Research on the Current Status and Key Issues of China’s Green Electricity Trading Development

Abstract

1. Introduction

2. Materials and Methods

2.1. Qualitative Inorganic Analysis

2.2. Bibliometric Analysis

2.3. Data

3. Results and Discussion

3.1. Operational Mechanism and Development Status of Green Electricity Trading

3.1.1. Design of China Green Electricity Trading Mechanisms

3.1.2. Current Status of Green Electricity Trading

Current Status of International Green Electricity Trading

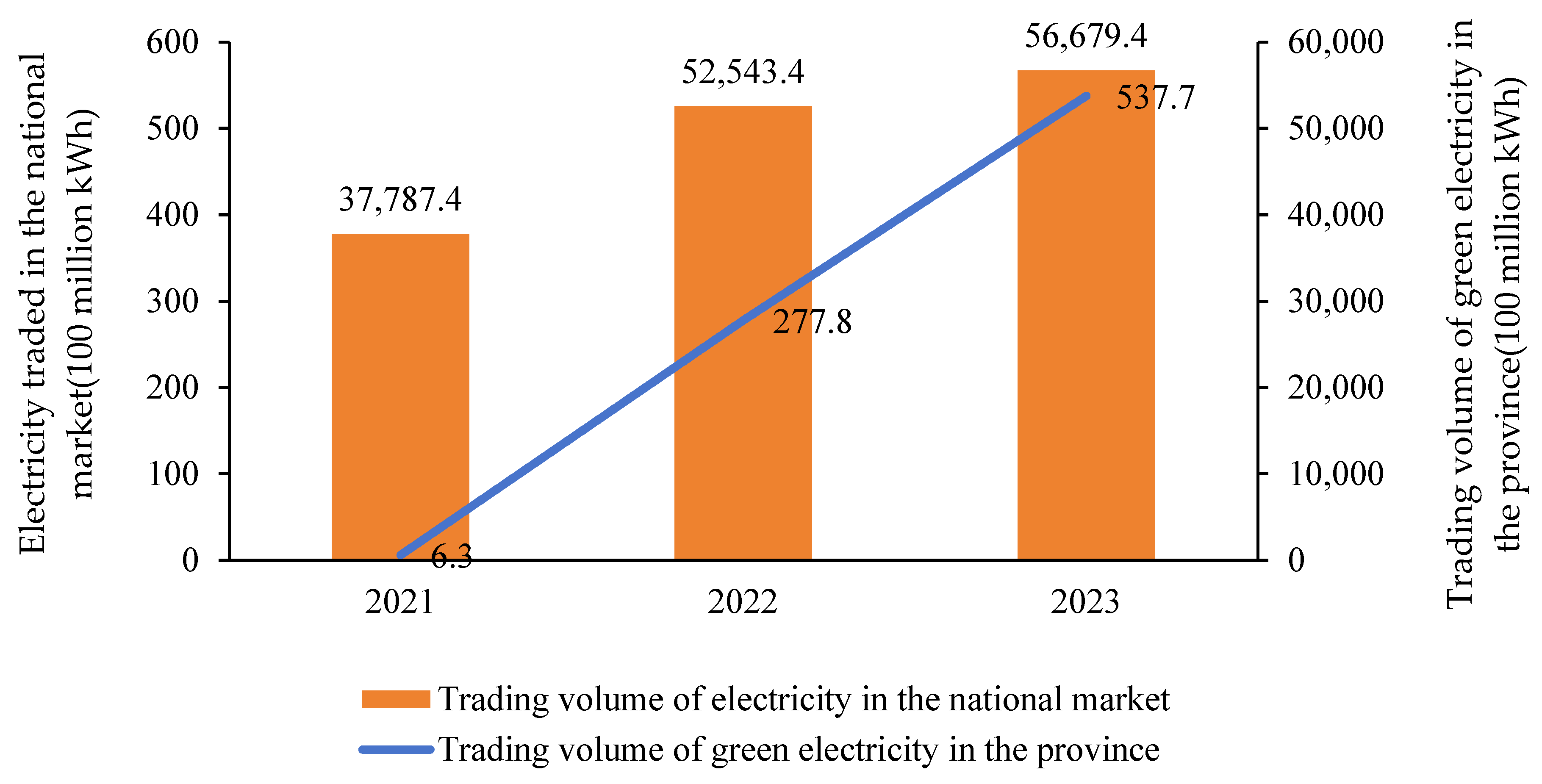

Current Status of China Green Electricity Trading

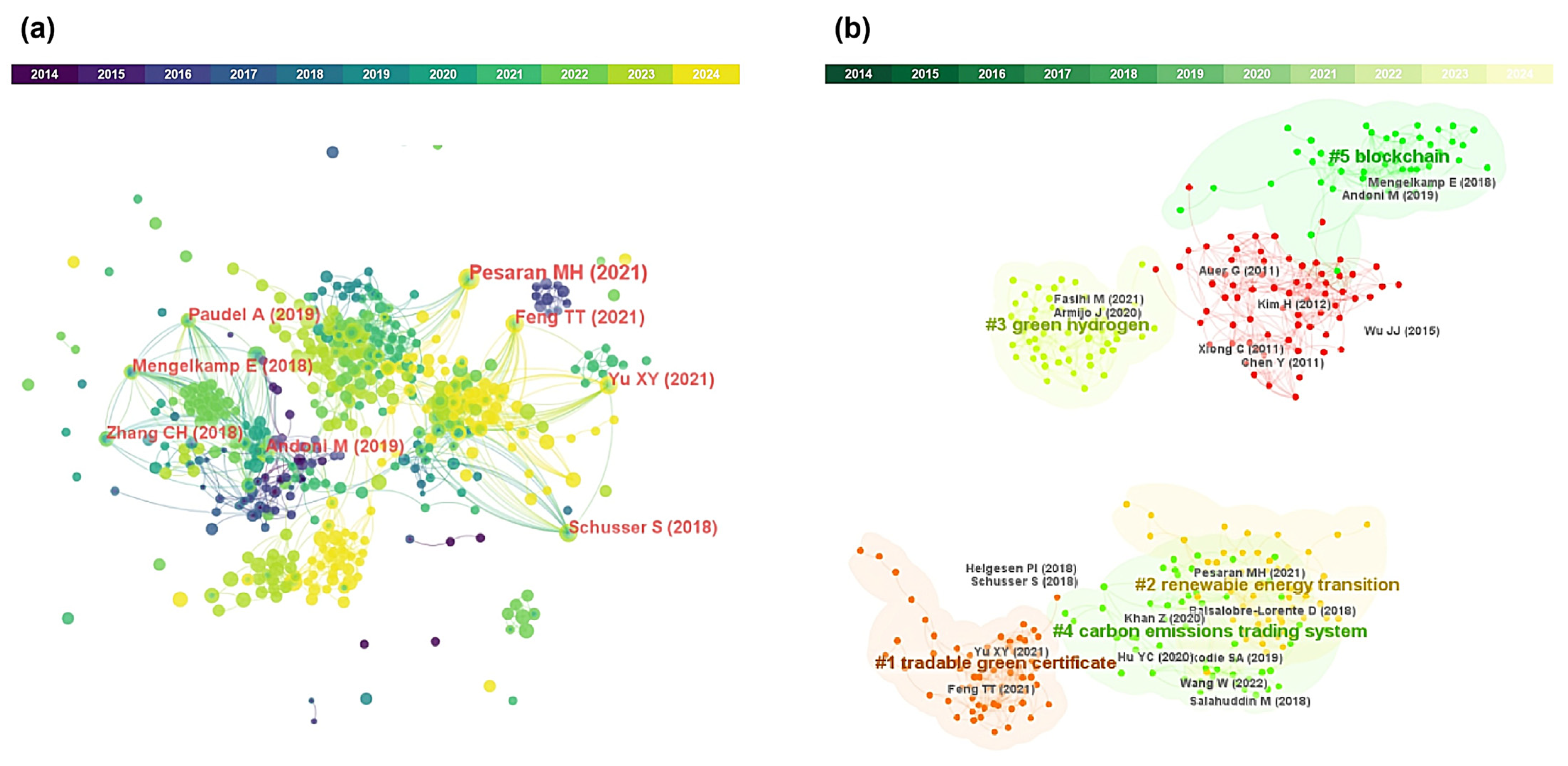

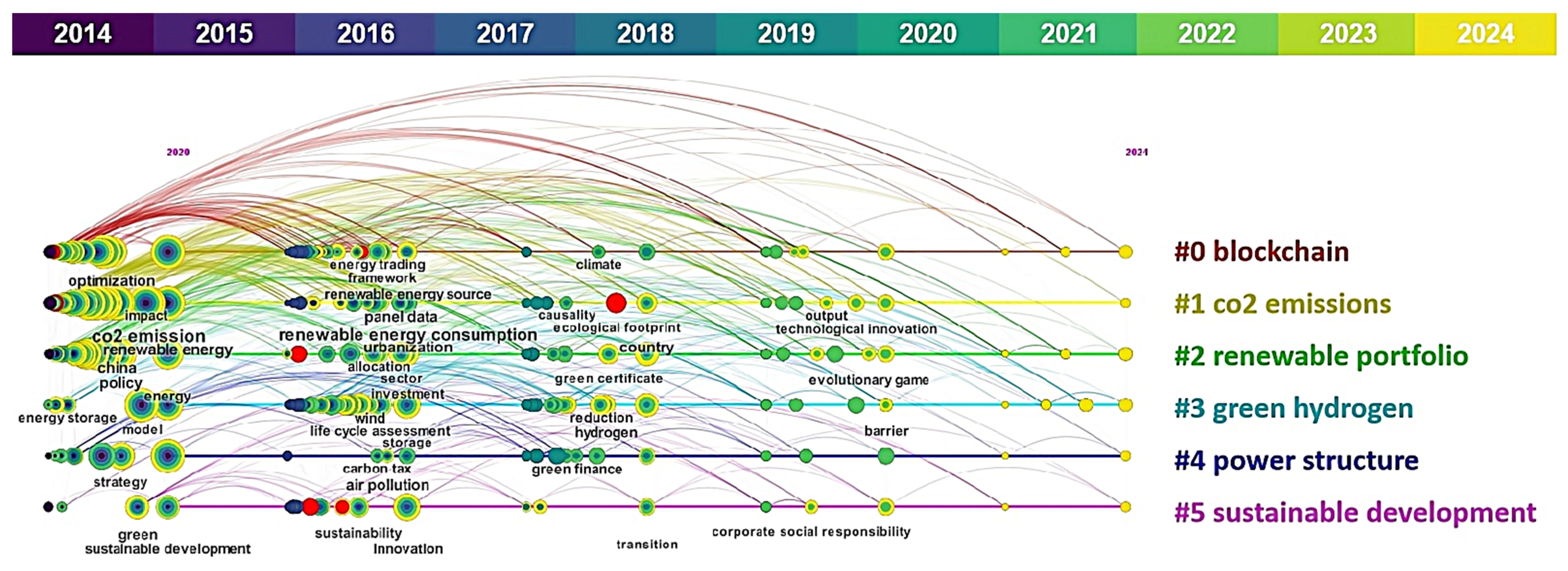

3.2. Bibliometric Analysis Results

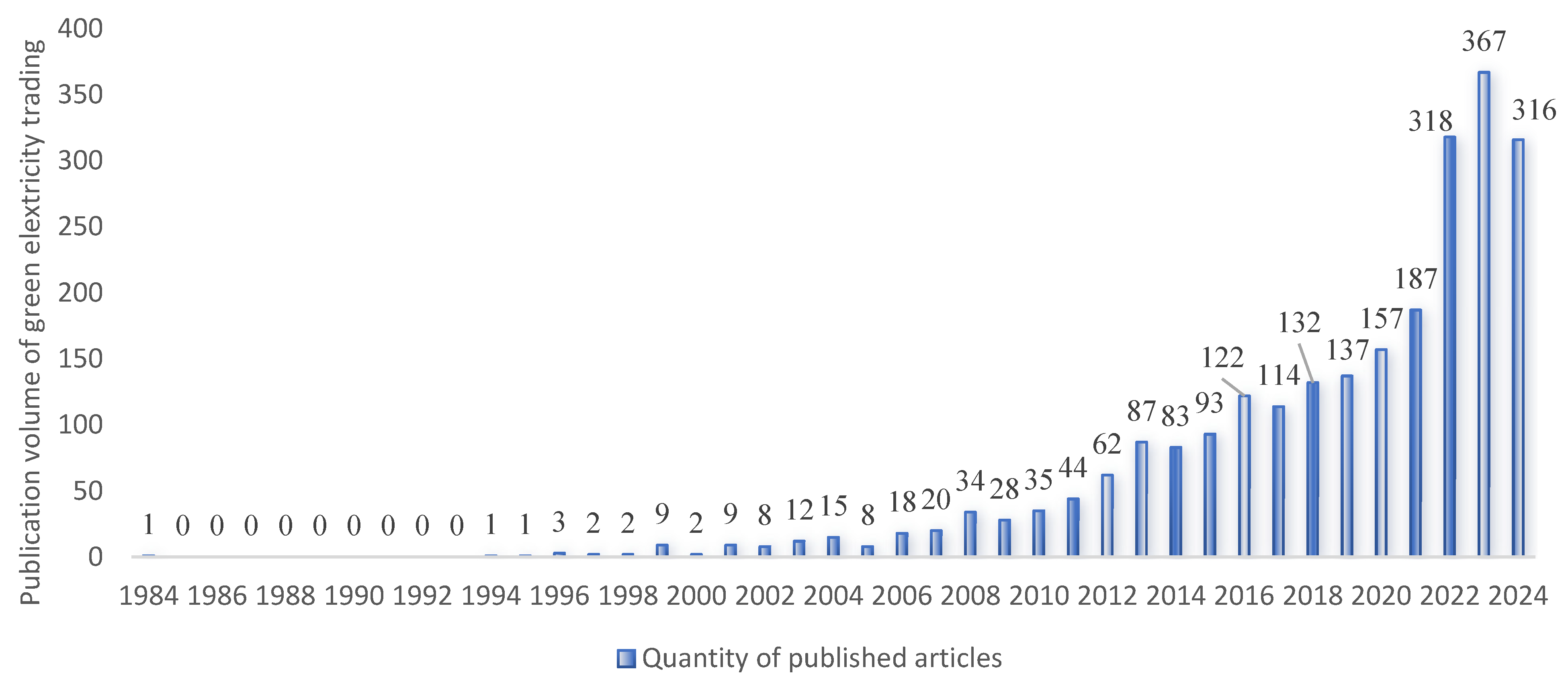

3.2.1. Publication Volume

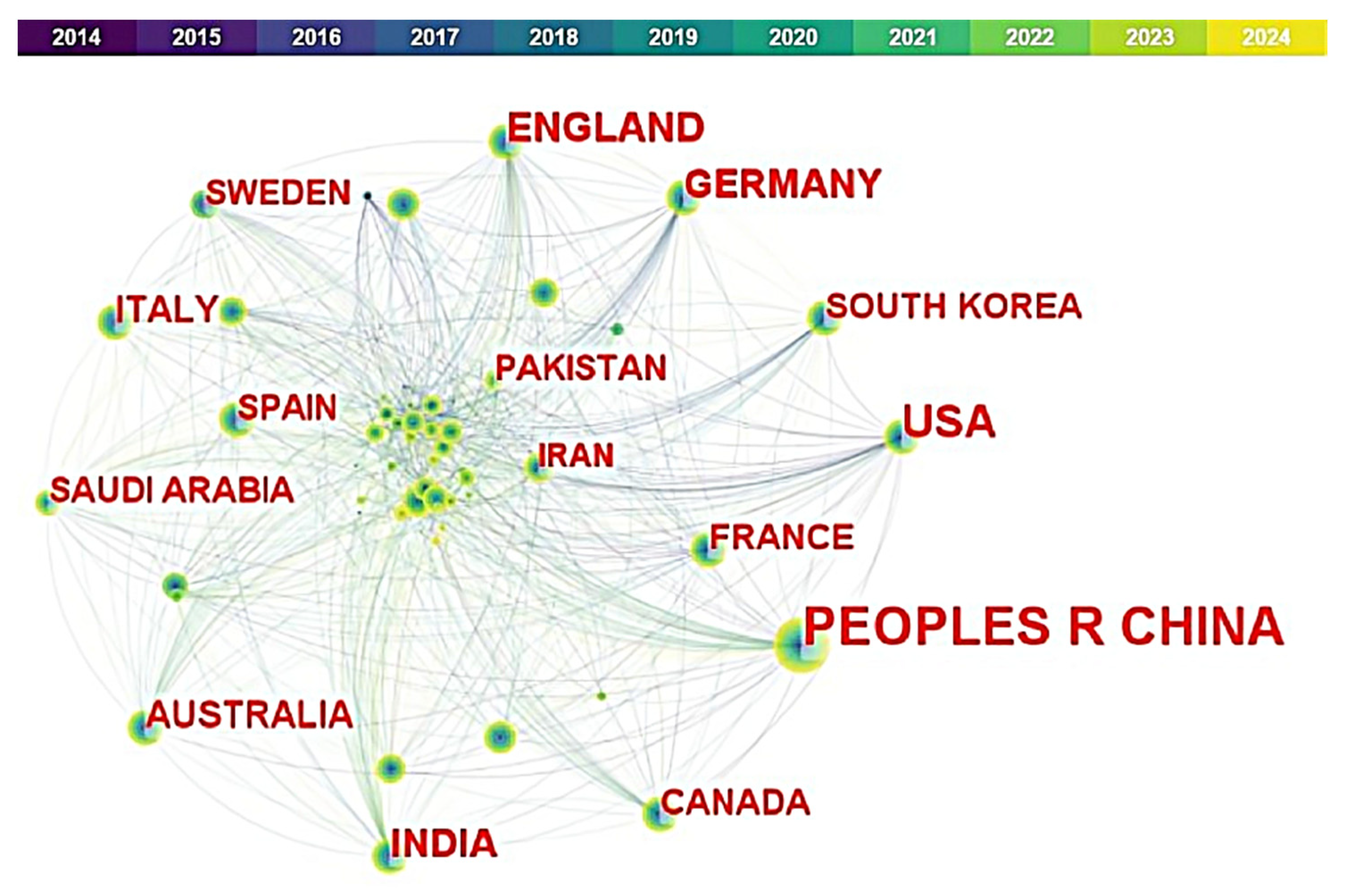

3.2.2. Analysis of Issuing Countries

3.2.3. Co-Citation Analysis on Cited References

3.2.4. Research Hotspots in the Last 5 Years

Renewable Energy

Low-Carbon Policy Synergies

The Relationship Between Green Electricity–Economy and Environmental Development

4. Conclusions

- (1)

