1. Introduction

Europe’s accelerating transition towards renewable energy systems necessitates innovative digital and operational solutions to reconcile renewable intermittency with the defossilization of hard-to-abate sectors, such as steel, aviation, and shipping. Power-to-X (PtX) technologies, particularly hydrogen production through electrolysis, have emerged as pivotal enablers in this transformation, facilitating sector coupling by converting surplus renewable electricity into storable fuels and feedstocks [

1,

2]. In Denmark, the national PtX strategy targets 4–6 GW of electrolysis capacity by 2030, positioning PtX facilities as major electricity consumers capable of providing demand-side flexibility to stabilize grids and reduce curtailment [

3,

4,

5].

However, the economic viability of PtX remains constrained by high operational expenditures dominated by electricity costs, which are becoming increasingly volatile under evolving European market regulations [

6,

7]. A particularly transformative regulatory development is the European Union’s transition from an hourly (60 min) to a 15 min Market Time Unit (MTU) in day-ahead electricity markets, effective from 1 October 2025, mandated by Regulation (EU) 2019/943 and operationalized through the Capacity Allocation and Congestion Management Guideline [

8,

9]. This shift aims to enhance market efficiency and renewable integration by capturing intra-hour price signals and allowing finer-grained balancing between supply and demand [

10,

11,

12]. Because PtX hydrogen production is highly sensitive to short-term electricity-price dynamics, the shift to a 15 min MTU fundamentally alters the operational landscape that these facilities must navigate.

For large electricity consumers, such as PtX hydrogen facilities, this reform introduces a new volatility regime. If operations remain optimized for hourly schedules, intra-hour fluctuations could raise costs and increase reliance on marginal fossil generation. Conversely, the new structure opens opportunities for adaptive, sub-hourly optimization to exploit arbitrage, reduce curtailment, and provide flexibility services [

13,

14,

15]. Failure to adapt could result in suboptimal grid interaction, higher CO

2 emissions, and diminished competitiveness for Europe’s hydrogen industry. These emerging dynamics underscore the need for rigorous, process-level operational analysis capable of capturing how market granularity interacts with non-linear PtX behaviors.

Despite the extensive literature on demand-side management (DSM) for industrial consumers under dynamic pricing, three major research gaps remain unresolved. First, most DSM models operate at hourly granularity, ignoring sub-hourly volatility that strongly affects flexible processes like electrolysis [

16,

17,

18]. Second, the existing frameworks rarely capture PtX-specific non-linear performance, renewable co-generation, and dual grid-buy/sell participation [

19,

20,

21]. Third, although synthetic data are increasingly used for scenario generation [

22], they have not been applied to evaluate a 15 min MTU impact on PtX operational cost, flexibility, or sustainability, leaving a critical scenario-data gap.

This study addresses these gaps by investigating how the 15 min MTU transition in European day-ahead electricity markets influences the operational costs, flexibility, and sustainability of PtX hydrogen production, and how adaptive optimization can mitigate risks while exploiting new opportunities. To answer this research question, the analysis pursues three objectives: (i) to develop and validate advanced optimization models: mixed-integer linear programming (MILP) and mixed-integer quadratically constrained programming (MIQCP) for PtX scheduling under dynamic electricity prices, benchmarking their performance against static 60 min strategies; (ii) to generate synthetic 15 min electricity-price datasets with varying intra-hour volatility and evaluate adaptive versus non-adaptive scheduling; and (iii) to extend the optimization formulation to incorporate both grid-purchase costs and revenues from on-site renewable-electricity sales, enabling assessment of economic trade-offs and flexibility potentials.

Taken together, this study makes three principal contributions. Scientifically, it pioneers a reproducible, synthetic-data-driven approach that directly closes the documented scenario-data gap by preserving hourly price statistics while systematically varying intra-hour volatility for the now-operational 15 min MTU regime. Methodologically, it advances the state of the art by embedding both linear (MILP) and non-linear (MIQCP) optimization within an agent-based simulation environment, enabling realistic representation of heterogeneous actors, feedback loops, and bidirectional market participation at 15 min resolution. Additionally, the tight integration of synthetic data, agent-based modelling, and global non-convex optimization provides the first fully reproducible testbed for evaluating sub-hourly PtX strategies under controlled volatility scenarios. Practically, the framework quantifies the economic and environmental implications of the 15 min MTU transition for PtX competitiveness, providing actionable insights for plant operators and policymakers designing flexible hydrogen systems [

23].

The remainder of this paper is organized as follows:

Section 2 reviews the related literature on industrial flexibility under dynamic pricing;

Section 3 presents the methodological framework integrating synthetic data generation, agent-based simulation, and optimization;

Section 4 describes the case study and scenario design;

Section 5 reports the results; and

Section 6 discusses implications and future research directions.

2. Literature Review

The transition toward renewable-based energy systems requires industrial consumers to operate with increasing flexibility, responding dynamically to fluctuating electricity prices and market regulations. This literature review synthesizes research on three interrelated domains that form the foundation of this study: (i) demand-side optimization of large electricity consumers under dynamic pricing; (ii) operational and economic challenges of PtX technologies, particularly electrolysis; and (iii) market design transformations toward sub-hourly (15 min) trading and the use of synthetic data for scenario-based modeling. By critically examining existing approaches and identifying unresolved gaps in temporal resolution, process representation, and data generation, this section establishes the conceptual and methodological rationale for the adaptive optimization framework developed in

Section 3.

2.1. Industrial Flexibility and Dynamic Electricity Pricing

Industrial energy management has evolved rapidly with the emergence of dynamic electricity pricing regimes, such as time-of-use, real-time pricing, and day-ahead spot markets [

24]. These regimes expose large electricity consumers, including manufacturing, refining, and metallurgical industries, to substantial cost volatility that reflects supply–demand balance, renewable variability, and network constraints. Electricity often accounts for 30–60% of production costs in such sectors, motivating the adoption of DSM strategies that enable price-responsive operation through load shifting, peak shaving, and flexible scheduling [

25].

A significant portion of the literature focuses on process-integrated energy-management systems capable of coordinating production cycles with electricity-market signals. For example, [

16] formulated an energy-management systems model for oil refineries that dynamically coordinated on-site generation and load allocation, reducing total energy cost by integrating day-ahead market participation. Likewise, [

26] implemented a programmable-logic-controller-based load-control mechanism that rescheduled machine operations in response to hourly price fluctuations, achieving both cost savings and DSM-related revenues.

From a methodological standpoint, optimization approaches can be divided into two main strands: mathematical programming and artificial intelligence meta-heuristics. Classical mathematical programming, including linear, integer, and mixed-integer formulations, offers computational robustness and interpretability for real-time control. For instance, [

17] applied integer programming to coordinate electric-arc-furnace loads, achieving up to 50% reduction in peak demand and 5.7% reduction in total cost. In contrast, artificial intelligence methods, such as genetic algorithms, particle-swarm optimization, and bee-colony algorithms, exhibit flexibility for non-linear, high-dimensional scheduling problems, as illustrated in [

19].

Recent hybrid frameworks integrate energy-storage flexibility and multi-energy coupling. In [

18], MILP was used to evaluate flexibility over optimization horizons from one hour to one year, revealing that shorter horizons increased annual operational expenditure savings by 7.5% but altered key performance indicators, such as battery-cycle depth and CO

2 emissions.

While these studies confirm the economic benefits of adaptive industrial scheduling, most are limited to hourly market resolution. The absence of research addressing sub-hourly optimization horizons, where intra-hour volatility and response time are critical, restricts understanding of how flexible industrial systems might perform under the new 15 min European market structure. This temporal gap forms a primary motivation for the sub-hourly modeling introduced in this paper.

2.2. Power-to-X Systems and Operational Challenges

PtX technologies have emerged as a critical pillar of the global energy transition, enabling the conversion of renewable electricity into storable and transportable energy carriers, such as hydrogen, methane, methanol, and ammonia. These technologies serve as vital enablers for sector coupling (linking electricity, transport, industrial, and heating sectors), thereby enhancing energy-system flexibility and accelerating decarbonization [

27]. The concept of PtX is particularly relevant for countries like Denmark, where abundant variable renewable energy generation from wind and solar increasingly exceeds instantaneous demand. In this context, PtX provides a pathway to transform surplus renewable power into chemical energy carriers, reducing curtailment, and supporting grid stability [

4].

2.2.1. Electrolyzer Technologies and Efficiency Behavior

At the technological core of PtX systems lies electrolysis, the process of decomposing water into hydrogen and oxygen using electricity. The predominant commercial technologies include alkaline, proton exchange membrane, and solid oxide electrolyzers [

28]. Electrolyzer efficiency varies non-linearly with part-load operation, temperature, and stack aging, a relationship often oversimplified as linear in conventional optimization models. Ref. [

29] demonstrated that the conversion efficiency and hydrogen output of modern alkaline electrolyzers follow a strongly non-linear curve with respect to input power, especially under dynamic operating conditions. These non-linearities have profound implications for operational scheduling, as they directly influence the marginal cost of hydrogen production at varying load levels.

Recent research also highlights the increasing role of electrolyzers as flexible assets in electricity systems. Ref. [

30] reviewed European pilot projects where electrolyzers participated in frequency-control reserves and balancing markets, showing that their rapid ramping capability enables real-time grid support. Similarly, [

31] observed that advanced control strategies allow proton exchange membrane systems to switch between hydrogen production and grid-service provision within seconds. This evolution positions PtX facilities not merely as passive consumers but as active participants in future flexibility markets, reinforcing the need for optimization frameworks that account for bi-directional market participation and sub-hourly responsiveness.

