Equilibrium Analysis of Electricity Market with Multi-Agents Considering Uncertainty

Abstract

1. Introduction

- We propose an electricity market framework incorporating EVA, CESSO, and LA, investigating the operational paradigm under coordinated participation of heterogeneous customer-side energy aggregators.

- We characterize the operational uncertainties inherent in EVA and LA scheduling processes, employing leased cloud-based energy storage to mitigate uncertainties.

- We develop a stochastic optimization framework for EVA and LA decision-making in cloud-based energy storage leasing markets. An equilibrium model integrating EVA, CESSO, LA, and TG is established, with a hybrid solution methodology combining nonlinear complementarity principles and genetic algorithms.

2. Basic Framework and Method

2.1. Market Trading Framework

2.2. Model Assumptions

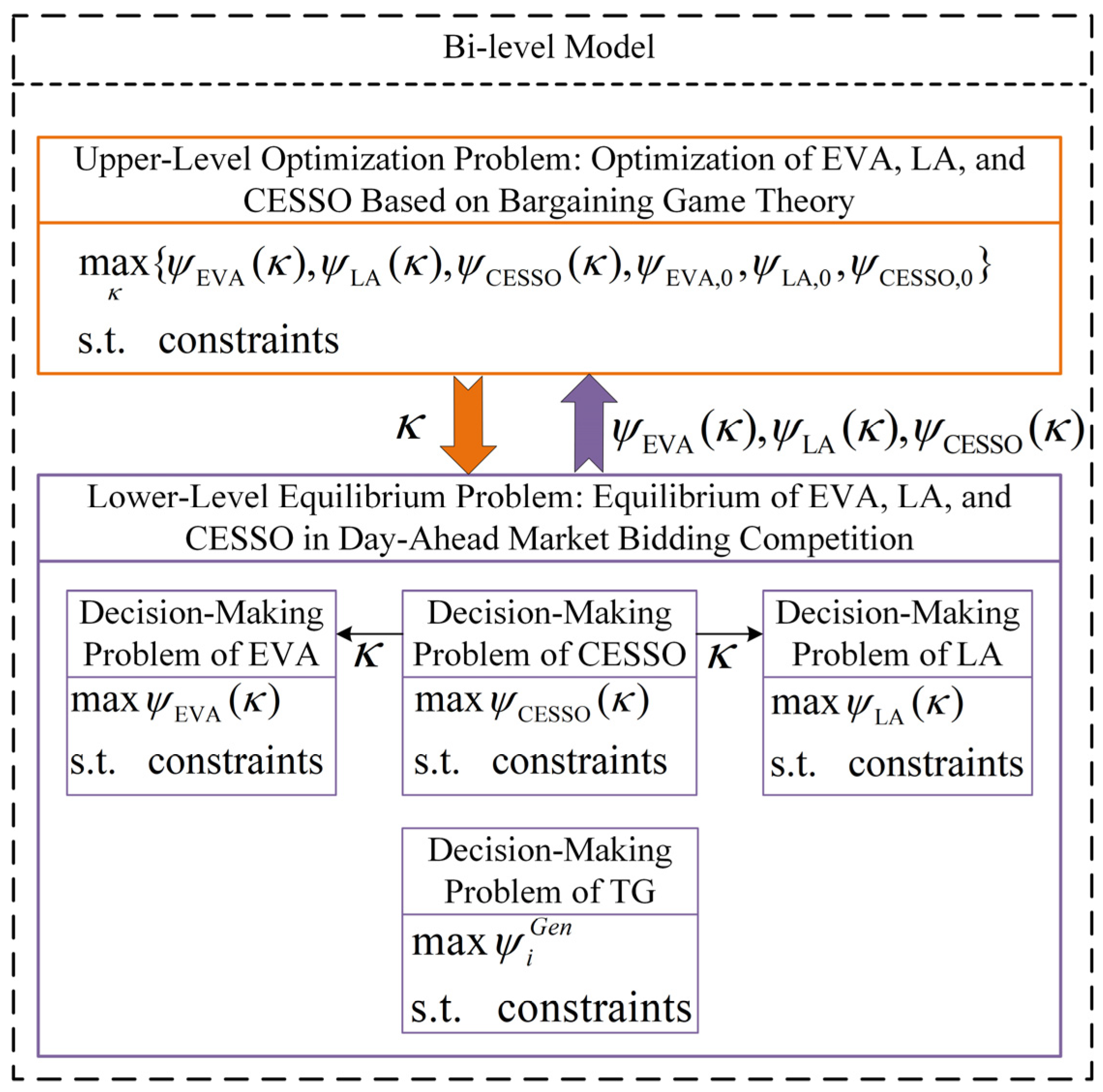

2.3. Bi-Level Gaming Framework

3. Uncertainty Smoothing with Cloud Energy Storage

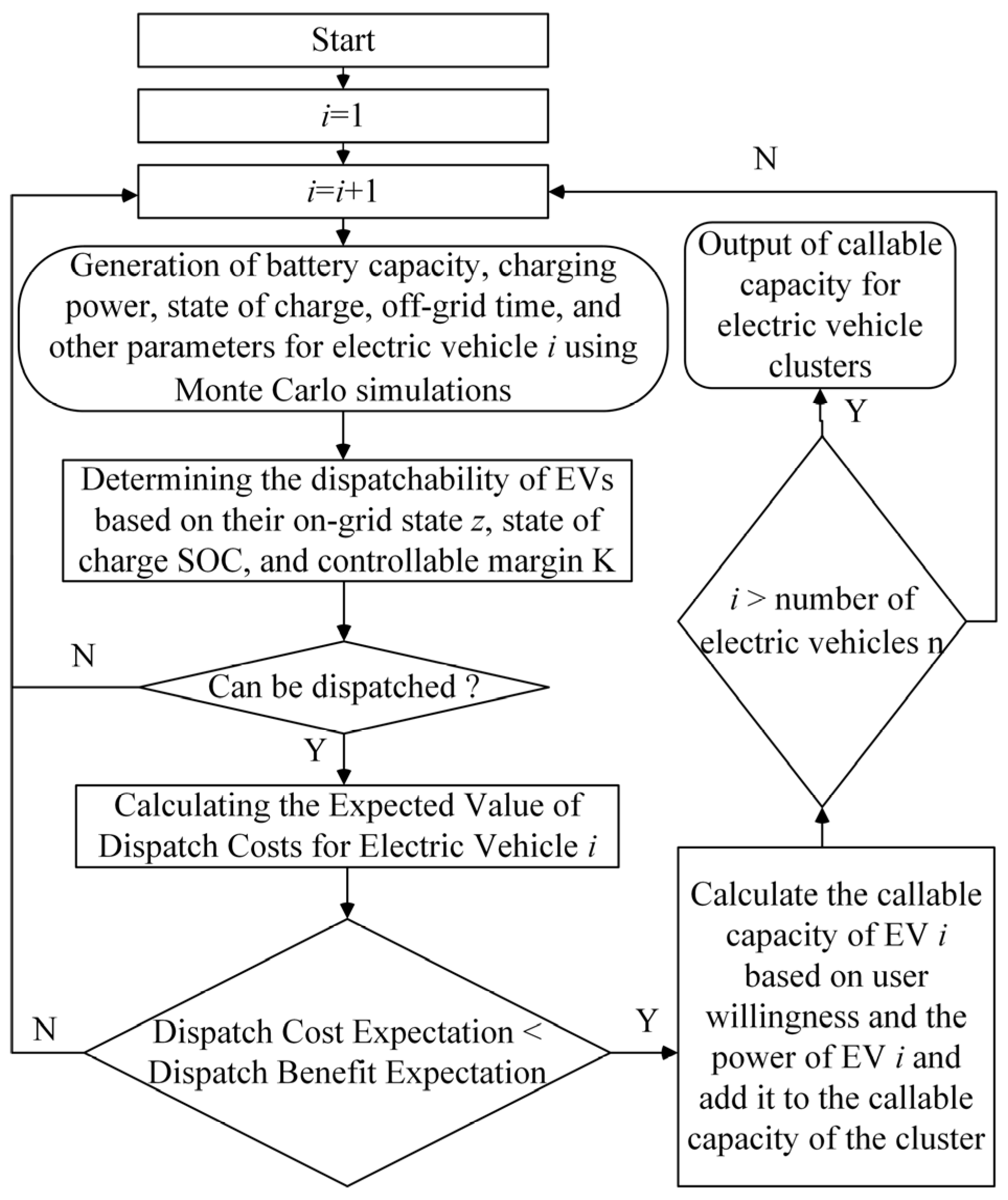

3.1. Output Uncertainty Analysis for EVA and LA

