1. Introduction

Chile is a minor contributor to global greenhouse gas (GHG) emissions (0.2%). However, according to the last official GHG national inventory, the emissions from the energy sector have grown 101% between 1990 and 2010.

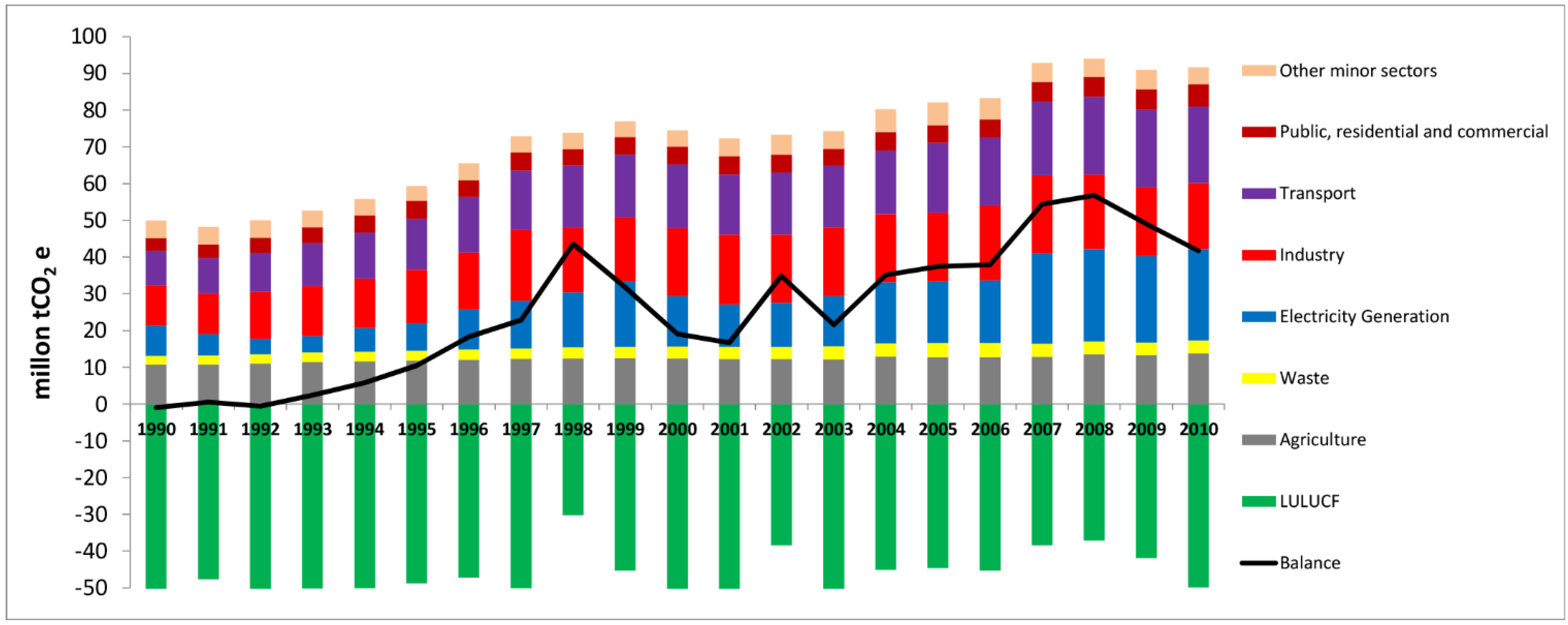

Figure 1 shows the national inventory by sectors [

1]. These statistics also show that the electricity generation sector is responsible for the highest amount of emissions. A recent study led by the government shows this situation has not changed. The electricity generation sector will continue to be the main GHG emitter, followed by the transport and industry sectors. These three sectors represent 77.2% of total emissions in 2013 [

2].

Chile’s motivation to contribute to worldwide emissions reductions stems from the United Nations Framework Convention on Climate Change (UNFCCC) and its principle of common but differentiated responsibilities. The country intends to contribute to achieving the ultimate objective of the Convention by undertaking mitigation actions, as well as taking advantage of the potential environmental and social benefits and improvements in the quality of growth that can be directly derived from mitigation actions. Following this line of action, Chile will take nationally appropriate mitigation actions to achieve a 20% deviation below the “Business as Usual” emissions growth trajectory by 2020, as projected from the year 2007 according to Chile’s commitment at Copenhagen in 2010. During the last Climate Summit in New York in September 2014, the current president reaffirmed this voluntary commitment, subject to international support.

