Economic Feasibility of V2G Frequency Regulation in Consideration of Battery Wear

Abstract

:1. Introduction

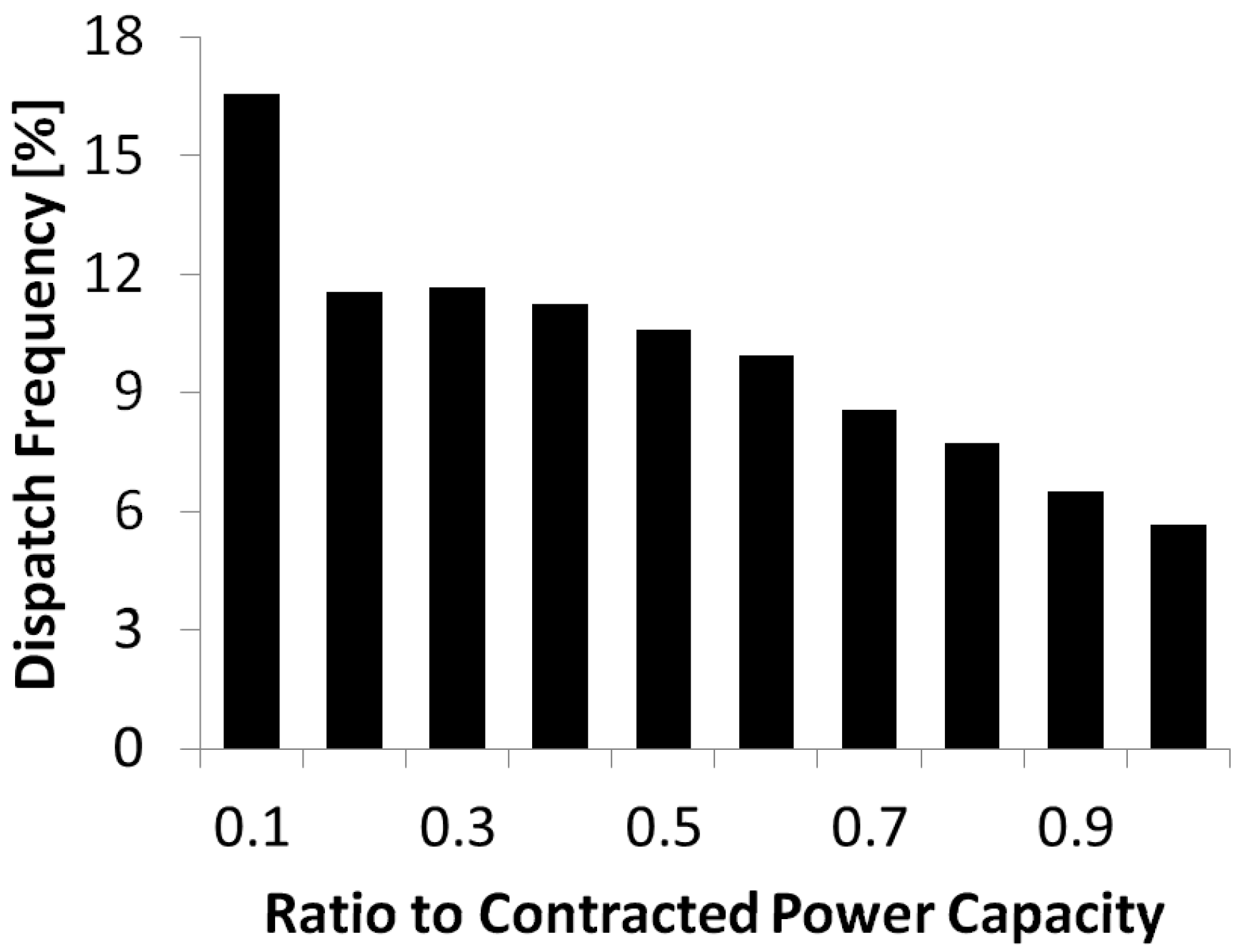

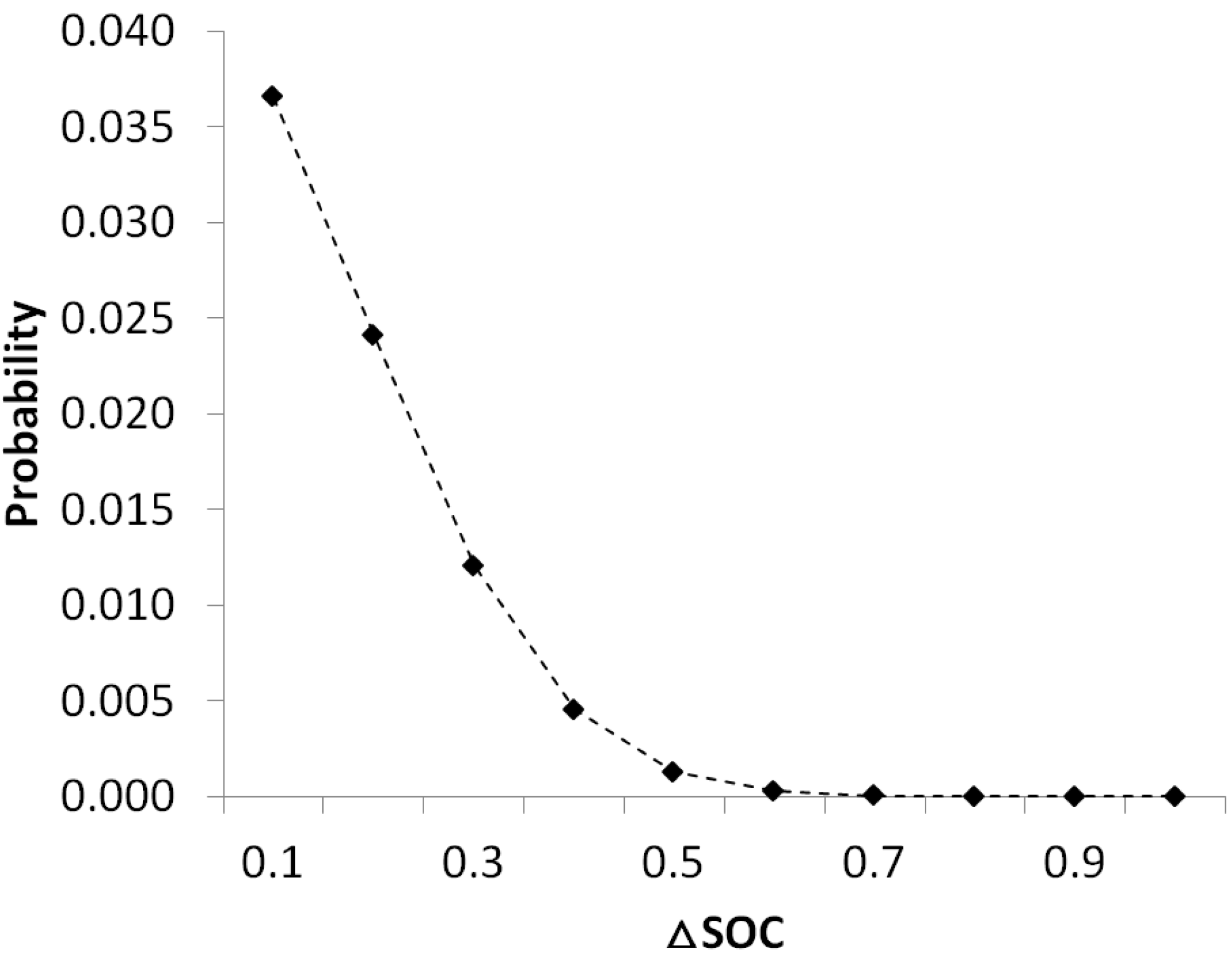

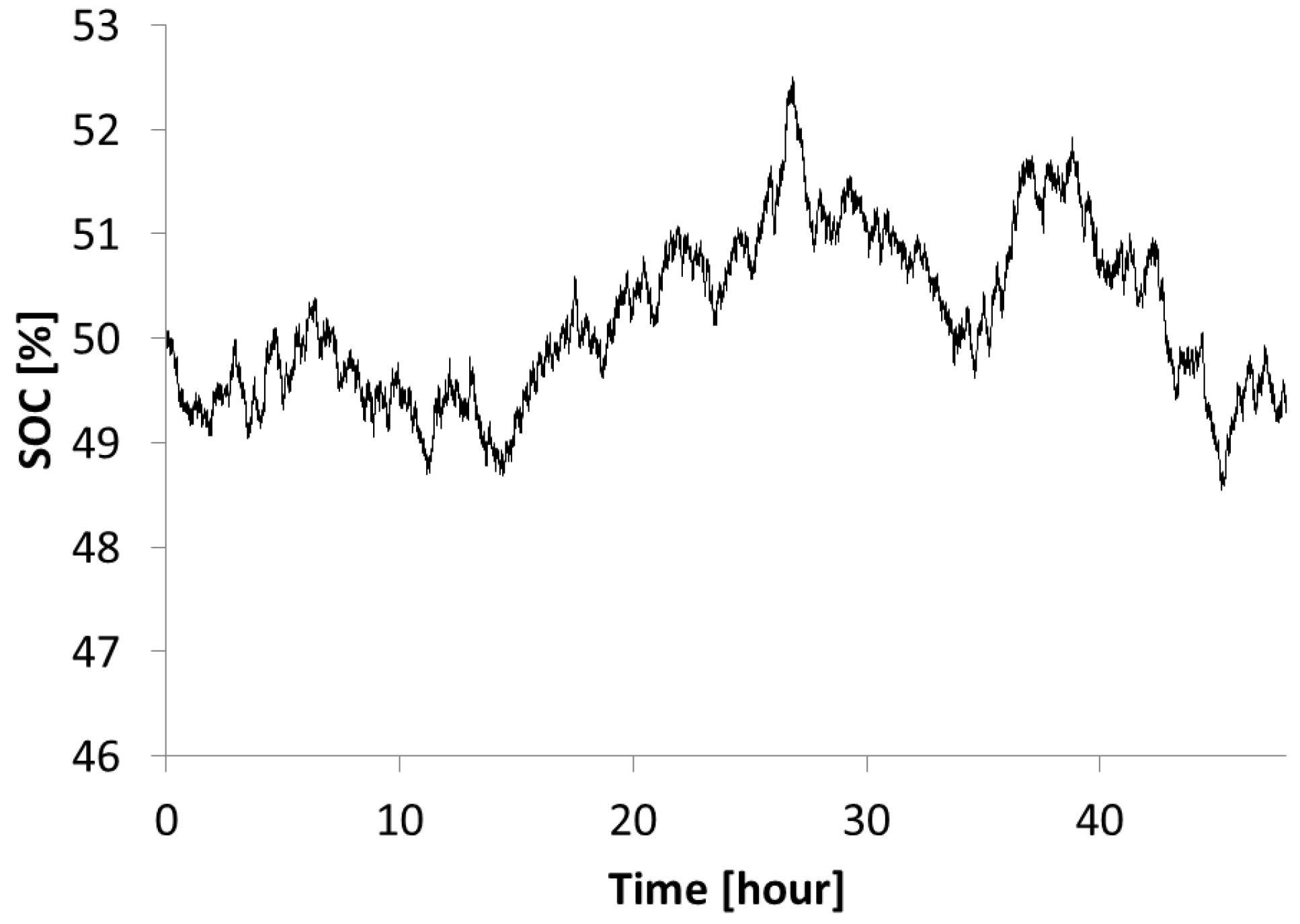

2. Analysis on the Regulation Signals

3. Considerations on Battery Wear Parameters

3.1. Temperature and Charge Rate

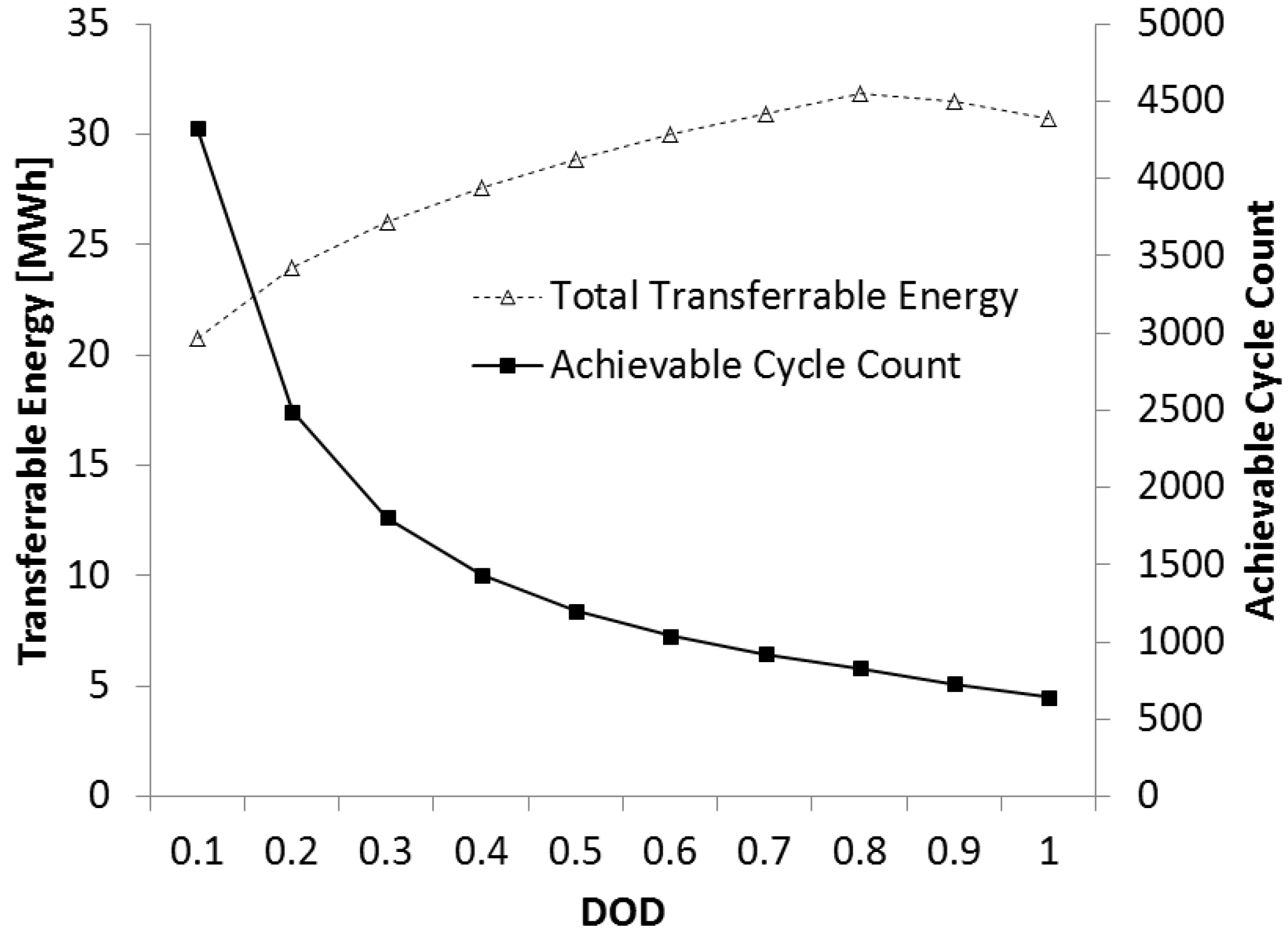

3.2. Depth-of-Discharge

4. Economic Feasibility of V2G Frequency Regulation

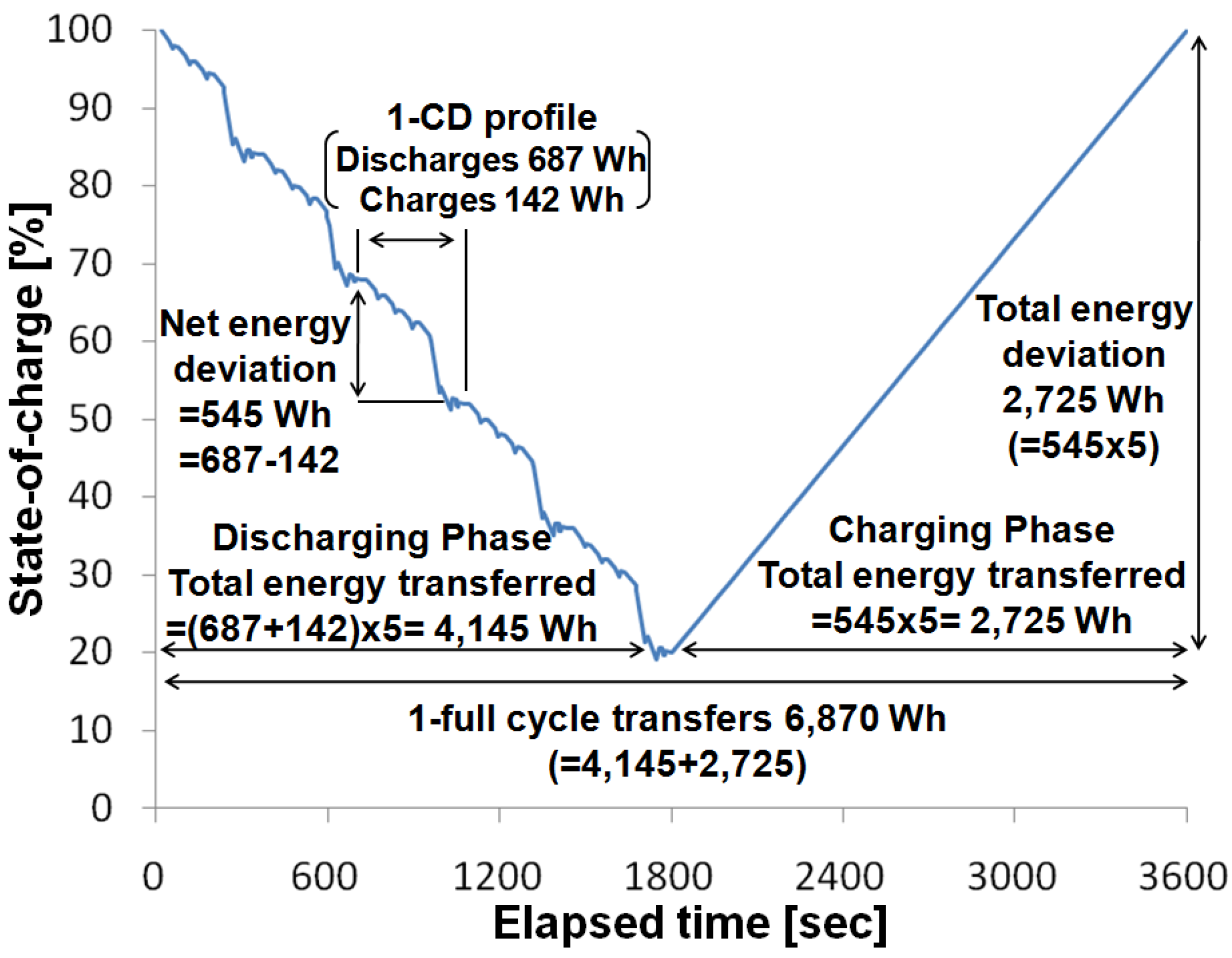

4.1. Analysis of the USABC Test Profiles

