Linking Spatialized Sustainable Income and Net Value Added in Ecosystem Accounting and the System of National Accounts 2025: Application to the Stone Pine Forests of Andalusia, Spain

Abstract

1. Introduction

1.1. Background to Economic Accounts of Sustainable Social Income from Forest Ecosystems

1.2. The Research Objective

1.3. Innovations

1.4. Economic Data Sources

1.5. Research Structure

2. Conceptual Issues on Sustainable Income

2.1. Biological and Environmental–Economic Sustainability Concepts of a Natural Area

2.2. Products and Capital Valuations at Transaction Prices

2.3. Subjective Meaning of Gross Values Added of Natural Area

2.4. Preferential Remuneration Order of Production Factors

2.5. Measurement of Standard Net Value Added and Sustainable Income of Forest Ecosystem Under Idealized Conditions

2.6. Intermediate Product and Own Intermediate Consumption

3. Accounting Methods to Consistently Integrate Values Added into Sustainable Income

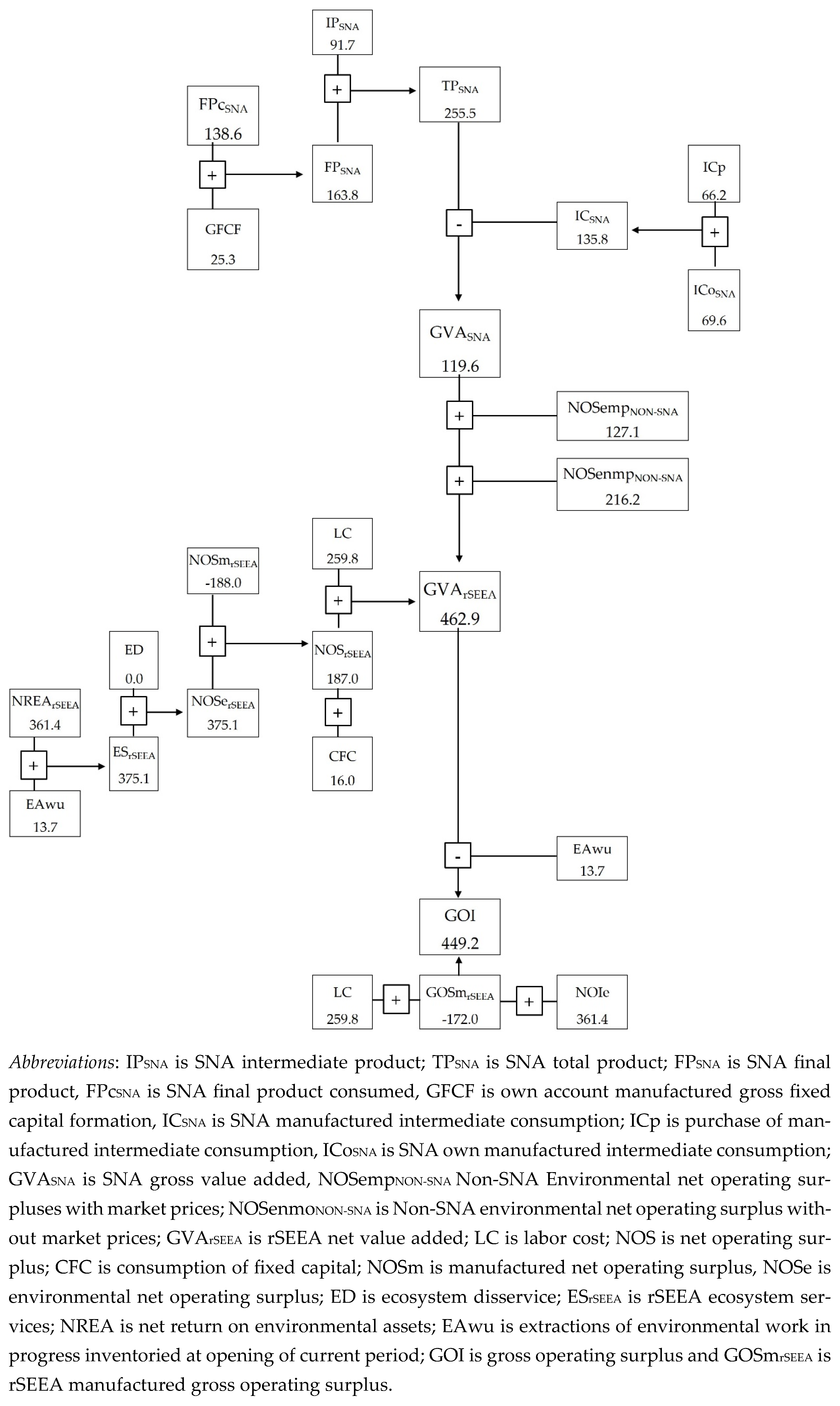

3.1. SNA Values Added Equations

3.1.1. SNA Gross Value Added

3.1.2. SNA Net Value Added

3.2. rSEEA Sustainable Income Equations Under Idealized Conditions

SI = NVASNA + ESNON-SNA + CEAcoNON-SNA + CMFCo − FCmeo + CFC

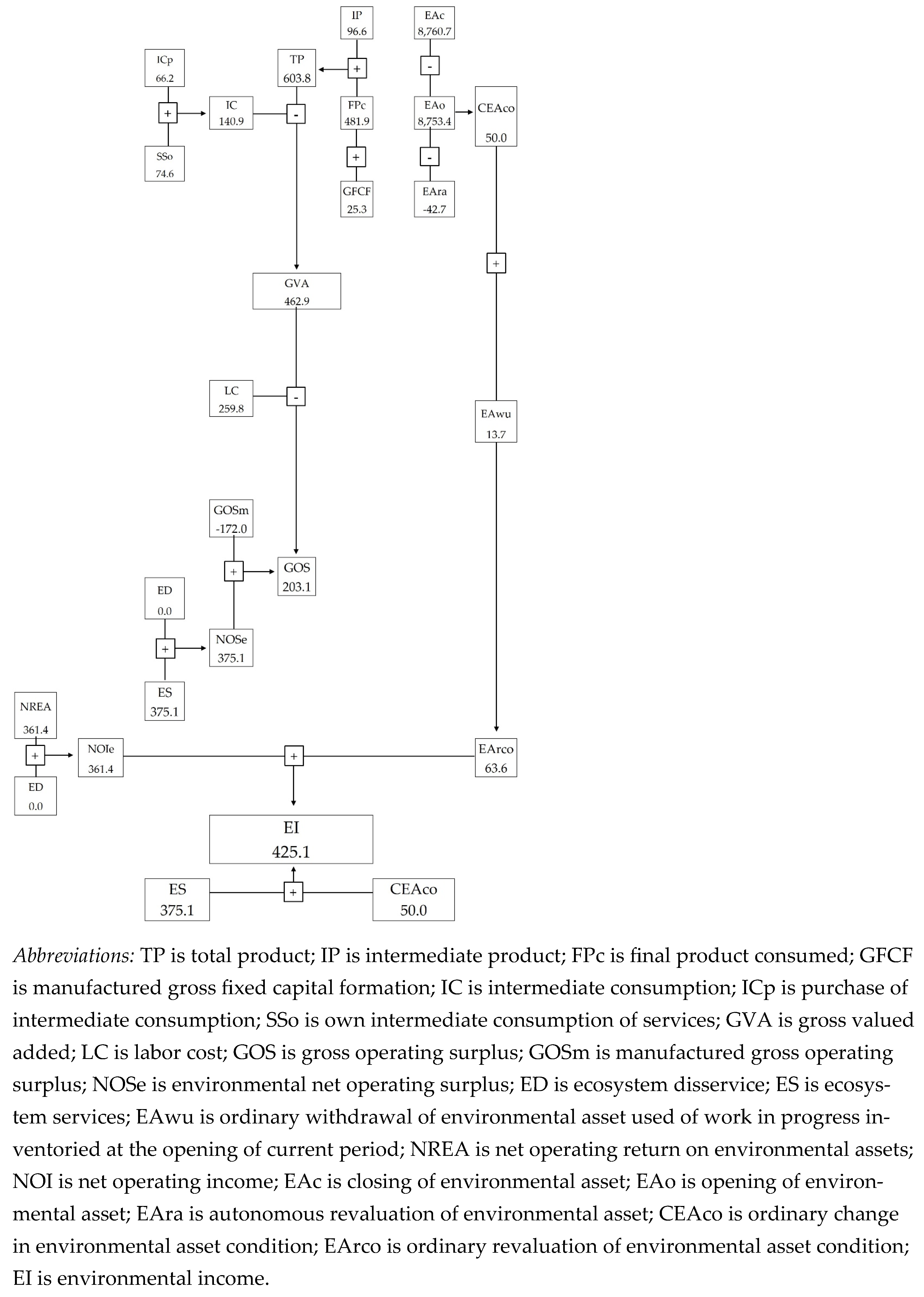

