The Dynamics of Beech Roundwood Prices in Selected Central European Markets

Abstract

1. Introduction

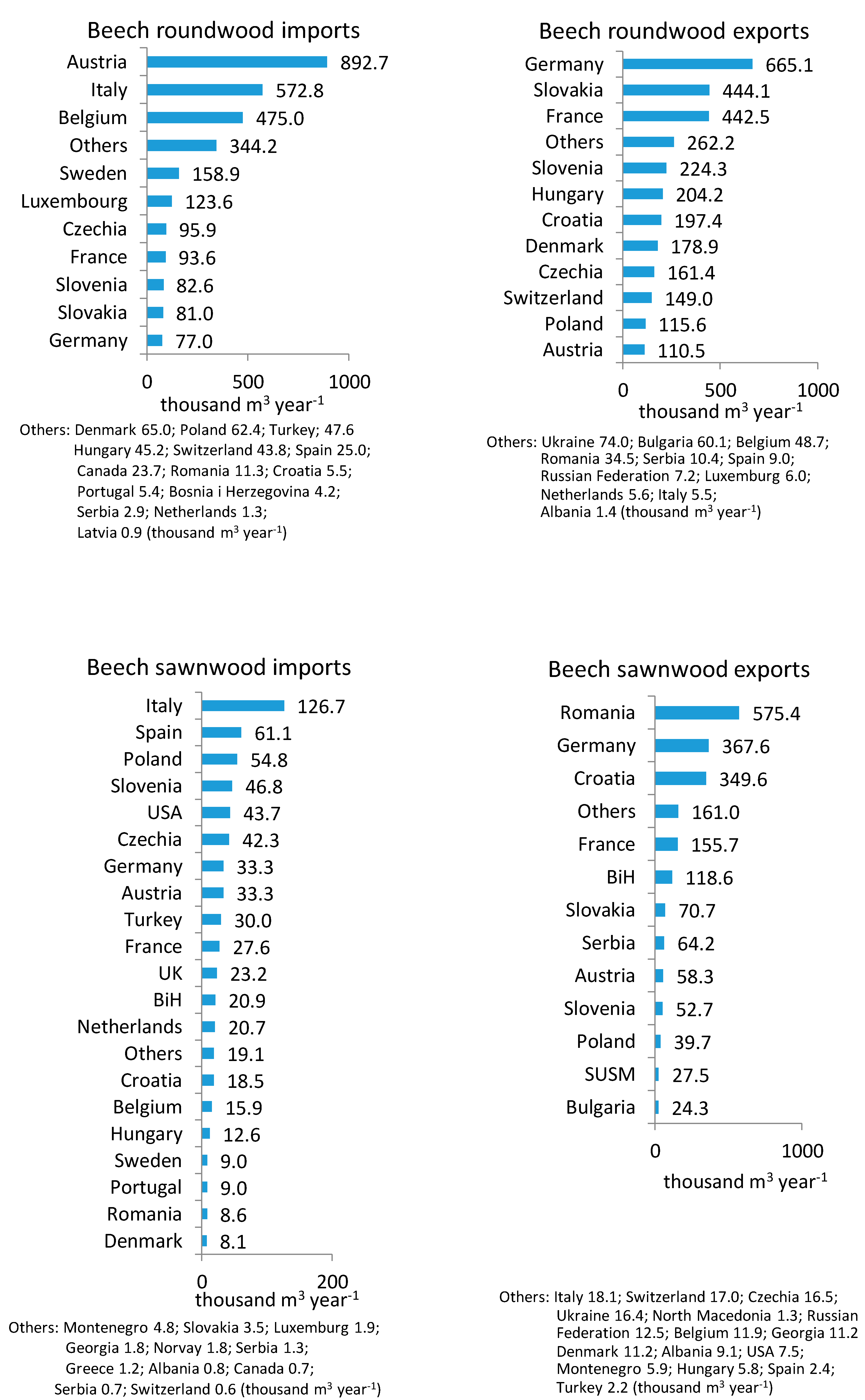

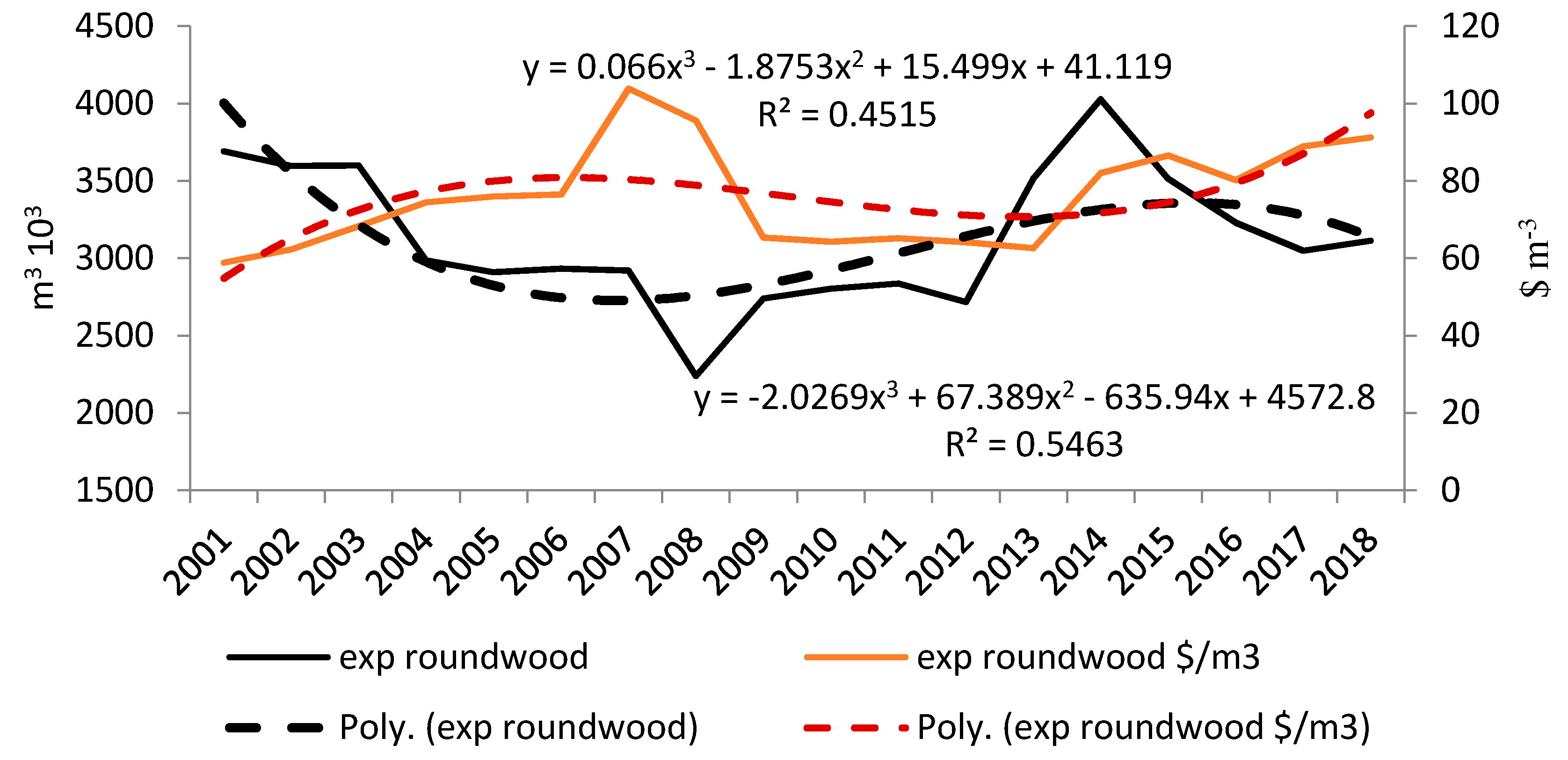

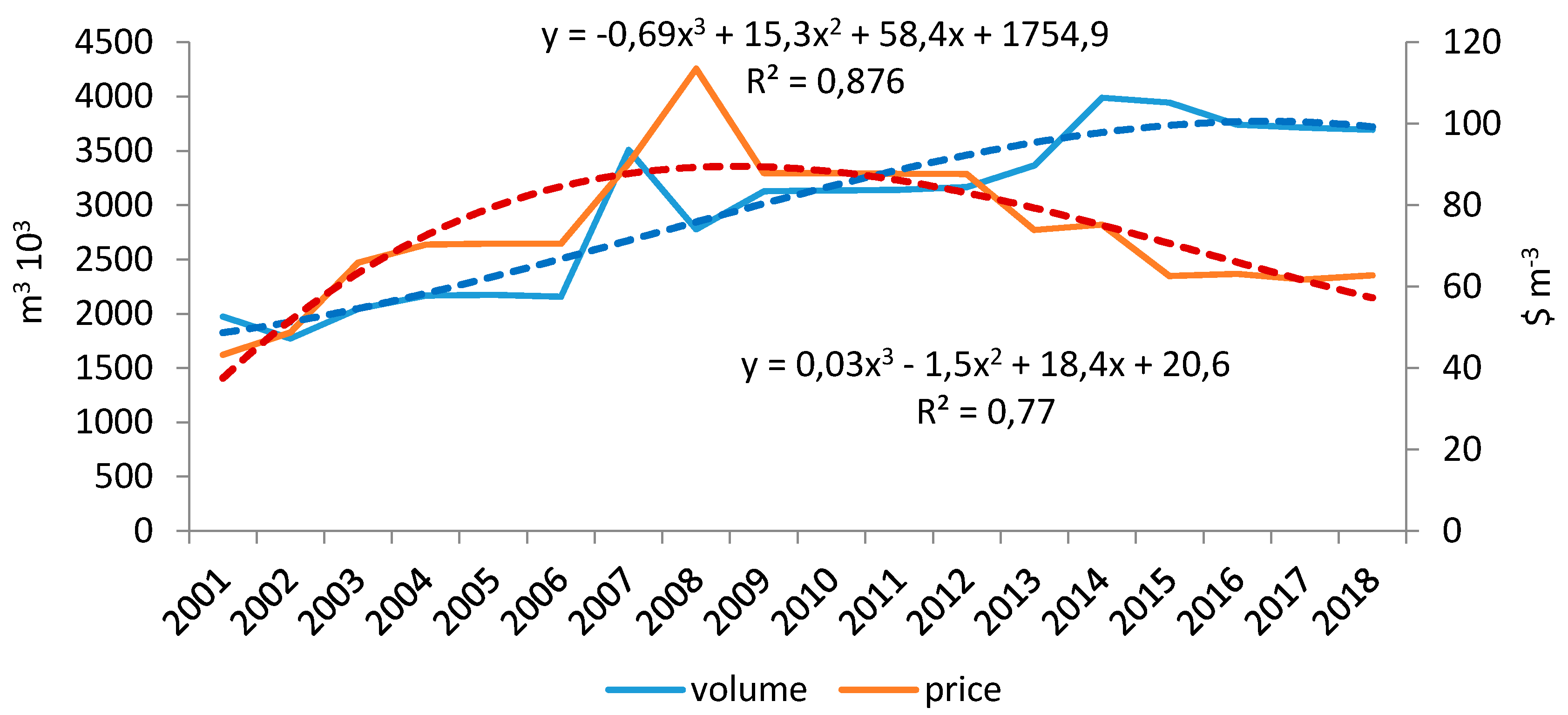

Beech Growing Stock and Roundwood Trade in Europe

2. Materials and Methods

2.1. Materials

2.2. Price Time Series Decomposition

2.3. Cointegration of Beech Roundwood Markets

- Each series was tested for a unit root using ADF.

- Cointegrating regression was run via OLS. To this end, a potentially cointegrated dependent variable (yt—beech roundwood price in one country) and another potentially cointegrated variable (xt—beech roundwood price in another country) were selected as regressors.yt = γ0 + γ1xt + εt

- ADF was performed on residuals (εt) from the cointegrating regression.