| Parameters | Minimum PHEV | Maximum PHEV | EV |

|---|---|---|---|

| CD cycle life target/Transferrable Energy(MWh) | 5000/34 | 5000/116 | 1000/79 |

| CS cycle life target/Transferrable Energy(MWh) | 300,000/30 | 300,000/30 | NA |

| LCE (MWh) | 64 | 146 | 79 |

| Effective energy capacity (kWh) | 2.7 | 9.3 | 32 |

| Average C-rate for CS profile | 1.25 | 0.37 | NA |

| Average C-rate for CD profile | 2.43 | 0.61 | 1.48 * |

4.2. V2G Economics Considering the Battery Price

| Title | Min. PHEV | Max. PHEV | EV |

|---|---|---|---|

| Battery Size (kWh) | 3.4 | 11.6 | 40 |

| Current Price ($) | 3400 | 11,600 | 12,000~20,000 |

| Goal Price ($) | 1700 | 3400 | 4000~6000 |

| V2G Income ($) | 12,800 | 29,200 | 15,800 * |

| Break-Even Regulation Price ($/kW-h) | 10.6 | 2.5 | 40 |

5. Experiment with a Real Battery: A Case Study

| Title | Min. PHEV | Max. PHEV | EV |

|---|---|---|---|

| Battery Size (kWh) | 3.4 | 11.6 | 40 |

| Current Price ($) | 3400 | 11,600 | 12,000~20,000 |

| Goal Price ($) | 1,700 | 3400 | 4000~6000 |

| V2G Income ($) with USABC goals | 12,800 | 29,200 | 15,800 * |

| V2G Income ($) with SK’s cells | 27,000 | 53,400 | 47,400 * |

| Break-Even Regulation Price for SK’s Battery ($/kW-h) | 5 | 8.7 | 13.8 |

6. Conclusions

Appendix

A1. For Minimum PHEV

A1.1. Charge Sustaining Mode

- ▪

- Charged energy: 50 Wh

- ▪

- Discharged energy: 50 Wh

- ▪

- Net energy deviation: 0 Wh

- ▪

- Single cycle energy (SCE): 100 Wh

- ▪

- Target cycle count: 300,000

- ▪

- Transferrable Energy during the target life cycle: (50 Wh + 50 Wh ) × 300,000 = 30 MWh

