Investments in Pinus elliottii Engelm. Plantations: Real Options Analysis in Discrete Time

Abstract

:1. Introduction

2. Materials and Methods

2.1. Site Description and Experimental Details

2.2. Deterministic Model

Opportunity Cost Rate Estimate

2.3. Stochastic Model

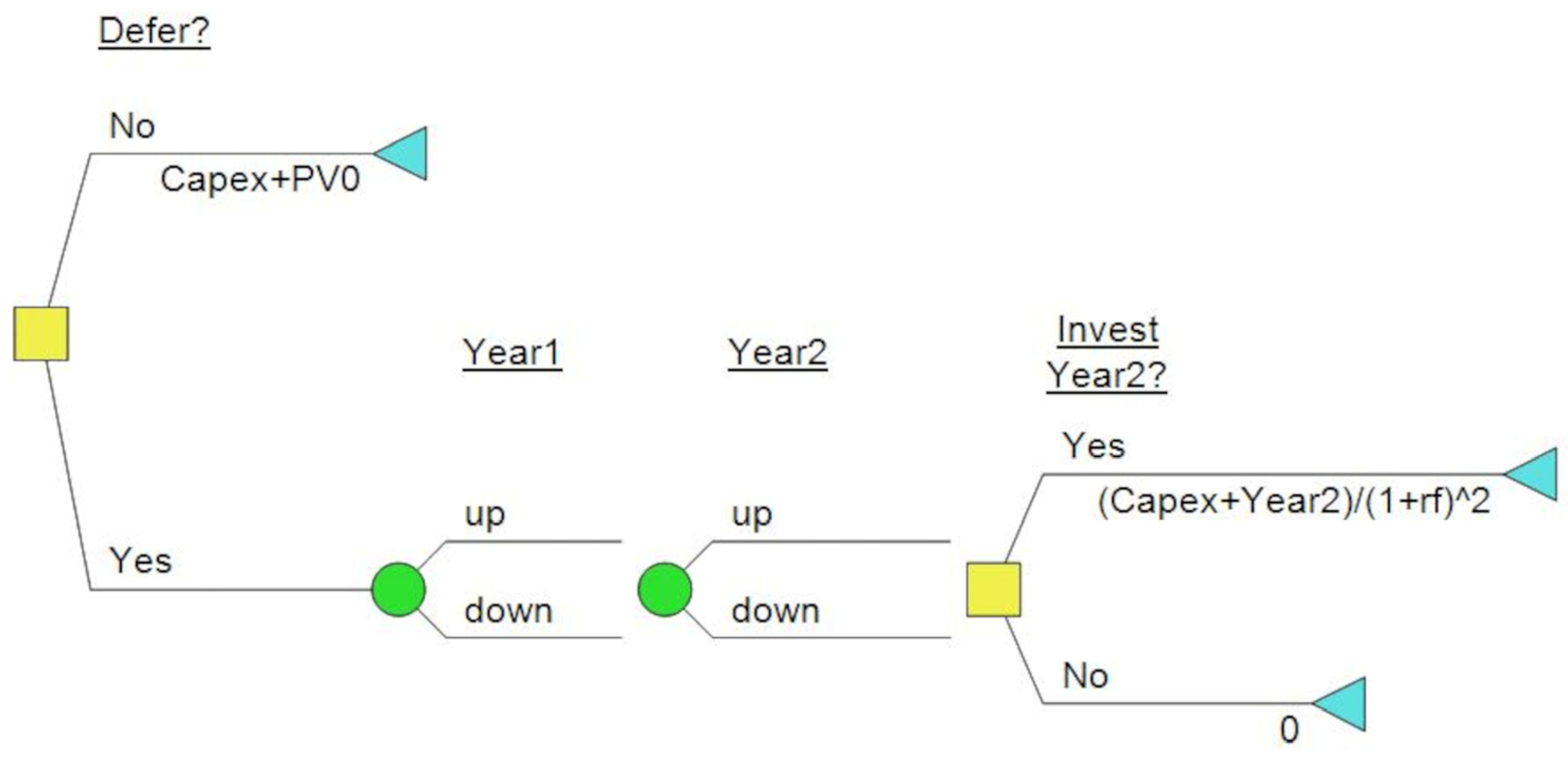

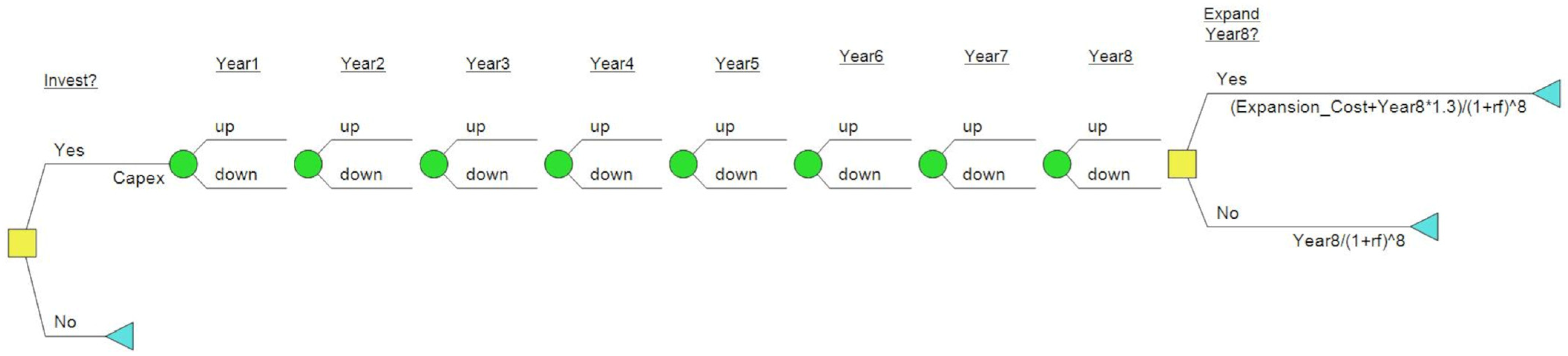

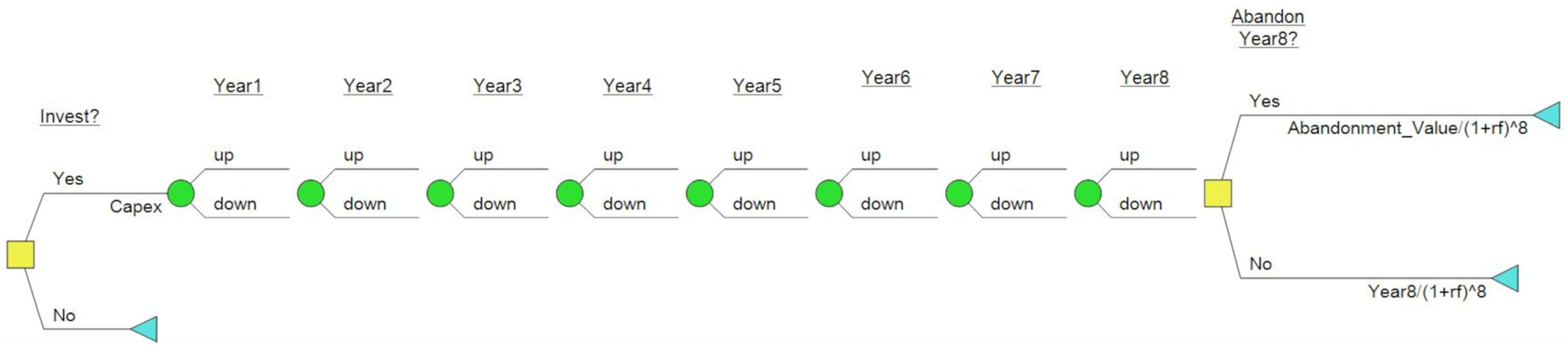

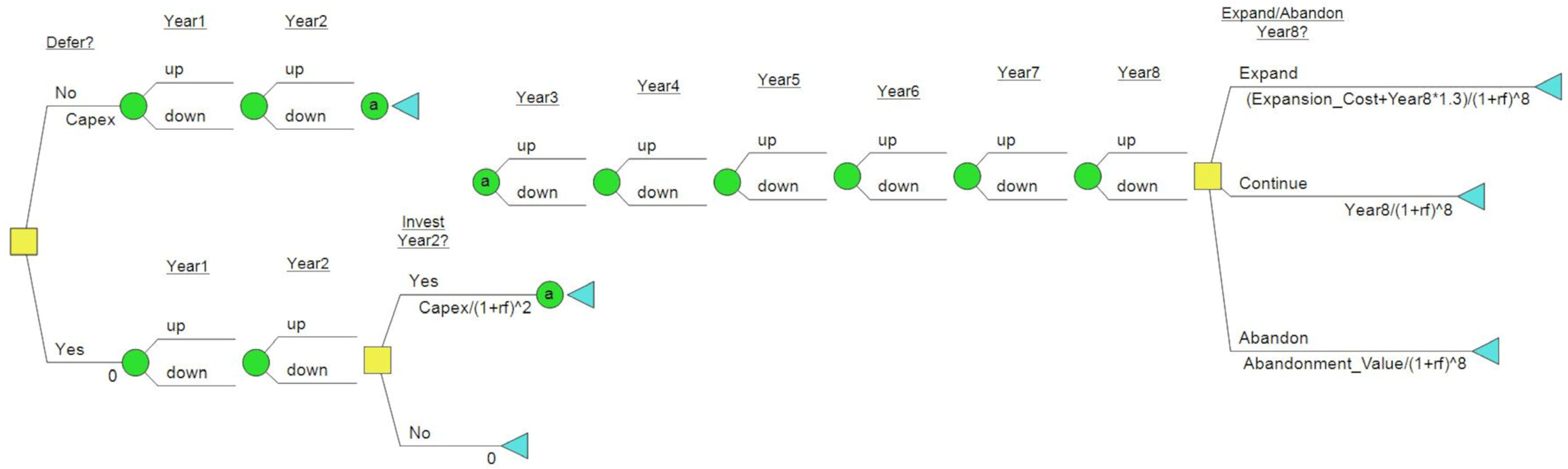

2.3.1. Modeling Investment Projects and Uncertainties

2.3.2. Volatility of Investment Projects and Risk-Neutral Probabilities of Upward and Downward Movements

2.3.3. Binomial Options Pricing Model

3. Results and Discussion