3.3. Ordinary Cash Flow

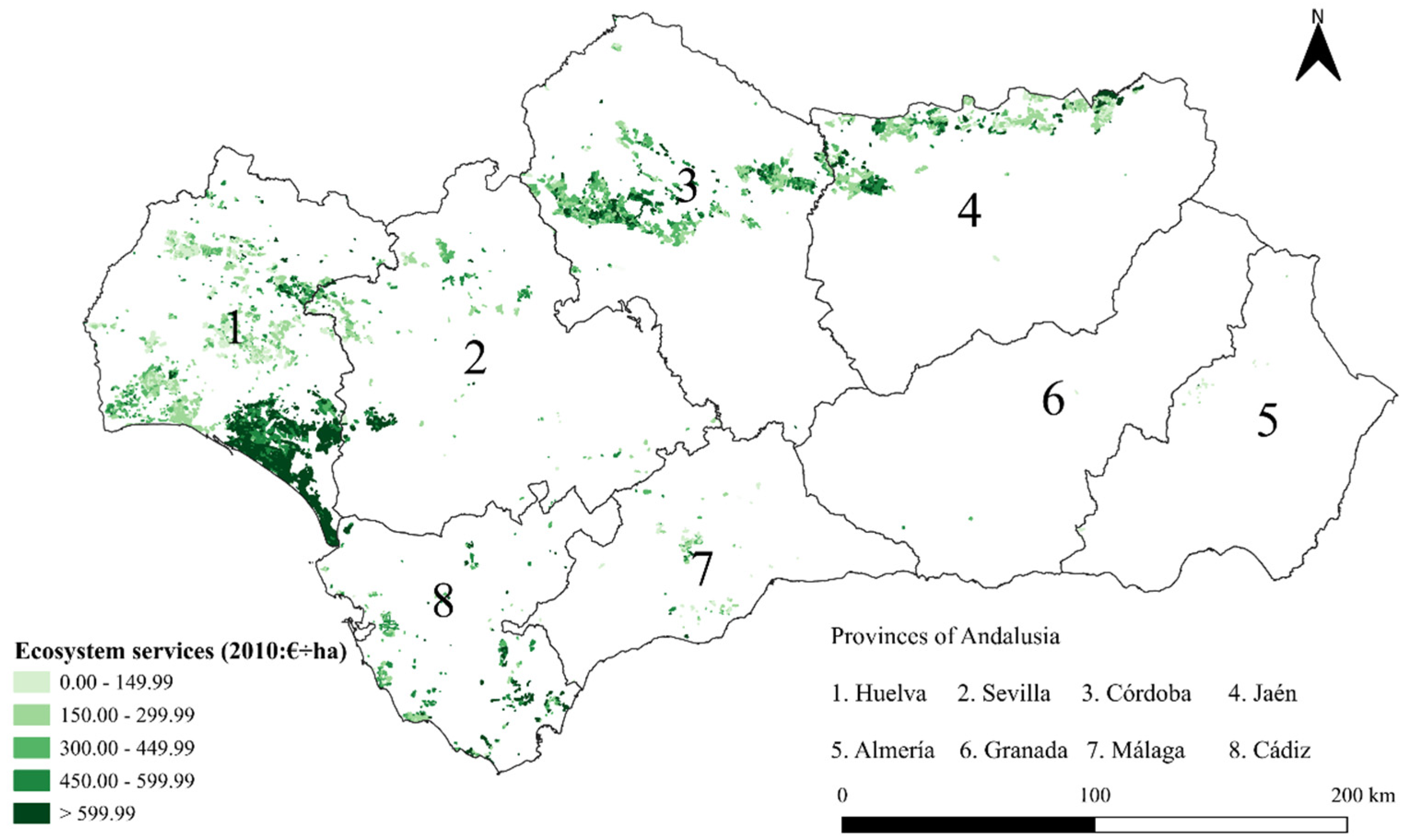

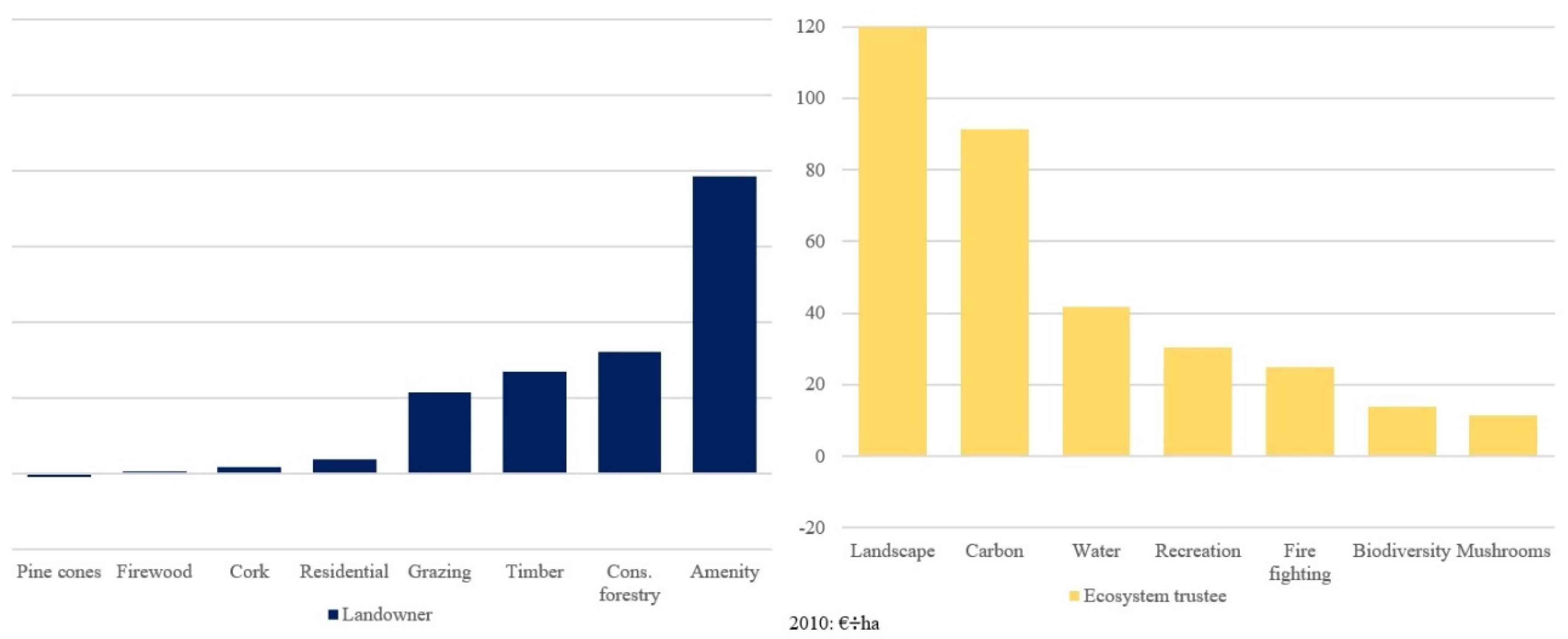

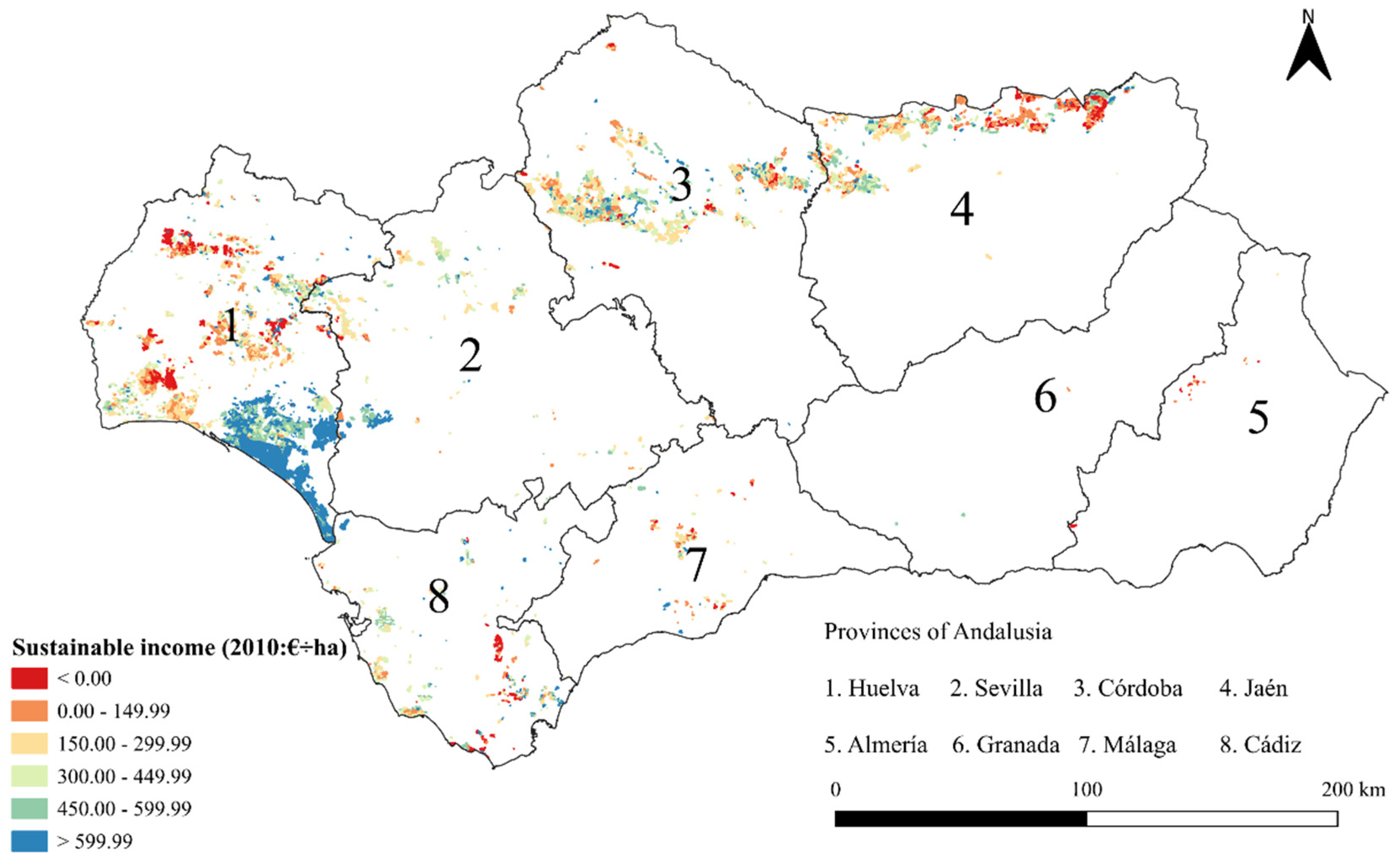

4. Andalusian Stone Pine Forest Capital and Income Results Under SNA and rSEEA

4.1. Total Capital Under rSEEA

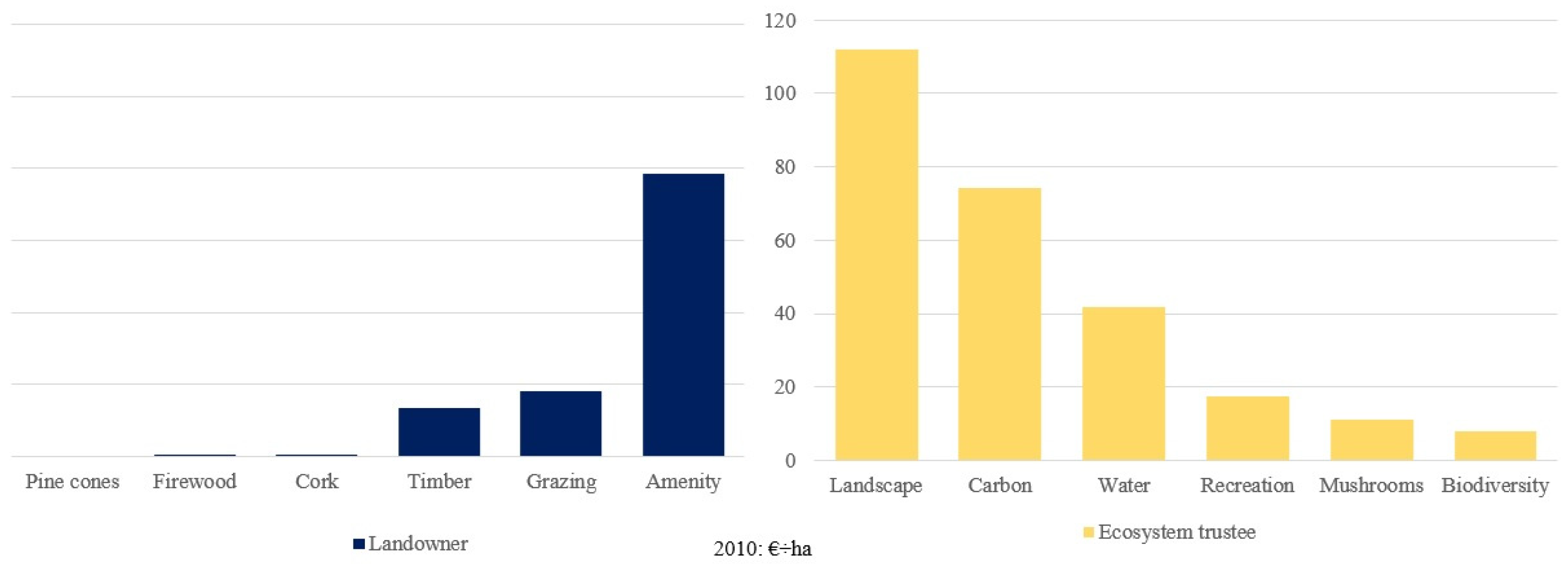

4.2. Values Added Under SNA

4.3. Gross Operating Income Under rSEEA

4.4. Ecosystem Service Under rSEEA

4.5. Environmental Income Under rSEEA

4.6. Sustainable Income Under rSEEA

4.7. Ordinary Cash Flow

5. Discussion

5.1. New Advancements in Forest Ecosystem Sustainable Income

5.2. The Economic Rationale of the Negative Ordinary Cash Flow of the Stone Pine Forest

5.3. Challenge of Economic Meaning of Carbon Net Sequestration Environmental Asset

5.4. The Omissions of Consumed Product Valuations in the Stone Pine Forest Case Study

5.5. Environmental Assets Dependent on a Subjective Rate of Discounting

5.6. Threatened Wild Biodiversity Preservation Existence Value Service

5.7. Policy Implications

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Brundtland, G.H. Editorial: The Scientific Underpinning of Policy. Science 1997, 277, 457. [Google Scholar] [CrossRef]

- Stone, R. The Accounts of Society. 1984. Available online: https://www.nobelprize.org/uploads/2018/06/stone-lecture.pdf (accessed on 19 November 2024).