2.2.2. System Integration and Sector Coupling

PtX deployment requires tight integration across multiple infrastructure layers. On the upstream side, coupling with renewable energy sources ensures that hydrogen production remains low-carbon. However, intermittent generation from photovoltaics (PVs) and wind introduces temporal mismatches between supply and electrolysis demand. On the downstream side, hydrogen can be stored, injected into gas grids, or further synthesized into liquid fuels, such as methanol or ammonia. System-integration studies across Europe and Asia have examined these interactions. Ref. [

32] reviewed hydrogen-driven PtX applications in China, highlighting that multi-stage conversion chains (e.g., hydrogen to methanol) magnify the challenge of balancing dynamic electricity input with chemical-process stability. In a European context, [

33] analyzed industrial-scale PtX integration scenarios and stressed the necessity of coordinated control architectures to manage the interface between renewable variability, grid operations, and electrochemical conversion.

In Denmark, PtX plays a central role in achieving the national 2030 target of 4–6 GW of electrolysis capacity [

3]. Flagship projects such as GreenLab Skive and Kassø PtX exemplify this integration model, combining large-scale wind and solar farms with electrolyzers and downstream synthesis plants. However, despite high renewable penetration, the Danish experience reveals operational bottlenecks, including variable curtailment, grid-connection constraints, and inconsistent price signals across markets. These factors underscore the value of adaptive optimization models that explicitly incorporate temporal variability and cross-sectoral interactions to schedule PtX operations effectively.

2.2.3. Economic Viability and Market Participation

The economic feasibility of PtX remains one of the most widely studied yet unresolved issues. Multiple techno-economic reviews conclude that electricity cost and electrolyzer capital cost dominate the levelized cost of hydrogen [

6,

7]. Ref. [

34] reported global levelized cost of hydrogen estimates ranging from 3.8 to 11.9 USD/kg, depending on renewable source, capacity factor, and system scale. Although ongoing cost reductions are narrowing this gap, electricity price volatility, especially under sub-hourly markets, introduces significant uncertainty into financial projections.

Traditional PtX studies often treat electrolyzers as price-takers, responding to exogenous day-ahead prices. However, with growing installed capacity and participation in ancillary-service markets. Ref. [

30] noted that electrolyzers providing reserve capacity actively influence market balancing, implying a need for bi-directional optimization that considers both hydrogen production and grid-service revenues. Economic modeling also shows that adaptive participation in intraday markets could improve annual profitability significantly even without additional capital investment [

35]. Such evidence supports integrating price-responsive scheduling within facility-level optimization models, as developed in this study.

2.2.4. Operational Optimization and Relevance to Sub-Hourly Markets

Existing optimization approaches for PtX generally operate at hourly time steps, focusing on annual or monthly planning horizons. While useful for strategic assessments, such temporal granularity overlooks intra-hour variability, precisely where flexibility value is most significant. A recent review by [

36] emphasized the need for process-level operational models capable of resolving part-load efficiencies, ramping dynamics, and variable renewable inputs. These studies call for the development of hybrid optimization frameworks that integrate high-frequency electricity-price data with electrochemical process models.

Against this backdrop, the current research advances the literature by embedding MILP and MIQCP optimization within an agent-based simulation environment, operating at a 15 min resolution. This design captures both the non-linear efficiency characteristics of the electrolyzer and its dual role as energy consumer and prosumer. The model’s capacity to couple on-site renewable generation with market-responsive scheduling directly addresses the methodological and practical limitations identified in earlier PtX research.

2.3. Market Granularity and the 15 Min Time Unit Reform

The evolution of electricity-market design toward higher temporal granularity represents one of the most significant structural transformations in European power systems. The transition from hourly (60 min) to 15 min MTU in the Single Day-Ahead Coupling aims to enhance price accuracy, system flexibility, and renewable-energy integration across all EU bidding zones. The change, mandated by Regulation (EU) 2019/943 and operationalized through the Capacity Allocation and Congestion Management Guideline (Regulation 2015/1222), became effective on 1 October 2025 following extensive coordination among European Power Exchanges and Transmission System Operators [

8,

9,

10].

2.3.1. Regulatory Context and Implementation Objectives

The regulatory foundation of the 15 min reform lies in the EU’s Clean Energy Package, which promotes an integrated internal market capable of real-time balancing between renewable generation and consumption. Ref. [

12] outlined that shorter MTUs enable more precise price formation, improved liquidity in intraday markets, and stronger incentives for flexible demand participation. The reform also harmonizes Europe’s imbalance–settlement period with the trading time unit, minimizing market distortions and facilitating cross-border scheduling. Market participants, especially aggregators, battery operators, and large consumers, such as PtX facilities, can thereby align operations with real-time price dynamics and ancillary-service opportunities.

The transition, however, introduces non-trivial computational and organizational challenges. As noted by [

37], sub-hourly trading increases the complexity of market-clearing and forecasting tasks, requiring enhanced digital infrastructure and higher-frequency data exchange between Transmission System Operators (TSOs), Distribution System Operators (DSOs), and market actors. Furthermore, refined settlement intervals amplify the need for automated optimization and model-predictive control to manage intra-hour load adjustments, precisely the type of high-frequency scheduling explored in this study.

2.3.2. Expected Impacts on Flexibility and Market Efficiency

Academic and regulatory analyses converge on the expectation that 15 min trading will strengthen short-term flexibility and renewable integration. Ref. [

12] projected that sub-hourly granularity could reduce curtailment of variable renewable energy by 3–5% across interconnected systems. Similarly, analyses of national pilots show tangible operational benefits: in Greece, intra-hour volatility and load-balancing efficiency improved following the pre-implementation of 15 min day-ahead products [

13]. Complementary studies [

14] emphasized that finer MTUs enhance the responsiveness of flexible resources, enabling faster alignment between supply and demand and reducing reserve-activation costs.

Yet, the literature also notes potential drawbacks. Increased data frequency can create forecast-error amplification, as prediction accuracy generally decreases with shorter horizons [

38]. Moreover, smaller MTUs intensify exposure to volatility for participants lacking adaptive control mechanisms. Without automation or advanced optimization, such volatility can lead to higher procurement costs rather than savings. Consequently, advanced algorithmic approaches, such as mixed-integer optimization or reinforcement-learning-based control, are essential to realize the promised efficiency gains.

Beyond PtX-specific studies, broader system-integration research has shown that flexible energy assets increasingly participate across multiple electricity and carbon-market layers, often under multi-objective optimization frameworks. For example, recent work on EVs has examined coordinated charging and discharging across electricity, reserve, and carbon markets, demonstrating that cross-market scheduling can unlock additional value streams and enhance system-level flexibility [

39]. Although these studies focus on different technologies and regional contexts, such as China, the methodological principles—integrating heterogeneous energy sources, multiple market mechanisms, and conflicting operational objectives—are conceptually relevant. They highlight the growing need for optimization frameworks capable of representing diverse flexibility resources in increasingly granular electricity markets. The present study extends these system-integration insights to hydrogen-based PtX facilities by evaluating how sub-hourly market granularity interacts with non-linear electrolyzer performance and adaptive scheduling under dynamic electricity prices.

2.3.3. Synthetic-Data Modeling for Market-Reform Analysis

Evaluating the operational and economic implications of the 15 min reform requires high-frequency price and demand data, which remain limited because the regime was only recently implemented. Consequently, synthetic data generation has become a central methodological tool in electricity-market research. Earlier studies demonstrated that synthetic bids and price curves can replicate market behavior under hypothetical designs, enabling pre-implementation policy analysis [

40]. Ref. [

41] used synthetic datasets to test market-clearing algorithms under multi-zonal configurations, while [

42] built open synthetic networks to facilitate transparent research in renewable integration.

Recent methodological developments combine stochastic volatility and machine-learning techniques to emulate sub-hourly price patterns and renewable-generation variability. Ref. [

43] proposed a stochastic-volatility model for synthetic price generation in high-frequency markets, while [

44] developed a data-driven framework integrating machine learning forecasts for renewable production with synthetic-price generation to study volatility propagation. The International Energy Agency’s Electricity 2024 Report further emphasized that synthetic-data methods are indispensable for evaluating the stability and volatility of future 15 min markets [

15].

These advances establish synthetic-data simulation as a foundational research approach for understanding market-granularity reform. Within this context, the present study adopts a reproducible synthetic-data framework to analyze how varying intra-hour price volatility affects adaptive scheduling of PtX hydrogen production. The detailed generation methodology is provided in

Section 3.3.

2.3.4. Implications for Power-to-X Operations

Despite broad agreement on systemic benefits, process-level implications for industrial flexibility resources remain underexplored. Few studies have quantified how 15 min markets affect the operational behavior of PtX hydrogen facilities. Most techno-economic analyses of hydrogen production employ hourly price series, implicitly smoothing intra-hour fluctuations. However, as indicated by [

45], failure to account for intra-hour variability can misrepresent both cost and flexibility potentials of electrolyzers. Understanding how electrolyzer efficiency, ramping, and renewable coupling interact with sub-hourly price dynamics is, therefore, crucial for realistic operational modeling.

The present study responds directly to this gap by modeling PtX operation at 15 min resolution using adaptive MIQCP optimization. By capturing intra-hour volatility, bidirectional power exchange, and renewable availability, the framework demonstrates how market-time-unit reform redefines the economics of flexible hydrogen production.

3. Integrated Simulation–Optimization Framework

This study develops an integrated framework to evaluate the operational and economic implications of the European transition from hourly (60. min) to 15 min MTU in day-ahead electricity markets for large electricity consumers, with a focus on PtX hydrogen production. The framework combines three methodological layers:

Synthetic data generation to simulate sub-hourly price volatility;

Agent-based simulation to model the PtX system as an interacting ecosystem;

Optimization-based operational scheduling using MILP and MIQCP models.

This framework builds on established agent-based energy system models [

46] but extends them with adaptive optimization and synthetic-data-driven analysis of market granularity. By integrating data generation, simulation, and optimization, it enables reproducible sensitivity analyses and quantifies the value of sub-hourly flexibility, aligning with emerging needs for renewable integration and intelligent DSM [

14,

27].

