1. Introduction

The global energy landscape is undergoing a profound transformation, driven by two parallel goals: accelerating the low-carbon transition and safeguarding energy security. The outbreak of the war in Ukraine in 2022 triggered a geopolitical and economic shock that disrupted traditional energy supply chains and underscored Europe’s dependency on fossil fuels imported from Russia [

1]. In response, the European Union (EU) has strengthened its policy frameworks, most notably through the REPowerEU Plan and the Fit for 55 package, both of which emphasize diversification of energy sources, expansion of renewable energy, and enhancement of energy resilience [

2]. Within this strategic context, the Baltic Sea has become a critical maritime corridor linking fossil fuel imports with the large-scale deployment of offshore renewables [

3]. Poland, with its extensive coastline, growing port infrastructure, and ambitious national energy policy goals, is positioned to play a leading role in this transition.

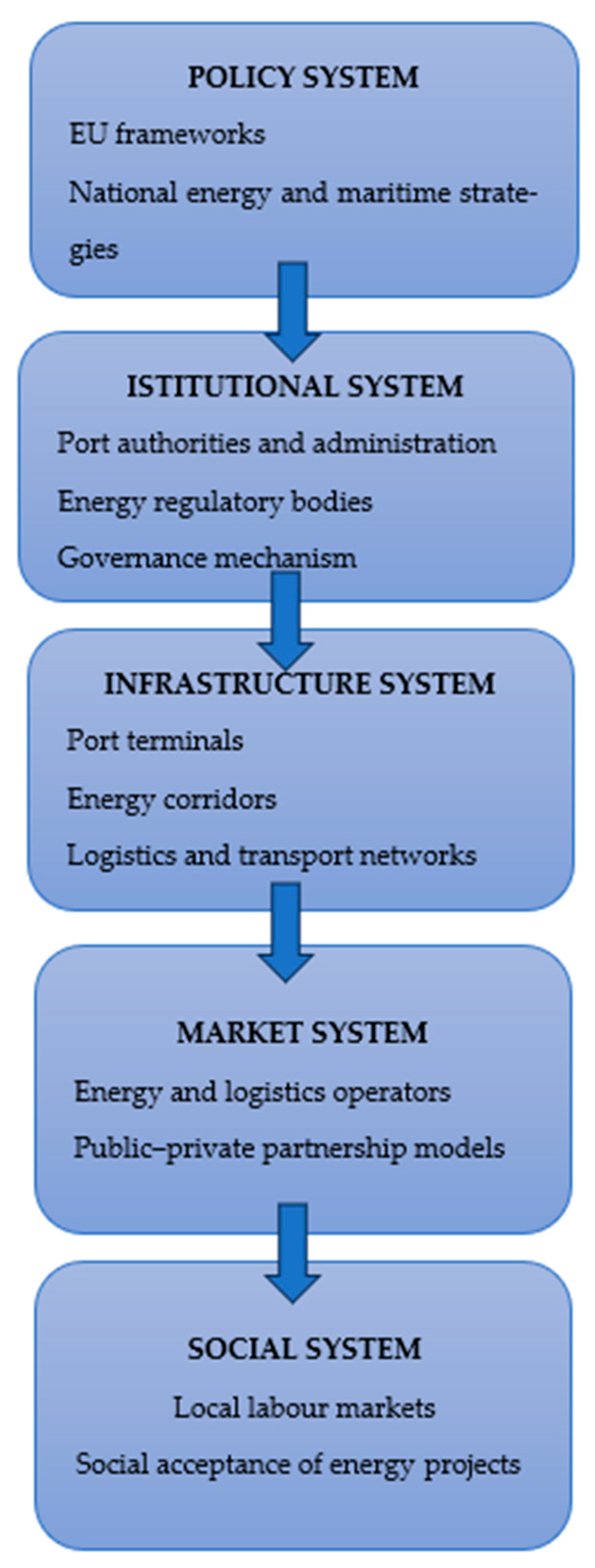

From a theoretical standpoint, the study adopts a multi-system perspective linking political, institutional, infrastructural, market, and social dimensions of the energy transition. This approach enables a holistic interpretation of how ports function as nodes where energy, transport, and policy systems intersect. The interaction between these systems determines both short-term energy security and long-term decarbonization capacity. Such a perspective provides an analytical framework for understanding the hybrid nature of Baltic ports, which operate simultaneously as strategic infrastructure and as catalysts of socio-technical transformation.

The basin offers favorable wind conditions, shallow waters, and proximity to industrial centers, which enhance its attractiveness for offshore wind investments. According to the European Commission, the Baltic Sea could host more than 90 GW of offshore wind capacity by 2050, with Poland expected to account for nearly one-third of this development. Such prospects underline Poland’s central role in shaping the energy future of the region [

4,

5]. Energy transition, understood as the shift from fossil fuel–based systems toward renewable and diversified sources, is directly linked to the concept of energy security, which emphasizes reliable, affordable, and sustainable access to energy resources. For Poland, which historically relied heavily on coal and external suppliers of oil and gas, the diversification of energy sources and the development of maritime infrastructure have become central pillars of long-term energy security [

6,

7].

