An Evolutionary Game Analysis of Decision-Making and Interaction Mechanisms of Chinese Energy Enterprises, the Public, and the Government in Low-Carbon Development Based on Prospect Theory

Abstract

1. Introduction

2. Literature Review

3. Model Assumptions and Payoff Matrix

3.1. Model Assumptions

3.2. Basic Model Assumptions

3.2.1. Assumption 1

3.2.2. Assumption 2

3.2.3. Assumption 3

3.2.4. Assumption 4

4. Model Solution

4.1. Stability Analysis of Energy Enterprises

4.2. Stability Analysis of the Public

4.3. Stability Analysis of the Government

4.4. Analysis of System Evolutionary Stability Points

5. Simulation

5.1. Simulation Analysis Data

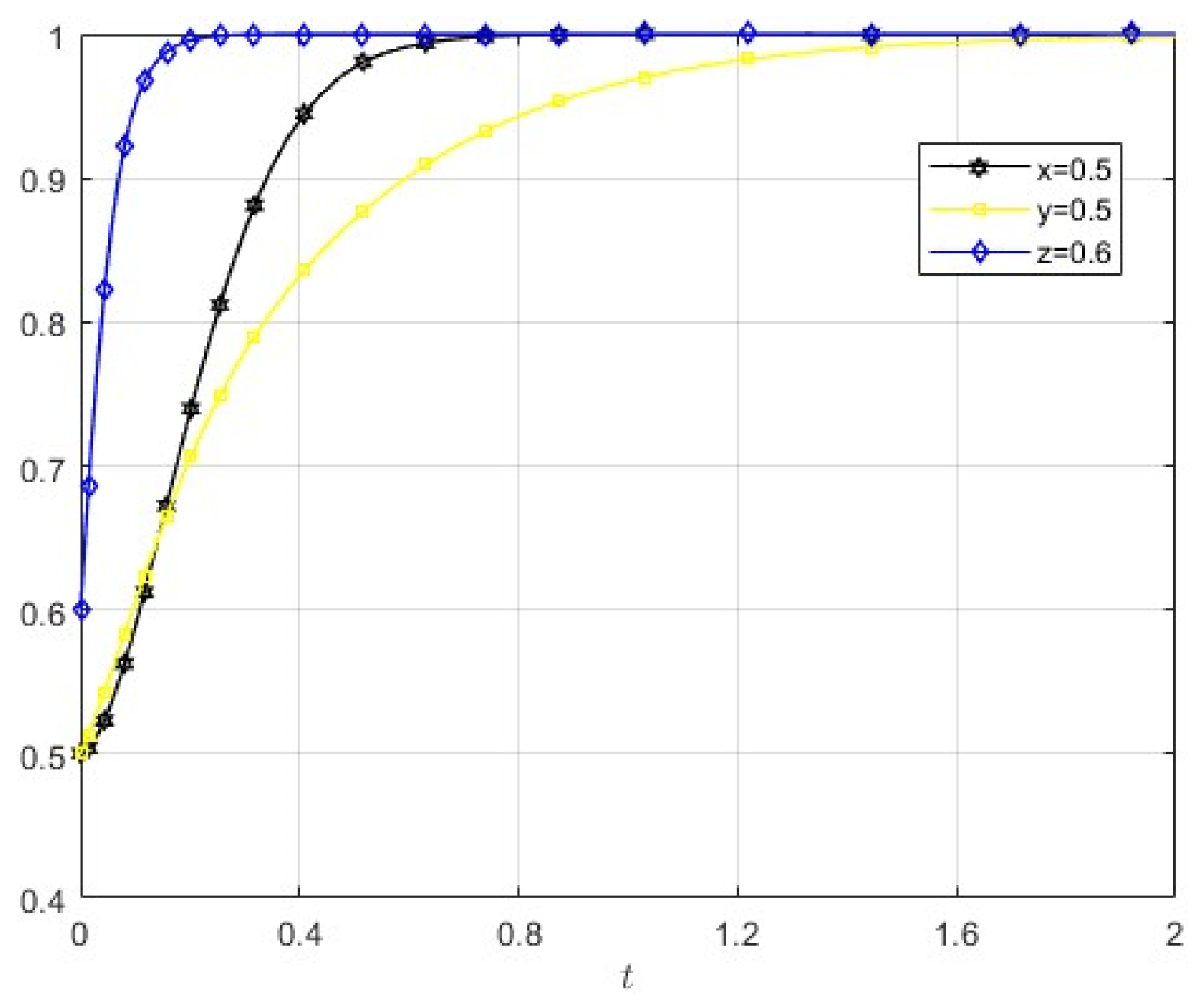

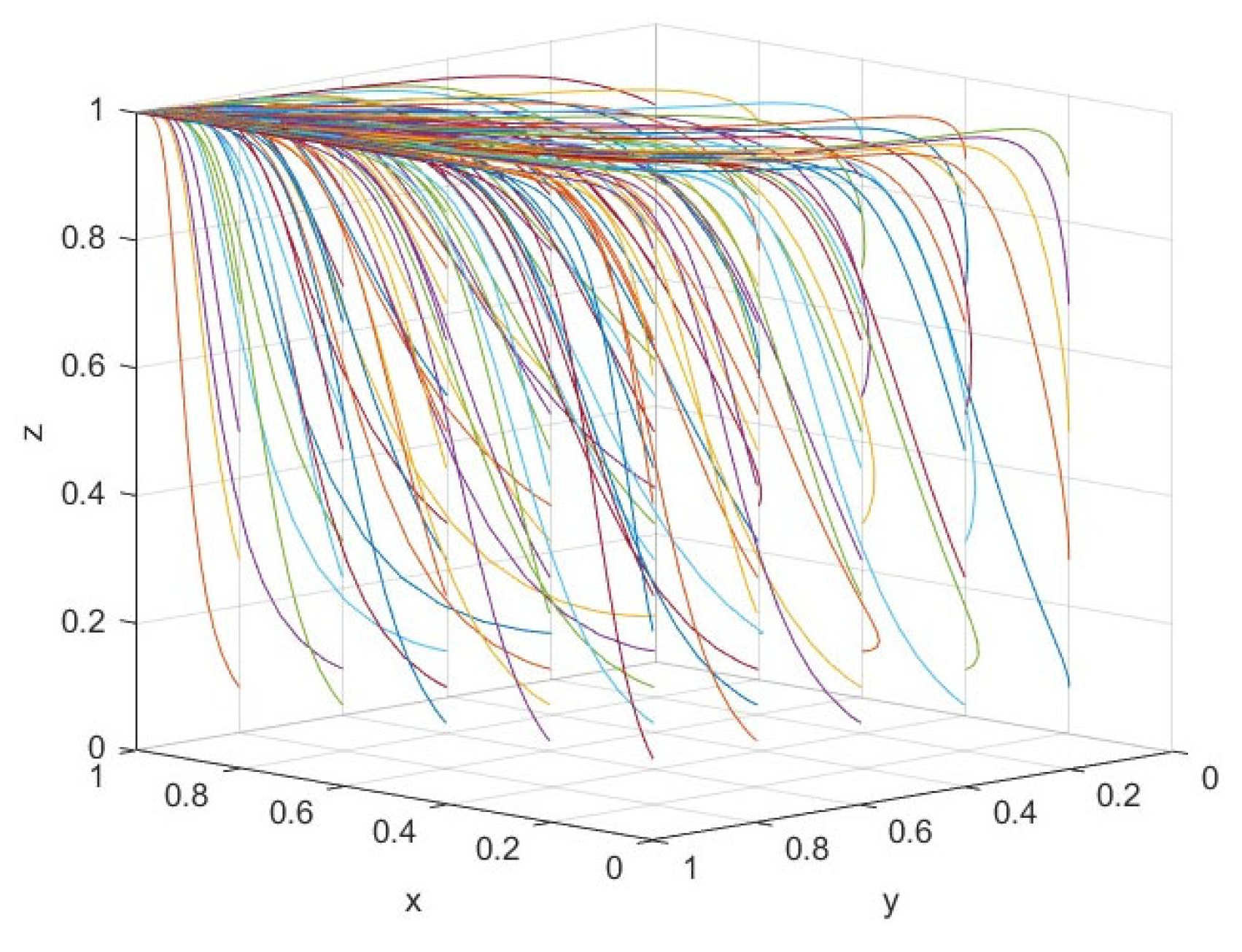

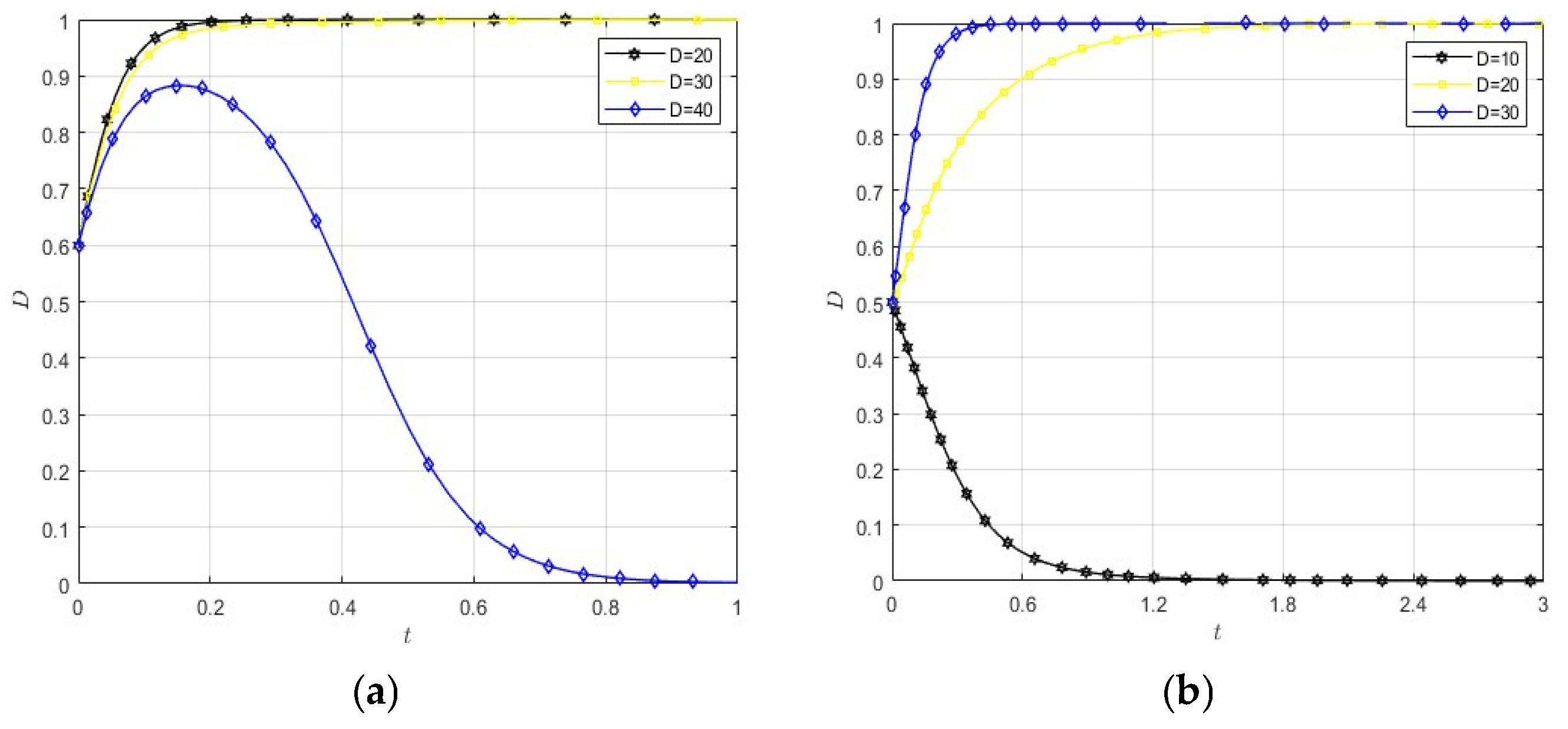

5.2. Simulation Analysis of Initial Values Affecting Evolution

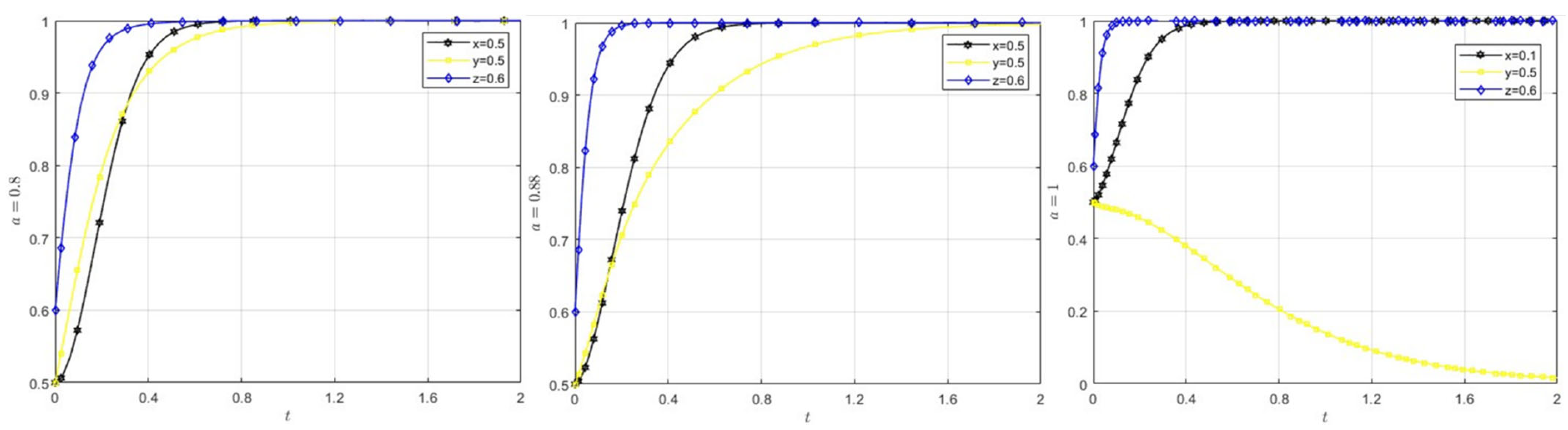

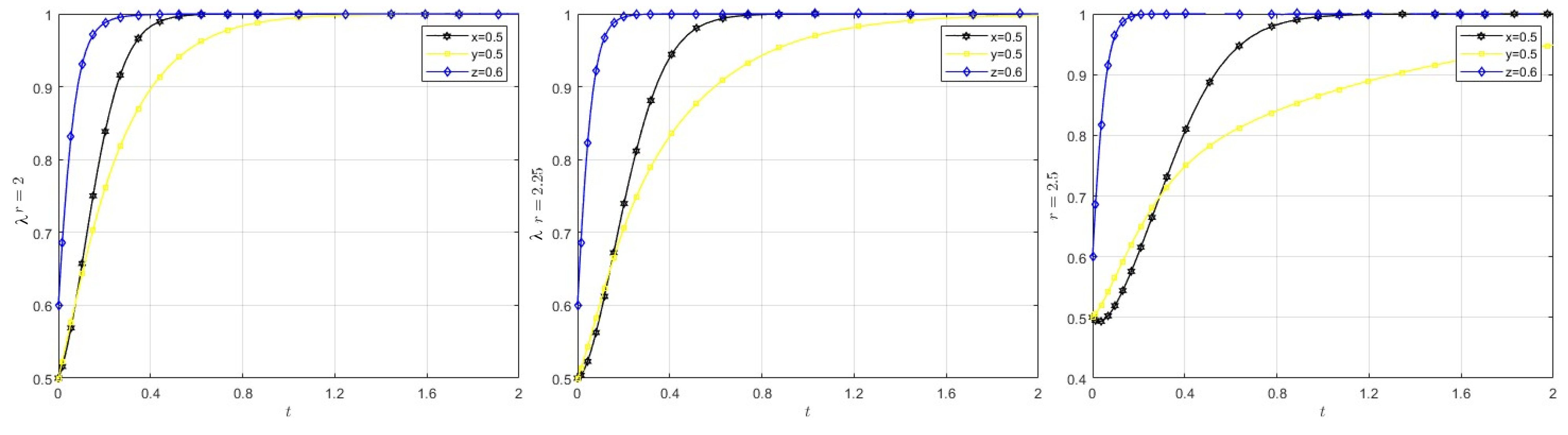

5.3. Simulation Analysis of Factors Affecting Evolution

5.4. Strategy Evolution for Different Values of , , and

6. Discussion and Suggestions

6.1. Conclusions

6.2. Discussion

6.3. Policy Suggestions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Qiu, L.; Liu, C.; Yang, Y.; Wang, X.; Han, J. China Energy Big Data Report (2024); China Energy Media Research Institute: Beijing, China, 2024. [Google Scholar]

- Long, R.; Bao, S.; Wu, M.; Chen, H. Overall evaluation and regional differences of green transformation: Analysis based on “government-enterprise-resident” three-dimensional participants perspective. Environ. Impact Assess. Rev. 2022, 96, 106843. [Google Scholar] [CrossRef]

- Wang, R.; Ni, X. Mass Supervision and Government Response Driven by Digital Platforms—A Supervision Information Platform in the Field of People’s Livelihood in Province A. Gov. Stud. 2023, 39, 124–138. [Google Scholar] [CrossRef]

- Su, X.; Ni, X. Citizens on Patrol: Understanding Public Whistleblowing against Government Corruption. J. Public Adm. Res. Theory 2018, 28, 406–422. [Google Scholar] [CrossRef]