3.1. Agent-Based Modelling of the PtX System

This study adopts an agent-based simulation (ABS) framework to represent the PtX hydrogen production facility as a dynamic ecosystem of interacting entities, each possessing distinct goals, information flows, and behavioral rules. The adoption of ABS is motivated by the increasing complexity of PtX systems operating at the intersection of volatile electricity markets, distributed renewable assets, and heterogeneous stakeholders. Unlike deterministic techno-economic or system-dynamics models, ABS explicitly captures temporal dependencies, feedback loops, and decision interdependencies among actors. This capability is essential for analyzing adaptive scheduling under the new 15 min MTU regime, where decentralized decisions evolve in response to short-term market and system signals.

The rationale for using ABS is grounded in the authors’ recent framework presented [

46]. That study demonstrated that ABS enables realistic representation of actor heterogeneity (e.g., grid operators, PtX owners, and transporters) and infrastructure coupling, revealing emergent operational behaviors that static optimization models cannot reproduce. Building on this foundation, the present work extends the approach by embedding a real-time optimization layer within the ABS environment, thereby integrating behavioral simulation with quantitative optimization.

3.1.1. Rationale for ABS in Sub-Hourly Market Analysis

The transition to 15 min MTUs increases intra-hour price volatility and requires actors to make faster, decentralized decisions. ABS provides a natural framework for capturing these dynamics because of the following:

It models heterogeneous decision-making among multiple autonomous agents (PtX operator, DSO/TSO, renewables, storage, and transport).

It enables bottom-up emergence of system-level indicators (costs, emissions, and flexibility) from local interactions.

It allows integration of optimization routines as behavioral components of agents.

It supports scenario extensibility, where different market structures or regulatory parameters can be introduced without re-formulating mathematical equations.

These features align ABS with the data-driven and socio-technical orientation where digital representation of actors and markets forms the basis for adaptive control and policy design [

14,

27,

47].

3.1.2. Model Architecture and Agent Interactions

The ABS is implemented in AnyLogic™ version 8.8.3, which supports hybrid simulation combining agent-based and discrete-event methods [

48].

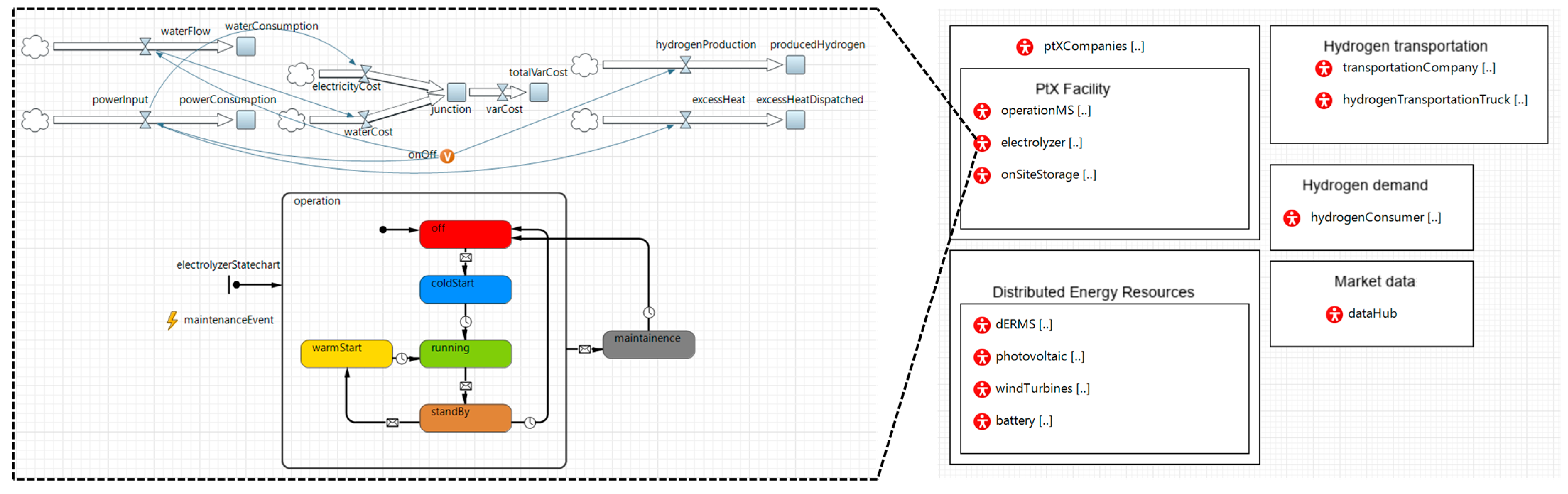

Figure 1 illustrates the architecture, in which each actor is represented as an autonomous software agent with internal states, decision rules, and communication protocols.

Figure 2 shows a screenshot from the AnyLogic implementation, where the logic inside the electrolyzer agent is shown.

The major agents and their functions are summarized below (extended from [

46]):

Operation Management System (OMS)—The central decision-making agent that monitors market prices, renewable forecasts, and hydrogen demand, and triggers the MILP/MIQCP optimization routine via the Gurobi Java API to determine the next-period operational schedule.

Electrolyzer agent—Simulates electrochemical conversion with a non-linear efficiency curve, and receives power-allocation instructions from the OMS.

Renewable Energy Agents (PV and wind)—Supply stochastic generation profiles based on meteorological inputs and communicate available capacity to the OMS.

Grid and Market Agents (DSO, TSO, and DataHub)—Provide dynamic tariffs and day-ahead prices, enforce grid-exchange constraints, and broadcast 15 min MTU updates.

Hydrogen Storage and Transport Agents—Manage buffering and logistics and interact with the OMS to coordinate production and delivery.

Hydrogen Consumer Agent—Represents industrial off-takers with fixed daily demand profiles.

This architecture forms a digital twin of the PtX facility and its operational environment, allowing direct testing of regulatory or market modifications (e.g., varying MTU lengths or tariff structures). The simulation time step matches the optimization horizon (60 min or 15 min), ensuring coherent feedback between system state and market dynamics.

3.1.3. Integration with the Optimization Layer

At each simulation interval, the OMS agent collects updated market and generation data, invokes the optimization solver, and transmits the resulting operational schedule to relevant agents. The outcome (e.g., power dispatch, hydrogen output, and grid interaction) feeds back into the simulation environment, influencing subsequent price signals and storage behavior. This closed feedback loop mirrors real operational decision cycles and quantifies how adaptive strategies improve flexibility and cost efficiency under sub-hourly volatility.

The ABS’s modular structure also facilitates future integration of multi-criteria decision-making tools or reinforcement-learning controllers for strategic planning, consistent with the authors’ previous research on dynamic ecosystems [

49].

Overall, the ABS provides the dynamic operational context for evaluating how the 15 min MTU influences PtX cost, flexibility, and emissions when coupled with adaptive optimization.

3.2. Optimization Models for Operation Scheduling

3.2.1. Overview and Rationale

The OMS agent employs mathematical optimization to determine the cost-optimal operation schedule of the PtX hydrogen production facility at each simulation step. The optimization models translate high-frequency market inputs (15 min or hourly electricity prices) and renewable forecasts into actionable dispatch decisions for the electrolyzer and energy exchanges with the grid.

Two optimization formulations are implemented within the OMS agent using the Gurobi 12.0.3 Java API, integrated directly in the AnyLogic™ simulation environment:

This configuration enables efficient execution of long-horizon simulations using the MILP formulation, while the MIQCP formulation preserves modelling accuracy under non-linear, partial-load operation. The optimization module dynamically interacts with the ABS environment: every 24 h, the OMS invokes the solver, obtains the daily optimal consumption and production schedule, and communicates the results to the electrolyzer, storage, and market agents at every time step.

The optimization-based control complements the agent-based framework (

Section 4.2) by providing the quantitative decision logic required to evaluate how adaptive scheduling responds to intra-hour price volatility under the 15 min MTU regime. This approach follows recent developments in optimization-enabled energy system simulations [

18,

20,

21]. Inputs to the optimization include the following:

Day-ahead electricity prices (hourly or synthetic 15 min data);

On-site renewable generation forecasts (assuming perfect foresight);

Electrolyzer efficiency curve, defined by breakpoints at 0–100% load;

Daily hydrogen demand, expressed in MWh (LHV basis = 33.33 kWh/kg);

Installed capacity of the electrolyzer.

The optimization seeks to minimize electricity procurement cost, while satisfying energy and mass balances.

The key assumptions are as follows:

Unlimited grid access (no congestion or curtailment penalties);

Negligible electrolyzer ramping constraints;

Electrolyzer degradation effects are neglected (future work will address this);

Surplus renewable generation may be exported to the grid;

The facility acts as a price-taker in the electricity market;

“No buy-and-sell” rule enforced per time step to prevent simultaneous grid purchase and export.

Before execution, the model performs feasibility checks (e.g., demand ≤ maximum hydrogen output). If infeasible, the solver triggers a fallback heuristic that uses only on-site renewables. Solver settings follow Gurobi best practices: relative MIP gap = 10

−5, time limit = 15 s, and NonConvex = 2 for MIQCP quadratic terms [

50].

3.2.2. MILP Formulation for Linearized Scheduling

The MILP formulation constitutes the first operational model used by the OMS to determine the least-cost scheduling of electricity flows for hydrogen production. It is designed for computational efficiency and thus linearizes the electrolyzer’s non-linear efficiency curve through a piecewise-linear approximation. This enables rapid and repeated solutions of sub-hourly or hourly scheduling problems within the integrated simulation framework.

The model focuses on the minimization of grid-purchased electricity cost while satisfying hydrogen-production and energy-balance constraints under operational limits. Piecewise linearization via Special Ordered Set type 1 (SOS1) variables ensures convexity without introducing non-linear terms [

17,

19].

Sets:

Time periods (, 24 for 60 min and 96 for 15 min).

: Breakpoints (load percentage ; consumption points ).

: Segments between breakpoints.

Parameters:

: Electricity price in period (DKK/MWh).