In this evolving energy environment, ports have become indispensable nodes of the energy transition and security architecture [

8]. Traditionally perceived as gateways for trade and logistics [

9,

10], ports are increasingly recognized as strategic infrastructure for the import [

11,

12], handling, and distribution of energy carriers, including crude oil, liquefied natural gas (LNG), and, in the near future, hydrogen and ammonia [

13]. At the same time, ports provide essential facilities for offshore wind logistics, including installation terminals and operations and maintenance (O&M) bases, thereby linking short-term energy security goals with long-term decarbonization pathways. This emerging perspective aligns with the concept of ports as energy hubs, emphasizing their multifunctional role in logistics and energy system integration [

14,

15]. Recent European initiatives, such as the Port of Antwerp-Bruges hydrogen transition strategy, further exemplify this evolving paradigm [

16].

Although many studies address offshore wind energy in the Baltic and Poland’s oil and gas diversification, few connect these two dimensions in a single analytical framework [

17,

18]. Few studies explicitly address the dual role of ports as both guarantors of immediate energy supply security (through oil and gas logistics) and enablers of the renewable energy transition (through offshore wind and green fuels). Bridging this gap is essential for understanding how Polish ports contribute to both national resilience and regional energy transformation.

The purpose of this article is therefore to examine the role of the Baltic Sea and Polish ports as strategic pillars of energy transition and security. By analyzing key facilities such as the Naftoport in Gdańsk, the LNG terminal in Świnoujście, the planned Floating Storage Regasification Unit (FSRU) in Gdańsk, and the emerging offshore wind hubs in Gdynia, Gdańsk, Łeba, and Ustka, the paper situates Poland’s maritime infrastructure within broader EU energy strategies and geopolitical dynamics.

To guide the analysis, the following research questions are posed:

RQ1: What is the strategic importance of the Baltic Sea for Poland’s energy transition and security?

RQ2: How do Polish ports contribute to the diversification of energy supplies and the development of offshore renewable energy?

RQ3: What infrastructural, political, and institutional conditions enable ports to act as key energy transition hubs?

RQ4: What challenges and risks threaten the resilience of port-based energy infrastructure in Poland?

The remainder of this paper is structured as follows:

Section 2 provides the background and policy context, including EU and Polish energy strategies.

Section 3 outlines the applied research methodology.

Section 4 presents the results, focusing on the role of major and local ports in energy diversification and renewable energy integration.

Section 5 discusses the findings in light of European experiences and best practices. Finally,

Section 6 concludes the study and offers policy recommendations.

2. Background of Analysis

The European Union has placed the acceleration of the low-carbon transition and the strengthening of energy security at the center of its energy policy agenda. The European Green Deal, the Fit for 55 package, and the REPowerEU Plan collectively set ambitious targets for reducing greenhouse gas emissions, diversifying energy supplies, and increasing the share of renewable energy [

2,

19,

20]. In particular, REPowerEU responds directly to the disruption of energy flows caused by the Russian invasion of Ukraine in 2022, aiming to reduce Europe’s dependency on Russian fossil fuels through a combination of LNG imports, accelerated deployment of renewables, and improved interconnections within the EU. Within this framework, the Baltic Sea has been identified as a key maritime basin for Europe’s energy transition, functioning both as a corridor for fossil fuel imports and as a platform for large-scale offshore renewable energy. This dual role highlights its strategic importance for energy diversification and long-term decarbonization [

21].

The data presented in

Table 1 illustrate Poland’s offshore wind development pathway. According to the official Energy Policy of Poland until 2040 (PEP2040), the declared target was set at 11 GW by 2040 [

22]. However, the 2024 amendment of the Renewable Energy Sources Act (UC99) raises this ambition to 18 GW, reflecting Poland’s increasing role in the Baltic offshore wind market. The designated maritime areas for offshore wind amount to 2340 km

2, representing about 10% of the country’s 22,500 km

2 Exclusive Economic Zone (EEZ), with a total technical potential estimated at approximately 33 GW [

23].

Poland’s energy system has historically been dominated by coal and external suppliers of oil and natural gas, but in recent years, the country has sought to diversify its energy mix and align with EU decarbonization goals. The Polish Energy Policy until 2040 (PEP2040) and the National Recovery and Resilience Plan (KPO) highlight offshore wind, LNG infrastructure, and future hydrogen integration as central pillars of the transition strategy [

24]. Key infrastructure investments include the Naftoport in Gdańsk, which ensures diversified oil supplies; the LNG terminal in Świnoujście, which provides an alternative to pipeline gas; and the planned Floating Storage Regasification Unit (FSRU) in Gdańsk, aimed at further strengthening energy diversification [

25]. At the same time, Poland has launched ambitious offshore wind projects—such as Baltic Power, Baltica 2 and 3, and Bałtyk II and III—which will require specialized port infrastructure for installation and operations [

26,

27]. These developments emphasize the evolving role of ports as critical enablers of both short-term security and long-term energy transition.

Ports, traditionally understood as gateways for trade, are increasingly recognized as strategic energy nodes. Their role has expanded to include the import, storage, and distribution of crude oil, LNG, and petroleum products, while also supporting offshore renewable energy through installation terminals and O&M bases [

28]. In Poland, large ports such as Gdańsk, Gdynia, and Świnoujście are developing specialized facilities for energy-related logistics, while smaller ports like Łeba and Ustka are being adapted as service bases for offshore wind operations. This dual functionality situates ports at the intersection of energy security and energy transition. On the one hand, they ensure immediate resilience through diversification of oil and gas supplies. On the other hand, they provide the logistical backbone for integrating renewables, positioning Poland not only as a consumer but also as a potential hub in the regional energy architecture of the Baltic Sea.