- Analyzing green electricity trading mechanisms and current trends reveals that as carbon neutrality goals advance, countries worldwide are increasingly prioritizing green electricity development. Governments are adopting policies to promote widespread green electricity adoption through both mandatory and voluntary measures. Notably, there are significant national variations and distinct features in these policies. Unlike conventional electricity trading, green electricity trading integrates both the value of electricity and its environmental value, with the latter mainly reflected through higher electricity prices and green certificate costs. The introduction of green certificates allows multinational corporations to meet their carbon neutrality goals by purchasing green electricity certificates, thereby accelerating the rapid expansion of the international green electricity trading market. Compared to other countries, China has a significant volume of green electricity trading, but its policy framework still requires refinement. The large-scale integration of green electricity presents significant challenges to grid integration due to its inherent randomness and intermittency. First, the expansion of distributed renewable energy has exacerbated the uncertainty in power system planning, with current operational mechanisms proving inadequate for supporting large-scale renewable energy deployment [74]. Second, the integration of large-scale, high-share renewable energy generation faces technical bottlenecks that hinder its absorption capacity, further compounded by the inadequacy of grid infrastructure to support the influx of renewable energy on a large scale [75]. Third, variations in energy policies, incentives, and market regulations across countries complicate the coordination of pricing, taxation, and subsidies for green electricity in international markets, leading to higher transaction costs and greater complexity.

- (2)

- In recent years, research in the field of green electricity trading has flourished, with a notable increase in the number of publications. This trend is jointly driven by various factors, including the urgent need for global climate change mitigation and energy transition, advancements and cost reductions in renewable energy technologies, national policy support, the improvement of market mechanisms, and deepened international cooperation. China and the United States dominate research in this field, accounting for nearly half of the total number of papers. This is attributed to China’s series of actions in recent years to fulfill its dual-carbon goals, such as green electricity trading pilots and expanding the scope of green certificate coverage. Meanwhile, the United States, as a leader in renewable energy development among developed countries, has been exploring ways to encourage renewable energy consumption for over 20 years. Through state-led initiatives and participation from various market entities, it has formed a pattern of clean energy consumption characterized by both mandatory and voluntary procurement methods and diverse procurement approaches. Additionally, the United Kingdom, India, and Germany follow closely in terms of the number of publications, with their practical experiences providing abundant cases and an empirical foundation for research on green electricity trading. In the future, with the further advancement of the global energy transition and the continued support of national policies, research in the field of green electricity trading is expected to achieve more breakthroughs.