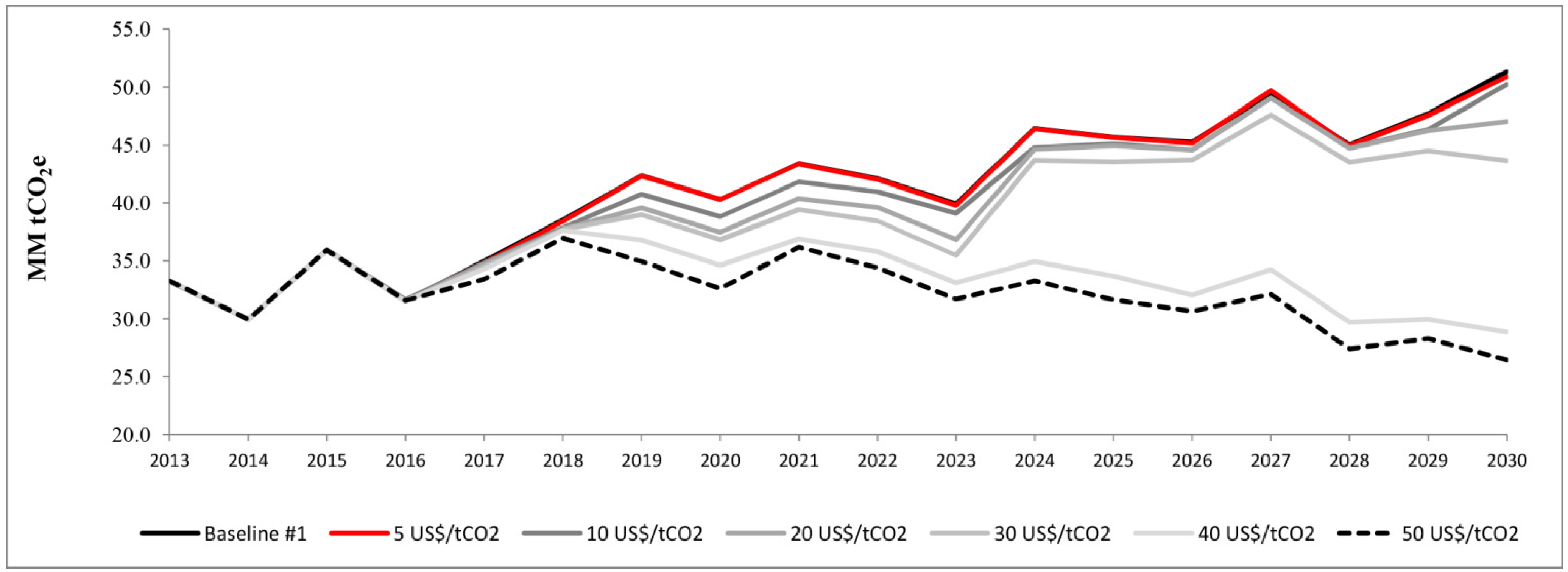

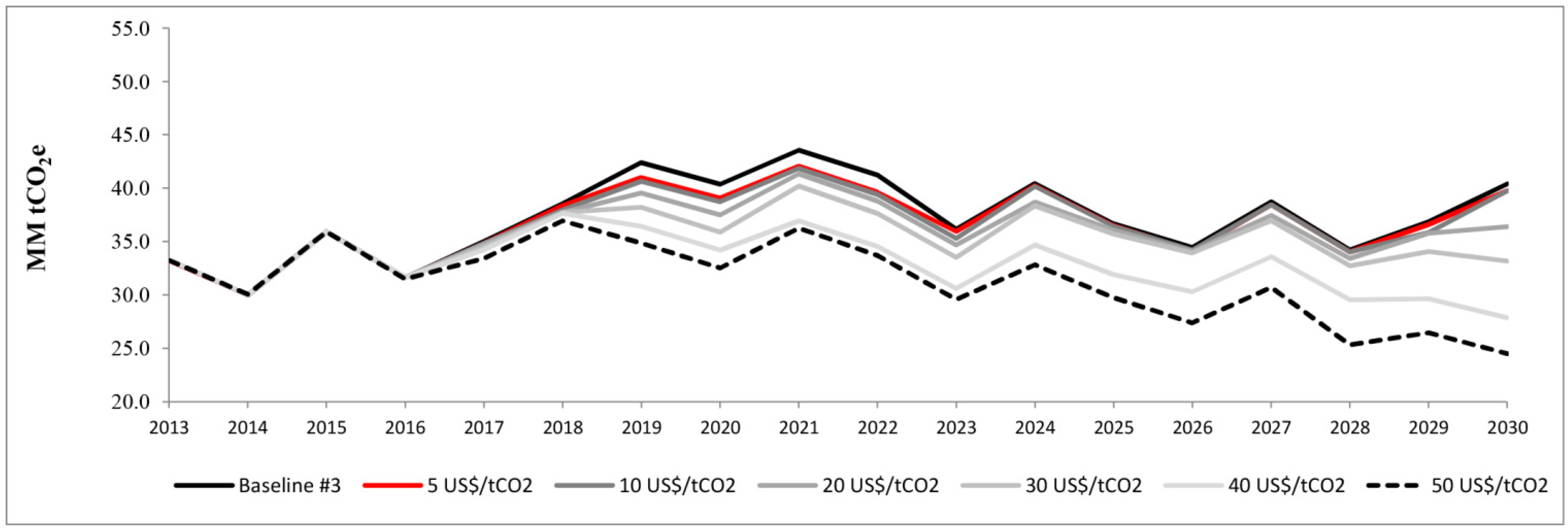

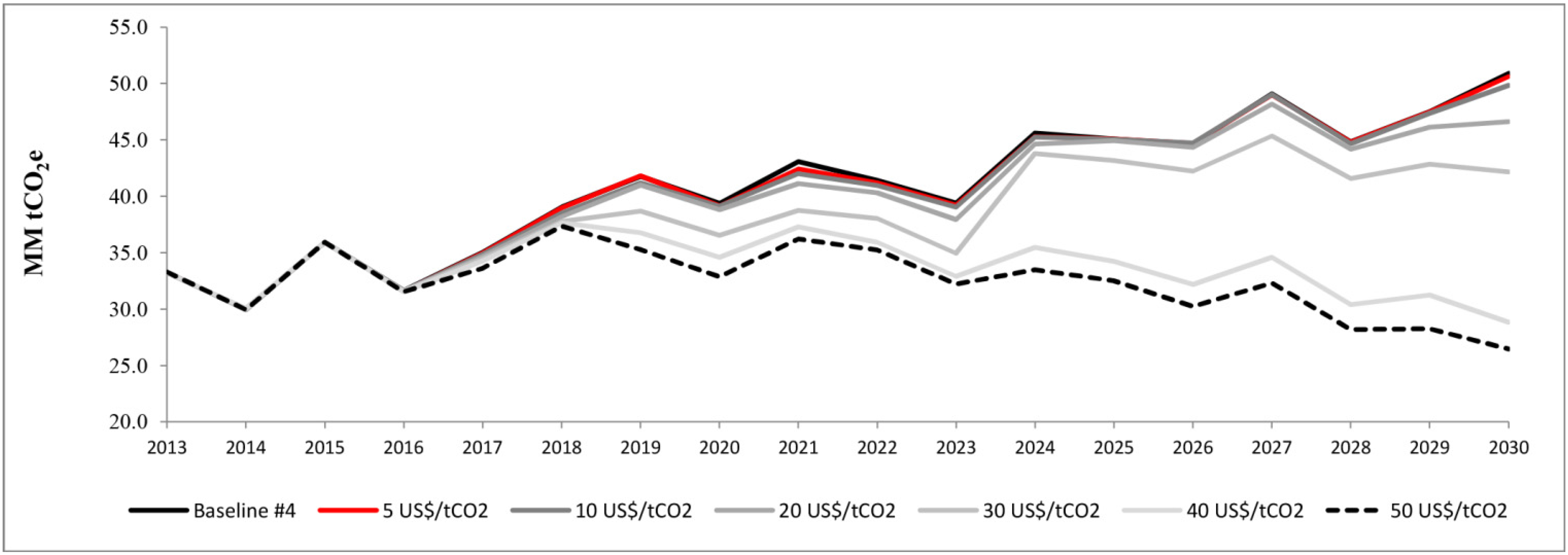

A more comprehensive analysis will help to establish exactly how Chile will fulfil its commitment to achieve its desired reduction in emissions. This paper aims to analyse the impact of a specific economic instrument: a carbon tax applied to the electricity generation sector. In 2014 Chile had a change of government following the presidential elections. The new government proposed a tributary reform which includes a carbon tax of 5 US$/tCO2 applied on fixed sources with installed capacity up to 50 MW (therefore, the carbon tax is not applied to the industry, transport, commercial, and residential sectors). A carbon tax would reduce the GHG emissions through two broad influences—a demand effect, reducing energy demand due to higher prices in the electricity sector as well as in the whole economy, and a substitution effect, that is switching from more to less carbon intensive fuels. The second effect is analysed in this paper. In addition, this instrument is compared with other energy policies such as an increase in non-conventional renewable energy sources and a cap on the total emissions of the electricity generation sector.

Figure 1.

Chilean national GHG inventory by sector [

1]. The blue bar is the electricity generation sector which is analysed in this paper.

Figure 1.

Chilean national GHG inventory by sector [

1]. The blue bar is the electricity generation sector which is analysed in this paper.

