Research on Multi-Objective Programming Model of Profits and Carbon Emission Reduction in Manufacturing Industry

Abstract

1. Introduction

1.1. Research Background and Motivation

1.2. Research Objectives and Contributions

1.3. Research Framework

- Model Construction: this paper will construct the function of profit and carbon emissions for each model based on activity-based costing and the theory of constraints.

- Data Collection: example data will be set up with reference to publicly available company operating data.

- Error Handling: sensitivity analysis will be used to evaluate the impact of each model’s parameters on the results to ensure the stability of the model.

- Results Analysis: the results of each model will be analyzed in various scenarios.

2. Literature Review

2.1. Carbon Emissions and Carbon Tax in Petrochemical Production Processes

2.2. Multi-Objective Programming

- Multi-objective programming can be divided into three categories according to the flow of preference information of the decision-making goal: Non-preference multi-objective programming, Preference multi-objective programming, and Interactive multi-objective programming. The methods of each category are as follows: Non-Preference multi-objective programming: Weighting Method, Constraint Method, NISE Method, Simplex Method.

- Preference multi-objective programming: Fuzzy Planning Method, Utility Function Method, Compromise Planning Method.

- Interactive multi-objective programming: Interactive Chebyshev Method, Step Method, Geoffrion Method.

2.3. Activity-Based Costing and Theory of Constraints

3. Research Design

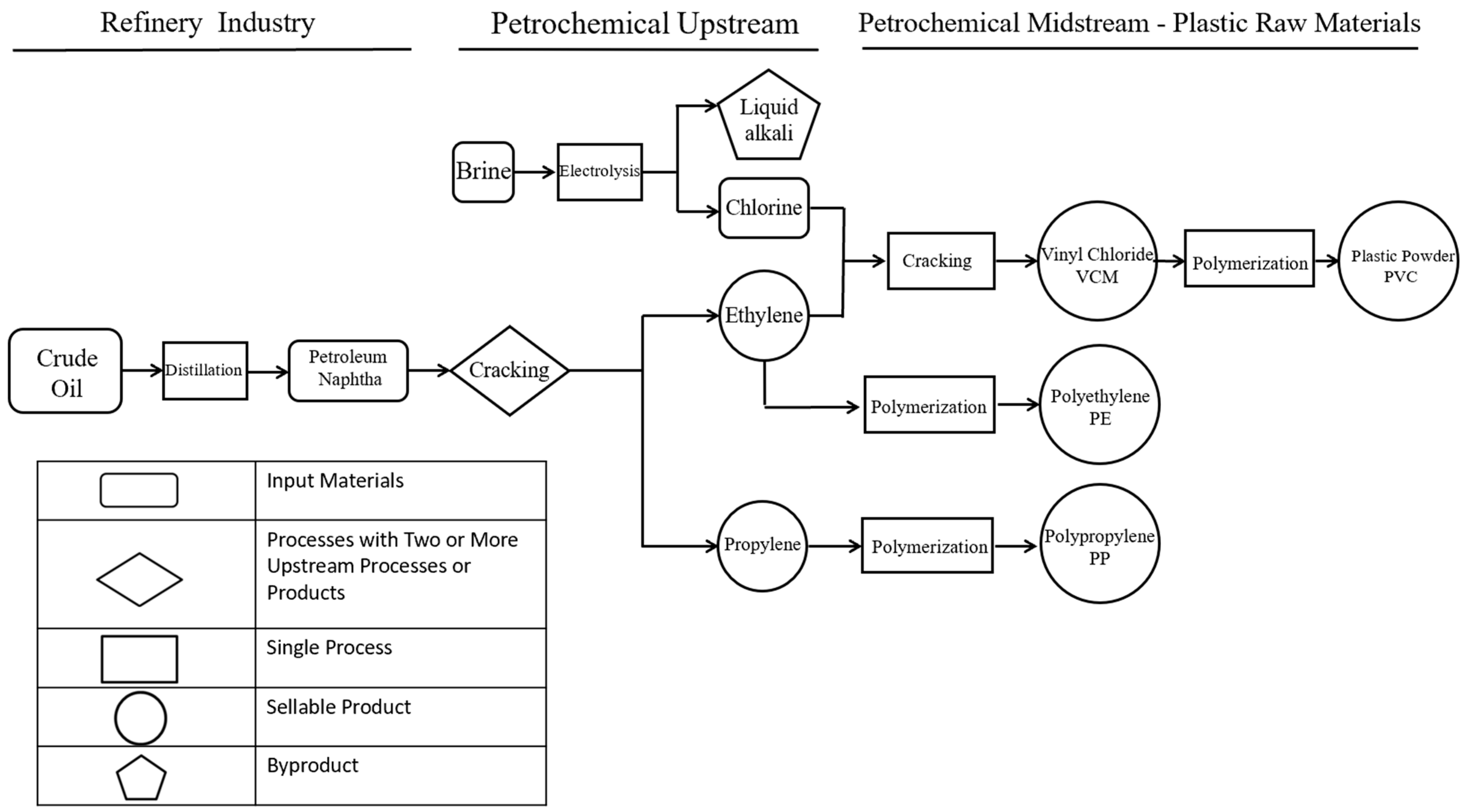

3.1. Production Process

3.2. Research Assumptions

- There are six main products: ethylene (i = 1), propylene (i = 2), vinyl chloride (i = 3), plastic powder (i = 4), polyethylene (i = 5), and polypropylene (i = 6); there is one byproduct: liquid alkali. The unit prices of the above products are fixed during the production process.

- The costs of the main raw materials put into production remain unchanged during the production process.

- The quantity of products produced is equal to the quantity sold, and the model does not include any inventory.

- The products produced in the same production step will be produced at a certain production ratio.

- Labor costs will be paid in accordance with the first and second stage overtime rates as overtime hours increase, and in accordance with the government’s policies. Each stage rate will remain constant during the production process.

- In the carbon tax cost model, each unit of product produced is subject to a carbon tax, without setting an upper limit. That is, the amount of carbon tax depends on the quantity of products produced.

3.3. Objective Functions

3.3.1. General Form of the Objective Functions

- Profit Maximization = Total Primary Product Revenue + Byproduct Revenue − Total Direct Material Cost − Total Direct Labor Cost − Total Output-Level Costs − Total Batch-Level Costs − Total Fixed Costs

| : | Maximizing Business Profit |

| : | The unit selling price of product () |

| : | The production quantity of product () |

| : | The product categories include Ethylene (i = 1), Propylene (i = 2), Vinyl Chloride (i = 3), Plastic Powder (i = 4), Polyethylene (i =5), Polypropylene (i = 6) |

| : | The price of the byproduct (liquid alkali) |

| : | The production quantity of the byproduct (liquid alkali) |

| : | The raw materials include Petroleum (), Salt () |

| : | The cost per unit of raw material () |

| : | The amount of raw material used to produce one unit of product i (, ) |

| : | The total direct labor cost at the point |

| : | The total direct labor cost at the point |

| : | The total direct labor cost at the point |

| : | This represents non-negative variables, with at most two adjacent variables being non-zero. |

| : | The processes include Distillation and cracking ( Electrolysis (), Cracking (), Polymerization (), Polymerization (), Polymerization () |

| : | The machine cost per hour in production process |

| : | The number of machine hours required to produce product in process (, ) |

| : | The batch activities include Material delivery (), Machine setup () |

| : | The setup cost per hour in batch activity () |

| : | The number of setup hours required for each batch activity (, ) |

| : | The batch number of product i produced in batch activity (, ) |

| : | Total fixed costs |

| : | Minimizing carbon dioxide emissions. |

| : | The carbon dioxide emission coefficient of the product (tons of CO2 per ton of production). |

| : | The geographical adjustment factor coefficient for vinyl chloride () and its processed products. |

