Energy’s Shadow Price and Energy Efficiency in China: A Non-Parametric Input Distance Function Analysis

Abstract

:1. Introduction

2. Method and Materials

2.1. Framework of Energy’s Shadow Price and Energy Efficiency

2.2. Data Description

| Variable | Descriptive statistics | Pearson correlation | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | Max | Min | Standard deviation | L | K | E | Y | |

| L | 2393.15 | 2046.50 | 6547.75 | 254.84 | 1601.767 | 1.00 | -- | -- | -- |

| K | 6880.71 | 4469.63 | 46,916.31 | 230.03 | 7340.121 | 0.62 | 1.00 | -- | -- |

| E | 8495.40 | 6619.40 | 35,978.00 | 409.30 | 6467.278 | 0.69 | 0.89 | 1.00 | -- |

| Y | 3338.61 | 2259.18 | 22,118.75 | 117.60 | 3422.192 | 0.69 | 0.96 | 0.87 | 1.00 |

2.3. Energy Consumption in China

3. Results and Discussion

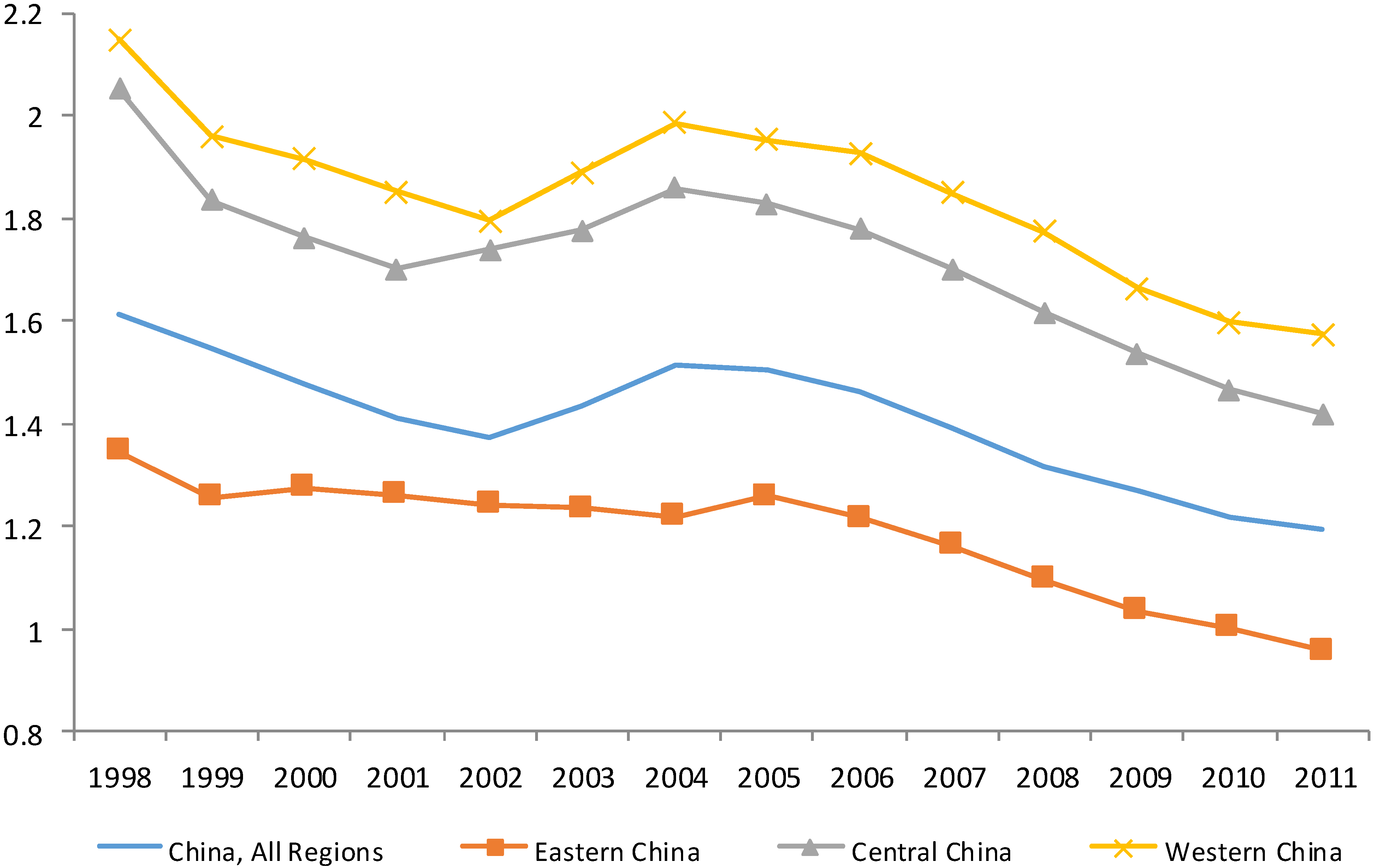

3.1. Energy Efficiency

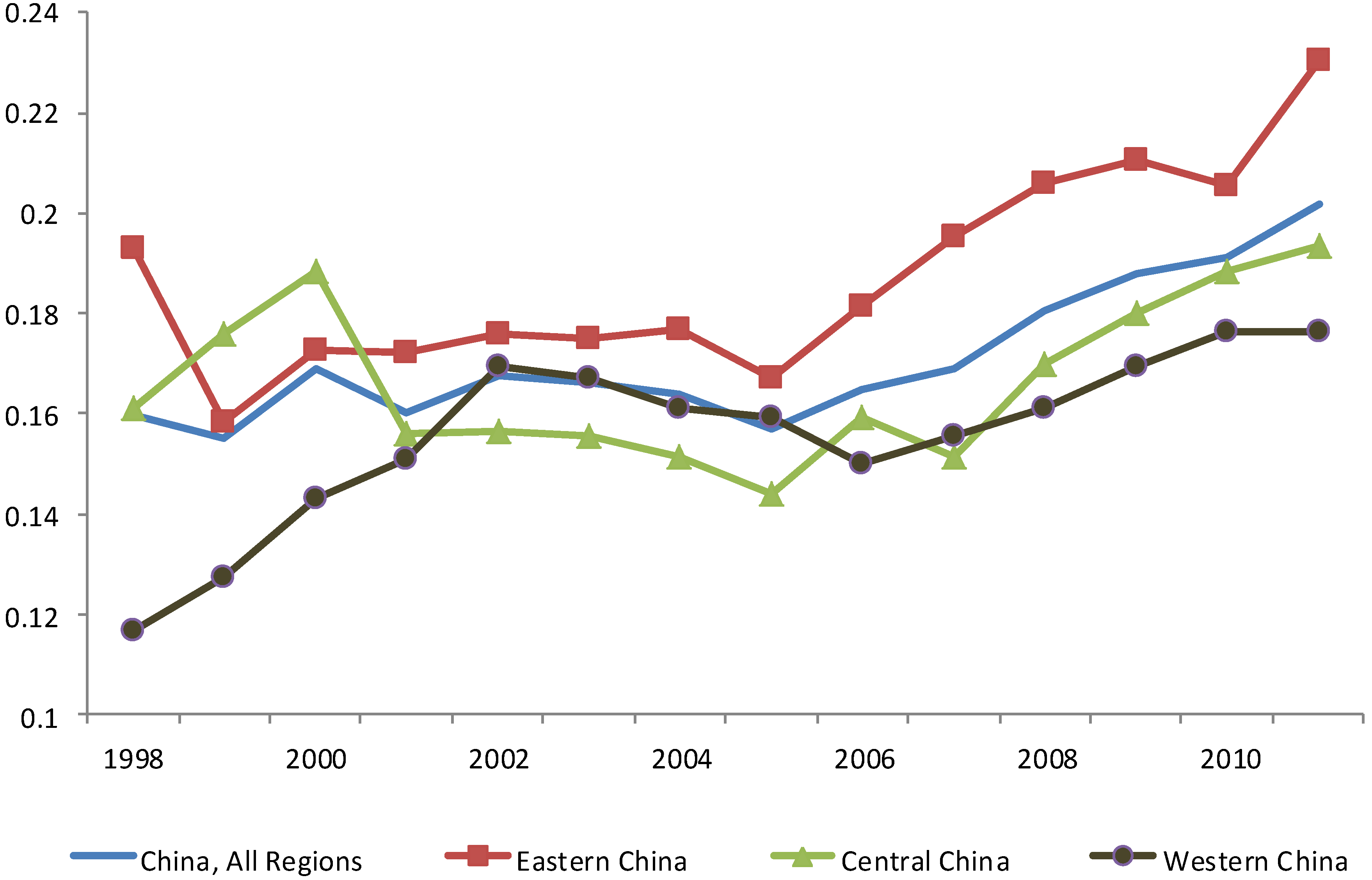

3.2. Shadow Price of Energy

3.3. Shadow Price versus Market Price of Energy

| Province | 1999 | 2001 | 2003 | 2005 | 2007 | 2009 | 2011 | T (R < 1) | T (R ≠ 1) | T (R > 1) |

