Abstract

Energy storage technology is a critical component in supporting the construction of new power systems and promoting the low-carbon transformation of the energy system. Currently, new energy storage in China is in a pivotal transition phase from research and demonstration to the initial stage of commercialization. However, it still faces numerous challenges, including incomplete business models, inadequate institutional policies, and unclear cost and revenue recovery mechanisms, particularly on the generation and grid sides. Therefore, this paper focuses on grid-side new energy storage technologies, selecting typical operational scenarios to analyze and compare their business models. Based on the lifecycle assessment method and techno-economic theories, the costs and benefits of various new energy storage technologies are compared and analyzed. This study aims to provide rational suggestions and incentive policies to enhance the technological maturity and economic feasibility of grid-side energy storage, improve cost recovery mechanisms, and promote the sustainable development of power grids. The results indicate that grid-side energy storage business models are becoming increasingly diversified, with typical models including shared leasing, spot market arbitrage, capacity price compensation, unilateral dispatch, and bilateral trading. From the perspectives of economic efficiency and technological maturity, lithium-ion batteries exhibit significant advantages in enhancing renewable energy consumption due to their low initial investment, high returns, and fast response. Compressed air and vanadium redox flow batteries excel in long-duration storage and cycle life. While molten salt and hydrogen storage face higher financial risks, they show prominent potential in cross-seasonal storage and low-carbon transformation. The sensitivity analysis indicates that the peak–valley electricity price differential and the unit investment cost of installed capacity are the key variables influencing the economic viability of grid-side energy storage. The charge–discharge efficiency and storage lifespan affect long-term returns, while technological advancements and market optimization are expected to further enhance the economic performance of energy storage systems, promoting their commercial application in electricity markets.

1. Introduction

With the accelerated global transition toward a low-carbon energy structure, the large-scale integration of renewable energy has introduced significant volatility and intermittency, posing serious challenges to the secure and stable operation of power systems. To address these issues, emerging energy storage technologies—particularly grid-side energy storage—are increasingly regarded as critical solutions for enhancing system flexibility and improving the integration capacity of renewable energy sources.

However, the development of grid-side energy storage still faces a series of core challenges, including the following. (1) Incomplete market mechanisms: Grid-side standalone energy storage has not yet been fully integrated into the electricity market, lacking a clear market role. This results in an unstable profit model and hinders the formation of sustainable commercial models. (2) Absence of spot market and capacity compensation mechanisms: The role of energy storage in providing peak shaving, frequency regulation, and reserve capacity has not been fully recognized. The lack of a market-based compensation mechanism leads to high uncertainty in investment returns. (3) Lagging electricity pricing mechanisms: The current pricing framework fails to fully reflect the system value of grid-side energy storage, resulting in limited revenue streams that are insufficient to cover the high capital and operational expenditures. (4) Inadequate assessment of techno-economic performance and environmental value: There is a lack of comprehensive lifecycle quantitative analyses on the costs, benefits, and environmental impacts of various energy storage technologies, which affects investor confidence and decision-making.

In 2024, China’s Government Work Report incorporated new energy storage into the national development agenda for the first time, signifying an elevated strategic role for storage technologies in ensuring energy security, supporting large-scale renewable integration, and facilitating the low-carbon energy transition. In the same year, a series of policies—including the Guidelines on Strengthening Grid Peak Regulation, Energy Storage, and Intelligent Dispatching Capabilities and the Notice on Promoting the Grid Integration and Dispatch Utilization of New Energy Storage (NEA TechReg [2024] No. 26)—were issued. These policies proposed concrete pathways and support measures to facilitate the large-scale development of new energy storage by advancing market mechanism reforms, standardizing grid connection and dispatching, and optimizing resource allocation, thereby promoting a dual-driven development model of technological progress and institutional innovation.

In 2025, the Notice on Deepening Market-Oriented Reform of Feed-in Tariffs for New Energy and Promoting High-Quality Development (NDRC Price [2025] No. 136) further reinforced market-based reform directions. It called for the comprehensive promotion of market-based trading for renewable electricity and the establishment of a pricing and settlement mechanism that accounts for the full lifecycle cost of energy storage. This policy not only provides clear price signals to promote renewable energy consumption but also offers revenue security for energy storage systems participating in the electricity spot market and ancillary services markets, addressing the structural challenge of “insufficient flexibility” in the new power system.

Despite increasingly supportive policy frameworks, the commercial models of grid-side new energy storage remain in the exploratory phase, with unclear profitability structures and underdeveloped economic viability. To thoroughly analyze the current commercial models and applicable scenarios of grid-side storage, this study takes Hebei Province as a case study. It systematically categorizes typical business models for standalone grid-side storage and employs a lifecycle assessment (LCA) approach to quantitatively evaluate the cost–benefit performance of key technologies, including lithium-ion batteries, compressed air energy storage, vanadium redox flow batteries, molten salt storage, and hydrogen storage. By analyzing dimensions such as technological maturity and economic feasibility, this study aims to explore the viability and development pathways of grid-side energy storage, providing theoretical support and policy recommendations for constructing a clean, low-carbon, secure, and efficient modern energy system.

2. Literature Review

At present, scholars both in China and abroad have conducted extensive and in-depth research on grid-side new energy storage technologies, focusing on aspects such as planning and configuration, operational scheduling, management, and techno-economic analysis [1,2,3,4,5,6]. Overall, existing studies primarily explore the mechanisms through which standalone energy storage systems enhance power system regulation capability, improve regional grid flexibility, facilitate renewable energy integration, and participate in ancillary service markets. Systematic analyses have been carried out from multiple perspectives, including configuration optimization [7], operational control [8], revenue mechanisms [9], and economic evaluation [10].

In terms of configuration optimization, Bai et al. [11] proposed a grid-side energy storage configuration method that accounts for the value of operational efficiency across multi-level grids. By employing a bi-level iterative optimization algorithm, the method balances resource complementarity and interest coordination between upper and lower grid levels, emphasizing a combination of bottom-up and system-level perspectives. Tian et al. [12] in response to the impact of volatile wind and solar resources on system stability, developed a typical-day extraction strategy based on K-means clustering and constructed a Mixed-Integer Linear Programming (MILP) model to optimize large-scale energy storage deployment for peak shaving and curtailment reduction. Additionally, Wu et al. [13] adopted a Fuzzy Multi-Criteria Decision-Making (FMCDM) approach, incorporating technical feasibility, cost constraints, and environmental factors into an integrated trade-off framework. Their findings highlighted the superior performance and scalability of photovoltaic-compressed air energy storage (PV-CAES) combinations under multiple scenarios.

Regarding techno-economic analysis, research has mainly focused on quantifying investment returns, levelized cost of electricity (LCOE), and lifecycle benefits of different storage technologies. Fu et al. [14] applied the lifecycle cost (LCC) method to evaluate the economic performance of pumped hydro, compressed air, and battery storage systems, identifying pumped hydro as the most cost-effective option. Liu et al. [15] introduced a levelized cost of discharge (LCOD)-based assessment method and conducted empirical analysis using case studies from western China to illustrate the cost evolution paths of various storage technologies under different configurations, utilization frequencies, and degradation conditions. Rotella et al. [16] provided a comprehensive review of economic assessment methods for battery energy storage systems, analyzing the applicability and limitations of common indicators such as the net present value (NPV), internal rate of return (IRR), and Payback Period (PBP), and emphasized the sensitivity of investment outcomes to the choice of economic metrics.

In addition to configuration and economic evaluation, significant progress has also been made in operational scheduling and control strategies. Li et al. [17] proposed a distributed hybrid-triggered secondary control method for multi-bus DC microgrids, integrating event-triggered communication with self-triggered sampling mechanisms. This approach effectively reduces the communication burden caused by frequent sampling while enhancing system voltage recovery and load current sharing performance. Hu et al. [18] addressed the issue of frequency fluctuations induced by wind power integration by designing a robust load frequency control strategy that combines Model Predictive Control (MPC) with event-triggered mechanisms. Considering practical challenges such as Phasor Measurement Unit (PMU) failures and communication intermittency, the proposed strategy demonstrated strong frequency regulation accuracy and disturbance rejection capability in hardware-in-the-loop experiments, offering an engineering-feasible solution for high-penetration renewable energy scenarios.

Despite the significant progress in grid-side energy storage planning, operation, and economic evaluation, several limitations remain. First, most existing studies focus on technical optimization or economic estimation, with limited attention to incorporating energy storage into the broader context of power system sustainability over its full lifecycle. As a result, the contributions of storage systems in terms of environmental benefits, carbon reduction, and resource efficiency are often underexplored. Second, research often targets individual technologies or single scenarios, lacking comprehensive cost–benefit comparisons across different storage technologies in typical application contexts. Third, in representative regions of China—particularly the northern areas characterized by mismatches between resource availability and load demand—empirical studies on storage business models and revenue paths remain scarce. There is a pressing need to develop locally adaptive indicator systems and dynamic evaluation models based on contextualized scenarios.

