Abstract

Accurate forecasting of carbon credit prices is increasingly vital for the effective functioning of forest carbon markets, which play a growing role in global climate mitigation strategies. Against this backdrop, the present study conducts a systematic literature review to evaluate the state of carbon price forecasting methodologies, with particular emphasis on their applicability to forest-based carbon credits. The review highlights the predominance of machine learning (ML) and hybrid modeling approaches, which demonstrate enhanced predictive capabilities relative to conventional econometric techniques, particularly in capturing nonlinear dynamics and integrating heterogeneous data sources. However, their predictive power is limited by data scarcity, market opacity, and regulatory volatility. These issues are particularly severe in voluntary forest credit markets. The review identifies a critical research gap. Few studies explicitly model the behavior of forest credit prices. The findings suggest that future research should prioritize the development of policy-sensitive, scenario-based models that incorporate ecological, economic, and regulatory dimensions. While the majority of studies concentrate on compliance carbon markets, the methodological insights and forecasting approaches reviewed are highly relevant for the evolving forest carbon sector, nature-based mitigation strategies, and climate solutions. It also offers guidance for creating more transparent and robust forecasting tools in the forest carbon sector.

1. Introduction

Efforts to mitigate climate change have accelerated the development of carbon markets globally, wherein carbon emissions are assigned monetary value to incentivize their reduction [1]. Carbon markets have developed unevenly across countries. The EU Emissions Trading System (EU ETS), launched in 2005, remains the largest and most mature scheme, covering more than 10,000 installations and setting the global benchmark for carbon pricing. In contrast, emerging systems in China, South Korea, and New Zealand reflect varying levels of regulatory maturity, market liquidity, and coverage. The EU has taken a leading role due to its early adoption of cap-and-trade, strong institutional capacity, and political commitment to climate neutrality.

Alongside the establishment of compliance carbon markets, a voluntary over-the-counter (OTC) market has emerged and remains the largest market for forestry-based carbon credit transactions [2]. The voluntary carbon market enables governments, companies, and individuals to offset emissions beyond regulatory requirements [3]. Voluntary forest carbon markets function differently from compliance schemes. They often depend on over-the-counter (OTC) transactions instead of trading through a centralized exchange. The credibility of these markets is upheld by certification organizations like Verra and the Gold Standard, which establish methods and oversee verification [4]. Despite their increasing role in funding forest conservation, concerns have been raised regarding their shortcomings, including questionable credit reliability, lack of transparency in accounting, limited regulatory oversight, and elevated business risks [5]. These challenges are largely due to the absence of standardized methodologies and weak validation and verification processes. Forest-based carbon offset initiatives—such as REDD+ programs and afforestation projects—have gained prominence as mechanisms for financing forest conservation through the generation and sale of carbon credits [4]. These credits are primarily traded in voluntary carbon markets, though in limited cases they may be utilized for compliance in regulated schemes [5,6]. In this way, forest conservation efforts are increasingly integrated into broader carbon pricing frameworks.

Carbon prices in both compliance systems, most notably the European Union Emissions Trading System (EU ETS), and voluntary offset markets exhibit pronounced volatility and sensitivity to policy interventions [7,8]. For example, EU allowance prices reached unprecedented levels of approximately €100 per ton in 2023, before sharply declining to below €60 in early 2024 due to a policy-induced increase in allowance supply. Similarly, the voluntary market for forest carbon offsets has experienced considerable price instability [9]. An extensive investigation by journalists from The Guardian, Die Welt, and SourceMaterial published in early 2023, which included scientific analysis of Verra’s projects and interviews with experts, found that over 90% of a sample of forest-based credits were deemed essentially “worthless,” undermining buyer confidence and contributing to a dramatic price collapse. Τhe assumption that the voluntary carbon market and voluntary forest credit are not supporting effective climate mitigation has also been put forward by [10]. Their evidences suggest that most companies that have decided to offset through the voluntary carbon market have relied on inexpensive, low-quality offsets [10]. Such volatility presents significant challenges for stakeholders in forest carbon markets, including project developers, investors, and policymakers who rely on carbon revenues to support conservation activities.

Within this context, the capacity to forecast carbon prices has become increasingly critical [11]. Reliable price forecasts can guide investment decisions, such as evaluating whether projected carbon credit revenues can justify the costs of afforestation or reforestation. They inform the design of regulatory mechanisms aimed at market stabilization, and assist in assessing the financial sustainability of long-term conservation strategies [12]. Nonetheless, carbon price forecasting remains a complex task. Prices are shaped by a confluence of economic, policy, and social factors, including legislative decisions, energy market fluctuations, and public sentiment [13]. Additional uncertainties in forest offset markets arise from the variable environmental integrity of credits (e.g., concerns about permanence and additionality) and evolving regulatory frameworks that define offset eligibility [14].

The European Union represents a particularly illustrative case. The EU ETS currently excludes international forest offsets due to historical concerns regarding credit integrity, and the European Commission is in the process of establishing a Carbon Removal Certification Framework (CRCF) to formalize standards for future forestry-based and carbon removal credits [15]. Moreover, forthcoming EU legislation plans to prohibit corporate claims of “carbon neutrality” based on offsetting practices by 2026, a move expected to significantly affect demand for voluntary forest credits. These policy developments underscore the urgency of developing forward-looking tools capable of projecting carbon price trajectories under alternative regulatory and market scenarios [16].

In recent years, ML and other data-driven techniques have emerged as powerful tools for addressing the forecasting challenges posed by carbon markets [17,18]. Compared to traditional econometric approaches—such as time-series regressions, which often struggle with nonlinearity and structural breaks—ML models are better equipped to handle high-dimensional data and capture complex, nonlinear interactions [19]. A growing body of research, particularly from Europe and China, has demonstrated the application of various ML techniques in carbon price prediction. These include neural networks, ensemble methods, deep learning architectures, and hybrid models (the combination of two or more modeling approaches to improve prediction accuracy), some of which integrate textual sentiment data to account for psychological drivers of market behavior [20,21,22,23,24,25]. While these approaches have shown promise in enhancing predictive accuracy, they also introduce concerns related to model interpretability, data transparency (especially in the context of forest offsets, where pricing information is often limited), and robustness under shifting policy environments.

To address this issue, this paper presents a systematic and narrative review of the literature on carbon price forecasting, with a particular emphasis on its relevance to forest carbon markets and offset projects—an area that remains underexplored despite growing policy and investment interest. While numerous studies have examined carbon price forecasting more broadly, few have focused on the specific challenges posed by forest-based credits, particularly in light of evolving regulatory frameworks such as those in the European Union.

To our knowledge, no prior systematic review has synthesized the methods and results of forest carbon price forecasting. So, the specific objectives of this review are threefold: (i) to systematically map the existing forecasting approaches applied to carbon credit markets, (ii) to assess their applicability and limitations for forest-based carbon credits, and (iii) to identify research gaps and propose directions for future methodological and policy-oriented work.

2. Materials and Methods

This review adhered to the PRISMA (Preferred Reporting Items for Systematic Reviews) guidelines to ensure methodological rigor and transparency in the literature identification process [26,27,28]. A comprehensive search was conducted in the Scopus database (coverage up to mid-2025), employing a broad set of keywords related to carbon price forecasting, carbon markets, forest carbon offsets, and machine learning. In particular, the terms “carbon price” OR “carbon payments“ OR “carbon credit*” OR “carbon market” OR “emission allowance” AND “price prediction” OR “price forecasting” OR “deep learning” OR “machine learning” AND “forest*” were entered in the search fields “Article title, Abstracts, Keywords”. Following the removal of non-English publications, titles and abstracts were screened to eliminate irrelevant studies [29,30], such as those focused exclusively on carbon stock measurement or remote sensing without any market or pricing component. Peer-reviewed material was considered eligible, provided it addressed carbon pricing either through historical analysis or predictive modeling. Emphasis was placed on studies relevant to forest carbon offsets or emissions trading systems, though methodological diversity (including econometric, statistical, and machine learning approaches) was encouraged to capture a broad spectrum of analytical techniques.

Studies focusing on forest carbon projects or climate policies without direct price analysis were included only if they offered valuable contextual insights, such as the effectiveness of carbon offsets or the influence of policy on market behavior. Applying these criteria, a total of 47 relevant studies were identified from the Scopus search. Each article underwent full-text review and detailed evaluation. Additionally, a limited number of supplementary references (e.g., policy reports, news articles) were incorporated through cross-referencing and expert knowledge to provide background on recent EU regulatory developments and market trends; these were not part of the formal systematic search.

