Abstract

The European Union air transport sector has been repeatedly exposed to major disruptions such as the 2008 financial crisis, the COVID-19 pandemic, the war in Ukraine, and volatile energy prices. Strengthening resilience has, therefore, become a strategic priority. This study examines how strategic energy investments—covering renewable energy, sustainable aviation fuels (SAFs), electrification, hydrogen technologies, and advanced infrastructure—contribute to the resilience of the EU air transport system. The methodology integrates both primary and secondary data from EU policy documents, ICAO and IATA databases, Eurostat, and national statistics. A multi-criteria evaluation was applied using four key performance indicators: emission reduction efficiency (ER), annual exposure index (AEI), investment performance index (IPI), and net present value (NPV). Projects were assessed through Simple Additive Weighting (SAW) and the Technique for Order Preference by Similarity to Ideal Solution (TOPSIS), complemented by sensitivity analysis. The results show that the Pioneer project delivers the strongest environmental and financial outcomes, ranking first in ER, AEI, and NPV. Hermes performs best in job creation and social impact, while BioOstrand achieves substantial absolute CO2 reductions but lower cost efficiency. TULIPS shows limited effectiveness across all indicators. Sensitivity analysis confirmed that rankings remain robust under alternative weighting scenarios. The findings underscore that project design and alignment with resilience objectives matter more than investment size. Strategic energy investments should, therefore, be prioritized not only for decarbonization but also for their ability to reinforce both technological and socio-economic resilience, providing a reliable foundation for a sustainable and crisis-resistant EU air transport sector.

1. Introduction

The air transport sector—one of the most dynamic and global branches of the economy—is highly sensitive to economic shocks.

History shows that various crises—financial downturns, pandemics, and military conflicts—have a direct and often long-term impact on the stability and development of this sector. Traditionally, aviation is a capital-intensive industry. Therefore, when financing air transport companies, the main focus is on aircraft financing, and there are many different financing options available. In this context, the importance of individual sources of financing may increase or decrease over time, as demonstrated by recurring economic crises. In the aviation sector, capital has become a key determinant of supply structures, as restricted financial availability poses a major obstacle to entry [1]. Research on economic crises often spans multiple sectors, yet aviation receives comparatively little focus. Existing work tends to concentrate on stable environments, thereby failing to capture the industry’s unique responses to recessions [2,3,4,5]. This is particularly evident when assessing the most significant crises of recent decades: the 2008 financial crisis, the COVID-19 pandemic, and Russia’s war against Ukraine. These crises have triggered substantial fluctuations in energy prices, disrupted routes, restricted passenger and cargo flows, and increased the vulnerability of the sector.

Compared to other modes of transport, air transport is exceptionally sensitive to changes and external factors. It is, therefore, essential not only to understand the impact of each crisis but also to seek ways to strengthen the resilience of the air transport sector. Different crises generate new challenges to the air transport sector’s ability to operate efficiently in a crisis environment [6,7].

Policymakers, when formulating responses to major recent macroeconomic shocks—whether a financial crisis, a pandemic, or now the war in Europe—must remember that although conditions generally improve after a catastrophic shock, they can also deteriorate significantly. Therefore, fiscal policy planning should prioritize resilience rather than the recently popular maximalist approaches [8].

Research findings confirm that the air transport sector has a substantial positive impact on economic growth, particularly because its positive effects significantly increase under normal economic conditions and diminish during economic crises. Therefore, a successful recovery of the air transport sector following economic downturns is likely to stimulate long-term economic growth [9].

In the current context, the resilience of the air transport sector is closely linked to energy independence. Greater integration between energy production, transmission, and consumption sectors can significantly enhance the operational flexibility of the air transport industry [10,11,12].

The role of energy investments is indeed becoming increasingly important for the economic resilience of the air transport sector. This is also closely linked to the impacts of climate change and the strengthening of environmental regulations, which compel the air transport industry to modify its operational practices and adapt to new rules established by both the EU and global institutions. Although significant progress has been made over the past decades, the aviation industry continues to invest in further improving flight efficiency, particularly regarding energy efficiency [13]. A review of scientific research reveals that environmental regulations are now perceived as an inherent operational environment for the air transport sector, to which adaptation is essential. When assessing economic crises through this lens, it becomes evident that sustainability objectives and climate policy requirements determine the sector’s ability to adapt and maintain long-term economic resilience. During economic downturns, various market regulations and government policy measures are implemented not only to stabilize the sector but also to advance climate change mitigation goals [14,15,16,17].

The air transport sector—one of the most dynamic and global industries—is highly sensitive to economic shocks. Historical evidence demonstrates that various crises—financial downturns, pandemics, and military conflicts—have direct and often long-lasting impacts on the sector’s stability and growth. This is particularly evident when examining some of the most significant crises of recent decades: the 2008 financial crisis, the COVID-19 pandemic, and the Russia–Ukraine war. These events have triggered substantial fluctuations in energy prices, disrupted flight routes, restricted passenger and cargo flows, and increased the sector’s vulnerability [18,19,20].

The losses caused by the pandemic—particularly in Europe, North America, and Asia—highlighted how closely the aviation sector is linked to a country’s economic development. At the same time, the necessity of developing more flexible business models capable of surviving even a complete operational shutdown became evident. The scientific literature distinguishes two stages in the pandemic’s progression: the shock (decline) phase and the recovery phase, during which significant changes in passenger behavior and market structure were observed [21,22].

Meanwhile, the war in Ukraine triggered another major shock. The closure of airspace over Ukraine and Russia resulted in extended flight routes, increased airfare prices, and additional pressure on logistics chains [6,7,23]. Geopolitical crises have underscored that air transport infrastructure is not only an economic but also a strategic factor. In response to such challenges, increasing attention is being paid to systemic preparedness and the capacity to operate during crises.

In the face of macroeconomic shocks, policymakers increasingly recognize resilience as a key objective of strategic planning [24,25,26]. Short-term fiscal or financial measures alone are insufficient—there is a need for a long-term strategy that includes sustainable energy policies and investments in infrastructure [8,27,28,29,30].

Scientific studies show that the recovery of the air transport sector after a crisis often acts as a catalyst for the recovery of the entire economy [9]. However, this process is not possible without strategic decisions related to energy transformation. Today, the resilience of the air transport sector is increasingly linked to energy independence and efficiency [10]. Investments in renewable energy sources, the implementation of advanced technologies, and the synergy between production, transmission, and consumption are not only becoming climate policy objectives but also key factors of economic stability.

From this perspective, energy investments acquire a new significance as a resilience tool: they help reduce dependence on fossil fuels and geopolitical fluctuations, while enhancing the sector’s capacity to adapt to a constantly changing market and environmental regulations. This also implies the necessity to view economic crises not only as threats but as catalysts for systemic changes—centered on sustainability, innovation, and energy efficiency [13,14,31,32].

While EU policies and projects in sustainable aviation have been widely discussed, existing studies remain largely descriptive and lack systematic, multi-criteria assessments of resilience. Prior research does not provide an integrated framework that evaluates how energy-related investments simultaneously affect financial, environmental, and social dimensions.

This study addresses that gap by applying key performance indicators (ER, AEI, IPI, and NPV) in combination with multi-criteria methods (SAW, TOPSIS). The novelty of the research lies in moving beyond policy summaries to deliver an evidence-based, comparative evaluation of investment options. By ranking and testing alternative scenarios, the study generates insights unavailable in EU reports or prior academic work, thus offering policymakers and industry stakeholders a robust tool for strengthening the resilience of the EU air transport sector during crises. Therefore, the aim of this article is to analyze the role that strategic energy investments can play in strengthening the resilience of the EU air transport sector to economic crises, considering not only the financial and geopolitical contexts but also the demands posed by climate change.

2. Literature Review

Aviation plays a very important role in supporting world economic activity through employment generation, trade facilitation, tourism promotion, and infrastructure investment. According to the 2024 Aviation: Benefits Beyond Borders report, the sector directly employs 11.6 million people worldwide and supports a total of 86.5 million jobs, including indirect and induced employment across the global economy. In 2023 alone, air transport contributed approximately USD 4.1 trillion to global GDP, representing 3.9% of the total global economic output. Beyond these macroeconomic indicators, aviation is essential for ensuring global connectivity, with airlines serving 21,000 unique city pairs, enabling business, tourism, education, healthcare access, and cultural exchange. Air transport also underpins global trade: 33% of global trade by value—equivalent to USD 8 trillion in goods—was transported by air in 2023, particularly high-value or time-sensitive items such as medical equipment and vaccines. Moreover, 58% of global tourists travel by air, further amplifying aviation’s contribution to sectors such as hospitality, retail, and services. The aviation sector also attracts significant capital investment; for instance, in 2022, USD 49.2 billion was invested in airport infrastructure, primarily funded by industry stakeholders. Given this scale of influence, air transport is not merely a mode of transportation—it is a strategic enabler of economic growth, resilience, and sustainable development [33].

