Have the Links Between Natural Gas and Coal Prices Changed over Time? Evidence for European and Pacific Markets

Abstract

1. Introduction

- How are price linkages formed, and what characteristics do they exhibit for energy commodities such as coal and natural gas?

- How have long-term and short-term price linkages between coal and natural gas markets in the Pacific and Europe evolved between 2006 and 2023?

- Have there been significant changes in the long-term and short-term price relationships between coal and natural gas in the European and Pacific regions during the period 2006–2023?

2. Literature Review

2.1. Market Price Linkages—Theory

2.2. Rationale for the Connections Between Commodities

2.3. Connections Between Gas and Coal in Europe and the Asia-Pacific Region

3. Materials and Methods

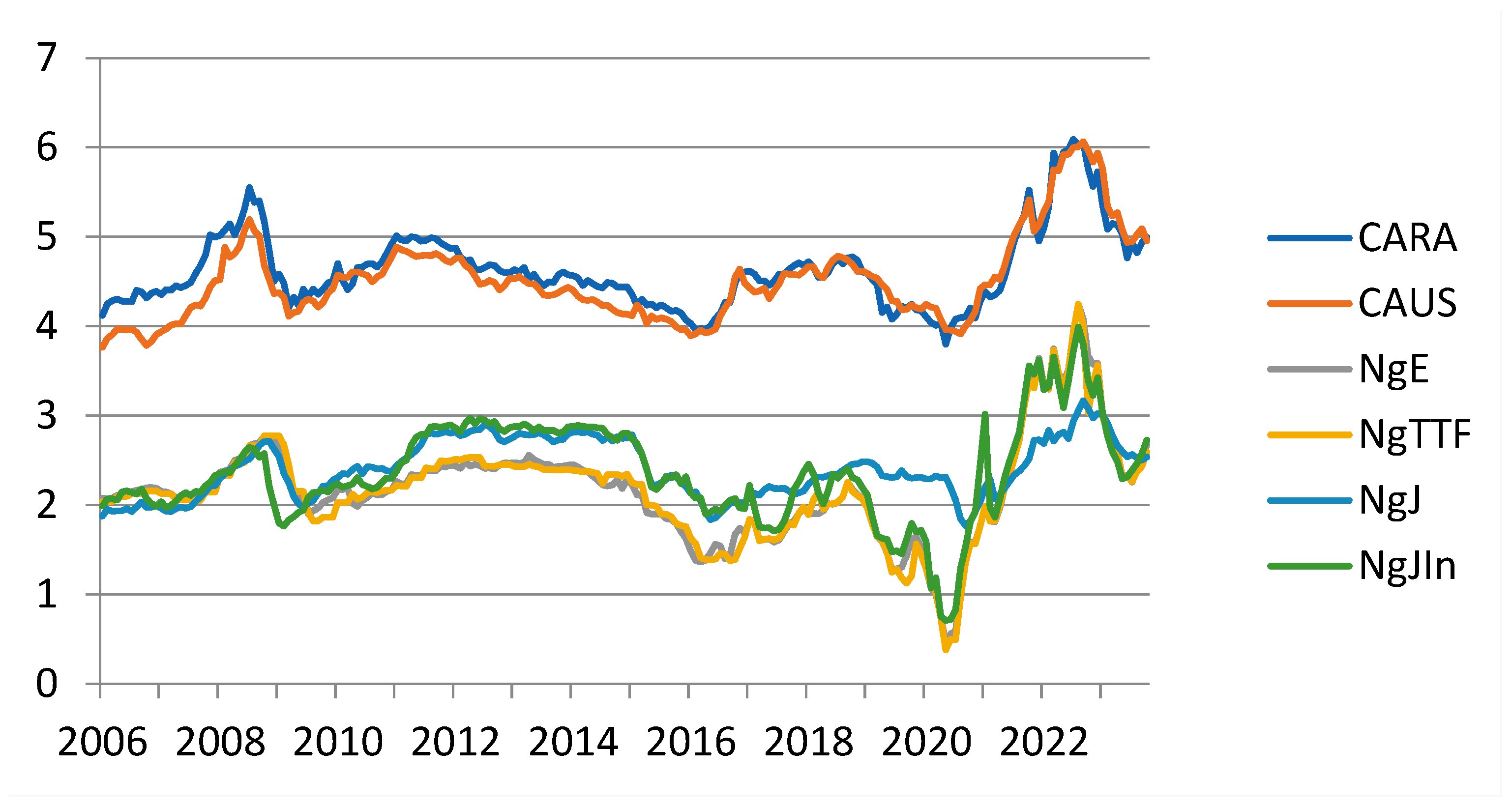

- CARA—ARA Coal Prices (Amsterdam–Rotterdam–Antwerp) refer to coal prices set in the European market. These are some of the most commonly used reference prices for coal trading in Europe.

- CAUS—AUS Coal Prices refer to coal exported from Australia, which are determined based on transactions in international markets. AUS coal mainly refers to coal exported from ports in Australia, one of the largest coal exporters in the world.

- NgE—E Gas Prices refer to natural gas prices on European markets, specifically the prices of gas at the NBP (National Balancing Point) hub in the United Kingdom. NBP is a virtual trading point within the UK gas system that facilitates natural gas trading. It is one of the oldest and most developed gas markets in Europe.

- NgTTF—TTF Gas Prices refer to natural gas quotations on the Dutch gas exchange, which is one of the most important wholesale gas markets in Europe. TTF is a virtual trading point that allows natural gas trading in Europe through futures and spot contracts.

