Abstract

The Central Appalachian region, where family forest landowners (FFLs) control much of the carbon sequestration potential, holds the potential for forest-based climate solutions. Despite this, participation in carbon offset programs remains low, largely due to the disconnect between small landowner needs and program structure. This study examines FFL preferences for carbon programs in Central Appalachia. Utilizing a panel-data mixed logit model, we evaluated the effects of contract length, payment amount, harvest requirements, and program administration on participation decisions. Our results indicate that higher payments significantly increase program participation. Furthermore, contract lengths of at least 15 years and restrictive harvests negatively influence program participation. Program administration played a significant role, with government-administered programs being less preferred, with odds 48% lower than privately administered programs. Landowner characteristics such as carbon-oriented ownership, education, and income also influence participation. The willingness-to-accept analysis shows high compensation demands for less favorable terms: $107–$397/ha/year for longer contracts and $104–$173/ha/year for harvest restrictions. Additionally, landowners require an extra $66/ha/year for government administration. The findings underscore the importance of designing carbon offset programs that are flexible, offer adequate compensation, and foster trust, while aligning with landowners’ management objectives.

1. Introduction

The Central Appalachian region is home to some of the most biologically diverse and ecologically significant forests in North America [1]. These forests provide a wide array of ecosystem services that sustain both natural systems and human communities. Beyond their environmental value, the region’s forests support rural economies through the production of timber and other forest products, offer extensive outdoor recreation opportunities, and hold deep cultural and historical significance for local residents. This multifaceted forest landscape plays a critical role in the well-being of Central Appalachian communities, delivering environmental, economic, and cultural benefits [2].

Central Appalachia is also a hotspot for climate resilience and carbon sequestration. The region’s forests—many of which are recovering from past timber harvesting—are projected to see increasing rates of carbon uptake as they continue to mature [3]. Due to their diversity, relative intactness, and management potential, these forests have been identified as a key area for forest-based climate solutions (FbCS), especially within the broader eastern U.S. forest biome [4,5]. As a result, Central Appalachia has rapidly emerged as a leading hub for FbCS projects in the United States. It now ranks as the third largest region nationally for Improved Forest Management (IFM) carbon offset projects approved by the California Air Resources Board and holds the highest concentration of such projects in the eastern U.S. [6].

Globally, forest carbon programs operate within hybrid policy mixes where public and private institutions shape rules, funding, verification, and where program participation hinges on design choices around additionality, permanence, and access [7]. Programs such as Scotland’s Woodland Carbon Code also incorporate values beyond carbon (e.g., biodiversity, community benefits), underscoring the need to align programs with landowner goals in multiple-use forests [8]. In many countries, carbon rights and entitlement rules remain critical to participation and benefit sharing, an institutional consideration relevant to private lands in the U.S. as well [9].

Family forest landowners (FFLs) are at the heart of this opportunity. FFLs control the majority of forestland in this region and, by extension, a large portion of the region’s carbon sequestration potential [10]. Collectively, their forest management decisions influence a range of outcomes such as climate mitigation, biodiversity conservation, watershed protection, and rural economic resilience. Yet despite this influence, many carbon offset programs and markets remain inaccessible or poorly aligned with the needs of small forest landowners [11]. Historically, carbon offset programs in the U.S. have catered to industrial-scale ownership, often requiring significant acreage, long-term contracts, complex enrollment processes, and compliance with costly monitoring and reporting protocols. As a result, many small landowners have been excluded from participating [12,13,14,15,16]. Barriers include lack of awareness, misalignment with land management goals, upfront planning requirements, and concerns about additionality and harvest restrictions.

International evidence highlights similar challenges and offers insights into more effective program design. Studies in Finland reveal that while landowners are generally willing to join contract-based programs, participation depends on favorable terms: shorter contracts, higher payments and trusted intermediaries (i.e., non-profit) increase willingness, while longer commitments raise compensation demands [17,18]. These patterns reflect sensitivity to risk and loss aversion. Additionally, landowners place high value on biodiversity and carbon storage, suggesting that environmental outcomes are integral to participation decisions. Research from India shows strong preferences for shorter contracts, smaller land commitments, and higher payments, with trust in implementing institutions a critical determinant [19]. In Australia, Indigenous participation depends on culturally relevant benefits and inclusive, bottom-up governance, underscoring that social and cultural priorities must complement financial incentives [20]. Other studies report similar dynamics. In France, even with streamlined contracts, long-term program commitment and administrative burden can discourage participation [21]. In Brazil’s Atlantic forests, engagement varies with landscape and socioeconomic context [22]. In Sweden, non-industrial owners continue to prioritize multiple ecosystem services (e.g., water quality, recreation, biodiversity), reinforcing the importance of co-benefits in program framing [23]. Considering the financial, social, and ecological challenges to participation, there is a critical need for thoughtfully designed FbCS programs that are tailored to small forest landowners. The program design should support both sustainable forest management and offer sufficient economic incentives to encourage FFL engagement.

In response to these challenges, newer voluntary programs in the U.S., such as the Family Forest Carbon Program, have emerged. These programs aim to increase participation by lowering transaction costs, offering shorter contracts, and reducing acreage requirements [24]. Despite this momentum, participation from FFLs remains low, particularly in Central Appalachia [25]. This suggests a need to better understand what motivates FFLs to participate in carbon offset programs. Increasing participation among FFLs will likely require a combination of improved outreach, reduction in entry barriers, and stronger recognition of the broader ecological value of sustainable forest practices. Many private landowners manage their forests for multiple objectives (e.g., timber production, recreation, ecosystem services) and often view carbon as a secondary benefit [26]. Carbon programs must therefore accommodate other expectations of forest ownership [27]. International experience also highlights the importance of incorporating co-benefits in program design and, where feasible, co-crediting of biodiversity and carbon to align with owner priorities [8,28].

A growing body of literature has examined the willingness of private forest landowners to participate in carbon offset programs, highlighting both the opportunities and persistent challenges of engaging this critical group in climate mitigation efforts. Numerous national and regional studies find that while many landowners support conservation in principle, actual enrollment in carbon programs remains relatively low. A major barrier is limited awareness or understanding of carbon markets and FbCS mechanics [11,29]. Even among informed landowners, skepticism about long-term contractual obligations, harvest restrictions, and additionality requirements can reduce willingness to participate [12,15,26]. Studies in states like Massachusetts, Vermont, Florida, and Oregon report early withdrawal penalties, complex enrollment procedures, and transaction costs as key deterrents [14,15,30]. Some landowners also view carbon storage as ancillary to other objectives, particularly when forests are managed for timber, recreation, or other ecosystem services [27,31]. These findings align with international evidence that measurement, reporting and verification (MRV) complexity; liability clarity; and trust in administrators are important factors influencing participation [7,17,21]. Moreover, the effectiveness, efficiency, and equity of benefit-sharing mechanisms are important for sustaining engagement, as illustrated by Indonesia’s REDD+ experience [32].

Evidence consistently shows that program design matters. Landowners favor shorter contracts, flexible harvest allowances, no withdrawal penalties, upfront or higher payments, and recognition of co-benefits such as wildlife habitat enhancement, water quality protection, and recreational access [13,16,27,33,34,35,36]. Participation is higher among owners with higher educational attainment, larger parcels, active engagement in forest planning, and a stated interest in carbon as a management objective, especially when aligned with broader management goals [11,29,35]. Within Central Appalachia, recent work in West Virginia offers useful insight but focuses on relatively small subsets of landowners in the Managed Timberland Program [35]. Because these landowners already operate under sustainability requirements, a broader, multi-state assessment is needed to understand what motivates the wider population of private family forest landowners in the region to participate in carbon offset programs.

The literature underscores the need for flexible, accessible, and incentive-aligned program models that recognize the diverse values, goals, and constraints of FFLs. A more nuanced understanding of this preference, particularly in understudied but strategically important regions like Central Appalachia, can inform more effective strategies to scale up FbCS in the U.S. This study investigates the perspectives and preferences of FFLs across Central Appalachia regarding carbon offset programs. Using a discrete choice experiment (DCE), we explore how key program attributes such as contract length, payment amount, harvest requirements, and program administration affect landowners’ willingness to enroll. By identifying the most influential program attributes, this study aims to inform the design of more inclusive and effective forest carbon initiatives that align with landowner goals, support national climate mitigation priorities, and enhance ecosystem services across a highly forested and ecologically significant region.

