1. Introduction

The energy transition towards green and blue technologies is a process currently implemented in the European Union, as well as in the other part of the world. Environmental concern, as well as strategic, geopolitical and economic issues, have been the key drivers of such activities. Transition refers mostly to the energy and transport sector being responsible for the majority of emissions (51% of the EU GHG emissions in 2022). Today, the EU’s directional policy document, the European Green Deal (EGD) [

1], followed by the Sustainable and Smart Mobility Strategy (SSMS) [

2], together with numerous related directives and regulations, creates serious energy transition challenges for companies and society, where road transport decarbonization is one of the most important elements. It refers both to the role of road haulage in the European transport system and to the level of emissions generated by the combustion engines of cars and trucks.

In addition to technical, operational and cost challenges, the decarbonization of road freight transport will also impact the competitiveness structure of transport markets, as it will change the conditions of firms’ operation. A special case here is international road haulage within the European Union, as the long-distance transport rendered across the territories of different countries. The implementation of zero-emission vehicles should influence internal competitive structures in road freight transport, as well as its external competition towards other modes. Ultimately, this will affect the market prices of service and therefore the competitiveness of the European economy and the level of social welfare.

The basic solution in the decarbonization process is the transition to green trucks, including the use of vehicles with electric drive. Unfortunately, this process of renewal of fleets of trucks is associated with the higher costs of acquiring new rolling stock today. Thus, purchasing zero-emission vehicles will seriously burden companies operating in the very competitive road freight market in the EU. The impact of decarbonization efforts on the functioning of truck businesses, transport markets and the economy is therefore an important area of uncertainty.

Taking the above issues into account, three research questions can be formulated that constitute the authors’ primary area of interest:

- Q1:

What could be the consequences of decarbonizing road freight transport for the functioning of the transport market in terms of its structure and competitiveness, including the level of service prices?

- Q2:

How will national support programs for the implementation of zero-emission trucks impact the international competitiveness of transport companies?

- Q3:

Who will be the market winners, and who will be the losers in the process of decarbonizing international road freight transport in Europe?

In the research process, the following hypothesis was also defined: Full implementation of the requirements of the European Union’s decarbonization measures through the deployment of electric trucks will reduce the level of competitiveness of international road freight transport in Europe in the context of increasing market concentration and a deterioration in its position in relation to other modes of transport.

The paper is structured as follows:

Section 2 reviews the literature,

Section 3 presents the sources of information and research methods used,

Section 4 analyzes the data and information necessary for the conclusion process, and

Section 5 provides a discussion that summarizes the potential market impacts of decarbonization measures in road freight transport. A summary is also provided, which addresses policy implications, limitations and suggestions for future research.

2. Literature Review

The decarbonization of road freight transport is a global challenge, because the actions, regulations and process of elimination of traditional fossil fuels are observed in many countries. However, research on the implementation of electromobility is largely focused on passenger cars used by individuals. For this reason, the literature lacks studies relating to the impact of introducing electric cars on the competitive structures of the market, characteristic of commercial road freight transport.

When it comes to analyses of the use of sustainable means of transport for road freight service, several leading issues dominate. Apart from the technical and engineering aspects that are outside the scope of this publication, the authors, who deal with economics and management, focus mainly on the issues of the costs and emission of using sustainable trucks, comparing different drive types (e.g., electric, fuel cell, hydrogen, bioethanol, ammonia, methanol, dimethyl) [

3,

4,

5,

6,

7,

8]. The key method of assessment is the life-cycle analysis (LCA) of financial costs, including costs of emissions [

9,

10,

11], referring to the concept of total cost of ownership (TCO) [

7,

11,

12,

13,

14,

15] or total cost of driving (TCD) [

16]. The authors of analyses often focus on transport provided by light- or medium-duty vehicles, carried out in a limited area (city logistics, last-mile delivery), demonstrating the premises and factors that increase the efficiency of electric trucks [

13,

17,

18,

19]. Comparative analyses of the total costs of ownership of trucks used over longer distances (>300 km) indicate a reduction in the efficiency of battery electric trucks in favor of other sustainable solutions (e.g., hybrids, hydrogen fuel cells) [

3,

7,

14,

20,

21]. TCO analyses presented in the studies always refer to a uniform, national area of operation of carriers, assuming a uniform regulatory system (taxes, fees) and a uniform level of energy prices. The significantly smaller range of electric trucks (approx. 500 km) compared to diesel trucks eliminates the possibility of optimizing fuel costs by using the reserve. In international cross-European transport, charging an electric truck will probably take place several times, often in different countries and at different prices. From that perspective, a crucial element is the energy supply, which concerns both the structure of deployment or travel planning using the optimal network of chargers, as well as the use of modern technological solutions enabling shortening the charging time (megawatt chargers, battery replacement) [

22,

23,

24,

25].

An essential part of most studies is the reference of the process of implementing electromobility in road freight transport to the support policies that individual countries implement or should implement. Such indications apply to European countries (e.g., Sweden [

5,

26,

27], Finland [

28]), Brazil [

29,

30], Australia [

31] or China [

32]. A very interesting thread related to both policy issues and the environmental efficiency of electric vehicles is the reference to energy sources. Using Australia [

9] as an example, a similar discussion can be applied to the countries of Central Europe, where coal-based energy still has a dominant share in the energy mix.

