1. Introduction

The value chain study started with an analysis of the global wood market. Although North America and Europe remain the key players in the international wood industry, China is quickly catching up as a major player, utilizing cheaper raw materials and exporting finished, value-added products. China’s need for logs contradicts the policy of some Governments to ban log exports [

1,

2], and China’s exports of finished wood products strain some companies striving to develop higher value-added products for the home market and exports [

3,

4]. Europe is thus likely to remain a more attractive market for some West African value-added wood products than China [

5,

6]. However, trade with Europe and America is increasingly hampered by stringent standards and requirements concerning tropical timber products [

7,

8]. Tropical wood exporters, for example, are increasingly required to produce internationally recognized certificates confirming that the forests are managed sustainably and trees are harvested legally [

9,

10,

11]. The global wood sector is continuously scrutinized; thus, value-added wood products must diligently fulfill quality standards, including strength tests and tests confirming that harmful chemicals, such as formaldehyde, have not been used in their manufacture. However, studies indicate that wood-exporting companies in the West Africa sub-region remain unaware of most of these standards [

12,

13].

The West Africa’s sub-region’s forest cover has dwindled alarmingly during the past few decades to a fraction of what it once was. The two main reasons are illegal logging, mainly for the local market, and over-granting felling permits by zealous officials to sawmills for export [

14]. National efforts to replant forests will likely take decades to halt the decline. West Africa’s sub-region wood companies primarily export to Europe and, to a lesser extent, to the Americas and Asia. However, over the past few decades, there has been a remarkable growth in exports to neighboring West African countries, particularly Nigeria. The dwindling forest reserves have severely impacted traditional hardwood species, such as Iroko [

15,

16]. Hence, soft tropical timber species have become essential substitutes for exports. In recent years, some West African sub-regional parliaments have enacted numerous expedient laws to protect and expand forest reserves, strengthen the wood industry, and facilitate international trade and investment [

13,

17]. However, the implementation is often weak because the enforcing bodies are inadequately trained and equipped.

Research and academic institutions, government offices, and private organizations provide services to the wood industry. However, their effects are weak mainly due to inadequate financing and coordination. A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis of the West Africa sub-region’s wood value chain confirms the abovementioned weaknesses. In the long term, however, the many good factors, such as the humid climate suitable for tropical forests, long-term laws, the well-staffed institutions, the political and economic stability, and the qualified wood specialists, could spell a bright future for the West Africa sub-region and consequently the global wood industry [

18,

19,

20]. An in-depth study of the priority wood products for the European market included the factors affecting their value chains [

6]. The manufacturing companies, other key players, and their respective value chains were identified and listed. Current programs and projects should identify and support some impactful value chains, and their effects should be analyzed. The institutions that educate wood specialists, administrators, and technicians for the wood companies should be examined, and their strengths and needs should be evaluated.

In this review, the final section focuses on identifying significant obstacles or “gaps” that hinder the smooth flow of priority goods to European markets and provides recommendations to improve the situation accordingly. The first gap identified was the lack of proper certification to prove sustainable forest management and the legality of the exported wood. The corresponding recommendation was implemented. The West Africa sub-region’s Voluntary Partnership Agreement (VPA) is more diligent with the European Union [

21,

22]. A second gap was identified as persistent poor management in the processing industries [

23], and the recommendation was to establish an institution to assist wood companies in implementing internationally recognized quality management systems. The lack of appropriate testing facilities and a standardization board was confirmed as a serious gap. Hence, establishing a wood and wood product testing facility by UNIDO (United Nations Industrial Development Organization) in cooperation with CSIR-FORIG (Council for Scientific and Industrial Research-Forestry Research Institute of Ghana) and BFH (Bern University of Applied Sciences—Berner Fachhochschule) is thus confirmed as a move in the right direction. Hence, ref. [

24] recommended that the wood companies desire better information about the European market and easier access to potential trading partners in Europe. The recommendations included organizing study tours for exporters from the West Africa sub-region to select European trade fairs. Hence, export-oriented wood product processing companies confirmed their need for technical training to produce and export products to the European market [

24].

Bearing in mind the abovementioned context, this literature survey aimed to investigate the current status of the global supply chain of wood products, identifying trends and focusing on future perspectives. This literature review makes several significant contributions to the field of supply chain management within the wood product sector. First, it comprehensively synthesizes fragmented research across disciplines such as forestry, logistics, sustainability, and industrial systems. This integrated perspective offers a clearer understanding of the structural and functional dynamics of the global wood product supply chain, a sector characterized by complexity and regional variability.

Second, the study identifies critical research gaps that remain underexplored in the current literature. These include the lack of emphasis on supply chain power relations, leadership, and organizational culture, the limited adoption of digital tools and real-time traceability systems, and insufficient attention to risk management and resilience, particularly in response to global disruptions such as the COVID-19 pandemic. Third, the study contributes to policy and practice by highlighting supply coordination inefficiencies and emphasizing the need for improved governance and sustainable practices. It offers evidence-based insights that can inform industry leaders and policymakers in designing targeted interventions to strengthen transparency, traceability, and efficiency.

Finally, by emphasizing sustainability and the role of supply chains in achieving environmental and social governance (ESG) goals, the review supports ongoing global efforts to enhance responsible forest management, carbon tracking, and socio-economic development in timber-producing regions. This study provides a comprehensive and interdisciplinary review of the worldwide wood products supply chain, distinguishing itself by integrating insights from forestry, industrial systems, logistics, and sustainability science. In contrast to prior research that often isolates segments or emphasizes regional studies, this review adopts a holistic, global perspective, covering the full spectrum from forest resource extraction to product distribution. It uniquely addresses underexplored dimensions such as supply chain governance, power dynamics, leadership roles, and digital transformation, which are critical for improving traceability, efficiency, and resilience. Furthermore, the study contributes a forward-looking framework by identifying key research gaps and proposing future directions in integrated modeling, sustainability metrics, and supply chain innovation. By aligning the wood product sector with the broader discourse on sustainable supply chains and the UN Sustainable Development Goals (SDGs), this review offers theoretical advancement and practical relevance, serving as a valuable resource for scholars, practitioners, and policymakers engaged in forest-based value chains.

2. Methodology

This literature review was conducted using a structured and systematic approach. Searches were conducted in databases such as FAOSTAT, Scopus, ScienceDirect, DOAJ, SciELO, and CAPES, as well as government and institutional repositories such as EMBRAPA and AGNIC. Searches were conducted between December 2024 and March 2025. The search covered the period between 2000 and 2025. The keywords used included “wood supply chain”, “wood products trade”, “wood panels”, “forestry logistics”, “sustainability”, and “digitalization in forestry”. A representative search string used in Scopus was the following: (“wood products” OR “forest products”) AND (“supply chain” OR “global trade” OR “logistics”). Inclusion criteria prioritized peer-reviewed journal articles, technical reports, public policy documents, and industry analyses. Documents unrelated to the global wood product supply chain or without available text were disregarded.

Records were selected by title and abstract, followed by full-text review. The selection process was reconstructed retrospectively to ensure transparency, following PRISMA guidelines. The PRISMA 2020 checklist and PRISMA-S flowchart were included in

Supplementary Materials. The Rayyan platform (

https://rayyan.ai, accessed on 19 June 2025) was used to support article screening and duplicate identification. Article readings and annotations were organized with Adobe Acrobat Reader (version 25.001.20521). References and PDF files were managed through Mendeley Reference Manager (version 2.108.0), allowing citations to be organized by subtopics related to the global timber trade. In addition, VOSviewer (version 1.6.20) was used to create maps with the most used keywords and visualize the geographic distribution of studies. CiteSpace (version 6.3.1 Basic) was applied to identify topics with trending themes, thematic clusters, and the most relevant authors in the analyzed literature.

The evaluated documents were discussed based on a narrative synthesis. The collected literature was categorized thematically into production, transformation, distribution, consumption, governance, and innovation. Special attention was given to identifying gaps in certification, integration of smallholders, digital transformation, and resilience. This framework aligns with the framework used in systematic reviews, but expands by integrating interdisciplinary themes and highlighting future research needs. Due to the heterogeneity of the types of documents analyzed and the exploratory and narrative nature of the review, no meta-analysis or formal assessment of risk of bias was performed. Furthermore, this review was not previously registered.

3. Review Development

3.1. Wood Product Raw Material Sourcing

Wood is one of the most versatile natural resources, serving as a raw material for various industries, including construction, furniture, paper, and bioenergy. Sourcing raw materials for wood products is crucial for ensuring sustainability, economic viability, and environmental conservation. Global wood product raw material sourcing includes: (i) Natural forests, which are unmanaged or minimally managed forests that provide a significant portion of global timber. Therefore, logging in these forests must adhere to sustainable practices to prevent deforestation and biodiversity loss, such as for tropical hardwoods from the Amazon, Congo Basin, and Southeast Asia. (ii) Plantation forests are managed forests where trees are planted, harvested, and replanted systematically. They provide a renewable source of wood, reducing pressure on natural forests. A typical example is the

Eucalyptus grandis W. Hill ex Maiden plantations in Brazil and the

Pinus taeda L. plantations in the U.S. and New Zealand. (iii) Agroforest systems combine agriculture with tree planting to provide raw materials while maintaining soil and ecosystem health. (iv) Recycled wood and wood residues—these are wood residues from construction, old furniture, and paper production. Their utilization reduces dependency on fresh timber and promotes circular economy practices [

9,

25,

26,

27,

28,

29].

Sourcing raw materials for global wood products balances industrial needs and environmental stewardship. Emphasizing sustainable forestry practices, legal compliance, and innovative tracking technologies can help mitigate industry challenges. By adopting responsible sourcing strategies, businesses and governments can contribute to global efforts to preserve forests while ensuring a steady supply of wood resources.