- Lavena, C. Whistle-Blowing: Individual and Organizational Determinants of the Decision to Report Wrongdoing in the Federal Government. Am. Rev. Public Adm. 2014, 46, 113–136. [Google Scholar] [CrossRef]

- Wang, X.; Zhang, S. The Interplay Between Subsidy and Regulation Under Competition. IEEE Trans. Syst. Man Cybern. Syst. 2023, 53, 1038–1050. [Google Scholar] [CrossRef]

- Hu, S.; Obłój, J.; Zhou, X.Y. A Casino Gambling Model Under Cumulative Prospect Theory: Analysis and Algorithm. Manag. Sci. 2022, 69, 2474–2496. [Google Scholar] [CrossRef]

- Aydogan, I. Prior Beliefs and Ambiguity Attitudes in Decision from Experience. Manag. Sci. 2021, 67, 6934–6945. [Google Scholar] [CrossRef]

- Cai, W.; Gallani, S.; Shin, J. Incentive Effects of Subjective Allocations of Rewards and Penalties. Manag. Sci. 2022, 69, 3121–3139. [Google Scholar] [CrossRef]

- Elahi, E.; Khalid, Z.; Zhang, Z. Understanding farmers’ intention and willingness to install renewable energy technology: A solution to reduce the environmental emissions of agriculture. Appl. Energy 2022, 309, 118459. [Google Scholar] [CrossRef]

- Jiang, T.; Ji, P.; Shi, Y.; Ye, Z.; Jin, Q. Efficiency assessment of green technology innovation of renewable energy enterprises in China: A dynamic data envelopment analysis considering undesirable output. Clean Technol. Environ. Policy 2021, 23, 1509–1519. [Google Scholar] [CrossRef]

- Tian, J.X.; Sun, J.; Liu, D.; Zhang, W.H. Evaluation of the Green and Low-carbon Development in the Yangtze River Delta Region. J. Ecol. Rural Environ. 2024, 40, 1144–1154. [Google Scholar]

- Li, X.; Hu, J.; Lyu, X.; Bhuiyan, M.A. Are low-carbon city pilot policies conducive to carbon reduction? An analysis of experiences from China. Environ. Dev. Sustain. 2025. [Google Scholar] [CrossRef]

- Liu, F.; Wei, Y.; Du, Y.; Lv, T. Mechanism and Influencing Factors of Low-Carbon Coal Power Transition under China’s Carbon Trading Scheme: An Evolutionary Game Analysis. Int. J. Environ. Res. Public Health 2023, 20, 463. [Google Scholar] [CrossRef] [PubMed]

- Chen, Y.; Nie, P.; Wang, C. Effects of carbon tax on environment under duopoly. Environ. Dev. Sustain. 2021, 23, 13490–13507. [Google Scholar] [CrossRef]

- Wang, D.; Shen, X.; Fan, X. Low-Carbon Transition and Firm Value: Analysis Based on Text Big Data. China J. Econom. 2024, 4, 1576–1604. [Google Scholar]

- Khan, A.; Qu, X.Y.; Gong, Z.D. Decision mechanism of farmers’ low-carbon agricultural technology adoption: An evolutionary game theory approach. Empirica 2025. [Google Scholar] [CrossRef]

- Wurlod, J.; Noailly, J.E.L. The impact of green innovation on energy intensity: An empirical analysis for 14 industrial sectors in OECD countries. Energy Econ. 2018, 71, 47–61. [Google Scholar] [CrossRef]

- Wang, Y.; Shen, N. Environmental regulation and environmental productivity: The case of China. Renew. Sustain. Energy Rev. 2016, 62, 758–766. [Google Scholar] [CrossRef]

- Li, C.; Song, T.; Wang, W.; Gu, X.; Li, Z.; Lai, Y. Analysis and Measurement of Barriers to Green Transformation Behavior of Resource Industries, in International. J. Environ. Res. Public Health 2022, 19, 13821. [Google Scholar] [CrossRef]

- Wang, M.; Yin, S.; Lian, S. Collaborative elicitation process for sustainable manufacturing: A novel evolution model of green technology innovation path selection of manufacturing enterprises under environmental regulation. PLoS ONE 2022, 17, e0266169. [Google Scholar] [CrossRef]

- Zhao, M.; Zhao, G.; Zhang, B. Research on Green Responsibility Dynamic Mechanism of Resource-based Enterprises from the Perspective of Local Government Behavior. East China Econ. Manag. 2019, 33, 161–166. [Google Scholar] [CrossRef]