From a theoretical standpoint, this study integrates four interrelated concepts forming the analytical framework:

- (1)

Energy hubs, referring to port areas that concentrate flows of energy carriers and services across multiple sectors;

- (2)

Critical infrastructure resilience, emphasizing the capacity of port systems to maintain functionality under disruption;

- (3)

Socio-technical transitions, describing the co-evolution of technology, institutions, and societal norms in the energy shift;

- (4)

Multi-level governance, highlighting the interaction between EU, national, and regional actors in implementing the transition.

Together, these perspectives provide a lens through which the empirical cases are interpreted, linking the physical transformation of ports with broader institutional and systemic change.

3. Materials and Methods

This study applies a qualitative and exploratory research design, combining policy analysis, document review, and case study methods to investigate the role of the Baltic Sea and Polish ports as pillars of energy transition and security. The methodological framework is structured around three main components.

First, a document and policy analysis was conducted to examine European and national strategies relevant to energy transition and security. The analysis covered key EU frameworks (REPowerEU, Fit for 55, European Green Deal) and national documents (PEP2040, KPO, and the Spatial Development Plan for Polish Maritime Areas), which provide the strategic and regulatory background for offshore wind, LNG, and oil diversification in Poland.

Second, secondary data collection was carried out using statistical databases and industry reports. Data sources included Eurostat, the Polish Wind Energy Association (PWEA), BalticWind.eu, the International Energy Agency (IEA), and annual reports from the Port of Gdańsk, the Port of Gdynia, and the Szczecin–Świnoujście Seaport Authority. These materials were used to gather information on energy import volumes, LNG regasification capacity, offshore wind development forecasts, and port infrastructure investment projects. All data sources are publicly available, ensuring reproducibility of the results and transparency of the analytical process.

Third, a case study approach was applied to analyze selected ports that play a central role in Poland’s energy landscape. The study focused on (1) the Naftoport in Gdańsk, which secures diversified oil supplies; (2) the LNG terminal in Świnoujście and the planned Floating Storage Regasification Unit (FSRU) in Gdańsk, which enhance natural gas diversification; and (3) ports such as Gdańsk, Gdynia, Łeba, and Ustka, which are being adapted as installation and operations and maintenance (O&M) hubs for offshore wind energy. These cases illustrate how different types of port infrastructure contribute simultaneously to short-term energy security and long-term decarbonization.

The analysis followed a comparative framework, assessing how different categories of ports—oil terminals, LNG facilities, and offshore wind bases—contribute to Poland’s overall energy strategy. By integrating policy analysis with case study findings, the research provides a comprehensive perspective on how ports act as both guarantors of resilience and enablers of energy transition. Where available, quantitative indicators (e.g., terminal throughput, storage capacity, quay length) were compared with forecasted project demand to evaluate the adequacy of port infrastructure for future energy transition needs.

The selected cases represent the largest and most functionally diverse ports, ensuring coverage of Poland’s main energy modalities. Alternative sites were reviewed, but only those with operational data and strategic relevance were retained to ensure analytical comparability.

The study applied a structured analytical procedure combining document coding, thematic mapping, and cross-case synthesis. The document and policy analysis was conducted using directed content analysis, in which key themes—such as energy diversification, critical infrastructure resilience, and offshore wind development—were identified and coded according to their relevance to port infrastructure and governance.

The diagram shows how policy, institutional, infrastructural, market, and social systems interact to shape both short-term energy security and long-term decarbonization strategies (

Figure 1). The boundaries between systems are defined functionally: policy systems provide strategic direction; institutional systems translate it into governance mechanisms; infrastructure systems implement physical capacity; market systems mobilize investment; and social systems reflect societal response and acceptance.

This framework guided the comparative and cross-case synthesis by linking policy and institutional dynamics with measurable infrastructure and market outcomes.

The case selection followed a purposive approach, ensuring representation of the three main categories of port functions: oil (Naftoport Gdańsk), gas (Świnoujście LNG and the planned FSRU Gdańsk), and renewables (Gdynia, Łeba, and Ustka). This cross-sectoral design enabled comparison across different energy modalities and scales of operation.

Finally, cross-case synthesis was used to identify common patterns, synergies, and trade-offs among the cases. The triangulation of policy documents, secondary statistics, and expert reports strengthened the internal validity of the qualitative findings.

4. Results

4.1. Energy Security and Transition Through Baltic Ports

4.1.1. Naftoport Gdańsk and Oil Diversification

Naftoport in Gdańsk plays a pivotal role in Poland’s energy security strategy, functioning as the country’s main maritime hub for crude oil imports. Its strategic location within the Northern Port, combined with deep-water access, enables the handling of large tankers up to 300,000 DWT. This makes Naftoport the most important alternative to pipeline supplies, securing crude oil deliveries for Poland’s refineries in Gdańsk and Płock, as well as for German plants in Schwedt and Leuna [

29].