|---|---|---|---|---|---|---|---|---|---|---|

| Beijing | 0.93 | 0.92 | 0.92 | 0.83 | 1.00 | 0.77 | 1.25 | 0.08 | 0.15 | 0.92 |

| Tianjin | 1.09 | 0.92 | 0.95 | 0.84 | 1.50 | 0.95 | 0.97 | 0.45 | 0.90 | 0.55 |

| Hebei | 1.06 | 0.93 | 0.93 | 0.81 | 1.04 | 1.02 | 0.97 | 0.01 | 0.01 | 0.99 |

| Liaoning | 0.28 | 0.06 | 1.10 | 0.95 | 0.99 | 0.94 | 1.53 | 0.88 | 0.24 | 0.12 |

| Shanghai | 1.03 | 0.89 | 1.00 | 0.88 | 1.03 | 1.02 | 1.00 | 0.02 | 0.04 | 0.98 |

| Jiangsu | 1.05 | 1.03 | 0.92 | 0.82 | 1.11 | 1.26 | 1.05 | 0.49 | 0.98 | 0.51 |

| Zhejiang | 0.95 | 1.03 | 0.93 | 0.86 | 1.02 | 1.10 | 1.42 | 0.21 | 0.42 | 0.79 |

| Fujian | 0.85 | 1.00 | 0.91 | 0.73 | 1.05 | 1.17 | 0.94 | 0.03 | 0.07 | 0.97 |

| Shandong | 1.06 | 0.89 | 0.95 | 0.81 | 0.99 | 1.02 | 0.99 | 0.01 | 0.02 | 0.99 |

| Guangdong | 1.01 | 1.03 | 0.90 | 0.84 | 1.00 | 1.08 | 0.81 | 0.01 | 0.01 | 0.99 |

| Hainan | 1.00 | 1.06 | 0.89 | 0.85 | 1.00 | 1.08 | 0.98 | 0.10 | 0.22 | 0.89 |

| Shanxi | 1.09 | 0.39 | 0.89 | 0.81 | 0.34 | 0.99 | 0.94 | 0.02 | 0.05 | 0.98 |

| Inner Mongolia | 1.28 | 1.00 | 1.01 | 0.81 | 1.05 | 1.00 | 1.00 | 0.19 | 0.39 | 0.81 |

| Jilin | 1.00 | 0.87 | 0.88 | 0.85 | 1.07 | 1.10 | 0.93 | 0.02 | 0.04 | 0.98 |

| Heilongjiang | 1.01 | 0.97 | 1.02 | 0.96 | 1.04 | 0.95 | 0.94 | 0.15 | 0.29 | 0.85 |

| Anhui | 1.09 | 1.03 | 0.99 | 0.31 | 1.09 | 0.94 | 0.80 | 0.65 | 0.70 | 0.35 |

| Jiangxi | 1.22 | 1.07 | 0.98 | 0.84 | 0.98 | 1.10 | 1.03 | 0.56 | 0.88 | 0.44 |

| Henan | 1.03 | 0.95 | 0.95 | 0.83 | 1.06 | 0.95 | 0.89 | 0.00 | 0.00 | 1.00 |

| Hubei | 1.06 | 1.04 | 0.92 | 0.87 | 1.08 | 1.12 | 0.96 | 0.15 | 0.30 | 0.85 |

| Hunan | 1.06 | 1.03 | 0.92 | 0.78 | 1.04 | 1.11 | 0.93 | 0.05 | 0.11 | 0.95 |

| Guangxi | 1.24 | 1.10 | 0.86 | 0.76 | 0.97 | 1.03 | 0.95 | 0.73 | 0.54 | 0.27 |

| Chongqing | 1.15 | 1.15 | 1.00 | 0.91 | 0.97 | 1.01 | 0.87 | 0.76 | 0.47 | 0.24 |

| Sichuan | 1.26 | 1.08 | 0.91 | 0.83 | 0.96 | 1.01 | 0.95 | 0.64 | 0.72 | 0.36 |