- NgJ—JKM Gas Prices (Japan Korea Marker) refer to liquefied natural gas (LNG) prices in the North-East Asian market, primarily covering Japan, South Korea, China, and Taiwan. JKM is a key price index used in spot LNG transactions, i.e., short-term market trading in this region.

- NgJIn—Import Gas Prices from Indonesia to Japan refer to the prices that Japan pays for liquefied natural gas (LNG) imported from Indonesia. These prices can depend on various factors, including the type of contract involved. In this study, spot prices were used.

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Xing, X.; Cong, Y.; Wang, Y.; Wang, X. The Impact of COVID-19 and War in Ukraine on Energy Prices of Oil and Natural Gas. Sustainability 2023, 15, 14208. [Google Scholar] [CrossRef]

- Zakeri, B.; Paulavets, K.; Barreto-Gomez, L.; Echeverri, L.G.; Pachauri, S.; Boza-Kiss, B.; Zimm, C.; Rogelj, J.; Creutzig, F.; Ürge-Vorsatz, D.; et al. Pandemic, War, and Global Energy Transitions. Energies 2022, 15, 6114. [Google Scholar] [CrossRef]

- Zakeri, B.; Staffell, I.; Dodds, P.E.; Grubb, M.; Ekins, P.; Jääskeläinen, J.; Cross, S.; Helin, K.; Gissey, G.C. The role of natural gas in setting electricity prices in Europe. Energy Rep. 2023, 10, 2778–2792. [Google Scholar] [CrossRef]

- ENTSO-E. Available online: https://www.entsoe.eu/data/power-stats/ (accessed on 4 June 2023).

- Perrings, C. Substitutability and the Valuation of Natural Capital. In Conservation: Economics, Science, and Policy; Oxford Academic: Oxford, UK, 2021. [Google Scholar] [CrossRef]

- Puka, R.; Jedrusik, S. A New Measure of Complementarity in Market Basket Data. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 670–681. [Google Scholar] [CrossRef]

- Telser, L.G. A theory of monopoly of complementary goods. J. Bus. 1979, 52, 211–230. [Google Scholar] [CrossRef]

- Gentzkow, M. Valuing new goods in a model with complementarity: Online newspapers. Am. Econ. Rev. 2007, 97, 713–744. [Google Scholar] [CrossRef]