Carbon taxes have mostly been implemented in Scandinavian countries, Australia (it was abolished in 2014), and a few other European countries. Finland (1990), Sweden (1991), Norway (1991) and Denmark (1992) led the way in implementing a carbon tax [

3].

Economic and energy models have been used in previous studies. Large-scale energy-economy models have been extensively used in the European Union (EU) climate and energy policies [

4,

5,

6], and combining energy and economic models has been a standard in the EU. The link is necessary when sectorial models cannot provide all the answers that policy makers are looking for, for example, the impact on GDP pathway of an energy policy [

7]. Most previous studies have used computable general equilibrium (CGE) models to analyse the economic implication of this kind of environmental policy. The GEM-E3 (a CGE model called General Equilibrium Model for Energy–Economy–Environment interactions) and the Energy–Environment–Economy macro-econometric (E3ME) model are being used to evaluate policy issues for the European Commission. These models are linked to the Price-Induced Market Equilibrium System (PRIMES) energy model [

6]. In the Long Term Mitigation Scenario process [

8,

9] and in [

10] a CGE model is used to evaluate the impact of a carbon tax in South Africa. In [

11] the macroeconomic impact in Thailand of introducing an emission trading system and carbon capture storage technologies was evaluated. In [

12,

13] a CGE model is used to evaluate how a carbon tax policy impacts on energy consumption and GHG emissions in China. In [

14] a multi-sector and multi-region CGE model is used to quantify the economic impacts of EU climate and energy package in Poland. In [

15] two scenarios are evaluated to quantify the macroeconomic impacts in Pakistan, the first scenario only included different levels of carbon tax, and in the second scenario a carbon tax and energy efficiency improvements that have been jointly simulated are evaluated. Another approach is possible to find in [

16], in this reference a Dynamic Stochastic General Equilibrium (DSGE) is developed to evaluate the macroeconomic impact of different mitigation action in Poland. In [

17] an Input-Output matrix is used to estimate the short-term effects of a carbon tax in Italy, which includes the percentage increase in prices and the increase in the imports of commodities to substitute domestically produced ones as intermediate input.

Energy sectorial models have also been used in previous studies. TIMES (The Integrated MARKAL-EFOM System) Integrated Assessment Model (TIAM) is a bottom-up energy system model with a detailed description of different energy forms, resources, processing technologies and end-uses [

18]. Model for Energy Supply Systems and their General Environmental impact (MESSAGE) is a supply energy model. Both models have been used by the Intergovernmental Panel on Climate Change (IPCC) to project global energy and emission scenarios. Also these models have been used to analyse local options with more details. For example, in [

19] renewable energy options are analysed to mitigate climate change in India, and in [

20] the MESSAGE model was used to evaluate 12 strategies to reduce the Malaysia’s carbon footprint of the energy sector. In [

21] the Asian Pacific Integrated Model (AIM) is used for scenario analysis of GHG emission and the impacts of global warming in the Asian Pacific region. This model comprises 4 discrete models which are linked: The emission model and the global warning impact model are linked to two global physical models.

In [

22] a fuzzy mixed-integer energy planning model under carbon tax policy is developed. In [

23] an end-use energy model is presented for assessing policy options to reduce greenhouse gas emissions. This model evaluates the effects of imposing a carbon tax on various carbon emitting technologies in order to reduce CO

2 emissions. In [

24] the impact of renewable energy source incentives and mitigation policies (feed-in tariffs, quota obligation, emission trade, and carbon tax) are considered in the framework of the generation planning problem to be solved by a generation company. Renewable energy quota and emission limits result in a set of new constraints to be included in a traditional generation expansion planning model. In [

25] an integrated power generation expansion planning model towards low-carbon economy is proposed. In [

26] a short term optimization method is proposed to determine the optimal tax rate among generating units.

The literature review shows that macroeconomic models (CGE, DSGE, I/O matrix,

etc.) do not represent endogenously all the details of the power sector to simulate the generation expansion planning under carbon tax scenarios. Due to this fact, in this paper both energy sectorial and macroeconomic models have been implemented, and an approach to link these two is presented. In [

6] the GEM-E3 model cannot produce energy system simulations as accurately as the PRIMES model, therefore the GEM-E3 model is calibrated according to projections obtained by the PRIMES model [

27]. The PRIMES model is more aggregated than engineering models and far more disaggregated than econometric models. Also in [

6], the power generation mix was treated as exogenous in E3ME model and adapted to the results of the PRIMES model. In [

14] a detailed bottom-up representation is used to model the electricity generation sector, however, this representation is less detailed in comparison to sectorial models. In [

10] a long-term electricity investment plan of a previous study is used to calibrate a CGE multi-sectorial model. Also in [

14] the power development plan is an input for the CGE model. In [

28] a technological and the time period detail is introduced in a CGE framework to represent electricity demand and electricity generation by power plants. In a typical CGE model the energy sector is represented using one load block or stage per year. However, in this work [

28] it was represented until 180 load blocks.