| Guizhou | 1.15 | 1.06 | 0.90 | 0.96 | 0.99 | 0.97 | 0.92 | 0.10 | 0.21 | 0.90 |

| Yunan | 1.04 | 1.04 | 0.96 | 0.82 | 1.05 | 0.92 | 0.97 | 0.05 | 0.09 | 0.95 |

| Shannxi | 1.18 | 0.98 | 0.93 | 0.84 | 0.99 | 0.96 | 0.95 | 0.07 | 0.15 | 0.93 |

| Gansu | 1.01 | 0.98 | 0.96 | 0.82 | 1.02 | 0.95 | 0.92 | 0.05 | 0.11 | 0.95 |

| Qinghai | 0.90 | 1.05 | 0.97 | 0.79 | 1.00 | 0.93 | 0.86 | 0.03 | 0.05 | 0.97 |

| Ningxia | 1.09 | 1.00 | 0.80 | 0.82 | 1.09 | 0.96 | 0.85 | 0.02 | 0.04 | 0.98 |

| Xinjiang | 1.07 | 0.89 | 1.00 | 0.87 | 0.96 | 0.93 | 0.83 | 0.08 | 0.16 | 0.92 |

4. Conclusions and Policy Recommendations

Acknowledgments

Author Contributions

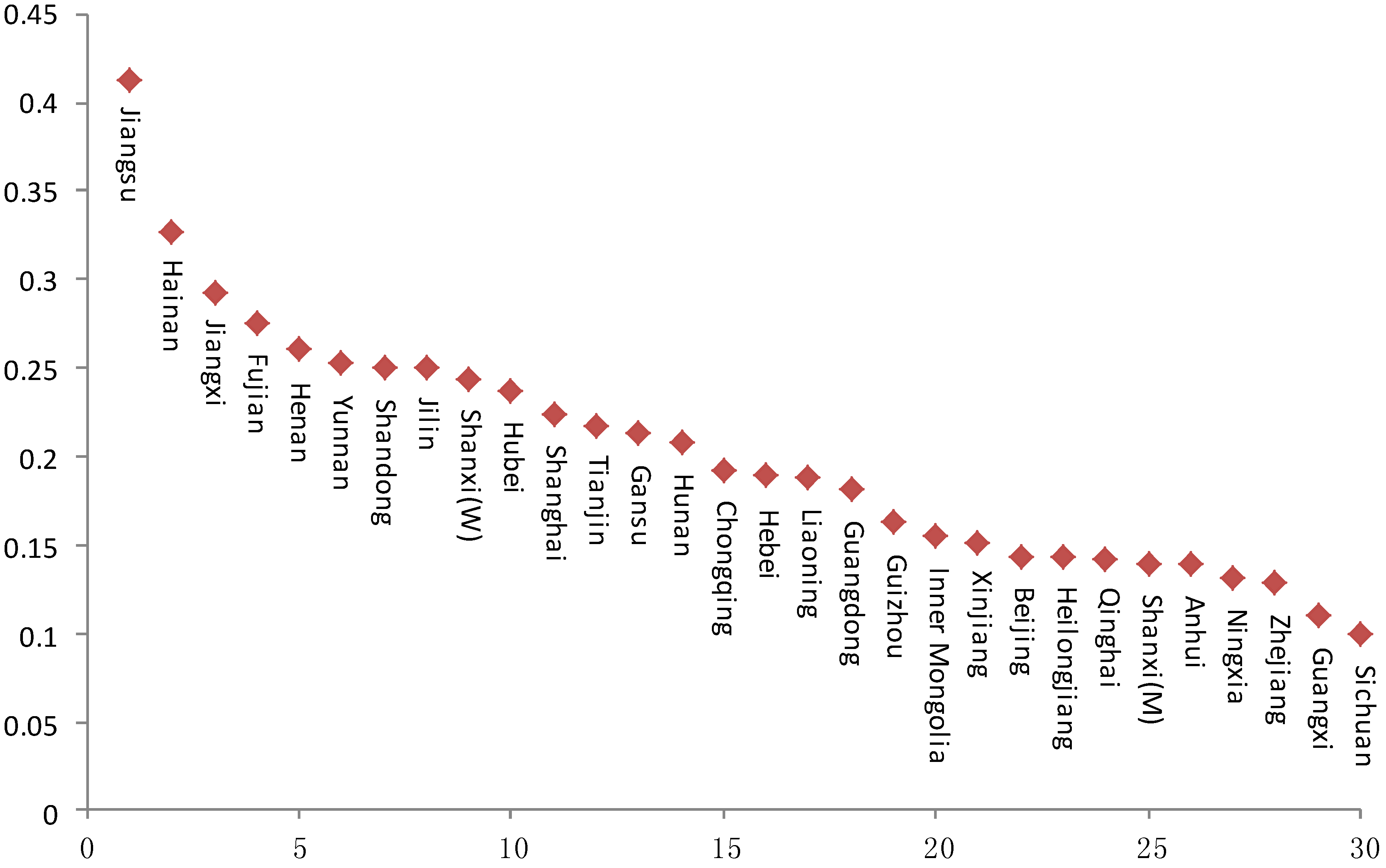

Appendix A. Energy Efficiency across China’s Thirty Provinces

| Province | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Beijing | 0.68 | 0.78 | 0.77 | 0.81 | 0.82 | 0.86 | 0.86 | 0.89 | 0.89 | 0.89 | 0.89 | 1.00 | 1.00 | 1.00 |

| Tianjin | 0.59 | 0.60 | 0.62 | 0.74 | 0.78 | 0.83 | 0.81 | 0.83 | 0.84 | 0.87 | 0.90 | 0.89 | 0.88 | 0.85 |

| Hebei | 0.43 | 0.44 | 0.39 | 0.38 | 0.37 | 0.37 | 0.37 | 0.38 | 0.38 | 0.39 | 0.49 | 0.47 | 0.48 | 0.47 |

| Liaoning | 0.38 | 0.40 | 0.41 | 1.00 | 1.00 | 1.00 | 0.46 | 0.47 | 0.47 | 0.50 | 0.56 | 0.58 | 0.61 | 0.60 |

