Assessing the Economic Impact of Forest Management in the Brazilian Amazon Through Real Options Analysis

Abstract

:1. Introduction

2. Materials and Methods

2.1. Study Area

2.2. The Steps of the Investment Decision Model for SFM Projects

2.3. Cash Flow

2.3.1. Main Components

2.3.2. Financial Analysis

2.4. Deterministic Input

2.5. Investment Project Volatility

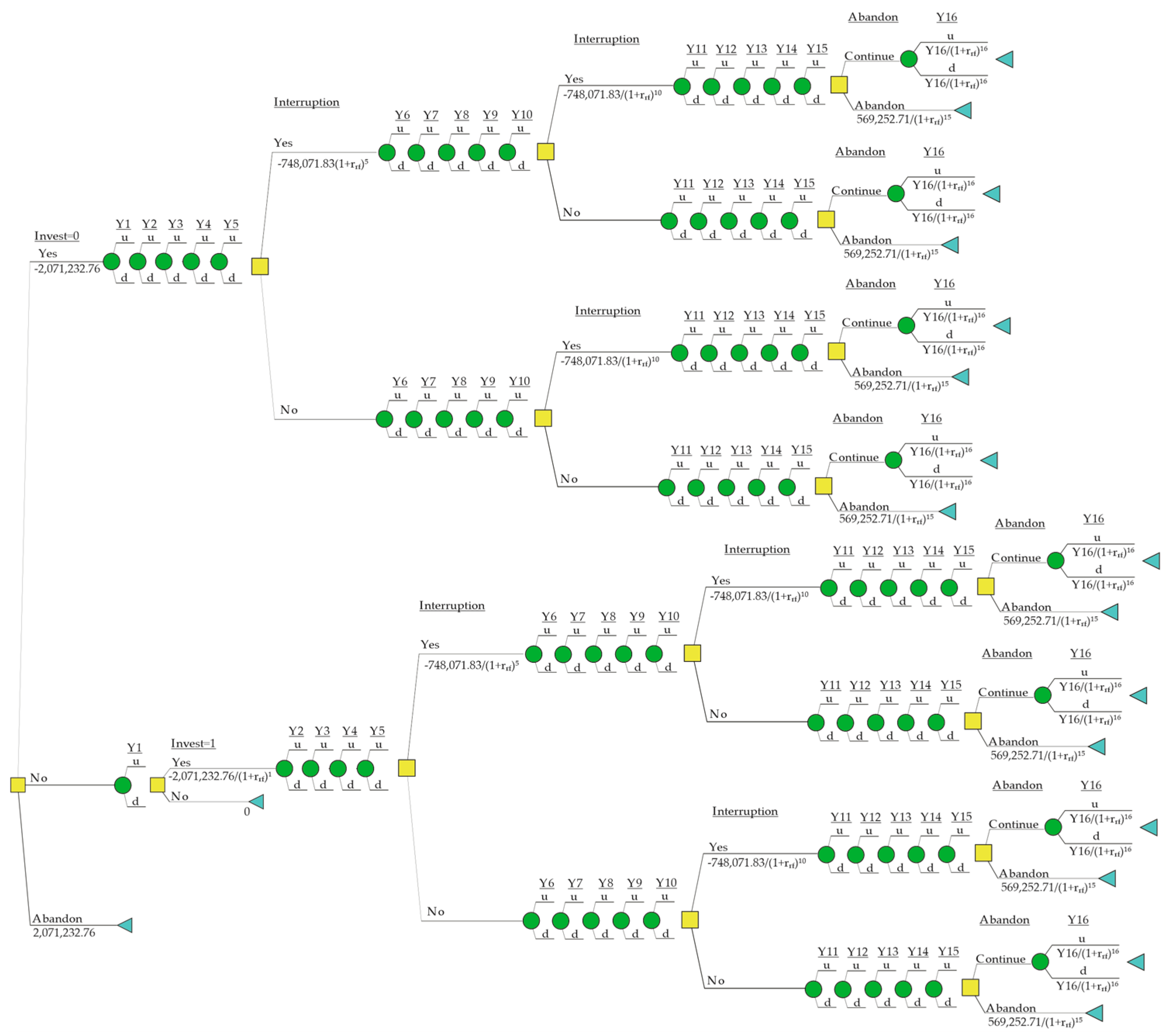

2.6. Calculation of Real Options

3. Results and Discussion

3.1. Deterministic Input

3.2. Investment Project Volatility

3.3. Calculation of Real Options

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Barlow, J.; França, F.; Gardner, T.A.; Hicks, C.C.; Lennox, G.D.; Berenguer, E.; Castello, L.; Economo, E.P.; Ferreira, J.; Guénard, B.; et al. The Future of Hyperdiverse Tropical Ecosystems. Nature 2018, 559, 517–526. [Google Scholar] [CrossRef] [PubMed]

