Abstract

Achieving the European Union’s (EU) energy efficiency targets is essential for reducing greenhouse gas emissions, enhancing energy security, and ensuring sustainable investments in the building and small and medium-sized enterprises (SMEs) sectors. However, stagnant investments hinder progress towards these goals. This study examines successful sustainable financing practices for energy efficiency projects, with a focus on replicable financing schemes and models across EU countries. By examining long-term, replicable initiatives, the paper identifies best practices that can be adapted across various EU Member States, despite differing regulatory frameworks. Key selection criteria include project scale, duration, results, and private financing attraction. The study also provides market updates, evaluates financial schemes and models, assesses barriers to private fund leveraging, and shares lessons learned in overcoming these challenges. This research contributes to understanding effective strategies for encouraging investments in energy efficiency and renewable energy across the EU by promoting large-scale communication campaigns and fostering greater public-private cooperation.

1. Introduction

The transition towards a sustainable energy landscape is a pressing challenge for countries worldwide. Energy efficiency plays a pivotal role in this endeavour by reducing energy consumption, curbing greenhouse gas emissions, and fostering economic growth. Energy efficiency remains the critical area of action in the European Union’s (EU’s) growth and recovery strategy (European Green Deal), with a recognised need for higher investments in energy efficiency in all sectors of the EU economy as the most sustainable pathway towards climate neutrality [1,2].

The revised Energy Efficiency Directive (EU/2023/1791) significantly raises the EU’s ambition for energy efficiency [3]. It establishes ‘energy efficiency first’ as a fundamental principle of EU energy policy, giving it legal standing for the first time. In practical terms, EU countries must consider energy efficiency in all relevant policies and significant investment decisions in the energy and non-energy sectors.

The EU continues to keep a structured dialogue with the finance industry to de-risk energy efficiency financing and make private investments more attractive, striving to set favourable framework conditions to ensure private financing contributions to investments in the broader context of the EU policy focus on Sustainable Finance and the development of the Strategy for Financing the Transition to a Sustainable Economy [4,5]. Recognising the challenges faced by public and private investors alike to take their energy efficiency projects from idea to implementation, the EU also puts forward a wide range of legal, technical and financial support for the mobilisation of large-scale projects with the ambition to maximise the impact of the public investments [6].

Investment in energy efficiency at the European Union (EU) level continues to stagnate, but at least a doubling of investment is needed to meet the Union’s targets [7]. Achieving these targets is crucial to reducing greenhouse gas emissions, increasing energy security, and reducing dependence on fossil fuels [8]. Without a significant increase in funding, the EU risks falling short of its climate commitments and hindering progress towards a sustainable and resilient energy system [5]. Policymakers must prioritise and incentivise energy efficiency to ensure that the necessary investments are made to support the green transition, paying particular attention to buildings and small and medium-sized enterprises (SMEs) [9].

Innovative approaches to financing energy efficiency investments are kept at the centre of the EU’s energy efficiency policy, legislation, and funding [10]. Although European countries have set instruments and initiatives supporting energy efficiency in buildings covering all sectors public, private and commercial buildings and SMEs, they are characterised by campaigns and the availability of free financial resources from various public sources rather than by sustainability and massive leveraging of private funds to achieve the ambitious goals set out in their strategy documents [11,12,13,14]. It is also clear that one of the main challenges is the renovation of residential buildings, for which citizens need to be involved, and this requires much more decisive action within sustainable and predictable programmes supported by large-scale communication campaigns [15,16,17].

Furthermore, despite some successful practices related to sustainable financing of energy efficiency and renewable energy projects at the European level, they are not yet widespread and are applied sporadically by member states, which indicates the need for further action [6,11]. Furthermore, reviews of so-called “best practices” are very common, but these are often small-scale initiatives that have not shown either sustainability over time or potential for replication [18,19,20].

The purpose of this study is to analyse several best practices for sustainable financing of energy efficiency and renewable energy projects from Bulgaria, Croatia, Greece, Romania, and Slovenia. The importance of this study lies in analysing the effectiveness and replicability of financial models implemented in the energy efficiency sector of the case study countries. By examining case studies and stakeholder perspectives, the aim is to contribute valuable insights into the design and implementation of successful funding strategies that could be adopted in other regions or countries. This research is particularly significant given the increasing global emphasis on achieving climate goals and transitioning to renewable energy sources.

The main objectives of this paper are threefold: to evaluate the impact of existing financial models and funding mechanisms in the case study countries’ energy efficiency sector; to identify the key success factors and challenges associated with their implementation; and to explore the potential for upscaling and replicating these models in other contexts.

This paper, based on detailed analyses and pre-selected criteria, have identified only initiatives and tools that have proven themselves over time and could be successfully replicated in their respective countries and in other EU Member States despite different regulatory frameworks. The main selection criteria were the scale of the individual initiatives and projects, their duration over time, the results achieved, and the possibility of attracting private financing. Furthermore, the paper provides market updates for each country under examination, including specific national experience with the application of different financial schemes and various financial models assessing the barriers still influencing the greater leverage of private funds for energy efficiency investments, as well as lessons learned in overcoming them.

Apart from this introductory section, the paper follows with an outline of the methodological framework, including desk research, case studies, and policy analysis, to evaluate sustainable financing models across the five countries. Section 3 provides a detailed, country-by-country analysis of best practices in energy efficiency financing. In contrast, Section 4 synthesizes findings through a structured comparison of policy frameworks, funding mechanisms, energy efficiency outcomes, and replication potential. Section 5 contextualizes the results by discussing regional barriers, scalability challenges, and policy implications, emphasizing the role of EU funding dependency and private-sector engagement. Finally, the Section 6 summarizes key insights, highlights actionable recommendations for policymakers, and proposes future research directions to address gaps in sustainable financing.

2. Analytical Approach

The study analyses in a standardised way the identified best practises in the five countries under examination, namely Bulgaria, Croatia, Greece, Romania, and Slovenia, facilitating sustainable financing for renovation projects in the building sector. Through desk research, case studies, and policy analysis, this study evaluates various financial instruments, initiatives, and funding sources, analysing their impact on energy efficiency projects and potential for replication. The approach (Figure 1) is to provide the objective of each instrument, main features, key outcomes, and the replication potential. Market updates for each country are provided, assessing various financial schemes, models, barriers to private fund leveraging, and lessons learned in overcoming them.

Figure 1.

Basis of approach.

The table below (Table 1) presents an overview of the identified best practices for financing energy efficiency and renewable energy projects per country.

Table 1.

Overview of the identified best practices with high replication potential per country.

3. Results

Following the proposed approach for the comprehensive analysis of best practices from energy efficiency projects in the building sector and market updates, the following sections provide an analysis of the results and conclusions that can be drawn.

3.1. Bulgaria

3.1.1. Overview

In mid-2022, Bulgaria’s population was around 6.5 million, and the continuing trend of steady population decline in recent years persists. On the other hand, in 2023, the GDP reached approximately EUR 14,595 per capita, which is a significant increase compared to EUR 5803 a decade earlier [21]. However, it is important to note that according to the 2023 Country Report, Bulgaria still has the most carbon-intensive economy in the EU, with greenhouse gas levels four times higher than the EU average [22]. The same report highlights that while Bulgaria stands to gain from a significant boost in investments supporting the green transition of its economy, the decarbonization of the energy sector remains a critical challenge [22,23]. Despite alignment with the European Green Deal and REPowerEU initiatives, substantial progress has yet to be achieved [1,2,24].

This is precisely where the National Energy and Climate Plan (NECP) [25] should intervene, outlining the necessary reforms for mobilization of private investments for energy and climate targets, based on investment needs analysis and a comprehensive overview of public and private investment needs. The main objectives of draft-updated integrated NECP are as follows [25]:

- Stimulating low-carbon development of the economy;

- Development of a competitive and secure energy sector;

- Increasing energy efficiency and reducing carbon emissions, including by exploiting the full potential of natural gas as an energy source and transitional fuel;

- Reducing dependence on fuel and energy imports;

- Ensuring energy is affordable for all consumers.