Aviation is a major contributor to Europe’s economy, with over 100 scheduled airlines, more than 400 airports, and 60 air navigation service providers. It directly employs 1.4–2 million individuals and directly or indirectly backs 4.7–5.5 million jobs [34]. The importance of the air transport sector in today’s global economy increasingly extends beyond traditional economic boundaries and is emerging as a strategic factor in international relations and geopolitical stability. The large-scale flows of passengers and cargo—dependent on unrestricted access to airspace, stable fuel prices, and reliable supply chains—make the aviation industry particularly sensitive to geopolitical shocks. In the current period, the main geopolitical challenges affecting this sector are directly related to energy policy, including both the availability and volatility of traditional energy sources and the need to develop sustainable energy systems and enhance energy independence.

The war in Ukraine and the resulting airspace restrictions have demonstrated how geopolitical decisions directly shape the operating conditions of air transport—routes have lengthened, costs have increased, and logistical connections have been disrupted. At the same time, the availability of energy resources has become even more dependent on the dynamics of international relations. These developments underscore the necessity of viewing the air transport sector not only as an economic actor but also as a strategic infrastructure component closely tied to national energy security. Accordingly, energy investments aimed at developing alternative fuels, modernizing infrastructure, and improving energy efficiency are becoming instruments not only of climate policy but also of geopolitical resilience. Thus, the ability of the air transport sector to adapt to geopolitical challenges increasingly depends on strategic energy-related decisions that determine the sector’s flexibility, competitiveness, and long-term resilience to external shocks.

Since the beginning of the jet age, the aviation industry has focused on reducing the fuel consumption of aircraft, as fuel costs represent a major portion of airline operating costs: at a global level, these were about 19% of airline operating costs in 2021 [35].

It is essential for the air transport industry to acknowledge the opportunities and risks linked to sustainability and energy changes to secure its long-term endurance [36]. Strategic energy investments in the air transport sector are focused on sustainable aviation fuel (SAF). SAF requires no significant modifications to current systems, making adoption easier. Its use is set to rise toward 2050, with leading carriers already planning around 10% usage by 2030 [37]. The energy resilience of the air transport sector is inextricably linked to SAF, which is why most companies link their strategic energy investments to SAF.

Aviation has one of the highest energy demands per passenger or cargo unit, and unlike other sectors, it lacks feasible electrification options. Net-zero goals rely mainly on sustainable biofuels, alongside policy support for SAF and emerging technologies like hydrogen [38].

The global air transport sector is constantly affected by various economic crises, which have a significant impact on the sector. In the European Union, the main economic crises that have had the most significant impact on the sector are the 2008 financial crisis, the COVID-19 pandemic, and the war in Ukraine (Table 1).

Table 1.

Major crises and impacts on EU air transport sector [1,23,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60].

Aviation must reduce its fossil fuel dependence to strengthen resilience and cut emissions. Progress toward net-zero by 2050 hinges on efficiency measures, next-generation aircraft, and large-scale SAF adoption, backed by stable policies [58].

Various economic crises and their impact on the air transport sector have shown that it is important for this sector to be as prepared as possible for various changes. Economic resilience is a necessity, and energy investments play a very important role in achieving this necessity. The Air Transport Network (ATN) is a key pillar of global connectivity, supporting trade and passenger movement. Scholars highlight its resilience and adaptability in the face of risks such as terrorism and financial crises [61]. The concept of resilience is defined differently in the scientific literature, but most often, resilience is associated with economic recovery after shocks [62]. Economic resilience is the spontaneous recovery and adaptation of the economy after external shocks. Greater economic resilience can help the economy quickly return to its previous growth trajectory or reallocate resources to expand new growth areas [62]. The concept of resilience is one of the fundamental concepts used in both natural, social, and economic sciences to assess the ability of systems to withstand shocks and adapt to changing conditions. The concept of resilience—an interdisciplinary concept with roots in engineering and materials science—originally referred to the ability of a system or individual to recover to its original state after an external shock or disturbance. In the 1970s, Holling was the first to use the term “ecological resilience,” integrating ecological thinking based on the complexity and non-linearity of systems and arguing that ecosystems are inherently sustainable [63]. Resilience is also divided into internal and external resilience [64,65,66,67]. Internal resilience involves the effective management of internal resources, processes, and relationships to maintain operational efficiency and stability in the face of internal pressures. External resilience is critical to economic stability and prosperity, but it is threatened by global shocks and pressures, including global financial stress, commodity price fluctuations, geopolitical events, pandemics, and climate change. Resilience also depends on sound policy-making and implementation, supported by credible institutions [68]. In the contemporary resilience literature, two theoretical approaches are of particular importance—Holling’s concept of ecological resilience and Martin’s concept of economic resilience. Holling defines ecological resilience as the capacity of a system to persist and function when subjected to significant disturbances, without crossing thresholds that would alter its structure and functions [1]. This perspective emphasizes long-term functional stability, adaptation to unexpected large-scale disruptions, and the ability to operate across multiple equilibrium states. In contrast, Martin’s concept of economic resilience focuses on the ability of regions or sectors to absorb economic shocks, adapt, and recover while maintaining competitiveness and a growth trajectory. It highlights absorptive capacity, structural change, the adoption of innovations, and the speed of recovery following a crisis [2].

Both concepts are closely linked to the characteristics of the aviation sector—high capital intensity, global interconnectedness, and vulnerability to external shocks. From Holling’s perspective, the assessment of aviation resilience should encompass the diversification of supply chains, infrastructure adaptability, and operational flexibility—for instance, diversifying fuel supply sources (including SAF or hydrogen) to ensure operational continuity even during crises. Martin’s perspective stresses the importance of rapid recovery after a shock by adapting business models, optimizing route networks, and accelerating technological innovation. For example, during the COVID-19 pandemic, some airlines converted passenger aircraft for cargo transport, thereby mitigating revenue losses and strengthening their resilience.

Integrating these two theoretical perspectives provides a comprehensive approach to strengthening resilience in the aviation sector, encompassing both long-term adaptation to uncertainty and the capacity to rapidly restore operations and maintain competitiveness after crises.

An analysis of resilience in the air transport sector reveals that one of the key factors in the sector’s ability to adapt and recover is energy security. Therefore, the importance of energy for air transport operations and its resilience in crisis situations is examined further. The aviation sector is highly dependent on fossil fuels and continues to grow. Carbon dioxide (CO2) emissions from air transport are projected to triple by 2050, while the EU is expected to achieve net-zero emissions across the economy by that time. Studies show that, in addition to technological innovations related to zero-emission electric and hydrogen engines, the transition must include policy measures such as polluter pays, investment in research and development, subsidies, and promotion of alternatives to flying [69].

McKinsey’s analysis indicates that power-to-fuel technologies face substantial economic barriers to scaling, with costs of USD 1550–5600 per ton. These levels remain well above conventional jet fuel prices, generally situated between USD 500 and USD 1125 per ton [70,71]. The steady growth in global air traffic [72], combined with the technical challenges inherent in decarbonizing a sector where emissions are particularly difficult to reduce, has placed aviation at the top of the climate agenda in many countries [73].

The lack of technologically feasible solutions is the biggest challenge for aviation in achieving climate neutrality [74,75]. In a sector where electrification faces significant technical constraints in all but the smallest aircraft [76], all major scenario projections foresee significant use of SAF. As a result, SAF plays a key role in the air transport sector policies of many countries [73]. As a global leader in climate governance, the European Union (EU) has adopted three major measures to curb domestic aviation emissions. Aviation GHG emissions are incorporated into the EU ETS to apply carbon pricing, while renewable fuel blending has been made compulsory across the sector [77].

Given the close link between the air transport sector and energy consumption and its dependence on fossil fuels, it is particularly important to analyze the role of strategic energy investments in strengthening the resilience of this sector.

Airports are among the most energy-intensive infrastructure facilities, requiring large amounts of electricity and fuel to meet various operational needs, such as lighting, heating, cooling, and ventilation systems, airport management, baggage handling, and ground support equipment. Energy costs account for approximately 10–15% of airport operating costs, which puts significant financial pressure on airports. With increasing energy demand and growing environmental concerns, the use of sustainable energy in airport infrastructure has become a strategic necessity. In 2023, global investment in clean energy reached a record high of USD 1.7 trillion. However, the challenge for airport operators is to balance energy efficiency and cost savings with the sector’s stringent safety, reliability, and uninterrupted service requirements [78]. Most scientific studies have shown that it is precisely the investments in sustainable aviation energy that ensure greater resilience of the air transport sector to various economic shocks.

While the existing literature is very useful for certain components of sustainable aviation, such as the development of SAF, aircraft electrification, and emissions trading systems, it is fragmented and lacks a comprehensive cross-sectoral synthesis. For example, studies on SAF often do not consider policy alignment and economic feasibility, while technological assessments may not consider social acceptability or regulatory challenges. Furthermore, few studies provide comparative insights across different regions [79] and the ability to adapt to necessary energy transitions.