While findings are context-specific, the same attributes have been shown to influence participation in other countries’ FbCS programs. By quantifying how these attributes influence willingness to enroll, this study offers transferable insights for designing credible programs tailored to privately owned forest landscapes in other temperate regions.

2. Theoretical Framework

There are two primary methods to gather information about individuals’ preferences: stated-preference methods and revealed- preference methods. This study aims to examine landowners’ preferences for various attributes of forest carbon offset programs using a DCE framework, a stated preference method. DCE is the most widely used type of stated preference method in behavioral economics and market research to understand how individuals make choices [37]. Stated preference methods are survey-based approaches used to elicit individuals’ preferences for specific behavior or choices, especially when that behavior is not well understood. They collect respondents stated choices under experimentally varied scenarios and use this data to estimate how utility changes with the proposed changes in the quality or quantity of a product, service, idea, or policy [38]. Compared to revealed preference methods, which rely on observed real-world behavior in existing markets, stated preference approach offers two key advantages: (1) it enables the evaluation of policy scenarios before they are implemented and (2) it can account for non-use values, such as carbon storage. This makes stated preference, and particularly DCE, well suited for environmental goods and services like forest carbon offsets, where markets are still emerging and behavioral data are limited. Thus, it has gained popularity among environmental economists in the last decade [39].

Unlike other stated preference techniques, DCEs differ primarily in how responses are gathered [40]. The survey is designed where respondents are presented hypothetical scenarios known as choice tasks. Within each task, individuals choose their preferred option from two or more alternatives, simulating real-world contexts [41]. Each alternative is defined by a combination of attributes, and each attribute can take on different levels. By observing choices across multiple tasks, researchers can infer the relative importance of each attribute, and the trade-off respondents are willing to make [42,43]. The ability to estimate attribute-level preference makes DCE especially useful for assessing potential participation in forest carbon offset programs, where real market behaviors are limited or not yet observable. Originally developed by Louviere and Hensher [44] and Louviere and Woodworth [45] for transport marketing and economics, DCE methodology has since evolved substantially, drawing on theory and methods from the fields of psychology and economics [46].

The econometric foundation of DCE lies in the Random Utility Theory (RUT) developed by McFadden [47], which allows researchers to infer utility without directly observing it. It relies on the assumption of economic rationality and utility maximization. Individuals choose the option that provides the highest perceived utility from a finite set of alternatives. Because utility cannot be directly observed, it is represented as a function of observed components and unobserved factors.

Thus, a landowner i’s decision to enroll in a proposed forest carbon offset program at a choice task t can be represented as:

where is the utility that the landowner i obtains from choosing alternative j in choice task t; represents the vector of program-specific attributes; represents landowner-specific characteristics; and are the respective coefficient vectors; and is the random error term or the unobserved component of the utility. Based on these assumptions, the probability of selecting a given option can be estimated using discrete choice models such as conditional or mixed logit, which accommodates heterogeneity in preferences across respondents.

Applying this framework allows the study to quantify the trade-offs landowners are willing to make among program features. When one of the attributes is expressed in monetary terms, these trade-offs can be translated into willingness to pay (WTP) or willingness to accept (WTA) for changes in other attributes. It provides a separate WTP or WTA for each program attribute. Understanding this trade-off is essential for designing carbon offset programs that align with landowner preferences and increase participation, thereby enhancing the effectiveness of forest-based climate solutions.

3. Materials and Methods

3.1. Study Area

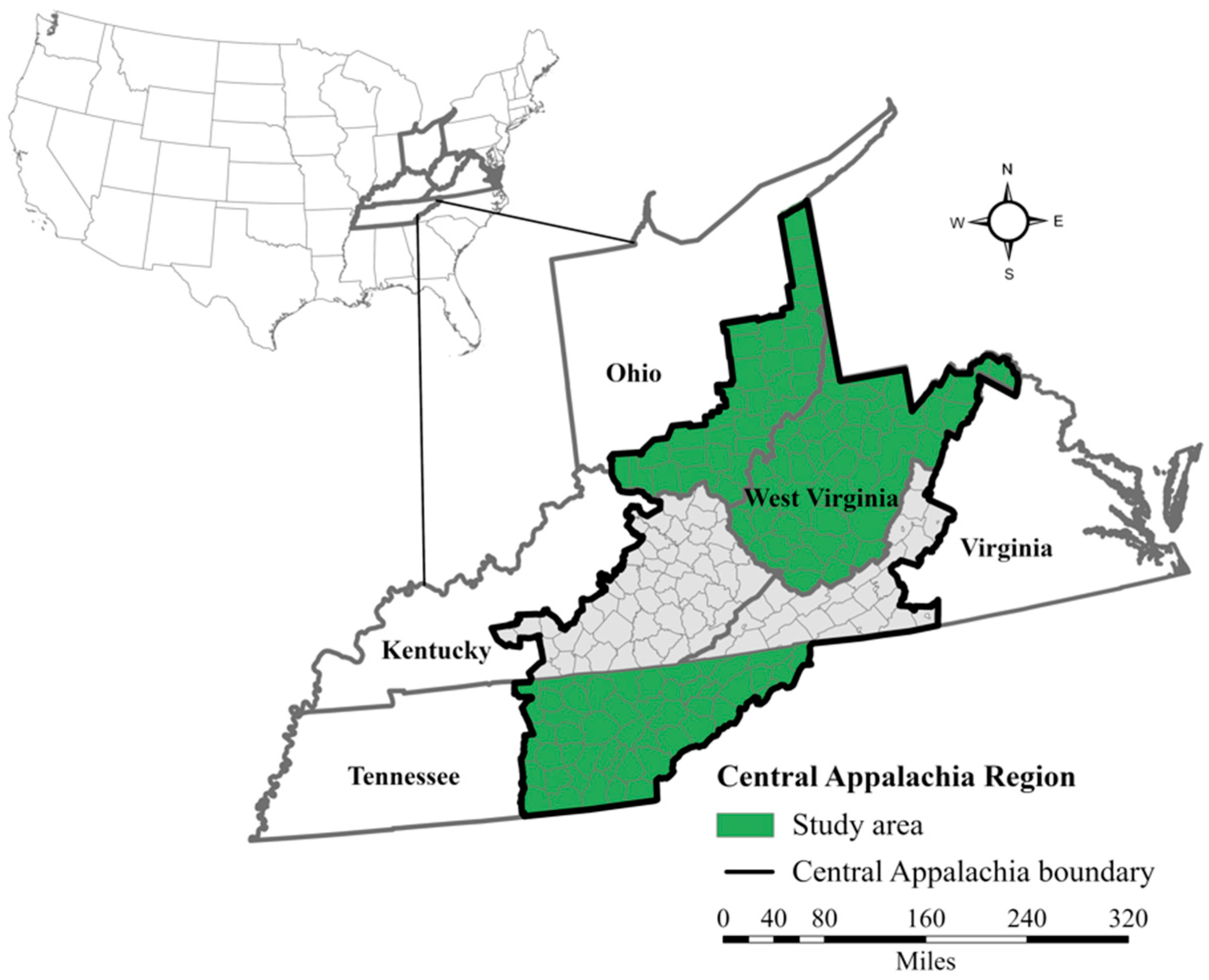

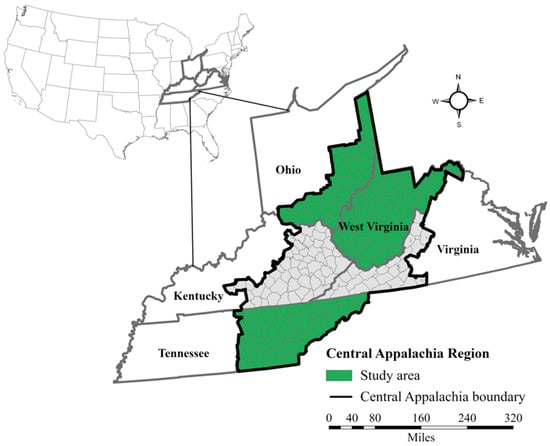

Geographically, Central Appalachia sit in the eastern United States. Specifically, our study area covers three Central Appalachian states: Ohio, Tennessee, and West Virginia, three largely hardwood-dominated landscapes with extensive private forest ownership (Figure 1). Ohio is about 29% forested (3.13 million hectares), Tennessee is about 51% forested (5.62 million hectares), and West Virginia is about 87% forested (35.21 million hectares). While forest cover varies substantially across states, private forest landowners own over 80% of the forest land across these states [48,49,50]. These biophysical and ownership patterns make these states broadly representative of Central Appalachia as a whole, providing a suitable study area for drawing regional insights.