- EVs’ grid access timeConsidering the bidirectional interaction requirements between EVs and the power grid, all parked EVs are assumed to be grid-connected. The grid connection time can therefore be defined as the termination instant of an EV’s final daily trip. As reported in [27], the distribution of this time parameter follows a lognormal distribution.where refers to the corresponding probability density function, represents the mean value, and indicates the standard deviation. Normally, , .

- EV off-grid timeDuring EV mobility periods, charging/discharging operations and dispatch participation are technically infeasible. Therefore, the disconnection time is logically defined as the initiation instant of the first daily trip. According to travel pattern statistics from the FHWA 2009 National Household Travel Survey [23], the first departure time also conforms to a lognormal distribution.where refers to the corresponding probability density function. Normally, and .

- EV daily traveling distance distributionThe daily travel distance was identified to follow a gamma distribution [16]. The mathematical expressions for this distribution are given in Equations (13) and (14).where refers to the gamma function, denotes the parameter of the scale, and represents the parameter of the shape. As the conclusion, and .

3.2. Scene Reduction Methods

- (1)

- Identify the scenario pair with the smallest Kantorovich distance.

- (2)

- Calculate the distance product for this scenario pair.

- (3)

- Determine the minimum Kantorovich distance product value among all scenario pairs.

- (4)

- Eliminate scenarios associated with and update remaining scenario probabilities.

3.3. Cloud Energy Storage Leasing Model Based on Scenario Analysis Approach

4. Methods for Construction and Solution of Bi-Level Game Models

4.1. Rental Price Optimization Model

- , , and denote the respective profits of EVA, LA, and CESSO under the lease-sharing agreement.

- , , and represent the disagreement point corresponding to the profits obtained when the entities independently participate in day-ahead market competition through non-cooperative game strategies.

- , , and indicate the profit increments resulting from the lease-sharing cooperation.