| Shanghai | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| Jiangsu | 0.84 | 0.87 | 0.89 | 0.92 | 0.95 | 0.94 | 0.88 | 0.83 | 0.84 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| Zhejiang | 0.83 | 0.83 | 0.80 | 0.78 | 0.77 | 0.77 | 0.78 | 0.82 | 0.83 | 0.84 | 0.85 | 0.88 | 0.88 | 1.00 |

| Fujian | 1.00 | 0.99 | 0.99 | 0.97 | 0.93 | 0.91 | 0.94 | 0.80 | 0.80 | 0.81 | 0.81 | 0.95 | 0.97 | 0.93 |

| Shandong | 0.74 | 0.77 | 0.65 | 0.58 | 0.55 | 0.55 | 0.60 | 0.58 | 0.58 | 0.59 | 0.75 | 0.73 | 0.75 | 0.75 |

| Guangdong | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| Hainan | 0.71 | 0.72 | 0.70 | 0.68 | 0.72 | 0.70 | 0.63 | 0.65 | 0.65 | 0.65 | 0.65 | 0.65 | 0.65 | 0.75 |

| Shanxi | 1.00 | 1.00 | 1.00 | 0.99 | 0.93 | 0.91 | 0.93 | 0.96 | 0.94 | 0.96 | 0.92 | 0.92 | 0.96 | 0.98 |

| Inner Mongolia | 0.23 | 0.28 | 0.24 | 0.25 | 0.21 | 0.22 | 0.24 | 0.25 | 0.25 | 0.25 | 0.30 | 0.30 | 0.31 | 0.30 |

| Jilin | 0.32 | 0.32 | 0.31 | 0.30 | 0.29 | 0.27 | 0.25 | 0.32 | 0.31 | 0.31 | 0.31 | 0.32 | 0.33 | 0.31 |

| Heilongjiang | 0.40 | 0.40 | 0.45 | 0.45 | 0.43 | 0.45 | 0.41 | 0.51 | 0.51 | 0.52 | 0.63 | 0.63 | 0.65 | 0.63 |

| Anhui | 0.32 | 0.34 | 0.40 | 0.41 | 0.42 | 0.46 | 0.44 | 0.50 | 0.54 | 0.57 | 0.58 | 0.49 | 0.55 | 0.59 |

| Jiangxi | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| Henan | 0.77 | 0.75 | 0.67 | 0.67 | 0.66 | 0.64 | 0.66 | 0.69 | 0.69 | 0.70 | 0.71 | 0.71 | 0.73 | 0.72 |