The search for direct references to the subject undertaken in this article comes down to three issues and indications resulting from the available literature. The first is the significantly higher initial investment costs (CAPEX) [

33,

34] associated with the purchase of battery electric trucks compared to diesel trucks. Higher up-front costs raise questions about what kind of businesses will choose to purchase electric trucks. Sallberg and Numminen [

35] refer to this issue in their analysis of the Swedish road haulage market, where the receptiveness of companies to the implementation of vehicles powered by alternative fuels was examined with respect to the size of the company, the level of service diversification and age. Their results supported two hypotheses referring to the firm size and its diversification. Large companies providing a wide range of services will be more receptive to implementing electric trucks. The issue of firm size and risk exposure in deploying electric trucks in Australia was also analyzed by Moglia et al. [

36]. In their study of 199 decision-makers, they found that small private trucking companies might be more risk-averse than large shippers and retailers who have publicly committed to fleet electrification. Singuara et al. conducted research on the relationship between the organizational structures of companies (formalization, centralization) and the decision-making processes regarding the implementation of electric trucks [

37]. Despite the lack of a clear causal relationship, a slightly higher propensity to undertake such actions was observed in formalized structures, which can be interpreted as larger companies. The issue of company size (single truck vs. fleet) is also addressed in the cross-sectional study conducted by Danielis et al. [

38] The systematic literature review provided by the authors indicates a higher susceptibility to BET implementation among large-fleet companies. Higher profitability allowing for financing up-front costs, using economies of scale, less sensitivity to the level of TCO or easier access to public support measures (decarbonization policy) favor investments in sustainable solutions. Parviziomran et al. come to similar conclusions by examining the susceptibility of basic financing sources to BET implementation. Using an agent-based model, they relate the implementation possibilities to the financial condition of the company [

5]. The analysis indicates that debt is the most adequate way of financing the purchase of electric trucks. Therefore, companies investing in sustainable technologies must demonstrate the ability to incur liabilities.

No studies were found in the literature that demonstrate the market effects of implementing electromobility in road freight transport, especially in long-distance international connections. In this case, market effects will be related to the competitive structure of the market, understood as the level of concentration. This research gap prompted the authors to undertake research that would verify the ability of international road transport companies to implement the changes required in the European Union.

3. Materials and Methods

A review of the literature referring to decarbonization and the introduction of zero-emission vehicles to road transport has identified an existing research gap, which the authors decided to fill. Determining the future impacts of planned and implemented changes on the competitive structure of the market requires, first of all, identification of the current situation. The main research method in this case was the analysis of statistical data. For this purpose, data and information from Eurostat (e.g., EU Statistical Pocketbook, EU Transport in Figures), industry transport portals and thematic studies were used. Information from the following sources was of key importance: 1. EEA (European Energy Agency); 2. EC (European Commission); 3. IRU (International Road Union); 4. ZMPD (Association of International Road Carriers in Poland); 5. PSPD (Pomeranian Association of Road Carriers).

In addition, some data and information were made available thanks to numerous interviews conducted with representatives of road carrier employers’ organizations. Particularly valuable were the consultations held with representatives of road carrier associations, both at the national level (ZMPD) and at the regional level (PSPD).

The background for the conducted research is the requirements defined at the level of legal EU acts and sectoral regulations regarding the decarbonization of road freight transport. Therefore, a revision of legal acts was carried out, along with the verification of legal comments and opinions regarding this area of transport policy regulation.

These materials allowed obtaining basic data on all analyzed components, specifying at the same time existed relationships between them, which potentially made it possible to examine the impact of the ongoing energy transformation in the road freight transport sector on the road haulers companies as well as the changes in the market structure and the competitiveness within the sector and with other providers of transport services in the EU transport market.

Moreover, the collected and processed data, as well as the obtained information and materials, enabled the development of the methodological basis for the implementation of this research project.

Due to the fact that the conducted study is of an ex ante nature, where it is possible to identify only selected partial causative factors, and their future changes are uncertain, the authors did not have the opportunity to use purely statistical tools to analyze the data. Therefore, the study used a deductive method, where general conclusions in the studied area were defined based on specific premises. Other complementary research methods were used within the methodological triangulation formula. They included a critical literature analysis (CLA), data mining obtained mainly from EU statistical sources (Eurostat) and market analysis (MA). The work also used comparative analysis (CA) and case study (CS).

4. Research

4.1. The Role of Road Haulage in the European Transport System

The market share of road transport compared to other modes in the total movement of goods, measured in billions of ton-kilometers [tkm], as well as the growing importance of this form of transport, is an important factor for the further development of the European Union and its member states. It is the only transport mode that has not only maintained its dominant market position but also significantly strengthened it, reaching in 2022 ca. 54% of the EU transport market share (

Table 1). Moreover, the long-term prognoses for 2050 suggest that road transport will maintain its dominant position for both freight and passenger transport service [

39]. Thus, providing favorable conditions for the functioning of the sector, especially in the context of the transport service supply, is probably a key element in maintaining prosperity in Europe.

This was possible thanks to the fact that road carriers operating in the highly competitive transport market have not only a lofty adaptability to changing market conditions, but also a number of logistic and operational advantages, such as above-average flexibility and mobility, which determine their competitive advantages in terms of direct access to potential shippers. These data clearly indicate the significant competitive advantages that road transport currently has over rail and inland waterway transport. They are a consequence of the developed, competitive transport market typical of this transport sector and, as a result, its high adaptability to various kinds of supply chain disruptions that are a characteristic feature of the current period.

