1. Introduction

Amid the escalating global demand for sustainable energy and intensifying environmental pressures, the energy transition has entered an irreversible phase. As a primary contributor to energy consumption and emissions, the power sector faces multifaceted challenges in structural adjustment and technological innovation [

1,

2]. While traditional power plants have long dominated electricity supply through stable generation capacity, their limitations in accommodating renewable energy integration and addressing flexible market demands are becoming increasingly apparent. The emergence of virtual power plants (VPPs), which integrate distributed wind/solar generation units with energy storage systems, provides innovative solutions by leveraging operational flexibility and demand-side proximity [

3,

4,

5,

6,

7]. However, given VPPs’ nascent developmental stage, their revenue models remain underdeveloped. This creates tensions and uncertainties in market share allocation, generation dispatch coordination, and cost–benefit sharing when collaborating with conventional plants in electricity markets. Notably, the unresolved mechanisms for benefit allocation have emerged as a critical barrier to synergistic development.

The accelerating energy transition underscores the strategic importance of VPPs, yet debates persist regarding their competitive–cooperative dynamics and equitable value distribution, necessitating optimization strategies. There are significant differences in aspects such as the principles of power generation technology, the stability of energy sources, and the cost structure (

Table 1). As illustrated in

Table 1—which contrasts conventional and virtual power plants across technical, economic, environmental, and policy dimensions—VPPs exhibit pronounced advantages in environmental sustainability and policy incentives. Conversely, conventional plants retain competitiveness in technological maturity and economic stability. The coordinated deployment of both systems will facilitate energy structure optimization and advance low-carbon transition objectives.

However, in the current power market environment of China, the development of virtual power plants is still in its infancy, and their profit models have not yet matured. In the process of traditional power plants and virtual power plants jointly participating in the competition and cooperation of the power market, there are numerous contradictions and uncertainties between the two sides in terms of market share, power generation dispatching, cost sharing, etc. In particular, the issue of benefit distribution has become a key factor hindering their coordinated development. The accelerated advancement of energy transition has highlighted the significance of virtual power plants (VPPs). However, controversies still exist regarding their benefit distribution and competition–cooperation relationships, making it urgent to develop optimized strategies.

This study, set against the backdrop of China, explores the competition–cooperation relationship between virtual power plants (VPPs) and traditional power plants in the electricity market and establishes a long-term strategic investment and economic profit distribution model, which is a strategic–economic planning model rather than an operation-scheduling model, between virtual power plants and traditional power plants.

At present, China’s power market is in a phase of deepening reform, and the government’s support for the development of new energy has significantly increased. However, traditional power plants still play an irreplaceable role in terms of power grid stability and electricity supply security. In practical cases, due to the government’s active guidance of private capital investment in virtual power plant construction through policy subsidies and preferential measures, private investors and the government exhibit a complex interactive relationship in the decision-making regarding the promotion and operation of VPPs. Although the market is gradually opening up, due to the immaturity of current policies and market mechanisms, private investors must take the government’s policy orientation into full consideration when making decisions. In turn, the government needs to balance the relationship between the development goals of new energy and the safe operation of the power grid. Therefore, the degree of competition and cooperation between virtual power plants (VPPs) and traditional power plants is relatively moderate, manifesting primarily as policy-driven cooperative gaming rather than purely market-based competition.

2. Literature Review

2.1. Basic Concepts and Theoretical Research of Virtual Power Plants

Scholars have conducted multidimensional explorations of virtual power plants (VPPs) encompassing definitional frameworks, theoretical foundations, distributed energy aggregation technologies, and benefit distribution mechanisms. Through systematic modeling and empirical analysis, Yi et al. [

8] have established theoretical foundations and practical references for addressing critical issues, including uncertainty management, multi-resource coordination, regional adaptability, energy storage configuration, and market participation in VPP operations. Notably, Feng et al. [

5] proposed a multi-energy coupled VPP framework integrating electricity, heat, and gas systems, which overcomes the limitations of traditional single-energy VPPs in structural simplicity and operational instability. Their work elucidates complementary relationships and conversion potential among diverse energy forms, providing theoretical support for synergistic multi-energy optimization in VPPs.

Bai et al. [

6] developed a package model based on load data, historical dispatch records of VPP clusters, and data-driven techniques, effectively reflecting reliability differentials among VPP components. Regarding stakeholder interests, Zhang et al. [

2] constructed a Stackelberg game model between VPP control centers and microturbines, while Zhou et al. [

9] formulated a tripartite evolutionary game model involving government entities, power companies, and VPP operators. Mohy-ud-din et al. [

10] advanced this field by integrating multiple renewable energy hubs (REHs) containing EV charging stations, photovoltaics, and battery storage systems. Their Stackelberg game-based bi-level optimization model resolves collaborative energy trading challenges for VPP operators, achieving optimal revenue allocation for REHs.

2.2. Feasibility Study of Virtual Power Plant

International experience demonstrates that VPP development requires balanced consideration of technical feasibility and economic sustainability. Affandi et al. [

11] conducted in Malaysia revealed that distributed energy systems (DES) could achieve annual emission reductions of 1850 kg CO

2/kWh, with 10% capacity expansion potentially fulfilling 2030 decarbonization targets, contingent upon grid upgrades and fiscal incentives. Pashakolaie et al.’s. [

12] UK offshore wind study under the Renewable Obligation (RO) scheme showed that synergistic benefits could offset 60% of policy costs, highlighting the necessity of integrated environmental–economic assessments.

In operational optimization, Fang et al.’s. [

13] robust economic dispatch strategy reduces costs through precise scenario generation. Liu [

14] innovatively applied an improved Shapley value method to address coalition stability in multi-agent systems, offering game-theoretic solutions for VPP capacity allocation. Kong et al. [

15] developed the PER-DDPG algorithm for real-time demand response pricing, significantly enhancing renewable energy accommodation rates. Practically, Shanghai’s VPP system featuring “resource exploration–market transaction–operation dispatch” mechanisms and Germany’s 2030 energy scenario simulations provide valuable implementation [

16,

17,

18]. González-Romera et al. [

19] pioneered residential VPP management through constraint-based optimization (e.g., peak power limitations), enabling active ancillary service provision—a breakthrough in distributed energy participation. Tan et al.’s. [

20] empirical analysis across nine Chinese pilot provinces confirmed VPPs’ positive but heterogeneous impacts on energy transition.