Historically, Poland relied heavily on Russian crude oil transported via the “Druzhba” pipeline. However, the expansion of Naftoport has allowed the diversification of supply sources by facilitating imports from Norway, Saudi Arabia, the United States, and West Africa. The terminal’s integration with PERN’s transmission and storage system, including the bi-directional Pomeranian Pipeline, ensures flexibility in distribution and resilience in case of disruptions. A notable example was the 2019 contamination crisis of the Druzhba pipeline, when Naftoport successfully compensated for suspended Russian flows, proving its strategic importance for uninterrupted oil supply [

30].

This trend is illustrated in

Figure 2, which presents Naftoport’s total crude oil and petroleum product transshipments over the last decade. After a period of relative stability between 2015 and 2020 (ranging from 12 to 17 million tonnes annually), a significant upward shift occurred from 2022 onwards. Transshipments rose to 24.5 million tonnes in 2022, 36.6 million tonnes in 2023, and reached a record 38.8 million tonnes in 2024. These dynamics clearly demonstrate how maritime imports through Gdańsk have replaced pipeline flows as the dominant supply channel, underlining Naftoport’s role as Poland’s primary oil gateway and a strategic enabler of diversification.

The ongoing expansion of Naftoport represents the largest oil infrastructure investment of its kind in Poland. Key developments include new transshipment stations, modernized loading arms, and the construction of additional storage tanks, which increased capacity by nearly 600,000 m3, bringing total storage to over 4 million m3. Equally important is the construction of a second Pomeranian Pipeline linking Gdańsk with central Poland, which will further enhance diversification by enabling the separation and transport of different oil blends. These investments not only strengthen Poland’s independence from Russian supplies but also provide new opportunities for re-export to regional markets.

From a supply chain perspective, Gdańsk has emerged as a critical node in multiple oil delivery models identified for Poland. While the traditional model relied on Russian supplies via the Druzhba pipeline (Model A), alternative scenarios increasingly emphasize maritime imports through Gdańsk (Model C), positioning Naftoport as a “safety valve” for the national energy system [

31,

32]. Its competitive advantages derive from location, ice-free conditions, and strong infrastructural connections, including road and rail links as well as integration into Poland’s petrochemical cluster.

Naftoport therefore embodies both infrastructural and systemic resilience. By expanding import capacities and storage facilities, it contributes directly to the EU’s strategic objectives of supply diversification and reduced dependency on Russian hydrocarbons. In this context, the terminal is not only a logistics facility but also a strategic asset ensuring national and regional energy security in an era of geopolitical uncertainty.

While Naftoport enhances diversification and resilience, it also reveals a structural dependency on maritime logistics and external suppliers. The trade-off between security and sustainability remains evident—oil import infrastructure secures short-term resilience but may lock in carbon-intensive assets. This duality underlines the challenge of aligning immediate energy needs with long-term decarbonization goals.

4.1.2. LNG Infrastructure: Świnoujście and Gdańsk FSRU

The LNG terminal in Świnoujście, commissioned in 2015 and officially named after President Lech Kaczyński, represents one of the most strategic energy investments in Poland. Designed as the first LNG regasification facility in the country, it significantly enhanced Poland’s capacity to diversify natural gas supplies and reduce dependency on Russian pipeline imports [

33]. With an initial annual capacity of 5 bcm, the facility has undergone expansions aimed at reaching 8.3 bcm by 2025, making it one of the largest terminals in Central and Eastern Europe [

34].

The terminal’s rising utilization mirrors Europe’s post-2022 pivot away from Russian pipeline gas. In 2023, Świnoujście received 62 cargoes (~4.66 Mt LNG), with a strong contribution from U.S. and Qatari supplies, evidencing both supply diversification and the growing liquidity of Poland’s LNG portfolio. These flows built on the 2022 capacity step-up and bookings, which enabled higher throughput.

As shown in

Figure 3, the number of LNG deliveries to the Świnoujście terminal rose from a single shipment in 2015 to over 30 per year before 2021. A sharp increase followed in 2022, with 58 cargoes, and the record 62 deliveries in 2023 confirmed the terminal’s role as Poland’s main LNG gateway and a critical element of energy security.

Recent academic literature underscores these dynamics. Biały (2024) documents the stepwise capacity increases at Świnoujście (5 → 6.2 → planned 8.3 bcm) and shows that EU LNG terminals experienced a structural rise in utilization in 2022 relative to 2018–2021 [

35]. In parallel, Orysiak (2024) estimates growing LNG demand for maritime uses in the southern Baltic, highlighting the terminal’s enabling role for regional bunkering and ship-to-ship distribution strategies [

36]. Together, these findings position Świnoujście as both a security-of-supply anchor and a platform for low-sulfur maritime fuels in the Baltic Sea.

Beyond national impacts, Świnoujście contributes to broader EU objectives under REPowerEU by facilitating non-Russian gas imports and interfacing with new and upgraded interconnectors. The terminal’s expansion—combined with Baltic Pipe and cross-border links—supports regional balancing, enhances bargaining power, and reinforces Poland’s emerging role as a gas hub in Central-Eastern Europe. Recent analyses also frame Poland’s rapid LNG-led diversification as emblematic of Eastern Europe’s market overhaul since 2022.