- Yalcin, T.; Ofek, E.; Koenigsberg, O.; Biyalogorsky, E. Complementary goods: Creating, capturing, and competing for value. Mark. Sci. 2013, 32, 554–569. [Google Scholar] [CrossRef]

- Syverson, C. Product substitutability and productivity dispersion. Rev. Econ. Stat. 2004, 86, 534–550. [Google Scholar] [CrossRef]

- Georgieff, A.; Hyee, R. Artificial intelligence and employment: New cross-country evidence. Front. Artif. Intell. 2022, 5, 832736. [Google Scholar] [CrossRef]

- Tian, Y.; Lautz, S.; Wallis, A.O.G.; Lambiotte, R. Extracting complements and substitutes from sales data: A network perspective. EPJ Data Sci. 2021, 10, 45. [Google Scholar] [CrossRef]

- Adhikari, R.; Putnam, K.J. Comovement in the commodity futures markets: An analysis of the energy, grains, and livestock sectors. J. Commod. Mark. 2020, 18, 100090. [Google Scholar] [CrossRef]

- Hamao, Y.; Masulis, R.W.; Ng, V. Correlations in Price Changes and Volatility across International Stock Markets. Rev. Financ. Stud. 1990, 3, 281–307. [Google Scholar] [CrossRef]

- Wang, Y.; Jian, C. Sustainable plant-based ingredients as wheat flour substitutes in bread making. npj Sci. Food 2022, 6, 49. [Google Scholar] [CrossRef]

- Przekota, G. Do High Fuel Prices Pose an Obstacle to Economic Growth? A Study for Poland. Energies 2022, 15, 6606. [Google Scholar] [CrossRef]

- Debnath, D.; Whistance, J.; Thompson, W.; Binfield, J. Complement or substitute: Ethanol’s uncertain relationship with gasoline under alternative petroleum price and policy scenarios. Appl. Energy 2017, 191, 385–397. [Google Scholar] [CrossRef]

- Katarzyński, D.; Przekota, G. Pro-Inflationary Significance of Energy Commodity and Electricity Prices. Acta Scientiarum Polonorum. Oeconomia 2024, 23, 29–40. [Google Scholar] [CrossRef]

- Neely, C.J. The Russian Invasion, Oil and Gasoline Prices, and Recession. Econ. Synop. 2022, 10, 1–2. [Google Scholar] [CrossRef]

- von Homeyer, I.; Oberthür, S.; Dupont, C. Implementing the European Green Deal during the Evolving Energy Crisis. J. Common Mark. Stud. 2022, 60, 125–136. [Google Scholar] [CrossRef]

- Painter, D.S. Oil and Geopolitics: The Oil Crises of the 1970s and the Cold War. Hist. Soc. Res. 2014, 39, 186–208. [Google Scholar]

- Kilian, L.; Zhou, X. Oil Prices, Gasoline Prices and Inflation Expectations: A New Model and New Facts; Federal Reserve Bank of Dallas: Dallas, TX, USA, 2020. [Google Scholar]

- Rembeza, J. Coal prices in Poland: Is the domestic market separated from the international market? Int. J. Energy Econ. Policy 2020, 10, 405–410. [Google Scholar] [CrossRef]

- Li, H.; Chen, L.; Wang, D.; Zhang, H. Analysis of the Price Correlation between the International Natural Gas and Coal. Energy Procedia 2017, 142, 3141–3146. [Google Scholar] [CrossRef]

- Villar, J.A.; Joutz, F.L. The relationship between crude oil and natural gas prices. Energy Inf. Adm. 2006, 1, 1–43. [Google Scholar]

- Aloui, D.; Goutte, S.; Guesmi, K.; Hchaichi, R. COVID 19’s Impact on Crude Oil and Natural Gas S&P GS Indexes. 2020. Available online: https://shs.hal.science/halshs-02613280/ (accessed on 29 May 2024).