To address these gaps, this study selects typical business models of grid-side standalone energy storage in Hebei Province as the research focus. Employing the lifecycle cost (LCC) method, we systematically evaluate the cost–benefit characteristics of new energy storage technologies under different operational mechanisms. Furthermore, we develop an integrated evaluation framework that considers economic, environmental, and flexibility dimensions. Based on this framework, we conduct multi-scenario sensitivity analyses to reveal the heterogeneous techno-economic performance and system adaptability of various storage technologies. This study aims to provide regionally adaptive empirical evidence and theoretical insights for the planning, investment decision-making, and policy formulation of new energy storage systems in China.

3. Analysis of Business Models for Grid-Side New Energy Storage Technologies

In May 2022, the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) jointly issued the Notice on Further Promoting the Participation of New Energy Storage in Electricity Markets and Dispatch Utilization, aiming to facilitate the transition of new energy storage projects from ancillary construction models to independent energy storage models, thereby supporting their autonomous operation and market-oriented development. As of now, independent energy storage stations have become the primary form of grid-side energy storage, accounting for nearly 90% of the total energy storage capacity. In terms of business models, grid-side energy storage has shown a trend of diversification. Based on the research of Li et al. [19], Zhang and Zhang [20], and the 2024 China New Energy Storage Industry Development White Paper: Opportunities and Challenges, the typical models of grid-side independent energy storage are systematically summarized as follows:

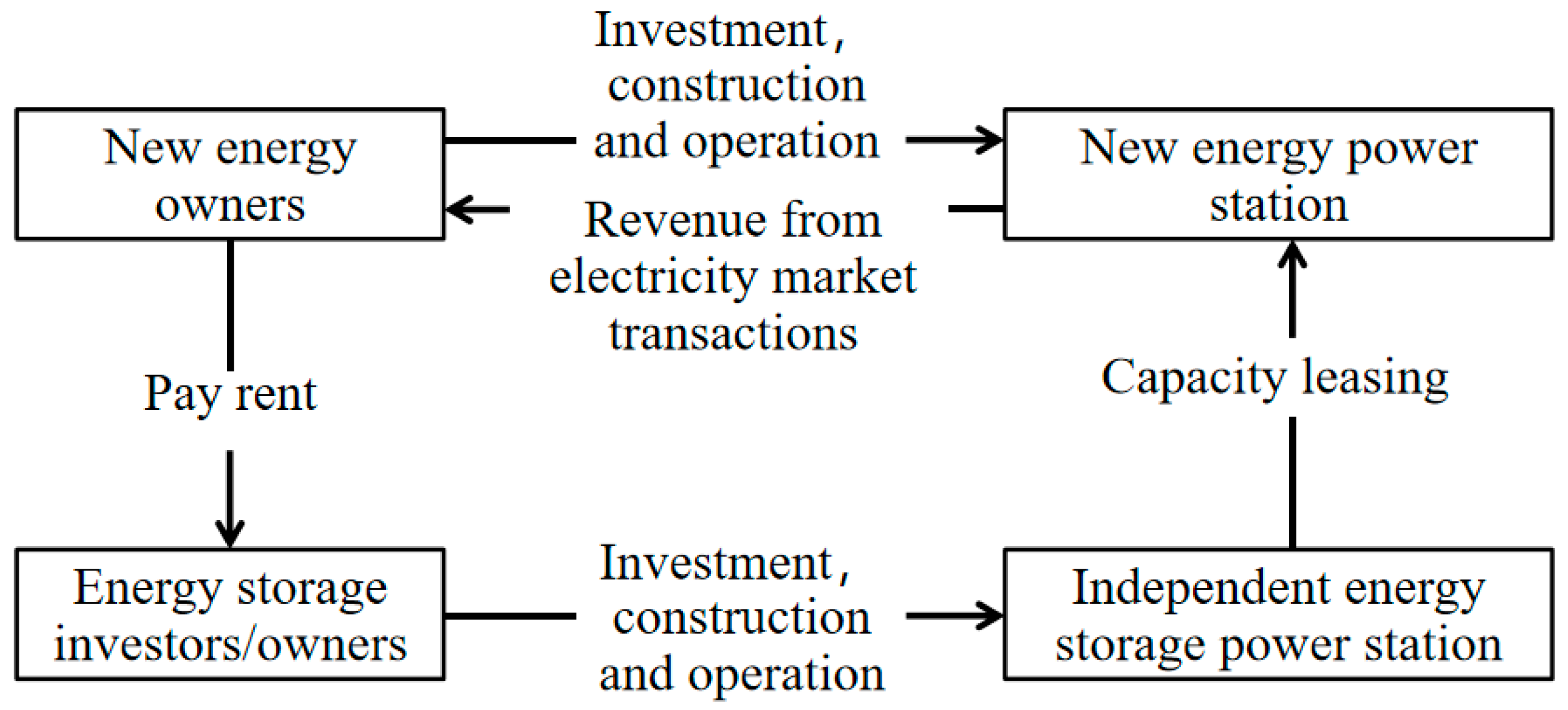

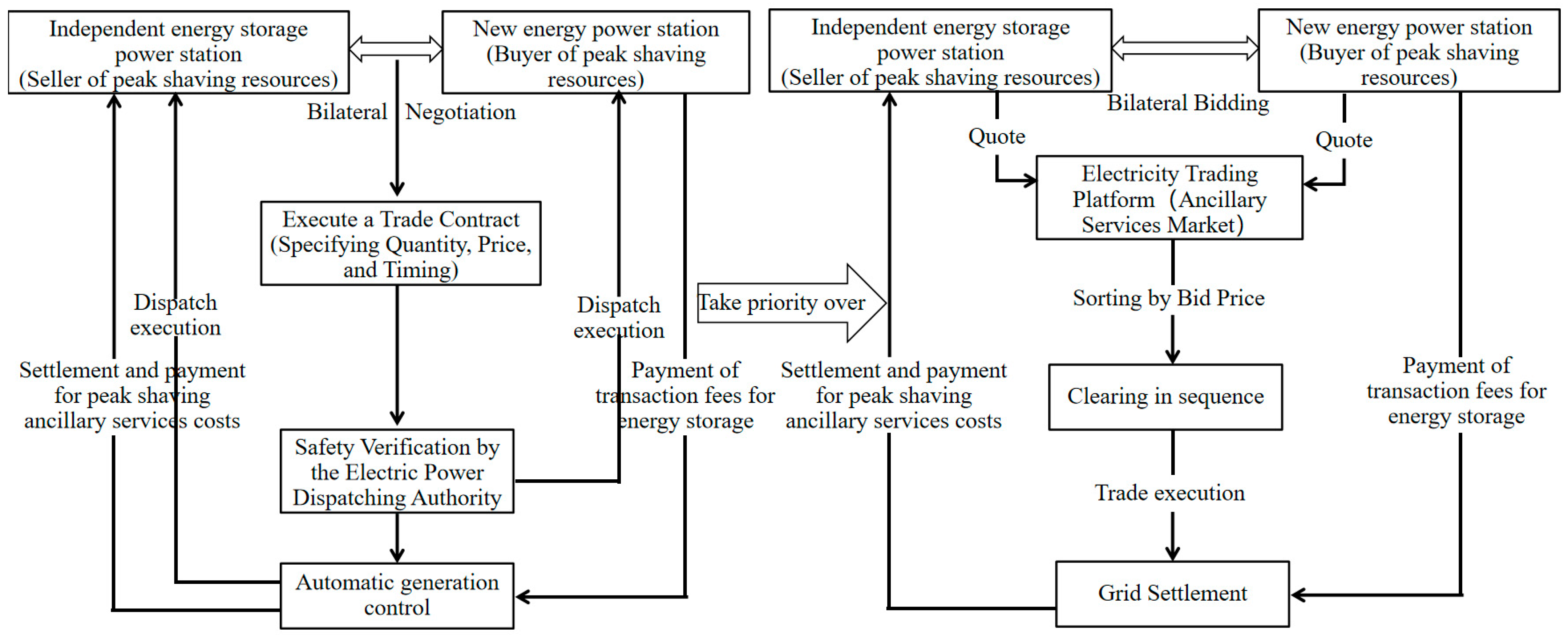

3.1. Shared Leasing Model

The shared leasing model involves investors or owners leasing the power and capacity of energy storage systems as commodities to users on the generation, grid, and load sides, adhering to the principle of “who benefits, who pays” to collect rental fees from lessees. Clients can include large public utility grids, independent power producers, industrial and commercial users, and off-grid energy users, among others. Under the unified dispatch of the grid, this model helps optimize the resource allocation of energy storage stations and reduces the initial capital investment for lessees. This model can be summarized as shown in Figure 1:

Figure 1.

Schematic diagram of the shared leasing model.