4.2. Optimization Decision Modeling for Conventional Power Producers

4.3. Optimized Decision Model for EVA

4.4. Optimized Decision Model for LA

4.5. Optimized Decision Model for CESSO

4.6. Solution Methods for Equilibrium Models in Electricity Markets

5. Simulation and Analysis

5.1. Parameter Setting

5.2. Analysis of Operational Results Under Different Scenarios

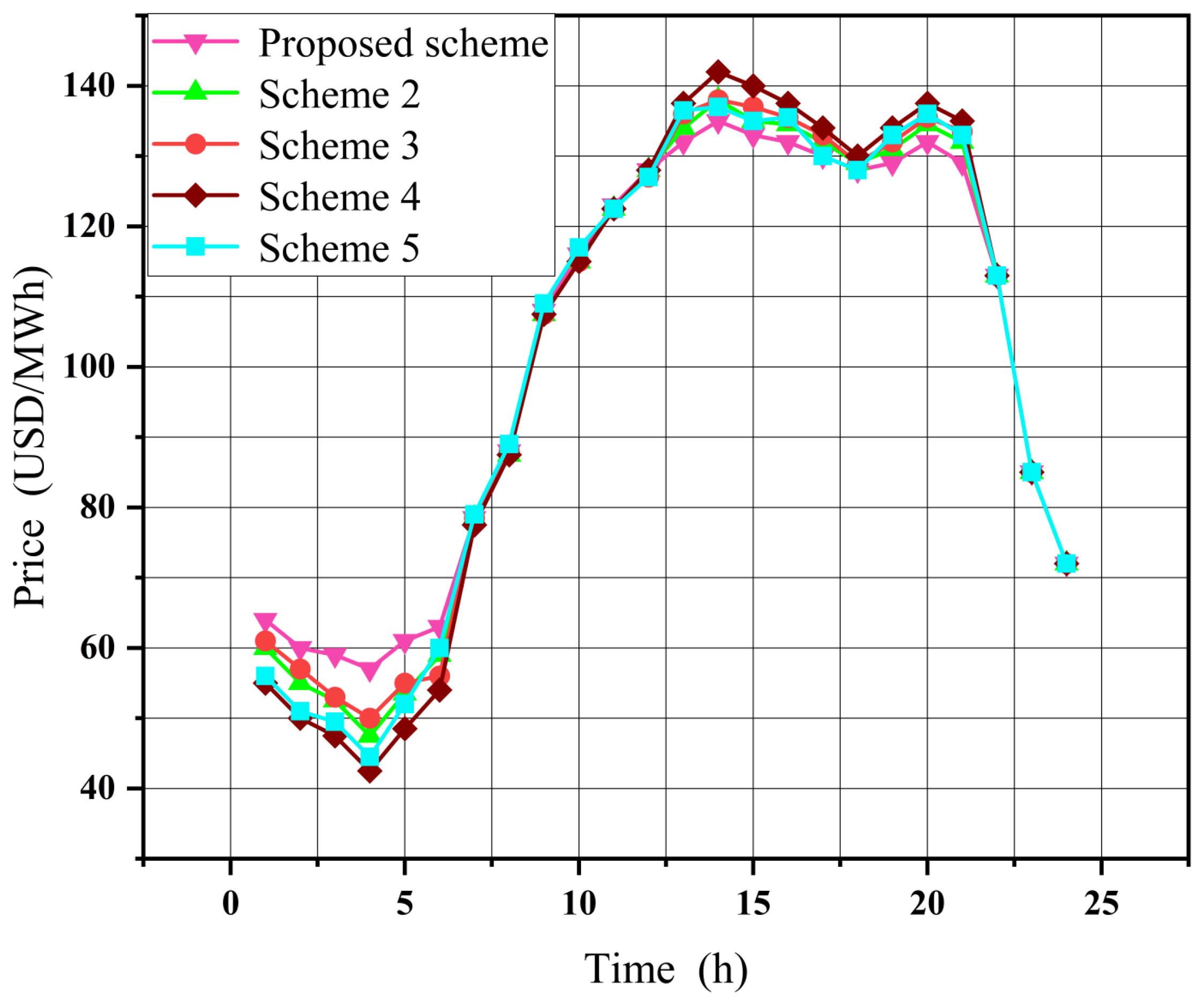

- Proposed scheme: EVA, LA, and CESSO participate in a competition in the electricity market, and CESSO rents out cloud energy storage services to EVA and LA to help the two market players to mitigate the impacts of the uncertainty.

- Scheme 2: EVA, LA, and CESSO participate in the competition in the electricity market, but they do not interfere with each other, and CESSO does not rent cloud energy storage services to other interested parties.

- Scheme 3: EVA and LA compete together in the electricity market.

- Scheme 4: EVA and CESSO compete in the electricity market together and CESSO and EVA do not interfere with each other; CESSO does not lease cloud energy storage services to EVA.

- Scheme 5: LA and CESSO compete in the electricity market together and they do not interfere with each other. CESSO does not lease cloud energy storage services to LA.

5.3. Impact of Energy Aggregation Agents on Market Equilibrium Prices

6. Conclusions

- (1)

- The proposed cloud storage leasing mechanism effectively reduces bidding deviations of EVA and LA, thereby enhancing their market competitiveness. Compared with independent market participation by EVA, LA, and CESSO, the collaborative scheme increases profits by 10.38%, 8.65%, and 39.47% for the three parties, respectively, demonstrating their willingness to establish leasing agreements.

- (2)

- When CESSO participates in electricity market competition within a non-cooperative game framework while refraining from providing cloud energy storage leasing services to other market participants, its market power demonstrates a significant decline. Compared with the scenario where cloud energy storage leasing services are commercially available, under the independent operation mode, the profit margins of all market entities (including CESSO itself) exhibit measurable reductions. This empirical evidence suggests that introducing cloud energy storage leasing services into non-cooperative game-theoretic electricity markets can yield Pareto improvements among multiple stakeholders.