In this paper a DSGE model is selected instead of a CGE model. What DSGE and CGE modelling have in common is that they belong to the micro founded macroeconomic models of general equilibrium, but they differ in two important issues regarding modelling results: dynamics and uncertainty. DSGE models are strictly dynamic models, while CGE models are comparatively static ones. The dynamic characterization of the models allows for optimal decision rules that are not policy invariant, and where time is directly considered. This characterization has gained in terms of allowing analyses of the paths of the variables behavior instead of comparing different equilibriums, and by analysing the reachability of them, relative to the static characterization. The CGE type of model allows comparing steady state equilibriums but not the trajectories toward the equilibriums.

The treatment of uncertainty in the DSGE models makes them superior to CGE models, which are deterministic, because they allow a better fit of the theoretical models with the data. These features are causing a shift from CGE to DSGE modeling, which is becoming a valuable tool for assessing policy analysis, mechanisms analysis and projections [

29,

30]. However, the CGE models include a large variety of sectors, so they make possible to analyze sectoral composition of output, employment, capital,

etc., while the DSGE models focus in more aggregated analysis.

In Chile there are two main independent power systems, the Central Interconnected System (in Spanish, Sistema Interconectado Central, SIC), and the Norte Grande Interconnected System (in Spanish, Sistema Interconectado del Norte Grande, SING).