3.3.2. Constraints Related to Objective Functions

- (1)

- Direct Materials

| : | The upper limit of the m-th type of usable raw materials quantity. |

- (2)

- Direct Labor

| : | The number of labor hours required to produce product in each process . (, ) |

| : | This represents non-negative variables, with at most two adjacent variables being non-zero. |

| : | This refers to binary variables (0 or 1), where only one of the two variables can be 1 at any given time. |

- (3)

- Output Unit Level

| : | The maximum available machine hours. |

- (4)

- Batch Level

| : | The quantity of product in each batch activity . |

| : | The available time (in hours) for handling batch activity . |

3.4. Model Assumptions

3.4.1. Basic Function

3.4.2. Function with Renewable Energy Usage

| : | The cost savings per unit of using SRF to replace coal. |

| : | The amount of SRF used in the production process. |

| : | The amount of carbon emissions reduced per unit by replacing coal with SRF (tons of CO2 per ton of usage). |

| : | The correlation coefficient between the use of SRF and each product (, ). |

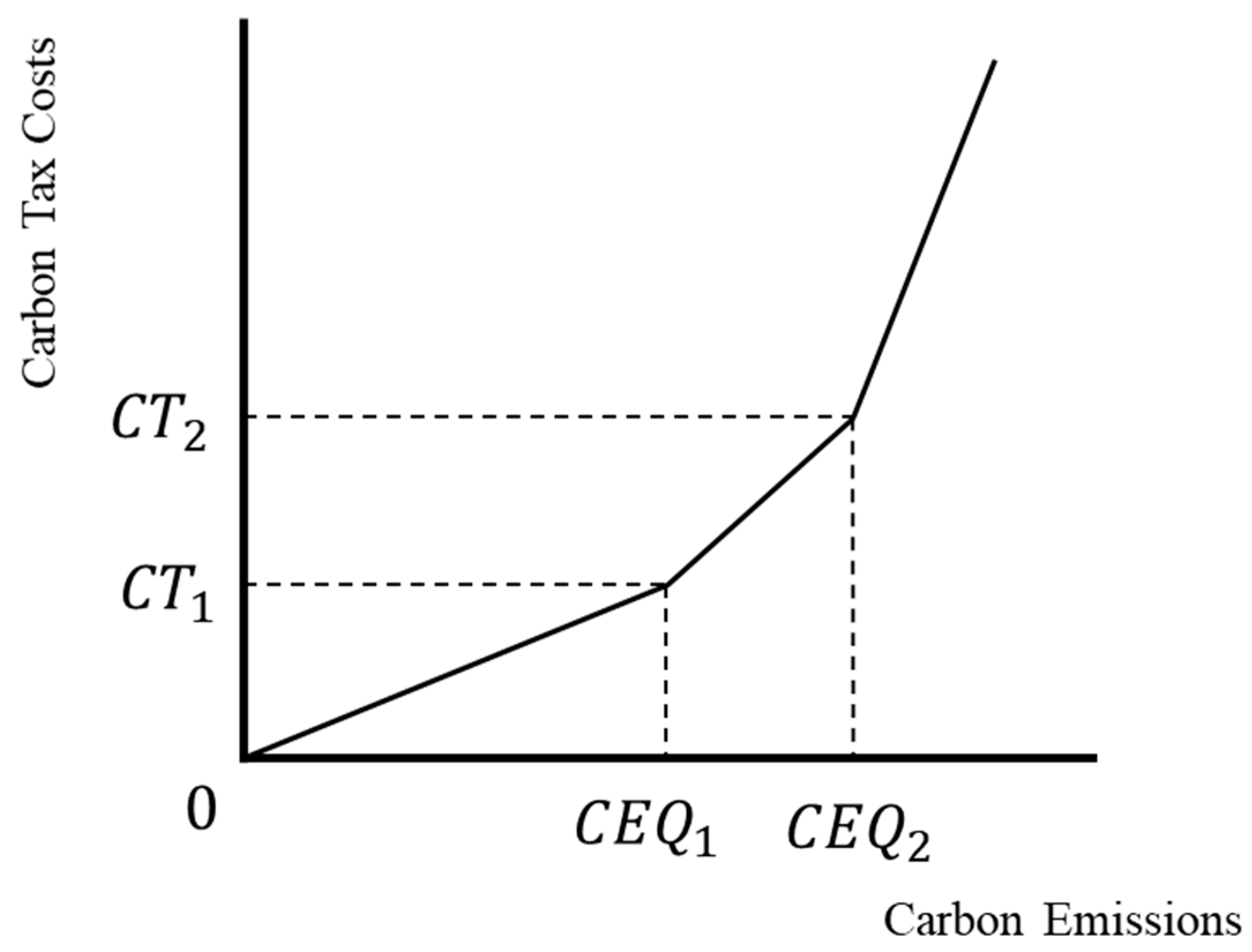

3.4.3. Carbon Tax Cost Function with Continuous Incremental Progressive Tax Rates

| : | The total carbon tax cost of the company |

| : | Represents a binary variable (0, 1), where at most two adjacent variables are non-zero. |

| : | The carbon tax cost at the carbon emission level of |

| : | The carbon tax cost at the carbon emission level of |

| : | The carbon tax cost at the carbon emission level of |

| : | The carbon emission per unit of product in process . (, ) |

| : | The carbon emission in the first stage. |

| : | The carbon emission in the second stage. |

| : | The carbon emissions exceeding the second stage , with no upper limit for this stage. |

| : | It is a binary variable (0, 1), with only one of the three items being 1. |