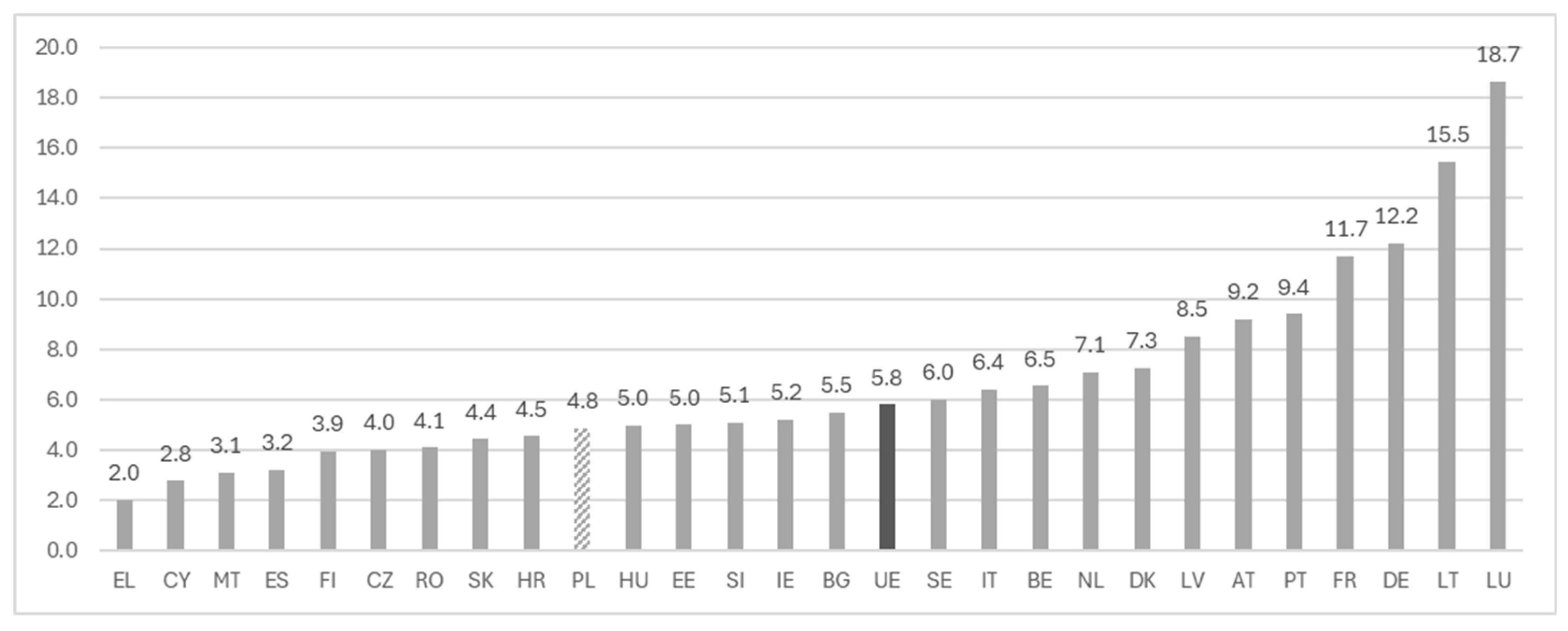

The internal structure of the market is the second dimension of the competitiveness of road freight transport in Europe. In this case, we can point to the large fragmentation of the road transport services market, which is reflected in the high number of companies. In 2022, there were a total of 582 thousand companies. The competitive structure of companies is determined by the size of employment or the number of vehicles, which should be related to size classes. Unfortunately, Eurostat last published such information in 2012. The reason is most likely the low level of feedback from member states (in 2012, the data concern Poland only). Currently, we can only refer to medium-sized companies, where the EU average employment is 5.8 people per company (this includes domestic and international carriers). The data obtained for the member states confirm that the level of fragmentation of companies is higher in Central and Eastern European countries (

Figure 1).

The market is therefore created by small and medium-sized enterprises. Their relatively strong market position on the one hand and weakness in economic and financial terms on the other hand is reflected in low unit revenues and falling profitability. Such a large fragmentation of the road transport services market is characteristic of extremely competitive market structures (striving for a model of perfect competition), where limited opportunities to generate profits are observed. Transport companies are the market price takers, with marginal revenues (MR) approaching the level of marginal costs (MC). Relatively low barriers to entry into the market and a homogeneous product (high substitutability) are the key factors of limited financial surpluses in the long term. As a result, the investment potential of small and medium carriers becomes restricted. This apparent lack of coherence between the economic and ecological spheres, which are the essence of sustainable development and mobility, has led to the main problems and challenges in decarbonization being presented in the form of a case study, using Poland as an example.

4.2. Environmental Impacts of European Road Transport

Road freight transport, apart from its undoubted advantages and role in the European Union transport system, is also a source of high external costs, where emissions of pollutants into the atmosphere are of particular importance (apart from the costs of accidents, noise, landscaping, etc.). Road freight transport is responsible for approximately 73% of greenhouse gas emissions from the transport sector in the European Union. In 2022, total GHG emissions reached 763.7 million tons of CO

2 equivalent (

Figure 2) [

42].