Figure 1.

Map of the study area.

3.2. Survey Design and Data

A mail survey was administered to a random sample of forest landowners selected across Ohio, Tennessee, and West Virginia. These states were selected based on the availability and accessibility of forest landowner databases within the region. The study population consisted of 91,094 family forest landowners. Using the Krejcie–Morgan finite population criterion (95% confidence interval, 5% sampling error), the recommended sample size was approximately 384 respondents [51]. This sample size was used as the target for the study. In addition, to ensure attribute-level precision for DCE, we applied the Johnson–Orme rule-of-thumb and set a secondary target of a minimum of 200 usable completes [52,53]. The rule indicates that the number of respondents N should satisfy the inequality:

where Lmax is the largest number of levels for any attributes (i.e., 4), J is the number of alternatives (i.e., 2) per choice task (excluding the “Neither”), and S is the number of choice sets for each respondent (i.e., 5). Considering historically low response rate in the region—typically around 20% or less [54]—about 3300 landowners were contacted in the survey. Institutional Review Board (IRB) approval was obtained before the survey was administered using Dillman’s Tailored Design Method [55]. Three mailings were conducted—initial, follow-up, and final mailing. Prior to conducting the full survey, the questionnaire was pre-tested in two stages. First, eight colleagues and experts in the forest carbon markets reviewed the survey and suggested refinements, leading to revision in attribute levels and improved clarity of wording. Second, a pre-test with nine respondents was conducted to assess survey length and identify potential areas for confusion. Most respondents completed the survey within 10–15 min and found it easy or mostly easy to complete. Feedback on the DCE section showed that most respondents felt confident in comparing alternatives and understanding payment information; however, some noted difficulties in processing multiple pieces of information and confusion over harvest restrictions. When asked about the most challenging part of the comparison tasks, participants identified harvest restrictions and length of commitment, and two respondents indicated that none of the options offered was a perfect fit for their circumstances. Additional comments pointed to difficulties in answering questions related to forest carbon markets and forest management activities. Based on these findings, we revised the survey by clarifying the language for harvest restrictions and contract terms, simplifying complex phrasing, and improving instructions for the DCE section. No major structural changes were necessary.

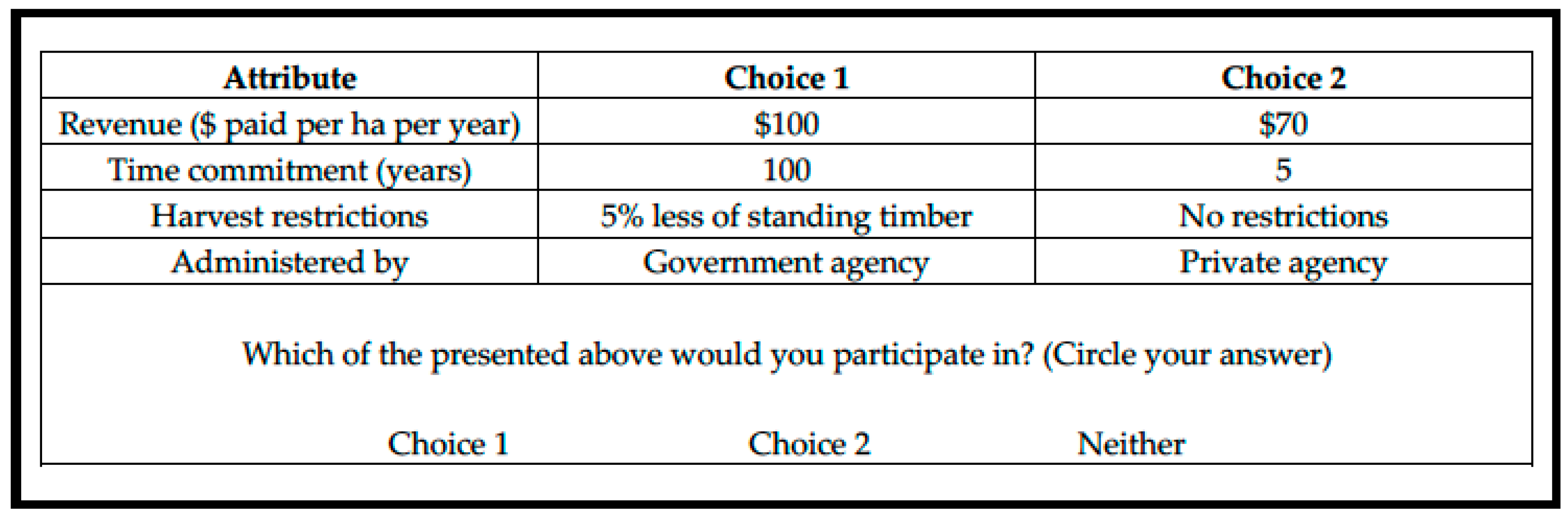

We collected data on ownership and owner characteristics (demographics), knowledge of carbon programs, and preferences for program features. Landowners were asked to evaluate hypothetical carbon programs that differed across several key attributes, including revenue, contract duration, harvest limitations, and program administrator (Table 1). For program administrator, “private” includes non-profit organizations and private companies, while “government” includes federal and state agencies. The specific attribute levels were informed by findings from previous studies [15,16,26,35]. To reduce the full set of scenarios down to a manageable level, a fractional factorial design was generated in Stata 18.5. A D-efficient design was used to minimize the number of choice sets required while maximizing statistical efficiency [56]. The final design included 25 choice sets, which were randomly assigned across 5 survey versions to reduce respondent burden and avoid fatigue. Each respondent received 5 choice tasks. Figure 2 shows an example of a choice set presented to survey respondents.

Table 1.

Description of program attributes in the DCE model.

Figure 2.

Example of choice set presented to survey respondents.

3.3. Empirical Model

Following the random utility framework, the program-specific component of the utility function, , for the empirical model can be defined as follows:

where is the constant, is the coefficient on revenue to the landowner, is the coefficient on time commitment if the duration of the program is 15 years, is the coefficient on time commitment if the duration of the program is 40 years, is the coefficient on time commitment if the duration of the program is 100 years, is the coefficient on harvest restrictions if limited timber harvest is allowed, is the coefficient on harvest restrictions if 10-year increase to harvest cycle is allowed, is the coefficient on harvest restrictions if harvest is limited to 5% of timber, if no timber harvest is allowed, and is the coefficient if the program is administered by a government agency (i.e., federal or state). Each coefficient in the utility function reflects the marginal utility associated with a specific program attribute, relative to a designated reference level. For contract duration, the reference category is a short-term commitment of 1–5 years; for timber harvest, the base is no restriction; and for program administration, the base is private. Because these base levels are generally viewed as the most favorable by landowners, the coefficients for the corresponding attribute levels (e.g., 15-year commitment, 40-year commitment, 100-year commitment, 10-year increase to harvest cycle, limited to 5% of timber, no harvest allowed, and program administrator is a government entity) are expected to be negative. The revenue attribute is treated as a continuous variable, and its coefficient is expected to be positive, indicating that higher payments increase the likelihood of landowner participation. The selection of program attributes included in the utility model is informed by prior research on landowner preferences for carbon offset programs [12,15,16,26,27]. These studies consistently identify revenue payments, contract duration, harvest restrictions, and program administrator as key factors influencing enrollment decisions.

Table 2 summarizes the variables representing landowner-specific attributes included in the analysis. These include importance of owning a forest property for timber and carbon, harvest activity, importance of keeping land forested, familiarity with forest carbon offset programs, availability of forest management plan, ownership size, and demographic characteristics (age, education, income, and gender). Previous studies have also shown that several factors can influence participation in carbon offset programs such as landowners’ reasons for ownership [12,13,31,35,36,57]; recent or planned harvest activity [29,58]; awareness or understanding of carbon offset programs [14]; demographic characteristics such as age, education, or income [12,13,29,35,57]; and property-level features like ownership size [11].

Table 2.

Description and summary statistics of respondent-specific variables in the DCE model.