3. Results

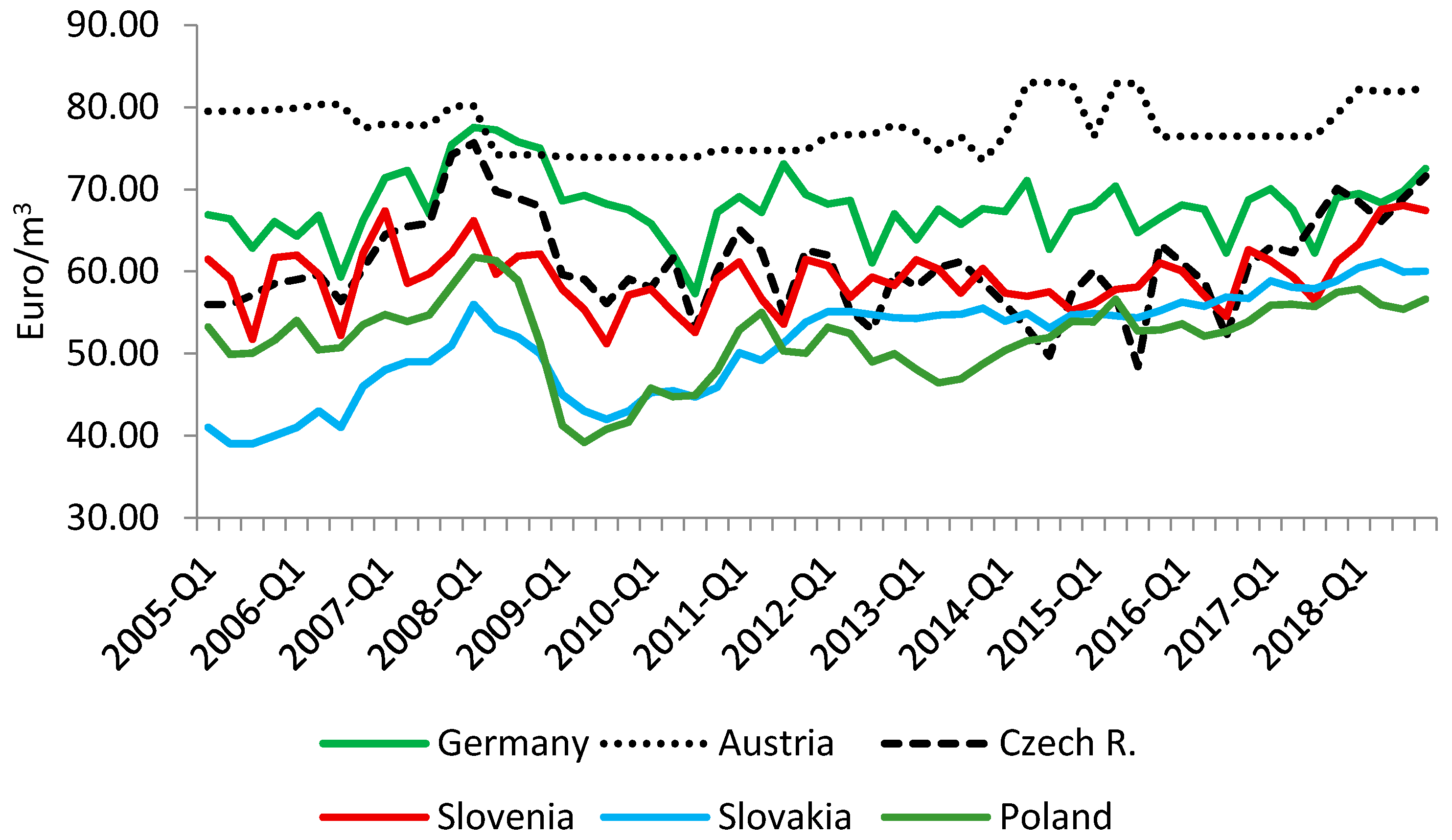

3.1. Price Level and Variability

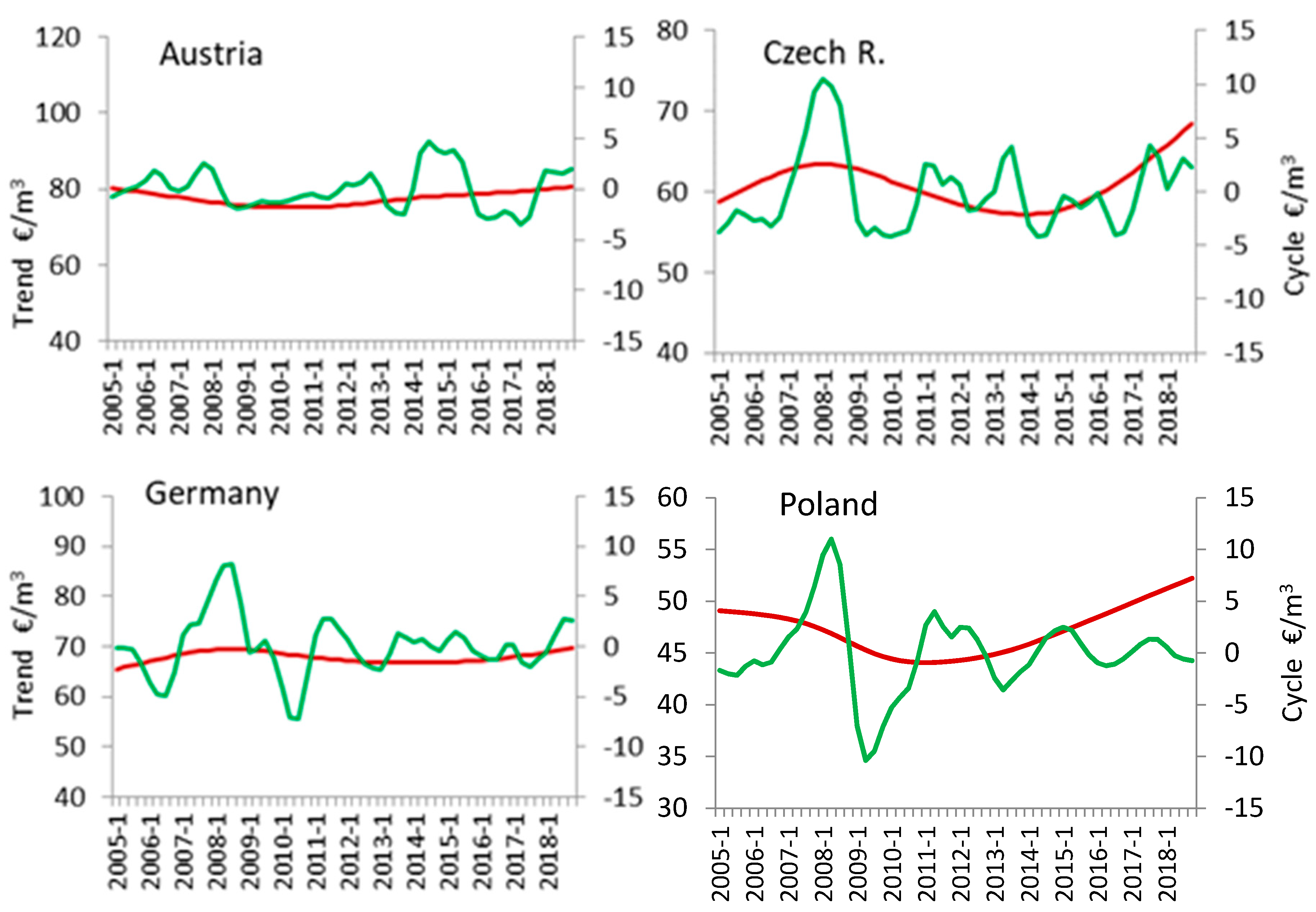

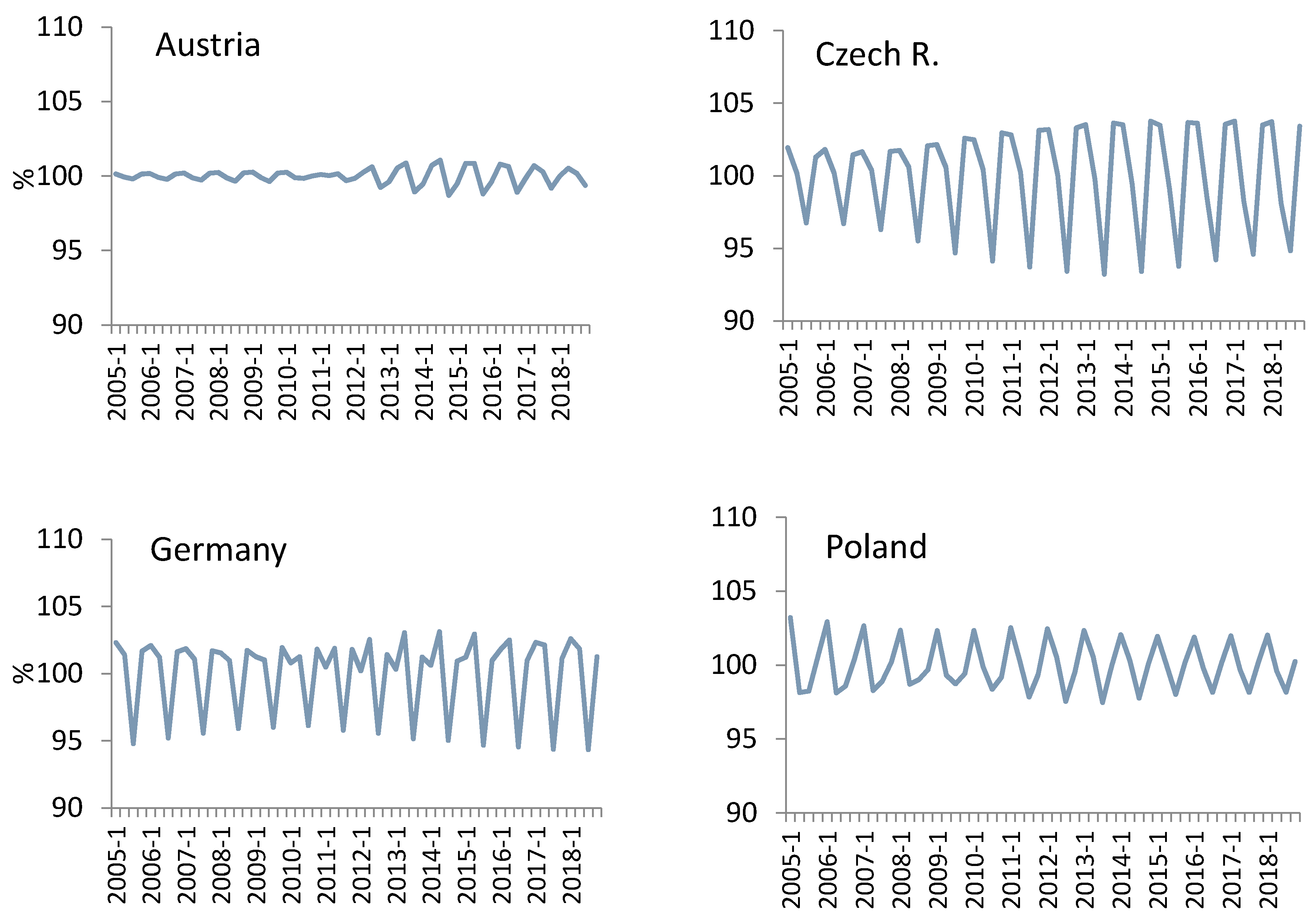

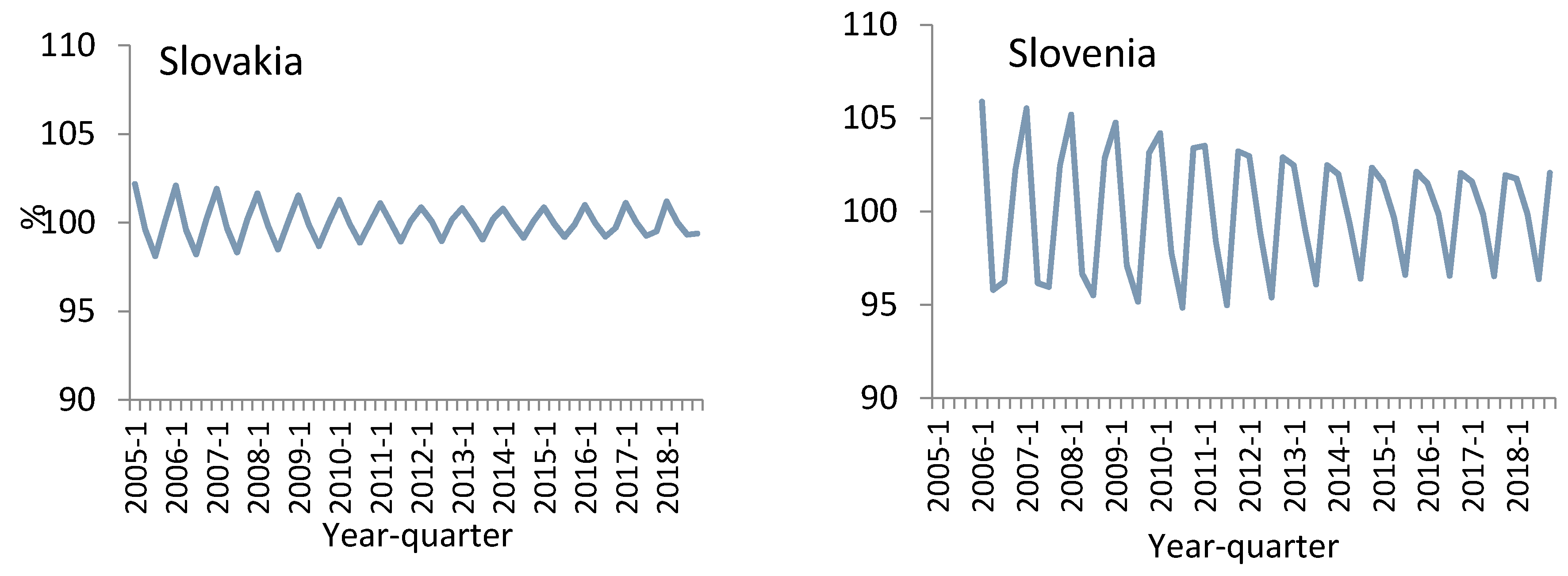

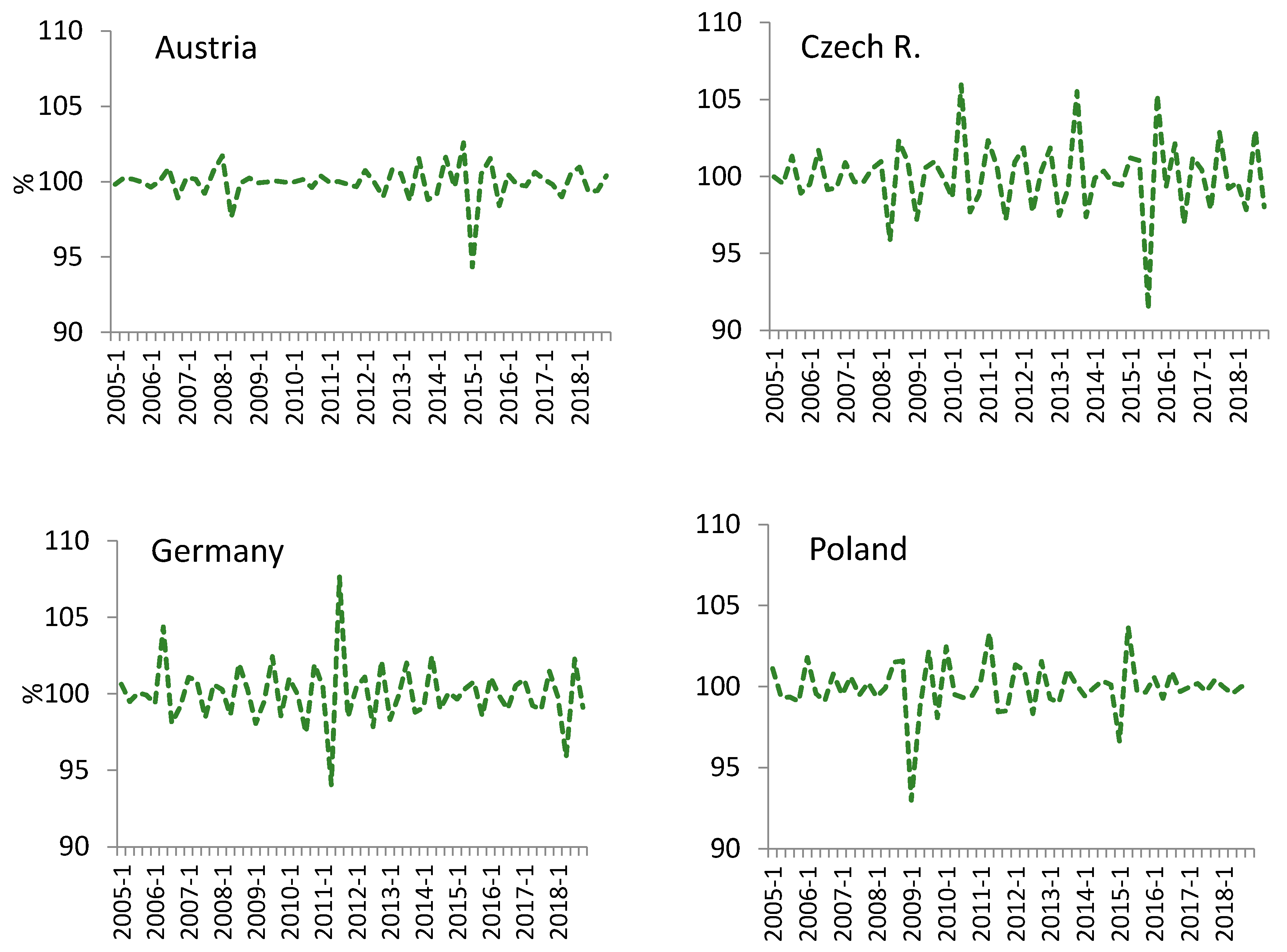

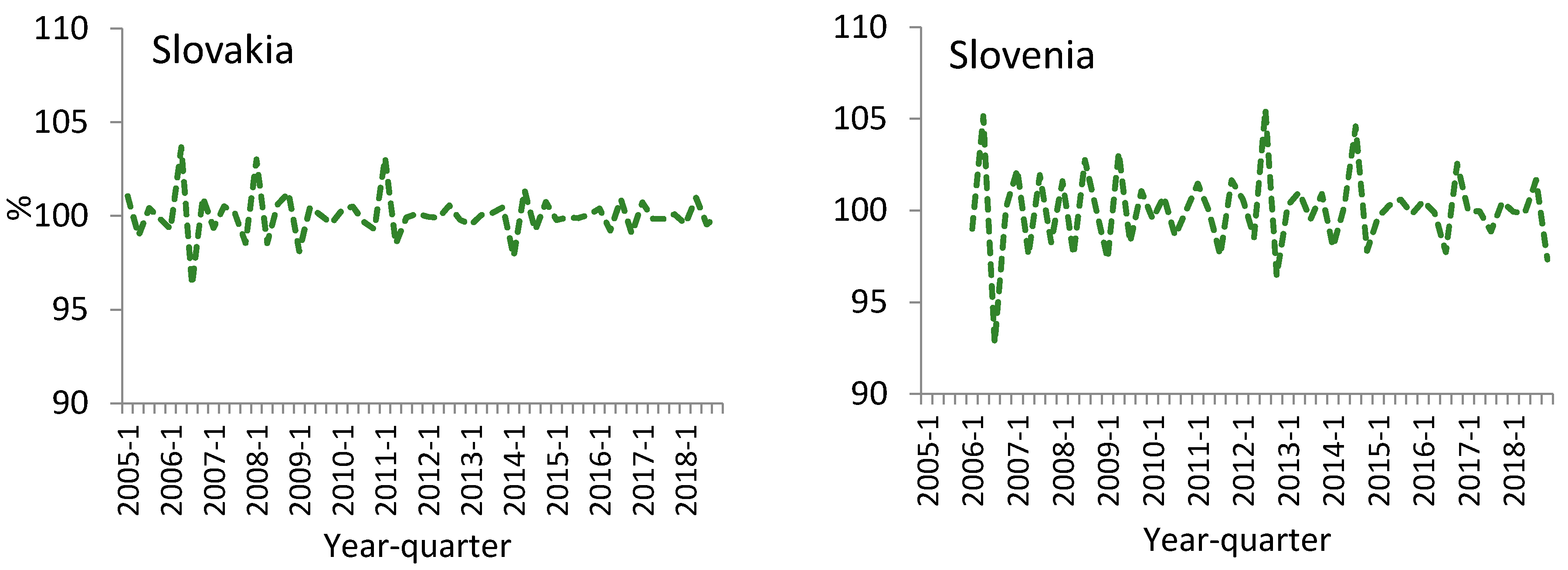

3.2. Seasonal, Cyclical, and Irregular Price Components

3.3. Price Cointegration

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Hurmekoski, E.; Hetemäki, L. Studying the future of the forest sector: Review and implications for long-term outlook studies. For. Policy Econ. 2013, 34, 17–29. [Google Scholar] [CrossRef]

- Gołos, P. Wartość zasobów leśnych Polski. Sylwan 2013, 1, 3–16. [Google Scholar]

- Hlavackova, P.; Brezina, D.; Sujova, A. The price formation of raw wood in the czech republic and a comparison with the neighbor states. Proced. Econ. Financ. 2015, 26, 389–395. [Google Scholar] [CrossRef][Green Version]

- Kangas, J.; Leskinen, P.; Pukkala, T. Integrating timber price scenario modeling with tactical management planning of private forestry at forest holding level. Kangas Leskinen 2000, 34, 399–409. [Google Scholar] [CrossRef][Green Version]

- Alberdi, I.; Bender, S.; Riedel, T.; Avitable, V.; Boriaud, O.; Bosela, M.; Camia, A.; Cañellas, I.; Castro Rego, F.; Fischer, C.; et al. Assessing forest availability for wood supply in Europe. For. Policy Econ. 2020, 111, 102032. [Google Scholar] [CrossRef]

