From NFT 1.0 to NFT 2.0: A Review of the Evolution of Non-Fungible Tokens

Abstract

:1. Introduction

- A review of the technological support offered by the blockchain to NFTs, focusing on the various blockchain network types, their consensus protocols, and their impacts on NFT projects;

- An analysis of NFT 1.0, including a discussion of their properties and standards proposed;

- A comparison between NFT-supporting blockchains in terms of six key properties that define the blockchains’ support for NFTs;

- Highlighting innovations of NFT 2.0 with respect to NFT 1.0;

- Pointing out the sources of dynamism for NFT 2.0 metadata, and how metadata can be stored;

- Showcasing the most promising NFT 2.0 applications.

2. Background and Preliminaries

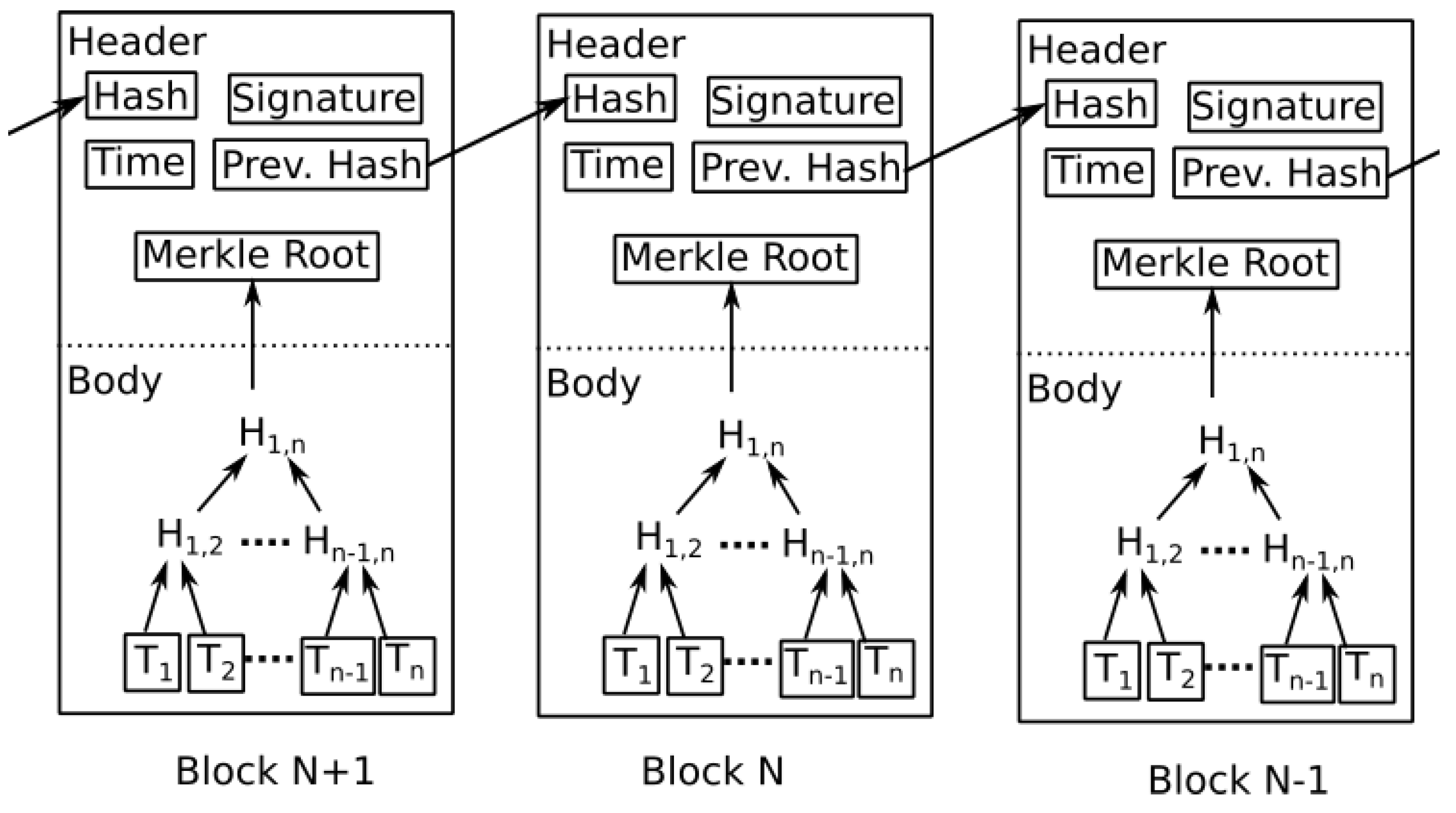

2.1. Blockchain Technology

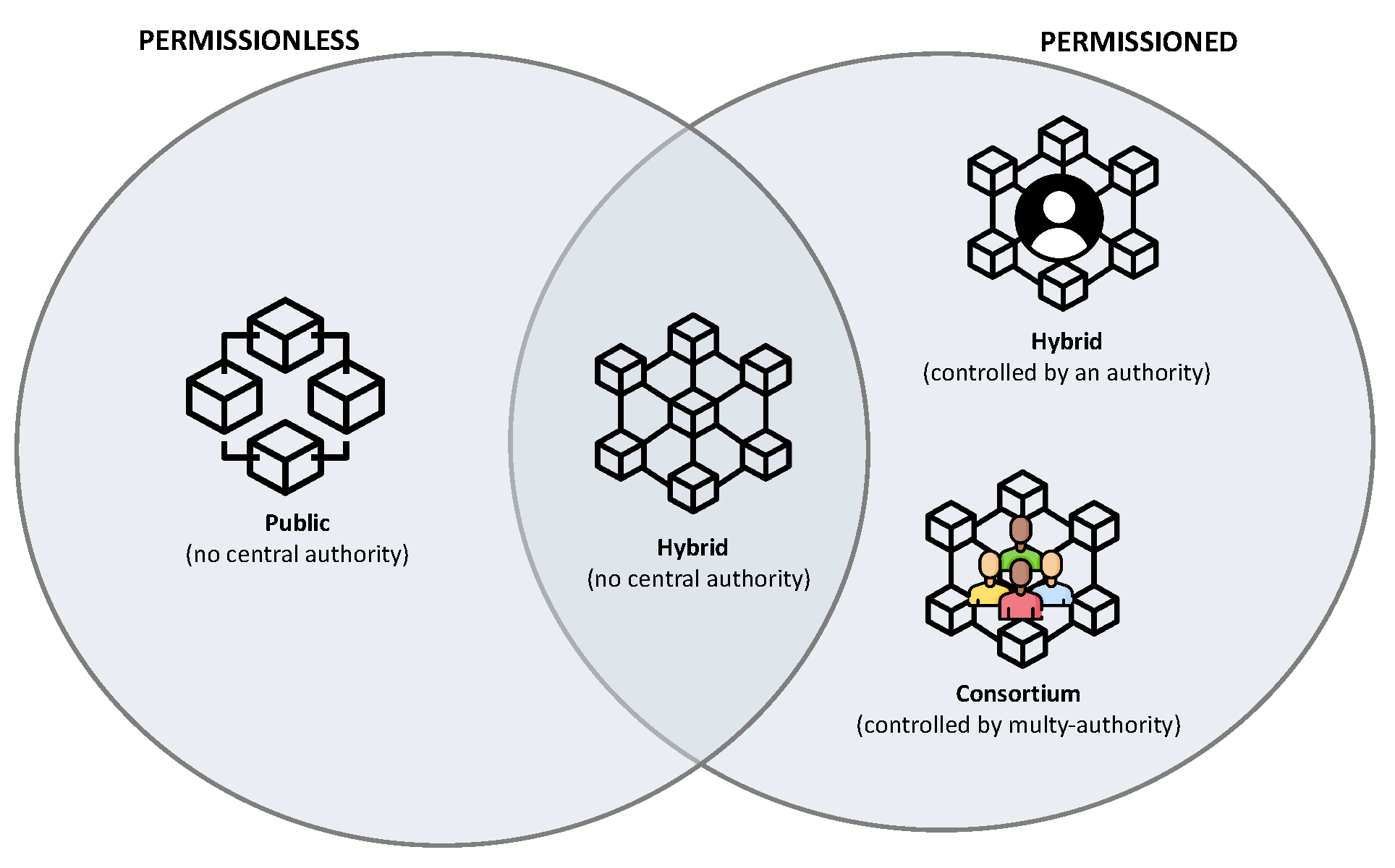

2.2. Blockchain Classification

- Public blockchains. Public blockchains are permissionless and completely decentralized, and are primarily used for exchanging and mining cryptocurrencies, such as bitcoin and Ethereum.