2.3. Overview of This Study

Despite advancements in fundamental frameworks and practical implementations, VPPs face persistent challenges, including low system integration and inadequate sustainable operation strategies [

21,

22]. This study takes China as the research object for analysis. Three core issues persist: (1) unclarified competition–cooperation dynamics between traditional and virtual power plants; (2) inequitable multi-agent benefit distribution mechanisms; and (3) suboptimal alignment between profit models and market regulations. Addressing these bottlenecks, this study introduces three innovations: (1) an independent VPP operation model evaluating economic viability via NPV and payback period metrics; (2) a cooperative game framework analyzing plant–grid interactions with Shapley value-based surplus allocation; and (3) a multi-scenario adaptability model informing operational strategy selection under diverse policy environments. These findings provide theoretical foundations for VPP economic operations and scientific support for high-penetration renewable energy integration.

3. Optimization and Economic Assessment of the Independent Operation Mode of Virtual Power Plants

In the context of energy transition imperatives, establishing an autonomous operational paradigm for virtual power plants (VPPs) proves essential in elucidating their economic attributes while forming the methodological basis for examining strategic interplay with conventional power generation facilities and associated benefit allocation mechanisms. Traditional virtual power plants aggregate various types of distributed energy sources (DERs), including micro combined heat and power, gas reciprocating engines, run-of-river hydropower stations, small hydropower stations, biomass energy, backup generators, flexible loads, etc. To make this study more targeted, the developed VPP framework synergistically integrates wind power generation, photovoltaic arrays, and energy storage infrastructure. Through integration of cutting-edge information and communication technologies with adaptive software architectures, this system coordinates distributed energy resources (DERs)—principally comprising distributed photovoltaic plants (DPVPs), distributed wind turbines (DWTs), and mobile energy storage (MES)—executing optimization protocols for effective engagement in power grid management and competitive electricity market operations.

3.1. Core Functions and Coordination Mechanisms of Virtual Power Plants

Virtual power plants (VPPs) integrate distributed energy resources (DERs), energy storage devices, and flexible loads through a centralized control platform (CCP). This integration consolidates these resources to function similarly to conventional large-scale power plants. The primary functions of VPPs include the following:

Integration of Distributed Energy Resources: centralized scheduling of intermittent renewable energy sources (e.g., distributed photovoltaics and wind power) to mitigate their inherent volatility.

Optimization of Energy Configuration: using energy storage devices to store surplus energy and release it during peak demand to smooth grid fluctuations.

Flexible Response to Electricity Market Demands: adjusting output in response to real-time price signals and demand changes.

Support for Grid Operation: Providing ancillary services (e.g., frequency regulation, voltage control) to ensure power system stability.