- (3)

- In recent years, research on green electricity trading has concentrated on generation, trading mechanisms, technological support, and interconnections with carbon markets. This focus is particularly evident in studies examining ecological footprints, distributed energy generation, peer-to-peer (P2P) trading, blockchain technology, microgrid development, and the influence of carbon markets on renewable energy growth. Renewable energy adoption significantly lowers ecological footprints, driving increased demand for further development. The unique attributes of distributed energy, such as cleanliness, local balance, and high efficiency, have spurred innovations in P2P trading models, platforms, and mechanisms. Notably, blockchain technology has been integrated into green electricity trading platforms, enabling greater transparency and efficiency. P2P trading fosters active user participation in electricity markets, particularly in green electricity trading, where users act as both producers and consumers, effectively reducing carbon emissions. This approach is anticipated to play a pivotal role in driving the low-carbon transition of the power sector.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Thompson, S. Strategic Analysis of the Renewable Electricity Transition: Power to the World without Carbon Emissions? Energies 2023, 16, 6183. [Google Scholar] [CrossRef]

- Hao, Y.; Liao, H.; Wei, Y.M. Is China’s carbon reduction target allocation reasonable? An analysis based on carbon intensity convergence. Appl. Energy 2015, 142, 229–239. [Google Scholar] [CrossRef]

- Lu, Y.; Liu, X.; Li, H.J.; Wang, H.R.; Kong, J.J.; Zhong, C.; Cui, M.L.; LI, Y.; Sun, X.Q.; Xuan, J.D.; et al. What Is the Impact of the Renewable Energy Power Absorption Guarantee Mechanism on China’s Green Electricity Market? Energies 2023, 16, 7434. [Google Scholar] [CrossRef]

- Zhang, H.J.; Wang, H.N.; Yuan, M.; Yin, X. Analysis and Suggestions on Trading Mechanism of China’s Medium-and Long-term Electricity Market. Autom. Electr. Power Syst. 2024, 48, 25–33. [Google Scholar] [CrossRef]

- Li, J.L.; Hu, Y.; Chi, Y.Y.; Liu, D.N.; Yang, S.X.; Gao, Z.Y.; Chen, Y.T. Analysis on the synergy between markets of electricity, carbon, and tradable green certificates in China. Energy 2024, 302, 131808. [Google Scholar] [CrossRef]

- Li, J.F.; He, X.T.; Niu, W.; Liu, X.N. Analysis of the joint trading of local green power certificates, carbon emissions rights, and electricity considering demand flexibility. Int. J. Electr. Power Energy Syst. 2024, 155, 109653. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, C.X.; Xie, K.; Li, Q.H.; Zhang, N.; Wu, S. Key issues of green electricity market construction in China under goals of carbon emission peak and carbon neutrality. Autom. Electr. Power Syst. 2024, 48, 25–33. [Google Scholar] [CrossRef]

- Yang, Y.S.; Xie, B.C.; Tan, X. Impact of green power trading mechanism on power generation and interregional transmission in China. Energy Policy 2024, 189, 114088. [Google Scholar] [CrossRef]

- Tang, C.; Liu, X.; Zhang, C. Does China’s green power trading policy play a role? Evidence from renewable energy generation enterprises. J. Environ. Manag. 2023, 345, 118775. [Google Scholar] [CrossRef] [PubMed]

- Knapp, L.; O’Shaughnessy, E.; Heeter, J.; Mills, S.; DeCicco, J.M. Will consumers really pay for green electricity? Comparing stated and revealed preferences for residential programs in the United States. Energy Res. Soc. Sci. 2020, 65, 101457. [Google Scholar] [CrossRef]

- Wang, X.R.; Long, R.Y.; Chen, H.; Wang, Y.J.; Shi, Y.M.; Yang, S.H.; Wu, M.F. How to promote the trading in China’s green electricity market? Based on environmental perceptions, renewable portfolio standard and subsidies. Renew. Energy 2024, 222, 119784. [Google Scholar] [CrossRef]

- Zhao, W.H.; Zhang, S.C.; Xue, L.; Chang, T.; Wang, L. Research on Model of Micro-grid Green Power Transaction Based on Blockchain Technology and Double Auction Mechanism. J. Electr. Eng. Technol. 2023, 19, 133–145. [Google Scholar] [CrossRef]

- Hong, N.N.; Duc, H.N. Virtual Power Plant’s Optimal Scheduling Strategy in Day-Ahead and Balancing Markets Considering Reserve Provision Model of Energy Storage System. Appl. Sci. 2024, 14, 2175. [Google Scholar] [CrossRef]

- Lin, B.Q.; Qiao, Q. Exploring the participation willingness and potential carbon emission reduction of Chinese residential green electricity market. Energy Policy 2023, 174, 113452. [Google Scholar] [CrossRef]

- Gao, H.J.; Hu, M.Y.; He, S.J.; Liu, J.Y. Green electricity trading driven low-carbon sharing for interconnected microgrids. J. Clean. Prod. 2023, 414, 137618. [Google Scholar] [CrossRef]

- Wang, T.; Gong, Y.; Jiang, C.W. A review on promoting share of renewable energy by green-trading mechanisms in power system. Renew. Sust. Energ. Rev. 2014, 40, 923–929. [Google Scholar] [CrossRef]

- Wallington, T.J.; Woody, M.; Lewis, G.M.; Adler, E.J.; Martins, J.R.R.A.; Collette, M.D. Green hydrogen pathways, energy efficiencies, and intensities for ground, air, and marine transportation. Joule 2024, 8, 2190–2207. [Google Scholar] [CrossRef]

- Bhavana, G.B.; Anand, R.; Ramprabhakar, J.; Benedetto, F. Applications of blockchain technology in peer-to-peer energy markets and green hydrogen supply chains: A topical review. Sci. Rep. 2024, 14, 21954. [Google Scholar] [CrossRef] [PubMed]

- Nicolini, M.; Tavoni, M. Are renewable energy subsidies effective? Evidence from Europe. Renew. Sustain. Energy Rev. 2017, 74, 412–423. [Google Scholar] [CrossRef]

- Sun, Y.; Ma, Z.; Chi, X.; Duan, J.; Li, M.; Khan, A.U. Decoding the Developmental Trajectory of Energy Trading in Power Markets through Bibliometric and Visual Analytics. Energies 2024, 17, 3605. [Google Scholar] [CrossRef]

