1. Introduction

Historically, the introduction of new ledgers changed our society and often marked significant steps forward. For example, the first ledgers on clay tablets in Mesopotamia enabled division of labor, and community cooperation or later the double-entry bookkeeping in the 15th century marked the development of capitalism [

1]. The blockchain offers a new way to create ledgers, in this case, a distributed ledger that provides a decentralized and secure solution to manage transactions, offering transparency and trust in various economy sectors [

2].

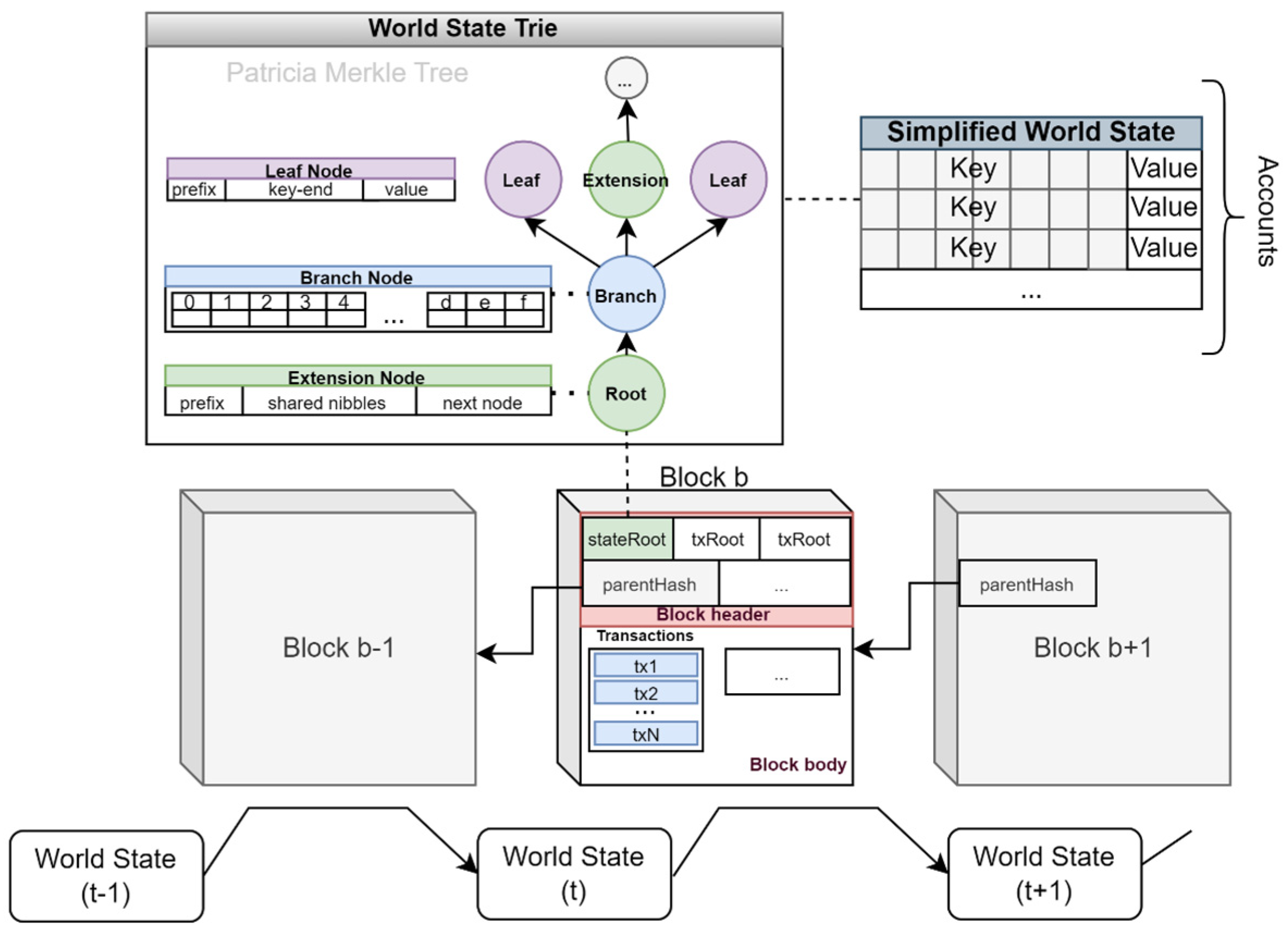

From a technical standpoint, the primary innovation is the strategy for enforcing trust and security in a trustless environment [

3]. The transactions issued by peers are aggregated by miners in blocks added to the blockchain through cryptographic hashes, making transaction modification practically impossible [

4]. A pair of public-private keys are associated with a wallet and used by the peer node to generate secured transactions by signing them with the private key [

5]. The other peers can validate the authenticity of the signed transactions in the presence of the peer public key. The consensus mechanisms are used to agree on the validity of transactions and the order in which they are added to the ledger [

6]. For example, in ‘proof of work’ (PoW), the miners search for a random number that hashed together with the block’s transactions and generates a hash that starts with a certain number of leading zeros [

7].

The incorporation of tokens to the blockchain ledger creates a new layer of functionality, as tokens can serve as a medium of exchange, represent physical assets, and possess value, supporting various economic activities. Cryptocurrencies are a new form of decentralized digital money and a subset of tokens that may have evident usefulness as a means of storing value [

8]. They are designed to facilitate the transfer of value between parties using their unit of account [

9]. Cryptocurrencies pose significant risks for users as they feature high volatility and are less regulated than traditional financial markets, thus not offering a stable medium of exchange [

10]. Asset tokenization is another significant economic innovation brought by blockchain technology, with Ethereum playing a crucial role in introducing and popularizing it [