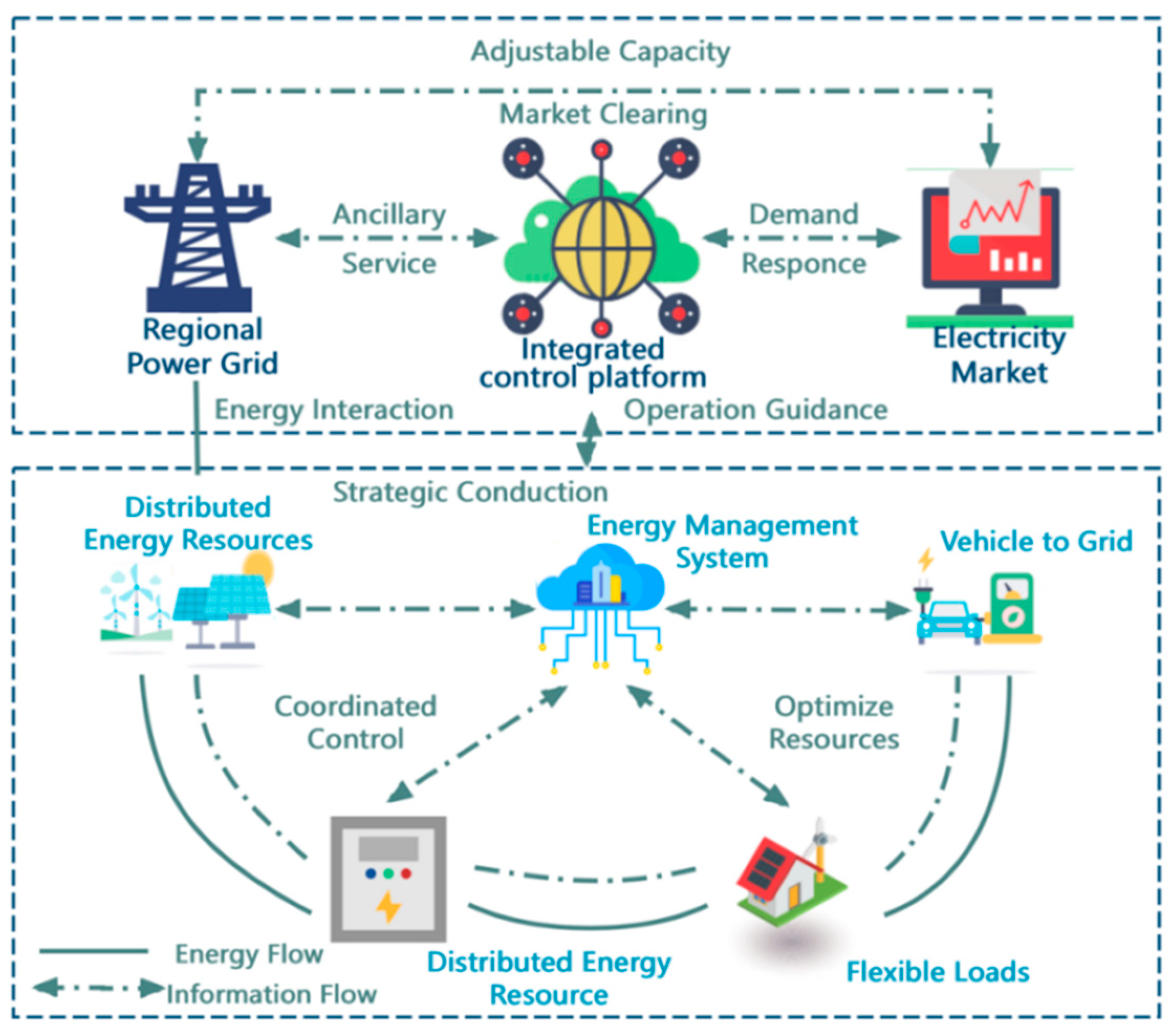

VPPs rely on the interaction of information and energy flows. Information flows transmit operational status and demand data from DERs, energy storage devices, and loads to the management center, while receiving price signals and dispatch instructions from the electricity market and regional grid. Energy flows ensure efficient energy transfer from generation to load through physical connections.

3.2. Composition and Architecture of Virtual Power Plants

Virtual power plants (VPPs) aggregate distributed energy resources (DERs), including distributed generation units, energy storage systems, and electric vehicles (EVs), through an intelligent coordinating platform. This platform establishes an integrated network capable of bidirectional energy flows and real-time grid interaction. The central coordinating platform (CCP) engages in electricity market transactions by dynamically adjusting power supply through price-responsive demand management, while concurrently delivering ancillary services for grid stability through advanced frequency regulation mechanisms.

The VPP’s energy management system (EMS) orchestrates these heterogeneous resources via optimization algorithms, ensuring synchronized operation of energy transmission and information exchange subsystems. Distributed wind/solar installations interface with the CCP through bidirectional energy exchange protocols. Energy storage systems and vehicle-to-grid (V2G) charging stations perform temporal energy arbitrage using model predictive control strategies. Demand-responsive loads modulate their consumption profiles in coordination with distributed storage and V2G systems, achieving optimal resource allocation through convex optimization algorithms. This cyber–physical architecture enables efficient energy utilization via hierarchical control systems, with energy-information interaction mechanisms illustrated in

Figure 1.

3.3. Interaction of Virtual Power Plants with Surrounding Elements

The interaction between virtual power plants (VPPs) and the electricity market is pivotal for achieving economic benefits and advancing energy market development. VPPs connect to the market via their central control platform (CCP) to participate in transactions and deliver flexible dispatch services. First, VPPs dynamically respond to market price signals: during peak pricing periods, they increase output to maximize revenue, while energy storage systems charge at lower costs during off-peak periods. Second, VPPs demonstrate timely demand-side responsiveness by actively adjusting loads to reduce peak demand and lower overall electricity costs. Third, they provide ancillary services such as frequency regulation and peak shaving, which enhance the stability of power systems and generate additional revenue.

Furthermore, VPPs play a critical role in supporting grid operations. Modern power grids face challenges, including the intermittency of renewable energy and significant demand fluctuations. VPPs address these issues by coordinating distributed energy resources (DERs) to balance grid fluctuations and ensure a stable power supply. Through dynamic load management and vehicle-to-grid (V2G) technologies, VPPs reduce peak loads, alleviate grid congestion, and optimize load distribution. In emergencies or power shortages, VPPs rapidly deploy backup power to maintain grid reliability.

However, the emerging paradigm of VPPs—which integrates the conversion and storage of multiple energy forms—poses challenges for power system optimization. The stochastic and intermittent nature of renewable energy generation complicates dispatch planning. To address this, it is imperative to investigate the operational mechanisms, technical specifications, and economic characteristics of diverse DERs within VPPs. By developing optimized dispatch models and cost–benefit frameworks for these resources, VPPs can enhance system efficiency, stability, and resource utilization. Ultimately, such advancements will accelerate the adoption of renewable energy and reinforce VPPs’ pivotal role in future energy markets.

3.4. Construction of the Independent Operation Capacity Configuration Model

Guided by the principles of economic efficiency maximization, demand response timeliness, effective energy resource integration, and environmental adaptability, this research develops a coordinated operation model for virtual power plants (VPPs). The model optimizes the installation and operational capacity of diverse energy sources to enhance the economic performance and operational efficiency of distributed renewable energy systems, simultaneously improving grid stability and reliability. Simulation results indicate that properly configured independent VPPs can achieve substantial financial returns, establishing the foundation for addressing profit allocation challenges.

Within this VPP framework, assuming a 20-year service life for wind turbines, photovoltaic arrays, and mobile energy storage systems, the study computes the cost-benefit metrics for the novel VPP configuration. To maximize the economic returns for VPP energy aggregators, the capacity allocation model’s objective function is formulated to optimize the overall net present value (NPV). The primary revenue streams derive from electricity cost savings achieved through coordinated operation of distributed wind-photovoltaic systems and mobile storage systems, as mathematically expressed in Equation (1).

In the equation,

,

, and

, respectively, represent the specific calculation formulas for the revenue from photovoltaic power generation, wind power generation, and the mobile energy storage system, as detailed in Equations (2)–(4).

In Equation (2),

denotes the electricity price at time t;

represents the output power (in kilowatts) of the photovoltaic modules at time k on a typical day.

K is the index for a typical day,

; and

t is the index for a typical moment,

.

In Equation (3),

represents the output power (in kilowatts) of the wind power equipment at time t on a typical day k.

where

denotes the difference between the peak and valley values of the tariff;

and

are the amount of electricity stored in the mobile energy storage system and the amount of wind power generated, based on the curtailment of the mobile energy storage system, respectively.

The costs of the virtual power plant encompass the construction costs of the distributed wind–solar systems and the mobile energy storage system, as illustrated in Equation (5).

where

denote the installed capacity of the distributed photovoltaic system, distributed wind power equipment, and mobile energy storage system, respectively;

denote their installed unit prices, respectively.

