1. Introduction

With the intensification of the global climate change problem, the international community has adopted the Paris Agreement to control the increase in global average temperature to within 2 °C of the pre-industrial level by the end of this century and strive to control it to within 1.5 °C [

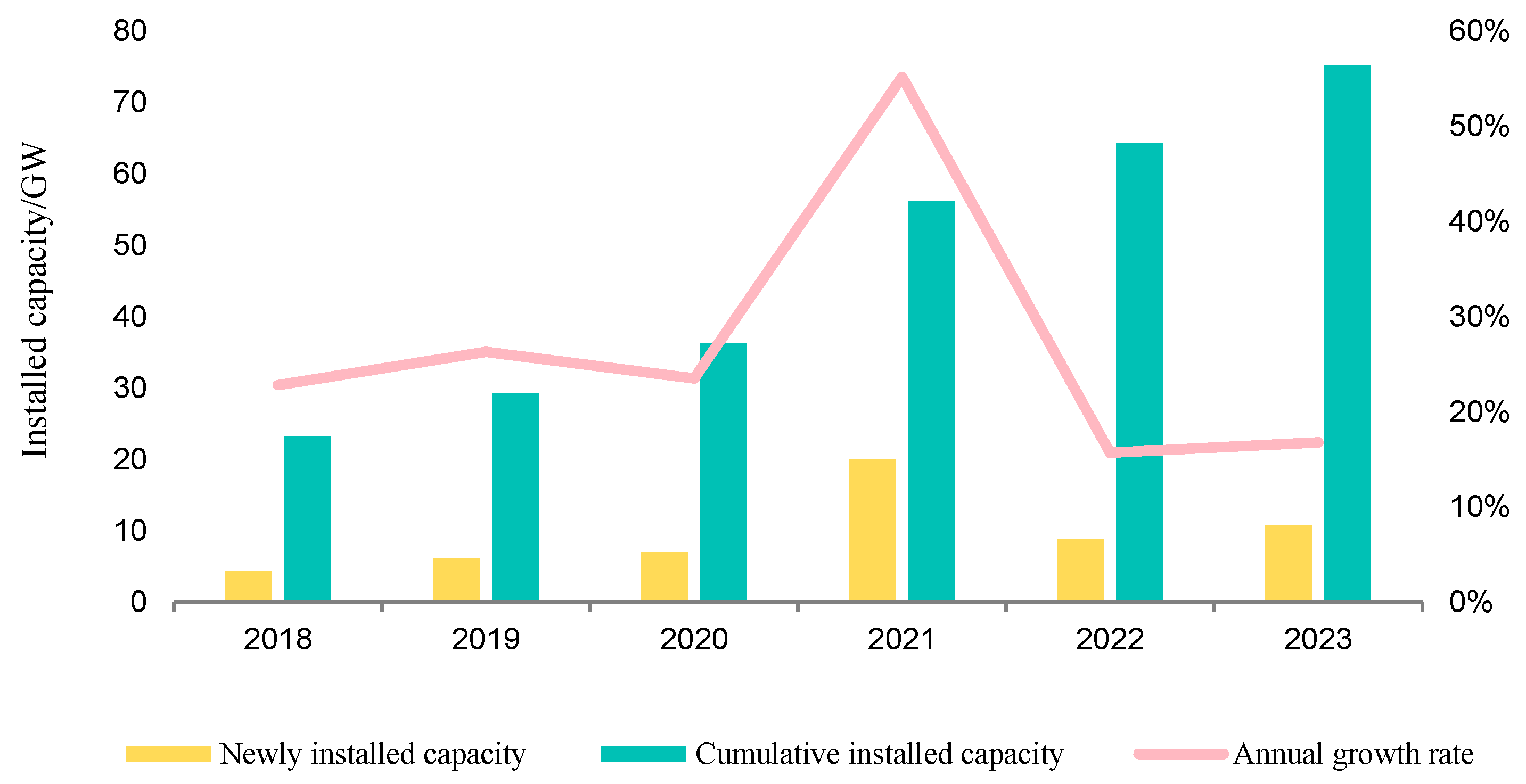

1], while the Chinese government has committed itself to the goal of carbon peaking by 2030 and carbon neutrality by 2060. Against this background, the transition from fossil energy to clean and low-carbon energy has become an urgent need, especially the promotion of the use of renewable energy sources such as solar and wind power. Offshore wind power has gradually become an important direction in the global energy transition due to its high efficiency and low environmental impact. According to the report of the Global Wind Energy Council (GWEC), the global offshore wind power newly installed capacity will reach 10.8 GW in 2023, and the cumulative installed capacity will be 75.2 GW; China’s performance in the field of offshore wind power is outstanding, with the new and cumulative installed capacity ranking first place in the world, as shown in

Figure 1. By the end of 2023, China’s cumulative installed capacity of offshore wind power exceeded 30 million kilowatts, accounting for about half of the world’s offshore wind power capacity.