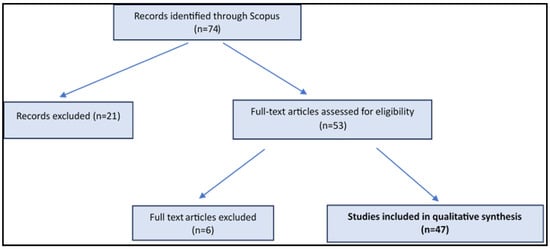

Figure 1 presents the PRISMA flow diagram illustrating the study selection process. In total, approximately 74 records were retrieved from the initial search. Of these, 21 were excluded for reasons such as lack of price-related content (e.g., studies on carbon sequestration mapping or public perceptions of carbon taxes). A full-text review was conducted for 53 articles, with an additional 6 excluded upon detailed inspection due to insufficient relevance (e.g., studies on remote sensing or purely methodological machine learning models unrelated to carbon markets). Ultimately, 47 articles met all inclusion criteria and formed the core literature base for the qualitative synthesis.

Figure 1.

PRISMA flow chart illustrating the systematic literature selection process.

For each included study, data were systematically extracted on the following parameters: market context (e.g., EU Emissions Trading System, Chinese carbon market, voluntary offset schemes), temporal coverage and datasets used (such as historical price data, macroeconomic indicators), forecasting methodologies (machine learning algorithms, econometric/statistical models, or hybrid approaches), and key findings (including forecast accuracy, identified price drivers, and policy implications).

Due to the heterogeneity of methods and objectives across studies, a quantitative meta-analysis of forecast performance was not undertaken. Instead, a narrative synthesis was conducted to identify recurring themes, methodological innovations, and areas of divergence. Particular attention was given to the integration of forest carbon-related variables, such as forestry-sector indicators or emission reduction targets, as well as the treatment of policy and regulatory dynamics within the forecasting frameworks.

The PRISMA flow diagram (Figure 1) and the synthesis table (Table A1 in the Appendix A section) serve to structure and present the findings comprehensively. While the majority of included studies focused explicitly on carbon price forecasting, a subset contributed valuable contextual understanding, such as assessments of offset project performance or the influence of specific policy instruments on carbon market behavior.

3. Results

3.1. Descriptive Overview of the Literature

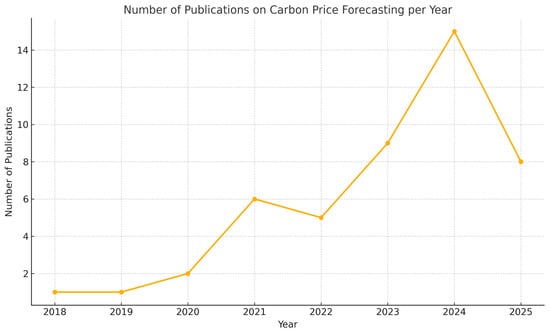

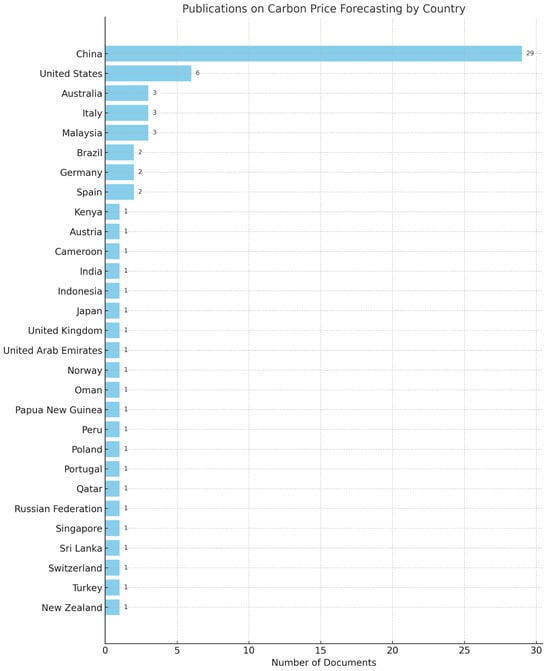

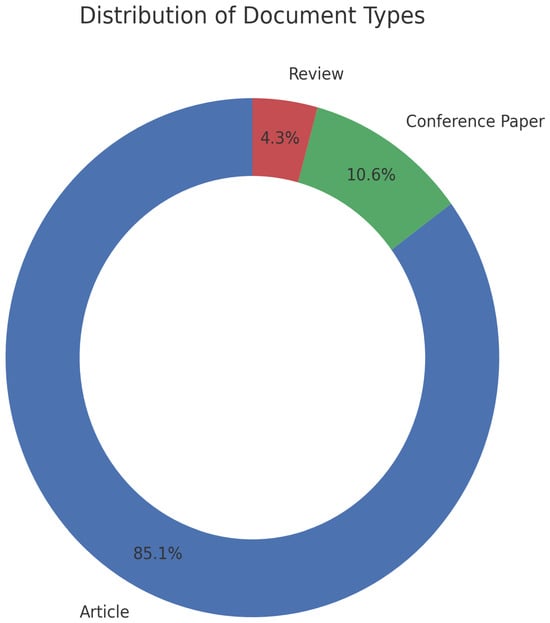

Before delving into the qualitative analysis of the studies, we present a descriptive analysis of the literature that is included in this review. The following Figure 2, Figure 3, Figure 4 and Figure 5 summarize publication volume per year trends, geographic and disciplinary distribution.

Figure 2.

Number of Publications per Year.

Figure 3.

Publications per Country.

Figure 4.

Type of Publication.

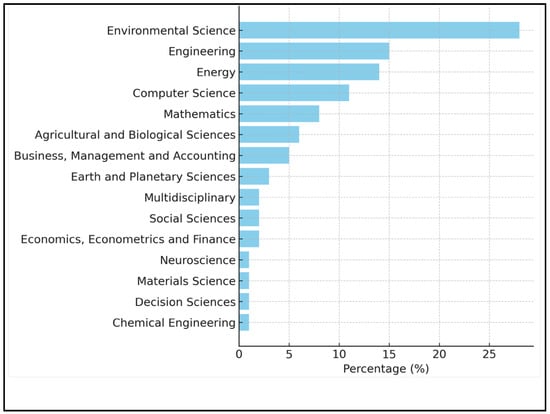

Figure 5.

Publications by Field of Research.

As depicted in Figure 2, the number of publications has had a clear upward trend over the past years, rising from 1 paper in 2018 to 15 in 2024. With 8 publications by mid-2025, the strong research momentum appears to be maintained.

The analysis reveals contributions from 29 countries (Figure 3), with China leading by a significant margin (29 papers), followed by the United States (6 papers). Notably, as several studies were co-authored by researchers affiliated with institutions in different countries, the total number of contributing countries exceeds the number of publications. This also reflects the underlying international collaboration in carbon price forecasting research.

The majority of publications are research articles (85% approximately), followed by conference papers (11% approximately) and a small number of reviews (4% approximately), as demonstrated in Figure 4, highlighting the empirical orientation of the field.

Displaying the strong interdisciplinarity of the field, Figure 5 presents the wide range of scientific areas, with Environmental Science leading (27 publications), followed by Engineering (15), Energy (14), and Computer Science (11).

3.2. Forecasting Approaches and Methodological Trends

3.2.1. Market Contexts and Geographic Focus

This review encompasses an in-depth analysis of 47 academic studies published between 2018 and 2025, addressing the evolving landscape of carbon price forecasting across both compliance and voluntary markets (Table A1 in the Appendix A). The distribution of geographical focus among these studies reveals a substantial emphasis on the European Union Emissions Trading System (EU ETS) and the Chinese carbon market—two jurisdictions that provide extensive datasets and unique policy structures. The Chinese context, in particular, has gained prominence in the literature following the 2021 launch of the national emissions trading scheme, supplementing earlier regional pilot initiatives. This development has offered researchers a rich empirical basis, explaining why approximately half of the studies included in this review examine carbon price dynamics specifically within Chinese markets. Meanwhile, the EU ETS, as the longest-operating and most mature carbon market globally, also serves as a primary focal point in a significant number of studies.