- Eurostat; International Monetary Fund; Organization for Economic Co-operation and Development; United Nations Statistics Division-United Nations Secretariat; World Bank. System of National Accounts 2025; United Nations: New York, NY, USA, 2025; p. 1227. Available online: https://unstats.un.org/unsd/nationalaccount/snaupdate/2025/2025_SNA_Combined.pdf (accessed on 26 June 2024).

- Cavendish, W. Quantitative methods for estimating the economic value of resource use to rural households. In Uncovering the Hidden Harvest-Valuation Methods for Woodland & Forest Resources; Cambell, B.M., Luckert, M.K., Eds.; Earthscan: London, UK, 2002; pp. 17–65. [Google Scholar]

- Krutilla, J.V. Conservation reconsidered. Am. Econ. Rev. 1967, 57, 777–786. [Google Scholar]

- Eisner, R. The Total Incomes System of Accounts; The University of Chicago Press: Chicago, IL, USA, 1989; p. 336. ISBN 9780226196381. [Google Scholar]

- European Communities. Manual on the Economic Accounts for Agriculture and Forestry EAA/EAF 97 (Rev. 1.1); EUROSTAT: Luxembourg, 2000; p. 172. Available online: http://ec.europa.eu/eurostat/documents/3859598/5854389/KS-27-00-782-EN.PDF/e79eb663-b744-46c1-b41e-0902be421beb (accessed on 19 November 2024).