3.2. Wood Product Manufacturing Processes

Wood product manufacturing involves converting raw timber into finished goods, including furniture, construction materials, paper, and engineered wood products. These processes vary depending on the end product and involve multiple stages, including the harvesting, primary (initial transformation of harvested logs into usable raw materials), secondary (processed into various wood products), tertiary (furniture and fitments), processing, and finishing stages [

25,

26]. Sawmills, wood-based panel manufacturers (these convert raw logs into sawn wood, plywood, MDF, particleboard, and other basic wood materials), pulp and paper mills, sawn timber, engineered wood, furniture, and flooring [

30,

31,

32,

33] are of note here.

Wood product manufacturing is a complex process that requires balancing efficiency, sustainability, and regulatory compliance. Advances in automation, AI, and recycling technologies are helping to modernize the industry. However, addressing raw material shortages, environmental concerns, and skill gaps remains crucial for long-term growth. Future research should focus on optimizing manufacturing efficiency while reducing the ecological footprint of wood products.

3.3. Wood Product Transportation and Logistics

Wood product transportation and logistics play a critical role in the timber industry, ensuring that raw materials and finished goods move efficiently from forests to processing facilities and then to the market. Given the bulkiness, weight, and environmental considerations of wood products, optimizing transportation and logistics is crucial for achieving cost efficiency, sustainability, and compliance with regulations. Studies indicate that efficient transportation is critical at every stage of the wood supply chain. Shipping companies, rail operators, and freight brokers facilitate the global movement of wood products. Statista [

34] informs us that the COVID-19 pandemic and subsequent global container shortages (2020–2022) disrupted wood product supply chains [

23,

35,

36,

37]. Efficient transportation and logistics in the wood industry are crucial for cost management, sustainability, and meeting market demands. By adopting modern tracking systems, optimizing supply chains, and prioritizing sustainability, businesses can enhance efficiency while minimizing environmental impact. Future advancements in automation, AI-driven logistics, and alternative fuels will further transform the sector.

3.4. The Value Chain

The value chain analysis should include a detailed list of product groups such as wood fuel, pulp, fiberboard, recovered paper, paper, and paperboard. Regarding the different processing steps (primary, secondary, and tertiary), the following product groups could be considered:

- (a)

Round wood;

- (b)

Sawn wood;

- (c)

Wood-based panels;

- (d)

Construction wood/engineered wood;

- (e)

Doors and windows;

- (f)

Interior work/flooring;

- (g)

Wooden ware/furniture;

- (h)

Packing materials.

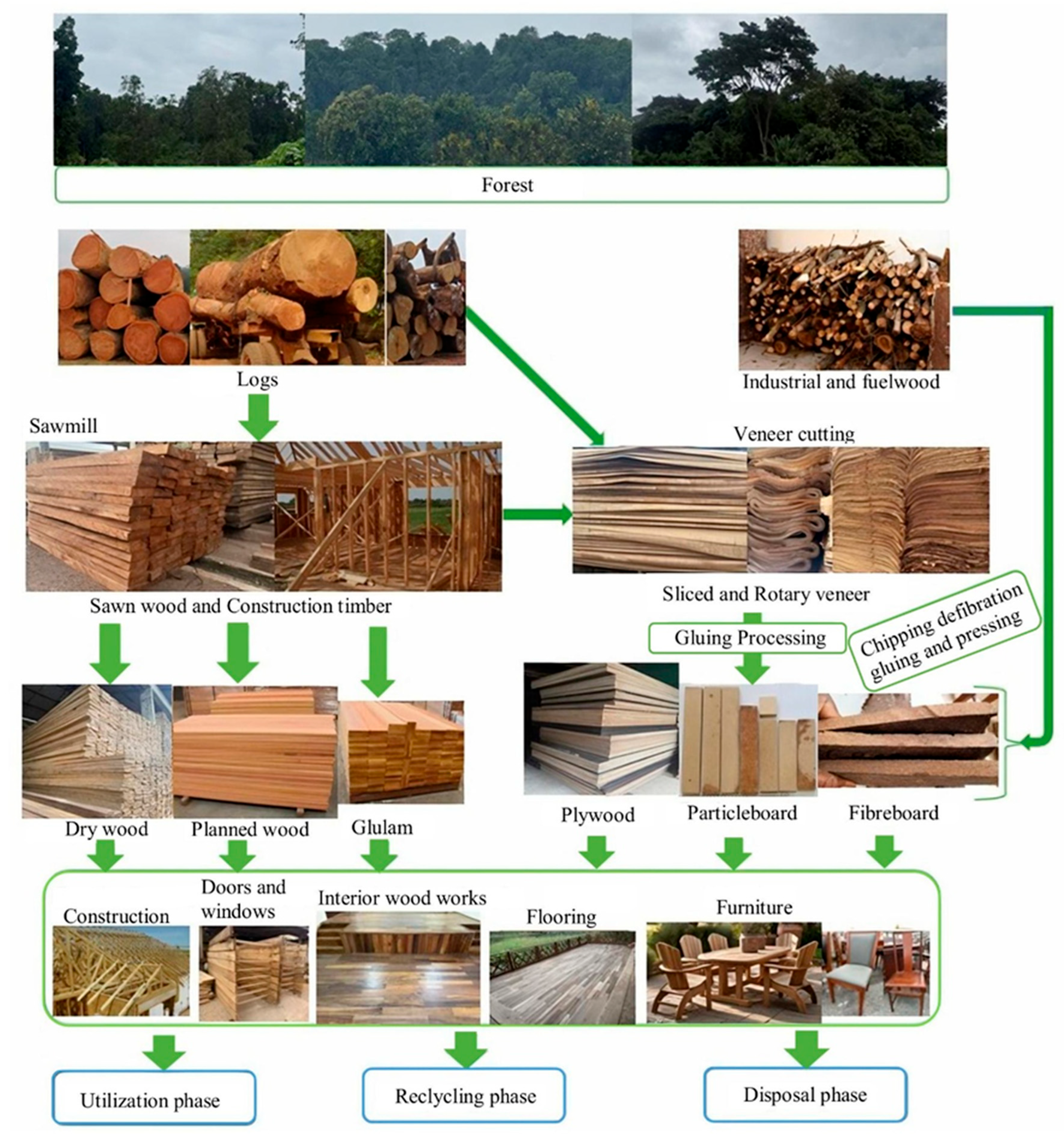

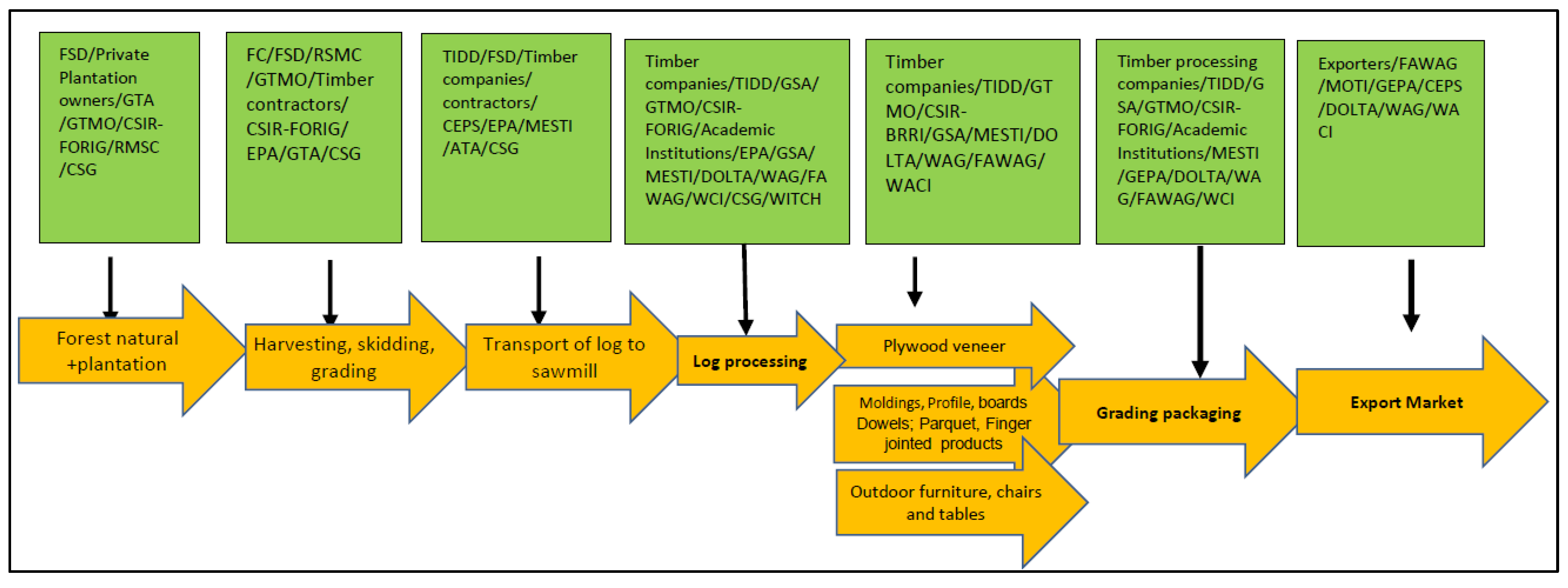

Figure 1 shows the main steps from wood harvesting to the end products in a simplified form.