Strategic industrial investors, such as airlines and OEMs (Original Equipment Manufacturers), are investors with motives other than purely financial gain. Many of them probably consider SAF to be a “license to fly”. SAF is essential for these industrial investors, who are seeking to maintain the legitimacy of their operations and meet the expectations of regulators and stakeholders regarding sustainability. These investors want to accelerate the commercialization of projects with high growth potential while maintaining their overall risk profile. Strategic industrial investors are as follows: Airlines: Airlines consider SAF to be (one of) the most important levers for decarbonization. Although often criticized for “insufficient action”, several airlines have made greater efforts by investing directly in SAF producers and assuming part of the risk. Through these investments, in addition to reducing carbon emissions, airlines hope to gain preferential access to future SAF production to meet voluntary and government commitments and potentially secure attractive market prices. OEMs: Currently, aircraft are certified to fly with up to a 50% SAF blend. Ensuring a sufficient and accessible supply of SAF will make it easier to order traditional aircraft and align with emerging green aviation taxonomies until zero-carbon propulsion is developed. Airports: Airports are under increasing pressure from airlines to secure physical SAF supplies. This may lead them to invest in SAF infrastructure and possibly even in projects to attract airlines committed to sustainability, providing incentives for an increasingly environmentally conscious industry. Energy and oil companies: SAF offers a solution for moving away from fossil fuels, especially once blending restrictions are lifted. By being the first to adopt SAF, energy companies and fuel suppliers can protect their market share in the aviation fuel market as demand for green alternatives grows, while reducing the impact of their operations. Raw material suppliers: SAF can open new sources of income and strong demand signals for raw materials. These companies could opt for vertical integration, ensuring that their agricultural or waste products are used in SAF production [80].

Scientific studies indicate that the impact of strategic investments on the resilience of the air transport sector can be assessed through key indicators such as the volume of investment, the reduction in CO2 emissions, and economic factors, including job creation.

To ensure the effectiveness of renewable energy projects, it is essential to make sector-specific investment decisions, particularly in the air transport sector, which has unique energy demands and infrastructure. Precisely selected energy sources that meet technological requirements are crucial for both operational sustainability and economic resilience [81]. Strategic investments in sustainable aviation fuels, electrification, or hydrogen technologies can reduce costs and enhance financial efficiency [82]. Furthermore, sector-appropriate projects help mitigate environmental impacts by contributing to the reduction in greenhouse gas emissions. Such targeted investments strengthen the resilience of the air transport sector to economic crises and support the implementation of the European Green Deal [83].

Several major projects are currently underway in the EU air transport sector, demonstrating how investments in energy infrastructure can fundamentally strengthen the sector. Through joint efforts by the EU, individual member states, and private capital, the aviation sector is becoming not only more energy efficient but also more resilient to various crises.

CINEA has overseen EU co-financing of aviation projects amounting to EUR 4.5 billion since 2014, delivered through programs, including the Connecting Europe Facility, Horizon Europe, and the Innovation Fund [84].

One of the largest projects currently underway in the EU is TULIPS. TULIPS is a consortium led by Schiphol that aims to develop innovations that facilitate the transition to low-carbon transport and increase the sustainability of airports over the next four years. The TULIPS project, which has received EUR 25 million in EU funding and a total funding of nearly EUR 32 million [85], started in January 2022 and will continue until December 2025 and beyond. The consortium aims to accelerate the deployment of sustainable technologies in aviation, thereby contributing significantly to zero-emission and zero-waste airports by 2030 and a climate-neutral aviation sector by 2050. Amsterdam Schiphol Airport is a model airport and will be the testing ground for 17 demonstration projects to be implemented in collaboration with this consortium [86].

A particularly significant initiative is the BioOstrand project, which is constructing the world’s first commercial-scale biorefinery in Sweden to produce sustainable aviation fuel and naphtha from solid forest residues. The project has received EUR 166 million in funding from the European Union [87]. During the first ten years of operation, cumulative GHG (Greenhouse gas) emissions savings are expected to reach 8.7 million tons of CO2 equivalent. For comparison, this is twice as much as the annual emissions from all domestic flights in Sweden. It should be noted that the Östrand project directly contributes to the SAF targets set out in the ReFuelEU Aviation initiative, as well as to the renewable hydrogen and autonomy targets set out in the REPowerEU action plan and the EU hydrogen strategy. The project strengthens the European value chain for advanced biofuels, from forest industry residues and local renewable electricity to the end user’s fuel tank filled with sustainable fuel. This ensures both sustainability and resilience for Europe’s most important transport economy sector, while delivering a technology and business model that can be replicated across Europe and beyond. The project is expected to create 60 direct and 660 indirect full-time equivalent green jobs per year, which will also have a positive impact on the local economy [88].

One more huge project—The Hermes project, led by the French start-up Aura Aero, aims to develop, certify, and produce a hybrid-electric 19-seat regional aircraft. The initiative has received EUR 95 million in funding from the European Union [89]. Hermes is expected to achieve an estimated total absolute GHG emission avoidance of 10 million tons of CO2 equivalent over its first ten years of operation, supporting the European Green Deal’s objectives. The project will contribute to decarbonization and the development of Europe’s aviation sector. It will also contribute to more sustainable regional air travel. Hermes is expected to create 1600 direct jobs by 2036 and up to 1600 indirect jobs later [90].

Investments in energy increase the resilience of the air transport sector, as shown in Figure 1.

Figure 1.

The impact of investments in energy on the resilience of the air transport sector. Source: Authors‘ elaboration.

These investments enhanced resilience by simultaneously reducing exposure to fossil fuel price volatility, lowering operational costs during demand shocks, and generating social co-benefits through job creation and innovation capacity. In this sense, resilience emerges not as a static outcome but as a dynamic capacity to absorb and adapt to cross-sectoral disruptions.

The rest of this article is based on research conducted on EU-funded projects.

3. Methodology

This study relies on both primary and secondary data collected from the following authoritative sources: the European Commission reports, including ReFuelEU Aviation, REPowerEU, and TEN-T (Trans-European Transport Network) program documents. Databases of the International Civil Aviation Organization (ICAO) and the International Air Transport Association (IATA). National statistical offices and Eurostat indicators related to employment, investments, and air traffic. Data from EU funding instruments (e.g., Connecting Europe Facility and Horizon Europe) concerning project investment volumes, emission reduction potential, and employment impact. The scientific literature and expert studies evaluating the effectiveness of SAF and other decarbonization technologies

The assessment of the impact of strategic investments on the air transport sector’s resilience is based on the following key indicators:

Investment volume—total financial input allocated to the project (in EUR).

CO2 emission reduction—expressed in tons of CO2 equivalent over a defined period. Economic impact, including the following: Job creation, both direct and indirect, calculated based on the multiplier effect.

The main EU projects examined in the study—TULIPS, BioOstrand, Hermes, and Pioneer (see Table 2). CO2 reduction values represent the total projected reduction over the full project duration.

Table 2.

EU projects examined in the study [91].

Four EU flagship projects (TULIPS, BioOstrand, Hermes, and Pioneer) were selected because they represent distinct technological pathways: SAF production, electrification, hybrid energy systems, and solar-based circular solutions. Together, they provide typical cases for analyzing structural transformation in the aviation sector. Major projects related to strategic energy investments in the air transport sector not only contribute to the decarbonization and resilience of aviation but also play a significant role in fostering broader economic growth within the European Union. By promoting innovation, enhancing energy efficiency, and stimulating high-value industrial activity, these initiatives generate positive spillover effects across multiple sectors, thereby strengthening the EU’s overall economic competitiveness and sustainability (see Table 3).

Table 3.

Economic indicators [91].

Emission reduction efficiency (ER):

t—CO2 reduction in tons after project implementation.

—project investments in EUR.

These metrics indicate how many tons of CO2 emissions are reduced per euro invested. It helps assess the cost-effectiveness of emission reduction [92].

Annual exposure index formula:

t—CO2 reduction in tons after project implementation.

—project duration in years.

The AEI shows the average annual CO2 emission reduction. It helps evaluate how much impact is achieved annually.

Investment performance index:

W—jobs created.

I—investment.

This index reflects the number of jobs created per million euros invested, illustrating the social return of investment [93].

Net present value (NPV):

r—discount rate, which reflects the time value of money and risk. A discount rate of 5% is often used in public sector analyses.

NPV—shows how much value the project will generate in today’s money, taking into account future benefit flows [94].

Simple regression analysis formula:

Y—dependent variable (e.g., CO2 reduction, number of jobs);

X—independent variables (Investments);

β0—constant;

β1—regression coefficient indicating how changes in X affect Y;

e—error term (residual).

Pearson Correlation Coefficient:

The Pearson correlation coefficient measures the linear relationship between two variables:

Xi—individual values of the independent variable (investment);

Yi—individual values of the dependent variable (CO2 reduction);

X and Y—means of the respective variables.

3.1. SAW Method

SAW method calculates the sum Sj of the weighted normalized values of all indicators for each j-th object (alternative):

;

s the normalized value of the i-th indicator for the j-th object. The initial data, if the criterion is minimizing, is normalized according to the following formula:

—the value of the i-th criterion for the j-th alternative.

If the criterion is maximizing, it is normalized according to the following formula:

3.2. TOPSIS Method

TOPSIS evaluates alternatives by measuring their proximity to ideal positive and negative solutions. Given equal weighting of criteria, the first stage requires normalization of the matrix using the following specified formula:

Next, we calculate the weighted matrix using the following formula:

wj

The next step is to calculate the ideal positive and ideal negative solutions using the following formula:

where I is identified with the maximizing criterion and J with the minimizing criterion; i = 1, … m; j = 1, …, n.

The distances between the ideal positive and ideal negative solutions are then calculated using the following formula:

The relative closeness to the ideal positive solution is then calculated using the following formula:

The final step involves ranking the objects under investigation.