| Hubei | 0.53 | 0.53 | 0.53 | 0.53 | 0.53 | 0.50 | 0.47 | 0.50 | 0.50 | 0.50 | 0.51 | 0.52 | 0.53 | 0.61 |

| Hunan | 0.55 | 0.55 | 0.55 | 0.59 | 0.60 | 0.57 | 0.54 | 0.58 | 0.57 | 0.58 | 0.60 | 0.61 | 0.62 | 0.71 |

| Guangxi | 0.81 | 0.94 | 0.93 | 0.82 | 0.75 | 0.61 | 0.58 | 0.51 | 0.50 | 0.50 | 0.50 | 0.51 | 0.51 | 0.51 |

| Chongqing | 0.67 | 0.57 | 0.56 | 0.58 | 0.61 | 0.64 | 0.54 | 0.59 | 0.51 | 0.51 | 0.48 | 0.53 | 0.55 | 0.56 |

| Sichuan | 0.61 | 0.62 | 0.61 | 0.56 | 0.54 | 0.50 | 0.49 | 0.51 | 0.53 | 0.56 | 0.55 | 0.60 | 0.63 | 0.68 |

| Guizhou | 0.21 | 0.23 | 0.21 | 0.22 | 0.24 | 0.21 | 0.22 | 0.27 | 0.27 | 0.27 | 0.27 | 0.27 | 0.28 | 0.27 |

| Yunan | 0.43 | 0.45 | 0.45 | 0.43 | 0.42 | 0.43 | 0.41 | 0.40 | 0.40 | 0.40 | 0.40 | 0.41 | 0.42 | 0.41 |

| Shannxi | 0.47 | 0.55 | 0.56 | 0.54 | 0.52 | 0.52 | 0.48 | 0.48 | 0.48 | 0.48 | 0.49 | 0.49 | 0.59 | 0.57 |

| Gansu | 0.32 | 0.30 | 0.31 | 0.33 | 0.34 | 0.35 | 0.35 | 0.36 | 0.36 | 0.37 | 0.37 | 0.38 | 0.39 | 0.44 |

| Qinghai | 0.28 | 0.23 | 0.25 | 0.26 | 0.27 | 0.27 | 0.26 | 0.24 | 0.23 | 0.23 | 0.23 | 0.24 | 0.29 | 0.25 |

| Ningxia | 0.24 | 0.25 | 0.19 | 0.20 | 0.19 | 0.15 | 0.14 | 0.15 | 0.15 | 0.18 | 0.19 | 0.18 | 0.19 | 0.15 |

| Xinjiang | 0.28 | 0.29 | 0.30 | 0.30 | 0.31 | 0.31 | 0.30 | 0.37 | 0.36 | 0.36 | 0.35 | 0.33 | 0.33 | 0.29 |

Appendix B

Appendix C. Domain Division in China

Conflicts of Interest

References

- Hu, J.L.; Wang, S.C. Total-factor energy efficiency of regions in China. Energy Policy 2006, 34, 3206–3217. [Google Scholar] [CrossRef]

- Zhang, X.P.; Cheng, X.M.; Yuan, J.H.; Gao, X.J. Total-factor energy efficiency in developing countries. Energy Policy 2011, 39, 644–650. [Google Scholar] [CrossRef]

- Chen, Z.C.; Lin, Z.S. Multiple timescale analysis and factor analysis of energy ecological footprint growth in China 1953–2006. Energy Policy 2008, 36, 1666–1678. [Google Scholar] [CrossRef]

- Khademvatani, A.; Gordon, D.V. A marginal measure of energy efficiency: The shadow value. Energy Econ. 2013, 38, 153–159. [Google Scholar] [CrossRef]

- Aigner, D.; Chu, S.F. On the estimating the industry production function. Am. Econ. Rev. 1968, 58, 226–239. [Google Scholar]

- Schmidt, P. On the statistical estimation of parametric frontier production functions. Rev. Econ. Stat. 1976, 58, 238–239. [Google Scholar] [CrossRef]

- Pitman, R.W. Multilateral productivity comparisons with undesirable outputs. Econ. J. 1983, 93, 883–891. [Google Scholar] [CrossRef]

- Shephard, R.W. Theory of Cost and Production Functions; Princeton University Press: Princeton, NJ, USA, 1970. [Google Scholar]

- Hailu, A.; Veeman, T.S. Environmentally sensitive productivity analysis of the Canadian pulp and paper industry, 1959–1994: An input distance function approach. J. Environ. Econ. Manag. 2000, 40, 251–274. [Google Scholar] [CrossRef]