- Private blockchains. Private blockchains are permissioned blockchains fully controlled by a single organization. A famous private blockchain is Hyperledger [21].

- Consortium blockchains. Consortium (or federated) blockchains [22] are permissioned blockchains governed by a group of organizations instead of only a single organization; therefore, they are more decentralized than private blockchains.

- Hybrid blockchains. A hybrid blockchain is defined as a blockchain that attempts to use the best part of both private and public blockchain solutions. Indeed, hybrid blockchains are controlled by a single organization, but with a level of oversight performed by the public blockchain, which is required to perform certain transaction validations.

2.3. Consensus Protocols

2.4. Non-Fungible Tokens (NFTs)

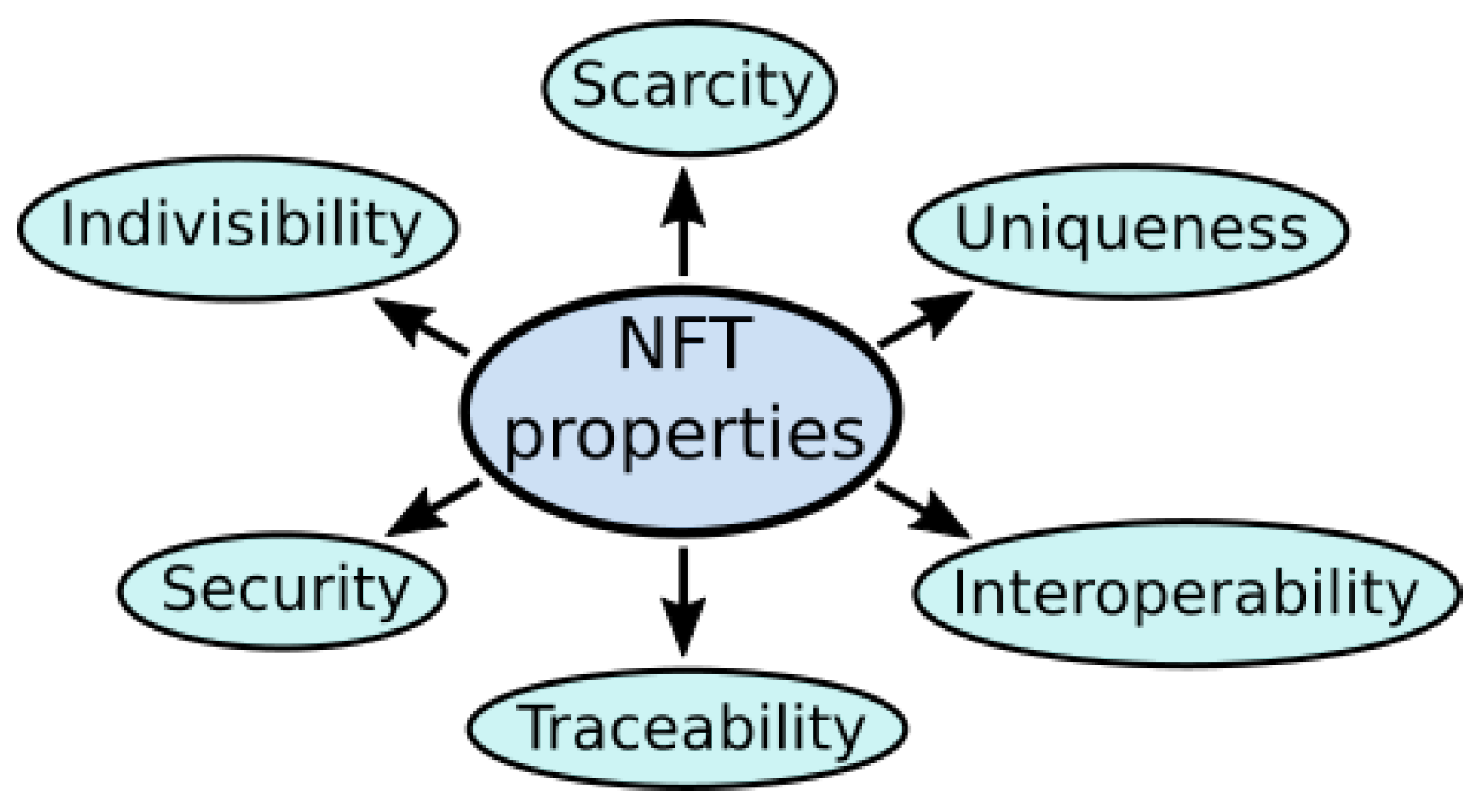

2.5. NFT Key Properties

- Indivisibility. NFTs have been tailored to be indivisible by default for serving their utility. Indeed, this property comes from the non-fungible nature of NFTs, and means that NFTs can not be divided into smaller tokens, but the whole NFT can be purchased for owning an item.

