Impact of Facility Location on the Financial Performance of Integrated and Distributed LVL Production in Subtropical Eastern Australia

Abstract

1. Introduction

- which log types should be procured?

- where should processing facilities be located?

- what scale of production should be targeted?

- which final products should be produced (i.e., how much value-adding)?

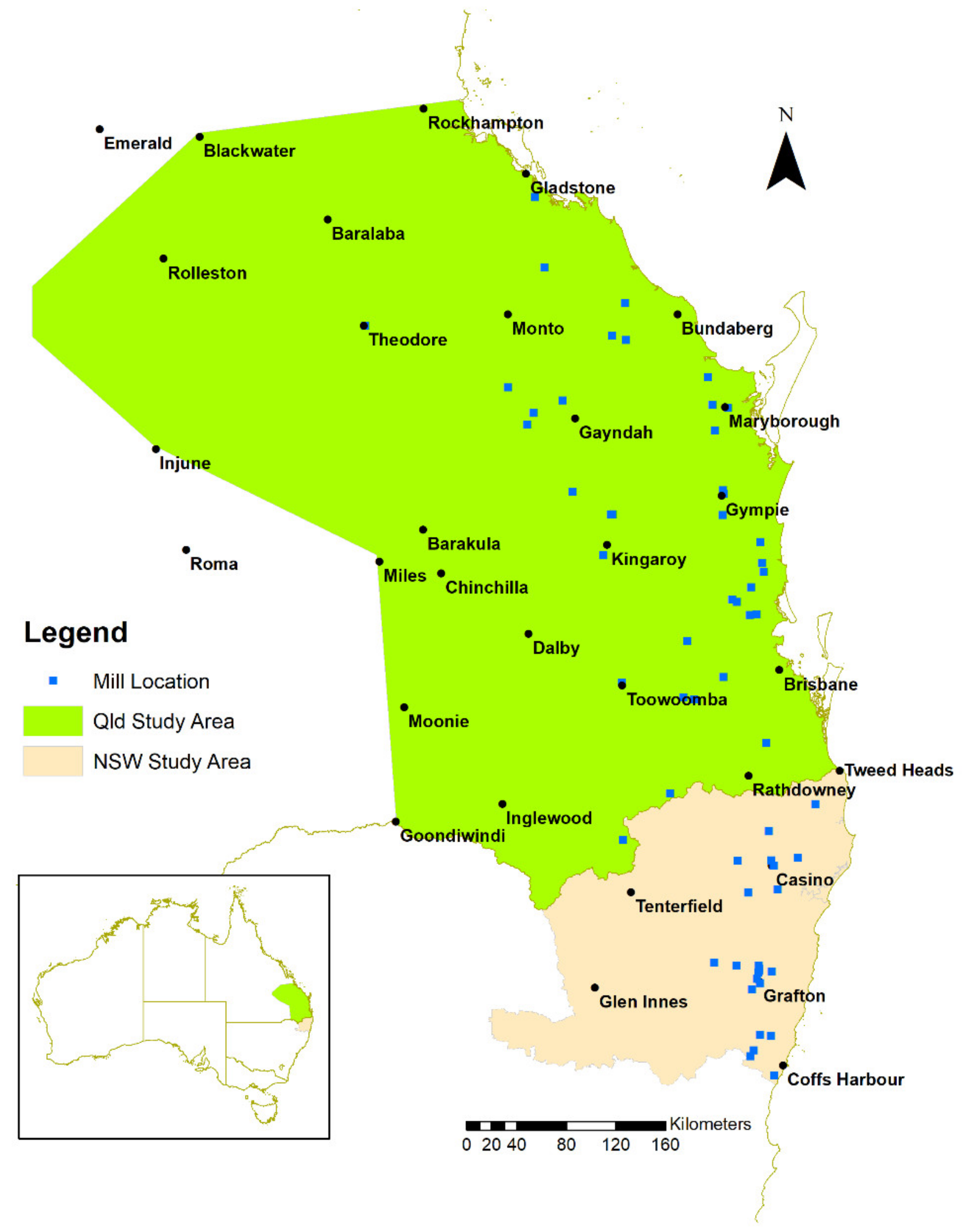

2. Subtropical Eastern Australia Case Study

3. Materials and Methods

3.1. Mathematical Model

3.2. Model Parameters and Case Study Scenarios for Subtropical Eastern Australia

3.2.1. Log Procurement Scenarios

- Only top logs and small peeler logs from each harvested hectare. Other log types from harvested forests are assumed to be processed into other products (e.g., sawnwood) and are not considered further;

- All four log types from each harvested hectare; and

- All four log types can be used for veneering, but the model optimally procures particular log types from each harvested hectare to maximise NPV.

3.2.2. Facility Location Scenarios

3.2.3. Processing Scale Scenarios

- Part-time operation at 7500 m3/y of log;

- Full-time operation processing 15,000 m3/y of log; and

- Full-time operation processing 30,000 m3/y of log with two veneering lines.