: Forecasted renewable production in (MWh).

: Electrolyzer capacity per period (MWh).

: Efficiency at breakpoint .

: Daily demand (MWh).

: Big-M constant.

Decision variables:

: Total consumption in (MWh).

: Renewable energy in (MWh).

: Grid energy in (MWh).

: Excess renewable energy in (MWh).

: Weights for breakpoint in .

: Binary for segment in .

: Binary buy/sell mode in (1 for buy, 0 for selling).

The objective function minimizes grid-electricity cost to ensure minimum expenditure on market electricity while on-site renewables are used at zero marginal cost:

where

is the grid electricity price (DKK/MWh) and

is grid power consumption.

Subject to:

These constraints ensure that each period’s energy balance, operational limits, and total hydrogen output are satisfied, while the SOS1 structure allows convex interpolation between two adjacent efficiency breakpoints.

The MILP formulation achieves an effective balance between computational speed and modelling fidelity, allowing the OMS agent to solve sub-hourly scheduling problems within milliseconds at each simulation step. Its linear structure ensures stable convergence for large-scale annual simulations while accurately representing electrolyzer behavior through the SOS1-based efficiency approximation. Consequently, the MILP provides the practical decision engine for adaptive scheduling in the agent-based framework, supporting cost- and flexibility-oriented analysis under both hourly and 15 min MTU regimes. The subsequent

Section 3.2.3 extends this linear formulation to an MIQCP model that explicitly represents non-linear efficiency curvature and partial-load effects to enhance precision in evaluating operational trade-offs.

3.2.3. MIQCP Formulation for Non-Linear Efficiency Representation

The MIQCP formulation extends the MILP model by capturing the non-linear efficiency characteristics of electrolyzers more accurately at partial-load conditions.

Whereas the MILP uses a linearized, piecewise-linear approximation for fast optimizations, the MIQCP formulation introduces segment-specific quadratic relationships between power input and hydrogen output. This allows the OMS agent to evaluate cost–efficiency trade-offs at finer resolution and is particularly useful under volatile 15 min market conditions.

This extension maintains the same optimization logic and constraints as the MILP, but replaces the piecewise-linear efficiency interpolation with quadratic functions of the form

where

are segment-specific coefficients derived from the electrolyzer’s efficiency curve. The introduction of segment-specific quadratic efficiency relationships renders the problem a non-convex MIQCP. Modern commercial solvers such as Gurobi can reliably solve such non-convex MIQCPs to global optimality for practically sized instances using spatial branch-and-bound combined with advanced presolve, cutting planes, and heuristics. In this work the model is solved globally with Gurobi 12.0.3 by setting the parameter NonConvex = 2 [

50]. This approach follows recent studies applying advanced non-linear optimization to PtX scheduling problems with variable renewables [

51].

New set for segments (for notational clarity):

Each segment

represents the linearized interval between two adjacent breakpoints on the load–efficiency curve defined in the MILP formulation (

Section 3.2.2).

Additional parameters for the MIQCP:

, : Lower/upper consumption (MWh) bounds for segment (, ).

: Linear coefficients for efficiency in segment ( and are calculated based on and , efficiency is then ).

The objective function remains identical to the MILP (minimize grid-electricity cost). However, the linear interpolation and hydrogen-production equations are replaced and subject to:

The MIQCP preserves all other MILP constraints (energy balance, power limits, buy/sell logic, and renewable use) but substitutes the linearized efficiency representation with a quadratic one. This enhances accuracy in capturing non-linear part-load efficiency losses while retaining the same decision framework and data inputs. The runtime increases moderately (typically 1.5–2.5× the MILP) but remains tractable for year-long simulations due to Gurobi’s efficient quadratic constraint handling.

The MIQCP formulation extends the MILP model by capturing the non-linear efficiency behavior of the electrolyzer, enabling higher-fidelity optimization that quantifies how conversion characteristics influence operational cost and emissions. Within the agent-based simulation, MIQCP is primarily employed for detailed scenario analyses and validation of scheduling outcomes, whereas the MILP formulation is retained as a computational benchmark to assess scalability and runtime performance. Using both formulations allows the framework to balance modelling accuracy with computational efficiency across experiments, in line with established practices in energy-systems optimization [

4,

21].

To ensure the correctness of the ABS–optimization integration, the framework was validated through a two-step approach. First, pure optimization runs of the MILP and MIQCP models were executed outside the agent-based environment, using identical inputs to verify consistency between stand-alone solver outputs and ABS-coupled scheduling decisions. The results matched exactly, confirming correct model integration and data exchange. Second, Scenario 1 (

Section 5.1) functions as an empirical validation against established modelling expectations: the MIQCP formulation reproduces the non-linear efficiency curve with high fidelity, while the MILP approximation exhibits the expected deviation in hydrogen output under partial load. As real-world PtX operational data at 15 min resolution are not yet available for the now-operational MTU regime, this validation strategy follows established practice in PtX modelling and agent-based simulation research.

3.3. Electricity Price Signal Data Generation

The adaptive optimization framework developed in this study requires high-frequency electricity-price inputs that reflect the intra-hour volatility of the forthcoming 15 min MTU described in

Section 2.3. Because this regulatory change only became operational in October 2025 [

12], no sufficiently long historical dataset yet exists at that temporal resolution. Consequently, a synthetic-data-generation method is implemented to produce 15 min price series that reproduce the statistical properties of hourly Nord Pool day-ahead prices, while allowing controlled variation of intra-hour volatility.

This approach follows the synthetic-data modeling principles reviewed in

Section 2.3, where such methods have been shown to support analysis of new market designs and to enable reproducible testing of optimization algorithms under unobserved regulatory conditions [

40,

43,

44]. By adopting a volatility-controlled synthetic-price framework, the present study ensures that the optimization models introduced in

Section 3.2 can be evaluated under a range of realistic market scenarios, from low- to high-volatility conditions, in a manner that is both systematic and reproducible.

The following subsections describe (i) the data sources and composition of electricity-price components, (ii) the mathematical formulation used to generate synthetic 15 min prices from hourly inputs, (iii) validation of the generated datasets, and (iv) integration of these signals into the MILP and MIQCP scheduling models within the agent-based simulation environment.

3.3.1. Data Source and Price Composition

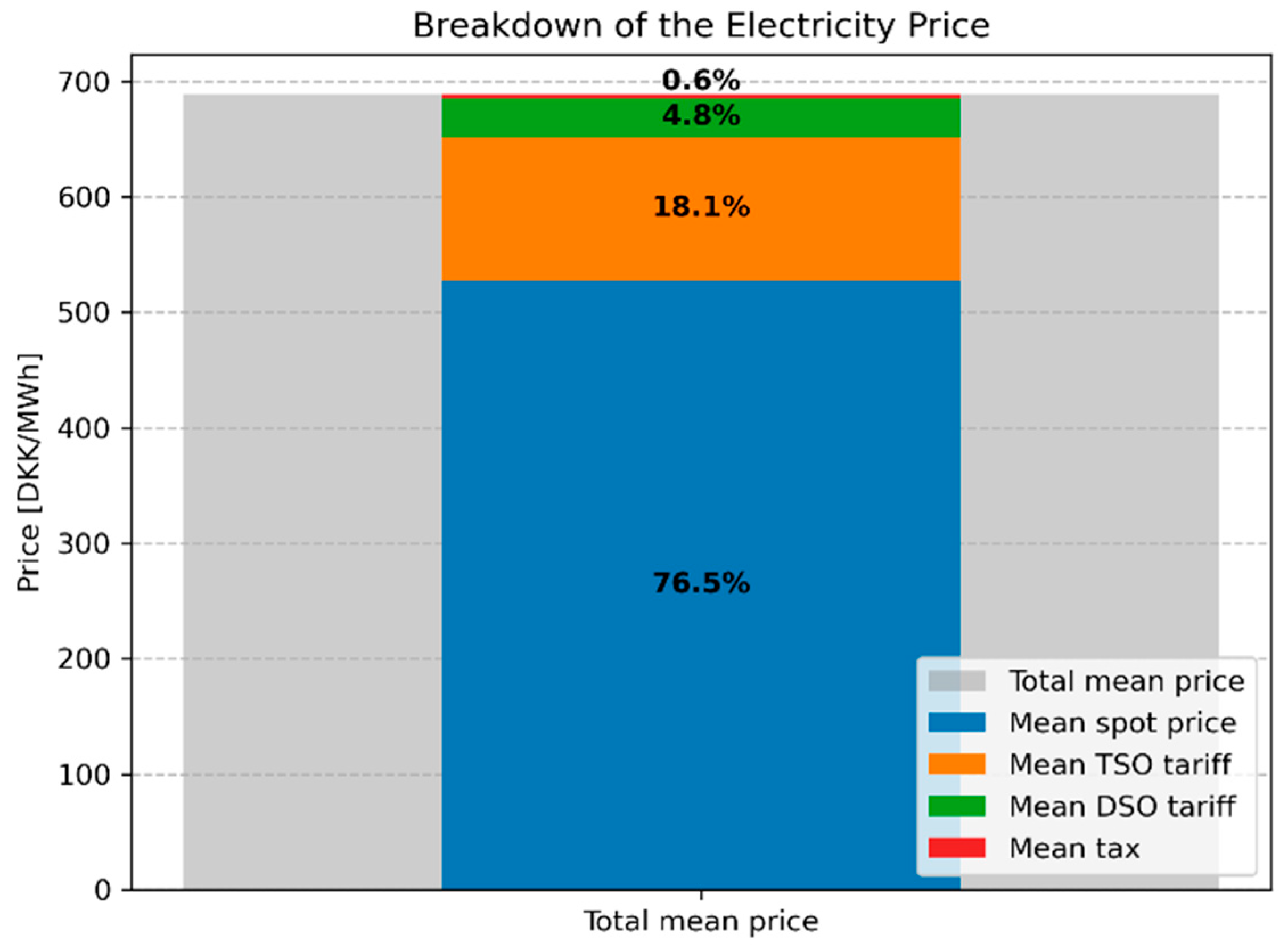

The base data comprise hourly 2024 Nord Pool spot-price records for the DK1 (West Denmark) bidding zone. For large electricity consumers, such as PtX facilities, the spot price dominates total electricity costs, representing an average share of 76.5% of the 2024 price, while DSO and TSO tariffs, plus taxes, contribute the remainder (

Figure 3). Because these network charges are currently invariant to MTU granularity, this study focuses on the spot-price component, which directly drives operational cost volatility [

15].