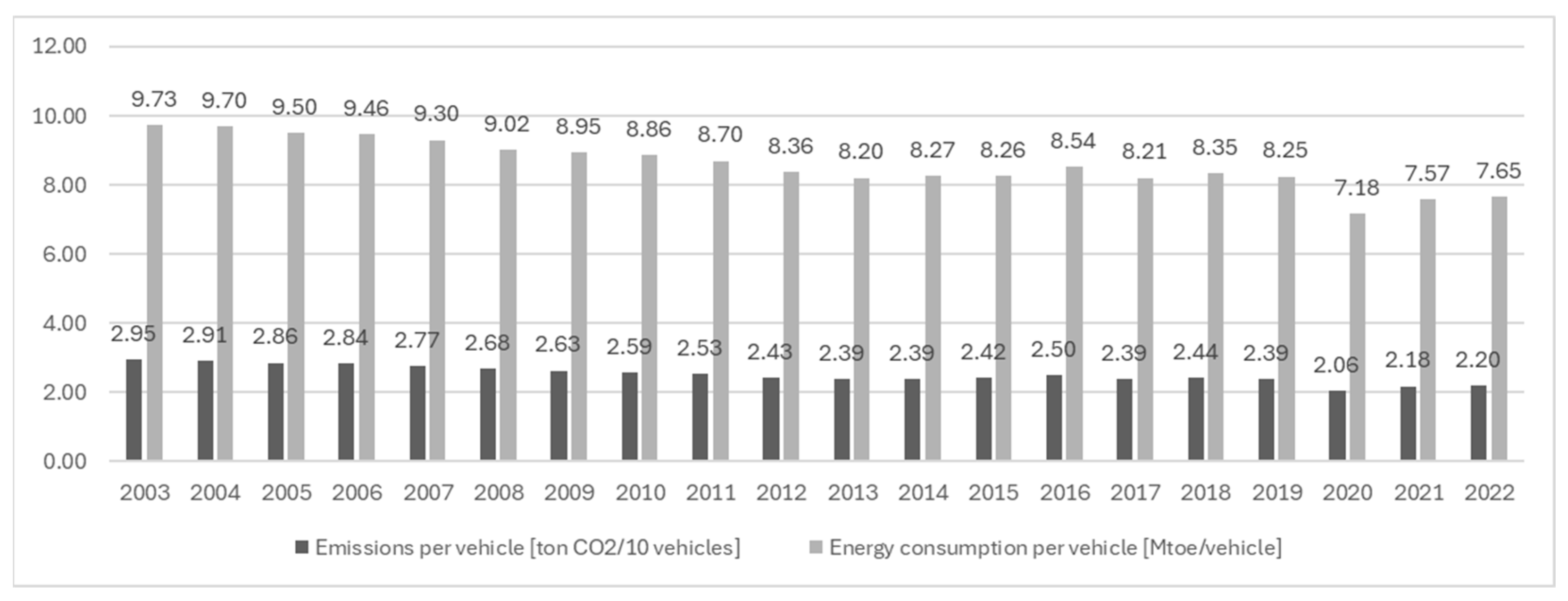

Road freight transport is currently based on traditional propulsion technology (diesel engines). The total level of emissions will therefore be the result of several factors, such as the number of trucks, the demand for transport (tkm) and the level of unit emissions. In practice, the level of total greenhouse gas emissions has not changed, despite the increase in the number of trucks and transport performance (

Figure 3). Similarly, fluctuations of the share of road transport in total emissions were mostly determined by the activity of other modes of transport, in particular airlines.

The lack of increases in total emissions was possible thanks to the introduction of successive, increasingly stringent emission standards in Europe (EURO). This is confirmed by the historical data showing gradual decrease of unit CO2 emissions, both in relation to the number of trucks and the energy consumed. Pro-environmental activities can therefore be considered effective, although the pace of change does not match contemporary decarbonization challenges defined in the European Green Deal in 2019.

4.3. European Union Priorities and Regulations for Decarbonizing Transport

The European Green Deal (EGD) [

1], being the key policy document of the European Union, assumed the reduction of net greenhouse gas emissions by 2030 at least 55% less compared to year 1990. Similarly, the 90% reduction of greenhouse gas emissions in the transport sector is targeted by 2050. The EU package Fit for 55 is supporting the EGD process by detailed regulations. Considering the European road haulage sector, the following actions will have a strong influence on the future market situation:

- (1)

New CO

2 standards for new heavy-duty vehicles [

43];

- (2)

Revised ETS Directive (ETS2) [

44];

- (3)

Clean Vehicle Directive [

45].

For new heavy-duty vehicles, the CO2 standards revised in May 2024 set a 15% emissions reduction target by 2025 compared to a 2019 baseline. Accordingly, a 45% reduction by 2030, a 65% reduction by 2035 and a 90% reduction by 2040 will be implemented. The ETS Directive creates a new emissions trading system (ETS2) covering fuel combustion in buildings, road transport and additional sectors. The system will be fully operational in 2027. The aim is to reduce emissions by 42% by 2030 compared to 2005 levels. Similarly, the directive on promotion of clean and energy-efficient road transport vehicles sets minimum targets and requires member states to ensure an adequate share of clean light and heavy-duty vehicles in public procurement carried out by contracting authorities and contracting entities.

Such ambitious goals require radical action, especially with regard to fuels and propulsion systems used in road transport. The key driver is therefore transition towards low or zero-emission vehicles. Implementation of alternative fuels and clean technologies is a must. Several solutions are currently being implemented to reduce emissions from trucks, like battery electric, hybrid electric, plug-in hybrid and fuel cell electric. However, regulatory framework, especially in the long term, will require a full transition to pure electric vehicles, and the remaining (hybrid) solutions should be considered transitional. The deployment of zero emission trucks (ZETs) therefore needs to ramp up drastically in the next years and replace the sales of most combustion engine trucks.

In the case of ETS, the main effect of the regulation will be an increase in the prices of mineral fuels, because sellers will be obliged to pay for future emissions. The increase in costs will undoubtedly be passed on to users (including transport companies). An option of replacement of expensive traditional fuel (diesel oil) will be alternative drives, including electromobility.

4.4. Deploying Electric Trucks as a Key Decarbonization Compliance Strategy

The global electric truck market is currently at an early stage of development, but environmental regulations, both in Europe and other parts of the world, influence the rapid expansion of the offer as well as an increase in the share of sales. In 2023, the value of the global electric truck sales market reached USD 21.1 billion, of which only USD 2.5 billion was in Europe (

Table 2) [

46].