- Wilson, S.J.; Schelhas, J.; Grau, R.; Nanni, A.S.; Sloan, S. Forest Ecosystem-Service Transitions: The Ecological Dimensions of the Forest Transition. Ecol. Soc. 2017, 22, art38. [Google Scholar] [CrossRef]

- Davidson, E.A.; de Araújo, A.C.; Artaxo, P.; Balch, J.K.; Brown, I.F.; Bustamante, M.M.; Coe, M.T.; DeFries, R.S.; Keller, M.; Longo, M.; et al. The Amazon Basin in Transition. Nature 2012, 481, 321–328. [Google Scholar] [CrossRef] [PubMed]

- Silva Junior, C.H.L.; Aragão, L.E.O.C.; Anderson, L.O.; Fonseca, M.G.; Shimabukuro, Y.E.; Vancutsem, C.; Achard, F.; Beuchle, R.; Numata, I.; Silva, C.A.; et al. Persistent Collapse of Biomass in Amazonian Forest Edges Following Deforestation Leads to Unaccounted Carbon Losses. Sci. Adv. 2020, 6, eaaz8360. [Google Scholar] [CrossRef]

- Amazonia, M. Collection 4.0 of Annual Maps of Land Cover and Land Use in the Amazon. Available online: https://brasil.mapbiomas.org/wp-content/uploads/sites/4/2023/08/FactSheet_Panamazonia_INGLES_09.08.pdf (accessed on 16 October 2024).

- INPE PRODES. Coordenaçao-Geral de Observaçao da Terra. Available online: https://terrabrasilis.dpi.inpe.br/app/dashboard/deforestation/biomes/legal_amazon/rates (accessed on 18 November 2024).

- Koval, V.; Mikhno, I.; Trokhymets, O.; Kustrich, L.; Vdovenko, N. Modeling the Interaction between Environment and the Economy Considering the Impact on Ecosystem. E3S Web Conf. 2020, 166, 13002. [Google Scholar] [CrossRef]

- Garrett, R.D.; Cammelli, F.; Ferreira, J.; Levy, S.A.; Valentim, J.; Vieira, I. Forests and Sustainable Development in the Brazilian Amazon: History, Trends, and Future Prospects. Annu. Rev. Environ. Resour. 2021, 46, 625–652. [Google Scholar] [CrossRef]

- Brancalion, P.H.S.; de Almeida, D.R.A.; Vidal, E.; Molin, P.G.; Sontag, V.E.; Souza, S.E.X.F.; Schulze, M.D. Fake Legal Logging in the Brazilian Amazon. Sci. Adv. 2018, 4, eaat1192. [Google Scholar] [CrossRef]

- Guan, Z.; Chen, X.; Xu, Y.; Liu, Y. Are Imports of Illegal Timber in China, India, Japan and South Korea Considerable? Based on a Historic Trade Balance Analysis Method. Int. Wood Prod. J. 2020, 11, 211–225. [Google Scholar] [CrossRef]

- Baragwanath, K.; Bayi, E. Collective Property Rights Reduce Deforestation in the Brazilian Amazon. Proc. Natl. Acad. Sci. USA 2020, 117, 1–8. [Google Scholar] [CrossRef]

- Bonilla-Bedoya, S.; Estrella-Bastidas, A.; Molina, J.R.; Herrera, M.Á. Socioecological System and Potential Deforestation in Western Amazon Forest Landscapes. Sci. Total Environ. 2018, 644, 1044–1055. [Google Scholar] [CrossRef]

- Lima, T.A.; Beuchle, R.; Griess, V.C.; Verhegghen, A.; Vogt, P. Spatial Patterns of Logging-Related Disturbance Events: A Multi-Scale Analysis on Forest Management Units Located in the Brazilian Amazon. Landsc. Ecol. 2020, 35, 2083–2100. [Google Scholar] [CrossRef]

- Andrade, R.A.d.; Sacomano Neto, M.; Candido, S.E.A. Implementing Community-Based Forest Management in the Brazilian Amazon Rainforest: A Strategic Action Fields Perspective. Environ. Politics 2022, 31, 519–541. [Google Scholar] [CrossRef]

- Köhl, M.; Ehrhart, H.P.; Knauf, M.; Neupane, P.R. A Viable Indicator Approach for Assessing Sustainable Forest Management in Terms of Carbon Emissions and Removals. Ecol. Indic. 2020, 111, 1–10. [Google Scholar] [CrossRef]