A1.2. Charge Depleting Mode

- ▪

- Charged energy: 142 Wh

- ▪

- Discharged energy: 687 Wh

- ▪

- Net energy deviation: −545 Wh

- ▪

- Transferred energy: 829 Wh

- ▪

- Repeat count for a single discharge cycle: 5

- ▪

- Single cycle energy (SCE): (829 Wh + 545 Wh) × 5 = 6870 Wh

- ▪

- Target cycle count: 5000

- ▪

- Transferrable Energy during the target life cycle: 6870 Wh × 5000 = 34 MWh

- -

- Life cycle energy (LCE): 30 MWh + 34 MWh = 64 MWh

- -

- Expected V2G income for minimum PHEV: 64 MWh × $200 = $12,800

A2. For Maximum PHEV

A2.1. Charge Sustaining Mode

- ▪

- Same as minimum PHEV: 30 MWh

A2.2. Charge Depleting Mode

- ▪

- Charged energy: 119 Wh

- ▪

- Discharged energy: 582 Wh

- ▪

- Net energy deviation: −463 Wh

- ▪

- Transferred energy: 701 Wh

- ▪

- Repeat count for a single discharge cycle: 20

- ▪

- Single cycle energy (SCE): (701 Wh + 463 Wh) × 20 = 23,280 Wh

- ▪

- Target cycle count: 5000

- ▪

- Transferrable Energy during the target life cycle: 23,280 MWh × 5000 = 116 MWh

- -

- Life cycle energy (LCE): 30 MWh + 116 MWh = 146 MWh

- -

- Expected V2G income for maximum PHEV: 146 MWh × $200 = $29,200

A3. For EV (with FUDS)