The objective of the multi-criteria assessment is to develop a coherent framework of indicators and apply it in practice to evaluate how strategic energy investments contribute to strengthening the resilience of the European Union’s air transport sector in the context of economic crises.

In this study, all four indicators—emission reduction efficiency (ER), annual exposure index (AEI), investment performance index (IPI), and net present value (NPV)—were assigned equal weights (0.25) in both the SAW and TOPSIS methods. This decision was made for two main reasons. First, the scientific literature [1,2] as well as more recent studies on aviation energy transitions) often recommends equal weighting when the indicators represent distinct but equally relevant sustainability dimensions (environmental, economic, and social). Second, equal weighting eliminates the subjectivity of expert judgment, which was not applied in this study, thus ensuring transparency and comparability of the results.

To enhance the interpretability and reliability of the data, the study also specifies the monitoring methodologies used for CO2 reduction assessment across the evaluated projects.

Pioneer—the reported 16,000 t CO2 reduction was monitored using the EU MRV (monitoring, reporting, and verification) system, based on actual fuel consumption data, independent audits, and ICAO CORSIA emission factors.

BioOstrand—the applied life cycle covers the entire value chain impact of SAF production from forest residues.

TULIPS—relied on the Airport Carbon Accreditation (ACA) scheme, which standardizes airport emission accounting based on energy consumption data.

Hermes—CO2 reduction estimates were derived from EU funding reporting guidelines, integrating projected efficiency gains of hybrid-electric aviation technologies.

These clarifications ensure that the multi-criteria analysis conducted through SAW and TOPSIS is grounded in robust and transparent data sources, while the equal weighting approach provides a balanced evaluation framework. This strengthens both the readability and interpretability of the results, offering a scientifically consistent basis for policy and investment recommendations in the air transport sector.

Workflow:

- Project Selection—Identification of four major EU strategic energy investment projects in the air transport sector (TULIPS, BioOstrand, Hermes, and Pioneer).

- Indicator Calculation—Computation of four key performance indicators: Emission reduction efficiency (ER), annual exposure index (AEI), investment performance index (IPI), and net present value (NPV).

- Normalization—Standardization of indicator values to enable comparability across projects.

- Application of SAW/TOPSIS—Use of multi-criteria decision-making techniques (Simple Additive Weighting and Technique for Order Preference by Similarity to Ideal Solution) to derive project rankings.

- Sensitivity analysis performed.

- Results Interpretation—Comparative analysis and interpretation of rankings, linking findings to resilience enhancement in the EU air transport sector.

4. Results

To evaluate the effectiveness of strategic energy investments in the EU air transport sector, this section applies a multi-criteria analysis using key performance indicators that capture environmental, economic, and social dimensions. Specifically, the assessment focuses on emission reduction efficiency (ER), annual exposure index (AEI), investment performance index (IPI), and net present value (NPV). By comparing four major projects—TULIPS, BioOstrand, Hermes, and Pioneer—across these indicators, the analysis aims to identify which investments yield the most substantial contributions to decarbonization, economic return, and job creation. Supplementary evaluation through SAW and TOPSIS methodologies provides a holistic perspective on the overall ranking of the projects.

The emission reduction efficiency (ER) indicator shows how many tons of CO2 are reduced per euro invested (see Table 4).

Table 4.

Emission reduction efficiency.

Pioneer is the most cost-effective in terms of emissions reduced per euro invested, while TULIPS has the lowest efficiency.

The annual exposure index (AEI) indicates the average annual CO2 emissions reduced by the project (see Table 5).

Table 5.

Annual exposure index.

Pioneer again leads with the highest average annual impact, followed by BioOstrand and Hermes.

The investment performance index (IPI) reflects the number of direct jobs created per EUR 1 million invested (see Table 6).

Table 6.

Investment performance index.

Hermes demonstrates the strongest social return in job creation.

Net present value (NPV) calculated using a 5% discount rate and assuming EUR 100/year benefit per ton of CO2 saved (see Table 7).

Table 7.

Net present value.

Pioneer has the highest NPV, indicating the largest overall value creation from emission reductions, followed closely by Hermes.

The net present value (NPV) was calculated using a 5% discount rate and the assumption of EUR 100 per ton of CO2 savings, reflecting a conservative estimate of the monetary value of avoided emissions. Job creation effects, measured through the Investment in People Indicator (IPI), are based exclusively on direct employment figures reported in project documentation.

The following results were obtained using the Pearson correlation method.

Investment vs. CO2 reduction: r = −0.093, a very weak negative correlation.

These results suggest no strong linear relationship between investment size and either CO2 reduction, possibly due to project-specific differences.

Best performer in cost-effectiveness and overall impact: Pioneer excels in ER, AEI, and NPV. Best performer in job creation per investment: Hermes shows the strongest employment impact. BioOstrand shows high emission reductions, but with lower job creation and economic impact compared to Hermes and Pioneer. TULIPS shows a relatively low performance across all indicators. The analysis highlights how strategic energy investments vary in their effectiveness, with implications for future funding prioritization in strengthening air transport resilience and sustainability.

SAW (Simple Additive Weighting) and TOPSIS (Technique for Order Preference by Similarity to Ideal Solution) were applied to evaluate four strategic EU air transport projects using four indicators: Emission reduction efficiency (ER); annual exposure index (AEI); investment performance index (IPI); and net present value (NPV).

All criteria were treated as benefit criteria (the higher the value, the better), and each was assigned an equal weight (0.25).

The SAW method calculates the weighted sum of normalized values. The higher the SAW score, the better the project performs (see Table 8).

Table 8.

The SAW method.

Pioneer stands out due to its excellent ER, AEI, and NPV scores. Hermes benefits from strong job creation (IPI) and high NPV. TULIPS received low scores across all metrics. TOPSIS evaluates projects based on their distance from the ideal and anti-ideal solutions, providing a close score between 0 and 1 (see Table 9).

Table 9.

The TOPSIS method.

Pioneer again ranks first for its overall balanced performance.

Hermes is a close second, and it was particularly strong in social (job) and financial (NPV) benefits. BioOstrand performs reasonably well but falls short in job creation and cost efficiency. TULIPS again ranks lowest, consistent with previous findings. Both the SAW and TOPSIS methods consistently identify Pioneer as the top-performing strategic investment in terms of environmental, economic, and social indicators. Hermes also ranks highly due to its strong social impact and economic returns. These results can support funding prioritization, policy alignment, and resilience-building strategies in the EU air transport sector.

The Pioneer project, which ranks highest in this study in terms of emission reduction efficiency (ER), annual exposure index (AEI), and net present value (NPV), demonstrates that investments in advanced, circular-economy-based energy systems significantly enhance the resilience of the air transport sector. The integration of solar energy and second-life EV batteries not only reduces CO2 emissions but also strengthens energy independence and infrastructure flexibility. These findings confirm that the most effective solutions are those addressing environmental, economic, and technological challenges simultaneously. Pioneer serves as a model for sectoral transformation and a strong rationale for prioritizing similar investments in the future.

The comparative evaluation reveals that Pioneer consistently outperforms other projects, ranking highest in emission reduction efficiency, annual exposure index, and net present value, and securing the top position in both SAW and TOPSIS rankings. Hermes emerges as a strong performer in social and economic terms, particularly in job creation per investment unit. BioOstrand, while achieving high absolute CO2 reductions, shows relatively moderate returns in other dimensions. In contrast, TULIPS ranks lowest across all indicators, suggesting limited effectiveness. These findings underscore the importance of integrated performance assessments for guiding funding priorities, with Pioneer and Hermes representing models of balanced investment impact in strengthening the sustainability and resilience of the air transport sector.