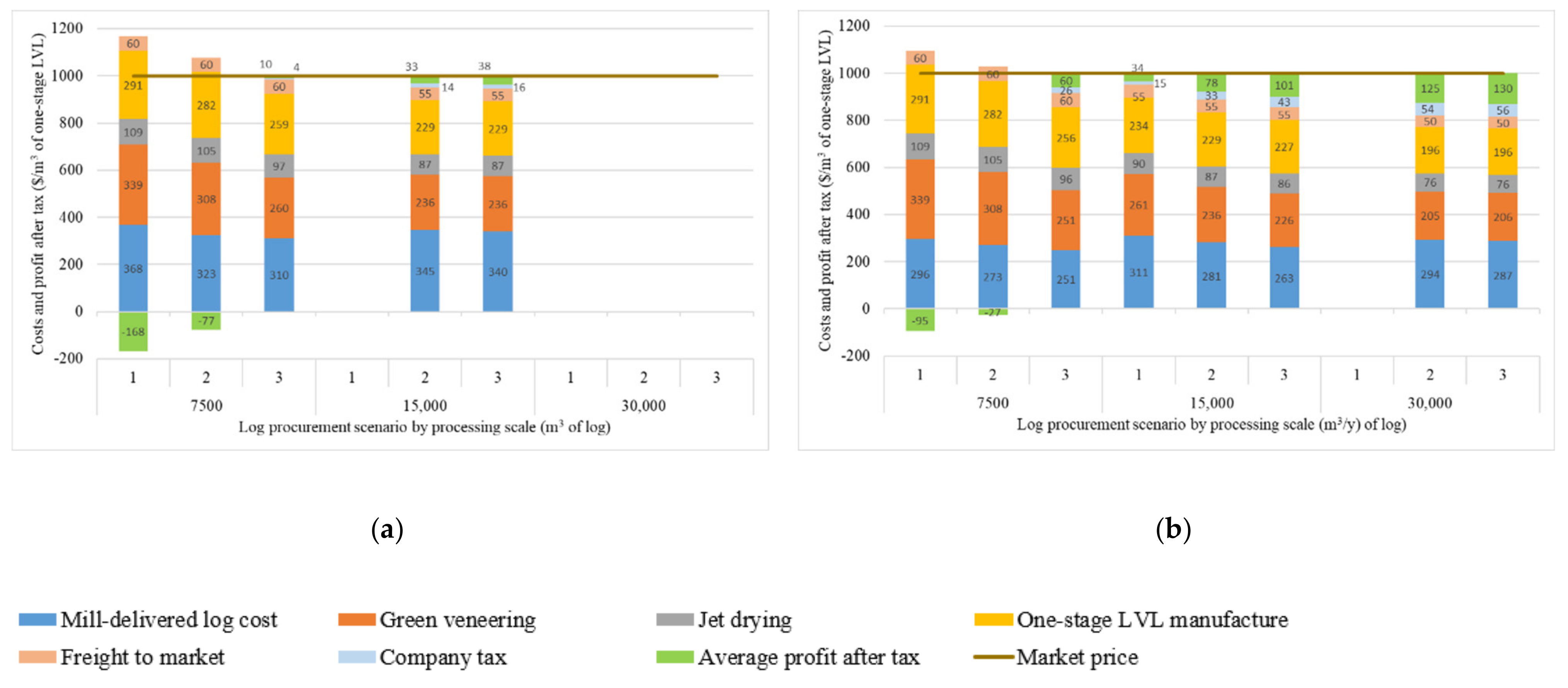

3.2.4. LVL Final Product Scenarios

- One-stage LVL that is assumed to substitute for sawn timber in applications where high mechanical performance is required (e.g., in multi-storey construction) with a wholesale market price of $1000/m3; and

- Two-stage LVL that is assumed to be an electricity pole cross-arm that can substitute for solid wood or fibre glass cross-arms with a wholesale market price of $1375/m3.

3.2.5. Distributed Production Scenarios

- One veneering facility processing 15,000 m3/y of log;

- One veneering facility processing 30,000 m3/y of log; and

- Two separate veneering facilities processing 15,000 m3/y of log each.