Furthermore, although funding sources are outlined as follows, the lack of quantification of the needed investments makes it impossible to identify the funding gaps and distinguish between public and private funding [26,27]:

- Structural Funds 2021–2027

- The Invest EU Programme;

- The Modernisation Fund;

- The Energy Efficiency and Renewable Sources Fund;

- National Programme for Energy Efficiency in Multi-Apartment Buildings;

- National Trust EcoFund—Climate Investment Programme;

- Renewable Energy, Energy Efficiency, Energy Security Programme, financed by the Financial Mechanism of the European Economic Area 2014–2021;

- National Recovery and Resilience Plan of the Republic of Bulgaria;

As far as the banking sector is concerned, products specifically targeting energy efficiency investments have not yet been observed.

3.1.2. Energy Efficiency and Renewable Sources Fund

The Energy Efficiency and Renewable Sources Fund (EERSF) is structured as a self-sustainable commercial entity that concentrates its efforts on facilitating energy efficiency investments and promoting the development of a working energy efficiency market in Bulgaria [28,29]. The fund’s main environmental objective is to support the identification, development, and financing of viable energy efficiency projects, resulting in substantial reduction of greenhouse gases.

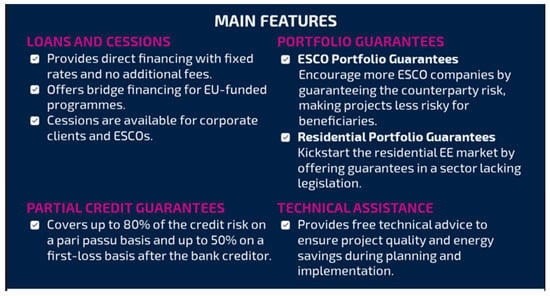

Objective: To support deep renovations in the public sector through a combination of public and private financing.

Main Features: Figure 2 presents the overview of the main features of the EERSF.

Figure 2.

Energy efficiency best practice in Bulgaria: EERSF main features.

Key outcomes: Since its inception in 2005, EERSF has provided funding for over 215 projects divided into three main groups by type of client: municipalities (~50% of the projects); corporations (~38%); and others, including hospitals, universities, etc. (~12%). The total value of the supported projects is about EUR 50 million, which shows good efficiency considering the fund’s loan portfolio of EUR 5–6 million. The instrument’s sustainability is evidenced by the quality of the loan portfolio, which can hardly be matched by any commercial bank. More than 98% of the loans are regularly serviced, mainly due to the technical support provided by the Fund’s experts during the planning and implementation phases, ensuring stable cash flows following the achievement of the envisaged energy savings. The EERSF has successfully leveraged small resources to deliver large-scale energy efficiency improvements, achieving sustainability through its governance model [28,29].

Replication Potential: The fund’s self-sustaining model, which combines loans, guarantees, and technical support, is adaptable across sectors and countries with varying regulatory frameworks.

3.1.3. Market Analysis of Financial Models for Energy Efficiency in Bulgaria

Best Practice: Large-scale renovation of the public building stock

Objective: Renovated and decarbonised building stock by 2050, providing a high quality of life in a healthy, safe, energy efficient, modernised and high-tech living environment.

Key Initiatives:

- Fund FLAG: Supporting Bulgarian municipalities and public companies for extending and developing of local infrastructure, providing public services, and creating sustainable local authorities.

- National Trust EcoFund: Developing and implementing programmes to support local authorities in mitigating climate change.

- Bulgarian Energy Efficiency and Renewable Energy Sources Fund: Proving financing for energy efficiency improvement in both public and private sectors [29,30].

3.2. Croatia

3.2.1. Overview

Croatia, located in southeastern Europe, had an estimated population of 3.8 million in mid-2022. With an average density of 68.1 inhabitants per km2, its GDP reached 14,660 EUR 14 (50.64% EU27), indicating significant growth over the past three years [31]. In the latest Annual Energy Report for 2022, their final energy consumption in 2022 amounted to 281.1 PJ (equivalent to 6714 Mtoe) and decreased by 2.4% compared to the previous year (288 PJ, equivalent to 6.9 Mtoe) [32].

In the final energy consumption analysis in 2022, the structure share of total national buildings stock was 47.30% (101.95 PJ), industry was 16.50% (47.3 PJ), transport was 31% (93.1 PJ), and other sectors were 5.20% (140.7 PJ) [31,32]. Entering the Schengen zone and adopting the Euro on 1 January 2023, Croatia became the 20th member state of the eurozone, elevating its credit rating and attractiveness to real estate investors. By mid-2022 estimates, Zagreb was home to 767,445 residents, comprising one-fifth of Croatia’s total population. However, in 2020, Croatia faced two devastating earthquakes: one in Zagreb during the COVID-19 pandemic in March, and another registering 6.2 on the Richter scale, striking the Sisak-Moslavina, Karlovac, and Zagreb counties in December, causing additional damage to buildings in Zagreb [33]. The estimated damage in Zagreb and surrounding areas, including Banovina, totals around EUR 17 billion or HRK 129 billion, necessitating not only the implementation of existing non-regulatory energy efficiency measures proposed in the National Energy and Climate Plan (NECP) for 2021–2030, but also the acquisition of new funding [34].

The NECP 2021–2030 is under the responsibility of the Ministry of Economy and Sustainable Development, builds on existing national strategies and plans, and outlines how Croatia intends to address energy efficiency, renewables, greenhouse gas emissions reductions, interconnections, research, and innovation. In Croatia’s first progress report on the NECP, submitted in the first half of 2023, commission reviews indicate that while energy efficiency policies are well-described, there is only a partial estimation of energy savings, particularly in buildings [33,34]. Croatia’s NECP goals aim to increase final energy consumption to 274.20 PJ, equivalent to 6.55 Mtoe, by 2030, with a significant rise in renovation rates from 0.7% to 3% by 2023. Croatia’s Long-Term Renovation Strategy estimates a total investment of €32.3 billion by 2050, focusing on energy and comprehensive renewal of its building stock, with substantial allocations for energy-efficient buildings and renewable electricity generation [35,36].

3.2.2. PhotoVoltaic for Croatia

The PhotoVoltaic for Croatia (PVMax) project, supported by European Local Energy Assistance (ELENA), likely involves efforts to promote and finance the installation of photovoltaic solar systems in Croatia for private, public, and commercial buildings.

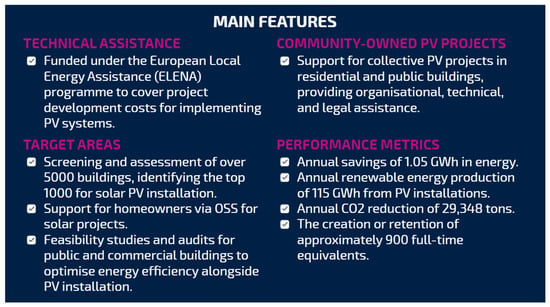

Objective: Support the development of photovoltaic solar systems across private, public, and commercial sectors to increase renewable energy capacity.

Main Features: Figure 3 presents the overview of the main features of the PVMax project.

Figure 3.

Energy efficiency best practice in Croatia: PVMax main features.

Key outcomes: Since the project’s public call opening, the North-West Croatia Regional Energy Agency (REGEA) has forged cooperation agreements with clients from both the private and public sectors to provide tailored support, be it technical, financial, and/or legal, for the development of integrated solar power plants at 676 locations. These plants boast a cumulative installed capacity of approximately 182.3 MWp. Currently, roughly 90 integrated solar power plants with a total installed capacity of around 20 MWp have been successfully completed and are operating permanently. Conversely, at the project level, several clients from private and public sectors have inked contracts to construct around 50 integrated solar power plant projects. Upon completion, as per standardized contractual documentation, these projects are expected to contribute to a total installed capacity of around 24 MWp. The commissioning of these plants is anticipated by the end of 2024, contingent upon the scale and intricacy of execution [36].

Replication Potential: The project’s success demonstrates potential for replication, especially in regions with similar rooftop solar capacity and policy environments supportive of renewable energy.