Outside these two key markets, a limited subset of studies considers other contexts, including voluntary offset markets and emerging systems in developing regions [31,32,33]. These studies are relatively few, likely due to the fragmented nature and limited availability of high-frequency, standardized data in such settings. Despite this limitation, the existing literature in these areas provides valuable insights, particularly concerning price dynamics in over-the-counter offset transactions and the influence of evolving regulatory frameworks.

3.2.2. Machine Learning and Hybrid Modeling Approaches

Across the reviewed body of work, the vast majority of studies employ quantitative forecasting methods, with only a minor fraction engaging in qualitative policy analysis that interprets price dynamics without relying on predictive models. The predominant methodological trend is the application of machine learning (ML) techniques and hybrid frameworks designed to accommodate the nonlinear, non-stationary nature of carbon price time series [34,35,36,37,38,39]. Over 70% of the studies reviewed utilize one or more ML approaches, ranging from conventional methods such as artificial neural networks (ANNs) and support vector machines (SVMs) to more advanced models including long short-term memory (LSTM) networks, transformer-based architectures, and ensemble strategies like stacking and boosting [38,39,40,41].

These models are frequently embedded within comprehensive hybrid forecasting frameworks that leverage signal decomposition methods—such as Empirical Mode Decomposition (EMD) and Singular Spectrum Analysis (SSA)—to denoise and segment the input time series before applying machine learning algorithms to predict individual components [42,43,44]. The reconstructed outputs then provide a composite forecast that more accurately reflects underlying market dynamics. The integration of ensemble learning methods is also widely reported to enhance predictive accuracy by combining the strengths of multiple models [45,46,47].

In parallel, approximately 30% of the reviewed studies incorporate or compare econometric models such as ARIMA, GARCH, and vector error-correction models [43,48,49]. These are often used as benchmark frameworks to evaluate the incremental predictive value offered by machine learning approaches. The prevailing consensus in the literature suggests that, when equipped with sufficient training data and subject to careful hyperparameter tuning, machine learning models typically outperform traditional statistical models in carbon price forecasting. However, this superiority is not absolute. For instance, some studies demonstrate that simpler ML models, such as basic backpropagation neural networks, do not always outperform well-calibrated econometric models like GARCH, indicating that the efficacy of model choice is contingent on feature selection, training length, and structural assumptions.

3.2.3. Input Features and Data Sources

The nature and breadth of the input data also influence the predictive performance of these models. Most studies use historical carbon price time series as their foundational input, such as EUA prices from the EU ETS or provincial-level market prices in China [48,49]. These are frequently supplemented by a diverse array of explanatory variables, reflecting both macroeconomic and sector-specific dynamics. Commonly included variables encompass energy market data (e.g., oil, coal, natural gas prices; electricity indices), financial market indicators (e.g., stock indices like the DAX or the S&P Global Clean Energy Index; interest rates), and macroeconomic signals such as GDP, industrial production, and manufacturing output [25,50].

More innovative studies incorporate textual and sentiment-based data streams to account for behavioral and expectation-driven price movements [51]. For instance, the use of online search trends, news articles, or sentiment indices related to climate policy and carbon trading has been shown to enhance model accuracy. One study highlighted the substantial improvement in predictive performance achieved by incorporating a sentiment index based on online climate-related news articles when modeling China’s carbon market [32]. Another found that social attention metrics—such as the frequency of media mentions of emissions trading—ranked among the most influential predictors of price changes, alongside traditional variables like oil prices and financial indices [25]. These findings underscore the complex interplay between fundamentals, investor sentiment, and media narratives in shaping carbon market dynamics.

3.2.4. Incorporating Policy and Scenario Sensitivity

Beyond purely methodological and data considerations, many studies also account for the policy context in their model design. Carbon markets are inherently policy-driven constructs, shaped by rule-based mechanisms such as cap settings, allowance allocation procedures, offset eligibility criteria, and compliance timelines [52,53]. Accordingly, a subset of forecasting models incorporates variables that reflect major regulatory interventions or structural shifts. Li et al. [22] integrate China’s multi-stage carbon peaking and neutrality commitments, along with the EU’s long-term emissions reduction targets, into a hybrid SSA-Transformer model to forecast European carbon prices. The model dynamically adjusts factor projections based on anticipated regulatory milestones, thereby capturing potential shifts in price trajectories under evolving policy regimes [54]. Similarly, studies of China’s pilot ETS programs report variation in forecast accuracy across regions, attributable to differences in local policies governing allowance distribution, sectoral inclusion, and compliance enforcement [42,54,55].

These findings reinforce the notion that embedding policy variables—whether as scenario dummies, segmented market states, or through expert-informed inputs—is essential to capture the institutional structure of carbon markets and to improve the realism of forecasts. Table A1 (in the Appendix A section) summarizes a representative subset of studies, cataloging the modeling approaches, data features, and regional contexts covered.

3.2.5. Forest Carbon Offsets and Voluntary Markets

While the bulk of the reviewed literature centers on compliance carbon markets—where standardized pricing and transparent transactions offer fertile ground for empirical research—several studies also engage with forest carbon markets and voluntary offset mechanisms, either directly or by implication [56]. Although the number of works explicitly focused on the pricing of forest carbon credits remains limited, insights derived from compliance markets provide a foundational methodological base for these more opaque and less standardized markets [20,57].

In contrast to compliance systems, the voluntary carbon market remains the dominant arena for forestry-based credit transactions, but it faces significant challenges. Price formation is largely over-the-counter and lacks centralized exchanges, resulting in limited transparency and substantial heterogeneity across project types and standards. According to the Ecosystem Marketplace report by Goldstein et al. (2021) [58], voluntary markets have exhibited considerable price instability, reflecting both uncertainty in credit integrity and fragmented demand. Such volatility complicates the task of reliable price forecasting.

Several studies suggest that machine learning models developed for the EU ETS and Chinese ETS can be adapted for use in voluntary forest credit markets, provided appropriate modifications are made to account for data availability and market structure [38,59]. For instance, the incorporation of news sentiment indices and indicators of public attention—demonstrated to be effective in forecasting China’s carbon market—may be equally relevant in the context of forest offsets. Pricing in such markets often responds to external developments, including public debates on credit integrity, corporate climate commitments, and regulatory announcements regarding offset standards [20,24,60]. As such, model architectures capable of integrating unstructured textual inputs and online behavioral signals are particularly valuable.

Notably, several studies emphasize that random forest models and other feature importance-based methods may offer insights into the key drivers of forest credit prices, even when time series data are sparse [22]. Such drivers may include general trends in compliance carbon prices (which often serve as reference benchmarks), deforestation and land-use change indicators, and fluctuations in the supply of credits from large-scale forestry projects. However, the lack of a centralized trading platform and the over-the-counter nature of most voluntary offset transactions create significant challenges in constructing robust and generalizable models [45,52]. Prices vary widely depending on project location, verification standard, co-benefits (e.g., biodiversity, community development), and buyer preferences, producing high variance and potential noise in the available data [31].

Some innovative contributions seek to address these limitations. One study proposes a blockchain-based system for credit verification aimed at reducing greenwashing risks by leveraging ML to validate project data integrity—a solution that, although not focused on direct price forecasting, supports the preconditions for trustworthy market functioning and, by extension, more accurate forecasts [20]. Another work by [61] utilizes unsupervised learning techniques to identify anomalies in carbon market trading patterns, thereby contributing to fraud detection and enhancing market integrity. These auxiliary ML applications—ranging from sentiment analysis and anomaly detection to carbon stock estimation via remote sensing—underscore the diverse ways in which artificial intelligence is being mobilized to support the development of forest carbon finance, even if explicit price forecasting remains underexplored [46,62,63].

Emerging approaches suggest that integrating remote sensing and land-use data can help address some of these challenges [64,65]. For example, Harris et al. [66] developed global maps of forest carbon fluxes using satellite data, illustrating how high-resolution monitoring can provide proxies for credit supply and quality in regions where transparent market price data are unavailable.

These contributions underscore the potential for combining methodological advances in machine learning with independent ecological data sources. While explicit price forecasting for forest carbon credits remains scarce, such innovations lay the groundwork for developing more trustworthy and transparent markets.