- Paluš, H.; Krahulcová, M.; Parobek, J. Assessment of Forest Certification as a Tool to Support Forest Ecosystem Services. Forests 2021, 12, 300. [Google Scholar] [CrossRef]

- Kazama, V.S.; Corte, A.P.D.; Robert, R.C.G.; Sanquetta, C.R.; Arce, J.E.; Oliveira-Nascimento, K.A.; DeArmond, D. Global Review on Forest Road Optimization Planning: Support for Sustainable Forest Management in Amazonia. For. Ecol. Manag. 2021, 492, 119159. [Google Scholar] [CrossRef]

- Carvalho, S.; Oliveira, A.; Pedersen, J.S.; Manhice, H.; Lisboa, F.; Norguet, J.; de Wit, F.; Santos, F.D. A Changing Amazon Rainforest: Historical Trends and Future Projections under Post-Paris Climate Scenarios. Glob. Planet. Change 2020, 195, 103328. [Google Scholar] [CrossRef]

- Wang, S. One Hundred Faces of Sustainable Forest Management. For. Policy Econ. 2004, 6, 205–213. [Google Scholar] [CrossRef]

- Banerjee, O.; Macpherson, A.J.; Alavalapati, J. Toward a Policy of Sustainable Forest Management in Brazil. J. Environ. Dev. 2009, 18, 130–153. [Google Scholar] [CrossRef]

- Miranda, K.; Amaral Neto, M.; Sousa, R.; Coelho, R. Manejo Florestal Sustentável Em Unidades de Conservação de Uso Comunitário Na Amazônia. Soc. Nat. 2020, 32, 778–792. [Google Scholar] [CrossRef]

- Pokorny, B.; Pacheco, P. Money from and for Forests: A Critical Reflection on the Feasibility of Market Approaches for the Conservation of Amazonian Forests. J. Rural Stud. 2014, 36, 441–452. [Google Scholar] [CrossRef]

- Hari Poudyal, B.; Maraseni, T.; Cockfield, G. Evolutionary Dynamics of Selective Logging in the Tropics: A Systematic Review of Impact Studies and Their Effectiveness in Sustainable Forest Management. For. Ecol. Manag. 2018, 430, 166–175. [Google Scholar] [CrossRef]

- Rodrigues, M.I.; Souza, Á.N.d.; Mazzei de Freitas, L.J.; Silva, J.N.M.; Joaquim, M.S.; Pereira, R.S.; Biali, L.J.; Inkotte, J.; Araújo, J.B.C.N.; Matias, R.A.M. Case Study on the Financial Viability of Forest Management on Public Lands in the Brazilian Amazon. Forests 2023, 14, 2309. [Google Scholar] [CrossRef]

- Lima, F.B.d.; Souza, Á.N.d.; Matricardi, E.A.T.; Coelho Júnior, L.M.; Lima, I.B.d.; Mosmann, A.J.; Mossmann, C.R.d.N.; Gomes, C.J.O. Determinants of Financial Viability of Forest Concession in Brazilian Amazon. Forests 2024, 15, 1808. [Google Scholar] [CrossRef]

- Rondon, X.J.; Gorchov, D.L.; Elliott, S.R. Assessment of Economic Sustainability of the Strip Clear-Cutting System in the Peruvian Amazon. For. Policy Econ. 2010, 12, 340–348. [Google Scholar] [CrossRef]

- Rodrigues, M.I.; Souza, Á.N.d.; Joaquim, M.S.; Sanches, K.L.; Araújo, J.B.C.N.; Castanheira Neto, F.; Coelho Junior, L.M. Financial Analysis of Investments in Forest Concession for Amazon Brazilian by Deterministic and Stochastic Methods. Cerne 2019, 25, 482–490. [Google Scholar] [CrossRef]

- Kogler, C.; Schimpfhuber, S.; Eichberger, C.; Rauch, P. Benchmarking Procurement Cost Saving Strategies for Wood Supply Chains. Forests 2021, 12, 1086. [Google Scholar] [CrossRef]

- Hernández, U.F. Analysis of Forest Wood Supply Chains for Round-Wood Production Restricted by Technical Constraints. For. Syst. 2019, 28, 1–6. [Google Scholar] [CrossRef]

- Mokhtari, H.; Kiani, S.; Tahmasebpoor, S.S. Economic Evaluation of Investment Projects under Uncertainty: A Probability Theory Perspective. Sci. Iran. 2020, 27, 448–468. [Google Scholar] [CrossRef]