- -

- Target pack size specified by USABC: 40 kWh

- -

- Net energy deviation (at 80% DOD): −32 kWh

- -

- Discharging energy/net energy ratio: 123%

- -

- Charging energy/net energy ratio: 23.2%

- -

- Discharging energy during the pattern: 40 kWh × 80% × 123% = 39.36 kWh

- -

- Charging energy during the pattern: 40 kWh × 80% × 23.2% = 7.424 kWh

- -

- Single cycle energy (SCE): (39.36 kWh + 7.424 kWh + 32 kWh) = 79 kWh

- -

- Target cycle count: 1000

- -

- Life cycle energy (LCE): 79 kWh × 1000 = 79 MWh

- -

- Expected V2G income for EV: 79 MWh × $200 = $15,800

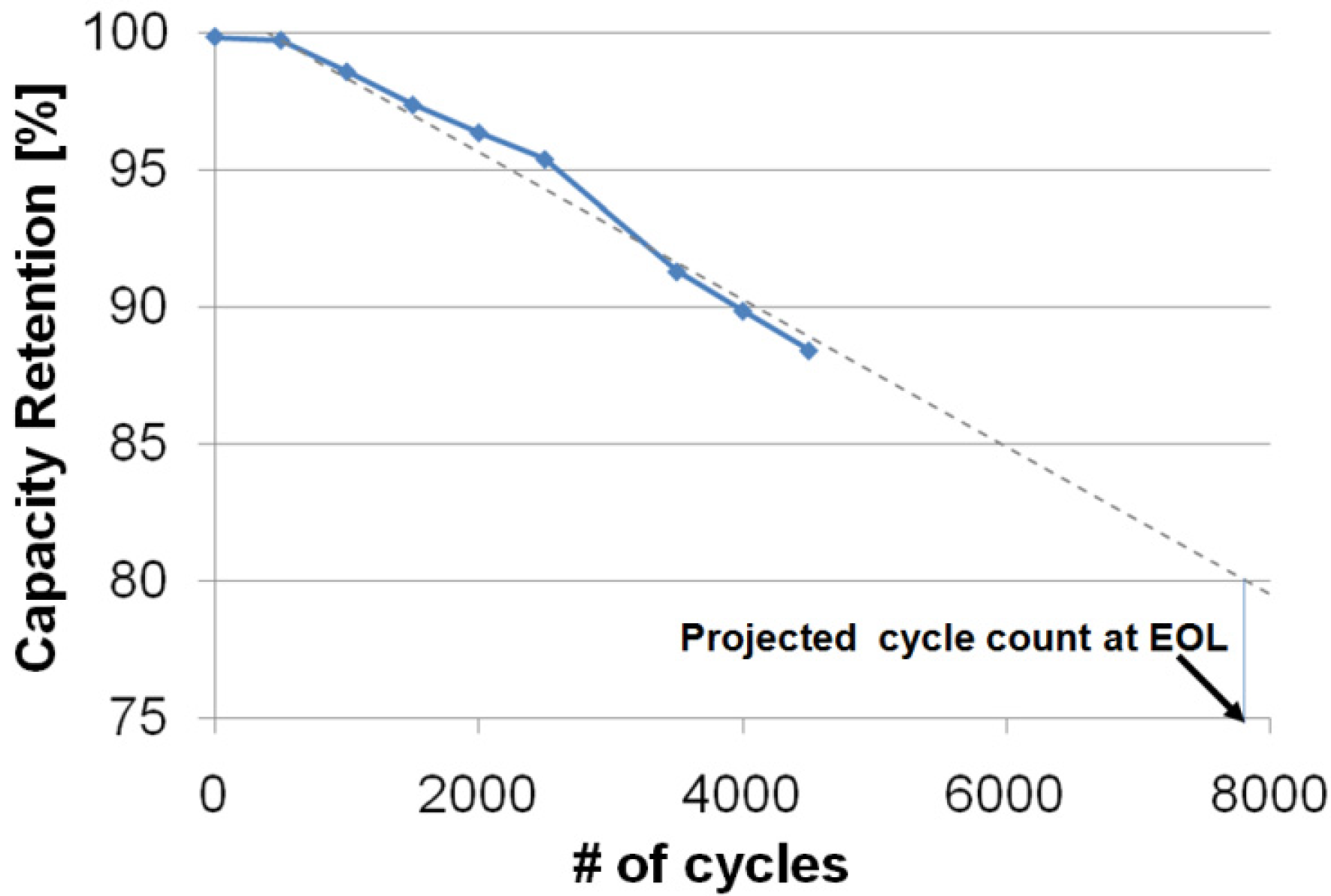

A3.1. SK Innovation’s 15 Ah cell for PHEV

- -

- Projected CS cycle count: 800,000 = 2.7 times of the target CS cycle count

- -

- Projected CD cycle count: 8000 = 1.6 times of the target CD cycle count

- -

- Life cycle energy (LCE) for minimum PHEV: 30 MWh × 2.7 + 34 MWh × 1.6 = 135 MWh

- -

- Life cycle energy (LCE) for maximum PHEV: 30 MWh × 2.7 + 116 MWh × 1.6 = 267 MWh