3.5. Global Production, Consumption, and Trade of Round Wood

The availability, production, and trade of round wood are essential indicators of the international wood sector. However, although the sale of round wood is well-known to create only limited added value, most developing countries continue to export large volumes of round timber to international markets [

8,

33,

38]. Hence, Midgley et al. [

8] and Scherr [

38] agreed that possible reasons include unfavorable investment framework conditions, restricted access to capital, limited market access, a lack of qualified labor, corruption, and high taxes. On the other hand, countries like China preserve their forest resources and import large volumes of round wood, which are further processed in the country and sold on the national and international markets as products with a higher added value [

5,

8,

39]. FAO defines two subgroups of round wood (

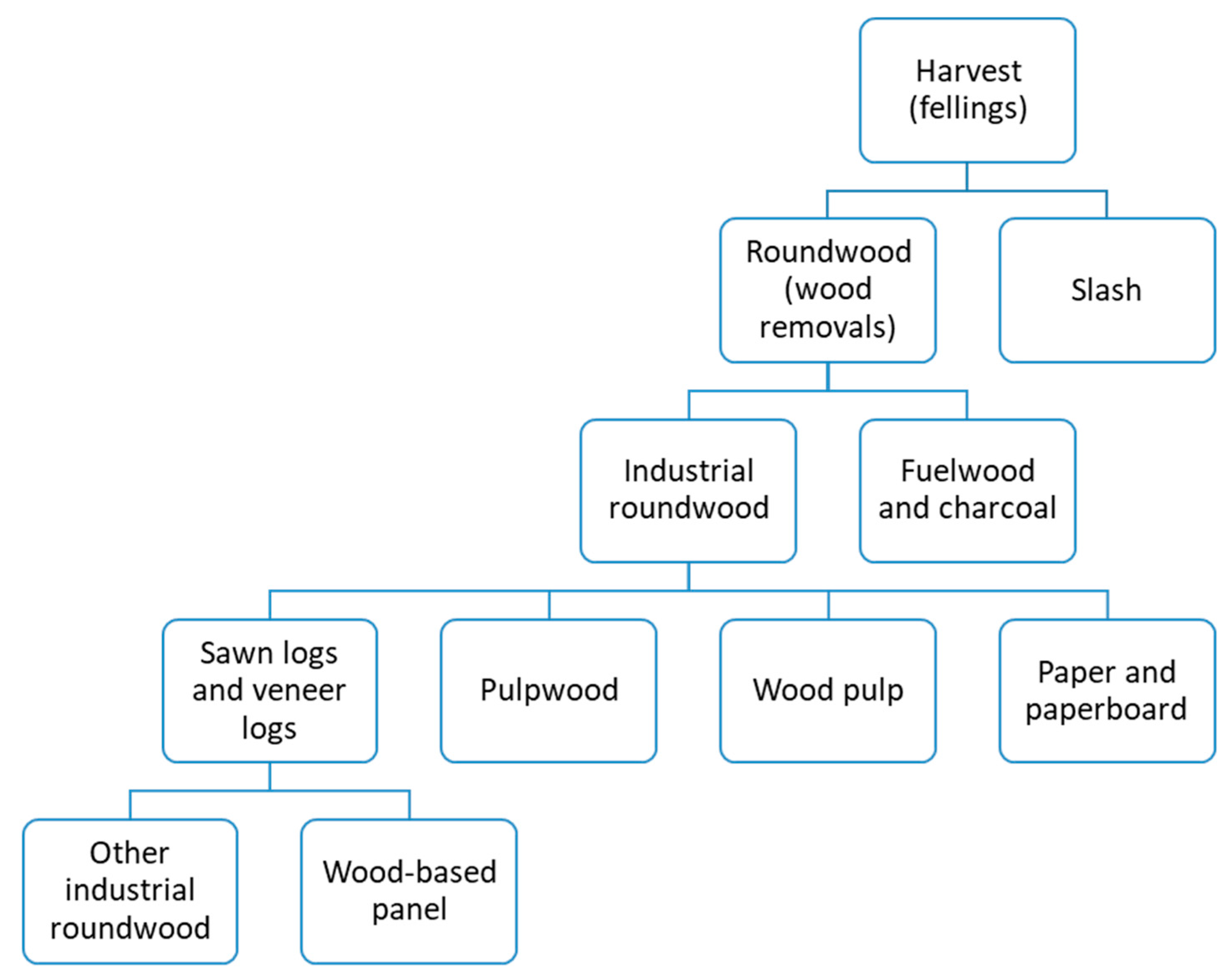

Figure 2): industrial round wood (sawn logs, veneer logs, wood for chips and particles, pulpwood, etc.) and fuel wood. According to the FAO database of 2022 [

25], the production of round wood has reached a volume of 3.55 billion m

3, of which 1.17 billion m

3 (33%) is softwood (SW) and 2.38 billion m

3 (67%) is hardwood (HW).

The total round wood production has remained relatively stable during the past twenty years. While global softwood roundwood production has decreased, hardwood roundwood production has increased regularly and is approximately 50% higher than during 1970–1990. ReportLinker [

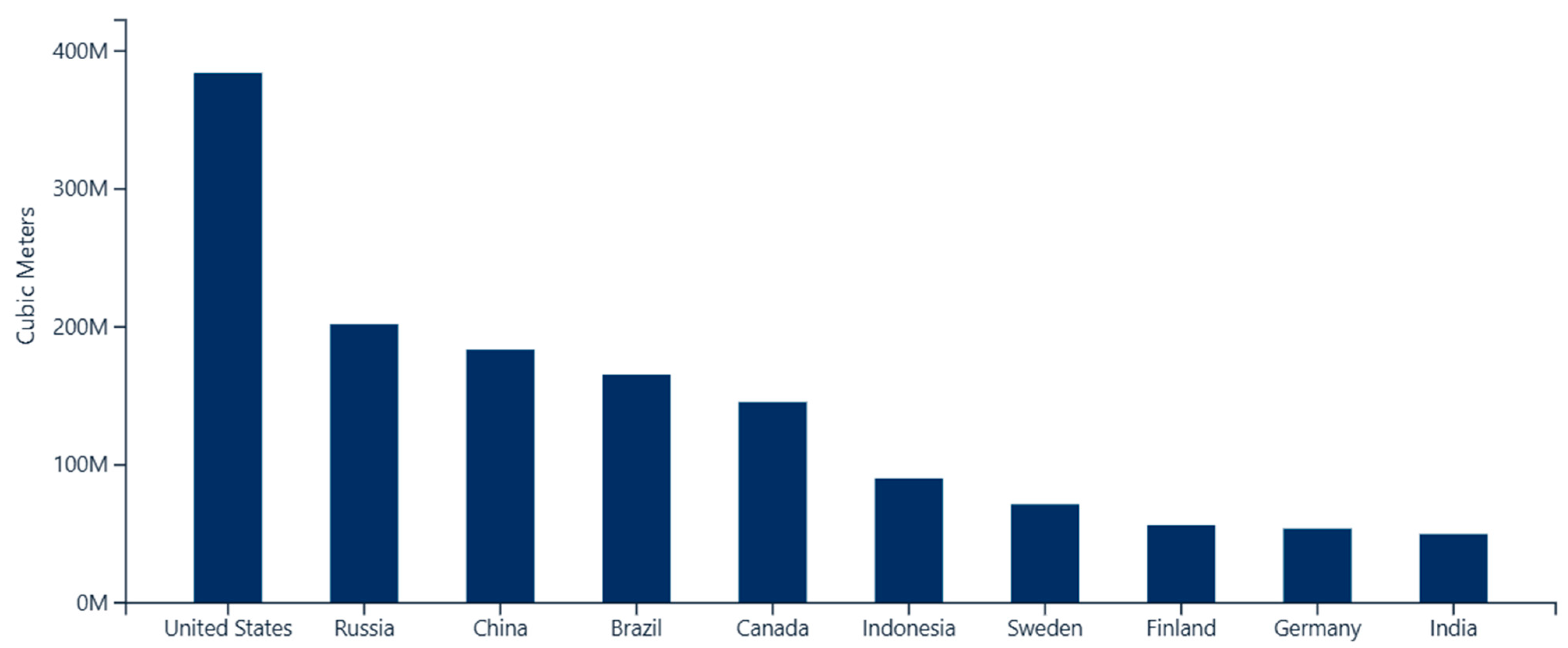

41] indicates that the data on global roundwood industrial output highlight that the United States leads significantly, with 384.07 million cubic meters, followed by Russia (202.03 million), China (183.55 million), and Brazil (165.39 million) (

Figure 3).

Approximately 1.9 billion m

3, or 53%, of the globally produced roundwood is classified as firewood. Koopmans [

42] noted that significant volumes are used in Asia and Africa, where fuelwood is the most critical energy source. A substantial potential for using wood resources for various purposes in conflicts also exists. The largest producers and consumers of fuelwood were India, with 308 million m

3, and China, with 182 million m

3, in 2012 [

43,

44]. The global production of sawn round wood is dominated by North America (the USA, Canada, Brazil, and Chile) and Europe, producing more than three-quarters of the global sawn round wood [

45,

46].

In 2012, the production of HW roundwood increased significantly in North America (+8.3%), South America (+7.8%), Africa (+6.7%), and Europe (+5.4%) [

47,

48]. Th literature indicates that the significant increase in hardwood roundwood production can be attributed to (a) rising demand for hardwood in construction, furniture, and flooring, particularly in emerging markets; (b) recovery from the 2008–2009 global financial crisis, which had previously curtailed timber production; (c) improvements in forest management and logging operations, especially in regions such as Africa and South America; and (d) strong export markets, notably in Asia—particularly China—which have driven up production in hardwood-exporting countries [

42,

45,

46]. The largest producers were India, the United States, Brazil, and China. In many developing countries in Asia, Africa, and South America, up to 80% of non-classified roundwood is used for energy. This is a very important factor in the future availability of timber for technical purposes. Barbu and Tudor [

5] emphasized that the largest producers of roundwood are also the largest consumers. The USA remains the largest consumer of round wood, with approximately 275 million m

3 in 2011, although demand decreased dramatically during the global economic crisis [

49,

50]. Consequently, the literature indicates that the consumption of China, Canada, Brazil, and the Russian Federation remained much more stable during the past few years, reaching volumes between 133 and 146 million m

3 in the year 2021 [

51,

52,

53,

54,

55].