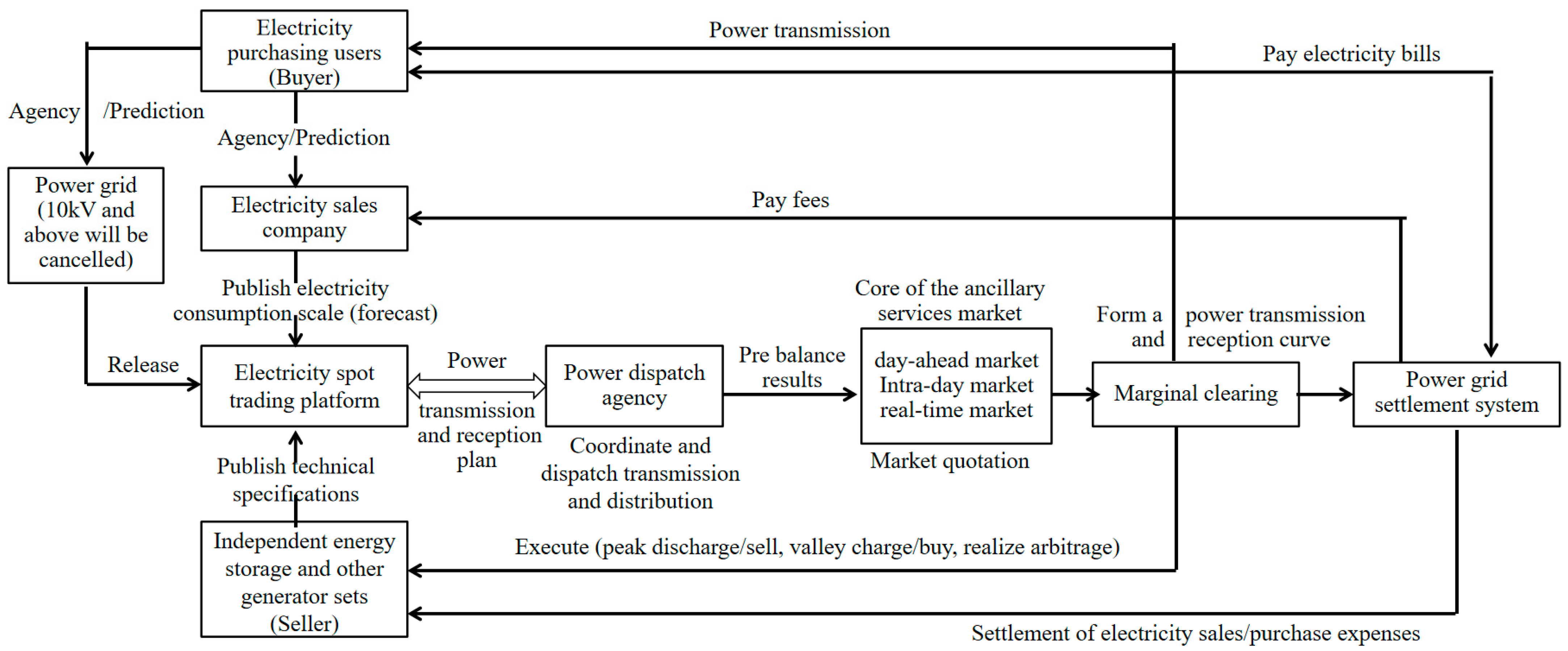

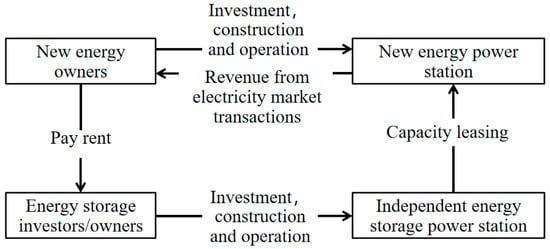

3.2. Spot Arbitrage Model

According to the Notice on Further Promoting the Participation of New Energy Storage in Electricity Markets and Dispatch Utilization issued in May 2022, independent energy storage stations are exempt from transmission and distribution tariffs and related government funds during charging. This reduces the cost per kilowatt-hour for energy storage stations participating in the spot market by approximately 0.1 to 0.2 yuan/kWh. In September 2023, the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) released the Basic Rules for Electricity Spot Markets (Trial), followed by the Electricity Market Supervision Measures issued by the NDRC in April 2024. These policies aim to promote the participation of emerging market entities, such as energy storage, distributed generation, load aggregators, virtual power plants, and renewable energy microgrids, in market transactions. Moreover, energy storage can only achieve profitability in market-based transactions by relying on established electricity prices. This model can be summarized as shown in Figure 2:

Figure 2.

Schematic diagram of the main processes in electricity spot trading.

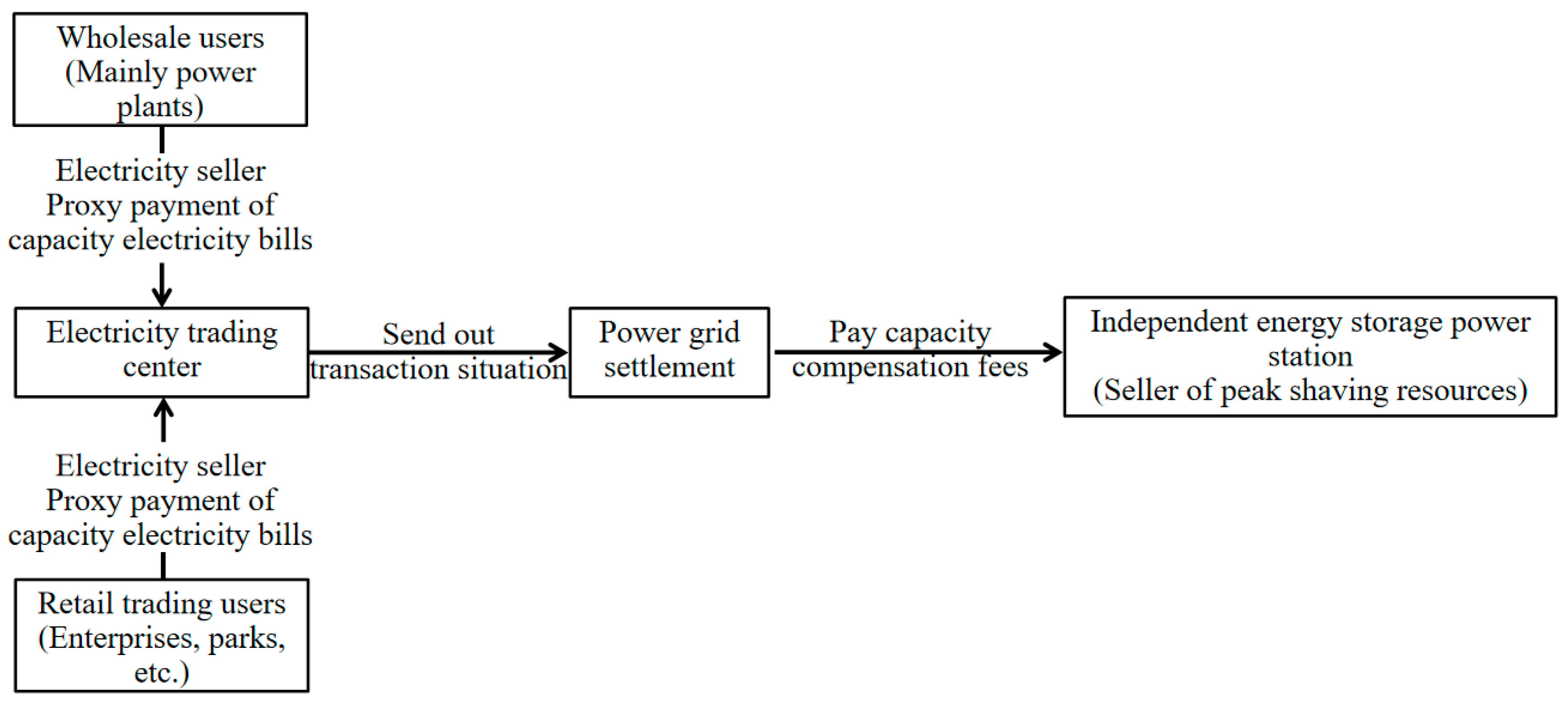

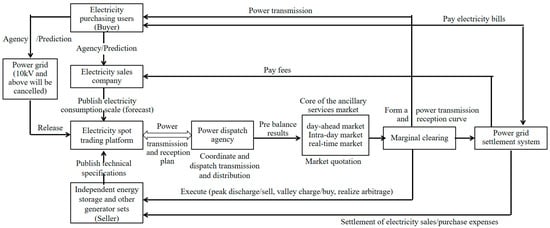

3.3. Capacity Price Compensation

The capacity price compensation model is a solution targeting the capacity market. Under this model, relevant entities such as State Grid power companies and electricity trading centers in various regions periodically collect capacity fees from electricity users based on capacity compensation prices and allocate a portion of these fees to market units, including independent energy storage. Although the revenue from this mechanism is relatively stable, the compensation amount is limited and often insufficient to significantly support the cost recovery of energy storage stations. As a result, it is difficult for this model to serve as the primary profit mechanism for projects. The specific model can be summarized as shown in Figure 3:

Figure 3.

