Critical Minerals for Zero-Emission Transportation

Abstract

:1. Introduction

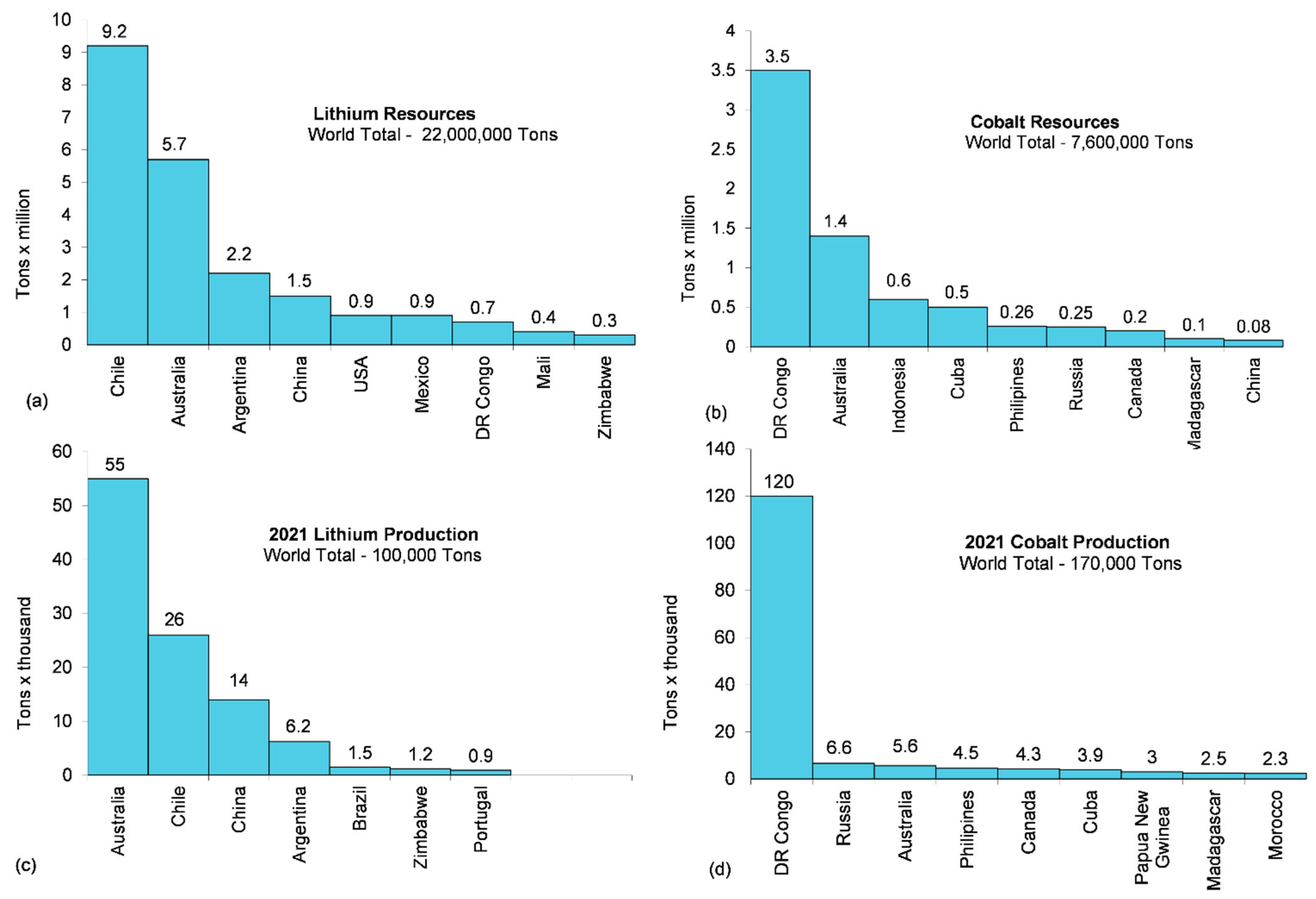

2. Critical Minerals

2.1. Defining Minerals Criticality

- Their significant economic importance for key sectors in the regional economy and/or national security;

- A high-supply risk due to the very high import dependence and high level of concentration of a set of critical raw materials in particular countries;

- A lack of viable substitutes, due to the very unique and reliable properties of these materials for existing, as well as future applications.