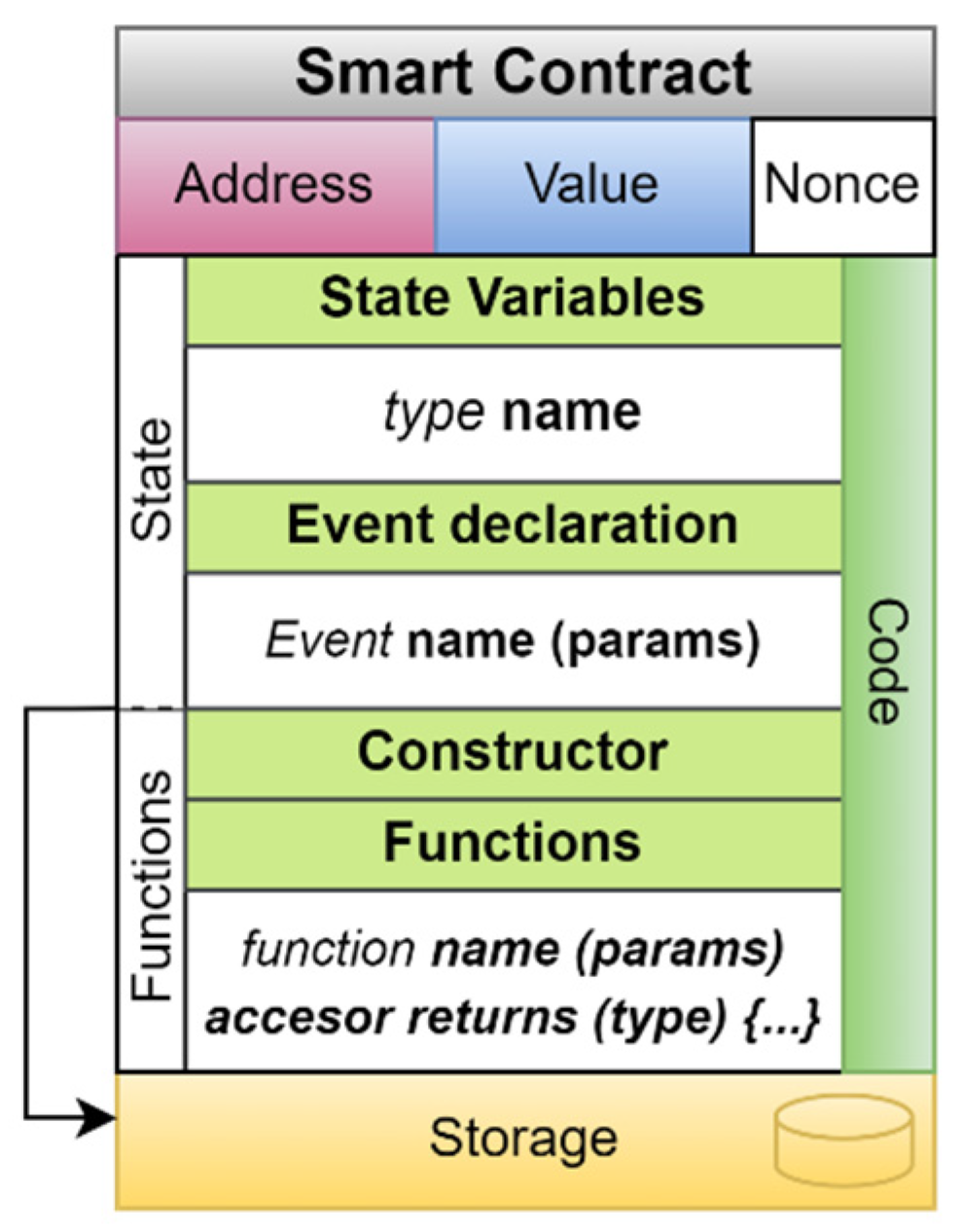

11]. The Ethereum blockchain platform supports the development of decentralized applications through smart contacts that are executable source codes enforcing the terms and conditions of specific agreements [

12]. It enables the creation of tokens instead of cryptocurrencies, that might symbolize possession of tangible assets, right to access, or alternative manifestations of worth [

13,

14]. The precise characteristics of blockchain tokens and the tokenization process may differ based on the intended purpose of their creation [

15]. They can correspond to physical assets such as gold, real estate, and art, or abstract assets such as voting rights, ownership rights, or content licensing. The security tokens can give the holder a share or a vote in a company [

16]. Utility tokens are a way of accessing a product or service, usually on a specific blockchain network, facilitating the operations of a decentralized market, covering transaction fees, or governing a decentralized autonomous organization or system [

17].

Research on tokens is still in its early stages compared to traditional markets, however, there is a greater diversity of blockchain tokens which makes the technical and economic decisions challenging. Different tokens may have unique technical features, use cases, and economic implications, requiring careful consideration and expertise when making decisions related to their creation and economic valuation. Various types of tokens use cases have been examined, such as non-fungible tokens (NFTs), decentralized finance (Defi), gamification, energy, supply chain, and arts [

18,

19]. They may offer some relevant economic and business advantages. Tokens ease access and participation in markets as they can be traded by anyone with access to a digital exchange, improve the liquidity of existing markets, allowing investors to enter and exit positions at a fair price, reduce the transaction costs associated with asset management and automatize the transaction processing and transfer of value. However, a comprehensive overview of the current state of research on token classification, creation, and valuation is necessary to help users and organizations make sound technical and economic decisions for reducing the inherent risks when working with blockchain tokens. Any asset that has value to someone, can be owned, and can be part of a larger asset market can be tokenized [

20]. However, the tokens’ valuation and price determinants are still challenging due to factors such as lack of intrinsic value being exposed to speculative processes, volatility, different valuation dynamics based on their utility, lack of regulation, etc. [

21,

22]. This makes them risky, as there is no oversight to ensure that the tokens are being traded fairly and transparently.

These issues reveal the need for a comprehensive literature review to explore and analyze the current state of token creation and valuation, providing insights that could help address the challenges and guide future developments in this field. In this paper, we address this knowledge gap by analyzing highly cited and popular methods for token creation and valuation and we have reviewed their applications across various sectors, including society and individuals, energy, supply chain, arts, and gamification. We have provided an overview of the token’s creation, issuance, and management by writing smart contracts on blockchain platforms such as Ethereum, providing valuable information for individuals or organizations looking to understand the essential technical aspects of token development. To ensure a methodological rigor, transparency, and clarity in our literature review process we have used the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) methodology [

23]. We defined relevant research questions and inclusion criteria to gain a deeper understanding of the blockchain tokens’ conceptual and practical aspects, from their purpose and representation to the economic forces that determine their market value. It allows for systematic exploration of the relevant challenges within this field while analyzing the applicability of tokens across different sectors and discussing the technical and economic drivers for their adoption.

The rest of the paper is structured as follows.

Section 2 presents an overview of the methodology used for conducting the survey.

Section 3 is focused on providing an overview of blockchain tokens development and classification processes.

Section 4 addresses aspects related to tokens valuation and price determination.

Section 5 presents a discussion on the main areas for token applicability.

Section 6 discusses the results, and

Section 7 concludes the paper.

