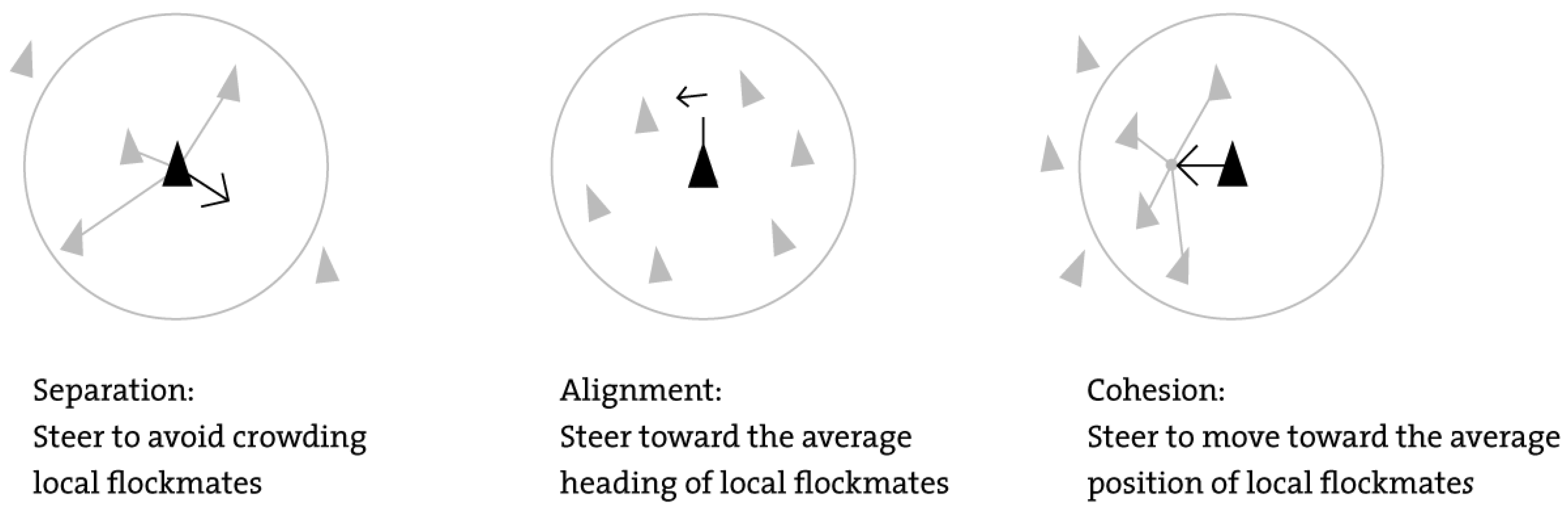

In this section, we briefly introduce the data we use and how a swarm model is applied in order to estimate the speed of following the leader, and we investigate the market pricing of slow- and fast-moving risk factors.

5.1. Data

The test assets are monthly Hou–Xue–Zhang 190 risk factors over 23 years obtained from the Q-factor data library,

https://global-q.org/index.html (accessed on 7 March 2025). It contains portfolios in six categories with different periods:

Frictions (February 1990~December 2022), 10 factors;

Intangibles (January 1990~December 2022), 31 factors;

Investments (January 1973~December 2022), 32 factors;

Momentum (July 1979~December 2022), 42 factors;

Profitability (January 1985~December 2022), 44 factors;

Value vs. growth (January 1985~December 2022), 31 factors.

In order to run our swarm model, we adopt the common period from February 1990 to December 2022, a total of 395 months.

We use lag for 12 months as features. That is, the universe of the swarm is a 12-dimensional space. In other words, on each month, a risk factor (i.e., a fish) is positioned in a 12-dimensional space according to its last 12 months of returns. As each month passes by, the risk factor moves to the next 12 months of returns.

However, to help visualize how we fit a swarm model via data, we only use lag for 2 months as a demonstration in

Figure 2.

Figure 2 plots frictions’ 10 risk factors for 4 consecutive months, April through July of 1990. Each panel contains positions (i.e., returns) of the last two months. For example, Panel (A) plots 10 risk factors’ February returns on the x-axis and March returns on the y-axis.

We pick two risk factors as an example; beta_1 (the market beta estimated using daily returns within a month) is marked in red, and tv_1 (total volatility computed from daily returns over the same period) is marked in yellow. From

Figure 2, we can clearly observe how they move from month to month. As explained earlier, on each month, the position of a risk factor is its last two months of returns. The returns of the two risk factors are given below.

In

Table 1, Panel (A), beta_1’s position is (3.5051, 7.4907), and tv_1’s position is (1.4045, 1.6897). In Panel (B), beta_1’s position is (7.4907, 0.3085), and tv_1’s position is (1.6897, −1.5450). From month to month, we can now see the migration of the two risk factors. We then use these positions to estimate the swarm speed. Then, Panel C illustrates how the velocity is calculated, which is measured as the difference between two consecutive positions.