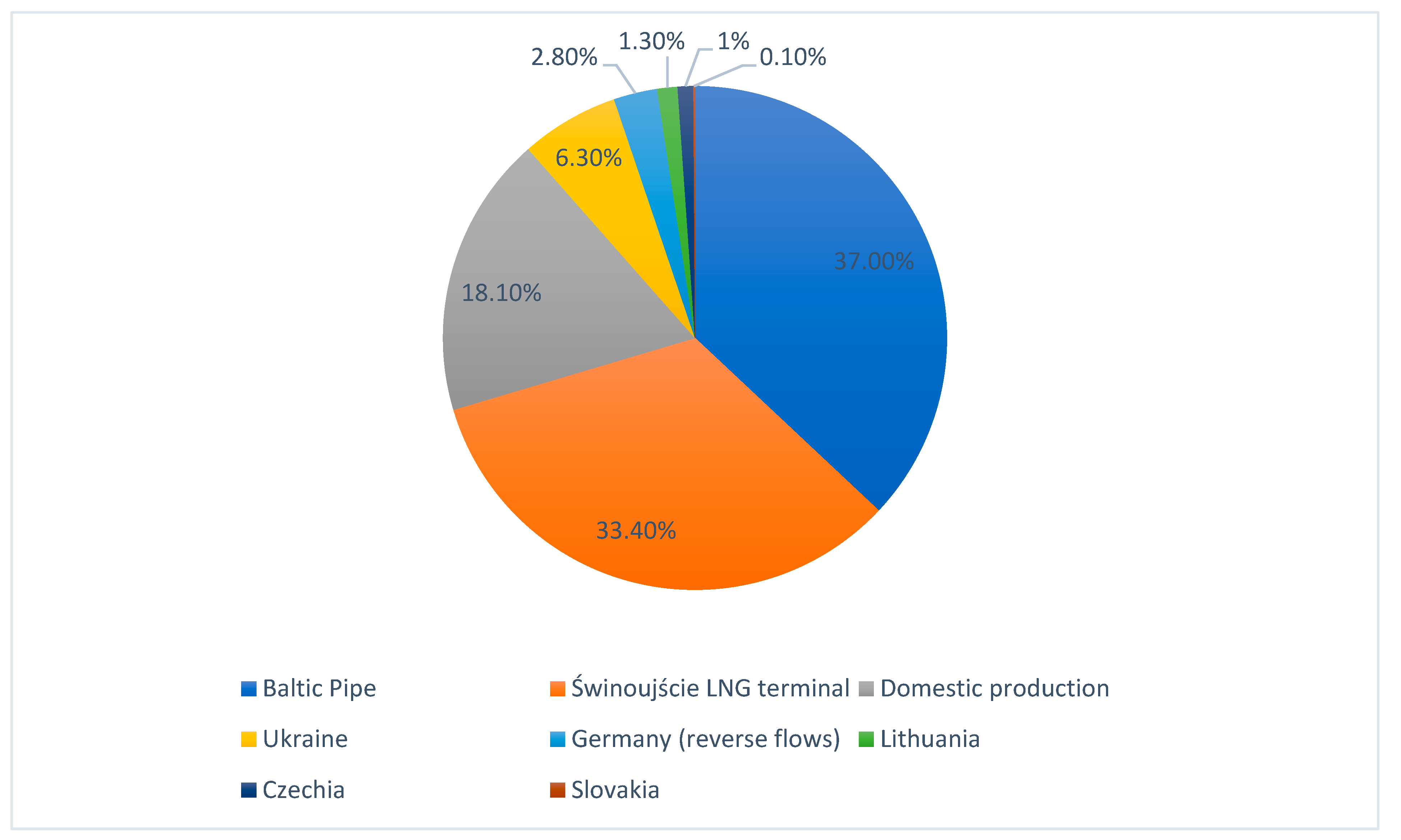

As illustrated in

Figure 4, LNG supplies through the Świnoujście terminal accounted for 33.4% of Poland’s gas balance in 2024, nearly matching the share of the Baltic Pipe (37.0%). Together, these two sources provided over 70% of total gas volumes, while domestic production covered 18.1%, and all other cross-border flows (via Ukraine, Germany, Lithuania, Czechia, and Slovakia) remained marginal. Baltic Pipe and the Świnoujście LNG terminal therefore constitute Poland’s critical energy infrastructure, whose strategic importance has grown even further in the current geopolitical context.

Complementing Świnoujście, the planned Floating Storage Regasification Unit (FSRU) in the Gulf of Gdańsk is expected to provide a regasification capacity of approximately 6.1 bcm per year, with earlier estimates ranging from 4.2 to 8.2 bcm [

37]. The project, scheduled for commissioning in 2028, includes the acquisition of a floating unit, construction of a breakwater, and the development of subsea and onshore pipelines with a total coastal length of 249 km [

38]. With domestic production covering only a fraction of national demand, the FSRU is designed not only to safeguard Polish consumption but also to strengthen the country’s role as a regional gas hub, conditional on the expansion of cross-border interconnections. This investment complements the LNG terminal in Świnoujście, creating a dual maritime infrastructure that underpins Poland’s long-term energy security and diversification strategy.

The LNG diversification strategy exemplifies a synergy between infrastructure expansion and geopolitical independence; however, it also creates new dependencies on global LNG markets and price volatility. These findings suggest that infrastructural diversification does not automatically translate into systemic resilience.