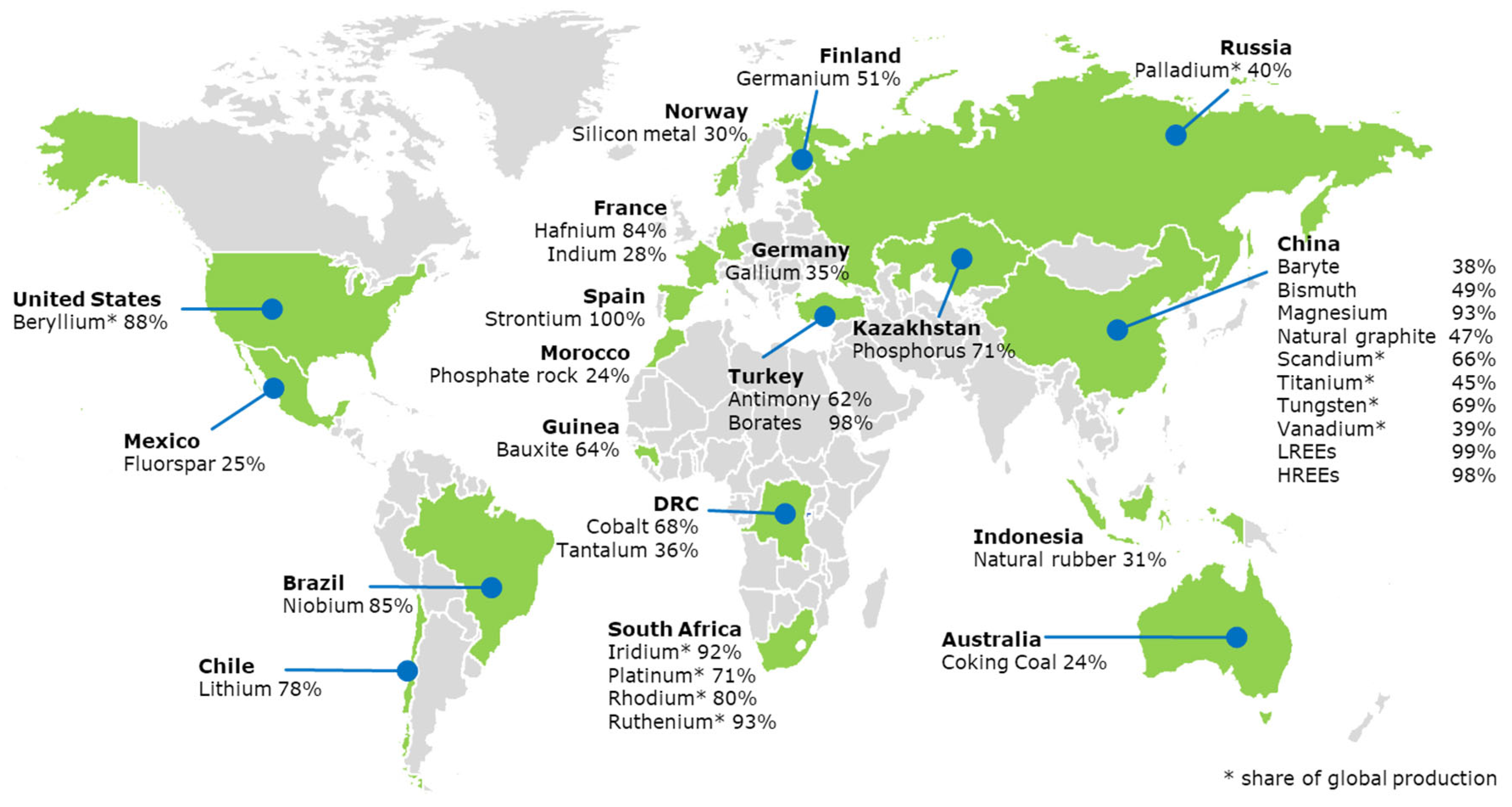

2.2. Geopolitical Factors and National Lists

2.3. Assessment of Critical Materials Supply Risks

3. Material Criticality and Circular Economy

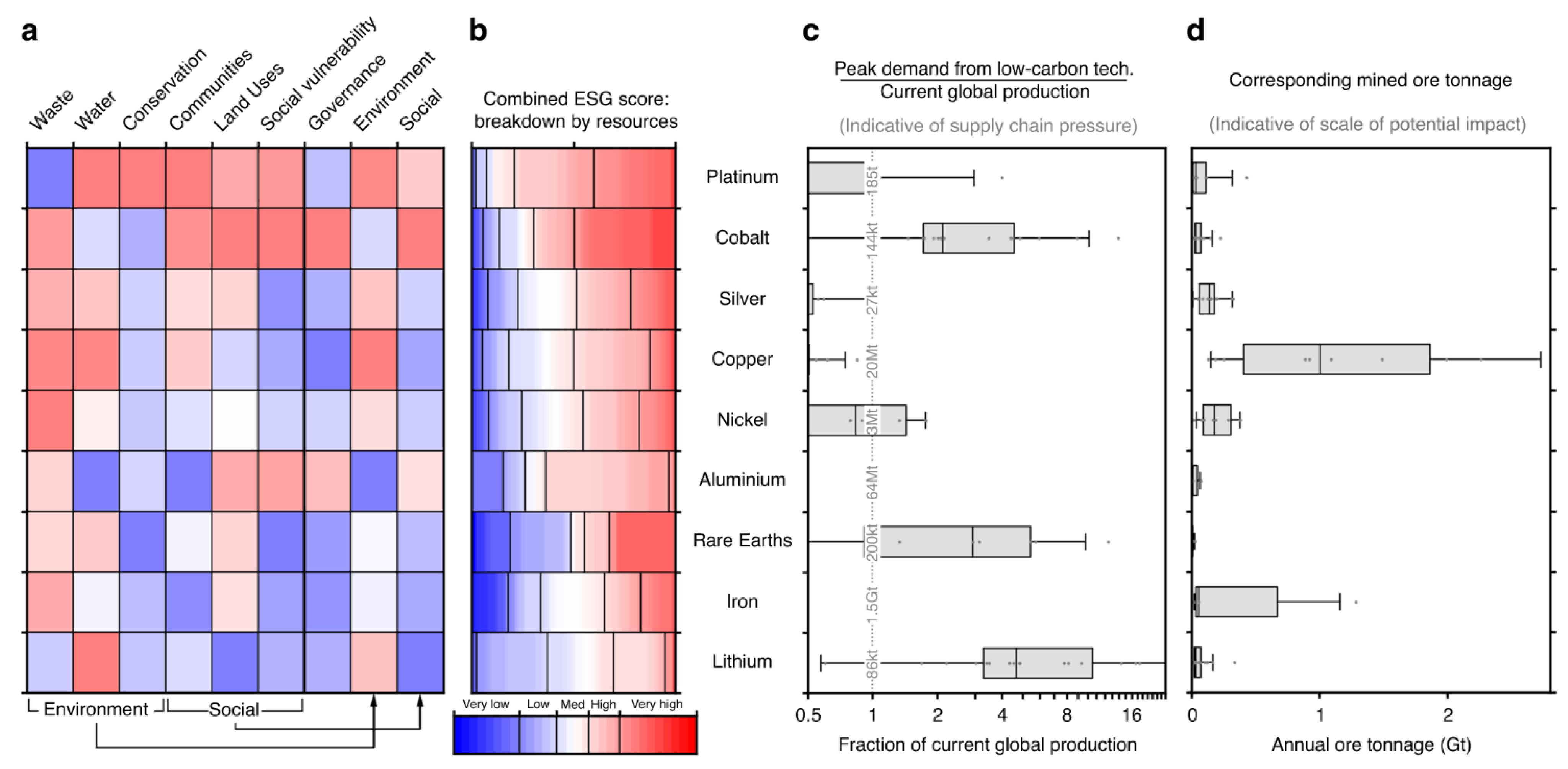

3.1. Impact of Critical Minerals Extraction and Processing

- Physical disturbances to the landscape;

- Soil and water contamination;

- Air contamination;

- Public safety.