These numerical results are then fed into Equation (16) to calculate the speed parameter. In our empirical work, 12 lags are used. We also tried different numbers of lags, and the results are qualitatively similar. They are available upon request. In terms of the number of risk factors, we follow [

42] and use 190 risk factors. Hence, we use

and

in our swarm model.

To visualize the movements of the risk factors (i.e., fish), we use beta_1 and tv_1 as an example and plot their movements in

Figure 3.

The movement of a risk factor is represented by the velocity. As described in Equation (10), the actual velocity from data can be calculated by taking the difference of the positions of two consecutive months. Panel (A) of

Figure 2 plots the positions of chosen risk factors in April 1990, and Panel (B) plots the positions of chosen risk factors in May 1990. Taking beta_1 as an example,

Figure 3 plots its positions in these two consecutive months. Its velocity is calculated (as the difference of positions) as (3.98, –7.18), which is the difference in two consecutive positions, (3.5051, 7.4907) and (7.4907, 0.3085), in April and May of 1990, respectively. Similarly, the velocity for tv_1 (orange) is (0.28, –3.23). The result is plotted in Panel (A) of

Figure 3. Similarly, the transitions from May to June and June to July of 1990 are plotted in Panels (B) and (C).

In estimating the parameters, such as in Equation (14), we simply iterate the parameter value until the model’s velocity matches the data’s velocity as closely as possible (i.e., minimized sum of squared errors).

5.2. Experimental Design and Procedure

This section clarifies the experimental environment, the fixed parameter settings of our adapted swarm model, and the step-by-step procedure used to conduct the monthly asset pricing tests.

The core empirical methodology is a time-series analysis built on monthly cross-sectional sorting. The fixed parameters of our estimation environment are determined based on the input data and the structural design of the swarm space. The agents, or “particles,” in the swarm are the 190 cross-sectional risk factors sourced from the Q-factor data library. The dimension of the swarm space is fixed at D = 12, representing the preceding 12 months of returns for each factor. This D = 12 choice serves as the input features that define the factor’s position vector () in the swarm space. The core estimation period spans T = 395 months, from February 1990 to December 2022.

The experiment is executed via a monthly rolling procedure, which consists of three distinct phases. The first phase involves the observation and modeling of factor dynamics. We first compute the position vector () for all 190 factors at the end of each month t using their returns from t − 11 to t. The empirically observed velocity () is then calculated as the change in position from the previous month: . Subsequently, the leader position () is identified as the factor exhibiting the highest cross-sectional return over the preceding 12-month period, t − 11 to t. Finally, using the time-series of and the position difference (), we estimate the factor-specific swarm velocity (SV), , for all 190 factors by minimizing the error via the closed-form solution (Equation (14)).

The second phase establishes the link between dynamics and returns. Specifically, at the end of month t, we sort the 190 factors into five equal-weight quintile portfolios based on their estimated SV. The Low SV portfolio comprises the slow-moving factors, and the High SV portfolio comprises the fast-moving factors. We then calculate the equal-weighted return for each of the five portfolios over the subsequent month, t + 1. This step establishes the core link between factor dynamics (measured at t) and subsequent return predictability (observed at t + 1).

The third phase involves the formal statistical evaluation. We calculate the time-series average of the return differential between the High SV and Low SV portfolios (High−Low). To test whether the predictability constitutes an unmodeled risk premium, the time-series returns of all five portfolios are regressed against various established factor models (FF5, FF6, Q, Q5). The intercept terms (α) are the primary metric for assessing abnormal performance. Finally, we examine the long-term return predictability by analyzing portfolio returns when the portfolios formed at month t are held and tested over horizons extending up to 12 months ahead (as summarized in Table 3). This comprehensive procedure is repeated for every month within the sample period, generating a time-series of monthly portfolio returns used for all subsequent statistical inference.

5.4. Market Pricing of Factor Velocity

To investigate how the market prices factors with different velocity measures derived from swarm intelligence, we conduct a portfolio-level analysis. Each month, we sort 190 factors from the Q-factor data library into quintiles based on their swarm velocity (SV). We then compute the equal-weighted returns for each quintile and compare the return differences between the top and bottom quintiles. Our portfolio-level analysis is conducted in an out-of-sample fashion in the time-series sense. Specifically, for each month, factor velocities are computed using only return data from the prior 12 months, and these estimates are then used to sort factors and evaluate one-month-ahead returns. This rolling structure ensures that no future information is used in forming the velocity measure, thereby preserving the out-of-sample integrity of the return predictions. To further address concerns about predictive validity across time, we perform a subsample analysis by splitting the sample into two equal subperiods and examining the return predictability of factor velocity separately within each. The results (available upon request) remain directionally consistent with the full-sample findings, with slow-moving factors continuing to earn higher average returns than fast-moving ones. These findings reinforce the robustness and generalizability of swarm velocity as a predictive signal.

