Techno-Economic Analysis of Bioethanol Production from Lignocellulosic Biomass in China: Dilute-Acid Pretreatment and Enzymatic Hydrolysis of Corn Stover

Abstract

:1. Introduction

1.1. Biofuel is an Important Alternative to Fossil Fuels in China and Globally

1.2. Goal of Bioethanol Development Was not Met in China

1.3. Purpose of the Research

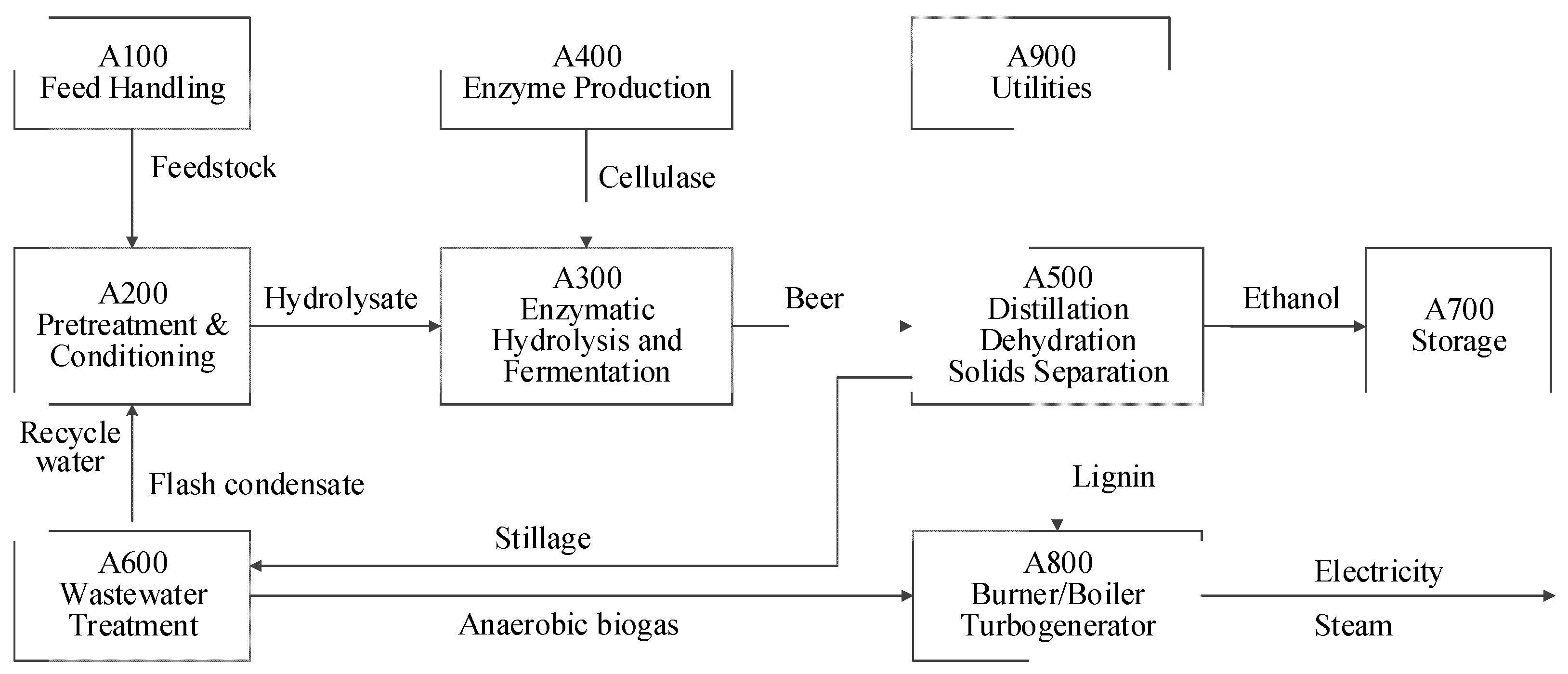

2. Process Pathway Description

3. Scenario Design

| Category | Scenarios | Policies | Technology | Economic data (prices, tax rates, etc.) |

|---|---|---|---|---|

| CN | CN_1 | No incentive policy | Status quo of China | Chinese |

| CN_2 | Feed-in tariff for excess electricity | |||

| CN_3 | VAT refunded upon collection | |||

| CN_4 | Consumption tax exempted | |||

| CN_5 | Sum of CN_3 and CN_4 | |||

| CN_6 | Sum of CN_2 and CN_5 | |||

| NREL-CN | NREL-CN_1 | No incentive policy | NREL, 2012 [8] | Chinese |

| NREL-CN_2 | Excess electricity sold to grid |

- 1)

- Taxes applicable to fuel ethanol in China include income tax, VAT, consumption tax, Urban Maintenance and Construction Tax (UMCT, 7% of the sum of VAT and consumption tax), and Education Surcharge (ES, 3% of the sum of VAT and consumption tax). To encourage the expansion of the biofuel industry in China, incentive policies have been set for four grain-based fuel ethanol producers approved by the Chinese government since 2002. The policies were as follows: consumption tax on fuel ethanol was waved, VAT was imposed first and then refunded to fuel ethanol producers, and a direct subsidy was provided to fuel ethanol producers to ensure they can make an appropriate level of profit [9,10]. The incentives may be considered for the promotion of lignocellulosic biomass-based ethanol production in the future.

- 2)

- In light of the Renewable Energy Law of the People’s Republic of China [11], which took effect in 2010, “the relevant electricity grid enterprise shall […] purchase the full amount of the synchronized electricity, as covered by its grid, of the project of synchronized electricity generation by using renewable energy, and provide synchronization service for electricity generation by using renewable energy.” The excess electricity produced by the lignocellulosic ethanol plant is in accordance with the law and should be protected by it.

- 3)

- Many countries offer tax preferences and direct subsidies to promote the development of fuel ethanol production. The United States is the world’s leading producer and consumer of ethanol, accounting for 50% of supply and 57% of demand in 2008 [12]. Producers of cellulosic biofuels are eligible for a production tax credit of $1.01 per gallon. Brazil was the global pioneer in promoting ethanol at large scale as a vehicle fuel through the Proalcool program, which was started in the 1970s. It is the second largest world producer in this market (38.2% of global production and 30.4% of demand in 2008 [12]). In Brazil, anhydrous ethanol, which is used to blend with gasoline, is untaxed [13].