- -

- Expected V2G income for minimum PHEV: 135 MWh × $200 = $27,000

- -

- Expected V2G income for maximum PHEV: 267 MWh × $200 = $53,400

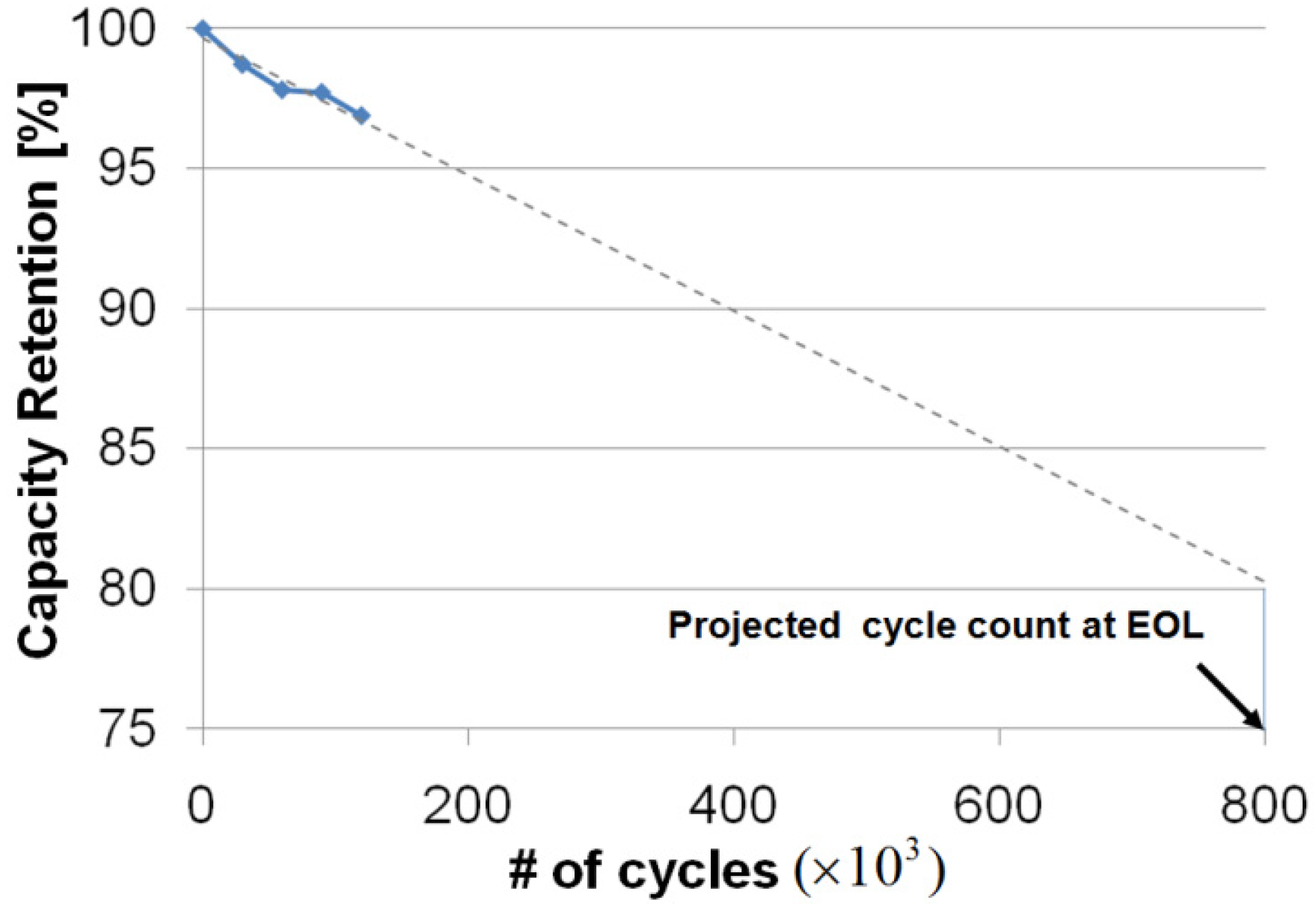

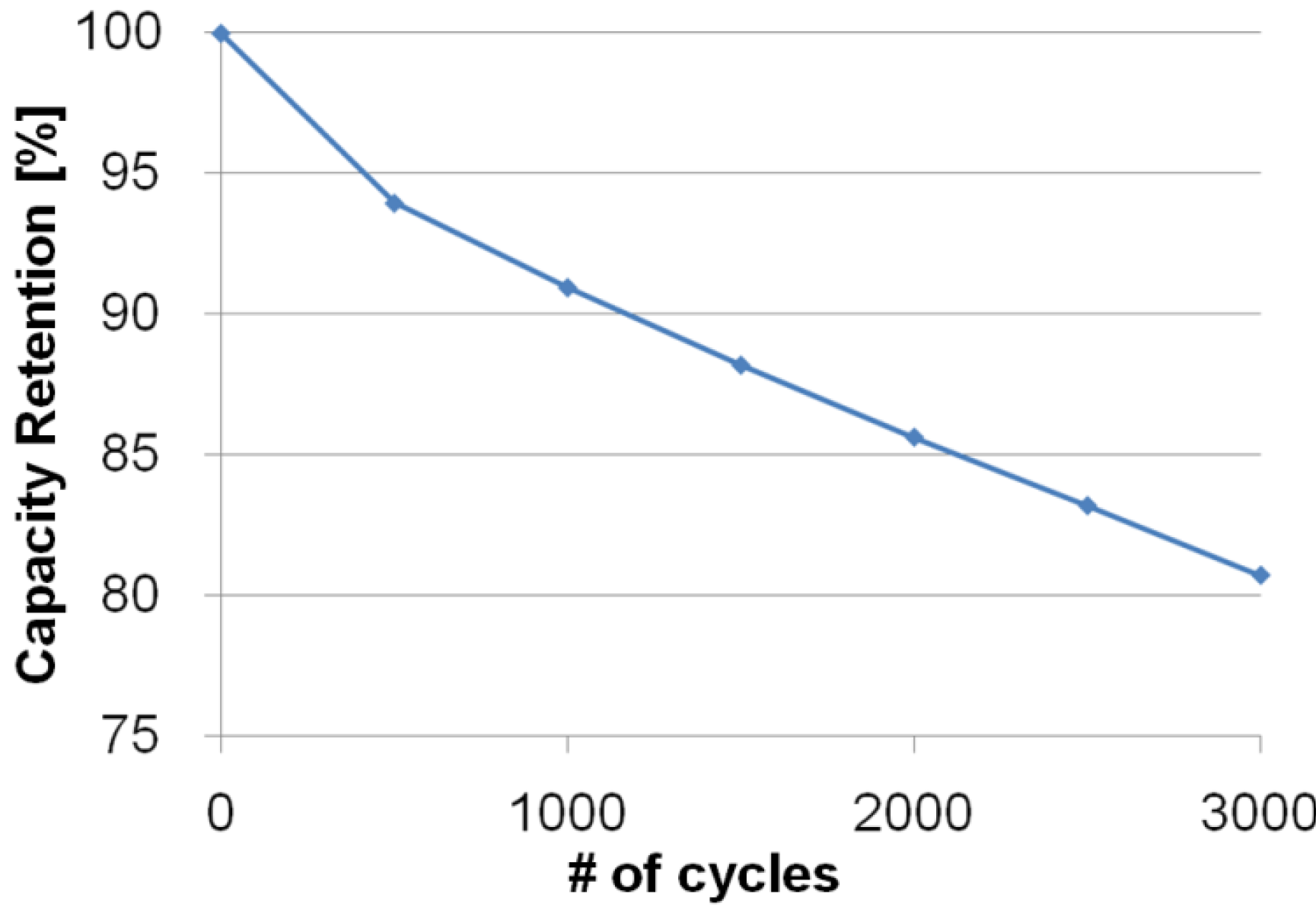

A3.2. SK Innovation’s 25 Ah cell for EV

- -

- Cycle count at EOL: 3000 = 3 times of the target EV cycle count

- -

- Life cycle energy (LCE) for EV (40 kWh): 79 MWh × 3 = 237 MWh

- -

- Expected V2G income for EV: 237 MWh × $200 = $47,400

References

- Kempton, W.; Letendre, S.E. Electric vehicles as a new power source for electric utilities. Transp. Res. D 1997, 2, 157–175. [Google Scholar] [CrossRef]

- Kempton, W.; Tomic, J. Vehicle-to-grid power fundamentals: Calculating capacity and net revenue. J. Power Sources 2005, 144, 268–279. [Google Scholar] [CrossRef]

- Kempton, W.; Kubo, T. Electric-drive vehicles for peak power in Japan. Energy Policy 2000, 28, 9–18. [Google Scholar] [CrossRef]

- Tomic, J.; Kempton, W. Using fleets of electric-drive vehicles forgrid support. J. Power Sources 2007, 168, 459–468. [Google Scholar] [CrossRef]

- Gage, T.B. Development and Evaluation of a Plug-in HEV with Vehicle-to-Grid Power Flow; Technical Report for AC Propulsion Inc.: San Dimas, CA, USA, 2003. [Google Scholar]

- Kempton, W.; Udo, V.; Huber, K.; Komara, K.; Letendre, S.; Baker, S.; Brunner, D.; Pearre, N. A Test of Vehicle-to-Grid (V2G) for Energy Storage and Frequency Regulation in the PJM System. Results from an Industry-University Research Partnership. 2008. Available online: http://www.udel.edu/V2G/resources/test-v2g-in-pjm-jan09.pdf (accessed on 31 January 2013).