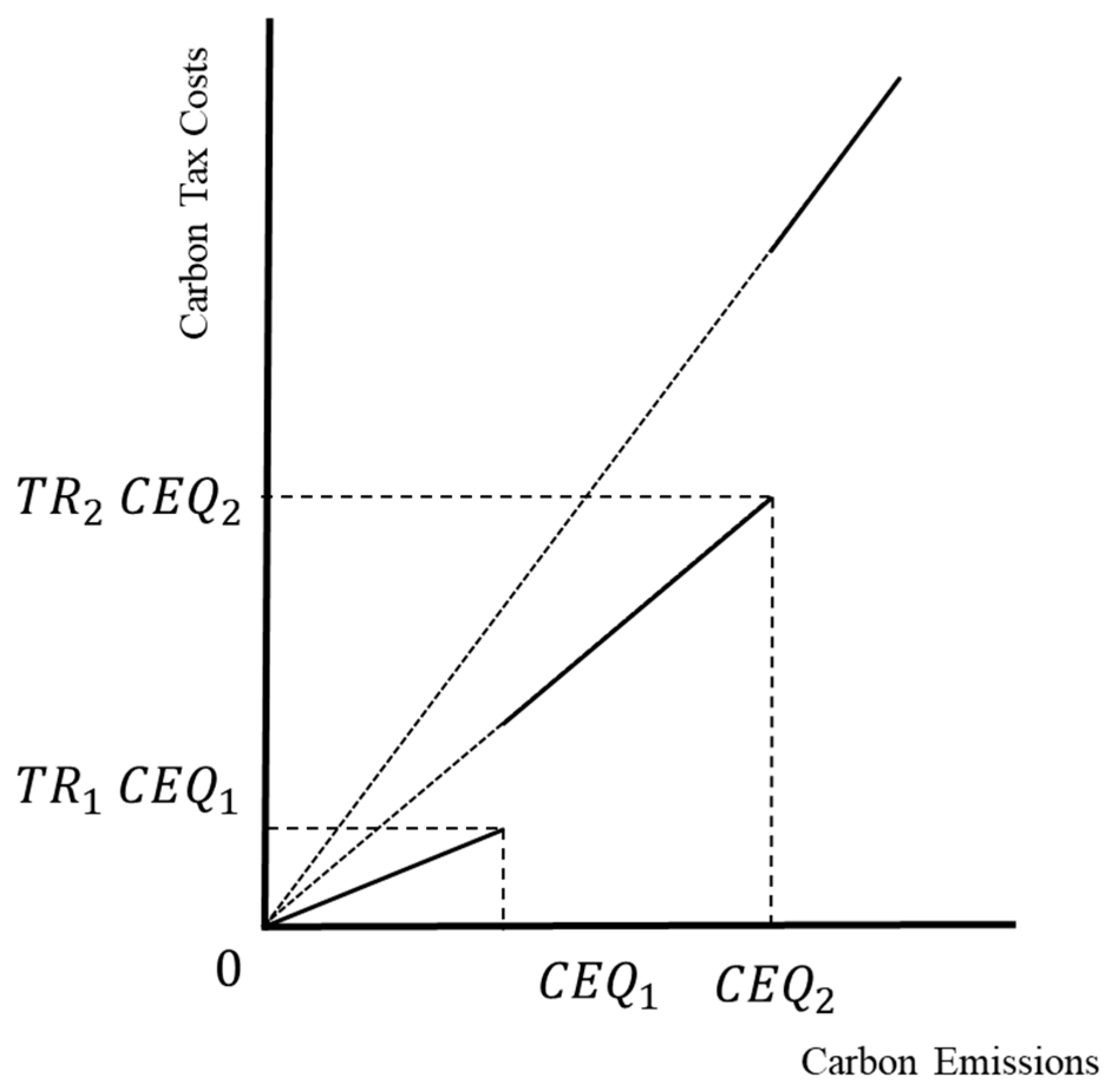

3.4.4. Carbon Tax Cost Function with Discontinuous Incremental Progressive Tax Rate

| : | The total carbon emissions falling within the first, second, or third phase. |

| , , : | The tax rate for the discontinuous carbon tax. |

| : | Represents a binary variable (0, 1), where only one of the three can be 1. |

4. Analysis of Research Results

4.1. ε-Constraint Method

- (1)

- Basic model: 5497.604~62,308.96 ton.

- (2)

- Renewable energy model: 4006.878~61,911.93 tons.

- (3)

- Carbon tax cost model with continuous incremental progressive tax rate: 5754.006~62,432.71 tons.

- (4)

- Carbon tax cost model with discontinuous incremental progressive tax rate: 4675.262~56,600.00 tons.