4. Results

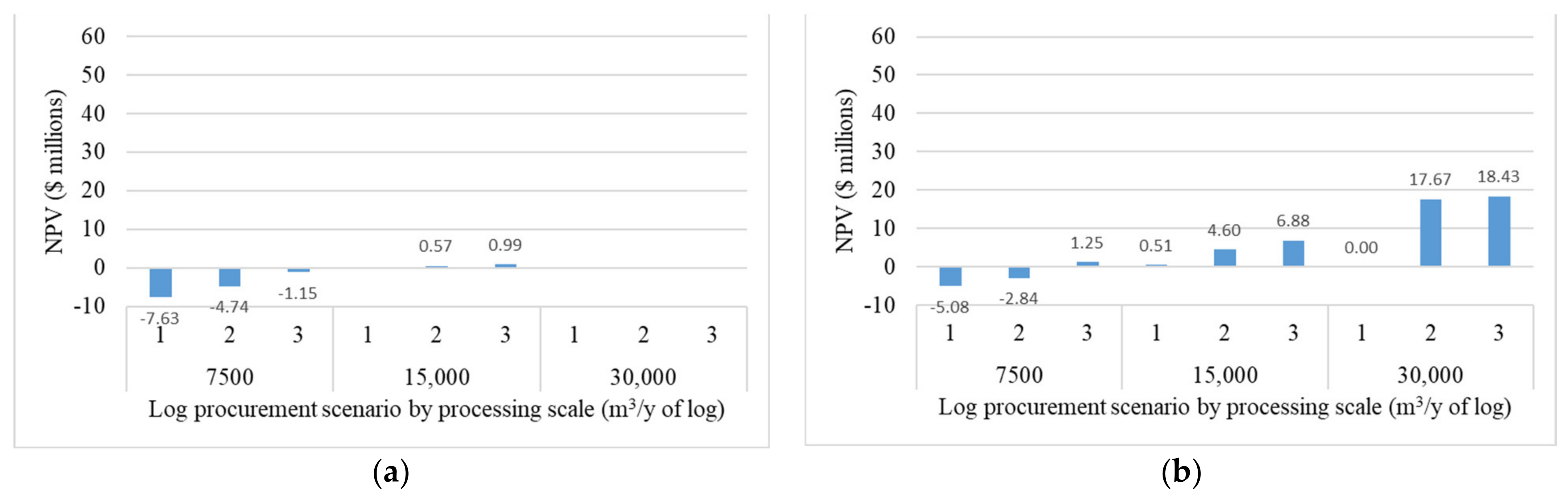

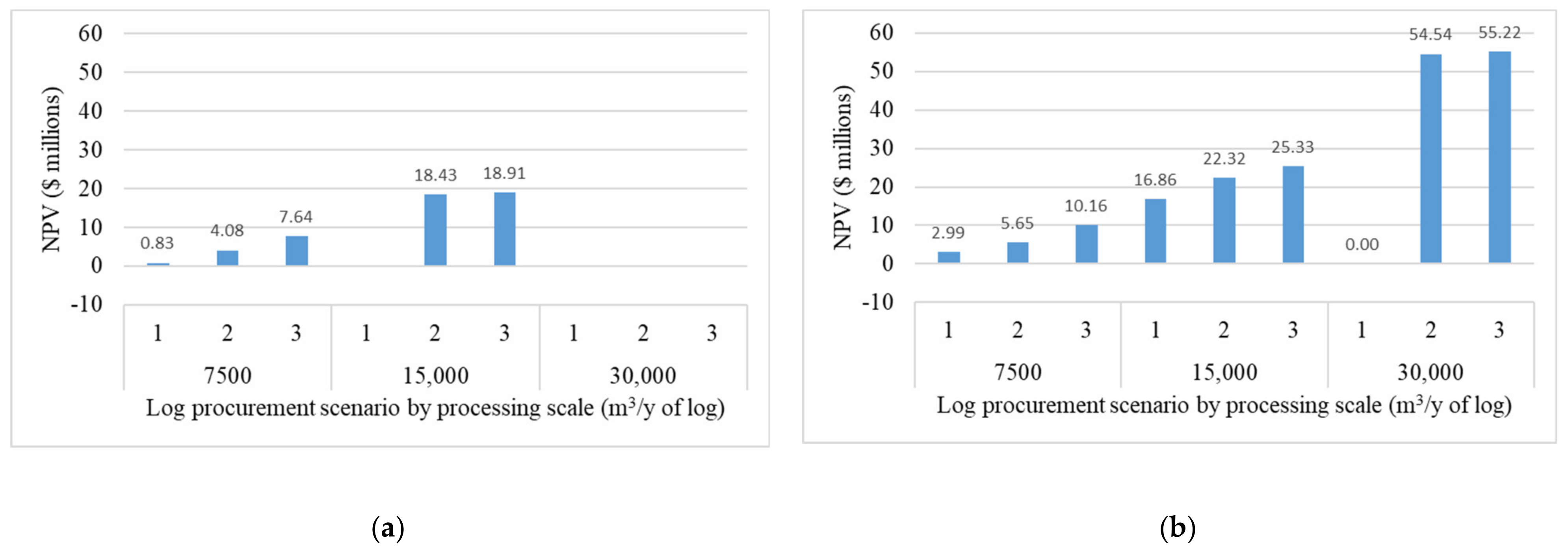

4.1. Financial Performance of Integrated Processing Facilities

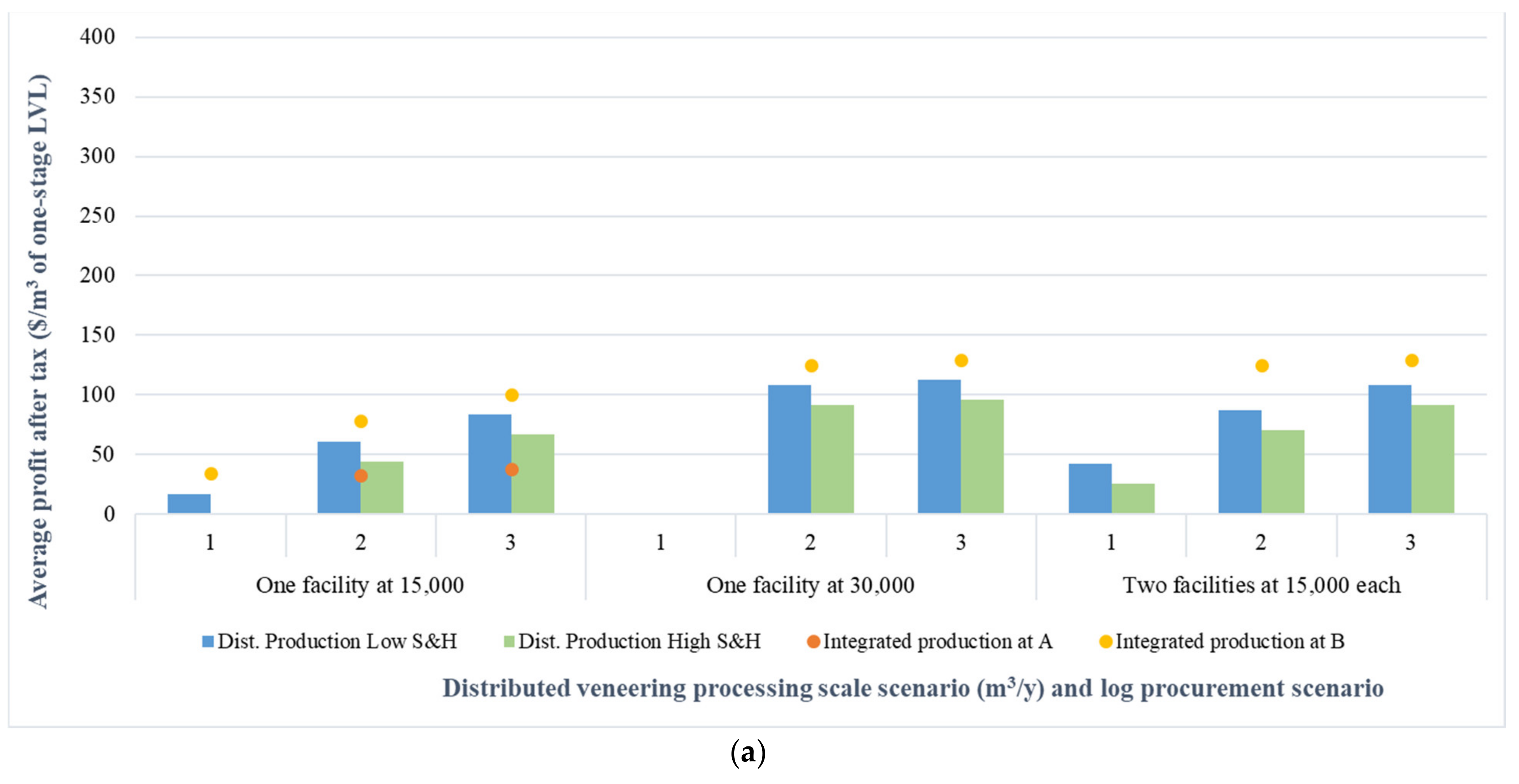

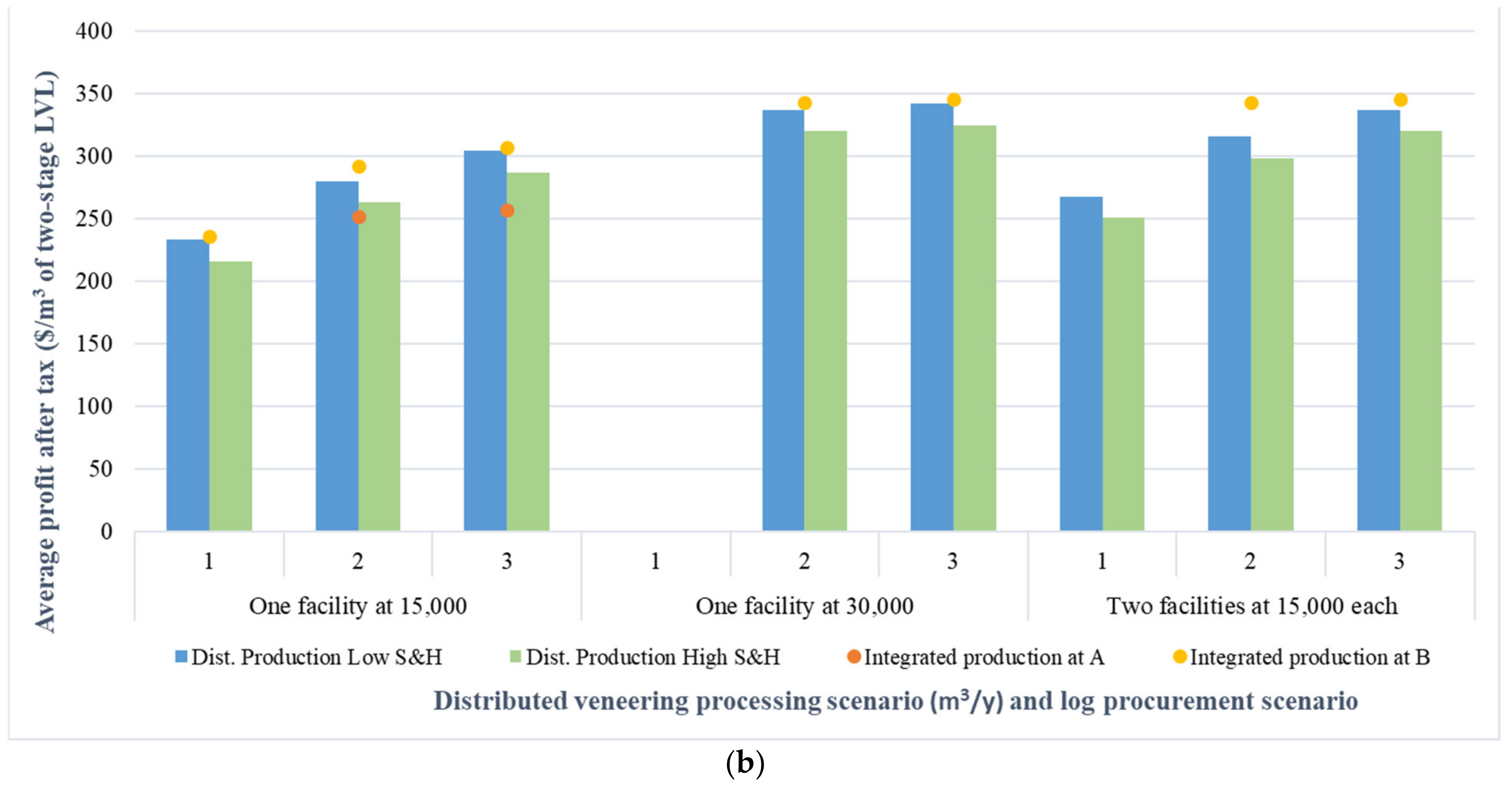

4.2. Financial Performance of Distributed Processing Operations

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Parameter | Level | NPV ($ Millions) by Processing Scale (m3/y of Log) and Log Procurement Scenario | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 7500 | 15,000 | 30,000 | ||||||||