- Nordhaus, W.D.; Kokkelenberg, E.C. Nature’s Numbers: Expanding the National Economic Accounts to Include the Environment; National Research Council (NRC), The National Academies Press: Washington, DC, USA, 1999; p. 262. [Google Scholar] [CrossRef]

- Hicks, J. Value and Capital; Oxford University Press: Oxford, UK, 1946; p. 340. [Google Scholar]

- United Nations Statistical Commission. Supplement to the Report of the Intersecretariat Working Group on National Accounts Prepared by the Intersecretariat Working Group on National Accounts; Fifty-First Session 3–6 March 2020 Item 3 (d) of the Provisional Agenda Items for Discussion and Decision: National Accounts; United Nations Statistical Commission: New York, NY, USA, 2020; Available online: https://unstats.un.org/unsd/statcom/51st-session/documents/BG-Item3d-NationalAccounts-E.pdf (accessed on 19 November 2024).

- United Nations; European Union; Food and Agriculture Organization of the United Nations; International Monetary Fund; Organization for Economic Co-operation and Development; United Nations Environment Program; World Bank. System of Environmental-Economic Accounting—Ecosystem Accounting (SEEA EA); United Nations: New York, NY, USA, 2024; p. 409. Available online: https://seea.un.org/sites/seea.un.org/files/documents/EA/seea_ea_f124_web_12dec24.pdf (accessed on 21 December 2024).

- King, S.; Juhn, D.; Vardon, M.; Larsen, T.; Grantham, H.S.; Brown, C.; Mark Eigenraam, M.; Turner, K. Linking biodiversity into national economic accounting. Environ. Sci. Policy 2021, 116, 20–29. [Google Scholar] [CrossRef]

- Droste, N.; Bartkowski, B. Ecosystem Service Valuation for National Accounting: A Reply to Obst, Hein and Edens (2016). Environ. Resour. Econ. 2018, 71, 205–215. [Google Scholar] [CrossRef]

- Narita, D.; Lemenihb, M.; Shimodac, Y.; Ayana, A.M. Economic accounting of Ethiopian forests: A natural capital approach. For. Pol. Econ. 2018, 97, 189–200. [Google Scholar] [CrossRef]

- Siikamäki, J.; Piaggio, M.; Da Silva, N.; Álvarez, I.; Chu, Z. The Changing Wealth of Nations: Global Assessment of the Economic Value of Non-Wood Forest Ecosystem Services; World Bank: Washington, DC, USA, 2024; p. 211. Available online: https://documents1.worldbank.org/curated/en/099101124145545368/pdf/P17844610f0e240911a4ad138b4c4c8780f.pdf (accessed on 18 December 2024).

- World Bank. The Changing Wealth of Nations. Revisiting the Measurement of Comprehensive Wealth; World Bank: Washington, DC, USA, 2024; p. 31. Available online: https://documents1.worldbank.org/curated/en/099101024111541936/pdf/P17844618018390a41b7e61b28be7f722d1.pdf (accessed on 18 December 2024).

- Campos, P.; Caparrós, A.; Oviedo, J.L.; Ovando, P.; Álvarez-Farizo, B.; Díaz-Balteiro, L.; Carranza, J.; Beguería, S.; Díaz, M.; Herruzo, A.C.; et al. Bridging the gap between national and ecosystem accounting application in Andalusian forests, Spain. Ecol. Econ. 2019, 157, 218–236. [Google Scholar] [CrossRef]

- Campos, P.; Alvarez, A.; Mesa, B.; Oviedo, J.L.; Caparrós, A. Linking standard economic account for forestry and ecosystem accounting: Total forest incomes and environmental assets in publicly-owned conifer farms in Andalusia-Spain. For. Pol. Econ. 2021, 128, 102482. [Google Scholar] [CrossRef]

- Campos, P.; Oviedo, J.L.; Álvarez, A.; Mesa, B. Measurement of the Threatened Biodiversity Existence Value Output: Application of the Refined System of Environmental-Economic Accounting in the Pinus pinea Forests of Andalusia, Spain. Land 2022, 11, 1119. [Google Scholar] [CrossRef]

- MMA. Mapa Forestal de España 1:50.000; Dirección General de Conservación de la Naturaleza, Ministerio de Medio Ambiente: Madrid, Spain, 2008; Available online: https://www.miteco.gob.es/es/biodiversidad/temas/inventarios-nacionales/mapa-forestal-espana/mfe_50.html (accessed on 19 November 2024).

- MMA. Tercer Inventario Forestal Nacional (IFN3); Ministerio de Medio Ambiente: Madrid, Spain, 2007; Available online: https://www.miteco.gob.es/es/biodiversidad/servicios/banco-datos-naturaleza/informacion-disponible/ifn3.aspx (accessed on 19 November 2024).

- Berrens, R. The safe minimum standard of conservation and endangered species: A review. Environ. Conserv. 2001, 28, 104–116. [Google Scholar] [CrossRef]

- Anderson, T.L.; McCheney, F.S. Property Rights: Cooperation, Conflict and Law; Princeton University Press: Princeton, NJ, USA, 2003; p. 408. ISBN 0-691-09997-9. [Google Scholar]

- Oviedo, J.L.; Campos, P.; Caparrós, A. Contingent valuation of landowner demand for forest amenities: Application in Andalusia, Spain. Eur. Rev. Agric. Econ. 2021, 49, 615–643. [Google Scholar] [CrossRef]

- Berbel, J.; Mesa, P. Valoración del agua de riego por el método de precios quasihedónicos: Aplicación al Guadalquivir. Econ. Agric. Resourc. Nat. 2007, 7, 127–144. [Google Scholar] [CrossRef]

- SENDECO2. Historical CO2 Prices for EUAs; Carbon Dioxide Emission Allowances Electronic Trading System; SENDECO2: Barcelona, Spain, 2011; Available online: http://www.sendeco2.com (accessed on 19 November 2024).

- Edens, B.; Hein, L. Towards a consistent approach for ecosystem accounting. Ecol. Econ. 2013, 90, 41–52. [Google Scholar] [CrossRef]

- IECA. Contabilidad Regional Anual de Andalucía. Revisión Estadística 2019; Consejería de Economía, Conocimiento, Empresas y Universidad, Instituto de Estadística y Cartografía de Andalucía: Seville, Spain, 2020; Available online: https://www.juntadeandalucia.es/institutodeestadisticaycartografia/craa/index.htm (accessed on 19 November 2024).

- Council of Europe. European Landscape Convention; European Treaty Series—No. 176; Council of Europe: Florence, Italy, 2000; Available online: https://www.citego.org/bdf_fiche-document-2630_en.html (accessed on 18 August 2025).

- Junta de Andalucía. Plan Estratégico del Sector de la Piña en Andalucía; Junta de Andalucía: Seville, Spain, 2013; p. 116.

- Buckley, R.; Chauvenet, A. Six caveats to valuing ecosystem services. Nature 2021, 592, 188. [Google Scholar] [CrossRef] [PubMed]

- Díaz-Balteiro, L.; Caparrós, A.; Campos, P.; Almazán, E.; Ovando, P.; Álvarez, A.; Voces, R.; Romero, C. Economía privada de productos leñosos, frutos industriales, bellota, pastos y el servicio del carbono en los sistemas forestales de Andalucía. In Economía y Selviculturas de los Montes de Andalucía; Campos, P., Díaz-Balteiro, L., Eds.; Memorias Científicas de RECAMAN, Memoria 1.3; Editorial CSIC: Madrid, Spain, 2015; Volume 1, pp. 397–722. Available online: http://libros.csic.es/product_info.php?products_id=987 (accessed on 19 November 2024).

- Campos, P.; Caparrós, A.; Oviedo, J.L.; Almazán, E.; Ovando, P.; Álvarez, A.; Mesa, B. RECAMAN Project Georeferenced Economic Accounts for Andalusian Forest Systems; Consejería de Agricultura, Pesca y Desarrollo Sostenible de la Junta de Andalucía and CSIC: Sevilla, Spain, 2015; Available online: https://recaman.agenciamedioambienteyagua.es/VICAF/visor.html (accessed on 19 November 2024).

- Campos, P.; Ovando, P.; Mesa, B.; Oviedo, J.L. Environmental income of livestock grazing on privately owned silvopastoral farms in Andalusia, Spain. Land Degrad. Dev. 2018, 29, 250–261. [Google Scholar] [CrossRef]

- Carranza, J.; Torres-Porras, J.; Seoane, J.M.; Fernández-Llario, P. Gestión de las poblaciones cinegéticas de los sistemas forestales de Andalucía. In Poblaciones, Demanda y Economía de las Especies Cinegéticas en los Montes de Andalucía; Campos, P., Martínez-Jauregui, M., Eds.; Memorias Científicas de RECAMAN, Memoria 3.1; Editorial CSIC: Madrid, Spain, 2015; Volume 3, pp. 7–185. [Google Scholar]

- Oviedo, J.L.; Campos, P.; Caparrós, A. Valoración de servicios ambientales privados de propietarios de fincas agroforestales de Andalucía. In Renta Total y Capital de las Fincas Agroforestales de Andalucía; Campos, P., Ovando, P., Eds.; Memorias Científicas de RECAMAN, Memoria 4.1; Editorial CSIC: Madrid, Spain, 2015; Volume 4, pp. 8–155. Available online: http://libros.csic.es/product_info.php?products_id=990 (accessed on 19 November 2024).

