Analyzing the Bitcoin Network: The First Four Years

Abstract

:1. Introduction

2. Bitcoin Technology and Economy

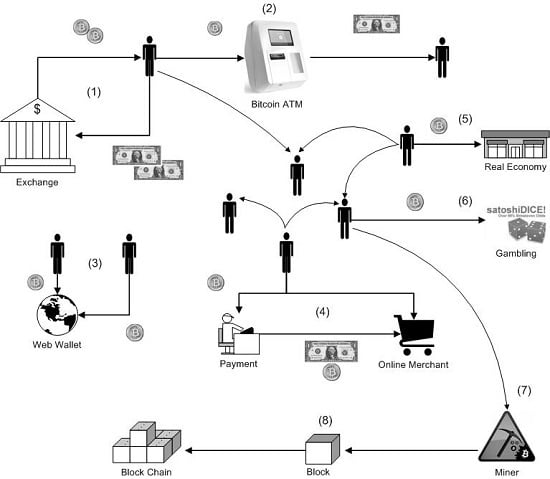

- Exchanges: on exchanges one can trade their fiat currencies, other crypto currencies, and even gold into Bitcoins. The exchange platforms are mainly electronic but there are also local exchanges.

- Wallets: web wallets are similar to banks in the real economy where Bitcoins owned by users can be centrally stored on online platforms. The major advantage is that users can access their Bitcoins from every device connected to the web and have less effort to protect their wallet.

- Mining: mining is the contribution to the coin generation process, mainly executed in a mining pool. For a definition and comparison of mining pools see [7]. In such mining pools, miners share their computing resources and each participant receives a reward for the particular contribution of computing power.

- Payments: payment services enable online merchants to accept Bitcoins in the same way as they accept Visa or Paypal payments in their local currency. It reduces transaction costs, avoids chargebacks, Bitcoin exchanges rate risks, and identity thefts.

- Gambling: gambling services offer a wide variety of online games such as dice games, roulette, and other casino related games where users can gamble with their Bitcoins.

- Vendors: via online merchants users can exchange their Bitcoins for almost every kind of product such as multimedia content, electronics, travel, gift cards, clothing etc. There are also vendors that function as marketplaces such as Ebay.