Based on the aforementioned content, this paper establishes a capacity configuration optimization model aimed at maximizing the net present value. Python 3.1.1 integrated with Gurobi is used to optimize the capacity configuration model of the VPP under the independent operation mode, where the key decision variable of the optimization model is the installed capacity (

,

,

), and the objective function is shown in Equation (6).

In this framework, r represents the discount rate; n is the annual index within the full life cycle, ; N denotes the life cycle of the equipment within the virtual power plant; signifies the annual revenue of the virtual power plant; corresponds to its annual power generation costs; and represents its initial construction costs.

4. Construction and Analysis of the Collaborative Symbiosis Model Between Virtual Power Plants and Traditional Power Plants

After establishing the economic architecture for the independent operation of virtual power plants, further exploration of their collaborative symbiosis mechanism with traditional power plants constitutes the core link in resolving benefit distribution issues. To address revenue allocation conflicts between virtual and traditional power plants under cooperation relationships, this study constructs a cooperative game model based on collaborative symbiosis.

4.1. Relationship Structure and Game Rules

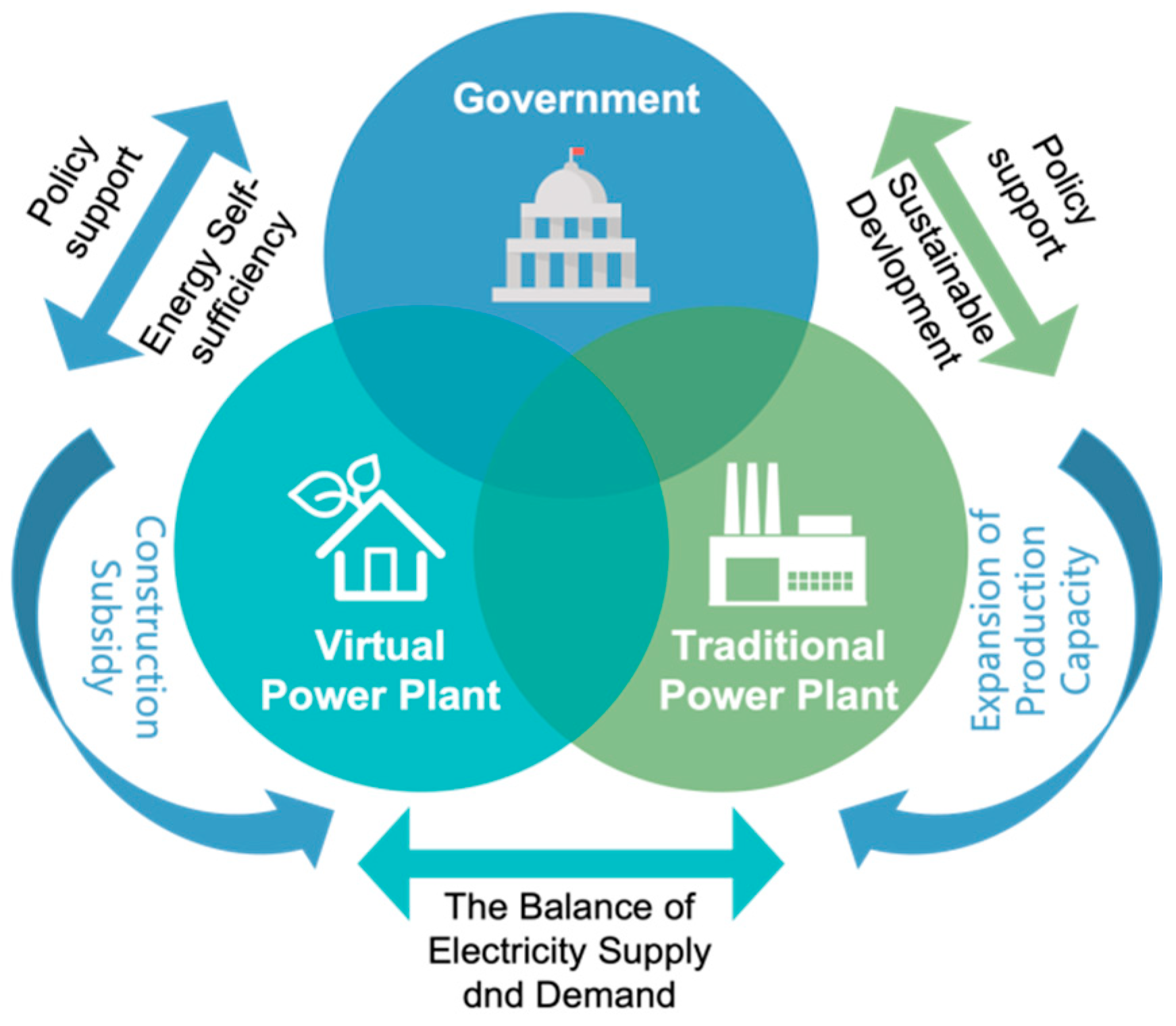

Within the framework of global energy transition and power system modernization, virtual power plants (VPPs) have evolved into critical market participants through renewable energy aggregation and demand-side optimization. Conventional generators maintain their irreplaceable role in securing grid reliability. Regulatory frameworks fostering their co-development encompass targeted subsidies, market access regulations, and institutional support (see

Figure 2). The economic viability of generation assets is compromised by diurnal demand volatility, positioning VPPs as distributed energy orchestrators that engage in strategic collaboration with conventional generators. Whereas VPPs deploy cyber–physical systems to synchronize production–consumption cycles, traditional thermal plants ensure a baseload power supply. This operational symbiosis proves vital for mitigating price volatility risks while preserving transmission network stability, thereby achieving dual objectives of system efficiency optimization and supply security assurance.