- Scarcity and uniqueness. These properties are strictly related to the previous one. Indeed, NFTs are unique by definition. This means that NFTs cannot be replicated or reproduced, which provides a verifiable scarcity property that is notoriously difficult to obtain online.

- Security. The support of blockchain technology guarantees a high security level. Indeed, NFTs are stored on the blockchain network, and for this reason, they are tamper-proof. Furthermore, the blockchain can be used to verify ownership.

- Traceability. When an NFT is issued, the holder is recorded on the blockchain, and all the transactions are also recorded. For this reason, all the history involved in a specific NFT can be retrieved.

- Interoperability. NFTs can be easily moved across multiple systems.

2.6. NFT Standards

- The contract stores a universal resource identifier (URI) that is accessible via the tokenURI() function. This URI points to a decentralised storage location such as IPFS or Arvweave [41], and applications such as Opensea can query these data directly from the source.

- The smart contract stores the data needed to recreate the asset. Generally speaking, the data are composed of a few bytes per token, and the smart contract also has a function that recreates the asset. This approach is more commonly used in generative art NFTs.

2.7. Ethereum Standards

- transferFrom allows the change of ownership of an NFT;

- approve allows the owner of an NFT to let another address transfer the NFT;

- getApproved returns the approved (via the approve function) addresses of an NFT;

- balanceOf returns the number of NFTs owned by an address;

- ownerOf returns the owner address of an NFT.

2.8. Non-Ethereum Standands

- They have a supply of 1, meaning only one token is in circulation.

- The token has 0 decimals, so it cannot be divided.

- They have no Mint Authority, meaning that it is impossible to mint additional tokens.

3. Blockchain and Solutions for NFT

- Transaction speed and confirmation time. Transaction speed plays an important role in the success of an NFT project. It is not feasible for blockchains with lower transaction speeds to perform a bigger number of transactions per second [44]. Additionally, transaction speed has also a big impact on transaction costs. Indeed, if a blockchain has a low throughput, users have to pay higher fees to make sure that miners prioritize their transactions over others [45].

- Transaction fee. To speed up the adoption of NFTs, the market needs lower fees. Indeed, low transaction costs are crucial to the wider adoption of NFTs. The high fees for the minting process, but also for buying and selling NFTs, means that people can easily lose money. For this reason, the chosen blockchain used to implement the NFT project should have no fee or a small fee, such as in Algorand [46].

- Smart contract functionality. The functionalities of an NFT are based on the underlying smart contracts. Indeed, all NFT platforms rely on smart contracts for verifying ownership and handling the transfer of tokens. For this reason, NFT smart contracts are important, and a current NFT project should be implemented by using a blockchain with robust and reliable smart contract functionality. Furthermore, the blockchain’s smart contract programming language is important because it impacts the time and cost of confirming a transaction.

- Consensus algorithm. A consensus algorithm is a basis for a blockchain to achieve an agreement. The chosen blockchain technology and its consensus algorithm can have an impact on the NFT environment. Blockchains based on the PoW consensus mechanisms normally have to deal with numerous issues related to scalability and the time required to reach a consensus. A good alternative is projects based on PoS consensus algorithms, such as the Ethereum blockchain. Another way to reduce the issues, in particular those related to energy consumption, is to use layer 2 solutions that help reduce the number of transactions.

3.1. Blockchain for NFTs

3.2. Other Solutions

| Platform | Transaction | Confirmation | Transaction Cost | Smart Contract | Consensus | NFT | Application |

|---|---|---|---|---|---|---|---|

| Speed | Time | Fee | Language | Algorithm | Standards | Fields | |

| Ethereum | 15–25 tps | ~12 s | ≈USD 4–USD 5.5 | Solidity | PoS | ERC-721, ERC-1155, ERC-988 | General purpose |

| Flow | 1000 tps | ~2.5 s | ~USD 0.03 | Solidity | PoS | ERC-721, ERC-1155 | Arts and sports collectibles |

| Cardano | 250 tps | 5–60 s | ≈USD 0.15–USD 0.3 | Plutus | PoS | CIP-721 | Collectibles and videogames |

| EOS | 4000 tps | 1.5 s | No fees | C++ | DPoS | dGoods SimpleAssets, AtomicAssets | Videogames |

| Tezos | 40 tps | 30 s | USD 0.001 | Michelson | LPoS | FA2 | Arts and collectibles |

| BSC | 300 tps | 3 s | ≈USD 0.1–USD 0.2 | Solidity and Vyper | PoSA | BEP-721 | Collectibles |

| Algorand | 6000 tps | 3.7 s | ŨSD 0.00022 | TEAL | Pure PoS | Algorand Standard Assets (ASAs) | Collectibles |

| Immutable X | ~9000 tps | - | No fees | Solidity | PoW | ERC-721 | Videogames |

| WAX | 8000 tps | 30 s | No fees | C++ | DPoS | SimpleAssets, AtomicAssets | Videogames |

| Polygon | 7200 tps | 2 s | ≈USD 0.01–USD 0.05 | Solidity | PoS | ERC-721, ERC-1155, ERC-988 | Collectibles |

| Solana | 8500 | 0.4 s | ŨSD 0.0002 | Rust, C, and C++ | Proof of history and proof of stake | Metaplex | Arts and collectibles |

| Ronin | 200 | 3 s | ŨSD 0.0016 | Solidity | Byzantine fault-tolerant proof of authority | ERC-721, ERC-1155, ERC-988 | Videogames |

| NFTSBL [63] | 15–25 tps | ~5 min | - | Solidity | PoW | ERC-721, ERC-1155, ERC-988 | General purpose |

4. From NFT 1.0 to NFT 2.0

4.1. Properties and Features of NFT 2.0

- Interactivity. NFTs of this kind can take input from users and other sources (i.e., servers or oracles). Based on the type of inputs, NFTs can change their behaviour, and even reflect the change on the asset represented.

