A Regret-Enhanced DEA Approach to Mapping Renewable Energy Efficiency in Asia’s Growth Economies

Abstract

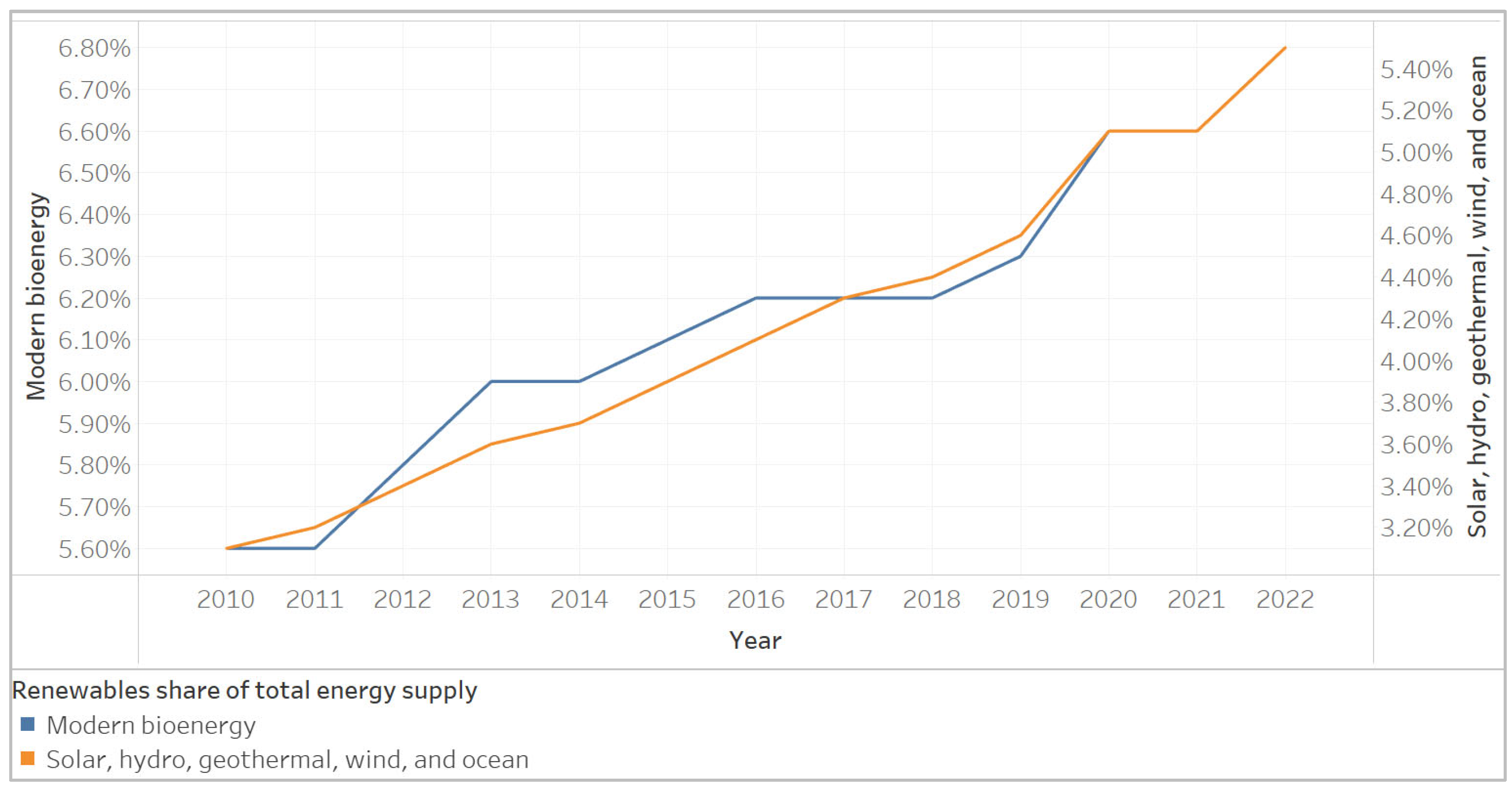

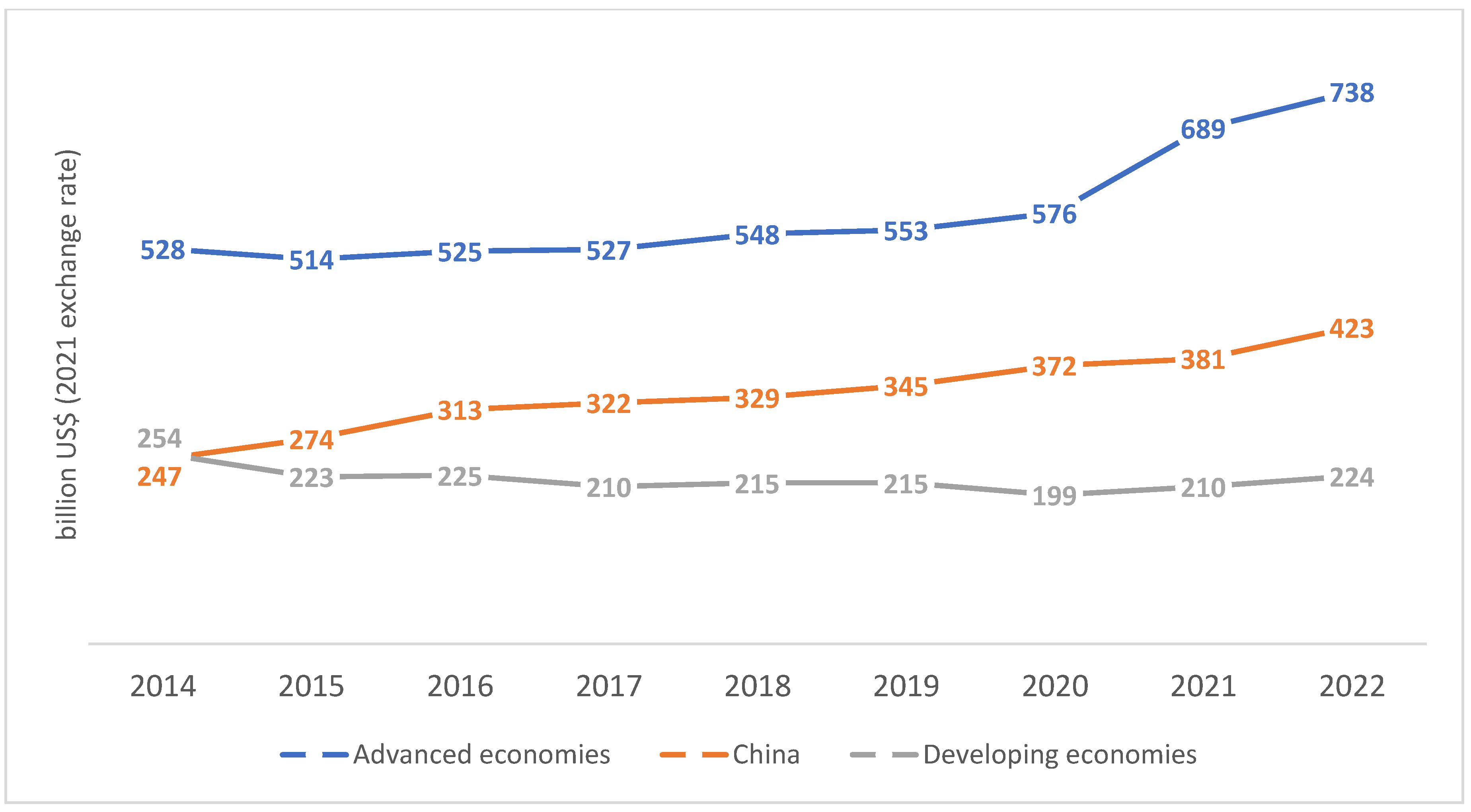

1. Introduction

2. Methodology

2.1. Bounded Rationality and Regret Theory

2.2. Self-Efficiency Data Envelopment Analysis

2.3. Cross-Efficiency DEA Model

2.4. Regret Theory Extension of Cross-Efficiency DEA Model

2.4.1. Rejoice Utility Cross-Efficiency DEA Model

2.4.2. Regret Utility Cross-Efficiency DEA Model

2.4.3. Rejoice–Regret Utility Cross-Efficiency DEA Model

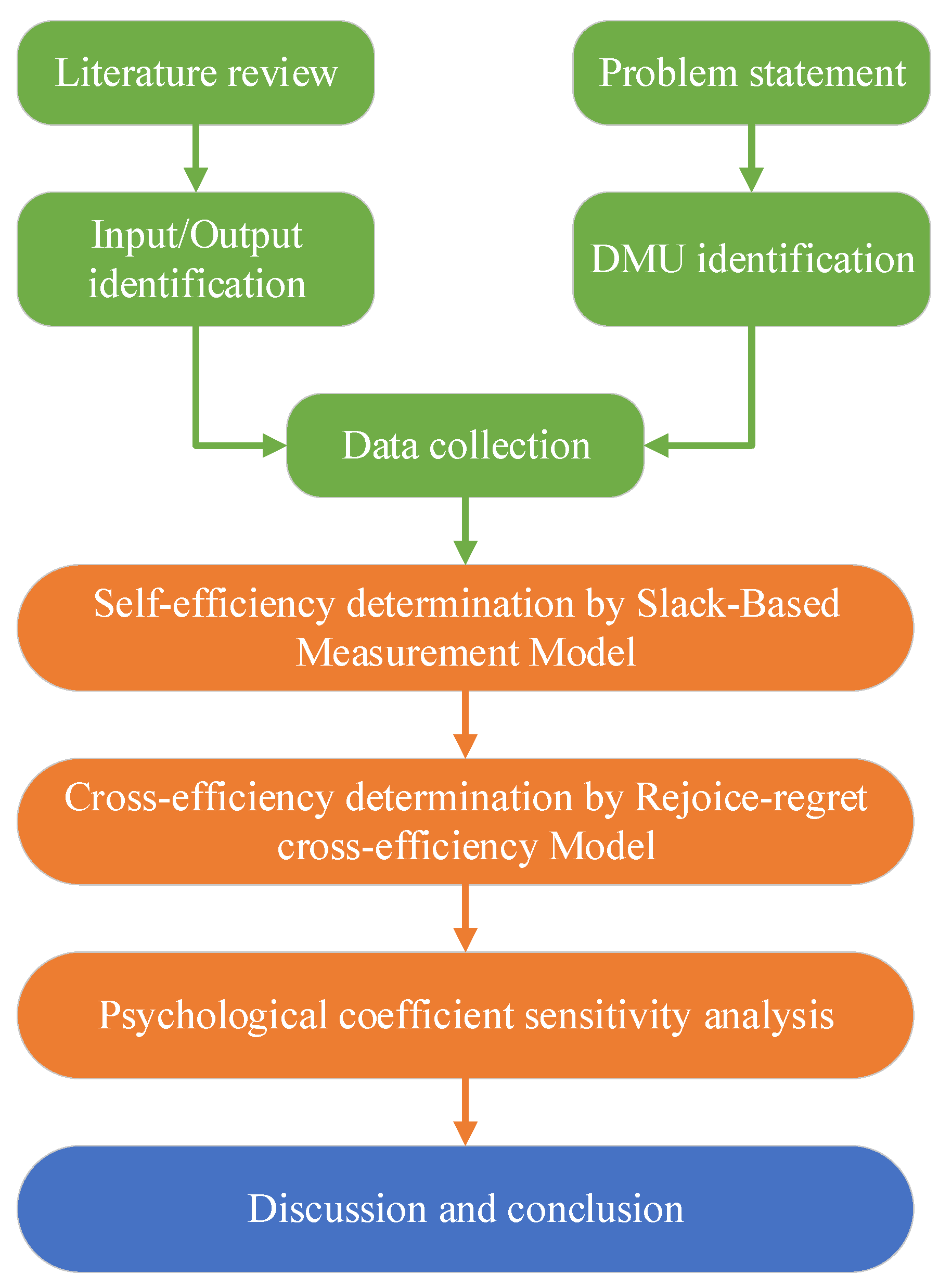

2.5. The Proposed Evaluation Framework

3. Results

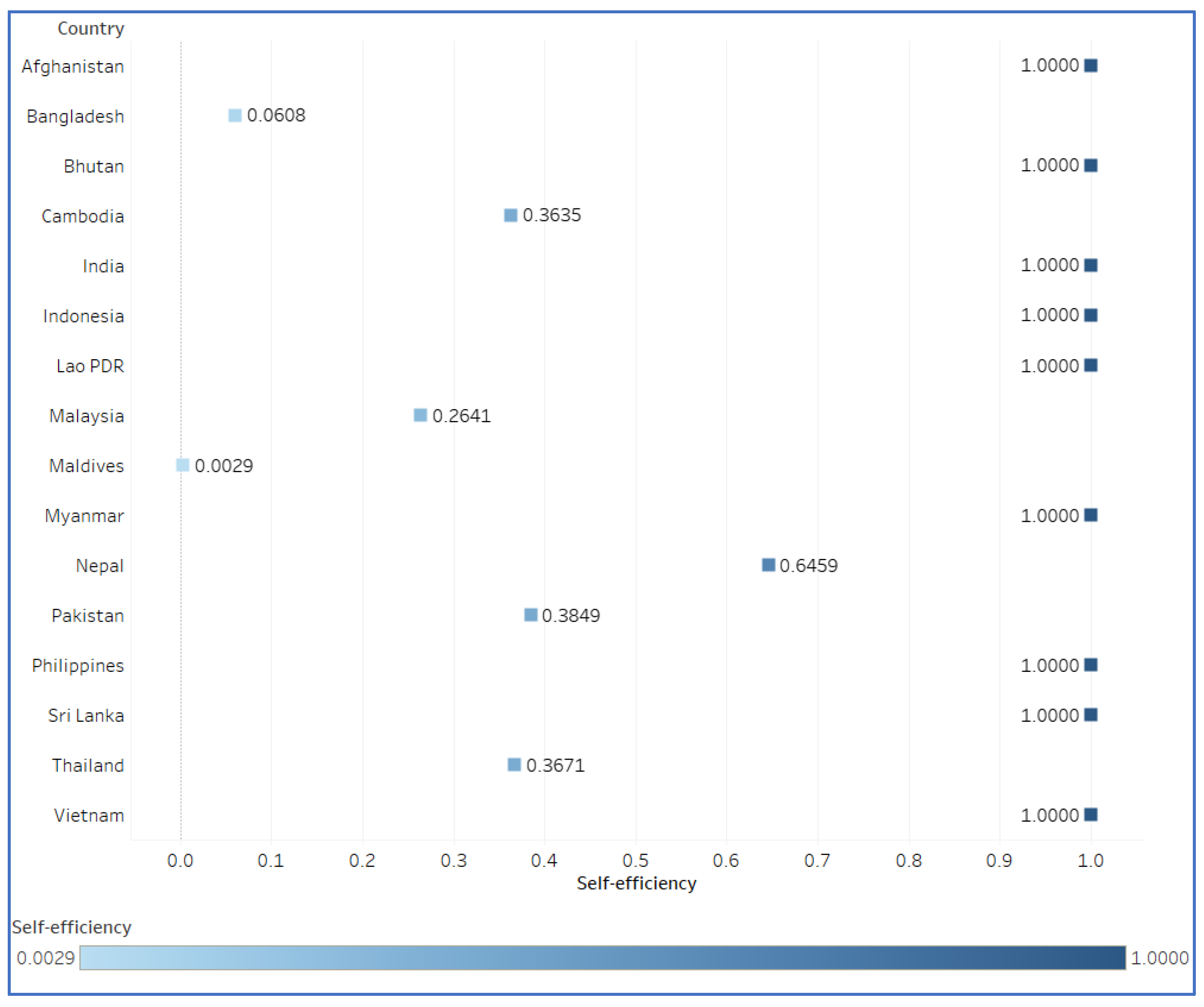

3.1. Self-Efficiency Determination by SBM Model

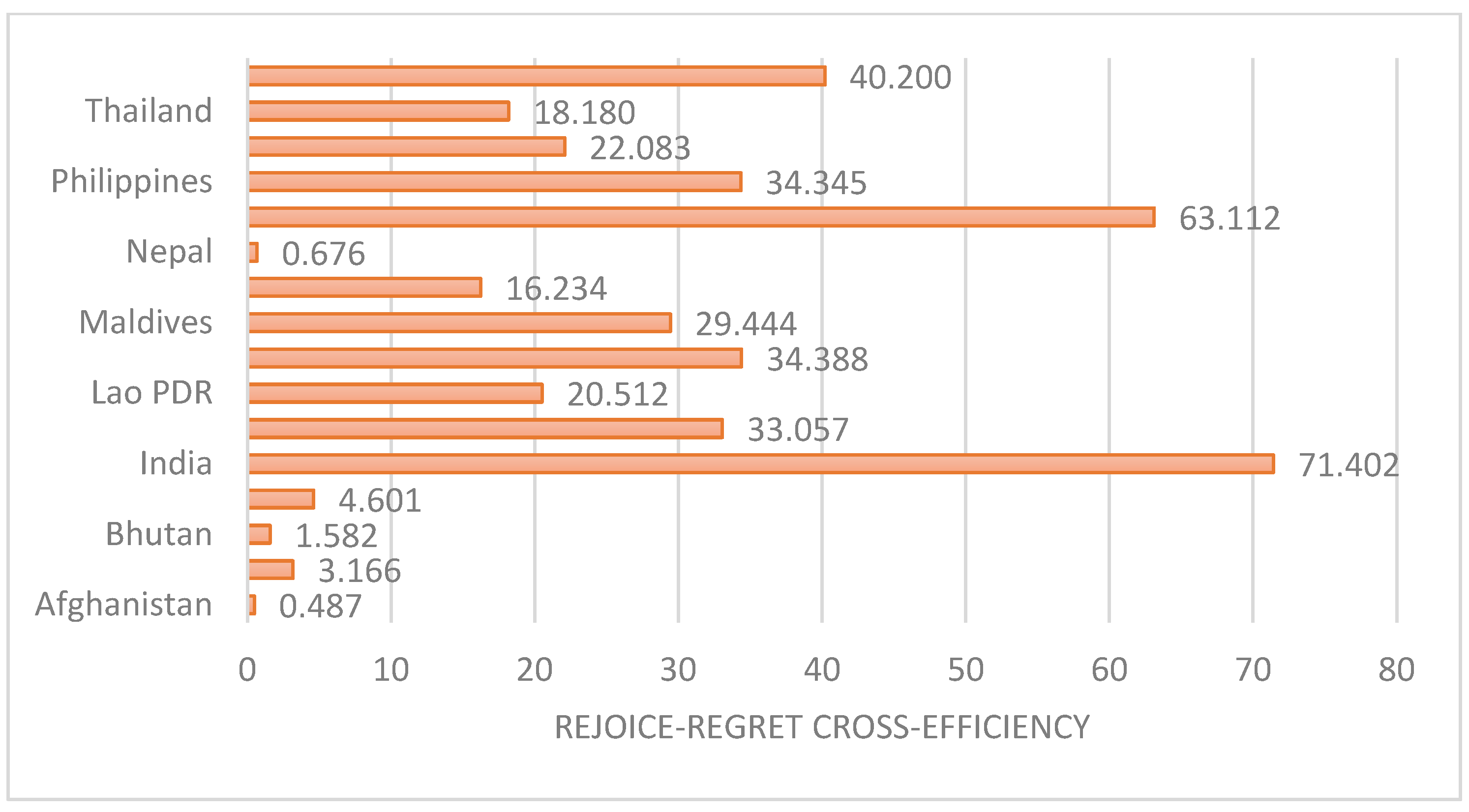

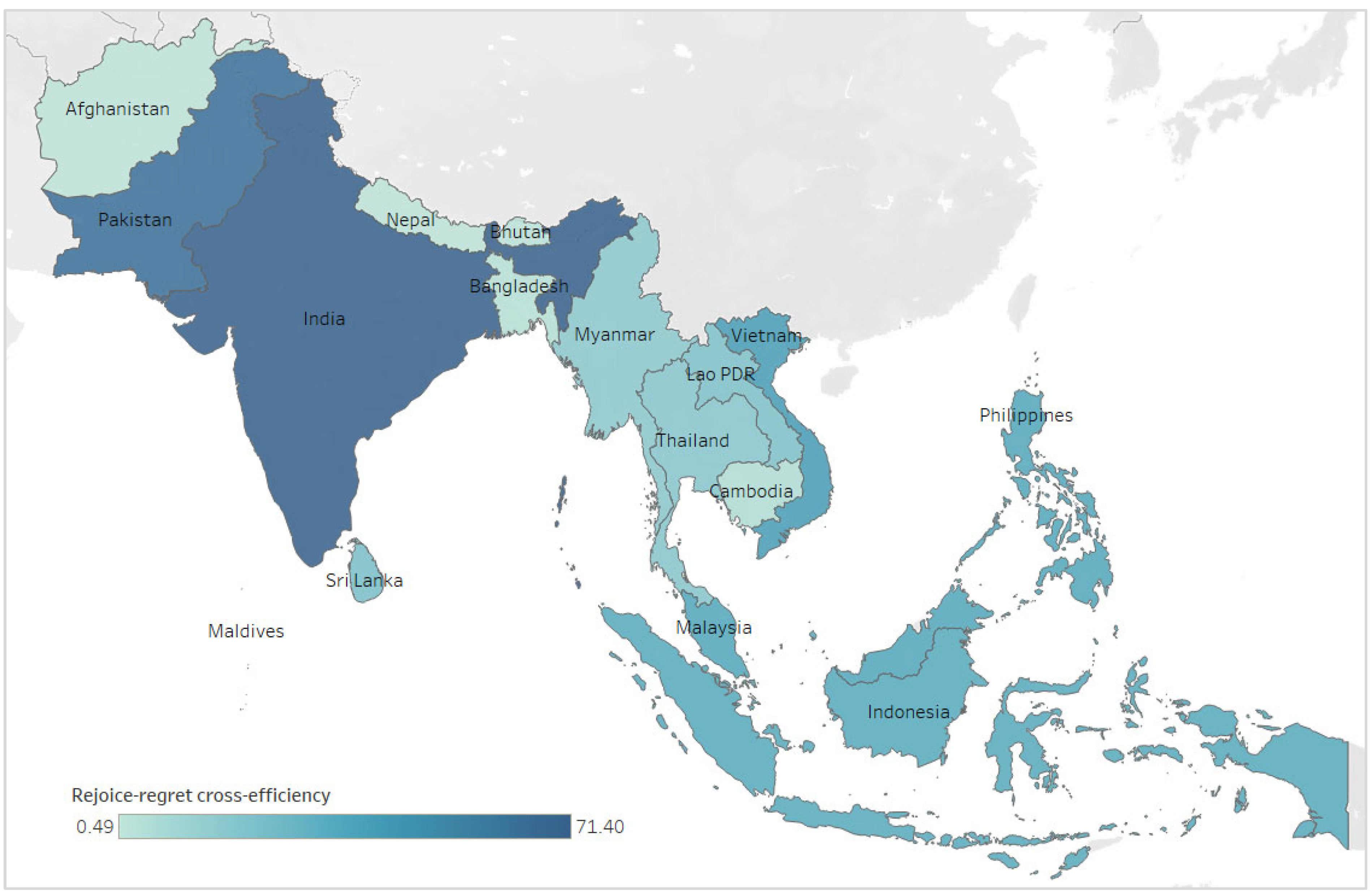

3.2. Rejoice–Regret Cross-Efficiency Determination by RRUCE Model

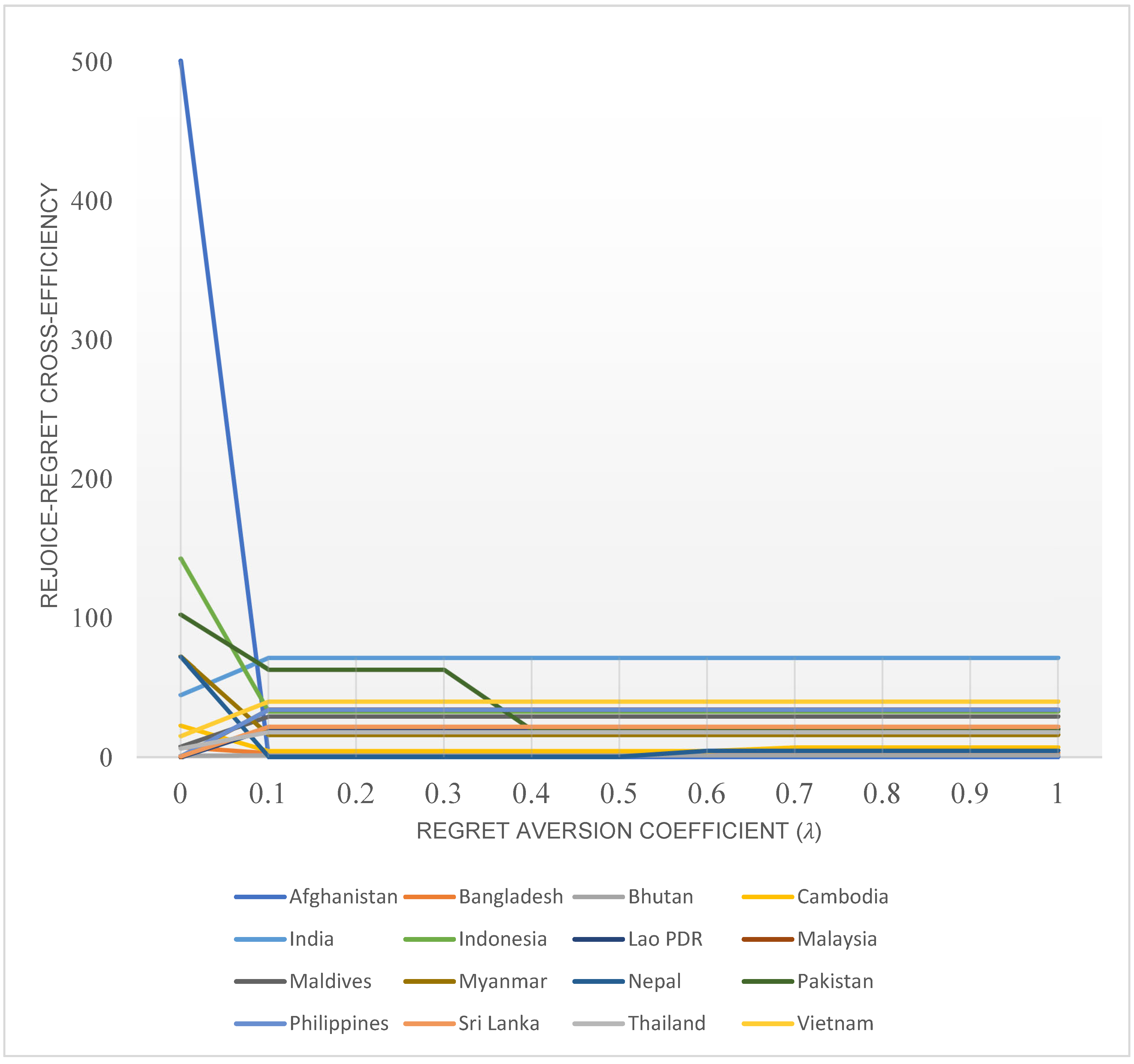

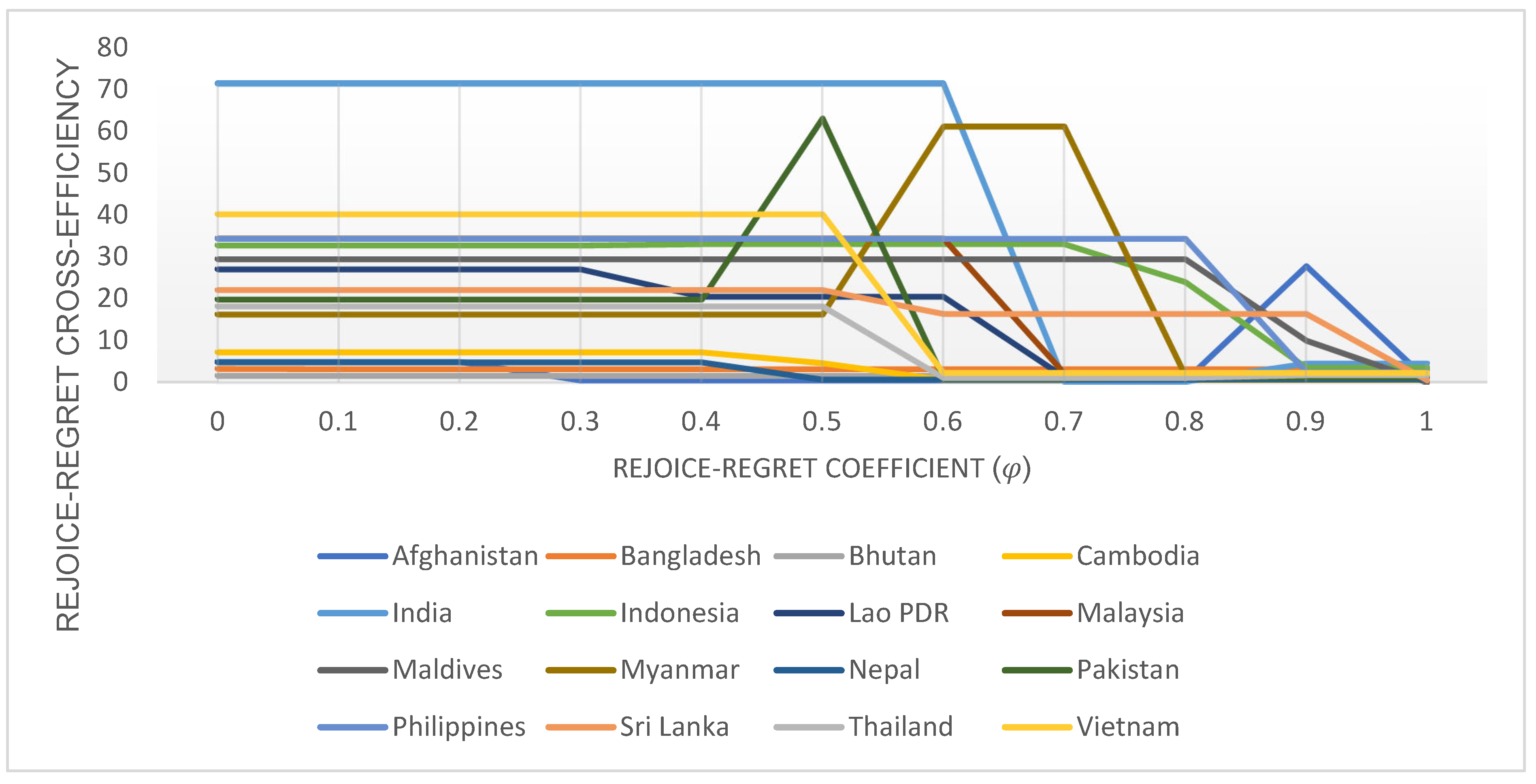

3.3. Sensitivity Analysis