The program-specific coefficients were specified as random parameters following a normal distribution, with the exception of the revenue coefficient, which was held fixed. Fixing the price coefficient is a standard approach in discrete choice modeling to ensure the normality of welfare estimates and avoid unrealistic variation in marginal utility of income [59,60,61,62]. The model was estimated using a panel-data mixed logit in Stata 18.5 with “Neither” as the base alternative [63]. This model fits choice data where decision makers make repeated choices (i.e., panel data). For an easier and intuitive interpretation of results, we utilize the odds ratio to discuss the impact of the factors affecting participation in hypothetical carbon offset programs.

To estimate how much compensation landowners would require for specific changes in program features, willingness to accept (WTA) was calculated for each attribute k as the ratio of the attribute’s coefficient to the negative of the revenue coefficient or:

WTA serves as an approximation of the minimum financial compensation that would make landowners indifferent to accepting a given program feature, maintaining their overall satisfaction or utility level [15]. Confidence intervals for these estimates were derived using a simulation procedure based on 20,000 random draws [64].

4. Results

4.1. Survey Results

Of the 3300 mailings sent, 360 surveys were returned, but only 311 were usable responses, as some recipients either declined to complete the survey or were not forest landowners. Thus, the resulting response rate is about 10% and consistent with other landowner surveys in the region [35,54]. While the resulting sample meets the minimum 200 required and the response rate is typical in the region, nonresponse bias remains possible. We therefore compared the distributions of early respondents and late respondents using the Kolmogorov–Smirnov (K-S) test based on key demographic variables (age, gender, income, and education) collected in the survey. This method infers nonresponse bias by comparing early and late respondents [65]. Results of the K-S tests indicate no statistically significant differences in the distributions of early and late respondents with respect to age (D = 0.0055; p-value = 1.0000), gender (D = 0.0136; p-value = 0.9846), income (D = 0.0142; p-value = 0.9897), and education (D = 0.0217; p-value = 0.6673). Therefore, it is reasonable to assume that the sample is representative of the study population.

4.2. Respondent Demographic and Ownership Characteristics

Respondents owned, on average, 644 hectares of forestland. Although this is large relative to typical U.S. family forest holding, it falls within the national distribution. Approximately 20% of FFLs own greater than 600 hectares [66]. A majority of respondents (86%) were under the age of 50, while 14% were 50 years or older. In terms of education, 75% of respondents reported having at least a college degree, while 25% had no college degree. Annual household income was below $100,000 for 64% of respondents, with the remaining 36% earning $100,000 or more. The sample was predominantly male, comprising 76% of respondents, while females represented 24%.

4.3. DCE Model Results

Table 3 presents the results of the DCE model, which examined the factors influencing landowners’ decisions to enroll in hypothetical carbon offset programs. Among the program-specific attributes, payment level (Revenue) was significant and positively associated with participation. The odds ratio (OR) indicates that each additional dollar offered increases the odds of selecting the program by 1%, suggesting that higher payments serve as a significant incentive. For example, a $10 increase in payment raises the odds of enrollment by about 10% and raising it to $50 increases the odds by 64%. These magnitudes reiterate the significance of payment level in influencing participation. In contrast, longer contract durations strongly discouraged participation. Compared to the 5-year baseline, 15-, 40-, and 100-year contracts decreased the odds of participation by 65%, 89%, and 98%, respectively. This indicates that long-term time commitment imposes a strong disutility, holding other attributes constant. The steep drop in odds from 15 to 100 years suggests that owners value flexibility in order to have the option to adjust management as markets, policies, or family circumstances change. Similarly, restrictions on timber harvesting significantly reduced the likelihood of enrollment. For example, extending the rotation length by 10 years compared to no restriction decreased the odds of participation by 81%. In addition, limiting harvest to only 5% of total timber decreased the odds of participation by 64% and disallowing harvest entirely decreased participation odds by 82%, emphasizing the importance of management flexibility to landowners. These effects are large and consistent across restrictions indicating that owners place considerable value on maintaining control over timing and intensity of harvests. Strict limits can raise perceived opportunity costs. Furthermore, programs administered by government agencies were less preferred than those managed by private entities, with participation odds 48% lower when the administering body was public. Owners may be concerned about regulatory issues and general distrust associated with government agencies.

Table 3.

Results of DCE model.

Landowner-specific characteristics also played a role in program preferences, particularly when comparing the decision to participate (“Yes”) versus being indifferent (“Neither”). Landowners who identified carbon as a forest ownership objective were more than twice as likely to participate (OR = 2.10), highlighting the importance of value alignment. Conversely, those with a forest management plan were 48% less likely to participate, which may reflect existing commitments or potential conflicts with program requirements. Forest size was negatively associated with participation, with the odds decreasing slightly (by 0.6%) for each additional hectare. This may indicate that larger landowners are more cautious or may require higher compensation to offset opportunity costs. Education was also a significant factor. Landowners with at least a college degree were more than twice as likely to participate (OR = 2.19), possibly due to greater awareness or openness to conservation programs.

When comparing those who chose “No” versus “Neither,” some similar patterns emerged. Landowners with carbon motivations were 59% more likely to reject the program outright, which could reflect a strong stance either for or against the specific program design. Higher income (≥$100,000) and college education were also associated with higher odds of opting out rather than remaining neutral, with odds ratios of 2.08 and 1.84, respectively. These findings suggest that more affluent and educated landowners may be skeptical about the program offerings.

4.4. Willingness-to-Accept (WTA) Estimates for Program Attributes

Table 4 presents the estimated mean willingness-to-accept (WTA) values for key program attributes, expressed in dollars per hectare per year. These values represent the minimum compensation landowners would require accepting less favorable program features. Landowners require higher program compensation for longer contract durations. Specifically, the mean WTA for a 15-year contract was $107/ha/year, increasing to $222/ha/year for a 40-year contract, and reaching $397/ha/year for a 100-year contract, all relative to the 5-year baseline. Harvesting restrictions also influenced WTA. Landowners require $169/ha/year in additional compensation if harvest rotation is extended by 10 years (Harvest2) or $104/ha/year if harvesting is limited to only 5% of timber (Harvest3), all compared to no harvest restrictions. WTA increased to $173/ha/year if harvesting is not permitted at all (Harvest4). While these values suggest that any limitation on harvest is viewed as a cost that must be offset by compensation, the relative magnitude within the harvest category is informative as well. Landowners require comparable compensation to accept no harvest (Harvest4; $172/ha/yr) or increasing the rotation length by 10 years (Harves2; $169/ha/yr), whereas a 5% cap (Harvest3) carries a smaller, yet still substantial, WTA ($104/ha/yr), all relative to no restriction. Additionally, if a program were administered by a government agency rather than a private entity, landowners required an average additional compensation of $66/ha/year, reflecting a modest but statistically significant preference for private or non-governmental administration.

Table 4.

Landowners’ WTA estimates by program attribute.

These results show that contract duration exhibits the largest compensation requirements, with WTA rising sharply from 15 to 40 to 100 years. This is followed by harvest restrictions and then by administrator.

5. Discussion

This study provides new evidence on FFLs preferences for carbon offset programs in Central Appalachia, a region characterized by extensive forest cover and emerging opportunities for FbCS. FFLs are critical stakeholders in advancing forest-based carbon mitigation strategies, yet their participation remains limited due to financial, structural, institutional, and informational barriers [12,13,14,15,16,35]. Building on an earlier work which focused on a subset of West Virginia landowners [35], this study expands the scope to include a broader and more diverse landowner population across Central Appalachia. Using a DCE, the findings offer an in-depth understanding of how both program design and individual landowner characteristics shape willingness to engage in carbon offset initiatives.

The results of this study indicate that revenue, harvest restrictions, contract duration, and program administration were significant factors in influencing participation, a finding strongly supported by other studies in the U.S. [27,35,67,68]. Evidence from other countries also shows higher participation rates for programs that offer shorter terms, flexible harvest provisions, trusted delivery (e.g., private or non-profit entities), and targeted compensation [17,21]. Central Appalachia therefore provides a globally relevant case for designing FbCS programs in privately owned landscapes.