3.1. Deterministic Ecoomic Model

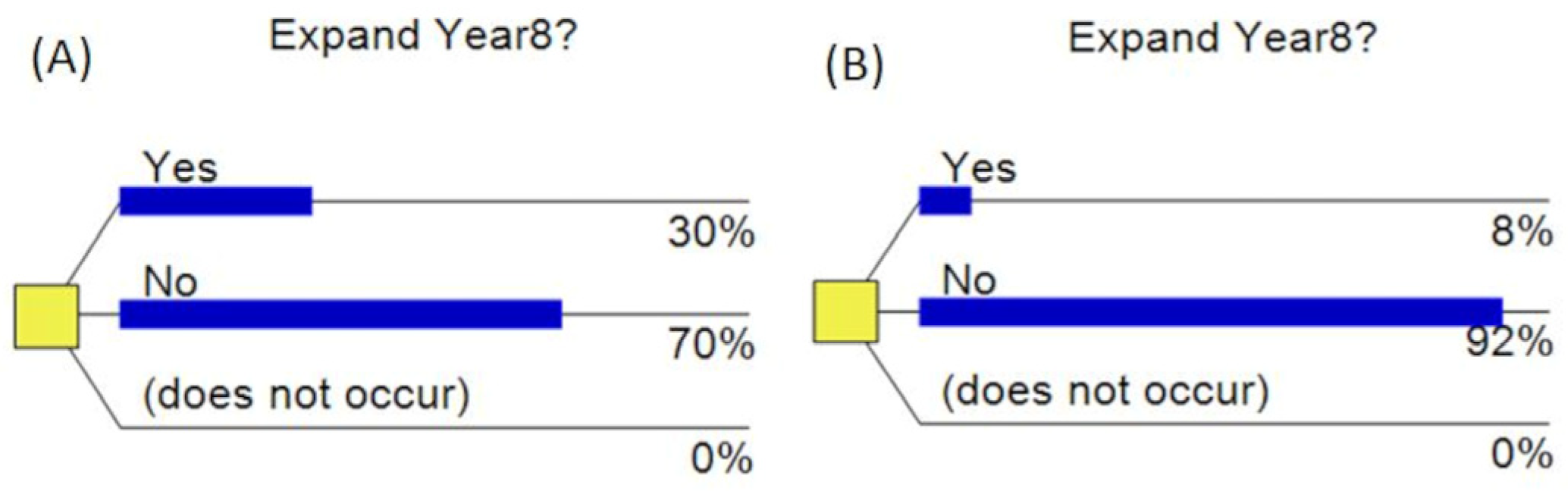

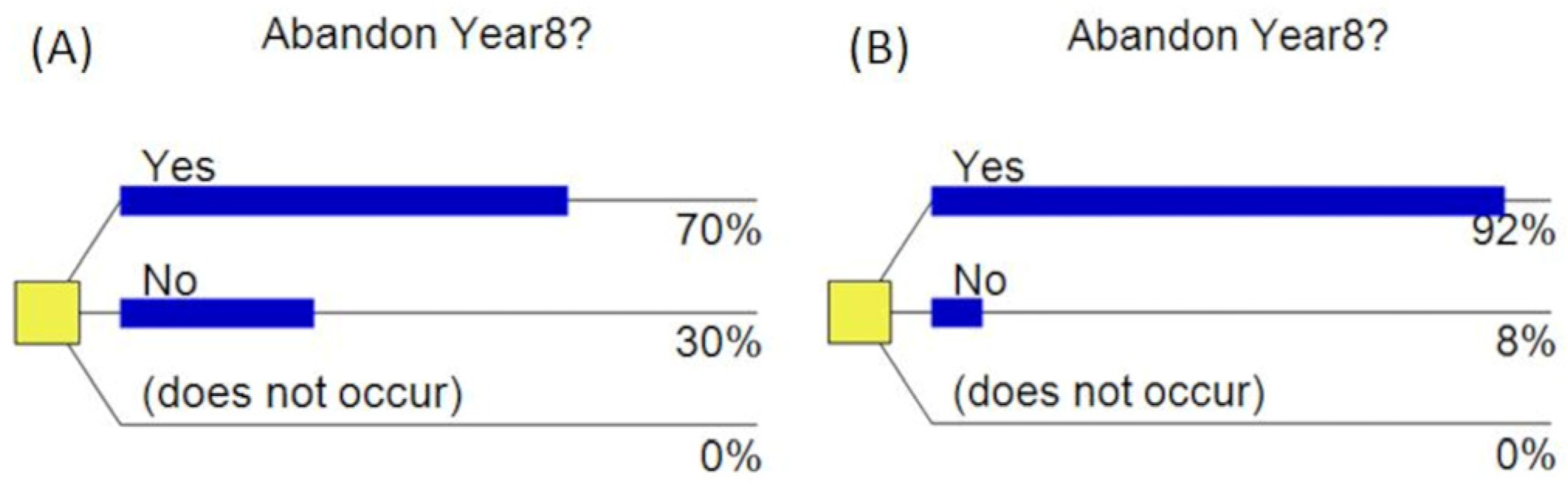

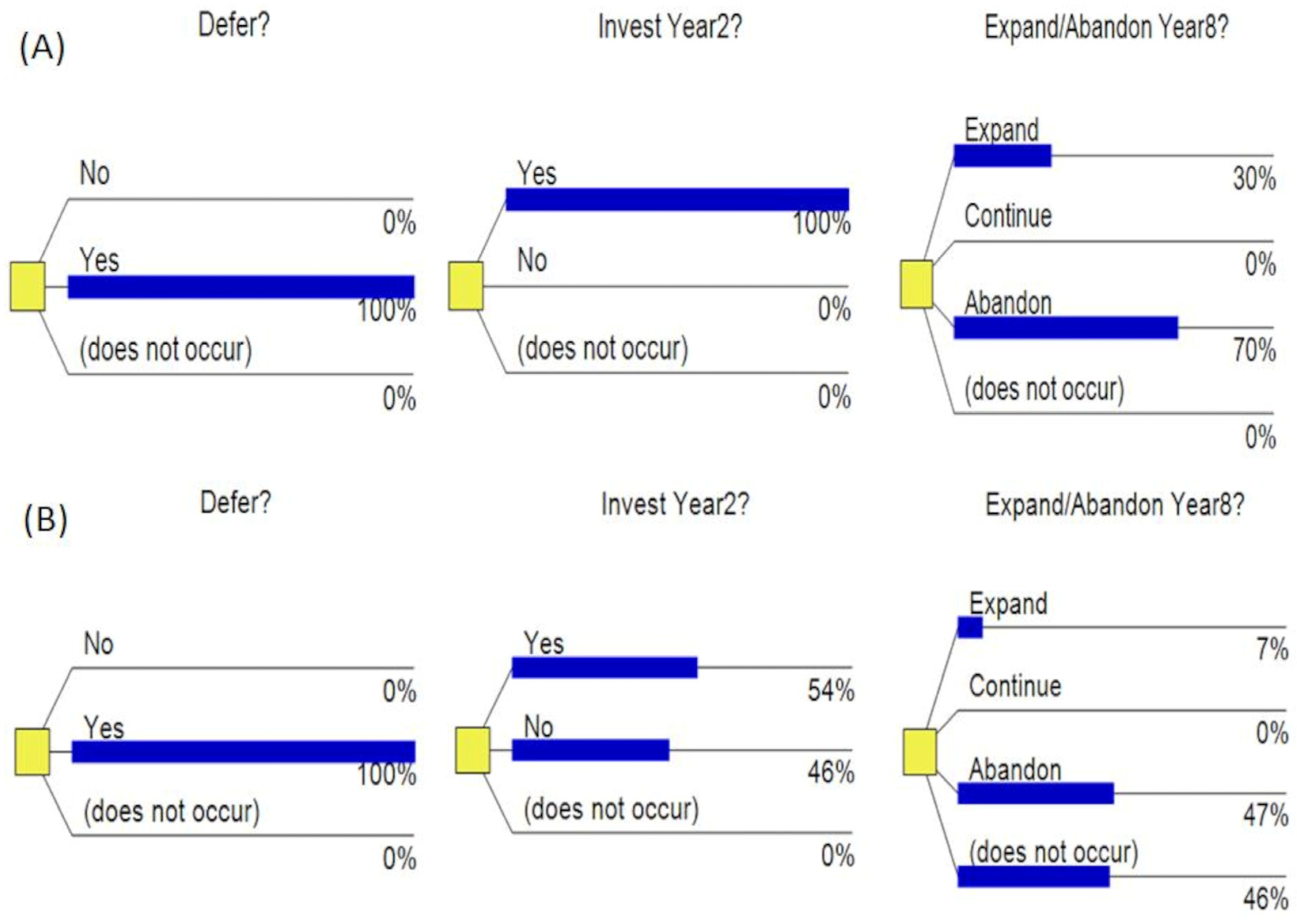

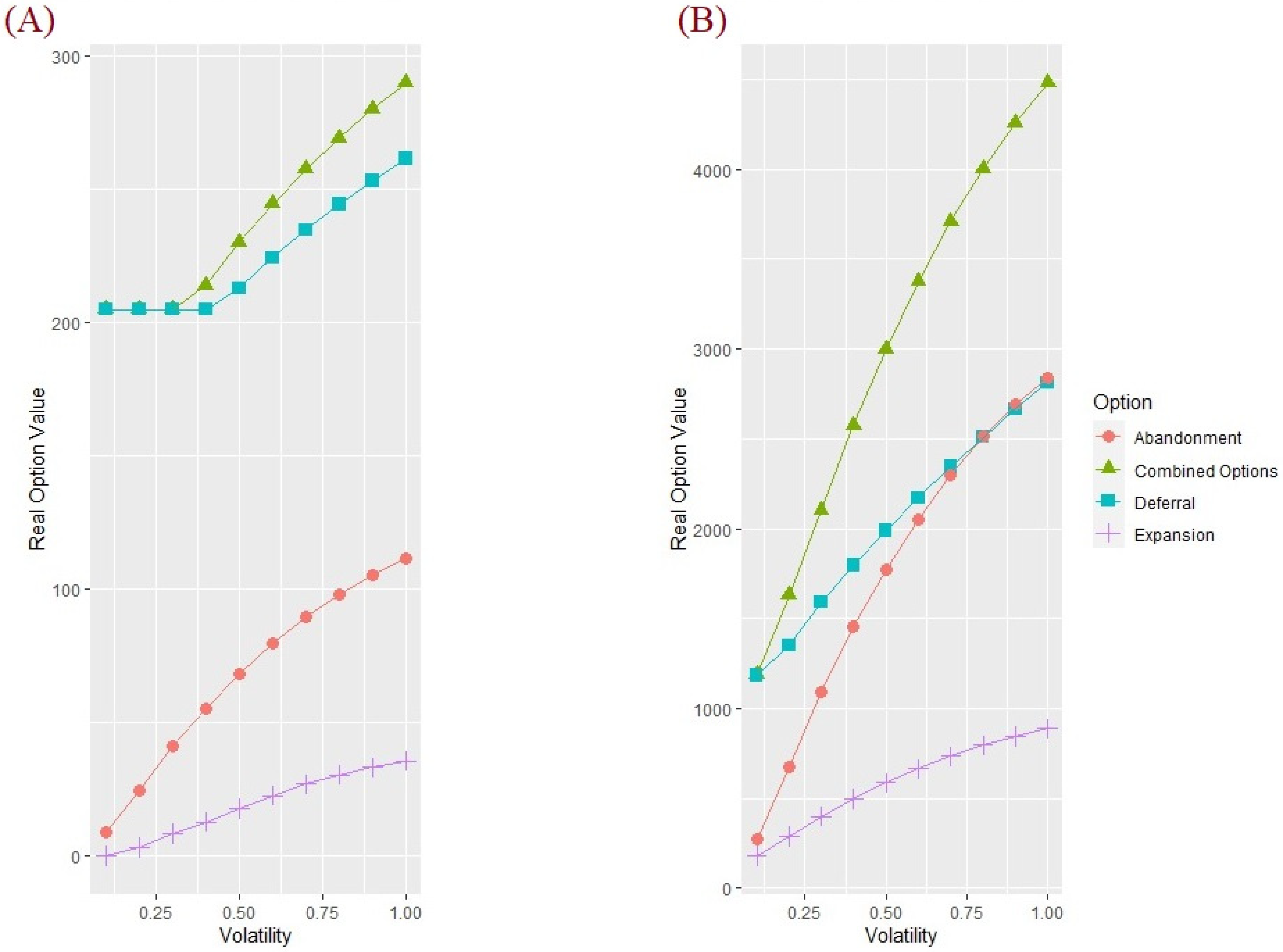

3.2. Stochastic Model

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Vihervaara, P.; Marjokorpi, A.; Kumpula, T.; Walls, M.; Kamppinen, M. Ecosystem services of fast-growing tree plantations: A case study on integrating social valuations with land-use changes in Uruguay. For. Policy Econ. 2012, 14, 58–68. [Google Scholar] [CrossRef]

- Brockerhoff, E.G.; Jactel, H.; Parrotta, J.A.; Ferraz, S.F.B. Role of eucalypt and other planted