4. Managerial Implementation

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Chiaramonti, D.; Maniatis, K. Security of supply, strategic storage and Covid19: Which lessons learnt for renewable and recycled carbon fuels, and their future role in decarbonizing transport? Appl. Energy 2020, 271, 115216. [Google Scholar] [CrossRef]

- Hwangbo, S.; Heo, S.; Yoo, C. Development of deterministic-stochastic model to integrate variable renewable energy-driven electricity and large-scale utility networks: Towards decarbonization petrochemical industry. Energy 2022, 238, 122006. [Google Scholar] [CrossRef]

- Rathore, N.S.; Panwar, N.L. Renewable Energy Sources for Sustainable Development; New India Publishing: New Delhi, India, 2007. [Google Scholar]

- Ilbahar, E.; Kahraman, C.; Cebi, S. Risk assessment of renewable energy investments: A modified failure mode and effect analysis based on prospect theory and intuitionistic fuzzy AHP. Energy 2022, 239, 121907. [Google Scholar] [CrossRef]

- Curtin, J.; McInerney, C.; Gallachóir, B.Ó.; Hickey, C.; Deane, P.; Deeney, P. Quantifying stranding risk for fossil fuel assets and implications for renewable energy investment: A review of the literature. Renew. Sustain. Energy Rev. 2019, 116, 109402. [Google Scholar] [CrossRef]

- Konoplyanik, A.A. Challenges and potential solutions for Russia during global gas transformation and “Green Revolution”. Energy Policy 2022, 164, 112870. [Google Scholar] [CrossRef]

- Kumari, P.; Shankar, A.; Alghafes, R.; Broccardo, L.; Walsh, S.T. Exploring the Interrelationship Between Energy, Geopolitical Risk, and Bitcoin Based Green Business Strategies. Bus. Strategy Environ. 2025; early access. [Google Scholar] [CrossRef]

- Jankauskas, V.; Rudzkis, P.; Kanopka, A. Risk factors for stakeholders in renewable energy investments. Energetika 2014, 60, 113–124. [Google Scholar] [CrossRef]

- IRENA. Renewable Energy Statistics; International Renewable Energy Agency (IRENA): Abu Dhabi, United Arab Emirates, 2024. [Google Scholar]