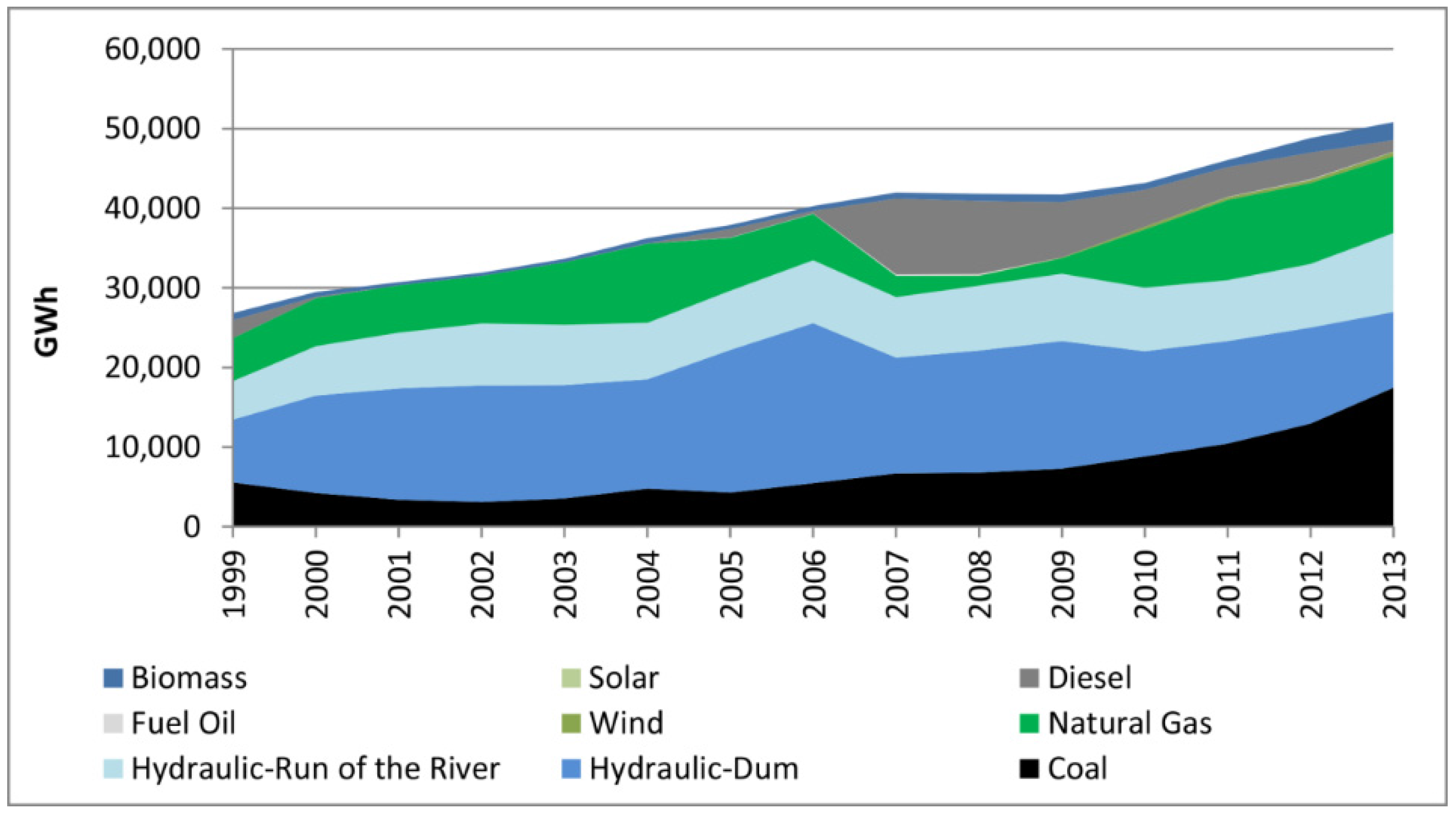

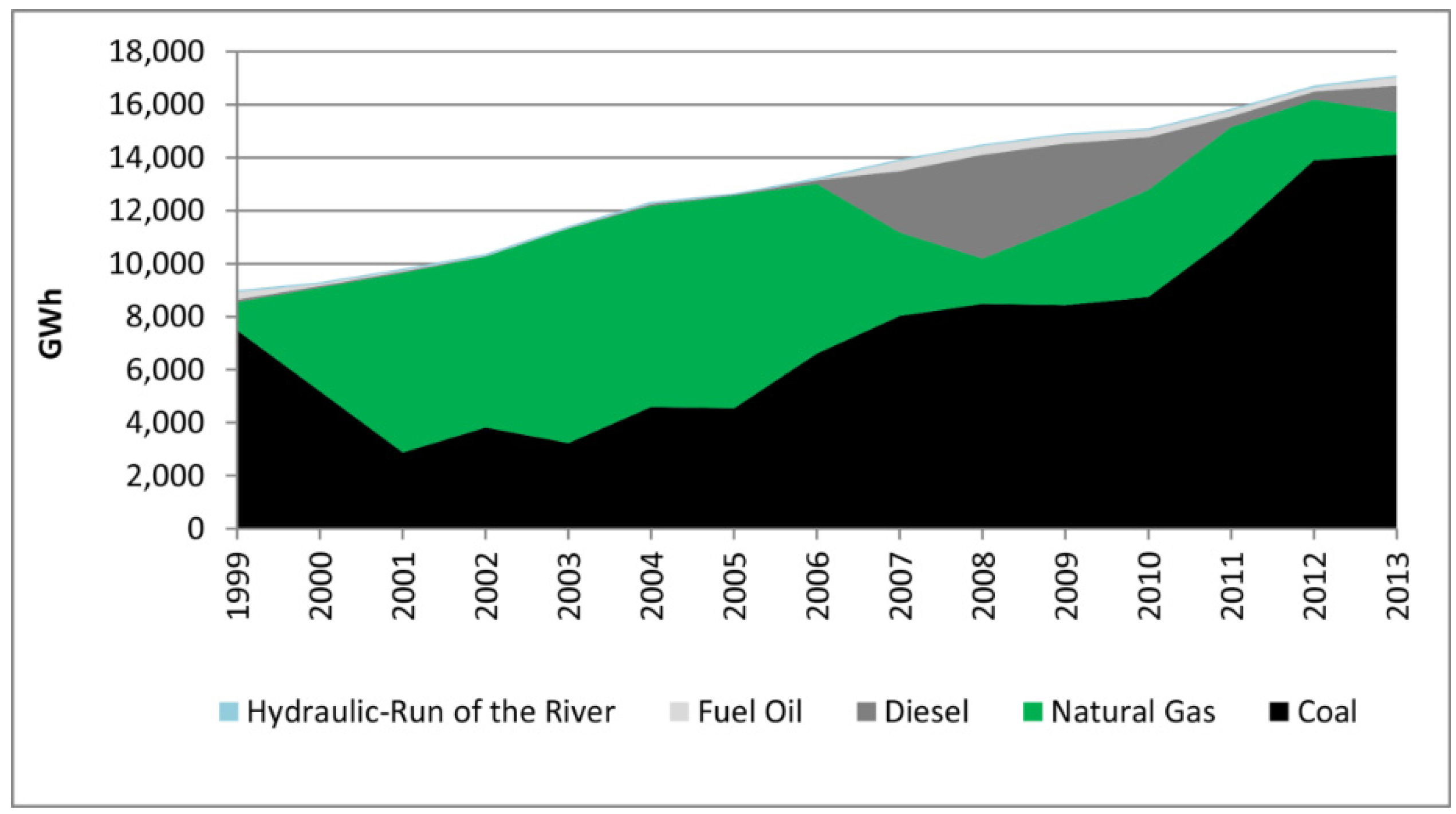

Figure 2 and

Figure 3 show the historical generation by source for the SIC and SING, respectively. The hydroelectricity generation is one of the main sources in the SIC, whereas in the SING coal is one of the main energy sources. The maximum demand in SIC was 7,535 MW and SING was 2,300 MW in 2014.