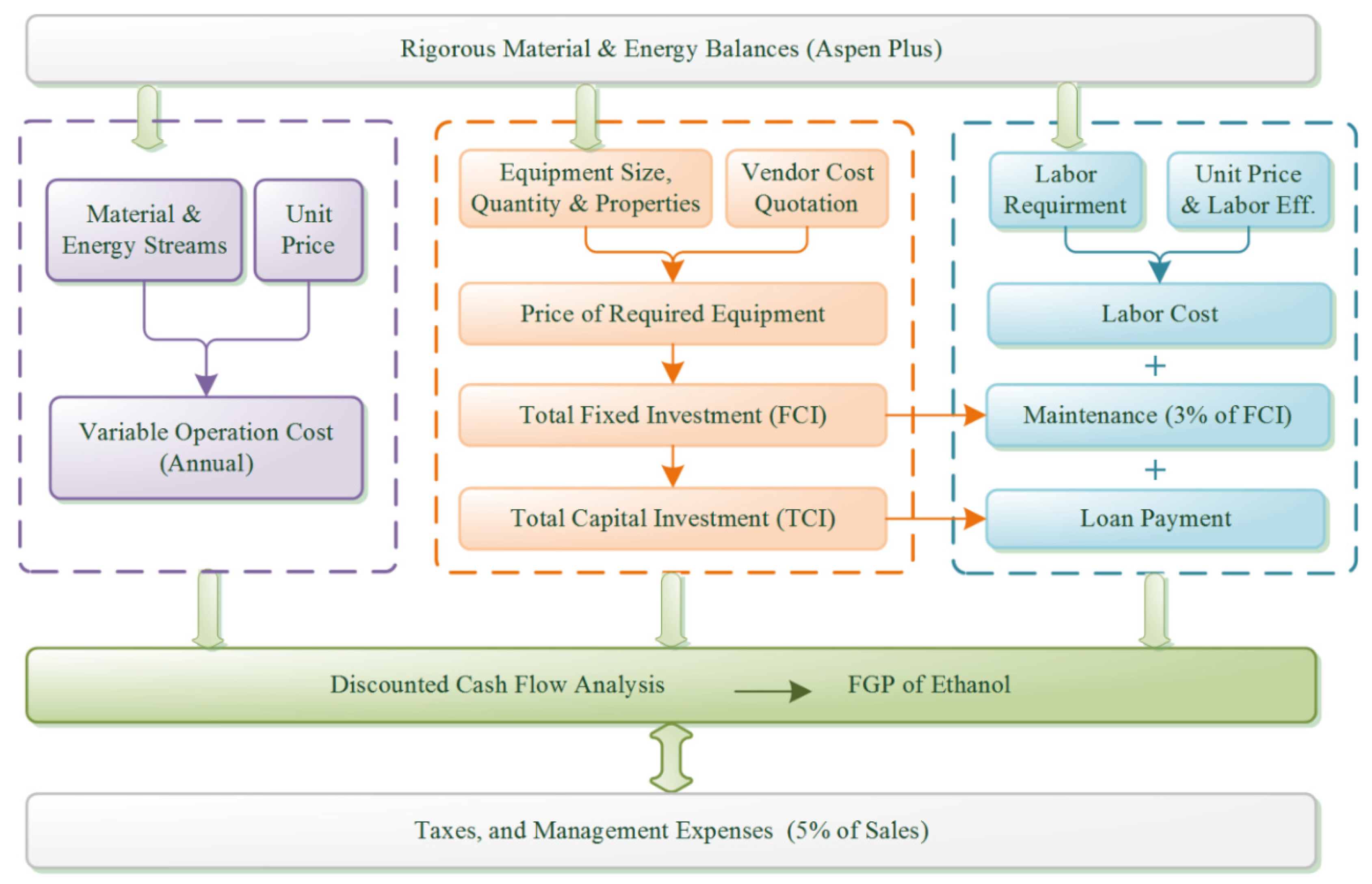

4. Methodology

4.1. Bioethanol Plant-Gate Price Assessment Model (BPAM)

- TCI is the initial total capital investment;

- t is the year of plant operation, and construction lasts for 3 years, i.e., t E (−2,−1,0);

- PGPt is plant-gate price of ethanol product in year t;

- Qt is ethanol production in year t;

- Pbt is the price of the byproduct (excess electricity) in year t;

- Qbt is the production of the byproduct in year t;

- Ft is feedstock cost in year t;

- Mct is the operating cost of ethanol in year t;

- Loant is the loan payment (including interest) in year t;

- Tt is the taxes paid by the plant in year t; and

- IRR is the internal rate of return.

4.2. Feedstock Cost Estimation Model (FCEM)

4.2.1. Model Framework

| No. | Costs for | Spatial transfer phases |

|---|---|---|

| 1 | At-field feedstock purchasing (C1n) | At field |

| 2 | Feedstock collection and transportation (C2n) | Field-to-center |

| 3 | Primary processing and storage (C3n) | At center |

| 4 | Transportation (C4n) | Center-to-plant |

4.2.2. Transportation Mode

4.2.3. Calculation Method of C2n, C3n, C4n, and P

(1) Field-to-center cost (C2n)

(2) Cost at the center (C3n)

(3) Center-to-plant cost (C4n)

(4) Profit of the agent (P)

5. Assumptions, Data and Calculation

5.1. Assumption

5.2. Feedstock Composition

| Component | Content | Component | Content | Component | Content |

|---|---|---|---|---|---|

| Cellulose | 35.05 | Mannan | 0.60 | Acetate | 1.81 |

| Xylan | 19.53 | Sucrose | 0.77 | Protein | 3.10 |

| Galactan | 1.43 | Lignin | 15.76 | Extractives | 14.65 |

| Arabinan | 2.38 | Ash | 4.93 |

5.3. Key Technical Parameters

| Technical Parameters | Scenarios CN ④ | Scenarios NREL-CN ⑤ |

|---|---|---|

| PT ① xylan to xylose | 90% | 90% |

| PT glucan to glucose | 9.9% | 9.9% |

| EH ② enzyme loading | 50 mg/g | 20 mg/g |

| EH cellulose to glucose | 80% | 90% |

| FERM ③ contamination losses | 6% | 3% |

| FERM xylose to ethanol | 0% | 85% |

| FERM arabinose to ethanol | 0% | 85% |

5.3.1. Key Parameters in Pretreatment

5.3.2. Key Parameters in Enzyme Hydrolysis

5.3.3. Key Parameters in Fermentation

5.4. Parameters Used in the Model of Discounted Cash Flow Analysis

| Item | Scenarios CN, NREL-CN | NREL case ② |

|---|---|---|

| Plant life | 30 years | 30 years |

| Discount rate | 13% [22] | 10% |

| General plant depreciation | SL ① Depreciation [23] | 200% declining balance (DB) |

| General plant recovery period | 20 years | 7 years |

| Steam plant depreciation | SL ① Depreciation [23] | 150% DB |

| Steam plant recovery period | 20 years | 20 years |

| Financing | 40% equity | 40% equity |

| Loan terms | 10-year loan at 6.9% | 10-year loan at 8% APR |

| Construction period | 3 years | 3 years |

| First 12 months’ expenditures | 8% | 8% |

| Next 12 months’ expenditures | 60% | 60% |

| Last 12 months’ expenditures | 32% | 32% |

| Working capital | 5% of FCI | 5% of FCI |

| Start-up time | 3 months | 3 months |

| Revenues during start-up | 50% | 50% |

| Variable costs during start-up | 75% | 75% |

| Fixed costs during start-up | 100% | 100% |

| Income Tax Rate | 25% [23] | 35% |

| VAT rate 1 | 17% [24] | - |

| VAT rate 2 | 13% [24] | - |

| Consumption rate | 5% [25] | - |

| UMCT&ES | 10% [23] | - |

| Feed-in tariff | $0.123/kwh ③ |

5.5. Feedstock Cost Calculation

| Items | Unit | Price |

|---|---|---|

| Diesel price | $/L | 1.23 ① |

| Electricity price | $/kWh | 0.12 [26] |

| Laborers’ salary for feedstock collection and pretreatment | $/laborday | 12.0 [27] |