- Sindhu, S.; Nehra, V.; Luthra, S. Investigation of feasibility study of solar farms deployment using hybrid AHP-TOPSIS analysis: Case study of India. Renew. Sustain. Energy Rev. 2017, 73, 496–511. [Google Scholar] [CrossRef]

- Paul, S.K.; Chowdhury, P.; Moktadir, M.A.; Lau, K.H. Supply chain recovery challenges in the wake of COVID-19 pandemic. J Bus. Res. 2021, 136, 316–329. [Google Scholar] [CrossRef]

- Georgieva, K. Global Challenges Facing ASEAN and Policy Priorities. International Monetary Fund. Available online: https://www.imf.org/en/News/Articles/2022/11/13/sp111322-md-global-challenges-facing-asean-and-policy-priorities (accessed on 2 February 2023).

- ACE. ASEAN Energy Investment 2024; ASEAN Centre of Energy (ACE): Jakarta, Indonesia, 2024. [Google Scholar]

- ACE; IRENA. Renewable Energy Outlook for Asean: A Remap; International Renewable Energy Agency (IRENA): Abu Dhabi, United Arab Emirates; ASEAN Centre for Energy (ACE): Jakarta, Indonesia, 2016. [Google Scholar]

- IEA. Energy Statistics Data; International Energy Agency (IEA): Paris, France, 2022. [Google Scholar]

- IEA. World Energy Investment 2022; International Energy Agency (IEA): Paris, France, 2022. [Google Scholar]

- UNTCAD. ASEAN Investment Report 2022: Pandemic Recovery and Investment Facilitation; United Nations Conference on Trade and Development (UNCTAD): Geneva, Switzerland, 2022. [Google Scholar]

- Tian, J.; Yu, L.; Xue, R.; Zhuang, S.; Shan, Y. Global low-carbon energy transition in the post-COVID-19 era. Appl. Energy 2022, 307, 118205. [Google Scholar] [CrossRef]

- Gunny, A.A.N.; Shahimin, M.F.M.; Mohamed, A.R.; Jalil, M.F.A. Current Status of Renewable Energy Development. In Renewable Energy from Bio-Resources in Malaysia; Springer: Singapore, 2022; pp. 1–19. [Google Scholar]

- Zhong, J.; Hu, X.; Yuksel, S.; Dincer, H.; Ubay, G.G. Analyzing the Investments Strategies for Renewable Energies Based on Multi-Criteria Decision Model. IEEE Access 2020, 8, 118818–118840. [Google Scholar] [CrossRef]