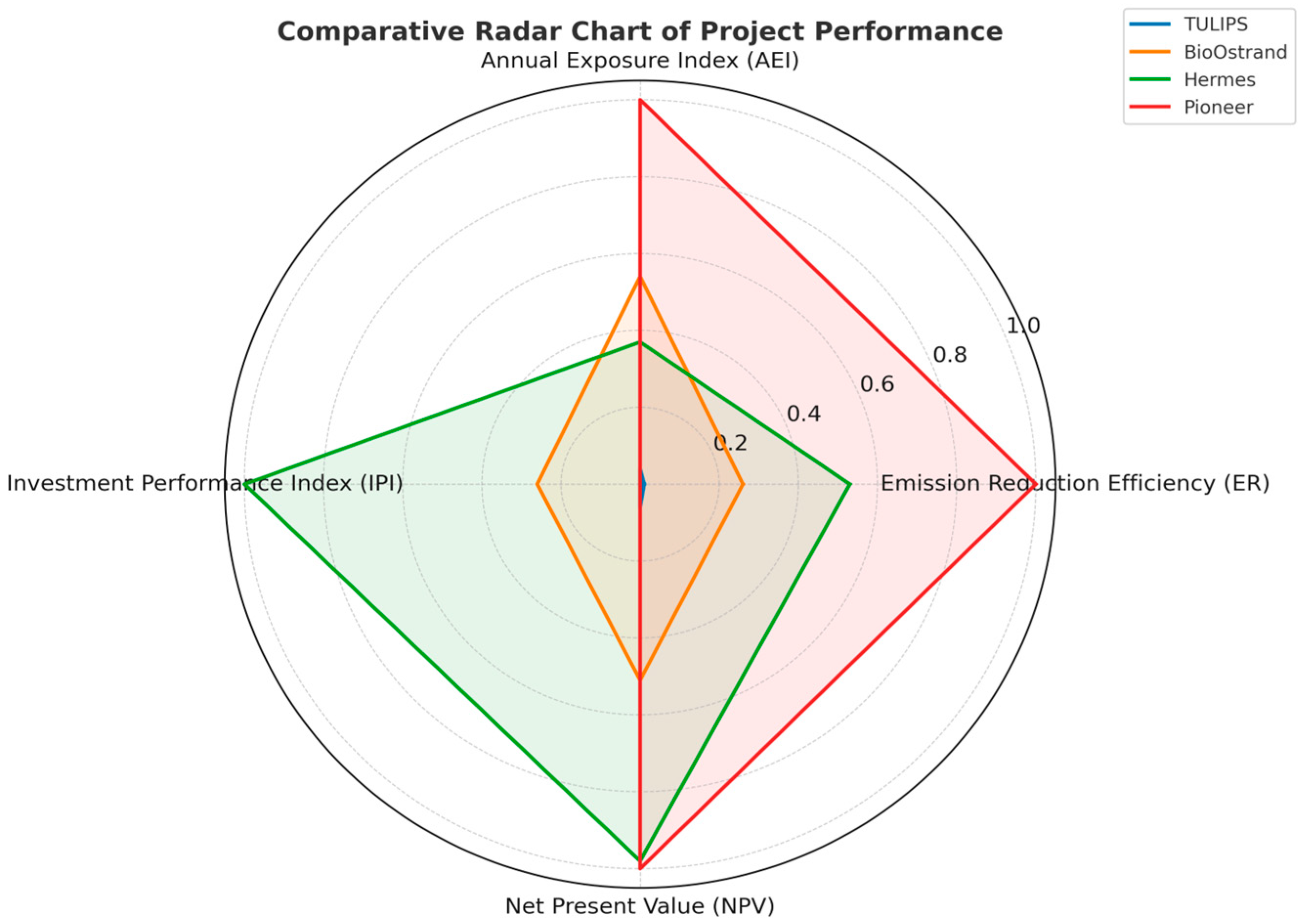

To verify the robustness of the multi-criteria evaluation, a sensitivity analysis was conducted by adjusting the weights assigned to the indicators. In the baseline scenario, all four criteria (emission reduction efficiency, annual exposure index, investment performance index, and net present value) were weighted equally at 0.25. In the alternative scenario, greater emphasis was placed on the investment performance index (IPI) by assigning it a weight of 0.40, while the remaining criteria were weighted at 0.20 each.

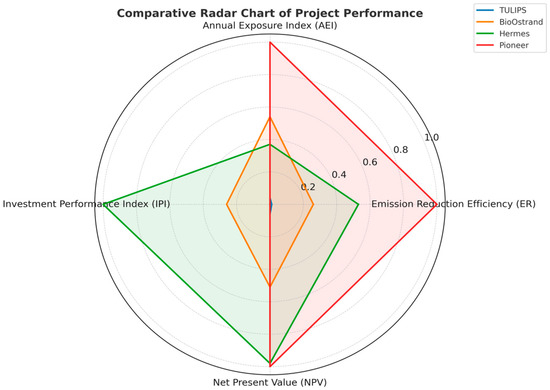

The results (see Figure 2) indicate that the overall project ranking remains stable, with Pioneer consistently ranked first and Hermes remaining a strong second. Although the relative scores of projects change slightly, no major shifts occur in the ranking order. This demonstrates that the findings are not overly sensitive to the choice of weighting scheme.

Figure 2.

Comparative radar chart of project performance. Source: Authors’ elaboration.

The radar chart further illustrates the multidimensional performance of each project, showing that Pioneer excels in environmental and financial criteria, while Hermes stands out in job creation. The robustness of the rankings under different weighting scenarios provides confidence that the evaluation approach yields reliable insights into the effectiveness of strategic energy investments in enhancing the resilience of the EU air transport sector (Figure 2).

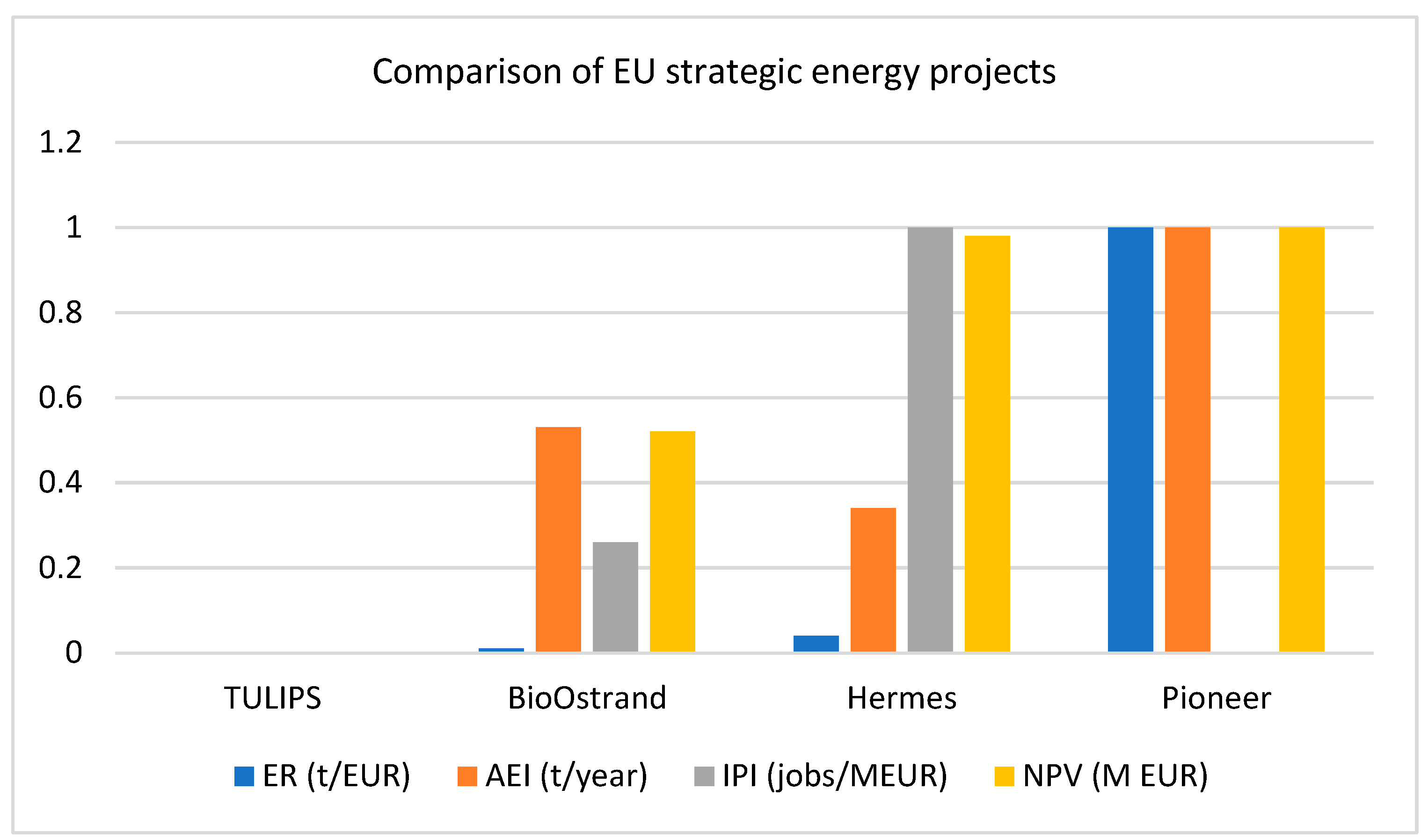

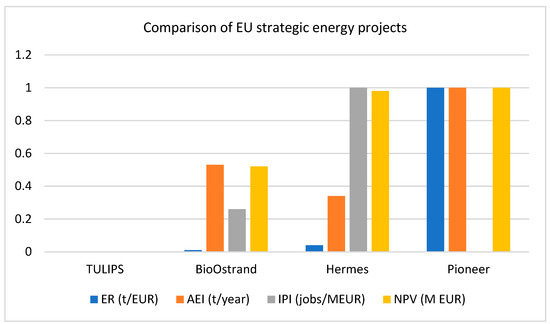

Performance index—IPI and net present value—NPV were normalized to a common scale between 0 and 1 using the min–max method. This normalization eliminates differences in magnitude between indicators (e.g., tons of CO2 vs. monetary values) and highlights the relative strengths and weaknesses of each project. The bar chart shows that Pioneer achieves the highest overall normalized performance, particularly in ER and NPV, while Hermes stands out in IPI (job creation). BioOstrand demonstrates strong AEI performance, whereas TULIPS consistently underperforms across most indicators (Figure 3).

Figure 3.

Comparison of EU strategic energy projects. Source: Authors’ elaboration.

5. Discussion

This study shows that strategic energy investments enhance the resilience of the EU air transport sector not only by supporting climate policy goals but also by strengthening its capacity to withstand shocks. The findings reveal two complementary dimensions of resilience: internal resilience, driven by technological renewal, energy independence, and infrastructure flexibility; and external resilience, linked to adaptability to market, social, and geopolitical disruptions (Table 10).