- Yurieva, T.; Voropaeva, L.; Beliakova, M.; Adamchuk, N. Infrastructure Investment Projects: Financing and Management Mechanisms. J. Model. Manag. 2021, 17, 1623–1638. [Google Scholar] [CrossRef]

- Li, Y.; Wu, M.; Li, Z. A Real Options Analysis for Renewable Energy Investment Decisions under China Carbon Trading Market. Energies 2018, 11, 1817. [Google Scholar] [CrossRef]

- Kottayi, N.M.; Mallick, R.B.; Jacobs, J.M.; Daniel, J.S. Economics of Making Roadway Pavements Resilient to Climate Change: Use of Discounted Cash Flow and Real Options Analysis. J. Infrastruct. Syst. 2019, 25, 1–10. [Google Scholar] [CrossRef]

- McDonald, R.; Siegel, D. The Value of Waiting to Invest. Q. J. Econ. 1986, 101, 707. [Google Scholar] [CrossRef]

- Boomen, M.v.d.; Spaan, M.T.J.; Schoenmaker, R.; Wolfert, A.R.M. Untangling Decision Tree and Real Options Analyses: A Public Infrastructure Case Study Dealing with Political Decisions, Structural Integrity and Price Uncertainty. Constr. Manag. Econ. 2019, 37, 24–43. [Google Scholar] [CrossRef]

- Čirjevskis, A. Value Maximizing Decisions in the Real Estate Market: Real Options Valuation Approach. J. Risk Financ. Manag. 2021, 14, 278. [Google Scholar] [CrossRef]

- Pacheco, G.C.R.; Campos, M.A.S. Real Options Analysis as an Economic Evaluation Method for Rainwater Harvesting Systems. Water Resour. Manag. 2019, 33, 4401–4415. [Google Scholar] [CrossRef]

- Manocha, N.; Babovic, V. Sequencing Infrastructure Investments under Deep Uncertainty Using Real Options Analysis. Water 2018, 10, 229. [Google Scholar] [CrossRef]

- Ajak, A.D.; Lilford, E.; Topal, E. Real Option Identification Framework for Mine Operational Decision-Making. Nat. Resour. Res. 2019, 28, 409–430. [Google Scholar] [CrossRef]

- Black, F.; Scholes, M. The Pricing of Options and Corporate Liabilities. J. Polit. Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Merton, R. Theory of Rational Option Pricing. Bell J. Econ. Manag. Sci. 1973, 4, 141–183. [Google Scholar] [CrossRef]

- Agaton, C.B. Will a Geopolitical Conflict Accelerate Energy Transition in Oil-Importing Countries? A Case Study of the Philippines from a Real Options Perspective. Resources 2022, 11, 59. [Google Scholar] [CrossRef]

- Li, M.; Garrison, L.; Lee, W.; Kowal, S.; Wong, W.; Veenstra, D. A Pragmatic Guide to Assessing Real Option Value for Medical Technologies. Value Health 2022, 25, 1878–1884. [Google Scholar] [CrossRef] [PubMed]

- Balliauw, M. Time to Build: A Real Options Analysis of Port Capacity Expansion Investments under Uncertainty. Res. Transp. Econ. 2021, 90, 1–11. [Google Scholar] [CrossRef]

- Tourinho, O.A.F. The Valuation of Reserves of Natural Resources: An Option Pricing Approach. Ph.D. Thesis, University of California, Los Angeles, CA, USA, 1979. [Google Scholar]

- Martins, G.N.; de Azevedo Melo, A.S. O Valor Da Opção de Preservação Do Parque Dos Manguezais Em Recife-PE: Uma Utilização Do Método de Opções Reais. Economica 2007, 8, 75–95. [Google Scholar]

- Munis, R.A.; Martins, J.C.; Camargo, D.A.; Simões, D. Dynamics of Pinus Wood Prices for Different Timber Assortments: Comparison of Stochastic Processes. Bois Forets Trop. 2022, 351, 45–52. [Google Scholar] [CrossRef]

- Martinez, I.M.; Batistela, G.C.; Simões, D. Strategic Flexibilities: Valuation of a Company with the Application of the Real Options Theory. Braz. J. Oper. Prod. Manag. 2019, 16, 650–658. [Google Scholar] [CrossRef]

- Broz, D.; Milanesi, G.; Rossit, D.A.; Rossit, D.G.; Tohmé, F. Forest Management Decision Making Based on a Real Options Approach: An Application to a Case in Northeastern Argentina. For. Stud. 2017, 67, 97–108. [Google Scholar] [CrossRef]