2. Materials and Methods

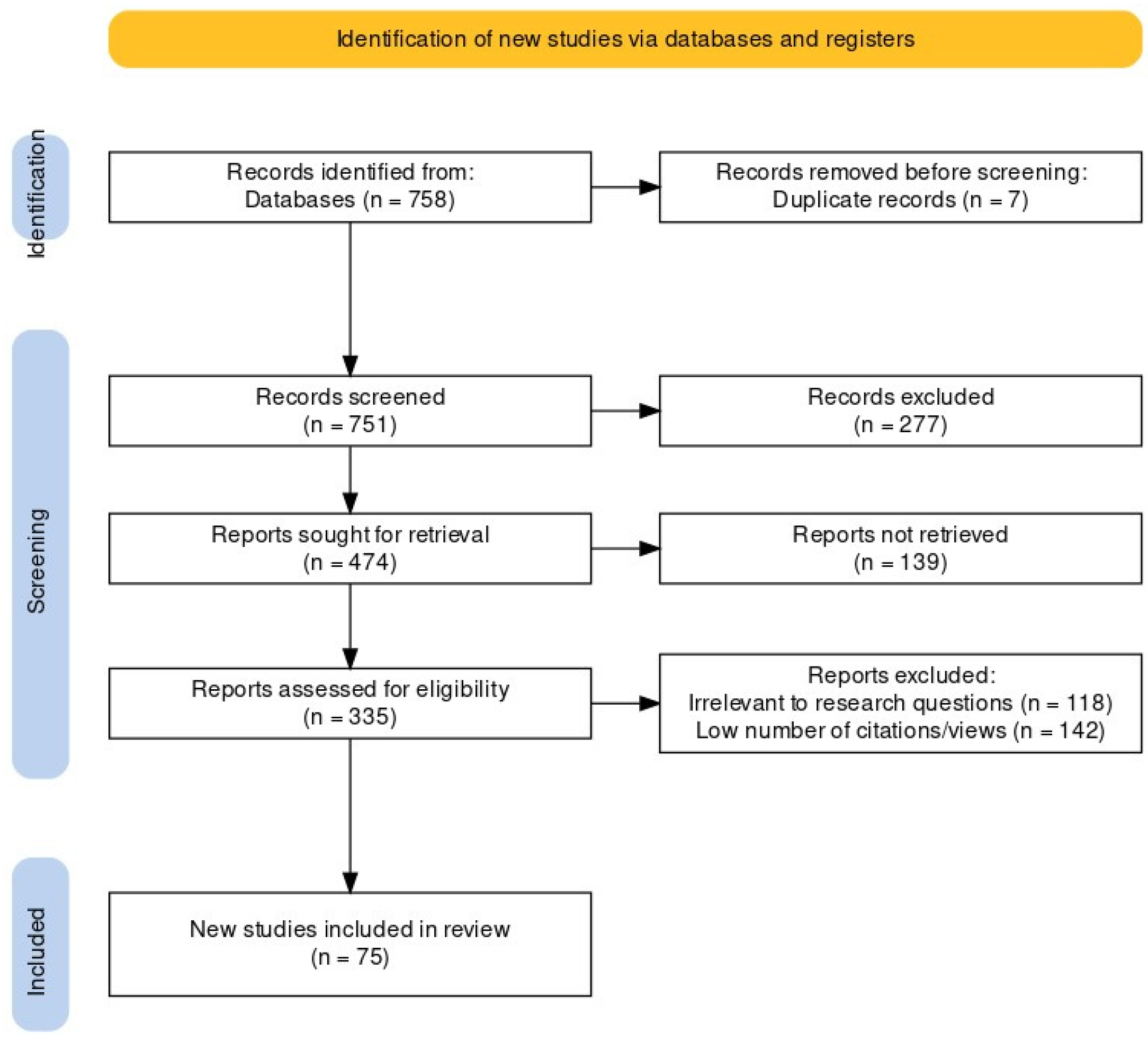

For conducting the research for state-of-the-art in the blockchain tokens domain the PRISMA methodology was applied. We have defined a comprehensive protocol outlining the inclusion and exclusion criteria, research questions, and keywords. We have established specific criteria that articles must meet to be included in the study as well as the criteria for excluding articles. They include factors such as relevance, language, recency, source credibility, and impact factor of the journals or conferences (see

Table 1).

The systematic review tries to find answers for the following research questions and their respective domains:

The research questions were broken down into relevant keywords and phrases. These keywords are used for searching databases, and online resources:

Blockchain token taxonomy/classification

Blockchain tokenization

Blockchain token value/price

Blockchain token applicability

We conducted the study by identifying, screening, and determining the eligibility of research articles to be included in the review (see

Figure 1). The WoS database was searched using the search keywords relevant to the research question or objectives of the study that allowed the usage of a single platform (Clarivate WoS web platform) that gives results from different publishers (IEEE, ACM, MDPI, etc.) [

24]. We have collected the results and removed the duplicates. The remaining articles were screened in two steps. First, we have used the article’s title and abstract to check if they potentially meet the inclusion criteria, and we have excluded the irrelevant ones. The ones that pass the initial screening are then assessed based on the full text using the inclusion and exclusion criteria to determine the articles that will be included in the systematic review.

In the end, 75 articles were selected for the review.