- Bartholomae, F.; Morasch, K. Oil Price Indexing of Natural Gas Prices: An Economic Analysis. Rev. Econ. 2007, 58, 250–264. [Google Scholar] [CrossRef]

- Mchich, A.; Till, H. Is Oil-Indexation Still Relevant for Pricing Natural Gas? CME Group, Articles and Reports. 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3709139 (accessed on 29 May 2024).

- Min, H. Examining the Impact of Energy Price Volatility on Commodity Prices from Energy Supply Chain Perspectives. Energies 2022, 15, 7957. [Google Scholar] [CrossRef]

- Lorenz, U.; Grudzinski, Z. Hard coal for energetic purposes: Price-quality relationships; international coal market observations and Polish practice. Appl. Energy 2003, 74, 271–279. [Google Scholar] [CrossRef]

- Zhu, S.; Chi, Y.; Gao, K.; Chen, Y.; Peng, R. Analysis of Influencing Factors of Thermal Coal Price. Energies 2022, 15, 5652. [Google Scholar] [CrossRef]

- Dubiński, J.; Turek, M. Chances and Threats of Hard Coal Mining Development in Poland. Arch. Min. Sci. 2014, 59. [Google Scholar]

- Liu, X.; Wojewodzki, M.; Cai, Y.; Sharma, S. The dynamic relationships between carbon prices and policy uncertainties. Technol. Forecast. Soc. Change 2023, 188, 122325. [Google Scholar] [CrossRef]

- Zarębski, P.; Katarzyński, D. Small Modular Reactors (SMRs) as a Solution for Renewable Energy Gaps: Spatial Analysis for Polish Strategy. Energies 2023, 16, 6491. [Google Scholar] [CrossRef]

- Anderson, R.J. Europe’s Dependence on Russian Natural Gas: Perspectives and Recommendations for a Long-Term Strategy; George C. Marshall European Center for Security Studies: Garmisch-Partenkirchen, Germany, 2008. [Google Scholar]

- Chai, J.; Zhang, X.; Lu, Q.; Zhang, X.; Wang, Y. Research on imbalance between supply and demand in China’s natural gas market under the double-track price system. Energy Policy 2021, 155, 112380. [Google Scholar] [CrossRef]

- Sgarciu, S.; Scholz, D.; Müsgens, F. How CO2 prices accelerate decarbonisation–The case of coal-fired generation in Germany. Energy Policy 2023, 173, 113375. [Google Scholar] [CrossRef]

- Loewen, B. Coal, green growth and crises: Exploring three European Union policy responses to regional energy transitions. Energy Res. Soc. Sci. 2022, 93, 102849. [Google Scholar] [CrossRef]

- Rečka, L.; Ščasný, M. Impacts of carbon pricing, brown coal availability and gas cost on Czech energy system up to 2050. Energy 2016, 108, 19–33. [Google Scholar] [CrossRef]

- Faiella, I.; Mistretta, A. The Net Zero Challenge for Firms’ Competitiveness. Environ. Resour. Econ. 2022, 83, 85–113. [Google Scholar] [CrossRef]

- Zábojník, S.; Steinhauser, D.; Peštová, V. Decarbonisation: Do EU Electricity Costs Harm Export Competitiveness? Amfiteatru Econ. 2023, 25, 522–540. [Google Scholar] [CrossRef]

- Mišík, M. The EU Needs to Improve Its External Energy Security. Energy Policy 2022, 165, 112930. [Google Scholar] [CrossRef]

- Alam, M.S.; Murshed, M.; Manigandan, P.; Pachiyappan, D.; Abduvaxitovna, S.Z. Forecasting oil, coal, and natural gas prices in the pre-and post-COVID scenarios: Contextual evidence from India using time series forecasting tools. Resour. Policy 2023, 81, 103342. [Google Scholar] [CrossRef]

- Nagle, P.; Tema, K. Energy Market Developments: Coal and Natural Gas Prices Reach Record Highs; World Bank Blogs: Washington, DC, USA, 2022. [Google Scholar]

- Alvarez, C.F.; Molnar, G. What Is Behind Soaring Energy Prices and What Happens Next? IEA: International Energy Agency. France. Available online: https://coilink.org/20.500.12592/4bx52n (accessed on 14 April 2025).