3. Related Work

4. Methods

4.1. Data Collection and Management

4.2. Network Metrics

4.2.1. Degree Distribution and Power Laws

4.2.2. Clustering

4.2.3. Shortest Path Length

4.2.4. Centrality

5. Data

5.1. Bitcoin Transaction Data

5.2. Enriching the Dataset

5.2.1. IP and Business Tags

5.2.2. IP Geo-location

5.2.3. Tor and Proxy Nodes

5.2.4. Trade Data

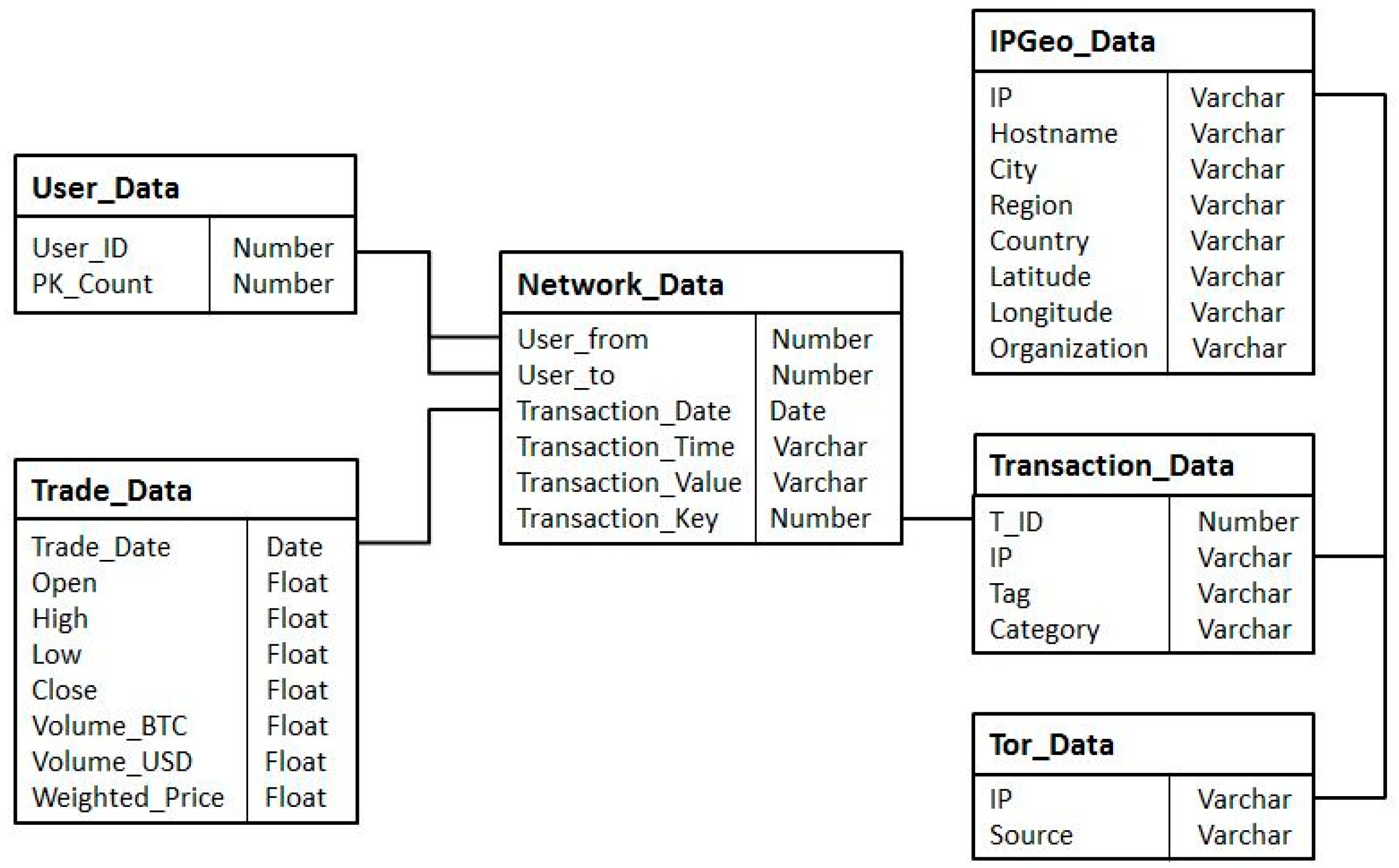

5.3. Final Data Model

6. Analysis and Results

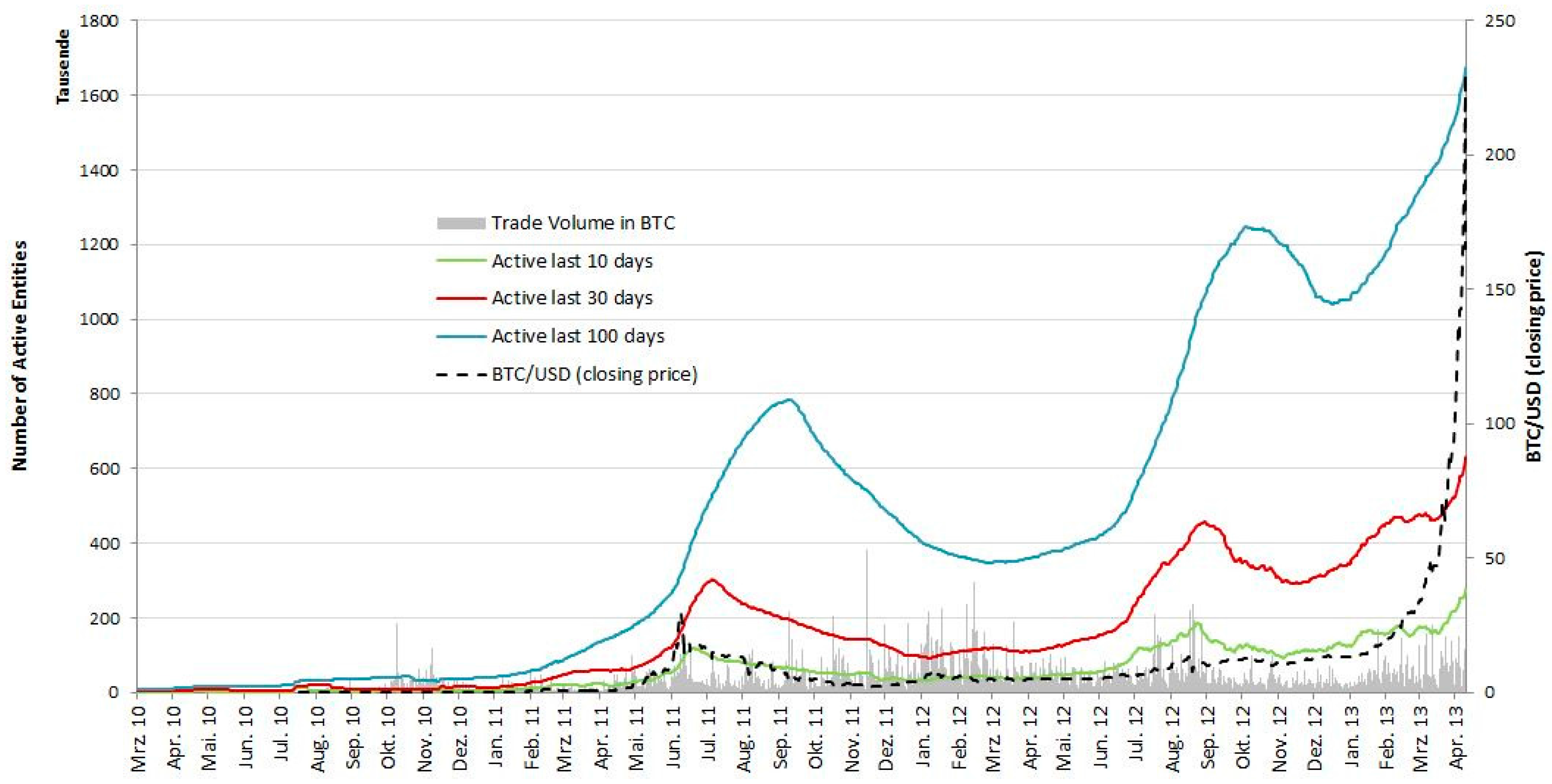

6.1. Statistics

6.1.1. Bitcoin General Statistics

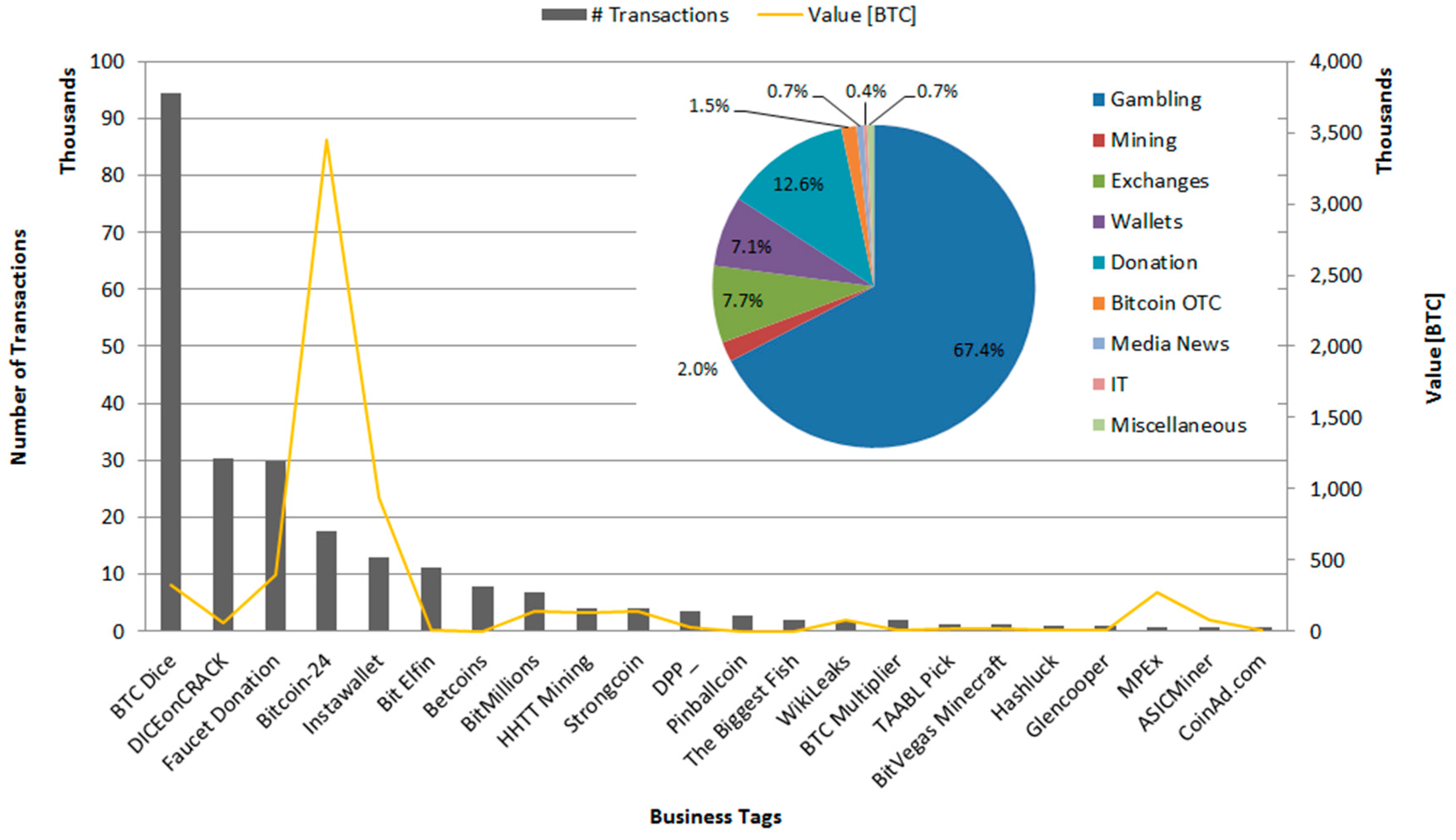

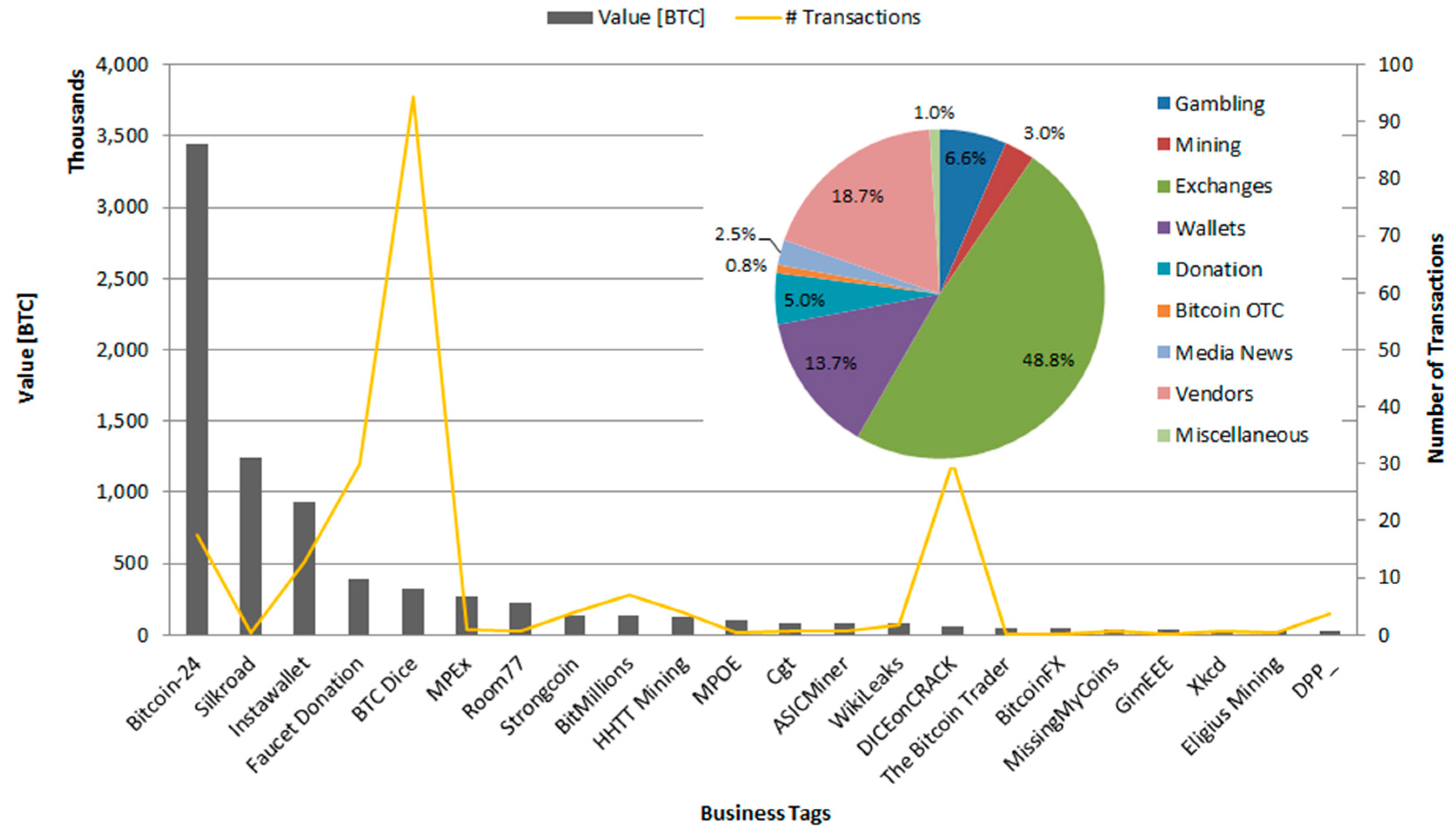

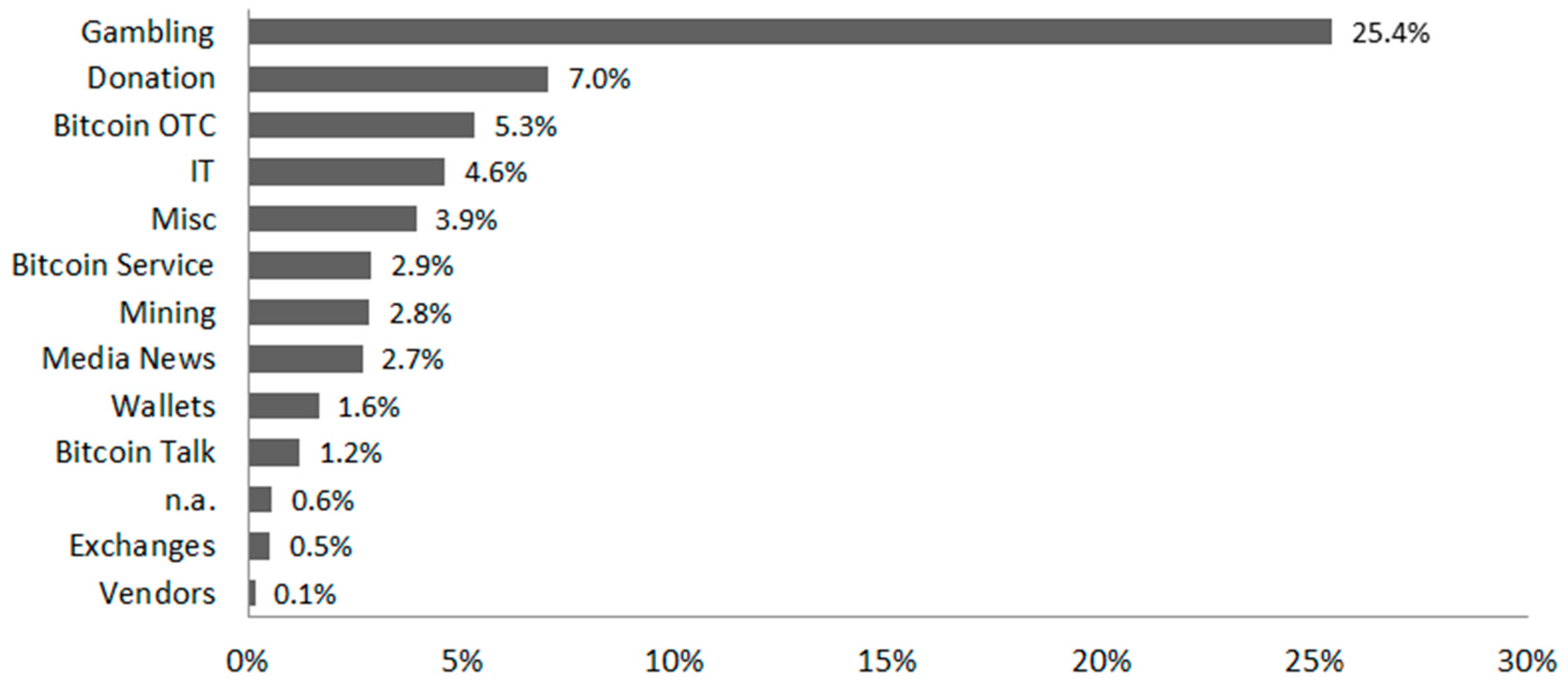

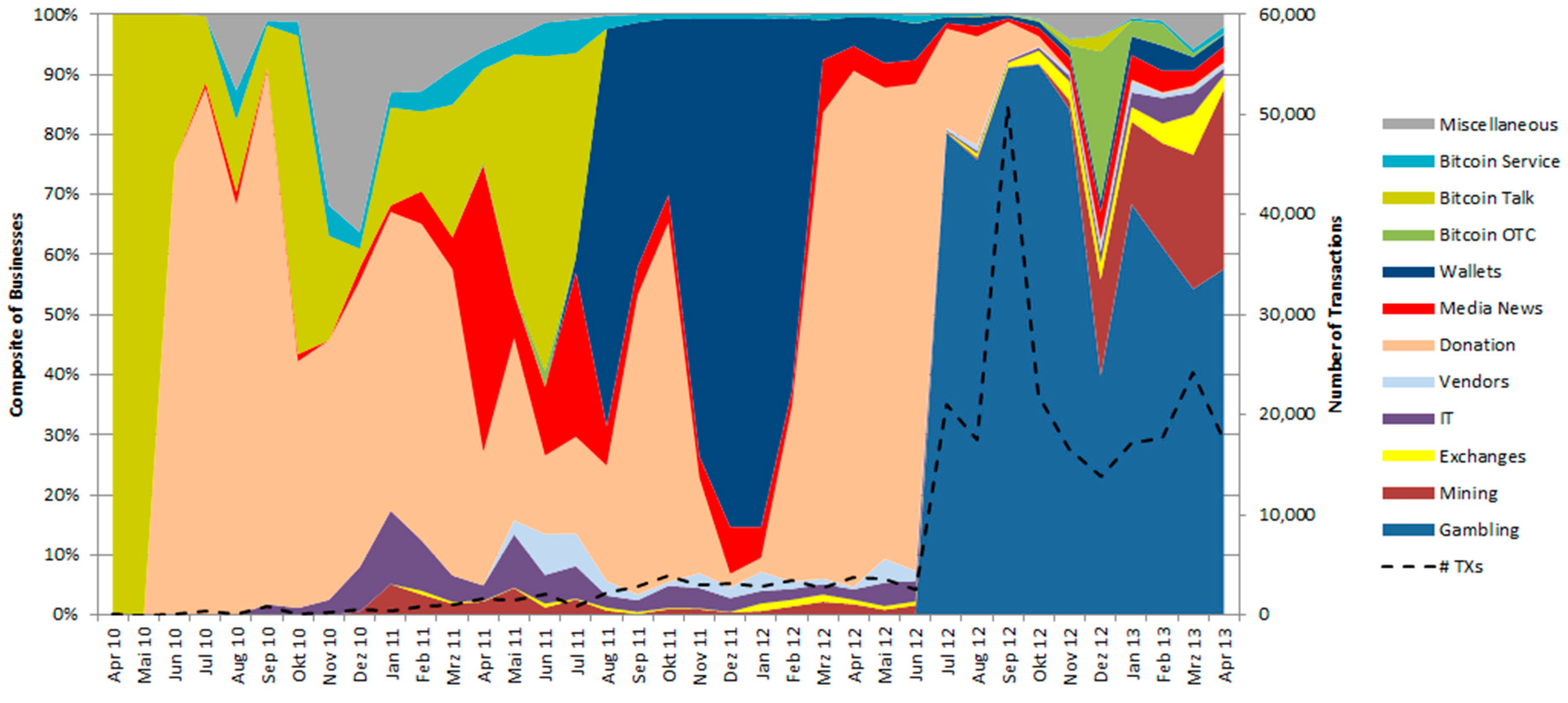

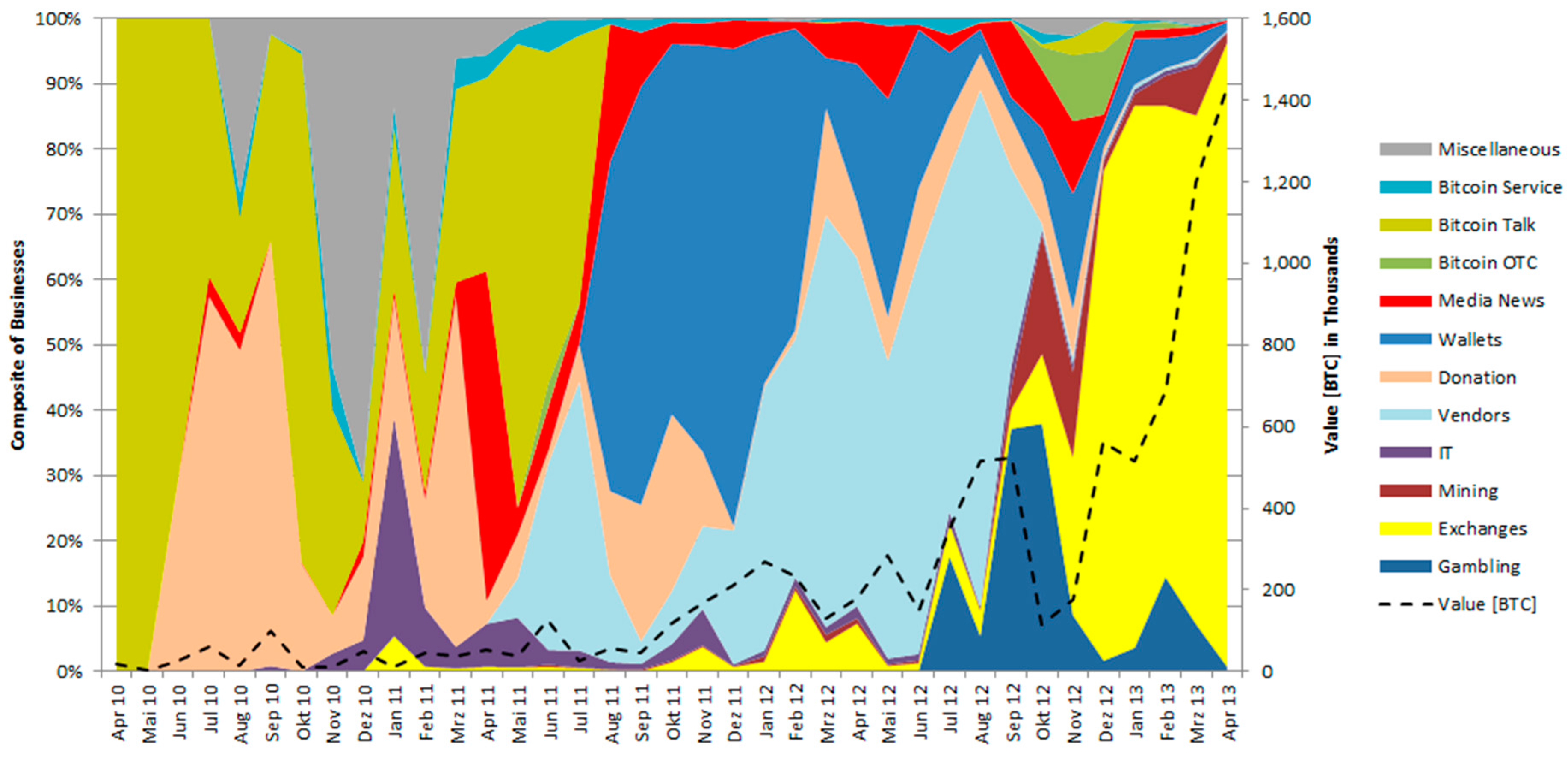

6.1.2. Bitcoin Business Statistics

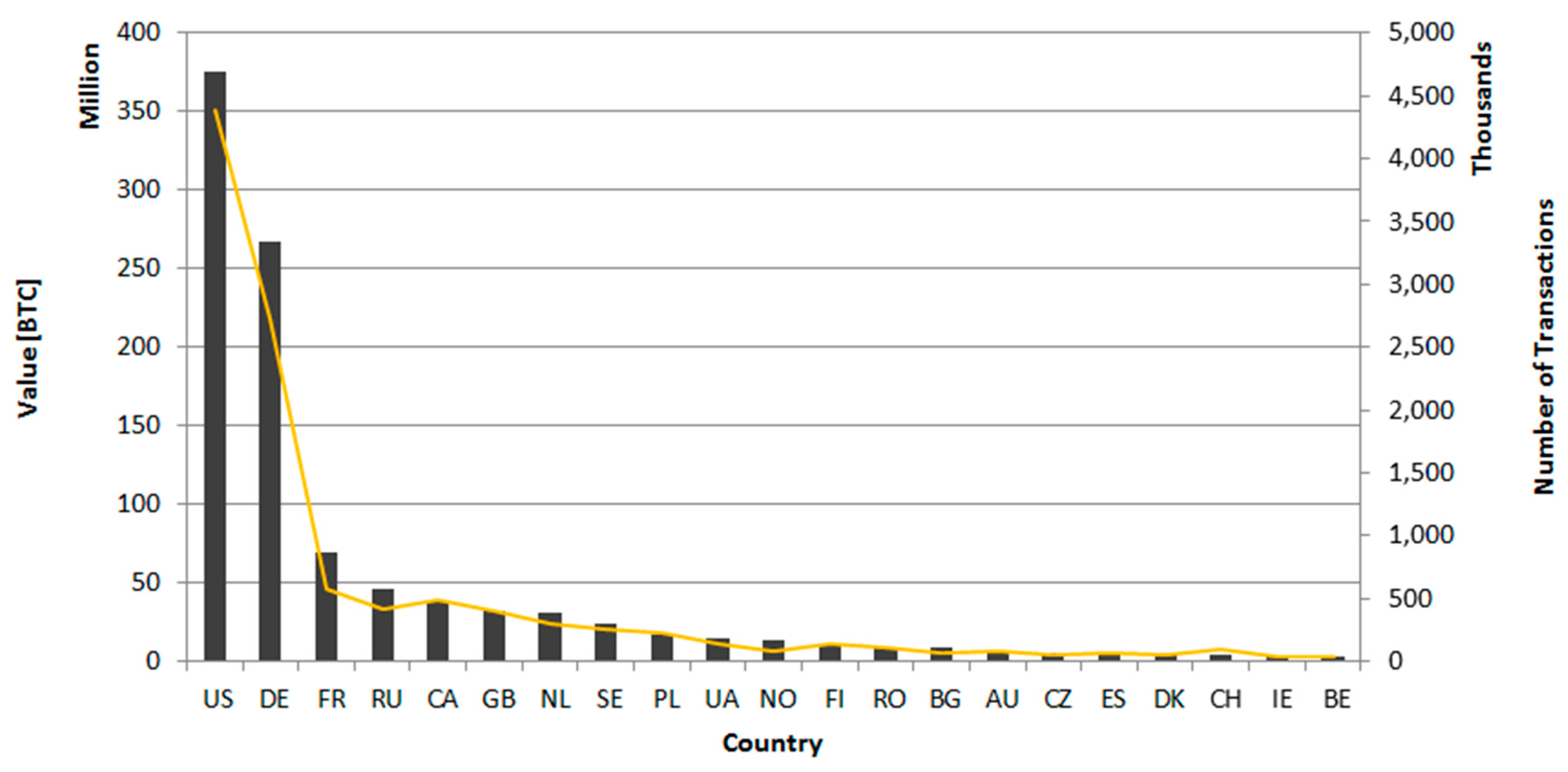

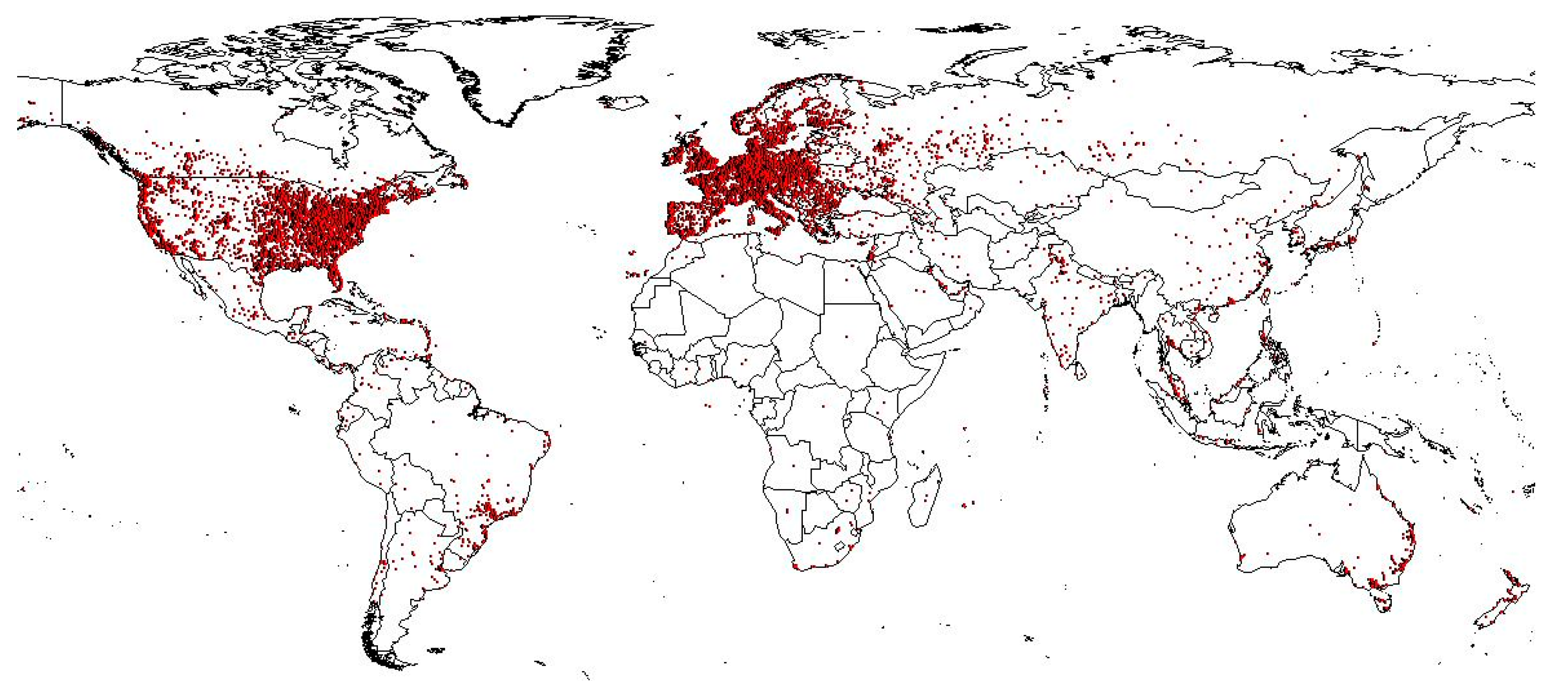

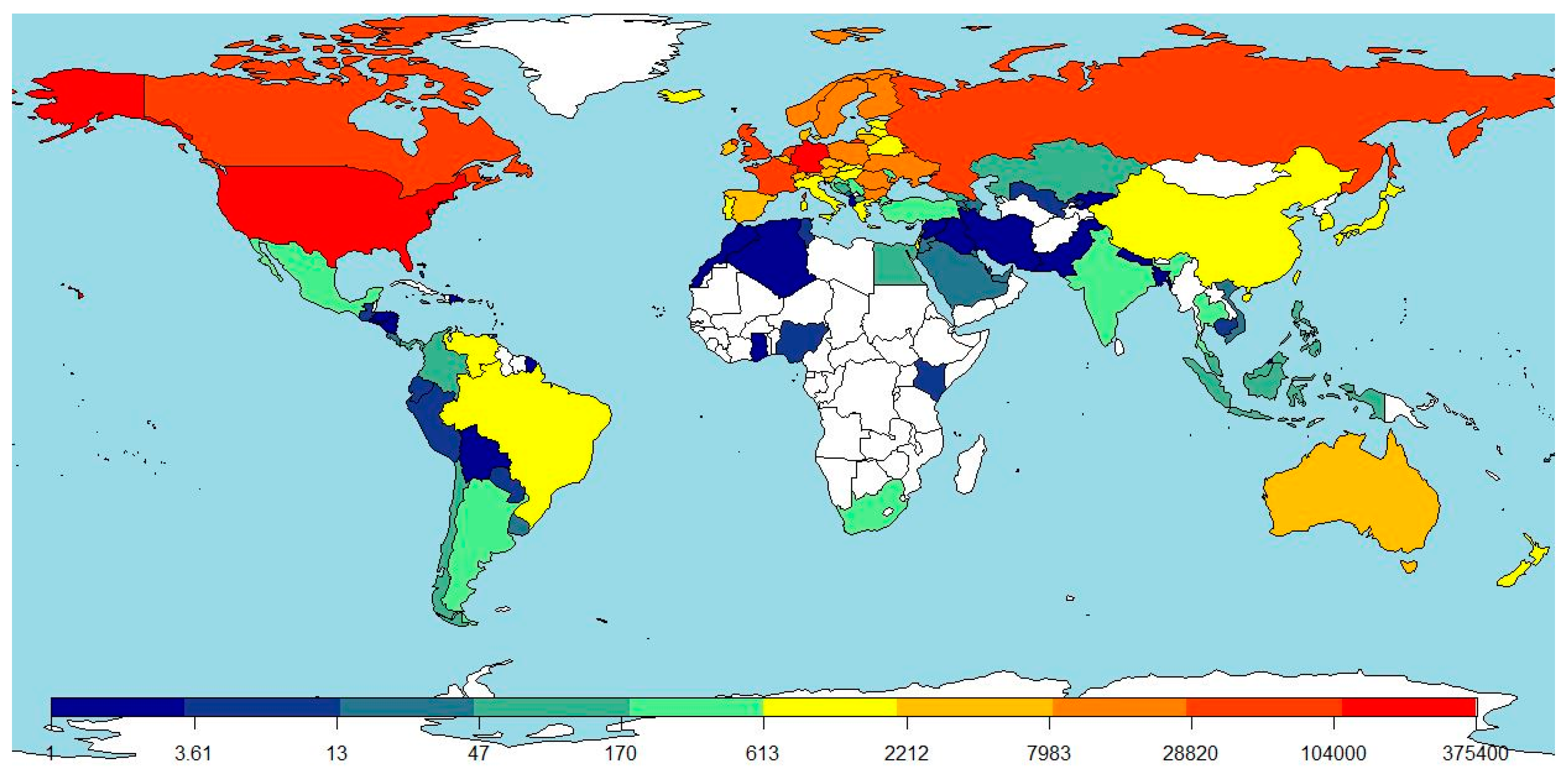

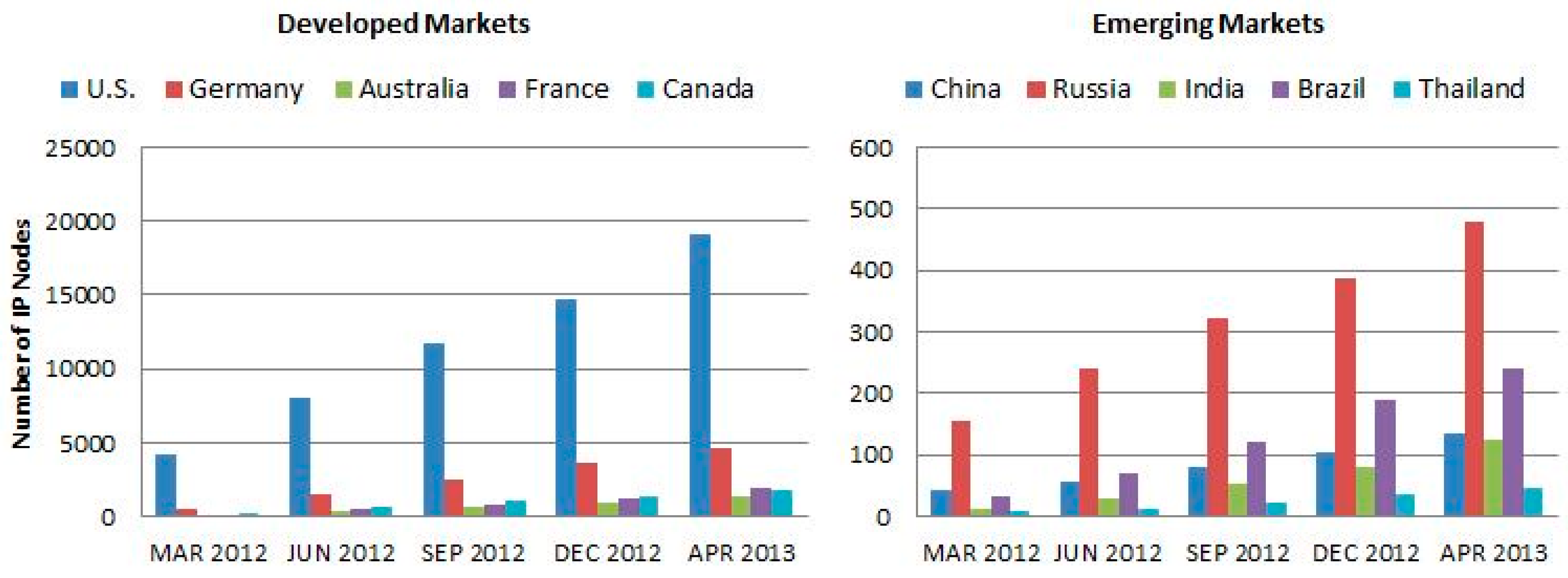

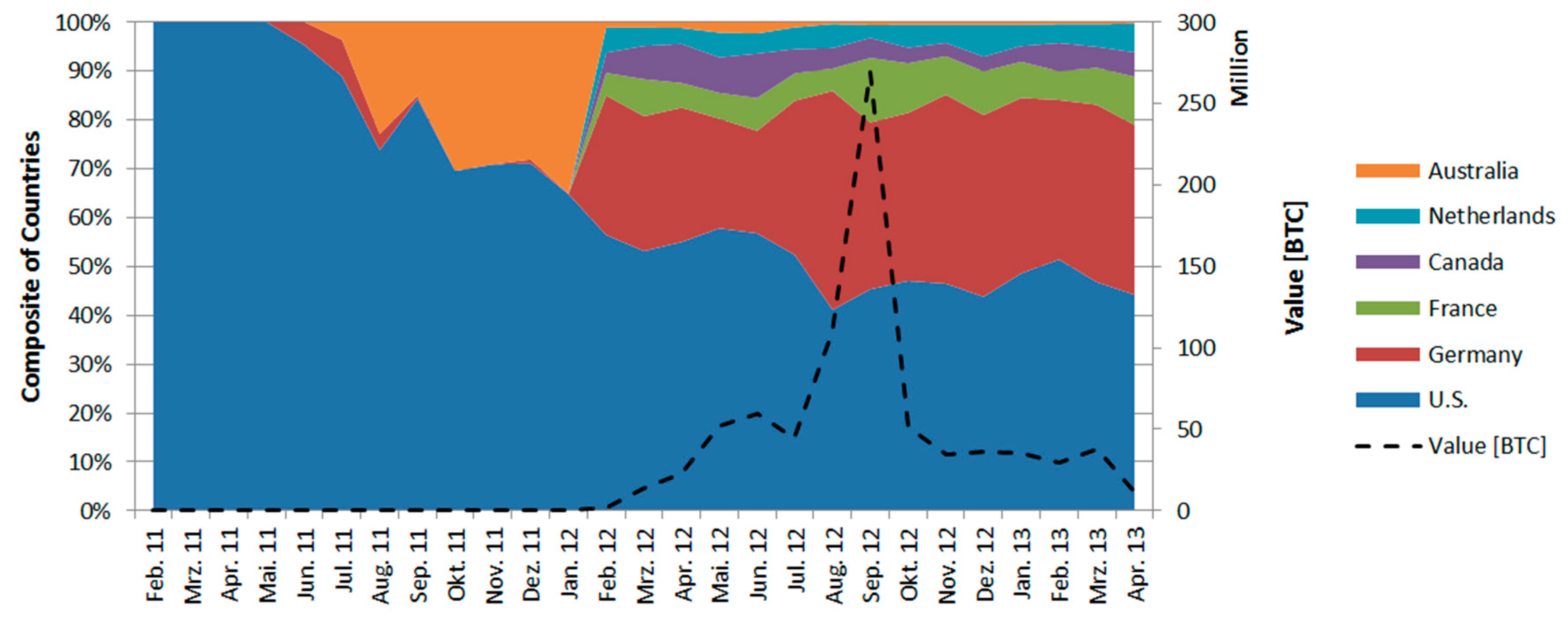

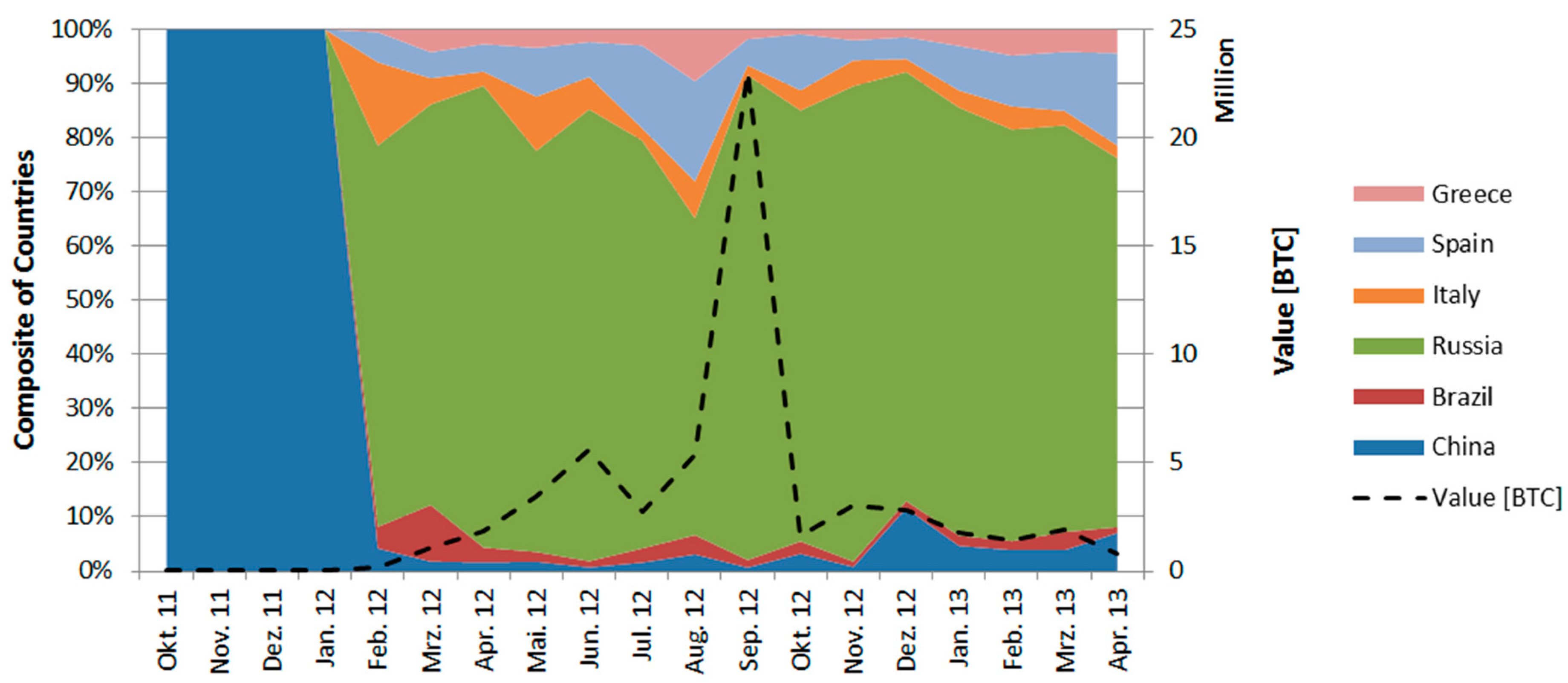

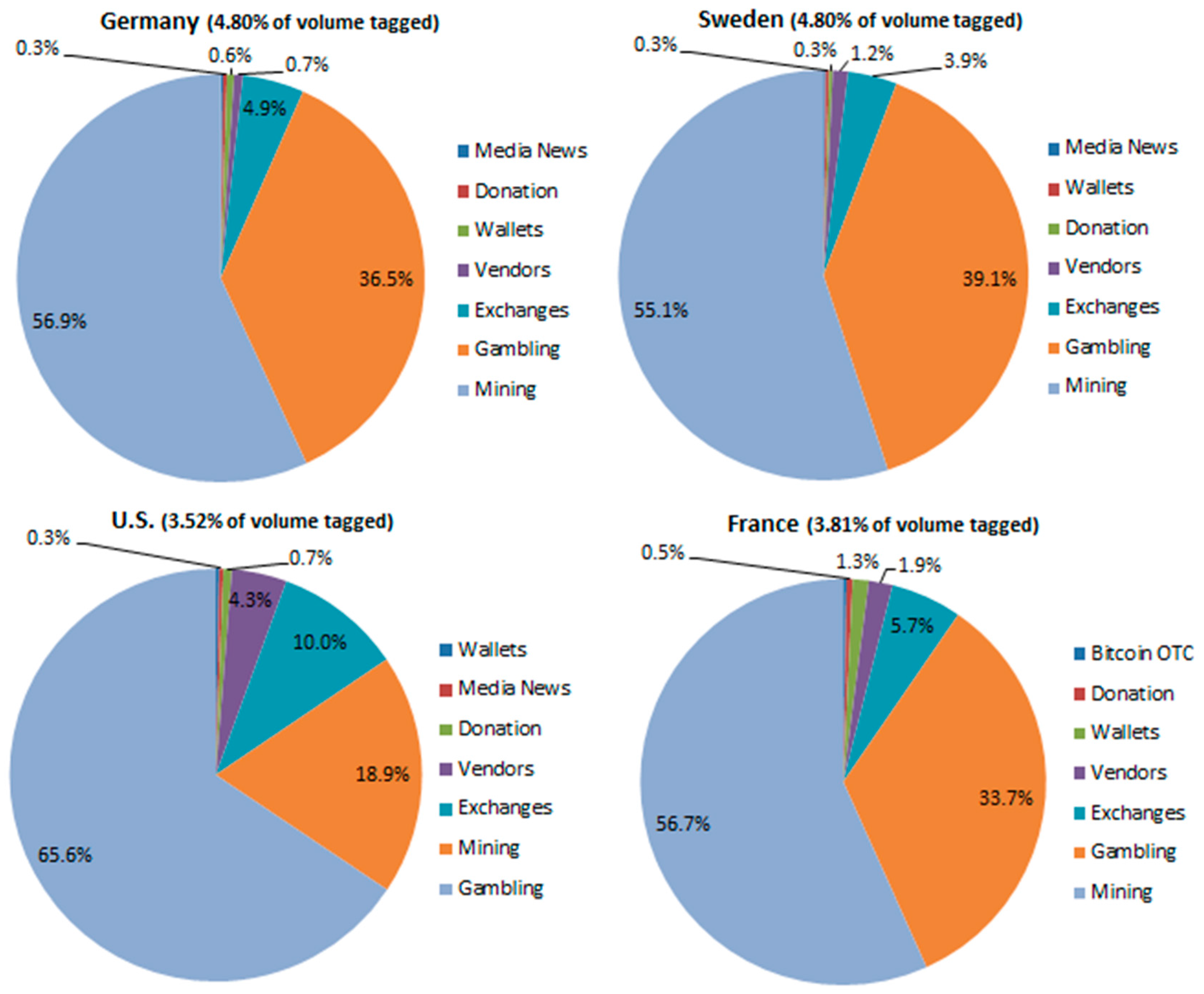

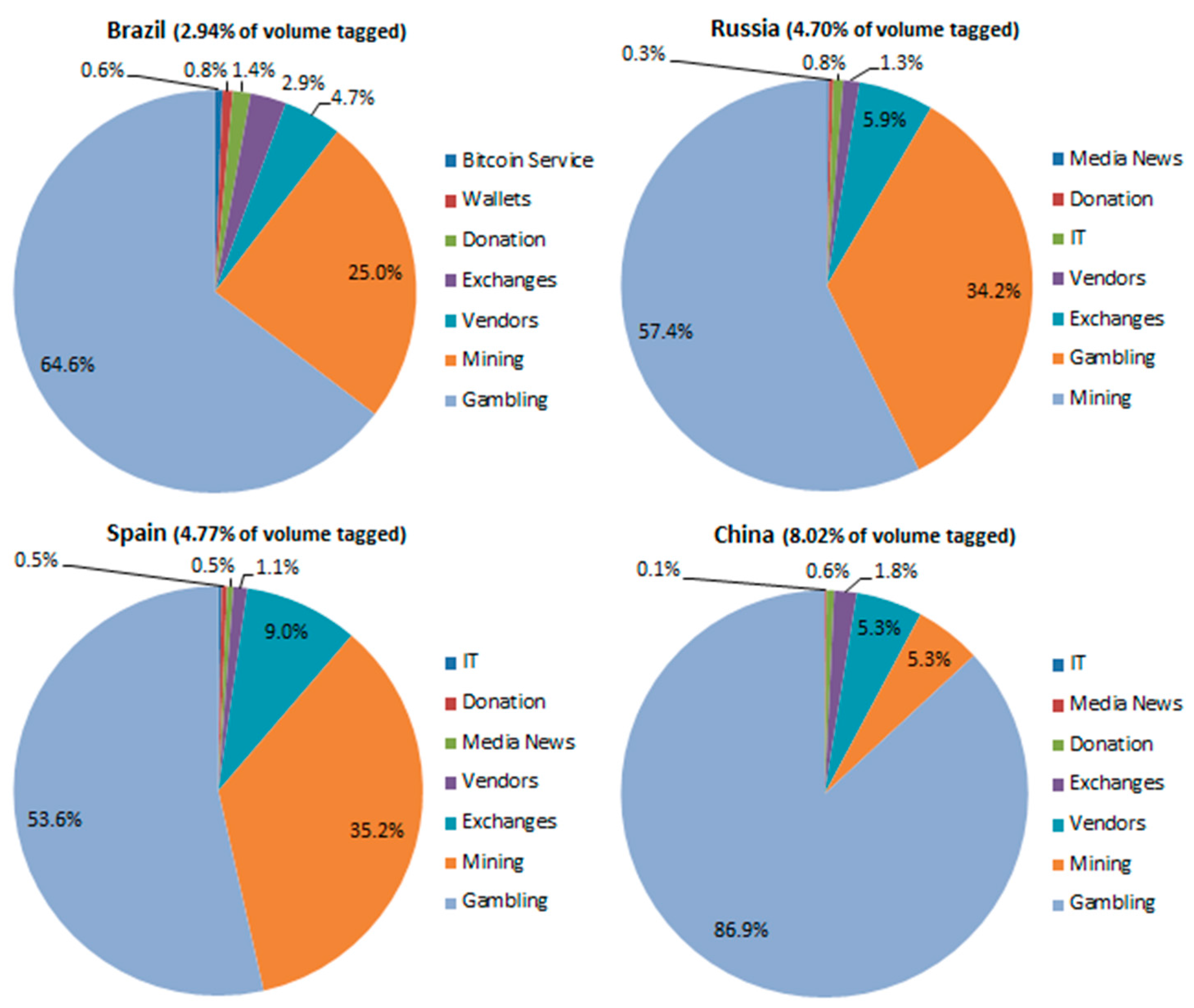

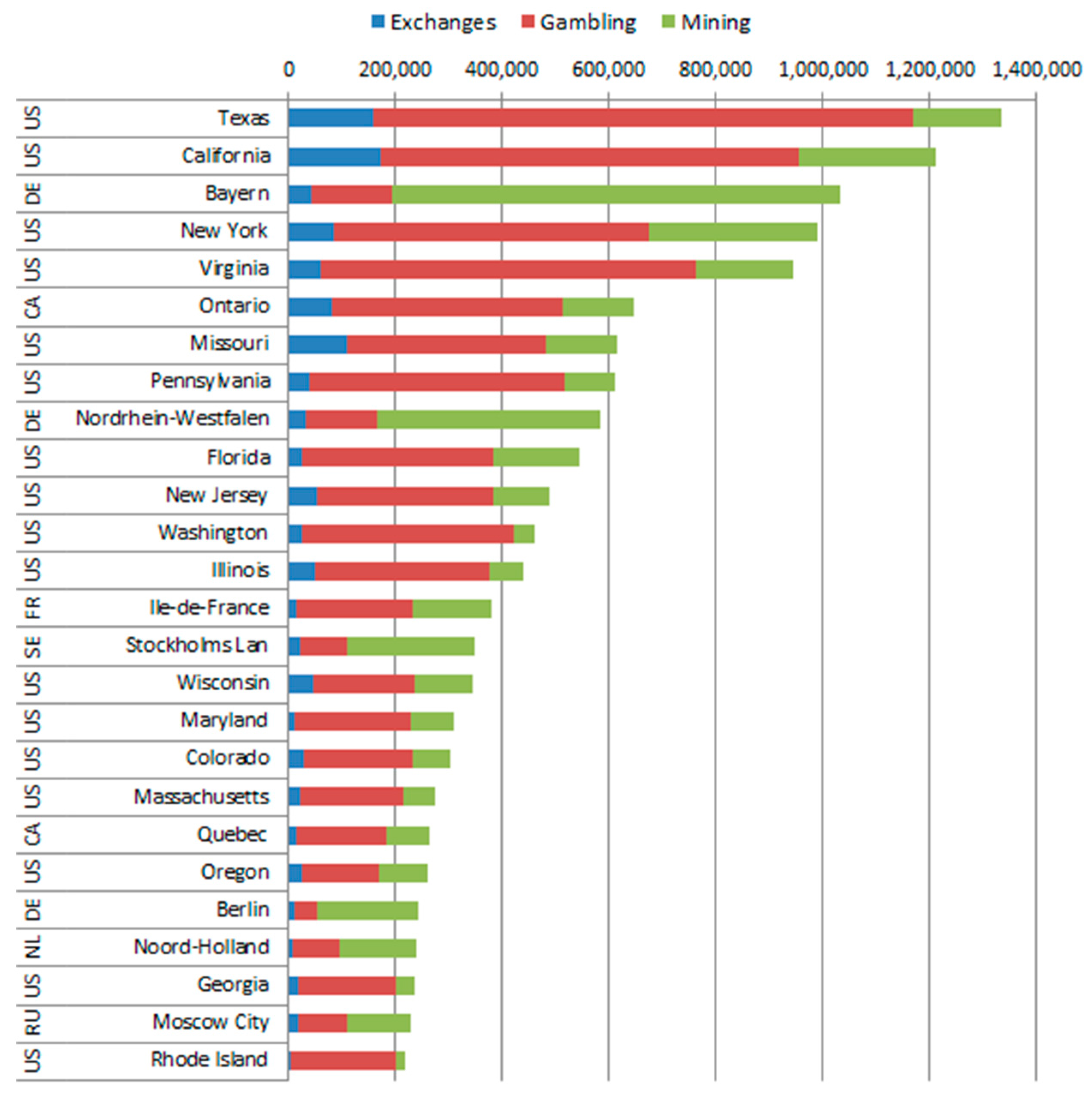

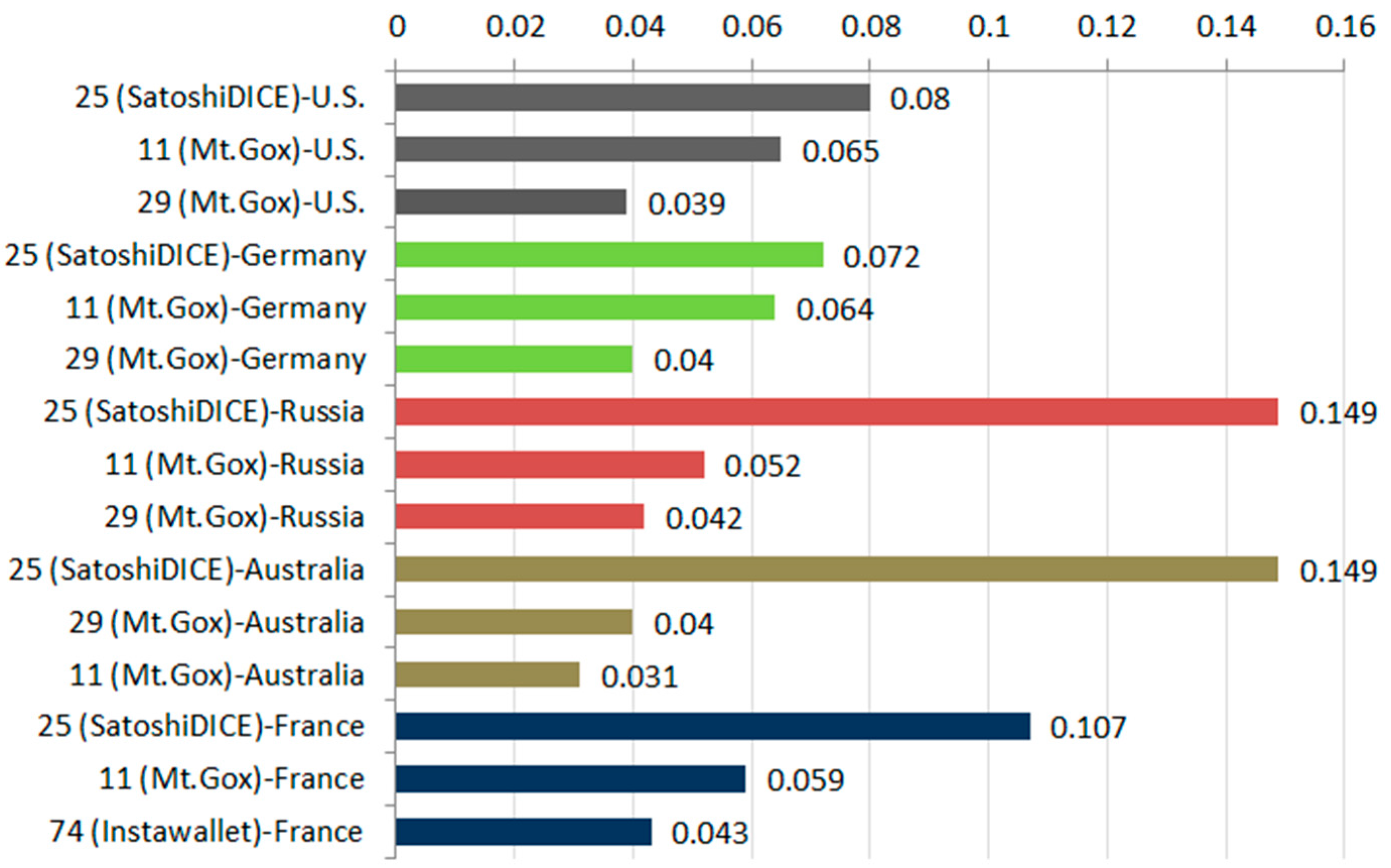

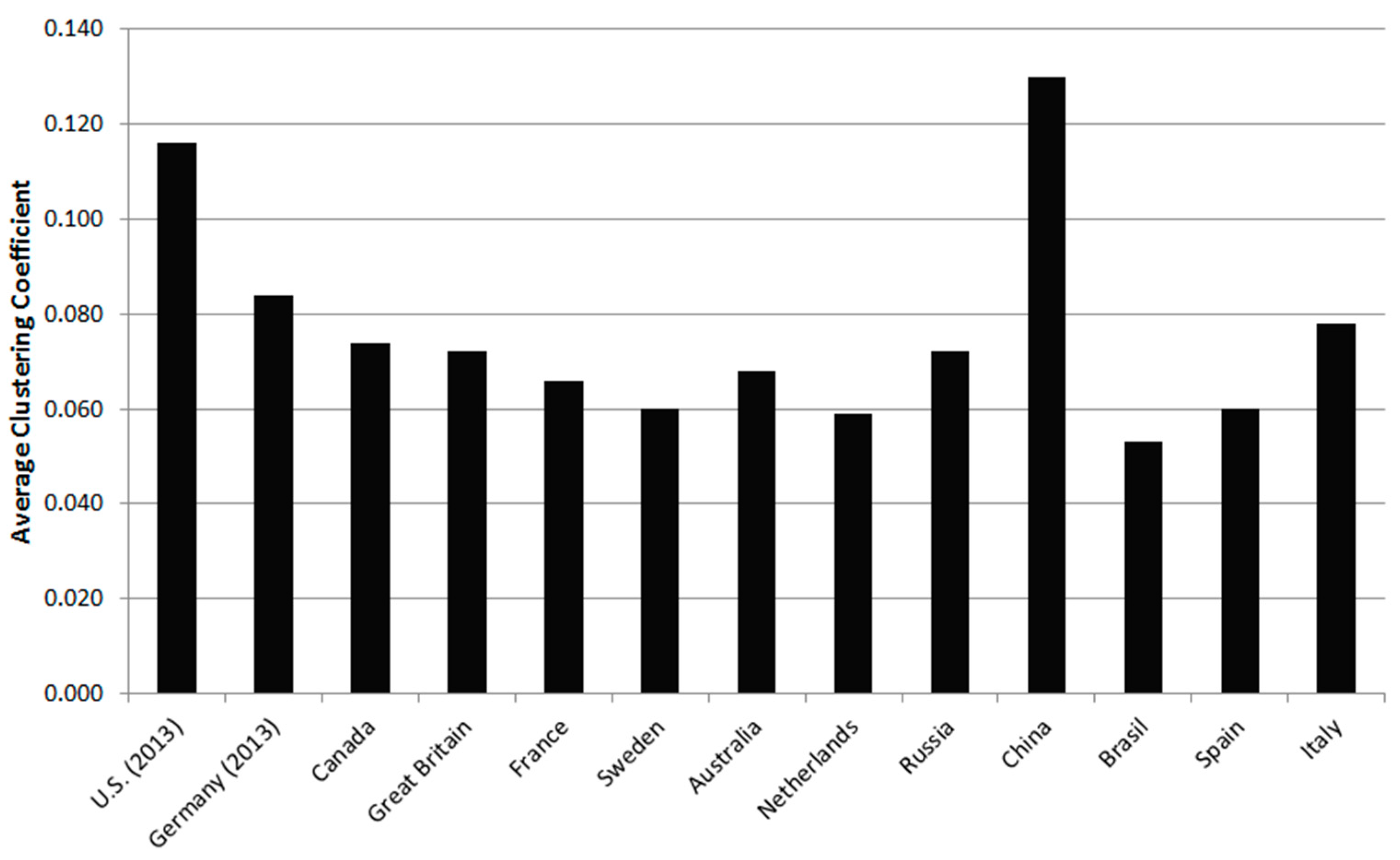

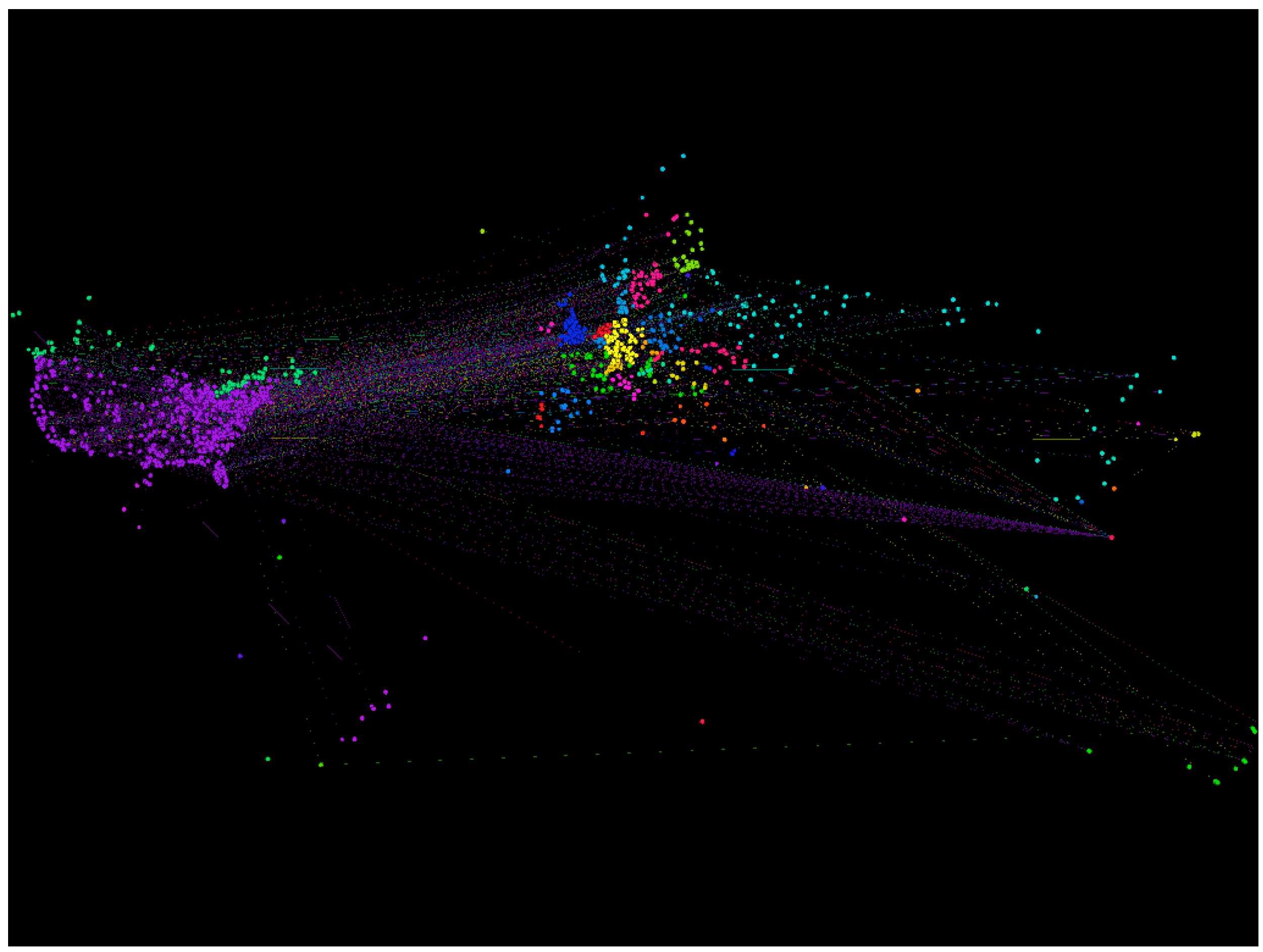

6.1.3. Geography of the Bitcoin Economy

6.2. Network Analysis

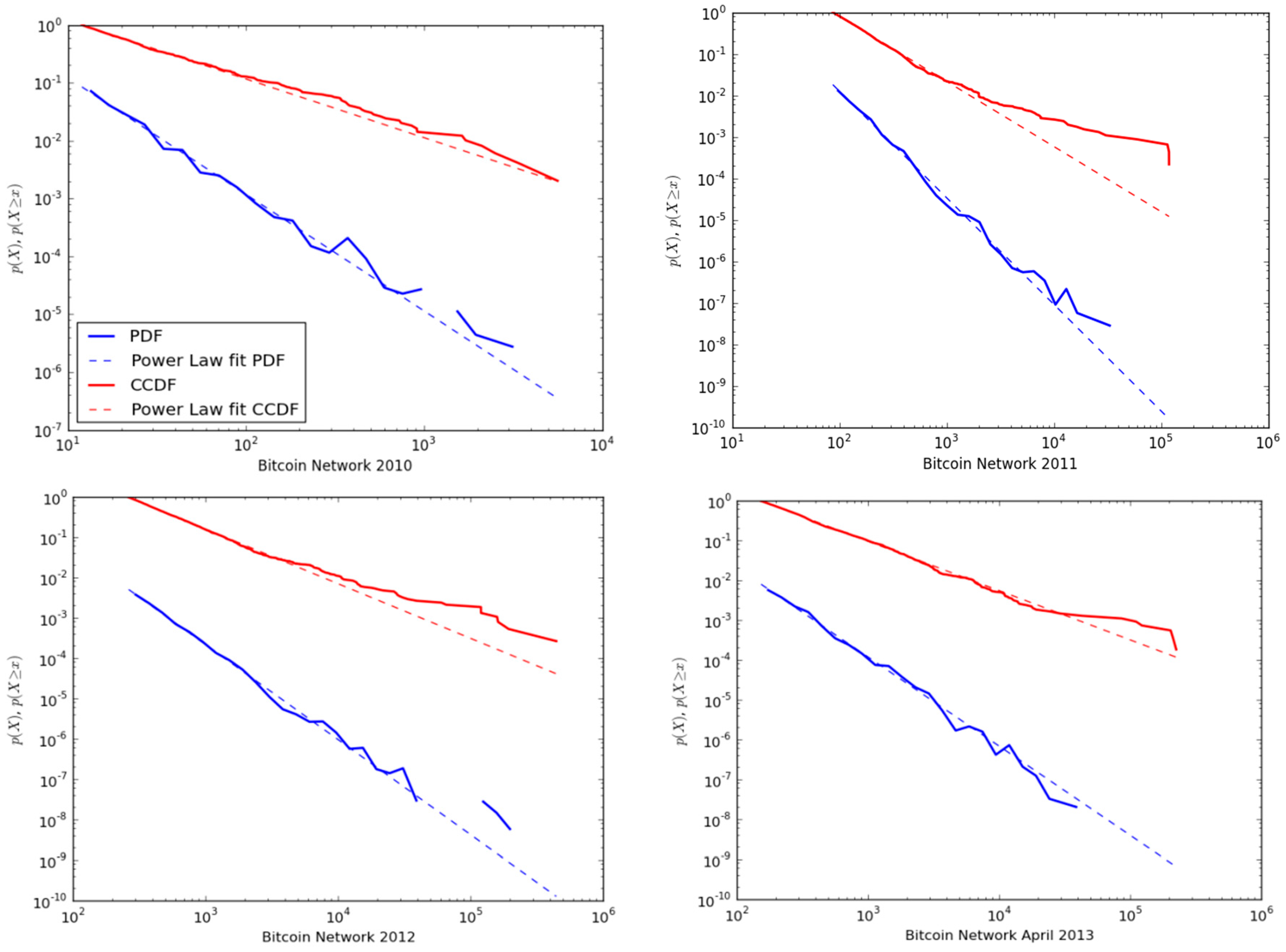

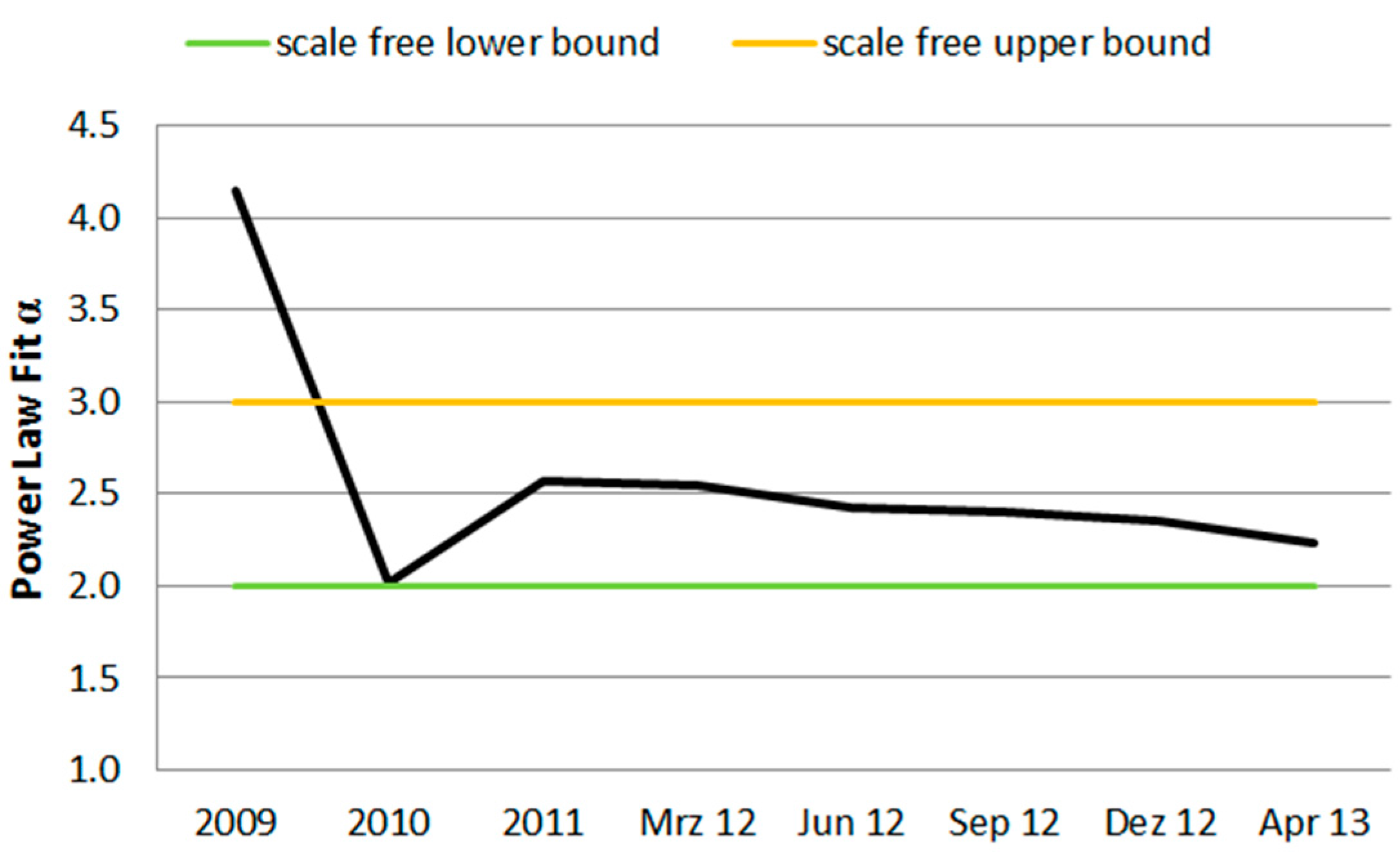

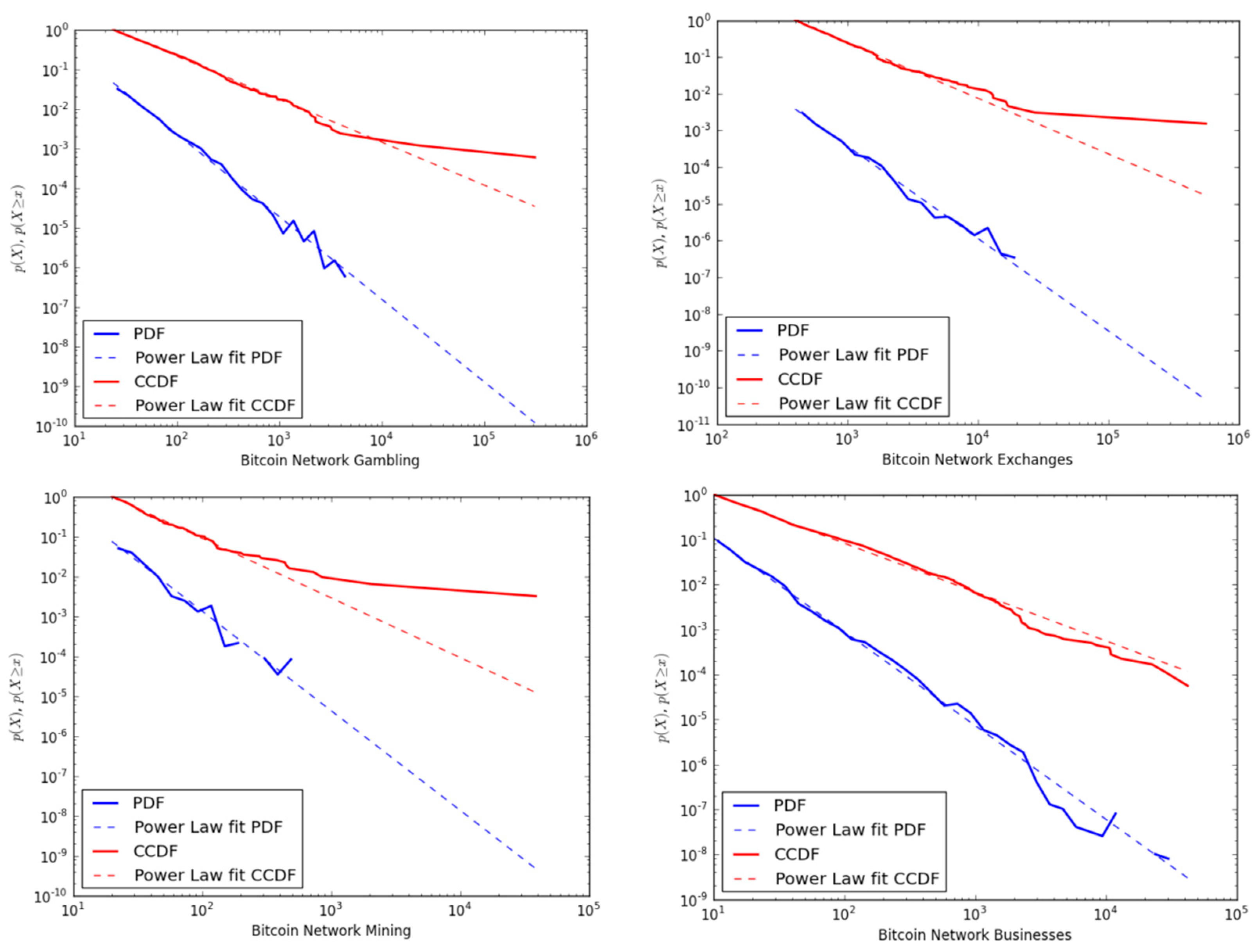

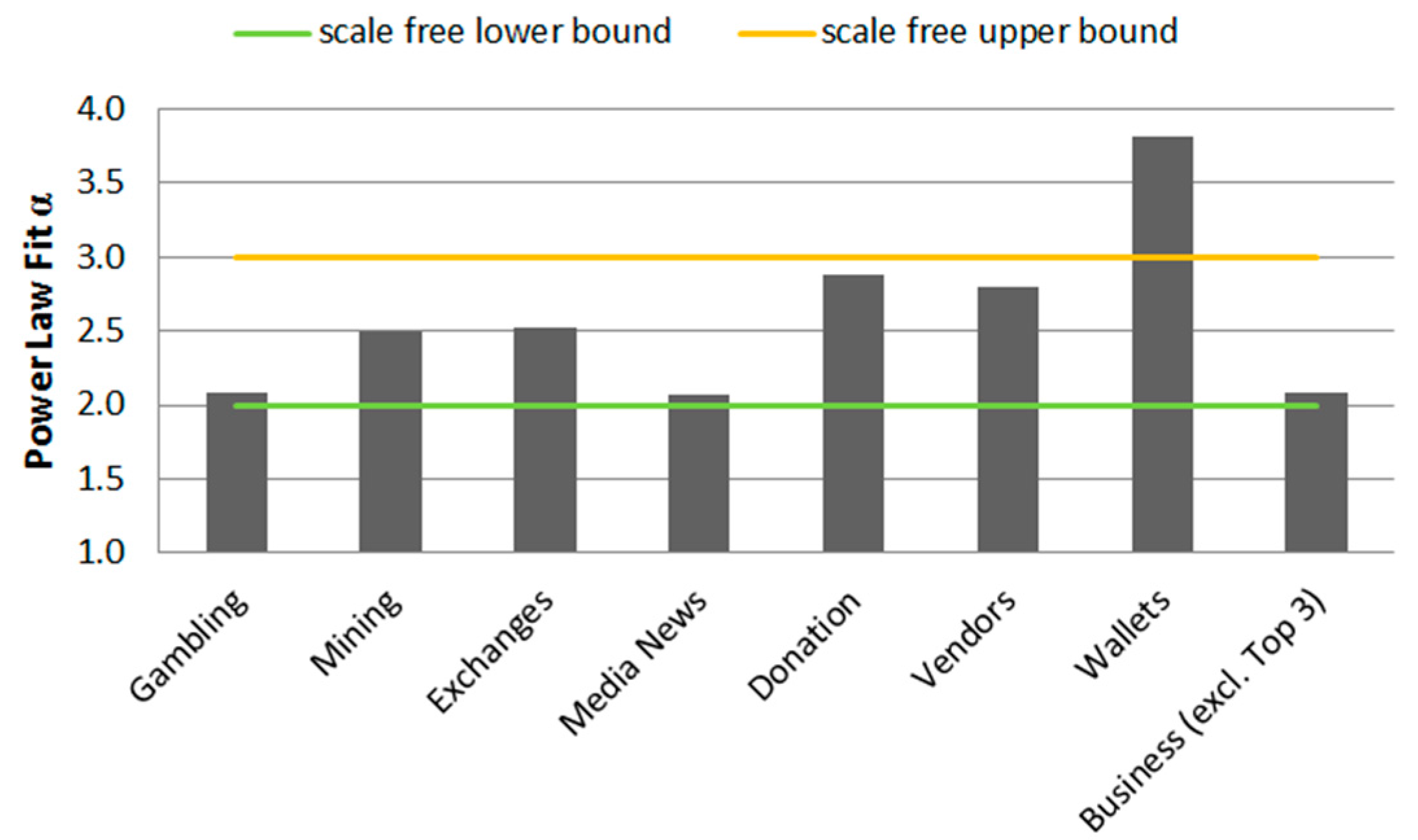

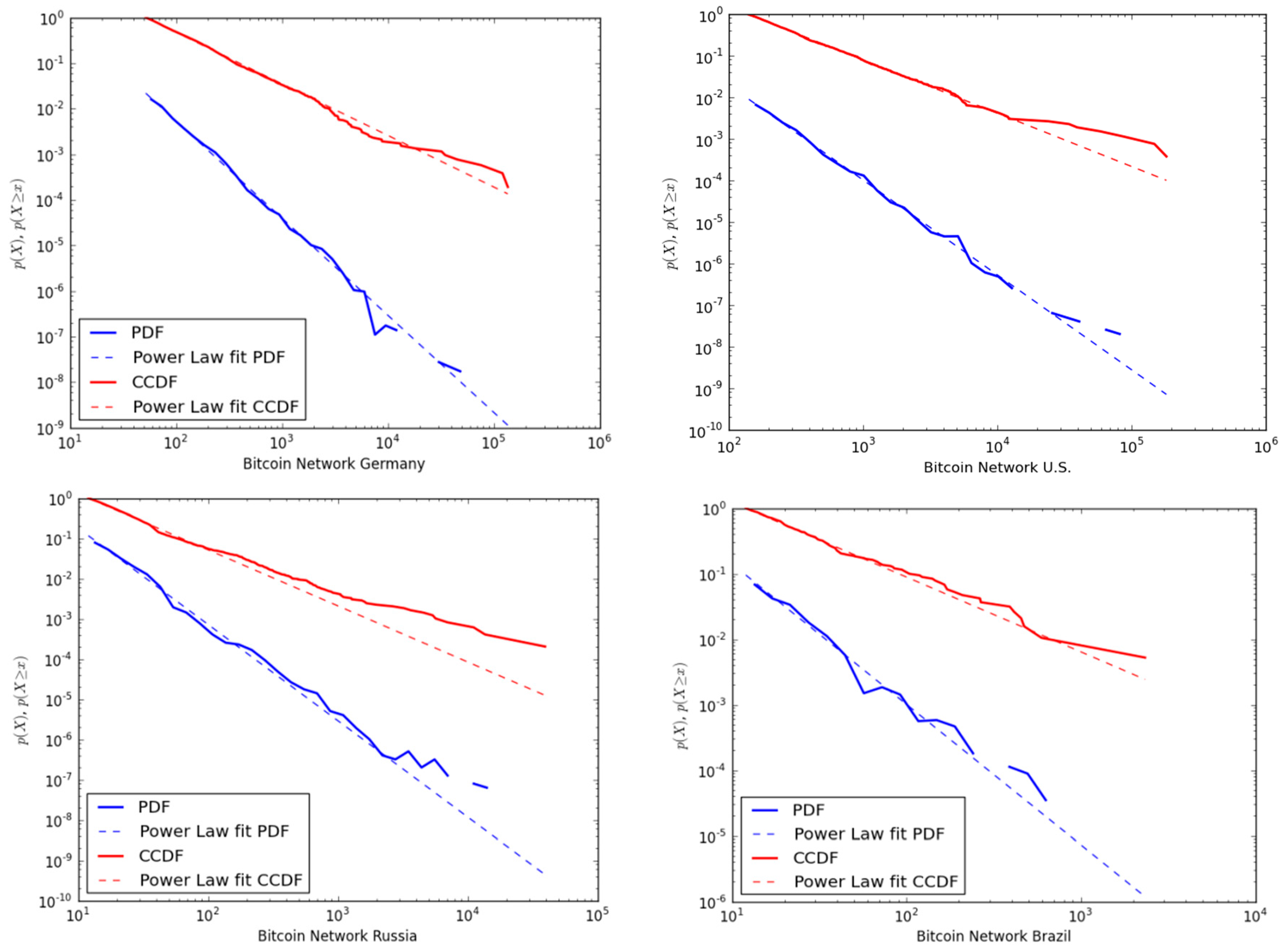

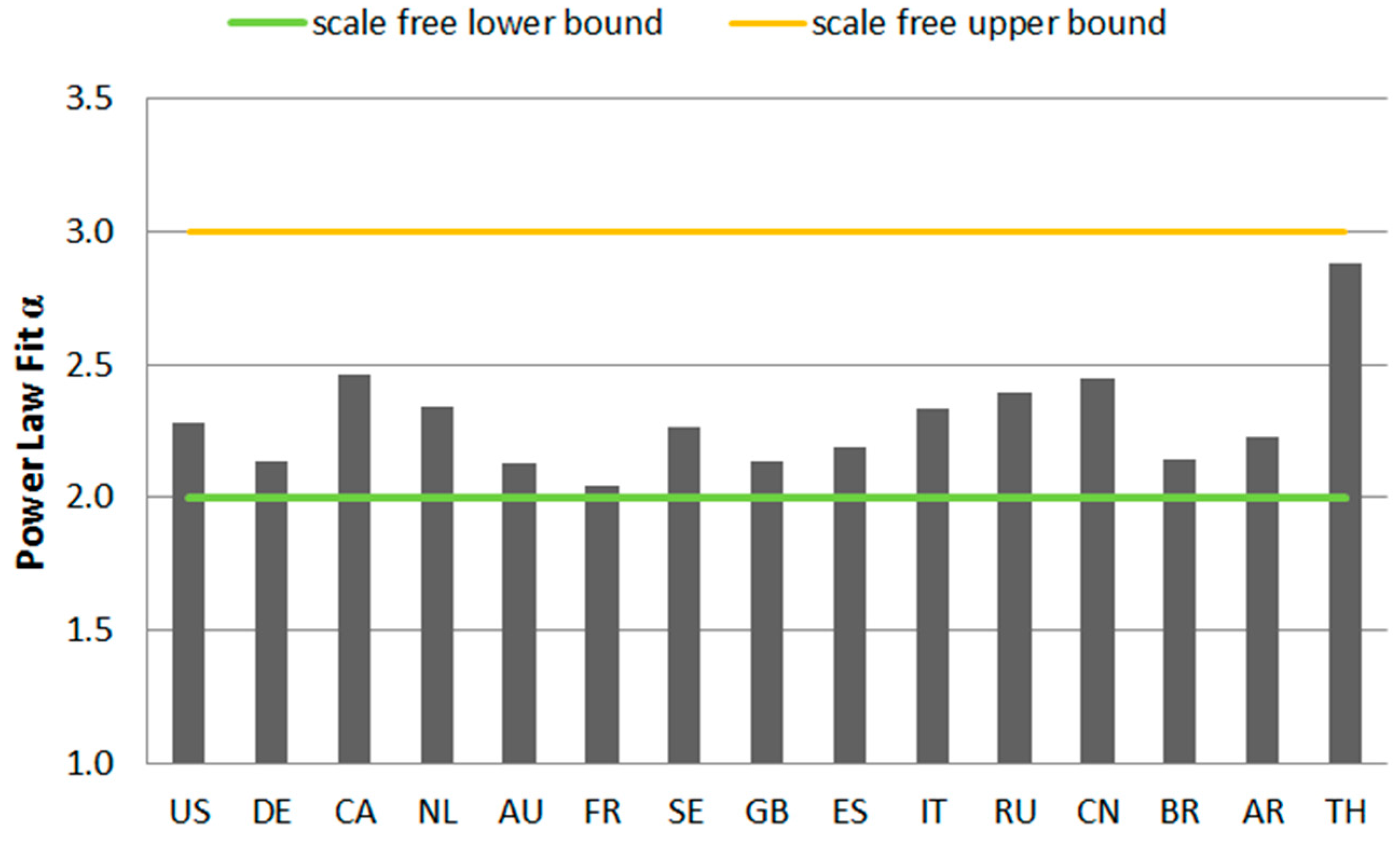

6.2.1. Degree Distribution and Power Law of the Bitcoin Network

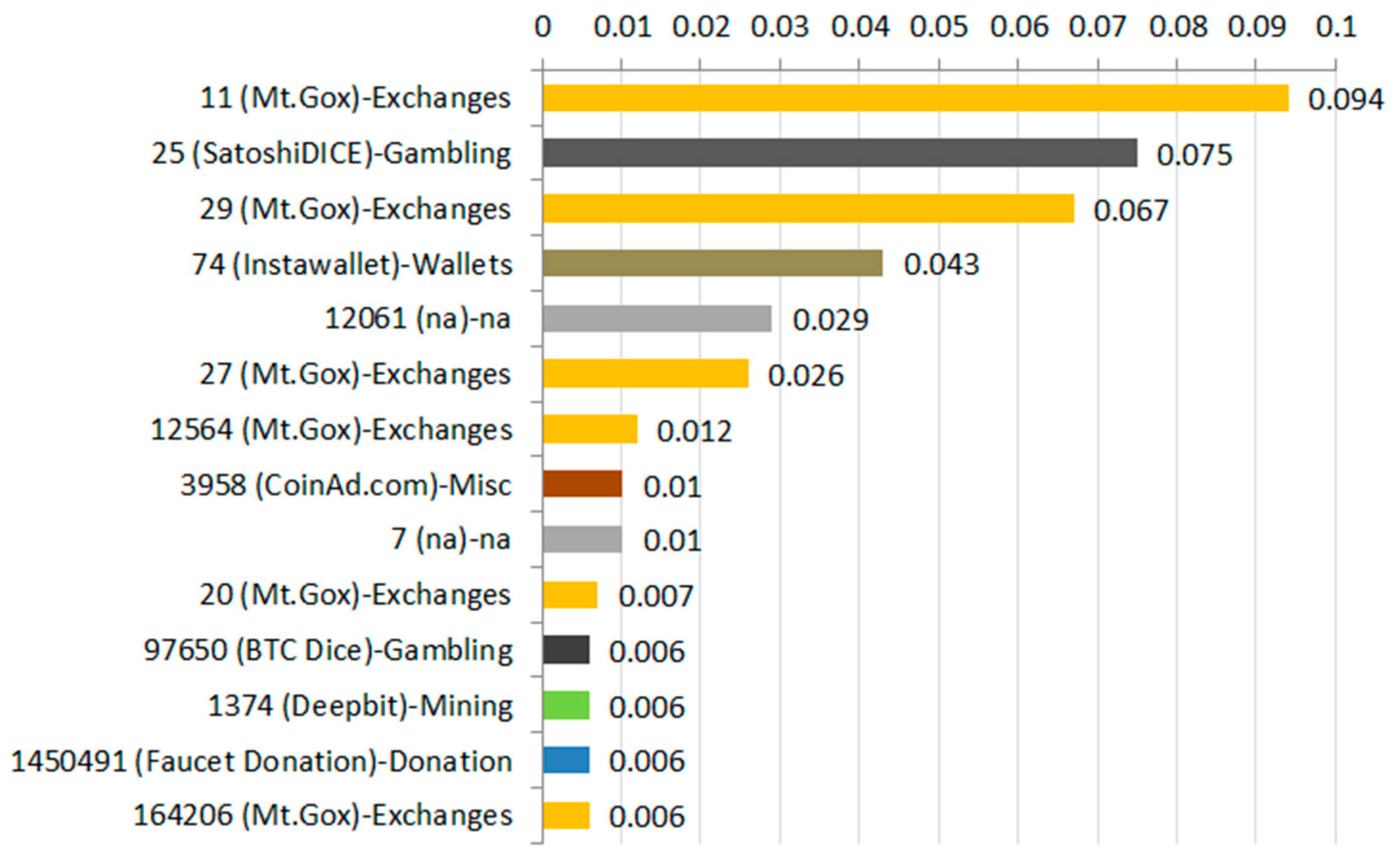

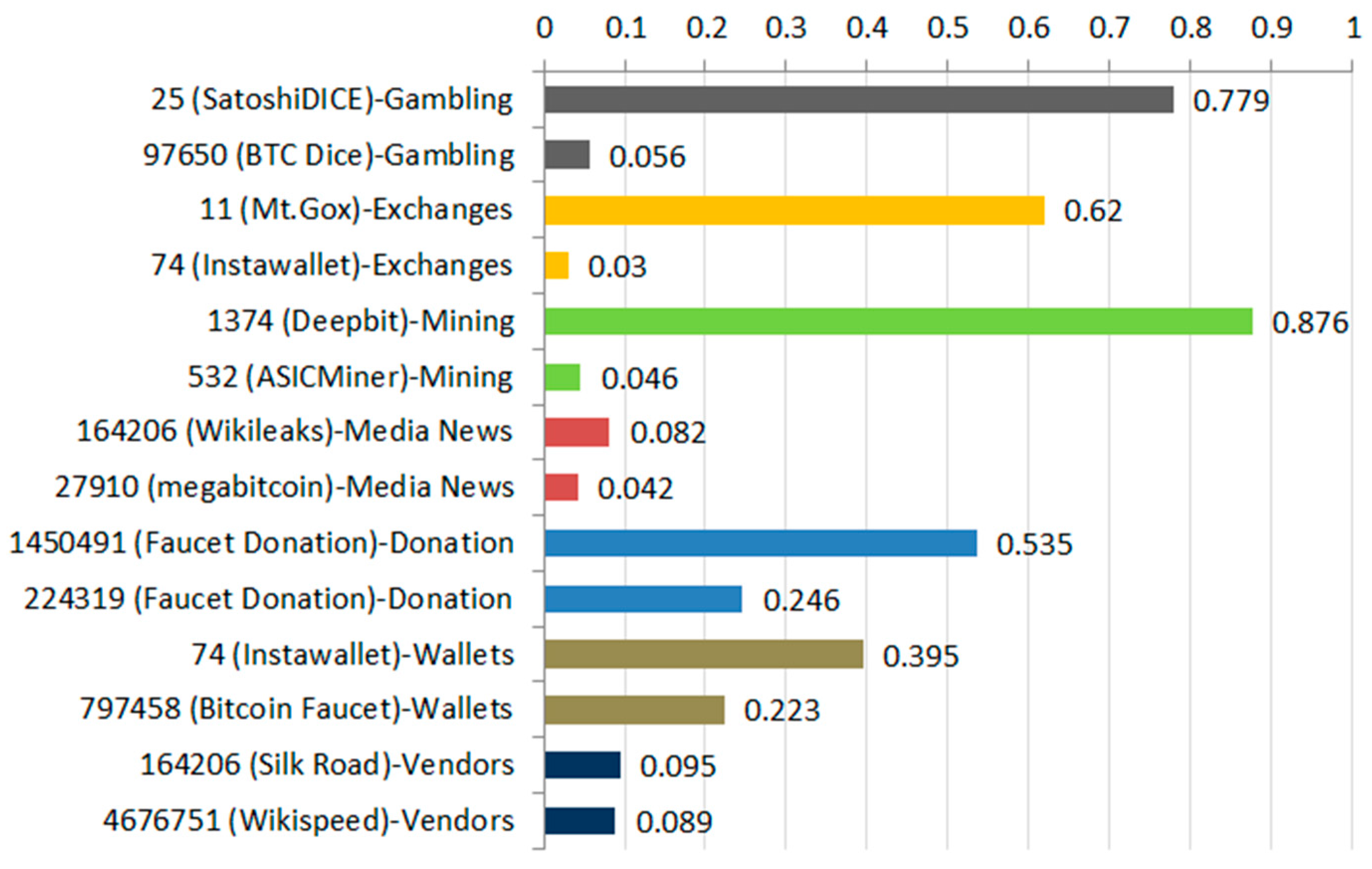

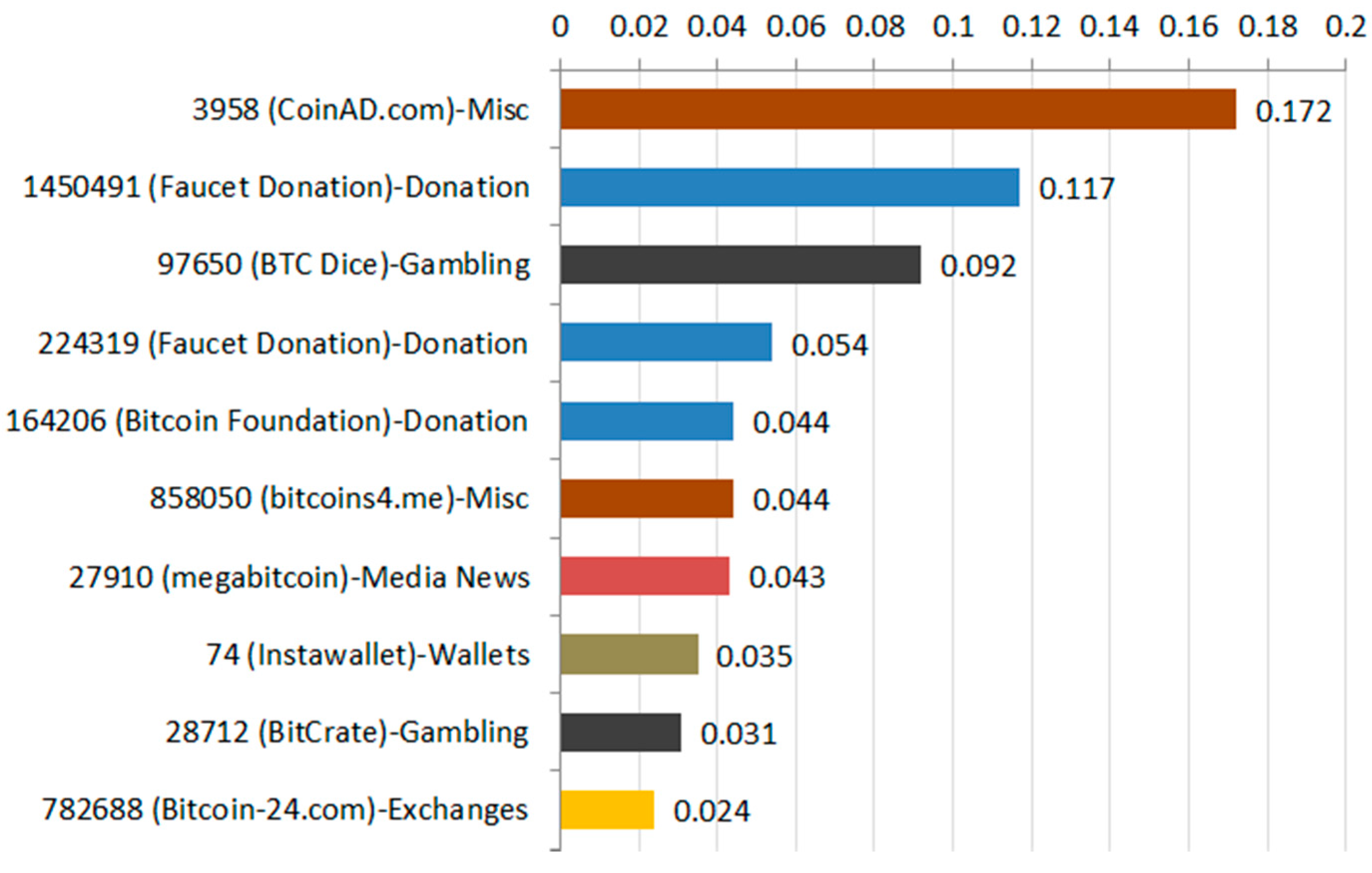

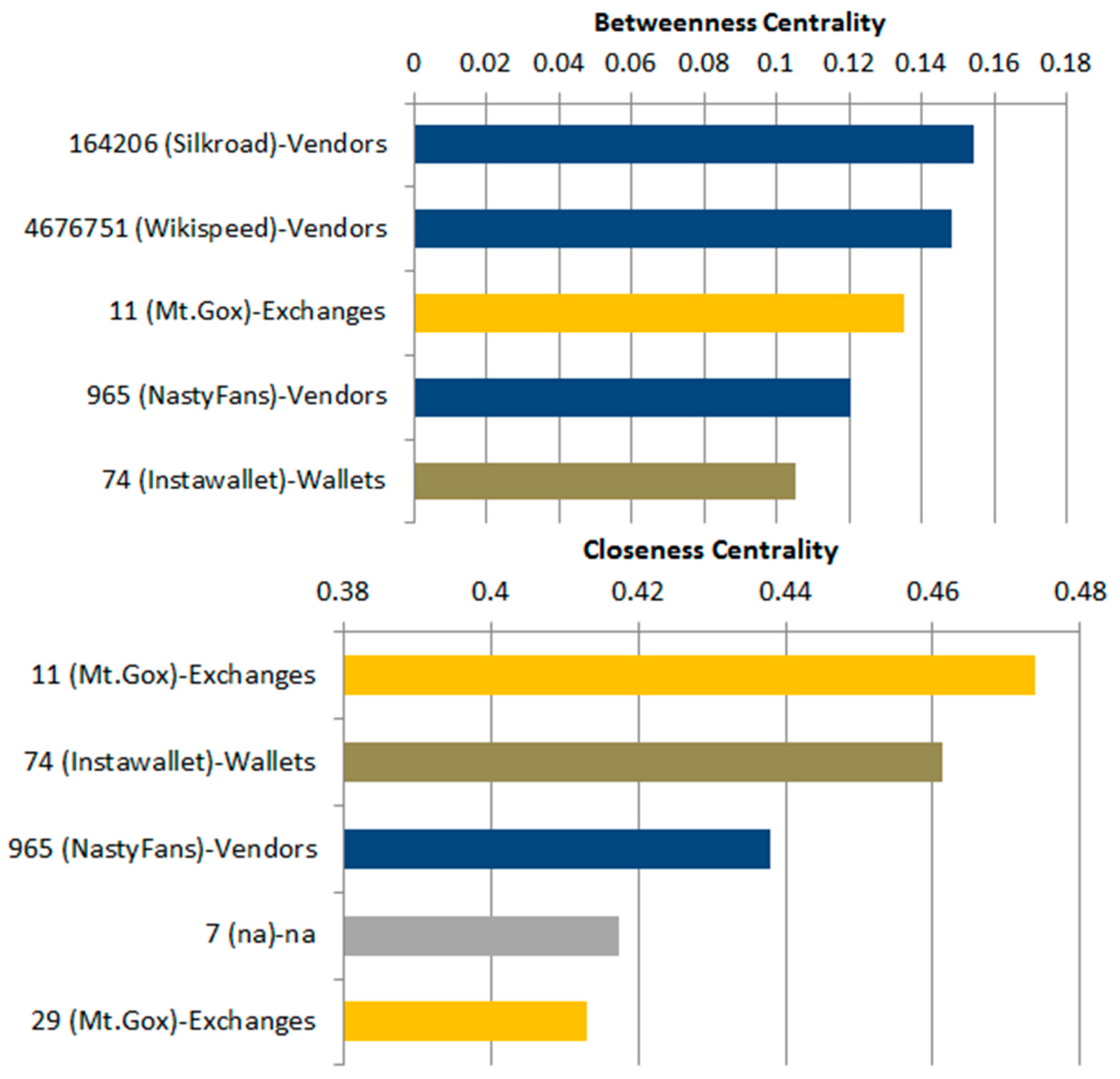

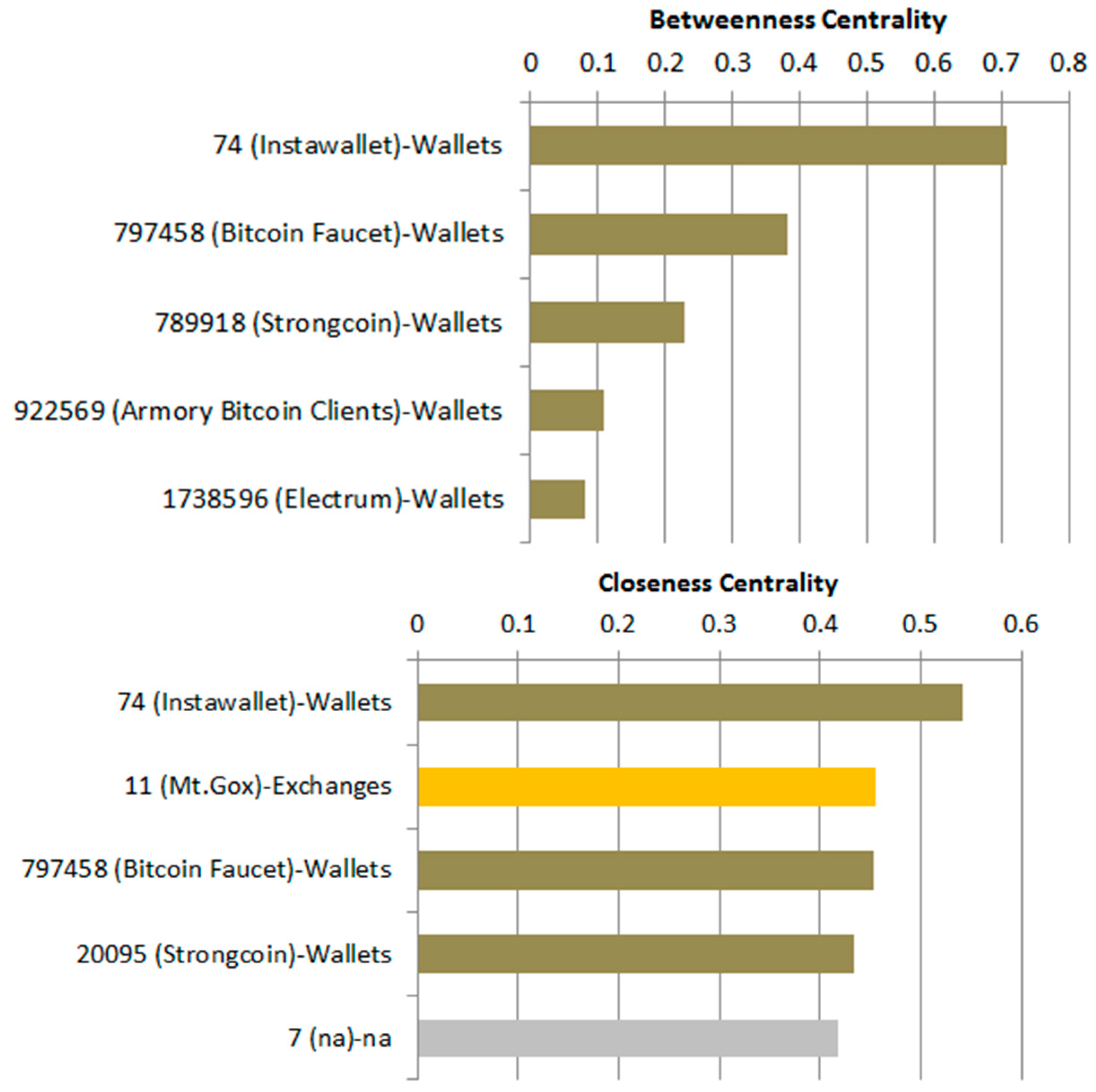

6.2.2. Centrality in the Bitcoin Network

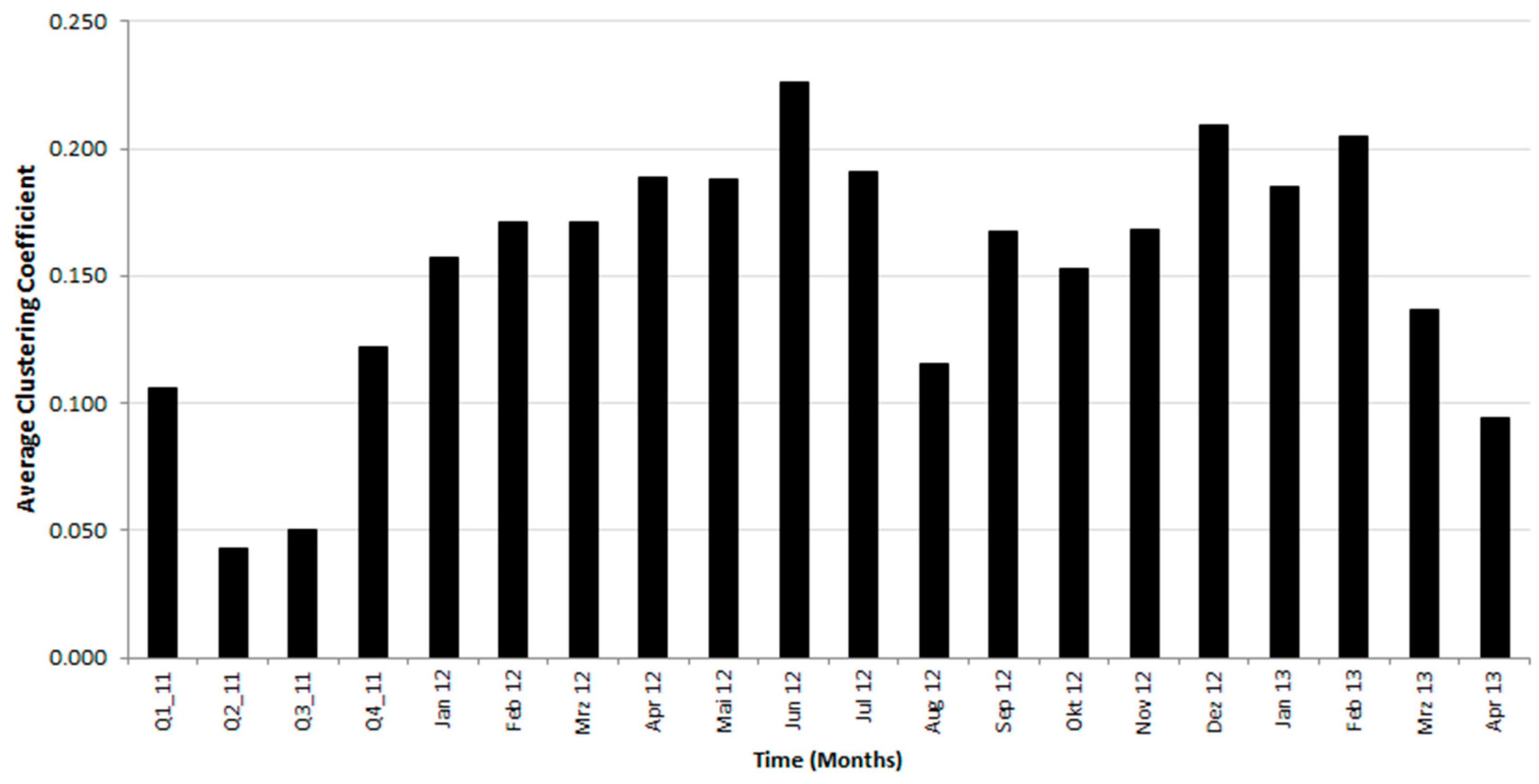

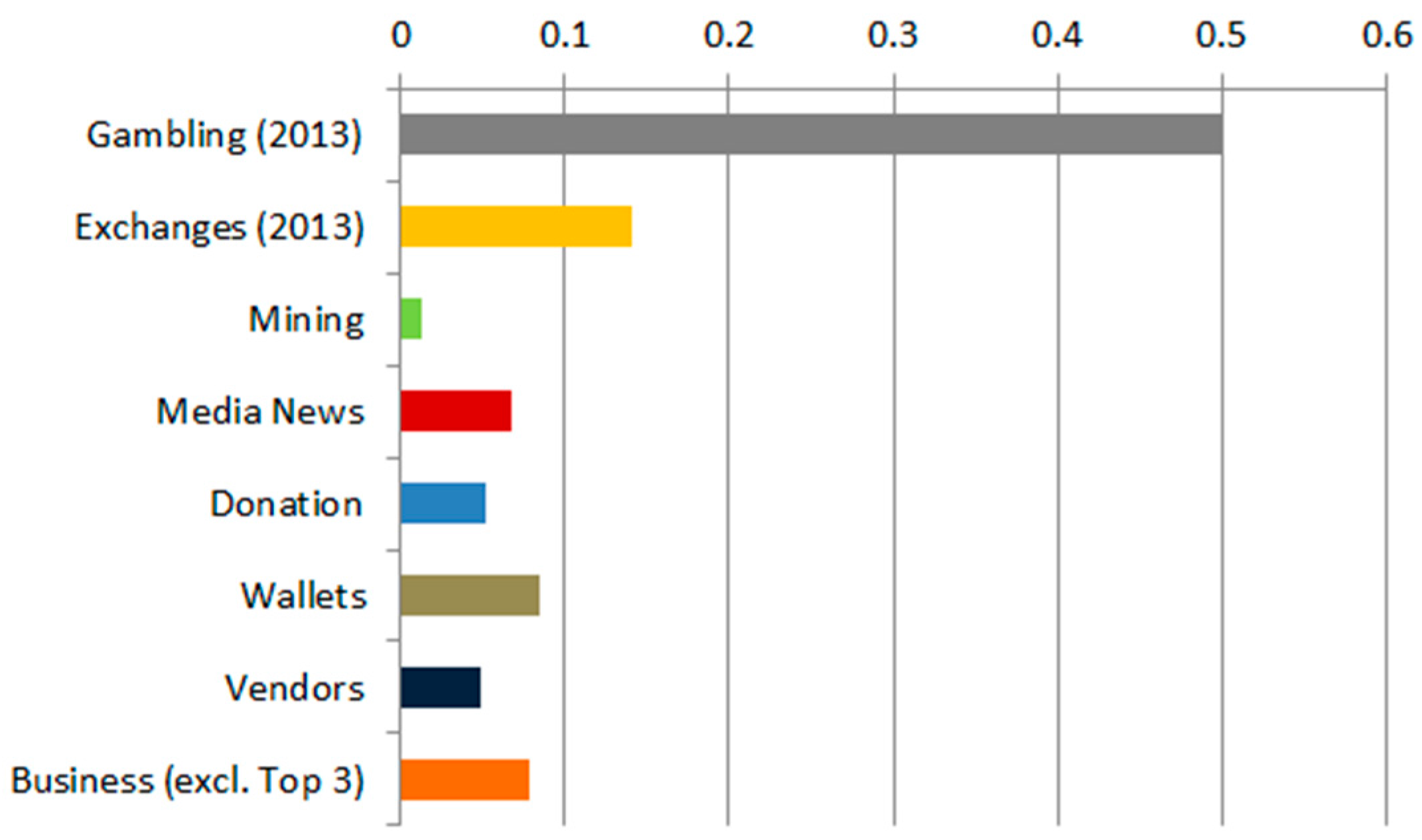