3.3.2. Synthetic 15 Min Price Generation Method

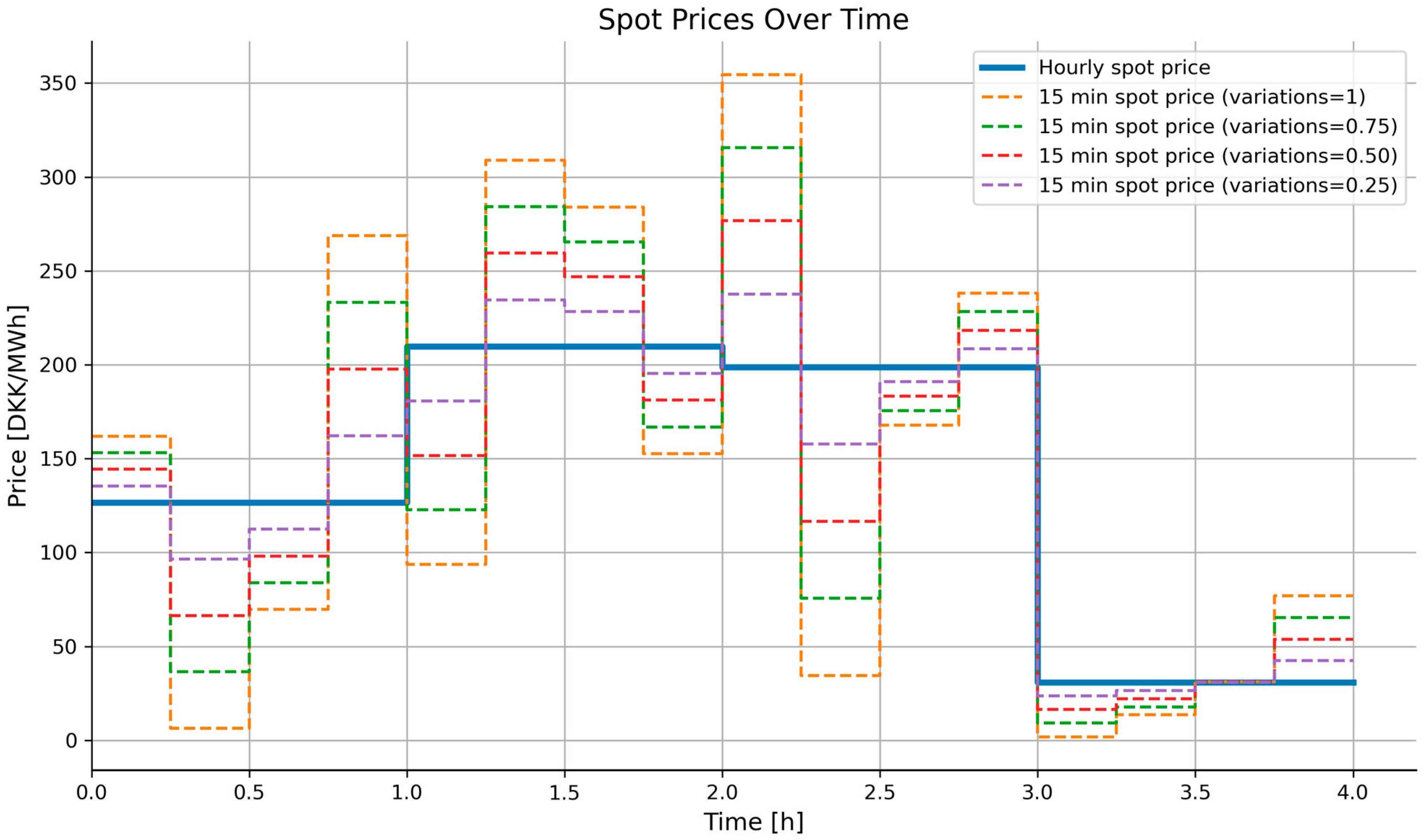

The transformation converts each hourly price

into four 15 min interval prices

(for

) whose arithmetic mean equals the original hourly price:

Controlled variability is introduced to simulate intra-hour price fluctuations, which are essential for evaluating the effects of reduced MTUs on consumption patterns and costs. The intra-hour fluctuations are generated by making three random offsets from a uniform distribution within a user-defined maximum variation

to make the variation range

(e.g.,

for a 25% intra-hour range) for the first three intervals. The fourth interval price is then computed to enforce the mean constraint:

This method introduces bidirectional volatility while maintaining hourly integrity, akin to scenario generation techniques in DSM studies [

52]. Four variation ranges (25%, 50%, 75%, and 100%, denoted as

= 0.25,

= 0.50,

= 0.75, and

= 1 in the rest of this paper) are generated with a fixed random seed to ensure reproducibility across the four datasets and to allow investigation of different price fluctuations on the operation.

Figure 4 visualizes four hours of original and synthetic prices, highlighting the introduced bidirectional fluctuations with uniform directional variations across the 15 min intervals.

3.3.3. Validation and Statistical Characteristics

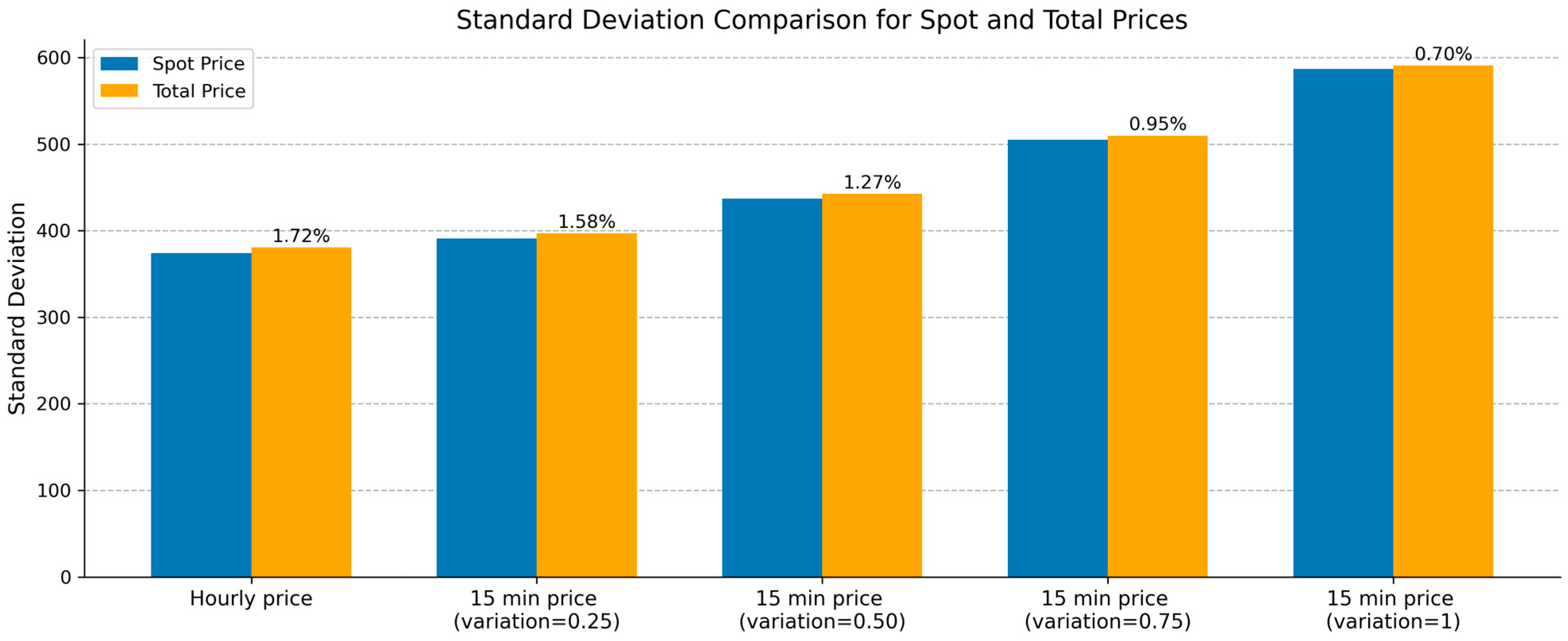

Figure 5 compares the standard deviation of the original hourly prices and the four synthetic 15 min datasets for both spot and total prices.

Figure 5 demonstrates that the standard deviation increases with finer temporal resolution, with tariffs and taxes contributing marginally to the total price variability. As the variation range increases, the relative impact of tariffs and taxes diminishes due to the growing dominance of the spot price.

Figure 6 visualizes the five datasets via boxplot distributions, descriptive statistics (mean, median, quartiles, and standard deviation), and average daily price ranges, revealing amplified interquartile ranges and daily spreads with higher v, which enhances load-shifting opportunities by exploiting larger price spreads.

The resulting synthetic datasets serve as dynamic inputs for the optimization models in

Section 3.2. The OMS agent uses the synthetic datasets to compute daily optimal scheduling decisions. This direct linkage between data generation and optimization ensures methodological consistency across

Section 3.2 and

Section 3.3 and allows reproducible exploration of cost-flexibility interactions under controlled volatility scenarios.

4. Scenario Design and Case Study Introduction

This section outlines the experimental setup used to assess how the 15 min MTU affects PtX hydrogen production costs, flexibility, and emissions. Building on the optimization and data-generation methods in

Section 3, three scenarios and a Danish case study are designed to test the impacts of market granularity and operational objectives under realistic renewable and market conditions.