3.6. Global Production, Consumption, and Trade of Sawn Wood

Sawn wood, often called lumber, is a vital commodity in the global forestry sector. It plays a crucial role in construction, furniture manufacturing, and other industries that require processed timber. Hosseini and Peer [

56] emphasized that sawn timber is the first wood product to create higher added value in the wood processing chain. Sawn wood comprises planks, beams, boards, laths, sleepers, etc., that exceed 5 mm in thickness. It can be raw, planed, grooved, chamfered, etc., but it excludes wooden flooring, which is defined as a distinct finished product [

57]. In 2020, global sawn wood production reached 473 million m

3. About 289 million m

3 (67%) was softwood sawn wood, and 122 million m

3 (33%) was hardwood sawn wood [

58]. Considering that globally, twice as much hardwood roundwood is harvested compared to softwood roundwood, it becomes evident that softwood roundwood is processed much more into higher-added-value products than hardwood roundwood, which is intensively used for energy. At the country level, the five largest producers of sawn wood were Canada (10.8 billion USD; 21.3% of the total sawn wood exports), Russia (5.3 billion USD; 10.5%), Sweden (4.8 billion USD; 9.5%), Germany (4.2 billion USD; 8.3%), and the USA (3.4 billion USD; 6.7%), [

59]. Together, they accounted for 56% of the global sawn wood production in 2022. Technological advancements in sawmilling, forest management practices, and sustainability certifications (e.g., FSC and PEFC) have increased efficiency and sustainable production levels [

60].

Raihan and Tuspekova [

61] emphasized that consumption patterns of sawn wood are closely tied to economic growth, urbanization, and population increases. In 2020, the FAO estimated global sawn wood consumption to be around 481 million cubic meters, with significant regional variations. The literature reveals the most critical trends in sawn wood consumption as follows: (a) North America: Brandeis et al. [

62], Grand View Research [

63], and Statistics Canada [

64] emphasize that the U.S. and Canada remain the largest consumers, primarily driven by housing and construction activities. The U.S. housing market alone accounts for a significant portion of global sawn wood demand [

65]. (b) In the Asia-Pacific Region, China is the second-largest consumer globally, fueled by rapid urbanization and infrastructure development [

63]. In 2020, China consumed approximately 96 million cubic meters, with a growing emphasis on softwood imports for construction [

63,

66]. (c) Europe: European consumption is stable, with Germany, the UK, and France leading. Sustainability and energy-efficient building practices influence sawn wood use [

67,

68]. (d) Emerging markets: countries like India, Vietnam, and Indonesia are witnessing growing consumption due to expanding construction and furniture sectors [

26,

69,

70].

The global production, consumption, and trade of sawn wood are pivotal components of the worldwide economy, with North America, Europe, and Asia playing significant roles. However, the sector faces evolving challenges related to sustainability, climate change, and trade policies. Empirical data from organizations such as the FAO, UNECE, and ITTO highlight ongoing shifts in production hubs, consumption patterns, and trade routes [

71,

72,

73]. A focus on sustainable practices, technological innovation, and fair-trade policies will shape the future landscape of the global sawn wood industry.

3.7. Global Production, Consumption, and Trade of Wood-Based Panels

Wood-based panels are a vital product in the global forest industry, encompassing a range of engineered wood products, including plywood, particleboard, oriented strand board (OSB), medium-density fiberboard (MDF), and hardboard. These panels are widely used in construction, furniture, packaging, and interior decoration due to their versatility, cost-effectiveness, and resource efficiency. Over the past decades, the global production, consumption, and trade of wood-based panels have seen significant growth, driven by combined effects of urbanization (population growth), technological innovation, and increasing demand for sustainable building materials (economic development and end-user acceptance) [

74,

75,

76], with the global wood-based panel market projected to grow steadily through 2030, driven by the rising demand for eco-friendly and sustainable construction materials [

77].

According to the Food and Agriculture Organization (FAO) definition, wood-based panels include particle boards, fiber boards, plywood, and veneer sheets. The production of wood-based panels has increased dramatically since the beginning of the new century. However, the global economic crisis has slowed development over the past few years, and in 2022, particleboard, fiberboard, and plywood production reached a volume of 649 million m

3 [

53,

78,

79]. Comparing this tendency with the relatively stagnant production of round wood and sawn wood, it is evident that wood-based panels are increasingly replacing solid wood in many application areas. Due to two main technological advances, wood-based panels have evolved into products with high market potential. First, it is now possible to use different resources as basic materials. Secondly, it is possible to regulate swelling and shrinking properties, homogeneity, and weight [

74].

According to the literature, global wood-based panel production reached approximately 402 million cubic meters in 2020, reflecting continuous growth despite temporary disruptions caused by the COVID-19 pandemic [

45,

66,

80,

81]. By 2022, global production stood at 286 million m

3 of wood-based panels, produced in the following categories: 97 million m

3 of particleboards—16% in the USA, 13% in China, and 7% in Germany; 103 million m

3 of fiberboards—53% in China, 7% in the USA, and 5% in Germany; 86 million m

3 of plywood—52% in China, 11% in the USA, and 6% in Indonesia [

82]. The leading producers of wood-based panels are also the primary consumers. China dominates production and consumption, having driven global demand significantly over the past decades [

5,

83].

China is the largest producer of wood-based panels, accounting for over 50% of global production. In addition, China has heavily invested in large-scale panel manufacturing industries, especially MDF and plywood, to meet domestic and export market demands [

60]. Other significant producers are the European Union—particularly countries like Germany, Poland, and Italy—which is a leading producer of particleboard and MDF, benefiting from advanced technology and sustainable forest management; the United States, which remains a significant producer, specializing in OSB and plywood, primarily driven by the housing and construction sectors; and Russia, whose growing panel production is supported by its vast forest resources, with increasing emphasis on plywood and MDF for export, mainly to Asian markets.

The global production, consumption, and trade of wood-based panels have shown remarkable growth, driven by economic development, technological advancements, and changing consumer preferences [

84,

85]. China, the U.S., and the EU dominate production and consumption, with trade patterns reflecting interdependencies among these regions. However, sustainability concerns, regulatory frameworks, and evolving market demands are reshaping the industry’s landscape. Ensuring responsible forest management, promoting recycling, and embracing innovative technologies will be key to the sustainable future of the global wood-based panel industry.

3.8. Global Production, Consumption, and Trade of Construction Wood/Engineered Wood

Construction wood and engineered wood are crucial materials in the global construction industry. They include products such as sawn timber, plywood, oriented strand board (OSB), laminated veneer lumber (LVL), glue-laminated timber (Glulam), and cross-laminated timber (CLT). These products offer strength, versatility, and sustainability, making them essential in residential, commercial, and industrial construction projects. Several studies confirm that the global construction and engineered wood market has expanded significantly over recent decades due to increasing urbanization, growing environmental consciousness, technological innovations, and the need for cost-effective building materials [

86,

87,

88,

89].

Accurately determining the global volumes and values of wood and wood-based products explicitly used in the construction sector is essential for informed policy-making and market supply chain assessment. This is particularly important because many related products, such as lumber, are also extensively utilized in other sectors, including interior design, furniture manufacturing, and decorative applications. Cheraghali [

90] and Husgafvel and Sakaguchi [

91] agreed that differentiating between these end-uses enables more precise evaluation of demand, resource allocation, and sustainability implications within the construction industry. In developed countries, the construction sector is the leading consumer of wood and wood-based products [

24]. These authors state that in Switzerland for example, a country with a rich tradition in wood construction, about 45% of the wood (excluding energy wood) is used in the form of beams, boards, finger-jointed structural wood, glulam, laminated veneer lumber, form work, etc., which are used for the construction of roofs, wall constructions, facades, ceilings, etc. While solid wood products are primarily made from coniferous species, wood-based panels are produced using a combination of coniferous and non-coniferous species [

24]. A helpful overview of future market potential can be achieved by considering, on the one hand, the development of the entire construction sector and, on the other hand, the production and importation of key wood and wood-based products.

In several of Africa’s 54 countries, the construction sector has high potential due to strong population growth, rapid urbanization, robust current and projected economic growth, a rising middle class, strengthened democracy, and improved access to global markets, among other factors. In regions with abundant forest resources, wood is often used as a construction material for inexpensive houses, primarily in rural areas. In fast-growing cities, the high demand for residential buildings, offices, shops, and other structures is met by building with bricks, steel, and concrete, which are primarily imported. Extensive regional and international infrastructure projects, such as roads, railways, and ports, require wood as a construction and supporting material; however, the requisite volumes and qualities are not always locally available. Hence, they may need to be imported or replaced by other materials. The African continent has considerable potential for wood and wood-based products for use in the construction sector—products that can be produced by African countries, at least in part [

24].

According to the FAO, global construction and engineered wood production have grown significantly, reaching an estimated 520 million m

3 in 2020, despite temporary setbacks caused by the COVID-19 pandemic [

66]. The report identified the major producers: (a) China is the leading producer of engineered wood products, particularly plywood, MDF, and particleboard [

5,

92,

93]. Its production capacity exceeds 300 million cubic meters annually, primarily driven by strong domestic demand and significant exports [

60]. (b) United States and Canada: North America is a key producer, specializing in OSB, Glulam, and CLT, with production heavily influenced by the residential construction sector. The U.S. and Canada collectively account for about 25% of global engineered wood production [

94,

95,

96]. (c) The European Union (EU): Europe, particularly Germany, Austria, Finland, and Sweden, is a major producer of CLT, Glulam, and particleboard [

90,

97]. Lovrić et al. [

98] and Ngaba et al. [

99] confirmed that the EU has invested significantly in sustainable forest management and advanced wood-processing technologies. (d) Russia: Russia’s engineered wood production, especially plywood and MDF, has increased steadily, mainly aimed at export markets in China and Europe [

5,

55,

100]. (e) Brazil and Chile: South America, especially Brazil, is a growing hub for plywood and MDF production, supported by fast-growing plantation forests [

101,

102].