- Petersona, S.; Whitacrea, J.; Apt, J. The economics of using plug-in hybrid electric vehicle battery packs for gridstorage. J. Power Sources 2010, 195, 2377–2384. [Google Scholar] [CrossRef]

- Petersona, S.; Apt, J.; Whitacrea, J. Lithium-ion battery cell degradation resulting from realistic vehicle andvehicle-to-grid utilization. J. Power Sources 2010, 195, 2385–2392. [Google Scholar] [CrossRef]

- Zhou, C.; Qian, K.; Zhou, W. Modeling of the cost of EV battery wear due to V2G application in power systems. IEEE Trans. Power Syst. 2011, 26, 1041–1050. [Google Scholar]

- Electric Vehicles Participating in the PJM Ancillary Services Market. Available online: http://www.pjm.com/about-pjm/exploring-tomorrows-grid/phev/evp-ancillary-serv-market.aspx (accessed on 20 December 2012).

- Hawkins, D. Power storage R&D—What do the next five years look like? In Proceedings of 2nd Annual Power Storage Conference, Houston, TX, USA, 8 February 2010.

- Cost Development Guideline from PJM. Available online: http://www.pjm.com/~/media/committees-groups/subcommittees/cds/20120409/20120409-item-06b-m15-unit-types-not-in-m15-solar-batteries-flywheels.ashx (accessed on 20 December 2012).

- PJM Regulation Zone Preliminary Billing Data. Available online: http://www.pjm.com/markets-and-operations/market-settlements/preliminary-billing-reports/pjm-reg-data.aspx (accessed on 20 December 2012).

- Han, S.; Han, S.H.; Sezaki, K. Development of an optimal Vehicle-to-Grid aggregator for frequency regulation. IEEE Trans. Smart Grid 2010, 1, 65–72. [Google Scholar] [CrossRef]

- PJM Regulation Make Whole Percentages-2010. Available online: http://www.pjm.com/~/media/markets-ops/ancillary/regulation-make-whole-mw.ashx (accessed on 20 December 2012).

- Marano, V.; Onori, S.; Guezennec, Y.; Rizzoni, G.; Madella, N. Lithium-ion batteries life estimation for plug-in hybrid electric vehicles. In Proceedings of IEEE Vehicle and Propulsion Conference, Dearborn, MI, USA, 7–10 September 2009; pp. 536–543.

- Drouilhet, S.; Johnson, B.L. A battery life prediction method for hybrid power application. In Presented at 35th AIAA Aerospace Sciences Meeting Exhibit, Reno, NV, USA, 6–9 January 1997.

- Bashash, S.; Moura, S.J.; Forman, J.C.; Fathy, H.K. Plug-in hybrid electric vehicle charge pattern optimization for energy cost and battery longevity. J. Power Sources 2011, 196, 541–549. [Google Scholar] [CrossRef]

- USABC Requirements of End of Life Energy Storage Systems for PHEVs. Available online: http://batt.lbl.gov/files/USABC-Goals-for-PHEVs-EVs-2-pg.pdf (accessed on 31 January 2013).

- Idaho National Laboratory. Battery Test Manual for Plug-in Hybrid Electric Vehicles; U.S. Department of Energy: Washington, DC, USA, 2010. Available online: http://batt.lbl.gov/files/USABC-Goals-for-PHEVs-EVs-2-pg.pdf (accessed on 31 January 2013).

- Kruse, R.; Huls, T. Development of the Federal Urban Driving Schedule; SAE Technical Paper 730553; SAE International: Warrendale, PA, USA, 7305. [Google Scholar] [CrossRef]

- Anderman, M. Electric, plug-in, and hybrid vehicles: Demonstration, niche markets, and mass markets. In Proceedings of 9th International Advanced Automotive Battery & EC Capacitor Conference, Long Beach, CA, USA, 10–12 June 2009.

- EV Batteries Plummet in Price: Down to $400 per kWh. Available online: http://www.greentechmedia.com/articles/read/ev-batteries-dropping-rapidly-in-price (accessed on 20 December 2012).

- Miller, T. Lithium, lithium everywhere, but who can make it economical? In Proceedings of 9th International Advanced Automotive Battery & EC Capacitor Conference, Long Beach, CA, USA, 10–12 June 2009.

- Howell, D. Electric drive vehicle battery R&D and manufacturing initiatives at the US Department of Energy. In Proceedings of 9th International Advanced Automotive Battery & EC Capacitor Conference, Long Beach, CA, USA, 10–12 June 2009.

- USABC Goals for Advanced Batteries for EV. Available online: http://www.uscar.org/commands/files_download.php?files_id=27 (accessed on 20 December 2012).

© 2013 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Han, S.; Han, S. Economic Feasibility of V2G Frequency Regulation in Consideration of Battery Wear. Energies 2013, 6, 748-765. https://doi.org/10.3390/en6020748

Han S, Han S. Economic Feasibility of V2G Frequency Regulation in Consideration of Battery Wear. Energies. 2013; 6(2):748-765. https://doi.org/10.3390/en6020748

Chicago/Turabian StyleHan, Sekyung, and Soohee Han. 2013. "Economic Feasibility of V2G Frequency Regulation in Consideration of Battery Wear" Energies 6, no. 2: 748-765. https://doi.org/10.3390/en6020748

APA StyleHan, S., & Han, S. (2013). Economic Feasibility of V2G Frequency Regulation in Consideration of Battery Wear. Energies, 6(2), 748-765. https://doi.org/10.3390/en6020748