6.2.3. Clustering in the Bitcoin Network

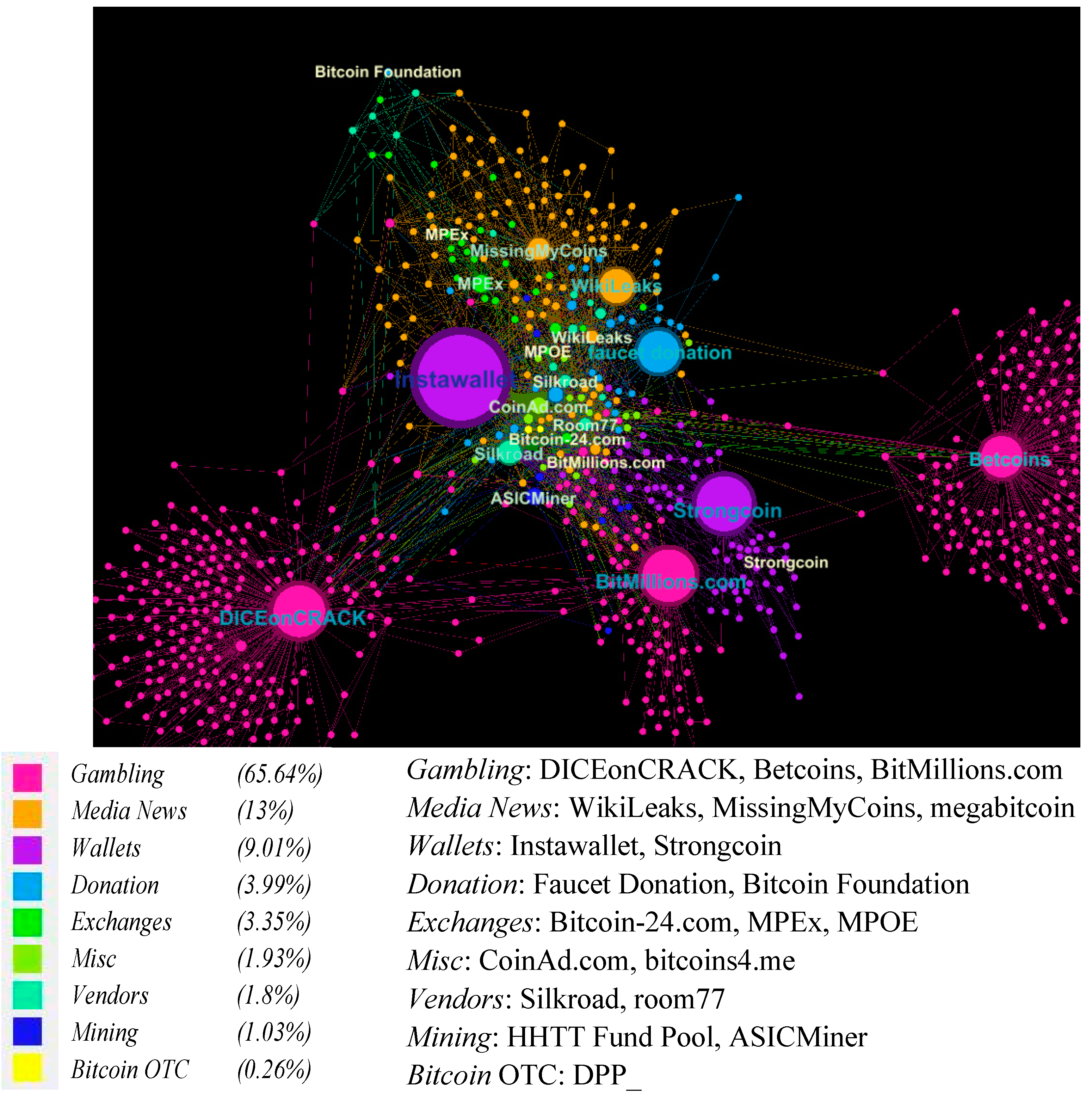

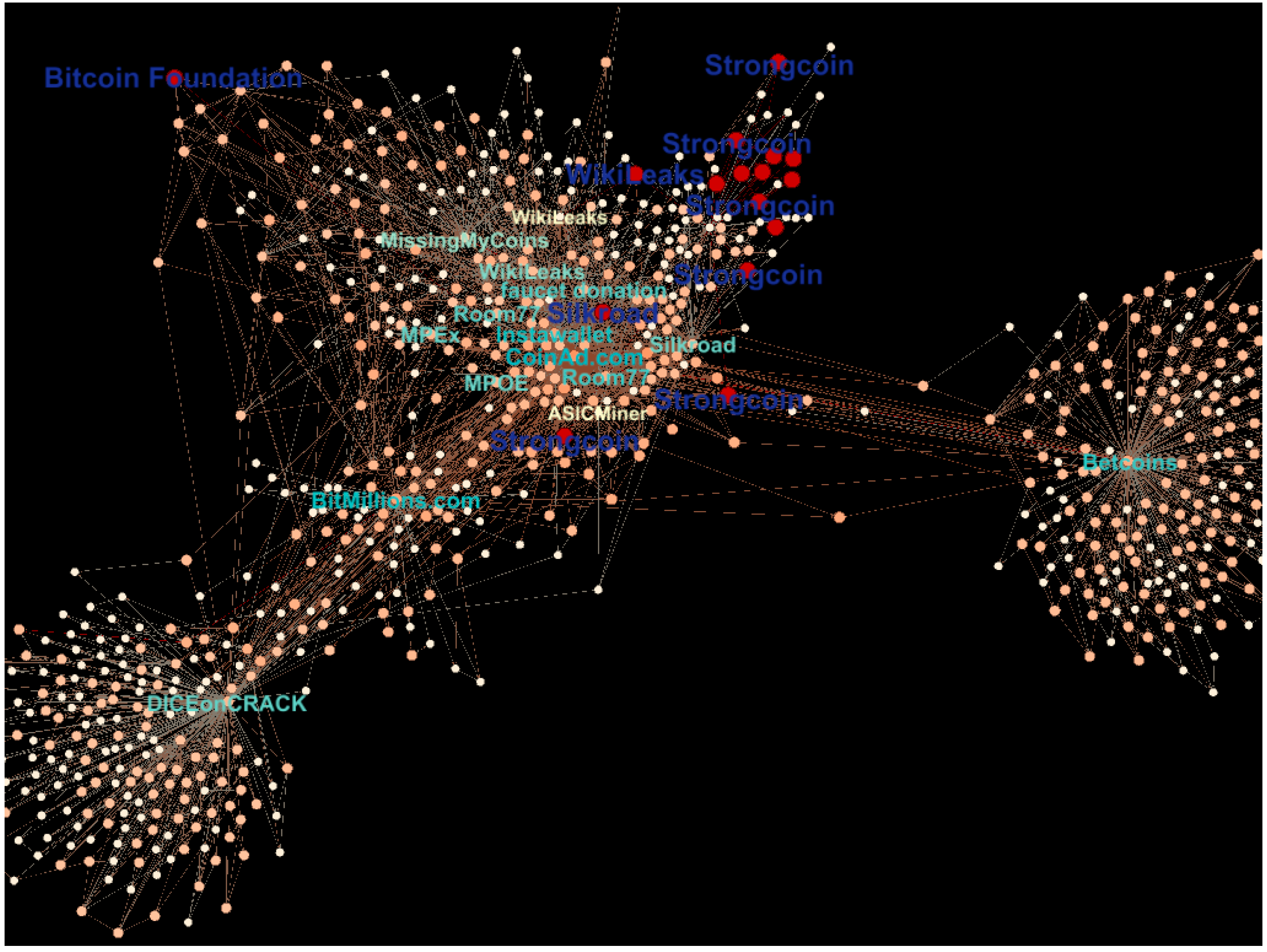

6.2.4. Visual Analysis of the Bitcoin Network

7. Conclusion, Limitations and Outlook

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. 2008. Available online: http://bitcoin.org/bitcoin.pdf (accessed on 1 March 2016).

- Reid, F.; Harrigan, M. An Analysis of Anonymity in the Bitcoin System. In Security and Privacy in Social Networks; Springer: New York, NY, USA, 2012; pp. 197–223. [Google Scholar]

- The Economist: Bitcoins. Available online: http://www.economist.com/topics/bitcoins (accessed on 1 March 2016).

- Baumann, A.; Fabian, B.; Lischke, M. Exploring the Bitcoin Network. In Proceedings of the 10th International Conference on Web Information Systems and Technologies (WEBIST); WEBIST: Barcelona, Spain, 2014. [Google Scholar]

- Drainville, D. An Analysis of the Bitcoin Electronic Cash System. 2012. Available online: http://cryptolibrary.org/handle/21/601 (accessed on 1 March 2016).

- Ober, M.; Katzenbeisser, S.; Hamacher, K. Structure and Anonymity of the Bitcoin Transaction Graph. Future Internet 2013, 5, 237–250. [Google Scholar] [CrossRef]

- Bitcoinmining: Bitcoin Mining Pools. Available online: https://www.bitcoinmining.com/bitcoin-mining-pools/ (accessed on 1 March 2016).

- Meiklejohn, S.; Pomarole, M.; Jordan, G.; Levchenko, K.; McCoy, D.; Voelker, G.M.; Savage, S. A Fistful of Bitcoins: Characterizing Payments Among Men with No Names. In Proceedings of the 2013 Internet Measurement Conference; ACM: New York, NY, USA, 2013; pp. 127–140. [Google Scholar]

- Spagnuolo, M. BitIodine: Extracting Intelligence from the Bitcoin Network. Thesis, Politecnico di Milano, 2013. Available online: http://miki.it/pdf/thesis.pdf (accessed on 1 March 2016). [Google Scholar]

- Androulaki, E.; Karame, G.O.; Roeschlin, M.; Scherer, T.; Capkun, S. Evaluating User Privacy in Bitcoin. In Financial Cryptography and Data Security; Lecture Notes in Computer Science; Springer: Berlin, Geramny; Heidelberg Germany, 2013; Volume 7859, pp. 34–51. [Google Scholar]