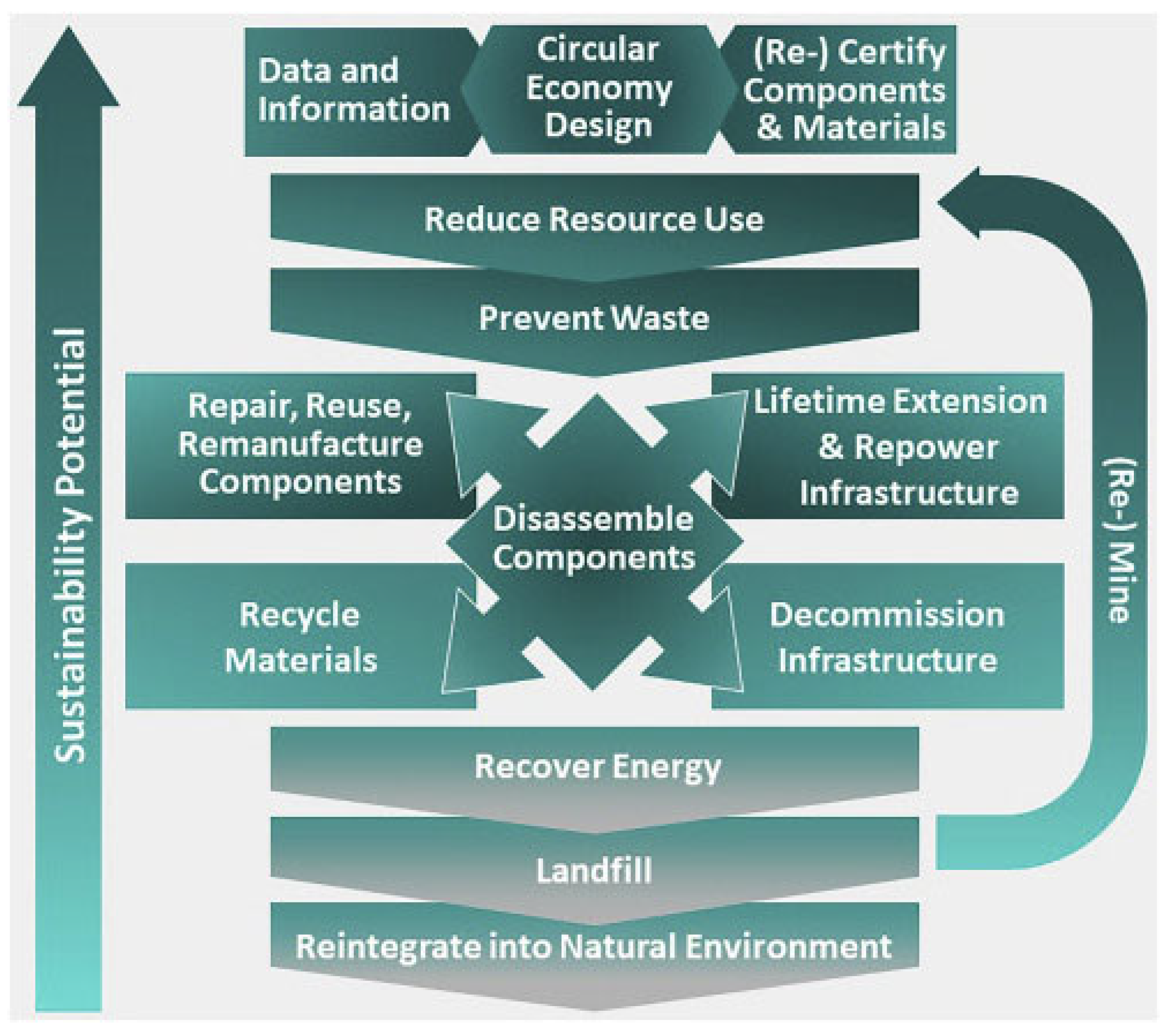

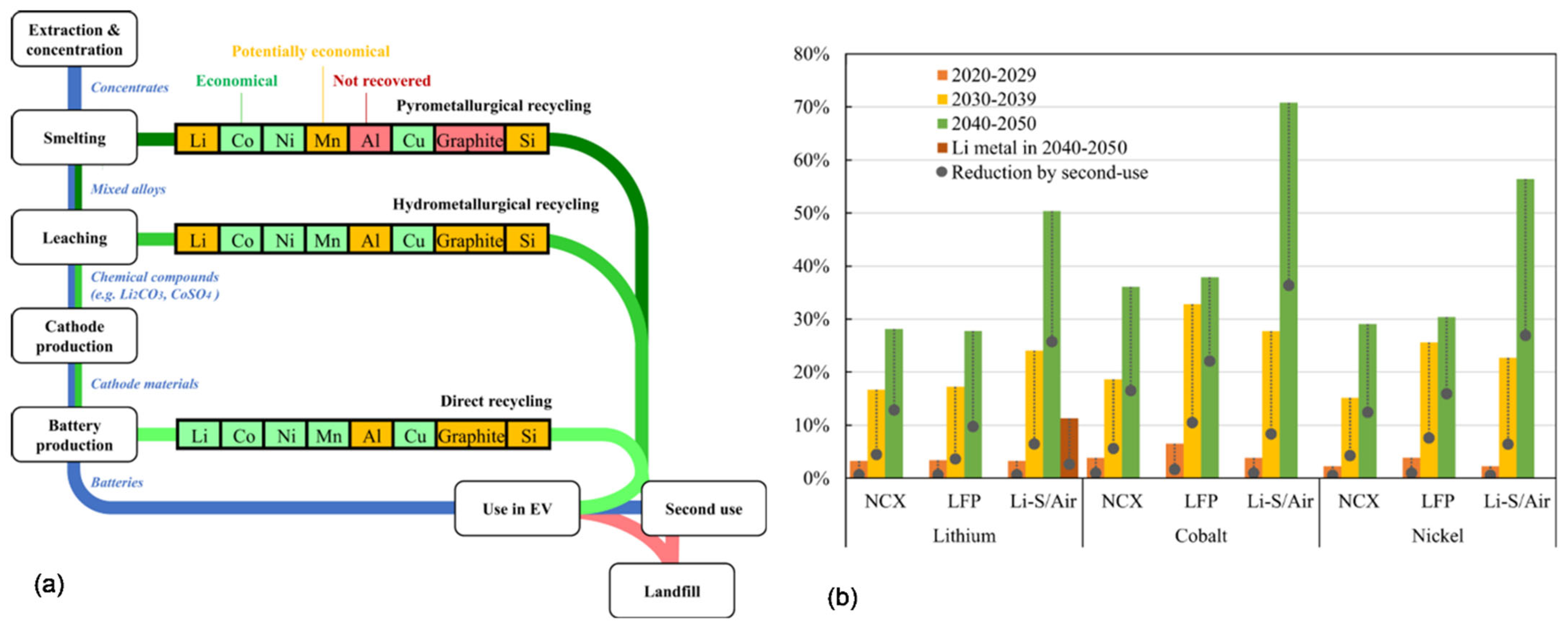

3.2. Circularity as a Solution for Criticality

- Narrowing resource loops—this refers to resource-efficient processes being able to fulfill societal needs but at the same time reducing the net quantity of materials used per unit of economic activity;

- Slowing resource loops—this refers to methods used to retain the use and value of a material or product for as long as possible; it includes designing products that are durable and retain both their function and their appeal to users over an extended lifespan;

- Closing resource loops—this refers to the processes used to recover a resource at the end of their lifespan, and send it back to productive use, as shown in Figure 6.