- Chen, L.; Pan, L.; Zhang, K. The Dynamic Cointegration Relationship between International Crude Oil, Natural Gas, and Coal Price. Energies 2024, 17, 3126. [Google Scholar] [CrossRef]

- Erdős, P. Have Oil and Gas Prices Got Separated? Energy Policy 2012, 49, 707–718. [Google Scholar] [CrossRef]

- Chiappini, R.; Jégourel, Y.; Raymond, P. Towards a Worldwide Integrated Market? New Evidence on the Dynamics of US, European and Asian Natural Gas Prices. Energy Econ. 2019, 81, 545–565. [Google Scholar] [CrossRef]

- Ramberg, D.J.; Parsons, J.E. The weak tie between natural gas and oil prices. Energy J. 2012, 33, 13–35. [Google Scholar] [CrossRef]

- Bai, J.; Perron, P. Critical values for multiple structural change tests. Econom. J. 2003, 6, 72–78. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Campos, A.; Fernandes, C.P. The geopolitics of energy. Geopolit. Energy Energy Secur. 2017, 23–40. [Google Scholar] [CrossRef]

- Chevallier, J.; Nguyen, D.K.; Reboredo, J.C. A conditional dependence approach to CO2-energy price relationships. Energy Econ. 2019, 81, 812–821. [Google Scholar] [CrossRef]

- Wilson, I.A.G.; Staffell, I. Rapid fuel switching from coal to natural gas through effective carbon pricing. Nat. Energy 2018, 3, 365–372. [Google Scholar] [CrossRef]

- Kartal, M.T.; Pata, U.K.; Depren, S.K.; Depren, Ö. Effects of possible changes in natural gas, nuclear, and coal energy consumption on CO2 emissions: Evidence from France under Russia’s gas supply cuts by dynamic ARDL simulations approach. Appl. Energy 2023, 339, 120983. [Google Scholar] [CrossRef]

- Zhang, Y.; Hajiyev, N.; Smirnov, V. Tariff and non-tariff instruments of OPEC+ trade wars. Energy Strategy Rev. 2021, 38, 100771. [Google Scholar] [CrossRef]

- Khan, K.; Su, C.-W.; Rehman, A.U. Do multiple bubbles exist in coal price? Resour. Policy 2021, 73, 102232. [Google Scholar] [CrossRef]

- Ma, Y.; Wang, J. Co-movement between oil, gas, coal, and iron ore prices, the Australian dollar, and the Chinese RMB exchange rates: A copula approach. Resour. Policy 2019, 63, 101471. [Google Scholar] [CrossRef]

- Thomas, S.; Rosenow, J. Drivers of increasing energy consumption in Europe and policy implications. Energy Policy 2020, 137, 111108. [Google Scholar] [CrossRef]