- Kaminsky, D. Black Ops of TCP/IP, Presentation, Black Hat & Chaos Communication Camp 2011. Available online: http://de.slideshare.net/dakami/black-ops-of-tcpip-2011-black-hat-usa-2011 (accessed on 1 March 2016).

- Ortega, M. The Bitcoin Transaction Graph Anonymity. Master Thesis, Universitat Oberta de Catalunya, 2013. Available online: http://openaccess.uoc.edu/webapps/o2/bitstream/10609/23562/9/msantamariaoTFM0613memoria.pdf (accessed on 1 March 2016). [Google Scholar]

- Python. Available online: http://www.python.org/ (accessed on 1 March 2016).

- BTC-Network Data Scraper. Available online: https://github.com/ivan-brugere/Bitcoin-Transaction-Network-Extraction (accessed on 1 March 2016).

- Bitcoin Client v0.5.3.1. Available online: https://bitcoin.org/en/release/v0.5.3.1 (accessed on 1 March 2016).

- Brugere, I. Bitcoin Transaction Network Dataset. Data Set 2013. Available online: http://compbio.cs.uic.edu/data/bitcoin/ (accessed on 1 March 2016).

- Eclipse SDK Workbench. Available online: http://www.eclipse.org/downloads/ (accessed on 1 March 2016).

- NetworkX. Available online: http://networkx.github.io/ (accessed on 1 March 2016).

- MatPlotLib. Available online: http://matplotlib.org/ (accessed on 1 March 2016).

- PyGraphviz. Available online: http://networkx.lanl.gov/pygraphviz/index.html (accessed on 1 March 2016).

- Gephi. Available online: https://gephi.org/ (accessed on 1 March 2016).

- Cran-R. Available online: http://www.r-project.org/ (accessed on 1 March 2016).

- Cran-R Spatial Data Package. Available online: http://cran.r-project.org/web/packages/sp/index.html (accessed on 1 March 2016).

- Cran-R Maptools Package. Available online: http://cran.r-project.org/web/packages/maptools/index.html (accessed on 1 March 2016).

- Cran-R RColorBrewer Package. Available online: http://cran.r-project.org/web/packages/RColorBrewer/index.html (accessed on 1 March 2016).