4.1. Scenario Definitions and Experimental Setup

This section outlines the experimental design and case study used to evaluate the impacts of transitioning to a 15 min MTU on PtX hydrogen production. Three interconnected scenarios are developed, each aligned with one of this study’s research objectives.

Scenario 1 establishes a baseline by validating the proposed MILP and MIQCP models against a static, non-optimized strategy in a 60 min MTU environment.

Scenario 2 quantifies the risks and opportunities arising from the 15 min MTU shift by applying synthetic price datasets to compare adaptive and non-adaptive scheduling.

Scenario 3 extends the optimization objective to incorporate both revenue from on-site renewable electricity exports and costs of grid purchases, assessing trade-offs between hydrogen production and grid-market participation.

All scenarios assume an annual hydrogen demand of 870 tons (converted using a lower heating value of 33.33 kWh/kg). Simulations are executed over one full operational year using the agent-based and optimization framework introduced in

Section 3, integrating day-ahead Nord Pool spot prices, on-site renewable forecasts (perfect foresight), and 5 min CO

2-intensity data.

The performance of each scenario is evaluated using three key indicators:

Hydrogen production cost (DKK/kg);

Electricity-sales revenue (mDKK);

CO2 emissions intensity (kg CO2/kg H2).

This setup provides a consistent foundation for quantifying cost efficiency, flexibility, and environmental performance under evolving electricity-market conditions.

4.1.1. Scenario 1: Operation Scheduling Strategy Evaluation

Scenario 1 establishes a performance baseline for the proposed optimization models in the 60 min MTU regime. It quantifies improvements in cost efficiency and operational flexibility compared to the static strategy described in [

46], thereby validating both the MILP and MIQCP formulations.

The scenario utilizes four experiments using the agent-based simulation framework: (1) a static baseline strategy (fixed-load operation, disregarding price signals); (2) MILP with 10 breakpoints; (3) MILP with 30 breakpoints (testing approximation sensitivity); and (4) MIQCP with 10 breakpoints. Each experiment generates daily operation schedules across the full simulation year, minimizing grid electricity expenditure while satisfying hydrogen demand. The OMS agent integrates forecasts and executes the optimization routine daily.

4.1.2. Scenario 2: From 60 Min to 15 Min MTU

Scenario 2 evaluates the operational consequences of transitioning to a 15 min MTU, comparing non-adaptive scheduling against adaptive strategies that exploit intra-hour volatility.

The scenario encompasses five experiments: (1) non-adaptive, where a 60 min MIQCP schedule is applied to 15 min prices; and (2–5) adaptive MIQCP optimization directly on four synthetic 15 min datasets (volatility v = 0.25, 0.50, 0.75, 1.00). This design isolates the effects of intra-hour variability, revealing the cost-saving potential and flexibility gains achievable through adaptive scheduling and load shifting under finer temporal resolution.

4.1.3. Scenario 3: A Different Objective Function

Scenario 3 extends the MIQCP framework to include both the revenue from selling on-site renewable electricity and the cost of grid electricity purchases, providing a more comprehensive representation of facility-level economics.

Five experiments, mirroring those in Scenario 2, are conducted using the modified objective function. This scenario investigates the economic trade-offs between hydrogen production and electricity market participation, highlighting how incorporating grid sales can influence cost and overall financial performance under the 15 min MTU.

4.2. Case Study

The three scenarios introduced in

Section 4.1 are applied to a realistic Danish PtX hydrogen-production facility to ensure empirical relevance and reproducibility of the simulation results. The case configuration is adapted from [

46] and reflects the design of next-generation PtX plants being developed in Denmark’s renewable-energy clusters, such as GreenLab Skive and Kassø PtX.

4.2.1. Facility Configuration

The system consists of a 10 MW electrolyzer coupled with hybrid on-site renewables and a grid connection that enables both import and export of electricity.

On-site generation: four 4.2 MW wind turbines (16.8 MW total) and a photovoltaic park covering 160 ha with a 206 MWp capacity, resulting in a combined renewable peak capacity of 223 MW.

Electrolyzer characteristics: non-linear efficiency adopted from [

53].

Grid interface: medium-voltage connection (10–20 kV), allowing participation in the day-ahead market and potential export of surplus renewable power.

This configuration typifies hybrid PtX installations in Denmark that combine high renewable penetration with grid flexibility for stable hydrogen production.

4.2.2. Renewable-Generation Profiles

Renewable electricity production data for 2024 were derived from DMI’s wind and solar radiation data.

Figure 7 shows the hourly wind and solar generation throughout 2024, revealing complementary seasonal behavior: solar output rises sharply in summer and declines in winter, while wind power exhibits the opposite pattern. The combined profile remains largely solar-dominated, due to the higher capacity of PV panels.

Figure 8 presents the average hourly production profiles by season. Summer exhibits pronounced midday peaks driven by solar output, whereas winter shows lower total production but higher contributions during evening, night, and early-morning hours, consistent with stronger seasonal wind patterns in Denmark.

4.2.3. Simulation Data and Inputs

The simulations cover the full operational year 2024 and are executed within the agent-based and optimization framework described in

Section 3. The following datasets are integrated:

Electricity-market data: hourly Nord Pool DK1 day-ahead prices and synthetic 15 min price datasets generated in

Section 3.3.

CO2-intensity data: five-minute emission-intensity series from Energinet’s Data Portal, aggregated to match the simulation’s 60 or 15 min resolution.

Renewable forecasts: perfect-foresight forecasts for the on-site wind and PV generation derived from meteorological inputs.

System parameters: electrolyzer efficiency curve, annual hydrogen demand (870 t; 33.33 kWh/kg LHV), and grid-tariff data from the N1 DSO and Energinet TSO.

These inputs allow the OMS agent to generate adaptive operation schedules reflecting the real Danish market and environmental dynamics.

The Danish case study serves as the empirical foundation for all three scenarios. Together, the scenario design and case study create a coherent experimental environment linking the optimization, simulation, and data-generation components detailed in

Section 3. This integrated setup enables reproducible assessment of how market-time-unit reform affects PtX hydrogen-production efficiency, cost, and emissions in a renewable-rich context. The following

Section 5 presents quantitative findings and analyzes the implications of the 15 min MTU transition.

5. Results and Performance Analysis of Adaptive Power-to-X Scheduling

This section presents the analytical outcomes of the three scenarios introduced in

Section 4, focusing on how progressively adaptive optimization strategies improve the operational and economic performance of the Danish PtX hydrogen-production facility. The results are structured sequentially to reflect the methodological development of this study.

Section 5.1 validates the optimization framework by comparing the MILP and MIQCP models against a static benchmark under the conventional 60 min market regime.

Section 5.2 examines the implications of transitioning to the 15 min MTU and quantifies the benefits of adaptive scheduling in exploiting intra-hour price signals.

Section 5.3 then extends the analysis by incorporating renewable-electricity sales revenues into the objective function to assess the trade-offs between hydrogen-production cost, flexibility, and profitability.

Across the three scenarios, the results progressively demonstrate (i) the benefits of flexible optimization relative to static scheduling, (ii) the operational gains from sub-hourly market adaptation, and (iii) the extended profitability achievable when incorporating electricity sales into the optimization objective.

5.1. Baseline Model Validation Under Hourly Market (Scenario 1)

Scenario 1 establishes a reference benchmark for validating the optimization framework developed in this study. It compares the performance of the flexible scheduling models, MILP and MIQCP, with a static, fixed-load operation that ignores market and renewable variations under the conventional 60 min MTU. Four experiments were executed: a static baseline representing constant electrolyzer operation and three optimization cases, including MILP with 10 breakpoints, MILP with 30 breakpoints, and MIQCP with 10 breakpoints. The corresponding quantitative outcomes are summarized in

Table 1.

Therefore, Scenario 1 also functions as a validation benchmark for the ABS–optimization coupling. The agreement between stand-alone MILP/MIQCP optimization results and the outputs produced when these models are executed within the agent-based framework confirms that the ABS architecture accurately reproduces the mathematical scheduling behavior of the underlying optimization formulations.

Across all experiments, the optimization-based strategies demonstrate substantial improvements in cost and emission performance relative to the static benchmark. The fixed-load configuration exhibits the poorest economic and environmental outcomes, producing hydrogen at 19.71 DKK/kg and emitting 2.37 kg CO2/kg H2. Because this configuration operates independently of market signals, it relies heavily on grid electricity during high-price, high-emission periods. Introducing optimization reduces both metrics dramatically: all flexible configurations achieve more than 60% cost savings and roughly 61% emission reductions compared with the baseline. The MIQCP model yields the most accurate and stable solution, achieving a hydrogen-production cost of 6.31 DKK/kg and an emission intensity of 0.92 kg CO2/kg H2 while fully meeting the annual demand of 870 tons. The MILP versions, although faster computationally, exhibit small deviations in hydrogen output (864–869 t/year) caused by the linear approximation of the electrolyzer efficiency curve. These deviations slightly increase electricity consumption and marginally affect cost performance, confirming that the MIQCP’s quadratic formulation captures non-linear efficiency behavior more faithfully.

The results, therefore, validate the capability of optimization-based scheduling to align electrolyzer operation with renewable availability and market conditions. By dynamically adjusting electricity procurement to periods of low price and high renewable penetration, the optimization models significantly enhance both cost efficiency and sustainability. Among the tested approaches, the MIQCP provides the best compromise between physical accuracy and computational feasibility and is consequently adopted for the subsequent analyses of sub-hourly market adaptation (Scenario 2) and revenue-integrated optimization (Scenario 3).