- Knoke, T.; Stang, S.; Remler, N.; Seifert, T. Ranking the importance of quality variables for the price of high quality beech timber (Fagus sylvatica L.). Ann. For. Sci. 2006, 63, 399–413. [Google Scholar] [CrossRef]

- Höwler, K.; Vor, T.; Seidel, D.; Annighöfer, P.; Ammer, C. Analyzing effects of intra-and interspecific competition on timber quality attributes of Fagus sylvatica L.—From quality assessments on standing trees to sawn boards. Eur. J. For. Res. 2019, 138, 327–343. [Google Scholar] [CrossRef]

- Vacek, Z.; Vacek, S.; Slanař, J.; Bílek, L.; Bulušek, D.; Štefančík, I.; Králíček, I.; Vančura, K. Adaption of Norway spruce and European beech forests under climate change: From resistance to close-to-nature silviculture. Cent. Eur. For. J. 2019, 65, 129–144. [Google Scholar] [CrossRef]

- Nichols, J.D.; Bristow, M.; Vanclay, J.K. Mixed-species plantations: Prospects and challenges. For. Ecol. Manag. 2006, 233, 383–390. [Google Scholar] [CrossRef]

- García-Robredo, F. Effect of species complementarity on financial return in mixed stands of european beech and scots pine in northern spain. Forests 2018, 9, 559. [Google Scholar] [CrossRef]

- Knoke, T.; Ammer, C.; Stimm, B.; Mosandl, R. Admixing broadleaved to coniferous tree species: Areviewon yield, ecological stability and economics. Eur. J. For. Res. 2008, 127, 89–101. [Google Scholar] [CrossRef]

- Knoke, T.; Kindu, M.; Jarisch, I.; Gosling, E.; Friedrich, S.; Bödeker, K.; Paul, C. How considering multiple criteria, uncertainty scenarios and biological interactions may influence the optimal silvicultural strategy for a mixed forest. For. Policy Econ. 2020, 118, 102239. [Google Scholar] [CrossRef]