- Li, C.; Gu, X.; Li, Z.; Lai, Y. Government-enterprise collusion and public oversight in the green transformation of resource-based enterprises: A principal-agent perspective. Syst. Eng. 2023, 27, 417–429. [Google Scholar] [CrossRef]

- Tang, J.; Li, S. Can public participation promote regional green innovation? —Threshold effect of environmental regulation analysis. Heliyon 2022, 8, e11157. [Google Scholar] [CrossRef] [PubMed]

- Chen, Y.; Zhang, J.; Tadikamalla, P.R.; Gao, X. The Relationship among Government, Enterprise, and Public in Environmental Governance from the Perspective of Multi-Player Evolutionary Game. Int. J. Environ. Res. Public Health 2019, 16, 3351. [Google Scholar] [CrossRef]

- Chu, Z.; Bian, C.; Yang, J. How can public participation improve environmental governance in China? A policy simulation approach with multi-player evolutionary game. Environ. Impact Assess. Rev. 2022, 95, 106782. [Google Scholar] [CrossRef]

- Gao, C.F.; Tan, B.H.; Peng, D.H. Evaluation of green transformation capability of small and medium-sized manufacturing enterprises based on hesitant fuzzy CIDI method. Ecol. Econ. 2024, 40, 55–62. [Google Scholar]

- Hou, L.; Zhang, Y.; Wu, C.; Song, J. Improving the greenness of enterprise supply chains by designing government subsidy mechanisms: Based on prospect theory and evolutionary games. Front. Psychol. 2023, 14, 1283794. [Google Scholar] [CrossRef]

- Du, K.; Cheng, Y.; Yao, X. Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Econ. 2021, 98, 105247. [Google Scholar] [CrossRef]

- Wu, R.; Lin, B. Environmental regulation and its influence on energy-environmental performance: Evidence on the Porter Hypothesis from China’s iron and steel industry. Resour. Conserv. Recycl. 2022, 176, 105954. [Google Scholar] [CrossRef]

- Ruggeri, K.; Alí, S.; Berge, M.L.; Bertoldo, G.; Bjørndal, L.D.; Cortijos-Bernabeu, A.; Davison, C.; Demić, E.; Esteban-Serna, C.; Friedemann, M.; et al. Replicating patterns of prospect theory for decision under risk. Nat. Hum. Behav. 2020, 4, 622–633. [Google Scholar] [CrossRef]

- Villacis, A.H.; Alwang, J.R.; Barrera, V. Linking risk preferences and risk perceptions of climate change: A prospect theory approach. Agric. Econ. 2021, 52, 863–877. [Google Scholar] [CrossRef]

- Liu, Y.; Cai, D.; Guo, C.; Huang, H. Evolutionary Game of Government Subsidy Strategy for Prefabricated Buildings Based on Prospect Theory. Math. Probl. Eng. 2020, 2020, 8863563. [Google Scholar] [CrossRef]

- Wu, G.; Deng, L.; Niu, X. Evolutionary Game Analysis of Green Technology Innovation Behaviour for Enterprises from the Perspective of Prospect Theory. Discret. Dyn. Nat. Soc. 2022, 2022, 5892384. [Google Scholar] [CrossRef]

- Liu, C.; Wu, X. An Evolutionary Game Study on the Behavioral Strategies of Carbon Label Stakeholders Based on Prospect Theory. In Trends and Technological Challenges in Green Energy; Green Energy Technology; Springer: Cham, Switzerland, 2024; pp. 125–139. [Google Scholar]

- Yang, Y.; Pan, L. An Evolutionary Game Model of Market Participants and Government in Carbon Trading Markets with Virtual Power Plant Strategies. Energies 2024, 17, 4464. [Google Scholar] [CrossRef]

- Fan, B.; Guo, T.; Xu, R.; Dong, W. Evolutionary Game Research on the Impact of Environmental Regulation on Overcapacity in Coal Industry. Math. Probl. Eng. 2021, 2021, 5558112. [Google Scholar] [CrossRef]

- Li, Y.; Shi, Y. Dynamic Game Analysis of Enterprise Green Technology Innovation Ecosystem under Double Environmental Regulation. Int. J. Environ. Res. Public Health 2022, 19, 11047. [Google Scholar] [CrossRef]

- Duan, J.; Wang, Y.; Zhang, Y.; Chen, L. Strategic interaction among stakeholders on low-carbon buildings: A tripartite evolutionary game based on prospect theory. Environ. Sci. Pollut. Res. 2024, 31, 11096–11114. [Google Scholar] [CrossRef]