3.2.3. Market Analysis of Financial Models for Energy Efficiency in Croatia

Best Practice: Comprehensive Energy Efficiency and Renovation Strategies

Objective: Croatia focuses on significant improving energy efficiency, with ambitious goals for building renovations and reducing greenhouse gas emissions through public and private sector initiatives.

Key Initiatives:

- NRRP 2021–2026: Secured financial resources for building renovation—including those damaged by the earthquake—energy efficiency, green transition, and ensuring competitiveness of the SME and tertiary sector.

- National Energy and Climate Plan (NECP) 2021–2030: Croatia’s energy and climate plan updated with the REPowerEU chapter, renovation targets of 3% by 2030, enhanced energy efficiency and energy management across various sectors.

- Energy renovation is focused on multi-apartment, public, and cultural heritage buildings, including measures to prevent energy poverty.

3.3. Greece

3.3.1. Overview

Greece, which spans 132,049 km2, is situated at the southernmost point of continental Europe. The revised 2021 Population and Housing Census results indicate that the country’s resident population was 10,816,286 [37]. Exports, investments, and private consumption are anticipated to contribute to a slight increase in GDP growth in 2024 and 2025, following a solid but diminished economic performance in 2023 [38]. By 2025, headline inflation is anticipated to decrease to 2.1%. The public debt ratio is anticipated to continue decreasing, and the general government deficit is expected to go down further due to the muted growth of expenditures [39].

In general, the authorities think medium-term growth may be higher than the staff’s expectations as global inflationary pressures and uncertainty levels decrease, and the ambitious reform agenda continues [40]. In this context, productivity growth may be facilitated by a sustained increase in private and public investment, facilitated by structural reforms, such as those incorporated into Greece 2.0 and the National Recovery and Resilience Plan (NRRP) under the Next Generation EU (NGEU) Programme. To expedite the Greek economy’s structural transformation through 2026, the revised Greek NRRP plan comprises 76 structural reforms and 103 investment projects. The total quantity of EU funds that Greece will receive in the upcoming years exceeds EUR 70 billion (in 2018 prices), as the NRRP resources are added to the EU budget structural funds under the Multiannual Financial Framework for 2021–2027 [41]. The authorities anticipate that the implementation of Greece 2.0 will result in a permanent increase in real GDP of at least seven percentage points, substantially exceeding the staff’s 1.3% projection [38,39,41].

The revised National Energy and Climate Plan (NECP) priority at the level of planned policies and the implementation of specific measures is the achievement of particular goals regarding the security of energy supply, the operation of energy markets and the role of consumers, the strengthening of the competitiveness of the economy, as well as promotional activities, research, and innovation. Regarding energy efficiency, the value submitted in the updated NECP for their final energy consumption is 15.4 Mtoe, above the indicated target resulting from EU legislation (14.6 Mtoe) [39,41].

Specifically for the building sector, the primary objective of the document is to save jobs and combat energy poverty [42]. A significant proportion of the Recovery Fund’s resources, combined with the Partnership Agreement for the Development Framework (NSRF) and other European funds, support multiple cycles of the ‘Save’ program, the ‘Recycling Equipment’ program, the “ELECTRA” program for public buildings, the program for solar water heaters at homes, as well as the ‘Photovoltaics on the roof’ in combination with batteries [43]. The common axes are to increase the energy efficiency of the country’s building stock, improve the quality of life, protect against high costs, and meet the country’s needs with additional targeted actions for specific vulnerable groups that need support [44].

Regarding the tertiary sector, energy efficiency potential is considered relatively high, as it is closely related to the energy efficiency of private offices, commercial buildings, and hotels [45]. Small and medium enterprises (SMEs), tiny enterprises, and micro enterprises, representing the vast majority of the Greek economy, have the greatest need to improve their energy efficiency, given the lack of internal energy managers and experts and the difficulty of accessing funding for the required interventions [46]. The National Recovery and Resilience Plan finances the “Save at Business” action. It is part of the policies and measures of the NECP for enterprises.

3.3.2. Saving-Exoikonomo 2021

The “SAVING-EXOIKONOMO 2021” Program, supporting energy renovation of homes, with a total budget of 632 million euros, adapted and improved the previous financial scheme, aiming to maximise the benefits for citizens by increasing the number of households that are eligible to participate, with increased benefits for vulnerable and low income citizens, simplifying the certification of interventions and activating the market by mobilising private capital to finance the required interventions.

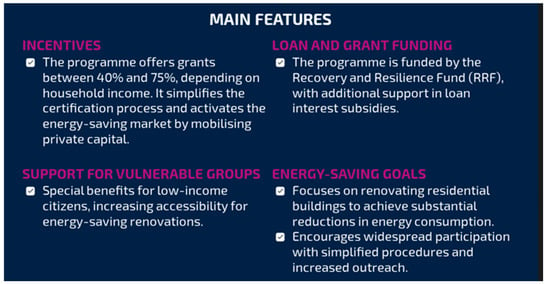

Objective: Improve energy efficiency in residential buildings, reduce energy consumption, and contribute to national energy-saving targets.

Main Features: Figure 4 presents the overview of the main features of the Saving-Exoikonomo 2021.

Figure 4.

Energy efficiency best practice in Greece: Saving-Exoikonomo 2021 main features.

Key outcomes: In total, the beneficiaries of the Program are 87,578 households, and the budget amounts to 1.2 billion euros. In the framework of the revision of the National Energy and Climate Plan, a reduction of final energy consumption by 11.9% is proposed for the period 2020–2030. This is planned to be achieved by the energy upgrading of buildings at an annual rate of 58,000 units/year during the period 2020–2025, which is projected to increase to 68,000 units/year during the next five years 2025–2030. The continuation of the Saving-Exoikonomo program is expected to contribute to achieving these goals.

Replication Potential: Aside from the replication potential at the national level, the program is considered a successful tool to be transferred as a valuable experience in other EU countries with similar needs and challenges in the residential building sector.

3.3.3. Market Analysis of Financial Models for Energy Efficiency in Greece

Best Practice: Accelerated Energy Transition and Green Investments

Objective: Greece is making significant progress in its energy transition by utilising EU funding mechanisms like the Recovery and Resilience Facility (RRF) and REPowerEU to implement large-scale energy efficiency projects across the public and private sectors.

Key Initiatives:

- National Recovery and Resilience Plan (Greece 2.0): Focuses on green and digital transitions, investing heavily in energy renovations of public building and renewable energy installations.

- NECP: “Save at Business” action provides financial incentives for enterprises to invest in energy-saving technologies and renewable energy solutions, focusing on small- and medium-sized enterprises (SMEs).

- REPowerEU Plan: Accelerates energy independence by supporting renewable energy development and reducing reliance on imported fossil fuels.

3.4. Romania

3.4.1. Overview

Romania is currently facing a significant decline in its population, which is expected to exceed 15% by 2050 [47]. According to the 2011 Population and Housing Census, the number of dwellings exceeds the number of families–approximately 8 million dwellings to 7.2 million families, with a dwelling vacancy rate of 16% at that time [48,49,50]. The extensive migration in recent years has led to massive depopulation of rural or even urban localities in areas that have fallen into economic decline.

The National Long-Term Renovation Strategy (LTRS) to support the renovation of the national stock of residential and non-residential buildings, both public and private, and to gradually transform it into a highly energy-efficient and decarbonised building stock by 2050, remains the primary policy frame for guiding cost-effective renovation measures and financing mechanisms to sustain the actions towards reaching country’s strategic objectives in the field of energy efficiency [51].

Romania’s Integrated National Energy and Climate Plan (NECP) was updated at the end of 2023 to provide a strong energy efficiency dimension that reflects a dedicated commitment to sustainability and a greener future [52]. The energy consumption projections for 2050 are based on the guiding principle of prioritising energy efficiency. The anticipated energy consumption projections indicate a targeted reduction of 5% in primary energy consumption by 2030 compared to 2019, and the final energy consumption is expected to experience a slight decrease of 2% in 2030 [49,50]. The long-term plan aims for a substantial reduction of 15% in primary energy consumption by 2050 relative to the 2019 level, accompanied by a more pronounced drop of 28% in final energy consumption. Compared to the 2030 projections established by the Primes model, Romania’s energy efficiency goal by 2030 is to achieve a remarkable 46% reduction in primary energy consumption and a corresponding 45% reduction in final energy consumption. By 2050, Romania aims to lower its primary energy consumption by 52%, while the final energy consumption is projected to decrease further by 59% compared to the 2030 Primes model projections [49,50,51,52].