- Knoke, T.; Stimm, B.; Ammer, C.; Moog, M. Mixed forests reconsidered: A forest economics contribution on an ecological concept. For. Ecol. Manag. 2005, 213, 102–116. [Google Scholar] [CrossRef]

- Neuner, S.; Knoke, T. Economic consequences of altered survival of mixed or pure Norway spruce under a dryer and warmer climate. Clim. Chang. 2017, 140, 519–531. [Google Scholar] [CrossRef]

- Friedrich, S.; Paul, C.; Brandl, S.; Biber, P.; Messerer, K.; Knoke, T. Economic impact of growth effects in mixed stands of Norway spruce and European beech–A simulation based study. For. Policy Econ. 2019, 104, 65–80. [Google Scholar] [CrossRef]

- Paluch, J. Buk Zwyczajny. Wzrost i Produkcyjność, 1st ed.; PWRiL: Warszawa, Poland, 2012; ISBN 978830901083. [Google Scholar]

- Leskinen, P.; Kangas, J. Modelling and simulation of timber prices for forest planning calculations. Scand. J. For. Res. 1998, 13, 469–476. [Google Scholar] [CrossRef]

- Leskien, P.; Kangas, J. Modelling future timber price development by using expert judgments and time series analysis: Silva Fennica. Silva Fenn. 2001, 35, 93–102. [Google Scholar]

- Khajuria, R.P.; Kant, S.; Laaksonen-Craig, S. Modeling of timber harvesting options using timber prices as a mean reverting process with stochastic trend. Can. J. For. Res. 2012, 42, 179–189. [Google Scholar] [CrossRef]