4. Zero-Emission Vehicles (ZEV)

4.1. California’s Zero-Emission Vehicle Mandate

4.2. Focus of Present Definitions

4.3. Net-Zero Economy—Life Cycle Emissions

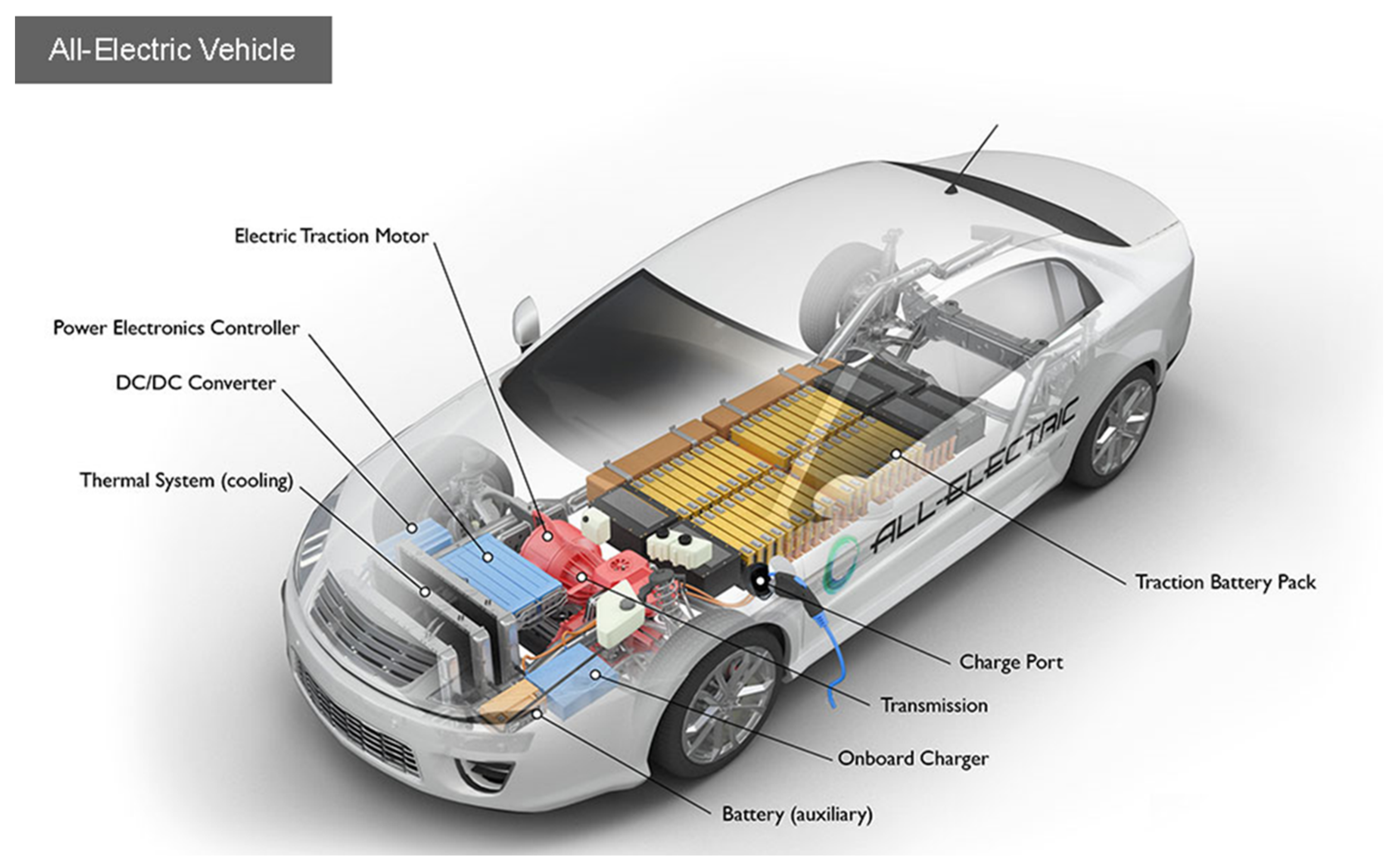

5. Materials for Zero-Emission Vehicles

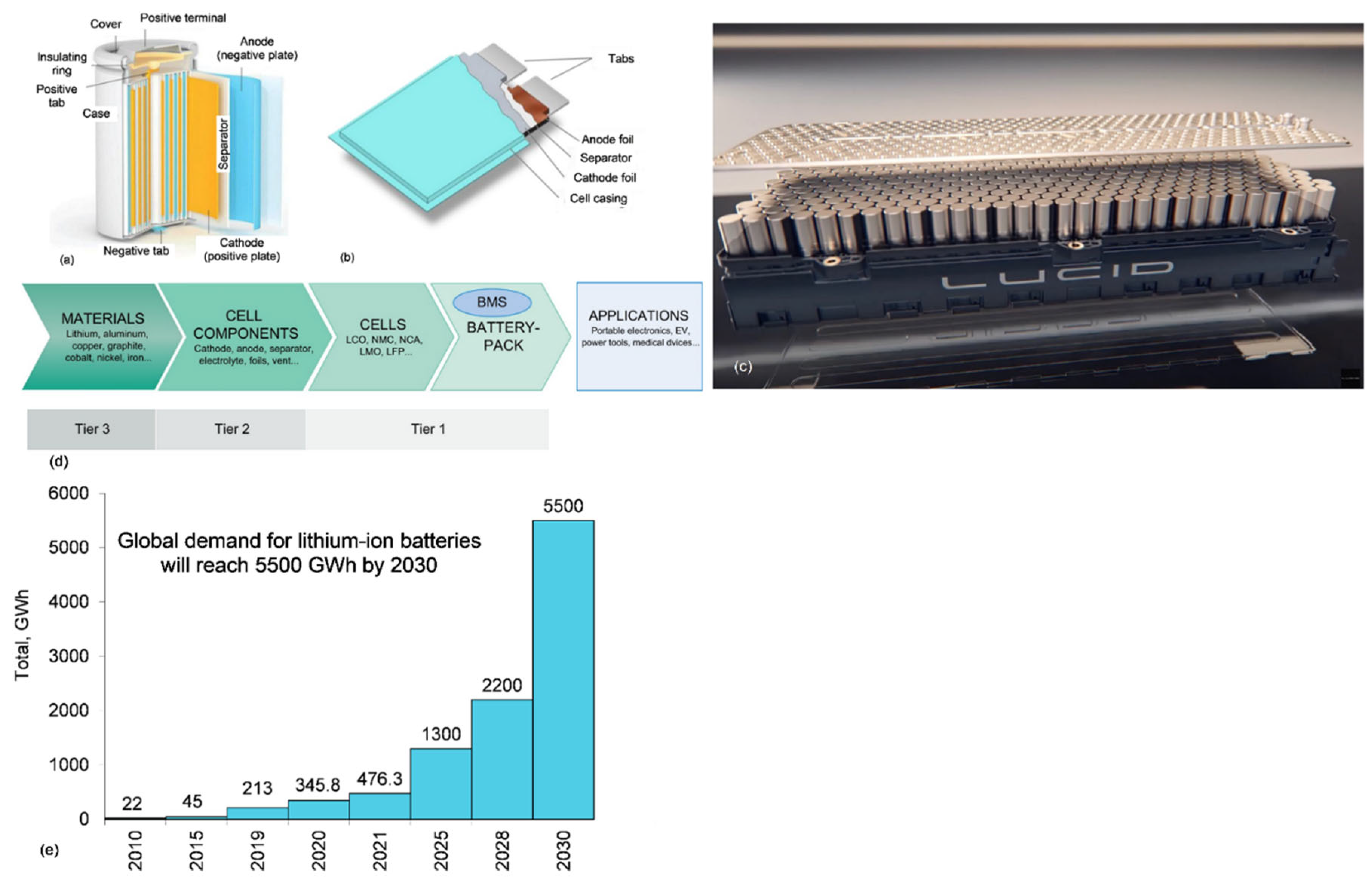

5.1. Materials for Batteries

5.1.1. Battery Cell Materials

- Lithium-ion battery (LIB), used by most EV vehicles;

- Nickel–metal hydride battery, used by hybrid vehicles.

5.1.2. Battery Pack Materials

5.2. Materials for Electric Traction Motors

5.2.1. Nd-Fe-B Magnets with Heavy Rare Earths

5.2.2. Heavy-Rare-Earth-Free Nd-Fe-B Magnets

5.2.3. Heavy REE Supply and Demand

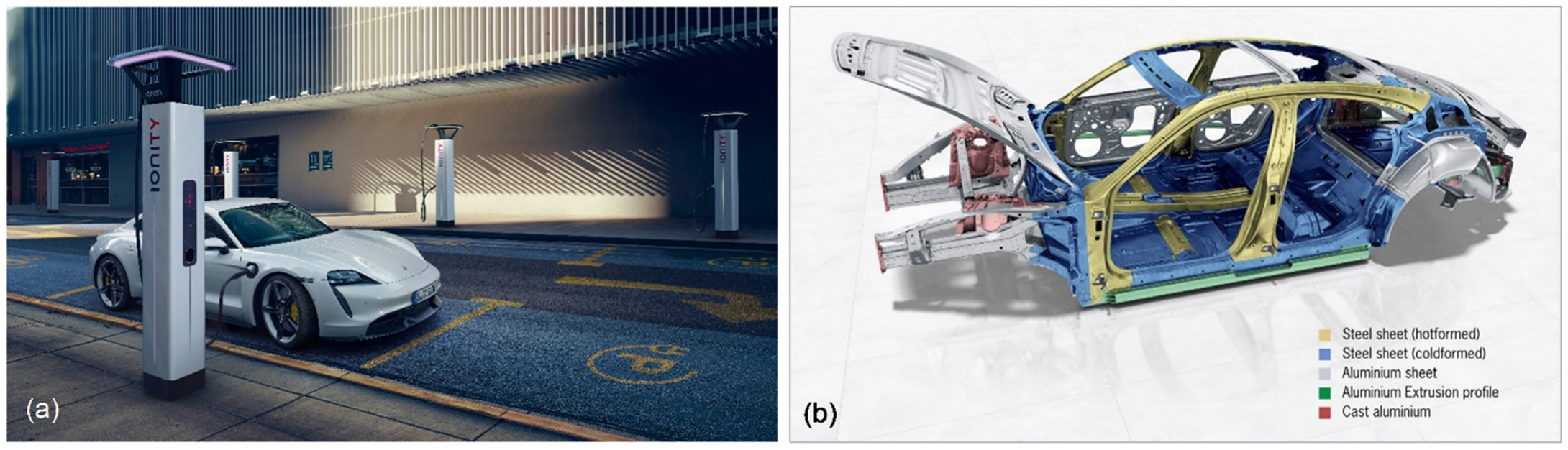

5.3. Materials for Car Body

5.3.1. Ferrous Alloys

5.3.2. Aluminum Alloys

5.3.3. Magnesium Alloys

5.3.4. Substitution Dilemma of Critical Materials and Lightweighting Goals

5.4. Auxiliaries

5.4.1. Twelve-Volt Lead Auxiliary Batteries

5.4.2. Copper Conductors in EV

5.4.3. Aluminum Conductors as an Alternative to Copper

6. Recovering the Critical Minerals from EV

6.1. Recovering Metals from Lithium-Ion Batteries

6.2. Recovering Graphite from Lithium-Ion Batteries

6.3. Recycling the NdFeB Magnets from Electric Drive Motors

7. Concluding Remarks

Funding

Conflicts of Interest

References

- International Energy Agency (IEA). The Role of Critical Minerals in Clean Energy Transitions, World Energy Outlook Special Report; International Energy Agency (IEA): Paris, France, March 2022; Available online: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/executive-summary (accessed on 20 April 2022).