- Hoang, A.T.; Sandro, N.; Olcer, A.I.; Ong, H.C.; Chen, W.H.; Chong, C.T.; Thomas, S.; Bandh, S.A.; Nguyen, X.P. Impacts of COVID-19 pandemic on the global energy system and the shift progress to renewable energy: Opportunities, challenges, and policy implications. Energy Policy 2021, 154, 112322. [Google Scholar] [CrossRef] [PubMed]

- Owen, A.D. Renewable energy: Externality costs as market barriers. Energy Policy 2006, 34, 632–642. [Google Scholar] [CrossRef]

- Prest, R.; Daniell, T.; Ostendorf, B. Using GIS to evaluate the impact of exclusion zones on the connection cost of wave energy to the electricity grid. Energy Policy 2007, 35, 4516–4528. [Google Scholar] [CrossRef]

- Sánchez-Lozano, J.M.; García-Cascales, M.S.; Lamata, M.T. Comparative TOPSIS-ELECTRE TRI methods for optimal sites for photovoltaic solar farms. Case study in Spain. J. Clean. Prod. 2016, 127, 387–398. [Google Scholar] [CrossRef]

- Sandberg, A.; Klementsen, E.; Muller, G.; de Andres, A.; Maillet, J. Critical Factors Influencing Viability of Wave Energy Converters in Off-Grid Luxury Resorts and Small Utilities. Sustainability 2016, 8, 1274. [Google Scholar] [CrossRef]

- Adefarati, T.; Bansal, R.C. Reliability, economic and environmental analysis of a microgrid system in the presence of renewable energy resources. Appl. Energy 2019, 236, 1089–1114. [Google Scholar] [CrossRef]

- Reddy, S.; Painuly, J.P. Diffusion of renewable energy technologies—Barriers and stakeholders’ perspectives. Renew. Energy 2004, 29, 1431–1447. [Google Scholar] [CrossRef]

- Sen, S.; Ganguly, S. Opportunities, barriers and issues with renewable energy development–A discussion. Renew. Sustain. Energy Rev. 2017, 69, 1170–1181. [Google Scholar] [CrossRef]

- Boudghene Stambouli, A. Algerian renewable energy assessment: The challenge of sustainability. Energy Policy 2011, 39, 4507–4519. [Google Scholar] [CrossRef]

- Ozcan, M. Assessment of renewable energy incentive system from investors’ perspective. Renew. Energy 2014, 71, 425–432. [Google Scholar] [CrossRef]

- Kim, K.-T.; Lee, D.J.; Park, S.-J.; Zhang, Y.; Sultanov, A. Measuring the efficiency of the investment for renewable energy in Korea using data envelopment analysis. Renew. Sustain. Energy Rev. 2015, 47, 694–702. [Google Scholar] [CrossRef]

- Chang, Y.; Fang, Z.; Li, Y. Renewable energy policies in promoting financing and investment among the East Asia Summit countries: Quantitative assessment and policy implications. Energy Policy 2016, 95, 427–436. [Google Scholar] [CrossRef]

- Dvořák, P.; Martinát, S.; der Horst, D.V.; Frantál, B.; Turečková, K. Renewable energy investment and job creation; a cross-sectoral assessment for the Czech Republic with reference to EU benchmarks. Renew. Sustain. Energy Rev. 2017, 69, 360–368. [Google Scholar] [CrossRef]

- Liu, X.; Zeng, M. Renewable energy investment risk evaluation model based on system dynamics. Renew. Sustain. Energy Rev. 2017, 73, 782–788. [Google Scholar] [CrossRef]

- Budak, G.; Chen, X.; Celik, S.; Ozturk, B. A systematic approach for assessment of renewable energy using analytic hierarchy process. Energy Sustain. Soc. 2019, 9, 37. [Google Scholar] [CrossRef]

- Kul, C.; Zhang, L.; Solangi, Y.A. Assessing the renewable energy investment risk factors for sustainable development in Turkey. J. Clean. Prod. 2020, 276, 124164. [Google Scholar] [CrossRef]

- Chebotareva, G.; Strielkowski, W.; Streimikiene, D. Risk assessment in renewable energy projects: A case of Russia. J. Clean. Prod. 2020, 269, 122110. [Google Scholar] [CrossRef]

- Hashemizadeh, A.; Ju, Y.; Bamakan, S.M.H.; Le, H.P. Renewable energy investment risk assessment in belt and road initiative countries under uncertainty conditions. Energy 2021, 214, 118923. [Google Scholar] [CrossRef]

- Igliński, B.; Pietrzak, M.B.; Kiełkowska, U.; Skrzatek, M.; Kumar, G.; Piechota, G. The assessment of renewable energy in Poland on the background of the world renewable energy sector. Energy 2022, 261, 125319. [Google Scholar] [CrossRef]

- Le, M.-T.; Nhieu, N.-L. An Offshore Wind–Wave Energy Station Location Analysis by a Novel Behavioral Dual-Side Spherical Fuzzy Approach: The Case Study of Vietnam. Appl. Sci. 2022, 12, 5201. [Google Scholar] [CrossRef]

- Le, M.-T.; Nhieu, N.-L.; Pham, T.-D.T. Direct-Use Geothermal Energy Location Multi-Criteria Planning for On-Site Energy Security in Emergencies: A Case Study of Malaysia. Sustainability 2022, 14, 15132. [Google Scholar] [CrossRef]

- Mohd Chachuli, F.S.; Ahmad Ludin, N.; Md Jedi, M.A.; Hamid, N.H. Transition of renewable energy policies in Malaysia: Benchmarking with data envelopment analysis. Renew. Sustain. Energy Rev. 2021, 150, 111456. [Google Scholar] [CrossRef]

- Halkos, G.E.; Tzeremes, N.G. Analyzing the Greek renewable energy sector: A Data Envelopment Analysis approach. Renew. Sustain. Energy Rev. 2012, 16, 2884–2893. [Google Scholar] [CrossRef]

- Rodríguez-Lozano, G.; Cifuentes-Yate, M. Efficiency assessment of electricity generation from renewable and non-renewable energy sources using Data Envelopment Analysis. Int. J. Energy Res. 2021, 45, 19597–19610. [Google Scholar] [CrossRef]

- Bouyssou, D. Using DEA as a tool for MCDM: Some remarks. J. Oper. Res. Soc. 2017, 50, 974–978. [Google Scholar] [CrossRef]

- Cook, W.D.; Seiford, L.M. Data envelopment analysis (DEA)—Thirty years on. Eur. J. Oper. Res. 2009, 192, 1–17. [Google Scholar] [CrossRef]

- Azadeh, A.; Rahimi-Golkhandan, A.; Moghaddam, M. Location optimization of wind power generation–transmission systems under uncertainty using hierarchical fuzzy DEA: A case study. Renew. Sustain. Energy Rev. 2014, 30, 877–885. [Google Scholar] [CrossRef]

- Wang, C.-N.; Nhieu, N.-L.; Nguyen, H.-P.; Wang, J.-W. Simulation-Based Optimization Integrated Multiple Criteria Decision-Making Framework for Wave Energy Site Selection: A Case Study of Australia. IEEE Access 2021, 9, 167458–167476. [Google Scholar] [CrossRef]

- Pittenger, L.M.; Glassman, A.M.; Mumbower, S.; Merritt, D.M.; Bollenback, D. Bounded Rationality: Managerial Decision-Making and Data. J. Comput. Inf. Syst. 2022, 63, 890–903. [Google Scholar] [CrossRef]