- Munis, R.A.; Camargo, D.A.; Silva, R.B.G.d.; Tsunemi, M.H.; Ibrahim, S.N.I.; Simões, D. Price Modeling of Eucalyptus Wood under Different Silvicultural Management for Real Options Approach. Forests 2022, 13, 478. [Google Scholar] [CrossRef]

- Kallio, M.; Kuula, M.; Oinonen, S. Real Options Valuation of Forest Plantation Investments in Brazil. Eur. J. Oper. Res. 2012, 217, 428–438. [Google Scholar] [CrossRef]

- Munis, R.A.; Camargo, D.A.; Martins, J.C.; Simões, D. Incorporating Management Flexibility: A Real Options Approach Harvesting Eucalyptus Plantations. Aust. For. 2022, 85, 133–140. [Google Scholar] [CrossRef]

- Joaquim, M.S.; Souza, Á.N.d.; Souza, S.N.d.; Pereira, R.S.; Angelo, H. Aplicação Da Teoria Das Opções Reais Na Análise de Investimentos Em Sistemas Agroflorestais. Cerne 2015, 21, 439–447. [Google Scholar] [CrossRef]

- Rocha, K.; Moreira, A.R.B.; Reis, E.J.; Carvalho, L. The Market Value of Forest Concessions in the Brazilian Amazon: A Real Option Approach. For. Policy Econ. 2006, 8, 149–160. [Google Scholar] [CrossRef]

- Insley, M. A Real Options Approach to the Valuation of a Forestry Investment. J. Environ. Econ. Manag. 2002, 44, 471–492. [Google Scholar] [CrossRef]

- Reeson, A.; Rudd, L.; Zhu, Z. Management Flexibility, Price Uncertainty and the Adoption of Carbon Forestry. Land Use Policy 2015, 46, 267–272. [Google Scholar] [CrossRef]

- Di Corato, L.; Gazheli, A.; Lagerkvist, C.-J. Investing in Energy Forestry under Uncertainty. For. Policy Econ. 2013, 34, 56–64. [Google Scholar] [CrossRef]

- Castellanos, Y.; Marco, J. A Bioeconomic Approach to Sustainable Forest Management In the Colombian Amazon; EfD Discussion Paper 23-13, Environment for Development; University of Gothenburg: Göteborg, Sweden, 2023. [Google Scholar]

- Santos de Lima, L.; Merry, F.; Soares-Filho, B.; Oliveira Rodrigues, H.; dos Santos Damaceno, C.; Bauch, M.A. Illegal Logging as a Disincentive to the Establishment of a Sustainable Forest Sector in the Amazon. PLoS ONE 2018, 13, e0207855. [Google Scholar] [CrossRef] [PubMed]

- Golub, A.; Herrera, D.; Leslie, G.; Pietracci, B.; Lubowski, R. A Real Options Framework for Reducing Emissions from Deforestation: Reconciling Short-Term Incentives with Long-Term Benefits from Conservation and Agricultural Intensification. Ecosyst. Serv. 2021, 49, 101275. [Google Scholar] [CrossRef]

- Soler, R.; Lorenzo, C.; González, J.; Carboni, L.; Delgado, J.; Díaz, M.; Toro Manríquez, M.D.R.; Alejandro, H.H. The Politics behind Scientific Knowledge: Sustainable Forest Management in Latin America. For. Policy Econ. 2021, 131, 102543. [Google Scholar] [CrossRef]

- Cozendey, G.; Chiavari, J. Ensures the Management of Public Forests for Sustainable Production; Official Gazette of the Federative Republic of Brazil: Brasília, Brazil, 2006. [Google Scholar]

- Kulakov, N.Y.; Kulakova, A.N. Evaluation of Nonconventional Projects. Eng. Econ. 2013, 58, 137–148. [Google Scholar] [CrossRef]

- Pará State Pará State Treasury Department. Available online: https://www.sefa.pa.gov.br/home (accessed on 9 June 2024).

- Mellichamp, D.A. Internal Rate of Return: Good and Bad Features, and a New Way of Interpreting the Historic Measure. Comput. Chem. Eng. 2017, 106, 396–406. [Google Scholar] [CrossRef]

- Markauskas, M.; Saboniene, A. Evaluation of Capital Cost: Long Run Evidence from Manufacturing Sector. Eng. Econ. 2020, 31, 169–177. [Google Scholar] [CrossRef]

- B3, S.A. Brasil Bolsa Balcão Séries Históricas. Available online: https://www.b3.com.br/pt_br/market-data-e-indices/servicos-de-dados/market-data/historico/mercado-a-vista/series-historicas/ (accessed on 15 June 2024).