Schematic diagram of capacity price compensation model.

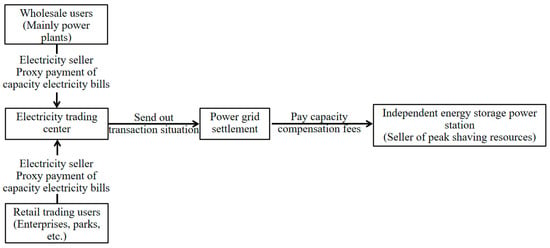

3.4. Unilateral Dispatch

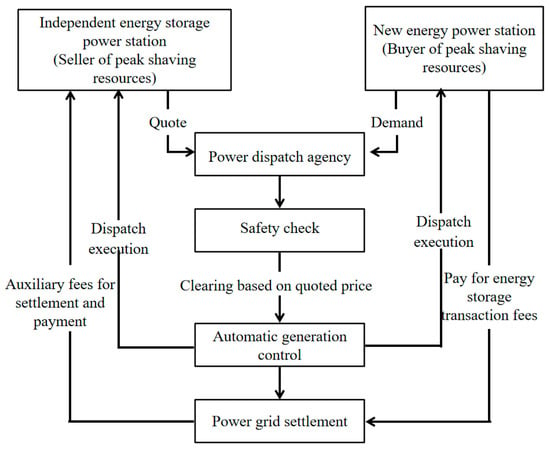

The unilateral dispatch model refers to the direct dispatching of independent energy storage stations by the grid to obtain auxiliary service revenues through peak shaving, frequency regulation, and other ancillary services provided by these stations. Under this mechanism, when additional peak shaving demand (such as from the operational side of renewable energy power stations) remains after market bidding clearance, the grid can unilaterally dispatch resources, including independent energy storage stations, in order of their peak shaving resource bids from low to high. In practical applications, independent energy storage stations participate in the unilateral dispatch mechanism to provide auxiliary services such as peak shaving and frequency regulation to the power system, thereby earning corresponding service fees. The operational logic of this model can be briefly summarized as shown in Figure 4:

Figure 4.

Schematic diagram of unilateral dispatch model.

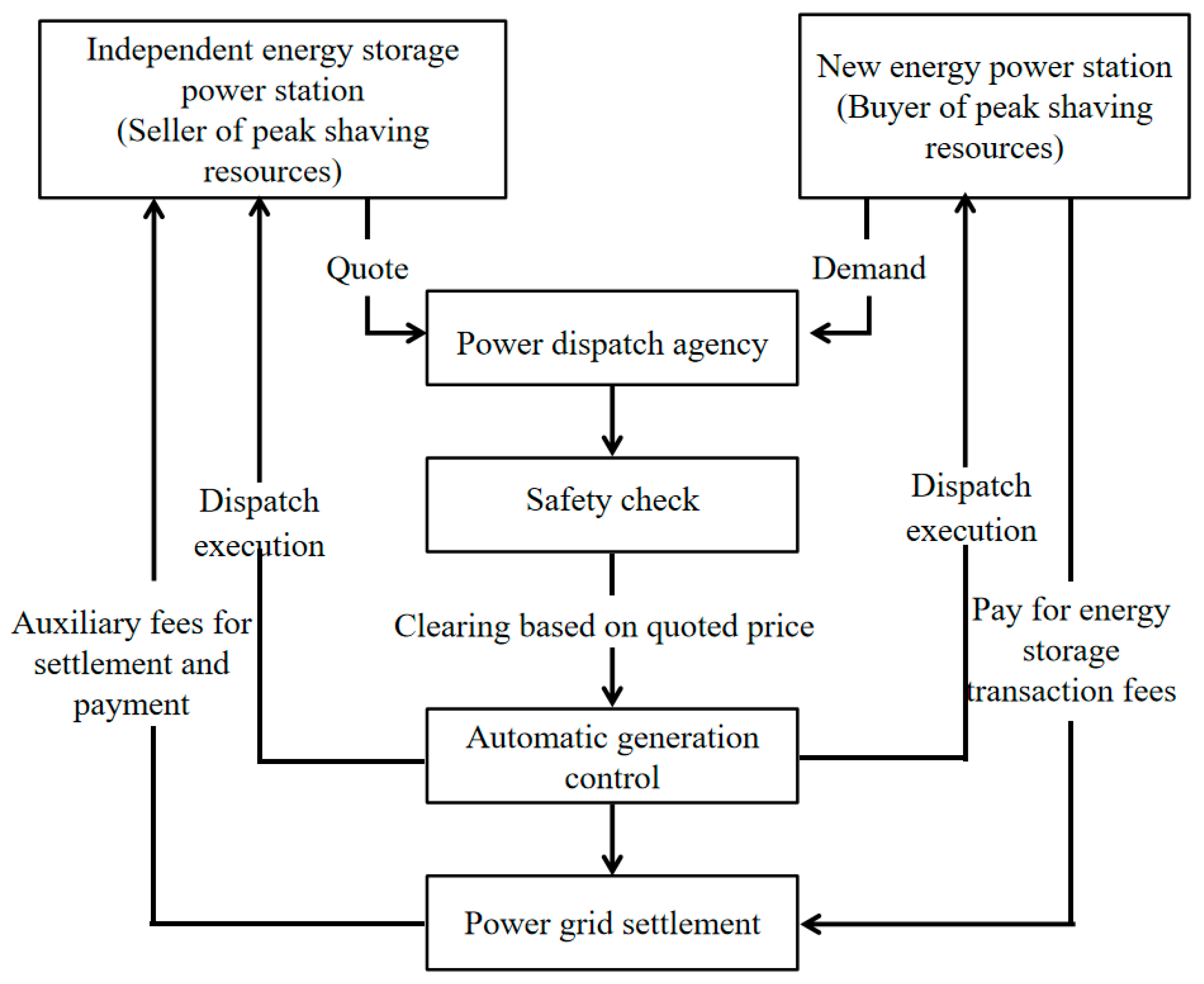

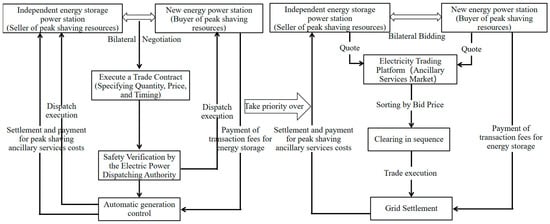

3.5. Bilateral Trading

Grid-side independent energy storage stations and renewable energy power stations can engage in market-based electricity transactions through bilateral negotiation or bilateral bidding models. In this trading mechanism, energy storage stations act as suppliers (i.e., sellers) of peak shaving resources, utilizing their “reservoir” characteristics to charge during off-peak periods and discharge during peak periods, while renewable energy power stations act as demand-side entities (i.e., buyers) for peak shaving resources. The transaction process typically prioritizes the bilateral negotiation model, followed by market clearance through bilateral bidding, with unilateral grid dispatch potentially triggered under special circumstances. The operational logic of this trading mechanism is illustrated in Figure 5:

Figure 5.

Schematic diagram of bilateral trading model between grid-side independent energy storage stations and new energy power stations.

4. Evaluation of Costs and Benefits for Grid-Side New Energy Storage Technologies

4.1. Introduction to Cost–Benefit Analysis (CBA) Model

Cost–benefit analysis (CBA) aims to provide a quantitative assessment of the economic benefits of projects, policies, or decisions. By converting all costs and benefits into monetary values, CBA facilitates direct comparisons between different alternatives, with its core principle being the maximization of economic efficiency in resource allocation. In this process, the identification of costs and benefits is a critical step, requiring comprehensive coverage of both direct and indirect costs and benefits to ensure the integrity of decision-making. CBA also evaluates the difference between total benefits and total costs by calculating metrics such as the net present value (NPV) and internal rate of return (IRR). If the NPV is positive or the IRR exceeds the benchmark rate, the project is considered economically viable; otherwise, cautious decision-making is advised.

4.2. Cost and Benefit Accounting Based on LCA

4.2.1. Cost Accounting Methods

The cost accounting for grid-side new energy storage systems can be divided into four parts, as shown in Equation (1).

In the equation, represents the installation cost of the energy storage battery; represents the cost of each replacement of the energy storage battery; represents the operational and maintenance cost; and represents the salvage value of the energy storage system.

- ①

- Installation Cost

The installation cost of the energy storage battery is a major component of the new energy storage system’s installation cost. The energy storage battery equipment mainly consists of the battery cell itself, power conversion devices, and necessary auxiliary facilities. The calculation of the installation cost is shown in Equation (2).

wherein denotes the cost of the battery; denotes the cost of the power conversion device; and denotes the cost of necessary auxiliary facilities.