- Gonzalez-Gomez, M.; Bergen, V. Berücksichtigung der Nichtstationarität von Zeitreihen bei empirischen Untersuchungen des deutschen Rohholzmarktes. Allg. Forst Jagdztg. Allg. F. U. J. Ztg. 2014, 186, 53–62. [Google Scholar]

- Kolo, H.; Tzanova, P. Forecasting the German forest products trade: A vector error correction model. JFE 2017, 26, 35–45. [Google Scholar] [CrossRef]

- Zhou, M.; Buongiorno, J. Space-Time Modeling of Timber Prices. J. Agric. Resour. Econ. 2006, 31, 40–56. [Google Scholar]

- Buongiorno, J.; Rougieux, P.; Barkaoui, A.; Zhu, S.; Harou, P. Potential impact of a Transatlantic trade and investment partnership on the global forest sector. JFE 2014, 20, 252–266. [Google Scholar] [CrossRef]

- Michinaka, T.; Kuboyama, H.; Tamura, K.; Oka, H.; Yamamoto, N. Forecasting monthly prices of japanese logs. Forests 2016, 7, 94. [Google Scholar] [CrossRef]

- Knauf, M. An analysis of wood market balance modeling in Germany. For. Policy Econ. 2015, 50, 319–326. [Google Scholar] [CrossRef]

- Beljan, K. Economic Analysis of Even-Aged Silver Fir (Abies alba Mill.) Forest Management Thesis. Ph.D. Thesis, University of Zagreb, Zagreb, Croatia, 2015. [Google Scholar]

- Suchodolski, P.; Idzik, M. Identyfikacja i ocena zmienności cen drewna w nadleśnictwie Płock. Wiadomości Stat. 2018, 11, 41–55. [Google Scholar]

- Malaty, R.; Toppinen, A.; Viitanen, J. Modelling and forecasting Finnish pine sawlog stumpage prices using alternative time-series methods. Can. J. For. Res. 2007, 37, 178–187. [Google Scholar] [CrossRef]