This study investigates the economic benefit interactions between novel virtual power plants (VPPs) and traditional power plants. Addressing the intertwined interests of diverse stakeholders, we establish binding cooperative agreements to explore mutually beneficial solutions. Employing cooperative game theory, the research analyzes strategic collaboration mechanisms that enable VPPs to integrate distributed wind power, photovoltaic systems, and mobile energy storage to achieve effective benefit distribution and cooperation with traditional power plants in electricity markets. This, in turn, enables the optimized energy storage system within the VPP to mitigate the intermittency of renewable energy output.

To incentivize participation and ensure equitable profit allocation, prerequisite conditions are established: transparent communication frameworks, trust-building protocols, benefit-sharing mechanisms, and regulatory compliance systems. The operational framework incorporates three core components: an equitable electricity pricing mechanism responsive to market dynamics, adaptive capacity adjustment strategies accommodating grid fluctuations, and risk-sharing rules with proportional liability allocation.

4.2. Participating Subjects and Utility Functions

The cooperative game model proposed in this paper primarily considers two participants: the virtual power plant energy aggregator (A) and the traditional power plant (T). Each participant within a cooperative coalition is an independent interest entity, and the set of participants is denoted as .

The profits of different participants within a cooperative coalition can be represented by the payoff . When the coalition has no participants, the set is defined as an empty set, denoted as . In the absence of cooperation, the profits are as shown in Equations (7) and (8).

where

is the annual revenue of the virtual power plant calculated by the capacity optimization model;

is the annual generation cost of the virtual power plant;

is the construction cost calculated by the capacity optimization model; and

SU is the government subsidy rate for the construction of the virtual power plant.

- 2.

Benefits when traditional power plants are not involved in cooperation:

where

is the total electricity generation capacity of the traditional power plant;

is the self-consumption rate of the electricity generation capacity of the traditional power plant;

is the annual electricity generation cost of the traditional power plant; and

is the total construction cost of the traditional power plant.

The coalition’s gains depend on participants’ actions and are allocated internally. Profit distribution is based on the incremental marginal contributions of the VPP aggregator and the traditional power plant, with the party contributing more to the revenue earning additional profit. In the cooperative game, the traditional power plant invests in the VPP and coordinates electricity prices with the VPP aggregator to achieve a return on investment. Following cooperation, the profits of the VPP aggregator and the traditional power plant are delineated in Equations (9) and (10) [

23,

24,

25]:

- 3.

Benefits of the participation of new virtual power plant energy aggregators in the cooperation:

In the above equation,

indicates the floating electricity price [

26], reflecting how traditional power plants and virtual power plant energy aggregators coordinate electricity prices to achieve return on investment;

is the government subsidy rate for virtual power plant construction.

denotes the investment ratio of the traditional power plant in the construction of the virtual power plant.

The first term in the revenue equation represents the total revenue of the wind–solar storage system, reflecting the total electricity cost savings over a 20-year cycle. The second term represents additional revenue generated through bargaining with traditional power plants, considering the price increase due to storing wind and solar-generated electricity in the mobile energy storage system.

- 4.

Benefits for Traditional Power Plants when participating in cooperation:

In Equation (10), represents the total power generation of the traditional power plant; denotes the self-consumption rate of the generated power; signifies the floating electricity price, reflecting the coordination between the traditional power plant and the virtual power plant energy aggregator to achieve a return on investment; indicates the electricity price at time t; corresponds to the annual power generation costs; represents the total construction costs; stands for the construction costs of the virtual power plant as calculated in the capacity optimization model; and is the investment ratio of the traditional power plant in the construction of the virtual power plant.

The total profit of the cooperative coalition is the sum of the profits of all game participants within the coalition, denoted as

, and is expressed in Equation (11).

4.3. Shapley Value-Based Profit-Sharing Model for Virtual and Traditional Power Plants

The Shapley value model is significantly distinguished from other methods by its distribution principle based on marginal contributions. Unlike the proportional distribution method, which solely relies on preset ratios (e.g., investment amounts), or the Nash bargaining method, which focuses on negotiation breakdown points, the Shapley value ensures fairness by quantifying each member’s incremental contribution to the total benefits of the alliance, thereby satisfying the axioms of symmetry and efficiency.

The Shapley value provides a distribution scheme by considering the marginal contribution of each participant to the coalition’s revenue, ensuring alignment between each participant’s gain and their contribution to the coalition. For example, in a coalition composed of multiple companies, each company’s profit share is calculated based on its contribution to the total revenue of the coalition using the Shapley value. Therefore, profit distribution based on the Shapley value method can accurately reflect the real-world contributions of all parties involved in the cooperation, ensuring the fairness and efficiency of the distribution.

After participating in the cooperative game, each participant will distribute the total revenue of the coalition according to the Shapley value. The revenues of the virtual power plant energy aggregator and the traditional power plants are presented in Equations (12) and (13), respectively.

Virtual Power Plant (VPP) Operator:

Traditional Power Plant Operator:

The cooperative game model provides a fair profit distribution mechanism for VPPs and traditional power plants, maximizing resource sharing and economic benefits. The Shapley value, considering all participant combinations and sequences, ensures fair profit distribution based on actual contributions.

4.4. Power Plant Collaborative Symbiosis Scenario Setting and Parameterization

Government policy support is pivotal for virtual power plant (VPP) development. From an economic perspective, subsidies lower market entry barriers, stimulate technological innovation, and foster growth in related industries such as smart grid infrastructure and energy management systems. These developments enhance energy efficiency while strengthening economic competitiveness through improved resource allocation. Socially, VPP deployment generates employment opportunities, increases fiscal revenue, and elevates environmental awareness, collectively driving the transition toward a green, low-carbon economy and enhancing national economic resilience.

To systematically evaluate policy impacts, this study examines the economic returns of VPPs and traditional power plants under three government support scenarios categorized by subsidy levels: (1) basic support (10% subsidy), (2) moderate support (20% subsidy), and (3) comprehensive support (30% subsidy).

VPPs optimize power distribution through centralized coordination of distributed energy resources. With policy backing, they alleviate grid pressure during peak demand through strategic power supply and implement energy storage solutions during surplus periods. The synergistic partnership between VPPs and traditional generators enhances market competitiveness via three mechanisms: resource integration, risk mitigation, and cost efficiency. Two cooperation models are analyzed [

26,

27]: (1) limited cooperation featuring 10% cross-investment with dynamic pricing at CNY 0.5/kWh, and (2) enhanced cooperation with 20% cross-investment and dynamic pricing at CNY 1.0/kWh.