- Martínez-Peña, F.; Aldea, J.; de Frutos, P.; Campos, P. Renta ambiental de la recolección pública de setas silvestres en los ecosistemas forestales de Andalucía. In Biodiversidad, Usos del Agua Forestal y Recolección de Setas Silvestres en los Ecosistemas Forestales de Andalucía; Campos, P., Díaz, M., Eds.; Memorias Científicas de RECAMAN, Memoria 2.3; Editorial CSIC: Madrid, Spain, 2015; Volume 2, pp. 274–388. Available online: http://libros.csic.es/product_info.php?products_id=988 (accessed on 19 November 2024).

- Beguería, S.; Campos, P.; Serrano, R.; Álvarez, A. Producción, usos, renta y capital ambientales del agua en los ecosistemas forestales de Andalucía. In Biodiversidad, Usos del Agua Forestal y Recolección de Setas Silvestres en los Ecosistemas Forestales de Andalucía; Campos, P., Díaz, M., Eds.; Memorias Científicas de RECAMAN, Memoria 2.2; Editorial CSIC: Madrid, Spain, 2015; Volume 2, pp. 102–273. Available online: https://libros.csic.es/product_info.php?products_id=988 (accessed on 19 November 2024).

- Oviedo, J.L.; Álvarez-Farizo, B.; Caparrós, A.; Campos, P. Valoración ambiental de servicios recreativos públicos de los sistemas forestales de Andalucía. In Valoración de los Servicios Públicos y la Renta Total Social de los Sistemas Forestales de Andalucía; Campos, P., Caparrós, A., Eds.; Memorias Científicas de RECAMAN, Memoria 5.1; Editorial CSIC: Madrid, Spain, 2016; Volume 5, pp. 7–111. Available online: http://libros.csic.es/product_info.php?products_id=1013 (accessed on 19 November 2024).

- Campos, P.; Oviedo, J.L.; Álvarez, A.; Ovando, P.; Mesa, B.; Caparrós, A. Measuring environmental incomes beyond standard national and ecosystem accounting frameworks: Testing and comparing the agroforestry Accounting System in a holm oak dehesa case study in Andalusia-Spain. Land Use Policy 2020, 99, 104984. [Google Scholar] [CrossRef]

- Díaz, M.; Concepción, E.D.; Oviedo, J.L.; Caparrós, A.; Álvarez-Farizo, B.; Campos, P. A comprehensive index for threatened biodiversity valuation. Ecol. Indic. 2020, 108, 105696. [Google Scholar] [CrossRef]

| Class | Abbreviation | Slightly Refined System of National Accounts (SNA) | Refined System of Environmental-Economic Accounting (rSEEA) | Reference |

|---|---|---|---|---|

| Landowner | ||||

| Consumed final product of timber | FPcti | Observed market price: farm gate price | Observed market price: farm gate price | [7] |

| Consumed final product of cork | FPcco | Observed market price: farm gate price | Observed market price: farm gate price | [7] |

| Consumed final product of firewood | FPcfi | Observed market price: farm gate price | Observed market price: farm gate price | [7] |

| Consumed final product of pine cones | FPcpc | Observed market price: farm gate price | Observed market price: farm gate price | [7] |

| Intermediate product of grazing | IPgr | Observed market price: resource rent price | Observed market price: resource rent price | [7] |

| Consumed intermediate product of residential accommodation | ISSac/FPcac | Imputed market price: farm gate rental price | Imputed market price: farm gate price | [3] |

| Consumed final product of private amenity | FPcam | na | Simulated market price: contingent valuation method: private non-industrial landowner average willingness to pay | [24] |

| Intermediate product of conservation forestry service | ISScf | Imputed market price: market total cost plus competitive manufactured net operating surplus hidden in the general government production account | Imputed market price: market total cost plus competitive manufactured net operating surplus. | [3,17] |

| Ecosystem trustee | ||||

| Intermediate product of firefighting service | ISSff | Imputed market price: market total cost plus competitive manufactured net operating surplus hidden in the general government production account | Imputed market price: market total cost plus competitive manufactured net operating surplus hidden in the general government production account | [3,17] |

| Consumed final product of mushrooms | FPcmu | Imputed market price: market total cost plus competitive manufactured net operating surplus hidden in the general government production account | Imputed market price: farm gate price | [3,17] |

| Consumed final product of economic water runoff stored in public dams | FPcwa | na | Imputed market price outside the Stone pine forest: resource rent measured by 3% rate of environmental asset of water from applying hedonic price method to irrigated land market price in Guadalquivir Valley | [17,25] |

| Consumed final product of carbon sequestration net of emission | FPcca | na | Imputed market price: market price from other industries outside the Stone pine forest | [26] |

| Consumed final product of open access active use recreation | FPcre | Imputed market price: market total cost plus competitive manufactured net operating surplus hidden in the general government production account | Simulated market price: active consumer median willingness to pay measured by contingent valuation | [17] |

| Consumed final product of landscape conservation passive use | FPcla | Imputed market price: market total cost plus competitive manufactured net operating surplus hidden in the general government production account | Simulated market price: passive consumer marginal willingness to pay measured by choice experiment and simulated exchange value | [17] |

| Consumed final product of threatened wild specie passive use | FPcbi | Imputed market price: market total cost plus competitive manufactured net operating surplus hidden in the general government production account | Simulated market price: passive consumer marginal willingness to pay measured by choice experiment and exchange value methods | [19] |

| Own account manufactured gross fixed capital formation | GFCF | Market price: total cost hidden in the general government production account | Market price: total cost | [3] |

| Class | Abbreviation | Definition | Refined System of Environmental-Economic Accounting (rSEEA) |

|---|---|---|---|

| Production function | P | P shows the factors that contribute to the generation of total product as input (I) of intermediate consumption (IC), labor force (L), manufactured fixed capital (FCm), and environmental asset (EA), in the current period. | P ≡ F(I, LC, FCm, EA) |

| Total product | TP | Total product (TP) contening the intermediate (IP) and final product (FP). The FP includes final product consumed (FPc) and accumulated product denoted as own account manufactured gross fixed capital formation (GFCF), in the current period. | TP = IP + FP FP = FPc + GFCF |

| Gross value added | GVA | GVA is estimated by subtracting from the total product (TP) at observed, imputed and simulated market (before taxes and subsidies linked to production) transaction price less purchased and own intermediate consumption (IC) valued at market price. GVA represents the remunerations of labor cost (LC) and gross operating surplus (GOS) embedded in the total product (TP). The GVA contains the GVASNA plus the ecosystem service omitted by the SNA (ESNON-SNA). | GVA = TP − IC GVA = LC + GOS GVA = GVASNA + ESNON-SNA |

| Labor cost | LC | LC is gross remuneration for employees that includes social charges. | LC = LCe |

| Gross operating surplus | GOS | GOS components are the manufactured gross operating surplus (GOSm) and the environmental gross operating surplus (GOSe) embedded in the total product (TP). GOSe and environmental net operating surplus (NOSe) coincide. GOSe includes ecosystem service (ES) and ecosystem disservice (ED). | GOS = GOSm + GOSe GOSe = ES + ED GOSe = NOSe Being ED = 0: GOS = GOSm + ES |

| Net value added | NVA | NVA under the rSEEA is gross value added (GVA) less consumption of manufactured fixed capital (CFC), with the latter item denoted as depreciation by the SNA. NVA contains the net added value of the SNA (NVASNA) plus the ecosystem service omitted by the SNA (ESNON-SNA) less the ordinary change in the SNA environmental asset condition (CEAcoSNA). | NVA = GVA − CFC NVA = NVASNA + ESNON-SNA − CEAcoSNA |

| Environmental net operating surplus | NOSe | The environmental net operating surplus embedded in a consumed product may contain an ecosystem service (ES) or an ecosystem disservice (ED). | NOSe = ES + ED |