- ②

- Replacement Cost

The current lifecycle of energy storage projects typically ranges from 5 to 20 years; however, the lifespan of the battery itself generally does not reach 20 years, leading to the need for battery replacement during the project. The calculation of the single replacement cost of the energy storage battery is shown in Equation (3).

In the equation, represents the annual reduction rate of the energy storage battery installation cost; represents the number of times the battery is replaced; represents the project duration in years; and represents the lifespan of the energy storage battery in years. When is not an integer, it is rounded up to the nearest whole number.

- ③

- Annual Operation and Maintenance Cost

The annual operation and maintenance cost of the new energy storage system can be expressed using Equation (4).

wherein denotes the fixed operation and maintenance cost and denotes the variable operation and maintenance cost. Management costs and labor costs are significant components of , which are independent of the operation process and mainly depend on fixed parameter indicators such as the technology type and power capacity of the energy storage system, as shown in Equation (5).

In the equation, represents the operation and maintenance cost per unit of power, and represents the rated power of the energy storage system.

Additionally, in the case of , there are many factors involved, such as electricity costs, fuel costs, new energy subsidies, CO2 emission costs, etc. This leads to varying with changes in the external environment of the new energy storage system and its own operating conditions. Considering the multitude of factors, this section primarily selects the electricity cost, which accounts for a relatively large proportion in , to represent its magnitude, as shown in Equation (6).

In the equation, represents the average annual electricity cost per unit of power for the new energy storage system, and the calculation method is shown in Equation (7).

In the equation, represents the electricity price for charging, represents the rated discharge time, represents the system efficiency, and represents the number of operating days.

For the overall system, the relationship between the rated capacity and the rated power is as follows:

In the equation, represents the rated capacity of the new energy storage system.

4.2.2. Revenue Accounting Methods

The revenue of grid-side independent energy storage systems generally includes the following aspects: capacity charges, capacity leasing revenue, charging and discharging revenue, peak shaving and frequency regulation ancillary service revenue, benefits from deferring grid construction, and indirect benefits from reducing line losses. The specific formulas are as follows:

In the equations, represents the revenue from ancillary services, represents the revenue from frequency regulation ancillary services, and represents the revenue from peak shaving ancillary services. represents the revenue from deferring grid construction, represents the amount of electricity used for peak shaving and valley filling by the energy storage, represents the exempt capacity cost per unit, represents the revenue from reducing line losses, represents the annual number of charge–discharge cycles, represents the average duration of each discharge, and represent the change in active power of the line, and , represent the peak and valley time-of-use electricity prices, respectively, represents the revenue from capacity charges, represents the capacity charge rate, and represents the rated capacity of the energy storage system. represents the revenue from capacity leasing, represents the capacity leasing rate, and represents the capacity leased to external parties. represents the revenue from charging and discharging, and represent the charging and discharging power of the energy storage system, represents the usage duration of the energy storage system, and represents the electricity market transaction price. represents the total general revenue of the grid-side independent energy storage system.

4.3. Analysis of Investment Benefit Indicators

The main profitability indicators for grid-side new energy storage projects include operating income obtained after project implementation, total investment, operating cost expenses, financial internal rate of return (FIRR), financial net present value (FNPV), and price-to-book ratio (P/B ratio), among others.

4.3.1. Total Investment

The estimation of the total investment is composed of the total investment in the multi-energy complementary project and the calculation of the investment expenditures required each year during the construction period of the multi-energy complementary project. The calculation formula is as follows:

4.3.2. Operating Cost Expenses

Operating cost expenses refer to the various costs incurred and their compensation values during the operation of the multi-energy complementary project. The calculation formula is as follows:

4.3.3. Operating Revenue

The operating revenue of new energy storage technologies varies across different application scenarios, as detailed in the aforementioned section on energy storage revenue accounting.

4.3.4. Internal Rate of Return (IRR)

The internal rate of return, as one of the indicators of project profitability, refers to the discount rate at which the net present value of cash flows over the project’s calculation period is zero. A project is financially acceptable when the financial IRR is greater than or equal to the benchmark discount rate. The calculation formula is as follows:

In the equation, represents the financial internal rate of return; represents the cash inflow in year t; represents the cash outflow in year t; and n represents the project calculation period.

4.3.5. Net Present Value (NPV)

The net present value is also one of the important indicators for evaluating project profitability, referring to the sum of the present values of net cash flows over the project’s calculation period, discounted at a reference benchmark yield rate. A project is financially acceptable when the financial NPV is greater than or equal to zero. The calculation formula is as follows:

In the equation, is the net present value; , represent the cash inflow and outflow in year t, respectively; n is the project duration; and r is the discount rate.

4.3.6. Price-to-Book Ratio (P/B Ratio)

The price-to-book ratio is the ratio of the present value of the equity cash flows of the project to the amount of the project’s own capital investment, used to describe the return on capital. When the P/B ratio is greater than 1, it indicates that the project has good feasibility. The calculation formula is as follows:

In the equation, PB represents the price-to-book ratio.

5. Cost–Benefit Analysis of Grid-Side New Energy Storage Technologies: A Case Study of Hebei Province

By the end of 2024, the installed capacity of renewable energy generation nationwide reached approximately 1.41 billion kilowatts, accounting for over 40% of the total installed power capacity in the country, surpassing that of coal-fired power. In the Southern Hebei Power Grid, the installed capacity of wind and solar energy reached 42.69 million kilowatts, with the maximum output accounting for more than 25% of the total grid load and generation. The Southern Hebei Power Grid electricity market has established a market system for renewable energy characterized by “medium- and long-term time-shared trading + long-cycle spot market settlement trial operation”. In 2024, the volume of market-based transactions for renewable energy increased by 65% year-on-year, while green electricity transactions grew by 80% year-on-year.

5.1. Core Assumptions for Cost–Benefit Evaluation

5.1.1. Project Financing Scheme

Taking a 100 MW/400 MWh independent energy storage station in the Hebei Southern Grid as an example for investment analysis, this project, approved by the provincial government before 1 January 2024, qualifies for capacity tariffs. The total investment varies depending on the type of new energy storage technology. The project financing consists of equity capital and commercial bank loans, with equity accounting for 20% of the total investment and the remainder financed through bank loans. The loan interest rate is calculated based on the latest Loan Prime Rate (LPR) for loans over five years, set at 3.95%, with a loan term of 15 years. Repayment adopts the equal principal method, whereby the principal repaid annually remains constant, and corresponding loan interest is paid periodically.

5.1.2. Key Technical Indicators of New Energy Storage

This study focuses on five types of new energy storage technologies: lithium-ion battery storage, vanadium redox flow battery storage, compressed air storage, molten salt storage, and hydrogen storage. It is assumed that the storage project has an operational period of 20 years, with different replacement frequencies for various technologies. For example, lithium-ion batteries typically require replacement within 10 years, whereas compressed air, molten salt, and hydrogen storage systems do not require battery replacement during their operational periods. According to the notification on formulating supportive pilot tariff policies for independent energy storage development, energy storage systems are required to operate with at least 330 charge–discharge cycles annually. Key technical parameters for each new energy storage technology, including energy conversion efficiency, cycle life, and charge–discharge depth, are detailed in Table 1.

Table 1.

Summary of technical specifications for new energy storage technologies.

5.1.3. Cost Assumptions for New Energy Storage Technologies on the Grid Side

This new energy storage project assumes an average annual battery cost reduction rate of 5%. Lithium-ion batteries are scheduled for replacement in the 11th year, while vanadium redox flow batteries are to be replaced in the 16th year. The unit investment costs of various energy storage technologies are based on the average quoted prices from EPC (Engineering, Procurement, and Construction) turnkey contracts for energy storage systems, with reference to the studies by Wu et al. [21], Zhang [22], and Li et al. [23]. The material cost is set at 30 CNY/kW. Insurance expenses are calculated as 0.5% of the total investment, and repair costs are estimated at 1.5% of the total investment. Other operation-related costs are set at 30 CNY/kW. The project requires the employment of 15 staff members, with an annual salary of CNY 120,000 per person. Social security contributions are calculated at 47.5% of the salary, resulting in a per capita social security cost equal to 47.5% of the individual’s wage. For depreciation, the straight-line method is adopted with a depreciation period of 20 years and a residual value rate of 3%.

In the tax settings for this energy storage project, the output tax rate for electricity sales is 13%, and the tax rate applicable to rental fees is 6%. Additionally, the project must pay urban maintenance and construction tax and education surcharges, which are levied at 7% and 5% of the value-added tax (VAT), respectively. The corporate income tax rate is 25%, which includes both central and local income taxes; the enterprise must pay 25% of the total profit as corporate income tax annually, with the tax base being the taxable income. At the same time, the enterprise must extract 10% of the after-tax profit as a reserve fund in accordance with relevant financial management regulations.