3.2.6. Challenges and Limitations in Forecasting

The methodological insights derived from this growing body of literature point to several recurring challenges in carbon price forecasting, particularly in forest-related contexts. Chief among these is the issue of policy uncertainty and the prevalence of regime shifts. Carbon markets are not merely subject to economic fundamentals but are inherently policy constructs, whose underlying rules and structures can change unpredictably [42]. Sudden announcements—such as the EU’s REPowerEU measure, which released additional allowances to stabilize energy markets—can result in structural breaks in price series that are difficult for even advanced models to anticipate. In the forest carbon context, potential regulatory shifts—such as the EU deciding to allow or exclude certain offset types—may radically alter demand dynamics, rendering past price behavior a poor guide to future outcomes [34].

Even when policy changes are gradual or telegraphed in advance, their impact may involve nonlinear feedback that complicates model design [67]. For example, a tightening emissions cap might spur speculative trading, trigger shifts in compliance behavior, or accelerate investments in mitigation technologies, each of which could affect prices in unforeseen ways. Although some models, such as that of Li et al. [22], attempt to incorporate long-term policy commitments as structural variables, forecasting under policy uncertainty remains a central limitation.

Compounding this challenge is the issue of data availability and quality, particularly in the voluntary market segment. Whereas the EU ETS and Chinese ETS offer daily trading data, forest carbon markets operate with limited transparency [6,68,69]. Credits differ by verification standard, project type, vintage, and registry, creating a fragmented dataset with high variance. Prices are often not publicly disclosed or may be averaged across dissimilar project types, leading to potential distortions [23]. This heterogeneity undermines the assumptions of many statistical and ML models, which rely on consistent, high-frequency data. In some cases, models may need to predict not a single price, but a price distribution or index value reflecting a class of comparable credits [11,70]. Even then, overfitting remains a significant risk, particularly when training data are limited in length or contaminated by noise.

The non-stationarity refers to the changes due to fluctuating prices, evolving relationships between market factors, energy prices, economic cycles, etc., and seasonal variation in carbon markets further complicate modeling efforts [24]. Compliance deadlines, energy consumption cycles, and periodic climate events all introduce seasonality into price dynamics. In the voluntary forest offset space, external shocks—such as large wildfires that destroy credited forest areas or widespread media scrutiny of offset methodologies—can trigger abrupt shifts in sentiment and market activity [71,72,73]. These dynamics often violate the stationarity assumptions of classical models and reduce the stability of ML model performance over time. Techniques such as time-series decomposition, frequent retraining, and ensemble learning may alleviate some of these concerns, but the risk of model obsolescence following a major market or policy shift remains [43,66,74,75].

One particularly unique challenge in forest carbon forecasting is the question of credit integrity and additionality [76]. Unlike compliance allowances, whose value is anchored in a regulatory framework, voluntary offsets must convince buyers of their environmental credibility. If widespread doubts emerge—such as in cases where avoided deforestation credits were later revealed to be overestimated—market confidence and pricing can deteriorate rapidly. Some studies suggest that sentiment analysis or media monitoring could function as early warning indicators, but integrating such information into quantitative models remains complex [36,51]. Moreover, the erosion of trust can lead to a collapse of the “quality premium” that some high-integrity credits enjoy, resulting in price convergence at the lower end of the market spectrum.

Finally, interpretability and model transparency are recurring themes in the literature. While deep learning models such as LSTMs or transformers offer superior performance in many cases, their black-box nature limits their utility for policy analysis [45]. Policymakers, project developers, and market regulators are unlikely to rely on model outputs that they cannot understand or interrogate. Efforts to address this include the use of SHAP values or feature importance analyses (e.g., in random forest models) to identify key drivers of forecasted prices [77]. These insights often align with economic intuition—such as the influence of energy prices, stock market performance, or climate policy news—offering partial validation of model assumptions. Nonetheless, a gap remains between technical forecasting outputs and actionable, policy-relevant insights, which may only be bridged through interdisciplinary collaboration.

Despite the complexities and challenges discussed, forecasting carbon prices—including those of forest-related credits—yields significant benefits for a range of stakeholders, including project developers, policymakers, investors, and conservation organizations [11]. A well-developed forecasting model, even if probabilistic or scenario-based, can serve as a strategic tool for guiding investment decisions in nature-based climate solutions, evaluating regulatory design, and managing risk in project portfolios.

From a financial planning perspective, project developers engaged in afforestation, reforestation, or REDD+ initiatives frequently rely on projected carbon credit revenues to assess long-term viability [78]. Accurate or even directional forecasts of future carbon prices can inform capital allocation, project design, and investment timing. For example, if models predict rising credit prices over the next decade—perhaps due to increasing climate ambition or improved market integration—developers may confidently plan for higher future returns, strengthening the case for upfront investments. Conversely, if a forecast anticipates stagnation or decline due to regulatory oversupply or weakening demand, project structures may be adjusted to reduce reliance on carbon revenues or diversify income sources [38]. Thus, forecasting contributes to business model resilience, especially in the inherently uncertain realm of environmental finance.

Policymakers, too, can leverage forecasting models as analytical tools to assess the likely effects of proposed interventions. For instance, regulators considering the introduction of price corridors, offset protocols, or market stability reserves can simulate expected market responses under various assumptions. If certain scenarios reveal high volatility or price collapse, adjustments can be made in advance to mitigate unintended consequences [34]. The study by [54] exemplifies how policy-oriented modeling can inform the co-design of energy and carbon pricing systems to improve stability and effectiveness. In the European context, although forest offsets are not part of the EU ETS, they intersect with policies such as the Land Use, Land-Use Change and Forestry (LULUCF) regulation and the forthcoming Carbon Removal Certification Framework (CRCF) [79]. Forecasting models that account for potential credit supply under these regimes—and the price impacts of different design options—can inform not only climate planning but also the design of complementary fiscal and investment incentives.

Forecasting also plays a central role in risk management [67]. Conservation NGOs and private developers that generate forest carbon credits often face the challenge of timing credit issuance and sales. Forward-looking price signals can support strategies such as banking credits during low-price periods or locking in value via forward contracts when price spikes are expected [54]. In the case of increasing volatility or falling prices—due, for example, to market saturation or policy reversals—projects can adjust their cash flow projections and diversify revenue sources. Companies that purchase credits to meet voluntary or internal climate commitments may also use forecasts to plan procurement schedules or hedge against future price increases. With the emergence of exchanges offering futures on certain voluntary credits, these strategies are becoming increasingly viable [80].

More broadly, governments and large conservation organizations involved in landscape-scale planning may integrate carbon price forecasts into national or regional decision-making [81]. For instance, a country preparing a forest protection plan under its Nationally Determined Contribution (NDC) may use price projections to estimate the revenue potential of crediting initiatives, thereby informing budget allocations and international financing strategies. Forecasts that include policy-dependent price scenarios—e.g., high prices under ambitious regulatory frameworks and low prices under weak governance—can reinforce the case for strong climate action. They also assist in communicating expectations to private investors and communities involved in project implementation [38].

While these applications are promising, their reliability is constrained by substantial policy risks, particularly in the context of the European Union, where evolving legislation on carbon markets and removals introduces both uncertainty and strategic inflection points. One of the most consequential policy developments is the EU’s effort to create a Carbon Removal Certification Framework (CRCF). Intended to establish standardized procedures for certifying carbon removals—including forestry, soil carbon, and technological pathways—the CRCF could eventually form the foundation of a formalized removals market in the EU [15]. However, the regulatory design of the CRCF remains contentious. An analysis by Carbon Market Watch criticizes the draft methodologies as being of “lower quality” than even some earlier voluntary standards, raising concerns that the certification of non-additional or low-integrity credits could erode market trust (carbonmarketwatch.org). Such an outcome would mirror the price collapse seen in voluntary markets flooded with questionable REDD+ credits.

Alternatively, if the CRCF is implemented with high stringency—limiting certification to only the most rigorously verified projects—the volume of eligible removals may be small, potentially leading to illiquidity and elevated prices [15]. For forecasting purposes, this dual possibility introduces a wide error margin in any price estimate related to EU-certified forest carbon credits. Until the final rules are published and market behavior observed, assumptions regarding the size, integrity, and price trajectory of CRCF-compliant credits must remain highly conditional.