forests in biodiversity conservation and the provision of biodiversity-related ecosystem services. For. Ecol. Manag. 2013, 301, 43–50. [Google Scholar] [CrossRef]

- Marchi, M.; Paletto, A.; Cantiani, P.; Bianchetto, E.; De Meo, I. Comparing Thinning System Effects on Ecosystem Services Provision in Artificial Black Pine (Pinus nigra J. F. Arnold) Forests. Forest 2018, 9, 188. [Google Scholar] [CrossRef] [Green Version]

- Torres, I.; Moreno, J.M.; Morales-Molino, C.; Arianoutsou, M. Ecosystem Services Provided by Pine Forests. In Pines and Their Mixed Forest Ecosystems in the Mediterranean Basin. Managing Forest Ecosystems; Ne’eman, G., Osem, Y., Eds.; Springer: Cham, Switzerland, 2021; pp. 617–629. [Google Scholar]

- Rossato, F.G.F.S.; Susaeta, A.; Adams, D.C.; Hidalgo, I.G.; de Araujo, T.D.; de Queiroz, A. Comparison of revealed comparative advantage indexes with application to trade tendencies of cellulose production from planted forests in Brazil, Canada, China, Sweden, Finland and the United States. For. Policy Econ. 2018, 97, 59–66. [Google Scholar] [CrossRef]

- Brazilian Institute of Geography and Statistics Vegetal Extraction and Forestry Production. Available online: https://biblioteca.ibge.gov.br/visualizacao/periodicos/74/pevs_2020_v35_informativo.pdf (accessed on 20 November 2021).