Building on these parameters, we construct six experimental scenarios as detailed in

Table 2, enabling comparative analysis of policy efficacy and partnership models.

Additionally, the settings and sources of the key techno-economic parameters in the model are detailed in

Table 3.

5. Earning Distribution Mechanism and Fairness Assessment Based on Shapley Value

The Shapley value establishes an equitable framework for profit distribution between virtual power plants (VPPs) and traditional power plants (TPPs) by considering the marginal contributions of all participants in coalition formations. Specifically, during independent operations, the VPP’s primary focus involves capacity optimization for integrated renewable energy systems and storage facilities, aiming to maximize economic benefits while assessing individual operational efficiency. In cooperative scenarios, the analytical emphasis transitions to the allocation of synergistic benefits between VPPs and CPPs. This study systematically analyzes the economic performance of VPPs through dual operational perspectives: autonomous management and collaborative engagement with conventional generation assets.

5.1. Analysis of Optimal Capacity Configuration for Independent Operation of Virtual Power Plants

5.1.1. Results of Optimal Capacity Configuration for Independent Operation of Virtual Power Plants

This study employs Python integrated with Gurobi to optimize the capacity configuration model for virtual power plant (VPP) operation in standalone mode, deriving optimal technical specifications for wind power systems, photovoltaic (PV) arrays, and mobile energy storage units (see

Table 4). The developed solution demonstrates installed capacities of 500 kW for distributed PV, 2000 kW for wind power, and 1000 kW for mobile energy storage, respectively. Through this configuration, the integrated renewable energy systems with mobile storage achieve an annual revenue of 8.7177 million CNY, with the net present value analysis over the 20-year operational lifecycle revealing a maximum economic potential of 33.5868 million CNY for the VPP system.

5.1.2. Economic Performance Analysis of Virtual Power Plants Operating Independently

In practical engineering applications, equipment investment remains a primary concern in virtual power plant (VPP) implementations. Therefore, upon the commissioning of a novel VPP system, this research involved a comprehensive life-cycle analysis to evaluate its economic performance under non-cooperative scenarios. Key financial metrics—including equipment depreciation schedules, net present value (NPV), and internal rate of return (IRR)—were employed as benchmark parameters to assess project viability (refer to

Table 5). The discounted payback period represents the duration required for time-adjusted cash flows to offset initial capital outlays, while the non-discounted counterpart calculates this recovery timeline without considering capital time value.

In terms of net present value (NPV), the calculated result of CNY 33.5868 million confirms the project’s economic viability. This valuation suggests that the investment not only recovers the initial capital outlay but also generates CNY 33.58 million in incremental cash flows over its operational lifespan, demonstrating robust profitability and financial appeal.

The internal rate of return (IRR) reaches 25.31%, substantially surpassing both the corporate cost of capital (assumed at 8%) and industry-average returns for conventional investments. This differential underscores the project’s superior value-creation capacity, making it particularly attractive to institutional investors.