- Wang, C.-N.; Nguyen, T.-D.; Nhieu, N.-L.; Hsueh, M.-H. A Novel Psychological Decision-Making Approach for Healthcare Digital Transformation Benchmarking in ASEAN. Appl. Sci. 2023, 13, 3711. [Google Scholar] [CrossRef]

- Turk, S.; Koc, A.; Sahin, G. Multi-criteria of PV solar site selection problem using GIS-intuitionistic fuzzy based approach in Erzurum province/Turkey. Sci. Rep. 2021, 11, 5034. [Google Scholar] [CrossRef] [PubMed]

- Bell, D.E. Regret in decision making under uncertainty. Oper. Res. 1982, 30, 961–981. [Google Scholar] [CrossRef]

- Ramos, G.M.; Daamen, W.; Hoogendoorn, S. A state-of-the-art review: Developments in utility theory, prospect theory and regret theory to investigate travellers’ behaviour in situations involving travel time uncertainty. Transp. Rev. 2014, 34, 46–67. [Google Scholar] [CrossRef]

- Simon, H. Bounded rationality in social science: Today and tomorrow. Mind Soc. 2000, 1, 25–39. [Google Scholar] [CrossRef]

- Kahneman, D. Prospect theory: An analysis of decisions under risk. Econometrica 1979, 47, 278. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of super-efficiency in data envelopment analysis. Eur. J. Oper. Res. 2002, 143, 32–41. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W. Programming with linear fractional functionals. Nav. Res. Logist. Q. 1962, 9, 181–186. [Google Scholar] [CrossRef]

- Liu, J.; Shao, L.; Jin, F.; Tao, Z. A Multi-Attribute Group Decision-Making Method Based on Trust Relationship and DEA Regret Cross-Efficiency. IEEE Trans. Eng. Manag. 2022, 71, 824–836. [Google Scholar] [CrossRef]

- Liu, Z.; Xu, J.; Wei, Y.; Hatab, A.A.; Lan, J. Nexus between green financing, renewable energy generation, and energy efficiency: Empirical insights through DEA technique. Environ. Sci. Pollut. Res. 2023, 30, 61290–61303. [Google Scholar] [CrossRef] [PubMed]

- Moon, H.; Min, D. Assessing energy efficiency and the related policy implications for energy-intensive firms in Korea: DEA approach. Energy 2017, 133, 23–34. [Google Scholar] [CrossRef]

- Zhang, R.; Wei, Q.; Li, A.; Ren, L. Measuring efficiency and technology inequality of China’s electricity generation and transmission system: A new approach of network Data Envelopment Analysis prospect cross-efficiency models. Energy 2022, 246, 123274. [Google Scholar] [CrossRef]

- Mousavi-Avval, S.H.; Rafiee, S.; Jafari, A.; Mohammadi, A. Optimization of energy consumption for soybean production using Data Envelopment Analysis (DEA) approach. Appl. Energy 2011, 88, 3765–3772. [Google Scholar] [CrossRef]

- Wang, C.-N.; Nguyen, H.-K.; Nhieu, N.-L. Integrating prospect theory with DEA for renewable energy investment evaluation in South America. Renew. Energy 2025, 247, 123018. [Google Scholar] [CrossRef]

- IRENA. Renewable Energy Country Profiles; International Renewable Energy Agency (IRENA): Abu Dhabi, United Arab Emirates, 2022. [Google Scholar]

- The World Factbook; Central Intelligence Agency (CIA): Langley, VA, USA, 2023.

- ADB Data Library; Asian Development Bank: Mandaluyong, Philippines, 2022.

- ACE. The 5th ASEAN Energy Outlook (AEO5); ASEAN Center for Energy (ACE): Jakarta, Indonesia, 2017. [Google Scholar]

| No. | Country | Region | Alpha-3 Code |

|---|---|---|---|

| 1 | Afghanistan | SA | AFG |

| 2 | Bangladesh | SA | BGD |

| 3 | Bhutan | SA | BTN |

| 4 | Cambodia | SEA | KHM |

| 5 | India | SA | IND |

| 6 | Indonesia | SEA | IDN |

| 7 | Lao PDR | SEA | LAO |

| 8 | Malaysia | SEA | MYS |

| 9 | Maldives | SA | MDV |

| 10 | Myanmar | SEA | MMR |

| 11 | Nepal | SA | NPL |

| 12 | Pakistan | SA | PAK |

| 13 | Philippines | SEA | PHL |

| 14 | Sri Lanka | SA | LKA |

| 15 | Thailand | SEA | THA |

| 16 | Vietnam | SEA | VNM |

| Measurement | Input/Output | Notation | Unit |

|---|---|---|---|

| Public Flows to Renewable Energy | Input | IP1 | Million USD |

| Energy Intensity | Input | IP1 | MJ per 2017 USD PPP |

| Transmission Loss | Input | IP1 | Million kWh |

| Renewable Energy Supply | Output | OP1 | TJ |

| Renewable Energy Consumption | Output | OP2 | TJ |

| Renewable Electricity Generation | Output | OP3 | % |

| Installed renewable Electricity Capacity | Output | OP4 | MW |

| Non-renewable Emissions Replaced | Output | OP5 | Million Tons CO2eq |

| Country | Input | Output | ||||||

|---|---|---|---|---|---|---|---|---|

| Public Flows to RE 2020 | Energy Intensity | Transmission Loss | RE Supply | Renewable Energy Consumption | Renewable Electricity Generation | Installed Renewable Electricity Capacity | Non-Renewable Emissions Replaced | |