- Lee, M. The shadow price of substitutable sulfur in the US electric power plant: A distance function approach. J. Environ. Manag. 2005, 77, 104–110. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Lovell, C.A.K.; Yaisawarng, S. Derivation of shadow prices for undesirable outputs: A distance function approach. Rev. Econ. Stat. 1993, 75, 374–380. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Noh, D.; Weber, W. Characteristics of a polluting technology: Theory and practice. J. Economet. 2005, 126, 469–492. [Google Scholar] [CrossRef]

- Murty, M.N.; Kumar, S.; Dhavala, K.K. Measuring environmental efficiency of industry: A case study of thermal power generation in India. Environ. Resour. Econ. 2007, 38, 31–50. [Google Scholar] [CrossRef]

- Boyd, G.; Molburg, J.; Prince, R. Alternative methods of marginal abatement cost estimation: Nonparametric distance functions. In Proceedings of the 17th North American Conference of the International Association for Energy Economics, Boston, MA, USA, 26–30 October 1996; pp. 86–95.

- Chung, Y.H.; Fare, R.; Grosskopf, S. Productivity and undesirable output: A directional distance function approach. J. Environ. Manag. 1997, 51, 229–240. [Google Scholar] [CrossRef]

- Lee, J.D.; Park, J.B.; Kim, T.Y. Estimation of the shadow prices of pollutants with production/environment inefficiency taken into account: A nonparametric directional distance function approach. J. Environ. Manag. 2002, 64, 365–375. [Google Scholar] [CrossRef]

- Ouyang, X.; Sun, C. Energy savings potential in China’s industrial sector: From the perspectives of factor price distortion and allocative inefficiency. Energy Econ. 2015, 48, 117–126. [Google Scholar] [CrossRef]

- China Statistical Yearbook; Chinese Statistical Bureau: Beijing, China, 1998–2011.

- Statistical Yearbook of the Chinese Investment in Fixed Assets; Chinese Investment Press: Beijing, China, 1998–2011.

- China Energy Statistical Yearbook; China Statistics Press: Beijing, China, 1998–2011.

- Zhang, J.; Wu, G.; Zhang, J. The estimation of China’s provincial capital stock: 1952–2004. Econ. Res. J. 2004, 10, 35–44. (In Chinese) [Google Scholar]

- Hidemichi, F.; Shinji, K.; Shunsuke, M. Changes in environmentally sensitive productivity and technological modernization in China’s iron and steel industry in the 1990s. Environ. Dev. Econ. 2010, 15, 485–504. [Google Scholar] [CrossRef]

- Chang, T.; Hu, J. Total-factor energy productivity growth, technical progress, and efficiency change: An empirical study of China. Appl. Energy 2010, 87, 3262–3270. [Google Scholar] [CrossRef]

- Wang, Z.; Feng, C.; Zhang, B. An empirical analysis of China’s energy efficiency from both static and dynamic perspectives. Energy 2014, 74, 322–330. [Google Scholar] [CrossRef]

- Zhang, N.; Kong, F.; Yu, Y. Measuring ecological total-factor energy efficiency incorporating regional heterogeneities in China. Ecol. Indic. 2015, 51, 165–172. [Google Scholar] [CrossRef]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sheng, P.; Yang, J.; Shackman, J.D. Energy’s Shadow Price and Energy Efficiency in China: A Non-Parametric Input Distance Function Analysis. Energies 2015, 8, 1975-1989. https://doi.org/10.3390/en8031975

Sheng P, Yang J, Shackman JD. Energy’s Shadow Price and Energy Efficiency in China: A Non-Parametric Input Distance Function Analysis. Energies. 2015; 8(3):1975-1989. https://doi.org/10.3390/en8031975

Chicago/Turabian StyleSheng, Pengfei, Jun Yang, and Joshua D. Shackman. 2015. "Energy’s Shadow Price and Energy Efficiency in China: A Non-Parametric Input Distance Function Analysis" Energies 8, no. 3: 1975-1989. https://doi.org/10.3390/en8031975

APA StyleSheng, P., Yang, J., & Shackman, J. D. (2015). Energy’s Shadow Price and Energy Efficiency in China: A Non-Parametric Input Distance Function Analysis. Energies, 8(3), 1975-1989. https://doi.org/10.3390/en8031975