- Generativity and randomness. NFT 2.0 can integrate randomness in digital assets, so that new interactions are always possible. Additionally, thanks to the introduction of artificial intelligence (AI), NFTs can be personalised and build connections with users.

- Composability. This refers to the ability to personalize an asset or create a new one. Furthermore, this property lets collectors explore new possibilities by bundling different assets together as one. NFT holders can expand the utility of their NFTs by embedding additional digital assets.

- Experientiality. NFTs can capture true user experience, or generate NFTs based on how a user interacts with the application, thus creating new ways to experience an NFT.

- Enhanced metadata. NFT 2.0 allows for the creation of enhanced metadata, providing greater context and information about an asset. This can include information about the artist, the history of the asset, and even its environmental impact.

- Nested NFTs. NFT 2.0 introduces the nesting feature, which enables the NFT to own several other NFTs. An NFT can be considered a “parent” NFT, which contains one or more “child” NFTs. These child NFTs can themselves contain other child NFTs, creating a nested hierarchy of digital assets. These nested NFTs are more commonly used in the gaming industry, as it makes it easy for the token holder to own the rights over several digital assets or to bundle NFTs together.

- Customised NFTs. Unlike in NFT 1.0, the customized property of NFT 2.0 not only supports use cases such as buying and selling on the exchange platforms, but also allows each NFT to have a multi-faceted ability, thus supporting various use cases and applications.

- Rental NFTs. An NFT can be considered a “rental” NFT, which represents a digital asset that can be rented or leased. For example, an NFT representing a digital artwork or collectible could be rented out to a collector for a specified period, allowing them to enjoy the asset without owning it outright. One potential application of rental NFTs 2.0 is in the creation of rental marketplaces for digital assets. These marketplaces would allow owners of digital assets to rent them out to others, creating a new source of revenue. This could include anything from digital artwork and collectibles to virtual real estate in the metaverse and other digital assets.

- Smart NFTs. The NFTs can be linked to upgradable smart contracts, thus enabling complex and automatic interactions with other blockchain assets as well.

- Co-Owned NFTs. An NFT can be considered a “co-owned” NFT, which represents a digital asset that is co-owned by multiple individuals. A potential application of co-owned NFTs 2.0 is in the creation of fractional ownership marketplaces for digital assets. These marketplaces would allow multiple individuals to co-own a digital asset, with each owner holding a fraction of the asset’s value or ownership rights. Another application is the creation of investment opportunities for digital assets. By co-owning an NFT, investors can gain exposure to the asset’s value without having to purchase the entire asset outright. This could help small investors to team up and invest in pricey assets together.

- DAO NFTs. DAO NFTs is a concept that combines the power of NFTs with decentralized autonomous organizations (DAOs), allowing for the creation of community-governed digital assets. This creates a new level of flexibility and versatility for NFTs, allowing for the creation of new forms of decentralised ownership and governance. The DAO itself is represented by a smart contract on a blockchain, and it allows community members to vote on key decisions related to the asset, such as its use, sale, or distribution. A potential application is the creation of community-governed digital art collections. By creating a DAO that owns and governs a collection of NFTs, community members can collectively make decisions about how to manage and distribute the collection. Another application is the creation of decentralised ownership and governance structures for virtual real estate. By creating a DAO that owns and governs a virtual world or virtual real estate, community members can collectively make decisions about how to manage and develop the space.