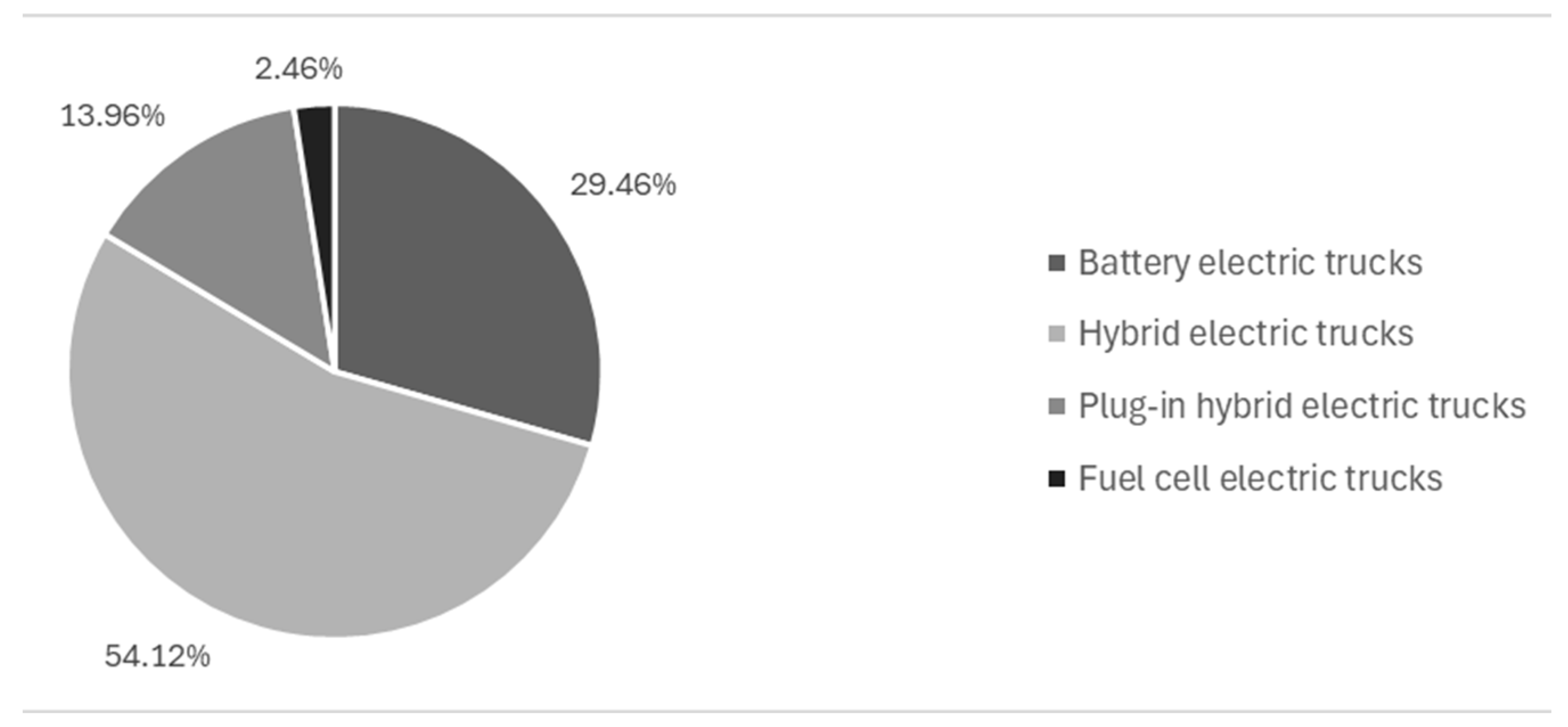

The leader is the Asia-Pacific region, which recorded 71% of sales. In 2023, the year-on-year increase in the market value was 19% (12% in 2022), indicating a growing interest in this type of solution. This applies to light-duty trucks (LDV), medium-duty trucks and heavy-duty trucks (HDV). The largest share is held by light trucks, which in 2023 accounted for 65.3% of the market. The data concern trucks equipped with electric systems, both supporting combustion engines (hybrid) and constituting the sole source of drive. Thus, the most widely used technology is the hybrid system, which has a 54% share of sales (

Figure 4). Trucks using only electric drive (battery or cells) accounted for a total of 32%.

Of the overall market, only 7.6% of electrified light and medium commercial vehicles (LCV) sold in Europe in 2023 were electric. Meanwhile, electrification of heavy goods vehicles remains in its infancy and will account for just 2% of the EU market in 2023 (

Figure 5) [

47].

The range of electric trucks available on the market is also growing. In 2024, there were more than 60 models of battery electric trucks (BET), mainly LDVs. The first long-distance electric trucks with a range of over 500 km also appeared on the market (MAN, Scania and Daimler). Truck makers have announced that 4–9% of their truck sales will be zero emission by 2025, rising to 41–47% by 2030 [

48]. It is predicted that the global market will reach 1.067.985 electric commercial trucks by 2030, at a compound annual growth rate (CAGR) of 34% from 2022 to 2030 [

49].

4.5. Support Policies and Market Actions for the Deployment of Electric Trucks in Europe

Replacing a fleet of trucks with zero-emission electric vehicles, in line with regulatory requirements, involves significantly higher upfront costs (CAPEX), which are estimated at 2.5–2.8 times higher than for an equivalent diesel-powered vehicle [

50,

51]. For this reason, individual countries are trying to support transport companies in fleet replacement. Financial incentives make electric heavy-duty trucks more affordable. Government subsidies and grants lower the required initial investment, while tax incentives lower the total cost of ownership by reducing the tax burden of purchases and operations. In addition, there are programs available to encourage the construction of charging infrastructure that supports the practical use of electric trucks.

In the UK, the government offers the Plug-in Truck Grant, which reduces the cost of buying smaller electric trucks by 20% and larger trucks by up to GBP 25,000. The maximum discount available for some small trucks is GBP 16,000. In Germany, The Federal Ministry for Digital and Transport Infrastructure (BMDV) offers direct purchase subsidies through programs like the Electromobility Funding Guideline, which provides subsidies for electric vehicles, including trucks, that can cover up to 80% of the additional investment costs compared to conventional vehicles. Additionally, Germany has a subsidy scheme for setting up electric vehicle charging infrastructure targeting commercial fleets, as well as actively investing in research and development. The National Electromobility Development Plan focuses on advancing battery technology, electric drivetrains and other key components essential for the practical implementation of electric trucks in commercial use. In Norway, electric trucks are exempt from purchase tax and VAT, making them competitively priced compared to diesel trucks. Sweden, on the other hand, has implemented a subsidy program that covers up to 35% of the cost of an electric truck. The French government offers an “ecological premium” that applies to light commercial vehicles and heavier electric trucks. The premium can be as much as EUR 5000, depending on the vehicle’s weight and emission criteria. In addition, a program has been developed that provides an incentive to replace older, less environmentally friendly trucks with cleaner electric models [

52]. However, placing the responsibility for supporting the replacement of the fleet with zero-emission trucks in the hands of European countries results in unequal levels of support between individual countries, which may ultimately lead to a distortion of competition.