The country remains a significant beneficiary of EU solidarity. EU funds allocated to Romania during the 2014–2020 programming period amounted to EUR 30.8 billion, representing around 2.4% of its annual GDP [48,49,53]. The absorption rate for the multiannual financial framework between 2014–2020 increased to 97% at the beginning of 2024. The EU funds’ absorption capacity becomes essential in an environment affected by economic growth decelerating below the previous decade’s levels. This makes it difficult for Romania to reduce domestic disequilibria and support strategic sectors to ensure a transition to a green and inclusive economy, and a structural shift towards a higher value-added economy [54,55].

Romania’s National Recovery and Resilience Plan allocates 28.5 billion euros to major reforms and investments to increase sustainability, resilience, and preparedness for the challenges and opportunities of the European green and digital transition [54]. The plan, approved in November 2021, was revised on 8 December 2023 to introduce a REPowerEU chapter [55]. Meanwhile, the national banking sector maintains its soundness, with solvency and liquidity ratios at the highest levels compared to other European Union member states.

The Romanian banking sector includes 34 credit institutions, eight of which are branches of foreign banks. Approximately 67.6% of the banking sector assets in Romania are owned by institutions with foreign capital, a downward trend compared to the 91.3% recorded at the end of 2016 [53]. The banking system owns three-quarters of the assets of the financial system in Romania; the leading banks in Romania in 2023 are Banca Transilvania S.A., Banca Comercială Română S.A., and BRD–Groupe Société Générale S.A. [49,50].

In September 2023, the green loans amounted to almost 3 billion lei and accounted for 1.6% of banks’ corporate loan stock. The breakdown shows that nearly half of them are directed towards green buildings (47%), followed by electricity, heating, and cooling systems, including renewable energy (24%), and energy efficiency (10%) [47,48,49]. Firms in construction, real estate, and services finance their investments in green buildings through credit, whereas trading companies access green loans primarily for energy efficiency.

3.4.2. Green Homes and Green Mortgage

The Green Homes and Green Mortgage (GHGM) program is a specialized home loan offered by selected banks to incentivize purchasing certified residential projects, achieving exemplary energy and other green performance. Certification programs–such as the Green Homes certified by RoGBC program and other holistic and credible residential certifications present on the market allow residential investors and developers to distinguish their projects by emphasizing quality and environmental performance.

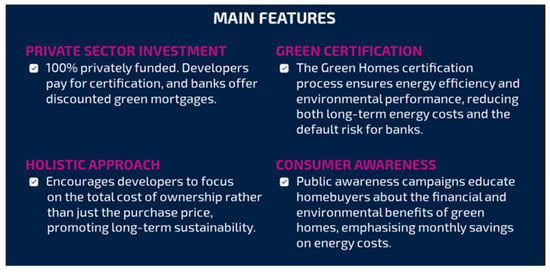

Objective: Promote sustainable housing by offering financial incentives for certified energy-efficient homes through green mortgages.

Main Features: Figure 5 presents the overview of the main features of the GHGM program.

Figure 5.

Energy efficiency best practice in Romania: GHGM main features.

Key outcomes: Romania is effectively using GHGM programs to promote sustainable housing, reduce energy consumption, and increase the sustainability of the residential property market. More than 15,000 housing units have been pre-certified or certified up to date. In 2024, there are now partnerships with eight banks—both international banking groups and independents—and demonstrated success with replication in new markets. More than 2 billion euros worth of projects have been certified or have signed agreements with developers to certify. Following the national success, the Romania Green Building Council, together with 17 partners and with support from Horizon 2020 and LIFE programmes, created a successful, international green finance program named SMARTER Finance for Families. This was followed by a second project, Smarter Finance for EU (these two projects are collectively referred to as “SMARTER” going forward). SMARTER replicated a successful GHGM program to 15 new countries, addresses barriers, and brings green innovation with relevant research and cluster formation, adapts essential tools for administration and communication, and effectively expands the collection of actual energy and financial performance to improve risk analysis with local data.

Replication Potential: The programme’s success has already been replicated internationally and is a best practice model for integrating private finance into energy-efficient housing.

3.4.3. Market Analysis of Financial Models for Energy Efficiency in Romania

Best Practice: Holistic Approach to Energy Efficiency through EU Funding

Objective: Romania leverages EU funds to drive energy efficiency improvements and foster renewable energy adoption, focusing on boosting digital transformation alongside sustainable energy initiatives.

Key Initiatives:

- National Recovery and Resilience Plan (NRRP): Allocated 28.5 billion euros for energy and digital projects that aim to reduce energy consumption and carbon emissions while enhancing energy efficiency in public buildings.

- Green Investment Initiatives: Specific funds are directed towards green investment opportunities, including renewable energy projects and the modernization of industrial energy systems.

- Energy Poverty Reduction: Programmes target reducing energy costs for low-income households through energy-saving measures and improved building insulation.

3.5. Slovenia

3.5.1. Overview

Slovenia, with a population of about 2.1 million, saw a 2.4% increase in inhabitants between 2010 and 2020. In 2023, the GDP per capita was approximately EUR 29,750. The GDP growth rate for Slovenia was 2.3% in the first quarter of 2024, driven by strong domestic demand and significant contributions from construction investment. In 2022, Slovenia’s total primary energy supply was 4.81 Mtoe. The final energy consumption (FEC) in 2022 amounted to just over 201,000 TJ. The main sectors contributing to Slovenia’s FEC in 2022 were transport (41%), the manufacturing and construction industry (25%), households (22%), and services (9%). Between 2010 and 2020, Slovenia’s FEC decreased by 11.8% [55,56].

The occupied residential building stock is estimated at 778,500 buildings, covering nearly 65 million m2. Notably, 84% of these residential buildings were constructed before 2002, highlighting the potential for energy efficiency improvements in older structures. Public buildings in Slovenia have a total floor area of 9.7 million m2, out of which central government buildings account for 0.9 million m2 and wider public sector buildings account for 8.8 million m2 [57,58].

The National Energy and Climate Plan (NECP) of Slovenia is a comprehensive policy document guiding energy and climate strategies across all sectors until 2030. The Long-Term Renovation Strategy for 2050 (LTRS 2050) outlines a comprehensive plan for building renovation. By 2050, it aims to achieve net-zero emissions by extensively renovating buildings with low-carbon materials and renewable energy technologies. The Energy Efficiency Act aims to achieve several objectives in energy efficiency and efficient energy utilisation, including reducing energy consumption, enhancing energy efficiency, ensuring energy security, promoting efficient energy conversion, and transitioning towards a climate-neutral society with low-carbon energy technologies. The “Rules on efficient use of energy in buildings” outlines technical requirements for constructing almost zero-energy buildings to enhance energy efficiency. It covers aspects such as thermal envelope properties, technical building systems, heating, cooling, ventilation, hot water preparation, lighting, automation, control, and renewable energy sources. The “Act on the Promotion of the Use of Renewable Energy Sources” regulates the implementation of the state and municipal policies in the field of renewable energy, establishes binding targets for the share of energy from renewable energy sources in gross final consumption in the Republic of Slovenia, as well as measures the achievement of this target and ways of financing them.

An important decision-making process for significant investments in multi-apartment buildings is regulated by the Property Code, the Housing Act, and the Rules on Multi-Apartment Building Management. The legal framework, aligned with the Resolution on the national housing program 2015–2025, guides investment decisions, including those related to energy efficiency in multi-apartment buildings [55,57]. For multi-apartment buildings with more than eight individual units and more than two owners, the legislator has prescribed establishing a reserve fund for maintenance purposes. These buildings also require a manager to be appointed. Owners must achieve a 75% consensus for non-maintenance improvements not requiring a construction permit. This includes EE measures like building insulation, early-stage boiler room renovation, and installation of air-conditioning or solar panels. Funds from the reserve fund can also act as a loan for the building’s reserve fund, as stipulated in the Property Code and Housing Act. According to the legislation, obtaining one hundred per cent consent from apartment owners is required to take out a loan for the reserve fund [57,58].