The primary metrics used to evaluate the performance of portfolios sorted by swarm velocity (SV) are the modified Jensen’s Alpha (α), serving as the gold standard for measuring risk-adjusted abnormal returns in empirical asset pricing (e.g., [

40,

41,

44,

45]); among many others). Specifically, α is calculated as the intercept term in a time-series regression of the monthly returns of each factor portfolio (

) on established market risk factors (

) using the general K-factor model,

. A positive alpha (α > 0) indicates superior performance, returns exceeding those predicted by the model given its risk, suggesting an abnormally high return after accounting for portfolio p’s exposure to market risk factors. Conversely, a negative alpha indicates underperformance. The statistical significance of alpha is determined by its t-statistic (Newey–West adjusted to account for serial correlation), where an absolute value typically exceeding 1.96 confirms that the abnormal return is statistically robust across the alternative factor models tested. Following prior studies, we estimate alphas for each factor portfolio and the return difference between the top and the bottom SV quintiles relative to the following established models: the Fama–French Five-Factor Model (FF5, including excess market return (MKT−RF), size factor (SMB), book-to-market factor (HML), investment growth factor (CMA), and operating profitability factor (RMW)); the Fama–French Six-Factor Model (FF6, extending FF5 with a momentum factor (UMD)); the augmented FF6 model (FF6PS, including the Pastor–Stambaugh illiquidity factor (PS)); the Hou, Xue, and Zhang Four-Factor Model (Q, including excess market return (R_MKT), size factor (R_ME), investment growth factor (R_IA), and operating profitability factor (R_ROE)); and the extended Q-Factor Model (Q5, including the growth-related factor (R_EG)).

Table 2 presents the results. Column 1 reports the average characteristics of the sorting variable, Column 2 provides the mean equal-weighted returns within each quintile, and Columns 3 to 8 display alphas relative to various factor models. These models include (1) the Fama–French Five-Factor Model (FF5), which includes market (MKT), size (SMB), book-to-market (HML), investment (CMA), and profitability (RMW) factors [

40], with the resulting intercept term labeled FF5 alpha; (2) the Fama–French Six-Factor Model (FF6), which adds the momentum (UMD) factor to FF5, producing FF6 alpha [

40,

44]; (3) the Fama–French–Carhart Six-Factor Model augmented with the Pastor–Stambaugh liquidity factor [

14], generating FF6PS alpha; (4) the Hou–Xue–Zhang Four-Factor Model (Q-factor model), which includes R_MKT, R_ME, investment (R_IA), and profitability (R_ROE) [

42], with the corresponding Q alpha; and (5) the Hou–Mo–Xue–Zhang Five-Factor Model [

46], which extends the Q-factor model with the growth (R_EG) factor, producing Q5 alpha. The last row of

Table 2 reports the differences in mean returns and alphas between the top and bottom quintiles, with Newey–West-adjusted

t-statistics) accounting for serial correlation. Our sample period spans March 1991 to December 2022 to ensure all 190 factors are available each month.

Table 2 reveals that factors in the lowest SV quintile earn significantly higher abnormal returns than those in the highest SV quintile, with an alpha difference ranging from 17 to 22 basis points per month. Importantly, this return differential is primarily driven by the superior performance of slower-moving factors. The time period robustness test shows that the predictive power of the SV factor holds across both the pre-Global Financial Crisis or GFC (March 1993–December 2008) and post-GFC (January 2009–December 2022) periods, with slow-moving factors outperforming fast-moving factors at the one-month-ahead horizon, suggesting that its predictive strength is not confined to a specific economic cycle or market regime.

We further examine whether swarm speed exhibits return predictability beyond a one-month horizon. To test this, we relate the swarm velocity measure to future returns of the previously formed quintile factor values over horizons extending from 2 months to 12 months ahead.

Table 3 presents the Hou–Mo–Xue–Zhang Five-Factor alphas (Q5) for these horizons. The results show that the return spread between the top and bottom SV quintile factor values remains negative across all horizons, ranging from 5 to 17 basis points per month. However, only the two-month-ahead alpha spread is statistically significant, driven by the continued outperformance of slow-moving factors.

Next, we explore the characteristics of fast-moving versus slow-moving factors. Panel A of

Table 4 lists the top 10 slowest-moving factors (left panel) and the top 10 fastest-moving factors (right panel). For comparison, values in the table are demeaned. The slowest-moving factors exhibit an average velocity below the mean of all 190 factors, with a probability exceeding 50% of falling into the slow-moving quintile and a 20% lower likelihood of appearing in the fast-moving quintile. Conversely, the fastest-moving factors exhibit significantly higher velocity scores, with probabilities more than 50% above the mean for appearing in the fast-mover quintile and approximately 20% lower for falling into the slow-mover quintile.