The global production, consumption, and trade of construction and engineered wood continue to grow significantly, driven by rising demand in the construction sector, technological advancements, and increasing concerns about sustainability. China, North America, and Europe dominate production and consumption, with emerging economies in Asia and South America playing increasingly significant roles. The sector is evolving rapidly, with sustainability certifications, green building trends, and innovative product development shaping the future landscape. However, challenges related to trade policies, climate change, and resource availability must be addressed to ensure long-term growth and sustainability.

Global consumption of engineered wood products mirrors production growth, with an estimated 500 million cubic meters consumed in 2020 [

66]. Key factors influencing consumption include urbanization, population growth, infrastructure development, housing demand, and the global shift toward sustainable construction materials.

Table 1 outlines the regional consumption trends of construction and engineered wood.

3.9. Global Production, Consumption, and Trade of Doors and Windows

Doors and windows are vital components of residential, commercial, and industrial buildings, providing security, ventilation, lighting, and esthetic value. Additionally, doors and windows are crucial in enhancing building sustainability and energy conservation. Several factors, including urbanization, growth in the construction industry, technological advancements, and an increasing demand for energy-efficient building solutions, influence the global market for wooden doors and windows. The door and window markets are strongly linked to the building construction sector. Ghaffar, [

103] and Papadakis and Katsaprakakis [

104] emphasized that apart from the volumes and sizes of newly built or renovated buildings, the number and type of doors and windows required depend on the climatic conditions, requisite standards, kind of use, available technologies, trends, purchasing power, etc., in a related country or region. All these factors influence the choice of the window frame material [

24]. Traditionally, wooden doors were esthetically preferred over plastic doors, but advancements in processing techniques enable manufacturers to produce fiberglass doors that closely resemble wood.

According to industry reports, the global window and door market was valued at approximately USD 208.1 billion in 2022 and is projected to reach USD 356.7 billion by 2032, growing at a compound annual growth rate (CAGR) of 5.5% during the forecast period [

7,

29,

63]. In terms of unit production, the global demand for windows and doors is forecasted to rise by 2.2% annually, reaching approximately 1.1 billion units by 2028. This growth is primarily driven by increased urbanization, higher construction activities, and a growing emphasis on energy-efficient and impact-resistant building materials [

7,

29,

63,

105]. The Asia-Pacific region, particularly countries like China and India, plays a pivotal role in this growth due to rapid urbanization and significant infrastructure development. These figures underscore the robust demand and production in the door and window sector, aligning with the industry’s expansion trends [

63]. China is the largest producer of doors and windows, accounting for around 30%–35% of global production. The country benefits from its massive manufacturing capacity, availability of raw materials, and strong domestic and export demand [

34]. The next major producer is the U.S., particularly in producing vinyl and wooden windows and doors. The American market emphasizes high-quality, energy-efficient, and impact-resistant products. The European Union (EU) follows, with countries like Germany, Italy, Poland, and the UK having well-developed door and window manufacturing industries, focusing on sustainable products with high energy efficiency ratings. Next is India and Southeast Asia: rapid urbanization and growing infrastructure projects in India, Vietnam, and Indonesia have increased domestic production, particularly in the mid- and low-cost segments. Studies indicate that Latin America’s production, led by Brazil and Mexico, is growing, primarily due to the expansion of the residential housing sector [

106,

107,

108].

3.10. World Window and Door Demand

Other door and window markets, such as India and Indonesia, are also growing rapidly, although the demand in these countries is significantly smaller than that in China. Wooden doors and windows are attractive in countries with limited purchasing power because of their relatively low cost and reduced maintenance requirements [

38]. Increasing demands are also expected in other developing regions, particularly Africa, the Middle East, and Central and South America (

Table 2). Internationally traded wooden doors can be roughly divided into three groups: interior doors, exterior doors, and security doors [

105,

109]. Wooden doors are made of solid wood, wood-based panels, or other supporting materials that may be covered with veneer, color, laminate, or other finishes. China, which produces mainly low-cost doors, dominates the export market. Germany and Italy are significant in the higher-quality segments.

The global production, consumption, and trade of doors and windows are integral to the growth of the construction industry worldwide. With China, the U.S., and Europe leading production and consumption, emerging economies in Asia, Latin America, and the Middle East are rapidly catching up. Studies emphasized that trends toward energy efficiency, innovative technologies, and sustainable materials are reshaping the industry [

110,

111]. However, supply chain disruptions, rising raw material costs, and stringent regulations present ongoing challenges. The future of the global wooden door and window market lies in innovation, customization, and environmentally sustainable practices [

112,

113]. It is worth noting that wooden doors and windows are valued for their esthetic appeal, primarily used in premium markets, and their trade flows are influenced by factors such as raw material availability, labor costs, technological capacity, and tariff/non-tariff barriers [

114,

115].

3.11. Global Production, Consumption, and Trade of Interior Woodwork and Flooring

Interior woodwork and flooring significantly enhance the esthetics, functionality, and value of residential, commercial, and industrial buildings. This category includes wooden cabinetry, paneling, moldings, staircases, doors, and various types of wood flooring, such as solid wood, engineered wood, and laminated flooring. The demand for interior wood products has witnessed robust growth globally, driven by increased construction activities, rising disposable incomes, urbanization, environmental sustainability, and the growing popularity of wood as an eco-friendly and renewable material [

86,

112,

116].

The market for interior woodwork encompasses products such as stairs, handrails, paneling, and built-in wardrobes. These products are strongly related to the construction sector: unlike structural elements like beams, they are generally not designed with calculations. The international parquet market is challenging to assess. European countries are the leading importers and exporters of parquet. The USA, another significant importer of parquet, has been set back by the global economic crisis. This has resulted in a dramatic decline in construction work and, with it, in the parquet sector [

117,

118]. In absolute production figures, Poland is the biggest producer with 19%, followed by Germany with 15% and Sweden with 13% in Europe. Regarding consumption per country, Germany is the leading country with about 24%, followed by France with 14% and Italy with 9% [

36]. Austria and Switzerland have the highest per capita parquet consumption, followed by Sweden [

119,

120]. In Europe, multilayer parquet holds the largest market share, followed by solid wood parquet and a relatively small mosaic parquet [

121,

122]. China and several other Asian countries have significantly increased their production and exports of parquet [

123,

124]. It is, therefore, worth appreciating that the global economic crisis has negatively impacted the parquet market in Europe; its recovery will largely depend on the state of the construction sector [

24].

As of 2022, the global production of interior woodwork and flooring is estimated at over 450 million square meters and millions of cubic meters of interior wood products annually [

25]. The production landscape shapes the availability of raw timber, manufacturing infrastructure, skilled labor, and proximity to key markets. Globally, countries that play a significant role in the consumption and trade of interior woodwork and flooring are shown in

Table 3.

Global consumption of interior wood products and flooring has reached unprecedented levels, estimated at around USD 60 billion annually [

29]. This growth is fueled by increasing urbanization, rising disposable incomes, lifestyle changes, and the growing preference for esthetically appealing, sustainable interiors. Consumption trends are summarized in

Table 4.

The global production, consumption, and trade of interior woodwork and flooring continue to thrive, supported by growing urbanization, sustainability concerns, and advancements in manufacturing technology. Key players, including China, the United States, and the European Union, dominate production and trade, while emerging economies in Asia, Latin America, and Africa present new growth opportunities. As consumer preferences shift toward eco-friendly, customizable, and technologically advanced wood products, the market is poised for further expansion [

112,

134].

3.12. Global Production, Consumption, and Trade of Wooden Ware and Furniture

Wooden ware is a general term for various products, including wooden frames, kitchenware, caskets, clothes hangers, and toys. Bansal [

135] and Norhazaedawati et al. [

93] agree that wooden ware and furniture represent one of the most significant parts of the global wood-based product industry. In most cases, wooden wares are small-sized products with a high degree of added value. This category encompasses household, office, outdoor, and institutional furniture and smaller wooden items, including utensils, decorative pieces, kitchenware, and storage units. The demand for wooden furniture and wooden ware is closely linked to trends in housing, commercial development, urbanization, lifestyle preferences, and global trade dynamics [

29,

110,

111]. Depending on their use, they must fulfill specific requirements about size, form, surface treatment, etc. The United States, the United Kingdom, Germany, and Japan are the largest importers of wooden ware [

119].

According to industry reports, the global window and door market was valued at approximately USD 208.1 billion in 2022 and is projected to reach USD 356.7 billion by 2032, growing at a compound annual growth rate (CAGR) of 5.5% during the forecast period [

7,

29,

63,

105] (

Table 5). In terms of unit production, the global demand for windows and doors is forecasted to rise by 2.2% annually, reaching approximately 1.1 billion units by 2028. This growth is primarily driven by increased urbanization, higher construction activities, and a growing emphasis on energy-efficient and impact-resistant building materials [

7,

29,

63,

105]. China is the largest furniture manufacturing country, followed by the US, Italy, and Germany. The furniture trade amounted to

$694.32 billion in 2023, higher than in 2014–2022. The United States, Germany, France, the United Kingdom, and Japan are the most significant furniture importers. Statista [

34] has forecasted the figures for 2024–2027 to be

$804.6 to

$931.9 billion. Analysts predict the global furniture market will grow at a compound annual growth rate (CAGR) of 4.53% from 2013 to 2023. In emerging-market countries, furniture production has grown remarkably over the past decade at an average annual rate of 18%. With the growing economy, people are investing more in real estate for home and office space. This development in the real estate sector is driving global demand for furniture [

34].