5.2. Impact of 15 Min Market Granularity (Scenario 2)

Scenario 2 investigates how the transition from an hourly (60 min) to a sub-hourly (15 min) MTU alters the operational and economic behavior of the PtX facility. Using the MIQCP model validated in Scenario 1, this study compares a non-adaptive strategy, where a 60 min schedule is applied to 15 min prices, with four adaptive optimization cases that explicitly respond to intra-hour price variations of different magnitudes (v = 0.25,0.50,0.75,1.00). The results, reported in

Table 2, quantify the cost, flexibility, and emission consequences of this regulatory shift.

The analysis demonstrates that adaptive scheduling under finer market granularity substantially improves cost efficiency. The non-adaptive configuration yields a hydrogen-production cost of 7.25 DKK/kg, whereas the adaptive model achieves progressively lower costs as volatility increases from 6.99 DKK/kg at v = 0.25 to 4.33 DKK/kg at v = 1.00. These outcomes correspond to a reduction of approximately 40% compared with the non-adaptive case. The improvement stems from the OMS agent’s ability to exploit transient price dips within the 15 min market, dynamically rescheduling electrolyzer load to periods of low cost or high renewable generation.

Figure 9 and

Figure 10 illustrate a typical daily schedule for the adaptive (v = 0.25) and non-adaptive experiments, respectively. The adaptive case (

Figure 9) exhibits pronounced intra-hour load variations that align with short-term price fluctuations, especially at night and in the late evening. This contrasts with the non-adaptive case (

Figure 10), maintaining a flat hourly load at the electrolyzer’s maximum capacity, missing opportunities to exploit sub-hourly fluctuations.

Although economic performance improves markedly, the results reveal a modest environmental trade-off. CO2-intensity increases slightly, from 0.88 kg CO2/kg H2 at low volatility to 1.06 kg CO2/kg H2 at v = 1.00, because the optimization occasionally favors grid purchases during inexpensive periods with associated CO2-emissions compared to using on-site produced electricity without CO2-emissions. Nonetheless, total emissions remain far below the static baseline (2.37 kg CO2/kg H2), indicating that adaptive operation preserves the overall sustainability advantage of PtX systems.

In summary, Scenario 2 confirms that sub-hourly market participation enables PtX facilities to realize significant cost savings and flexibility gains. The results underscore the importance of adaptive digital control in the forthcoming European 15 min market regime while highlighting a need to balance short-term cost optimization with carbon-intensity awareness.

5.3. Revenue-Integrated Economic Optimization (Scenario 3)

Scenario 3 extends the MIQCP framework by incorporating revenues from the sale of on-site renewable electricity into the optimization objective, transforming the PtX facility from a cost-minimizing consumer into a market-responsive prosumer. The same volatility datasets as in Scenario 2 (v = 0.25,0.50,0.75,1.00) are applied, and the results are summarized in

Table 3.

Integrating electricity-sales revenue fundamentally changes the operational behavior of the facility. When both buying and selling decisions are optimized, the electrolyzer no longer seeks merely to minimize hydrogen-production cost but instead strategically modulates load to exploit short-term market opportunities. As volatility intensifies, the optimization favors exporting renewable electricity during high-price intervals while producing hydrogen when market prices are lower. This adaptive, bidirectional behavior enhances overall profitability even though the direct production cost per kilogram of hydrogen increases. At the highest volatility (v = 1.00), the hydrogen-production cost rises to 9.89 DKK/kg (compared with 4.33 DKK/kg in Scenario 2), yet the facility’s net revenue, defined as electricity-sales revenue minus grid-purchase cost, improves from 84.5 mDKK in Scenario 2 to 92.2 mDKK, a gain of roughly 9%. These results indicate that short-term market arbitrage can compensate for higher unit-production costs and strengthen financial resilience under volatile market conditions.

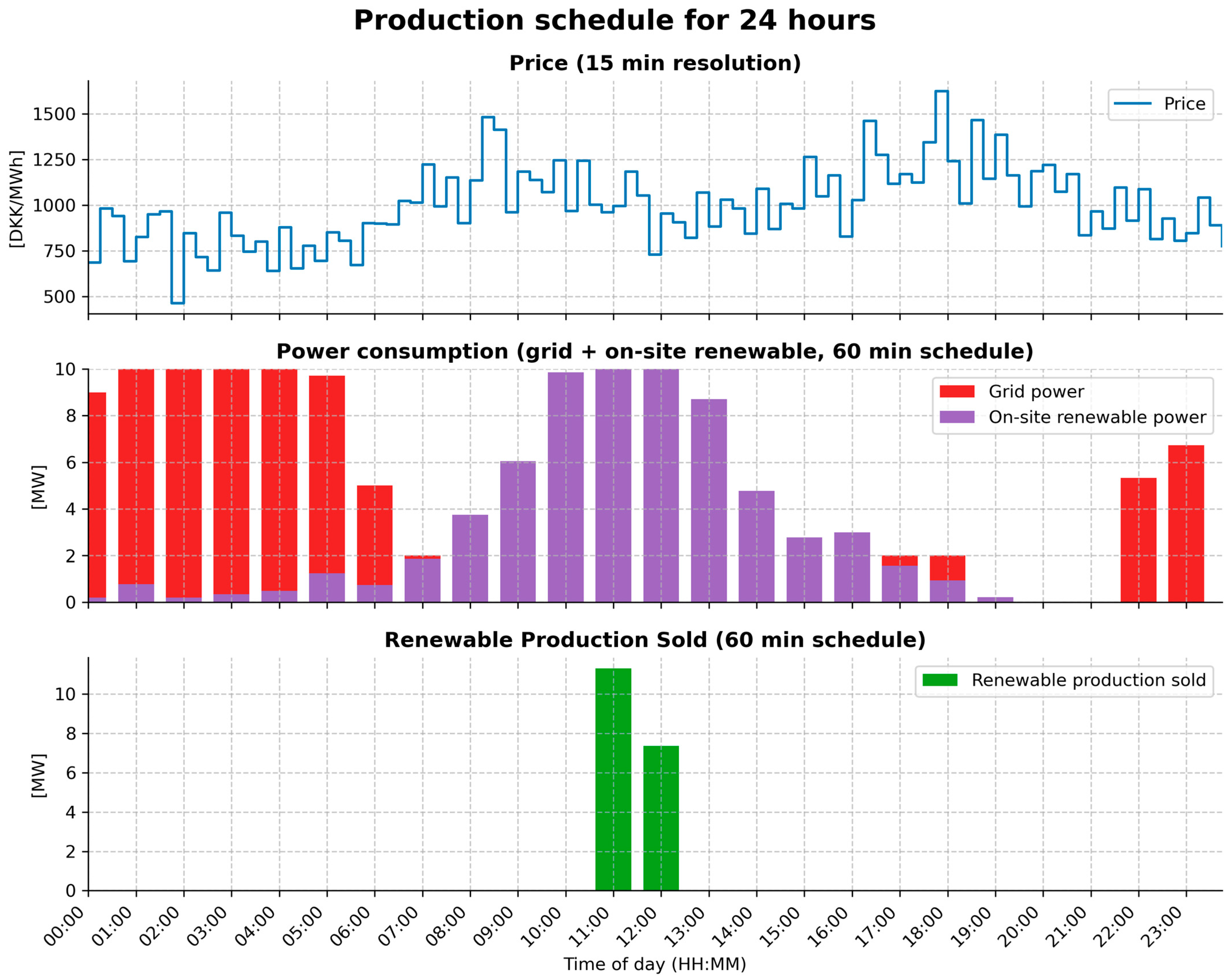

Figure 11 illustrates the daily production schedule for the MIQCP experiment that jointly optimizes hydrogen production costs and revenue from selling on-site renewable electricity under the 15 min MTU, using the dataset with a volatility variation = 0.25. Comparing

Figure 9 and

Figure 11, both representing the same day, highlights the practical implications of the two objective functions. The extended objective in

Figure 11 shifts operational behavior to exploit price peaks through strategic grid exports, thereby demonstrating the interplay between production flexibility and revenue maximization. In contrast, the objective function in

Figure 9 focuses on maximizing the utilization of on-site renewable electricity to minimize grid purchases and reduce operational costs.

From an environmental perspective, the inclusion of renewable-electricity sales slightly increases the CO2-intensity of hydrogen (1.44–2.11 kg CO2/kg H2) because a smaller fraction of renewable energy is self-consumed. Nevertheless, total emissions remain considerably below those of the static baseline, confirming that the overall system continues to contribute to decarbonization.

Overall, Scenario 3 demonstrates that coupling production and market participation enables PtX facilities to operate not only as hydrogen producers but also as active providers of grid flexibility. By monetizing their ability to respond dynamically to short-term price signals, these systems can enhance profitability, support electricity-market stability, and strengthen the business case for large-scale hydrogen deployment in renewable-rich power systems.

6. Discussion

This study aims to investigate how the European transition to a 15 min MTU influences the operational cost, flexibility, and environmental performance of PtX hydrogen production, and to determine the extent to which adaptive optimization strategies can mitigate volatility risks and harness new market opportunities. The three objectives, validating the proposed MILP/MIQCP models, analyzing adaptive scheduling under sub-hourly volatility, and integrating renewable-electricity sales into the optimization framework, directly shaped the modelling, scenario design, and empirical analysis.

The results across the three scenarios collectively demonstrate that market granularity profoundly affects PtX operational behavior. Adaptive scheduling using MIQCP optimization substantially lowers hydrogen-production costs, up to 40% compared with static or non-adaptive strategies, confirming that finer temporal resolution unlocks significant flexibility value. However, the findings also indicate that the cost improvements are accompanied by slight increases in CO2 emissions under high-volatility conditions, as optimization tends to exploit low-price grid electricity with associated CO2 emissions. Extending the optimization objective to include renewable-electricity sales shifts PtX facilities from cost-minimizing consumers to active market participants, improving net revenues by roughly 9%. These outcomes collectively address the research question: adaptive optimization is both necessary and effective for achieving techno-economic efficiency in hydrogen production under sub-hourly market conditions.