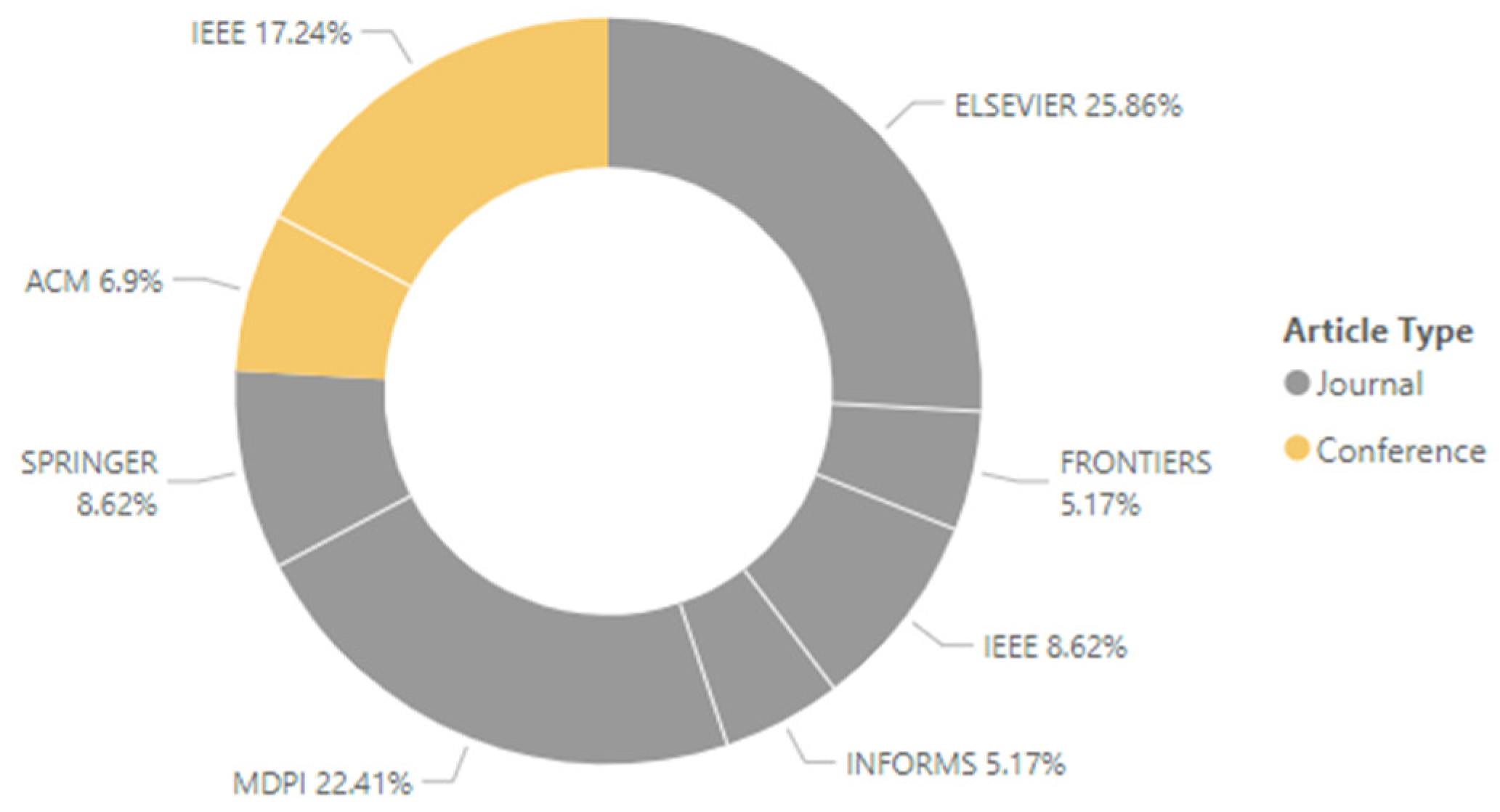

Figure 2 shows the paper distribution per publisher (e.g., IEEE, MDPI, Elsevier, Springer, etc.) as well as the ratio between journal and conference articles. Most of the articles included are journal articles.

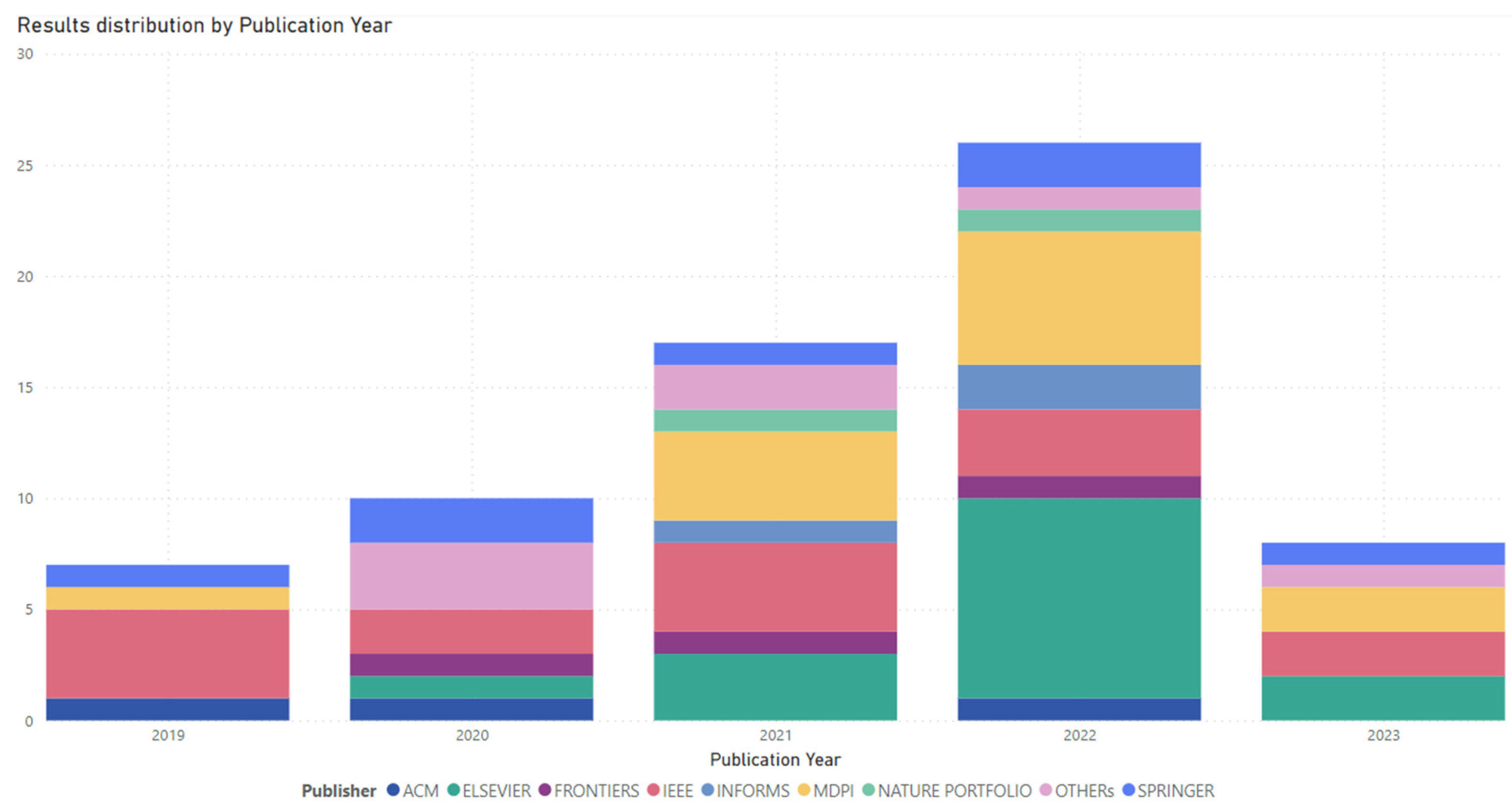

As depicted in

Figure 3, we can observe that from 2022, the blockchain tokens area of research received significantly more attention. This correlates with the increased use of blockchain tokens, which gained widespread attention and popularity around this time.