Figure 2.

Electricity generation by sources, SIC 1999–2013.

Figure 2.

Electricity generation by sources, SIC 1999–2013.

Figure 3.

Electricity generation by sources, SING 1999–2013.

Figure 3.

Electricity generation by sources, SING 1999–2013.

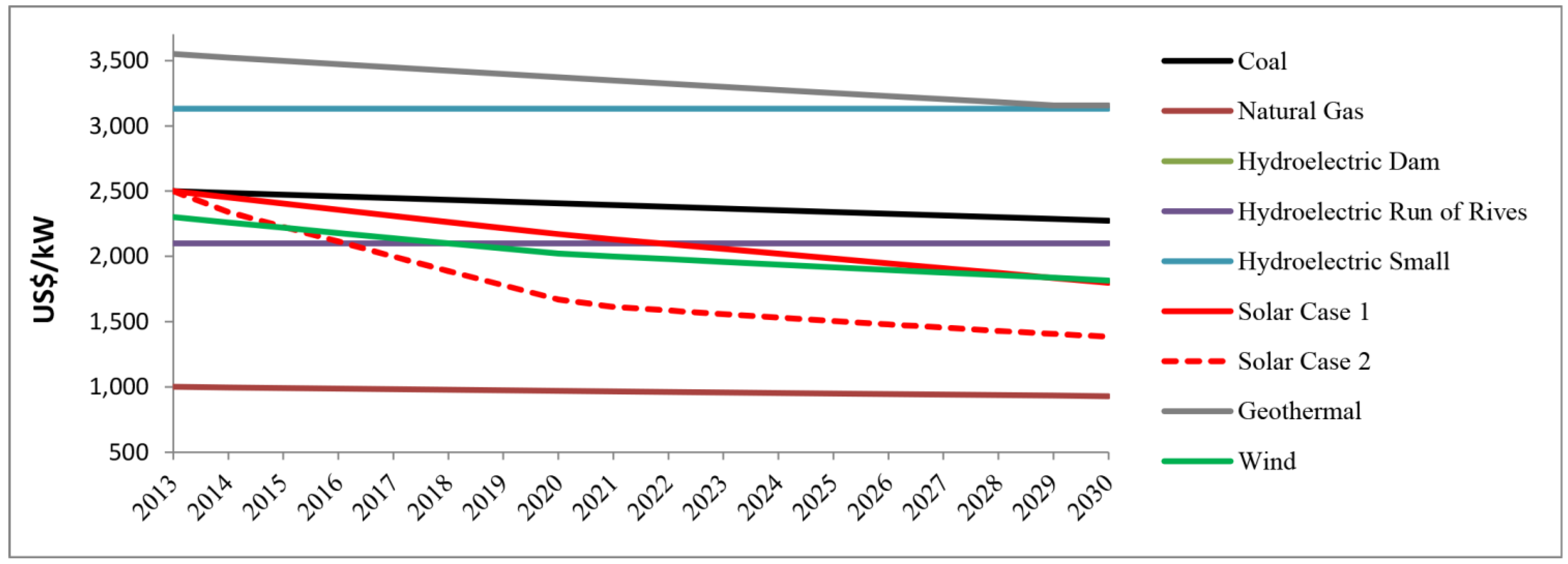

Chile has great potential to produce electricity with renewable energy sources, such as hydroelectric (12,000 MW), solar (1,000,000 MW), wind (40,000 MW) and geothermal (16,000 MW) sources [

31]. However, some issues have affected the development of this technology in Chile. In the case of solar and wind energy, there is uncertainty related to the evolution of the future investment cost and the lack of access to long term contracts constitutes a barrier for project developments. In the case of hydroelectric sources, environmental problems have faced some projects. For example, the hydroelectric generation potential of the Aysén region has been estimated to be more than 7,000 MW. Two specific projects have been evaluated in this zone: HidroAysen (2,750 MW) and Cuervo (640 MW). However, these projects have faced the opposition of several groups due to the fact that these would be installed in a pristine region of Patagonia, known for glaciers and lakes. In addition, these projects require a transmission line of more than 2,000 km to inject its energy to SIC power system. The first project presented its environmental evaluation in year 2008, and was approved in May of 2011. However an action complaint against the environmental resolution was presented which had to be resolved by a Minister Committee. The final resolution of this was extended for more than three years. Finally, the environmental evaluation was rejected by the current Minister Committee, and it is not clear if the company will present the environmental evaluation again. The environmental evaluation of the transmission line has not been presented yet.