The development of offshore wind power is faced with two significant problems: the high-cost transmission of electricity and large-scale consumption [

2]. China’s current offshore transmission network architecture cannot support the transmission capacity of large-scale offshore wind power, which makes the transmission of large-scale offshore wind power subject to double limitations in capacity and distance. Offshore wind power hydrogen technology can effectively alleviate the problem of simultaneous, large-scale grid-connected consumption difficulties, reduce power abandonment, and improve the utilization rate of wind energy; for the high cost of electricity delivery of offshore wind power in the distant sea through electrolysis of water, the use of pipelines or ships will be hydrogen delivery, in terms of cost and cycle time have advantages, but also the use of existing natural gas pipeline doping combustion of hydrogen, to further reduce the cost of hydrogen delivery, and to further promote the development of China’s low-carbon energy system development. Therefore, the study of hydrogen production from offshore wind power is crucial to the development of offshore wind power.

The shipping industry is responsible for approximately 90% of global trade traffic, and reductions in emissions from the shipping industry are critical to combating global climate change. In July 2023, the International Maritime Organization (IMO) adopted a revised Greenhouse Gas Emission Reduction Strategy for Ships, announcing the need for the maritime industry to achieve a 20% reduction in total GHG emissions by 2030 compared to 2008 and a development target of net zero emissions by around 2050. The use of hydrogen-fueled ships is one of the solutions to achieve zero-carbon maritime shipping. The construction of marine hydrogen refueling stations to provide hydrogen sources for hydrogen ships travelling to and from the sea will solve the problem of hydrogen ships’ range [

3].

The economic analysis of the offshore wind hydrogen supply chain for an offshore hydrogen refueling station consumption is a complex and multidimensional research field, which involves not only the development level of offshore wind technology, the efficiency and cost of hydrogen production from electrolytic water but also the storage, transport, and final distribution of hydrogen. Despite the enormous potential and advantages of offshore wind hydrogen production technology, such as its proximity to hydrogen consumption centers and its ability to effectively utilize the abundant wind resources offshore, it still faces many challenges in terms of economics. These challenges include, but are not limited to, the high cost of offshore wind power construction and maintenance, the investment and operating costs of electrolytic water hydrogen production equipment, the safety and efficiency issues of hydrogen storage and transport, and the economic burden of hydrogen refueling station construction and operation.

Hydrogen has a wide range of applications in several fields. In the medical field, hydrogen therapy is effective for many diseases such as neurological, respiratory, skin, etc., conditions. Hydrogen released from magnesium metal in medical materials also has a positive effect. In the industrial field, hydrogen plays an indispensable role in the chemical industry, metal processing, welding, and other industries. Nowadays, research on hydrogen consumption has become a hotspot; in particular, its application as a fuel in the field of transportation has attracted much attention. Hydrogen, as a sustainable energy carrier, is valued for its environmentally friendly characteristics, and green hydrogen supply chain design and related infrastructure design analysis have become a research hotspot [

4,

5,

6,

7,

8,

9]. Research focuses on the techno-economic analysis and modeling optimization of renewable energy-based hydrogen supply chains. Literature [

10] investigates the cost competitiveness of using renewable hydrogen in 75% of light-duty vehicles in Germany, compared to conventional fuels. Literature [

11] analyzes the economics of the hydrogen supply chain for different market penetration rates, exploring the costs and optimal configurations of five hydrogen transport routes. Literature [

12] analyzes the system architecture, the requirements of each monitoring subsystem of the onshore hydrogen refueling station, offshore hydrogen production station and offshore wind turbine. In this way, the energy management requirements were stratified. Literature [

13] proposes a wind-powered hydrogen supply system planning and optimization method and investigates the configuration and cost of six hydrogen demand scenarios using Jeju Island, South Korea, as an example. Literature [

14] develops a hydrogen supply chain optimization model based on wind power generation, taking into account practical factors such as wind speed variations and energy storage, aiming to decarbonize the UK transport sector.