- Damodaran, A. Valuation: Como Avaliar Empresas e Escolher as Melhores Ações, 1st ed.; Editora LTC: Rio de Janeiro, Brazil, 2022; ISBN 9781118004777. [Google Scholar]

- United States Department of the Treasury. Daily Treasury Yield Curve Rates. Available online: https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield (accessed on 18 June 2024).

- Dilli, S.; Carmichael, S.G.; Rijpma, A. Introducing the Historical Gender Equality Index. Fem. Econ. 2019, 25, 31–57. [Google Scholar] [CrossRef]

- Morgan, J.P. Emerging Markets Bond Index. Available online: https://www.jpmorgan.com/global (accessed on 19 June 2024).

- S&P. Dow Jones Indices S&P 500. Available online: https://www.spglobal.com/spdji/en/indices/equity/sp-global-timber-and-forestry-index/#overview (accessed on 20 June 2024).

- Bastian-Pinto, C.D.L.; Brandão, L.E.T.; Ozorio, L.D.M.; do Poço, A.F.T. A Parameter Based Approach to Single Factor Stochastic Process Selection for Real Options Applications. Eur. J. Financ. 2021, 27, 1533–1552. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the Estimators for Autoregressive Time Series With a Unit Root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar] [CrossRef]

- Kwiatkowski, D.; Phillips, P.C.B.; Schmidt, P.; Shin, Y. Testing the Null Hypothesis of Stationarity against the Alternative of a Unit Root. J. Econom. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Mac Cawley, A.; Cubillos, M.; Pascual, R. A Real Options Approach for Joint Overhaul and Replacement Strategies with Mean Reverting Prices. Ann. Oper. Res. 2020, 286, 303–324. [Google Scholar] [CrossRef]

- Dixit, A.K.; Pindyck, R.S. Investment Under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Samanez, C.P.; da Rocha Ferreira, L.; do Nascimento, C.C.; de Almeida Costa, L.; Bisso, C.R.S. Evaluating the Economy Embedded in the Brazilian Ethanol-Gasoline Flex-Fuel Car: A Real Options Approach. Appl. Econ. 2014, 46, 1565–1581. [Google Scholar] [CrossRef]

- Aquila, G.; Queiroz, A.R.; Balestrassi, P.P.; Rotella Junior, P.; Rocha, L.C.S.; Pamplona, E.O.; Nakamura, W.T. Wind Energy Investments Facing Uncertainties in the Brazilian Electricity Spot Market: A Real Options Approach. Sustain. Energy Technol. Assessments 2020, 42, 100876. [Google Scholar] [CrossRef]

- Vianello, J.M.; Costa, L.; Teixeira, J.P. Dynamic Modeling of Uncertainty in the Planned Values of Investments in Petrochemical and Refining Projects. Energy Econ. 2014, 45, 10–18. [Google Scholar] [CrossRef]

- Samuelson, P.A. Proof That Properly Anticipated Prices Fluctuate Randomly. Ind. Manag. Rev. 1965, 6, 41–49. [Google Scholar] [CrossRef]

- Palisade Corporation @Risk Versão 8.0 Ithaca. Available online: https://lumivero.com/products/at-risk (accessed on 28 May 2024).

- Leduc, G.; Palmer, K. What a Difference One Probability Makes in the Convergence of Binomia Trees. Int. J. Theor. Appl. Financ. 2020, 23, 1–26. [Google Scholar] [CrossRef]

- Tian, N.; Gan, J.; Lu, F. A Real Options Model for Evaluating a Tree and Mushroom Vertical Agroforestry System in Shandong, China. Agrofor. Syst. 2022, 97, 163–174. [Google Scholar] [CrossRef]

- Wynn, K.; Spangenberg, G.; Smith, K.F.; Wilson, W. Valuing GM Technologies Using Real Options: The Case of Drought Tolerant Wheat in Australia. Technol. Anal. Strateg. Manag. 2018, 30, 1470–1482. [Google Scholar] [CrossRef]

- Syncopation. Software DPL—Decision Programming Language. Available online: https://www.syncopation.com (accessed on 5 June 2024).