| 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | ||

| Average mill-delivered log costs | −20% | −5.04 | −2.32 | −1.68 | 4.91 | 5.27 | ||||

| Base | −7.63 | −4.74 | −3.97 | 0.57 | 0.99 | |||||

| +20% | −10.36 | −7.20 | −6.37 | −4.20 | −3.63 | |||||

| Utilisation rate of equipment and machinery | −20% | −9.62 | −6.73 | −5.99 | −2.61 | −2.12 | ||||

| Base | −7.63 | −4.74 | −3.97 | 0.57 | 0.99 | |||||

| +20% | −6.35 | −3.41 | −2.64 | 2.79 | 3.21 | |||||

| Capital costs | −20% | −4.69 | −1.84 | −1.15 | 3.30 | 3.73 | ||||

| Base | −7.63 | −4.74 | −3.97 | 0.57 | 0.99 | |||||

| +20% | −10.61 | −7.68 | −6.91 | −2.02 | −1.58 | |||||

| Labour costs | −20% | −5.92 | −2.97 | −2.23 | 3.98 | 4.40 | ||||

| Base | −7.63 | −4.74 | −3.97 | 0.57 | 0.99 | |||||

| +20% | −9.40 | −6.51 | −5.76 | −2.97 | −2.54 | |||||

| Market price | −20% | −15.17 | −12.56 | −11.84 | −14.41 | −13.90 | ||||

| Base | −7.63 | −4.74 | −3.97 | 0.57 | 0.99 | |||||

| +20% | −1.01 | 1.94 | 2.69 | 12.61 | 13.06 | |||||

| Discount rate | 4% | −9.18 | −5.22 | −4.16 | 2.13 | 2.73 | ||||

| Base | −7.63 | −4.74 | −3.97 | 0.57 | 0.99 | |||||

| 10% | −6.58 | −4.36 | −3.77 | −0.32 | 0.00 | |||||

| Parameter | Level | NPV ($ Millions) by Processing Scale (m3/y of Log) and Log Procurement Scenario | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 7500 | 15,000 | 30,000 | ||||||||

| 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | ||

| Average mill-delivered log costs | −20% | 3.02 | 6.10 | 6.86 | 22.63 | 23.06 | ||||

| Base | 0.83 | 4.08 | 4.89 | 18.43 | 18.91 | |||||

| +20% | −1.38 | 2.02 | 2.90 | 14.24 | 14.76 | |||||

| Utilisation rate of equipment and machinery | −20% | −0.89 | 2.33 | 3.13 | 15.36 | 15.86 | ||||

| Base | 0.83 | 4.08 | 4.89 | 18.43 | 18.91 | |||||

| +20% | 1.98 | 5.23 | 6.05 | 20.67 | 21.15 | |||||

| Capital costs | −20% | 3.73 | 6.85 | 7.64 | 21.34 | 21.84 | ||||

| Base | 0.83 | 4.08 | 4.89 | 18.43 | 18.91 | |||||

| +20% | −2.12 | 1.18 | 2.02 | 15.75 | 16.23 | |||||

| Labour costs | −20% | 2.35 | 5.61 | 6.42 | 21.84 | 22.33 | ||||

| Base | 0.83 | 4.08 | 4.89 | 18.43 | 18.91 | |||||

| +20% | −0.69 | 2.53 | 3.34 | 15.09 | 15.52 | |||||

| Market price | −20% | −7.71 | −4.64 | −3.83 | 2.42 | 2.85 | ||||

| Base | 0.83 | 4.08 | 4.89 | 18.43 | 18.91 | |||||

| +20% | 8.40 | 12.09 | 13.02 | 34.29 | 34.82 | |||||

| Discount rate | 4% | 2.69 | 7.25 | 8.39 | 27.48 | 28.15 | ||||

| Base | 0.83 | 4.08 | 4.89 | 18.43 | 18.91 | |||||

| 10% | −0.22 | 2.23 | 2.85 | 13.01 | 13.37 | |||||

| Parameter | Level | NPV ($ Millions) by Processing Scale (m3/y of Log) and Log Procurement Scenario | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 7500 | 15,000 | 30,000 | ||||||||

| 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | ||

| Average mill-delivered log costs | −20% | −3.01 | −0.99 | 0.39 | 4.13 | 8.05 | 10.21 | 24.81 | 25.38 | |

| Base | −5.08 | −2.84 | −1.32 | 0.51 | 4.60 | 6.88 | 17.67 | 18.43 | ||

| +20% | −7.16 | −4.91 | −3.15 | −3.37 | 1.06 | 3.49 | 10.49 | 11.46 | ||

| Utilisation rate of equipment and machinery | −20% | −7.00 | −4.83 | −3.19 | −2.85 | 1.60 | 4.03 | 10.98 | 11.75 | |

| Base | −5.08 | −2.84 | −1.32 | 0.51 | 4.60 | 6.88 | 17.67 | 18.43 | ||

| +20% | −3.81 | −1.63 | −0.15 | 2.65 | 6.75 | 9.05 | 21.42 | 22.19 | ||

| Capital costs | −20% | −2.16 | −0.18 | 1.25 | 3.02 | 7.22 | 9.61 | 21.56 | 22.32 | |

| Base | −5.08 | −2.84 | −1.32 | 0.51 | 4.60 | 6.88 | 17.67 | 18.43 | ||

| +20% | −8.02 | −5.78 | −4.09 | −2.08 | 2.13 | 4.45 | 13.75 | 14.53 | ||

| Labour costs | −20% | −3.38 | −1.25 | 0.23 | 3.82 | 7.91 | 10.21 | 23.18 | 23.94 | |

| Base | −5.08 | −2.84 | −1.32 | 0.51 | 4.60 | 6.88 | 17.67 | 18.43 | ||

| +20% | −6.79 | −4.60 | −2.96 | −2.99 | 1.28 | 3.49 | 12.15 | 12.91 | ||

| Market price | −20% | −12.29 | −10.42 | −10.94 | −13.17 | −8.97 | −6.72 | −7.42 | −6.41 | |

| Base | −5.08 | −2.84 | −1.32 | 0.51 | 4.60 | 6.88 | 17.67 | 18.43 | ||

| +20% | 1.16 | 3.52 | 3.70 | 11.63 | 16.50 | 19.21 | 41.39 | 42.10 | ||

| Discount rate | 4% | −5.69 | −2.62 | −2.78 | 2.05 | 7.79 | 10.99 | 27.33 | 28.40 | |

| Base | −5.08 | −2.84 | −1.32 | 0.51 | 4.60 | 6.88 | 17.67 | 18.43 | ||

| 10% | −4.62 | −2.90 | −2.99 | −0.36 | 2.72 | 4.44 | 11.97 | 12.54 | ||

| Parameter | Level | NPV ($ Millions) by Processing Scale (m3/y of Log) and Log Procurement Scenario | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 7500 | 15,000 | 30,000 | ||||||||