| Laborers’ salary at the fuel ethanol station | $/laborday | 11.5 [28] |

| Salary of tractor drivers | $/laborday | 12.0 [27] |

| Salary of truck drivers | $/laborday | 32.8 [29] |

| Salary of liquid tank truck drivers | $/laborday | 32.8 [30] |

| Feedstock on-field purchasing price | $/t | 27.6 [31] |

| Items | Unit | results |

|---|---|---|

| Ethanol production of the plant | t/year | 106,557 ① |

| Feedstock requirement of the plant | t/year | 876,042 [8] |

| Feedstock processing efficiency | 0.90 [31] | |

| Feedstock collected from the field | t/year | 973,380 ② |

| Maximum capacity of the center | T | 50,000 [31] |

| Number of collection center | 20 |

5.6. Total Capital Investment

| Item | Description | Amount | |

|---|---|---|---|

| Total equipment purchased cost, TEPC | $72,666,884 | ||

| Equipment installation | 39% | of TEPC | $28,340,085 |

| Instrumentation and control system | 13% | of TEPC | $9,446,695 |

| Process piping | 31% | of TEPC | $22,526,734 |

| Electrical equipment | 10% | of TEPC | $7,266,688 |

| Buildings | 10% | of TEPC | $7,266,688 |

| Site development | 10% | of TEPC | $7,266,688 |

| Total plant direct cost, TPDC | $154,780,464 | ||

| Engineering design and supervision | 32% | of TEPC | $23,253,403 |

| Construction | 34% | of TEPC | $24,706,741 |

| Total plant indirect cost, TPIC | $47,960,144 | ||

| Total plant cost, TPC | $202,740,607 | ||

| Contractor’s fee | 5% | of TPC | $10,137,030 |

| Contingency | 10% | of TPC | $20,274,061 |

| Fixed capital investment, FCI | $233,151,698 | ||

| Working capital | 5% | of FCI | $11,657,585 |

| Land | $10,497,049 | ||

| Total capital investment, TCI | $255,306,332 | ||

5.7. Operating Costs

5.7.1. Variable Operating Cost

5.7.2. Fixed Operating Cost

| Process area | Stream Description | Usage ① (kg/hr) | Cost ② ($/ton) | MM$/year (2013) | Cent/Gal Ethanol |