4.2. Illustrative Model Data

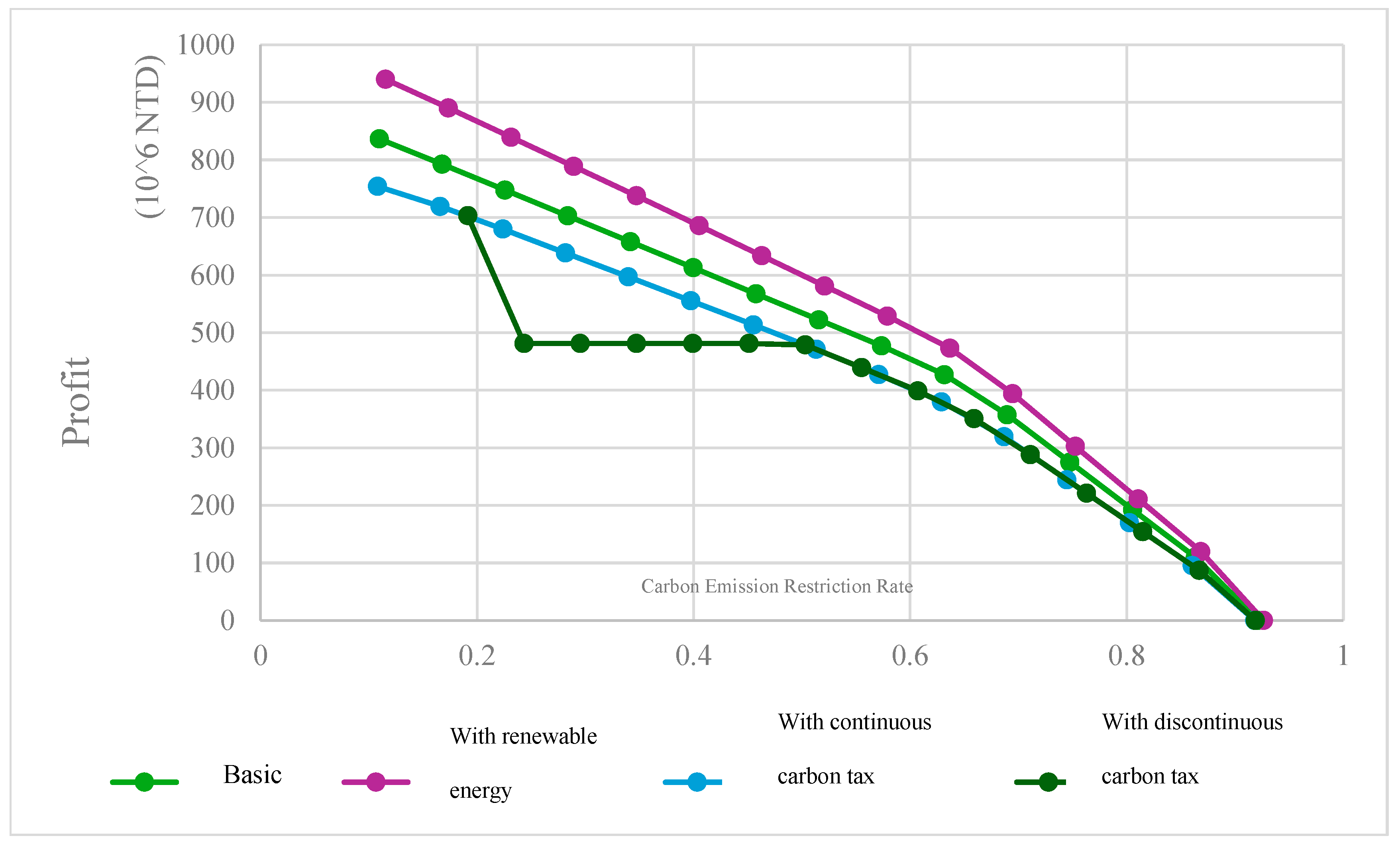

4.3. Results Comparison and Analysis

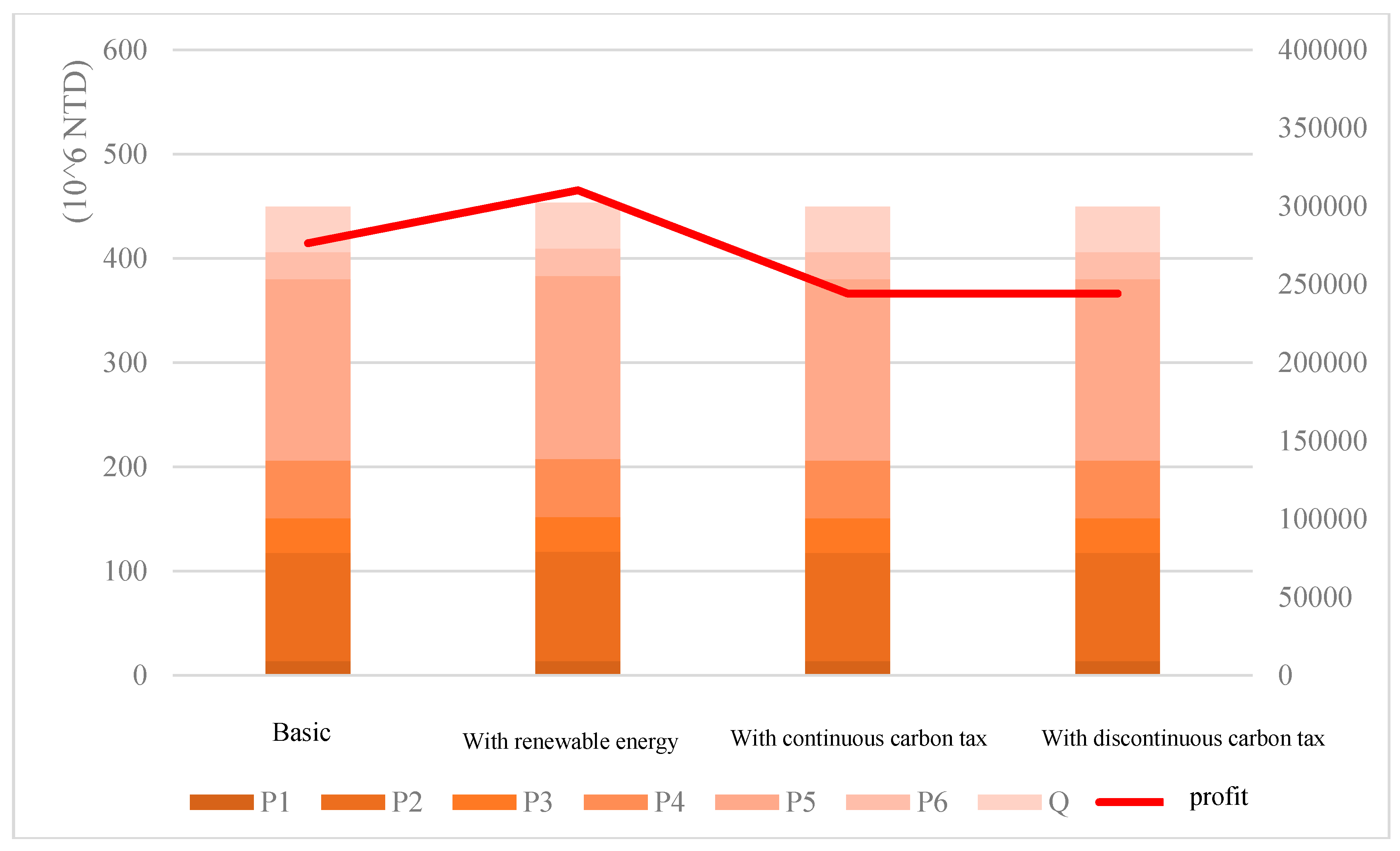

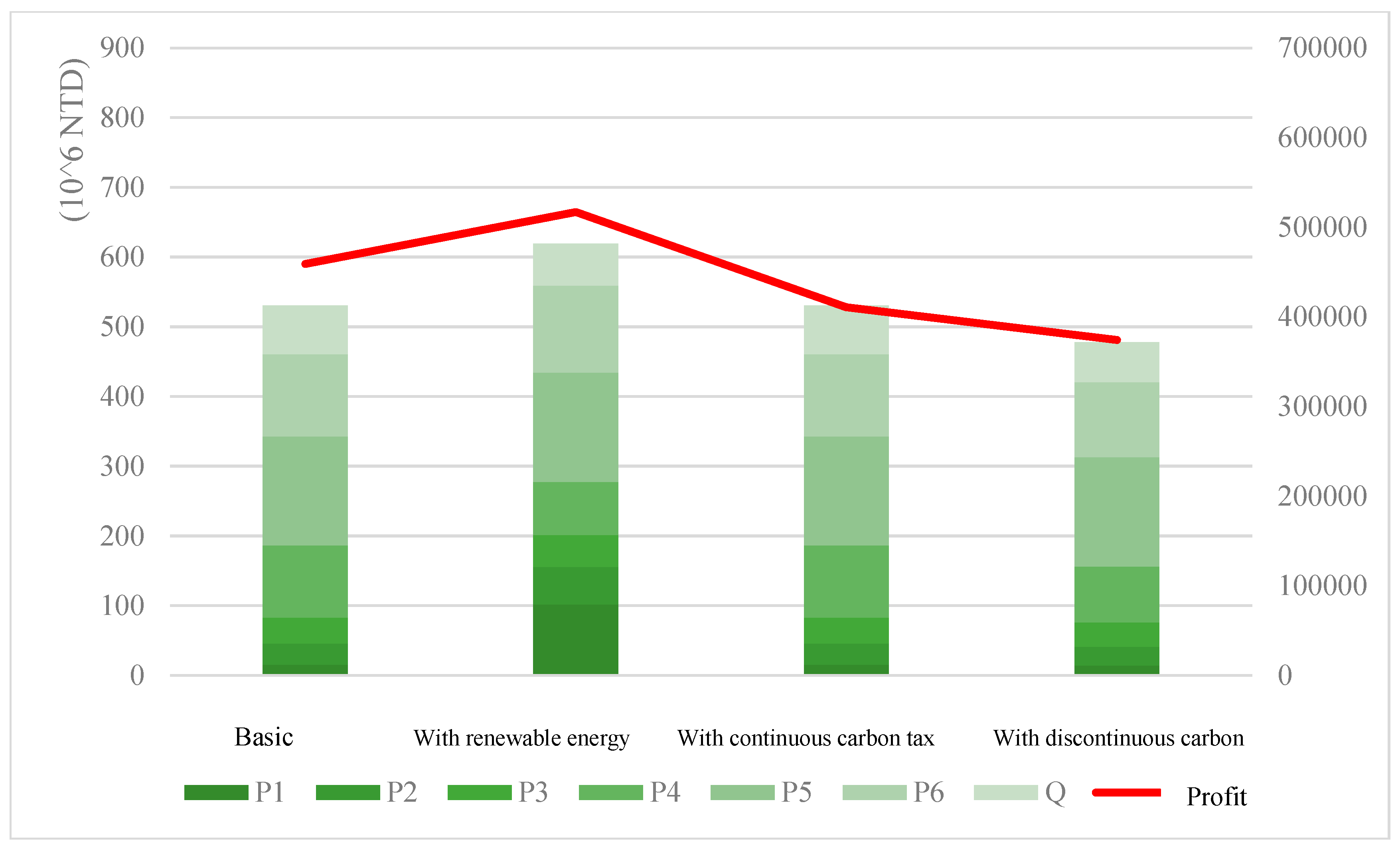

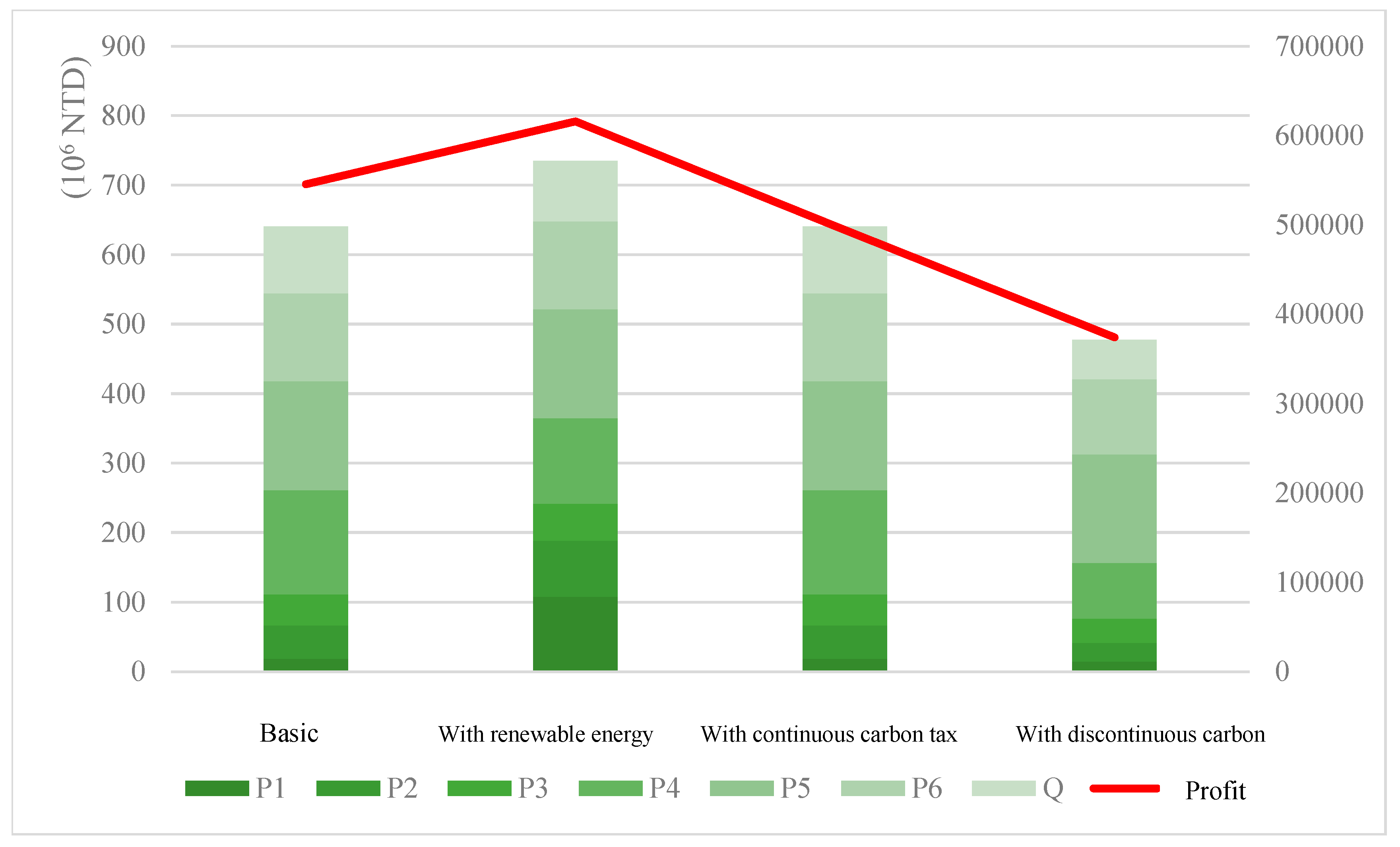

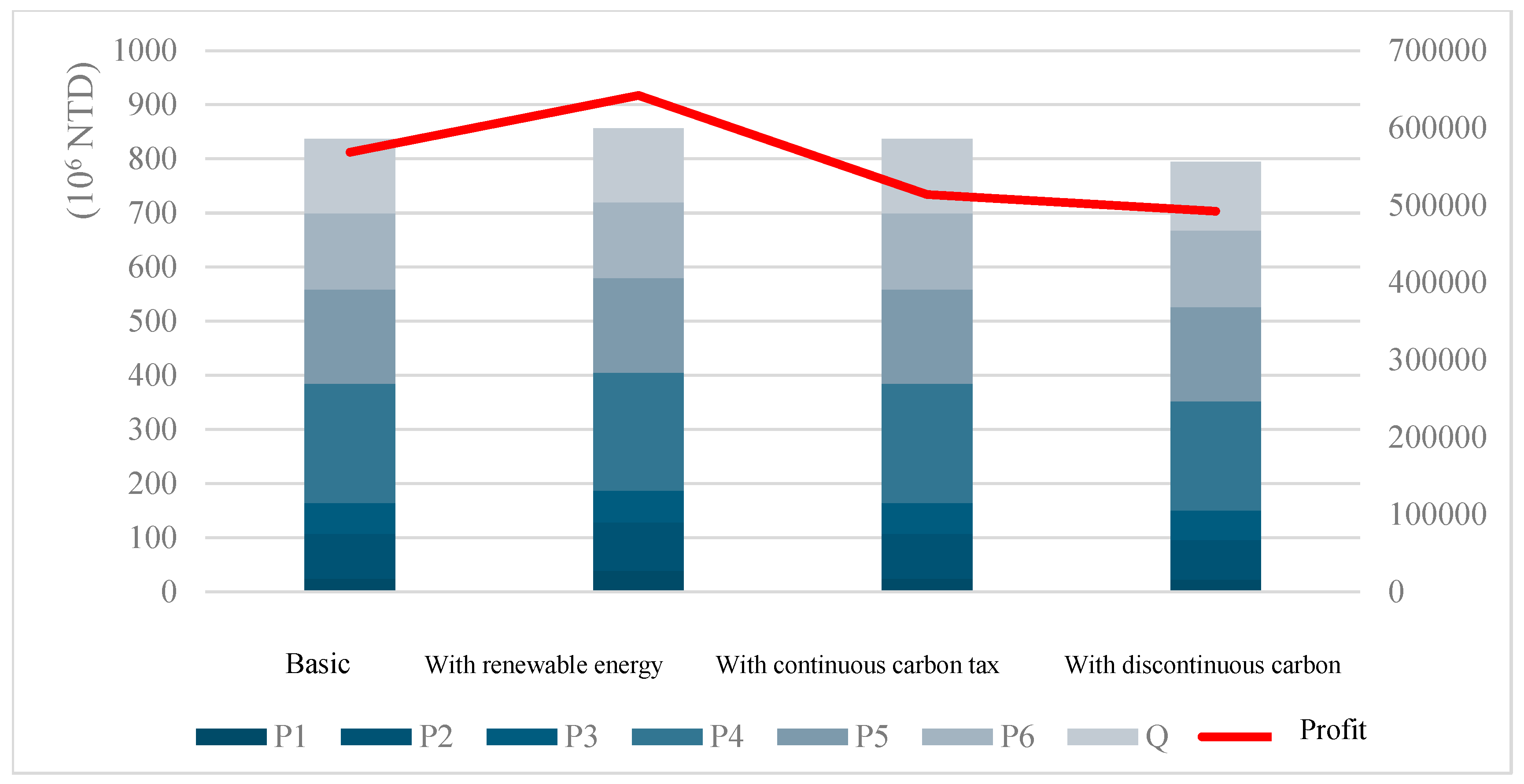

4.3.1. Model Profit Analysis

- (1)

- As the restriction rate on carbon emissions increases, the profit of all models shows a downward trend.

- (2)

- The model incorporating renewable energy consistently achieves the highest profit under any given carbon emission restriction. By utilizing renewable energy in production processes, companies can reduce some carbon emissions. Therefore, under the same carbon emission restrictions, this model can produce more products and achieve relatively higher profits compared to other models.

- (3)

- The basic model, as it does not involve carbon tax imposition, has higher profits than the two models with carbon tax. Moreover, as the carbon tax amount increases, the profit gap between the basic model and the continuous incremental progressive tax cost model widens under higher carbon emissions.

- (4)

- For the two models with carbon tax costs, both are subject to a tax rate of 300 TWD/ton during the first stage of carbon taxation. Thus, their profits remain identical when emissions are below 35,000 tons. However, in the second stage, the discontinuous incremental progressive tax cost model applies a higher tax rate of 500 TWD/ton to all emissions. Consequently, when the emission limits range between 35,001 and 56,599 tons, to maximize profits, the total product emissions remain at 35,000 tons, with profits maintained between TWD 481,157,800 and TWD 481,158,000. This strategy avoids the additional tax burden that would otherwise reduce profits. Table 5 illustrates the emission limits and corresponding profits under the second-stage tax rate for the discontinuous incremental progressive tax cost model.