- Buongiorno, J. Global modelling to predict timber production and prices: The GFPM approach. Forestry 2015, 88, 291–303. [Google Scholar] [CrossRef]

- Hetemaki, L.; Hanninen, R.; Toppinen, A. Short-Term Forecasting models for the finnish forest sector: Lumber exports and sawlog demand. For. Sci. 2004, 50, 461–472. [Google Scholar]

- Yin, R. Forecasting short-term timber prices with univariate ARIMA Models. SJAF 1999, 23, 53–58. [Google Scholar] [CrossRef]

- Mei, B.; Clutter, M.; Harris, T. Modeling and forecasting pine sawtimber stumpage prices in the US South by various time series models. Can. J. For. Res. 2010, 40, 1506–1516. [Google Scholar] [CrossRef]

- Tzanova, P. Time series analysis for short-term forest sector market forecasting. Austrian J. For. Sci. 2017, 134, 2005–2230. [Google Scholar]

- Toppienen, A. Incorporating cointegration relations in a short-run model of the Finnish sawlog market. Can. J. For. Res. 1998, 28, 291–298. [Google Scholar] [CrossRef]

- Meyer, J.; Von Cramon-Taubadel, S. Asymmetric Price Transmission: A Survey. J. Agric. Econ. 2004, 55, 581–611. [Google Scholar] [CrossRef]

- Mäki-Hakola, M. Roundwood Price Development and Market Linkages in Central and Northern Europe; Pellervo Economic Research Institute Working Papers: Helsinki, Finland, 2004. [Google Scholar]

- Mäki-Hakola, M. Cointegration of the Roundwood Markets around the Baltic Sea: An Empirical Analysis of Roundwood Markets in Finland, Estonia, Germany and Lithuania; Pellervo Economic Research Institute Working Papers: Helsinki, Finland, 2002. [Google Scholar]

- Mutanen, A.; Toppinen, A. Price dynamics in the Russian-Finnish roundwood trade. Scand. J. For. Res. 2007, 22, 71–80. [Google Scholar] [CrossRef]

- Niquidet, K.; Manley, B. Testing for nonlinear spatial integration in roundwood markets. For. Sci. 2011, 57, 301–308. [Google Scholar]

- Ning, Z.; Sun, C. Vertical price transmission in timber and lumber markets. JFE 2014, 20, 17–32. [Google Scholar] [CrossRef]

- Olmos, M.; Siry, J. The law of one price in global coniferous sawlog markets. Silva Fenn. 2018, 52, 1–19. [Google Scholar] [CrossRef]

- Kallio, A. Analysing the Finnish pulpwood market under alternative hypotheses of competition. Can. J. For. Res. 2011, 31, 236–245. [Google Scholar] [CrossRef]

- Sun, C.; Zhang, D. Assessing the financial performance of forestry related investment vehicles: Capital asset pricing model vs. arbitrage pricing theory. Am. J. Agric. Econ. 2001, 83, 617–628. [Google Scholar]

- Bolkesjø, T.F. Projecting pulpwood prices under different assumptions on future capacities in the pulp and paper industry. Silva Fenn. 2005, 39, 103–116. [Google Scholar] [CrossRef][Green Version]

- Beljan, K.; Posavec, S.; Orsag, S.; Teslak, K. Simulation model for prediction of timber assortment price trends in Croatia—A case study of brinje forest office. Drvna Ind. 2017, 68, 145–152. [Google Scholar] [CrossRef]

- Parajuli, R.; Tanger, S.; Joshi, O.; Henderson, J. Modeling prices for sawtimber stumpage in the south-central United States. Forests 2016, 7, 148. [Google Scholar] [CrossRef]

- Bolte, A.; Czajkowski, T.; Kompa, T. The north-eastern distribution range of European beech a review. Forestry 2007, 80, 413–429. [Google Scholar] [CrossRef]

- Kantor, P.; Hurt, V. Production potential and ecological stability of mixed forest stands in uplands–V. A mixed spruce/beech stand on a nutrient-rich site of the Křtiny Training Forest Enterprise. J. For. Sci. 2003, 49, 502–514. [Google Scholar] [CrossRef]

- Hurt, V.; Kantor, P. Production potential and ecological stability of mixed forest stands in uplands–VI. A beech/larch stand on a mesotrophic site of the Křtiny Training Forest Enterprise. J. For. Sci. 2007, 53, 170–184. [Google Scholar] [CrossRef]

- Stefancik, I.; Stefancik, L. Effect of long-term tending on qualitative and quantitative production in mixed stands of spruce, fir and beech on Motyčky research plot. J. For. Sci. 2003, 49, 108–124. [Google Scholar] [CrossRef]

- Parobeková, Z.; Pittner, J.; Kucbel, S.; Saniga, M.; Filípek, M.; Sedmáková, D.; Vencurik, J.; Jaloviar, P. Structural diversity in a mixed spruce-fir-beech old-growth forest remnant of the western carpathians. Forests 2018, 9, 379. [Google Scholar] [CrossRef]

- Gutsch, M.; Lasch-Born, P.; Suckow, F.; Reyer, C.P.O. Evaluating the productivity of four main tree species in Germany under climate change with static reduced models. Ann. For. Sci. 2016, 73, 401–410. [Google Scholar] [CrossRef]

- Paul, C.; Brandl, S.; Friedrich, S.; Falk, W.; Härtl, F.; Knoke, T. Climate change and mixed forests: How do altered survival probabilities impact economically desirable species proportions of Norway spruce and European beech? Ann. For. Sci. 2019, 76, 363. [Google Scholar] [CrossRef]

- Bolte, A.; Hilbrig, L.; Grundmann, B.; Kampf, F.; Brunet, J.; Roloff, A. Climate change impacts on stand structure and competitive interactions in a southern Swedish spruce—Beech forest. Eur. J. For. Res. 2010, 129, 261–276. [Google Scholar] [CrossRef]

- Bartkowicz, L.; Jaworski, A.; Pach, M. Przypuszczalne mechanizmy zmian jaworu i buka w bieszczadzkich drzewostanach o charakterze pierwotnym. Roczniki Bieszczadzkie. Rocz. Bieszcz. 2008, 16, 33–46. [Google Scholar]

- Lebourgeois, F.; Bréda, N.; Ulrich, E.; Granier, A. Climate-tree-growth relationships of European beech (Fagus sylvatica L.) in the French Permanent Plot Network (RENECOFOR). Trees 2005, 19, 385–401. [Google Scholar] [CrossRef]

- Augustaitis, A.; Jasineviciene, D.; Girgzdiene, R.; Kliucius, A.; Marozas, V. Sensitivity of beech trees to global environmental changes at most north-eastern latitude of their occurrence in Europe. Sci. World J. 2012, 1–12. [Google Scholar] [CrossRef]

- Stjepanović, S.; Matović, B.; Stojanović, D.; Lalić, B.; Levanič, T.; Orlović, S.; Gutalj, M. The impact of adverse weather and climate on the width of european beech (fagus sylvatica l.) tree rings in Southeastern Europe. Atmosphere 2018, 9, 451. [Google Scholar] [CrossRef]

- Almeida, I.; Rösch, C.; Saha, S. Comparison of ecosystem services from mixed and monospecific forests in southwest Germany: A survey on public perception. Forests 2018, 9, 627. [Google Scholar] [CrossRef]

- European Organization of the Sawmill Industry. Annual Report of the European Sawmill Industry 2018/2019; EOS: Brussels, Belgium, 2019. [Google Scholar]

- Yang, L.; Yin, Z.; Gan, J.; Wang, F. Asymmetric price transmission of hardwood lumber imported by china after imposition of the comprehensive commercial logging ban in all natural forests. Forests 2020, 11, 200. [Google Scholar] [CrossRef]

- European Organization of the Sawmill Industry. Annual Report of the European Sawmill Industry 2017/2018; EOS: Brussels, Belgium, 2018. [Google Scholar]

- UNECE/FAO Forestry and Timber Section. Forest Products Annual Market Review 2018–2019; United Nation Publikation: Geneva, Switzerland, 2019; ISBN 978-92-1-117218-8. [Google Scholar]

- UNCE. Forest. Data and Statistics. Available online: http://www.unece.org/forests/output/prices.html (accessed on 2 January 2020).