4.1.3. Offshore Wind and Port Involvement

Offshore wind energy in the Baltic Sea constitutes the most dynamic component of Poland’s long-term energy transition. While oil and LNG terminals address short-term diversification, offshore wind represents a structural shift towards decarbonization. Its development is closely tied to the availability and adaptation of port infrastructure, which provides assembly, installation, and long-term maintenance functions.

As of 2025, first-phase projects amounting to nearly 6 GW are progressing through different stages of maturity. The most advanced is Baltic Power (1.2 GW), developed by Orlen and Northland Power, which has already launched construction of the installation terminal in Gdynia and plans to start offshore works in 2025–2026, with commissioning expected by 2027. Other large projects, such as Baltica 2 (1.5 GW) and Baltica 3 (1 GW), are in the pre-construction stage, with commissioning anticipated around 2027–2028. Bałtyk II and Bałtyk III (both 720 MW, Equinor/Polenergia), as well as FEW Baltic II (350 MW, RWE), remain in the permitting phase, while BC-Wind (400–450 MW, EDPR & Engie) is at the stage of environmental studies and early preparations. These projects form the backbone of the first phase of Poland’s offshore wind program (

Table 2).

The execution of these projects requires a multi-port system adapted to different functions. The Port of Gdynia has been designated as Poland’s first offshore wind installation terminal, equipped with heavy-lift quays and assembly yards to handle large components such as turbine towers and foundations. The Port of Gdańsk plays a complementary role by hosting industrial facilities, including tower and cable manufacturing, which integrate into the offshore wind supply chain. Szczecin–Świnoujście is positioning itself as a western logistics hub, supporting assembly and transport for projects located in the western Baltic.

At the same time, smaller ports such as Łeba and Ustka are being transformed into service and maintenance bases (O&M). Their proximity to concession areas in the Polish Exclusive Economic Zone makes them optimal for daily operations, while regional investments in quays, warehouses, and transport infrastructure are expected to generate significant socio-economic benefits, including job creation and the diversification of local economies.

Nevertheless, the offshore wind supply chain in Poland faces logistical and infrastructural challenges. Adequate quay length, bearing capacity, deep-water access, and storage areas are prerequisites for efficient port operations. International experience indicates that insufficient port readiness may delay project implementation and increase costs. Furthermore, competition for port space, administrative bottlenecks, and environmental constraints (notably under the Polish Maritime Spatial Plan, 2021) pose additional risks.

Aligning port investments with the offshore wind project pipeline is essential if Poland is to deliver on its national offshore wind targets. In this way, Polish ports can establish themselves not only as national energy nodes but also as regional hubs within the Baltic offshore wind supply chain.

The offshore wind segment demonstrates the transition towards sustainable energy, yet exposes capacity and coordination gaps among ports. Effective synchronization of port investments with project pipelines emerges as a critical governance challenge.

4.1.4. The Baltic Sea as an Energy Corridor

The Baltic Sea has become a critical energy corridor for Poland and the wider region of Central and Eastern Europe. Traditionally associated with the transit of crude oil and natural gas from Russia, the basin is undergoing a profound transformation as fossil fuel flows are being replaced by diversified maritime imports and renewable energy development. This evolution underscores the Baltic’s dual function as both a gateway for short-term energy security and a platform for long-term decarbonization.

From the perspective of traditional energy supply, the Baltic ensures direct access to crude oil, LNG, and pipeline gas. The Naftoport in Gdańsk secures diversified oil imports for Polish and regional refineries, while the Świnoujście LNG terminal—together with the planned FSRU in Gdańsk—provides entry points to global LNG markets. The Baltic Pipe interconnector, inaugurated in 2022, links Poland directly to Norwegian resources and has already become a cornerstone of the gas system. According to recent analyses, Poland’s energy dependence on the Baltic reached 48% in 2023 and is projected to grow to 61% by 2040, demonstrating the basin’s rising significance for national energy security.

Alongside fossil fuel flows, the basin is simultaneously being prepared for large-scale offshore renewable generation, particularly wind energy [

39].

The strategic importance of the Baltic is reinforced by its integration into European frameworks such as the Baltic Energy Market Interconnection Plan (BEMIP) and the Trans-European Networks for Energy (TEN-E), which promote cross-border interconnections, hybrid offshore grids, and energy islands. These initiatives will transform the basin into a renewable energy backbone for Northern and Central Europe, linking Polish, German, Danish, and Baltic States’ offshore projects into a coherent system.

Finally, the Baltic as an energy corridor must also be considered in terms of infrastructure security. The sabotage of the Nord Stream pipelines in 2022 highlighted the vulnerability of subsea assets, while growing geopolitical tensions underscore the need to protect critical facilities such as LNG terminals, offshore wind farms, and subsea cables. As NATO’s presence in the region increases, the Baltic is increasingly perceived as a “NATO lake”, where the protection of energy infrastructure has become a matter of collective security.

In this sense, the Baltic Sea exemplifies the duality of Europe’s energy transition: it continues to serve as a vital route for fossil fuel imports while simultaneously evolving into a renewable energy hub. Its role as an energy corridor will therefore remain central to Poland’s and the EU’s strategy of achieving both supply diversification and climate neutrality.