Urbanization, population growth, disposable income levels, lifestyle preferences, and real estate development highly influence global consumption of wooden furniture and wooden ware (

Table 6). In 2022, the total consumption value of wooden furniture was approximately USD 430 billion, indicating steady growth driven by increased demand for home furnishings and renovations [

29].

The global production, consumption, and trade of wooden ware and furniture are integral to the broader wood product sector, driven by urbanization, rising incomes, and sustainability concerns. China, Vietnam, the European Union, and the United States dominate production and trade, while emerging economies such as Brazil, Indonesia, and India steadily expand their market share. Sustainability certifications, technological advancements, and shifting consumer preferences toward eco-friendly, customizable products will continue shaping the industry’s future [

110,

111,

112]. Eco-friendly furniture appears to be gaining mainstream popularity. Environmental concerns, such as awareness of how deforestation contributes to climate change or the effects of toxic finishes on indoor air quality, have led furniture manufacturers to adopt greener practices [

112,

134,

136,

137]. However, supply chain disruptions, raw material shortages, and environmental regulations require strategic management to ensure continued growth.

3.13. Global Production, Consumption, and Trade of Packaging Materials

Packing materials are crucial in the global supply chain, enabling protection of goods, storage, and transportation across various industries [

138,

139]. These materials encompass many products, including paper and cardboard packaging, wooden crates and pallets, and more recently, biodegradable and eco-friendly alternatives [

140,

141]. The global packaging materials market is driven by increasing e-commerce, international trade, demand for food and beverages, and growing environmental awareness. In 2022, wooden packaging products, such as containers and pallets, and products made from jute and textiles, had an estimated market share of approximately 5%–7%, corresponding to around USD 53 billion [

34]. This market is projected to experience significant growth by 2030. The major producers in the industry are outlined in

Table 7.

The global consumption of packaging materials is closely tied to industrial production, retail growth, e-commerce expansion, and population trends. In 2022, the total consumption exceeded USD 950 billion and is expected to continue expanding due to the increasing demand for packaged food, pharmaceuticals, personal care products, and online shopping.

Table 8 demonstrates the regional consumption trends.

The global production, consumption, and trade of packaging materials are integral to the functioning of modern economies, supporting industries ranging from retail and manufacturing to healthcare and e-commerce. Asia-Pacific leads production and consumption, followed closely by North America and Europe. Sustainability, technological innovation, and supply chain resilience are shaping the future of this sector [

35,

143]. However, challenges such as environmental regulations, material cost fluctuations, and trade disruptions must be effectively managed to ensure continued growth.

3.14. Trends in the Global Wood Supply Chain

Adhikari and Ozarska [

136] and Khan [

145] confirmed that the global wood supply chain forms the backbone of industries such as construction, furniture, pulp and paper, bioenergy, and packaging. It encompasses activities ranging from forest management and logging, through processing, transportation, and distribution, to the consumption and recycling of the final product. Global trends in the wood processing sector are influenced by various factors, including technological advancements, economic development, population growth, and the efficient use of available resources [

24,

146,

147]. Over the past decade, the wood supply chain has undergone significant shifts driven by sustainability demands, technological advancements, globalization, evolving regulatory frameworks, and shifting market dynamics. These trends have significantly influenced the global sourcing, processing, and trading of wood products. The following trends are already visible or expected within the next few years:

- (a)

Solid wood products will likely be replaced more frequently by fiber- and chip-based products. This will significantly influence the processing technologies and the required qualities of round wood.

- (b)

The demand for energy wood will continue to increase due to population growth (mainly in Asia and Africa), the shift from nuclear power to green energy (mainly in EU countries), and the expected shortage of non-renewable energy sources, such as oil and gas.

- (c)

Innovative products include light boards for the growing take-home furniture market (e.g., IKEA) or wood composite materials with improved properties from combining different materials. They offer a vast potential for research and development and will compete with pure wood products in the not-so-distant future.

- (d)

Agricultural residues, bamboo, and other fast-growing plants will increasingly replace wood-based materials in producing panels, beams, and similar products.

- (e)

The shortages of well-known and internationally traded wood species will promote the testing of lesser-known wood species and their introduction to the international markets.

- (f)

Plantation wood will replace wood mainly from natural forests, which may impact the wood processing sector in terms of wood properties and qualities;

- (g)

The fast-growing construction sector will consume large volumes of wood and wood-based products, increasing the demand for new engineered products;

- (h)

Technology and quality requirements for wood and wood-based products will increase as general improvements in living conditions lead to higher standards and regulations;

- (i)

The indispensable need to manage global forests more sustainably, along with stricter implementation of binding regulations such as the European Timber Regulation or the US Lacey Act, may strengthen the position of international certification systems like FSC and PEFC, especially in countries that face challenges in implementing sustainable forest management.

A more comprehensive overview of the current trends mentioned above is provided below.

3.14.1. Paradigm Shift Toward Sustainable and Certified Wood

The increasing demand for sustainably sourced wood products is one of the most prominent trends. Certifications such as the Forest Stewardship Council (FSC) and Program for the Endorsement of Forest Certification (PEFC) have become critical for market access, particularly in developed countries. According to the FSC Global Market Report (2022), over 220 million hectares of forests worldwide are certified under FSC, covering nearly 15% of the world’s productive forests. Certified products have experienced a significant increase in demand, particularly in Europe and North America. These activities are driven by consumer awareness, regulatory pressures (e.g., the EU Timber Regulation, the US Lacey Act), and corporate sustainability policies, which drive this trend.

3.14.2. Digitalization and Technological Advancements

Technological innovations, including digital supply chain management, traceability blockchain, and processing facility automation, are transforming the wood supply chain [

148,

149,

150]. A study by Singh et al. [

151] in the report “Digitizing the Forest Sector” (World Economic Forum) highlighted that digital tools, such as IoT sensors, drones for forest inventory, and blockchain traceability systems, can reduce supply chain costs by up to 12% while enhancing transparency. DHL’s Digital Timber Tracking System currently utilizes Internet of Things (IoT) devices to monitor real-time timber movements. Scandinavian countries have integrated digital forestry platforms to enhance efficiency in harvesting and transportation. The Forestry Commission of Ghana and a few other West African countries utilize XyloTron open-source software (

http://xylotron.org/, accessed on 10 June 2025) to monitor forest resources [

152,

153].

3.14.3. Emergence of Bioenergy and Biomaterials

The global push toward renewable energy has increased the demand for wood-based bioenergy, including wood pellets and biomass, as well as bioproducts such as bioplastics and bio-chemicals. According to the International Energy Agency [

154], global wood pellet production exceeded 37 million tons in 2021, with Europe and North America leading producers and consumers. Renewable energy policies in the EU and Asia primarily drive this growth. Consequently, increased competition for raw wood between traditional sectors (construction, pulp, and paper) and the bioenergy sector puts pressure on forest resources.

3.14.4. Increased Focus on Circular Economy and Recycling

There is a growing emphasis on extending the life cycle of wood products through reuse, recycling, and upcycling practices. The European Panel Federation [

82] estimated that over 30% of raw material input in Europe’s panel production comes from recycled wood, demonstrating significant progress in creating circular supply chains. Studies confirm that the use of reclaimed wood in construction and furniture is increasing [

155,

156]. Meanwhile, the recycling of wood-based panels and paper products is accelerating significantly [

157,

158].

3.14.5. Climate Change and Forest Resource Constraints

Climate change-induced risks, including forest fires, pest outbreaks, and droughts, disrupt wood supply chains, resulting in price volatility and supply shortages. According to UNECE/FAO [

159], forest fires in the U.S., Canada, Australia, and parts of Europe between 2019 and 2023 resulted in a significant reduction in timber supply, contributing to a sharp increase in global lumber prices, with reported spikes of up to 300% during the COVID-19 peaks. Consequently, sourcing diversification to mitigate regional supply shocks and investment in climate-resilient forest management practices are key paradigms [

160,

161].

3.14.6. E-Commerce and Direct-to-Consumer Models

The rise of e-commerce, even in traditional B2B segments such as the wood products industry, transforms distribution models [

162,

163]. For example, online platforms now facilitate the direct sale of timber, lumber, and wooden furniture to end consumers or small businesses, thereby reducing intermediary costs [

155,

164]. The global wood supply chain is undergoing a significant transformation driven by sustainability concerns, digitalization, the growth of bioenergy, geopolitical shifts, and climate-related disruptions. Literature and industry reports consistently highlight the increasing role of certified and sustainable sourcing, technological innovation, and the circular economy [

165,

166]. However, challenges such as resource constraints, labor shortages, and logistical disruptions continue to pose risks. To remain competitive and sustainable, future supply chains will likely focus on resilience, transparency, and eco-efficiency.

3.14.7. Leading Countries in the Production, Consumption, and Trade of Wood Products

The global wood products industry is critical to the economy, supporting various sectors, including construction, furniture, paper, packaging, and bioenergy [

31,

84]. The wood products supply chain includes sawn wood, wood-based panels, pulp and paper, engineered wood, furniture, and biomass. Production, consumption, and trade patterns of wood products vary significantly across regions, influenced by forest resources, industrial capacity, technological advancement, environmental policies, and market demand [

142,

167]. Analyzing the production, consumption, and trade of wood and wood-based products has shown China’s dominant and increasing role in the international wood processing sector [

39,

168]. With a population of approximately 1.35 billion, China protects its forest resources while importing large quantities of round and sawn wood from around the world. The way the Chinese purchase raw materials in other countries is often criticized due to the absence of sustainable forest management criteria and transparency in the deals [

169,

170].