- Bettinger, P.; Boston, K.; Siry, J.; Grebner, D. Forest Management and Planning; Academic Press: San Diego, CA, USA, 2019. [Google Scholar]

- De Rezende, J.L.P.; de Oliveira, A.D. Análise Econômica e Social de Projetos Florestais; UFV: Viçosa, Brazil, 2008. [Google Scholar]

- Hazra, T.; Samanta, B.; Dey, K. Real option valuation of an Indian iron ore deposit through system dynamics model. Resour. Policy 2019, 60, 288–299. [Google Scholar] [CrossRef]

- Venetsanos, K.; Angelopoulou, P.; Tsoutsos, T. Renewable energy sources project appraisal under uncertainty: The case of wind energy exploitation within a changing energy market environment. Energy Policy 2002, 30, 293–307. [Google Scholar] [CrossRef]

- Yao, J.-S.; Chen, M.-S.; Lin, H.-W. Valuation by using a fuzzy discounted cash flow model. Expert Syst. Appl. 2005, 28, 209–222. [Google Scholar] [CrossRef]

- Berger, R.; Júnior, R.T.; dos Santos, A.J.; Bittencourt, A.M.; de Souza, V.S.; de Loyola Eisfeld, C.; Polz, W.B. Rentabilidade econômica da produção de Pinus spp. por mesorregião homogênea no estado do Paraná. Floresta 2011, 41, 161–168. [Google Scholar] [CrossRef] [Green Version]

- Shogren, J.F. Behavior in forest economics. J. For. Econ. 2007, 12, 233–235. [Google Scholar] [CrossRef]

- Salles, T.T.; Nogueira, D.A.; Beijo, L.A.; da Silva, L.F. Bayesian approach and extreme value theory in economic analysis of forestry projects. For. Policy Econ. 2019, 105, 64–71. [Google Scholar] [CrossRef]

- Feinstein, S.P.; Lander, D.M. A better understanding of why npv undervalues managerial flexibility. Eng. Econ. 2002, 47, 418–435. [Google Scholar] [CrossRef]

- Huchzermeier, A.; Loch, C.H. Project Management Under Risk: Using the Real Options Approach to Evaluate Flexibility in R…D. Manag. Sci. 2001, 47, 85–101. [Google Scholar] [CrossRef]

- Makropoulou, V. Decision tree analysis and real options: A reconciliation. Manag. Decis. Econ. 2011, 32, 261–264. [Google Scholar] [CrossRef]

- Pringles, R.; Olsina, F.; Garcés, F. Designing regulatory frameworks for merchant transmission investments by real options analysis. Energy Policy 2014, 67, 272–280. [Google Scholar] [CrossRef] [Green Version]

- Allen, F.; Bhattacharya, S.; Rajan, R.; Schoar, A. The Contributions of Stewart Myers to the Theory and Practice of Corporate Finance. J. Appl. Corp. Financ. 2008, 20, 8–19. [Google Scholar] [CrossRef]

- Borison, A. Real Options Analysis: Where Are the Emperor’s Clothes? J. Appl. Corp. Financ. 2005, 17, 17–31. [Google Scholar] [CrossRef]

- Kumbaroğlu, G.; Madlener, R.; Demirel, M. A real options evaluation model for the diffusion prospects of new renewable power generation technologies. Energy Econ. 2008, 30, 1882–1908. [Google Scholar] [CrossRef]

- Ford, D.N.; Lander, D.M. Real option perceptions among project managers. Risk Manag. 2011, 13, 122–146. [Google Scholar] [CrossRef]

- Driouchi, T.; Bennett, D.J. Real Options in Management and Organizational Strategy: A Review of Decision-making and Performance Implications. Int. J. Manag. Rev. 2012, 14, 39–62. [Google Scholar] [CrossRef] [Green Version]

- Miller, L.T.; Park, C.S. Decision Making Under Uncertainty—Real Options to the Rescue? Eng. Econ. 2002, 47, 105–150. [Google Scholar] [CrossRef]

- Savolainen, J. Real options in metal mining project valuation: Review of literature. Resour. Policy 2016, 50, 49–65. [Google Scholar] [CrossRef]

- Dyner, I.; Larsen, E.R. From planning to strategy in the electricity industry. Energy Policy 2001, 29, 1145–1154. [Google Scholar] [CrossRef]

- Yin, R. Combining Forest-Level Analysis with Options Valuation Approach—A New Framework for Assessing Forestry Investment. For. Sci. 2001, 47, 475–483. [Google Scholar] [CrossRef]

- Bouchaud, J.; Potters, M. Theory of Financial Risk and Derivative Pricing: From Statistical Physics to Risk Management; Cambridge University Press: Cambridge, UK, 2003. [Google Scholar]

- Santos, L.; Soares, I.; Mendes, C.; Ferreira, P. Real Options versus Traditional Methods to assess Renewable Energy Projects. Renew. Energy 2014, 68, 588–594. [Google Scholar] [CrossRef]

- Ajak, A.D.; Lilford, E.; Topal, E. Real Option Identification Framework for Mine Operational Decision-Making. Nat. Resour. Res. 2019, 28, 409–430. [Google Scholar] [CrossRef]

- Fichman, R.G.; Keil, M.; Tiwana, A. Beyond Valuation: “Options thinking” in IT project management. Calif. Manag. Rev. 2005, 47, 74–96. [Google Scholar] [CrossRef] [Green Version]

- Triantis, A.; Borison, A. Real Options: State of the Practice. J. Appl. Corp. Financ. 2001, 14, 8–24. [Google Scholar] [CrossRef]

- Xiao, Y.; Fu, X.; Oum, T.H.; Yan, J. Modeling airport capacity choice with real options. Transp. Res. Part B Methodol. 2017, 100, 93–114. [Google Scholar] [CrossRef]

- Manfredo, M.R.; Shultz, C.J. Risk, Trade, Recovery, and the Consideration of Real Options: The Imperative Coordination of Policy, Marketing, and Finance in the Wake of Catastrophe. J. Public Policy Mark. 2007, 26, 33–48. [Google Scholar] [CrossRef] [Green Version]