A second major regulatory development with far-reaching implications is the EU’s proposed ban on using carbon offsets—voluntary or otherwise—to substantiate “climate neutral” marketing claims on products and services [20]. As reported by The Guardian, this ban could reduce corporate demand for voluntary forest offsets from European companies, many of whom previously purchased credits to meet sustainability pledges or to enhance their environmental brand image (https://www.theguardian.com/environment/, 20 June 2025). This impending shift introduces a structural demand risk that is difficult to quantify. Forecast models that previously assumed steady growth in corporate demand for voluntary offsets—particularly in the context of net-zero transitions—must now consider a scenario in which this demand plateaus or even contracts after 2025–2026 [82]. For project developers and investors, this underscores the importance of diversifying their client base beyond the EU and not relying solely on corporate actors subject to the bloc’s consumer protection rules [20].

A third issue of strategic importance concerns the potential interaction between voluntary forest carbon markets and the EU ETS. To date, the EU has maintained a strong firewall between compliance allowances (EUAs) and offsets. UN-certified forest credits from the Clean Development Mechanism (CDM) were excluded from the EU ETS from its inception, and the post-2020 framework has further tightened this boundary. However, long-term speculation persists around whether and when some form of fungibility might be allowed, especially for high-quality removals certified under the CRCF [34,45]. Should this occur, CRCF credits could potentially trade near the EUA price, given their substitutability in regulatory compliance. This scenario would likely raise the value of forest carbon credits significantly, encouraging supply-side investment and spurring efforts to meet EU eligibility standards. On the other hand, some analysts argue that introducing removals into the ETS risks lowering the EUA price by capping demand-side ambition, thereby weakening the system’s mitigation signal). For forecasting models, this debate introduces fundamental uncertainty about long-term price convergence and market segmentation.

Additional policy-related risks pertain to permanence rules and liability frameworks. Forest credits are uniquely exposed to reversal risks: fires, pests, illegal logging, and climate stress can all erase previously sequestered carbon [83]. As a result, emerging EU or national legislation may impose stringent permanence requirements—such as 30-year monitoring obligations, credit buffers, or reversal liability clauses [24]. If credit sellers are held responsible for reversals, they will demand a higher price to compensate for future risk exposure [83]. Conversely, if the system includes insurance mechanisms or public risk-sharing provisions, the required risk premium may be lower. Current forecasting models have not yet incorporated permanence risk explicitly, but in practice, it functions as a volatility driver on the supply side [37,40]. A sudden legislative change introducing such obligations could shift the credit supply curve, influencing both volume and price [40].

In summary, the literature strongly indicates that the evolution of EU legislation will play a central role in shaping the future dynamics of forest carbon markets in Europe and, by extension, the global offset landscape [84]. Depending on how regulatory frameworks such as the CRCF are finalized, and whether they are linked to compliance instruments like the EU ETS, the resulting market structure may either enhance long-term confidence and price stability or introduce further fragmentation and volatility. Robust forecasts in this context must be scenario-based and policy-sensitive, making clear the assumptions embedded in each projection [45,47]. More broadly, this reinforces the conclusion that quantitative and machine learning models alone are insufficient; interdisciplinary integration with legal analysis, political economy, and environmental science is essential for constructing carbon price forecasts that are not only statistically rigorous but also contextually valid and decision-relevant [85].

4. Discussion

4.1. Discussion of the Findings

Synthesizing the findings of this systematic review reveals that carbon price forecasting is a rapidly evolving field, driven by the increasing sophistication of machine learning (ML) techniques, yet still constrained by the distinctive features of carbon markets [20,86,87,88]. While ML and hybrid methods—such as random forests, artificial neural networks, generative adversarial networks, and Transformer-based architectures—have demonstrably improved forecasting accuracy compared to traditional econometric models, they have not eliminated underlying uncertainties. These approaches are particularly effective at detecting and modeling nonlinear dependencies, including the influence of oil price shocks or media sentiment on carbon price movements [47,89,90]. However, they remain limited in their ability to anticipate abrupt structural breaks, such as wars, major regulatory interventions, or unplanned policy shifts. These exogenous events introduce forms of uncertainty that are difficult, if not impossible, to fully capture with historical data alone. Consequently, forecasts should be viewed as one input among many in decision-making processes, rather than definitive predictions. Furthermore, most reviewed studies emphasize point forecasts and accuracy metrics but rarely report confidence intervals or probability distributions [11,22]. Future research would benefit from integrating probabilistic forecasting frameworks to better convey the range of plausible outcomes and to communicate forecast uncertainty more effectively to end-users [91].

Beyond highlighting the effectiveness of machine learning and hybrid models, future discussions would also benefit from a comparison of the relative strengths and weaknesses of different modeling approaches. For example, while neural networks are effective at identifying complex nonlinear relationships, these models require a substantial amount of data. In contrast, econometric methods may offer greater interpretability but lower flexibility, and they cannot well capture the nonlinear characteristics of carbon price [86,87,88,89,92]. In this context, techniques such as data augmentation or transfer learning could offer good opportunities to address data scarcity, particularly in emerging markets.

An important development in the field is the integration of heterogeneous and multi-disciplinary data sources, which has proven essential for understanding the socio-political and economic nature of carbon markets [40,43]. Recent studies have begun to combine quantitative variables—such as allowance volumes, energy prices, and emissions data—with qualitative inputs including policy announcements, regulatory discourse, and public sentiment derived from news and social media [11,51]. This convergence reflects a growing recognition that carbon markets are not purely economic mechanisms but are embedded in broader political and social contexts [89,90,93,94]. For instance, the use of news sentiment analysis has been shown to enhance carbon price prediction in Chinese markets by incorporating investor expectations and market psychology. In the context of forest carbon offsets, there is significant potential for incorporating data from remote sensing technologies, such as deforestation rates or canopy height models, into forecasting models [78]. These environmental indicators could serve as proxies for future credit supply, thereby influencing price expectations. This interdisciplinary fusion—where environmental data inform financial forecasting—mirrors developments in energy markets, where weather patterns are commonly integrated into demand forecasts. Advancing such cross-sectoral methodologies could significantly improve the precision and relevance of models applied to nature-based credit markets.

The role of policy design emerges as another critical determinant of forecast reliability. Markets that are well-regulated, transparent, and guided by consistent policy frameworks tend to produce more stable and predictable price signals. Instruments such as the Market Stability Reserve (MSR) in the European Union or the dynamic adjustment mechanisms in China’s pilot trading schemes have demonstrated that thoughtful policy interventions can reduce volatility and enhance market credibility [95]. From a forecasting perspective, regulatory predictability enhances model performance by reducing the frequency and magnitude of unanticipated shocks. Therefore, the stability and clarity of policy frameworks can be considered indirect enablers of more accurate and actionable carbon price forecasting. In the case of forest carbon markets, measures such as establishing price floors, buffer credit reserves, or public-sector buyer-of-last-resort programs may contribute to dampening price crashes and fostering investor confidence. Conversely, unpredictable or fragmented policy environments—such as ad hoc invalidation of offset categories or inconsistent rules across jurisdictions—exacerbate volatility and undermine forecast robustness [96]. The variability observed across regional policies in China and the exclusion of forest offsets from the EU ETS due to integrity concerns underscore the need for harmonized regulatory frameworks that support long-term planning and model development.

A notable gap in the literature concerns the forecasting of prices for voluntary forest carbon credits. Despite their growing importance in global mitigation strategies, few studies have explicitly modeled the price dynamics of forest-based offsets. The unique attributes of these credits—including their project-based nature, issues of non-permanence, and co-benefits such as biodiversity or community development—necessitate tailored forecasting methodologies. Differentiated modeling approaches are required depending on the type of forest intervention (e.g., afforestation, REDD+, improved forest management), given that each credit category operates under distinct market conditions. As data availability improves through registries, trading platforms, and voluntary market indices (such as those developed by Xpansiv/CBL), future research will be better positioned to construct models that are calibrated specifically to forest offset markets. Enhanced collaboration between academic researchers and market platforms would facilitate access to more granular price and volume data, thereby accelerating model development and validation.

Lastly, the interdisciplinary nature of this field underscores the need for improved communication and collaboration among researchers, policymakers, and practitioners. Each community brings a unique perspective: forest ecologists contribute essential data on carbon sequestration and ecosystem dynamics; ML scientists offer advanced modeling techniques and algorithmic innovations; and policymakers provide the regulatory and institutional context that shapes market behavior. However, gaps in mutual understanding can hinder the effective translation of forecasts into actionable strategies. For instance, machine learning specialists may not fully appreciate the constraints imposed by regulatory processes, while policymakers may misinterpret the significance or limitations of model outputs. Facilitating dialogue across these domains is essential to ensure that models are both scientifically rigorous and policy-relevant. This review has sought to bridge such gaps by presenting technical content in an accessible narrative form, linking specific ML techniques to practical policy considerations and market behaviors.