|---|---|---|---|---|---|

| Raw Materials | |||||

| A200 | Sulfuric acid, 93% | 1,981 | 90 | 1.50 | 4.27 |

| Ammonia | 1,047 | 575 | 5.07 | 14.42 | |

| A300 | Corn steep liquor | 1,143 | 105 | 1.01 | 2.88 |

| Diammonium phosphate | 141 | 1,439 | 1.71 | 4.87 | |

| Sorbitol | 44 | 3,069 | 1.15 | 3.26 | |

| A400 | Purchased enzyme | 0 | 0 | 0.00 | 0.00 |

| Glucose | 6,252 | 787 | 41.37 | 117.71 | |

| Corn steep liquor | 425 | 90 | 0.32 | 0.92 | |

| Ammonia | 297 | 492 | 1.23 | 3.50 | |

| Host nutrients | 174 | 630 | 0.92 | 2.63 | |

| Sulfur dioxide | 42 | 328 | 0.12 | 0.33 | |

| A600 | Caustic (as pure) | 2187 | 297 | 5.47 | 15.56 |

| A800 | Boiler chemicals | 0 | 4,949 | 0.01 | 0.03 |

| FGD Lime | 1097 | 96 | 0.88 | 2.52 | |

| Feedstock | 0 | 0 | 0.00 | 0.00 | |

| A900 | Cooling tower chemicals | 4 | 2455 | 0.08 | 0.21 |

| Makeup water | 226,045 | 0 | 0.44 | 1.24 | |

| Subtotal | 125.90 | 174.35 | |||

| Waste disposal | |||||

| A800 | Disposal of Ash | 6,062 | 35 | 1.78 | 5.08 |

| Subtotal | 1.78 | 5.08 | |||

| Total variable operating costs | 127.69 | 179.43 | |||

| Labor Cost | |||

|---|---|---|---|

| Position | Salary | # required a | Cents/Gal EtOH |

| Plant manager | 70,492 [37] | 1 | 0.20 |

| Vice plant managers | 49,180 [37] | 3 | 0.42 |

| Plant engineer | 39,344 [37] | 1 | 0.11 |

| Maintenance supervisors | 9,836 [38] | 3 | 0.08 |

| Maintenance technician | 6,557 [39] | 21 | 0.39 |

| Lab manager | 14,754 [40] | 1 | 0.04 |

| Lab technician | 9,836 [41] | 4 | 0.11 |

| Lab technician-enzyme | 9,836 [41] | 4 | 0.11 |

| Shift supervisors | 8,197 [42] | 21 | 0.49 |

| Shift operators | 5,738 [43] | 222 | 3.62 |

| Sales manager | 13,115 [44] | 1 | 0.04 |

| Salesmen | 8,197 [45] | 6 | 0.14 |

| Clerks & secretaries | 4,918 [46] | 12 | 0.17 |

| Total salaries | 5.93 | ||

| Labor burden (40%) | 2.37 | ||

| Subtotal | 8.31 | ||

| Maintenance | 5% of FCI b | 33.17 | |

| Management | 5% of Sales b | 30.25 | |

| Total | 71.72 |

6. Results and Discussion

6.1. PGP of Bioethanol in Different Scenarios

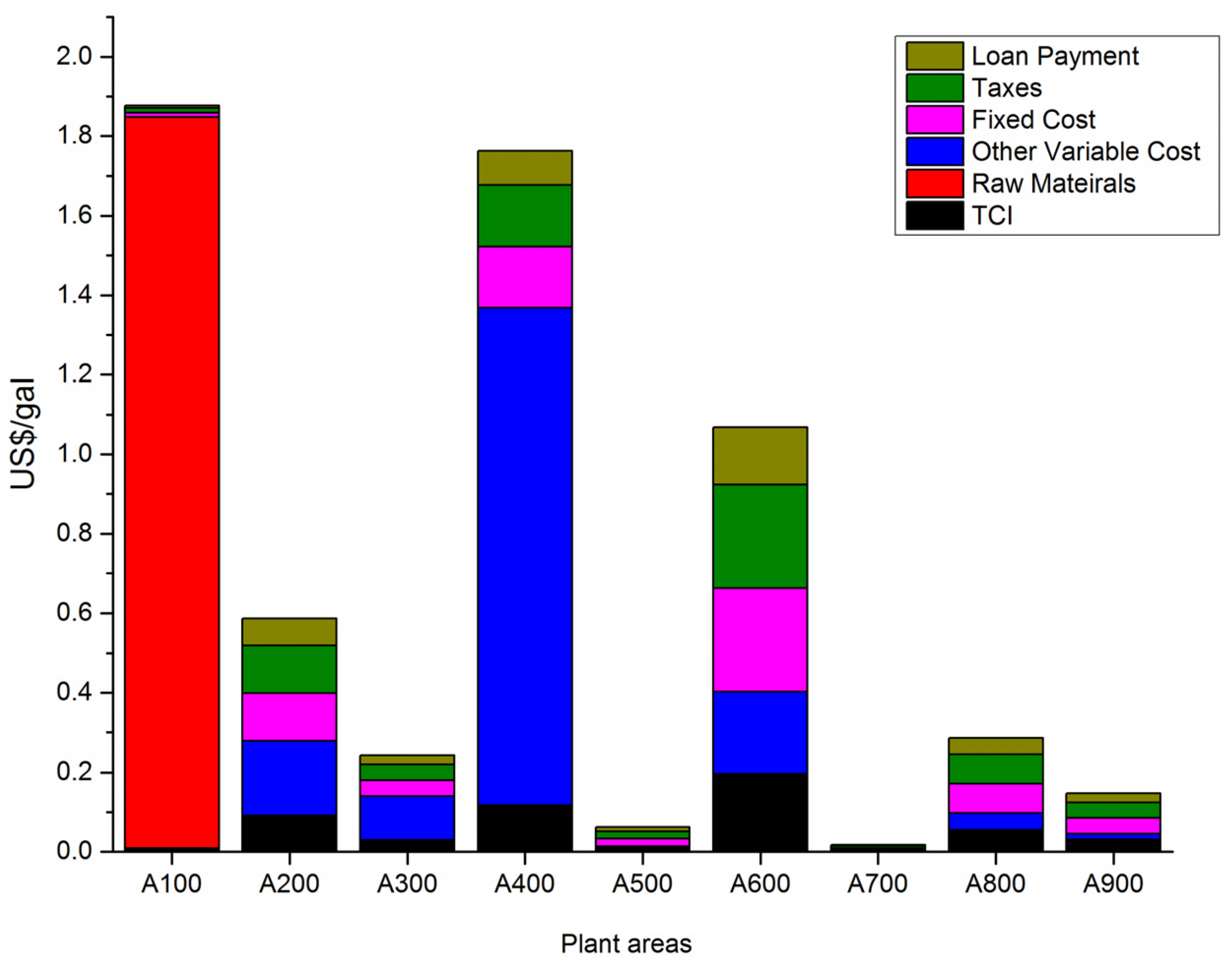

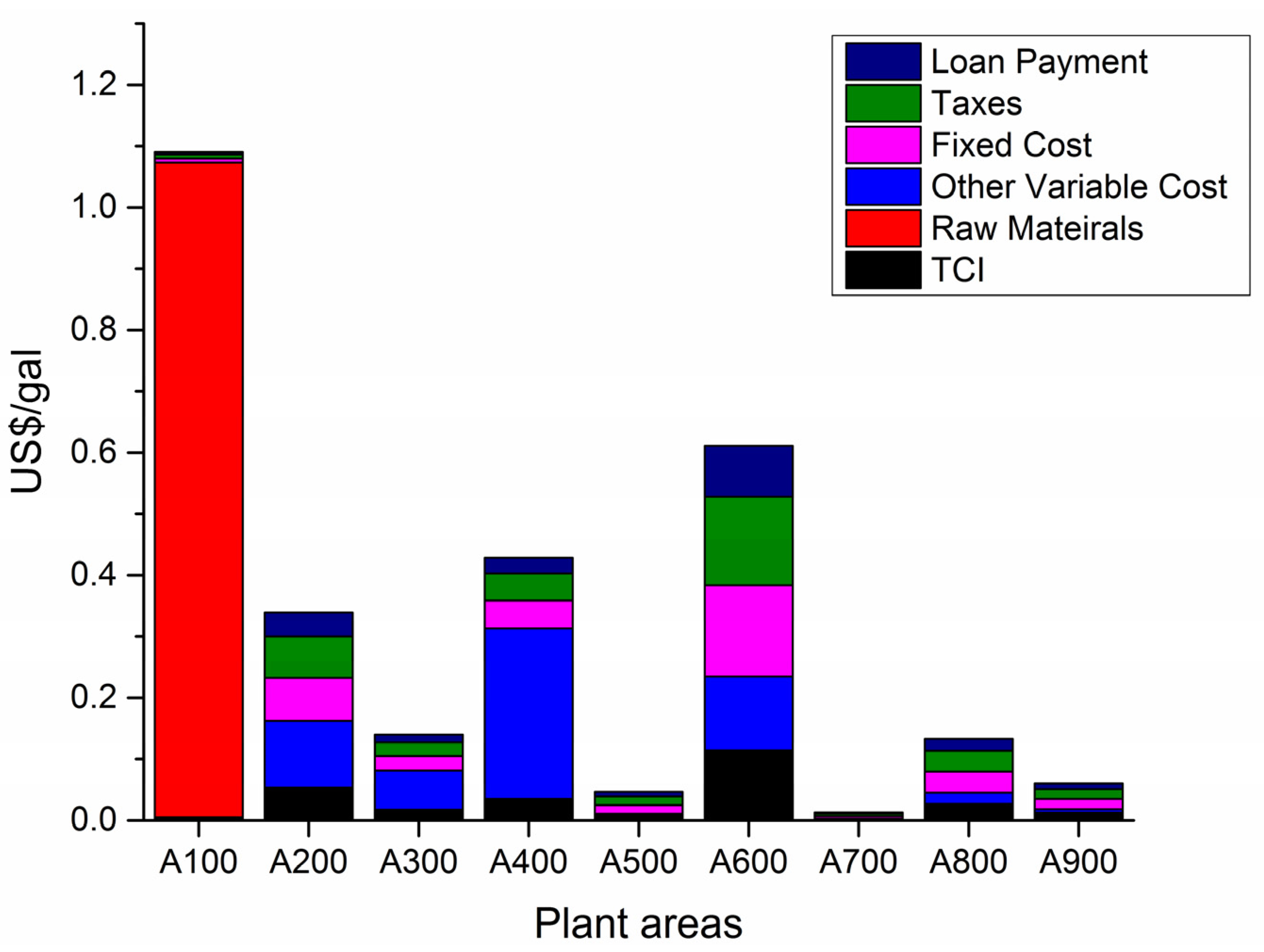

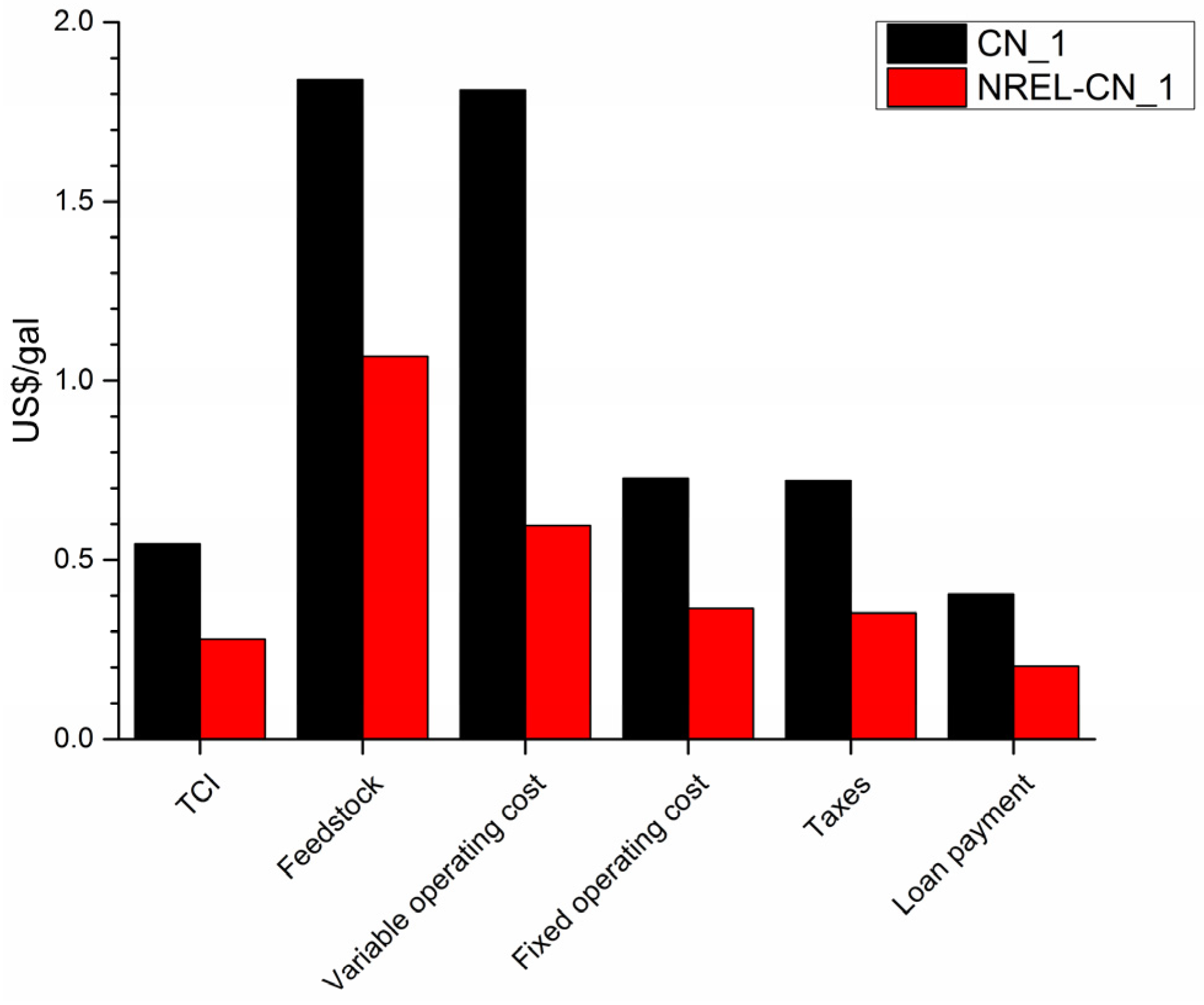