| 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | ||

| Average mill-delivered log costs | −20% | 4.72 | 7.34 | 9.07 | 20.34 | 25.74 | 28.66 | 61.68 | 62.17 | |

| Base | 2.99 | 5.65 | 7.47 | 16.86 | 22.32 | 25.33 | 54.54 | 55.22 | ||

| +20% | 1.23 | 3.93 | 5.85 | 13.38 | 18.90 | 22.00 | 47.39 | 48.27 | ||

| Utilisation rate of equipment and machinery | −20% | 1.29 | 3.92 | 5.72 | 13.65 | 19.25 | 22.36 | 47.66 | 48.34 | |

| Base | 2.99 | 5.65 | 7.47 | 16.86 | 22.32 | 25.33 | 54.54 | 55.22 | ||

| +20% | 4.11 | 6.78 | 8.62 | 19.00 | 24.55 | 27.61 | 58.44 | 59.12 | ||

| Capital costs | −20% | 5.81 | 8.37 | 10.16 | 19.54 | 25.22 | 28.37 | 58.78 | 59.45 | |

| Base | 2.99 | 5.65 | 7.47 | 16.86 | 22.32 | 25.33 | 54.54 | 55.22 | ||

| +20% | 0.06 | 2.80 | 4.68 | 14.17 | 19.63 | 22.65 | 50.22 | 50.90 | ||

| Labour costs | −20% | 4.47 | 7.15 | 8.99 | 20.15 | 25.73 | 28.80 | 60.23 | 60.91 | |

| Base | 2.99 | 5.65 | 7.47 | 16.86 | 22.32 | 25.33 | 54.54 | 55.22 | ||

| +20% | 1.48 | 4.12 | 5.93 | 13.56 | 18.98 | 21.86 | 48.85 | 49.53 | ||

| Market price | −20% | −5.17 | −2.79 | −2.89 | 2.07 | 6.44 | 8.84 | 22.83 | 23.57 | |

| Base | 2.99 | 5.65 | 7.47 | 16.86 | 22.32 | 25.33 | 54.54 | 55.22 | ||

| +20% | 10.43 | 13.61 | 14.25 | 31.47 | 38.14 | 41.75 | 86.03 | 86.64 | ||

| Discount rate | 4% | 5.72 | 9.45 | 9.85 | 25.25 | 32.96 | 37.21 | 79.62 | 80.58 | |

| Base | 2.99 | 5.65 | 7.47 | 16.86 | 22.32 | 25.33 | 54.54 | 55.22 | ||

| 10% | 1.41 | 3.42 | 3.63 | 11.83 | 15.92 | 18.18 | 39.48 | 39.99 | ||

References

- Warman, R.D. Global wood production from natural forests has peaked. Biodivers. Conserv. 2014, 23, 1063–1078. [Google Scholar] [CrossRef]

- Leggate, W.; McGavin, R.L.; Bailleres, H. (Eds.) A Guide to Manufacturing Rotary Veneer and Products from Small Logs; Australian Centre for International Agricultural Research: Canberra, Australia, 2017; p. 159.

- Spelter, H.; Sleet, G. Potential reductions in plywood manufacturing costs resulting from improved technology. For. Prod. J. 1989, 39, 8–15. [Google Scholar]

- Pease, D.A. Small-log diet agrees with spindleless lathe. Wood Technol. 1993, 120, 16–18. [Google Scholar]

- Dobner, M., Jr.; Nutto, L.; Higa, A.R. Recovery rate and quality of rotary peelerd veneer from 30-year-old Pinus taeda L. logs. Ann. For. Sci. 2013, 70, 429–437. [Google Scholar] [CrossRef]

- Wang, B.J.; Dai, C. Development of structural laminated veneer lumber from stress graded short-rotation hem-fir veneer. Constr. Build. Mater. 2013, 47, 902–909. [Google Scholar] [CrossRef]

- McGavin, R.L.; Bailleres, H.; Lane, F.; Blackburn, D.; Vega, M.; Ozarska, B. Veneer recovery analysis of plantation eucalypt species using spindleless lathe technology. BioResources 2014, 9, 613–627. [Google Scholar] [CrossRef]

- McGavin, R.L.; Bailleres, H.; Lane, F.; Fehrmann, J.; Ozarska, B. Veneer grade analysis of early to mid-rotation plantation Eucalyptus species in Australia. BioResources 2014, 9, 6565–6581. [Google Scholar] [CrossRef]

- McGavin, R.L.; Bailleres, H.; Fehrmann, J.; Ozarska, B. Stiffness and density analysis of rotary veneer recovered from six species of Australian plantation hardwoods. BioResources 2015, 10, 6395–6416. [Google Scholar] [CrossRef]

- McGavin, R.L.; Bailleres, H.; Hamilton, M.; Blackburn, D.; Vega, M.; Ozarska, B. Variation in rotary veneer recovery from Australian plantation Eucalyptus globulus and Eucalyptus nitens. BioResources 2015, 10, 313–329. [Google Scholar] [CrossRef][Green Version]

- Gilbert, B.P.; Bailleres, H.; Fischer, M.F.; Zhang, H.; McGavin, R.L. Mechanical properties of rotary veneers recovered from early to midrotation subtropical-hardwood plantation logs for veneer-based composite applications. J. Mater. Civ. Eng. 2017, 29, 04017194. [Google Scholar] [CrossRef]

- Khoo, P.S.; H’ng, P.S.; Chin, K.L.; Bakar, E.S.; Maminski, M.; Raja-Ahmad, R.; Lee, C.L.; Ashikin, S.N.; Saharudin, M. Peeling of small diameter rubber log using spindleless lathe technology: Evaluation of veneer properties from outer to inner radial section of log at different veneer thicknesses. Eur. J. Wood Wood Prod. 2018, 76, 1335–1346. [Google Scholar] [CrossRef]

- Verkasalo, E. Evaluating the potential of European white birch (Betula pubescens) for veneer and plywood by timber and wood quality. In Proceedings of the Second Workshop, Connection between Silviculture and Wood Quality through Modelling and Simulation Software, Berg-en-Dal, Kruger National Park, South Africa, 26–31 August 1996; pp. 431–439. [Google Scholar]

- Heräjärvi, H.; Arponen, J. Log and veneer quality of Finnish and Russian birch in plywood production. In Proceedings of the International Panel Products Symposium, Espoo, Finland, 24–26 September 2008. [Google Scholar]

- Verkasalo, E.; Heräjärvi, H. Potential of European birch species for product development of veneer and plywood—Recovery, grades and mechanical properties and future market requirements. In Proceedings of the ISCHP 09, 2nd International Scientific Conference on Hardwood Processing, Paris, France, 28–29 September 2009; pp. 11–19. [Google Scholar]

- Evison, D.C.; Kremer, P.D.; Guiver, J. Mass timber construction in Australia and New Zealand—Status, and economic and environmental influences on adoption. Wood Fibre Sci. 2018, 50, 128–138. [Google Scholar] [CrossRef]

- McGavin, R.L.; Leggate, W. Comparison of processing methods for small diameter logs: Sawing versus rotary peeling. BioResources 2019, 14, 1545–1563. [Google Scholar]

- Jena, S.D.; Cordeau, J.F.; Gendron, B. Modelling and solving a logging camp location problem. Ann. Oper. Res. 2015, 232, 151–177. [Google Scholar]

- Ronnqvist, M. Optimization in forestry. Math. Program. 2003, 97, 267–284. [Google Scholar] [CrossRef]