- Trigeorgis, L. The Nature of Option Interactions and the Valuation of Investments with Multiple Real Options. J. Financ. Quant. Anal. 1993, 28, 1–20. [Google Scholar] [CrossRef] [Green Version]

- Lambrecht, B.M. Real options in finance. J. Bank. Financ. 2017, 81, 166–171. [Google Scholar] [CrossRef]

- Cox, J.C.; Ross, S.A.; Rubinstein, M. Option pricing: A simplified approach. J. Financ. Econ. 1979, 7, 229–263. [Google Scholar] [CrossRef]

- Guo, K.; Zhang, L.; Wang, T. Optimal scheme in energy performance contracting under uncertainty: A real option perspective. J. Clean. Prod. 2019, 231, 240–253. [Google Scholar] [CrossRef]

- Herath, H.S.B.; Park, C.S. Multi-stage capital investment opportunities as compound real options. Eng. Econ. 2002, 47, 1–27. [Google Scholar] [CrossRef]

- Ho, S.-H.; Liao, S.-H. A fuzzy real option approach for investment project valuation. Expert Syst. Appl. 2011, 38, 15296–15302. [Google Scholar] [CrossRef]

- Hu, X.; Jie, C. Randomized Binomial Tree and Pricing of American-Style Options. Math. Probl. Eng. 2014, 2014, 291737. [Google Scholar] [CrossRef] [Green Version]

- Bakker, H.; Dunke, F.; Nickel, S. A structuring review on multi-stage optimization under uncertainty: Aligning concepts from theory and practice. Omega 2020, 96, 102080. [Google Scholar] [CrossRef]

- Block, S. Are “Real Options” Actually Used in the Real World? Eng. Econ. 2007, 52, 255–267. [Google Scholar] [CrossRef]

- Čulík, M. Real options valuation with changing volatility. Perspect. Sci. 2016, 7, 10–18. [Google Scholar] [CrossRef] [Green Version]

- Alvares, C.A.; Stape, J.L.; Sentelhas, P.C.; de Moraes Gonçalves, J.L.; Sparovek, G. Köppen’s climate classification map for Brazil. Meteorol. Z. 2013, 22, 711–728. [Google Scholar] [CrossRef]

- Santos, H.G.; Almeida, J.A.; Oliveira, J.B.; Lumbreras, J.F.; Anjos, L.H.C.; Coelho, M.R.; Jacomine, P.K.T.; Cunha, T.J.F.; Oliveira, V.A. Sistema Brasileiro de Classificação de Solos; EMBRAPA: Brasilia, Brazil, 2018. [Google Scholar]

- Nascimento, R.A.; Nunoo, D.B.O.; Bizkarguenaga, E.; Schultes, L.; Zabaleta, I.; Benskin, J.P.; Spanó, S.; Leonel, J. Sulfluramid use in Brazilian agriculture: A source of per- and polyfluoroalkyl substances (PFASs) to the environment. Environ. Pollut. 2018, 242, 1436–1443. [Google Scholar] [CrossRef] [PubMed]

- Deng, Y.; Yang, G.; Xie, Z.; Yu, J.; Jiang, D.; Huang, Z. Effects of Different Weeding Methods on the Biomass of Vegetation and Soil Evaporation in Eucalyptus Plantations. Sustainability 2020, 12, 3669. [Google Scholar] [CrossRef]

- Collet, C.; Vast, F.; Richter, C.; Koller, R. Cultivation profile: A visual evaluation method of soil structure adapted to the analysis of the impacts of mechanical site preparation in forest plantations. Eur. J. For. Res. 2021, 140, 65–76. [Google Scholar] [CrossRef]

- Hevia, A.; Álvarez-González, J.G.; Majada, J. Comparison of pruning effects on tree growth, productivity and dominance of two major timber conifer species. For. Ecol. Manag. 2016, 374, 82–92. [Google Scholar] [CrossRef]

- Dobner, M., Jr.; de Quadros, D.S. Economic Performance of Loblolly Pine Stands in Southern Brazil as a Result of Different Crown Thinning Intensities1. Rev. Árvore 2019, 43, 43. [Google Scholar] [CrossRef]

- Pereira Filho, G.M.; Jacovine, L.A.G.; Schettini, B.L.S.; de Paiva, H.N.; Villanova, P.H.; da Rocha, S.J.S.S.; Leite, H.G. Influence of the Replanting Age on Yield and Growth of Eucalypt Clonal Stands. Rev. Árvore 2020, 44, 2–7. [Google Scholar] [CrossRef]

- Brasil Law No. 9,430, December 27, 1996. Available online: http://www.planalto.gov.br/ccivil_03/LEIS/L9430 (accessed on 17 October 2019).

- Kulakov, N.Y.; Kulakova, A.N. Evaluation of Nonconventional Projects. Eng. Econ. 2013, 58, 137–148. [Google Scholar] [CrossRef]

- Brotherson, W.; Eades, K.; Harris, R.; Higgins, R. “Best Practices” in Estimating the Cost of Capital: An Update. J. Appl. Financ. 2013, 23, 1–19. [Google Scholar]

- Moody’s Rating Country Default Spreads. Available online: https://www.moodys.com/credit-ratings/Brazil-Government-of-credit-rating-114650 (accessed on 17 October 2019).

- Baker, H.K.; English, P. Capital Budgeting Valuation: Financial Analysis for Today’s Investment Projects; John Wiley & Sons: Hoboken, NJ, USA, 2011. [Google Scholar]

- Department of the Treasury T-Bonds. Available online: https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll (accessed on 17 October 2019).

- Viebig, J.; Poddig, T.; Varmaz, A. Equity Valuation: Models from Leading Investment Banks; John Wiley & Sons: Chichester, UK, 2008. [Google Scholar]

- Bowman, R.G.; Bush, S.R. Using Comparable Companies to Estimate the Betas of Private Companies. J. Appl. Financ. 2006, 16, 71–82. [Google Scholar]

- Brasil, Bolsa, B. Cotações Históricas. Available online: http://www.b3.com.br/pt_br/market-data-e-indices/servicos-de-dados/market-data/historico/mercado-a-vista/cotacoes-historicas (accessed on 17 December 2019).