- (3)

- The three types of emerging energy aggregation entities proposed in this study exhibit discernible market power when participating in electricity market competition. By employing their respective arbitrage strategies, these entities collectively contribute to peak shaving and valley filling effects on electricity prices. This mechanism effectively diminishes the market dominance of conventional power generators. Moreover, the mutually constraining interactions among these entities demonstrate significant potential for enhancing social welfare and promoting sustainable development in electricity markets.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Sarker, M.R.; Dvorkin, Y.; Ortega-Vazquez, M.A. Optimal Participation of an Electric Vehicle Aggregator in Day-Ahead Energy and Reserve Markets. IEEE Trans. Power Syst. 2016, 31, 3506–3515. [Google Scholar] [CrossRef]

- Shafie-Khah, M.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K.; Catalão, J.P.S. Optimised performance of a plug-in electric vehicle aggregator in energy and reserve markets. Energy Convers. Manag. 2015, 97, 393–408. [Google Scholar] [CrossRef]

- Cao, Y.; Huang, L.; Li, Y.; Kittisak, J.; Ahmadi-Nezamabad, H. Optimal scheduling of electric vehicles aggregator under market price uncertainty using robust optimization technique. Int. J. Electr. Power Energy Syst. 2019, 117, 105628. [Google Scholar] [CrossRef]

- Liu, J.; Zhang, N.; Kang, C. Research Framework and Basic Models for Cloud Energy Storage in Power System. Proc. CSEE 2017, 37, 3361–3371+3663. [Google Scholar]

- Liu, J.; Zhang, N.; Kang, C.; Kirschen, D.S.; Xia, Q. Decision-Making Models for the Participants in Cloud Energy Storage. IEEE Trans. Smart Grid 2018, 9, 5512–5521. [Google Scholar] [CrossRef]

- Zeng, K.; Liu, J.; Wang, H.; Zhou, Y.; Zhou, S. The Improved Model of the Deep Peak Regulation Market Considering the Load Aggregator Participation. IOP Conf. Ser. Earth Environ. Sci. 2021, 811, 012015. [Google Scholar] [CrossRef]

- Vaya, M.G.; Andersson, G. Optimal bidding strategy of a plug-in electric vehicle aggregator in day-ahead electricity markets. In Proceedings of the 10th International Conference on European Energy Market, Stockholm, Sweden, 27–31 May 2013. [Google Scholar]

- Yang, H.; Zhang, S.; Jing, Q.; Qiu, D.; Lai, M.; Dong, Z. CVaR-Constrained Optimal Bidding of Electric Vehicle Aggregators in Day-Ahead and Real-Time Markets. IEEE Trans. Ind. Inform. 2017, 13, 2555–2565. [Google Scholar] [CrossRef]

- Yao, E.; Wong, V.; Schober, R. Optimization of Aggregate Capacity of PEVs for Frequency Regulation Service in Day-Ahead Market. IEEE Trans. Smart Grid 2018, 9, 3519–3529. [Google Scholar] [CrossRef]

- Hasan, M.M.; Rahman, M.A.; Manshaei, M.H.; Saad, W. A Game-Theoretic Analysis of Pricing Competition Between Aggregators in V2G Systems. In Proceedings of the 2019 IEEE 43rd Annual Computer Software and Applications Conference (COMPSAC), Milwaukee, WI, USA, 15–19 July 2019. [Google Scholar]

- Rahmani-Andebili, M. Spinning reserve supply with presence of electric vehicles aggregator considering compromise between cost and reliability. IET Gener. Transm. Distrib. 2013, 7, 1442–1452. [Google Scholar] [CrossRef]

- Rahmani-Andebili, M.; Venayagamoorthy, G. Investigating effects of changes in power market regulations on demand-side resources aggregators. In Proceedings of the 2015 IEEE Power & Energy Society General Meeting, Denver, CO, USA, 26–30 July 2015. [Google Scholar]

- Wu, H.; Shahidehpour, M.; Alabdulwahab, A.; Abusorrah, A. A Game Theoretic Approach to Risk-Based Optimal Bidding Strategies for Electric Vehicle Aggregators in Electricity Markets with Variable Wind Energy Resources. IEEE Trans. Sustain. Energy 2017, 7, 374–385. [Google Scholar] [CrossRef]