6.2. Cost Breakdown of Areas in Scenarios CN_1 and NREL-CN_1

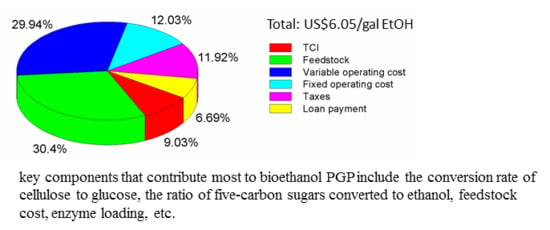

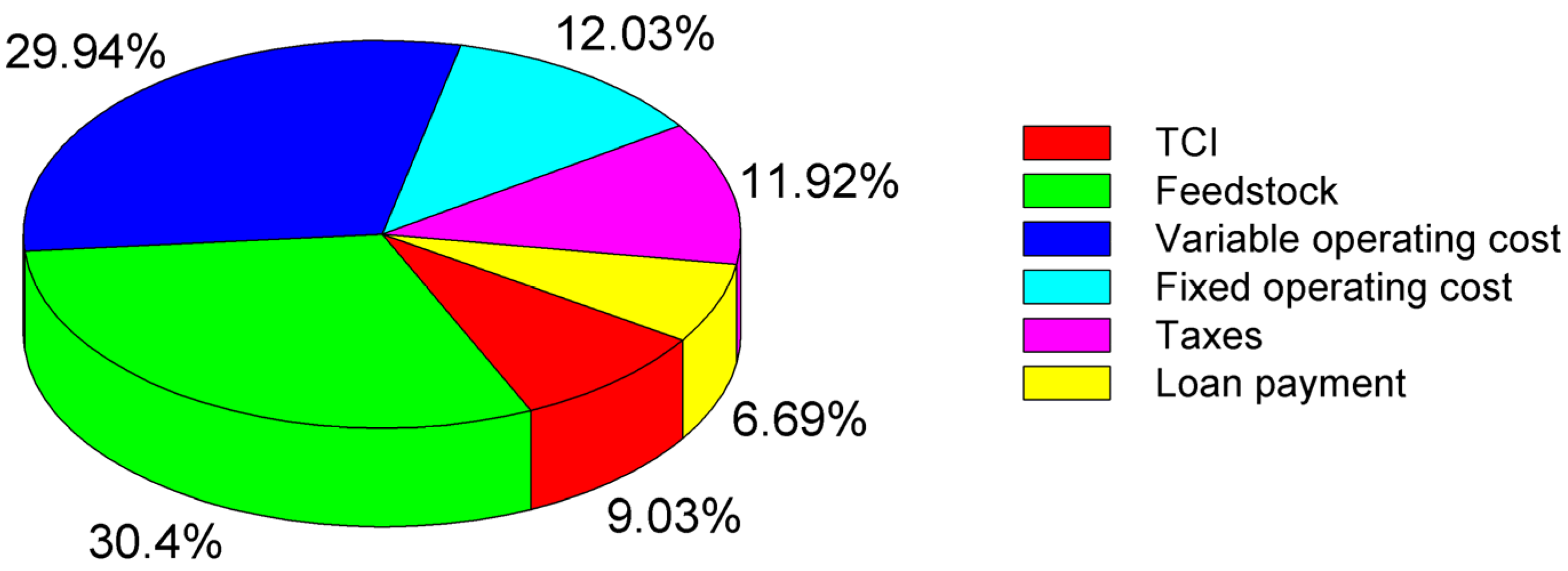

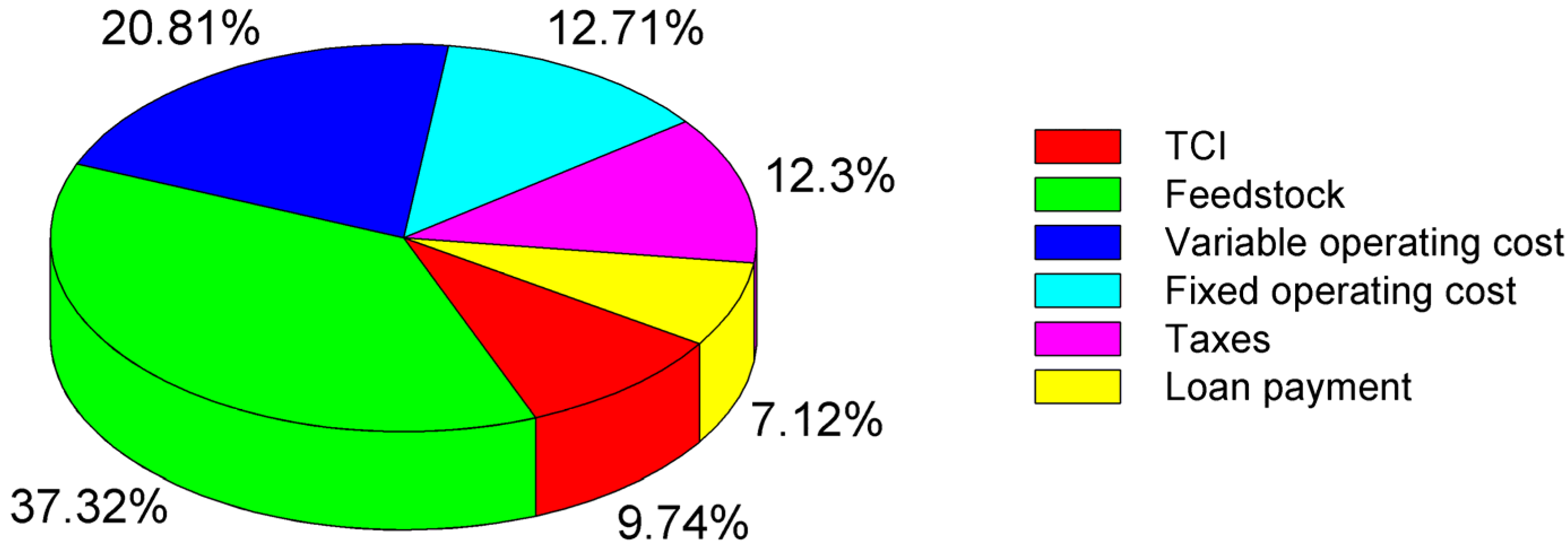

6.3. Cost Breakdown by Composition in Scenarios CN_1 and NREL-CN_1

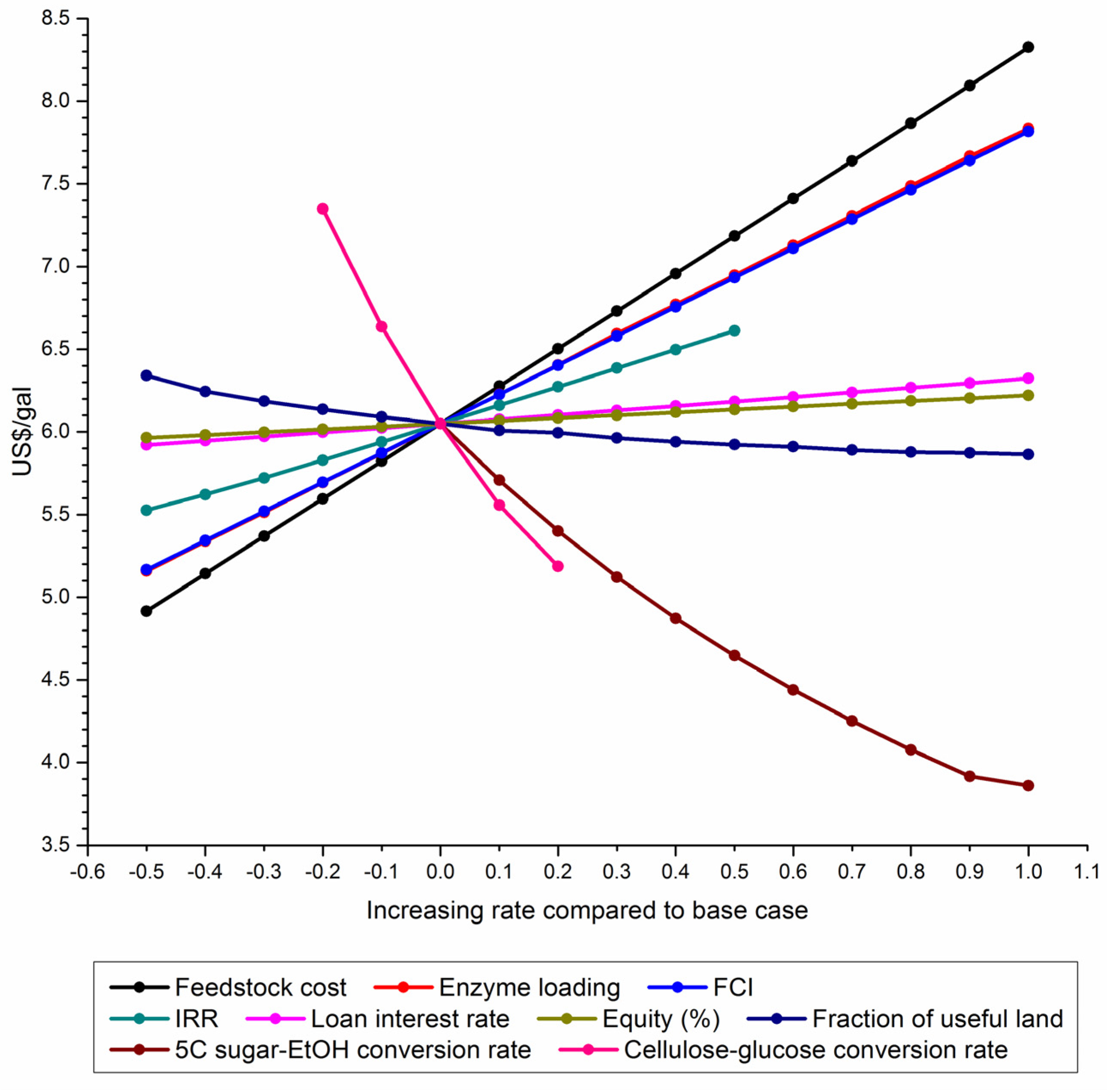

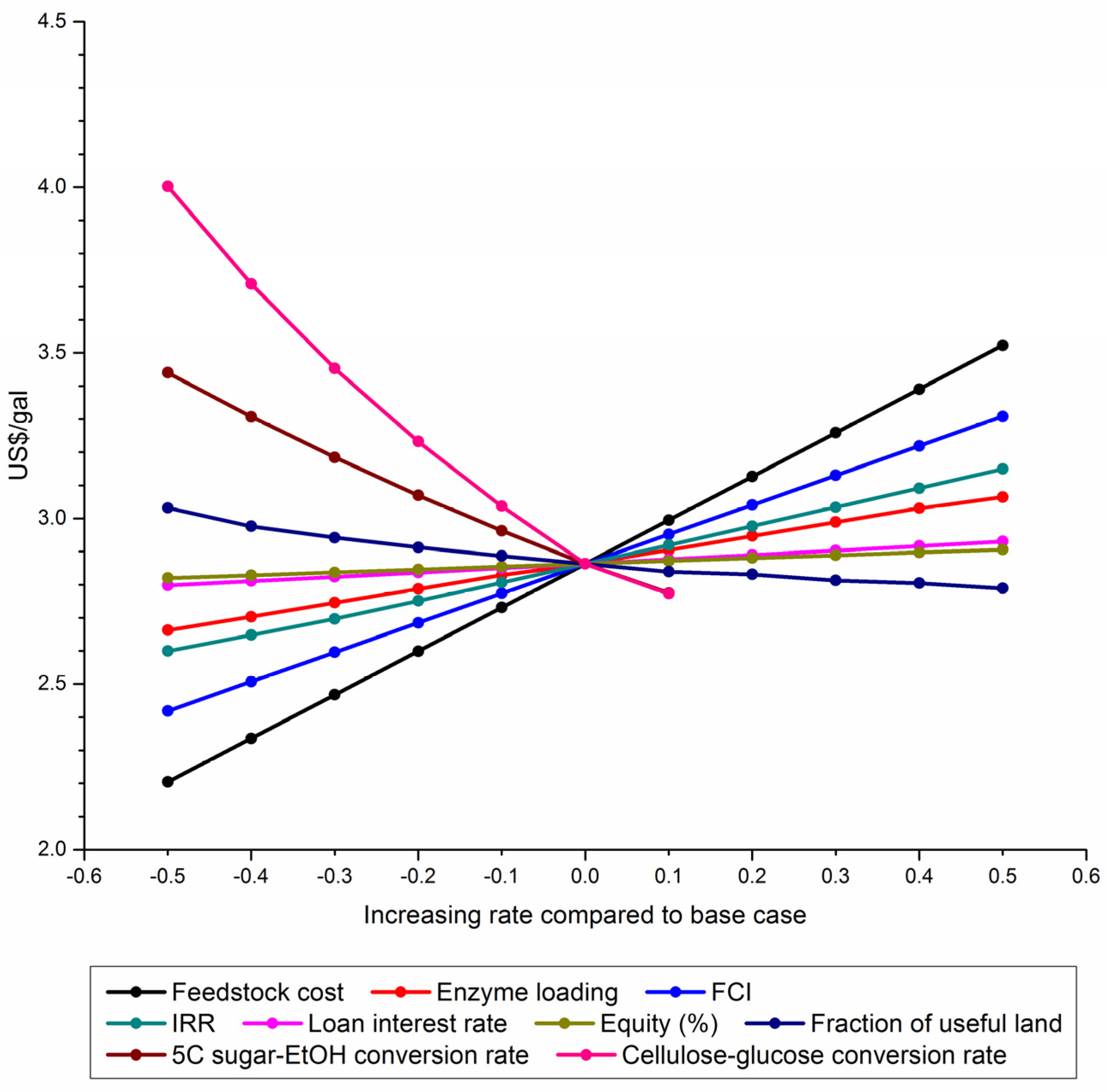

7. Sensitivity Analysis

Result of Sensitivity Analysis in Scenario CN_1

8. Conclusions and Policy Proposals

- l)

- R&D promotion: Strong support should be given to the R&D of the key technologies involved in ligocellulosic ethanol production, including technologies for five-carbon sugar ethanol conversion, and low-cost cellulase enzyme preparation, as they have a significant impact on the PGP of bioethanol.

- 2)

- Tax preference: It is suggested the consumption tax be exempted and VAT be refunded upon collection.

- 3)

- Feed-in tariff and compulsory purchase of electricity: To obtain byproduct credit, it is suggested that the excess electricity produced by the ethanol plant be purchased compulsorily by the grid under a certain feed-in tariff program.

- 4)

- Direct subsidy. Subsidy is imperative, since the plant will suffer from financial loss even in the most optimistic scenario (Scenario CN_6) under China’s technical status quo. The amount of subsidy is suggested at a minimum of $1.23/gal EtOH (2,500 yuan/t EtOH).

Acknowledgments

Author Contributions

Nomenclature

| BAU | Business as usual |

| BPAM | Bioethanol Plant-Gate Price Assessment Model |

| CN | China |

| ES | Education Surcharge |

| EtOH | Ethanol |

| FCEM | Feedstock Cost Estimation Model |

| FCI | Fixed capital investment |

| FGP | Plant-gate price |

| FOC | Fixed operating cost |

| GHG | Greenhouse gas |

| IRR | Internal rate of return |

| NPV | Net present value |

| NREL | National Renewable Energy Laboratory |

| SL | Straight line |

| TCI | Total capital investment |

| TEPC | Total equipment purchasing cost |

| TPC | Total plant cost |

| UMCT | Urban Maintenance and Construction Tax |

| VAT | Value-added tax |

| VOC | Variable operation cost |

Supplementary Materials

Conflicts of Interest

References