- Weintraub, A.; Romero, C. Operations research models and the management of agricultural and forestry resources: A review and comparison. Interfaces 2006, 35, 446–457. [Google Scholar] [CrossRef]

- D’Amours, S.; Rönnqvist, M.; Weintraub, A. Using operational research for supply chain planning in the forest products industry. INFOR Inf. Syst. Oper. Res. 2008, 46, 265–281. [Google Scholar] [CrossRef]

- Kaya, A.; Bettinger, P.; Boston, K.; Akbulut, R.; Ucar, Z.; Siry, J.; Merry, K.; Cieszewski, C. Optimisation in Forest Management. Curr. For. Rep. 2016, 2, 1–17. [Google Scholar] [CrossRef]

- Ronnqvist, M.; D’Amours, S.; Weintraub, A.; Jofre, A.; Gunn, E.; Haight, R.G.; Martell, D.; Murray, A.T.; Romero, C. Operations research challenges in forestry: 33 open problems. Ann. Oper. Res. 2015, 232, 11–40. [Google Scholar] [CrossRef]

- Troncoso, J.J.; Garrido, R.A. Forestry production and logistics planning: An analysis using mixed-integer programming. For. Policy Econ. 2005, 7, 625–633. [Google Scholar] [CrossRef]

- Singer, M.; Donoso, P. Internal supply chain management in the Chilean sawmill industry. Int. J. Oper. Prod. Manag. 2007, 27, 524–541. [Google Scholar] [CrossRef]

- Natarajan, K.; Leduc, S.; Pelkonen, P.; Tomppo, E.; Dotzauer, E. Optimal locations for second generation Fischer Trosch biodiesel production in Finland. Renew. Energy 2014, 62, 319–330. [Google Scholar] [CrossRef]

- Delivand, M.K.; Cammerino, A.R.B.; Garofalo, P.; Monteleone, M. Optimal locations of bioenergy facilities, biomass spatial availability, logistics costs and GHG (greenhouse gas) emissions: A case study on electricity productions in South Italy. J. Clean. Prod. 2015, 99, 129–139. [Google Scholar] [CrossRef]

- Zhang, F.; Johnson, D.; Johnson, M.; Watkins, D.; Froese, R.; Wang, J. Decision support system integrating GIS with silumation and optimisation for a biofuel supply chain. Renew. Energy 2016, 85, 740–748. [Google Scholar] [CrossRef]

- Crandall, M.S.; Adams, D.M.; Montgomery, C.A.; Smith, D. The potential rural development impacts of utilising non-merchantable forest biomass. For. Policy Econ. 2017, 74, 20–29. [Google Scholar] [CrossRef]

- Sanchez-Garcia, S.; Athanassiadis, D.; Alonso, C.M.; Tolosana, E.; Majada, J.; Canga, E. A GIS methodology for optimal location of a wood-fired power plant: Quantification of available woodfuel, supply chain costs and GHG emissions. J. Clean. Prod. 2017, 157, 201–212. [Google Scholar] [CrossRef]

- Vanzetti, N.; Corsano, G.; Montagna, J.M. A comparison between individual factories and industrial clusters location in the forest supply chain. For. Policy Econ. 2017, 83, 88–98. [Google Scholar] [CrossRef]

- Bordon, M.R.; Montagna, J.M.; Corsano, G. An exact mathematical formulation for the optimal log transportation. For. Policy Econ. 2018, 95, 115–122. [Google Scholar] [CrossRef]

- Duc, D.N.; Nananukul, N. Supply chain model for renewable energy resource from biomass in Vietnam. In Proceedings of the 5th International Conference on Industrial Engineering and Applications, Singapore, 26–28 April 2018; pp. 520–525. [Google Scholar]

- Flatberg, T.; Norstebo, V.S.; Bjorkelo, K.; Astrup, R.; Sovde, N.E. A mathematical model for infrastructure investments in the forest sector of coastal Norway. For. Policy Econ. 2018, 92, 202–209. [Google Scholar] [CrossRef]

- Jenkins, T.L.; Jin, E.; Sutherland, J.W. Effect of harvest region shape, biomass yield, and plant location on optimal biofuel facility size. For. Policy Econ. 2020, 111, 102053. [Google Scholar] [CrossRef]

- Lin, W.; Carino, H.F.; Muehlenfeld, K.J. OSB/LOCATION: A computer model for determining optimal oriented strandboard plant location and size. For. Prod. J. 1996, 46, 71–79. [Google Scholar]

- Maturana, S.; Pizani, E.; Vera, J. Scheduling production for a sawmill: A comparison of a mathematical model versus a heuristic. Comput. Ind. Eng. 2010, 59, 667–674. [Google Scholar] [CrossRef]

- Kong, J.; Ronnqvist, M.; Frisk, M. Modeling an integrated market for sawlogs, pulpwood, and forest bioenergy. Can. J. For. Res. 2012, 42, 315–332. [Google Scholar] [CrossRef]

- Melo, M.T.; Nickel, S.; Saldanha-da-Gama, F. Facility location and supply chain management—A review. Eur. J. Oper. Res. 2009, 196, 401–412. [Google Scholar] [CrossRef]

- Arnold, R.J.; Xie, Y.J.; Midgley, S.J.; Luo, J.Z.; Chen, X.F. Emergence and rise of eucalypt veneer production in China. Int. For. Rev. 2013, 15, 33–47. [Google Scholar] [CrossRef]

- Venn, T.J.; McGavin, R.L. A decision-support system to assist forest industry planning and investment when data are scarce: The case of hardwood veneering in subtropical eastern Australia. Aust. For. 2021, 84, 59–72. [Google Scholar] [CrossRef]

- Venn, T.J.; Dorries, J.W.; McGavin, R.L. A mathematical model to support investment in veneer and LVL manufacturing in subtropical eastern Australia. For. Policy Econ. 2021, 128, 102476. [Google Scholar] [CrossRef]

- Francis, B.; Venn, T.; Lewis, T. A review of the private native forest resource, with a focus on economic contributions. In Improving Productivity of the Private Native Forest Resource in Southern Queensland and Northern New South Wales; Lewis, T., Venn, T., Francis, B., Ryan, S., Brawner, J., Cameron, N., Kelly, A., Menzies, T., Schulke, B., Eds.; Forest and Wood Products Australia: Melbourne, Australia, 2020; pp. 60–95. Available online: https://www.fwpa.com.au/images/resources/-2020/Final_Report_PNF_PNC379-1516.pdf (accessed on 6 February 2022).

- Florence, R.G. Ecology and Silviculture of Eucalypt Forests; CSIRO: Collingwood, Australia, 1996. [Google Scholar]

- Ryan, S.; Taylor, D. Sustainable Native Forest Management: Case Studies in Managing Private Native Forest in South-east Queensland; Department of Primary Industries and Fisheries: Brisbane, Australia, 2006. Available online: http://era.daf.qld.gov.au/id/eprint/1640/1/Sustainable_native_forestf_final-sec.pdf (accessed on 20 September 2017).

- Department of Natural Resources and Mines. Managing a Native Forest Practice: A Self-Asessable Vegetation Clearing Code; Department of Natural Resources and Mines: Brisbane, Australia, 2014.