| NON-SNA environmental net operating surplus | NOSeNON-SNA | NOSeNON-SNA includes environmental net operating surplus without market prices (NOSenmpNON-SNA) and the environmental net operating surplus with market prices (NOSempNON-SNA) embedded in consumed final products that are omitted in the SNA. | NOSeNON-SNA = NOSenmpNON-SNA + NOSempNON-SNA |

| Ecosystem service | ES | Ecosystem service is a positive exchange value contribution to the forest ecosystem individual total product estimated by the market price in the first observed transaction and/or the residual exchange value after having remunerated the services of labor and the immobilized manufactured capital. The ecosystem services contain the extraction of the provisioning opening environmental asset used (EAwu) and the net return on environmental asset (NREA). | ES = TP − IC − LC − GOSm − ED Being ED = 0: ES = EAwu + NREA |

| Environmental net operating income | NOIe | NOIe is estimated by subtracting EAwu from the environmental net operating surplus (NOSe). NOIe contains NREA and ED. | NOIe = NOSe − EAwu NOIe = NREA + ED Being ED = 0: NOIe = NREA |

| Gross operating income | GOI | GOI contains the gross operating remunerations on production factors of human labor and total capital investment. It is estimated according to the gross value added less the environmental opening extraction cost (EAwu). GOI contains labor remuneration (LC), gross operating surplus (GOSm) of immobilized manufactured capital, and environmental net operating income (NOIe). | GOI = GVA − EAwu GOI = LC + GOSm + NOIe |

| Sustainable income | SI | SI contains gross operating income (GOI) and ordinary revaluation of capital (Cro). SI represents the remunerations for the production factors of labor (LC), manufactured capital income (CIm), and environmental income (EI). SI extends the gross value added of the SNA (GVASNA) by incorporating the latter’s omissions from the ecosystem service (ESNON-SNA), the ordinary change in the condition of the environmental asset (CEAco), and the ordinary revaluation of manufactured fixed capital nominal price (FCmrpo). SI contains the net value added of the SNA (NVASNA) and the latter’s omissions of the ecosystem service (ESNON-SNA), the ordinary change in the condition of the environmental asset (CEAcoNON-SNA) and the ordinary change in manufactured fixed capital (CMFCo), less the ordinary entry of fixed capital (FCeo) and plus depreciation (CFC). The latter two items avoid double counting. | SI = GOI + Cro SI = GVA + CCo − FCmeo SI = LC + CIm + EI Being ED = 0: SI = GVASNA + ESNON-SNA + CEAco + FCmrpo SI = NVASNA + ESNON-SNA + CEAco NON-SNA + CMFCo – FCmeo + CFC |

| Ordinary revaluation of total capital | Cro | Cro is estimated by the revaluation of total capital (Cr) minus the autonomous (extraordinary) revaluation (Cra) of total capital caused by changes in the dynamics of institutional and other autonomous (exogenous) factors. Cro contains the ordinary revaluation of the environmental asset condition (EArco) and the ordinary revaluation of manufactured fixed capital (FCmrpo). | Cro = Cr − Cra Cro = EArco + FCmrpo |

| Ordinary revaluation of environmental asset condition | EArco | EArc is estimated by the total revaluation (EAr) less the autonomous revaluation (EAra) of the environmental asset. EArco contains the ordinary change in the condition of the environmental asset (CEAco) plus the extraction of the environmental work in progress (EAwu) inventoried at the opening of the period. | EArco = EAr − EAra EArco = CEAco + EAwu |

| Ordinary revaluation of manufactured fixed capital | FCmro | FCmrpo is revalued due to the effects of degradation due to normal use and the unanticipated change in nominal price. | FCmrpo = CMFCo − FCmeo |

| Environmental income | EI | EI contains the contribution of the environmental net operating income (NOIe) and the ordinary revaluation of environmental asset condition (EArco) to total sustainable social income. As the ecosystem disservice (ED) is absent, EI represents the ecosystem services (ES) plus the ordinary change in environmental asset condition (CEAco). | EI = NOIe + EArco EI = ES + CEAco |

| Manufactured capital income | CIm | CIm contains manufactured gross operating surplus (GOSm) plus ordinary revaluation in manufactured fixed capital (FCmrpo) used during the current period in the generation of total sustainable social income. | CIm = GOSm + FCmrpo |

| Class | Opening of Capital | Manufactured Fixed Capital Entries | Environmental Asset Withdrawals Used | Revaluation of Capital | Closing of Capital | |||

|---|---|---|---|---|---|---|---|---|

| Ordinary Revaluation of Capital | Autonomous Revaluation of Environmental Asset | Revaluation of Capital | ||||||

| Ordinary Condition Revaluation of Environmental Asset | Ordinary Price Revaluation of Manufactured Fixed Capital | |||||||

| Co | FCme | EAwu | EArco | FCmrpo | EAra | Cr | Cc | |

| 1. Environmental asset (EA) | 8753.4 | 13.7 | 63.6 | −42.7 | 21.0 | 8760.7 | ||

| 1.1 Landowner (EALO) | 2290.8 | 13.7 | 46.3 | −42.7 | 3.7 | 2280.8 | ||

| Timber | 725.7 | 13.4 | 41.3 | 41.3 | 753.5 | |||

| Cork | 28.0 | 0.2 | 1.6 | 1.6 | 29.4 | |||

| Firewood | 9.5 | 0.0 | 0.5 | 0.5 | 10.1 | |||

| Pine cones | 78.3 | 2.6 | 2.6 | 81.0 | ||||

| Grazing | 680.7 | 0.3 | 0.3 | 681.0 | ||||

| Amenity | 768.5 | −42.7 | −42.7 | 725.8 | ||||

| 1.2 Ecosystem trustee (EAET) | 6462.6 | 17.3 | 17.3 | 6479.9 | ||||

| Recreation | 737.1 | 737.1 | ||||||

| Mushrooms | 370.4 | 370.4 | ||||||

| Carbon | 639.0 | 17.3 | 17.3 | 656.3 | ||||

| Landscape | 3702.0 | 3702.0 | ||||||

| Biodiversity | 263.2 | 263.2 | ||||||

| Water | 750.9 | 750.9 | ||||||

| 2. Manufactured fixed capital (FCm) | 422.0 | 25.3 | −14.8 | −14.8 | 432.5 | |||

| 2.1 Landowner (FCmLO) | 292.3 | 16.5 | −4.3 | −4.3 | 304.5 | |||

| Plantation | 115.3 | 16.5 | 4.4 | 4.4 | 136.2 | |||

| Construction | 177.0 | −8.7 | −8.7 | 168.2 | ||||

| Equipment | ||||||||

| 2.2 Ecosystem trustee (FCmET) | 129.7 | 8.8 | −10.4 | −10.4 | 128.1 | |||

| Plantation | 0.0 | 0.0 | 0.0 | 0.0 | ||||

| Construction | 110.7 | 6.1 | −8.4 | −8.4 | 108.4 | |||

| Equipment | 4.6 | 0.4 | 0.0 | 0.0 | 5.0 | |||

| Others | 14.4 | 2.2 | −2.0 | −2.0 | 14.6 | |||

| Capital (C) | 9175.4 | 25.3 | 13.7 | 63.6 | −14.8 | −42.7 | 6.2 | 9193.3 |

| Class | Landowner | Ecosystem Trustee | Stone Pine Forest |

|---|---|---|---|

| (LO) | (ET) | (SPF) | |

| 1. Total product (TP) | 101.4 | 154.1 | 255.5 |

| 1.1 Intermediate product (IP) | 53.4 | 38.2 | 91.6 |

| Grazing of livestock | 13.9 | 13.9 | |

| Grazing of game species | 8.0 | 8.0 | |

| Conservation forestry | 31.5 | 31.5 | |

| Fire fighting | 38.2 | 38.2 | |

| 1.2 Final product (FP) | 48.0 | 112.6 | 160.5 |

| 1.2.1 Final product consumption (FPc) | 31.4 | 107.1 | 138.5 |

| Timber | 21.5 | 21.5 | |

| Cork | 0.3 | 0.3 | |

| Firewood | * | * | |

| Pine cones | 4.8 | 4.8 | |

| Residential | 4.9 | 4.9 | |

| Recreation | 20.0 | 18.9 | |

| Mushrooms | 0.1 | 0.1 | |

| Landscape | 77.5 | 77.5 | |

| Biodiversity | 8.5 | 8.5 | |

| 1.2.2 Manufactured gross fixed capital formation (GCF) | 16.5 | 8.8 | 25.3 |

| 2. Intermediate consumption (IC) | 44.0 | 91.8 | 135.8 |

| 2.1 Purchase of intermediate consumption (ICp) | 44.0 | 22.2 | 66.2 |

| 2.2 Own intermediate consumption (ICo) | 69.6 | 69.6 | |

| 3. Gross value added (GVA) | 57.4 | 62.3 | 119.7 |

| 3.1 Labor cost (LC) | 208.2 | 51.6 | 259.8 |

| 3.2 Gross operating surplus (GOS) | −150.8 | 10.7 | −140.1 |

| 3.2.1 Manufactured gross operating surplus (GOSm) | [−182.6] | 10.7 | [−171.9] |