- (5)

- In the second stage of carbon taxation, the tax rate is already set at a high and stable level. Increased production leads to higher carbon tax costs, which offset the additional profits from increased production. Hence, under the trade-off between minimizing carbon emissions and maximizing profits, the emission limits in this stage keep profits stable. Similarly, when the emission limits exceed 56,600 tons up to 70,000 tons, corresponding to the third stage of taxation, the same pattern is observed. Examples of this situation will be discussed in Section 4.3.2.

4.3.2. Model Output Analysis

- A.

- Values within Carbon Emission Quantity 25,000 and 30,000

- B.

- Values within Carbon Emission Quantity 40,000 and 50,000

- C.

- Values within Carbon Emission Quantity 60,000 and 65,000

4.4. Sensitivity Analysis

- Scenario 1: When demand increases significantly, companies increase production by 10% and simultaneously raise prices by 10%.

- Scenario 2: When demand increases slightly, companies increase production by 5% and simultaneously raise prices by 5%.

- Scenario 3: When demand decreases slightly, companies decrease production by 5% and simultaneously lower prices by 5%.

- Scenario 4: When demand decreases significantly, companies decrease production by 10% and simultaneously lower prices by 10%.

4.5. Comprehensive Analysis and Recommendations

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Li, H.-C. Optimal delivery strategies considering carbon emissions, time-dependent demands and demand-supply interactions. Eur. J. Oper. Res. 2015, 241, 739–748. [Google Scholar] [CrossRef]

- Oxford Languages. Word of the Year 2019: Climate Emergency; Oxford University Press: Oxford, UK, 2019; Available online: https://languages.oup.com/word-of-the-year/2019/ (accessed on 22 January 2025).

- Lee, J.L. Greenhouse Gas Concentrations Reach New Highs. World Journal, 26 November 2019. Available online: https://maritime-executive.com/article/greenhouse-gas-concentrations-reach-yet-another-high (accessed on 22 January 2025).

- Liu, B.; Holmbom, M.; Segerstedt, A.; Chen, W. Effects of carbon emission regulations on remanufacturing decisions with limited information of demand distribution. Int. J. Prod. Res. 2015, 53, 532–548. [Google Scholar] [CrossRef]

- IPCC. Climate Change 2014: Synthesis Report; Intergovernmental Panel on Climate Change: Geneva, Switzerland, 2014. [Google Scholar]

- Industrial Development Bureau, MOEA. Product Environmental Footprint and Sustainable Resource Information Zone; Taiwan Ministry of Economic Affairs: Taipei, Taiwan, 2023. Available online: https://www.idbcfp.org.tw/ (accessed on 22 January 2025).

- Knight, P.; Jenkins, J.O. Adopting and applying eco-design techniques: A practitioner’s perspective. J. Clean. Prod. 2009, 17, 549–558. [Google Scholar] [CrossRef]

- Verbruggen, A. Financial appraisal of efficiency investments: Why the good may be the worst enemy of the best. Energy Effic. 2012, 5, 571–582. [Google Scholar] [CrossRef]

- Boons, F. Greening products: A framework for product chain management. J. Clean. Prod. 2002, 10, 495–505. [Google Scholar] [CrossRef]

- Hsu, A.; Brandt, J.; Widerberg, O.; Chan, S.; Weinfurter, A. Exploring links between national climate strategies and non-state and subnational climate action in nationally determined contributions (NDCs). Climate Policy 2023, 20, 443–457. Available online: https://dspace.library.uu.nl/handle/1874/409411 (accessed on 8 March 2025). [CrossRef]

- Climate Change Administration. 2023 Greenhouse Gas Inventory Report of the Republic of China. 2024. Available online: https://www.cca.gov.tw/en/information-service/publications/national-ghg-inventory-report/1851.html (accessed on 22 January 2025).

- Carbon Tax Center. Where Carbon is Taxed (Overview). 2019. Available online: https://www.carbontax.org (accessed on 22 January 2025).

- David, S.L.; Kotler, P. Designing and Managing the Supply Chain: Concepts, Strategies, and Case Studies; McGraw-Hill: Singapore, 1998. [Google Scholar]

- Kuhn, H.W.; Tucker, A.W. Nonlinear programming. In Proceedings of the Second Berkeley Symposium on Mathematical Statistics and Probability, Berkeley, CA, USA, 31 July–12 August 1950; University of California Press: Berkeley, CA, USA, 1951; Volume 2, pp. 481–492. [Google Scholar]

- Goicoechea, A.; Hansen, D.R.; Duckstein, L. Multiobjective Analysis with Engineering and Business Applications; Wiley: New York, NY, USA, 1982. [Google Scholar]

- Hsu, G.; Chou, F. Integrated planning for mitigating CO2 emissions in Taiwan: A multi-objective programming approach. Energy Policy 2000, 28, 519–523. [Google Scholar] [CrossRef]

- Hsu, C.Y. Multi-Objective Decision Making, 2nd ed.; Wu-Nan: Taipei, Taiwan, 2003. [Google Scholar]

- Bai, Y.; Wang, S. Development Status of Refining Production Planning Optimization Technology and Its Application in Daqing Petrochemical Company. J. Southwest Pet. Univ. 2018, 40, 6–14. [Google Scholar] [CrossRef]

- Wang, L.; Chen, Y.; Zhang, H. Digital Development and Competition Regulation in Petrochemical Industry. Fair Trade Q. 2021, 29, 45–60. [Google Scholar] [CrossRef]

- Tsai, W.H.; Lai, C.W.; Tseng, L.J.; Chou, W.C. Embedding management discretionary power into an ABC model for a joint products mix decision. Int. J. Prod. Econ. 2008, 115, 210–220. [Google Scholar] [CrossRef]

- Cooper, R.; Kaplan, R.S. Activity-based systems: Measuring the costs of resource usage. Account. Horiz. 1992, 6, 1–13. [Google Scholar]

- Datar, S.M.; Rajan, M.V. Horngren’s Cost Accounting: A Managerial Emphasis, 16th ed.; Pearson: London, UK, 2018. [Google Scholar]

- Goldratt, E.M.; Cox, J. The Goal: A Process of Ongoing Improvement; North River Press: Great Barrington, MA, USA, 1992. [Google Scholar]

- Plenert, G. Optimizing theory of constraints when multiple constrained resources exist. Eur. J. Oper. Res. 1993, 70, 126–133. [Google Scholar] [CrossRef]

- Turney, P.B.B. Common Cents: The ABC Performance Breakthrough: How to Succeed with Activity-Based Costing; McGraw-Hill: New York, NY, USA, 1991. [Google Scholar]

- Tsai, W.H.; Hsu, J.L.; Chen, C.W. An activity-based costing decision model for life cycle assessment in green building projects. Energies 2011, 4, 1426–1445. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Anderson, S.R. Time-Driven Activity-Based Costing: A Simpler and More Powerful Path to Higher Profits; Harvard Business Review Press: Brighton, MA, USA, 2007. [Google Scholar]

- Keel, G.; Savage, C.; Rafiq, M.; Mazzocato, P. Time-driven activity-based costing in health care: A systematic review of the literature. Health Policy 2017, 121, 755–763. [Google Scholar] [CrossRef] [PubMed]

- Afonso, P.; Silva, R.; Guzmán, B.A. Activity-based costing (ABC) and its implication for open innovation. J. Open Innov. Technol. Market Complex. 2021, 7, 41. [Google Scholar]

- Resource Circulation Administration. Taiwan 2050 Net-Zero Emission Pathway and Strategy General Explanation; Resource Circulation Administration: Taipei, Taiwan, 2024.