- Gross, J.; Yellen, J. Handbook of Graph Theory; CRC Press LLC: Boca Raton, FL, USA, 2004. [Google Scholar]

- Nykamp, D.Q. The Degree Distribution of a Network. 2013. Available online: http://mathinsight.org/degree_distribution (accessed on 1 March 2016).

- Albert, R.; Barabasi, A.-L. Statistical Mechanics of Complex Networks. Rev. Mod. Phys. 2002, 74, 47. [Google Scholar] [CrossRef]

- Clegg, R. Power Laws in Networks, Lecture, University of York, 2006. Available online: http://www.richardclegg.org/networks2/SpecialLecture_06.pdf (accessed on 1 March 2016).

- Newman, M.E.J. The Structure and Function of Complex Networks. SIAM Rev. 2006, 45, 167–256. [Google Scholar] [CrossRef]

- Newman, M.E.J. Power Laws, Pareto Distributions, Zipf’s Law. Contemp. Phys. 2005, 46, 323–351. [Google Scholar] [CrossRef]

- Barabasi, A.-L.; Albert, R.; Jeong, H. Scale-free Characteristics of Random Networks: The Topology of the World-Wide Web. Phys. A 2000, 281, 2069–2077. [Google Scholar]

- Inaoka, H.; Ninomiya, T.; Taniguchi, K.; Shimizu, T.; Takayasu, H. Fractal Network Derived from Banking Transaction—An Analysis of Network Structures Formed by Financial Institutions. 2004. Available online: https://www.boj.or.jp/en/research/wps_rev/wps_2004/data/wp04e04.pdf (accessed on 1 March 2016).

- Saramäki, J.; Kivela, M.; Onnela, J.-P.; Kaski, K.; Kertesz, J. Generalizations of the Clustering Coefficient to Weighted Complex Networks. Phys. Rev. E 2007, 75, 027105. [Google Scholar] [CrossRef] [PubMed]

- Watts, D.; Strogatz, S. Collective Dynamics of Small-World Networks. Nature 1998, 393, 440–442. [Google Scholar] [CrossRef] [PubMed]

- Mao, G.; Zhang, N. Analysis of Average Shortest-Path Length of Scale-Free Network. J. Appl. Math. 2013. [Google Scholar] [CrossRef]

- Freeman, L. Centrality in Social Networks Conceptual Clarification. Soc. Netw. 1979, 1, 215–239. Available online: http://leonidzhukov.ru/hse/2013/socialnetworks/papers/freeman79-centrality.pdf (accessed on 1 March 2016). [Google Scholar] [CrossRef]