Table 10.

Project contributions to internal and external resilience.

The use of SAW and TOPSIS confirmed the robustness of rankings, while sensitivity analysis demonstrated stability across alternative weighting scenarios. This indicates that project design and strategic alignment—rather than investment size—determine resilience outcomes.

Overall, the results highlight that Pioneer strengthens internal technological resilience, Hermes enhances external socio-economic resilience, and both align with the EU Green Deal and energy transition strategies. Strategic energy investments should, therefore, be prioritized not only for their decarbonization benefits but also for their role in reinforcing resilience at multiple levels.

This study demonstrates that different types of strategic energy investment affect distinct dimensions of resilience. Investments in renewable energy generation (e.g., solar and wind infrastructure) primarily enhance environmental resilience, reducing dependence on fossil fuels and exposure to external price shocks. Electrification and hybrid-energy solutions strengthen operational resilience by increasing flexibility in energy use, improving efficiency, and reducing vulnerability to supply chain disruptions. Meanwhile, investments in SAF and hydrogen technologies have a strong impact on economic resilience, as they diversify fuel portfolios and mitigate the financial risks of volatile global energy markets.

The interplay between internal and external resilience provides an integrated framework for guiding EU policy and investment decisions [65,66,68]. This ensures that technological innovation and socio-economic benefits jointly reinforce the long-term sustainability of the air transport sector.

Internal resilience—the sector’s ability to absorb and adapt to internal shocks—is reinforced by technological renewal and energy efficiency gains [64,65,66,67], as illustrated by the Pioneer project’s integration of solar energy and second-life batteries. External resilience—the capacity to withstand external macroeconomic, social, or geopolitical disruptions [68]—is most visible in projects such as Hermes, where job creation and social capital provide buffers against wider systemic shocks. In contrast, projects with limited alignment to resilience objectives, such as TULIPS, highlight the risks of symbolic sustainability initiatives that fail to deliver robust responses to either internal or external vulnerabilities.

6. Conclusions

This study examined whether strategic investments in energy strengthen the resilience of the EU air transport sector. The hypothesis was that projects that integrate environmental, economic, and social objectives ensure greater resilience than projects with narrower objectives.

The results confirm this hypothesis. Using a multidimensional indicator system (ER, AEI, IPI, and NPV), the analysis shows that Pioneer delivers exceptional environmental and economic value, while Hermes leads in terms of social impact. The BioOstrand project shows a significant reduction in emissions but limited financial returns, while the TULIPS project illustrates the weaker contribution of symbolic flagship projects. These models emphasize that resilience arises from the complementarity of different types of investments.

By distinguishing between internal resilience (driven by technological innovation, energy diversification, and operational flexibility) and external resilience (social and geopolitical adaptation), the study shows that a balanced energy investment portfolio is needed. Sensitivity analysis has reconfirmed that the ratings remain stable across various weighted scenarios, which reinforces the reliability of the results.

Taking into account EU strategies (European Green Deal, REPowerEU, and Horizon Europe), the study results show that resilience not only depends on financial resources but also on governance and stakeholder cooperation.

In summary, the study confirms the hypothesis that strategic energy investments, assessed using a multifaceted and rigorously tested model, play a key role in strengthening the resilience of the EU air transport sector, combining climate action with economic and social stability.

Author Contributions

Conceptualization, L.O.N.; methodology, L.O.N. and E.S.-N.; experiment and data analysis, L.O.N., E.S.-N., and M.T.; conclusions, L.O.N. and M.T.; discussion, L.O.N. and E.S.-N.; writing—original draft preparation, L.O.N., E.S.-N., and M.T.; writing—review and editing, L.O.N., E.S.-N. and M.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in the study are included in the article.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| ER | Emission reduction efficiency |

| AEI | Annual exposure index |

| IPI | Performance index |

| NPV | Net present value |

| EU | European union |

| SAF | Sustainable aviation fuel |

| ICAO | International Civil Aviation Organization |

| IATA | International Air Transport Association |

| SAW | Simple Additive Weighting |

| TOPSIS | Technique for Order Preference by Similarity to Ideal Solution |

| GHG | Greenhouse gasses |

| OEMs | Original equipment manufacturer |

| TEN-T | Trans-European Transport Network |

| GDP | Gross domestic product |

| ATN | Air Transport Network |

| LCA | Life Cycle Assessment |

| MRV | Monitoring, Reporting and Verification system |

| ACA | Airport Carbon Accreditation |

References

- Bjelicic, B. Financing airlines in the wake of the financial markets crisis. J. Air Transp. Manag. 2012, 21, 10–16. [Google Scholar] [CrossRef]

- Akyildirim, E.; Corbet, S.; Nicolau, J.L.; Oxley, L. Understanding reputational disaster during economic crises: Evaluating aviation sector response differentials. Tour. Manag. 2025, 106, 105028. [Google Scholar] [CrossRef]

- Fan, S.; Ge, Q.; Ho, B.; Ma, L. Sorry Doesn’t Cut It, or Does It? Insights from Stock Market Responses to Corporate Apologies. J. Econ. Behav. Organ. 2023, 205, 68–86. [Google Scholar] [CrossRef]

- Cioroianu, I.; Corbet, S.; Larkin, C. Guilt through association: Reputational contagion and the Boeing 737-MAX disasters. Econ. Lett. 2021, 198, 109657. [Google Scholar] [CrossRef]

- Periokaitė, P.; Dobrovolskienė, N. The impact of COVID-19 on the financial performance: A case study of the Lithuanian transport sector. Insights Into Reg. Dev. 2021, 3, 34–50. [Google Scholar] [CrossRef]

- Adams, J. Russia-Ukraine-Impact-Aerospace-Defense; KPMG: Amstelveen, The Netherlands, 2022. [Google Scholar]

- Ennen, D.; Wozny, F. Airspace closures following the war of aggression in Ukraine: The impact on Europe-Asia airfares. Transp. Res. Procedia 2024, 78, 103–110. [Google Scholar] [CrossRef]

- Rogoff, K. The Long-lasting Economic Shock of War 2022. Available online: https://www.imf.org/en/Publications/fandd/issues/2022/03/the-long-lasting-economic-shock-of-war (accessed on 20 November 2024).

- Xu, G.; Zhang, X. Statistical analysis of resilience in an air transport network. Front. Phys. 2022, 10, 969311. [Google Scholar] [CrossRef]

- Xu, L.; Lin, N.; Perera, A.T.D.; Poor, H.V.; Guo, Q.; Sun, H.; Oppenheimer, M. Cross-sector energy system resilience and interdependence in a changing climate. Joule 2025, 9, 101967. [Google Scholar] [CrossRef]

- Redouani, A.; Ikmel, G.; Zared, K.; Čyras, G.; El Amrani El Idrissi, N. A comprehensive review of integrated energy storage batteries in renewable energy stations: Technological advancements, challenges and future trends. Insights Into Reg. Dev. 2024, 6, 40–52. [Google Scholar] [CrossRef]

- Mugunzva, F.I.; Manchidi, N.H. Re-envisioning the artificial intelligence-entrepreneurship nexus: A pioneering synthesis and future pathways. Insights Into Reg. Dev. 2024, 6, 71–84. [Google Scholar] [CrossRef]

- Demouge, C.; Mongeau, M.; Couellan, N.; Delahaye, D. Climate-aware air traffic flow management optimization via column generation. Transp. Res. Part C Emerg. Technol. 2024, 166, 104792. [Google Scholar] [CrossRef]

- Wild, P.; Mathys, F.; Wang, J. Impact of political and market-based measures on aviation emissions and passenger behaviors (a Swiss case study). Transp. Res. Interdiscip. Perspect. 2021, 10, 100405. [Google Scholar] [CrossRef]

- Amraoui, B.; Zemlickienė, V.; El Amrani El Idrissi, N. Renewable energy clusters: The cases of leading countries, lessons applicable to Morocco. Insights Into Reg. Dev. 2025, 7, 93–108. [Google Scholar] [CrossRef]

- Okunevičiūtė Neverauskienė, L.; Dirma, V.; Tvaronavičienė, M.; Danilevičienė, I. Assessing the Role of Renewable Energy in the Sustainable Economic Growth of the European Union. Energies 2025, 18, 760. [Google Scholar] [CrossRef]

- Okuneviciute Neverauskiene, L.; Klepone, D. Empirical evidence on the startup growth in the Baltic Region high tech land-scape. Transform. Bus. Econ. 2024, 23, 1164–1191. [Google Scholar]

- Pearce, B. The state of air transport markets and the airline industry after the great recession. J. Air Transp. Manag. 2012, 21, 3–9. [Google Scholar] [CrossRef]

- Statfor, E. EUROCONTROL Five-Year Forecast 2020–2024 European Flight Movements and Service Units Three Scenarios for Recovery from COVID-19; EUROCONTROL: Brussels, Belgium, 2020. [Google Scholar]

- Franke, M.; John, F. What comes next after recession?—Airline industry scenarios and potential end games. J. Air Transp. Manag. 2011, 17, 19–26. [Google Scholar] [CrossRef]