- Xuan, X.D.; Zheng, Y.H. Collaborative mechanism and simulation of low-carbon travel for residents in community-built environment based on evolutionary game. J. Clean. Prod. 2024, 443, 141098. [Google Scholar] [CrossRef]

- Wang, S.-J.; Kang, B.; Zhang, Y.-X. Evolutionary game analysis of green input decision making of supply chain enterprises based on consumers’ low-carbon preferences. Int. J. Transp. Econ. 2024, 51, 87–126. [Google Scholar]

- Zhu, H.; Zhu, X.; Ding, L.; Guo, Y. Decision and coordination analysis of extended warranty service in a remanufacturing closed-loop supply chain with dual price sensitivity under different channel power structures. RAIRO-Oper. Res. 2022, 56, 1149–1166. [Google Scholar] [CrossRef]

- Wang, D.; Wu, M.; Qu, J.; Fan, Y. How to motivate planners to participate in community micro-renewal: An evolutionary game analysis. Front. Psychol. 2022, 13, 943958. [Google Scholar] [CrossRef]

- Cheng, X.; Cheng, M. An evolutionary game analysis of supervision behavior in public-private partnership projects: Insights from prospect theory and mental accounting. Front. Psychol. 2023, 13, 1023945. [Google Scholar] [CrossRef] [PubMed]

- Fennema, H.; Wakker, P. Original and cumulative prospect theory: A discussion of empirical differences. J. Behav. Decis. Mak. 1997, 10, 53–64. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263–292. [Google Scholar] [CrossRef]

- Wei, S.; Wang, D. Tripartite Evolutionary Game Analysis of Emergency Network Public Opinion Governance Based on Prospect Theory. Inf. Res. 2024, 10, 39–47. [Google Scholar] [CrossRef]

- Friedman, D. Evolutionary economics goes mainstream: A review of the theory of learning in games. J. Evol. Econ. 1998, 8, 423–432. [Google Scholar] [CrossRef]

- Ritzberger, K.; Weibull, J.O.R.W. Evolutionary Selection in Normal-Form Games. Econometrica 1995, 63, 1371–1399. [Google Scholar] [CrossRef]

- Tversky, A.; Kahneman, D. Advances in prospect theory: Cumulative representation of uncertainty. J. Risk Uncertain. 1992, 5, 297–323. [Google Scholar] [CrossRef]

- Wang, X.; Zhang, L.; Zhang, N. A three-way game analysis of health information quality in WeChat based on prospect theory. Comput. Sci. 2022, 49, 694–704. [Google Scholar]

- Zhang, J.; Qi, L. Evolutionary Game Analysis of Servitization of Equipment energy enterprises Based on Prospect Theory: From the View of Consumers. Oper. Res. Manag. Sci. 2023, 32, 43–44. [Google Scholar]

- Zhang, J.; Wen, S.; Li, H.; Lyu, X. Evolutionary Game Analysis of Supply Chain Operations Decision under the Background of Low-carbon Economy Based on the Perspective of Government-Enterprise-Consumer Synergy. Oper. Res. Manag. Sci. 2024, 33, 77–83. [Google Scholar]

- Zhou, W.; Shi, Y.; Zhao, T.; Cao, X.; Li, J. Government regulation, horizontal coopetition, and low-carbon technology innovation: A tripartite evolutionary game analysis of government and homogeneous energy enterprises. Energy Policy 2024, 184, 113844. [Google Scholar] [CrossRef]

- Qiao, Y.S.; Qiao, R.S.; Qiao, Y.M. Competitive Game Model and Evolutionary Strategy Analysis of Green Power and Thermal Power Generation. Symmetry 2024, 16, 959. [Google Scholar] [CrossRef]

- Feng, N.; Ge, J.M. How does fiscal policy affect the green low-carbon transition from the perspective of the evolutionary game? Energy Econ. 2024, 134, 107578. [Google Scholar] [CrossRef]

- Wu, Z.Q.; Yang, C.; Zheng, R.J. An analytical model for enterprise energy behaviors considering carbon trading based on evolutionary game. J. Clean. Prod. 2024, 434, 139840. [Google Scholar] [CrossRef]

- Xu, Q.; Liu, Y.; Chen, C.; Lou, F. Research on multi-stage strategy of low carbon building material’s production by small and medium-sized manufacturers: A three-party evolutionary game analysis. Front. Environ. Sci. 2023, 10, 1086642. [Google Scholar] [CrossRef]