- Bonacich, P. Power and Centrality: A Family of Measures. Am. J. Sociol. 1987, 92, 1170–1182. [Google Scholar] [CrossRef]

- Borgatti, S. Centrality and Network Flow. Soc. Netw. 2005, 27, 55–71. [Google Scholar] [CrossRef]

- Yan, E.; Ding, Y. Applying Centrality Measures to Impact Analysis: A Coauthorship Network Analysis. 2010. Available online: http://arxiv.org/pdf/1012.4862.pdf (accessed on 1 March 2016).

- Newman, M.E.J. A measure of betweenness centrality based on random walks. Soc. Netw. 2005, 27, 39–54. Available online: http://arxiv.org/pdf/cond-mat/0309045.pdf (accessed on 1 March 2016). [Google Scholar] [CrossRef]

- Brugere, I. Bitcoin tools. Available online: https://github.com/ivan-brugere/Bitcoin-Transaction-Network-Extraction (accessed on 1 March 2016).

- Blockchain.info. Blockchain Data API. Available online: https://blockchain.info/de/api/blockchain_api (accessed on 1 March 2016).

- Bitcoin Charts. Historical Trade Data. Available online: http://bitcoincharts.com/charts/mtgoxUSD#igDailyzczsg2010-07-17zeg2013-12-23ztgSzm1g10zm2g25zv (accessed on 1 March 2016).

- Bitcoin Talk Forum. Available online: https://bitcointalk.org/ (accessed on 1 March 2016).

- Alstott, J. Powerlaw: A Python Package for Analysis of Heavy-Tailed Distributions. 2014. Available online: http://arxiv.org/pdf/1305.0215v3.pdf (accessed on 1 March 2016).

| Median | Mean | Sd | Skew | Min | Max | Correl [EXRate] | |

|---|---|---|---|---|---|---|---|

| Transaction Value [BTC] | 173,457 | 910,053 | 2,231,647 | 7 | 50 | 29,958,714 | 0.199 |

| Number of Users | 1637 | 4049 | 5243 | 2 | 1 | 36,120 | 0.730 |

| Number of Transactions | 3678 | 24,084 | 38,303 | 2 | 1 | 189,284 | 0.680 |

| Trade Measure | User Activity (Rolling Windows) | |||

|---|---|---|---|---|

| 1 Day | 10 Days | 30 Days | 100 Days | |

| BTC/USD | 0.718 | 0.687 | 0.639 | 0.604 |

| Volume | 0.292 | 0.267 | 0.252 | 0.241 |

| Category | Content | Examples | # Transactions | in % |

|---|---|---|---|---|