- Pringles, R.; Olsina, F.; Penizzotto, F. Valuation of Defer and Relocation Options in Photovoltaic Generation Investments by a Stochastic Simulation-Based Method. Renew. Energy 2020, 151, 846–864. [Google Scholar] [CrossRef]

- Hirigoyen, A.; Acuna, M.; Rachid-Casnati, C.; Franco, J.; Navarro-Cerrillo, R. Use of Optimization Modeling to Assess the Effect of Timber and Carbon Pricing on Harvest Scheduling, Carbon Sequestration, and Net Present Value of Eucalyptus Plantations. Forests 2021, 12, 651. [Google Scholar] [CrossRef]

- Rezaei, F.; Najafi, A.A.; Ramezanian, R.; Demeulemeester, E. Simulation-Based Priority Rules for the Stochastic Resource-Constrained Net Present Value and Risk Problem. Comput. Ind. Eng. 2021, 160, 1–13. [Google Scholar] [CrossRef]

- Joshi, D.; Chithaluru, P.; Singh, A.; Yadav, A.; Elkamchouchi, D.H.; Breñosa, J.; Anand, D. An Optimized Open Pit Mine Application for Limestone Quarry Production Scheduling to Maximize Net Present Value. Mathematics 2022, 10, 4140. [Google Scholar] [CrossRef]

- Chaudhary, R.; Bakhshi, P.; Gupta, H. Volatility in International Stock Markets: An Empirical Study during COVID-19. J. Risk Financ. Manag. 2020, 13, 208. [Google Scholar] [CrossRef]

- Dai, Z.; Zhou, H.; Wen, F.; He, S. Efficient Predictability of Stock Return Volatility: The Role of Stock Market Implied Volatility. North Am. J. Econ. Financ. 2020, 52, 1–8. [Google Scholar] [CrossRef]

- Liang, C.; Wei, Y.; Zhang, Y. Is Implied Volatility More Informative for Forecasting Realized Volatility: An International Perspective. J. Forecast. 2020, 39, 1253–1276. [Google Scholar] [CrossRef]

- Rios, D.; Blanco, G.; Olsina, F. Integrating Real Options Analysis with Long-Term Electricity Market Models. Energy Econ. 2019, 80, 188–205. [Google Scholar] [CrossRef]

- Taylor-de-Lima, R.L.N.; Silva, A.J.G.d.; Legey, L.F.L.; Szklo, A. Evaluation of Economic Feasibility under Uncertainty of a Thermochemical Route for Ethanol Production in Brazil. Energy 2018, 150, 363–376. [Google Scholar] [CrossRef]

- Hui, C.H.; Lo, C.F.; Cheung, C.H.; Wong, A. Crude Oil Price Dynamics with Crash Risk under Fundamental Shocks. N. Am. J. Econ. Financ. 2020, 54, 1–20. [Google Scholar] [CrossRef]

- Winkelried, D. Unit Roots in Real Primary Commodity Prices? A Meta-Analysis of the Grilli and Yang Data Set. J. Commod. Mark. 2021, 23, 1–15. [Google Scholar] [CrossRef]

- Schwartz, E.S. The Stochastic Behavior of Commodity Prices: Implications for Valuation and Hedging. J. Financ. 1997, 52, 923–973. [Google Scholar] [CrossRef]

- Golub, A.A.; Lubowski, R.N.; Piris-Cabezas, P. Business Responses to Climate Policy Uncertainty: Theoretical Analysis of a Twin Deferral Strategy and the Risk-Adjusted Price of Carbon. Energy 2020, 205, 117996. [Google Scholar] [CrossRef]

- Acheampong, T. On the Valuation of Natural Resources: Real Options Analysis of Marginal Oilfield-Development Projects under Multiple Uncertainties. SPE Prod. Oper. 2021, 36, 734–750. [Google Scholar] [CrossRef]

- Couto, G.; Martins, D.; Pimentel, P.; Castanho, R.A. Investments on Urban Land Valuation by Real Options—The Portuguese Case. Land Use Policy 2021, 107, 1–7. [Google Scholar] [CrossRef]

- Chi, T.; Li, J.; Trigeorgis, L.G.; Tsekrekos, A.E. Real Options Theory in International Business. J. Int. Bus. Stud. 2019, 50, 525–553. [Google Scholar] [CrossRef]

- Gaspars-Wieloch, H. Project Net Present Value Estimation under Uncertainty. Cent. Eur. J. Oper. Res. 2019, 27, 179–197. [Google Scholar] [CrossRef]

- Yang, L.; Xu, M.; Yang, Y.; Fan, J.; Zhang, X. Comparison of Subsidy Schemes for Carbon Capture Utilization and Storage (CCUS) Investment Based on Real Option Approach: Evidence from China. Appl. Energy 2019, 255, 1–12. [Google Scholar] [CrossRef]

- Benitez, G.B.; do Rego Ferreira Lima, M. The Real Options Method Applied to Decision Making—An Investment Analysis. Braz. J. Oper. Prod. Manag. 2019, 16, 562–571. [Google Scholar] [CrossRef]