5.1.4. Revenue Assumptions for New Energy Storage Technologies on the Grid Side

According to the “Hebei South Power Grid Independent Energy Storage Participation in Mid-to-Long-Term Electricity Trading Plan for 2024”, the profit model for independent energy storage power stations in the Hebei South Grid mainly comes from three aspects: capacity electricity fees, capacity rental income, and charging–discharging income. First, the capacity electricity price, as required by the “Plan”, assumes that the project is scheduled to be connected to the grid by the end of the year, with a capacity electricity price set at 50 CNY/kW, valid for 12 months. Second, in terms of energy storage capacity rental income, it is temporarily calculated at 200 CNY/kW, with an estimated rental capacity of 50 MW in 2024, increasing to 100 MW in 2025. Finally, the charging–discharging income of energy storage is calculated based on the proxy electricity purchase price in Hebei South Grid in April 2024: the charging electricity price is the low-valley period electricity price of 0.34737875 CNY/kWh. After deducting the electricity transmission and distribution price of 0.0933 CNY/kWh, system operation costs of 0.0658 CNY/kWh, and government funds and surcharges of 0.02406875 CNY/kWh, the charging electricity price is 0.16421 CNY/kWh; the discharging electricity price is the peak period electricity price of 0.92935875 CNY/kWh. After deducting the proxy electricity purchase fee of 0.0224 CNY/kWh, electricity transmission and distribution price of 0.0933 CNY/kWh, government funds and surcharges of 0.02406875 CNY/kWh, and system operation costs of 0.0658 CNY/kWh, the discharging electricity price is 0.72379 CNY/kWh.

5.2. Comparative Analysis of Costs and Benefits of Different New Energy Storage Technologies on the Grid Side

Based on the assumed scenarios and technical indicators of different new energy storage technologies, a cost–benefit analysis of the independent energy storage business model for the Hebei provincial grid side was conducted. In this analysis, different energy storage technologies were evaluated based on several key dimensions, including total costs, total revenues, internal rate of return (IRR), net present value (NPV), levelized cost of energy (LCOE), and price-to-book (PB) ratio. Among these indicators, the levelized cost of energy (LCOE) serves as a core metric for assessing the economic viability of energy storage technologies, effectively reflecting the cost level of energy storage technologies over their entire lifecycle. The internal rate of return (IRR) and net present value (NPV) directly reflect the financial return level of the project, while the price-to-book (PB) ratio provides further market valuation reference for the investment value of the project. Specific results are detailed in Table 2 below:

From the analysis results, it is evident that lithium batteries, vanadium redox flow batteries, compressed air energy storage, molten salt energy storage, and hydrogen energy storage technologies exhibit significant differences in terms of economic viability and technical performance, which are closely related to the maturity of the technology, market application, and policy support.

Table 2.

Investment analysis results for different new energy storage technologies.

Table 2.

Investment analysis results for different new energy storage technologies.

| Lithium Battery | Vanadium Redox Flow Battery | Compressed Air Energy Storage (CAES) | Molten Salt Energy Storage | Hydrogen Energy Storage | |

|---|---|---|---|---|---|

| Total Cost (Billion CNY) | 8.38 | 11.63 | 10.87 | 12.77 | 14.44 |

| Total Revenue (Billion CNY) (Excluding Initial Loan) | 10.56 | 12.37 | 12.40 | 12.44 | 12.46 |

| Internal Rate of Return (IRR) (%) | 17.4 | 9.5 | 8.8 | 2.0 | −2.4 |

| Net Present Value (NPV) (Billion CNY) | 1.95 | 0.53 | 1.24 | −0.6 | −2.22 |

| Levelized Cost of Energy (LCOE) (CNY/kWh) | 0.58 | 0.65 | 0.6 | 0.8 | 0.9 |

| Price-to-Book Ratio | 3.01 | 1.42 | 1.81 | 0.67 | 0.05 |

| Total Cost (Billion USD) | 1.18 | 1.64 | 1.53 | 1.80 | 2.03 |

| Total Revenue (Billion USD) (Excluding Initial Loan) | 1.49 | 1.74 | 1.75 | 1.75 | 1.76 |

| Internal Rate of Return (IRR) (%) | 17.4 | 9.5 | 8.8 | 2.0 | −2.4 |

| Net Present Value (NPV) (Billion USD) | 0.27 | 0.07 | 0.17 | −0.08 | −0.31 |

| Levelized Cost of Energy (LCOE) (USD/kWh) | 0.08 | 0.09 | 0.08 | 0.11 | 0.13 |

| Price-to-Book Ratio | 3.01 | 1.42 | 1.81 | 0.67 | 0.05 |

| Total Cost (Billion EUR) | 1.09 | 1.51 | 1.41 | 1.66 | 1.87 |

| Total Revenue (Billion EUR) (Excluding Initial Loan) | 1.37 | 1.60 | 1.61 | 1.61 | 1.62 |

| Internal Rate of Return (IRR) (%) | 17.4 | 9.5 | 8.8 | 2 | −2.4 |

| Net Present Value (NPV) (Billion EUR) | 0.25 | 0.07 | 0.16 | −0.08 | −0.29 |

| Levelized Cost of Energy (LCOE) (EUR/kWh) | 0.08 | 0.08 | 0.08 | 0.10 | 0.12 |

| Price-to-Book Ratio | 3.01 | 1.42 | 1.81 | 0.67 | 0.05 |

Lithium batteries stand out in all indicators, with a total cost of CNY 838 million, significantly lower than other technologies, and a total revenue of CNY 1.056 billion, demonstrating a good potential for economic returns. Its internal rate of return (IRR) is 17.4%, the highest among the five technologies, and the net present value (NPV) is CNY 195 million, indicating that it can generate significant positive cash flows with a lower initial investment. The levelized cost of energy (LCOE) is 0.58 CNY/kWh, meeting economic requirements, and the price-to-book (PB) ratio is 3.01, showing a positive market attitude towards its development. Vanadium redox flow batteries have a total cost of CNY 1.163 billion and a total revenue of CNY 1.237 billion, showing a good potential for returns. Its IRR is 9.5%, and the NPV is CNY 74 million, indicating a relatively stable return on investment. The LCOE is 0.65 CNY/kWh, slightly higher than that of lithium batteries but still within a reasonable range, and the PB ratio is 1.42, showing good market acceptance. Compressed air energy storage is also economically noteworthy, with a total cost of CNY 1.087 billion and a total revenue of CNY 1.24 billion. The IRR is 12.5%, and the NPV is CNY 153 million, showing a stable cash flow. The LCOE is 0.6 CNY/kWh, with a cost control advantage, and the PB ratio is 1.81, indicating a positive market outlook. In comparison, molten salt energy storage underperforms, with a total cost of CNY 1.277 billion and a total revenue of only CNY 1.244 billion, resulting in an internal rate of return (IRR) of just 2%. Its NPV is CNY −60 million, showing that it cannot generate positive cash flows under the current market environment and poses a financial risk. The LCOE is 0.8 CNY/kWh, at a higher level, and the PB ratio is 0.67, reflecting a conservative market attitude. Hydrogen energy storage has the poorest economic performance, with a total cost of CNY 1.444 billion and a total revenue of only CNY 1.246 billion. The IRR is −2.4%, and the NPV is CNY −222 million, reflecting a serious financial loss risk. The LCOE is 0.9 CNY/kWh, the highest among the five technologies, and the PB ratio is −0.05, indicating a negative market expectation and a lack of investor confidence.

Considering economic indicators such as total cost, total revenue, IRR, NPV, LCOE, and PB, lithium batteries are undoubtedly the most economically attractive energy storage technology at present, showing low costs, high returns, and a positive market outlook. Compressed air energy storage ranks second; although it has a higher total cost, it has a lower LCOE and a good NPV performance. Vanadium redox flow batteries rank third, and despite the higher total cost, their IRR and NPV still have some appeal. Molten salt energy storage and hydrogen energy storage face significant financial risks, especially hydrogen energy storage, which is at a disadvantage in many indicators and currently lacks investment value.

5.3. Sensitivity Analysis of Cost–Benefit Evaluation Method

Sensitivity analysis is a commonly used method in project economic evaluation, primarily employed to assess the impact of variations in key variables on the economic performance of a project, thereby evaluating its risk tolerance. Typically, a selection of core variables that significantly affect project economics is made from a range of uncertain factors for quantitative analysis. According to the study by Xue [24], Dou et al. [25], the key variables influencing the economic viability of grid-side energy storage include the peak–valley electricity price spread, unit investment cost, charge–discharge efficiency, and storage system lifetime.

In this study, a data-based sensitivity analysis model is constructed using Microsoft Excel. The baseline is established from the cost–benefit calculations of different grid-side new energy storage technologies. The model systematically evaluates the impact of uncertainties on the internal rate of return (IRR). Through a one-way sensitivity analysis, this study identifies the variation trends of key variables and their respective impacts on the economic performance of energy storage systems, thus providing quantitative support for investment decision-making in storage projects.