- Pantazi, T.; Papatheodorou, A. Government support in the European air transport sector during COVID-19: A Delphi study. Res. Transp. Bus. Manag. 2024, 54, 101130. [Google Scholar] [CrossRef]

- Talíř, M.; Chytilová, E. Impact of digitalisation on companies’ performance during COVID-19. Entrep. Sustain. Issues 2024, 11, 260–275. [Google Scholar] [CrossRef]

- Chu, C.; Zhang, H.; Zhang, J.; Cong, L.; Lu, F. Assessing impacts of the Russia-Ukraine conflict on global air transportation: From the view of mass flight trajectories. J. Air Transp. Manag. 2024, 115, 102522. [Google Scholar] [CrossRef]

- Churikanova, O.; Pilova, D.; Giordano, B.; Piccinetti, L.; Amoruso, M. Circular economy and smart specialisation business strategies: The Dnipropetrovsk region case. Insights Into Reg. Dev. 2025, 7, 109–130. [Google Scholar] [CrossRef]

- Stamatev, S.; Angelova, M. Unveiling the Resilience of Creative Business: Navigating the impact and recovery path of COVID-19 in Bulgaria. Entrep. Sustain. Issues 2024, 12, 127–147. [Google Scholar] [CrossRef]

- Okunevičiūtė Neverauskienė, L.; Ginevičius, R.; Danilevičienė, I. The influence of wage and employment on competitiveness: An assessment. J. Compet. 2024, 16, 83–105. [Google Scholar]

- Jašková, D.; Kráľová, K.; Sochuľáková, J. High-performance work systems and their impact on financial performance in SMEs. Entrep. Sustain. Issues 2024, 12, 163–175. [Google Scholar] [CrossRef]

- Bureš, J.; Sobotková, N.; Bartoš, V. Evaluation of the financial performance of engineering companies in the Czech Republic and Central Europe. Entrep. Sustain. Issues 2024, 12, 262–274. [Google Scholar] [CrossRef]

- Werbik, A.R. Capital and international growth: Lessons from IT companies for shaping entrepreneurship in the age of industry 4.0. Entrep. Sustain. Issues 2024, 12, 429–442. [Google Scholar] [CrossRef]

- Hunková, L.; Havierniková, K. Exploring the intersection of strategic human resource management and Industry 5.0: A systematic literature review. Entrep. Sustain. Issues 2024, 12, 25–35. [Google Scholar] [CrossRef]

- Mura, R.; Vicentini, F.; Fratocchi, L.; Botti, L.M.; Chiriacò, M.V. Exploring dynamic capabilities and green innovations in born sustainable firms. Entrep. Sustain. Issues 2024, 12, 152–168. [Google Scholar] [CrossRef] [PubMed]

- Dirma, V.; Neverauskienė, L.O.; Tvaronavičienė, M.; Danilevičienė, I.; Tamošiūnienė, R. The Impact of Renewable Energy Development on Economic Growth. Energies 2024, 17, 6328. [Google Scholar] [CrossRef]

- IATA. Aviation Supporting the Global Economy: Vital Role Connecting the World. 2024. Available online: https://www.iata.org/en/iata-repository/pressroom/fact-sheets/fact-sheet-benefits-aviation-statistics/ (accessed on 5 July 2025).

- European Commission. Air. Available online: https://transport.ec.europa.eu/transport-modes/air_en (accessed on 5 July 2025).

- Neiva, R.; Horton, G.; Pons, A.; Lokesh, K.; Casullo, L.; Kauffmann, A.; Giannelos, G. Investment Scenario and Roadmap for Achieving Aviation Green Deal Objectives by 2050 Final Study; European Parliament: Brussels, Belgium, 2022.

- Sincock Charles. How Will the Energy Transition Impact the Aviation Industry? Marsh, 22 May 2024. Available online: https://www.marsh.com/en/industries/aviation-space/insights/how-will-the-energy-transition-impact-the-aviation-industry.html (accessed on 8 July 2025).

- Zubi, G.; Kuhn, M.; Makridis, S.; Coutinho, S.; Dorasamy, S. Aviation sector decarbonization within the hydrogen economy—A UAE case study. Energy Policy 2025, 198, 114520. [Google Scholar] [CrossRef]

- Emami Javanmard, M.; Tang, Y.; Martínez-Hernández, J.A. Forecasting air transportation demand and its impacts on energy consumption and emission. Appl. Energy 2024, 364, 123031. [Google Scholar] [CrossRef]

- Cook, D.; Mayer, R.; Doy, G. Crises and the Resilience of the Aviation Industry: A Literature Review of Crises and Airline Responses. Transp. Res. Procedia 2023, 75, 33–42. [Google Scholar] [CrossRef]

- Cristea, A.D.; Miromanova, A. Telecommuting and the recovery of passenger aviation post-COVID-19. Econ. Transp. 2025, 42, 100409. [Google Scholar] [CrossRef]

- AlKheder, S. Modeling the impacts of COVID-19 on Arabian Gulf air transportation industry using multiple regression and Vector AutoRegression models. Case Stud. Transp. Policy 2025, 20, 101437. [Google Scholar] [CrossRef]

- Lisinge, R.T. Survival instincts in the aviation industry: How effective was Africa’s regional COVID-19 recovery strategy? Afr. Transp. Stud. 2025, 3, 100049. [Google Scholar] [CrossRef]

- Zhang, L.; Gong, J.; Yang, Y. How has the COVID-19 pandemic reshaped the aviation network? A comparative pre- and during-pandemic analysis. Transp. Policy 2025, 160, 228–244. [Google Scholar] [CrossRef]

- Wu, C.; Yan, H.; Xue, W.; Jiang, Y. Impacts of the COVID-19 pandemic on airline performance and tourism demand: Evidence from a quasi-natural experiment in Southwest China. J. Air Transp. Manag. 2025, 126, 102797. [Google Scholar] [CrossRef]

- Baumeister, S.; Leung, A.; Ryley, T. The Impacts of COVID-19 on Domestic Aviation in Finland and the Potential Role of Electric Aircraft for a Green Recovery. Transp. Res. Procedia 2025, 82, 660–673. [Google Scholar] [CrossRef]

- Li, Y.; Zheng, J.K. The impacts of the COVID-19 on the aircraft emissions from international routes from and to China. J. Air Transp. Manag. 2024, 119, 102640. [Google Scholar] [CrossRef]

- Sun, X.; Zheng, C.; Hanaoka, S.; Zhang, A.; Wandelt, S. Sayonara pandemic, Konnichiwa new normalcy: An analysis of Japanese aviation with COVID-19. Case Stud. Transp. Policy 2025, 19, 101371. [Google Scholar] [CrossRef]

- Wu, H.; Hong Tsui, K.W.; Ngo, T.; Lin, Y.H. Investigating aviation subsidy scheme’s impact on domestic aviation during the post-lockdown period: A case study of New Zealand. Case Stud. Transp. Policy 2025, 20, 101405. [Google Scholar] [CrossRef]

- Radchenko, O.; Tulush, L.; Leontovych, S. Financial instruments for ensuring national security: Experience of Ukraine in military conditions. Insights Into Reg. Dev. 2023, 5, 10–25. [Google Scholar] [CrossRef]

- IATA. IATA Factsheet. 2022. Available online: www.iata.org/economics (accessed on 11 July 2025).

- Xue, D.; Du, S.; Xu, Y.; Zhang, Q.; Sun, X. Airspace closure challenges: Exploring the impact of the Russia-Ukraine conflict on flight operations and pathways to solutions. Transp. Res. Interdiscip. Perspect. 2025, 31, 101396. [Google Scholar] [CrossRef]

- Lewtak, K.; Kanecki, K.; Tyszko, P.; Goryński, P.; Bogdan, M.; Nitsch-Osuch, A. Ukraine war refugees—Threats and new challenges for healthcare in Poland. J. Hosp. Infect. 2022, 125, 37–43. [Google Scholar] [CrossRef]

- Wang, X.; Zhang, J.; Wandelt, S. On the ramifications of airspace bans in aero-political conflicts: Towards a country importance ranking. Transp. Policy 2023, 137, 1–13. [Google Scholar] [CrossRef]

- Bun, R.; Marland, G.; Oda, T.; See, L.; Puliafito, E.; Nahorski, Z.; Jonas, M.; Kovalyshyn, V.; Ialongo, I.; Yashchun, O.; et al. Tracking unaccounted greenhouse gas emissions due to the war in Ukraine since 2022. Sci. Total Environ. 2024, 914, 169879. [Google Scholar] [CrossRef] [PubMed]

- Liobikienė, G.; Matiiuk, Y.; Krikštolaitis, R. The concern about main crises such as the Covid-19 pandemic, the war in Ukraine, and climate change’s impact on energy-saving behavior. Energy Policy 2023, 180, 113678. [Google Scholar] [CrossRef]

- Chomać-Pierzecka, E.; Sobczak, A.; Urbańczyk, E. RES Market Development and Public Awareness of the Economic and Environmental Dimension of the Energy Transformation in Poland and Lithuania. Energies 2022, 15, 5461. [Google Scholar] [CrossRef]

- Chen, Y.; Jiang, J.; Wang, L.; Wang, R. Impact assessment of energy sanctions in geo-conflict: Russian–Ukrainian war. Energy Rep. 2023, 9, 3082–3095. [Google Scholar] [CrossRef]