- Hertwich, E.G.; Gibon, T.; Bouman, E.A.; Arvesen, A.; Suh, S.; Heath, G.A.; Bergesen, J.D.; Ramirez, A.; Vega, M.I.; Shi, L. Integrated life-cycle assessment of electricity-supply scenarios confirms global environmental benefit of low-carbon technologies. Proc. Natl Acad. Sci. USA 2015, 112, 6277–6282. [Google Scholar] [CrossRef]

- Hache, E. Do renewable energies improve energy security in the long run? Int. Econ. 2018, 156, 127–135. [Google Scholar] [CrossRef]

- Gloser, S.; Espinosa, L.; Gandenberger, C.; Faulstich, M. Raw material criticality in the context of classical risk assessment. Resour. Policy 2015, 44, 35–46. [Google Scholar] [CrossRef]

- Dill, H. The “chessboard” classification scheme of mineral deposits: Mineralogy and geology from aluminum to zirconium. Earth Sci. Rev. 2010, 100, 1–420. [Google Scholar] [CrossRef]

- Roush, G. Strategic Mineral Supplies, 15. Strategic and Critical Minerals. Mil. Eng. 1938, 30, 370–374. [Google Scholar]

- Office of the Legislative Council. Strategic and Critical Materials Stock Piling Act; Office of the Legislative Council: Washington, DC, USA, 1939; Chapter 190; Section 1. [Google Scholar]

- Hayes, S.; McCullough, E. Critical minerals: A review of elemental trends in comprehensive criticality studies. Resour. Policy 2018, 59, 192–199. [Google Scholar] [CrossRef]

- Schrijvers, D. A review of methods and data to determine raw material criticality. Resour. Conserv. Recycl. 2020, 155, 104617. [Google Scholar] [CrossRef]

- Eggert, R. Minerals go critical. Nat. Chem. 2011, 3, 688–691. [Google Scholar] [CrossRef]

- European Commission. Critical Raw Materials Resilience: Charting a Path towards Greater Security and Sustainability; Communication from the European Parliament; the Council; the European Economic and Social Committee; the Committee of the Regions; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- McNulty, B.; Jowitt, S. Barriers to and uncertainties in understanding and quantifying global critical mineral and element supply. iScience 2021, 24, 102809. [Google Scholar] [CrossRef]

- Government of Canada. Critical Minerals. Available online: https://www.nrcan.gc.ca/our-natural-resources/minerals-mining/critical-minerals/23414 (accessed on 18 May 2022).

- Burton, J. US Geological Survey releases—2022 list of critical minerals. USGS, 22 February 2022. Available online: https://www.usgs.gov/news/national-news-release/us-geological-survey-releases-2022-list-critical-minerals(accessed on 16 May 2022).

- European Commission, Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs. Methodology for Establishing the EU List of Critical Raw Materials: Guidelines. 2017. Available online: https://op.europa.eu/en/publication-detail/-/publication/2d43b7e2-66ac-11e7-b2f2-01aa75ed71a1 (accessed on 28 June 2022).

- Andersson, P. Chinese assessments of “critical” and “strategic” raw materials: Concepts, categories, policies, and implications. Extr. Ind. Soc. 2020, 7, 127–137. [Google Scholar] [CrossRef]

- Zhai, M.; Wu, F.; Hu, R.; Jiang, S.; Li, W.; Wang, R.; Wang, D.; Qi, T.; Qin, K.; Wen, H. Critical Mineral Resources. China Sci. Found. 2019, 2, 106–111. [Google Scholar]

- Zhou, L.; Fan, H.; Ulrich, T. Editorial for Special Issue Critical metals in hydrothermal ores: Resources, recovery, and challanges. Minerals 2021, 11, 299. [Google Scholar] [CrossRef]

- Nakano, J. The Geopolitics of Global Supply Chains, Chapter 6—Japan; Center for Strategic and International Studies (CSIS): Washington, DC, USA; pp. 19–22, 1 March 2021.

- Australian Government. 2022 Critical Materials Strategy; Department of Industry, Science, Energy and Resources, Canberra, Australian Government: Canberra, Australia, 2022. [Google Scholar]

- Nansai, K.; Nakajima, K.; Kagawa, S.; Kondo, Y.; Suh, S.; Shigetomi, Y.; Oshita, Y. Global Flows of Critical Metals Necessary for Low-Carbon Technologies: The Case of Neodymium, Cobalt, and Platinum. Environ. Sci. Technol. 2014, 48, 1391–1400. [Google Scholar] [CrossRef]

- Gao, W.; Sun, Z.; Wu, Y.; Song, J.; Tao, T.; Chen, F.; Zhang, Y.; Cao, H. Criticality assessment of metal resources for light-emitting diode (LED) production—A case study in China. Clean. Eng. Technol. 2022, 6, 100380. [Google Scholar] [CrossRef]

- Cimprich, A.; Bach, V.; Helbig, C.; Thorenz, A.; Schrijvers, D.; Sonnemann, G.; Young, S.; Sonderegger, T.; Berger, M. Raw material criticality assessment as a complement to environmental life cycle assessment: Examining methods for product-level supply risk assessment. J. Ind. Ecol. 2019, 23, 1226–1236. [Google Scholar] [CrossRef]

- Frenzel, M.; Kullik, J.; Reuter, M.; Gutzmer, J. Raw material ‘criticality’—Sense or nonsense? J. Phys. D Appl. Phys. 2017, 50, 123002. [Google Scholar] [CrossRef]

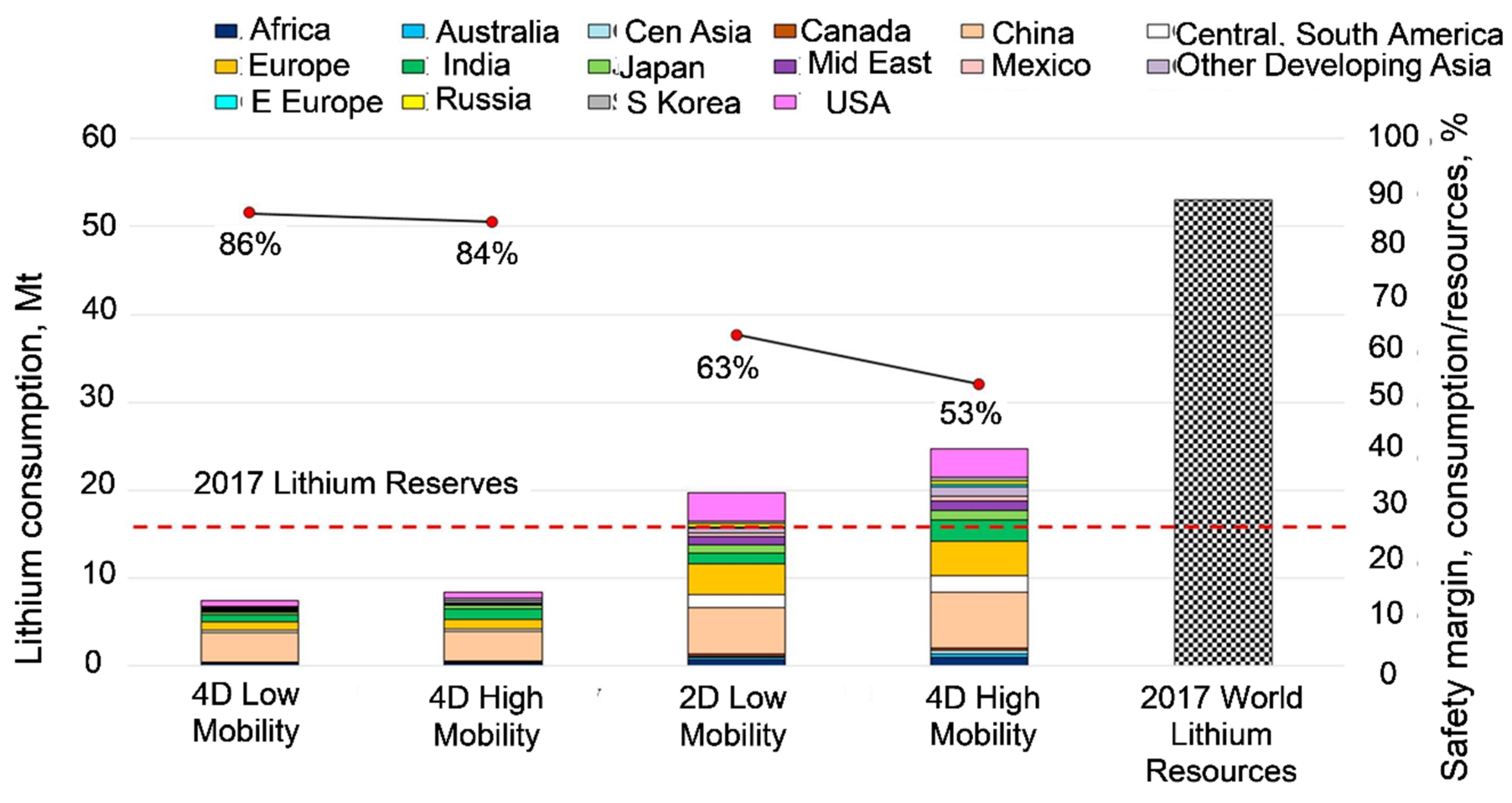

- Hache, E.; Seck, G.; Simoen, M.; Bonnet, C. Critical raw materials and transportation sector electrification: A detailed bottom-up analysis in world transport. Appl. Energy 2019, 240, 6–25. [Google Scholar] [CrossRef]