| Gambling | Dice & Casino Games | SatoshiDice, Betcoins | 7,615,051 | 47.90% |

| Mining | Mining Pools & Services | Deepbit, ASICMiner | 689,231 | 4.34% |

| Exchanges | Exchange Platforms | Mt.Gox, Bitcoin-24 | 293,969 | 1.85% |

| Wallets | Web Wallets and Clients | Instawallet, Strongcoin | 17,748 | 0.11% |

| IT | Programming & Hardware Services | Free Software Foundation | 4515 | 0.03% |

| Media News | Blogs, Media Channels, News | Wikileaks, Archive.org | 7563 | 0.05% |

| Vendors | Selling Goods | Room77, Silk Road | 2233 | 0.01% |

| Donation | Charity & other Donations | Faucet Donation | 30,612 | 0.19% |

| Bitcoin Services | Sites offering Information & Services | Blockexplorer, Bitcoinmonitor | 1420 | 0.01% |

| Bitcoin OTC | Over the Counter (OTC) Trader | DPP_, Eleuthria | 5054 | 0.03% |

| Bitcoin Talk | Bitcoin Forum Users | Quip, Nikkos | 3534 | 0.02% |

| Misc. | Free BTC Sites & Advertising | CoinAd, Hashluck | 4123 | 0.03% |

| Unknown | Not Classified Transactions | n.a. | 7,223,572 | 45.44% |

| Total | - | - | 15,898,625 | 100% |

| Transaction Value [BTC] | #TXs | % | Top 3 Business Categories | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Low | High | 1st | 2nd | 3rd | n.a. | |||||

| 0.00000001 | 0.00001 | 2,546,657 | 6.8 | Gambling | 60.0% | Media News | 3.3% | Misc. | 3.2% | 33.5% |

| 0.00001 | 0.0050 | 3,547,994 | 9.5 | Gambling | 43.5% | Misc. | 5.7% | Media News | 2.9% | 47.9% |

| 0.0050 | 0.0100 | 1,056,999 | 2.8 | Gambling | 77.4% | Exchanges | 0.7% | Misc. | 0.3% | 21.6% |

| 0.0100 | 0.0110 | 2,187,115 | 5.8 | Gambling | 57.0% | Mining | 4.0% | Exchanges | 1.2% | 37.8% |

| 0.0110 | 0.0199 | 1,928,654 | 5.1 | Gambling | 62.2% | Mining | 0.8% | Donation | 0.6% | 36.5% |

| 0.0199 | 0.0505 | 3,133,778 | 8.4 | Gambling | 62.5% | Mining | 3.4% | Exchanges | 0.8% | 33.3% |

| 0.0505 | 0.1001 | 2,387,548 | 6.4 | Gambling | 59.2% | Mining | 3.8% | Exchanges | 0.8% | 36.2% |

| 0.1001 | 1.0000 | 7,160,737 | 19.1 | Gambling | 55.7% | Mining | 4.4% | Exchanges | 1.4% | 38.5% |