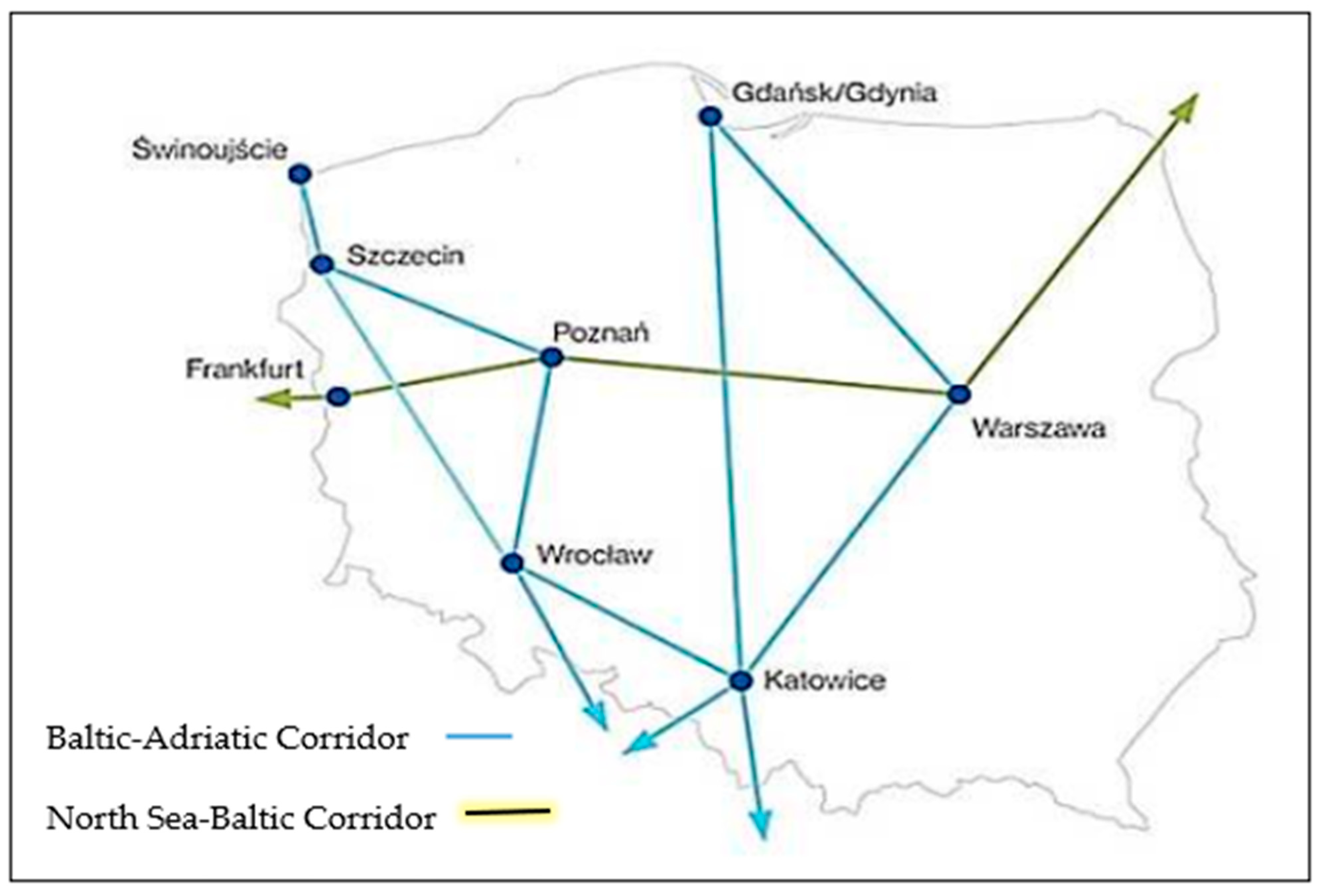

The role of the Baltic Sea as an energy corridor is reinforced by its integration into the Trans-European Transport Network (TEN-T). As shown in

Figure 5, Polish seaports such as Gdańsk, Gdynia, and Szczecin–Świnoujście are directly connected to the Baltic–Adriatic and North Sea–Baltic corridors, ensuring efficient hinterland access. These connections facilitate not only the flow of crude oil and LNG imports inland but also the future distribution of renewable energy carriers such as hydrogen and ammonia. In this way, transport corridors complement energy infrastructure (TEN-E), highlighting the interdependence of logistics and energy security in the Baltic region [

40].

These dynamics mirror broader regional trends: Germany’s LNG terminals in Wilhelmshaven and Brunsbüttel and Lithuania’s Klaipėda FSRU similarly underpin post-2022 diversification, positioning Poland as a comparable yet rapidly expanding Baltic energy hub.

5. Discussion

The findings confirm the Baltic Sea’s growing role in linking energy security with the transition. To place these results within a broader analytical framework, it is essential to consider the concept of energy security, which underpins both national resilience and the energy transition.