- Forest Portal o Lesoch Slovenska. Available online: https://www.forestportal.sk (accessed on 13 February 2020).

- Czech National Bank. Exchange Rate of the Czech National Bank. Available online: https://www.cnb.cz/cs (accessed on 15 March 2020).

- National Bank of Poland. Exchange Rate of the Polish National Bank. Available online: https://www.nbp.pl/home.aspx?c=/ascx/archa.ascx (accessed on 6 April 2020).

- Malinen, J.; Kilpeläinen, H. Price systems for standing sales of industrial roudwood in Finland. Balt. For. 2013, 19, 307–315. [Google Scholar]

- Gejdoš, M.; Lieskovský, M.; Giertliová, B.; Němec, M.; Danihelová, Z. Prices of raw-wood assortments in selected markets of central Europe and their development in the future. Bioresources 2019, 14, 2995–3011. [Google Scholar]

- Shiskin, J.; Young, A.H.; Musgrave, J.C. The X-11 Variant of the Census Method II Seasonal Adjustment Program. Technical Paper 15; US Goverment Printing Office: Washington, DC, USA, 1967.

- Dickey, D.A.; Fuller, W.A. Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 1981, 49, 1057–1072. [Google Scholar] [CrossRef]

- Kwiatkowski, D.; Phillips, P.; Schmidt, P.; Shin, Y. Testing the null hypothesis of stationarity against the alternative of unit root. J. Econom. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Maximum likelihood estimation and inference on cointegration—With applications to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Engle, R.; Granger, C.W.J. Co-integration and error correction: Representation, estimation and testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Gnu Regression. Econometrics and Time-Series Library. Available online: http://gretl.sourceforge.net/ (accessed on 4 May 2020).

- Toivonen, R.; Toppinen, A.; Tilli, T. Roundwood Price Co-Movement in Austria, Finland and Sweden; Pellervo Economic Research Institute Working Papers: Helsinki, Finland, 2000; ISBN 952-5299-16-3. [Google Scholar]

- Suchomel, J.; Gejdos, M.; Ambrusova, L.; Sulek, R. Analysis of price changes of selected roundwood assortments in some Central Europe countries. J. For. Sci. 2012, 58, 483–491. [Google Scholar] [CrossRef]

- Petersen, B.; Strongin, S. Why are some industries more cyclical than others? J. Bus. Econ. Stat. 1996, 14, 189–198. [Google Scholar]

- Mehrotra, S.N.; Kant, S.; Majumdar, I. Industry cycles in the US softwood lumber industry: 1985 through 2010. For. Prod. J. 2014, 64, 116–125. [Google Scholar] [CrossRef]

- Pöhler, E.; Klingner, R.; Künniger, T. Beech (Fagus sylvatica L.)–Technological properties, adhesion behaviour and colour stability with and without coatings of the red heartwood. Ann. For. Sci. 2006, 63, 129–137. [Google Scholar] [CrossRef][Green Version]

- Prka, M.; Krpan, A. Impact of tending measures on assortment structure of fellings in central croatian beech stands. Acta Silv. Lign. Hung. 2010, 6, 171–182. [Google Scholar]

- Parajuli, R.; Chang, S.J.; Hill, R.C. How effective is the United States-Canada softwood lumber agreement 2006? An econometric study. For. Sci. 2015, 61, 1041–1049. [Google Scholar] [CrossRef]

- Poljanec, A.; Kadunc, A. Quality and timber value of european beech (Fagus sylvatica L.) trees in the Karavanke region. Croat. J. For. Eng. 2013, 34, 151–165. [Google Scholar]

- Gejdoš, M.; Potkány, M. Prediction and analysis of Slovakian timber trade on global market conditions. Serb. J. Manag. 2017, 12, 281–289. [Google Scholar] [CrossRef]

- Kożuch, A.; Banaś, J.; Zięba, S.; Adamowicz, K. Analysis of the supply and price of beech wood in southern Poland. Acta Sci. Pol. Silv. 2016, 15, 87–96. [Google Scholar] [CrossRef]

- Hatemaki, L.; Muys, B.; Pelkonen, P.; Pettenella, D. Forest Bioenergy in Europe: Reassessment Needed; European Forest Institute: Joensuu, Finland, 2014. [Google Scholar]

- Zwirglmaier, K. Seasonality of Prices–The Example of German Timber Prices. Technisce Universitat Munchen. 2010. Available online: http://www.gipecofor.org/doc/drupal/liens_article/evenements/2010/ZWIRGLMAIER_IUFRO_Paris_Mai2010.pdf (accessed on 4 April 2020).

- Brown, R.N.; Kilgore, M.A.; Coggins, J.S.; Blinn, C.R. The impact of timber-sale tract, policy, and administrative characteristics on state stumpage prices: An econometric analysis. For. Policy Econ. 2012, 21, 71–80. [Google Scholar] [CrossRef]

- Wear, D.N.; Prestemon, J.P.; Foster, M.O. US forest products in the global economy. J. For. 2016, 114, 483–493. [Google Scholar] [CrossRef]

- Federal Minister for Sustainability and Tourism. Austrian Market Report 2018; Federal Minister for Sustainability and Tourism—Forestry and Sustainability: Vienna, Austria, 2018. [Google Scholar]

- UN Economic Commission for Europe. Market Statement of the Czech Republik 2018; UN Economic Commission for Europe Committee on Forests and the Forest Industry Seventy-Sixth Session: Vancouver, BC, Canada, 2018.

- Puriņa, L.; Dreimanis, A.; Kārkliņa, A.; Sisenis, L.; Adamovičs, A.; Puriņš, M. Financial assessment of Fagus sylvatica stands in Latvia. For. Wood Process. 2017, 1, 81–85. [Google Scholar]

- Wühlisch, G.V.; Muhs, H.J. Current State of European Beech (Fagus sylvatica L.) Forests in Germany. In COST Action E 52 Genetic Resources of Beech in Europe-Current State; Johann Heinrich von Thünen-Institut: Braunschweig, Germany, 2011; ISBN 978-3-86576-076-0. [Google Scholar]

- Breinig, L.; Brüchert, F.; Haas, A.; Sauter, U.H. Evaluation of European Beech (Fagus sylvatica L.) Roundwood for Improved Production of Strength-Graded Lamellas. In Projekt-Wood Wisdom-Net Project European Hardwoods for the Bulding Sector (EU Hardwoods); University of Freiburg: Freiburg, Germany, 2015; Available online: https://www.researchgate.net/publication/301548219 (accessed on 10 April 2020).

- Biel, A. Baza Surowcowa Buka Zwyczajnego (Fagus Sylvatica) i Jodły Pospolitej (Abies alba Mill.) w Bieszczadach Zachodnich; Manuskrypt SGGW: Warszawa, Poland, 2007.

- Kaczmarski, W. Jakość Drewna Bukowego Pozyskiwanego w Nadleśnictwie Lutowiska; Manuskrypt SGGW: Warszawa, Poland, 2007.