To improve interpretability and identify underlying drivers of return differentials, we follow [

42,

46] and categorize factor-level results by their respective themes, including frictions, intangibles, investments, momentum, profitability, and value vs. growth. Panel B of

Table 4 shows that friction-related factors are disproportionately overrepresented in the slow-mover risk factor, appearing at more than twice their unconditional share. In contrast, investment-related factors are significantly underrepresented, comprising less than 50% of their unconditional share. Within the fast-mover risk factor, momentum-related factors dominate, accounting for 36.20% of the risk factor versus their unconditional share of 25.37%, while intangibles and value vs. growth factors are notably underrepresented. The non-random factor categorization bias in

Table 4, Panel B, is formally confirmed using a Chi-Squared (

) goodness-of-fit test. The test compares the observed distribution of factor categories within the extreme quintiles against the unconditional distribution and finds the bias statistically significant at the 1% level or better for both slow- and faster-mover portfolios, validating that the factor bias is non-random.

The concentration of specific factor categories in the extreme velocity quintiles strongly supports our behavioral interpretation. The heavy overrepresentation of friction factors (e.g., beta1, tv1, ivff1) within the slow-mover portfolio directly confirms the hypothesis that the low swarm velocity is driven by trading impediments and delayed information diffusion. These factors, which are often proxies for low liquidity or high idiosyncratic risk, inherently lead to slow price adjustments, as institutional investors may be slow to trade or incorporate new information due to high transaction costs. Conversely, the significant domination of the fast-mover portfolio by momentum factors (e.g., cm12, sim12, abr12) is consistent with the literature on investor attention and herding. Momentum factors are highly sensitive to recent price action and news, leading to rapid collective movements. These factors act as the trend-setters or “leaders” within the swarm system, and their high swarm velocity confirms their role as the fastest responders to market sentiment. This empirical factor alignment validates that the estimated swarm velocity is a direct, data-driven measure of a factor’s speed of price adjustment.

Next, we examine the persistence of swarm velocity (SV) using a portfolio transition matrix, which reports the probability that a factor in the

-th SV quintile at month

t remains in the

-th SV quintile at month

, where n ranges from 1 to 60 months (i.e., from 1 month ahead to 5 years ahead). Under the null hypothesis of random portfolio assignment, the probability of a factor remaining in the same quintile over time would be 20%. Panel A of

Table 5 shows that for the one-month-ahead transition matrix, 79% (81%) of factors in the highest (lowest) SV quintile at month

t remain in the same quintile at month

. Moreover, for all SV quintiles, the probability of remaining in the same quintile at

exceeds the random benchmark of 20%, indicating meaningful short-term persistence. Panels B through H of

Table 5 present the SV transition matrices at 3-, 6-, 12-, 24-, 36-, 48-, and 60-month horizons. The results reveal strong and sustained persistence in SV. For example, 70%, 60%, 45%, 42%, 40%, and 41% of factors in the high-SV portfolio remain in the high-SV quintile after 3, 6, 12, 24, 36, 48, and 60 months, respectively. Similarly, the corresponding persistence rates for factors in the low-SV portfolio are 71%, 62%, 50%, 49%, 48%, and 46%. These probabilities are substantially higher than the 20% expected under random assignment and provide compelling evidence that swarm velocity is highly persistent over time. The persistence of swarm velocity (SV) is formally confirmed by testing the factor retention rates against the 20% random benchmark (null hypothesis). The retention rates in the extreme portfolios (Low SV and High SV) are statistically significant at the 1% level across all horizons tested (up to 60 months).

These findings, combined with our risk factor return results, support the hypothesis that trading frictions impede the swift incorporation of value-relevant information, leading to subsequent outperformance of slow-moving factors. On the other hand, the statistically insignificant alphas of future returns of fast movers are inconsistent with the idea that heightened investor attention results in temporary overvaluation of fast movers, leading to subsequent underperformance.

While the persistence of the negative alpha differential across all major asset pricing models (FF5, FF6, FF6PS, Q, Q5) strongly suggests that the abnormal return is not compensation for known, priced risk, we acknowledge that it could theoretically be attributed to an unpriced macroeconomic risk premium. However, we find the behavioral interpretation to be more compelling and coherent; the high concentration of friction factors in the slow-moving quintile (

Table 4, Panel B) provides empirical support for the mechanism of delayed price discovery. In this view, the alpha is not a risk premium but rather a premium earned for exploiting market inefficiency caused by trading impediments and slow information assimilation, which is the direct economic counterpart to a factor’s low swarm velocity.