- International Transport Forum at the OECD. Transport Policy Responses How the War in Ukraine Impacts Aviation-and What to Do About it at a Glance; International Transport Forum: Paris, France, 2022. [Google Scholar]

- Halteh, K.; AlKhoury, R.; Adel Ziadat, S.; Gepp, A.; Kumar, K. Using machine learning techniques to assess the financial impact of the COVID-19 pandemic on the global aviation industry. Transp. Res. Interdiscip. Perspect. 2024, 24, 101043. [Google Scholar] [CrossRef]

- Ostroumov, I.; Ivannikova, V.; Kuzmenko, N.; Zaliskyi, M. Impact analysis of Russian-Ukrainian war on airspace. J. Air Transp. Manag. 2025, 124, 102742. [Google Scholar] [CrossRef]

- Deng, Y.; Zhang, Y.; Wang, K.; He, Y. Navigating through and beyond the COVID-19 crisis: Evaluating the resilience of Chinese international air freighter networks. Transp. Policy 2025, 163, 285–297. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P.; Tyler, P. Local growth evolutions: Recession, resilience and recovery. Camb. J. Reg. Econ. Soc. 2015, 8, 141–148. [Google Scholar] [CrossRef]

- Feng, X.; Zeng, F.; Loo, B.P.Y.; Zhong, Y. The evolution of urban ecological resilience: An evaluation framework based on vulnerability, sensitivity and self-organization. Sustain. Cities Soc. 2024, 116, 105933. [Google Scholar] [CrossRef]

- Elshaer, I.A.; Azazz, A.M.S.; Kooli, C.; Alqasa, K.M.A.; Afaneh, J.; Fathy, E.A.; Fouad, A.M.; Fayyad, S. Resilience for Sustainability: The Synergistic Role of Green Human Resources Management, Circular Economy, and Green Organizational Culture in the Hotel Industry. Adm. Sci. 2024, 14, 297. [Google Scholar] [CrossRef]

- Bedianashvili, G.; Tsartsidze, M.; Mikeladze, N.; Gabroshvili, Z. Human capital and economic growth under modern globalization. Entrep. Sustain. Issues 2024, 12, 268–289. [Google Scholar] [CrossRef]

- Žárská, V.; Smetanová, E. Dynamics of human capital development and competitiveness in selected European countries. Entrep. Sustain. Issues 2024, 12, 430–447. [Google Scholar] [CrossRef] [PubMed]

- Barkóciová, M.; Mihalčová, B.; Černák, F.; Šišulák, S. Hybrid threats and their impact on the performance of the business environment. Entrep. Sustain. Issues 2023, 11, 466–479. [Google Scholar] [CrossRef]

- International Monetary Fund. Resilience To Shocks. IMF Annual Report 2023; 2023; Available online: https://www.imf.org/external/pubs/ft/ar/2023/in-focus/resilience-to-shocks/ (accessed on 11 November 2024).

- European Commission. Reducing Air Travel Climate Effects Requires more than Technological Innovation and Carbon Pricing—European Commission. 2024. Available online: https://joint-research-centre.ec.europa.eu/jrc-news-and-updates/reducing-air-travel-climate-effects-requires-more-technological-innovation-and-carbon-pricing-2024-12-09_en (accessed on 13 July 2025).

- Tiwari, S.; Patrizio, P.; Leduc, S.; Stratton, A.; Kraxner, F. Fuel from air: A techno-economic assessment of e-fuels for low-carbon aviation in China. Energy Convers. Manag. 2025, 333, 119796. [Google Scholar] [CrossRef]

- Chong, C.T.; Ng, J.H. Limitations to sustainable renewable jet fuels production attributed to cost than energy-water-food resource availability. Nat. Commun. 2023, 14, 8156. [Google Scholar] [CrossRef]

- Gössling, S.; Humpe, A. The global scale, distribution and growth of aviation: Implications for climate change. Glob. Environ. Change 2020, 65, 102194. [Google Scholar] [CrossRef] [PubMed]

- Prussi, M.; Noussan, M.; Laveneziana, L.; Chiaramonti, D. The risk of increasing energy demand while pursuing decarbonisation: The case of the e-fuels for the EU aviation sector. Transp. Policy 2025, 160, 154–158. [Google Scholar] [CrossRef]

- Becken, S.; Mackey, B.; Lee, D.S. Implications of preferential access to land and clean energy for Sustainable Aviation Fuels. Sci. Total Environ. 2023, 886, 163883. [Google Scholar] [CrossRef] [PubMed]

- Lai, Y.Y.; Christley, E.; Kulanovic, A.; Teng, C.C.; Björklund, A.; Nordensvärd, J.; Karakaya, E.; Urban, F. Analysing the opportunities and challenges for mitigating the climate impact of aviation: A narrative review. Renew. Sustain. Energy Rev. 2022, 156, 111972. [Google Scholar] [CrossRef]

- Justin, C.Y.; Payan, A.P.; Mavris, D.N. Integrated fleet assignment and scheduling for environmentally friendly electrified regional air mobility. Transp. Res. Part C Emerg. Technol. 2022, 138, 103567. [Google Scholar] [CrossRef]

- Ovaere, M.; Proost, S. Strategic climate policy in global aviation: Aviation fuel taxes and efficiency standards with duopolistic aircraft producers. Econ. Transp. 2025, 41, 100397. [Google Scholar] [CrossRef]

- Didem Mizrak, F.; Şahin, R. Investment strategies for renewable energy technologies and harvesting systems in airport operations using spherical fuzzy MCDM models. Sci. Rep. 2025, 15, 24075. [Google Scholar] [CrossRef]

- Raihan, A. Sustainable Aviation: A Critical Review of Policies, Technologies, and Future Pathways. J. Air Transp. Res. Soc. 2025, 5, 100080. [Google Scholar] [CrossRef]

- World Economic Forum. Financing Sustainable Aviation Fuels: Case Studies and Implications for Investment; World Economic Forum: Geneva, Switzerland, 2025. [Google Scholar]

- Ibrahim, I.A.; Choudhury, T.; Sargeant, J.; Shah, R.; Hossain, M.J.; Islam, S. Cerei: An open-source tool for Cost-Effective Renewable Energy Investments. SoftwareX 2024, 26, 101708. [Google Scholar] [CrossRef]

- Gurmani, S.H.; Zhang, S.; Awwad, F.A.; Ismail, E.A.A. Combinative distance-based assessment method using linguistic T-spherical fuzzy aggregation operators and its application to multi-attribute group decision-making. Eng. Appl. Artif. Intell. 2024, 133, 108165. [Google Scholar] [CrossRef]

- Yüksel, S.; Ecer, F.; Krishankumar, R.; Dinçer, H.; Gökalp, Y. TRIZ-driven assessment of sector-wise investment decisions in renewable energy projects through a novel integrated q-ROF-DEMATEL-SRP model. Energy 2025, 314, 133970. [Google Scholar] [CrossRef]

- European Commission. Transforming EU Aviation for a Sustainable Future. European Commission; 2025. Available online: https://cinea.ec.europa.eu/transforming-eu-aviation-sustainable-future_en (accessed on 20 July 2025).

- European Commission. TULIPS: Amsterdam’s Schiphol Airport Leads the Way to Circularity. European Commission; 2025. Available online: https://cinea.ec.europa.eu/featured-projects/tulips-amsterdams-schiphol-airport-leads-way-circularity_en?prefLang=hr (accessed on 20 July 2025).

- Tulips. Innovative & More Sustainable Airports. 2025; Available online: https://tulips-greenairports.eu/ (accessed on 20 July 2025).

- European Commission. Innovation Fund. 2025. Available online: https://ec.europa.eu/assets/cinea/project_fiches/innovation_fund/101132801.pdf (accessed on 21 July 2025).

- EU Funding & Tenders Portal. Biorefinery Östrand—The First Commercial Deployment of Solid Biomass-and-Power-to- Sustainable Aviation Fuels Technology Line-Up. Available online: https://ec.europa.eu/info/funding-tenders/opportunities/portal/screen/opportunities/projects-details/43089234/101132801/Innovfund (accessed on 21 July 2025).

- European Commission. Shaping the Future of Aviation. Available online: https://cinea.ec.europa.eu/shaping-future-aviation_en (accessed on 21 July 2025).

- European Commission. Innovation Fund. 2025. Available online: https://ec.europa.eu/assets/cinea/project_fiches/innovation_fund/101191083.pdf (accessed on 21 July 2025).

- EU Funding & Tenders Portal. Electrification of Ground Operations at ANA. Available online: https://ec.europa.eu/info/funding-tenders/opportunities/portal/screen/opportunities/projects-details/43251567/101164848/CEF2027 (accessed on 21 July 2025).

- Xiaoxi, C. Analysis of carbon emission reduction efficiency of China’s thermal power plants from a multi-dimensional perspective. Energy Rep. 2025, 14, 624–633. [Google Scholar] [CrossRef]

- Bhatnagar, S.; Sharma, D.; Bundel, R. Green finance and investment index for assessing scenario and performance in selected countries. World Dev. Sustain. 2024, 5, 100183. [Google Scholar] [CrossRef]

- Sokolov, M.V. NPV, IRR, PI, PP, and DPP: A unified view. J. Math. Econ. 2024, 114, 102992. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).