| 3.2.2 Ecosystem service (ES) | [31.8] | [31.8] | |

| 4. Depreciation of manufactured fixed capital (CFC) | 8.6 | 7.4 | 16.0 |

| 5. Depletion (D) | −32.6 | −32.6 | |

| 6. Net value added (NVA) (3 – 4 − 5) | 81.4 | 54.9 | 136.3 |

| 7. Net operating surplus (NOS) (6 − 3.1) | −126.8 | 3.3 | −123.5 |

| 8. Manufactured net operating surplus (NOSm) (3.2.1 − 4) | [−191.4] | 3.3 | [−91.7] |

| 9. Ordinary cash flow (CFo) | [−217.8] | [−53.2] | [−271.0] |

| Class | Landowner | Ecosystem Trustee | Stone Pine Forest |

|---|---|---|---|

| LO | ET | SPF | |

| 1. Total product (TP) | 184.9 | 418.8 | 603.8 |

| 1.1 Intermediate product (IP) | 58.3 | 38.3 | 96.6 |

| 1.1.1 Intermediate product of raw material (IRM) | 21.9 | 21.9 | |

| Livestock grazing | 13.9 | 13.9 | |

| Game species grazing | 8.0 | 8.0 | |

| 1.1.2 Intermediate service product (ISS) | 36.4 | 38.3 | 74.6 |

| Conservation forestry | 31.5 | 31.5 | |

| Residential | 4.9 | 4.9 | |

| Firefighting | 38.3 | 38.3 | |

| 1.2 Final product (FP) | 126.6 | 380.6 | 507.2 |

| 1.2.1 Final product consumed (FPc) | 110.1 | 371.8 | 481.9 |

| Timber | 21.5 | 21.5 | |

| Cork | 0.3 | 0.3 | |

| Firewood | 0.0 | 0.0 | |

| Pine cones | 4.8 | 4.8 | |

| Amenity | 83.6 | 83.6 | |

| Recreation | 38.4 | 38.4 | |

| Mushrooms | 11.3 | 11.3 | |

| Landscape | 189.7 | 189.7 | |

| Biodiversity | 16.5 | 16.5 | |

| Water | 41.8 | 41.8 | |

| Carbon | 74.1 | 74.1 | |

| 1.2.2 Manufactured gross fixed capital formation (GFCF) | 16.5 | 8.8 | 25.3 |

| 2. Intermediate consumption (IC) | 48.9 | 91.9 | 140.9 |

| 2.1 Purchase of intermediate consumption (ICp) | 44.0 | 22.2 | 66.2 |

| 2.2 Own intermediate consumption of service (ICo) | 4.9 | 69.7 | 74.6 |

| 3. Gross value added (GVA) | 136.0 | 326.9 | 462.9 |

| 3.1 Labor cost (LC) | 208.2 | 51.6 | 259.8 |

| 3.2 Gross operating surplus (GOS) | −72.2 | 275.3 | 203.1 |

| 3.2.1 Manufactured gross operating surplus (GOSm) | −182.7 | 10.7 | −172.0 |

| 3.2.2 Environmental gross operating surplus (GOSe) | 110.5 | 264.6 | 375.1 |

| 4. Consumption of manufactured fixed capital (CFC) | 8.6 | 7.4 | 16.0 |

| 5. Net value added (NVA) | 127.4 | 319.5 | 446.9 |

| 5.1 Labor cost (LC) | 208.2 | 51.6 | 259.8 |

| 5.2 Net operating surplus (NOS) | −80.9 | 267.9 | 187.0 |

| 5.2.1 Manufactured net operating surplus (NOSm) | −191.3 | 3.3 | −188.0 |

| 5.2.2 Ecosystem service (ES) | 110.5 | 264.6 | 375.1 |

| Opening environmental asset withdrawal used (EAwu) | 13.7 | 13.7 | |

| Net return on environmental asset (NREA) | 96.8 | 264.6 | 361.4 |

| 6. Capital income (CI) | −43.9 | 282.2 | 238.3 |

| 6.1 Manufactured capital income (CIm) | −187.0 | 0.3 | −186.8 |

| 6.1.1 Manufactured gross operating surplus (GOSm) | −182.7 | 10.7 | −172.0 |

| 6.1.2 Ordinary revaluation of manufactured fixed capital (FCmrpo) | −4.3 | −10.4 | −14.8 |

| 6.2 Environmental income (EI) | 143.2 | 281.9 | 425.1 |

| 6.2.1 Environmental net operating income (NOIe) | 96.8 | 264.6 | 361.4 |

| 6.2.2 Ordinary revaluation of environmental asset (EArco) | 46.3 | 17.3 | 63.6 |

| 7. Ordinary change in environmental asset (CEAo) | 32.7 | 17.3 | 50.0 |

| 8. Sustainable income (SI) | 164.4 | 333.8 | 498.1 |

| 8.1 Gross operating income (GOI) | 122.3 | 326.9 | 449.2 |

| 8.2 Ordinary revaluation of capital (Cro) | 42.0 | 6.9 | 48.9 |

| 9. Ordinary cash flow | −217.8 | −53.2 | −271.0 |

| Class | Manufactured Gross Operating Surplus | Ordinary Revaluation of Manufactured Fixed Capital | Manufactured Capital Income | Environmental Net Operating Income | Ordinary Revaluations of Environmental Asset | Environmental Income | Labor Cost | Sustainable Incomes |

|---|---|---|---|---|---|---|---|---|

| GOSm | FCmrpo | CIm | NOIe | EArco | EI | LC | SI | |

| 1.1 | 1.2 | 1 = 1.1 + 1.2 | 2.1 | 2.2 | 2 = 2.1 + 2.2 | 3 | 4 = ∑ 1 − 3 | |

| Landowner | −182.7 | −4.3 | −187.0 | 96.8 | 46.3 | 143.2 | 208.2 | 164.4 |

| Timber | −137.5 | −2.1 | −139.6 | 41.3 | 41.3 | 125.1 | 26.8 | |

| Cork | 0.0 | 0.0 | 1.6 | 1.6 | 0.1 | 1.7 | ||

| Firewood | 0.0 | 0.0 | 0.0 | 0.5 | 0.5 | 0.0 | 0.5 | |

| Pine cones | −50.9 | −0.5 | −51.4 | 2.6 | 2.6 | 48.0 | −0.8 | |

| Grazing | 0.9 | −0.3 | 0.6 | 18.1 | 0.3 | 18.4 | 2.4 | 21.5 |

| Conservation forestry | 1.1 | −0.5 | 0.6 | 31.6 | 32.2 | |||

| Residential | 3.6 | −0.9 | 2.7 | 1.0 | 3.7 | |||

| Amenity | 78.7 | 78.7 | 78.7 | |||||

| Ecosystem trustee | 10.7 | −10.4 | 0.3 | 264.6 | 17.3 | 281.9 | 51.6 | 333.8 |

| Fire fighting | 2.9 | −4.1 | −1.1 | 26.1 | 24.9 | |||

| Recreation | 4.7 | −3.6 | 1.0 | 17.4 | 17.4 | 12.0 | 30.4 | |

| Mushrooms | 0.1 | 0.0 | 0.0 | 11.2 | 11.2 | 0.1 | 11.3 | |

| Carbon | 74.1 | 17.3 | 91.4 | 91.4 | ||||

| Landscape | 1.5 | −1.2 | 0.3 | 112.1 | 112.1 | 7.7 | 120.2 | |

| Biodiversity | 1.6 | −1.6 | 0.0 | 8.0 | 8.0 | 5.7 | 13.8 | |

| Water | 41.8 | 41.8 | 41.8 | |||||

| Stone pine forest | −172.0 | −14.8 | −186.8 | 361.4 | 63.6 | 425.1 | 259.8 | 498.1 |

| Class | SNA Gross Values Added | Non-SNA Ecosystem Services | Gross Values Added of rSEEA | Change in Capitals | Autonomous Revaluation of Environmental Assets | Ordinary Change in Capitals | Ordinary Entries of Fixed manufactured Capitals | Sustainable Incomes |