- Chrysikopoulos, S.K.; Chountalas, P.T.; Georgakellos, D.A.; Lagodimos, A.G. Green Certificates Research: Bibliometric Assessment of Current State and Future Directions. Sustainability 2024, 16, 1129. [Google Scholar] [CrossRef]

- Danish, S.M.; Zhang, K.; Amara, F.; Cepeda, J.C.O.; Vasquez, L.F.R.; Marynowski, T. Blockchain for Energy Credits and Certificates: A Comprehensive Review. IEEE Trans. Sustain. Comput. 2024, 9, 727–739. [Google Scholar] [CrossRef]

- Sun, L.J. Synergy Management of Green Electricity Trading under the Carbon Peaking and Neutrality Goals. North China Electr. Power Univ. 2024, 4, 285. [Google Scholar] [CrossRef]

- Chen, H.W. Study on Market-based Trading Mechanism for Green Power under Spot Environment. Energy 2022, 7, 67–71. [Google Scholar]

- Shan, M.H.; Tang, H.H.; Geng, M.Z.; Cao, Y.; Yang, Z.L.; Wang, Y.Z. The intrinsic motivation and design considerations of the green electricity market. Autom. Electr. Power Syst. 2020, 44, 12–20. [Google Scholar] [CrossRef]

- Shi, Z.Y. Work Route of Standardization and Certification of Green Power Consumption. Inf. Technol. Stand. 2023, 12, 89–93. [Google Scholar]

- Song, D.D.; Liu, Y.W.; Qin, T.B.; Gu, H.S.; Cao, Y.; Shi, H.J. Overview of the policy instruments for renewable energy development in China. Energies 2022, 15, 6513. [Google Scholar] [CrossRef]

- Yu, X.Y.; Dong, Z.J.; Zhou, D.Q.; Sang, X.Z.; Chang, C.T.; Huang, X.H. Integration of tradable green certificates trading and carbon emissions trading: How will Chinese power industry do? J. Clean. Prod. 2021, 279, 123485. [Google Scholar] [CrossRef]

- Xu, B.; Lin, B. Green finance, green technology innovation, and wind power development in China: Evidence from spatial quantile model. Energy Econ. 2024, 132, 107463. [Google Scholar] [CrossRef]

- Ali, S.; Yan, Q.; Hussain, M.S.; Irfan, M.; Ahmad, M.; Razzaq, A.; Dagar, V.; Işık, C. Evaluating Green Technology Strategies for the Sustainable Development of Solar Power Projects: Evidence from Pakistan. Sustainability 2021, 13, 12997. [Google Scholar] [CrossRef]

- Zhao, F.Q.; Bai, F.L.; Liu, X.L.; Liu, Z.W. A review on renewable energy transition under China’s carbon neutrality target. Sustainability 2022, 14, 15006. [Google Scholar] [CrossRef]

- Li, W.B.; Jiang, Z.M.; Liu, H.; Chi, Y.S. Discussion on the Decision-making of Green Power and Green Certificate Transactions of Large Enterprises Groups under Dual Carbon Targets. Energy 2024, 8, 67–72. [Google Scholar]

- Feng, T.T.; Li, R.; Zhang, H.M.; Gong, X.L.; Yang, Y.S. Induction mechanism and optimization of tradable green certificates and carbon emission trading acting on electricity market in China. Resour. Conserv. Recycl. 2021, 169, 105487. [Google Scholar] [CrossRef]

- Abbasi, K.R.; Shahbaz, M.; Jiao, Z.L.; Tufail, M. How energy consumption, industrial growth, urbanization, and CO2 emissions affect economic growth in Pakistan? A novel dynamic ARDL simulations approach. Energy 2021, 221, 119793. [Google Scholar] [CrossRef]

- Armijo, J.; Philibert, C. Flexible production of green hydrogen and ammonia from variable solar and wind energy: Case study of Chile and Argentina. Int. J. Hydrogen Energy 2020, 45, 1541–1558. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Mollah, M.B.; Zhao, J.; Niyato, D.; Lam, K.Y.; Zhang, X.; Ghias, A.M.Y.M.; Koh, L.H.; Yang, L. Blockchain for Future Smart Grid: A Comprehensive Survey. IEEE Internet Things J. 2021, 8, 18–43. [Google Scholar] [CrossRef]

- Pesaran, M.H. General diagnostic tests for cross-sectional dependence in panels. Empir. Econ. 2021, 60, 13–50. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets A case study: The Brooklyn Mi-crogrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Paudel, A.; Chaudhari, K.; Long, C.; Gooi, H.B. Peer-to-peer energy trading in a prosumer-based community microgrid: A game-theoretic model. IEEE Trans. Ind. Electron. 2019, 66, 6087–6097. [Google Scholar] [CrossRef]

- Schusser, S.; Jaraite, J. Explaining the interplay of three markets: Green certificates, carbon emissions and electricity. Energy Econ. 2018, 71, 1–13. [Google Scholar] [CrossRef]

- Zhang, C.H.; Wu, J.Z.; Zhou, Y.; Chen, M.; Long, C. Peer-to-Peer energy trading in a Microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Helgesen, P.I.; Tomasgard, A. An equilibrium market power model for power markets and tradable green cer-tificates, including Kirchhoff’s Laws and Nash-Cournot competition. Energy Econ. 2018, 70, 270–288. [Google Scholar] [CrossRef]

- Balsalobre-lorente, D.; Shahbaz, M.; Roubaud, D.; Farhani, S. How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 2018, 113, 356–367. [Google Scholar] [CrossRef]