- U.S. Geological Survey. Mineral Commodity Summaries; U.S. Geological Survey: Reston, VA, USA, 2022. [Google Scholar]

- Temper, L.; Del Bene, D.; Martinez-Alier, J. Mapping the frontiers and front lines of global environmental justice: The EJAtlas. Political Ecol. 2015, 22, 255–278. [Google Scholar] [CrossRef]

- American Geosciences Institute. How Can Metal Mining Impact the Environment? Available online: https://www.americangeosciences.org/critical-issues/faq/how-can-metal-mining-impact-environment (accessed on 14 June 2022).

- Lèbre, É.; Stringer, M.; Svobodova, K.; Owen, J.R.; Kemp, D.; Côte, C.; Arratia-Solar, A.; Valenta, R.K. The social and environmental complexities of extracting energy transition metals. Nat. Commun. 2020, 11, 4823. [Google Scholar] [CrossRef]

- ESG Working Group. Enabling the UK’s Green Industrial Revolution: A Blueprint for Responsible Sourcing of Critical Minerals Environmental; The Critical Minerals Association ESG Working Group, Social and Governance (ESG): London, UK, 2021. [Google Scholar]

- Velenturf, A.; Purnell, P.; Jensen, P. Reducing material criticality through circular business models: Challenges in renewable energy. One Earth 2021, 4, 350–352. [Google Scholar] [CrossRef]

- Wang, P.; Kara, S. Material Criticality and Circular Economy: Necessity of manufacturing oriented strategies. Proceedia CIRP 2019, 80, 667–672. [Google Scholar] [CrossRef]

- Babbitt, C.; Althaf, S.; Rios, F.C.; Bilec, M.; Graedel, T. The role of design in circular economy solutions for critical materials. One Earth 2021, 4, 353–362. [Google Scholar] [CrossRef]

- Schaubroeck, T. Circular economy practices may not always lead to lower criticality or more sustainability; analysis and guidance is needed per case, Resour. Conserv. Recycl. 2020, 162, 104977. [Google Scholar] [CrossRef]

- Collantes, G.; Sperling, D. The origin of California’s zero emission vehicle mandate. Transp. Res. Part A 2008, 42, 1302–1313. [Google Scholar] [CrossRef]

- Rokadiya, S.; Yang, Z. Overview of Global Zero-Emission Vehicle Mandate Programs, The International Council of Clean Transportation. Available online: https://theicct.org/publication/overview-of-global-zero-emission-vehicle-mandate-programs/ (accessed on 20 April 2022).

- Moawad, B.; Wolinetz, M. California and Québec’s ZEV mandates description. Navius Research, May 2019; (updated March 2020). Available online: www.naviusresearch.com(accessed on 12 May 2022).

- Gustafsson, T.; Johansson, A. Comparison between Battery Electric Vehicles and Internal Combustion Engine Vehicles Fueled by Electrofuels. Master’s Thesis, Department of Energy and Environment, Chalmers University of Technology, Gothenburg, Sweden, 2015. [Google Scholar]

- Nunes, A.; Woodley, L.; Rossetti, P. Re-thinking procurement incentives for electric vehicles to achieve net-zero emissions. Nat. Sustain. 2022, 5, 527–532. [Google Scholar] [CrossRef]

- Melin, H. Analysis of the Climate Impact of Lithium-Ion Batteries and How to Measure It; Commissioned by Transport & Environment by Hans Eric Melin, Circular Energy Storage; Circular Energy Storage: London, UK, 2019. [Google Scholar]

- Crawford, I. How much CO2 is emitted by manufacturing batteries? MIT Climate Portal, 1 March 2022. Available online: https://climate.mit.edu/ask-mit/how-much-co2-emitted-manufacturing-batteries(accessed on 2 August 2022).

- Hall, D.; Lutsay, N. Effects of Battery Manufacturing on Electric Vehicle Life-Cycle Greenhouse Gas Emissions. Int. Counc. Clean Transp. 2018. Available online: https://theicct.org/publication/effects-of-battery-manufacturing-on-electric-vehicle-life-cycle-greenhouse-gas-emissions/ (accessed on 17 April 2022).

- How clean are electric cars? European Federation for Transport and Environment, 30 May 2022. Available online: https://www.transportenvironment.org/discover/how-clean-are-electric-cars/(accessed on 9 June 2022).

- Zemo Partnership—Accelerating Transport to Zero Emission. Available online: https://www.zemo.org.uk/ (accessed on 12 June 2022).

- Agrawal, V.; Sharma, S. Critical Minerals: Current Challenges and Future Strategies. Int. J. Environ. Sci. Nat. Res. 2021, 27, 556215. [Google Scholar]

- Fankhauser, S.; Smith, S.M.; Allen, M.; Axelsson, K.; Hale, T.; Hepburn, C.; Kendall, J.M.; Khosla, R.; Lezaun, J.; Mitchell-Larson, E.; et al. The meaning of net zero and how to get it right. Nat. Clim. Chang. 2022, 12, 15–21. [Google Scholar] [CrossRef]

- Lipman, T.; Maier, P. Advanced materials supply considerations for electric vehicle applications. MRS Bull. 2021, 46, 1164–1175. [Google Scholar] [CrossRef]

- How Do All-Electric Cars Work? US Department of Energy Vehicle Technologies Office. Available online: https://afdc.energy.gov/vehicles/how-do-all-electric-cars-work (accessed on 22 June 2022).

- 7 Reasons Why Electric Cars Are So Heavy. Motorhills. Available online: https://www.motorhills.com/7-reasons-why-electric-cars-are-so-heavy/ (accessed on 15 June 2022).

- Edmondson, J.; Holland, A. Materials for Electric Vehicle Battery Cells and Packs 2021–2031. IDTechEx. Available online: https://www.idtechex.com/en/research-report/materials-for-electric-vehicle-battery-cells-and-packs-2021-2031/796 (accessed on 15 June 2022).

- Whittingham, M. Electrical energy storage and intercalation chemistry. Science 1976, 192, 1126–1127. [Google Scholar] [CrossRef] [PubMed]

- Edelstein, S. Lucid Air: Energy, power, cells, modules, cooling. Green Cars Reports, 13 March 2022. Available online: https://www.greencarreports.com/news/1135299_energy-power-cells-modules-cooling-lucid-ev-battery-primer(accessed on 25 June 2022).

- Zubi, G.; Dufo-López, R.; Carvalho, M.; Pasaoglu, G. The lithium-ion battery: State of the art and future perspectives. Renew. Sustain. Energy Rev. 2018, 89, 292–308. [Google Scholar] [CrossRef]

- Global lithium-ion battery capacity to rise five-fold by 2030. Wood McNenzie, 22 March 2022. Available online: https://www.woodmac.com/press-releases/global-lithium-ion-battery-capacity-to-rise-five-fold-by-2030/(accessed on 25 June 2022).

- Xiao, M. Lithium-ion battery market expected to grow. Control Engineer, 10 May 2022. Available online: https://www.controleng.com/articles/lithium-ion-battery-market-expected-to-grow/(accessed on 25 June 2022).