4.2. NFT 2.0 Metadata

4.3. Generativity and Randomness

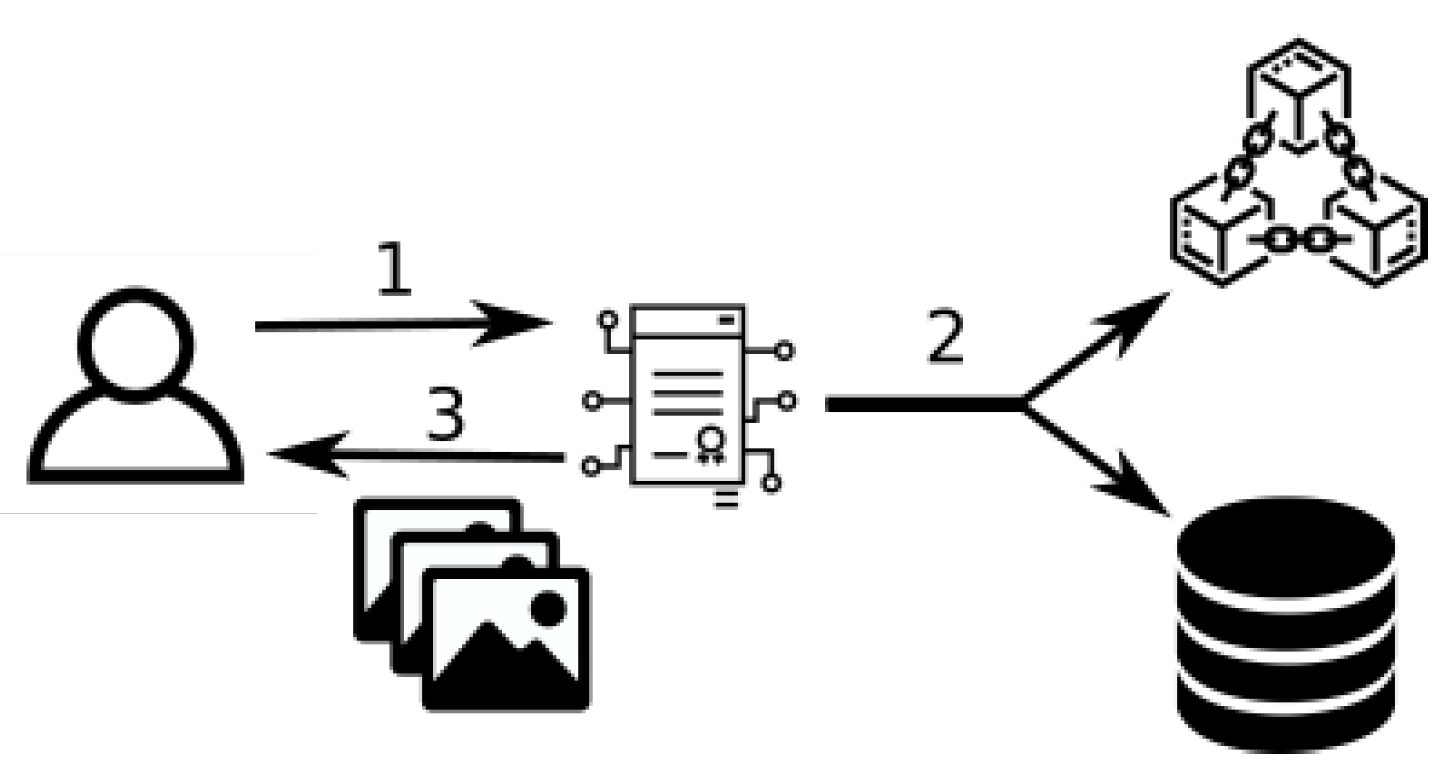

- First, an NFT request is sent to a smart contract, as shown in Figure 4, Step 1.

- The smart contract processes the request according to its code.

- The smart contract makes a call for on-chain data, and/or it uses an oracle to make a call for off-chain data, as highlighted in Figure 4, Step 2. The results obtained by these calls are then used to personalise the answer.

- The smart contract then sends back the media necessary to show the current state of the NFT, as shown in Figure 4, Step 3.

- Providing the underlying NFT with instructions on when and how to change the metadata;

- Accessing relevant external data sources.

4.4. On-Chain vs. Off-Chain Metadata

- Risk of losing the NFT. In particular, with any centralised server or storage, the owner can shut down the system or delete the file stored on it anytime. Furthermore, the link will break, and the file will be lost.

- Security risk. Principally, due to server hacking.

4.5. NFT 2.0: Applications

- Music. NFT 2.0 can be used to create unique digital music assets that can be traded and owned by fans. Music NFTs are considered certificates of ownership for identifying owners of a piece of musical work. Artists can sell the music NFT to anyone while retaining the rights to make any changes to its content. Furthermore, the artist can have complete discretion over how the buyer uses the piece of music.

- Gaming. NFTs can have a significant impact on gaming, and in particular, on play-to-earn (P2E) games. Game developers can create customised NFTs that represent in-game items or achievements, allowing players to own and trade unique digital assets that are tied to the game’s ecosystem. NFT 2.0 has the potential to transform the gaming industry by providing new ways for players to own and transfer in-game assets, verifying authenticity and rarity, enabling interoperability, and providing tangible representations of rewards and achievements.

- Sports. The sports industry is benefiting much from this evolution. NFT 2.0 can be used to create unique digital collectibles that represent ownership of sports memorabilia. They also can be used to create digital tickets and fan experiences, or to represent athletes and their sponsorships, allowing for new forms of revenue and endorsement deals. Finally, NFT 2.0 can be used to represent digital assets used in fantasy sports and gaming, such as virtual teams and players that mirror the performance of the athlete.

- Metaverse. NFT 2.0 can be used to represent ownership of real estate assets, allowing for the fractional ownership of high-value properties [65]. This opens up new opportunities for investment and ownership of real estate assets. For instance, an NFT representing a property should be dynamic enough to reflect the maintenance history, age, market value, and much more in real time.

- Token gating. Token gating is a way of restricting access to something and using NFTs as a way to unlock access. NFT 2.0 can be used in the practice of “token gating”, which involves requiring users to hold a specific NFT to access certain content or services. This concept can be used to create exclusive communities or provide access to premium content. Thanks to their dynamic nature, NFTs 2.0 can be used to grant access only once to an event, and even reveal additional properties [64].

- Art. NFT 2.0 has several applications in the art industry, as it allows for the creation of unique and verifiable digital assets that can represent artwork and provide new ways for artists to monetise their work [66]. NFT 2.0 can be used to represent fractional ownership of artwork, allowing multiple owners to own a portion of a piece of art. This can create new opportunities for investment in art and provide a new revenue stream for artists. Furthermore, NFT 2.0 can be used to represent licenses or royalties for artwork, allowing artists to receive ongoing revenue for their work. This can also create new opportunities for secondary markets and provide a new way for artists to monetise their work.

- Healthcare. Healthcare is another field that could benefit widely from digital twin NFTs 2.0. For instance, in an organ donation scenario, NFT 2.0 can be used to keep track of the donor, and the organ. Additionally, IoT devices can be employed to periodically monitor the condition of the organ (i.e., temperature, humidity) while it is transported. Lastly, NFT 2.0 has been employed to trace refurbished medical devices: each part of the machine is modelled as a separate NFT that keeps track of its condition, and the medical devices are composable and dynamic NFTs [11].

4.6. Upgrading from NFT 1.0 to NFT 2.0

5. Final Remarks

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Pinto-Gutiérrez, C.; Gaitán, S.; Jaramillo, D.; Velasquez, S. The NFT hype: What draws attention to non-fungible tokens? Mathematics 2022, 10, 335. [Google Scholar] [CrossRef]

- Nadini, M.; Alessandretti, L.; Di Giacinto, F.; Martino, M.; Aiello, L.M.; Baronchelli, A. Mapping the NFT revolution: Market trends, trade networks and visual features. arXiv 2021, arXiv:2106.00647. [Google Scholar] [CrossRef] [PubMed]

- Franco, M.; Gaggi, O.; Guidi, B.; Michienzi, A.; Palazzi, C.E. A decentralised messaging system robust against the unauthorised forwarding of private content. Future Gener. Comput. Syst. 2023, 145, 211–222. [Google Scholar] [CrossRef]

- Lee, J.; Kwon, K.H. Novel pathway regarding good cosmetics brands by NFT in the metaverse world. J. Cosmet. Dermatol. 2022, 21, 6584–6593. [Google Scholar] [CrossRef]

- Guidi, B.; Michienzi, A. Social games and Blockchain: Exploring the Metaverse of Decentraland. In Proceedings of the 2022 IEEE 42nd International Conference on Distributed Computing Systems Workshops (ICDCSW); Bologna, Italy, 10 July 2022, IEEE: Piscataway, NJ, USA, 2022; pp. 199–204. [Google Scholar]