- Beaudin, M.; Zareipour, H.; Schellenberg, A.; Rosehart, W. Energy Storage for Mitigating the Variability of Renewable Electricity Sources. In Energy Storage for Smart Grids; Academic Press: Oxford, UK, 2015; pp. 1–33. [Google Scholar]

- Wang, Q.; Zhang, C.; Ding, Y.; Xydis, G.; Wang, J.H.; Østergaard, J. Review of real-time electricity markets for integrating Distributed Energy Resources and Demand Response. Appl. Energy 2015, 138, 695–706. [Google Scholar] [CrossRef]

- Liu, J.; Zhang, N.; Kang, C.; Kirschen, D.; Xia, Q. Cloud energy storage for residential and small commercial consumers: A business case study. Appl. Energy 2017, 188, 226–236. [Google Scholar] [CrossRef]

- Liu, Z.; Yang, J.; Song, W.; Xue, N.; Li, S.; Fang, M. Research on cloud energy storage service in residential microgrids. IET Renew. Power Gener. 2019, 13, 3097–3105. [Google Scholar] [CrossRef]

- Nagill, N.; Reddy K., S.; Kumar, R.; Panigrahi, B.K. Feasibility analysis of heterogeneous energy storage technology for cloud energy storage with distributed generation. J. Eng. 2019, 2019, 4970–4974. [Google Scholar] [CrossRef]

- Xia, Y.; Xu, Q.; Zhao, J.; Yuan, X. Two-stage robust optimisation of user-side cloud energy storage configuration considering load fluctuation and energy storage loss. IET Gener. Transm. Distrib. 2020, 14, 3278–3287. [Google Scholar] [CrossRef]

- Verkade, N.; Johanna, H. Collective Energy Practices: A Practice-Based Approach to Civic Energy Communities and the Energy System. Sustainability 2019, 11, 3230. [Google Scholar] [CrossRef]

- Hoffman, S.; High-Pippert, A. From private lives to collective action: Recruitment and participation incentives for a community energy program. Energy Policy 2010, 38, 7567–7574. [Google Scholar] [CrossRef]

- van Summeren, L.F.; Wieczorek, A.J.; Bombaerts, G.J.; Verbong, G.P. Community energy meets smart grids: Reviewing goals, structure, and roles in Virtual Power Plants in Ireland, Belgium and the Netherlands. Energy Res. Soc. Sci. 2020, 63, 101415. [Google Scholar] [CrossRef]

- Nguyen, D.; Long, B. Risk-Constrained Profit Maximization for Microgrid Aggregators with Demand Response. IEEE Trans. Smart Grid 2015, 6, 135–146. [Google Scholar] [CrossRef]

- Wang, X.; Gong, Y. Air conditioner fast dispatching model based on load aggregator and direct load control. J. Eng. 2017, 2017, 2535–2538. [Google Scholar] [CrossRef]

- Zamani, A.; Zakariazadeh, A.; Jadid, S. Day-ahead resource scheduling of a renewable energy based virtual power plant. Appl. Energy 2016, 169, 324–340. [Google Scholar] [CrossRef]

- Vuelvas, J.; Ruiz, F.; Gruosso, G. A time-of-use pricing strategy for managing electric vehicle clusters. Sustain. Energy Grids Netw. 2021, 25, 100411. [Google Scholar] [CrossRef]

- Amirioun, M.; Kazemi, A. A new model based on optimal scheduling of combined energy exchange modes for aggregation of electric vehicles in a residential complex. Energy 2014, 69, 186–198. [Google Scholar] [CrossRef]

- Chao, P.; Zou, J.; Lian, L. Dispatching strategies of electric vehicles participating in frequency regulation on power grid: A review. Renew. Sustain. Energy Rev. 2017, 68, 147–152. [Google Scholar]

- Wang, X.; Zhang, H.; Zhang, S. Impacts of joint operation of wind power with electric vehicles and demand response in electricity market. Electr. Power Syst. Res. 2021, 201, 107513. [Google Scholar] [CrossRef]

- Kamyab, F.; Amini, M.; Sheykhha, S. Demand response program in smart grid using supply function bidding mechanism. IEEE Trans. Smart Grid 2016, 7, 1277–1284. [Google Scholar] [CrossRef]