- Khan, Z.; Ali, S.; Umar, M.; Kirikkaleli, D.; Jiao, Z. Consumption-based carbon emissions and International trade in G7 countries: The role of Environmental innovation and Renewable energy. Sci. Total Environ. 2020, 730, 138945. [Google Scholar] [CrossRef] [PubMed]

- Hu, Y.C.; Ren, S.G.; Wang, Y.J.; Chen, C.H. Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Econ. 2020, 85, 104590. [Google Scholar] [CrossRef]

- Sarkodie, A.S.; Vladimir, S. Effect of foreign direct investments, economic development and energy consump-tion on greenhouse gas emissions in developing countries. Sci. Total Environ. 2019, 646, 862–871. [Google Scholar] [CrossRef] [PubMed]

- Wang, W.; Zhang, Y.J. Does China’s carbon emissions trading scheme affect the market power of high-carbon enterprises? Energy Econ. 2022, 108, 105906. [Google Scholar] [CrossRef]

- Salahuddin, M.; Alam, K.; Ozturk, I.; Sohag, K. The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew. Sustain. Energy Rev. 2017, 81 Pt 2, 2002–2010. [Google Scholar] [CrossRef]

- Wu, J.; Zhang, Y.; Zukerman, M.; Yung, K.N. Energy-Efficient Base-Stations Sleep-Mode Techniques in Green Cellular Networks: A Survey. IEEE Commun. Surv. Tutor. 2015, 17, 1–24. [Google Scholar] [CrossRef]

- Chen, Y.; Zhang, S.; Xu, S.; Li, G.Y. Fundamental tradeoffs on green wireless networks. Commun. Mag. IEEE 2011, 49, 30–37. [Google Scholar] [CrossRef]

- Fasihi, M.; Weiss, R.; Savolainen, J.; Breyer, C. Global potential of green ammonia based on hybrid PV-wind power plants. Appl. Energy 2021, 294, 116170. [Google Scholar] [CrossRef]

- Hongseok, K.; Gustavo, D.V.; Yang, X.Y.; Venkatachalam, M. Distributedα-Optimal User Association and Cell Load Balancing in Wireless Networks. IEEE/ACM Trans. Netw. 2012, 20, 177–190. [Google Scholar] [CrossRef]

- Auer, G.; Giannini, V.; Desset, C. How much energy is needed to run a wireless network? IEEE Wirel. Commun. 2011, 18, 40–49. [Google Scholar] [CrossRef]

- Xiong, C.; Li, G.Y.; Zhang, S.Q.; Chen, Y.; Xu, S.Q. Energy-Efficient Resource Allocation in OFDMA Networks. IEEE Trans. Commun. 2012, 60, 3767–3778. [Google Scholar] [CrossRef]

- Kahouli, B.; Hamdi, B.; Nafla, A.; Chabaane, N. Investigating the relationship between ICT, green energy, total factor productivity, and ecological footprint: Empirical evidence from Saudi Arabia. Energy Strateg. Rev. 2022, 42, 100871. [Google Scholar] [CrossRef]

- Liu, C.; Ni, C.J.; Sharma, P.; Jain, V.; Chawla, C.; Shabbir, M.S.; Tabash, M.I. Does green environmental innovation really matter for carbon-free economy? Nexus among green technological innovation, green international trade, and green power generation. Environ. Sci. Pollut. Res. 2022, 29, 67504–67512. [Google Scholar] [CrossRef] [PubMed]

- Ramzan, M.; Raza, S.A.; Usman, M.; Sharma, G.D.; Iqbal, H.A. Environmental cost of non-renewable energy and economic progress: Do ICT and financial development mitigate some burden? J. Clean. Prod. 2022, 333, 130066. [Google Scholar] [CrossRef]

- Ableitner, L.; Tiefenbeck, V.; Meeuw, A.; Wörner, A.; Fleisch, E.; Wortmann, F. User behavior in a real-world peer-to-peer electricity market. Appl. Energy 2020, 270, 115061. [Google Scholar] [CrossRef]

- Park, D.H.; Park, J.B.; Lee, K.Y.; Son, S.Y.; Ron, J.H. A Bidding-Based Peer-to-Peer Energy Transaction Model Considering the Green Energy Preference in Virtual Energy Community. IEEE Access 2021, 9, 87410–87419. [Google Scholar] [CrossRef]

- Zaman, M. A Multilayered Semi-Permissioned Blockchain Based Platform for Peer to Peer Energy Trading. In Proceedings of the 2021 IEEE Green Technologies Conference (GreenTech), Virtual Conference, 7–9 April 2021; pp. 279–285. [Google Scholar] [CrossRef]

- Nunna, H.S.V.S.K.; Turarbek, M.; Kassymkhan, A.; Syzdykov, A.; Bagheri, M. Comparative Analysis of Peer-to-Peer Transactive Energy Market Clearing Algorithms. In Proceedings of the IECON 2020: The 46th Annual Conference of the IEEE Industrial Electronics Society, Singapore, 18–21 October 2020; pp. 1561–1566. [Google Scholar] [CrossRef]

- Zhang, M.M.; Ge, Y.Q.; Liu, L.Y.; Zhou, D.Q. Impacts of carbon emission trading schemes on the development of renewable energy in China: Spatial spillover and mediation paths. Sustain. Prod. Consump. 2022, 32, 306–317. [Google Scholar] [CrossRef]

- Wu, C.; Zhou, D.; Zha, D. The interplay of the carbon market, the tradable green certificate market, and electricity market in South Korea: Dynamic transmission and spillover effects. Energy Environ. 2022, 35, 163–184. [Google Scholar] [CrossRef]