- Knoke, T. Value of Complete Information on Red Heartwood Formation in Beech (Fagus sylvatica). Silva Fenn. 2002, 36, 841–851. [Google Scholar] [CrossRef]

- Deckmyn, G.; Mali, B.; Kraigher, H.; Torelli, N.; op de Beeck, M.; Ceulemans, R. Using the process-based stand model ANAFORE including Bayesian optimisation to predict wood quality and quantity and their uncertainty in Slovenian beech. Silva Fenn. 2009, 43, 523–534. [Google Scholar] [CrossRef]

- Merganič, J.; Merganičová, K.; Marušák, R.; Tipmann, L.; Šálek, L.; Dragoun, L.; Stolariková, R. Relation between forest stand diversity and anticipated log quality in managed Central European forests. Int. J. Biodivers. Sci. Ecosyst. Serv. Manag. 2016, 12, 128–138. [Google Scholar] [CrossRef]

- Russo, D.; Marziliano, P.A.; Macrì, G.; Zimbalatti, G.; Tognetti, R.; Lombardi, F. Tree growth and wood quality in pure vs. mixed-species stands of european beech and calabrian pine in mediterranean mountain forests. Forests 2020, 11, 6. [Google Scholar] [CrossRef]

- Banaś, J.; Kożuch, A. The application of time series decomposition for the identification and analysis of fluctuations in timber supply and price: A case study from poland. Forests 2019, 10, 990. [Google Scholar] [CrossRef]

- Antonoaie, V. The effects of the Euro adoption on the timber market in Romania. Bull. Transilv. Univ. Braşov 2013, 5, 29–36. [Google Scholar]

- Gejdoš, M.; Danihelová, Z. Valuation and Timber Market in the Slovak Republic. Proced. Econ. Financ. 2015, 34, 697–703. [Google Scholar] [CrossRef]

- Slovenski Državni Gozdovi D.O.O. Letno Porocilo Skupine Slovenski Drzavni Gozdovi 2017; SiDG: Ljubliana, Slovenia, 2018. [Google Scholar]

- Toppinen, A.; Toivonen, R. Roundwood market integration in Finland: A multi-variate cointegration analysis. J. For. Econ. 1998, 4, 241–265. [Google Scholar]

- Chudy, R.P.; Hagler, R.W. Dynamics of global roundwood prices–Cointegration analysis. For. Policy Econ. 2020, 115, 102155. [Google Scholar] [CrossRef]

- Jukany, V.C.; Lundmark, R. Dynamics of spruce and pine market integration in Sweden. Forests 2015, 6, 4617–4633. [Google Scholar]

- Toppinen, A.; Vitanen, J.; Laskien, P.; Toivonen, R. Dynamic of roundwood prices in Estonia, Finland and Lithuania. Balt. For. 2005, 11, 88–96. [Google Scholar]

| Unit | Austria | Czechia | Germany | Slovenia | Slovakia | Poland | |

|---|---|---|---|---|---|---|---|

| Mean | € m−3 | 77.5 | 60.9 | 67.8 | 59.4 | 51.3 | 51.9 |

| Median | € m−3 | 76.5 | 60.1 | 67.6 | 59.3 | 53.9 | 52.7 |

| Maximum | € m−3 | 83.0 | 75.7 | 77.5 | 68.0 | 61.2 | 61.8 |

| Minimum | € m−3 | 73.5 | 48.4 | 57.3 | 51.2 | 39.0 | 39.2 |

| Max/min | - | 1.1 | 1.6 | 1.4 | 1.3 | 1.6 | 1.6 |

| Standard deviation | - | 3.0 | 5.8 | 4.1 | 3.8 | 6.2 | 4.8 |

| Variability coefficient | % | 3.8 | 9.6 | 6.0 | 6.5 | 12.2 | 9.3 |

| Maximum increase * | % | 8.6 | 30.8 | 17.3 | 19.1 | 12.2 | 10.3 |

| Maximum decrease * | % | −8.0 | −13.9 | −11.8 | −13.1 | −10.0 | −19.5 |

| Country | F Test | p-Value | Year | Maximum * % | Minimum * % | Amplitude % |

|---|---|---|---|---|---|---|

| Austria | 0.51 | 0.68 | Not significant | |||

| Czechia | 25.68 | 0.0001 | 2005 | 101.9 (Q1) | 96.7(Q3) | 5.2 |

| 2018 | 103.7 | 94.8 | 8.9 | |||

| Germany | 21.19 | 0.0001 | 2005 | 102.3 | 94.8 | 7.5 |

| 2018 | 102.6 | 94.3 | 8.3 | |||

| Slovenia | 20.30 | 0.0001 | 2006 | 105.9 | 95.8 | 10.1 |

| 2018 | 102.1 | 96.4 | 5.7 | |||

| Poland | 7.00 | 0.001 | 2005 | 103.2 | 98.1 | 5.1 |

| 2018 | 102 | 98.2 | 3.8 | |||

| Slovakia | 10.74 | 0.0001 | 2005 | 102.2 | 98.1 | 4.1 |

| 2018 | 101.2 | 99.3 | 1.9 | |||

| Country | Time Span in Quarters | Irregular Component | Cyclical Component | Seasonal Component |

|---|---|---|---|---|

| Austria | 1 | 49.2 | 39.5 | 11.3 |

| 2 | 21.9 | 64.6 | 13.5 | |

| 3 | 9.3 | 86.5 | 4.2 | |

| Annual average | 23.5 | 69.2 | 7.3 | |

| Czechia | 1 | 25.1 | 20.7 | 54.1 |

| 2 | 11.5 | 36.9 | 51.6 | |

| 3 | 6.1 | 66.6 | 27.2 | |

| Annual average | 13.0 | 53.7 | 33.3 | |

| Germany | 1 | 24.4 | 15.4 | 60.2 |

| 2 | 15.2 | 43.6 | 41.1 | |

| 3 | 5.4 | 59.8 | 34.8 | |

| Annual average | 15.0 | 50.9 | 34.1 | |

| Poland | 1 | 17.8 | 53.5 | 28.7 |

| 2 | 5.8 | 76.8 | 17.5 | |

| 3 | 3.8 | 88.7 | 7.6 | |

| Annual average | 7.6 | 78.9 | 13.4 | |

| Slovakia | 1 | 31.7 | 47.6 | 20.7 |

| 2 | 7.8 | 80.8 | 11.5 | |

| 3 | 4.9 | 90.2 | 4.9 | |

| Annual average | 12.1 | 78.6 | 9.3 | |

| Slovenia | 1 | 32.3 | 12.8 | 54.9 |

| 2 | 9.6 | 22.8 | 67.5 | |

| 3 | 11.6 | 48.7 | 39.7 | |

| Annual average | 18.7 | 40.7 | 40.6 |

| Country | Price Series | First Differences of Price Time Series | ||

|---|---|---|---|---|

| KPSS | ADF | KPSS | ADF | |

| Austria | 0.283 | −2.740 * | 0.134 | −7.105 ** |

| Czech | 0.148 | −3.048 * | 0.148 | −2.999 * |

| Germany | 0.089 | −4.240 ** | 0.064 | −3.478 ** |

| Poland | 0.186 | −3.128 * | 0.062 | −3.048 * |

| Slovakia | 1.182 ** | −1.643 | 0.047 | −6.664 ** |

| Slovenia | 0.354 * | −0.417 | 0.193 | −8.463 ** |

| Hypothesis | Eigenvalue | λ-Trace Test | p-Value | λ-Max Test | p-Value * |

|---|---|---|---|---|---|

| r = 0 | 0.1726 | 13.116 | 0.1106 | 10.040 | 0.2135 |

| r = 1 | 0.0564 | 3.0757 | 0.0795 | 3.0757 | 0.0795 |

| Variable | Coefficient | Standard Error | Student’s T-Test | p-Value |

|---|---|---|---|---|

| Constant | 46.861 | 4.001 | 11.71 | 0.0001 |

| Slovakia | 0.242 | 0.077 | 3.13 | 0.0028 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kożuch, A.; Banaś, J. The Dynamics of Beech Roundwood Prices in Selected Central European Markets. Forests 2020, 11, 902. https://doi.org/10.3390/f11090902

Kożuch A, Banaś J. The Dynamics of Beech Roundwood Prices in Selected Central European Markets. Forests. 2020; 11(9):902. https://doi.org/10.3390/f11090902

Chicago/Turabian StyleKożuch, Anna, and Jan Banaś. 2020. "The Dynamics of Beech Roundwood Prices in Selected Central European Markets" Forests 11, no. 9: 902. https://doi.org/10.3390/f11090902

APA StyleKożuch, A., & Banaś, J. (2020). The Dynamics of Beech Roundwood Prices in Selected Central European Markets. Forests, 11(9), 902. https://doi.org/10.3390/f11090902