- Carron, L.T. A History of Forestry in Australia; Australian National University Press: Canberra, Australia, 1985. [Google Scholar]

- DPI Forestry. An Overview of the Queensland Forest Industry; Department of Primary Industries: Brisbane, Australia, 1998.

- Jay, A.; Dillon, A. Modelling the outcomes of different silvicultural approaches in the private native forests of north-eastern New South Wales. Aust. For. 2016, 79, 85–95. [Google Scholar] [CrossRef]

- State of Queensland. Queensland Forest and Timber Industry. An Overview; Department of Agriculture and Fisheries: Brisbane, Australia, 2016.

- Queensland Government. Palaszczuk Government Takes Action to Support Timber Industry Jobs; Queensland Cabinet and Ministerial Directory; 2019. Available online: http://statements.qld.gov.au/Statement/2019/11/4/palaszczuk-government-takes-action-to-support-timber-industry-jobs (accessed on 19 December 2019).

- Francis, B.; Venn, T.; Lewis, T.; Brawner, J. Case Studies of the Financial Performance of Silvopastoral Systems in Southern Queensland, Australia. Forests 2022, 13, 186. [Google Scholar] [CrossRef]

- Lewis, T.; Pachas, N.; Venn, T.J. How can we grow the plantation estate and improve private native forest management in Australia? Silvopastoral systems provide a solution. Aust. For. 2022, 85, 55–59. [Google Scholar] [CrossRef]

- Lewis, T.; Brawner, J.; Menzies, T.; Ryan, S.; Schulke, B.; Francis, B.; Venn, T. Chapter 5: The effect of silvicultural treatments on forest growth rates and development of a decision support tool to determine forest value. In Improving the Productivity of the Subtropical Private Native Forest Resource in Southern Queensland and Northern New South Wales; Lewis, T., Venn, T., Francis, B., Ryan, S., Brawner, J., Cameron, N., Kelly, A., Menzies, T., Catchpoole, K., Eds.; Forest and Wood Products Australia: Melbourne, Australia, 2020; pp. 96–118. Available online: https://www.fwpa.com.au/images/resources/-2020/Final_Report_PNF_PNC2379-1516.pdf (accessed on 1 July 2020).

- Leggate, W.; McGavin, R.L.; Lewis, T. An assessment of native forests in Queensland for the potential supply of small-diamter, peeler logs for spindleless lathe rotary-veneer processing. BioResources 2019, 14, 9485–9499. [Google Scholar] [CrossRef]

- Venn, T.J.; McGavin, R.L.; Ergashev, A. Accommodating log dimensions and geometry in log procurement decisions for spindleless rotary veneer production. BioResources 2020, 15, 2385–2411. [Google Scholar] [CrossRef]

- Venn, T.; Dorries, J.; McGavin, R. Chapter 18: Financial performance of veneer and laminated veneer lumber (LVL) production using sub-optimum quality log resources. In Increasing the Value of Forest Resources through the Development of Advanced Engineered Wood Products; Forest and Wood Products Australia: Melbourne, Australia, 2020; pp. 429–466. Available online: https://www.fwpa.com.au/images/processing/2020/PNB407-1516_Advanced_EWP_Final_Report.pdf (accessed on 8 November 2020).

- MBAC Consulting Pty Ltd. South East Queensland Private Native Forest Inventory; A Report Prepared for the Commonwealth Government Department of Agriculture, Fisheries and Forestry, and Timber Queensland, Natural Heritage Trust and Bureau of Rural Sciences: Canberra, Australia, 2003. Available online: http://www.agriculture.gov.au/abares/publications/display?url=http://143.188.17.20/anrdl/DAFFService/display.php?fid=pe_brs90000002636.xml (accessed on 17 July 2017).

- MBAC Consulting Pty Ltd. Western Hardwoods Region Queensland Private Native Forest Inventory; A Report Prepared for the Commonwealth Government Department of Agriculture, Fisheries and Forestry, and Timber Queensland, Natural Heritage Trust and Bureau of Rural Sciences: Canberra, Australia, 2003.

- Venn, T.; McGavin, R. Chatper 17: Mill-delivered log costs and gross margins. In Increasing the Value of Forest Resources through the Development of Advanced Engineered Wood Products; McGavin, R., Leggate, W., Dorries, J., Eds.; Forest and Wood Products Australia: Melbourne, Australia, 2020; pp. 398–428. Available online: https://www.fwpa.com.au/images/processing/2020/PNB407-1516_Advanced_EWP_Final_Report.pdf (accessed on 1 July 2020).

- Kewilaa, B. Effects of wood species and log diameter on veneer recovery. J. Trop. Wood Sci. Technol. 2007, 5, 49–56. [Google Scholar]

- Wang, B.J.; Dai, C. Impact of mountain pine beetle-attacked lodgepole pine logs on veneer processing. Wood Fiber Sci. 2008, 40, 397–411. [Google Scholar]

- Belleville, B.; Redman, A.; Chounlamounty, P.; Phengthajam, V.; Xiong, S.; Boupha, L.; Ozarska, B. Potential of veneer peeled from young eucalypts in Laos. BioResources 2018, 13, 7581–7594. [Google Scholar] [CrossRef]

- Roos, A.; Flinkman, M.; Jappinen, A.; Lonner, G.; Warensjo, M. Production strategies in the Swedish softwood sawmilling industry. For. Policy Econ. 2001, 3, 189–197. [Google Scholar] [CrossRef]

- Lahtinen, K.; Toppinen, A. Financial performance of Finnish large-and medium-sized sawmills: The effects of value-added creation and cost-efficiency seeking. J. For. Econ. 2008, 14, 289–305. [Google Scholar] [CrossRef]

- Brege, S.; Nord, T.; Sjostrom, R.; Stehn, L. Value-added strategies and forward integration in the Swedish sawmill industry: Positioning and profitability in the high-volume segment. Scand. J. For. Res. 2010, 25, 482–493. [Google Scholar] [CrossRef]

- Srai, J.S.; Kumar, M.; Graham, G.; Phillips, W.; Tooze, J.; Ford, S.; Beecher, P.; Raj, B.; Gregory, M.; Tiwari, M.K.; et al. Distributed manufacturing: Scope, challenges and opportunities. Int. J. Prod. Res. 2016, 54, 6917–6935. [Google Scholar] [CrossRef]

- Rauch, E.; Dallasega, P.; Matt, D.T. Distributed manufacturing network models of smart and agile mini-factories. Int. J. Agil. Syst. Manag. 2017, 10, 185–207. [Google Scholar] [CrossRef]

- MacCormack, A.D.; Newmann, L.J.; Rosenfield, D.B. The new dynamics of global manufacturing site location. MIT Sloan Manag. Rev. 1994, 35, 69. [Google Scholar]