- Maier, S.; Polak, J.W.; Gann, D.M. Valuing Portfolios of Interdependent Real Options Using Influence Diagrams and Simulation-and-Regression: A Multi-Stage Stochastic Integer Programming Approach. Comput. Oper. Res. 2020, 115, 1–14. [Google Scholar] [CrossRef]

- Oliveira, A.; Couto, G.; Pimentel, P. Uncertainty and Flexibility in Infrastructure Investments: Application of Real Options Analysis to the Ponta Delgada Airport Expansion. Res. Transp. Econ. 2021, 90, 1–10. [Google Scholar] [CrossRef]

- Moreira, A.R.B.; Reis, E.J.; Rocha, K.; Carvalho, L. A Valoração Das Concessões Nas Florestas Nacionais Da Amazônia: Uma Abordagem Com Opções Reais. Pesq. Plan. Econ. 2000, 30, 327–354. [Google Scholar]

- Rodrigues, M.I.; Souza, Á.N.d.; Mazzei, L.; Silva, J.N.M.; Joaquim, M.S.; Pereira, R.S.; Biali, L.J.; Rodriguez, D.R.O.; Lustosa Junior, I.M. Financial Variability of the Second Cutting of Forest Management in Tapajós National Forest, Brazil. For. Policy Econ. 2022, 136, 102694. [Google Scholar] [CrossRef]

- Thorsen, B.J. Afforestation as a Real Option: Some Policy Implications. For. Sci. 1999, 45, 171–178. [Google Scholar] [CrossRef]

- Mei, B.; Clutter, M.L. Benefit-Cost Analysis of Forest Carbon for Landowners: An Illustration Based on a Southern Pine Plantation. Front. For. Glob. Change 2022, 5, 931504. [Google Scholar] [CrossRef]

- Openko, I.; Stepchuk, Y.; Tsvyakh, O. Estimation of Tax Receipts from the Use of Forest Land in the Conditions of Decentralization of Authority. Econ. Ecol. Socium 2019, 3, 65–72. [Google Scholar] [CrossRef]

- Koval, V.; Laktionova, O.; Udovychenko, I.; Olczak, P.; Palii, S.; Prystupa, L. Environmental Taxation Assessment on Clean Technologies Reducing Carbon Emissions Cost-Effectively. Sustainability 2022, 14, 14044. [Google Scholar] [CrossRef]

- Keenan, R.J. Climate Change Impacts and Adaptation in Forest Management: A Review. Ann. For. Sci. 2015, 72, 145–167. [Google Scholar] [CrossRef]

- Rice, A.C.; Froese, R.E. Incorporating Climate Adaptation into a Forest Management Plan: A Case Study on the Research and Teaching Forest of Michigan Technological University. For. Sci. 2024, 70, 215–227. [Google Scholar] [CrossRef]

- Petrasek, S.; Perez-Garcia, J. A Monte Carlo Methodology for Solving the Optimal Timber Harvest Problem with Stochastic Timber and Carbon Prices. Math. Comput. For. Nat.-Resour. Sci. (MCFNS) 2010, 2, 67–77. [Google Scholar]

- Yap, R.C. Option Valuation of Philippine Forest Plantation Leases. Environ. Dev. Econ. 2004, 9, 315–333. [Google Scholar] [CrossRef]

- Yin, R. Combining Forest-Level Analysis with Options Valuation Approach—A New Framework for Assessing Forestry Investment. For. Sci. 2001, 47, 475–483. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rocha, Q.S.; da Silva, R.B.G.; Munis, R.A.; Simões, D. Assessing the Economic Impact of Forest Management in the Brazilian Amazon Through Real Options Analysis. Forests 2024, 15, 2069. https://doi.org/10.3390/f15122069

Rocha QS, da Silva RBG, Munis RA, Simões D. Assessing the Economic Impact of Forest Management in the Brazilian Amazon Through Real Options Analysis. Forests. 2024; 15(12):2069. https://doi.org/10.3390/f15122069

Chicago/Turabian StyleRocha, Qüinny Soares, Richardson Barbosa Gomes da Silva, Rafaele Almeida Munis, and Danilo Simões. 2024. "Assessing the Economic Impact of Forest Management in the Brazilian Amazon Through Real Options Analysis" Forests 15, no. 12: 2069. https://doi.org/10.3390/f15122069

APA StyleRocha, Q. S., da Silva, R. B. G., Munis, R. A., & Simões, D. (2024). Assessing the Economic Impact of Forest Management in the Brazilian Amazon Through Real Options Analysis. Forests, 15(12), 2069. https://doi.org/10.3390/f15122069