the algorithm developer and automaker. This verification becomes more critical if the accident involves any kind of ethical dilemma.

If ethical aspects have been taken into account, then it should be analyzed by the ethical entity how the AV took different decisions at the time of the accident and what principles were taken into account. The accountability and transparency of the algorithms must be checked according to some defined legal ethical framework. The ethical entity must also make sure that all of the decision making processes in the ethical algorithms are following some defined set of rules, i.e., differentiating between legal and illegal things. Moreover, it must be made sure that all of the life-threatening decisions should be in the hand of humans and not in the control of machines in the decision making process. Therefore, the ethical entity evaluates and verifies the current algorithms with respect to ethical aspects in case of an accident.The ethical entity also interacts routinely with the settling authority, insurance company, software developer, and manufacturers to make sure that ethical aspects have been taken into account in the design and development process, i.e., current/future legal requirements.

For the proposed liability model to work efficiently, many factors are very important. One of them is the evidence integrity, which means that there must be no chance of changing evidence by any entity, especially after submitting the evidence in case of accident. Similarly, all of the previous data before the accident must be available to make any decision in case of accident. In this way, any entity will not be able to deny its actions and the liable entity can be defined from the evidence of multiple entities. However, the privacy and integrity of every entity must be maintained during this whole process [

49].

10. Conclusions

AVs will transform transportation. Currently, liability is mainly attributed to the driver in case of an accident. However, in the case of AVs, other entities such as the manufacturer, service provider, owner, operator, software provider, OEM, etc., will also haveliability attributed. This work comprehensively discusses all those liabilities, i.e., legal, civil, criminal, moral, insurance, product, etc., which should be considered in order to find out who is liable in the case of an AV accident, as compared to the existing literature, which generally discusses one or two liabilities only.

The work first describes the legal (criminal, civil, manufacturer, operator, and insurance, administrative) liabilities very comprehensively. Legal liability can have different forms and each one of them requires careful consideration in case of an accident. For civil liability, the work describes hownew administrative rules/regulations should be defined to take care of different issues such as speed, road infrastructure, fines, etc., for AVs. Similarly, new regulatory standards, the latest technology, and laws should be defined for the determination of criminal liability. The work also clearly highlights that it is very important to consider the capabilities of the operator while deciding a liable entity in case of an accident. The work emphasizes that product liability will be the main reason to hold a manufacturer liable in case of an AV accident. However, courts will not apply the product liability doctrine to the manufacturer unless clear evidence is provided. The work also describes howthe manufacturer can also use certain defenses against product liability, especially if some alteration has been done tothe AVs. Similarly, insurance regulations require a dynamic change, as current insurance regulations cannot cover all aspects/entities in the case of AV accidents.

The work also discusses moral liability and describes how much important it is to consider ethical dilemmas in this new technology. The work emphasizes that ethical principles must be incorporated into the algorithm developments and decision making process. The role of regulatory bodies has also been described. The work emphasizes that these bodies should work proactively to define new regulations which must be uniform and fair and should take care of all liability aspects so that this technology can become widely acceptable to society as soon as possible. A future mobility ecosystem has also been discussed which explains how the mobility will change in future and product liability insurance and shared mobility providers’ coverage will increase in the future, accordingly. The work also discusses different possible scenarios of AV accidents, and explains how the insurance coverage will be decided and who will be legally liable in these scenarios. The research work also describes current and future issues/challenges comprehensively related to this technology. The work also proposes several recommendations/solutions to overcome these challenges. The recommendations clearly explain that these challenges can be solved, if these recommendations are implemented appropriately.

The work also proposes a novel liability attribute model with a particular focus on moral aspects. Ethical aspects require urgent consideration (as the current legal system generally does not take into account this aspect) and must be incorporated in algorithm developments to find out a liable entity in case of accidents, rather than having multiple answers for an ethical dilemma. The proposed liability attribute model also comprehensively takes into account all entities which can be involved in an AV accident, as compared to other previous models in the literature which do not consider all entities. Finally, the work concludes that the operator should be held liable only after careful considerations of all aspects, especially taking into account the operator’s ability. The manufacturer and OEM should be held responsible for product failure, especially when the accident happens in autonomous mode and clear evidence isavailable. Otherwise, the manufacturers will stop investing in this technology, if they are always held liable. Hence, the manufacturers, OEMs, and suppliers have to build AVs in a complex liability regime with justified actions.

The work also identifies several areas/aspects in which future research/work should be done in order to make this technology adaptable by society quickly. The work clearly emphasizes that legislations regarding AVs will have a key role in the future. Regulatory bodies should develop new, fair, comprehensive and uniform regulations in a proactive manner, and these regulations should benefit every entity in the AV business. Moreover, these regulations should not hinder the pace of this technology. A worldwide regulatory body should be made to make such rules/regulations which are acceptable to every country with the exception of minor changes according to their country/regional requirements. This body should also provide clear and updated guidelines to AV manufactures, stakeholders, and regulatory bodies all across the globe to further enhance cooperation among the auto industry. Similarly, new authorities should be setup which should develop new testing measures, i.e., empirical evaluations, to verify the safety and security of the AVs. This can be achieved by evaluating AV performance using real world collision scenarios, as real world collision scenarios also take into account environmental effects, which play a key role in case of an accident. These testing measures should also be standardized globally. Similarly, new training courses/approaches should be developed for the operators to teach how to use AV safely, what kinds of expectation should be made from AVs, etc. These training courses should also be standardized. Similarly, insurance companies should also work closely with government bodies, regulators, and the auto industry to design such insurance policies that everyone feels justified in case of an AV accident.

The work makes it clear that the auto industry should develop such AVs which are best in design and fully safe; otherwise, product liability claims will be keep on rising in the future. Future work/research should also be done to find out how the product liability can be integrated with cost benefit analysis for the manufacturer perspective without having any compromise on safety, security, and efficiency of the AVs.