Figure 2 and

Figure 3 show that natural gas was one of the main energy sources between 2000 and 2006. Most of the natural gas was imported from Argentina, however this supply experienced many shortfalls. To overcome this energy problem in Chile, two Liquid Natural Gas (LNG) terminals were built: Mejillones and Quintero. The first began to operate in 2009. However, it is currently operating below its maximum capacity due to the high price of LNG in comparison to electricity generation from coal (see

Figure 3). In the case of the Quintero LNG terminal, it is operating at full capacity. Four companies share ownership of this terminal: British Gas; the National Petroleum Company of Chile (ENAP), which is a state refiner; Chilean Distributor for Natural Gas for Metropolitan Region (METROGAS), and National Electricity Company (ENDESA), which is one of the biggest private electricity generation companies in Chile. Apart from ENDESA, there are other companies which have natural gas power plants (for example Nehuenco (785 MW) and Nueva Renca (305 MW)), however, these do not have open access to the terminal. At times METROGAS or ENAP have sold gas surpluses to these companies, but at a high price. There are uncertainties about access to the terminal to get gas at competitive prices or the access using their own terminal.

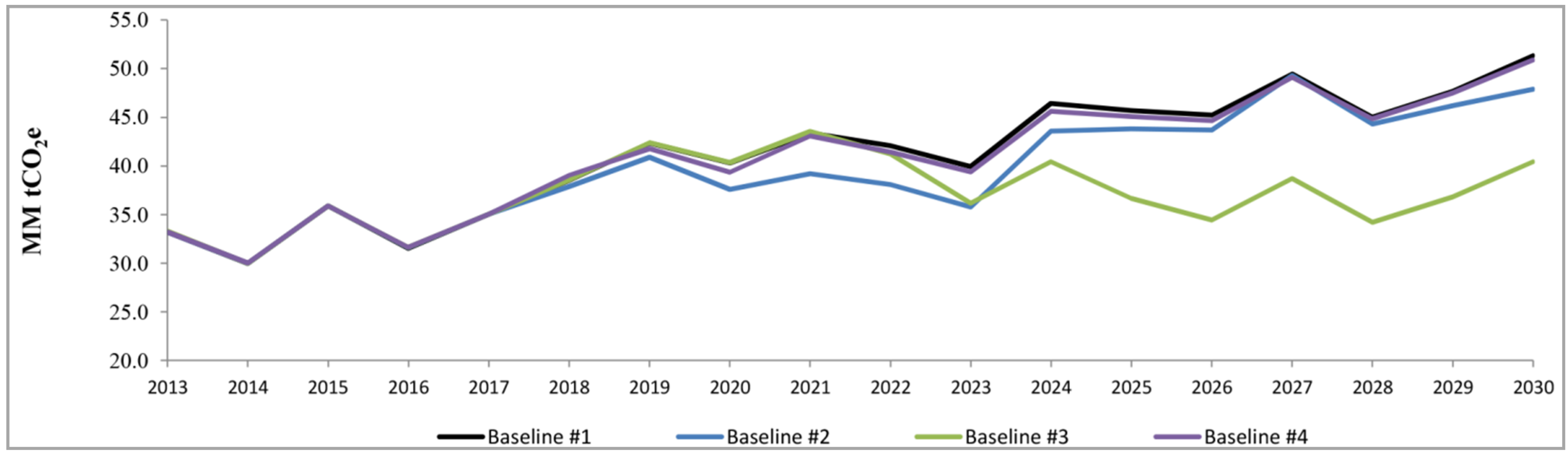

To evaluate the above uncertainties, a sensitivity analysis is proposed to manage the following aspects: solar photovoltaic technology investment cost, projection for LNG prices, and potential use of hydroelectric resources in the extreme south of Chile. Different baseline scenarios are built considering these variables. Other uncertain sources could be included in this analysis but the focus of this work has been limited to these in order to show the impact on the projection of GHG emission reduction and macroeconomic results.

The main contributions of this paper are: to analyse the impact of the carbon tax at the Chilean electricity sector using both a sectorial model and a DSGE model. A novel approach is proposed to integrate results from the sectorial model and a DSGE model. This work shows that the effectiveness of reducing GHG emission depends on some variables which could not be controlled by policy makers. Finally, the carbon tax is compared to other energy policies and interesting results are found.

The paper is organized in four sections. In

Section 2 the methodological approach and implementation are presented.

Section 3 presents the results and analysis of the Chilean case. Finally, in

Section 4 the main conclusions are summarized.