The main challenge, however, is the inequality related to the investment potential of enterprises. In the case of large global multifunctional transport and logistics corporations, the development of a fleet of electric trucks is currently an implemented development strategy. It is most often an element of the implemented ESG strategy, which is also part of the decarbonization processes programmed in the transport sector. Leading logistics operators are defining plans for the implementation of alternative fuels in road transport (

Table 3). Given the available technologies, there is no doubt that electric trucks are one of the key options. The first goals have already been set for 2025, so the process of replacing trucks is starting now.

Decarbonization targets will become increasingly stringent in the coming years. In selected cases, the entire fleet will be replaced with zero-emission trucks within the next 15 years.

This is confirmed by market information regarding contracts for the supply of electric trucks. For instance, DSV has signed a cooperation agreement for 300 Volvo electric heavy trucks (08.2024). Thus, DSV will have one of the largest company fleets of heavy electric trucks in Europe. The company plans to deploy 2000 electric trucks in its fleet by 2030 [

54]. Volvo also received an order for 100 electric trucks from logistics company DFDS, doubling its fleet of electric trucks to 225 trucks in total [

55]. Another example is the letter of intent to sell 1000 electric Volvo trucks to one of the world’s largest suppliers of construction solutions, Holcim, by 2030 [

56]. Amazon also plans to buy up to 2500 electric trucks from Canadian manufacturer Lion Electric by 2025. The deal also says Lion will hold spare production capacity for Amazon between 2026 and 2030. That means there is an option to sell at least another 2500 electric trucks by the end of 2030 [

57]. Lithuanian transport company Girteka has entered into cooperation with Scania, which will deliver a total of 600 electric trucks over the next four years [

58]. DB Schenker has placed orders for electric trucks, including Renault E-Tech (53 units), Mercedes eActros (100 units) and MAN eTruck (100 units). At the same time, the company is cooperating with Volta Trucks (London, UK), which is to deliver 150 Volta Zero vehicles in 2025. It is expected that the cooperation may ultimately involve 1500 units of vehicles from Volta Trucks [

59]. Finally, Renault Trucks also supplies 100 electric vehicles (Renault E-Tech) to XPO Logistic (logistics company Greenwich, Greenwich, CT, USA) [

60].

Small and medium businesses, which make up the majority of companies operating in road freight transport in Europe, are in a much worse situation. Due to the low level of margins, they have limited investment possibilities (ability to incur liabilities), which applies to both the purchase of more expensive electric trucks and the development of charging facilities.

5. Case Study—The Polish International Road Transport Companies

The effects of implementing electromobility in European freight transport and the impact on the competitive structures of the market will be presented using the example of the leader in international road transport, Poland. In 2023, Polish companies performed a total of 243 billion tkm, which is 33% of the EU market, significantly ahead of companies from Spain, Lithuania and Romania (

Figure 6). Polish international road transport companies are also the leaders in overall results in Europe (international and domestic transport), having performed a total of 377.8 million tkm in 2023. The next positions were occupied by road haulers from Germany (286.8 billion tkm), Spain (263.4 billion tkm) and France (169.2 billion tkm) [

61].