- Lei, X.; Yu, H.; Shao, Z.Y.; Jian, L.N. Optimal bidding and coordinating strategy for maximal marginal revenue due to V2G operation: Distribution system operator as a key player in China’s uncertain electricity markets. Energy 2023, 283, 128354. [Google Scholar] [CrossRef]

- Li, Z.K.; Lei, X.; Shang, Y.T.; Jia, Y.W.; Jian, J.L. A genuine V2V market mechanism aiming for maximum revenue of each EV owner based on non-cooperative game model. J. Clean. Prod. 2023, 414, 137586. [Google Scholar] [CrossRef]

- Lei, X.; Yu, H.; Yu, B.; Shao, Z.Y.; Jian, L.N. Bridging electricity market and carbon emission market through electric vehicles: Optimal bidding strategy for distribution system operators to explore economic feasibility in China’s low-carbon transitions. J. Sustain. Cities Soc. 2023, 94, 104557. [Google Scholar] [CrossRef]

- Sharif, A.; Mishra, S.; Sinha, A.; Jiao, Z.L.; Shahbaz, M.; Afshan, S. The renewable energy consumption-environmental degradation nexus in Top-10 polluted countries: Fresh insights from quantile-on-quantile regression approach. Renew. Energy 2020, 150, 670–690. [Google Scholar] [CrossRef]

- Ibrahiem, D.M.; Hanafy, S.A. Do energy security and environmental quality contribute to renewable energy? The role of trade openness and energy use in North African countries. Renew. Energy 2021, 179, 667–678. [Google Scholar] [CrossRef]

- Nuţă, F.M.; Nuţă, A.C.; Zamfir, C.G.; Petrea, S.M.; Munteanu, D.; Cristea, D.S. National Carbon Accounting—Analyzing the Impact of Urbanization and Energy-Related Factors upon CO2 Emissions in Central–Eastern European Countries by Using Machine Learning Algorithms and Panel Data Analysis. Energies 2021, 14, 2775. [Google Scholar] [CrossRef]

- Sun, Y.; Anwar, A.; Razzaq, A.; Liang, X.; Siddique, M. Asymmetric role of renewable energy, green innovation, and globalization in deriving environmental sustainability: Evidence from top-10 polluted countries. Renew. Energy 2022, 185, 280–290. [Google Scholar] [CrossRef]

- Iris, C.; Lam, J.S.L. Optimal energy management and operations planning in seaports with smart grid while harnessing renewable energy under uncertainty. Omega 2021, 103, 102445. [Google Scholar] [CrossRef]

- Sadiq, M.; Ali, S.W.; Terriche, Y.; Mutarraf, M.U.; Hassan, M.A.; Hamid, K.; Ali, Z.; Sze, J.Y.; Su, C.L.; Guerrero, J.M. Future Greener Seaports: A Review of New Infrastructure, Challenges, and Energy Efficiency Measures. IEEE Access 2021, 9, 75568–75587. [Google Scholar] [CrossRef]

- Fu, X.Q.; Wu, X.P.; Zhang, C.Y.; Fan, S.Q.; Liu, N. Planning of distributed renewable energy systems under uncertainty based on statistical machine learning. Prot. Control Mod. Power Syst. 2022, 7, 41. [Google Scholar] [CrossRef]

- Chen, Y.S.; Yu, Z. Digitalization, trust, and sustainability transitions: Insights from two blockchain-based green experiments in China’s electricity sector. Environ. Innov. Soc. Trans. 2024, 50, 100801. [Google Scholar] [CrossRef]

| Rank | Country | Volume of Publications |

|---|---|---|

| 1 | People’s Republic of China | 896 |

| 2 | USA | 284 |

| 3 | ENGLAND | 154 |

| 4 | INDIA | 125 |

| 5 | GERMANY | 112 |

| 6 | ITALY | 93 |

| 7 | AUSTRALIA | 90 |

| 8 | FRANCE | 73 |

| 9 | SOUTH KOREA | 71 |

| 10 | CANADA | 69 |

| 11 | SWEDEN | 61 |

| 12 | SPAIN | 60 |

| Keywords | Burst Strength | Starting Year | Ending Year |

|---|---|---|---|

| Trade off | 2.91 | 2021 | 2022 |

| Distributed energy resource | 2.88 | 2020 | 2021 |

| EU ETS | 2.36 | 2021 | 2022 |

| Economic growth nexus | 2.05 | 2020 | 2021 |

| Ecological footprint | 1.81 | 2022 | 2024 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lu, Y.; Ning, B.; Geng, P.; Li, Y.; Kong, J. Research on the Current Status and Key Issues of China’s Green Electricity Trading Development. Energies 2025, 18, 1726. https://doi.org/10.3390/en18071726

Lu Y, Ning B, Geng P, Li Y, Kong J. Research on the Current Status and Key Issues of China’s Green Electricity Trading Development. Energies. 2025; 18(7):1726. https://doi.org/10.3390/en18071726

Chicago/Turabian StyleLu, Yan, Bo Ning, Pengyun Geng, Yan Li, and Jiajie Kong. 2025. "Research on the Current Status and Key Issues of China’s Green Electricity Trading Development" Energies 18, no. 7: 1726. https://doi.org/10.3390/en18071726

APA StyleLu, Y., Ning, B., Geng, P., Li, Y., & Kong, J. (2025). Research on the Current Status and Key Issues of China’s Green Electricity Trading Development. Energies, 18(7), 1726. https://doi.org/10.3390/en18071726