- Domestic and International Oil and Gas Industry Development Report; Institute of CNPC Economics Technology Research: Beijing, China, 2014.

- Chinese Academy of Engineering. Medium and Long Term Energy Development Strategy in China: Electricity, Oil & Gas, Nuclear and Environment; Science Press: Beijing, China, 2011; Volume 1. [Google Scholar]

- Tong, X.; Zhao, L.; Wang, R. Several thoughts on overseas oil dependence ratio in China. Res. Econ. Manag. 2008, 1, 60–65. (In Chinese) [Google Scholar]

- Ma, L.W.; Fu, F.; Li, Z.; Liu, P. Oil development in China: Current status and future trends. Energy Policy 2012, 45, 43–53. [Google Scholar] [CrossRef]

- Chang, S.; Zhao, L.; Timilsina, G.R.; Zhang, X. Biofuels development in china: Technology options and policies needed to meet the 2020 target. Energy Policy 2012, 51, 64–79. [Google Scholar] [CrossRef]

- International Energy Agency. Technology Roadmap: Biofuels for Transport; OECD/IEA: Paris, France, 2011. [Google Scholar]

- China National Renewable Energy Center. The Renewable Energy Industrial Development Report 2013; China Environmental Science Press: Beijing, China, 2014; p. 98. [Google Scholar]

- Humbird, D.; Davis, R.; Tao, L.; Kinchin, C.; Hsu, D.; Aden, A.; Schoen, P.; Lukas, J.; Olthof, B.; Worley, M.; et al. Process Design and Economics for Biochemical Conversion of Lignocellulosic Biomass to Ethanol: Dilute-Acid Pretreatment and Enzymatic Hydrolysis of Corn Stover; NREL/TP-5100-47764; National Renewable Energy Laboratory: Golden, CO, USA, 2011.

- National Development and Reform Commission. Pilot Program Extension Plan of Ethanol Alcohol Gasoline for Vehicles; National Development and Reform Commission: Beijing, China, 2004.

- National Development and Reform Commission. Detailed Rules of Implementation for the Extension of the Pilot Program of Ethanol Alcohol Gasoline for Vehicles; National Development and Reform Commission: Beijing, China, 2004.

- The Standing Committee of the National People’s Congress of China. Renewable Energy Law of the People’s Republic of China [revised]; The Standing Committee of the National People’s Congress of China: Beijing, China, 2009.