For economic research into wind power hydrogen production technology, literature [

15] uses the levelized cost analysis method and internal rate of return method to analyze the cost-benefit changes in hydrogen production, hydrogen storage, and hydrogen transportation, and puts forward an economic analysis model of wind power hydrogen production considering the transmission of the industrial chain, which provides references to the new development mode of the wind power industry in the new energy consumption constrained areas under the background of a comprehensive levelized price and grid access. Literature [

16] puts forward four models of self-provided power plants or direct power supply and the local use of hydrogen or access to the natural gas pipeline network, estimates and compares the economics of each model, and draws the preliminary conclusions that the hydrogen market is the most crucial factor for the economics of wind power hydrogen production; the economics of the direct supply of wind power is better than the external transmission of hydrogen, and the access to the natural gas pipeline network of wind power hydrogen production needs the support of economic policies in various aspects, and so on. Ref. [

17] analyses the economics of different offshore wind project development models, taking “wind abandonment” as an essential factor, and concludes that the grid-connected electricity sales model has the best economics. In [

18] the synergistic operation of an offshore wind farm and a hydrogen production-storage system is investigated, and an optimization model is developed to configure the wind hydrogen production chain to maximize the sales profit. Literature [

19] concludes that in the process of actively developing the offshore wind power hydrogen industry, the hidden bottleneck constraints should be guarded against, from the perspective of policy standards, industrial layout, core technology, etc., China should scientifically design and reasonably lay out, to promote the development of the combination of offshore wind power and the hydrogen industry, and to help achieve the carbon peaking and carbon neutrality goals. In literature [

20], a feasibility evaluation model for hydrogen production from offshore wind farms was developed to quickly assess or optimize the economics and practicality of hydrogen production systems for dedicated offshore wind farms. Comprehensively, wind power hydrogen production technology has significant economic benefits and application potential in areas with limited new energy consumption, and the cost-effectiveness of wind power hydrogen production is affected by multiple factors, such as hydrogen market demand, the economics of direct wind power supply, and policy support. In the future, the synergistic optimization of offshore wind power and hydrogen production-storage systems and policy support will be the key to promoting the development of wind power hydrogen production technology.

Although numerous studies have initially explored the technology, market, and economics of offshore wind hydrogen production, most of these studies have measured the economics of delivering offshore wind hydrogen to shore. Relatively few studies have been conducted on the economics of offshore wind hydrogen supply chains that are directly orientated towards offshore hydrogen refueling stations for consumption. Furthermore, in the aspect of solid-state hydrogen storage, although relevant studies have been conducted, it is limited by issues such as materials, slow absorption and release rates, and high requirements for temperature and storage and transportation equipment [

21]. Based on the current technology, practical application at an acceptable cost has not yet been achieved [

22]. Moreover, offshore wind hydrogen production and onshore wind hydrogen production have their own characteristics, as shown in

Table 1. It is meaningful work to study the supply chain of hydrogen production from offshore wind power.