- Lewchalermwong, N.; Masomtob, M.; Masomtob, V.; Charoenphonphanich, C. Material selection and assembly method of battery pack for compact electric vehicle. In Proceedings of the IOP Conference Series: Materials Science and Engineering, 8th TSME-International Conference on Mechanical Engineering (TSME-ICoME 2017), Bangkok, Thailand, 12–15 December 2017; IOP Publishing Ltd.: Bristol, UK, 2018; Volume 297, p. 012019. [Google Scholar]

- Kane, M. GM plans electric motor components production in Western New York. INSIDEEVS, 22 January 2022. Available online: https://insideevs.com/news/562419/gm-electric-motor-components-lockport/(accessed on 25 June 2022).

- van Gosen, B.; Verplanck, P.; SealII, R.; Long, K.; Gambogi, J. Rare-Earth Elements; U.S. Geological Survey: Reston, VA, USA, 2017. [Google Scholar]

- Dias, A.; Bobba, S.; Carrara, S.; Plazzotta, B. The Role of Rare Earth Elements in Wind Energy and Electric Mobility: An Analysis of Future Supply/Demand Balances; European Commission: Luxembourg; Joint Research Centre: Ispra, Italy, 2020. [Google Scholar]

- Ruff, B.; Li, F.; Venkatasubramanian, R.; Mast, D. Chapter 21. Development of lightweight sustainable electric motors (micro and nano technologies). In Nanotube Superfiber Materials; Elsevier: Amsterdam, The Netherlands, 2014. [Google Scholar]

- Haque, N.; Hughes, A.; Lim, S.; Vernon, C. Rare Earth Elements: Overview of Mining, Mineralogy, Uses, Sustainability and Environmental Impact. Resources 2014, 3, 614–635. [Google Scholar] [CrossRef]

- Hioki, K. High performance hot-deformed Nd-Fe-B magnets (Review). Sci. Technol. Adv. Mater. 2021, 22, 72–84. [Google Scholar] [CrossRef]

- Toyota develops new magnet for electric motors aiming to reduce use of critical rare-earth element by up to 50%. Toyota, 20 February 2018. Available online: https://newsroom.toyota.eu/toyota-develops-new-magnet-for-electric-motors-aiming-to-reduce-use-of-critical-rare-earth-element-by-up-to-50/(accessed on 10 June 2022).

- Castle, E.; Sheridan, R.; Zhou, W.; Grasso, S.; Walton, A.; Reece, M.J. High coercivity, anisotropic, heavy rare earth-free Nd-Fe-B by Flash Spark Plasma Sintering. Sci. Rep. 2017, 7, 11134. [Google Scholar] [CrossRef] [PubMed]

- Matsuura, Y. Recent development of Nd–Fe–B sintered magnets and their applications. J. Magn. Magn. Mater. 2006, 303, 344–347. [Google Scholar] [CrossRef]

- Rare earth magnet market outlook to 2035. Adamas Intelligence, 20 April 2022. Available online: https://www.adamasintel.com/rare-earth-magnet-market-outlook-to-2035/(accessed on 20 June 2022).

- Czerwinski, F. Current Trends in Automotive Lightweighting Strategies and Materials. Materials 2021, 14, 6631. [Google Scholar] [CrossRef] [PubMed]

- The body: Intelligent mix of materials for maximum strength. Porsche, 9 April 2019. Available online: https://newsroom.porsche.com/en/products/taycan/body-18553.html(accessed on 22 June 2022).

- Yellishetty, M.; Mudd, G.; Ranjith, P.; Tharumarajah, A. Environmental life-cycle comparisons of steel production and recycling: Sustainability issues, problems and prospects. Environ. Sci. Policy 2011, 14, 650–653. [Google Scholar] [CrossRef]

- Swensen, A. Aluminum continues unprecedented growth in automotive applications. Light Metal Age, 20 October 2020. Available online: https://www.lightmetalage.com/news/industry-news/automotive/aluminum-continues-unprecedented-growth-in-automotive-applications/(accessed on 28 June 2022).

- Automotive life-cycle assessment model. European Aluminium, 16 June 2015; (Update December 2018). Available online: https://www.european-aluminium.eu/resource-hub/automotive-lca-model(accessed on 2 August 2021).

- Czerwinski, F. Cerium in aluminum alloys. J. Mater. Sci. 2020, 55, 24–72. [Google Scholar] [CrossRef]

- Kulekci, M. Magnesium and its alloys applications in automotive industry. Int. J. Adv. Manuf. Technol. 2008, 39, 851–865. [Google Scholar] [CrossRef]

- Czerwinski, F. Magnesium Injection Molding; Springer: New York, NY, USA, 2008. [Google Scholar]

- Javaid, A.; Czerwinski, F. Progress in twin roll casting of magnesium alloys: A review. J. Magnes. Alloy. 2021, 9, 362–391. [Google Scholar] [CrossRef]

- Electrifying auxiliaries: A flexible system approach for multiple auxiliaries. Charged Electric Vehicle Magazine, 16 June 2022. Available online: https://chargedevs.com/newswire/electrifying-auxiliaries-a-flexible-system-approach-for-multiple-auxiliaries/(accessed on 22 June 2022).

- How will the electric vehicle revolution impact lead’s key role in battery technology? The London Metal Exchange—An HKEX Company, February 2022. Available online: https://lme-poweringallourfutures.com/2022/02/24/how-will-the-electric-vehicle-revolution-impact-leads-key-role-in-battery-technology/(accessed on 2 August 2022).

- Copper Alliance. The Electric Vehicle Market and Copper Demand; International Copper Association, Copper Alliance: New York, NY, USA, 2017. [Google Scholar]

- Driving the green revolution: The use of copper in EVs. Innovation News Network, 22 June 2022. Available online: https://www.innovationnewsnetwork.com/green-revolution-use-of-copper-in-evs/22503/(accessed on 25 June 2022).

- Nishimura, N.; Otsuka, T.; Imasato, F.; Kusakari, M.; Akasofu, Y.; Sasaki, A. Aluminum Wiring Harness. SEI Tech. Rev. 2014, 79, 8–13. [Google Scholar]

- Taguchi, K.; Shimada, T.; Yoshimoto, J.; Kuwabara, T. High-Strength Aluminum Wires for Low-Voltage Automotive Engine Wiring Harnesses. SEI Tech. Rev. 2017, 84, 125–130. [Google Scholar]

- Cui, X.; Wu, Y.; Zhang, G.; Liu, Y.; Liu, X. Study on the improvement of electrical conductivity and mechanical properties of low alloying electrical aluminum alloys. Compos. Part B Eng. 2017, 110, 381–387. [Google Scholar] [CrossRef]

- Czerwinski, F. Critical Assessment 36: Assessing differences between the use of cerium and scandium in aluminium alloying. Mater. Sci. Technol. 2020, 36, 683–692. [Google Scholar] [CrossRef]

- Liao, H.; Liu, Y.; Lü, C.; Wang, Q. Mechanisms for Ce-induced remarkable improvement of conductivity in Al alloys. J. Mater. Res. 2017, 32, 566–574. [Google Scholar] [CrossRef]

- Chao, R.; Guan, X.; Guan, R.; Tie, D.; Lian, C.; Wang, X.; Zhang, J. Effect of Zr and Sc on mechanical properties and electrical conductivities of Al wires. Trans. Nonferrous Met. Soc. China 2014, 24, 3164–3169. [Google Scholar] [CrossRef]

- Belov, N.; Korotkova, N.; Akopyan, T.; Timofeev, V. Structure and properties of Al-0.6%Zr-0.4%Fe-0.4%Si (wt.%) wire alloy manufactured by electromagnetic casting. JOM 2020, 72, 1561–1570. [Google Scholar] [CrossRef]

- Pozdniakov, A.; Barkov, R. Microstructure and mechanical properties of novel Al-Y-Sc alloys with high thermal stability and electrical conductivity. J. Mater. Sci. Technol. 2020, 36, 1–6. [Google Scholar] [CrossRef]