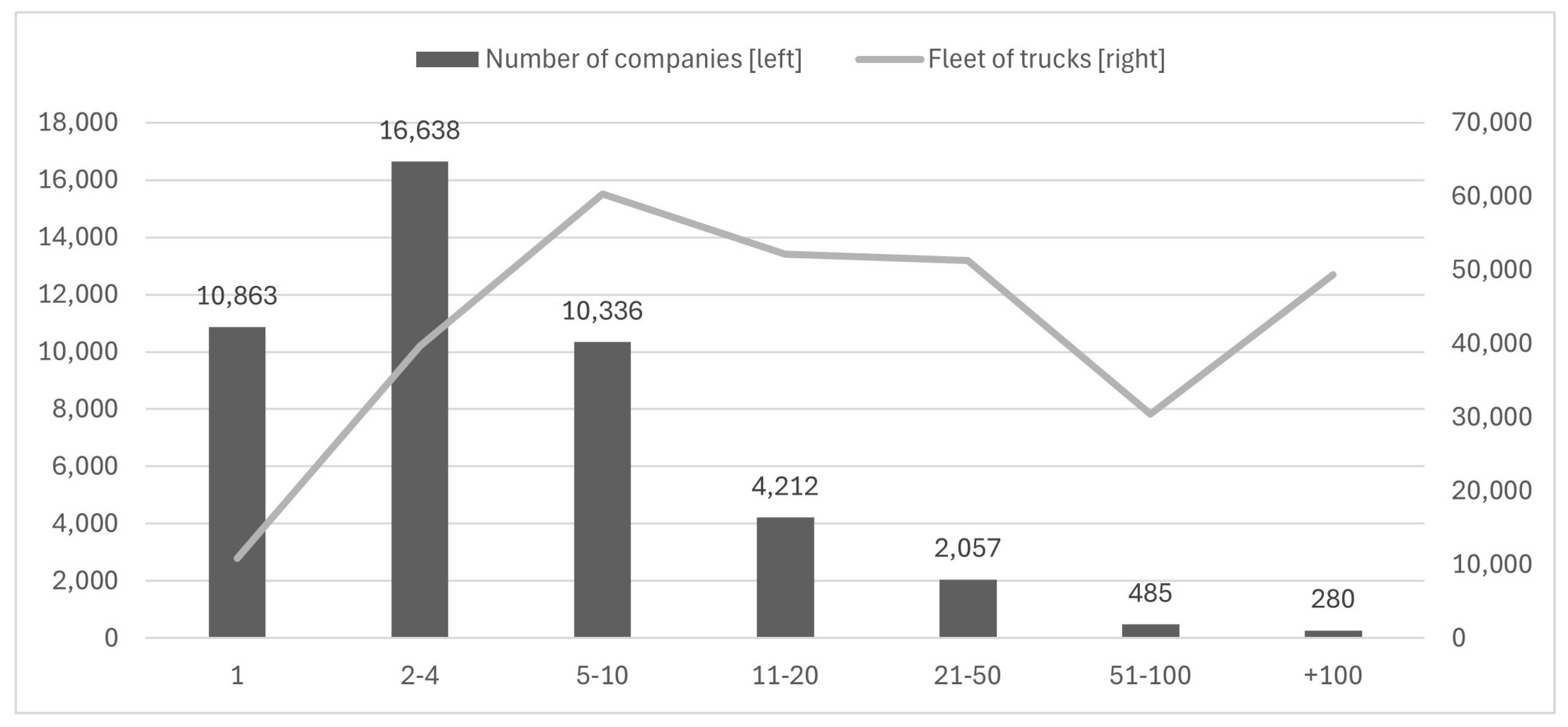

International road transport was carried out by 45,565 Polish companies, which had a total of 341 thousand trucks in 2023. Most of them were HDV (305 thousand vehicles). It can be said that the average size of a company is 7.5 trucks. However, the analysis of the structure of companies from the perspective of the size of the fleet indicates that companies with 2–4 trucks (37.1%) dominate, followed by those with one vehicle (24.2%) and 5–10 vehicles (23.0%). Large Polish road freight transport companies (+100 HDV) are only 0.6% of the number of companies. The structure is slightly different considering the number of trucks. Here, the largest fleet is operated by companies with 5–10 vehicles (20.5%). Companies with 11–20, 20–50 trucks and the largest ones (+100) also have a share exceeding 15% (

Figure 7) [

62].

The large fragmentation of the market on the supply side indicates a highly competitive structure of companies. This of course limits the possibilities of shaping market prices, which in consequence leads to a limitation of their profits and investment potential. Based on the average fleet size in individual categories, as well as the average margin generated from one vehicle-kilometer (EUR 0.04 in 2023) multiplied by average annual milage (140 thou. km), it is possible to estimate the average level of profits generated in individual size categories of international road transport companies in Poland (

Table 4).

The results indicate a very low development potential of companies with a limited fleet of trucks. With the average price of a new truck (road tractor) with a traditional drive (diesel engine) amounting to around EUR 100 thou., only companies with more than twenty trucks are able to buy another new vehicle per year. In other cases, any development must be based on used trucks. This very simplified approach to assessing the development opportunities of road carriers also allows identification of the impact of implementing electromobility on the road freight transport market. In the case of significantly higher upfront costs of purchase of electric trucks, estimated at 2.5–2.8 times, the investment opportunities of small and medium-sized companies will be even lower. It should be added that electric trucks will also require investments in charging facilities, as well as higher financial and insurance costs.

Doubts are also raised by the relatively lower utility of electric trucks, especially on long, international connections (over 500 km). In this case, there is a need to charge vehicles outside the company’s headquarters, which, given high energy prices and the need to immobilize the vehicle for a longer period of time, may lead to a decrease in the profitability of services. At the same time, work is being done on solutions that will eliminate these inconveniences.

The utility and flexibility of BET vehicles can be improved by developing fast charging infrastructure (called MCS—Megawatt Charging System), expanding overhead catenary (high costs and limited infrastructure availability), battery swapping technology or using hydrogen/fuel cells. Fast charging seems to be the best option in the short term, mainly due to the relatively scalable infrastructure [

63]. All of the indicated technical solutions are still in the implementation phase; therefore, there is no possibility of building a long-term strategy based on them. Therefore, the risk of decisions on energy transition from traditional fuels to electricity is growing.

6. Discussion

The follow-up of the current scenario of decarbonization of road freight transport in the EU, based on the regulatory requirements already implemented, may have different consequences for road haulers, for this segment of the transport market, as well as for the market itself, economy and consumers. As far as road carriers are concerned, the effects of ongoing decarbonization, seen in the form of the shift from diesel trucks to electric ones, will undoubtedly depend on the size of the company, its market share and customers’ relationships. Taking this into account and classifying the supply side of this market’s segment according to the criterion of company size, i.e., the number of vehicles owned and employees employed, it can be clearly stated on the basis of the analyses carried out that the effects of decarbonization will mostly affect small and medium-sized companies (SME), i.e., those that employ less than 10 employees and, on average, operate six to seven vehicles. This category of companies is particularly economically sensitive and not very resistant to any structural or cyclical disruptions that occur on the market and in the supply chain. Meanwhile, symptoms of this type of disruption have been especially visible in this group of transport companies since 2023 and manifest themselves in the form of a lack of financial possibilities for renewing and retrofitting the transport fleet by purchasing electric trucks. In addition, systematically falling profitability, growing debt and loss of financial liquidity are particularly felt in the road freight transport market, not only in the countries of Central and Eastern Europe (CEE, example of Poland) but also in other EU countries. In France, for example, according to Altarès data, there were 1339 failures of freight transport companies, an increase of 37.8% year-on-year (2024/2023). Of this total, 939 resulted in a judicial liquidation, which is characteristic for small companies with fewer than 10 employees. A similar trend was also visible in Belgium, Germany and the UK. The Statbel figures, quoted by Allianz Trade (Paris, France), indicate that the number of bankruptcies in the transport sector in Belgium has increased by more than 50% in 2024 as compared to 2023. In Germany, the failure rate of transport and warehousing companies is about twice the overall business average. In the UK, accordingly to the Road Haulage Association, nearly 500 carriers were forced to suspend their activity in 2023, and the 2024 trend suggested a 10% increase in bankruptcies. However, the scale of the intensity of these negative phenomena is particularly visible in the CEE countries and, above all, in Poland, which is the leader in the EU road freight transport market. Even obtaining significant subsidies and other forms of financial support to reduce the high purchase prices and the operating costs of BETs will require too-high upfront costs (CAPEX), impossible for most of them to bear. As a result of the lack of ability to carry out deep restructuring, already in the initial phase of the ongoing energy transformation, i.e., by 2030, the phenomenon of suspending operations and resigning from and expiring community licenses will intensify in this category of road freight haulers. There will also be a large-scale wave of bankruptcies and takeovers by larger road transport haulers as well as carriers from other transport modes, including large container carriers, ferry operators, logistics intermodal transport operators and international freight forwarders.