| AF | 49.26 | 2.40 | 61.6 | 36,777 | 24,982 | 79.5 | 387.7 | 0.9 |

| BG | 23.13 | 2.36 | 9537.0 | 536,582 | 540,860 | 1.8 | 744.0 | 0.7 |

| BT | 0.75 | 7.91 | 60.0 | 57,149 | 131,124 | 100.0 | 2335.4 | 9.6 |

| KH | 27.94 | 4.68 | 1187.0 | 171,746 | 180,983 | 59.0 | 1748.6 | 4.2 |

| IN | 1677.24 | 4.28 | 270,701.0 | 9,072,449 | 10,196,470 | 18.9 | 147,170.6 | 281.8 |

| ID | 418.11 | 3.16 | 25,080.0 | 2,221,260 | 2,317,278 | 18.1 | 11,537.3 | 46.5 |

| LA | 0.44 | 4.35 | 2262.0 | 90,940 | 252,884 | 69.3 | 8934.3 | 29.9 |

| MY | 3.87 | 4.25 | 12,124.0 | 166,883 | 281,391 | 17.8 | 8898.2 | 21.5 |

| MV | 22.06 | 2.68 | 21.0 | 336 | 422 | 5.8 | 32.5 | 0.0 |

| MM | 63.26 | 3.58 | 21.0 | 496,449 | 488,910 | 46.4 | 3443.6 | 6.3 |

| NP | 59.38 | 5.23 | 1183.0 | 480,625 | 493,046 | 100.0 | 2096.2 | 6.4 |

| PK | 870.53 | 4.59 | 17,389.0 | 874,721 | 1,020,571 | 29.8 | 12,887.4 | 34.2 |

| PH | 1.72 | 2.68 | 9994.0 | 799,202 | 879,527 | 21.9 | 7312.3 | 18.2 |

| LK | 0.58 | 1.78 | 1337.0 | 162,464 | 183,001 | 51.3 | 2720.4 | 5.4 |

| TH | 54.82 | 4.52 | 13,286.0 | 705,237 | 810,786 | 18.8 | 12,197.2 | 25.9 |

| VN | 166.91 | 4.92 | 15,479.0 | 862,519 | 1,163,843 | 42.8 | 42,728.5 | 83.5 |

| Country | IP1 | IP2 | IP3 | OP1 | OP2 | OP3 | OP4 | OP5 |

|---|---|---|---|---|---|---|---|---|

| AFG | 0 | 0 | 0.0162 | 0 | 0 | 0.0126 | 0 | 0 |

| BGD | 0 | 0 | 0.0001 | 0 | 0 | 0 | 0 | 0 |

| BTN | 0 | 0.1264 | 0 | 0 | 0 | 0 | 0 | 0 |

| KHM | 0 | 0 | 0.0008 | 0 | 0 | 0.0062 | 0 | 0 |

| IND | 0.0006 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0035 |

| IDN | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| LAO | 0 | 0 | 0.0004 | 0 | 0 | 0.0144 | 0 | 0 |

| MYS | 0 | 0 | 0.0001 | 0 | 0 | 0 | 0 | 0 |

| MDV | 0.0453 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| MMR | 0.0158 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| NPL | 0 | 0.1912 | 0 | 0 | 0 | 0.0065 | 0 | 0 |

| PAK | 0.0011 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| PHL | 0 | 0 | 0.0001 | 0 | 0 | 0 | 0 | 0 |

| LKA | 0 | 0 | 0.0007 | 0 | 0 | 0 | 0 | 0 |

| THA | 0 | 0 | 0.0001 | 0 | 0 | 0 | 0 | 0 |

| VNM | 0 | 0 | 0.0001 | 0 | 0 | 0 | 0 | 0 |

| Country | AFG | BGD | BTN | KHM | IND | IDN | LAO | MYS | MDV | MMR | NPL | PAK | PHL | LKA | THA | VNM |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AFG | 1.00 | 0.00 | 1.29 | 0.04 | 0.00 | 0.00 | 0.02 | 0.00 | 0.21 | 1.71 | 0.07 | 0.00 | 0.00 | 0.03 | 0.00 | 0.00 |

| BGD | 0.65 | 0.06 | 1.03 | 0.16 | 0.04 | 0.10 | 0.04 | 0.01 | 0.02 | 25.56 | 0.44 | 0.05 | 0.09 | 0.13 | 0.06 | 0.06 |

| BTN | 2.62 | 0.06 | 1.00 | 1.00 | 0.35 | 0.45 | 1.26 | 0.33 | 0.17 | 1.03 | 1.51 | 0.51 | 0.65 | 2.28 | 0.33 | 0.69 |

| KHM | 9.44 | 0.00 | 12.20 | 0.36 | 0.00 | 0.01 | 0.22 | 0.01 | 2.03 | 16.17 | 0.62 | 0.01 | 0.02 | 0.28 | 0.01 | 0.02 |

| IND | 0.11 | 0.19 | 75.81 | 0.89 | 1.00 | 0.66 | 404.94 | 33.10 | 0.01 | 0.59 | 0.64 | 0.23 | 63.14 | 55.52 | 2.81 | 2.98 |

| IDN | 6.74 | 0.64 | 10.75 | 1.63 | 0.38 | 1.00 | 0.45 | 0.16 | 0.18 | 266.92 | 4.59 | 0.57 | 0.90 | 1.37 | 0.60 | 0.63 |

| LAO | 42.10 | 0.01 | 54.39 | 1.62 | 0.00 | 0.02 | 1.00 | 0.05 | 9.04 | 72.10 | 2.76 | 0.06 | 0.07 | 1.25 | 0.05 | 0.09 |

| MYS | 4.61 | 0.65 | 24.86 | 1.73 | 0.43 | 1.05 | 1.27 | 0.26 | 0.23 | 264.87 | 4.74 | 0.67 | 1.00 | 1.56 | 0.69 | 0.86 |

| MDV | 0.08 | 3.58 | 26.78 | 0.99 | 0.93 | 0.85 | 88.03 | 11.14 | 0.00 | 1.18 | 1.27 | 0.18 | 78.32 | 48.33 | 2.27 | 1.07 |

| MMR | 0.10 | 2.96 | 9.71 | 0.78 | 0.69 | 0.68 | 26.34 | 5.49 | 0.00 | 1.00 | 1.03 | 0.13 | 59.21 | 35.69 | 1.64 | 0.66 |

| NPL | 1.12 | 0.03 | 0.43 | 0.43 | 0.15 | 0.19 | 0.54 | 0.14 | 0.07 | 0.44 | 0.65 | 0.22 | 0.28 | 0.97 | 0.14 | 0.29 |

| PAK | 0.17 | 7.68 | 57.40 | 2.13 | 2.00 | 1.82 | 188.69 | 23.87 | 0.01 | 2.54 | 2.73 | 0.38 | 167.88 | 103.59 | 4.86 | 2.29 |

| PHL | 4.61 | 0.64 | 24.83 | 1.73 | 0.43 | 1.05 | 1.27 | 0.26 | 0.23 | 264.55 | 4.74 | 0.67 | 1.00 | 1.56 | 0.69 | 0.85 |

| LKA | 2.96 | 0.41 | 15.97 | 1.11 | 0.28 | 0.68 | 0.82 | 0.17 | 0.15 | 170.09 | 3.04 | 0.43 | 0.64 | 1.00 | 0.45 | 0.55 |

| THA | 2.44 | 0.34 | 13.14 | 0.92 | 0.23 | 0.56 | 0.67 | 0.14 | 0.12 | 140.03 | 2.51 | 0.35 | 0.53 | 0.82 | 0.37 | 0.45 |

| VNM | 5.39 | 0.75 | 29.07 | 2.03 | 0.50 | 1.23 | 1.49 | 0.31 | 0.27 | 309.64 | 5.54 | 0.78 | 1.17 | 1.82 | 0.81 | 1.00 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, C.-N.; Nhieu, N.-L.; Ye, Y.-C. A Regret-Enhanced DEA Approach to Mapping Renewable Energy Efficiency in Asia’s Growth Economies. Algorithms 2025, 18, 297. https://doi.org/10.3390/a18050297

Wang C-N, Nhieu N-L, Ye Y-C. A Regret-Enhanced DEA Approach to Mapping Renewable Energy Efficiency in Asia’s Growth Economies. Algorithms. 2025; 18(5):297. https://doi.org/10.3390/a18050297

Chicago/Turabian StyleWang, Chia-Nan, Nhat-Luong Nhieu, and Yu-Cin Ye. 2025. "A Regret-Enhanced DEA Approach to Mapping Renewable Energy Efficiency in Asia’s Growth Economies" Algorithms 18, no. 5: 297. https://doi.org/10.3390/a18050297

APA StyleWang, C.-N., Nhieu, N.-L., & Ye, Y.-C. (2025). A Regret-Enhanced DEA Approach to Mapping Renewable Energy Efficiency in Asia’s Growth Economies. Algorithms, 18(5), 297. https://doi.org/10.3390/a18050297