In Slovenia, fiscal instruments are underutilised for incentivising energy efficiency and renewable energy measures in buildings. Currently, the fiscal landscape includes two main instruments: reduced Value-Added Tax (VAT) and green and digital transition tax deduction [59]. A reduced VAT rate of 9.5% instead of the general 22% rate applies to construction, renovation, and repair activities for buildings within social policy and for restoration and repair services related to private residential buildings meeting specific criteria [60]. The digital transition tax deduction, implemented under the Corporate Income Tax Act, aims to facilitate investments in digital and green transitions.

There is currently no specific national legislation regarding the financing of building renovations. However, in addition to existing financing services legislation, the financing sector supervises renovation financing by EU taxonomy, relevant national regulations, and the Green Bond Principles. These measures aim to guide the financial sector towards increased investment in achieving climate neutrality. The issuance of government green bonds is subject to the Public Finance Act and is governed by the Slovenian Sustainability Bond Framework 2023 [57]. Furthermore, the Building Act provides the legal foundation for building codes, establishing minimum requirements for building energy performance, technical building systems, and calculation methodologies. Additionally, the Environmental Protection Act addresses the inspection of boilers.

3.5.2. Financing Deep Renovations via Energy Performance Contracting

In the 2014–2020 programming period, Slovenia embarked on comprehensive renovations of public sector buildings. The public sector deep renovation program is overseen by the Ministry of Environment, Climate, and Energy, and the combination of financial instruments and grants constitutes a single financing operation. The financing scheme was successfully implemented and will continue into the 2021–2027 programming period.

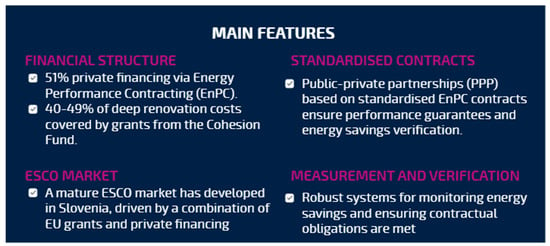

Financing Deep Renovations via Energy Performance Contracting (EnPC) serves as a key renovation mechanism for achieving ambitious energy-saving targets within a tight timeframe, providing performance guarantees and technical capacity, decreasing risks, and mobilizing private sector financing. Slovenia has a well-developed EnPC market characterized by high-quality projects, standardized business models, and contracts. EnPC providers, mainly small and medium companies, finance their projects through equity financing (both national and EU), forfaiting (EU), and debt financing. However, they still encounter difficulties in securing long-term financing from banks.

Objective: Support deep renovations in the public sector through a combination of public and private financing.

Main Features: Figure 6 presents the overview of the main features of the EnPC.

Figure 6.

Energy efficiency best practice in Slovenia: EnPC main features.

Key outcomes: There were 51 EnPC projects implemented in the public sector in the 2016–2021 programming period, and more than 696,000 m2 were renovated in the framework of the public buildings’ deep renovation programme. However, these projects covered almost three-quarters of the net floor area of all buildings renovated. The size of the EnPC market in Slovenia in that period was worth more than EUR 160 million, considering the conservative assumption that 90% of EnPC investments were allocated to the public sector.

Replication Potential: Slovenia’s success in combining grants with private financing and its mature EnPC market make it a strong model for other countries to replicate, especially in the public sector.

3.5.3. Market Analysis of Financial Models for Energy Efficiency in Slovenia

Best Practice: Sustainable Building Renovation and Green Transition

Objective: Slovenia prioritises sustainable building renovations and energy efficiency improvements, especially in public buildings, as part of its green transition strategy under the Recovery and Resilience Facility (RRF).

Key Initiatives:

- Recovery and Resilience Facility (RRF): Funds are allocated for large-scale renovation of public and central government buildings, focusing on improving energy efficiency and reducing CO2 emissions.

- Green Transition Strategy: Aligns Slovenia’s efforts with the European Green Deal by enhancing the sustainability of its building stock through renewable energy integration and energy-saving measures.

- Cohesion Policy Programme: Utilises EU cohesion funds to support the country’s energy transition, particularly in rural and less-developed regions.

4. Cross-Country Comparative Analysis

This section synthesizes findings from Bulgaria, Croatia, Greece, Romania, and Slovenia to identify common trends, contextual variations, and lessons for sustainable financing in Eastern Europe. Table 2 is a comparative table that contrasts outcomes across countries.

Table 2.

Cross-country comparison.

Policy Frameworks and EU Alignment

All five countries align their strategies with EU directives (e.g., NECPs, REPowerEU), but implementation varies:

- Bulgaria and Romania emphasize overcoming structural barriers (e.g., carbon-intensive industries, aging housing stock) through centralized funds (EERSF, GHGM).

- Croatia and Slovenia leverage post-disaster recovery (e.g., earthquake rebuilding) and mature EnPC markets to accelerate renovations.

- Greece uniquely integrates energy poverty alleviation into its “Saving-Exoikonomo” program, reflecting socio-economic priorities distinct from its peers.

Funding Mechanisms and Gaps

- Public-Private Mix: Slovenia and Croatia combine EU grants with private financing (e.g., EnPCs, PVMax), whereas Bulgaria and Romania rely heavily on EU structural funds due to underdeveloped green banking products.

- Private Sector Engagement: Greece and Romania show higher private-sector participation (e.g., green mortgages, SME-focused programs), while Bulgaria’s EERSF remains predominantly public.

- Scalability: Slovenia’s standardized EnPC model and Romania’s GHGM program demonstrate high replication potential, whereas Bulgaria’s EERSF requires contextual adaptation due to its niche governance structure.

Energy Efficiency Outcomes

- Residential Sector: Romania’s GHGM (15,000 certified units) and Greece’s “Saving-Exoikonomo” (87,578 households) outperform others in scale, reflecting targeted subsidies for vulnerable groups.

- Public Sector: Slovenia’s deep renovations (696,000 m2) and Croatia’s PVMax (182.3 MWp solar capacity) highlight the impact of blended finance and technical support.

- Carbon Intensity: Bulgaria remains an outlier, with GHG emissions four times higher than the EU average, underscoring the urgency of its NECP reforms.

Challenges and Regional Barriers

- Regulatory Fragmentation: Complex consent requirements for multi-apartment renovations (Slovenia) and unquantified funding gaps (Bulgaria) hinder progress.

- Financial Accessibility: SMEs in Greece and Croatia struggle with limited access to green loans, contrasting with Romania’s growing green mortgage market.

- Data Transparency: Inconsistent metrics (e.g., Croatia’s partial energy savings estimates) complicate cross-country benchmarking.

Replication and Policy Implications

- EU Funding Dependency: All countries rely on EU cohesion funds, raising sustainability concerns post-2027. Diversifying revenue (e.g., green bonds, carbon pricing) is critical.

- Model Adaptability: Slovenia’s EnPC framework and Romania’s GHGM offer templates for decentralizing energy transitions, but require localization to address disparities in governance capacity and market maturity.

Based on the analysis of the five countries (Bulgaria, Croatia, Greece, Romania, and Slovenia) and in an effort to implement a replication readiness assessment, a weighted scoring model that evaluates replication potential across five criteria (1–5 scale) was developed (Table 3). The weighted criteria focus on factors that are critical for assessing the potential for successful replication and scaling of sustainable financing programs. These criteria were selected to reflect both structural feasibility and contextual adaptability of best practices. Each country was scored on a scale from 1 to 5 (1 = low, 5 = high) for each criterion based on the data presented in the initial analysis. The following is a short description of the criteria used:

Table 3.

Replication readiness.

- Regulatory Compatibility: Assesses alignment with existing national/EU regulations (e.g., NECPs, Energy Efficiency Directives) and ease of integration into legal frameworks.

- Private-Sector Engagement: Examines the level of private-sector involvement, as higher engagement can drive replication and scaling.

- Technical Feasibility: Evaluates technical complexity, availability of expertise, and technological readiness for implementation.