Analyzing the topics of the papers included in the study, most of them gravitate around the concepts of fungible tokens (FTs)/NFTs and blockchain/asset tokenization. Further analyzing the results showed a great overlap of results within the four keywords, with all of them identified using the “blockchain token” keyword.

Table 2 presents an overview of the selected research papers classified in four categories that are further detailed in the next sections.

Due to it is a relatively young research area compared with many other established fields of study, the researchers, developers, and entrepreneurs are keen to explore and understand the latest developments, creation, and valuation of blockchain tokens, justifying the need for the study conducted in this paper.

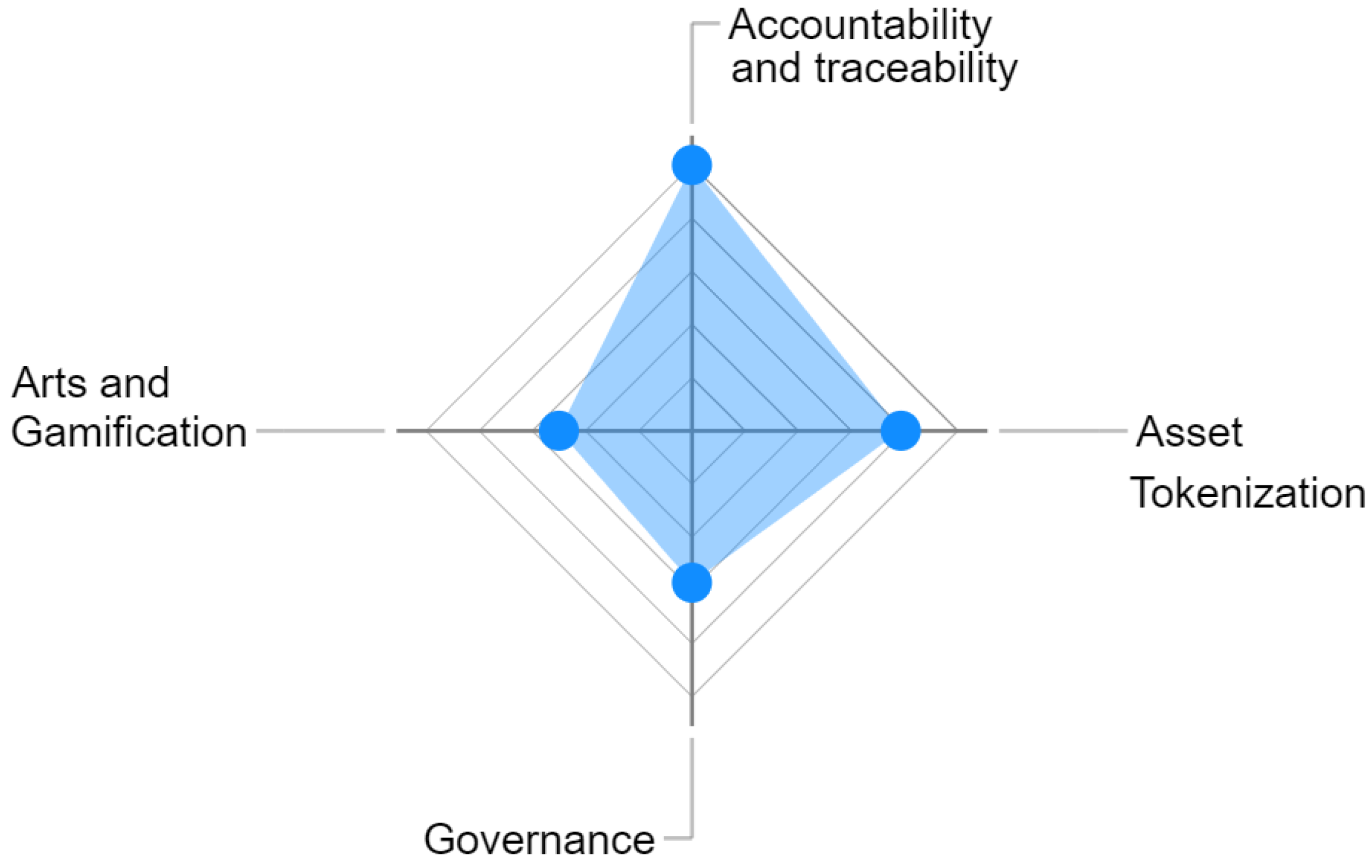

5. Blockchain Token’s Applicability

Asset tokenization is a highly backed-up category within the blockchain and cryptocurrency space and gained a lot of attention and support due to its potential to revolutionize how traditional assets are represented, traded, and managed. The assets can be physical or digital and can be used in various business use cases. The spider diagram in

Figure 8 presents an overview for the distribution of the numbers of state of the art papers included in the study in the four main domains.

Koens et al. [

60], have analyzed the possible business and technical impact of using blockchain, to determine whether the decision to use blockchain is based on a rationale. The main directions identified by the authors were supply chain and identity management and smart energy grid. The authors noticed that nontechnical drivers were not usually mentioned in the decision process of adopting blockchain. As directions, they identified, besides technical and economic drivers, network peer pressure, philosophical beliefs, and reducing the bottleneck scenarios (breaking the gridlock). The authors used the Wust and Gervais decision tree model to analyze whether the use of blockchain is rational. The tree nodes refer to storage, number of writers, trust, and public integrity, and the leaves are permissionless, private/public permissioned blockchains and the recommendation against blockchain. As scenarios, after acknowledging Bitcoin’s economic incentives and its intention of breaking the gridlock through consensus, the blockchain’s philosophical beliefs are highlighted in the use case of identity management and the ability to prove residency.

More common use cases of blockchain are the supply chain and smart grid management; due to the blockchain’s ledger property it allows for increased traceability, facilitating the audit [

43,

60]. However, the authors do point out the fact that it is of utmost importance, the trust in the system for this solution to become a replacement for an audit trail and that appropriate authorization remains a centralized issue to be tackled.