Ultimately, improving the forecasting of carbon prices—particularly for forest-based credits—is not an end in itself, but a means of strengthening climate action. Forecasts that are transparent, well-calibrated, and grounded in policy and environmental realities can enhance trust in carbon markets, support more informed investment decisions, and enable more effective conservation planning. Conversely, unreliable or opaque forecasts risk undermining confidence in offset mechanisms, potentially discouraging participation and investment [86]. While forecasting cannot resolve fundamental issues such as oversupply or questionable credit integrity, it can help stakeholders navigate a complex and evolving policy landscape. In this way, carbon price forecasting forms part of the broader institutional infrastructure necessary for the credibility and success of market-based climate mitigation.

The findings of this review suggest practical implications for different stakeholder groups. For forest project developers, forecasting methods can be used as complementary scenario tools to assess revenue risks under different policy regimes. For policymakers, the evidence indicates that forecasts are most valuable when embedded in policy-sensitive models that explicitly account for regulatory shocks and market design choices. For model designers, the review highlights the importance of hybrid and scenario-based approaches that integrate both quantitative data and qualitative policy pathways. Elaborating on these insights moves beyond descriptive mapping and translates the review into practical guidance for forestry carbon market actors.

4.2. Comparative Assessment of Forecasting Approaches

The review highlights distinct advantages and limitations across different forecasting approaches, which can be organized into a typology comprising econometric, machine learning, hybrid, and scenario/policy-sensitive models (Table 1). Econometric models (such as ARIMA, GARCH, and VECM) provide transparency, are relatively easy to implement, and are well-suited to capturing short-term market dynamics. However, they often struggle to incorporate structural breaks, policy shocks, and nonlinear dynamics that characterize carbon markets.

Table 1.

Comparative assessment of forecasting approaches.

Machine learning approaches (including ANN, SVM, random forests, and LSTM networks) demonstrate a strong capacity to capture nonlinearities and to integrate heterogeneous data sources. Their flexibility is particularly valuable when dealing with complex carbon price drivers. Yet, they require extensive datasets, are computationally intensive, and their “black box” character limits interpretability and policy trust.

Hybrid approaches (for example, combining empirical mode decomposition with ML models or ensemble methods) aim to capitalize on the strengths of multiple methods. These models often deliver robust performance and resilience to noisy data, but they also increase computational complexity and can be difficult to operationalize in practice.

Finally, scenario-based and policy-sensitive frameworks explicitly account for the institutional and regulatory context of carbon markets. While such approaches lack quantitative precision and can be more subjective, they are especially relevant in the case of forest carbon markets, where government interventions, permanence concerns, and heterogeneous credit quality play decisive roles.

Taken together, this comparative assessment underscores that forecasting methods should not be treated as universally applicable. Instead, their strengths and weaknesses must be evaluated in relation to specific market conditions, with scenario-based and hybrid approaches offering particularly valuable insights for forestry contexts characterized by uncertainty, fragmentation, and regulatory dominance.

4.3. Limitations

Notwithstanding the contributions of this review, several limitations should be acknowledged. First, while the study emphasizes forest carbon markets, the current literature remains sparse in terms of models that explicitly forecast voluntary forest offset prices. As a result, many conclusions are drawn from analogies to compliance markets, which may not fully capture the idiosyncrasies of forest-based credit mechanisms. In particular, the predominance of studies focused on compliance schemes represents a clear limitation for concluding specific to forest carbon. Second, data constraints in the voluntary offset space—particularly the lack of transparent, standardized, and high-frequency pricing data—pose challenges for both model development and cross-study comparison. Third, although much of the existing forecasting literature focuses on general carbon trading schemes, the insights remain relevant to forestry contexts. Forest-based credits are characterized by additionality requirements, risks of non-permanence, market fragmentation, and the generation of co-benefits. These specificities make forecasting especially challenging but also underscore the importance of robust, transparent methods for informing policy and ensuring credibility in forest carbon markets. Additionally, among the studies reviewed, approximately 20% relied on actual trading data (e.g., EU ETS, RGGI), whereas 80% were based on simulations, policy assumptions, or scenario analyses (e.g., several Chinese ETS studies without real trading of forest carbon credits). This distinction is important for interpreting the robustness and transferability of forecasting results. Lastly, the heterogeneity across markets further complicates synthesis. Forecasting results from liquid and mature systems (such as the EU ETS) are not directly comparable to findings from pilot schemes with low volumes and limited trading, such as many Chinese ETS studies. In particular, several Chinese studies included in this review did not involve real forest carbon credit trading, underscoring the need for caution when generalizing results across contexts.

These limitations highlight the need for ongoing, adaptive research and enhanced interdisciplinary collaboration.

5. Conclusions and Implications

5.1. Conclusions

This review systematically examines the current state of research on carbon price forecasting, with particular emphasis on forest carbon markets and the evolving policy environment, especially within the European Union. To our knowledge, no prior systematic review has synthesized the methods and results of carbon price forecasting. This novelty highlights the contribution of the present study, which addresses a significant gap in the academic literature by systematically mapping and evaluating forecasting approaches relevant to both compliance and forest carbon markets.

Through the analysis of 47 studies selected using the PRISMA methodology, a wide range of forecasting approaches were reviewed, from traditional econometric techniques to advanced ML and hybrid frameworks. The accumulated evidence strongly supports the conclusion that data-driven methods—especially when incorporating diverse inputs such as energy prices, financial indicators, public sentiment, and policy signals—can significantly enhance the capacity to anticipate carbon price dynamics. Machine learning models, particularly when embedded within hybrid architectures, have consistently outperformed traditional models in capturing the complex, nonlinear behavior of carbon markets, with demonstrated relevance in both the EU Emissions Trading System (EU ETS) and emerging markets such as China’s. These advances also offer promising, though still nascent, applications for forecasting in the domain of forest-based carbon credits.

Despite these methodological advances, the review also underscores that carbon price forecasting remains a formidable challenge. The principal source of this difficulty lies in the pivotal role of policy and regulatory interventions in shaping market behavior, factors that are often abrupt, exogenous, and difficult to model. Forest carbon offset markets exemplify this complexity, operating at the intersection of ecological processes and financial mechanisms. Unanticipated policy developments, such as the European Union’s proposed prohibition on offset-based neutrality claims or public scrutiny of credit quality, may trigger rapid and unpredictable price movements. In light of these uncertainties, the literature reviewed here increasingly advocates for a shift from deterministic forecasts to scenario-based modeling. Such an approach allows stakeholders to explore a spectrum of future trajectories, ranging from supportive policy environments to restrictive regulatory shifts, thereby enhancing strategic preparedness.

Carbon pricing remains a cornerstone of global climate mitigation policy, and forest carbon markets are likely to assume an increasingly central role in the deployment of nature-based solutions. At the same time, forest carbon markets face challenges different from those of compliance systems. Price volatility is often intensified by the lack of centralized exchanges and the over-the-counter nature of transactions. Additionally, the credibility of certification standards remains under scrutiny, as concerns about additionality, permanence, and monitoring rigor continue to influence buyer confidence. These challenges highlight the urgent need for forecasting models that explicitly consider ecological risks, project-specific factors, and the changing role of certification frameworks. Among the methods reviewed, ensemble and hybrid approaches appear particularly well suited for forest carbon markets, as they can integrate ecological variables with economic and policy drivers. Random forest is also valuable for identifying key determinants of forest credit prices, even when price series are limited. Furthermore, scenario-based modeling is especially relevant for this domain, as it allows researchers and practitioners to capture the impact of sudden policy changes, credit integrity debates, and project-specific risks.

5.2. Implications

The implications of these findings are also relevant for European climate policy. While regulatory clarity and robust credit integrity standards are essential for market credibility, they may introduce short-term disruptions if certain offset categories are constrained. Rather than focusing in detail on specific EU mechanisms, our results highlight the broader need for adaptive governance that balances environmental integrity with price stability. Such principles are equally important for the emerging forest carbon sector, where regulatory shifts and certification frameworks strongly influence market confidence and forecasting reliability.