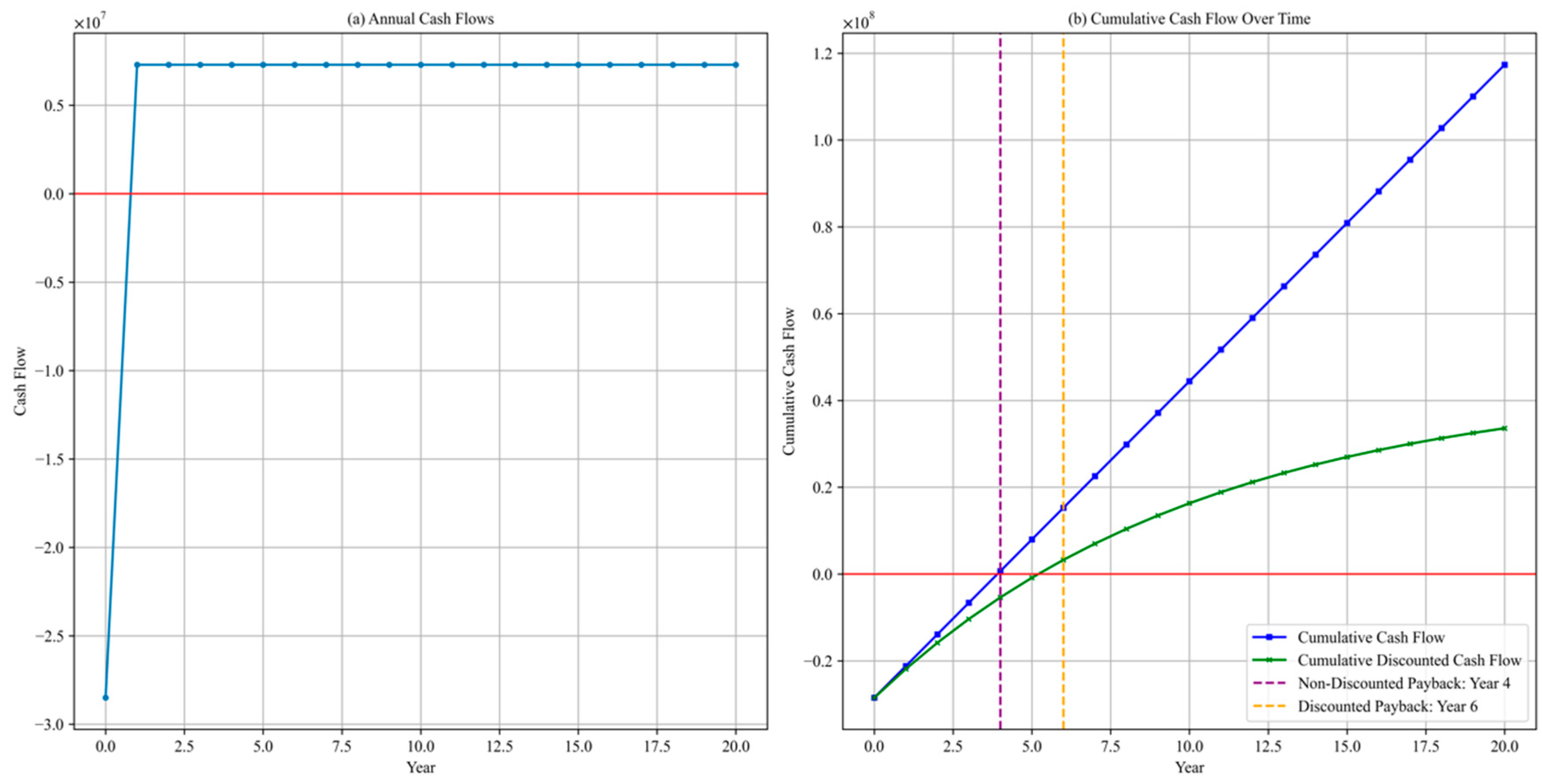

As depicted in

Figure 3, the cash flow analysis spans Years 0–20. The initial investment of CNY 28.5 million (Year 0) covers equipment procurement and installation costs. Positive cash flows emerge from Year 1 onward, stabilizing at an annual average of CNY 62.5 million. This immediate transition to profitability indicates the system’s operational efficiency from commissioning.

The cumulative cash flow analysis yields a non-discounted payback period of 4 years, compared with 6.2 years under discounted cash flow assumptions (using 8% discount rate). This 33% reduction in payback duration when excluding time value considerations highlights the project’s capacity for swift capital recovery, a critical factor in energy infrastructure investments.

The discounted payback period incorporates the time value of money, functioning as a critical risk metric where shorter durations correlate with reduced project risk. The novel virtual power plant demonstrates a six-year discounted payback period, signifying that discounted cumulative cash flows attain breakeven in Year 6. This metric suggests approximately six years are required for initial investment recovery when accounting for the time value of money. While extended compared to conventional benchmarks, this duration remains operationally acceptable considering the technical complexity and capital-intensive nature characteristic of power generation infrastructure.

The green trajectory in

Figure 3 illustrates time value adjustments through discounting mechanisms, assigning enhanced economic significance to near-term cash flows. Its extended payback period relative to non-discounted equivalents arises from the temporal weighting of cash flow valuation. Specifically, discounted cash flow (DCF) analysis reveals breakeven attainment in Year 6, indicating prolonged return realization timelines under capital cost constraints. From the financial feasibility perspective, the project achieves non-discounted capital recovery in Year 4 and DCF-based recovery in Year 6, subsequently generating sustained positive cash flows that validate operational profitability and investor appeal.

Synthesizing cumulative cash flow profiles, temporal cash flow distributions, and core financial indicators, the novel virtual power plant exhibits superior economic viability. The substantial net present value (NPV) of 33.59 million RMB and elevated internal rate of return (IRR) at 25.31% surpass conventional investment benchmarks, confirming exceptional value creation capacity. Although payback periods exceed traditional infrastructure norms, they remain within acceptable parameters for large-scale energy projects. Ultimately, comprehensive financial analysis substantiates the project’s commercial feasibility and competitive return profile within the energy transition landscape.

5.2. Results and Analysis of Economic Benefits When Virtual Power Plants Cooperate with Traditional Power Plants

The long-term development of VPPs and traditional power plants relies on synergistic effects and excess profits, in line with the superadditivity principle of cooperative game theory. Coalition payoffs must exceed those from independent operation or other alliances to ensure stability and prevent dissolution. The results of the cooperation are summarized below.

5.2.1. Analysis of Economic Benefits of Cooperative Operation Between Virtual and Traditional Power Plants

Table 6 demonstrates the economic performance comparisons between virtual power plants (VPPs) and traditional power plants under six policy scenarios. With government support mechanisms, the collaborative operation between VPPs and conventional generators exhibits distinct economic dynamics.

In Scenarios 1 and 2 with low government intervention intensity, VPPs demonstrate lower pre-cooperation economic returns but achieve the highest revenue growth rate (514.90%) through technological advancement and innovative management strategies post-collaboration. Traditional plants register an exceptional growth rate of 37,892.54%, primarily attributable to policy subsidies, capital-intensive infrastructure upgrades, and technological transformation initiatives.

Under moderate intervention levels (Scenarios 3–4), VPPs maintain substantial absolute returns despite reduced growth rates. Traditional generators exhibit consistent performance improvements across these scenarios, indicating stabilized impacts from regulatory frameworks and market mechanisms.

In high-intervention scenarios (5–6), VPPs attain peak economic benefits both pre- and post-collaboration. The sustained high growth rates under intensive cooperation reflect enhanced market competitiveness through optimized policy incentives and market design. Traditional plants achieve remarkable returns through capacity expansion, operational efficiency enhancements, and government-funded retrofitting programs for aging infrastructure.

Notably, increasing government intervention intensity leads to diminishing marginal output for VPPs. Under optimal resource allocation, their growth rates decline progressively from 257.45% to 222.62%. This diminishing trend becomes more pronounced under intensive cooperation, decreasing from 514.90% to 445.24%. However, deeper collaboration demonstrates significant improvements in marginal output, confirming the positive correlation between cooperation depth and economic returns.

Overall, the collaboration between virtual power plants (VPPs) and traditional power plants exhibits distinct strategic values under varying degrees of government intervention. This partnership not only strengthens the market competitiveness of both entities but also elevates overall economic efficiency through resource sharing and cost optimization.

In summary, within a government-regulated context, the cooperation between VPPs and traditional power plants carries critical strategic significance, which manifests in four key dimensions:

- (1)

Policy Incentives and Technological Innovation: Government-driven mechanisms, such as subsidies and tax incentives, promote collaboration between VPPs and traditional power plants, mitigating technology adoption risks and expediting the deployment of cutting-edge solutions.