Buldas et al. [

63] proposed an asset-backed token from converting both physical and digital assets on blockchain, by providing methods to quantify, map, and authenticate any kind of asset. Li et al. [

64] identified the opportunity to design and implement a blockchain platform, that could allow universal asset tokenization while remaining adaptive and highly scalable. The authors based their design on the ability to represent an asset through a unique identifier, one owner, and a list of relevant attributes.

Kim et al. [

62] considered a different ownership perspective, with art tokens as a case study, and analyzed the impact of fractional ownership while maintaining the ability to trade it, hence influencing its value and price. It was noticed that the fractional ability allows new traders to enter the market, investors that usually have higher investor sentiment, are motivated by liquidity but lack information and so creating an ideal environment for price bubbles. Weingärtner et al. [

65] analyzed the tokenization of physical assets from the perspective of representing the world digitally—the digital twin, as a digital copy of the real world. By using blockchain as a trust protocol, the link between the real and digital world can be defined and integrated with associated IoT sensors enabling the integration of AI algorithms for learning. Moreover, the inclusion of additional rules in the smart contracts responsible for digital twins’ tokens introduces the ability to automate the rules execution, which is vital in fostering machine-to-machine interoperability and interactions, as well as ensuring auditing tracking. Similarly, the potential of connecting IoT, blockchain, and AI in the automatization of business processes is analyzed in Sandner et al. [

66]. This can be achieved by leveraging IoT to generate and manage the data, blockchain to define the interaction between parties, and AI for finetuning and optimizing the process.

Schmidt et al. [

56] provided an extensive list of benefits to asset tokenization that included transparency, liquidity, reducing intermediaries, immutability, and efficiency—noticing the blockchain features being also highlighted in a multitude of cases and countries, starting from real estate in Spain, and Germany to smartphones in Switzerland and bananas in Laos. Rather than focusing on a linear transaction on blockchain, Zhou et al. [

67] focus on the user and their data. A permissionless blockchain is set up with each account being a node part of the greater graph while allowing data to be assembled, anchored, and authorized, unaffected by other users’ irrelevant transactions. However, the authors do mention the shortcomings such as the lack of incentives, storage off-chain, and the chance of the InterPlanetary File System (IPFS) nodes’ unavailability. Davydov et al. [

55] propose an architecture that would allow the division of assets into commodities. Starting from the direct association of one individual asset to an owner using ERC-20 and ERC-721 token standards, they proposed a new type of token, ERC-T(okenization). An ERC-T would allow the creation of a portfolio that has assigned a multitude of tokens and associated their profits and dividends. Under the multitude of NFTs backed by an asset, some authors have focused on virtual assets. Bamakan et al. [

68] propose a framework for tokenizing patents and intellectual properties and a proof-of-existence algorithm, in Davydov et al. [

55] the focus is on lending, while in Popov et al. [

59] a model is defined securities’ transformation by associating asset tokens and managing the rights of their issuance and circulations.

Morrow et al. [

69] analyzed the societal implications of tokenizing society and individuals using blockchains. As a first layer, they investigated the advantage of using tokens over encryption for their potential use cases and concluded that by using tokens for personal information, the relationship with the real object cannot be monetized in case of breaches. On a deeper layer, the subject of centralization was analyzed in the context of abuse, specifically regarding data. The concept of having a digital citizen-driven smart contract that also follows a social contract—a policy consensus between government and citizens. This approach enables an alternative way of building trust and human data privacy while providing accountability and transparency of data governance and regulations. As a final layer, the concept of the circular economy using blockchain was studied showing the incorporation of tokenization in each step of the society’s governance and individual well-being by ensuring better waste management, tracking supply chains, and incentivizing electrical vehicle charging.

Narayan et al. [

70] investigated the tokenization potential in a circular economy concerning ecology, social welfare, as well as political applicability by providing a framework for intra-cooperation and exchange of tokens that represent resources or access rights. The authors also mention competition management as a challenge, and as advantages, the ease of information sharing and the improvement through competition. Ballandies [

71] proposes the use of self-determination theory to investigate the impact of tokens for human behavior. The study analyses the effect of applying blockchain tokens for creating personalized incentives in the context of sharing economies. The usage of blockchain for governance on a global level of digital commons was analyzed in Rozas et al. [

72]. They considered principles for sustainable commons management, such as clear community boundaries, decision-making based on participation and inclusion, and conflict resolution mechanisms. Also, they noticed that blockchain tokenization, formalization, and enforcement of rules as well as autonomous automatization, support transparency and trust, which is ideal for governance.

Phadke et al. [

73], focus on tax recovery challenges, noticing that blockchain can alleviate some of the challenges in the calculation, payment, and recovery areas. The proposed solution would be a better integration with employers that ensures that if taxes are not paid, the government can set a hold directly from income, removing the need for external recovery operations. Being under government control, the price can remain as determined, avoiding the volatility of cryptocurrencies. Unlike standard blockchains, where the higher the token amount has a positive connotation, in this system, the token represents the owed amount in taxes, and the individual thrives towards a 0 token count. A framework for participation in the decision-making was also proposed by Benitez-Martinez et al. [

74]. It follows the concept of a neural network of connected blockchains in order to increase citizens’ interaction with their local institutions based on tokens, incentives, and rewards, that provide voting power. Following a similar desire to incentivize the engagement of citizens in programs with a social impact, Barclay et al. [

61] propose the tokenization of behavior changes through interventions and techniques by designing accountability based on the interest of actors. In the case of NFTs, governance plays a pivotal role in creating a legal base to avoid legal pitfalls for the exchange and trade of NFTs, and certain countries have strict regulations [

75]. Moreover, another aspect that can influence the price and desirability of a token is its taxability, under the governance of individual regulation.

Tokenization through blockchains can enable more flexibility in small-scale energy use while considering the building’s operational limits, the household’s preferences, and the social factors that reward the shifting of flexibility through peer-to-peer trading [

76]. Tokenization on blockchain means that a specific asset can be linked to it, such as the energy or the flexibility for producing and consuming energy. Marin et al. [

57] used two kinds of tokens, one for monetary value that was fungible and one for energy certification that was non-fungible. Bongini et al. [

43] used topic modeling to identify the themes in white papers regarding STOs. The most frequent themes are smart grid and renewable energy projects. There are two areas of interest for tokens in the energy sectors: the ability to trade energy in a community and tracking renewable energy. In Buccafurri et al. [

77], the authors propose an architecture based on redeeming tokens for energy while incorporating not only the prosumers and consumers, as in Marin et al. [

57] and Toderean et al. [

58] but also the retailers, entrusted by the energy authority, capable of selling and buying energy and responsible also for connecting the consumers to the network. However, the authors mention the inability to fully trust the retailer, with a solution of creating a dispute with the energy authority. Toderean et al. [

58] proposed an energy token that solves the trustiness issue, by providing a time-based locking mechanism of the token.