- EU Funding Independence: Assesses reliance on EU grants/structural funds versus domestic or private funding.

- Scalability: Considers how easily the model could be replicated in other contexts, including replication potential in terms of financing mechanisms or market maturity.

Slovenia and Greece score highest in most of the criteria due to standardized EnPC frameworks and hybrid financing models. Greece’s high score in the “Scalability” criterion aligns with its hybrid grant-loan model for vulnerable households. When considering the “Technical Feasibility” criterion, it could be mentioned that Croatia’s PVMax uses widely available solar technology, while Slovenia’s EnPC benefits from standardized retrofitting protocols. On the other hand, Bulgaria’s low score in most criteria reflects over-reliance on EU grants and regulatory fragmentation. In particular, Bulgaria’s low regulatory compatibility reflects its fragmented policies and unquantified funding gaps.

5. Discussion

The paper analyses best practices for sustainable financing of energy efficiency projects from the five countries under examination, namely Bulgaria, Croatia, Greece, Romania, and Slovenia. The identified practices range from specialized funds providing loans to public authorities, businesses, and individuals; as well as guarantees for ESCO companies (Bulgaria); Energy Performance Contracting (EnPC) in combination with grants (Greece, Croatia, and Slovenia); combinations of loans, grants, and technical assistance (Croatia and Greece); Green Mortgage (GM) product provided by commercial banks (Romania); and the provision of technical assistance for the identification and preparation of projects (Bulgaria, Croatia, Greece). Based on the analysis, the following key observations emerge:

- All the countries under-examination have financial instruments and programs to support energy efficiency and RES in buildings (private and public) and SMEs. However, these efforts remain episodic and dependent on the availability of public funds, limiting their sustainability and scalability.

- The ELENA programme has proven to be particularly effective, often combined with other programs (such as ELECTRA in Greece) and sustainable approaches (Design and Build and Finance in Croatia).

- While Environmental, Social, and Governance (ESG) requirements are slowly gaining traction among commercial banks, there has been limited activity on their part, with the notable exception of the Green Mortgage in Romania.

- There are various successful practices in the five countries based on different sustainable instruments and mechanisms, such as credit lines, dedicated funds, EnPCs, green mortgages, and technical assistance. However, mechanisms such as tax or bill financing and green bonds remain underdeveloped.

The paper also provides market updates for each country under examination, including specific national experience with the application of different financial schemes and various financial models assessing the barriers still influencing greater leverage of private funds for energy efficiency investments, as well as lessons learned in overcoming them. The key outcomes derived from the market analysis of financing models for energy efficiency per country could be summarised as follows:

Bulgaria: Due to the high percentage of renovated buildings and the variety of funding sources available, there is currently no investment gap for renovating public buildings to meet the 2023 targets set by the Long-Term Renovation Strategy.

Croatia: Croatia aims to modernize its building stock and significantly improve energy efficiency and use of renewable energy resources by leveraging EU and national funding, positioning itself as a regional leader in energy efficiency advancements.

Greece: Greece’s initiatives have significantly reduced energy consumption in both public and private buildings, emerging as a frontrunner in energy efficiency in Europe.

Romania: Romania has significantly improved its absorption of EU funds, driving investments in renewable energy and energy efficiency, while laying the groundwork for a greener economy.

Slovenia: Slovenia’s initiatives have led to a steady increase in the renovation rate of public buildings and significant energy saving, contributing to the country’s long-term sustainability goals and reduced carbon footprint.

A proposal for a future research direction would be to quantify the investment needs for energy efficiency projects in the five countries under-examination to identify funding gaps and facilitate public-private partnerships. Furthermore, exploring the potential for replicating these financial models in other countries and sectors through multicriteria analysis could be valuable. Studying the long-term impacts of these financial models on energy consumption reduction, greenhouse gas emissions, and socio-economic benefits would further strengthen the evidence base.

6. Conclusions

This paper aims to identify and assess successful financing models and best practices for energy efficiency projects in five Member State countries, particularly in Bulgaria, Croatia, Greece, Romania, and Slovenia, to address the challenges of decarbonization and promote sustainable investments. Previous research has highlighted the critical role of public funding and policy measures in promoting energy efficiency investments. However, the effectiveness of these mechanisms remains contingent on factors such as context-specific conditions, policy design, and stakeholder engagement. The study employs a combination of desk research, case studies, and policy analysis to comprehensively review and evaluate various financial instruments, initiatives, market updates, and funding sources to understand their impact on energy efficiency projects, as well as their potential for replication and expansion.

While some practices have proven successful, such as those identified in this paper, their application remains sporadic, indicating a need for further action. In Bulgaria, the successful EERSF and FLAG Fund, supporting energy efficiency projects in the public building stock, compete with the high intensity of grants for public authorities (close to 100%), while for residential buildings and industry, no sustainable models and instruments are currently observed. The technical assistance for renewable energy and building renovation projects in Croatia is a good example of supporting sustainable projects, but again, the main building stock, namely residential buildings, seems to remain a bit in the background.

In the example of Greece, the renovation of residential buildings is supported through the Recovery and Resilience Mechanism, but although the continuation of the initiative is foreseen, the financial resources for this are not yet fully secured. The green mortgage in Romania is a successful product predominantly targeting new buildings in the residential sector, but in the other sectors, there are episodic programmes and projects, mostly launched based on temporarily available financial resources rather than sustainable initiatives that effectively attract private funds. The development of the EnPC market in Slovenia is a strong example of sustainable policies fostering good practices, but the focus remains primarily on public buildings.

The analysis highlights that the development of sustainable financial instruments depends on strong political support and recognition of their importance by all stakeholders. To enhance the effectiveness of these instruments, identifying the necessary policies and reforms to channel resources into energy efficiency and renewable energy projects is crucial. These efforts must ensure that projects meet high standards and align with long-term goals.

Finally, it should be mentioned that while this study provides valuable insights into sustainable financing practices within Eastern Europe, future research could significantly benefit from expanding to heterogeneous regions, examining economies at varying stages of development levels, and regulatory cultures, as well as assessing how energy infrastructures shape financing models across disparate geographic regions. Such comparative analyses would deepen our understanding of contextual barriers—such as capital accessibility, technological readiness, and policy coherence—enabling the development of tailored strategies for different regions. Longitudinal studies tracking post-EU-funding sustainability would also clarify the resilience of current models.

Author Contributions

Conceptualization, C.K., A.C. and I.V.; methodology, C.K.; validation, C.K., A.C. and I.V.; formal analysis, C.K.; investigation, C.K. and A.C.; writing—original draft preparation, C.K.; writing—review and editing, C.K., A.C. and I.V.; visualization, C.K.; supervision, I.V. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Acknowledgments

The current paper was primarily based on the research conducted within the framework of the LIFE Programme project “SMAFIN Expanded: Supporting smart financing implementation for energy renovation of existing private and/or public buildings, investments in SMEs and the tertiary sector” (grant LIFE22-CET-SMAFIN-Expanded/101120412) aiming to support smart financing implementation of energy efficiency investments in five Balkan countries. The authors would also like to thank colleagues from CRES (project coordinator) as well as all consortium partners for their collaboration and continuous support. The contents of the paper are the sole responsibility of its authors and do not necessarily reflect the views of the EC.

Conflicts of Interest

The authors declare no conflicts of interest. ΙΝΖΕΒ is a non-profit organization and the author was not paid by the organization for the contribution to this paper.

References

- European Commission, Secretariat-General. Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions; The European Green Deal, COM (2019) 640 Final; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- Schunz, S. The ‘European Green Deal’—A paradigm shift? Transformations in the European Union’s sustainability meta-discourse. Political Res. Exch. 2022, 4, 2085121. [Google Scholar] [CrossRef]

- Directive (EU) 2023/1791 of the European Parliament and of the Council of 13 September 2023 on energy efficiency and amending Regulation (EU) 2023/955 (recast), L231/1. Off. J. Eur. Union 2023, 231, 1–111. Available online: https://eur-lex.europa.eu/legal-content/en/ALL/?uri=CELEX:32023L1791&qid=1706619805653 (accessed on 4 May 2024).