|---|---|---|---|---|---|---|---|---|

| GVASNA | ESNON-SNA | GVArSEEA | CC | EAra | CCo | FCmeo | SI | |

| 1 | 2 | 3 = 1 + 2 | 4 | 5 | 6 = 4 − 5 | 7 | 8 = 3 + 6 − 7 | |

| Landowner | 57.3 | 78.7 | 136.0 | 2.2 | −42.7 | 44.9 | 16.5 | 164.4 |

| Timber | 1.1 | 1.1 | 25.7 | 25.7 | 26.8 | |||

| Cork | 0.3 | 0.3 | 1.4 | 1.4 | 1.7 | |||

| Firewood | * | * | 0.5 | 0.5 | 0.5 | |||

| Pine cones | −2.9 | −2.9 | 2.1 | 2.1 | −0.8 | |||

| Grazing | 21.5 | 21.5 | * | * | 21.5 | |||

| Conservation forestry | 32.8 | 32.8 | 16.0 | 16.0 | 16.5 | 32.2 | ||

| tResidential | 4.6 | 4.6 | −0.9 | −0.9 | 3.7 | |||

| Amenity | 78.7 | 78.7 | −42.7 | −42.7 | 78.7 | |||

| Ecosystem trustee | 62.2 | 264.6 | 326.8 | 15.6 | 15.6 | 8.8 | 333.7 | |

| Firefighting | 28.9 | 29.0 | −0.8 | −0.8 | 3.3 | 25.0 | ||

| Recreation | 16.7 | 17.4 | 34.0 | −1.2 | −1.2 | 2.5 | 30.4 | |

| Mushrooms | 0.1 | 11.2 | 11.3 | * | * | * | 11.2 | |

| Carbon | 74.1 | 74.1 | 17.3 | 17.3 | 91.4 | |||

| Landscape | 9.2 | 112.1 | 121.3 | 0.3 | 0.3 | 1.5 | 120.2 | |

| Biodiversity | 7.3 | 8.0 | 15.3 | * | * | 1.5 | 13.8 | |

| Water | 41.8 | 41.8 | 41.8 | |||||

| Stone pine forest | 119.6 | 343.3 | 462.9 | 17.8 | −42.7 | 60.5 | 25.3 | 498.1 |

| Class | SNA Net Value Added | NON-SNA Ecosystem Service | NON-SNA Ordinary Change in Environmental Asset Condition | Ordinary Change In manufactured Fixed Capital | Ordinary Entries of Fixed Manufactured Capital | Manufactured Consumption of Fixed Capital | Sustainable Incomes |

|---|---|---|---|---|---|---|---|

| NVASNA | ESNON-SNA | CEAcoNON-SNA | CMFCo | FCmeo | CFC | SI | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7= 1 + 2 + 3 + 4 − 5 + 6 | |

| Landowner | 81.4 | 78.7 | 12.2 | 16.5 | 8.6 | 164.4 | |

| Timber | 24.7 | −2.1 | 4.2 | 26.8 | |||

| Cork | 1.7 | 1.7 | |||||

| Firewood | 0.5 | * | * | 0.5 | |||

| Pine cone | −1.3 | −0.5 | 1.1 | −0.8 | |||

| Grazing | 21.2 | −0.3 | 0.5 | 21.5 | |||

| Conservation forestry | 31.7 | 16.0 | 16.5 | 1.0 | 32.2 | ||

| Residential | 2.8 | −0.9 | 1.8 | 3.7 | |||

| Amenity | 78.7 | 78.7 | |||||

| Ecosystem trustee | 54.9 | 264.6 | 17.3 | −1.6 | 8.8 | 7.4 | 333.9 |

| Firefighting | 26.2 | −0.7 | 3.3 | 2.9 | 24.9 | ||

| Recreation | 14.1 | 17.4 | −1.2 | 2.5 | 2.6 | 30.4 | |

| Mushrooms | 0.1 | 11.2 | * | * | * | 11.3 | |

| Carbon | 74.1 | 17.3 | 91.4 | ||||

| Landscape | 8.4 | 112.1 | 0.3 | 1.5 | 0.8 | 120.2 | |

| Biodiversity | 6.2 | 8.0 | * | 1.5 | 1.1 | 13.8 | |

| Water | 41.8 | 41.8 | |||||

| Stone pine forest | 136.3 | 343.3 | 17.3 | 10.6 | 25.3 | 16.0 | 498.1 |

| Class | SNA | rSEEA | Index |

|---|---|---|---|

| (rSEEA ÷ SNA) | |||

| 1. Total product (TP) | 255.5 | 603.8 | 2.4 |

| 1.1 Intermediate product (IP) | 91.7 | 96.6 | 1.1 |

| 1.2 Final product (FP) | 163.8 | 507.2 | 3.1 |

| 1.2.1 Final product consumption (FPc) | 138.6 | 481.9 | 3.5 |

| 1.2.2 Manufactured gross fixed capital formation (GFCF) | 25.3 | 25.3 | 1.0 |

| 2. Intermediate consumption (IC) | 135.9 | 140.9 | 1.0 |

| 2.1 Purchase of intermediate consumption (ICp) | 66.2 | 66.2 | 1.0 |

| 2.2 Own intermediate consumption (ICo) | 69.7 | 74.6 | 1.1 |

| 3. Gross value added (GVA) | 119.6 | 462.9 | 3.9 |

| 3.1 Labor cost (LC) | 259.8 | 259.8 | 1.0 |

| 3.2 Gross operating surplus (GOS) | −140.2 | 203.1 | −1.4 |

| 3.2.1 Manufactured gross operating surplus (GOSm) | [−172.0] | −172.0 | 1.0 |

| 3.2.2 Ecosystem service (ES) | [31.8] | 375.1 | 11.8 |

| 4. Manufactured consumption of fixed capital (CFC) | 16.0 | 16.0 | 1.0 |

| 5. Depletion (D) | −32.7 | na | |

| 6. Net value added (NVA) | 136.3 | 446.9 | 3.3 |

| 7. Net operating surplus (NOS) | −123.6 | 187.0 | |

| 7.1. Manufactured net operating surplus (NOSm) | [−188.0] | −188.0 | 1.0 |

| 7.2 Environmental net operating surplus (NOSe) (7 − 7.1) | [64.5] | 375.1 | 5,8 |

| 7.2.1 Ecosystem services (ES) | [31.8] | 375.1 | 11.8 |

| 7.2.2 Depletion (D) (7.2 − 7.2.1) | −32.7 | na | - |

| 8. Gross operating income (GOI) | na | 449.2 | |

| 9. Ordinary revaluation of capital (Cro) | na | 48.9 | |

| 9.1 Ordinary revaluation of manufactured fixed capital (FCmrpo) | [−14.8] | −14.8 | 1.0 |

| 9.2 Ordinary revaluation of environmental asset condition (EArco) | na | 63.6 | |

| 10. Ordinary change in environmental asset condition (CEAco) | na | −50.0 | |

| 11. Manufactured capital income (CIm) | na | −186.8 | 1.0 |

| 12. Environmental income (EI) | na | 425.1 | |

| 13. Sustainable income (SI) | na | 498.1 | |

| 14. Ordinary cash flow (CFo) | [−271.0] | −271.0 | 1.0 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Campos, P.; Oviedo, J.L.; Álvarez, A.; Mesa, B. Linking Spatialized Sustainable Income and Net Value Added in Ecosystem Accounting and the System of National Accounts 2025: Application to the Stone Pine Forests of Andalusia, Spain. Forests 2025, 16, 1370. https://doi.org/10.3390/f16091370

Campos P, Oviedo JL, Álvarez A, Mesa B. Linking Spatialized Sustainable Income and Net Value Added in Ecosystem Accounting and the System of National Accounts 2025: Application to the Stone Pine Forests of Andalusia, Spain. Forests. 2025; 16(9):1370. https://doi.org/10.3390/f16091370

Chicago/Turabian StyleCampos, Pablo, José L. Oviedo, Alejandro Álvarez, and Bruno Mesa. 2025. "Linking Spatialized Sustainable Income and Net Value Added in Ecosystem Accounting and the System of National Accounts 2025: Application to the Stone Pine Forests of Andalusia, Spain" Forests 16, no. 9: 1370. https://doi.org/10.3390/f16091370

APA StyleCampos, P., Oviedo, J. L., Álvarez, A., & Mesa, B. (2025). Linking Spatialized Sustainable Income and Net Value Added in Ecosystem Accounting and the System of National Accounts 2025: Application to the Stone Pine Forests of Andalusia, Spain. Forests, 16(9), 1370. https://doi.org/10.3390/f16091370