- S&P Down Jones S&P Global Timber & Forestry Index. Available online: https://www.spglobal.com/spdji/en/indices/equity/sp-global-timber-and-forestry-index/#overview (accessed on 17 December 2019).

- Institute for Applied Economic Research Emerging Markets Bond Index + Risco Brasil (EMBI + RB). Available online: http://www.ipeadata.gov.br/ExibeSerie.aspx?serid=40940&module=M (accessed on 15 December 2019).

- Damodaran, A. The Dark Side of Valuation: Valuing Young, Distressed, and Complex Businesses; Pearson Education: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Aresb Average Price of Resin. Available online: http://www.aresb.com.br/portal/preco-medio-resina (accessed on 17 November 2021).

- Cepa Monthly Agricultural Prices. Available online: https://cepa.epagri.sc.gov.br/index.php/produtos/mercado-agricola/precos-agricolas-mensais-indice (accessed on 17 November 2021).

- Mendes, J.T.G.; Padilha Junior, J.B. Agronegócio: Uma Abordagem Econômica; Pearson Prentice Hall: São Paulo, Brizal, 2007. [Google Scholar]

- Team, R.D.C. RStudio: A Language and Environment for Statistical Computing; RStudio: Boston, MA, USA, 2020. [Google Scholar]

- Jarque, C.M.; Bera, A.K. Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Econ. Lett. 1980, 6, 255–259. [Google Scholar] [CrossRef]

- Cox, D.R.; Stuart, A. Some Quick Sign Tests for Trend in Location and Dispersion. Biometrika 1955, 42, 80–95. [Google Scholar] [CrossRef] [Green Version]

- Dickey, D.A.; Fuller, W.A. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar] [CrossRef]

- Ossenbruggen, P.J.; Laflamme, E.M. Explaining Freeway Breakdown with Geometric Brownian Motion Model. J. Transp. Eng. Part A Syst. 2019, 145, 4019037. [Google Scholar] [CrossRef]

- Maeda, M.; Watts, D. The unnoticed impact of long-term cost information on wind farms’ economic value in the USA—A real option analysis. Appl. Energy 2019, 241, 540–547. [Google Scholar] [CrossRef]

- Rębiasz, B. The valuation of real options in a hybrid environment. Oper. Res. Decis. 2019, 29, 97–119. [Google Scholar] [CrossRef]

- Insley, M. A Real Options Approach to the Valuation of a Forestry Investment. J. Environ. Econ. Manag. 2002, 44, 471–492. [Google Scholar] [CrossRef]

- Copeland, T.E.; Antikarov, V. Opções Reais: Um novo Paradigma para Reinventar a Avaliação de Investimentos; Campus Verlag: Rio de Janeiro, Brizal, 2001. [Google Scholar]

- Palisade Corporation @Risk Versão 8.0 Ithaca. Available online: https://www.palisade-br.com (accessed on 15 May 2020).

- Kim, K.; Park, H.; Kim, H. Real options analysis for renewable energy investment decisions in developing countries. Renew. Sustain. Energy Rev. 2017, 75, 918–926. [Google Scholar] [CrossRef]

- Brandão, L.E.; Dyer, J.S.; Hahn, W.J. Using Binomial Decision Trees to Solve Real-Option Valuation Problems. Decis. Anal. 2005, 2, 69–88. [Google Scholar] [CrossRef]

- Dalton, C.; Manzella, T.; Franz, N. Syncopation DPL: Decision Programming Language 2020; Syncopation: Concord, MA, USA, 2020. [Google Scholar]

- Miranda, O.; Brandão, L.E.; Lazo, J.L. A dynamic model for valuing flexible mining exploration projects under uncertainty. Resour. Policy 2017, 52, 393–404. [Google Scholar] [CrossRef]

- Mun, J. Real Options Analysis: Tools and Techniques for Valuing Strategic Investments and Decisions; John Wiley & Sons: Hoboken, NJ, USA, 2006. [Google Scholar]

- Trigeorgis, L. Making use of real options simple: An overview and applications in flexible/modular decision making. Eng. Econ. 2005, 50, 25–53. [Google Scholar] [CrossRef]

- Dimitrakopoulos, R.G.; Sabour, S.A.A. Evaluating mine plans under uncertainty: Can the real options make a difference? Resour. Policy 2007, 32, 116–125. [Google Scholar] [CrossRef]

- Lee, I.; Lee, K. The Internet of Things (IoT): Applications, investments, and challenges for enterprises. Bus. Horiz. 2015, 58, 431–440. [Google Scholar] [CrossRef]

- Liu, X.; Ronn, E.I. Using the binomial model for the valuation of real options in computing optimal subsidies for Chinese renewable energy investments. Energy Econ. 2020, 87, 104692. [Google Scholar] [CrossRef] [Green Version]

- Suttinon, P.; Nasu, S. Real Options for Increasing Value in Industrial Water Infrastructure. Water Resour. Manag. 2010, 24, 2881–2892. [Google Scholar] [CrossRef]

- Boomsma, T.K.; Meade, N.; Fleten, S.-E. Renewable energy investments under different support schemes: A real options approach. Eur. J. Oper. Res. 2012, 220, 225–237. [Google Scholar] [CrossRef]

- Martínez-Ceseña, E.A.; Mutale, J. Application of an advanced real options approach for renewable energy generation projects planning. Renew. Sustain. Energy Rev. 2011, 15, 2087–2094. [Google Scholar] [CrossRef]

- Shaffie, S.S.; Jaaman, S.H. Monte Carlo on Net Present Value for Capital Investment in Malaysia. Procedia-Soc. Behav. Sci. 2016, 219, 688–693. [Google Scholar] [CrossRef] [Green Version]

- Benaroch, M.; Kauffman, R.J. A Case for Using Real Options Pricing Analysis to Evaluate Information Technology Project Investments. Inf. Syst. Res. 1999, 10, 70–86. [Google Scholar] [CrossRef] [Green Version]

- Golub, A.A.; Lubowski, R.N.; Piris-Cabezas, P. Business responses to climate policy uncertainty: Theoretical analysis of a twin deferral strategy and the risk-adjusted price of carbon. Energy 2020, 205, 117996. [Google Scholar] [CrossRef]