With the acceleration of electricity market reforms, an increase in the peak–valley price spread is expected as a result of intensified market competition mechanisms. Therefore, the sensitivity analysis of the peak–valley price spread is of particular importance. In this analysis, the baseline peak–valley price spread is set at 0.56 CNY/kWh, and adjustments are made by ±1%. The corresponding internal rate of return (IRR) is calculated for each adjustment to assess the sensitivity of this factor. The results are presented in Table 3.

Table 3.

Sensitivity analysis of internal rate of return with respect to peak–valley price spread.

With advancements in production technologies, the construction cost of energy storage is experiencing a rapid decline in unit investment per installed capacity, potentially bringing previously unviable projects back into consideration. Therefore, the sensitivity analysis of unit investment cost is of particular importance. The analysis results are presented in Table 4.

Table 4.

Sensitivity analysis of internal rate of return with respect to unit investment cost.

The charge–discharge efficiency directly affects the charging costs and discharging revenues of an energy storage power station. Higher energy conversion efficiency results in lower operational losses, whereas lower efficiency leads to unnecessary expenditures. Therefore, the charge–discharge efficiency is a critical variable in sensitivity analysis. The results are presented in Table 5.

Table 5.

Sensitivity analysis of internal rate of return with respect to charge–discharge efficiency.

The lifespan of an energy storage power station directly impacts its economic viability and is a key variable in sensitivity analysis. However, in this case study, it is assumed that the operational period of the energy storage project is 20 years, with varying replacement cycles for different technologies. Lithium-ion batteries typically need to be replaced every 10 years, vanadium redox flow batteries are replaced approximately every 15 years, while compressed air, molten salt storage, and hydrogen storage technologies do not require equipment replacement within the 20-year operational period. Therefore, the sensitivity analysis focuses solely on lithium-ion and vanadium redox flow battery storage technologies, which require replacement. The results are presented in Table 6.

This section systematically evaluates the key factors influencing the economic viability of grid-side new energy storage through sensitivity analysis, including the impact of variables such as the peak–valley price spread, unit investment cost, charge–discharge efficiency, and storage lifespan on the internal rate of return (IRR). The results indicate significant differences in the extent to which these key variables affect the economic performance of energy storage technologies, with notable divergence in the economic outcomes of different storage technologies.

Table 6.

Sensitivity analysis of internal rate of return with respect to energy storage power station lifespan.

Table 6.

Sensitivity analysis of internal rate of return with respect to energy storage power station lifespan.

| Energy Storage Power Station Lifespan | IRR of Lithium-Ion Battery | IRR of Vanadium Redox Flow Battery |

|---|---|---|

| −2% | 15.5% | 6.8% |

| −1% | 16.5% | 8.1% |

| Energy Storage Power Station Lifespan | 17.4% | 9.6% |

| +1% | 18.2% | 11.0% |

| +2% | 18.9% | 12.2% |

Firstly, the peak–valley price spread is a core factor affecting the profitability of energy storage projects. As electricity market reforms deepen, an expanded price spread helps to improve the profitability of storage assets. Lithium-ion batteries, vanadium redox flow batteries, and compressed air storage systems exhibit high sensitivity to price spread changes. However, hydrogen storage, constrained by high investment costs and low conversion efficiency, remains economically unviable even with an expanded price spread.

Secondly, the unit investment cost has a particularly significant impact on the economic viability of energy storage systems. A reduction in costs can effectively enhance a project’s IRR, enabling certain storage technologies with weaker initial profitability to become commercially viable. This study shows that lithium-ion batteries are less sensitive to changes in investment cost, while molten salt storage and hydrogen storage, with higher initial investments, show a stronger dependence on cost reductions, leading to greater uncertainty in investment returns.

The charge–discharge efficiency is an important factor affecting the operational costs and revenues of energy storage systems. Improving energy conversion efficiency helps reduce charging losses and increase discharging revenues. The analysis reveals that technologies with lower conversion efficiency, such as compressed air storage and vanadium redox flow batteries, are more sensitive to efficiency changes, while high-efficiency lithium-ion batteries exhibit stronger economic stability.

Additionally, the lifespan of energy storage systems affects the equipment replacement cycle and long-term economic performance. Under the assumption of a fixed operational period, storage technologies with longer lifespans offer greater economic advantages. This study shows that the replacement cycle for lithium-ion and vanadium redox flow batteries has a significant impact on the IRR. Extending the equipment lifespan can effectively reduce long-term capital expenditure and improve overall investment returns.

In conclusion, the peak–valley price spread and unit investment cost are the core variables determining the economic viability of energy storage, while charge–discharge efficiency and storage lifespan impact different technology paths to varying degrees. In the future, with advancements in storage technologies, improvements in market mechanisms, and cost optimization, the economic feasibility of grid-side energy storage still has significant potential for further enhancement.

6. Conclusions and Policy Recommendations

6.1. Main Conclusions

Against the backdrop of the 2024 Hebei Southern Grid Independent Energy Storage Participation in Medium- and Long-Term Electricity Trading Plan issued by Hebei Province, this study conducted a cost–benefit evaluation of various new energy storage technologies under typical business models using a lifecycle assessment approach. The results indicate that lithium-ion batteries, due to their low initial investment costs and significant economic return potential, perform exceptionally well across multiple application scenarios, making them the most attractive energy storage technology at present. In contrast, compressed air energy storage, despite its higher initial construction costs, demonstrates high economic feasibility due to its low levelized cost of electricity (LCOE) and favorable net present value (NPV). Vanadium redox flow batteries, with their stability and market recognition, hold advantages in technical reliability, but their economic viability still requires further optimization due to high initial investment costs. Molten salt energy storage and hydrogen energy storage, however, exhibit poor performance across multiple key economic indicators due to higher financial risks, particularly with hydrogen energy storage’s return expectations falling below industry averages, leading to limited market confidence in its investment value.

The results of the sensitivity analysis indicate that the peak–valley price spread and unit investment cost are the core variables determining the profitability of energy storage. Specifically, an expanded price spread significantly enhances the economic viability of lithium-ion batteries, vanadium redox flow batteries, and compressed air storage, whereas hydrogen storage remains economically unfeasible due to high costs and low conversion efficiency. Meanwhile, the reduction in unit investment cost has a particularly pronounced effect on the internal rate of return (IRR) for molten salt storage and hydrogen storage, whereas lithium-ion batteries are less sensitive to cost changes. Additionally, the charge–discharge efficiency and storage lifespan affect the operational costs and long-term returns of energy storage systems. The sensitivity to these factors varies across different technological paths; low-efficiency technologies are more dependent on efficiency optimization, while extending the lifespan can effectively enhance long-term investment returns.

6.2. Policy Recommendations

6.2.1. Improve Policy Incentive Mechanisms to Promote the Market-Oriented Development of Grid-Side New Energy Storage Projects

Currently, the new energy storage market in China is still in its early stages of development, heavily influenced by policy, with commercial models not yet fully mature and the market-based revenue mechanisms needing optimization. Therefore, the government should focus on policy incentives to establish a long-term, stable, and sustainable policy system to promote the commercialization of energy storage technologies.

Firstly, the participation mechanisms for the electricity spot market and ancillary services market should be further optimized, with clear market positioning for independent energy storage projects. These projects should be enabled to earn reasonable returns in ancillary services such as frequency regulation, peak shaving, and reserve services, thus improving the economic viability of storage investments. Secondly, the government could consider establishing special funds or subsidy policies to provide financial incentives for energy storage projects that perform well in market transactions, such as capacity compensation, investment subsidies, or tax incentives. This would help lower investment costs and increase project returns. Furthermore, the government could guide financial institutions and social capital into the energy storage market by innovating green financial instruments, such as green bonds and energy storage asset securitization, to enhance the market attractiveness of energy storage investments.

By establishing a scientifically sound market-driven incentive mechanism, the profitability of energy storage systems can be effectively enhanced, boosting investor confidence and shifting the energy storage industry from policy-driven to market-driven development, thus promoting the large-scale development of grid-side new energy storage technologies.

6.2.2. Strengthen Technological Innovation and Market Regulation to Improve the Economics and Transparency of New Energy Storage Technologies

The development of new energy storage technologies largely depends on technological innovation and the improvement of market transparency. The government should increase support for the research and development (R&D) of energy storage technologies and improve the market regulatory framework to optimize the industry’s development environment.

In terms of technological innovation, the government should set up special research funds to support universities, research institutions, and enterprises in addressing key technical challenges, especially breakthroughs in long-duration storage technologies such as molten salt storage and hydrogen storage, to improve the safety, lifespan, and economics of energy storage systems. Additionally, it is important to strengthen collaboration between industry, academia, and research, promote the commercialization of technological innovations, and encourage enterprises to increase R&D investments through tax reductions, low-interest loans, and other policy tools.

Regarding market regulation, the government could establish a nationwide unified energy storage market information regulatory platform to publish real-time data on the operation, investment returns, and cost structures of energy storage projects, thereby improving market transparency and reducing information asymmetry. Furthermore, industry-specific technical standards and entry thresholds for energy storage should be developed, and the market regulatory system should be improved to ensure the safety, reliability, and economic feasibility of energy storage projects. By strengthening technological innovation and market regulation, the sustainable development of the energy storage industry can be promoted, increasing the economic returns and market competitiveness of energy storage projects.