Energy security is a multidimensional concept that goes beyond the traditional political and military domains of national security. It is commonly defined as the resilience of an economy to possible disruptions in the supply of strategic energy resources, while ensuring continuity of supply at socially acceptable prices and in line with environmental standards [

41,

42]. From this perspective, energy security combines three fundamental dimensions (

Figure 6): the energy dimension, referring to the reliability and diversification of supply; the economic dimension, related to competitiveness and affordability; and the ecological dimension, reflecting the growing importance of low-carbon transition and renewable energy sources.

Institutional and political conditions play a decisive role in shaping the ability of Polish ports and the Baltic Sea to function as energy corridors. At the European level, the regulatory framework of the Trans-European Networks for Energy (TEN-E) and Trans-European Transport Network (TEN-T) defines priority infrastructure and enables access to funding instruments such as the Connecting Europe Facility. Similarly, the REPowerEU plan accelerates investments in LNG, offshore wind, and hydrogen, linking energy diversification with decarbonization goals. At the national level, the Polish Energy Policy until 2040 (PEP2040) and the governmental Program for the Development of Offshore Wind Energy set targets and provide the legal environment for permitting and investment support [

23]. Furthermore, maritime spatial planning (MSP), introduced in line with Directive 2014/89/EU, directly influences port development by allocating areas for offshore wind farms, navigation, and environmental protection [

43]. Finally, the complexity of permitting procedures and environmental impact assessments remains a barrier, highlighting that institutional capacity and governance are as critical as physical infrastructure in enabling the energy transition.

While the Baltic Sea enhances Poland’s energy resilience, it also reveals significant vulnerabilities. The sabotage of the Nord Stream pipelines in 2022 illustrated the fragility of subsea infrastructure and the geopolitical risks inherent in the region [

44,

45]. As demonstrated by the Naftoport and LNG cases, Poland’s maritime diversification mitigates similar vulnerabilities by ensuring alternative import channels independent of subsea pipelines. Similarly, the reliance on a limited number of LNG entry points demonstrates that diversification of suppliers does not necessarily ensure diversification of infrastructure. These examples highlight that the energy transition does not eliminate risks but rather reshapes them [

46,

47].

At the same time, the Baltic offers unique opportunities. Diversified supply routes and cross-border projects such as the Baltic Pipe strengthen resilience, while offshore wind positions Poland as a potential leader in renewable energy generation. European frameworks such as TEN-E and BEMIP further support regional cooperation and the development of hybrid offshore grids, which could transform the Baltic into a renewable backbone for Northern and Central Europe [

4].

Beyond their commercial functions, Polish seaports must also be regarded as elements of national critical infrastructure. Their role in handling crude oil, LNG, coal, and, in the near future, offshore wind components and hydrogen carriers places them at the very core of Poland’s energy security. Critical infrastructure status implies not only economic significance but also heightened exposure to hybrid threats, including cyberattacks and maritime supply chain disruptions [

48]. This highlights the growing relevance of cyber-resilience frameworks and digital transition pathways for port security and energy infrastructure [

49,

50,

51]. Consequently, port facilities such as Gdańsk, Gdynia, and Świnoujście require both continued modernization of handling capacity and reinforced physical and digital protection. This dual function—as gateways of trade and pillars of security—underscores their strategic importance in safeguarding national and regional resilience.

To systematize the comparative role of different Polish ports in the energy transition process, a functional typology has been developed (

Table 3). It differentiates ports according to their dominant energy functions, level of infrastructure development, and contribution to national energy security. The research is guided by a multi-system analytical framework that integrates policy, infrastructural, market, institutional, and social dimensions.

The typology confirms that each category of port contributes differently to Poland’s energy strategy. Oil and gas terminals primarily reinforce short-term security through diversification of fossil imports, while renewable-oriented ports enhance long-term transition capacity. The integration of these infrastructures illustrates a complementary relationship between traditional and emerging energy functions, aligning with the hybrid security–transition logic of the Baltic region.

This typological synthesis further validates the multi-system analytical framework introduced in

Section 3, linking infrastructure typologies with institutional and policy conditions.

This discussion confirms that the qualitative findings correspond closely to the theoretical concepts of multi-level governance and critical infrastructure resilience introduced in

Section 2, thereby reinforcing the analytical coherence of the study.

This study is exploratory in nature and relies primarily on secondary data and publicly available policy and industry sources. While triangulation was applied to enhance validity, future research could complement these findings through primary data collection and stakeholder interviews to capture evolving governance and investment dynamics.

6. Conclusions

In answering the four research questions (RQ1–RQ4), this study demonstrates that the Baltic Sea acts as both a stabilizing energy corridor and a catalyst for transition. Ports such as Gdańsk, Świnoujście, Łeba, and Ustka illustrate how maritime infrastructure strengthens short-term resilience while enabling long-term decarbonization.

Integrating oil, gas, and renewable perspectives within a single analytical framework offers a novel contribution to understanding how ports support both energy security and transition.

Building on these findings, the study proposes several actionable recommendations. National authorities should streamline permitting and spatial planning processes and coordinate port upgrades with offshore wind project timelines through a dedicated Port Energy Transition Taskforce. Port authorities should adopt integrated investment roadmaps that combine fossil and renewable functions while reinforcing digital and cybersecurity protection. Industry actors should expand public–private partnerships to develop specialized offshore terminals and logistics clusters. At the regional level, BEMIP and HELCOM should promote cross-border cooperation and harmonized technical standards for offshore infrastructure across the Baltic region.