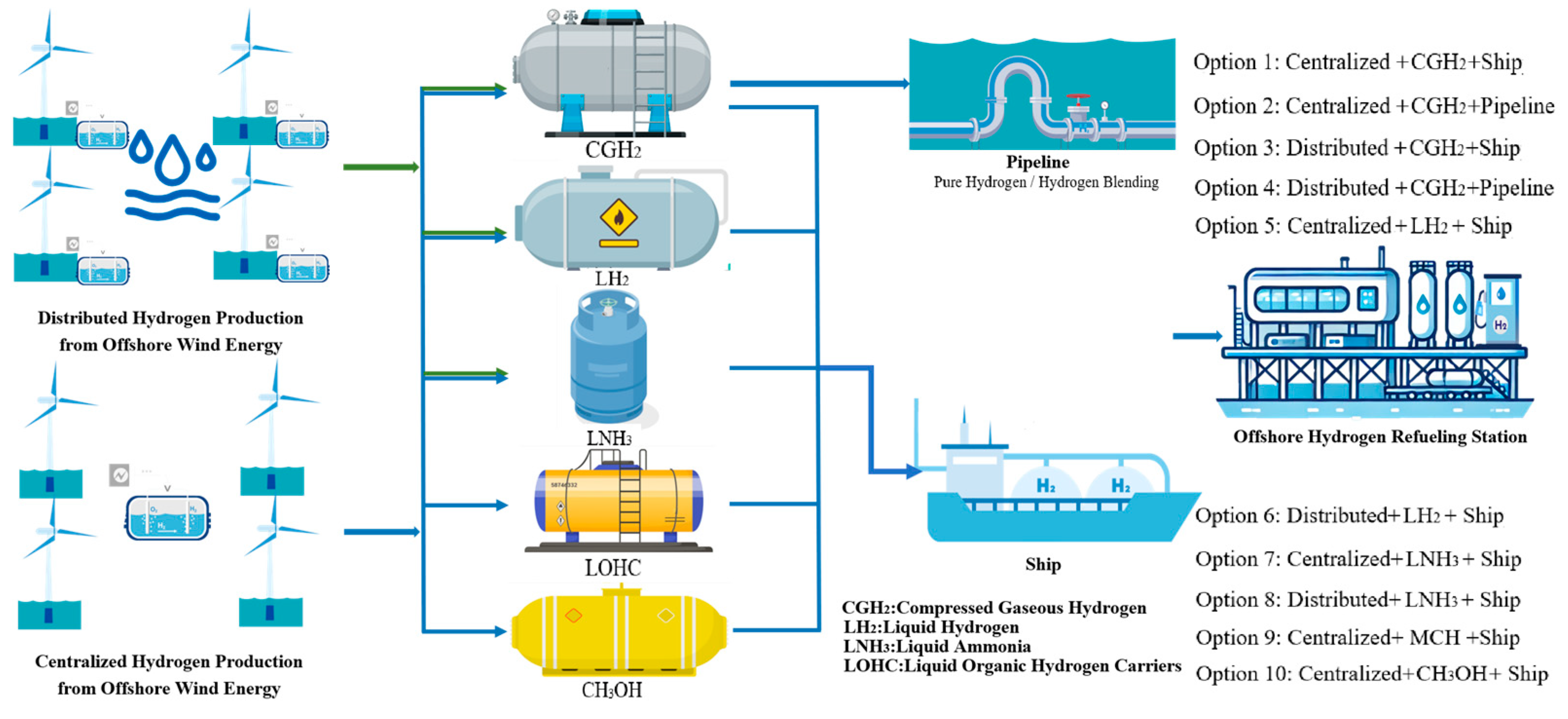

Therefore, this study investigates the economics of the offshore wind power hydrogen supply chain for offshore hydrogen refueling station consumption by proposing 10 feasible options for hydrogen production, storage and transportation, and application, as well as combining different hydrogen carriers. Using a levelized cost analysis method, the cost of the three links in the supply chain is measured, and a comparison of the economics of the 10 scenarios reveals that centralized hydrogen production is more economical than distributed hydrogen production in the current year; gas-hydrogen storage and transportation is still the most economical method; and offshore hydrogen refueling stations are very profitable in the guaranteed demand situation.

4. Results and Analyses

- (1)