- Cardin, M.-A.; Zhang, S.; Nuttall, W.J. Strategic real option and flexibility analysis for nuclear power plants considering uncertainty in electricity demand and public acceptance. Energy Econ. 2017, 64, 226–237. [Google Scholar] [CrossRef] [Green Version]

- Cardin, M.-A. Enabling Flexibility in Engineering Systems: A Taxonomy of Procedures and a Design Framework. J. Mech. Des. 2014, 136, 011005. [Google Scholar] [CrossRef] [Green Version]

- Sabri, Y.; Hadi, P.O.; Hariyanto, N. Decision Area of Distributed Generation Investment as Deferral Option in Industrial Distribution System Using Real Option Valuation. Int. J. Electr. Eng. Inform. 2016, 8, 1. [Google Scholar] [CrossRef]

- Folta, T.B.; Johnson, D.R.; O’Brien, J. Uncertainty, irreversibility, and the likelihood of entry: An empirical assessment of the option to defer. J. Econ. Behav. Organ. 2006, 61, 432–452. [Google Scholar] [CrossRef]

- Arango, M.A.A.; Cataño, E.T.A.; Hernández, J.D. Valoración de proyectos de energía térmica bajo condiciones de incertidumbre a través de opciones reales. Rev. Ing. Univ. Medellín 1970, 12. [Google Scholar] [CrossRef] [Green Version]

- Guo, K.; Zhang, L. Guarantee optimization in energy performance contracting with real option analysis. J. Clean. Prod. 2020, 258, 120908. [Google Scholar] [CrossRef]

- Durica, M.; Guttenova, D.; Pinda, L.; Svabova, L. Sustainable Value of Investment in Real Estate: Real Options Approach. Sustainability 2018, 10, 4665. [Google Scholar] [CrossRef] [Green Version]

- Chow, J.Y.J.; Regan, A.C. Network-based real option models. Transp. Res. Part B Methodol. 2011, 45, 682–695. [Google Scholar] [CrossRef]

- Arya, A.; Glover, J. Abandonment Options and Information System Design. Rev. Account. Stud. 2003, 8, 29–45. [Google Scholar] [CrossRef]

- Damaraju, N.L.; Barney, J.B.; Makhija, A.K. Real options in divestment alternatives. Strateg. Manag. J. 2015, 36, 728–744. [Google Scholar] [CrossRef]

- Bowe, M.; Lee, D.L. Project evaluation in the presence of multiple embedded real options: Evidence from the Taiwan High-Speed Rail Project. J. Asian Econ. 2004, 15, 71–98. [Google Scholar] [CrossRef]

- Schachter, J.A.; Mancarella, P. A critical review of Real Options thinking for valuing investment flexibility in Smart Grids and low carbon energy systems. Renew. Sustain. Energy Rev. 2016, 56, 261–271. [Google Scholar] [CrossRef]

- Duku-Kaakyire, A.; Nanang, D.M. Application of real options theory to forestry investment analysis. For. Policy Econ. 2004, 6, 539–552. [Google Scholar] [CrossRef]

- Shuiabi, E.; Thomson, V.; Bhuiyan, N. Entropy as a measure of operational flexibility. Eur. J. Oper. Res. 2005, 165, 696–707. [Google Scholar] [CrossRef]

- Bayram, K.; Ganikhodjaev, N. On pricing futures options on random binomial tree. J. Phys. Conf. Ser. 2013, 435, 12043. [Google Scholar] [CrossRef] [Green Version]

- Bøckman, T.; Fleten, S.-E.; Juliussen, E.; Langhammer, H.J.; Revdal, I. Investment timing and optimal capacity choice for small hydropower projects. Eur. J. Oper. Res. 2008, 190, 255–267. [Google Scholar] [CrossRef] [Green Version]

- Fleten, S.-E.; Gunnerud, V.; Hem, Ø.; Svendsen, A. Real Option Valuation of Offshore Petroleum Field Tie-ins. J. Real Options 2011, 1, 1–17. [Google Scholar]

| Parameters | Land Lease | Land Purchase |

|---|---|---|

| Volatility () | 0.7987 | 0.9125 |

| Up factor () | 2.2226 | 2.4906 |

| Down factor () | 0.4499 | 0.4015 |

| Risk-neutral probability () | 0.3409 | 0.3124 |

| Present value at focal date () | USD 723 | USD 4083 |

| CAPEX | USD 352 | USD 4693 |

| Real Option | Indicators | Land Lease | Land Purchase |

|---|---|---|---|

| Deferral | ENPV (USD) | 486 | 1812 |

| Real option value (USD) | 115 | 2422 | |

| Increase in NPV value (%) | 31 | 397 | |

| Expansion | ENPV (USD) | 559 | 392 |

| Real option value (USD) | 188 | 1002 | |

| Increase in NPV value (%) | 51 | 164 | |

| Abandonment | ENPV (USD) | 545 | 1949 |

| Real option value (USD) | 174 | 2559 | |

| Increase in NPV value (%) | 47 | 420 |

| Indicators | Land Lease | Land Purchase |

|---|---|---|

| ENPV (USD) | 768 | 3690 |

| Real option value (USD) | 397 | 4300 |

| Increase in NPV value (%) | 107 | 705 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Martins, J.C.; da Silva, R.B.G.; Munis, R.A.; Simões, D. Investments in Pinus elliottii Engelm. Plantations: Real Options Analysis in Discrete Time. Forests 2022, 13, 111. https://doi.org/10.3390/f13010111

Martins JC, da Silva RBG, Munis RA, Simões D. Investments in Pinus elliottii Engelm. Plantations: Real Options Analysis in Discrete Time. Forests. 2022; 13(1):111. https://doi.org/10.3390/f13010111

Chicago/Turabian StyleMartins, Jorge Carvalho, Richardson Barbosa Gomes da Silva, Rafaele Almeida Munis, and Danilo Simões. 2022. "Investments in Pinus elliottii Engelm. Plantations: Real Options Analysis in Discrete Time" Forests 13, no. 1: 111. https://doi.org/10.3390/f13010111

APA StyleMartins, J. C., da Silva, R. B. G., Munis, R. A., & Simões, D. (2022). Investments in Pinus elliottii Engelm. Plantations: Real Options Analysis in Discrete Time. Forests, 13(1), 111. https://doi.org/10.3390/f13010111