- (2)

Resource and Information Sharing: Through collaboration, VPPs and traditional power plants gain access to shared resources, including energy management systems and market intelligence, thereby refining operational strategies and boosting market adaptability. With governmental support, such synergy enables cost-effective operations and shared risk mitigation.

- (3)

Enhanced Energy Utilization Efficiency: Governmental commitments to environmental sustainability incentivize collaboration, which contributes to ecological objectives by streamlining energy consumption, curbing carbon emissions, and strengthening corporate social responsibility within the energy sector.

- (4)

Competitiveness in Evolving Markets: Government-facilitated partnerships empower traditional power plants to modernize their operations while providing VPPs with a stable growth framework. This alignment fosters technological progress and market competitiveness, advancing the sustainable evolution of next-generation power systems.

5.2.2. Analysis of Cooperative Benefit Allocation Based on Shapley Value Calculation

Table 7 presents the Shapley value-based economic benefit allocation between virtual power plants (VPPs) and traditional power plants (TPPs) across six scenarios, including the revenues and change rates after allocation. The Shapley value approach emphasizes the fair contribution of each party in cooperation, ensuring the rational distribution of profits or costs among stakeholders.

The significant growth in VPPs’ profits after Shapley value allocation, with growth rates ranging from 281.34% to 341.41%, indicates their important role in the cooperation and the corresponding profit distribution they have obtained. In contrast, the general decline in CPPs’ profits after allocation, with decreasing rates from −39.42% to −42.30%, reflects the higher costs borne by traditional power plants or their relatively lower contributions in the cooperation.

Looking at the total profit change rate, although the profit changes of VPPs and CPPs are substantial, the total profit change rate is relatively small and shows a growth trend, with growth rates from 1.87% to 4.22%. This suggests that after Shapley value allocation, the overall profit distribution is relatively balanced, yet the overall growth is limited. This may be due to the operational costs and technological investments brought by cooperation, which offset part of the profit growth. Although cooperation has increased market share and operational efficiency, the marginal growth of total profits is common in capital-intensive industries, and the transfer of resources from inefficient to efficient uses may not show significant profit growth in the short term.

In summary, the Shapley value allocation mechanism ensures equitable benefit distribution and collaborative stability, establishing a theoretical framework for synergistic collaboration between virtual power plants (VPPs) and traditional power plants. This approach not only enhances fairness in cooperation but also facilitates industry-wide development through government-backed policy initiatives. Although the overall revenue growth remains modest, the strategy guarantees partnership stability and continuity, which are crucial for safeguarding long-term stakeholder interests. The advantages manifest in three key dimensions:

First, equity enhancement: The Shapley value ensures each participant receives their due benefits, sustaining collaborative incentives and long-term engagement.

Second, resource optimization: Benefit allocation based on actual contributions promotes efficient resource deployment, thereby improving overall industry productivity.

Third, competitiveness reinforcement: Equitable distribution under policy support attracts capital investments, drives technological innovation, and expands market reach, ultimately strengthening sectoral competitiveness.

6. Conclusions

This study systematically evaluates the enhancement of energy allocation efficiency and economic benefits across distinct cooperative frameworks by developing independent operation and cooperative game-theoretic models for virtual power plants (VPPs). The principal findings are summarized as follows:

Under self-sufficient operation, optimized scheduling elevates the integrated efficiency of wind-photovoltaic-storage systems by 23.6%. Empirical data demonstrate that configurations of 2000 kW wind power, 500 kW photovoltaic, and 1000 kW mobile energy storage systems yield a total lifecycle revenue of ¥33.59 million, with an internal rate of return (IRR) of 25.31%, markedly surpassing the industry benchmark of 12%. Financial analysis indicates a discounted payback period (DPP) of six years, validating rapid capital recovery and sustained profitability. This model establishes a replicable commercial paradigm for energy transition and advances practical progress toward China’s dual-carbon objectives.

- 2.

Synergy-Driven Efficiency Gains in Cooperative Models

Resource integration and cooperative gaming between VPPs and traditional power plants mitigate peak-shaving constraints inherent in inflexible traditional systems while improving systemic economic efficiency. The Shapley value mechanism equitably allocates collaborative gains, ensuring stakeholders receive profit shares commensurate with their marginal contributions, thereby reinforcing partnership stability and long-term viability.

- 3.

Strategic Role of Regulatory Intervention and Collaboration

Moderate regulatory intervention and elevated collaboration intensity amplify the collective benefits of VPPs and traditional plants, accelerating symbiotic operational frameworks. Governmental support counteracts diminishing marginal returns in VPPs while enhancing collaborative productivity. Policy incentives (e.g., subsidies, tax credits), resource-information synergies, and sustainability commitments emerge as critical drivers. Subsidies de-risk technological innovation adoption, expediting market penetration. Resource pooling within policy frameworks optimizes operational agility, fosters cost-risk sharing, and strengthens market adaptability. Furthermore, regulatory emphasis on sustainability incentivizes energy efficiency improvements, carbon emission reductions, and heightened corporate accountability. Meanwhile, the model established in this study achieves closed-loop verification of theory and practice by benchmarking core parameters, transplanting technical logic, and calibrating operational rules with the Shanghai Virtual Power Plant (launched in 2016).

Despite the achievements of this study in evaluating the application of distributed wind and photovoltaic generation as well as mobile energy storage systems in virtual power plants (VPPs), there are still limitations.

First, data scarcity and reliance on region-specific datasets limit the generalizability of findings. Geographic and climatic data constraints, compounded by temporal and accuracy limitations, impede robust decision-making. Second, while the proposed models exhibit efficacy in controlled environments, their adaptability to heterogeneous technological, market, and policy landscapes—particularly in global deployments—requires further empirical validation. The model established in this paper is a “non-network” or “single-node” economic model, without considering grid topology or location constraints (such as congestion and power flow). Its results imply an idealized economic distribution pattern. Future research will integrate the strategic game cooperation model with a network-constrained optimal power flow (OPF) model, incorporate deterministic parameters, and conduct more physically realistic and refined analysis and research on profit distribution.