6.2.3. Establish Demonstration Projects and Evaluation Systems to Promote the Practical Application of New Energy Storage Technologies

The construction of demonstration projects and a scientific evaluation system are crucial for promoting the practical application of new energy storage technologies. The government should implement energy storage demonstration projects in typical application scenarios and establish a systematic evaluation framework to provide scientific guidance for industry development.

Firstly, the government should prioritize the deployment of grid-side independent energy storage demonstration projects in large-scale wind and solar bases, industrial parks, urban energy management systems, and other scenarios, to verify the applicability and economic feasibility of different energy storage technologies in various application contexts. The construction of demonstration projects can not only provide practical experience but also serve as a basis for subsequent policy optimization and market promotion.

Secondly, a unified evaluation system for energy storage projects should be established, covering multiple dimensions such as technical economic performance, resource utilization efficiency, market feedback, and environmental impact. Evaluation results should be published regularly to enhance industry transparency. At the same time, third-party evaluation organizations should be introduced to independently review the lifecycle cost–benefit analysis of energy storage projects, providing more scientific decision-making support for investment decisions.

Through the construction of demonstration projects and evaluation systems, the commercialization process of new energy storage technologies can be accelerated, market recognition can be enhanced, and ultimately, the sustainable development of the energy storage industry can be promoted, providing strong support for the creation of a clean, low-carbon, safe, and efficient modern energy system.

Author Contributions

Conceptualization: G.T. and Y.C.; methodology and software: P.L. and B.C.; formal analysis and investigation: P.L. and Y.Y.; data curation: J.W. and B.C.; writing—original draft preparation: G.T. and J.W.; writing—review and editing: Y.C. and Y.Y.; project administration: Y.Y.; funding acquisition: Y.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Humanities and Social Sciences of Ministry of Education Planning Fund of China, grant number 21YJA790009; National Natural Science Foundation of China, grant number 72140001.

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Conflicts of Interest

Authors Guang Tian, Penghui Liu, Yang Yang and Bin Che were employed by the company State Grid Hebei Electric Power Co., Ltd. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

- Hao, L.; Lv, X.; Ding, Y.; Jin, K. Optimal Configuration Strategy of New Energy-Grid-User Side Energy Storage Considering Capacity Sharing. Proc. CSEE 2024, 44, 5607–5620. [Google Scholar]

- Zhang, J.; Ouyang, S.; Wu, H.; Xin, X.; Huang, Y. Optimal Configuration of Grid-Side Energy Storage Considering Reliability and Operational Economy of Distribution Networks. Electr. Power Autom. Equip. 2024, 44, 62–68+85. [Google Scholar]

- Xiao, B.; Hou, Y.; Bao, Z.; Wang, Y.; Lan, X. Research on Comprehensive Evaluation Model of Grid-Side Battery Energy Storage Power Station. Autom. Technol. Appl. 2023, 42, 26–29. [Google Scholar]

- Zhang, D.; Liu, J.; Jiao, S.; Tian, H.; Lou, C.; Zhou, Z.; Zhang, J.; Wang, C.; Zuo, J. Research on the Configuration and Operation Effect of the Hybrid Solar-Wind-Battery Power Generation System Based on NSGA-II. Energy 2019, 189, 116121. [Google Scholar] [CrossRef]

- Li, J.; Li, X.; Wei, F.; Yan, P.; Liu, J. Techno-Economic Assessment of the New Type of Compressed Air Energy Storage System Coupled with Thermal Power Units. Proc. CSEE 2023, 43, 9171–9183. [Google Scholar]

- Ahadi, A.; Kang, S.K.; Lee, J.H. A Novel Approach for Optimal Combinations of Wind, PV, and Energy Storage System in Diesel-Free Isolated Communities. Appl. Energy 2016, 170, 101–115. [Google Scholar] [CrossRef]

- Zhou, N.; Pan, W.; Zhu, C.; Yue, F.; Li, C.; Zhang, X. Profit Model Analysis and Cost Compensation Mechanism Suggestions for New Energy Storage Projects under Multiple Scenarios. Sino-Foreign Energy 2024, 29, 13–22. [Google Scholar]

- Liu, J. Techno-Economic Analysis of Energy Storage for Renewable Energy Absorption. Energy Storage Sci. Technol. 2022, 11, 397–404. [Google Scholar]

- Wu, S.; Zhou, C.; Doroodchi, E.; Moghtaderi, B. Techno-Economic Analysis of an Integrated Liquid Air and Thermochemical Energy Storage System. Energy Convers. Manag. 2020, 205, 112341. [Google Scholar] [CrossRef]

- Feng, M.; Wen, S.; Shi, S.; Zhu, M.; Yang, W. A Review of Energy Storage Optimization Configuration and Operation to Meet the Peak-Shaving and Frequency-Regulation Needs of the New Power System. J. Shanghai Jiao Tong Univ. 2024, 1–32. [Google Scholar] [CrossRef]

- Bai, H.; Yu, L.; Liang, S.; Zhang, B.; Chen, G.; Chen, R. Optimal Configuration of Grid-Side Energy Storage Considering the Value of Enhancing the Operational Efficiency of Multi-Level Distribution Networks. J. Electr. Power Syst. Autom. 2020, 32, 7–13. [Google Scholar]

- Tian, B.; Wang, C.; Zhang, S.; An, J.; Liu, B. Research on Broad Area Energy Storage Capacity Optimization Configuration for Wind and Photovoltaic Comprehensive Absorption. Smart Power 2020, 48, 67–72. [Google Scholar]

- Wu, Y.; Zhang, T.; Gao, R.; Wu, C. Portfolio Planning of Renewable Energy with Energy Storage Technologies for Different Applications from Electricity Grid. Appl. Energy 2021, 287, 116562. [Google Scholar] [CrossRef]

- Fu, X.; Li, F.; Yang, X.; Yang, P. Energy Storage Cost Analysis Based on Full Life Cycle Cost. Distrib. Energy 2020, 5, 34–38. [Google Scholar]

- Liu, R.; Zhang, M.; Chu, Y.; Qu, Y.; Guo, T. Analysis and Prospect of New Energy Storage Technology Routes. New Energy Sci. Technol. 2023, 4, 44–51. [Google Scholar]

- Rotella Junior, P.; Rocha, L.C.S.; Morioka, S.N.; Bolis, I.; Chicco, G.; Mazza, A.; Janda, K. Economic analysis of the investments in battery energy storage systems: Review and current perspectives. Energies 2021, 14, 2503. [Google Scholar] [CrossRef]

- Li, X.; Hu, C.; Luo, S.; Lu, H.; Piao, Z.; Jing, L. Distributed Hybrid-Triggered Observer-Based Secondary Control of Multi-Bus DC Microgrids Over Directed Networks. In IEEE Transactions on Circuits and Systems I: Regular Papers; IEEE: New York, NY, USA, 2025. [Google Scholar]

- Hu, Z.; Su, R.; Veerasamy, V.; Huang, L.; Ma, R. Resilient Frequency Regulation for Microgrids Under Phasor Measurement Unit Faults and Communication Intermittency. IEEE Trans. Ind. Inform. 2024, 21, 1941–1949. [Google Scholar] [CrossRef]

- Li, J.; Sun, X.; Li, Y.; Guo, Z.; Guo, Y.; Yuan, X.; Zeng, F. Development of Commercialization Models for New Energy Storage Driven by Policies. Mod. Electr. Power 2024, 1–14. [Google Scholar] [CrossRef]

- Zhang, J.; Zhang, H. Overview of Existing and Potential New Energy Storage Business Models. Energy Energy Conserv. 2023, 6, 28–34. [Google Scholar]

- Wu, J.; Wang, Z.; Han, X.; Chen, Z.; Yang, Z.; Jiang, W. Analysis of Electrochemical Energy Storage Cost per Unit of Electricity and Its Profit Model in Power Systems. Electr. Power Constr. 2025, 46, 177–186. [Google Scholar]

- Zhang, K. Research on the Investment Risks of New Independent Energy Storage Under the “Dual Carbon” Background. Ph.D. Thesis, North China Electric Power University, Beijing, China, 2024. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, G.; Cheng, Y. Economic Analysis and Application Prospects of Different Energy Storage Technologies. Oil Petrochem. Green Low Carbon 2023, 8, 1–8. [Google Scholar]

- Xue, Y. Economic Analysis and Optimization Strategy of Electrochemical Energy Storage Station Operations. Ph.D. Thesis, North China Electric Power University, Beijing, China, 2023. [Google Scholar] [CrossRef]

- Dou, D.; Wang, Y.; Li, X.; Yang, W.; Zhou, W.; Li, H.; Zhang, S. Research on the Economic Optimization Configuration of Energy Storage in Mengxi Area. Electr. Power 2022, 55, 52–63. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).