5.3. Route for Future Studies

The analysis also identifies several key directions for future research. First, there is a clear need to develop forecasting models specifically designed for voluntary and nature-based carbon credit markets. These models should be capable of accounting for distinct risks such as non-permanence, credit heterogeneity, and the valuation of ecological co-benefits. Second, further exploration of ensemble and hybrid modeling frameworks is warranted, especially those that combine the interpretability of economic equilibrium models with the predictive flexibility of machine learning. Third, greater attention must be paid to the interpretability and transparency of ML models. Incorporating domain knowledge and economic constraints into model design may improve its utility for both academic and policy audiences. Finally, the field would benefit from periodic assessments of forecast performance as additional out-of-sample data become available. Such benchmarking will be essential for validating model robustness over time and avoiding overfitting to historical peculiarities.

Author Contributions

Conceptualization, D.C.L. and C.-I.P.; methodology, C.-I.P.; software, A.T.; validation, D.C.L., C.-I.P. and C.S.; formal analysis, C.-I.P.; investigation, A.T.; resources, A.T.; data curation, K.T.; writing—original draft preparation, C.-I.P.; writing—review and editing, C.S.; D.C.L. and A.T.; visualization, K.T.; supervision, D.C.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Acknowledgments

All errors and omissions remain the responsibility of the authors.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| ML | Machine learning |

| EU ETS | European Union Emissions Trading System |

| CRCF | Carbon Removal Certification Framework |

| EU | European Union |

| PRISMA | Preferred Reporting Items for Systematic Reviews |

| ANNs | Artificial neural networks |

| SVMs | Support vector machines |

| LSTM | Long short-term memory |

| EMD | Empirical Mode Decomposition |

| SSA | Singular Spectrum Analysis |

| LULUSF | Land Use, Land-Use Change and Forestry |

| NDC | Nationally Determined Contribution |

| CDM | Clean Development Mechanism |

| MSR | Market Stability Reserve |

Appendix A

Table A1.

Summary of reviewed studies on carbon price forecasting in forest and emissions markets (2018–2025).

Table A1.

Summary of reviewed studies on carbon price forecasting in forest and emissions markets (2018–2025).

| No. | Title | Authors | Forecasting Approach | Data and Features Used |

|---|---|---|---|---|

| [20] | Efficient ML technique in blockchain- based solution in carbon credit for mitigating greenwashing (2025) | Raja Segaran B.; Mohd Rum S.N.; Hafez Ninggal M.I.; Mohd Aris T.N. | Integrative approach using blockchain + Machine Learning (supervised ML models like Random Forest, XGBoost, Neural Networks) to detect fraud in carbon credits | Large datasets, including transaction records with satellite imagery and corporate disclosures as features |

| [21] | Remote sensing-based soil organic carbon monitoring using advanced ML techniques under conservation agriculture systems (2025) | Beisekenov N.; Banakinaou W.; Ajayi A.D.; Hasegawa H.; Tadao A. | Ensemble ML models for SOC Prediction (Random Forest, SVM, XGBoost—XGBoost yielded the highest accuracy) | Satellite data (Sentinel-1 SAR and Sentinel-2 MSI) with derived vegetation indices (NDVI, EVI, SAVI) as predictors; field SOC measurements for training. |

| [71] | An adaptive multi-factor Integrated forecasting model based on periodic reconstruction and random forest for carbon price (2025) | Zhao S.; Wang Y.; Deng J.; Li Z.; Deng G.; Chen Z.; Li Y. | Hybrid AI model combining periodic signal decomposition with a Random Forest regression (multi-factor, adaptive forecasting) | Multi-factor inputs: historical carbon prices with economic indicators, energy prices, and policy event variables (periodic components reconstructed for seasonality) |

| [45] | Deep Learning Approaches for Enhanced Predictive Modeling of Carbon Prices (2025) | Zhou Q. | Deep learning (DL)—proposed a hybrid LSTM—Transformer model for carbon price prediction. | Historical carbon price time-series (likely EU or China ETS data); feature extraction for nonlinear patterns (the model combines sequence learning with attention). |

| [22] | Machine learning enhancing biochar abatement predictions: Advancing China climate goals for food production and promoting application (2025) | Li Y.; Li L.; Sun H.; Zhang H.; Zhan W.; Zuo W.; Chen J.; Yong B.; Yong B.; Tian Y. | Predictive modeling with ML for biochar’s climate impact—data-driven model identifying optimal biochar use. | Extensive field and experimental datasets on biochar applications (soil properties, climate factors, feedstock types) analyzed by AI |

| [23] | Distortion amplification effects caused by imperfect climate policies: Evidence from China’s ETS (2025) | Wu L.; Zhang J.; Zhu Q.; Zhou D. | Causal analysis using econometrics + Machine Learning (Difference-in- Differences with a Double ML framework). | Panel data from 30 Chinese provinces (2000–2022): energy consumption, emissions, and carbon trading info. |

| [31] | A study on the differentiation of carbon prices in China: Insights from eight carbon trading pilots (2025) | Zhang T.; Deng M. | Comparative statistical analysis of regional carbon market drivers (unified factor framework for cross-market comparison). | Carbon price data from 8 pilot ETS regions in China (2013–2021) and regional factors (GDP, energy mix, policy stringency, etc.). |

| [42] | A hybrid model for carbon price forecasting based on SSANSTransformer: Considering the role of multi-stage carbon reduction targets (2025) | Li, J.; Guo, Y. | Hybrid timeseries model: Singular Spectrum Analysis (SSA) for trend extraction + a custom NSTransformer (novel transformer architecture) for prediction. | Historical carbon prices (likely China’s market), combined with policy stage data (multistage emission reduction targets timeline as input features). |

| [72] | Modest forest and welfare gains from initiatives for reduced emissions from deforestation and forest degradation (2024) | Wunder S.; Schulz D.; Montoya-Zumaeta J.G.; Börner J.; Frey G.P.; Betancur-Corredor B. | Meta-analysis (counterfactual evaluations) of REDD+ program impacts, assisted by machine learning literature review tools. | Global REDD+ studies (32 quantitative evaluations: 26 environmental effect sizes, 12 socioeconomic effect sizes). |

| [62] | Remote sensing-based mangrove blue carbon assessment in the Asia-Pacific: A systematic review (2024) | Dutta Roy A.; Pitumpe Arachchige P.S.; Watt M.S.; et al. | Systematic review of remote-sensing and modeling approaches for mangrove “blue carbon” estimation. | Literature corpus of Asia-Pacific mangrove studies using various remote sensors (satellite optical, radar, LiDAR) and carbon estimation models. |

| [46] | Accessing and modelling soil organic carbon stocks in Prairies, Savannas, and forests (2024) | Ruiz Potma Gonçalves, D.; Massao Inagaki, T.; Gustavo | Comparative modeling study using multiple SOC estimation methods across different ecosystems. | Soil organic carbon datasets from prairie grasslands, savanna woodlands, and forest sites; accompanied by climate and soil property data. |

| [34] | Application of Dynamic Weight Mixture Model Based on Dual Sliding Windows in Carbon Price Forecasting (2024) | Liu, R.; He, W.; Dong, H.; Han, T.; Yang, Y.; Yu, H.; Li, Z. | Ensemble forecasting model with dynamic weights, using two sliding time windows for model updating. | Carbon price time-series (e.g., EU ETS daily prices), split into recent-window and historical window for model calibration; uses multiple submodels (e.g., ARIMA, ANN) combined. |

| [43] | A multifactor hybrid model for carbon price interval prediction based on decomposition integration framework (2024) | Zheng, G.; Li, K.; Yue, X.; Zhang, Y. | Hybrid interval forecasting using time-series decomposition + multiple models integration for prediction intervals. | Carbon price data (possibly China’s or EU’s), decomposed into components (trend, cyclical, residual), with separate predictive models for each; multifactor inputs like energy prices, GDP for each |

| [89] | A Hybrid Model for Carbon Price Forecasting Based on Improved Feature Extraction and Non-Linear Integration (2024) | Zhu, Y.; Chen, Y.; Hua, Q.; Wang, J.; Guo, Y.; Li, Z.; Ma, J.; Wei, Q. | Two-stage hybrid model: advanced feature extraction (to capture latent patterns) followed by nonlinear ensemble integration of multiple prediction models. | Historical carbon price data enriched with extracted features (e.g., Principal components, wavelet coefficients capturing cycles) that feed into an ensemble of nonlinear models (like ANN, SVR, decision trees). |