- Liu, X.; Ding, M.; Jin, X.; Huang, X. Will Incentive Policies Induce Strategic Green Innovation in Power Plants: Policy Synergy and Intra-Inter Regulatory Effects. China Ind. Econ. 2025, 2, 137–155. [Google Scholar] [CrossRef]

- Yan, J.; Zhu, C. Adjustment of Public Policy in China: A Discussion on the Value Orientation and Practice of “Putting the People at the Center”. Gov. Stud. 2021, 37, 29–40. [Google Scholar]

- Liu, R.; Ding, M.; Wang, S. Thinking on the scientific and technological guidance of China’s carbon dioxide peak and carbon neutrality by European and American countries. Stud. Sci. Sci. 2023, 41, 51–57, 112. [Google Scholar]

- Shi, D.; Shi, K. Analysis of the Targets, Stylized Facts and Influencing Factors of Green and Low-carbon Development in China: Based on a Literature Review. Soc. Sci. Int. 2023, 4, 95–120+243–244. [Google Scholar]

- Zhang, L.; Li, A.; Zhou, J. Carbon Emission Management Strategies for Heavy Chemical Industries in Europe and America and the Insights for China. J. Jiangsu Adm. Inst. 2024, 6, 50–56. [Google Scholar]

- Sun, C.; Zhan, Y. Carbon Neutrality: International Development Trajectories and China’s Development Potentials. Soc. Sci. Int. 2022, 1, 120–132. [Google Scholar]

- Li, X.; Hao, J. Sino-EU Green Cooperation and Competition: New Patterns and China’s Responses. Glob. Rev. 2023, 15, 116–136. [Google Scholar]

- Cao, H.; Zhang, X. The foundations, challenges and prospects of China-EU low-carbon cooperation. Globalization 2024, 6, 44–51+134. [Google Scholar] [CrossRef]

| Subject of Decision | Variables | Description |

|---|---|---|

| Energy enterprises | Benefits of positive LCD | |

| Benefits of negative LCD | ||

| Costs of LCD | ||

| Penalties charged for negative LCD when reported by the public or positive regulation by the government | ||

| The public | Cost of time and effort in proactive supervision | |

| Government incentives | ||

| Loss of negative public supervision when energy enterprises adopt negative LCD | ||

| Loss of positive public supervision when energy enterprises adopt negative LCD | ||

| The government | Reputational benefits when regulation is positive | |

| Reputational loss when regulation is negative | ||

| Social benefits when energy enterprises adopt positive LCD and there is positive regulation | ||

| Costs under positive regulation | ||

| Costs under negative regulation | ||

| Subsidies for energy enterprises adopting positive LCD |

| The Government | The Public | Energy Enterprises | |||||

|---|---|---|---|---|---|---|---|

| Positive | Negative | ||||||

| Energy Enterprises | Public | Government | Energy Enterprises | Public | Government | ||

| Positive | Positive | ||||||

| Negative | 0 | ||||||

| Negative | Positive | ||||||

| Negative | 0 | ||||||

| Equilibrium Point | |||

|---|---|---|---|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, X.; Wang, Q.; Li, Z.; Jiang, S. An Evolutionary Game Analysis of Decision-Making and Interaction Mechanisms of Chinese Energy Enterprises, the Public, and the Government in Low-Carbon Development Based on Prospect Theory. Energies 2025, 18, 2041. https://doi.org/10.3390/en18082041

Liu X, Wang Q, Li Z, Jiang S. An Evolutionary Game Analysis of Decision-Making and Interaction Mechanisms of Chinese Energy Enterprises, the Public, and the Government in Low-Carbon Development Based on Prospect Theory. Energies. 2025; 18(8):2041. https://doi.org/10.3390/en18082041

Chicago/Turabian StyleLiu, Xiao, Qingjin Wang, Zhengrui Li, and Shan Jiang. 2025. "An Evolutionary Game Analysis of Decision-Making and Interaction Mechanisms of Chinese Energy Enterprises, the Public, and the Government in Low-Carbon Development Based on Prospect Theory" Energies 18, no. 8: 2041. https://doi.org/10.3390/en18082041

APA StyleLiu, X., Wang, Q., Li, Z., & Jiang, S. (2025). An Evolutionary Game Analysis of Decision-Making and Interaction Mechanisms of Chinese Energy Enterprises, the Public, and the Government in Low-Carbon Development Based on Prospect Theory. Energies, 18(8), 2041. https://doi.org/10.3390/en18082041