The most important export markets for Chinese wood products are the United States, Japan, and the United Kingdom. Meanwhile, the country imports most of its wood products from Russia, the United States, and Canada. Transition and developing countries from Asia, Africa, and South America also sell round and sawn wood to China. Many countries criticize China’s business behavior [

170,

171]. However, they still sell them round or sawn timber because China orders enormous volumes of wood of all qualities, is interested in countertrade (e.g., the construction of roads), and does not dictate ecological and social conditions, as the EU or the USA do [

24]. The imported round and sawn wood are further processed in China to produce products with higher added value, which are then exported to more than 200 countries or used to meet the increasing demand for domestic wood. With an import and export value of approximately USD 120 billion, China’s trade value is 8–10 times higher than that of the second-largest importer, the United States, or the second-largest exporter, Canada [

24].

The United States, with a population of over 347 million, and Canada, with a population of 35 million, are two other significant players in the global wood-processing sector. The United States is a major consumer and importer of nearly all types of wood products throughout the value chain. The United States’ main trade partners for wood products are Canada and China, for both imports and exports. Brazil is another vital exporter of wood products to the USA, while Japan imports significant volumes of wood products from the USA [

24]. Canada is the second-largest exporter of wood products behind China. Its position is based on its ample forest resources and the well-developed wood processing sector. The country primarily exports its wood products to the United States, China, Japan, and the United Kingdom [

32,

172,

173]. Another important group of countries in the international wood processing sector is the group of countries in Central and Northern Europe. Germany, with a population of 82 million, is the third biggest exporter and fourth biggest importer worldwide of wood products, whilst the United Kingdom, with 63 million inhabitants, is the fifth biggest importer of wood products globally, followed by Italy, which has 61 million, and France, which has 64 million [

174,

175,

176].

The countries mentioned above are characterized by vigorous import and export activities within Europe and significant trade with China, Russia, and the United States. The European Union has set ecological, economic, and social sustainability requirements for importing wood products. In 2013, the EU Timber Regulation Act was introduced as a new law, prohibiting the European marketing of illegally harvested timber and products derived from such timber by implementing a due diligence system [

24].

3.14.8. Main Factors Influencing the Ghanaian Wood Supply Chain

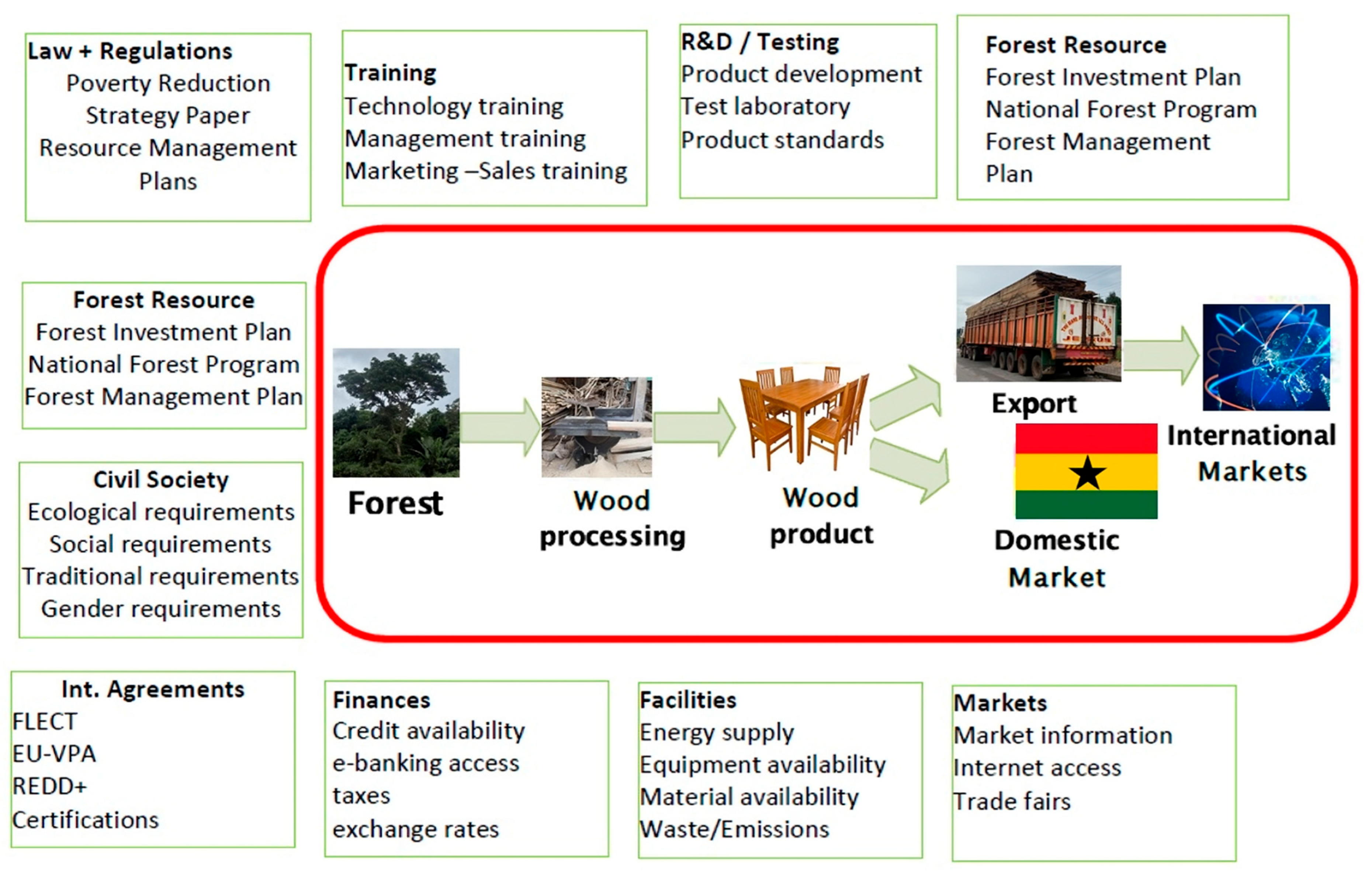

The wood value chain in Ghana plays a critical role in the country’s economy, contributing significantly to employment, exports, and industrial development. However, several factors, including regulatory frameworks and market dynamics, influence its efficiency and sustainability (

Figure 4).

Studies indicate that a Voluntary Partnership Agreement (VPA) with the EU, under the Forest Law Enforcement, Governance, and Trade (FLEGT) framework, ensures the legality of timber exports. However, Hansen et al. [

177] and Sheng et al. [

178] emphasized that weak enforcement of logging regulations leads to illegal timber trade, affecting sustainable supply chains. Again, Ghana loses approximately 2% of its forest cover annually [

25], reducing the availability of quality timber. Acheampong et al. [

179] named illegal logging and agricultural expansion as contributors to raw material shortages. Additionally, a low level of wood processing and value addition [

180] results in high dependence on raw log exports instead of finished products, poor road networks in forested regions increase transportation costs and delay delivery, and rising temperatures and erratic rainfall patterns influence forest growth and timber yield [

160]. The Ghanaian wood value chain is shaped by regulatory frameworks, resource availability, market forces, infrastructure, financial accessibility, and environmental factors. Addressing these challenges through sustainable forestry management, improved processing technology, and supportive policies can enhance Ghana’s position in the global wood industry.

3.14.9. Main Factors Influencing the Brazilian Wood Supply Chain

Brazil is one of the world’s largest producers and exporters of wood products, playing a critical role in the global timber industry. Multiple factors, including environmental policies, market dynamics, infrastructure, and socioeconomic considerations, influence the country’s wood value chain. Azevedo et al. [

181] and Stickler et al. [

182] confirmed that the Brazilian Forest Code (2012) [

183] mandates landowners to preserve a percentage of native forest. The Forest Stewardship Council (FSC) and Program for the Endorsement of Forest Certification (PEFC) influence market access, particularly in Europe and North America [

184,

185]. The Amazon Monitoring System (DETER) and IBAMA enforcement regulate illegal logging [

186]. Brazil has over 485 million hectares of forest [

25], but deforestation pressures impact timber supply. Eucalyptus and pine plantations cover over 7 million hectares, providing a sustainable alternative to native timber [

187,

188]. The authors emphasized that Foreign Direct Investment (FDI) in Brazilian forestry has increased, especially in timberland investment funds. The sector employs over 500,000 people; however, workforce training in digital forestry and sustainable management is necessary [

187,

188]. Regulations, market demand, infrastructure, and environmental concerns shape Brazil’s wood value chain. Addressing deforestation, investing in sustainable plantations, and improving supply chain efficiency can strengthen the industry’s global competitiveness.

3.14.10. Key Players Along the Supply Chains of Priority Wood Products

Globally, the supply chains of priority wood products involve multiple stakeholders who play significant roles in the extraction, processing, transportation, distribution, and consumption of wood-based commodities. These players operate at various levels, from local communities engaged in logging to global corporations managing large-scale timber trade. They may include forest owners and landowners, logging and harvesting companies, transportation and logistics providers, wood processing industries, wholesalers, distributors, retailers, end-users, regulatory bodies, certification agencies, and environmental and advocacy organizations. Thus, it is worth noting that the supply chains of priority wood products involve diverse stakeholders, each playing a crucial role in ensuring the sustainable and ethical movement of timber from forests to end-users [

176,

189]. Strengthening cooperation among these players, enhancing regulatory compliance, and promoting responsible consumption can contribute to a more sustainable wood industry. The synergy of these key players—businesses, policymakers, and consumers—can enable informed decisions supporting economic development and environmental conservation. In Ghana, the supply chain of priority wood products for the European market, along with the influencing institutions and groups at various stages of the value chain, is illustrated in

Figure 5. Their quality-related tasks and functions are indicated.