- Holl, A. Manufacturing location and impacts of road transport infrastructure: Empircal evidence from Spain. Reg. Sci. Urban Econ. 2003, 34, 341–363. [Google Scholar] [CrossRef]

| Name | Variable or Parameter | Description |

|---|---|---|

| LVilt | Dec | Harvested log volume (m3 ha−1) |

| AHit | Dec | Area harvested (ha) |

| ARt | Der | Annual revenues ($) |

| ACt | Der | Annual costs ($) |

| MDLCt | Der | Mill-delivered log cost ($) |

| MVt | Der | Marketable volume of final product (m3) |

| LCt | Der | Labour cost ($) |

| LRt | Der | Principal and interest repayment on a bank loan for buildings, equipment and machinery taken out in year zero ($). The model uses the PMT function in Excel. The principal is BB ∗ Cap. In the case study, the loan term is 10 years and interest rate is 6% per annum. |

| Cap | P | Buildings, equipment, and machinery costs in year zero ($) |

| LYCapt | P | Later year capital and equipment costs ($) |

| FTEjs | P | Number of full-time equivalent workers |

| HAi | P | Total area of commercially important and harvestable native forest (ha) |

| HLjs | P | Hourly cost of labour, including on-costs ($ h−1) |

| MP | P | Market price of the final product being evaluated ($ m−3 of product) |

| NLPS | P | Annual non-labour operating costs that vary by processing scale ($ m−3 of log processed) |

| NLMV | P | Annual non-labour operating costs that vary by marketable volume of final product ($ m−3 of final product) |

| PRsl | P | Processing rate of inputs per hour at a 100% utilisation rate of equipment and machinery (m3 h−1); |

| RFsl | P | Recovery of final marketable product from log volume (%) |

| Sl | P | Stumpage price paid to the landholder ($ m−3 of log) |

| Scale | P | Veneer plant processing scale examined (m3 y−1 of log) |

| URs | P | Utilisation rate of equipment and machinery (% of work hours) |

| SLVil | P | Standing harvestable log volume for the selection harvest regime permitted in the study area (m3 ha−1) |

| CSLl | P | Cut snig and load cost ($ m−3 of log) |

| HFCi | P | Haul fixed cost ($ m−3 of log) |

| HVCi | P | Haul variable cost ($ m−3 km−1 of log) |

| Disti | P | Straight-line haul distance to the veneer facility from haul zone i (km) |

| CFi | P | Competition factor, defined as the percent of total commercially important and harvestable forest area potentially available to the processing facility being modelled (%). |

| F | P | Freight cost ($ m−3 of final product) |

| r | SP 7% | Real (net of inflation) discount rate (%) |

| AL | SP 20 | Asset life of Cap (years) |

| BB | SP 70% | Proportion of Cap borrowed from the bank (%) |

| AM | SP 5% | Annual maintenance costs in parts (not labour) (% of Cap) |

| AI | SP 1.5% | Annual insurance costs (% of Cap) |

| WRF | SP 30% | ‘Windy road factor’, which accounts for roads not being in straight lines from the forest to the mill (% increase in haul distance relative to a straight-line haul) |

| HRI | SP 30 years | Harvest return interval, which is the minimum time between commercially viable harvests (years) |

| Dept | Bin 1, 0 | A dummy variable that tracks whether depreciation can be claimed on Cap. If t ≤ AL, then Dept is 1, else Dept is 0. |

| TAX | Bin 30%, 0% | Company tax rate. If ARt > ACt, then TAX is 30%, otherwise TAX is 0%. |

| Name | Description |

|---|---|

| i N | Haul zone. In the case study, there are 40 haul zones radiating out from the facility location in 10 km increments to a maximum of 400 km. |

| j J | Position or job type. |

| l L | Log type. In the case study these are: A-grade sawlog; B-grade sawlog; small peeler log; and top log. |

| t T | Time period since initial capital investment (years). |

| s S | Stage of production. In this case study there are four: green veneer production; dry veneer production; one-stage LVL production and two-stage LVL production. |

| Parameter | Log Type | ||

|---|---|---|---|

| Small Peeler or Top Log | B-Grade Sawlog | A-Grade Sawlog | |

| Small-end diameter under bark (SEDUB, cm) | 25 | 35 | 45 |

| Log volume (m3/log) | 0.138 | 0.264 | 0.432 |

| Log volume loss due to rounding (%) | 8.0 | 5.6 | 4.4 |

| SLVil (m3/ha) | 3.4/0.6 | 3.5 | 1.1 |

| Sl ($/m3) | 40 | 55 | 110 |

| CSLl ($/m3) | 66/48 | 43.5 | 43.5 |

| Disti (km) | HAi by Facility Location Scenario (ha) | CFi (%) | HFCi ($/m3) | HVCi ($/m3/km) | |

|---|---|---|---|---|---|

| A | B | ||||

| 0–30 | 0 | 30,000 | 59 | 10.33 | 0.3856 |

| 31–50 | 0 | 53,333 | 59 | 21.90 | 0.3153 |

| 51–80 | 21,667 | 130,000 | 26 | 28.21 | 0.2355 |

| 81–100 | 20,000 | 120,000 | 26 | 35.28 | 0.2007 |

| 101–200 | 347,222 | 288,889 | 8 | 39.29 | 0.1731 |

| 201–300 | 578,704 | 481,482 | 4 | 56.60 | 0.1731 |

| 301–400 | 810,185 | 674,074 | 2 | 73.91 | 0.1731 |

| Total | 1,777,778 | 1,777,778 | |||

| Final Product | Length (m) | Width (mm) | Thickness (mm) |

|---|---|---|---|

| One-stage LVL | 2.4 | 120 | 35 |

| Two-stage LVL | 2.4 | 150 | 100 |

| Log Type | Proportion (%) of Logs by Log Type to Maximise NPV for Each Processing Scale (m3/y of Log) and Facility Location. | |||||

|---|---|---|---|---|---|---|

| 7500 | 15,000 | 30,000 | ||||

| A | B | A | B | A | B | |

| A-grade sawlog | 0 | 0 | 5.6 | 0 | n.a. | 2.2 |

| B-grade sawlog | 73.9 | 95.3 | 54.6 | 90.7 | n.a. | 55.3 |

| Small peeler or top log | 26.1 | 4.7 | 39.8 | 9.3 | n.a. | 42.5 |

| Log Procurement Scenario | Average Mill-Delivered Log Cost ($/m3) by Processing Scale (m3/y of Log) and Facility Location | |||||

|---|---|---|---|---|---|---|

| 7500 | 15,000 | 30,000 | ||||

| A | B | A | B | A | B | |

| 1 | 163 | 131 | n.a. | 138 | n.a. | n.a. |

| 2 | 155 | 131 | 166 | 135 | n.a. | 141 |

| 3 | 152 | 126 | 164 | 132 | n.a. | 137 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Venn, T.J.; Dorries, J.W.; McGavin, R.L.; Leggate, W. Impact of Facility Location on the Financial Performance of Integrated and Distributed LVL Production in Subtropical Eastern Australia. Forests 2022, 13, 1903. https://doi.org/10.3390/f13111903

Venn TJ, Dorries JW, McGavin RL, Leggate W. Impact of Facility Location on the Financial Performance of Integrated and Distributed LVL Production in Subtropical Eastern Australia. Forests. 2022; 13(11):1903. https://doi.org/10.3390/f13111903

Chicago/Turabian StyleVenn, Tyron J., Jack W. Dorries, Robert L. McGavin, and William Leggate. 2022. "Impact of Facility Location on the Financial Performance of Integrated and Distributed LVL Production in Subtropical Eastern Australia" Forests 13, no. 11: 1903. https://doi.org/10.3390/f13111903

APA StyleVenn, T. J., Dorries, J. W., McGavin, R. L., & Leggate, W. (2022). Impact of Facility Location on the Financial Performance of Integrated and Distributed LVL Production in Subtropical Eastern Australia. Forests, 13(11), 1903. https://doi.org/10.3390/f13111903