- Soares, J.; Ghazvini, M.; Borges, N. A stochastic model for energy resources management considering demand response in smart grids. Electr. Power Syst. Res. 2017, 143, 599–610. [Google Scholar] [CrossRef]

- Baringo, L.; Amaro, R. A stochastic robust optimization approach for the bidding strategy of an electric vehicle aggregator. Electr. Power Syst. Res. 2017, 146, 362–370. [Google Scholar] [CrossRef]

- Chen, T.; Yang, J.; Jiang, W. Optimal configuration of energy storage capacity in wind farms based on cloud energy storage service. IET Renew. Power Gener. 2022, 16, 211–222. [Google Scholar] [CrossRef]

- Wen, F.; David, A.K. Optimal bidding strategies and modeling of imperfect information among competitive generators. IEEE Trans. Power Syst. 2001, 16, 15–21. [Google Scholar]

- Shafie-Khah, M.; Moghaddam, M.; Sheikh-El-Eslami, M. Modeling of interactions between market regulations and behavior of plug-in electric vehicle aggregators in a virtual power market environment. Energy 2012, 40, 139–150. [Google Scholar] [CrossRef]

- Moshari, A.; Ebrahimi, A.; Fotuhi-Firuzabad, M. Short-Term Impacts of DR Programs on Reliability of Wind Integrated Power Systems Considering Demand-Side Uncertainties. IEEE Trans. Power Syst. 2016, 31, 2481–2490. [Google Scholar] [CrossRef]

| Generator | (MW) | ($/MWh) | ($/MW2h) |

|---|---|---|---|

| 1 | 140 | 10 | 1.5 |

| 2 | 160 | 15 | 1 |

| Operating Parameter | (MW) |

|---|---|

| Self-loss factor (%) | 0.001 |

| Charge/discharge loss factor | 0.02 |

| Maximum charge/discharge power (MW) | 60 |

| Cloud Energy Storage Facility Capacity (MWh) | 100 |

| The peak of the state of charge | 0.9 |

| The valley of the state of charge | 0.15 |

| Scenario | Profits of Generator ($) | Profits of EVA ($) | Expected Penalty Cost of EVA ($) | Profits of LA ($) | Expected Penalty Cost of LA ($) | Profits of CESSO ($) |

|---|---|---|---|---|---|---|

| Proposed scheme | 98,562 | 8743 | 0 | 10,236 | 0 | 9827 |

| Scheme 2 | 95,321 | 7921 | 532 | 9421 | 426 | 7046 |

| Scenario | Profits of Generator 1 ($) | Profits of EVA ($) | Profits of LA ($) | Profits of CESSO ($) | Social Welfare ($) |

|---|---|---|---|---|---|

| Scheme 2 | 95,321 | 7921 | 9421 | 7046 | 214,827 |

| Scheme 3 | 98,672 | 8532 | 10,456 | 0 | 212,045 |

| Scheme 4 | 99,763 | 8834 | 0 | 9865 | 211,876 |

| Scheme 5 | 97,321 | 0 | 9986 | 9244 | 211,097 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, Z.; Pi, R.; Yang, J.; Yang, C.; Chen, X. Equilibrium Analysis of Electricity Market with Multi-Agents Considering Uncertainty. Energies 2025, 18, 2006. https://doi.org/10.3390/en18082006

Sun Z, Pi R, Yang J, Yang C, Chen X. Equilibrium Analysis of Electricity Market with Multi-Agents Considering Uncertainty. Energies. 2025; 18(8):2006. https://doi.org/10.3390/en18082006

Chicago/Turabian StyleSun, Zhonghai, Runyi Pi, Junjie Yang, Chao Yang, and Xin Chen. 2025. "Equilibrium Analysis of Electricity Market with Multi-Agents Considering Uncertainty" Energies 18, no. 8: 2006. https://doi.org/10.3390/en18082006

APA StyleSun, Z., Pi, R., Yang, J., Yang, C., & Chen, X. (2025). Equilibrium Analysis of Electricity Market with Multi-Agents Considering Uncertainty. Energies, 18(8), 2006. https://doi.org/10.3390/en18082006