| Commodity | I~0 | I~1 | ||

|---|---|---|---|---|

| Constant | Constant and Trend | Constant | Constant and Trend | |

| CARA | −3.9674 | −3.6825 | −12.7885 c | −13.3747 c |

| CAUS | −3.6297 | −3.5580 | −10.4768 c | −10.6301 c |

| NgE | −3.6362 | −4.2477 | −11.7214 c | −11.9260 c |

| NgTTF | −3.30989 | −4.0508 | −12.6312 c | −12.7935 c |

| NgJ | −3.6447 | −4.7157 a | −10.2566 c | −9.5703 c |

| NgJIn | −4.1785 a | −4.4394 | −4.4775 b | −4.8514 b |

| Variable | 2006–2023 | 2006–2011 | 2012–2017 | 2018–2023 | |

|---|---|---|---|---|---|

| Endogenous | Exogenous | ||||

| NgE | CARA | 13.07 c | 38.32 d | 6.33 b | 0.65 |

| CARA | NgE | 8.50 b | 8.93 b | 8.71 b | 18.58 d |

| NgTTF | CARA | 9.57 b | 25.66 d | 18.22 d | 0.87 |

| CARA | NgTTF | 2.56 | 10.21 c | 9.18 c | 11.27 c |

| NgJ | CAUS | 27.79 d | 25.42 d | 5.87 b | 28.82 d |

| CAUS | NgJ | 8.66 b | 2.88 | 3.54 | 4.26 |

| NgJIn | CAUS | 20.28 d | 19.57 d | 9.26 c | 10.45 b |

| CAUS | NgJIn | 7.86 b | 4.75 | 2.09 | 24.86 d |

| Endogenous, Exogenous Variable Period | Bounds Test | Cointegrated Equations |

|---|---|---|

| NgE, CARA | ||

| 2006–2023 | 2.3497 | NgE = −2.8820 d + 1.090 CARA b |

| 2006–2011 | 9.2270 d | NgE = −0.9325 b + 0.6849 CARA d |

| 2012–2017 | 3.2119 | NgE = −23.8508 + 5.7165 CARA |

| 2018–2023 | 2.9983 | NgE = −4.3185 d + 1.3772 CARA d |

| NgTTF, CARA | ||

| 2006–2023 | 4.8816 c | NgTTF = −3.6489 d + 1.2555 CARA d |

| 2006–2011 | 11.5936 d | NgTTF = −1.8847 b + 0.8875 CARA d |

| 2012–2017 | 7.6604 d | NgTTF = −18.7019 a + 4.5981 CARA b |

| 2018–2023 | 3.1423 | NgTTF = −4.3069 d + 1.3687 CARA d |

| NgJ, CAUS | ||

| 2006–2023 | 3.8901 a | NgJ = 0.9045 + 0.7368 CAUS d |

| 2006–2011 | 9.8642 d | NgJ = −1.0567 c + 0.7619 CAUS d |

| 2012–2017 | 2.6146 | NgJ = −8.5039 + 2.4859 CAUS |

| 2018–2023 | 9.7543 d | NgJ = 0.1522 + 0.4793 CAUS d |

| NgJIn, CAUS | ||

| 2006–2023 | 1.5264 | NgJIn = 0.6256 + 0.3742 CAUS |

| 2006–2011 | 0.3553 | NgJIn = −4.2565 + 1.5071 CAUS |

| 2012–2017 | 2.5873 | NgJIn = −12.7889 + 3.4195 CAUS |

| 2018–2023 | 2.0934 | NgJIn = −2.1498 + 0.9305 CAUS |

| Endogenous, Exogenous Variable Period | Bounds Test | Cointegrated Equations |

|---|---|---|

| CARA, NgE | ||

| 2006–2023 | 3.3705 | CARA = 3.441 d + 0.5550 NgE d |

| 2006–2011 | 3.9377 a | CARA = −4.9090 + 4.1969 NgE |

| 2012–2017 | 2.8533 | CARA = 5.3863 c − 0.4434 NgE |

| 2018–2023 | 16.1281 d | CARA = 3.2961 d + 0.6566 NgE d |

| CARA, NgTTF | ||

| 2006–2023 | 2.7845 | CARA = 3.5591 d + 0.5094 NgTTF d |

| 2006–2011 | 4.3841 b | CARA = −51.6903 + 24.8642 NgTTF |

| 2012–2017 | 3.3054 | CARA = 6.4541 a − 0.9668 NgTTF |