Supply chain cost measurement results

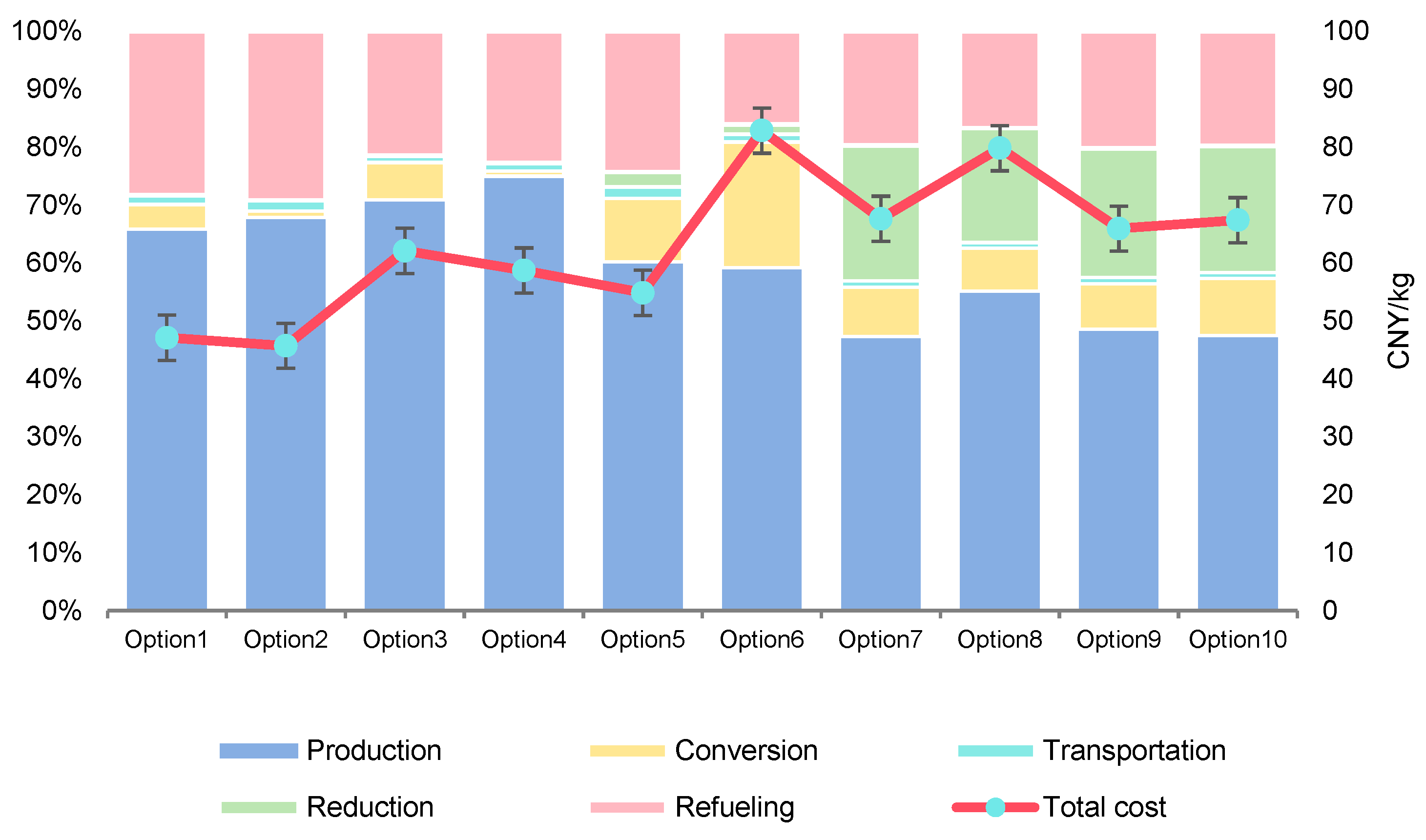

From the results of the supply chain measurements in

Figure 3, overall, the supply chain cost of hydrogen production for offshore wind power is higher than that for onshore wind power, but this paper has a unique advantage as it mainly tackles the specific scenario of offshore hydrogen refueling stations and considers the scenario of hydrogen-fueled ships facilitating the consumption of new energy at sea. In terms of specific links, in the hydrogen production end, the centralized hydrogen production cost is lower than the distributed hydrogen production; in the storage and transportation end, the gas-hydrogen pipeline cost is the lowest, and the liquid hydrogen ship cost is the highest; in the application end, the reduction cost of ammonia, MCH, and methanol hydrogen carriers is higher, and, except for the hydrogen carrier reduction link, in the refilling link the refueling cost is the same among the various scenarios due to the stipulation of the daily refueling volume of the offshore hydrogen refueling station.

- (2)

Supply chain sensitivity analysis

Since the daily hydrogenation volume is the same at the application end, the impact of different influencing factors on the cost of each scenario, except at the application end, is analyzed.

