1. Introduction

In Peru, 89,749 producers depend directly on cocoa cultivation, with 11,666 producers located in Amazonas. Cocoa represents 3.4% of the total national agricultural production of Peru and ranks eighth among the main export products (Free on Board (FOB) USD 154,094.92) [

1]. In Amazonas, at the end of 2023, cocoa became the third highest-exported product (FOB USD 420,682) after coffee and tara, reporting a negative variation (−21.4%) compared to exports in 2022 [

2]. On the other hand, cocoa production in the Amazon region has experienced variations in the last three years. From 2021 to 2022, there was an increase of 26%, from 3085.50 tons to 5887.60 tons. However, in 2023, production fell by 14.18% compared to the previous year, to 3085.50 tons [

1].

The decline in production and yields may be attributed to farms being affected by the increasing incidence of pests, which results in crop migration. Additionally, other factors impacting yield and therefore profitability include the high cost of inputs required for production, limited access to credit, and low selling prices of fine-aroma cocoa [

3]. In addition to the above, there are current limitations in the market due to the presence of cadmium in cocoa beans [

4], which hinders the entry of cocoa to all markets, making economic profitability one of the most important weaknesses of cocoa production [

5].

If we analyze the profitability of cocoa according to the benefit–cost ratio and yield, it is said that cocoa cultivation becomes profitable if it reaches a minimum production of 770 kg of dry cocoa per hectare [

6]. However, cocoa farms that are associated under an agroforestry system can be more beneficial as they can contribute up to 12% of gross income [

7] and can diversify economic income; this diversification of income also serves as an alternative to mitigate the impacts of climate change [

8], thereby seeking to minimize the negative effect of market price and production fluctuation on household income [

9].

On the other hand, reducing tax obligations for producers, companies, and/or organizations by employing more efficient energy in their activities is a mitigation alternative that has gained more prominence in recent years, known as the carbon tax [

10]. These actions are necessary, as unsustainable energy use and land use change are the main drivers for the ongoing increase in greenhouse gas emissions, collectively representing 47% of total greenhouse gas (GHG) emissions in Latin America and the Caribbean [

11,

12]. Despite the persistent issue, a few countries such as Colombia, Costa Rica, Chile, and Uruguay have presented and/or are implementing strategies to address this problem. Therefore, the IPCC, in its sixth assessment report, mentions that there are options in all areas to reduce emissions by at least half by 2030 [

11].

Furthermore, the Kyoto Protocol details regulations for the operation of the international carbon emissions market, where developed countries have a commitment to reducing the level of GHG emissions and not exceeding the permissible level. To achieve this, through the Clean Development Mechanism, the World Bank finances carbon sequestration [

13]. The adoption of this mechanism involves transactions between developed and developing countries through projects aimed at mitigating and/or capturing GHGs [

14]. Therefore, Peru, a developing country, currently has potential for implementing these types of projects, which facilitate the sale or issuance of certificates for reduced GHG emissions.

Under this context, recent trends show that carbon market opportunities continue to expand. For example, the total value of global markets grew by 11%, from USD 159,210 million in 2010 to USD 176,027 million in 2011. The volume has also increased from 88,835 to 101,189 tons of CO

2 equivalent per year [

15]. By 2021, the increase in global emissions of more than 2 billion tons was the largest in absolute terms ever, as energy demand in this year recovered compared to the previous year [

16]. Additionally, global revenues from carbon pricing increased by almost 60% in 2021 compared to 2020 levels, reaching approximately USD 84 billion [

17]. Therefore, more than two-thirds of countries now plan to use carbon markets to meet their nationally determined contributions stipulated in the Paris Agreement [

18], a document in which all developing countries commit to reducing their GHG emissions to limit warming to below 1.5 °C by 2030.

In this context, cocoa production faces significant challenges to improve its profitability. Efforts should focus on increasing production, combating phytosanitary problems, and addressing the effects of climate change. The implementation of agroforestry systems in cocoa cultivation emerges as a strategy to diversify income, conserve biodiversity, and provide ecosystem services, among others. Therefore, the implementation of research and programs that quantify the amount of CO2 sequestered by cocoa agroforestry systems and their economic evaluation in the region are vital to improve profitability and develop climate change mitigation strategies.