- Muthe, K.B.; Sharma, K.; Sri, K.E.N. A Blockchain Based Decentralized Computing And NFT Infrastructure For Game Networks. In Proceedings of the 2020 Second International Conference on Blockchain Computing and Applications (BCCA), Virtual, 3 November 2020; pp. 73–77. [Google Scholar] [CrossRef]

- Wang, D.; Ren, Q.; Li, X.; Qi, Y.; Zhou, Q. Defining Consumers’ Interest and Future of Nft Fashion. In Proceedings of the 2022 International Conference on Social Sciences and Humanities and Arts (SSHA 2022), Nanjing, China, 25–27 February 2022; Atlantis Press: Amsterdam, The Netherlands, 2022; pp. 584–594. [Google Scholar]

- Wang, Q.; Li, R.; Wang, Q.; Chen, S. Non-fungible token (NFT): Overview, evaluation, opportunities and challenges. arXiv 2021, arXiv:2105.07447. [Google Scholar]

- White, B.; Mahanti, A.; Passi, K. Characterizing the OpenSea NFT marketplace. In Proceedings of the Companion Proceedings of the Web Conference 2022, Virtual, 25–29 April 2022; pp. 488–496. [Google Scholar]

- Solouki, M.; Bamakan, S.M.H. An In-depth Insight at Digital Ownership Through Dynamic NFTs. Procedia Comput. Sci. 2022, 214, 875–882. [Google Scholar] [CrossRef]

- Gebreab, S.A.; Salah, K.; Jayaraman, R.; Zemerly, J. Trusted Traceability and Certification of Refurbished Medical Devices Using Dynamic Composable NFTs. IEEE Access 2023, 11, 30373–30389. [Google Scholar] [CrossRef]

- Bellagarda, J.; Abu-Mahfouz, A.M. Connect2NFT: A Web-Based, Blockchain Enabled NFT Application with the Aim of Reducing Fraud and Ensuring Authenticated Social, Non-Human Verified Digital Identity. Mathematics 2022, 10, 3934. [Google Scholar] [CrossRef]

- Zaucha, T. Gaming the Systems: Non-Fungible Tokens and the Blurring of Gambling and Finance in Play-to-Earn Games. Ph.D. Thesis, University of Minnesota, Minneapolis, MN, USA, 2022. [Google Scholar]

- Karapapas, C.; Pittaras, I.; Polyzos, G.C. Fully decentralized trading games with evolvable characters using NFTs and IPFS. In Proceedings of the 2021 IFIP Networking Conference (IFIP Networking), Virtual, 21–24 June; IEEE: Piscataway, NJ, USA, 2021; pp. 1–2. [Google Scholar]

- Gumelar, M.S.; Gumelar, M. What Is NFT for Beginners: NFT, NFT 2.0, NFT 3.0 Explore the Future of NFT Art; An1mage: South Tangerang, Indonesia, 2023. [Google Scholar]

- Nakamoto, S.; Bitcoin, A. A Peer-to-Peer Electronic Cash System. Bitcoin 2008, 4, 1–9. [Google Scholar]

- Dannen, C. Introducing Ethereum and Solidity; Springer: Berlin/Heidelberg, Germany, 2017; Volume 1. [Google Scholar]

- Jensen, J.R.; von Wachter, V.; Ross, O. An introduction to decentralized finance (defi). Complex Syst. Inform. Model. Q. 2021, 26, 46–54. [Google Scholar] [CrossRef]

- Helliar, C.V.; Crawford, L.; Rocca, L.; Teodori, C.; Veneziani, M. Permissionless and permissioned blockchain diffusion. Int. J. Inf. Manag. 2020, 54, 102136. [Google Scholar] [CrossRef]

- Attaran, M.; Gunasekaran, A. Blockchain Principles, Qualities, and Business Applications. In Applications of Blockchain Technology in Business: Challenges and Opportunities; Springer Nature: Cham, Switzerland, 2019; pp. 13–20. [Google Scholar]

- Aggarwal, S.; Kumar, N. Hyperledger. In Advances in Computers; Elsevier: Amsterdam, The Netherlands, 2021; Volume 121, pp. 323–343. [Google Scholar]

- Yao, W.; Ye, J.; Murimi, R.; Wang, G. A survey on consortium blockchain consensus mechanisms. arXiv 2021, arXiv:2102.12058. [Google Scholar]

- Gervais, A.; Karame, G.O.; Wüst, K.; Glykantzis, V.; Ritzdorf, H.; Capkun, S. On the security and performance of proof of work blockchains. In Proceedings of the 2016 ACM SIGSAC Conference on Computer and Communications Security, Vienna, Austria, 24–28 October 2016; pp. 3–16. [Google Scholar]

- Nguyen, C.T.; Hoang, D.T.; Nguyen, D.N.; Niyato, D.; Nguyen, H.T.; Dutkiewicz, E. Proof-of-stake consensus mechanisms for future blockchain networks: Fundamentals, applications and opportunities. IEEE Access 2019, 7, 85727–85745. [Google Scholar] [CrossRef]

- Hu, Q.; Yan, B.; Han, Y.; Yu, J. An improved delegated proof of stake consensus algorithm. Procedia Comput. Sci. 2021, 187, 341–346. [Google Scholar] [CrossRef]

- Dimitri, N. Liquid Proof-of-Stake in Tezos: An Economic Analysis. Information 2022, 13, 556. [Google Scholar] [CrossRef]

- Wang, Q.; Li, R.; Wang, Q.; Chen, S.; Xiang, Y. Exploring unfairness on proof of authority: Order manipulation attacks and remedies. In Proceedings of the 2022 ACM on Asia Conference on Computer and Communications Security, Nagasaki, Japan, 30 May–3 June 2022; pp. 123–137. [Google Scholar]

- Busayatananphon, C.; Boonchieng, E. Financial technology DeFi protocol: A review. In Proceedings of the 2022 Joint International Conference on Digital Arts, Media and Technology with ECTI Northern Section Conference on Electrical, Electronics, Computer and Telecommunications Engineering (ECTI DAMT & NCON), online, 26–28 January 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 267–272. [Google Scholar]

- Pierro, G.A.; Tonelli, R. Can solana be the solution to the blockchain scalability problem? In Proceedings of the 2022 IEEE International Conference on Software Analysis, Evolution and Reengineering (SANER), Honolulu, HI, USA, 15–18 March 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 1219–1226. [Google Scholar]

- Regner, F.; Urbach, N.; Schweizer, A. NFTs in practice–non-fungible tokens as core component of a blockchain-based event ticketing application. In Proceedings of the 40th International Conference on Information Systems, (ICIS), Munich, Germany, 15–18 December 2019; Association for Information Systems: Atlanta, GA, USA, 2019; pp. 1–17. [Google Scholar]

- Steinwold, A. The History of Non-Fungible Tokens (NFTs). 2019. Available online: https://medium.com/@Andrew.Steinwold/the-history-of-non-fungible-tokens-nfts-f362ca57ae10 (accessed on 23 May 2023).