- Directorate-General for Financial Stability, Financial Services and Capital Markets Union. Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions Empty; Strategy for Financing the Transition to a Sustainable Economy, {SWD(2021) 180 final}, COM(2021) 390 Final; European Commission: Strasbourg, France, 2021. [Google Scholar]

- Loureiro, T.; Gil, M.; Desmaris, R.; Andaloro, A.; Karakosta, C.; Plesser, S. De-Risking Energy Efficiency Investments through Innovation. Proceedings 2020, 65, 3. [Google Scholar] [CrossRef]

- Remeikienė, R.; Gasparėnienė, L.; Fedajev, A.; Szarucki, M.; Đekić, M.; Razumienė, J. Evaluation of Sustainable Energy Development Progress in EU Member States in the Context of Building Renovation. Energies 2021, 14, 4209. [Google Scholar] [CrossRef]

- European Commission. 2020, 2050 Long-Term Strategy. Available online: https://climate.ec.europa.eu/eu-action/climate-strategies-targets/2050-long-term-strategy_en (accessed on 11 September 2024).

- Woon, K.S.; Phuang, Z.X.; Taler, J.; Varbanov, P.S.; Chong, C.T.; Klemeš, J.J.; Lee, C.T. Recent advances in urban green energy development towards carbon emissions neutrality. Energy 2023, 267, 126502. [Google Scholar] [CrossRef]

- Greenhouse Gas Emissions from Energy Use in Buildings in Europe|European Environment Agency’s Home Page. Available online: https://www.eea.europa.eu/en/analysis/indicators/greenhouse-gas-emissions-from-energy (accessed on 2 September 2024).

- Cambra-Fierro, J.J.; López-Pérez, M.E.; Melero-Polo, I.; Pérez, L.; Tejada-Tejada, M. Smart innovations for sustainable cities: Insights from a public-private innovation ecosystem. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 1654–1666. [Google Scholar] [CrossRef]

- EEFIG. The Evolution of Financing Practices for EE in Buildings, SMEs and Industry, Publications Office of the European Union. 2021. Available online: https://op.europa.eu/en/publication-detail/-/publication/a3032517-c761-11ec-b6f4-01aa75ed71a1/language-en/format-PDF/source-256242892 (accessed on 16 June 2024).

- Fotiou, T.; Capros, P.; Fragkos, P. Policy Modelling for Ambitious Energy Efficiency Investment in the EU Residential Buildings. Energies 2022, 15, 2233. [Google Scholar] [CrossRef]

- Mexis, F.D.; Papapostolou, A.; Karakosta, C.; Psarras, J. Financing Sustainable Energy Efficiency Projects: The Triple-A Case. Environ. Sci. Proc. 2021, 11, 22. [Google Scholar] [CrossRef]

- Karakosta, C.; Papapostolou, A.; Vasileiou, G.; Psarras, J. 3—Financial Schemes for Energy Efficiency Projects: Lessons Learnt from In-Country Demonstrations. In Energy Services and Management, Energy Services Fundamentals and Financing; Borge-Diez, D., Rosales-Asensio, E., Eds.; Academic Press: Cambridge, MA, USA, 2021; pp. 55–78. ISBN 9780128205921. [Google Scholar] [CrossRef]

- Galassi, A.; Petríková, L.; Scacchi, M. Digital Technologies for Community Engagement in Decision-Making and Planning Process. In Smart and Sustainable Planning for Cities and Regions: Results of SSPCR 2019; Bisello, A., Vettorato, D., Haarstad, H., Beurden, J.B.-V., Eds.; Springer International Publishing: Berlin/Heidelberg, Germany, 2021; pp. 387–397. [Google Scholar] [CrossRef]

- Anthony, B. The Role of Community Engagement in Urban Innovation Towards the Co-Creation of Smart Sustainable Cities. J. Knowl. Econ. 2024, 15, 1592–1624. [Google Scholar] [CrossRef]

- EUfundingportal. Digital Solutions to Foster Participative Design, Planning and Management of Buildings, Neighbourhoods and Urban Districts (Built4People Partnership). Available online: https://eufundingportal.eu/digital-solutions-to-foster-participative-design-planning-and-management-of-buildings-neighbourhoods-and-urban-districts-built4people-partnership/ (accessed on 20 September 2024).

- Mondejar, M.E.; Avtar, R.; Diaz, H.L.B.; Dubey, R.K.; Esteban, J.; Gómez-Morales, A.; Hallam, B.; Mbungu, N.T.; Okolo, C.C.; Prasad, K.A.; et al. Digitalization to achieve sustainable development goals: Steps towards a Smart Green Planet. Sci. Total Environ. 2021, 794, 148539. [Google Scholar] [CrossRef]

- Feroz, A.K.; Zo, H.; Chiravuri, A. Digital Transformation and Environmental Sustainability: A Review and Research Agenda. Sustainability 2021, 13, 1530. [Google Scholar] [CrossRef]

- Navarro, J.P.J.; Bueso, M.C.; Vázquez, G. Drivers of and Barriers to Energy Renovation in Residential Buildings in Spain—The Challenge of Next Generation EU Funds for Existing Buildings. Buildings 2023, 13, 1817. [Google Scholar] [CrossRef]

- European Commission. Commission Staff Working Document, 2024 Country Report—Bulgaria, Accompanying the Document, Recommendation for Council Recommendation on the Economic, Social, Employment, Structural and Budgetary Policies of Bulgaria; {COM(2024) 602 Final}-{SWD(2024) 600 Final}; European Commission: Brussels, Belgium, 2024. [Google Scholar]

- European Commission. 2023 Country Report: Bulgaria, European Economy Institutional Paper 226; Publications Office of the European Union: Luxembourg, 2023; ISBN 978-92-68-03193-3. ISSN 2443-8014. [Google Scholar] [CrossRef]

- European Commission; European Investment Bank. The Potential for Investment in Energy Efficiency Through Financial Instruments in the European Union, Bulgaria in-Depth Analysis. FI-Compass. 2020. Available online: https://www.fi-compass.eu/sites/default/files/publications/The%20potential%20for%20investment%20in%20energy%20efficiency%20through%20financial%20instruments%20in%20the%20European%20Union%20-%20Bulgaria%20in-depth%20analysis_0.pdf (accessed on 17 June 2024).

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions ‘A Renovation Wave for Europe: Greening Our Buildings, Creating Jobs, Improving Lives’; COM(2020) 662 Final; EC: Brussels, Belgium, 2020. [Google Scholar]

- European Commission. Commission Recommendation of 26.4.2024 on the Draft Updated Integrated National Energy and Climate Plan of Bulgaria Covering the Period 2021–2030; {SWD(2024) 125 Final}, C(2024) 2901 Final; Directorate-General for Communication: Brussels, Belgium, 2024. [Google Scholar]

- National Recovery and Resilience Plan (NRRP) of the Republic of Bulgaria, in Bulgarian. Version 1.5, 6 April 2022. Available online: https://www.nextgeneration.bg/14 (accessed on 19 June 2024).

- Integrated Energy and Climate Plan of the Republic of Bulgaria 2021–2030. Available online: https://ec.europa.eu/energy/sites/ener/files/documents/bg_final_necp_main_en.pdf (accessed on 20 June 2024).

- Wang, X.; Stern, R.; Limaye, D.; Mostert, W.; Zhang, Y. Unlocking Commercial Financing for Clean Energy in East Asia, Case Study: Bulgarian Energy Efficiency Fund (BEEF), Directions in Development; World Bank: Washington, DC, USA, 2013. [Google Scholar]

- Koeva, D.; Kutkarska, R.; Zinoviev, V. High Penetration of Renewable Energy Sources and Power Market Formation for Countries in Energy Transition: Assessment via Price Analysis and Energy Forecasting. Energies 2023, 16, 7788. [Google Scholar] [CrossRef]

- Todorov, G.; Kralov, I.; Koprev, I.; Vasilev, H.; Naydenova, I. Coal Share Reduction Options for Power Generation during the Energy Transition: A Bulgarian Perspective. Energies 2024, 17, 929. [Google Scholar] [CrossRef]

- Eurostat: Real GDP per capita_sdg_08_10. Statistics|Eurostat (europa.eu). Available online: https://ec.europa.eu/eurostat/databrowser/view/sdg_08_10/default/table?lang=en (accessed on 7 September 2024).