6.1. Adaptive Optimization and Industrial Flexibility in Context

The cost and emission reductions observed in Scenario 1 validate the effectiveness of optimization-based control in industrial energy systems. These outcomes are consistent with DSM studies, such as those by [

54], who demonstrated that shorter optimization horizons enhance operational flexibility and reduce costs in energy-intensive industries. However, unlike most prior studies that relied on linear or deterministic models, this research incorporates the non-linear efficiency characteristics of electrolyzers, enabling continuous adaptation to price and renewable signals. This approach aligns with the recommendations of [

36], who highlighted the importance of capturing process-level, non-linearities in hydrogen systems to improve modeling accuracy.

At the same time, the results diverge from earlier DSM findings by quantifying benefits at the sub-hourly level. While previous hourly studies reported operational-expenditure reductions of 5–10%, the present analysis identifies savings up to 40%, illustrating that the flexibility potential of PtX facilities is much greater when market granularity and adaptive optimization are jointly considered. This difference can be attributed to the system’s ability to exploit transient 15 min price dips, opportunities that hourly models inherently smooth out.

6.2. Sub-Hourly Market Granularity and Its Operational Consequences

Scenario 2 quantifies, for the first time, the operational consequences of the 15 min MTU transition for PtX facilities. The findings confirm the system-level expectations articulated by [

12,

37] that shorter MTUs enhance flexibility and price efficiency. Yet this study goes beyond system-level analysis by demonstrating the facility-level mechanisms through which these benefits are realized. The MIQCP-optimized schedules dynamically shift consumption toward low-price intervals, yielding significant cost savings, while maintaining high electrolyzer utilization. These results empirically substantiate the theoretical flexibility potential proposed by [

45], who modeled sub-hourly electrolysis using simplified dispatch assumptions.

However, the observed trade-off between economic performance and emissions offers a novel insight that departs from the uniform optimism of most of the market-integration literature. The modest rise in CO

2 intensity under high-volatility conditions reflects the temporal mismatch between market prices and carbon intensity, a phenomenon similar to the forecast-error amplification reported by [

38]. This finding suggests that market reform alone cannot guarantee emission-optimal outcomes unless carbon-intensity signals or real-time guarantees of renewable sourcing are embedded within market mechanisms. To mitigate the trade without significantly compromising cost savings, several approaches can be directly incorporated into the existing framework: (i) adding a carbon-intensity constraint (e.g., an upper bound on hourly or daily kg CO

2/kg H

2), (ii) reformulating the problem as a multi-objective optimization that minimizes cost while keeping CO

2 emissions below a predefined threshold, or (iii) including a carbon-price signal or real-time emission factor in the objective function. These modifications would allow operators to tune the cost–carbon trade-off according to regulatory requirements or corporate sustainability targets.

Furthermore, the adaptive 15 min schedules derived in this study significantly improve cost efficiency. However, the resulting frequent part-load operation and rapid ramping may accelerate stack degradation and increase long-term O&M costs, as recent studies have shown that short-term intermittent and variable operation induces enhanced corrosion, catalyst dissolution, and accelerated performance loss in alkaline electrolyzers [

55,

56]. Degradation modelling was deliberately excluded from the present analysis in order to isolate the first-order economic and flexibility benefits of the new market regime; quantifying and mitigating degradation effects through ramp-rate limits, cumulative damage costs, or technology-specific durability constraints is, therefore, reserved for future work.

While this study focuses on a fixed electrolyzer capacity, hydrogen-demand requirement, and renewable-generation configuration to isolate the first-order impact of market-time-unit reform, the integrated ABS–MIQCP framework is fully capable of accommodating variation in these parameters. Incorporating capacity-scaling effects, alternative hydrogen-demand profiles, or different renewable-share scenarios would enable a broader assessment of robustness and generalizability across PtX system sizes and regional resource conditions. Such extensions were not pursued here to maintain a clear analytical focus on market granularity, but they constitute natural directions for applying the framework to strategic PtX planning, infrastructure sizing, and long-term investment studies.

6.3. Electricity-Market Participation and Revenue-Driven Behavior

Scenario 3 demonstrates how incorporating electricity-sales revenue transforms PtX operational strategies and financial performance. The observed shift from cost minimization to profit maximization mirrors the “dual-role” behavior of electrolyzers described by [

30,

31], who found that electrolyzers can serve as both flexible loads and grid-support assets. In this study, however, the dual role is operationalized quantitatively through MIQCP-based scheduling, which determines optimal buy–sell switching points based on sub-hourly price signals.

The resulting 9% improvement in net revenue extends the techno-economic findings of [

34], who reported comparable profitability margins in hourly intraday markets. By modeling intra-hour volatility explicitly, this research reveals additional value streams not captured in prior analyses. The accompanying rise in CO

2 emissions remains moderate, consistent with [

33] and [

32], who observed similar sustainability trade-offs in renewable-fuel production systems that engage in active market participation. Thus, this study underscores the need to balance economic incentives with carbon-aware scheduling if PtX facilities are to contribute fully to net-zero objectives.

6.4. Integration with Synthetic-Data Modeling and Literature Comparison

The use of synthetic 15 min price datasets in this study enables reproducible, controlled analysis of volatility effects that could not be observed using existing hourly datasets. This methodological choice aligns with the synthetic-data applications reported by [

43,

44], who demonstrated that such data generation can effectively simulate unimplemented market regimes. However, this study advances the approach by directly coupling synthetic data with process-level optimization, thereby linking system-level market design research with plant-level operational analysis.

The results validate that intra-hour volatility has quantifiable impacts on PtX operations, supporting the theoretical arguments of [

15] that market volatility and adaptive control co-evolve in high-renewable grids. The findings also highlight that adaptive optimization can convert volatility from a risk factor into an opportunity, a perspective rarely emphasized in the prior PtX or DSM literature, where variability was typically treated as a disturbance to be mitigated rather than exploited.

6.5. Implications for Sector Coupling and Market Design

Interpreting these findings in a broader context reveals how sub-hourly markets redefine the operational and strategic role of PtX systems. By enabling electrolyzers to respond to high-frequency price fluctuations, the 15 min MTU effectively integrates hydrogen production into short-term balancing markets. This observation corroborates the policy objectives outlined in [

23] and empirically substantiates claims that sector-coupled assets can stabilize renewable-rich systems.

At the same time, the results suggest that policy and market design must evolve further to capture the full flexibility potential of PtX. Without corresponding signals for carbon intensity, ancillary services, or congestion management, the current market structure may encourage economic optimization at the expense of emission reduction. This conclusion is consistent with insights from [

54], who stressed that multi-objective optimization frameworks, balancing cost, carbon, and flexibility, will be essential for future market participation of flexible industrial assets.

Overall, the findings show that adaptive optimization substantially enhances the economic and operational performance of PtX hydrogen systems under the new 15 min market regime, confirming the central research hypothesis. This research further demonstrates that finer temporal granularity introduces complex trade-offs between cost and emissions, and that synthetic-data-driven modeling provides a valid, reproducible basis for analyzing these effects. Compared with existing literature, this study distinguishes itself by providing process-level empirical evidence that connects regulatory reform, optimization modeling, and operational flexibility within a unified analytical framework.

7. Conclusions

This study examined the operational and economic implications of the European day-ahead electricity market’s transition from an hourly (60 min) to a 15 min Market Time Unit for Power-to-X (PtX) hydrogen-production facilities. Using an integrated agent-based simulation framework, combined with synthetic 15 min price datasets and advanced optimization models, mixed-integer linear programming (MILP), and mixed-integer quadratically constrained programming (MIQCP), this research quantified how sub-hourly market granularity reshapes PtX scheduling strategies. In the hourly baseline, the MIQCP formulation reduced hydrogen-production cost by approximately 63% and CO2 emissions by roughly 61% relative to static operation through accurate representation of electrolyzer non-linearities. Under the 15 min regime, adaptive scheduling exploited intra-hour price volatility to yield up to 40% additional cost savings, demonstrating substantial flexibility potential despite modest emission increases linked to carbon-intensive grid periods. When on-site renewable-electricity sales were included in the optimization objective, net revenue improved by around 9–11%, evidencing the dual role of PtX facilities as both hydrogen producers and active electricity-market participants.

Scientifically, this study advances the state of knowledge in three major ways. First, it develops and validates advanced optimization formulations (MILP and MIQCP) implemented within an agent-based simulation framework to evaluate hydrogen-production scheduling under dynamic electricity prices. The MILP model offers computational efficiency for long-horizon simulations, whereas the MIQCP formulation accurately represents non-linear electrolyzer performance and its interaction with variable grid conditions. Second, it bridges a critical gap in sub-hourly market modeling by introducing a reproducible synthetic-data framework that preserves statistical fidelity while enabling controlled volatility analysis, addressing the temporal-resolution and scenario-data gaps identified in the prior literature. Third, it provides new theoretical insight into the interplay between market granularity, operational flexibility, and process efficiency, showing empirically how the forthcoming 15 min Market Time Unit reform converts volatility from a cost risk into a flexibility opportunity for sector-coupled hydrogen systems. These contributions extend traditional demand-side-management research, typically confined to hourly resolutions and linear process approximations, into the sub-hourly domain relevant to emerging European electricity markets.

Practically, the findings deliver actionable guidance for PtX developers, operators, and energy-market regulators. For facility operators, the results demonstrate that adopting adaptive optimization can reduce production costs by up to two-thirds and increase profitability under volatile markets. For future PtX operations, the results imply that facility owners should prioritize real-time adaptive control systems and bidirectional market participation to remain competitive in the now-operational 15 min MTU market regime. For policymakers and transmission-system operators, the analysis quantifies how regulatory granularity reforms enhance system flexibility but also require supporting digital infrastructure for high-frequency forecasting and carbon-aware market signals. For the broader energy-system community, the demonstrated methodology provides a scalable framework for evaluating other flexibility assets, batteries, heat pumps, or industrial loads, under high-resolution market conditions.