| 1.0000 | 2.0008 | 2,645,839 | 7.1 | Gambling | 34.7% | Mining | 5.9% | Exchanges | 1.6% | 57.9% |

| 2.0008 | 10.000 | 3,632,013 | 9.7 | Gambling | 30.4% | Mining | 5.1% | Exchanges | 2.3% | 62.2% |

| 10.00 | 50.590 | 3,759,223 | 10.0 | Gambling | 12.7% | Mining | 9.8% | Exchanges | 2.8% | 74.6% |

| 50.59 | 100.09 | 703,960 | 1.9 | Mining | 11.2% | Gambling | 6.1% | Exchanges | 5.6% | 77.1% |

| 100.09 | 499.06 | 622,339 | 1.7 | Exchanges | 7.0% | Gambling | 5.3% | Mining | 4.7% | 83.0% |

| 499.06 | 1,000.0 | 197,254 | 0.5 | Exchanges | 2.8% | Gambling | 1.3% | Mining | 0.3% | 95.6% |

| 1,000.0 | 10,009 | 134,783 | 0.4 | Exchanges | 1.2% | Gambling | 0.5% | Vendors | 0.1% | 98.1% |

| 10,009 | 100,000 | 20,353 | 0.1 | Exchanges | 0.3% | Vendors | 0.05% | Wallets | 0.04% | 99.7% |

| 100,000 | 500,000 | 206 | 0.001 | Exchanges | 36.4% | Vendors | 1.9% | - | - | 61.7% |

| Aggregates | Bitcoin Graph | Random Graph | ||

|---|---|---|---|---|

| AVG Clustering | AVG Shortest Path | AVG Clustering | AVG Shortest Path | |

| Country | ||||

| China | 0.130 | 5.15 | 0.00071 | 4.45 |

| Brasil | 0.053 | 4.74 | 0.00115 | 4.45 |

| Italy | 0.078 | 4.39 | 0.00091 | 4.23 |

| Argentina | 0.078 | 4.78 | 0.00190 | 4.25 |

| Business | ||||

| Wallets | 0.085 | 3.90 | 0.00402 | 3.10 |

| Vendors | 0.048 | 3.32 | 0.062 | 1.95 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lischke, M.; Fabian, B. Analyzing the Bitcoin Network: The First Four Years. Future Internet 2016, 8, 7. https://doi.org/10.3390/fi8010007

Lischke M, Fabian B. Analyzing the Bitcoin Network: The First Four Years. Future Internet. 2016; 8(1):7. https://doi.org/10.3390/fi8010007

Chicago/Turabian StyleLischke, Matthias, and Benjamin Fabian. 2016. "Analyzing the Bitcoin Network: The First Four Years" Future Internet 8, no. 1: 7. https://doi.org/10.3390/fi8010007

APA StyleLischke, M., & Fabian, B. (2016). Analyzing the Bitcoin Network: The First Four Years. Future Internet, 8(1), 7. https://doi.org/10.3390/fi8010007