- Ministry of the Economy and Sustainable Development. Publication “Energy in Croatia 2022”, 2024 page 10: Energija-u-HR-22_WEBnovo.pdf (eihp.hr). Available online: https://eihp.hr/wp-content/uploads/2024/01/Energija-u-HR-22_WEB-1_compressed.pdf (accessed on 7 September 2024).

- Budin, L.; Holjevac, N.; Zidar, M.; Delimar, M. PV Sizing and Investment Support Tool for Household Installations: A Case Study for Croatia. Sustainability 2023, 15, 12502. [Google Scholar] [CrossRef]

- Veršić, Z.; Binički, M.; Nosil Mešić, M. Passive Night Cooling Potential in Office Buildings in Continental and Mediterranean Climate Zone in Croatia. Buildings 2022, 12, 1207. [Google Scholar] [CrossRef]

- Mikulić, D.; Keček, D. Investments in Croatian RES Plants and Energy Efficient Building Retrofits: Substitutes or Complements? Energies 2022, 15, 2. [Google Scholar] [CrossRef]

- Croatian Parliament. Low-Carbon Development Strategy of the Republic of Croatia Until 2030 with an OUTLOOK to 2050; Croatian Parliament: Zagreb, Croatia, 2020. [Google Scholar]

- Hellenic Statistical Authority, Census Results of Population and Housing. 2023. Available online: https://www.statistics.gr/documents/20181/18019778/census_results_2022_en.pdf/7c52ff55-9de3-d0d0-d9ea-73d6e908468b?version=1.0&t=1679057363566&download=true4 (accessed on 13 September 2024).

- Technical Chamber of Greece Technical Directive 20701-1/2017—Analytical National Specifications of Parameters for the Calculation of the Energy Efficiency of Building and the Issuance of Energy Efficiency Certificate, 1st Ed. Available online: https://web.tee.gr/wp-content/uploads/%CE%95%CE%93%CE%9A%CE%A1%CE%99%CE%A3%CE%97-TOTEE-1.pdf (accessed on 13 September 2024). (In Greek).

- Ministry for the Environment and Energy. Statistical Results for the Energy Efficiency of Buildings in the Residential, Tertiary and Public Sector. Available online: https://bpes.ypeka.gr/?page_id=21&stat=222 (accessed on 22 September 2024). (In Greek)

- Karakosta, C.; Papapostolou, A. Energy Efficiency Trends in the Greek Building Sector: A Participatory Approach. Euro-Mediterranean. J. Environ. Integr. 2023, 8, 3–13. [Google Scholar] [CrossRef]

- Ministry of Finance. Ministry of Environment Energy and Climate Change Regulation for Energy Efficiency in Buildings. Greek Off. Gov. Gaz. 2017, B2367, 23905–23924. Available online: https://ypen.gov.gr/wp-content/uploads/2020/11/KENAK_FEK_B2367_2017.pdf (accessed on 23 September 2024). (In Greek).

- Martinopoulos, G.; Tsimpoukis, A.; Sougkakis, V.; Dallas, P.; Angelakoglou, K.; Giourka, P.; Nikolopoulos, N. A Comprehensive Approach to Nearly Zero Energy Buildings and Districts: Analysis of a Region Undergoing Energy Transition. Energies 2024, 17, 5581. [Google Scholar] [CrossRef]

- Directorate-General for Energy; Verbeke, S.; Aerts, D.; Reynders, G.; Ma, Y.; Waide, P. Final Report on the Technical Support to the Development of a Smart Readiness Indicator for Buildings—Final Report; Publications Office of the European Union: Berlin/Heidelberg, Germany, 2020. [Google Scholar]

- Bellos, E.; Iliadis, P.; Papalexis, C.; Rotas, R.; Mamounakis, I.; Sougkakis, V.; Nikolopoulos, N.; Kosmatopoulos, E. Holistic Renovation of a Multi-Family Building in Greece Based on Dynamic Simulation Analysis. J. Clean. Prod. 2022, 381, 135202. [Google Scholar] [CrossRef]

- Dragonetti, L.; Papadaki, D.; Assimakopoulos, M.-N.; Ferrante, A.; Iannantuono, M. Environmental and Economic Assessment of Energy Renovation in Buildings, a Case Study in Greece. Buildings 2024, 14, 942. [Google Scholar] [CrossRef]

- Stavrakakis, G.M.; Bakirtzis, D.; Drakaki, K.-K.; Yfanti, S.; Katsaprakakis, D.A.; Braimakis, K.; Langouranis, P.; Terzis, K.; Zervas, P.L. Application of the Typology Approach for Energy Renovation Planning of Public Buildings’ Stocks at the Local Level: A Case Study in Greece. Energies 2024, 17, 689. [Google Scholar] [CrossRef]

- European Commission. Staff Working Document, Final Assessment of the Final National Energy and Climate Plan of Romania; October 2020 SWD (2020) 922; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- European Commission. Commission Staff Working Document, Country Report Romania 2020, European Semester: Assessment of Progress on Structural Reforms, Prevention and Correction of Macroeconomic Imbalances, and Results of in-Depth Reviews under Regulation; SWD (2020) 522 Final; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Ministry of Energy, Romania Website. Available online: https://energie.gov.ro/category/electricup/ (accessed on 12 October 2024).

- Environment Fund Administration-Romania Website. Available online: https://www.afm.ro/programe_finantate.php (accessed on 12 October 2024).

- Romania Long Term Renovation Strategy, Approved by GD no.1.034/27 November 2020. Available online: https://legislatie.just.ro/Public/DetaliiDocumentAfis/236612 (accessed on 10 October 2024).

- European Commission. Integrated National Energy and Climate Plan of Romania, 2021–2030 Update, First Draft Version. Available online: https://commission.europa.eu/publications/romania-draft-updated-necp-2021-2030_en#files (accessed on 11 October 2024).

- Muresan, A.A.; Attia, S. Energy efficiency in the Romanian residential building stock: A literature review. Renew. Sustain. Energy Rev. 2017, 74, 349–363. [Google Scholar] [CrossRef]

- Tablou de Monitorizare a Riscurilor Climatice Asupra Sectorului Bancar din România. 2023. Available online: https://bnro.ro/PublicationDocuments.aspx?icid=31565 (accessed on 10 October 2024).

- The National Committee for Macroprudential Oversight. Annual Report of the National Committee for Macroprudential Oversight for the Year 2022; National Bank of Romania: Bucharest, Romania, 2022; ISSN 2601-8802/-L 2601-8802. [Google Scholar]

- Malinauskaite, J.; Jouhara, H.; Egilegor, B.; Al-Mansour, F.; Ahmad, L.; Pusnik, M. Energy efficiency in the industrial sector in the EU, Slovenia, and Spain. Energy 2020, 208, 118398. [Google Scholar] [CrossRef]

- Banka Slovenije. Annual Report 2022; Issue: 33 Year; Banka Slovenije Slovenska: Ljubljana, Slovenia, 2023; ISSN 1518-2103. [Google Scholar]

- Al-Mansour, F. Energy efficiency trends and policy in Slovenia. Energy 2011, 36, 1868–1877. [Google Scholar] [CrossRef]

- SID—Slovenska Izvozna in Razvojna Banka, d.d., Ljubljana Okvir za Izdajo Zelenih Obveznic November 2018. Available online: https://www.sid.si/sites/www.sid.si/files/documents/investitorji/green_framework_-_final_slovenski_-30.11.2018.pdf (accessed on 15 October 2024).

- SID—Slovenska Izvozna in Razvojna Banka, d.d., Ljubljana Zelena Obveznica Sid Banke—Poročilo o Okoljskih Učinkih za Leto 2021. Available online: https://www.sid.si/sites/www.sid.si/files/documents/zelena_obveznica_sid_banke_-_porocilo_o_okoljskih_ucinkih_za_leto_2021.pdf (accessed on 15 October 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).