Antal et al. [

76] propose a local energy flexibility market that incorporates both monitoring energy flows and changes in prosumer behavior by using energy flexibility tokens in trading sessions. Karandikar et al. [

78] a community-based infrastructure was proposed using a permissioned blockchain, Hyperledger Fabric, that incorporates multiple sources of renewable energy in residential contexts as well as storage capability in batteries and uses tokens as a reward mechanism by gamification. The energy tokens can be used for issuing, tracking, trading, and retiring renewable energy certificates through tokenization [

79]. Kaur and Oza [

80] identified additional applicability for blockchain tokens, for recycled wastewater based on the assimilation tokenization of sustainable assets, to address water pollution. The challenges they identified include inadequate and inefficient monitoring of water treatments and a lack of incentives that could be mitigated by using the ERC20 token standard and IoT sensors.

Immutability and traceability represent some of the most relevant features of blockchain in the context of tokenization. One area that received attention is the supply chains. Patidar et al. [

81] proposed a permissioned blockchain along the food supply chain to follow the food from farmer to storage with tokens being allotted to the stores for purchasing. Dos Santos et al. [

82] proposed third-party certification for the agri-food supply chain using the Ethereum blockchain and the ERC-1155 token standard. They offer a solution to avoid green washing, meaning the misleading of positive environment practices, e.g., in wine production in areas with strict control of provenance, where the resulting wine quantity far outweighs the grapes production in the area. Munoz et al. [

83] propose an evidence, verifiability, and enforceability framework for tracing the wood volumes by assigning a token, a WoodToken, to each wood volume. The solution has the potential of improving the audit trail, a common issue in the wood sector while a second token, Recipes can be used for financial settlement. Based on a private permissioned blockchain Madhwal [

84] proposes a solution for a tokenized supply chain to avoid counterfeit products. To further reduce the chances of counterfeited parts, Madhwal et al. [

85] propose logging all components of the final product as tokens, connected in a directed acyclic graph of tokens in chronological order. The circular economy implication in supply chains through reverse logistics is discussed by Bekrar et al. [

86]. Blockchain can provide both regulations oblige-ness by removing dangerous materials, but also identifying high-value low-availability materials, that are in the first place tokenized.

Finally, a lucrative area of blockchain token applicability is represented by arts and games. The arts category is further segmented into blockchain tokens that represent a fraction of an actual physical piece of art or a digital piece of art, collectible or usable in a game [

44]. While the price of tokens is influenced firstly by the collection it is part of, it was noticed that certain visual characteristics of digital art can increase the token price [

87]. Kim et al. [

62] noticed that the token price on the market is influenced, unfortunately by new traders with increased trading volumes that precede the correlation with lack of liquidity and decentralization. In the art market of tokens, another important aspect is given by its author, namely the price bubble is higher for lesser-known artists due to the investor sentiment and valuation subjectivity—having potential but not yet peaked. In [

88] the capabilities of using blockchain for games are analyzed. Two categories of games are identified that rely heavily on blockchain tokens: developer-generated, namely assets ownership (e.g., CryptoKitties) and asset reusability games (e.g., KittyVerse—reusing the CryptoKitties assets) and user-generated (Adam’s Adventure).

The Metaverse as defined in Ritterbusch et al. [

89] can be seen as a step further into the digital world of games, where users’ avatars can interact in virtual walkable spaces, mimicking the physical world in terms of businesses as the next generation of the Internet, while also deciding if a new set of socio-economic rules might be necessary [

90]. This decision, of determining a set of community rules, was investigated by Davidová et al. [

91], by proposing the introduction of gamification of behavior in community collaboration- in both the digital and real world using a hybrid model. Gamification on the blockchain can be used in the same way as existing crowdfunding platforms, using reward mechanisms with multiple tiers and ranks (donation, equity) and leading to a novel concept of resolving legal disputes on-chain using smart contracts.

6. Discussion

The creation and valuation of blockchain tokens and their associated applications pose technical and economic challenges, making them risky assets for investors. This study reviews the factors influencing token investment and valuation, including the quality of the white paper, issuance country, token supply, regulation, voting rights, price-cost ratio, and the number of tokens sold. The tokens have widespread use in various domains, the most relevant use cases dealing with the digitization of virtual and physical assets, accountability, and traceability usual in smart grids or supply chain management, social governance, and art and gamification. Our analysis highlights the significant impact of these factors on stakeholders’ interest in tokens, their careful consideration being essential for positive outcomes of new applications.

Navigating the complex and evolving regulatory legal and regulatory compliance for tokens can be a significant challenge. Different jurisdictions may have different rules and classifications for tokens, and compliance is crucial to avoid legal issues. Starting from having laws and taxation mechanisms for such digital assets remains an area that could benefit for further investigation since they cannot always be clearly defined from a location perspective and can be seen as global, rather than country specific assets, resulting in unclear legal obligations.