- Environmental Protection Administration. 2020 Waste Management Report; Environmental Protection Administration: Taipei, Taiwan, 2020.

| Industry | Percentage of Carbon Emission | Number of Companies |

|---|---|---|

| Petrochemical | 49.06% | 10 |

| Steel | 25.99% | 7 |

| Electronic Components | 14.91% | 5 |

| Cement | 6.11% | 4 |

| Paper | 2.80% | 2 |

| Textile | 0.57% | 1 |

| Glass | 0.56% | 1 |

| Study | Method | Cost Consideration | Carbon Tax Policy | Multi-Objective Programming | Research Contribution |

|---|---|---|---|---|---|

| Hsu and Chou (2000) [16] | Multi-objective programming | None | Taiwan’s carbon emission policy | ✔ | Proposed a multi-objective programming approach but did not integrate Activity-Based Costing (ABC) and the Theory of Constraints (TOC) |

| Tsai et al. (2008) [20] | ABC cost decision model | Production cost | No carbon tax consideration | ✖ | Examined ABC in production decisions but did not incorporate environmental costs or multi-objective analysis |

| Liu et al. (2015) [4] | Decision-making model | Cost under demand uncertainty | Carbon emission regulations | ✖ | Investigated the impact of carbon regulations on recycling manufacturing decisions but did not integrate multi-objective optimization |

| This Study | Multi-objective programming (MOP) | Activity-Based Costing (ABC) and Theory of Constraints (TOC) | Basic carbon tax, continuous incremental carbon tax, discontinuous incremental carbon tax | ✔ | Integrated cost management with production decision-making to provide optimal strategies |

| Symbols | Products | Byproducts | Available Resources Limit | |||||||||

| Ethylene (i = 1) | Propylene (i = 2) | Vinyl Chloride (i = 3) | Plastic Powder (i = 4) | Polyethylene (i = 5) | Polypropylene (i = 6) | Liquid Alkali | ||||||

| Sales Price per Metric Ton | TWD 30,000 | TWD 32,000 | TWD 41,500 | TWD 45,300 | TWD 37,000 | TWD 38,400 | TWD 4700 | |||||

| Main Costs | ||||||||||||

| Direct Material Input | Naphtha | m = 1 | = 19,500 TWD/ton | 1.47 | 1.5 | 1.764 | 1.911 | 1.746 | 1.8 | 0 | 2,601,411 | |

| Salt | m = 2 | = 4600 TWD/ton | 0 | 0 | 1 | 1 | 0 | 0 | 0.5 | 457,450 | ||

| Direct labor hours | Distillation Cracking | p = 1 | 1.5 | 1.5 | 1.5 | 1.5 | 1.5 | 1.5 | ||||

| Electrolysis | p = 2 | 1 | ||||||||||

| Cracking | p = 3 | 0.5 | 0.5 | |||||||||

| Output per unit operation | ||||||||||||

| Machine hours | Distillation Cracking | p = 1 | = 150 TWD/Machine hours | 5 | 10 | 5 | 5 | 5 | 10 | 3,325,500 | ||

| Electrolysis | p = 2 | 2 | 340,000 | |||||||||

| Cracking | p = 3 | 2.27 | 2.27 | 485,800 | ||||||||

| Polymerization | p = 4 | 3.03 | 535,500 | |||||||||

| Polymerization | p = 5 | 1.01 | 123,000 | |||||||||

| Polymerization | p = 6 | 1.01 | 99,600 | |||||||||

| Symbols | Products | Byproducts | Available Resources Limit | |||||||||

| Ethylene (i = 1) | Liquid Alkali (i = 2) | Vinyl Chloride (i = 3) | Plastic Powder (i = 4) | Polyethylene (i = 5) | Polypropylene (i = 6) | Liquid Alkali | ||||||

| Batch Level Operations | ||||||||||||

| Material Distribution | b = 1 | = 15,000 TWD/Number of Deliveries | 1 | 2000 | ||||||||

| 10,000 | ||||||||||||

| Machine Maintenance | b = 2 | = 3400 TWD/Maintenance Hours | 2 | 2 | 10 | 12 | 5 | 5 | 10 | 50,000 | ||

| 600 | 600 | 400 | 800 | 300 | 300 | 500 | ||||||

| Direct Labor Cost | ||||||||||||

| Cost | = TWD 78,031,200 | = TWD 130,585,000 | = TWD 165,105,360 | |||||||||

| Labor Hours | = 426,400 | = 533,000 | = 539,560 | |||||||||

| Wage Rate | 183 TWD/hr | 245 TWD/h | 306 TWD/h | |||||||||

| Renewable Energy Use | ||||||||||||

| SRF Usage Reduces Carbon Emissions | 0.000788 tons per production unit | Reduce variable cost ratio | 15% per machine hour cost | Increase fixed cost ratio | 55% | |||||||

| Carbon tax | ||||||||||||

| Unit carbon emissions | 0.04 | 0.04 | 0.1764 | 0.2164 | 0.0751 | 0.0751 | 0 | |||||

| Segment costs | = TWD 10,500,000 | = TWD 28,300,000 | = TWD 560,000,000 | |||||||||

| Segment carbon emission limits | = 35,000 | = 56,600 | = 70,000 | |||||||||

| Segment tax rates | = 300 TWD/ton | = 500 TWD/ton | = 800 TWD/ton | |||||||||

| Basic Model | Model with Renewable Energy | |||

|---|---|---|---|---|

| Max Profit | Min Carbon Emissions | Max Profit | Min Carbon Emissions | |

| Profit | TWD 836,612,800 | 62,308.96 (tons) | TWD 940,166,300 | 61,911.93 (tons) |

| Carbon Emissions | TWD 13,649.5 | 5497.604 (tons) | TWD 620.25 | 5149.618 (tons) |

| Model with Continuous Incremental Progressive Tax Rates | Model with Discontinuous Incremental Progressive Tax Rates | |||

| Max Profit | Min Carbon Emissions | Max Profit | Min Carbon Emissions | |

| Profit | TWD 754,106,000 | 62,432.71 (tons) | TWD 703,262,000 | 56,600 (tons) |

| Carbon Emissions | TWD 521.67 | 5714.981 (tons) | TWD 197,627.3 | 5677.096 (tons) |

| Carbon Emission Restriction Rate (%) | Carbon Emission Limit (tons) | Profit |

|---|---|---|

| 24.3390718 | ≤52,962.64971 | TWD 481,158,000 |

| 29.5352865 | ≤49,325.29943 | TWD 481,157,900 |

| 34.7315012 | ≤45,687.94914 | TWD 481,157,900 |

| 39.9277159 | ≤42,050.59886 | TWD 481,158,000 |

| 45.1239306 | ≤38,413.24857 | TWD 481,157,800 |

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Profit | TWD 414,482,500 | TWD 465,254,700 | TWD 366,310,000 | TWD 366,310,000 |

| Ethylene () | 9198 | 9277 | 9198 | 9198 |

| Propylene () | 69,243 | 69,839 | 69,243 | 69,243 |

| Chloroethane () | 22,083 | 22,265 | 22,083 | 22,083 |

| Plastic Powder () | 36,800 | 37,123 | 36,800 | 36,800 |

| Polyethylene () | 11,5876 | 11,6873 | 11,5876 | 11,5876 |

| Polypropylene () | 17,325 | 17,473 | 17,325 | 17,325 |

| Liquid Alkali () | 29,150 | 29,400 | 29,150 | 29,150 |

| Total Product Output | 29,9675 | 30,2250 | 29,9675 | 29,9675 |

| Actual Carbon Emissions | 25,000.00 | 24,999.98 | 25,000.00 | 25,000.00 |

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Profit | TWD 478,628,300 | TWD 535,508,300 | TWD 426,882,800 | TWD 426,882,500 |