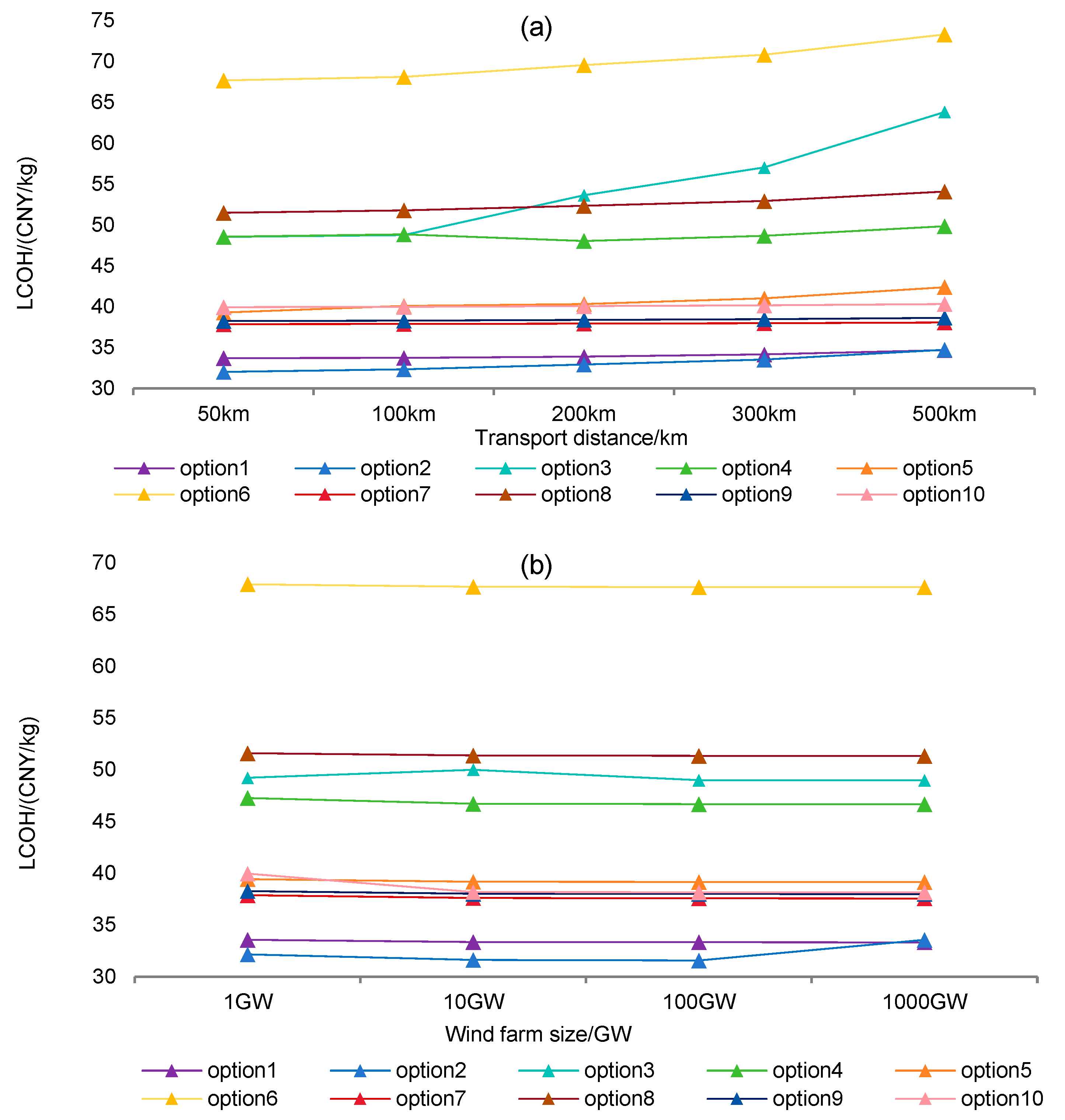

The distance offshore affects the LCOH by influencing the cost outlay for outgoing cables, hydrogen pipelines or transport vessels. With the augmentation in the wind farm size, scale effects will emerge in deep offshore wind hydrogen projects.

From

Figure 4, it can be seen that the cost of each option increases with the increase in the offshore distance, where pipeline transport is more suitable for wind farms with a closer offshore distance, while ship transport is appropriate for the long-distance transport of wind farms with greater offshore distances. The cost of the hydrogen pipeline is more sensitive to the offshore distance than the cost of ship transport to the offshore distance.

With the increase in the wind farm size, the cost of each technical solution decreases to different degrees; there is a scale effect, and the LCOH of the hydrogen pipeline model decreases more than that of the ship, while the overall impact on the LCOH is smaller due to the smaller proportion of the hydrogen pipeline. However, the decline is more moderate than the offshore distance, which shows that the wind farm size is not the key influencing factor on the cost of hydrogen production for deep and distant sea wind power.

The current cost of offshore wind power hydrogen production compared to onshore hydrogen production method has no economic advantage; therefore, according to the future cost prediction, in the optimistic scenario, offshore wind power hydrogen production has strong policy support and R&D funding, technology R&D enthusiasm is high and can be combined with the equipment technology learning rate based on the degree of maturity of the technology. The cost reduction rate was taken as 6~14%. In the pessimistic scenario, offshore wind power hydrogen production technology R&D difficulty, policy inclination is not high, R&D enthusiasm degree is low, the cost decline is not obvious, and the cost reduction rate was taken as 2~6%, as shown in

Figure 5. Predicting the trend of the LCOH change from the present to 2060, the optimistic scenario is expected to be the same as the Coal Hydrogen with CCS method for Scenario 2 in 2037.