- Richter, J. A circular economy approach is needed for electric vehicles. Nat. Electron. 2022, 5, 5–7. [Google Scholar] [CrossRef]

- Dunn, J.; Slattery, M.; Kendall, A.; Ambrose, H.; Shen, S. Circularity of lithium-ion battery materials in electric vehicles. Environ. Sci. Technol. 2021, 55, 5189–5198. [Google Scholar] [CrossRef]

- Ahuja, J.; Dawson, E.; Lee, R. A circular economy for electric vehicle batteries: Driving the change. J. Prop. Plan. Environ. Law 2020, 12, 235–250. [Google Scholar] [CrossRef]

- Castelvecchi, D. Electric cars: The battery challenge. Nature 2021, 596, 336–339. [Google Scholar] [CrossRef] [PubMed]

- Xu, C.; Dai, Q.; Gaines, L.; Hu, M.; Tukker, A.; Steubing, B. Future material demand for automotive lithium-based batteries. Commun. Mater. 2020, 1, 99. [Google Scholar] [CrossRef]

- Liu, J.; Shi, H.; Hu, X.; Geng, Y.; Yang, L.; Shao, P.; Luo, X. Critical strategies for recycling process of graphite from spent lithium-ion batteries. Sci. Total Environ. 2022, 816, 151621. [Google Scholar] [CrossRef]

- Gao, Y.; Wang, C.; Zhang, J.; Jing, Q.; Ma, B.; Chen, Y.; Zhang, W. Graphite Recycling from the Spent Lithium-Ion Batteries by Sulfuric Acid Curing–Leaching Combined with High-Temperature Calcination. ACS Sustain. Chem. Eng. 2020, 8, 9447–9455. [Google Scholar] [CrossRef]

- Wang, Y.; Tu, Y.; Xu, Z.; Zhang, X.; Chen, Y.; Yang, E. A promising method for recovery of graphite and cathode materials from spent lithium-ion batteries. Ionics 2022, 28, 2603–2611. [Google Scholar] [CrossRef]

- Elwert, T.; Goldmann, D.; Roemer, F.; Schwarz, S. Recycling of NdFeB Magnets from Electric Drive Motors of (Hybrid) Electric Vehicles. J. Sustain. Metall. 2017, 3, 108–121. [Google Scholar] [CrossRef]

- Bast, U. Recycling of Components and Strategic Metals of Electric Drive Motors, MORE (Motor Recycling): Final Research Report 2014. Available online: http://edok01.tib.uni-hanver.de/edoks/e01fb15/826920594.pdf (accessed on 20 April 2022).

- Maani, T.; Mathur, N.; Singh, S.; Rong, C.; Sutherland, J. Potential for Nd and Dy Recovery from End-of-Life Products to Meet Future Electric Vehicle. Procedia CIRP 2021, 98, 109–114. [Google Scholar] [CrossRef]

| Canada | USA | EU | China | Japan | Australia | Electric Vehicles | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | 2022 | 2020 | 2016–2020 | 2018 | 2022 | Battery | Fuel Cells | Motor | ||

| 1 | Aluminum/bauxite | × | × | × | × | × | × | |||

| 2 | Antimony, Sb | × | × | × | × | × | × | |||

| 3 | Arsenic, As | × | ||||||||

| 4 | Barite, Barium | × | × | × | ||||||

| 5 | Beryllium, Be | × | × | × | × | |||||

| 6 | Bismuth, Bi | × | × | × | × | × | ||||

| 7 | Borate, Boron | × | × | × | × | |||||

| 8 | Cesium, Cs | × | × | × | ||||||

| 9 | Chromium, Cr | × | × | × | × | × | × | × | ||

| 10 | Coal, Carbon, C | × | × | × | ||||||

| 11 | Cobalt, Co | × | × | × | × | × | × | × | × | |

| 12 | Copper, Cu | × | × | × | × | × | ||||

| 13 | Fluorspar, fluorine | × | × | × | × | × | ||||

| 14 | Gallium, Ga | × | × | × | × | × | ||||

| 15 | Gas-natural | × | ||||||||

| 16 | Gas-shell | × | ||||||||

| 17 | Germanium, Ge | × | × | × | × | × | ||||

| 18 | Gold, Au | × | ||||||||

| 19 | Graphite | × | × | × | × | × | × | × | ||

| 20 | Hafnium, Hf | × | × | × | × | |||||

| 21 | Helium, He | × | × | |||||||

| 22 | Indium, In | × | × | × | × | × | ||||

| 23 | Iron, Fe | × | ||||||||

| 24 | Lithium, Li | × | × | × | × | × | × | × | × | |

| 25 | Magnesium, Mg | × | × | × | × | × | × | |||

| 26 | Manganese, Mn | × | × | × | × | × | × | |||

| 27 | Methane-coalbed | × | ||||||||

| 28 | Molybdenum, Mo | × | × | × | × | |||||

| 29 | Nickel, Ni | × | × | × | × | × | × | |||

| 30 | Niobium, Nb | × | × | × | × | × | ||||

| 31 | Oil | × | ||||||||

| 32 | PGM | × | × (1) | × | × | × | × | |||

| 33 | Phosphate | × | ||||||||

| 34 | Phosphorus, P | × | × | |||||||

| 35 | Potash | × | × | |||||||

| 36 | REE-all | × | × (1) | × (2) | × | × | × | × | × | |

| 37 | Rhenium, Re | × | × | |||||||

| 38 | Rubber nat. | × | ||||||||

| 39 | Rubidium, Rb | × | × | |||||||

| 40 | Scandium, Sc | × | × | × | × | |||||

| 41 | Selenium, Se | × | ||||||||

| 42 | Silicon metal, Si | × | × | × | × | × | × | |||

| 43 | Silver, Ag | × | ||||||||

| 44 | Strontium, Sr | × | × | × | ||||||

| 45 | Tantalum, Ta | × | × | × | × | × | ||||

| 46 | Tellurium, Te | × | × | × | × | |||||

| 47 | Thallium, Tl | × | ||||||||

| 48 | Tin, Sn | × | × | × | ||||||

| 49 | Titanium, Ti | × | × | × | × | × | × | × | ||

| 50 | Tungsten, W | × | × | × | × | × | × | |||

| 51 | Uranium, U | × | × | |||||||

| 52 | Vanadium, V | × | × | × | × | × | × | |||

| 53 | Zinc, Zn | × | × | |||||||

| 54 | Zirconium, Zr | × | × | × | × | × | ||||

| Total | 31 | 50 | 30 | 24 | 34 | 26 | ||||

| Element | Battery Component | Abundance Rank | Global Reserves | 2020 Mine Production | Li Battery Industry Share | Critical Mineral List, Canada | Current Status [53] | Future Perspective [53] |

|---|---|---|---|---|---|---|---|---|

| Mt | t/year | |||||||

| Graphite | Conventional anode, electrolyte | 15 | 320 | 966,000 | Around 3% | Critical | Not critical | Not critical |

| Nickel | NCA, NMC cathode (1) | 24 | 95 | 2,510,000 | 1–2% | Critical | Not critical | Not critical |

| Cobalt | NCA, NMC cathode | 32 | 7.6 | 142,000 | 30% | Critical | Critical | Critical |

| Lithium | All cathodes, electrolyte | 33 | 22 | 82,500 | 39% | Critical | Not critical | Near-critical |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Czerwinski, F. Critical Minerals for Zero-Emission Transportation. Materials 2022, 15, 5539. https://doi.org/10.3390/ma15165539

Czerwinski F. Critical Minerals for Zero-Emission Transportation. Materials. 2022; 15(16):5539. https://doi.org/10.3390/ma15165539

Chicago/Turabian StyleCzerwinski, Frank. 2022. "Critical Minerals for Zero-Emission Transportation" Materials 15, no. 16: 5539. https://doi.org/10.3390/ma15165539

APA StyleCzerwinski, F. (2022). Critical Minerals for Zero-Emission Transportation. Materials, 15(16), 5539. https://doi.org/10.3390/ma15165539