| ) | 10,059 | 20,393 | 10,059 | 10,059 |

| ) | 19,097 | 19,800 | 19,097 | 19,094 |

| ) | 24,486 | 25,186 | 24,486 | 24,489 |

| ) | 44,800 | 42,181 | 44,800 | 44,797 |

| ) | 121,782 | 121,782 | 121,782 | 121,782 |

| ) | 75,551 | 78,808 | 75,551 | 75,554 |

| ) | 34,300 | 33,350 | 34,300 | 34,300 |

| Total Product Output | 33,0075 | 34,1500 | 33,0075 | 33,0075 |

| Actual Carbon Emissions | 30,000.00 | 29,999.99 | 30,000.00 | 29,999.98 |

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Profit | TWD 590,125,200 | TWD 664,616,200 | TWD 527,879,800 | TWD 481,157,800 |

| ) | 12,227 | 79,143 | 12,227 | 11,194 |

| ) | 23,182 | 41,997 | 23,182 | 20,988 |

| ) | 29,244 | 35,498 | 29,244 | 27,094 |

| ) | 80,442 | 59,139 | 80,442 | 62,392 |

| ) | 121,782 | 121,782 | 121,782 | 121,782 |

| ) | 91,498 | 97,091 | 91,498 | 83,700 |

| ) | 54,300 | 46,850 | 54,300 | 44,300 |

| Total Product Output | 41,2675 | 481,500 | 412,675 | 371,450 |

| Actual Carbon Emissions | 39,999.98 | 39,999.98 | 39,999.98 | 34,999.99 |

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Profit | TWD 701,221,400 | TWD 791,857,900 | TWD 635,614,800 | TWD 481,157,900 |

| Ethylene () | 14,393 | 83,880 | 14,393 | 11,194 |

| Propylene () | 37,200 | 62,832 | 37,200 | 20,989 |

| Chloroethane () | 34,816 | 41,115 | 34,816 | 27,093 |

| Plastic Powder () | 116,785 | 95,841 | 116,785 | 62,393 |

| Polyethylene () | 121,782 | 121,782 | 121,782 | 121,782 |

| Polypropylene () | 98,224 | 98,400 | 98,224 | 83,699 |

| Liquid Alkali () | 75,050 | 67,800 | 75,050 | 44,300 |

| Total Product Output | 498,250 | 571,650 | 498,250 | 371,450 |

| Actual Carbon Emissions | 49,999.99 | 49,999.79 | 49,999.99 | 34,999.99 |

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Profit | TWD 811,996,300 | TWD 917,234,200 | TWD 733,925,100 | TWD 703,290,700 |

| Ethylene () | 16,788 | 26,999 | 16,788 | 15,981 |

| Propylene () | 58,043 | 62,957 | 58,043 | 50,822 |

| Chloroethane () | 39,948 | 41,100 | 39,948 | 38,199 |

| Plastic Powder () | 154,376 | 152,618 | 154,376 | 141,581 |

| Polyethylene () | 121,782 | 121,782 | 121,782 | 121,782 |

| Polypropylene () | 98,613 | 98,219 | 98,613 | 98,610 |

| Liquid Alkali () | 96,200 | 95,900 | 96,200 | 89,000 |

| Total Product Output | 585,750 | 599,575 | 585,750 | 555,975 |

| Actual Carbon Emissions | 59,998.70 | 59,999.99 | 59,998.70 | 56,599.99 |

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Profit | TWD 836,612,800 | TWD 940,166,300 | TWD 754,106,000 | TWD 703,290,700 |

| Ethylene () | 17,131 | 17,131 | 17,104 | 15,981 |

| Propylene () | 62,619 | 62,619 | 62,363 | 50,822 |

| Chloroethane () | 41,115 | 41,115 | 41,049 | 38,199 |

| Plastic Powder () | 163,511 | 163,511 | 164,789 | 141,581 |

| Polyethylene () | 120,861 | 120,861 | 119,132 | 121,782 |

| Polypropylene () | 98,613 | 98,613 | 98,613 | 98,610 |

| Liquid Alkali () | 101,300 | 101,300 | 101,900 | 89,000 |

| Total Product Output | 605,150 | 605,150 | 604,950 | 555,975 |

| Actual Carbon Emissions | 62,308.96 | 61,911.93 | 62,432.71 | 56,599.99 |

| Profit | Profit Change Rate | Carbon Emissions (tons) | Carbon Emission Change Rate | |

|---|---|---|---|---|

| +10% | TWD 1,708,197,000 | 104.18% | 65,292.09 | 4.79% |

| +5% | 1,248,548,000 | 49.24% | 64,346.02 | 3.27% |

| 0% | 836,612,800 | 0.00% | 62,308.96 | 0.00% |

| −5% | 632,063,100 | −24.45% | 58,348.94 | −6.36% |

| −10% | 463,292,300 | −44.62% | 56,128.82 | −9.92% |

| Profit | Profit Change Rate | Carbon Emissions (tons) | Carbon Emission Change Rate | |

|---|---|---|---|---|

| +10% | TWD 1,812,296,000 | 92.76% | 64,910.38 | 4.84% |

| +5% | 1,352,475,000 | 43.85% | 63,959.45 | 3.31% |

| 0% | 940,166,300 | 0.00% | 61,911.93 | 0.00% |

| −5% | 729,051,700 | −22.46% | 57,951.91 | −6.40% |

| −10% | 556,781,900 | −40.78% | 55,794.29 | −9.88% |

| Profit | Profit Change Rate | Carbon Emissions (tons) | Carbon Emission Change Rate | |

|---|---|---|---|---|

| +10% | TWD 1,634,202,000 | 116.71% | 65,299.68 | 4.59% |

| +5% | 1,171,843,000 | 55.39% | 64,346.02 | 3.06% |

| 0% | 754,106,000 | 0.00% | 62,432.71 | 0.00% |

| −5% | 557,402,300 | −26.08% | 58,348.94 | −6.54% |

| −10% | 392,635,100 | −47.93% | 56,128.82 | −10.10% |

| Profit | Profit Change Rate | Carbon Emissions (tons) | Carbon Emission Change Rate | |

|---|---|---|---|---|

| +10% | TWD 1,516,499,000 | 115.64% | 56,600.00 | 0.00% |

| +5% | 1,072,256,000 | 52.47% | 56,599.97 | 0.00% |

| 0% | 703,262,000 | 0.00% | 56,600.00 | 0.00% |

| −5% | 546,200,400 | −22.33% | 56,600.00 | 0.00% |

| −10% | 390,343,900 | −44.50% | 56,600.00 | 0.00% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tsai, W.-H.; Wu, Y.-H. Research on Multi-Objective Programming Model of Profits and Carbon Emission Reduction in Manufacturing Industry. Energies 2025, 18, 1411. https://doi.org/10.3390/en18061411

Tsai W-H, Wu Y-H. Research on Multi-Objective Programming Model of Profits and Carbon Emission Reduction in Manufacturing Industry. Energies. 2025; 18(6):1411. https://doi.org/10.3390/en18061411

Chicago/Turabian StyleTsai, Wen-Hsien, and Yi-Han Wu. 2025. "Research on Multi-Objective Programming Model of Profits and Carbon Emission Reduction in Manufacturing Industry" Energies 18, no. 6: 1411. https://doi.org/10.3390/en18061411

APA StyleTsai, W.-H., & Wu, Y.-H. (2025). Research on Multi-Objective Programming Model of Profits and Carbon Emission Reduction in Manufacturing Industry. Energies, 18(6), 1411. https://doi.org/10.3390/en18061411