Therefore, the objective of this study was to evaluate the economic profitability of carbon sequestration of native fine-aroma cacao agroforestry systems in Amazonas, Peru. The specific objectives of this study were (i) to calculate the dry cocoa yield per hectare and CO2 sequestration of agroforestry systems (tons of CO2 per hectare per year), (ii) to calculate the income and expenditures of cocoa production, and (iii) to calculate the economic evaluation (Economic Net Present Value (NPV), Economic Internal Rate of Return (EIRR), and benefit–cost ratio (B/C)) of carbon sequestration in the agroforestry systems through the implementation of an environmental services project.

4. Discussion

The study reported that the producers involved own farms ranging from 0.25 ha to 5 ha, which may explain why 95% of Peru’s annual cocoa production comes from small producers with a planted area of between one and five hectares [

29].

The average yield of the APROCAM cooperative’s AFS is 957 kg of dry cocoa per hectare, which is above the national average (850 kg/ha) [

30]. This could support the consistent projection of production over the 5-year evaluation period of the study. The possibility that cocoa yields will increase and be higher is as the producer’s experience and access to credit is greater [

31]. In addition, the producer’s membership in an association increases the probability of improving crop yields [

31]. This positive relationship is due to the fact that farmers with greater experience in cultivation can more confidently understand appropriate agronomic practices, soil management, pest and disease control, as well as the selection of suitable varieties, as these are the factors directly impacting cocoa profitability. Additionally, access to credit allows the producer to invest in agricultural inputs and the adoption of improved practices in cocoa agroforestry systems. Finally, producer association will be reflected in the improvement of opportunities for access to competitive and broader markets. Associated producers can offer volume and product quality, which leads to improved selling prices.

In 2022, the national farm-gate selling price was reported to be PEN 7.17/kg dry cocoa, and in 2023, the farm-gate selling price was reported to be PEN 8.08/kg dry cocoa, evidencing an increase in PEN 0.91 in one year [

1]. These prices are within the sales range of APROCAM cooperative producers, who in 2022 sold their dry cocoa at an average price of 7.30 soles per kg at the farm gate, exceeding the national price that year. The higher selling price compared to the national average price may be due to cooperative members growing fine-flavor cocoas, which command a premium price in specialty markets. However, these data may be affected by external factors such as possible extreme weather events affecting production, market fluctuations, regulations, policies, and fluctuations in the dollar exchange rates, among others. However, in the economic analysis, a selling price of PEN 7.30/kg of dry cocoa was used because it was assumed that these external factors could be compensated for by the advancement of technological innovations, sales to differentiated markets, and the application of sustainable farm management.

The criterion to keep the yield and selling price of cocoa constant over the 5 years of evaluation is conservative, as the analysis of implementing environmental services does not directly intervene in cocoa production. Although the statistics show that from 2019 to 2022, cocoa yield has experienced a slight increase, from 5107.58 tons in 2019 to 5887.60 tons of dry cocoa harvested at the regional level, it does not guarantee that in 2023 the yield will decrease by 14% [

1].

Therefore, the instability of production in each year can affect its profitability. This is compounded by the high production costs, which, by being elevated, decrease the return on investment, making it difficult to cover and finance the future growth of the production unit [

32]. To address this issue, stakeholders in the chain are seeking alternatives to improve cocoa profitability. Recent international climate documents highlight the significant importance of afforestation of agricultural lands, which has a positive impact on CO

2 levels, not only through carbon absorption by trees that can be economically valued but also through the substitution of fossil fuels with biomass [

33]. Therefore, valuing the ecosystem systems of multifunctional agroforestry would result in a change in land use [

34], which directly favors producers. Exploiting these opportunities is made effective through the implementation of environmental service projects that sell carbon credits, allowing cocoa producers to diversify their income and obtain a carbon-neutral certification in the future.

In Latin America, to evaluate the profitability of the implementation of a project, the NPV and EIRR values are evaluated [

35]. These indicators are essential tools for assessing the feasibility and profitability of various ventures, aiding in decision making related to resource allocation [

36]. Their use is based on the close relationship between both indicators; NPV is a popular metric used to assess the economic performance of a project and is also used to calculate the value of EIRR [

37].