One of the most important findings of this study is the role of financial incentives in encouraging participation in climate-based solutions such as carbon-offset programs. Revenue was significantly and positively associated with participation, indicating that payment is a primary driver of engagement. Research suggests that monetary incentives mostly influence landowners’ decision to opt in to carbon offset programs and adopt sustainable forestry practices [16,30,69,70]. Participation in carbon offset program is a financial decision where landowners weigh opportunity costs against offered incentives. The WTA estimates provide further clarity to this by quantifying how much compensation landowners would require to accept specific program conditions. For example, WTA values increased substantially as contract length increased from 5 years to 15–100 years, ranging from $107 to $397 per hectare per year. This may indicate landowners’ stronger preference for the present over the future and aversion to long-term risk. In the Central Appalachia region, forestland is passed through generations [1] and therefore future land use flexibility may be more important. Landowners may be hesitant to commit to longer contracts due to the opportunity costs associated with delayed timber harvest in terms of forgone revenue.

Timber harvest was also a significant factor affecting landowners’ willingness to participate in carbon offset programs. Overall, any restriction is a deterrent to participation and represents a significant opportunity cost, especially for landowners who manage their forests for timber income. This finding is consistent with previous research, which has shown that restrictive harvesting conditions reduce participation rates in conservation and carbon initiatives [27,35]. From an economic standpoint, the decision to harvest timber is perhaps the most critical management choice forest landowners consider [71]. Forgoing or delaying harvest can result in significant financial losses not only due to missed revenue opportunities but also due to increased risk of loss of land and timber value from storms, pests, or diseases [27,72,73]. The results of this study reinforce these concerns. Landowners require between $104 and $173 per hectare per year to accept constraints on harvest timing or intensity. This clearly signals the perceived economic trade-off landowners face when enrolling in programs that limit harvests. Programs that offer greater flexibility in harvest may be more attractive to landowners. In fact, designing carbon programs that allows greater flexibility in harvesting can more effectively meet the program’s primary objective of increasing carbon sequestration while enhancing financial benefits for participating landowners [74].

With regard to program administration, this study has shown less preference for government-administered programs. Landowners in Central Appalachia were significantly less likely to participate in programs managed by public agencies, and WTA values suggest they would require an additional $66/ha/year to accept this condition. This finding aligns with prior research, which found that Vermont landowners preferred non-profit organizations over government entities to administer the aggregation of properties for forest carbon offset projects [15]. The preference for private or non-governmental administration likely reflects underlying dynamics of institutional trust, particularly concerning bureaucratic complexity, regulatory constraints, or inflexible program delivery often associated with government-run initiatives [75]. This may reflect long-standing skepticism toward government authorities in Appalachia, with cultural roots in Scotts-Irish traditions that emphasized kinship networks and local autonomy [76].

Landowner-specific characteristics also influenced the decision to participate in carbon offset programs. Those who identified carbon sequestration as important ownership objective were significantly more likely to participate, a finding consistent with previous research on forest landowners in the region [35]. This also supports previous findings that value alignment is a critical determinant of participation [12,13,35]. Similarly, landowners who are more familiar with carbon offset programs are more likely to enroll, which are similar to findings of other studies conducted in the United States [12,77,78,79]. When landowners are more informed about carbon offset programs work, they are better equipped to evaluate trade-offs and may perceive the programs as more credible. This underscores the importance of targeted outreach and educational efforts to increase awareness, particularly to landowners who may be unfamiliar with climate-based solutions or maybe skeptical of their benefits. Improving access to clear and transparent information could serve as a key strategy for increasing participation rates and enhancing the overall effectiveness of forest carbon initiatives [14,35]. Landowners also differ in how they prefer to learn and from whom. Some may rely on peer landowners, while others prefer extension agents, non-profits or consultants. Tailored outreach strategies that consider landowner learning preferences are crucial for increasing engagement in FbCS [80]. Interestingly, landowners with existing management plans were less likely to opt in, possibly because they are already engaged in activities that may be redundant, restrictive or in conflict with carbon sequestration requirements. Another interesting finding is that landowners with larger forest holdings were less likely to participate. While it is often expected that larger ownerships would encourage participation due to economies of scale, previous research has shown that the impact of property size on landowner behavior is mixed. For instance, studies have found that the relationship between property size and decisions such as delaying harvest is ambiguous [31,81]. Moreover, the influence of ownership size may vary across different forest management practices [82], suggesting that larger landowners may weigh opportunity costs, management complexity, and program restrictions differently than smaller landowners. Demographic variables such as education and income are also significant factors of participation, aligning with previous work [13,29,35,57]. Educated landowners are more likely to make choices, whether supportive (Yes) or opposed (No) because they may have a better understanding of the implications of participating in a carbon offset program. Income was positively and significantly associated with the “No” response but not with the Yes”, indicating that higher income landowners were more likely to reject participation, rather than remain undecided or supportive. This may be due to low marginal utility of program payments or higher opportunity costs associated with forgone timber revenues. These findings suggest that more affluent landowners may be less motivated by financial incentives and more likely prioritize management objectives that offer greater flexibility or long-term returns. The study highlights the considerable heterogeneity in landowner preferences, underscoring the need for targeted outreach and flexible program design.

5.1. Theoretical Implications

Using DCE, the findings align with random utility theory, which emphasizes trade-offs in shaping landowner choices for FbCS program design. The results provide several theoretical insights into landowner decision-making. The strong influence of revenue confirms that landowners approach participation in carbon programs as an economic decision, consistent with theories emphasizing rational choice and trade-offs. The willingness to accept (WTA) estimates further demonstrate how landowners weigh financial incentives against competing management priorities. Sensitivity to contract length and harvest restrictions highlights the role of risk and uncertainty in shaping FbCS choices, reinforcing the importance of incorporating risk considerations into behavioral models. The preference for non-governmental administration underscores the relevance of institutional trust in voluntary program adoption, indicating that participation is not driven by financial incentives alone. Knowledge and value alignment also emerged as important determinants of enrollment, supporting behavioral theories that emphasize the influence of familiarity and personal objectives on decision-making. Finally, the heterogeneity across demographic factors, property size, and ownership goals indicates that a “one-size-fits-all” approach is insufficient. Models predicting participation should account for socio-economic and behavioral differences to capture the complexity of landowner decisions.

5.2. Policy Implications

The study’s findings have important implications for designing and implementing carbon offset programs targeting family forest owners. Program flexibility is essential. Shorter initial contracts with renewal options can help reduce perceived risks associated with long-term commitments, while flexible harvest provisions can minimize opportunity costs for landowners who depend on timber revenue. Programs should consider conditional harvest allowances that maintain carbon goals without imposing absolute restrictions. Financial structures must also reflect risk and performance considerations. Sensitivity to revenue indicates that payment design strongly influences program attractiveness. Options such as upfront bonuses, tiered incentives, or risk-adjusted payments can address uncertainty and align compensation with landowner preferences. Institutional trust plays a critical role in program adoption. The lower willingness to enroll in government-administered programs suggests the need to involve trusted intermediaries such as non-profits or private forestry consultants. These entities may help reduce perceptions of bureaucratic complexity and enhance program credibility. Targeted outreach and education are also necessary to overcome informational barriers. Landowners unfamiliar with carbon markets are less likely to participate, highlighting the importance of extension services, peer learning, and communication strategies tailored to different learning preferences. Clear explanations of technical requirements, payment processes, and expected benefits can reduce skepticism and build confidence in program participation. Finally, program framing can influence enrollment decisions. While this study did not include co-benefit attributes, integrating ecosystem service co-benefits such as water quality, biodiversity, and soil health into messaging and compensation structures could broaden appeal. Co-benefit framing aligns with landowner stewardship values and may encourage participation by linking financial incentives to ecological outcomes [8,28,33,34,83].

5.3. Limitations and Future Research

While this study offers important insights, several limitations should be acknowledged. First, the sample represents three states in Central Appalachia, which may not fully capture variation across the entire region or other regions in the U.S. Future research should expand geographic scope and examine spatial heterogeneity in preferences. Understanding spatial variation in landowner attitudes and constraints will be critical for tailoring program design and outreach. Second, our study did not explicitly include co-benefit attributes in the DCE. Future work should incorporate co-benefits (e.g., water quality, biodiversity, soil health) to provide landowners the economic incentives for managing their property sustainably for a variety of ecosystem services. This is timely as these benefits are often not recognized in private forest management and are not adequately integrated into public policy and land use decision-making [84,85]. While there is interest among forest managers and policy makers, this is often hampered by insufficient scientific foundation for quantifying co-benefits in FbCS plans. Studies are needed to test whether co-benefit framing or payments materially increase participation and align program incentives with broader ecological outcomes. Lastly, as climate policies and market opportunities evolve, it is important to examine how landowner preferences change over time. Longitudinal data and case studies could provide deeper insights into the effectiveness of carbon offset programs, landowner satisfaction, and their long-term ecological and economic impacts. Such research would help inform adaptive policy strategies that remain responsive to shifting landowner needs, market conditions, and environmental goals.