Carbon taxes, as one of the most cost-effective carbon abatement tools, have received widespread attention from international organizations and governments. Considering the impact of the carbon tax price on the cost of offshore wind hydrogen production, the carbon emissions reduced through offshore wind hydrogen production can be traded in the carbon trading market, thus bringing additional carbon benefits to the project. Based on various current policy preferences and research results, this paper is biased towards optimism in the development prospects of offshore wind hydrogen production, and therefore adopts an optimistic scenario for the subsequent measurements. As shown in

Figure 6, the LCOHs after joining the carbon trading market have all decreased to different degrees. The year of economic advantage over other hydrogen production methods will be advanced, and the LCOH of the optimal offshore wind hydrogen production scheme will be on a par with coal hydrogen production under the CCS method around 2033; and it will have a competitive advantage over all other hydrogen production methods around 2038.

- (3)

Sensitivity analysis of offshore hydrogen refueling stations

The refueling cost of an offshore hydrogen refueling station is mainly related to the operating rate and the selling price of hydrogen. Considering the actual operation, the offshore hydrogen refueling station has a variable daily hydrogen sales volume, and different operational load rates are set to obtain a clearer picture of the profitability of the hydrogen refueling station. As shown in

Figure 7a, the refueling cost decreases as the operating load factor increases; and as the hydrogen price increases, the refueling cost increases slightly due to the rise in various taxes.

As shown in

Figure 7b, changes in the operating load factor and hydrogen selling price also have a direct impact on the profitability of hydrogen refueling stations, which increases significantly with the increase in the operating load factor and hydrogen selling price. However, at present, due to the small number of hydrogen fuel cell ships, the current operating rate is less than 100%, and the profitability is a little weak. With the continuous progress in technology and the development of the hydrogen energy market, the development prospects of the offshore hydrogen refueling station are bright and the profitability is very considerable.

- (4)

Hydrogen supply to offshore hydrogen refueling stations at different distances

Given the profitability of offshore hydrogen refueling stations and their promising development prospects, such stations are expected to be constructed in diverse regions in the future. Considering the supply of hydrogen to offshore hydrogen refueling stations to varying distances from the hydrogen source, the economy is the main consideration in the choice of the storage and transport method, and the comparison of the storage and transport economy of multi-technology options with different daily transport volumes and transport distances is analyzed.

Figure 8a represents the most economical hydrogen carrier transport mode at different transport distances and daily transport quantities. It can be concluded that a pipeline is the most economical way to transport when the offshore hydrogen refueling station is large in scale and far away from the hydrogen source point; when the daily hydrogen refueling scale of the offshore hydrogen refueling station is less than 10,000 t, the gas-hydrogen ship is the most economical way to transport it; the cost of transporting hydrogen carriers, such as liquid hydrogen, synthetic ammonia, MCH, methanol, etc., is not economically advantageous at a distance of 10,000 km and up to 1,000,000 t daily hydrogen refueling. Liquid hydrogen, synthetic ammonia, MCH, methanol and other hydrogen carriers have no economic advantage in the distance of 10,000 km from the hydrogen source point and in the scale of hydrogen refueling up to 1,000,000 t daily. Also based on the development prospects, the future transport distance and daily transport volume costs are predicted in

Figure 8b–e below.

The results in

Figure 8 show that pipelines are progressively shorter but still suitable for supplying large-scale offshore hydrogen refueling stations; that the economic advantages of ammonia and MCH become apparent after 2040; that the development of ammonia carriers is progressively more suitable for supplying large-scale, long-distance offshore hydrogen refueling stations; and that MCH will be more ideal for supplying small- and medium-sized, long-distance offshore hydrogen refueling stations in future developments. Liquid hydrogen, methanol, and other hydrogen carriers in the future development trend of ship transport costs in the distance of 10,000 km from the hydrogen source point and the hydrogen refueling scale of 1 million tonnes per day still do not have a cost advantage.

Combined with the economic calculation of the storage and transport end, the most economical hydrogen carrier transport method is selected according to the distance of the hydrogen source point and the size of the offshore hydrogen refueling station, which will help the construction and development of the offshore hydrogen refueling station and improve the application end link of the offshore wind hydrogen supply chain.