Therefore, NPV, EIRR, and the benefit–cost ratio are the most common and reliable indicators for investment decision making. According to these economic profitability indicators, the implementation of an environmental services project selling carbon credits in the study area would be profitable, yielding a profit of PEN 1,454,994.2 after 5 years of investment, with an EIRR of 44%, affirming the project’s viability.

In Colombia, a study determined that payments for ecosystem services exceeding 453.6 USD/ha/year are considered highly profitable in terms of NPV. Additionally, agroforestry systems with cocoa can receive payments of up to 36 USD/Tn CO

2 [

38], in this context, the cocoa agroforestry systems in this study can generate an NPV of PEN 13,956.78/ha/year, a value similar to that reported in previous research. Analyzing these payments for environmental services is important as they have become a means to promote biodiversity conservation and rural development, particularly in tropical and subtropical regions [

39,

40].

The results do not include a financial profitability analysis, because the analysis did not consider access to a loan for the project implementation, and thus, the financial profitability is the same as the economic one. APROCAM did not consider acquiring a loan, as a cooperative has the opportunity to acquire non-repayable funds from local, regional governments, NGOs, and other national and international funding sources. Access to credit for project implementation could raise production costs, and the return on investment might be slower. Regarding the benefit–cost ratio, the results indicate a positive ratio greater than 1. This value suggests that the project is economically viable, as the expected benefits of the project are 1.86 times greater than the implementation costs. In a different scenario, if the costs were to exceed the benefits, the project would not be economically viable and therefore would not be accepted for financing [

26].

When exploring the impact of carbon income on the profitability of agroforestry systems compared to monoculture, it was found that there is a possibility to increase profitability minimally by 0.5% when the carbon price ranges between 8 USD/Tn CO

2e and a maximum of 70% when considering the highest carbon price (40 USD/Tn CO

2e) and the highest carbon discount rate (17.2 Tn C/ha for year) [

41]. The present study conducted in the APROCAM cooperative demonstrates that, when considering a selling price of 7 USD/Tn CO

2e, cocoa agroforestry systems that include the carbon price are economically profitable, thus reinforcing the theory that the economic values of associated ecosystem services always have to increase the profitability of the system [

34]. Additionally, the sensitivity analysis of project implementation suggests that the decline in cocoa production (kg/ha) and the selling price of dry cocoa (PEN/ha) may jeopardize the project’s profitability, as a decrease of 47.49% in both leads to the EIRR value reaching the minimum profitability threshold (12%). Conversely, in a scenario where carbon selling prices and sequestration decrease by 80%, the project remains profitable. Therefore, the implementation of an environmental services project can significantly support the profitability of cocoa production under agroforestry systems. This is because the proper integration of trees into cultivated lands can provide greater welfare benefits for society as a whole, a case that does not occur with treeless agriculture or forest systems alone [

42].

Therefore, the implementation of agroforestry systems must be accompanied by principles related to land use planning and biodiversity, which will allow for a greater positive social and environmental impact [

43]. The social impacts will be reflected in the improvement of the quality of life of producers, as there will be greater opportunities to access basic services, especially education and health, job creation, community support through associativity, among others.

Therefore, the efficient use of agricultural lands is an alternative to contribute to the fulfillment of the Kyoto Protocol and the Paris Agreement objectives, which were created to reduce global greenhouse gas emissions. Agricultural lands are an important potential sink and could absorb large amounts of carbon. It is important to reintroduce trees into systems and manage them wisely along with the main crops and/or animals [

44]. These carbon-sequestering agricultural production systems have the potential to generate income for producing families [

45]. Peru, being a developing country, also has the commitment to adopt technologies, processes, and programs to limit global warming to below 1.5 °C by 2030; implementing a carbon tax and carbon bond sales can be carried out to counteract emissions from developed countries. To implement these strategies, cocoa agroforestry systems play a very important role, as it has been explained that their benefits are wide-ranging, involving economic, environmental, and social factors. The success of the implementation of these strategies will depend on the support of local and regional governments involved in the sector through the implementation and execution of political and environmental regulations.

Therefore, the economic analysis of this study serves as a precedent for local, regional, and national governments to implement environmental payment programs, either through fiscal incentives and/or subsidies. The coordination that governments can establish between environmental certifiers and cocoa producer organizations is the basis for developing environmental certification and labeling standards. These actions should be accompanied by continuous education and training for cocoa producers on the proper management of agroforestry systems and the benefits that carbon capture within these systems provides.