6. Conclusions

This study offers new evidence on FFL preferences for carbon offset programs in Central Appalachia, a region where private ownership dominates and landowner engagement is essential for advancing climate mitigation goals. The discrete choice experiment revealed that landowners are particularly sensitive to program length, harvest restrictions, and the administering entity, with longer contracts and limitations on timber harvest posing significant barriers to participation. These findings suggest that economic trade-offs and perceived risks are central to decision-making.

In addition, landowner characteristics such as carbon-related ownership goals, education, and income levels shaped participation preferences. Programs that align with landowner values, offer flexibility, and foster institutional trust are more likely to succeed. To improve participation, future carbon initiatives should focus on education and outreach strategies tailored to landowners’ preferred sources and methods of information. As carbon markets expand, future efforts should continue refining program design to reflect the diverse motivations, constraints, and learning preferences of landowners in the region, including pilot-testing the inclusion of co-benefit attributes in program design.

Author Contributions

Conceptualization, K.G. and B.E.; methodology, K.G., B.E., S.C. and K.A.; software, K.G. and K.A.; validation, K.G.; formal analysis, K.G. and K.A.; investigation, B.E. and K.G.; resources, K.G. and B.E.; data curation, K.G., S.C. and K.A.; writing—original draft preparation, K.G.; writing—review and editing, B.E., S.C., G.D. and K.A.; visualization, K.G.; supervision, K.G.; project administration, K.G.; funding acquisition, K.G. and B.E. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by USDA NIFA Award No. 2023-67019-40588, USDA NIFA Award No. 2023-67012-40334, and NSF Award No. 2408954.

Data Availability Statement

Data is unavailable due to privacy restrictions.

Acknowledgments

We want to thank Julian Hwang, for his valuable assistance with the design of the discrete choice experiment (DCE).

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

Abbreviations

The following abbreviations are used in this manuscript:

| DCE | Discrete Choice Experiment |

| FFLs | Family Forest Landowners |

| FbCS | Forest-based Climate Solutions |

| IFM | Improved Forest Management |

| MRV | Measurement, Reporting and Verification |

| WTA | Willingness-to-Accept |

| WTP | Willingness-to-Pay |

References

- Butler, P.R.; Iverson, L.; Thompson, F.R., III; Brandt, L.; Handler, S.; Janowiak, M.; Shannon, P.D.; Swanston, C.; Karriker, K.; Bartig, J.; et al. Central Appalachians Forest Ecosystem Vulnerability Assessment and Synthesis: A Report from the Central Appalachians Climate Change Response Framework Project; General Technical Report NRS-146; U.S. Department of Agriculture, Forest Service, Northern Research Station: Newtown Square, PA, USA, 2015; p. 310.

- Boettner, F.; Clingerman, J.; Mcmoill, R.; Hansen, E.; Hartz, L.; Hereford, A.; Vanderberg, M.; Arano, K.; Deng, J.; Strager, J.; et al. An Assessment of Natural Assets in the Appalachian Region: Forest Resources; Appalachian Regional Commission: Washington, DC, USA, 2014.

- Wu, C.; Coffield, S.R.; Goulden, M.L.; Randerson, J.T.; Trugman, A.T.; Anderegg, W.R.L. Uncertainty in US forest carbon storage potential due to climate risks. Nat. Geosci. 2023, 16, 422–429. [Google Scholar] [CrossRef]

- Anderegg, W.R.L.; Chegwidden, O.S.; Badgley, G.; Trugman, A.T.; Cullenward, D.; Abatzoglou, J.T.; Hicke, J.A.; Freeman, J.; Hamman, J.J. Future climate risks from stress, insects and fire across US forests. Ecol. Lett. 2022, 25, 1510–1520. [Google Scholar] [CrossRef] [PubMed]

- Jiang, F.; Ju, W.; He, W.; Wu, M.; Wang, H.; Wang, J.; Jia, M.; Feng, S.; Zhang, L.; Chen, J.M. A 10-year global monthly averaged terrestrial net ecosystem exchange dataset inferred from the ACOS GOSAT v9 XCO 2 retrievals. Earth Syst. Sci. Data 2022, 14, 3013–3037. [Google Scholar] [CrossRef]

- Schwartzman, G. Climate rentierism after coal: Forests, carbon offsets, and post-coal politics in the Appalachian coalfields. J. Peasant Stud. 2022, 49, 924–944. [Google Scholar] [CrossRef]

- Shen, X.; Gatto, P.; Pagliacci, F. Unravelling the role of institutions in market-based instruments: A systematic review on forest carbon mechanisms. Forests 2023, 14, 136. [Google Scholar] [CrossRef]

- Koronka, J.; Ovando, P.; Vergunst, J. Understanding values beyond carbon in the woodland carbon code in Scotland. Trees For. People 2022, 9, 100320. [Google Scholar] [CrossRef]

- Streck, C. Who owns REDD? Carbon markets, carbon rights and entitlements to REDD finance. Forests 2020, 11, 959. [Google Scholar] [CrossRef]

- vonHedemann, N.; Schultz, C.A. U.S. family forest owners’ forest management for climate adaptation: Perspectives from extension and outreach specialists. Front. Clim. 2021, 3, 674718. [Google Scholar] [CrossRef]

- Sass, E.M.; Caputo, J.; Butler, J. United States family forest owners’ awareness of and participation in carbon sequestration programs: Initial findings from the USDA Forest Service national woodland owner survey. For. Sci. 2022, 68, 447–451. [Google Scholar] [CrossRef]

- Markowski-Lindsay, M.; Stevens, T.; Kittredge, D.B.; Butler, B.J.; Catanzaro, P.; Dickinson, B.J. Barriers to Massachusetts forest landowner participation in carbon markets. Ecol. Econ. 2011, 71, 180–190. [Google Scholar] [CrossRef]

- Miller, K.A.; Snyder, S.A.; Kilgore, M.A. An assessment of forest landowner interest in selling forest carbon credits in the Lake States, USA. For. Policy Econ. 2012, 25, 113–122. [Google Scholar] [CrossRef]

- Kelly, E.C.; Gokd, G.J.; Tommaso, J.D. The willingness of non-industrial private forest owners to enter California’s carbon offset market. Environ. Manage. 2017, 60, 882–895. [Google Scholar] [CrossRef] [PubMed]

- White, A.E.; Lutz, D.A.; Howarth, R.B.; Soto, J.R. Small-scale forestry and carbon offset markets: An empirical study of Vermont Current Use forest landowner willingness to accept carbon credit programs. PLoS ONE 2018, 13, e021967. [Google Scholar] [CrossRef] [PubMed]

- Graves, R.A.; Nilesen-Pincus, M.; Haugo, R.D.; Holz, A. Forest carbon incentive programs for non-industrial private forests in Oregon (USA): Impacts of program design on willingness to enroll and landscape-level program outcomes. For. Policy Econ. 2022, 141, 102778. [Google Scholar] [CrossRef]

- Kosenius, A.K. Forest owner attitudes and preferences for voluntary temporary forest conservation. Small-Scale For. 2024, 23, 493–513. [Google Scholar] [CrossRef]

- Juutinen, A.; Kurttila, M.; Pohjanmies, T.; Tolvanen, A.; Kuhlmey, K.; Skudnik, M.; Triplat, M.; Westin, K.; Mäkipaä, R. Forest owners’ preferences for contract-based management to enhance environmental values versus timber production. For. Policy Econ. 2021, 132, 102587. [Google Scholar] [CrossRef]

- Mariyam, D.; Puri, M.; Harihar, A.; Karanth, K.K. Benefits beyond borders: Assessing landowner willingness-to-accept for conservation outside protected areas. Front. Ecol. Evol. 2021, 9, 663043. [Google Scholar] [CrossRef]

- Robinson, C.J.; Renwick, A.R.; May, T.; Gerrard, E.; Foley, R.; Battaglia, M.; Possingham, H.; Griggs, D.; Walker, D. Indigenous benefits and carbon offset schemes: An Australian case study. Environ. Sci. Policy 2016, 56, 129–134. [Google Scholar] [CrossRef]

- Fouqueray, T.; Génin, L.; Trommetter, M.; Frascaria-Lacoste, N. Efficient, sustainable, and multifunctional carbon offsetting to boost forest management: A comparative case study. Forests 2021, 12, 386. [Google Scholar] [CrossRef]

- Pienkowski, T.; Freni Sterrantino, A.; Tedesco, A.M.; Clark, M.; Brancalion, P.H.S.; Jagadish, A.; Mendes, A.; Pugliese de Siqueira, L.; Mills, M. Spatial predictors of landowners’ engagement in the restoration of the Brazilian Atlantic Forest. People Nat. 2025, 7, e10765. [Google Scholar] [CrossRef]

- Bergkvist, J.; Nikoleris, A.; Fors, H.; Jönsson, A.M. Maintenance and enhancement of forest ecosystem services: A non-industrial private forest owner perspective. Eur. J. For. Res. 2024, 143, 169–185. [Google Scholar] [CrossRef]

- Dezember, R. Carbon Offset Market Opens to Small Southern Timberland Owners. Wall Str. J. 2023. Available online: https://www.wsj.com/business/energy-oil/carbon-offset-market-opens-to-small-southern-timberland-owners-2bb4de17?reflink=desktopwebshare_permalink (accessed on 15 July 2025).