- Cavalcanti, M.; Szklo, A.; Machado, G.; Arouca, M. Taxation of automobile fuels in Brazil: Does ethanol need tax incentives to be competitive and if so, to what extent can they be justified by the balance of ghg emissions? Renew. Energy 2012, 37, 9–18. [Google Scholar] [CrossRef]

- Martines-Filho, J.; Burnquist, H.L.; Vian, C.E.F. Bioenergy and the rise of sugarcane-based ethanol in brazil. Choices 2006, 21, 94. [Google Scholar]

- NREL. Process Design for Biochemical Conversion of Biomass to Ethanol (dw1111a); U.S. National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2012.

- Yang, J.; Jiang, P. Overview of Chemical Engineering Design; China Petrochemical Press: Beijing, China, 2005. [Google Scholar]

- Overend, R.P. The average haul distance and transportation work factors for biomass delivered to a central plant. Biomass 1982, 2, 75–79. [Google Scholar] [CrossRef]

- Nguyen, M.H.; Prince, R.G.H. A simple rule for bioenergy conversion plant size optimisation: Bioethanol from sugar cane and sweet sorghum. Biomass Bioenergy 1996, 10, 361–365. [Google Scholar] [CrossRef]

- Pang, F. Study on Combination of Steam Explosion and Microwave Irradiation Pretreatment of Corn Stover. Ph.D. Thesis, Tianjin University, Tianjin, China, 2012. [Google Scholar]

- Song, J. Studies on Synergism of Cellulase, Esterase, and Xylanase on Corn Stalk. Master Thesis, Xinjiang Agricultural Univeristy, Urumqi, Xinjiang, China, 2011. [Google Scholar]

- Chen, X. Production Study of L-lactic Acid by Immobilized Rhizopus Oryzae from Corn Stalk hydrolyzate. Ph.D. Thesis, Chongqing University, Chongqing, China, 2012. [Google Scholar]

- Zhang, Q.; Ji, W.; Wang, Y. Research progress of strains using pentoses and hexoses in ethanol production. Chem. Ind. Eng. Prog. 2013, 32, 151–155. [Google Scholar]

- Li, X. Parameter & Data 2011—Sinopec Project Feasibility Study Technical Economy; SINOPEC Economic Research Institute: Beijing, China, 2011; pp. 1–97. [Google Scholar]

- Yin, Q.; Feng, R. Tax System of China, 1st ed.; Tsinghua University Press: Beijing, China, 2011. [Google Scholar]

- Ministry of Finance. Detailed Rules for the Implementation of the Provisional Regulation of the People’s Republic of China on Value-Added Tax; Ministry of Finance: Beijing, China, 1993.