- Dowling, M. Is non-fungible token pricing driven by cryptocurrencies? Financ. Res. Lett. 2022, 44, 102097. [Google Scholar] [CrossRef]

- Choudhary, V.V. Non Fungible Token (NFT): Delve into the World of NFTs Crypto Collectibles and How It Might Change Everything? Independently Published: Chicago, IL, USA, 2022. [Google Scholar]

- Liebi, L.J. Book Review: Decentralized Finance after Bitcoin & Ethereum; Springer: Berlin/Heidelberg, Germany, 2022. [Google Scholar]

- Serada, A.; Sihvonen, T.; Harviainen, J.T. CryptoKitties and the new ludic economy: How blockchain introduces value, ownership, and scarcity in digital gaming. Games Cult. 2021, 16, 457–480. [Google Scholar] [CrossRef]

- Kiong, L.V. Metaverse Made Easy: A Beginner’s Guide to the Metaverse: Everything you need to know about Metaverse, NFT and GameFi; Independently Published: Chicago, IL, USA, 2022. [Google Scholar]

- Das, D.; Bose, P.; Ruaro, N.; Kruegel, C.; Vigna, G. Understanding Security Issues in the NFT Ecosystem. arXiv 2021, arXiv:2111.08893. [Google Scholar]

- Popescu, A. Non-Fungible Tokens (NFT)-Innovation Beyond the Craze. In Proceedings of the 5th International Conference on Innovation in Business, Economics and Marketing Research, Online, 27–29 May 2021. [Google Scholar]

- Chohan, U.W. Non-Fungible Tokens: Blockchains, Scarcity, and Value. Critical Blockchain Research Initiative (CBRI); Working Papers. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3822743 (accessed on 23 May 2023).

- Guidi, B.; Michienzi, A.; Ricci, L. Data persistence in decentralized social applications: The ipfs approach. In Proceedings of the 2021 IEEE 18th Annual Consumer Communications & Networking Conference (CCNC), Las Vegas, NV, USA, 9–12 January 2021; IEEE: Piscataway, NJ, USA, 2021; pp. 1–4. [Google Scholar]

- Karnatak, A.; Suseela, G. Preserving Data Integrity in Legal Documents Using On-Chain NFTs. Adv. Sci. Technol. 2023, 124, 628–634. [Google Scholar]

- Di Angelo, M.; Salzer, G. Tokens, types, and standards: Identification and utilization in Ethereum. In Proceedings of the 2020 IEEE International Conference on Decentralized Applications and Infrastructures (DAPPS), Oxford, UK, 3–6 August 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 1–10. [Google Scholar]

- Arora, A.; Kanisk; Kumar, S. Smart Contracts and NFTs: Non-Fungible Tokens as a Core Component of Blockchain to Be Used as Collectibles. In Proceedings of the Cyber Security and Digital Forensics; Khanna, K., Estrela, V.V., Rodrigues, J.J.P.C., Eds.; Springer: Singapore, 2022; pp. 401–422. [Google Scholar]

- Quasim, M.T.; Khan, M.A.; Algarni, F.; Alharthy, A.; Alshmrani, G.M.M. Blockchain Frameworks. In Decentralised Internet of Things; Springer: Berlin/Heidelberg, Germany, 2020; pp. 75–89. [Google Scholar]

- Bamakan, S.M.H.; Motavali, A.; Babaei Bondarti, A. A survey of blockchain consensus algorithms performance evaluation criteria. Expert Syst. Appl. 2020, 154, 113385. [Google Scholar] [CrossRef]

- Micali, S. ALGORAND: The Efficient and Democratic Ledger. arXiv 2016, arXiv:1607.01341. [Google Scholar]

- Donmez, A.; Karaivanov, A. Transaction fee economics in the Ethereum blockchain. Econ. Inq. 2022, 60, 265–292. [Google Scholar] [CrossRef]

- Dowling, M. Fertile LAND: Pricing non-fungible tokens. Financ. Res. Lett. 2022, 44, 102096. [Google Scholar] [CrossRef]

- Damsgaard, J. The Real Value of Cryptocurrency. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4034312 (accessed on 23 May 2023).

- Lamela Seijas, P.; Thompson, S. Marlowe: Financial contracts on blockchain. In Proceedings of the International Symposium on Leveraging Applications of Formal Methods, Limassol, Cyprus, 5–9 November 2018; Springer: Berlin/Heidelberg, Germany, 2018; pp. 356–375. [Google Scholar]

- Bruhwiler, P.; Cachin, C.; Zanolini, L.; Micic, J. A Concurrent DEX on Cardano. Bachelor’s Thesis, University of Bern, Barn, Switzerland, 2021. [Google Scholar]

- Lamela Seijas, P.; Nemish, A.; Smith, D.; Thompson, S. Marlowe: Implementing and Analysing Financial Contracts on Blockchain. In Proceedings of the Financial Cryptography and Data Security; Bernhard, M., Bracciali, A., Camp, L.J., Matsuo, S., Maurushat, A., Rønne, P.B., Sala, M., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 496–511. [Google Scholar]

- Grigg, I. Eos—An Introduction. White Paper. 207. Available online: https://whitepaperdatabase.com/eos-whitepaper (accessed on 23 May 2023).