This trend will intensify as a result of the introduction of electric LDVs and HDVs into service, which could additionally strengthen and deepen the process of consolidation of this market segment and the entire EU transport market, too. The progressive consolidation of the road transport market and, consequently, the gradual decline in its large fragmentation will change not only the supply structure of the road transport market, but also the entire EU transport market. The process will be stimulated by capital integration of companies both within the road transport sector as well as outside it, i.e., with companies operating in other modes of transport.

Larger carriers with more than 50 vehicles, thanks to better access to financial support from EU governments, have a good chance of adapting to the established regulatory requirements for the decarbonization of this transport sector within a set time frame. Consequently, the market will gradually evolve towards an oligopoly in the formula typical for the maritime container shipping segment and rail freight transport in the EU.

This type of market, in turn, which will be formed in the road freight transport segment in the EU, could make it easier to build green intermodal logistics supply chains with the participation of large or larger road freight carriers operating mainly at their first and last legs. Such a model of integrating road transport with rail and inland waterways in the form of combined transport would be very beneficial and expected by both shippers and transport market regulators. By facilitating the development of such an integrated modal structure of the transport market it could accelerate the implementation of the sustainable and smart mobility strategy in the EU.

The evolving of the EU road freight transport market towards oligopoly, stimulated on one hand by weakening business activity in many EU countries and on the other by ongoing energy transition towards achieving the zero-emission zone, leads therefore to a significant structural change in this market, transforming it from a competitive into an oligopolistic one. However, the distribution of benefits and costs in this type of market will be shaped differently than on a competitive market between suppliers and recipients of transport services and final consumers of goods transported by road carriers. This in turn means that the creation of this type of market, with the relatively large market power of service providers, will lead to a shifting of a part of the costs resulting from the implementation of the energy transition goals in this sector to final consumers, i.e., taxpayers in EU countries. Therefore, the effects of the energy transition of this market segment, with such a significant share of the total EU transport market, will be felt by taxpayers, being also consumers of services provided by companies operating in this transport sector. They may be relatively high, considering that subsidizing the purchase of BETs also comes from budget revenues, i.e., from personal income taxes.

In this context, two questions arise. The first one is, who will bear the costs of achieving the energy transition goals in road freight transport towards achieving zero emissions under the current transport decarbonization strategy implemented by the EC, and to what extent. The second question is whether the expected effects of decarbonizing road freight transport, seen in terms of reducing total external costs generated by EU road haulers, will exceed the direct as well as indirect micro- and macroeconomic costs necessary to effectively proceed with the decarbonization process in the scheduled time. Obtaining comprehensive, reliable and factually correct answers to these questions requires further in-depth research in this area.

7. Conclusions

The concept of the sustainable development strategy is based on three pillars: ecological, economic and social. Its implementation in practice promotes only one of these dimensions—ecological—and thus marginalizes the other two. Therefore, it does not meet its own basic assumption and cannot be considered as such.

Decarbonization strategy, implemented with great dynamics and determination in EU transport, is strongly focused on the road transport segment. It only emphasizes the need to achieve one of the pillars of sustainable development in the period specified by the regulator until 2050. It treats the economic and social problems accompanying its implementation as secondary. As the authors’ research shows, this will lead to rapid changes in the market supply structure and, as a result, to its accelerated oligopolization. This process will then create significant change in the structure of the division of costs and benefits between freight forwarders and road carriers and thus to the transfer of value in the supply chain. Road carriers from Eastern European countries, which currently dominate the international transport market, may feel particular losses. The high fragmentation of the market, which determines high competitiveness and therefore low costs and prices of services, will be gradually reduced. These effects will also be felt by the consumer of goods transported by road carriers. It may therefore cause significant additional social and economic costs of implementing sustainability in the EU transport sector and also significantly delay its implementation.

Referring to the practical results of the study, first of all, it is necessary to indicate the recommendations for the regulator (EC) related to considering the possibility of spreading over time the currently implemented sustainable smart mobility strategy. Such a solution would significantly mitigate the negative economic and social effects that may accompany the transformation of the sector from its current competitive formula to an oligopolistic one, as well as the resulting change in the structure of the EU transport market. At the same time, actions should be taken at the European Union level to unify and harmonize support tools for enterprises. This applies both to the international dimension and the issue of access to funds by enterprises with different development potential. Unfortunately, there is a risk that leading countries will support their entrepreneurs more strongly. At the same time, companies with great potential will benefit from the public aid, pushing small players out of the market. As indicated, these changes will strengthen consolidation processes, which will translate into a wider use of alternative modes of transport (rail, inland waterway transport) on the main international sections. This will of course be in line with the sustainable mobility policy, although the costs of services will be higher.

The topic discussed in the article undoubtedly requires further research. So far, the implementation of zero-emission solutions in road freight transport has focused on technical issues (e.g., fuels, drives, power supply, charging) or on the cost side of the planned solutions. It is necessary to extend research to market issues, where the change in the operating costs of companies is reflected in competitive structures and service prices.