- Ministry of Finance. Detailed Rule for the Implementation of the Provisional Regulation of the People’s Republic of China on Consumption Tax; Ministry of Finance: Beijing, China, 1993.

- Yuan, Z.; Xu, J. Analysis of Technology Development of China Biofuels; Guangzhou Institute of Energy Conversion: Beijing, China, 2014; p. 41. [Google Scholar]

- Huang, J.; Qiu, H. Studies on the Socioeconomic Impact and Strategies of Bioethanol Development in China; Science Press: Beijing, China, 2010. (In Chinese) [Google Scholar]

- Zhaopin.com. Laborors’ salary at the fuel ethanol station. Available online: http://jobs.zhaopin.com/153493313250062.htm?ssidkey=y&ss=201&ff=03 (accessed on 20 December 2013).

- Zhaopin.com. Salary of truck drivers. Available online: http://jobs.zhaopin.com/137940357251296.htm?ssidkey=y&ss=201&ff=03 (accessed on 20 December 2013).

- Zhaopin.com. Salary of liquid tank truck drivers. 2013. Available online: http://jobs.zhaopin.com/137940357251296.htm?ssidkey=y&ss=201&ff=03 (accessed on 20 December 2013).

- Zhao, D. Report on 3E Models and LCA for a Power Generation System from Selected Agriculture and Forestry Biomass. China Renewable Energy Scale-up Program; Guangzhou Institute of Energy Conversion: Guangzhou, China, 2008. [Google Scholar]

- Ou, X.; Zhang, X.; Chang, S.; Guo, Q. Energy consumption and GHG emissions of six biofuel pathways by lca in (the) people’s republic of china. Appl. Energy 2009, 86, S197–S208. [Google Scholar] [CrossRef]

- China Machinery Industry Information & Publication. Machinery and Electronic Products Quotation Manual; China Machinery Industry Press: Beijing, China, 2012. [Google Scholar]

- Wang, W.; Zhong, S. China Statistical Abstract 2013; China Statistics Press: Beijing, China, 2013.

- Ministry of Land and Resources of China. The State Criterion on Minimum Assignment Price of Land for Industry Use; Ministry of Land and Resources of China: Beijing, China, 2006.

- Zheng, S. Techno-economic analysis of cellulosic ethanol fuel. Master Thesis, Beijing Univeristy of Chemical Technology, Beijing, China, 2011. [Google Scholar]

- 2012 report of COFCO biochemical (Anhui) Co., Ltd. Avaliable online: http://www.cninfo.com.cn/finalpage/2013-06-22/62602877.PDF (accessed on 20 December 2013).

- Salary of maintenance supervisor. Avaliable online: http://jobs.zhaopin.com/458619017250110.htm?ssidkey=y&ss=201&ff=03 (accessed on 20 December 2013).

- Salary of maintenance technician. Avaliable online: http://jobs.zhaopin.com/594358227250060.htm?ssidkey=y&ss=201&ff=03 (accessed on 20 December 2013).

- International Energy Agency. World Energy Outlook 2013; International Energy Agency: Paris, France, 2013. [Google Scholar]

- Slary of lab technician. Avaliable online: http://jobs.zhaopin.com/472283822250024.htm?ssidkey=y&ss=201&ff=03 (accessed on 20 December 2013).

- Slary of shift supervisors. Avaliable online: http://jobs.zhaopin.com/310456719250185.htm?ssidkey=y&ss=201&ff=03 (accessed on 20 December 2013).

- Slary of shift operators. Avaliable online: http://jobs.zhaopin.com/148064466250263.htm?ssidkey=y&ss=201&ff=03 (accessed on 20 December 2013).

- Slary of sales manager. Avaliable online: http://jobs.zhaopin.com/532761829250019.htm?ssidkey=y&ss=201&ff=03 (accessed on 20 December 2013).

- Slary of salesman. Avaliable online: http://search.51job.com/job/52857570,c.html (accessed on 20 December 2013).

- Slary of clerks & secretaries. Avaliable online: http://jobs.zhaopin.com/47776791090250794000.htm?ssidkey=y&ss=201&ff=03 (accessed on 20 December 2013).

- South China Institute of Environmental Sciences, Ministry of Environmental Protection of China. Environmental Impact Report on the Cassava-Based Fuel Ethanol Project with a Capacity of 300,000 t/y(phase i ) of Guangdong Can Alcohol co; South China Institute of Environmental Sciences, Ministry of Environmental Protection of China: Guangzhou, Beijing, 2010. [Google Scholar]

- Sandong Industrial Research and Design Institute. Feasibility Study Report on Industrial Lignocellulosic Waste-Based Fuel Ethanol Project Using Enzymatick Hydrolysis Technology; Sandong Industrial Research and Design Institute: Zibo, China, 2011. [Google Scholar]

- Donghai County Shuntai alcohol Factory Co., Ltd. Proposal Report on the Fuel Ethanol Project with Capacity of 300,000 t in Donghai, Jiangsu province, China; Donghai County Shuntai alcohol Factory Co., Ltd.: Donghai, China, 2006. [Google Scholar]

- Fu, Z. Project for the Project on 0.1 Million Ton Annual Output of Ethanol; Sichuan University: Chengdu, China, 2007. [Google Scholar]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, L.; Zhang, X.; Xu, J.; Ou, X.; Chang, S.; Wu, M. Techno-Economic Analysis of Bioethanol Production from Lignocellulosic Biomass in China: Dilute-Acid Pretreatment and Enzymatic Hydrolysis of Corn Stover. Energies 2015, 8, 4096-4117. https://doi.org/10.3390/en8054096

Zhao L, Zhang X, Xu J, Ou X, Chang S, Wu M. Techno-Economic Analysis of Bioethanol Production from Lignocellulosic Biomass in China: Dilute-Acid Pretreatment and Enzymatic Hydrolysis of Corn Stover. Energies. 2015; 8(5):4096-4117. https://doi.org/10.3390/en8054096

Chicago/Turabian StyleZhao, Lili, Xiliang Zhang, Jie Xu, Xunmin Ou, Shiyan Chang, and Maorong Wu. 2015. "Techno-Economic Analysis of Bioethanol Production from Lignocellulosic Biomass in China: Dilute-Acid Pretreatment and Enzymatic Hydrolysis of Corn Stover" Energies 8, no. 5: 4096-4117. https://doi.org/10.3390/en8054096

APA StyleZhao, L., Zhang, X., Xu, J., Ou, X., Chang, S., & Wu, M. (2015). Techno-Economic Analysis of Bioethanol Production from Lignocellulosic Biomass in China: Dilute-Acid Pretreatment and Enzymatic Hydrolysis of Corn Stover. Energies, 8(5), 4096-4117. https://doi.org/10.3390/en8054096