5. Conclusions

The results of the economic evaluation suggest that the implementation of a project focused on selling carbon credits could be economically viable. With an NPV of PEN 1,454,547.8, an EIRR of 44%, and a benefit–cost ratio of 1.86, the economic viability of the proposed project is evident.

These findings highlight the potential of carbon sequestration and emissions trading as innovative approaches for rural economic development and environmental conservation. According to the economic indicators evaluated, a promising alternative exists for national, regional, local governments, and/or peasant organizations to implement and promote ecosystem service programs. These programs can not only contribute to cocoa production income but also have the potential to mitigate climate change by promoting sustainable agricultural practices.

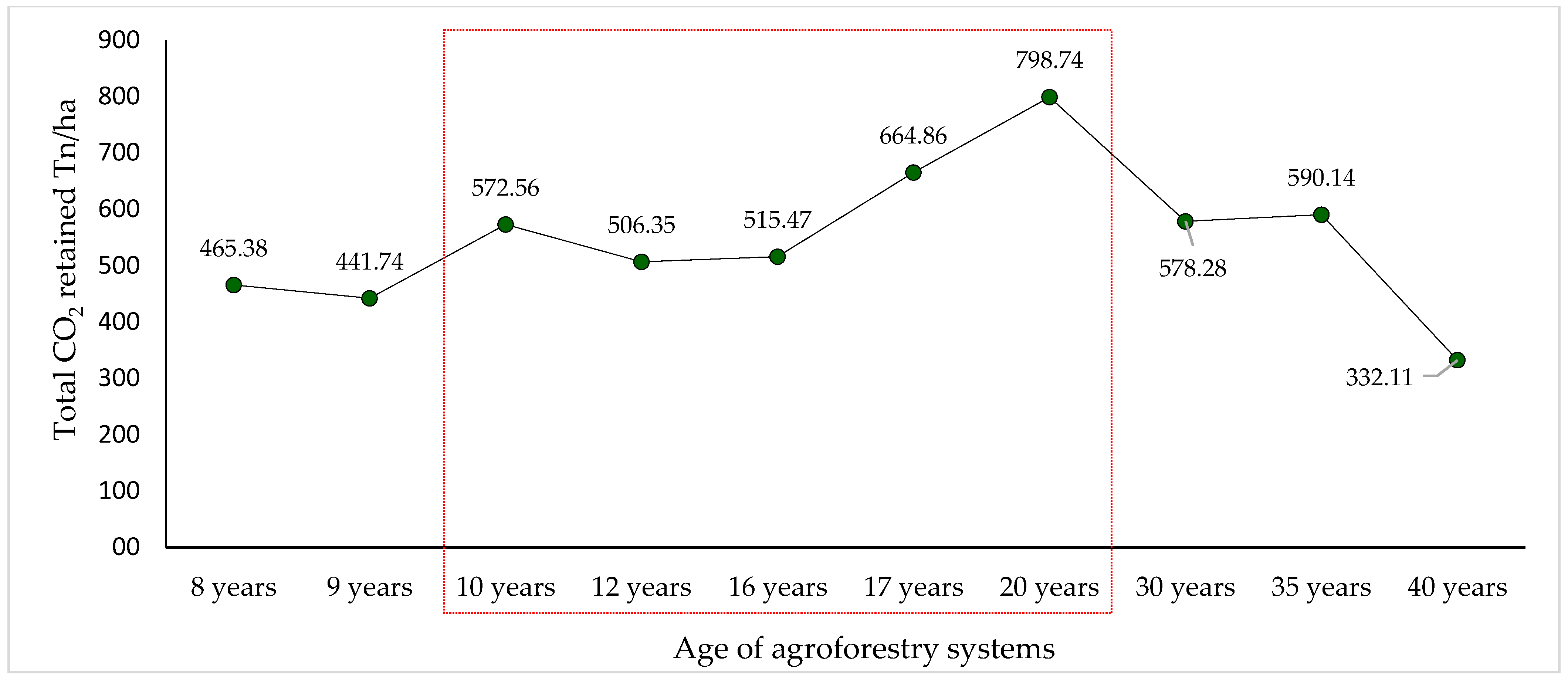

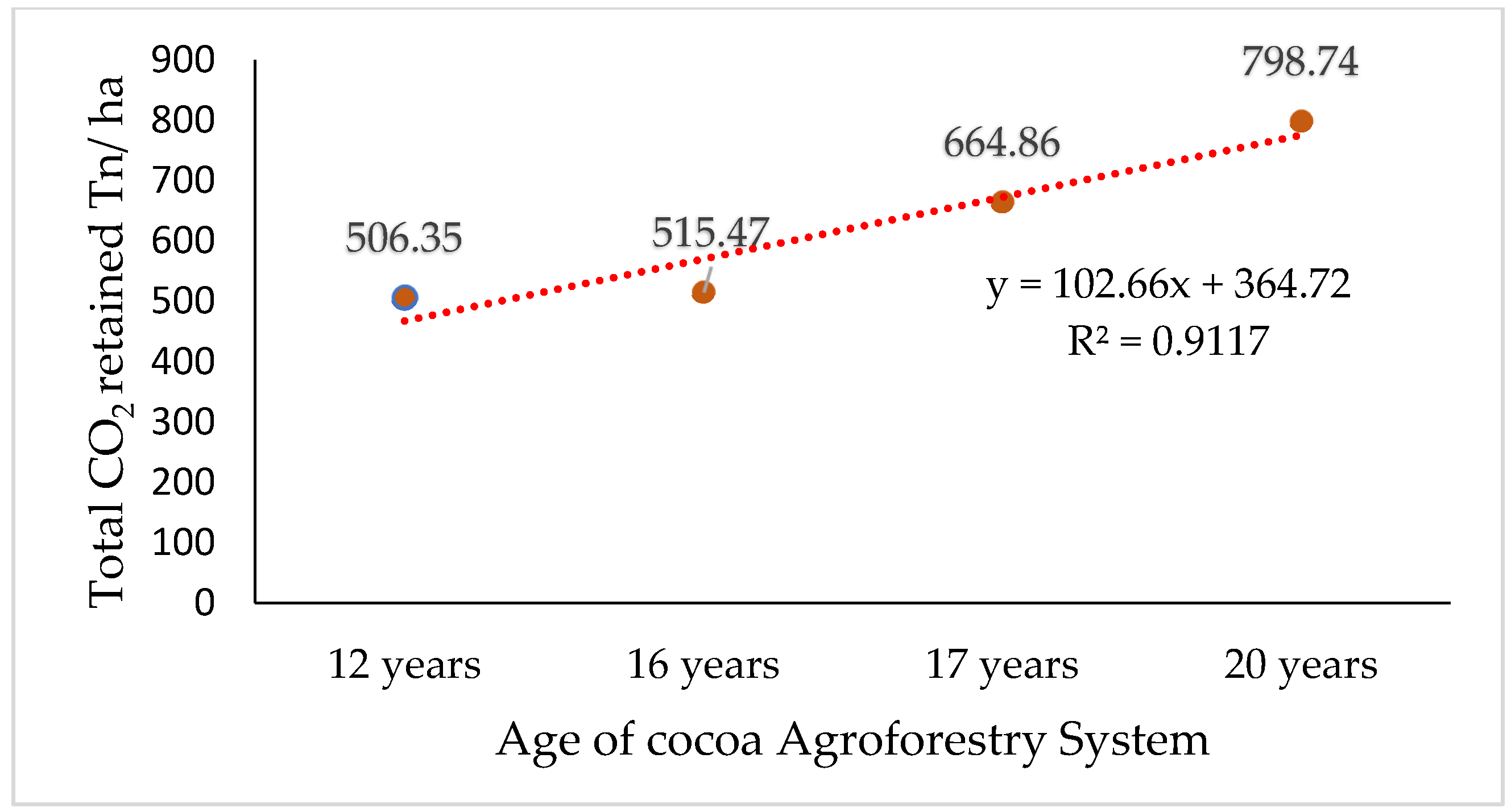

For future research, in addition to studying the socioeconomic characteristics of cocoa producers, should focus on validating the methodology for quantifying carbon sequestration in agroforestry systems. It is essential to subject this methodology to rigorous evaluation by an environmental services certifier, especially regarding the accurate quantification of carbon sequestration per hectare per year.