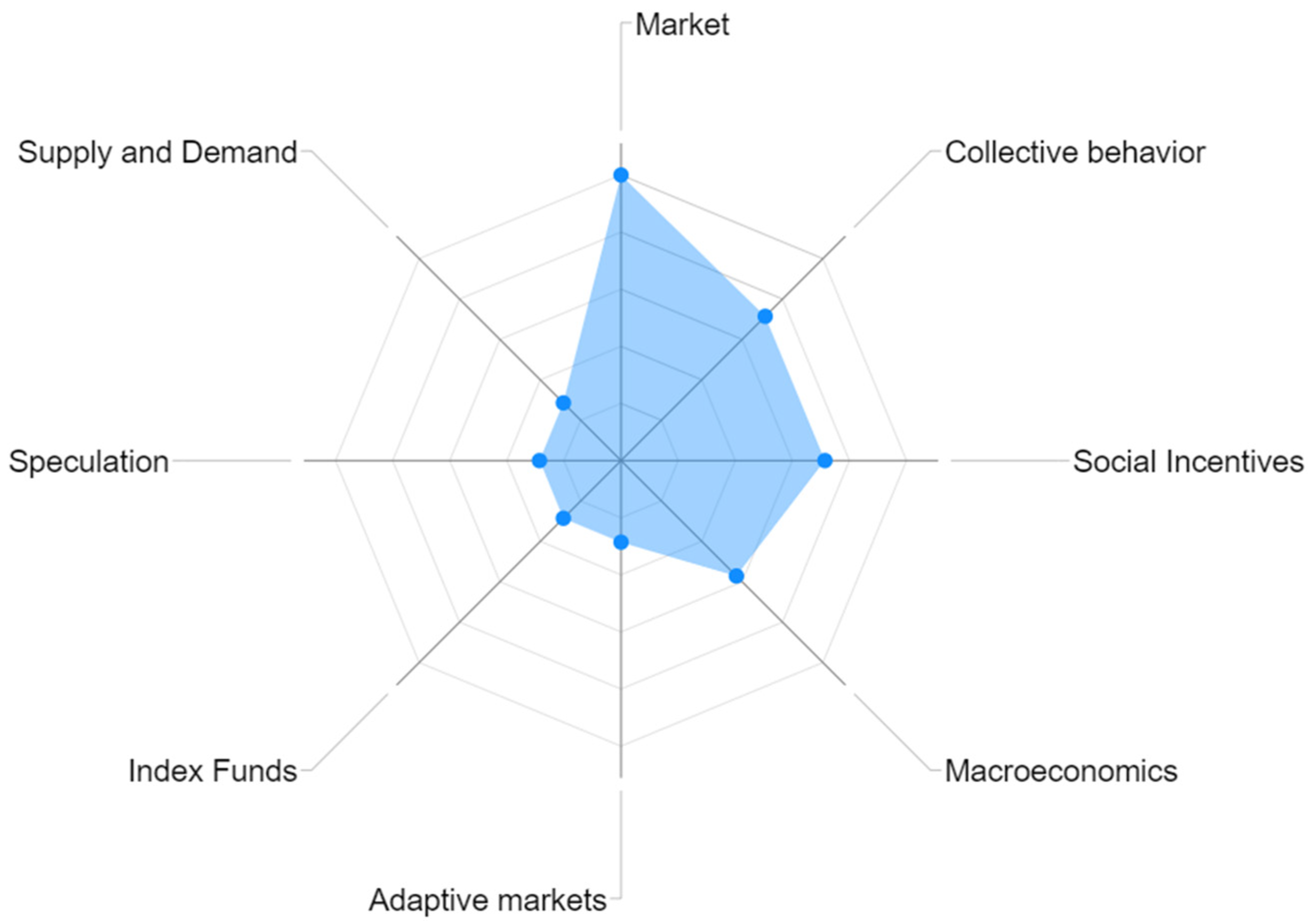

The valuation of a token is linked to the equilibrium between supply and demand as well as to social incentives, such as participatory governance, that may lead to increased token ownership and increased demand. Other factors such as market conditions, economic influences such as interest rates, and regulatory policies may have a significant influence on token valuation, while the collective behavior of people can also contribute to the formation of trends, resulting in both upward and downward price fluctuations. Speculation drives price fluctuations (even on short periods) as traders prioritize predicting price movements over token utility while token inclusion in index funds may boost investor demand. Cryptocurrencies and tokens are known for their price volatility making it challenging to determine a stable and accurate valuation. Many tokens do not have intrinsic value such as traditional assets. Their value is often driven by speculation and market sentiment, making valuation less straightforward. While a certain difference between pure digital assets and the ones backed by real assets exists, the rise in pricing is not consistent. To counteract this ongoing challenge, exploring innovative approaches to attach intrinsic value to tokens and developing standardized methods to assess their worth could open new opportunities for addressing this valuation challenge and while also enhancing market stability.

Market sentiment also plays a significant role in token valuation. Positive or negative news and events can have a substantial impact on prices. One challenge that seems to persist regards the herd behavior replicated across social networks, where investors rely heavily on each other, rather than on their own risk assessment and investment analysis. This behavior has the undesired effect of generating further ripples effect due to its cumulative power, creating higher market movements and, hence destabilizing the market. While having more informed investors could mitigate some of its effects, this cannot be fully resolved, being also an historical issue on the traditional markets. Traditional assets have fundamental metrics (e.g., earnings, assets) for valuation. Cryptocurrencies often lack these, making it harder to apply traditional valuation methods. To tackle this obstacle, the development of specialized metrics tailored to crypto and token market remains an ongoing challenge, and while certain solutions exist, such as on-chain activity, network participation and the token utility, these metrics could further improve and refined. Moreover, the establishment of a universal framework could provide a solid foundation for assessment of digital assets and further research in this direction could further improve its adoption. We concluded that the interplay of these factors is paramount in comprehending and addressing challenges related to token valuation while helping stakeholders reduce the risks associated with investments.

The social implications of tokenizing society, and individuals using blockchains are widely addressed especially from the perspective of privacy and governance participation. Tokens enable transparency, security, and efficiency, making them efficient for reinforcing trust in the digital age. Ensuring the security of the token and its associated smart contracts is essential since vulnerabilities can lead to hacks or loss of funds. Having a decentralized system comes with a greater responsibility for ensuring from the start great security, but in doing so enables a reinforcement of trust and security for the tokens it holds. Tokens have the potential to streamline the circular economy sector concerning ecology, social welfare, as well as political applicability by improving interoperability and cooperation. Tokens should have a clear utility or purpose within their ecosystem to gain value and adoption. For e-voting, civil participation, governance, renting bikes, identity management, startup investment, and smart grid energy trading, the use-cases for tokens are unlimited. They allow for the creation of an ecosystem that becomes specialized and secure in providing each use case the stage on which to shine and make the world better in a specific area. The most common use cases of blockchain are the supply chain and smart grid management due to the blockchain’s ledger properties of traceability, facilitating the audit. In grid management, blockchain-based digitization via tokenization could increase the participation of citizens, enacting the compensation of flexibility shifting and fairness in remuneration distribution. In this context, energy token design may consider monetary value through fungible standards and energy with certification through non-fungible standards and lately multi-token standards for multi-energy interoperability. Finally, blockchain tokens are lucrative in the arts and gaming industries representing a portion of physical or digital art and can be collected or used in games. These domains of applicability will be significantly boosted by the metaverse, a digital world where avatars interact in virtual spaces, mimicking the physical world’s businesses. The tokens have the potential to support the new socio-economic rules that may be required to govern this world.

We have systematized the findings on factors influencing the token’s creation and evolution in the

Figure 9 SWOT (strengths, weaknesses, opportunities, and threats) diagram to help readers make informed decisions by aligning the strengths with opportunities while highlighting the weaknesses and threats.