3.14.11. Current Programs/Projects Supporting the Selected Supply Chains

The Timber Industry Development Division, Ghana Export Promotion Authority, Ghana Investment Promotion Authority, Ghana Trade Fair Centre, and the Ministry of Trade and Industry will jointly host the annual exhibition. The following programs and projects in Ghana are supporting the selected value chains:

- (a)

VPA and FLEGT to regulate and track logs from the forest to products;

- (b)

The Tropenbos International-Ghana Program is implementing the EU-Chainsaw Project. The project aims to eliminate illegal chainsaw milling in Ghanaian forests to ensure sustainable forest management. Another objective is to promote efficient tree harvesting to minimize forest degradation. The project also aims to provide alternative livelihoods for illegal chainsaw operators, ensuring the successful elimination of the practice in the forest. This will make legal lumber available to the local timber market.

- (c)

Plantation Development Program: the Forestry Commission of Ghana is implementing a program initiated by the Government of Ghana to plant fast-growing indigenous and exotic tree species, thereby increasing Ghana’s forest cover and timber resource base.

- (d)

The Mahogany Plantation Project, implemented by CSIR-FORIG, aims to develop a silvicultural toolkit for the survival of mahogany (Swietenia macrophylla King) trees against shoot borer attacks. This will ensure the thriving plantation of mahogany trees in Ghana.

- (e)

The CDM Project, implemented by CSIR-FORIG, aims to develop the DNA footprints of tree species for tracking and identification.

With the current annual deforestation and forest degradation rate of 2%, equivalent to 135,000 hectares of forest cover loss, Ghana’s tropical forests continue to face the danger of depletion if efforts at sustainable management are not strengthened [

24]. Global Forest Watch summarizes the current forest crisis in Ghana as follows: the long-held assumptions about Ghana’s forest wealth are no longer valid. The off-reserve forest has primarily disappeared; future timber supplies will increasingly come from plantations, and constrained supply and changing international markets will necessitate industrial restructuring [

158].

3.14.12. Supply Network

Globally, the timber supply has entered a phase of severe decline [

167]. Underproduction from forest reserves has led to a shift in industry sourcing from non-reserve areas, including a mosaic of farmlands and bush-fallow regions [

190]. Nowicki et al. [

191] and Waldman and Kerr [

192] emphasized that production cannot be certified under reputable sustainability schemes because of the lack of environmental integrity of the source areas. Hence, Tuffour [

193] noted that this decreases the likelihood of the industry making the necessary investments to ensure sustainable management in the natural forest and intensifies pressure on the forest reserves. The author emphasized that the forest sector policy must address the domestic market’s immediate demands for rapid housing and construction. Unless this growing demand for domestic wood is adequately met, illegal logging will continue unabated, despite the strong task force chasing the offenders on the highways to halt their nefarious activities [

193].

3.15. Sustainability of Global Wood Supply Chain

Wood products are essential for numerous industries, but unsustainable practices, such as illegal logging, deforestation, and poor forest governance, pose significant environmental and social threats [

25]. Sustainable supply chains seek to ensure long-term forest productivity, fair labor conditions, and climate benefits. This section critically examines the key factors and actors that influence the sustainability of the global wood supply chain, drawing on empirical studies and regulatory examples.

3.15.1. Sustainable Forest Management (SFM)

Sustainable Forest Management (SFM) practices are fundamental to ensuring the longevity of forest resources and ecological integrity. Several studies have emphasized that certification systems such as the Forest Stewardship Council (FSC) and the Program for the Endorsement of Forest Certification (PEFC) have been instrumental in promoting SFM globally [

194,

195,

196,

197]. According to the Food and Agriculture Organization [

25], over 550 million hectares of forests are certified, a significant increase over the past decade. Gulbrandsen [

198] found that certification programs improve forest governance, reduce illegal logging, and ensure better adherence to sustainable harvesting practices. In Finland and Sweden, widespread private forest ownership and high certification rates have increased sustainability and improved biodiversity outcomes [

25].

3.15.2. Combatting Illegal Logging

Studies indicate that illegal logging remains a significant challenge, undermining sustainable forestry efforts and contributing to forest degradation [

27,

199,

200,

201]. Hence, regulatory instruments such as the European Union Timber Regulation (EUTR) and the U.S. Lacey Act Amendment require proof of legal sourcing [

202,

203]. Several studies have emphasized that between 2000 and 2023, illegal logging declined by 25% globally, particularly in countries with strong enforcement frameworks [

178,

204,

205,

206,

207,

208]. Moreover, initiatives such as the European Union’s Forest Law Enforcement, Governance, and Trade (FLEGT) program, particularly Voluntary Partnership Agreements (VPAs) with countries like Indonesia and Vietnam, have improved timber legality verification and enhanced transparency [

159].

3.15.3. Climate Change Mitigation

Sustainable forest management contributes directly to climate change mitigation by preserving forests’ role as carbon sinks. FAO [

66] reports that sustainably managed forests globally store over 300 gigatons of carbon. Furthermore, sustainable wood products, especially engineered wood used in construction, sequester carbon over long periods. Churkina et al. [

209] found that the increased use of wood-based construction materials could reduce global annual CO

2 emissions by up to 31% by 2050. This highlights the dual role of sustainable forestry: supplying renewable materials while contributing to global climate goals.

3.15.4. Resource Efficiency and Waste Reduction

Circular economy principles are vital to enhancing sustainability in the wood supply chain. Recycling wood residue for particleboards, pulp, and bioenergy production reduces pressure on virgin forests. In the European Union, over 30% of particleboard production relies on recycled wood materials [

82]. This approach supports resource efficiency, reduces landfill residues, and lowers the carbon footprint associated with wood processing.

3.15.5. Sustainable Trade and Governance

Sanders and Wood [

210] and Sanders et al. [

211] concur that sustainable trade practices are crucial for maintaining ethical and environmentally sound wood supply chains. While regulations such as the EUTR and FLEGT strengthen governance in exporting countries, disparities in enforcement capacity remain problematic [

10,

22,

37,

144,

212]. UNECE/FAO (2021) [

159] emphasizes that trade agreements, such as VPAs, have successfully improved legality verification and reduced illegal timber trade. However, gaps persist in some tropical regions, where illegal logging contributes significantly to forest loss due to weak governance [

213].

3.15.6. Socio-Economic Sustainability

Marchi et al. [

214] and Szulecka [

215] confirmed that sustainability in the wood sector also involves ensuring fair labor practices, safeguarding indigenous rights, and supporting local economies. Community forestry initiatives, particularly in developing countries, empower local populations and improve forest stewardship [

216,

217,

218]. Agrawal and Ostrom [

219] examined cases in Nepal and Mexico, finding that community-based forest management enhances forest conditions and household incomes. Incorporating local communities in forest governance has thus emerged as a socially sustainable approach.

3.15.7. Technological Innovation and Traceability

Technological advancements improve the sustainability and transparency of wood supply chains [

220,

221]. Blockchain technology and digital traceability systems offer tools to ensure legal sourcing and reduce fraud [

222,

223]. For instance, pilot blockchain projects in Ghana and Indonesia have demonstrated how digital systems can effectively track timber from harvest to the final consumer [

224]. These innovations increase accountability and bolster consumer confidence in sustainably sourced products.

3.15.8. Challenges to Sustainability

Despite these positive developments, challenges remain. Brown and Pearce [

225] and Pendrill et al. [

226] emphasized that deforestation continues at alarming rates, particularly in tropical regions. Global Forest Watch [

158] shows that over 11.1 million hectares of primary tropical forest were lost in 2021 alone. Additionally, global market demand for low-cost wood products often incentivizes unsustainable practices, particularly in countries where regulatory enforcement is weak [

90,

227]. Aligning economic growth with environmental and social sustainability remains a pressing concern [

228,

229].

Wardell et al. [

230] and Susilawati and Kanowski [

231] agreed that the sustainability of the global wood supply chain requires concerted efforts from governments, corporations, civil society, and consumers. Certification programs, legal frameworks, community-based forestry, and technological innovations drive positive change [

232,

233]. However, persistent challenges such as illegal logging, tropical deforestation, and uneven governance demand continued vigilance. Studies indicate that a globally coordinated approach is essential to ensuring that the wood supply chain remains a pillar of sustainable development, balancing economic, environmental, and social objectives [

159,

234,

235,

236].

3.16. Emerging Trends and Challenges in the Global Supply Chain of Wood Products

3.16.1. Sustainability and Certifications

There is a growing demand for sustainably sourced wood products certified by organizations such as the Forest Stewardship Council (FSC) and the Program for the Endorsement of Forest Certification (PEFC). Consumers and regulators increasingly prioritize products with low environmental impact and legal sourcing [

237,

238,

239].

3.16.2. Technological Innovation

Advancements in manufacturing techniques have led to the development of engineered flooring, laminated products, and digitally printed wood finishes. Smart technology integration, such as underfloor heating compatibility, is gaining popularity [

128,

240,

241].

3.16.3. Rising Popularity of Engineered and Composite Products

Due to cost-effectiveness, durability, and sustainability, engineered wood flooring and composite interior wood products are becoming preferred globally over solid hardwood [

30,

90,

242,

243].

3.16.4. Impact of COVID-19 and Post-Pandemic Recovery

The COVID-19 pandemic initially disrupted supply chains and production, but post-pandemic recovery has fueled increased consumption, particularly for home renovations and interior redesigns [

244,

245,

246,

247,

248].

3.16.5. Supply Chain Constraints and Raw Material Prices

Several studies indicate that volatility in timber prices, shipping costs, and supply chain disruptions remain ongoing challenges, impacting trade flows and product availability [

28,

249,

250].

3.16.6. Design Trends and Consumer Preferences