| [54] | Forecasting carbon prices in China’s pilot carbon market: A multi-source information approach with conditional generative adversarial networks (2024) | Huang, Z.; Zhang, W. | Deep learning approach using Conditional GAN (cGAN) for timeseries forecasting, incorporating multi-source inputs. | China pilot market carbon price data, combined with multi-source information such as macro indicators (e.g., industrial production index), energy prices, and possibly climate policy news sentiment as conditioning inputs to the cGAN. |

| [24] | Analysis of China’s carbon market price fluctuation and international carbon credit financing mechanism using random forest model (2024) | Song, C. | Random Forest analysis to identify drivers of price volatility and the role of financing mechanisms. | China’s carbon price data (time series of price and volume) and data on carbon credit financing (e.g., number of carbon loans, investments, offset credit issuances). |

| [25] | Leveraging machine learning to forecast carbon returns: Factors from energy markets (2024) | Xu, Y.; Dai, Y.; Guo, L.; Chen, J. | Regression ML model (e.g., gradient boosting) to predict carbon allowance returns using energy market variables. | Carbon returns (percentage change in carbon price) as target, with features from energy markets: oil, natural gas, coal prices, electricity indices, and possibly renewable generation data. |

| [35] | Forest carbon sequestration mapping and economic quantification infusing MLPnn–Markov chain and InVEST carbon model in Askot Wildlife Sanctuary, Western Himalaya (2024) | Verma, P.; Siddiqui, A.R.; Mourya, N.K.; Devi, A.R. | Hybrid modeling: Markov chain +MLP neural network for land use change projection, coupled with InVEST carbon sequestration model for carbon accounting. | Satellite landcover data for Askot Sanctuary (past and current), socioeconomic data for land use trends, and carbon stock values (biomass densities) for different land cover types. |

| [77] | Optimal weight random forest ensemble with Fuzzy C-means cluster-based subsampling for carbon price forecasting (2024) | Zhang, Y.; Li, Y.; Che, J. | Ensemble method: multiple Random Forest models trained on clustered subsamples of data (via Fuzzy CMeans), combined with optimized weights. | EU ETS carbon price data (daily) divided into clusters (regimes) based on patterns; each RF specializes on a cluster’s data; ensemble weighting optimized (e.g., by validation performance per cluster). |

| [61] | Potential Fraud Detection in Carbon Emission Allowance Markets Using Unsupervised Machine Learning Models (2024) | Hosseini, S.A.; Grimaccia, F.; Niccolai, A.; Lorenzo, M.; Casamatta, F. | Unsupervised anomaly detection (e.g., Isolation Forest, K-Means clustering) to flag irregular trading patterns indicative of fraud. | Market transaction data from carbon trading exchanges: trade volumes, prices, timestamps, participant IDs (possibly). |

| [40] | Advanced Pattern Detection and Trend Forecasting in European Carbon Markets Using Machine Learning Algorithms (2024) | Hosseini, S.A.; Niccolai, A.; Lorenzo, M.; Casamatta, F.; Grimaccia, F. | Pattern recognition + forecasting using ML (e.g., Support Vector Machines for classification of patterns, and regression trees or LSTM for trend prediction). | EU ETS market data spanning multiple phases; Technical indicators (moving averages, volatility) and macro signals as features. |

| [64] | Geospatial Foundational Model for Canopy Height Estimates Across Kenya’s Ecoregions (2024) | Da Silva, A.F.; Zortea, M.; Kuehnert, J.; Atluri, A.; Singh, G.; Srinivasan, H.; Klein, L.J. | Geospatial ML model (likely a deep neural network or large pretrained model) to predict forest canopy height from multi-source remote sensing. | Satellite data: GEDI LiDAR points (providing sample canopy heights) combined with wall-to-wall satellite imagery (optical, radar) across Kenya; topographic and climate layers as Additional features. |

| [85] | Multisource Data-Driven Carbon Price Composite Forecasting Model: Based on Feature Selection and Multiscale Prediction Strategy (2024) | Zou, S.; Zhang, J. | Composite forecasting model integrating multiple data sources and prediction horizons, with a feature selection step to pick informative inputs. | Carbon price data (target) with a wide set of candidate predictors: energy prices, economic indices, weather data, web search trends, etc. The model uses algorithms (e.g., mutual information or Boruta) to select top features, and employs different models for short-term vs. long-term predictions, which are then combined. |

| [48] | Carbon price Prediction based on decomposition technique and extreme gradient boosting optimized by the grey wolf optimizer algorithm (2023) | Feng, M.; Duan, Y.; Wang, X.; Zhang, J.; Ma, L. | Hybrid prediction model: timeseries decomposition (e.g., EMD/EEMD) + XGBoost machine learning, with hyperparameters tuned by Grey Wolf Optimizer (GWO). | Historical carbon price series (EU ETS Phase III daily prices, as an example), decomposed into intrinsic mode functions (IMFs representing trend and cycles); these IMF components are each predicted by XGBoost models. The GWO algorithm optimizes XGBoost parameters (trees, depth, learning rate). |

| [50] | The relationship between contaminating industries and the European carbon price: Machine learning approach (2023) | Nadirgil, O. | Supervised ML analysis (e.g., random forest or elastic net) linking industrial activity indicators to carbon price levels. | EU ETS carbon price data and industrial sector data (production/output indices for heavy industries like steel, cement, power; emissions data; perhaps sectoral stock indices as proxies). |

| [65] | Urban Carbon Price Forecasting by Fusing Remote Sensing Images and Historical Price Data (2023) | Mou, C.; Xie, Z.; Li, Y.; Liu, H.; Yang, S.; Cui, X. | Data fusion approach: combines remote sensing-derived emissions indicators with traditional time series models for local carbon price forecasting. | Satellite remote sensing data for urban areas (e.g., night-time light intensity, NO2 concentration maps as proxy for emissions) alongside historical carbon price series for that region’s market. Possibly auxiliary data, like temperature for power demand. |

| [44] | Carbon prices forecasting based on the singular spectrum analysis, feature selection, and deep learning: Toward a unified view (2023) | Zhang, C.; Lin, B. | Integrated framework: uses Singular Spectrum Analysis (SSA) for trend extraction, a feature selection method to pick relevant inputs, and a deep learning model (e.g., LSTM) for forecasting—presented as a unified approach. | Carbon price time-series (EU ETS or other) along with candidate features (macro indicators, energy prices, past volatility). SSA decomposes the series into trend and oscillatory components; feature selection (maybe genetic algorithm or mutual info) chooses which external inputs to include; the deep learning model then learns from the reconstructed series + selected features. |

| [49] | Forecasting the Return of Carbon Price in the Chinese Market Based on an Improved Stacking Ensemble Algorithm (2023) | Ye, P.; Li, Y.; Siddik, A.B. | Stacking ensemble learning to predict carbon price returns (percentage changes), with improvements like optimized base-learners and meta-learner tuning. | China’s carbon market data (e.g., daily return of the national carbon price index) and a set of base model predictions (e.g., outputs from ARIMA, SVR, LightGBM, etc.), which are fed into a metalearner (e.g., a second-stage ML like XGBoost). The improved stacking may involve cross-validation stacking and hyperparameter optimization for each layer. |

| [74] | Forecasting carbon price in China using a novel hybrid model based on secondary decomposition, multicomplexity and error correction (2023) | Yang, H.; Yang, X.; Li, G. | Three-stage hybrid model: (1) Secondary decomposition—apply two levels of time-series decomposition (e.g., EEMD then VMD) to carbon price data; (2) fit models to components addressing different complexities (like linear vs. nonlinear patterns); (3) apply an error correction module to adjust residual biases. | China’s carbon price series (e.g., national CCER price or allowance price)—decomposed into trend, seasonal, high-frequency noise, etc. Each type of component might be handled by a different model (linear regression for trend, ANN for nonlinear residual). The error correction might use a statistical model on the final residuals. |

| [32] | Using machine learning with case studies to identify practices that reduce greenhouse gas emissions across Australian grain production regions (2023) | Meier, E.; Thorburn, P.; Biggs, J.; Palmer, J.; Dumbrell, N.; Kragt, M. | Data-driven analysis of agricultural practices using ML classification/regression to find which farming practices most reduce GHG emissions. | Case study data from Australian grain farms—including farming practices (tillage type, fertilizer usage, crop rotation, residue management) and measured or estimated GHG emissions (e.g., CO2, N2O) for each farm/season. Possibly also soil and climate data per case. |