- Haya, B.K.; Bernard, T.; Abayo, A.; Rong, X.; So, I.S.; Elias, M. Voluntary Registry Offsets Database v2025-06, Berkeley Carbon Trading Project, University of California, Berkeley. 2025. Available online: https://gspp.berkeley.edu/berkeley-carbon-trading-project/offsets-database (accessed on 25 August 2025).

- Soto, J.R.; Adams, D.C.; Escobedo, F.J. Landowner attitudes and willingness to accept compensation from forest carbon offsets: Application of best-worst choice modeling in Florida USA. For. Policy Econ. 2016, 63, 35–42. [Google Scholar] [CrossRef]

- Sharma, S.; Kreye, M.M. Forest owner willingness to accept payment for forest carbon in the United States: A meta-analysis. Forests 2022, 13, 1346. [Google Scholar] [CrossRef]

- Tedersoo, L.; Sepping, J.; Morgunov, A.S.; Kiik, M.; Esop, K.; Rosenvald, R.; Hardwick, K.; Breman, E.; Purdon, R.; Groom, B.; et al. Towards a co-crediting system for carbon and biodiversity. Plants People Planet 2023, 5, e10405. [Google Scholar] [CrossRef]

- Thompson, D.W.; Hansen, E.N. Factors affecting the attitudes of nonindustrial private forest landowners regarding carbon sequestration and trading. J. For. 2012, 110, 129–137. [Google Scholar] [CrossRef]

- Alhassan, M.; Motallebi, M.; Song, B. South Carolina forestland owners’ willingness to accept compensations for carbon sequestration. For. Ecosyst. 2019, 6, 16. [Google Scholar] [CrossRef]

- Khanal, P.N.; Grebner, D.L.; Munn, I.A.; Grado, S.C.; Grala, R.K.; Henderson, J.E. Evaluating non-industrial forest landowner willingness to manage for forest carbon sequestration in the southern United States. For. Policy Econ. 2017, 75, 112–119. [Google Scholar] [CrossRef]

- Wahyudi, R.; Marjaka, W.; Silangen, C.; Fajar, M.; Dharmawan, I.W.S. Mariamah Effectiveness, Efficiency, and Equity in Jurisdictional REDD Benefit Distribution Mechanisms: Insights from Jambi Province, Indonesia. Trees For. People 2024, 18, 100726. [Google Scholar] [CrossRef]

- Adhikari, R.K.; Grala, R.K.; Petrolia, D.R.; Grado, S.C.; Grebner, D.L.; Shrestha, A. Landowner willingness to accept monetary compensation for managing forests for ecosystem services in the Southern United States. For. Sci. 2022, 68, 128–144. [Google Scholar] [CrossRef]

- Lou, J.; Hultman, N.; Patwardhan, A.; Qiu, Y.C. Integrating sustainability into climate finance by quantifying the co-benefits and market impact of carbon projects. Commun. Earth Environ. 2022, 3, 137. [Google Scholar] [CrossRef]

- Gazal, K.A.; Hwang, J.; Eastman, B. West Virginia forest landowners’ preferences for forest carbon offset programs. Trees For. People 2024, 18, 100683. [Google Scholar] [CrossRef]

- Stedman, R.C.; Armstrong, A.; Walsh, A.A.; Connelly, N. Private landowner willingness to manage their land for Carbon sequestration in New York state. J. For. 2024, 122, 373–382. [Google Scholar] [CrossRef]

- Johnson, F.R.; Lancsar, E.; Marshall, D.; Kilambi, V.; Mühlbacher, A.; Regier, D.A.; Bresnahan, B.W.; Kanninen, B.; Bridges, J.F.P. Constructing experimental designs for discrete-choice experiments: Report of the ISPOR conjoint analysis experimental design good research practices task force. Value Health 2013, 16, 3–13. [Google Scholar] [CrossRef] [PubMed]

- Shang, L.; Chandra, Y. An Overview of Stated Preference Methods: What and Why. In Discrete Choice Experiments Using R; Springer: Singapore, 2023. [Google Scholar] [CrossRef]

- Chèze, B.; Collet, C.; Paris, A. Estimating Discrete Choice Experiments: Theoretical Fundamentals. 2021. Available online: https://ifp.hal.science/hal-03262187v1 (accessed on 26 August 2025).

- Lambooij, M.S.; Harmsen, I.A.; Veldwijk, J.; de Melker, H.; Mollema, L.; van Weert, Y.W.; de Wit, G.A. Consistency between stated and revealed preferences: A discrete choice experiment and a behavioural experiment on vaccination behaviour compared. BMC Med. Res. Methodol. 2015, 15, 19. [Google Scholar] [CrossRef]

- Mangham, L.J.; Hanson, K.; McPake, B. How to do (or not to do) … Designing a discrete choice experiment for application in a low-income country. Health Policy Plan. 2009, 24, 151–158. [Google Scholar] [CrossRef]

- Trapero-Bertran, M.; Rodríguez-Martín, B.; López-Bastida, J. What attributes should be included in a discrete choice experiment related to health technologies? A systematic literature review. PLoS ONE 2019, 14, e0219905. [Google Scholar] [CrossRef] [PubMed]

- Spinks, J.; Chaboyer, W.; Bucknall, T.; Tobiano, G.; Whitty, J.A. Patient and nurse preferences for nurse handover—Using preferences to inform policy: A discrete choice experiment protocol. BMJ Open 2015, 5, e008941. [Google Scholar] [CrossRef]

- Louviere, J.; Hensher, D.A. On the design and analysis of simulated choice or allocation experiments in travel choice modelling. Transp. Res. Rec. 1982, 890, 11–17. [Google Scholar]

- Louviere, J.; Woodworth, G. Design and analysis of simulated consumer choice or allocation experiments: An approach based on aggregate data. J. Mark. Res. 1983, 20, 350–367. [Google Scholar] [CrossRef]

- Zinay, D.; Cameron, R.; Naughton, F.; Whitty, J.A.; Brown, J.; Jones, A. Understanding Uptake of Digital Health Products: Methodology Tutorial for a Discrete Choice Experiment Using the Bayesian Efficient Design. J. Med. Internet Res. 2021, 23, e32365. [Google Scholar] [CrossRef]

- McFadden, D. Conditional Logit Analysis of Qualitative Choice Behavior. UC Berkley IURD Working Paper Series. 1972. Available online: https://escholarship.org/content/qt61s3q2xr/qt61s3q2xr.pdf (accessed on 2 June 2025).