| 2018–2023 | 9.4005 d | CARA = 3.3168 + 0.6581 NgTTF |

| CAUS, NgJ | ||

| 2006–2023 | 4.1625 a | CAUS = 22.8752 − 7.8616 NgJ |

| 2006–2011 | 2.6221 | CAUS = −8.1853 + 5.3628 NgJ |

| 2012–2017 | 2.2799 | CAUS = 10.8431 − 2.6671 NgJ |

| 2018–2023 | 0.8794 | CAUS = −4.5728 + 3.7946 NgJ |

| CAUS, NgJIn | ||

| 2006–2023 | 1.8961 | CAUS = 4.1238 d + 0.2060 NgJIn |

| 2006–2011 | 1.8304 | CAUS = 6.4672 − 0.8703 NgJIn |

| 2012–2017 | 2.0118 | CAUS = 7.1325 a − 1.1540 NgJIn |

| 2018–2023 | 10.5194 d | CAUS = 3.0021 d + 0.7805 NgJIn d |

| Endogenous, Exogenous Variable Period | ECM Reressions |

|---|---|

| CARA, NgE | |

| 2006–2011 | d(NgE) = 0.0550 d(NgE(-−1) − 0.0414 d(CARA) − 0.0056 d(CARA(−1)– −0.2362 CEq(−1)d; Adj R2 = 0.4136 |

| NgTTF, CARA | |

| 2006–2023 | d(NgTTF) = 0.1436 d(NgTTF(−1)) b + 0.4882 d(CARA) d − 0.0992 CEq(−1) d Adj. R2 = 0.2556 |

| 2006–2011 | d(NgTTF) = 0.0297 d(CARA) − 0.1743 CEq(−1) d Adj R2 = 0.3971 |

| 2012–2017 | |

| NgJ, CAUS | d(NgTTF) = 0.1789(NgTTF(−1) − 0.2811 d(NgTTF(−2) + 0.1764 d(CARA) a− −0.0202 d(CARA(−1) + 0.3368 d(CARA(−2) c + 0.2398 d(CARA(−3)) d – 0.0359 CEq(−1) d Adj R2 = 0.4321 |

| 2006–2011 | d(NgJ) = 0.2275 d(NgJ(−1)) b + 0.3120 d(NgJ(−2)) c − 0.1421 CEq(−1) d Adj. R2 = 0.5885 |

| 2018–2023 | d(NgJ) = 0.2582 d(NgJ(−1)) c − 0.0154 d(CAUS) − 0.3119 CEq(−1) d Adj. R2 = 0.3965 |

| CARA, NgE | |

| 2018–2023 | d(CARA) = −0.4524 CEq(−1) d Adj. R2 = 0.4190 |

| CARA, NgTTF | |

| 2018–2023 | d(CARA) = 0.2308 d(CARA(−1)) b + 0.3373 d(NgTTF) d − 0.1332 d(NgTTF(−1)) – −0.1733 d(NgTTF(−2) c − 0.4792 CEq(−1) d; Adj. R2 = 0.4888 |

| CAUS, NgJIn | |

| 2018–2023 | d(CAUS) = 0.1559 d(CAUS(−1)) − 0.2170 CEq(−1) d Adj. R2 = 0.4467 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rembeza, J.; Katarzyński, D. Have the Links Between Natural Gas and Coal Prices Changed over Time? Evidence for European and Pacific Markets. Energies 2025, 18, 2201. https://doi.org/10.3390/en18092201

Rembeza J, Katarzyński D. Have the Links Between Natural Gas and Coal Prices Changed over Time? Evidence for European and Pacific Markets. Energies. 2025; 18(9):2201. https://doi.org/10.3390/en18092201

Chicago/Turabian StyleRembeza, Jerzy, and Dominik Katarzyński. 2025. "Have the Links Between Natural Gas and Coal Prices Changed over Time? Evidence for European and Pacific Markets" Energies 18, no. 9: 2201. https://doi.org/10.3390/en18092201

APA StyleRembeza, J., & Katarzyński, D. (2025). Have the Links Between Natural Gas and Coal Prices Changed over Time? Evidence for European and Pacific Markets. Energies, 18(9), 2201. https://doi.org/10.3390/en18092201