- Zheng, W.; Zheng, Z.; Dai, H.N.; Chen, X.; Zheng, P. XBlock-EOS: Extracting and exploring blockchain data from EOSIO. Inf. Process. Manag. 2021, 58, 102477. [Google Scholar] [CrossRef]

- Allombert, V.; Bourgoin, M.; Tesson, J. Introduction to the tezos blockchain. In Proceedings of the 2019 International Conference on High Performance Computing & Simulation (HPCS), Dublin, Ireland, 15–19 July 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 1–10. [Google Scholar]

- Bernardo, B.; Cauderlier, R.; Pesin, B.; Tesson, J. Albert, an intermediate smart-contract language for the Tezos blockchain. In Proceedings of the Financial Cryptography and Data Security: FC 2020 International Workshops, AsiaUSEC, CoDeFi, VOTING, and WTSC, Kota Kinabalu, Malaysia, 14 February 2020; Revised Selected Papers 24; Springer: Berlin/Heidelberg, Germany, 2020; pp. 584–598. [Google Scholar]

- Luong, H.H.; Huynh, T.K.N.; Dao, A.T.; Nguyen, H.T. An Approach for Project Management System Based on Blockchain. In Proceedings of the Future Data and Security Engineering. Big Data, Security and Privacy, Smart City and Industry 4.0 Applications; Dang, T.K., Küng, J., Chung, T.M., Takizawa, M., Eds.; Springer: Singapore, 2021; pp. 310–326. [Google Scholar]

- Li, X.; Wang, X.; Kong, T.; Zheng, J.; Luo, M. From bitcoin to solana–innovating blockchain towards enterprise applications. In Proceedings of the Blockchain–ICBC 2021: 4th International Conference, Held as Part of the Services Conference Federation, SCF 2021, Virtual Event, 10–14 December 2021; Proceedings. Springer: Berlin/Heidelberg, Germany, 2022; pp. 74–100. [Google Scholar]

- Sguanci, C.; Spatafora, R.; Vergani, A.M. Layer 2 Blockchain Scaling: A Survey. arXiv 2021, arXiv:2107.10881. [Google Scholar]

- Singh, A.; Click, K.; Parizi, R.M.; Zhang, Q.; Dehghantanha, A.; Choo, K.K.R. Sidechain technologies in blockchain networks: An examination and state-of-the-art review. J. Netw. Comput. Appl. 2020, 149, 102471. [Google Scholar] [CrossRef]

- Besançon, L.; Da Silva, C.F.; Ghodous, P.; Gelas, J.P. A Blockchain Ontology for DApps Development. IEEE Access 2022, 10, 49905–49933. [Google Scholar] [CrossRef]

- Yantis, W.Q.J.; CasSelle, M. Worldwide Asset eXchange White Paper. Technical Report. Available online: https://github.com/worldwide-asset-exchange/whitepaper (accessed on 23 May 2023).

- Takahashi, H.; Lakhani, U. Voting blockchain for High Security NFT. In Proceedings of the 2021 IEEE 10th Global Conference on Consumer Electronics (GCCE), Kyoto, Japan, 12–15 October 2021; pp. 358–361. [Google Scholar] [CrossRef]

- Yang, L.; Dong, X.; Zhang, Y.; Qu, Q.; Tong, W.; Shen, Y. Generic-NFT: A Generic Non-Fungible Token Architecture for Flexible Value Transfer in Web3. Available online: https://www.techrxiv.org/articles/preprint/Generic-NFT_A_Generic_Non-Fungible_Token_Architecture_for_Flexible_Value_Transfer_in_Web3/20486610 (accessed on 23 May 2023).

- Serrano, W. Real estate tokenisation via non fungible tokens. In Proceedings of the 2022 4th International Conference on Blockchain Technology, Shanghai, China, 25–27 March 2022; pp. 81–87. [Google Scholar]

- Marias, M. I Want My NFT!: How an NFT Creative Commons Parallel Would Promote NFT Viability and Decrease Transaction Costs in NFT Sales. NYU J. Intellect. Prop. Entertain. Law 2022, 12, 1–35. [Google Scholar] [CrossRef]

| Property | Public | Private | Consortium | Hybrid |

|---|---|---|---|---|

| Blockchain | Blockchain | Blockchain | Blockchain | |

| Consensus determination | All miners | One organisation | Multiple organisations | One organisation |

| Consensus process | Permissionless | Permissioned | Permissioned | Permissioned |

| Read permission | Public | Public or Restricted | Public or Restricted | Public or Restricted |

| Immutability | Almost tamper-proof | High potential for tampering | Medium potential for tampering | Low potential for tampering |

| Efficiency | Low | High | High | Medium |

| Centralised | No | Yes | Partial | Partial |

| Example | Bitcoin | Hyperledger | Quorum | IBM Food Trust |

| Acronym | Decide Block Creators | Confirmation Time |

|---|---|---|

| PoW | Solve a computationally hard problem | High |

| PoS | Stake cryptocurrency to have a chance | Medium |

| DPoS | Staking gives rights to vote | Low |

| LPoS | Mix of PoS and DPoS | Medium |

| PoA | Chosen by an authority | Low |

| PoSA | Authority choses from a pool of DPOS-elected nodes | Low |

| PoH | Compute a sequence of values | Medium |

| Parameter | Non-Fungible Token | Fungible Token |

|---|---|---|

| Interchangeability | Non-Interchangeable | Interchangeable |

| Uniformity | Unique | Identical |

| Divisibility | Non-Divisible | Divisible |

| Standard | ERC-721 | ERC-20 |

| NFT 1.0 | NFT 2.0 | |

|---|---|---|

| Behaviour: | Immutable | Dynamic |

| Structure: | Separate | Composable |

| Application: | Traditional | Experimental |

| Ownership: | Single owner | Multiple owners |

| Scope: | Tokenisation | Utility |

| Goal: | Ownership | Interaction |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guidi, B.; Michienzi, A. From NFT 1.0 to NFT 2.0: A Review of the Evolution of Non-Fungible Tokens. Future Internet 2023, 15, 189. https://doi.org/10.3390/fi15060189

Guidi B, Michienzi A. From NFT 1.0 to NFT 2.0: A Review of the Evolution of Non-Fungible Tokens. Future Internet. 2023; 15(6):189. https://doi.org/10.3390/fi15060189

Chicago/Turabian StyleGuidi, Barbara, and Andrea Michienzi. 2023. "From NFT 1.0 to NFT 2.0: A Review of the Evolution of Non-Fungible Tokens" Future Internet 15, no. 6: 189. https://doi.org/10.3390/fi15060189

APA StyleGuidi, B., & Michienzi, A. (2023). From NFT 1.0 to NFT 2.0: A Review of the Evolution of Non-Fungible Tokens. Future Internet, 15(6), 189. https://doi.org/10.3390/fi15060189