- USDA Forest Service. Forests of Tennessee, 2017; Resource Update FS-262; U.S. Department of Agriculture, Forest Service: Asheville, NC, USA, 2020; p. 2. [CrossRef]

- USDA Forest Service. Forests of West Virginia, 2020; Resource Update FS-339; U.S. Department of Agriculture, Forest Service: Madison, WI, USA, 2021; p. 2. [CrossRef]

- USDA Forest Service. Forests of Ohio, 2020; Resource Update FS-341; U.S. Department of Agriculture, Forest Service: Madison, WI, USA, 2021; p. 2. [CrossRef]

- Krejcie, R.V.; Morgan, D.W. Determining sample size for research activities. Educ. Psychol. Meas. 1970, 30, 607–610. [Google Scholar] [CrossRef]

- Orme, B. Sawtooth Software Sample Size Issues for Conjoint Analysis Studies; Research Paper Series; Sawtooth Software, Inc.: Sequim, WA, USA, 1998. [Google Scholar]

- Johnson, R.; Orme, B. Getting the Most from CBC; Sawtooth Software Research Paper Series; Sawtooth Software, Inc.: Sequim, WA, USA, 2003. [Google Scholar]

- Joshi, S.; Arano, K. Determinants of private forest management decisions: A study on West Virginia NIPF landowners. For Policy Econ. 2009, 11, 118–125. [Google Scholar] [CrossRef]

- Dillman, D.A. Mail and Internet Surveys—The Tailored Design Method; John Wiley and Sons: New York, NY, USA, 2000; p. 464. [Google Scholar]

- Ryan, M.; Kolstad, J.R.; Rockers, P.C.; Dolea, C. How to Conduct a Discrete Choice Experiment for Health Workforce Recruitment and Retention in Remote and Rural Areas: A User Guide with Case Studies (English); World Bank: Washington, DC, USA, 2012; Available online: https://documents1.worldbank.org/curated/en/586321468156869931/pdf/NonAsciiFileName0.pdf (accessed on 15 July 2025).

- Habesland, D.E.; Kilgore, M.A.; Becker, D.R.; Snyder, S.A.; Sjolic, H.K.; Lindstad, B.H. Norwegian family forest owners’ willingness to participate in carbon offset programs. For. Policy Econ. 2016, 70, 30–38. [Google Scholar] [CrossRef]

- Shin, S.; Yeo-Chan, Y. Perspectives of private forest owners toward investment in forest carbon offset projects: A case of Geumsan-Gun, South Korea. Forests 2019, 10, 21. [Google Scholar] [CrossRef]

- Gao, Z.; Schroeder, T.C. Effects of label information on consumer willingness-to-pay for food attributes. Am. J. Agric. Econ. 2009, 91, 795–809. [Google Scholar] [CrossRef]

- Train, K.E. Discrete Choice Methods with Simulation, 2nd ed.; Cambridge University Press: New York, NY, USA, 2009. [Google Scholar]

- Khachatryan, H.; Suh, D.H.; Zhou, G.; Dukes, M. Sustainable urban landscaping: Consumer preferences and willingness to pay for turfgrass fertilizers. Can. J. Agr. Econ. 2016, 65, 385–407. [Google Scholar] [CrossRef]

- Zhang, X.; Fang, Y.; Gao, Z. Accounting for attribute non-attendance (ANA) in Chinese consumers’ away-from-home sustainable salmon consumption. Mar. Resour. Econ. 2020, 35, 263–284. [Google Scholar] [CrossRef]

- StataCorp. Stata 19; Statistical software; StataCorp LLC.: College Station, TX, USA, 2019. [Google Scholar]

- Krisnky, I.; Robb, A. On approximating the statistical properties of elasticities. Rev. Econ. Stat. 1986, 64, 715–719. [Google Scholar] [CrossRef]

- Lin, I.F.; Schaefer, N.C. Using survey participants to estimate the impact of nonparticipation. Public Opon. Q. 1995, 59, 236–258. [Google Scholar] [CrossRef]

- Butler, B.J.; Butler, S.M.; Caputo, J.; Dias, J.; Robillard, A.; Sass, E.M. Family Forest Ownerships of the United States, 2018: Results from the USDA Forest Service, National Woodland Owner Survey; General Technical Report NRS-199; U.S. Department of Agriculture, Forest Service, Northern Research Station: Madison, WI, USA, 2021; p. 52. [CrossRef]

- Hovis, M. Estimating landowners’ willingness to accept payments for adopting nature-based solutions on their properties: Payment card contingent valuation. J. Soil Water Conserv. 2023, 78, 345–356. [Google Scholar] [CrossRef]

- Kilgore, M.A.; Frey, G.E.; Snyder, S.A.; Mihiar, C. Factors influencing a forest landowner’s choice of incentive program commitment length. For. Policy Econ. 2025, 177, 103513. [Google Scholar] [CrossRef]

- Chowdhury, P.K.; Brown, D.G. Modeling the effects of carbon payments and forest owner cooperatives on carbon storage and revenue in the Pacific Northwest forestlands. Land Use Policy 2023, 131, 106725. [Google Scholar] [CrossRef]

- Jayachandran, S.; De Laat, J.; Lambin, E.F.; Stanton, C.Y.; Audy, A.; Thomas, N.E. Cash for carbon: A randomized trail of payments for ecosystem services to reduce deforestation. Science 2017, 357, 267–273. [Google Scholar] [CrossRef] [PubMed]

- Plantinga, A.J. The optimal timber rotation: An option value approach. For. Sci. 1998, 44, 192–202. [Google Scholar] [CrossRef]

- Ekholm, T. Optimal forest rotation under carbon pricing and forest damage risk. For. Policy Econ. 2020, 115, 102131. [Google Scholar] [CrossRef]

- Kreye, M.; Kowalczyk, T.; Khanal, P.; Sharma, S. How Much Should I Be Paid to Manage for Forest Carbon? PennState Extension. 2023. Available online: https://extension.psu.edu/how-much-should-i-be-paid-to-manage-forest-carbon (accessed on 20 June 2025).

- Koirala, U.; Adams, D.C.; Susaeta, A.; Akande, E. Value of a Flexible Forest Harvest Decision with Short Period Forest Carbon Offsets: Application of a Binomial Option Model. Forests 2022, 13, 1785. [Google Scholar] [CrossRef]

- Sørensen, E.; Torfing, J. The ideational robustness of bureaucracy. Policy Soc. 2024, 43, 141–158. [Google Scholar] [CrossRef]

- Armstrong, J.; Oporto, G. Forest Resources in U.S. History, 2nd ed.; Kendal Hunt Publishing: Dubuque, IA, USA, 2024; 417p. [Google Scholar]

- Kilgore, M.A.; Greene, J.L.; Jacobson, M.G.; Straka, T.J.; Daniels, S.E. The influence of financial incentive programs in promoting sustainable forestry on the nation’s family forests. J. For. 2007, 105, 184–191. [Google Scholar] [CrossRef]

- Fletcher, L.S.; Kittredge, D., Jr.; Stevens, T. Forest landowners’ willingness to sell carbon credits: A pilot study. North. J. Appl. For. 2009, 26, 35–37. [Google Scholar] [CrossRef]

- Galik, C.S.; Murray, B.C.; Mercer, D.E. Where is the carbon? Carbon sequestration potential from private forestland in the southern United States. J. For. 2013, 111, 17–25. [Google Scholar] [CrossRef]

- Eastman, B.; Brzostek, E.R.; Cifelli, D.; Gazal, K.A.; Kannenberg, S.A.; Keck, M.; Kelly, C.N.; Kreye, M.; McGill, D.M.; Taylor, A.M.; et al. Building trust and efficacy in forest carbon programs: Lessons from stakeholder engagement in Central Appalachia. BioScience 2025, biaf098. [Google Scholar] [CrossRef]

- Mäntymaa, E.; Ovaskainen, V.; Juutinen, A.; Tyrväinen, L. Integrating nature-based tourism and forestry in private lands under heterogeneous visitor preferences for forest attributes. J. Environ. Plan. Manag. 2018, 61, 724–746. [Google Scholar] [CrossRef]

- Husa, M.; Kosenius, A.K. Non-industrial private forest owners’ willingness to manage for climate change and biodiversity. Scand. J. For. Res. 2021, 36, 614–625. [Google Scholar] [CrossRef]

- Nolan, C.J.; Field, C.B.; Mach, K.J. Constraints and enablers for increasing carbon storage in the terrestrial biosphere. Nat. Rev. Earth Environ. 2021, 2, 436–446. [Google Scholar] [CrossRef]

- Reed, M.S.; Allen, K.; Attlee, A.; Dougill, A.A.; Evans, K.L.; Kenter, J.O.; Holy, J.; McNab, D.; Stead, S.M.; Twyman, C.; et al. A placed-based approach to payments for ecosystem services. Glob. Environ. Chang. 2017, 43, 92–106. [Google Scholar] [CrossRef]

- Mutandwa, E.; Grala, R.K.; Petrolia, D.R. Estimate of willingness to manage pine stands for ecosystem services. For. Policy Econ. 2019, 102, 75–85. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).