1. Introduction

The transition toward carbon neutrality in energy markets involves numerous heterogeneous actors and complex interactions, making it difficult for traditional modeling approaches to capture long-term dynamics. Agent-based modeling (ABM) provides an effective framework for analyzing such complex systems. In electricity markets, ABM enables the representation of producers, consumers, storage units, market operators, and regulators, while also capturing their individual decision-making behaviors and interactions. This approach allows researchers to investigate how the collective behavior of agents influences the overall system, thereby facilitating a better understanding of real-world dynamics [

1]. In this way, newly introduced market participants, policies, regulations, and technologies can be examined in detail to support the development of effective decision-making frameworks.

In ABM studies, the accuracy of simulations can be improved by incorporating machine learning (ML) methods. Reinforcement learning (RL) techniques enable agents to learn and adapt their strategies in ways that more closely reflect real-world decision-making [

2]. A typical application is the adjustment of bidding strategies for producers or consumers through learning during the simulation process [

3]. Moreover, ML can be applied to predict exogenous variables such as demand or market prices, further enhancing model accuracy. Supervised ML methods are often used for such forecasting tasks [

4]. In the literature, studies focusing on agent learning significantly outnumber those relying on external data prediction [

5].

Among the general-purpose ABM software tools, the Recursive Porous Agent Simulation Toolkit (Repast) was one of the earliest platforms to integrate ML algorithms, including genetic algorithms, artificial neural networks (ANNs), and other methods [

6]. Another widely used tool is AnyLogic, a commercially developed software that enables agent modeling and simulation with reduced coding requirements and advanced visualization features [

7,

8]. These general-purpose ABM platforms paved the way for energy market-specific simulation frameworks. For instance, the Simulator for Electric Power Industry Agents (SEPIA) models stakeholders such as power plants, consumers, suppliers, and transmission operators [

9]. Similarly, the Electricity Market Complex Adaptive Systems (EMCAS) tool incorporates independent system operators (ISOs) and regulators, allowing users to define market rules and observe their effects [

10]. The Multi-Agent System that Simulates Competitive Electricity Markets (MASCEM) further extends this approach by introducing virtual producers that represent groups of agents and make strategic group decisions on their behalf [

11].

Several ABM frameworks have also been developed to represent specific national electricity markets. For instance, the National Electricity Market Simulation System (NEMSIM) models the Australian market, incorporating contracts, investments, and carbon emissions [

12]. ElectTrans simulates the Dutch system by capturing long-term capacity additions and plant retirements, while ElecSim provides a framework for analyzing investment decisions in the UK market [

13,

14]. The electricity markets investment suite–agent-based simulation (EMIS-AS) broadens this perspective by integrating financing options, technology preferences, and risk tolerance into investment decision-making [

15]. Nexus-e simulates the Swiss electricity market, including cross-border trading [

16,

17]. As a last example, Guven et al. [

18] developed a long-term ABM model with yearly resolution that integrates climate projections and policy scenarios, demonstrating how renewable incentives and nuclear development influence emissions and energy costs.

Despite these advances, the number of studies remains limited, with a review of ABM–ML integration in local energy markets between 2000 and 2019 indicating that only a small number of works existed, particularly those employing ML for external data prediction [

5]. Long-term studies are particularly challenging, as they require reliable projections of market behavior and policy developments. Consequently, most research has concentrated on short-term analyses [

19]. Nevertheless, incorporating ML-based forecasting of external variables can significantly enhance the accuracy of ABM simulations. For example, Fraunholz et al. [

20] employed the power agent-based computational economics (PowerACE) platform to predict European day-ahead prices from 2020 to 2050, with ANN models achieving the highest accuracy. Similarly, Kell et al. [

21] assessed forecasting models within the ElecSim tool for UK hourly demand data (2011–2017), finding that the extra trees regressor outperformed offline methods, whereas online retraining with a multilayer perceptron produced superior results.

Studies conducted between 2016 and 2021 show that ABM–ML research in energy markets has primarily focused on specific applications such as bidding and price forecasting [

22]. Most studies have been limited to electricity markets, with relatively little attention paid to broader system perspectives. Although some research has incorporated carbon emissions trading mechanisms, the number of such studies is still limited [

23]. Another notable shortcoming is that only a few studies explicitly discuss verification and validation procedures [

24]. In ABM, verification ensures that the model has been correctly implemented, whereas validation examines whether the model structure and behavior accurately reflect real-world dynamics [

25]. Notably, 58% of the studies published between 2014 and 2024 relied on artificial data, limiting their ability to validate models under actual market conditions and often resulting in less realistic simulations compared with those based on real-world data [

19]. This study addresses those gaps by presenting an ABM application that integrates machine learning and econometric forecasting, specifically designed for the Turkish energy market.

Türkiye’s electricity market is liberalized and is rapidly increasing its renewable electricity production share. By the end of September 2025, total installed capacity reached 121 GW, of which 61% was derived from renewable energy resources (hydropower, wind, solar, geothermal, and biofuel). Solar photovoltaics (PVs) have shown the strongest growth momentum, with capacity more than doubling within two years to reach 24.1 GW [

26]. Market operations are administered by the Energy Exchange Istanbul (EXIST), which oversees the hourly day-ahead and intraday electricity markets, while the Turkish Electricity Transmission Corporation (TEIAS)—a state-owned enterprise—manages transmission system reliability through balancing power and ancillary services. Electricity prices are strongly influenced by hydrology and fuel costs, since hydropower (reservoir and run-of-river) still has the largest installed capacity, and natural gas and coal-fired generation continue to play a critical role in meeting rising demand [

26]. The Turkish natural gas market is organized around BOTAS, the state-owned pipeline operator and principal importer, alongside the EXIST-operated natural gas spot market. In practice, gas prices for power plants are largely governed by BOTAS’s wholesale tariff-setting mechanisms, meaning that the marginal costs of the electricity market are heavily influenced by BOTAS’s pricing decisions [

27].

Türkiye ratified the Paris Agreement on 7 October 2021 and committed to achieving net-zero greenhouse gas emissions by 2053 [

28]. The National Energy Plan foresees a large additional capacity for renewables consistent with this target, while the Akkuyu Nuclear Power Plant (NPP), whose first unit is scheduled to start test production in 2025, is expected to significantly alter the emissions’ trajectory [

29]. Complementary climate policy instruments are also evolving. A draft regulation for a national emissions trading scheme (ETS)—aligned in structure with the European Union (EU) ETS—was published in 2023 to establish allowance allocation and auctioning mechanisms [

30]. In parallel, Türkiye supports low-carbon investment through feed-in tariffs (FITs) and renewable energy resource area (YEKA) schemes, which provide long-term power purchase guarantees and auctions for increased wind and solar PV capacities, respectively [

31,

32]. Moreover, the EXIST guarantee of origin system certifies renewable electricity and enables voluntary green-energy trading [

33]. TEIAS continues to expand high-voltage infrastructure and interconnection projects to facilitate renewable integration, although a comprehensive long-term grid expansion master plan is not publicly disclosed. Together, these market, policy, and infrastructure initiatives frame Türkiye’s transition toward a more flexible, low-carbon electricity system.

This study examines how renewable energy integration, nuclear deployment, a potential carbon trading scheme, and various demand scenarios may shape electricity market dynamics, investment decisions, generation mix, prices, and emissions. Through scenario-based simulations, the model projects possible future developments of the Turkish market, thereby providing valuable insights for policymakers and investors seeking to align with the 2053 net-zero target.

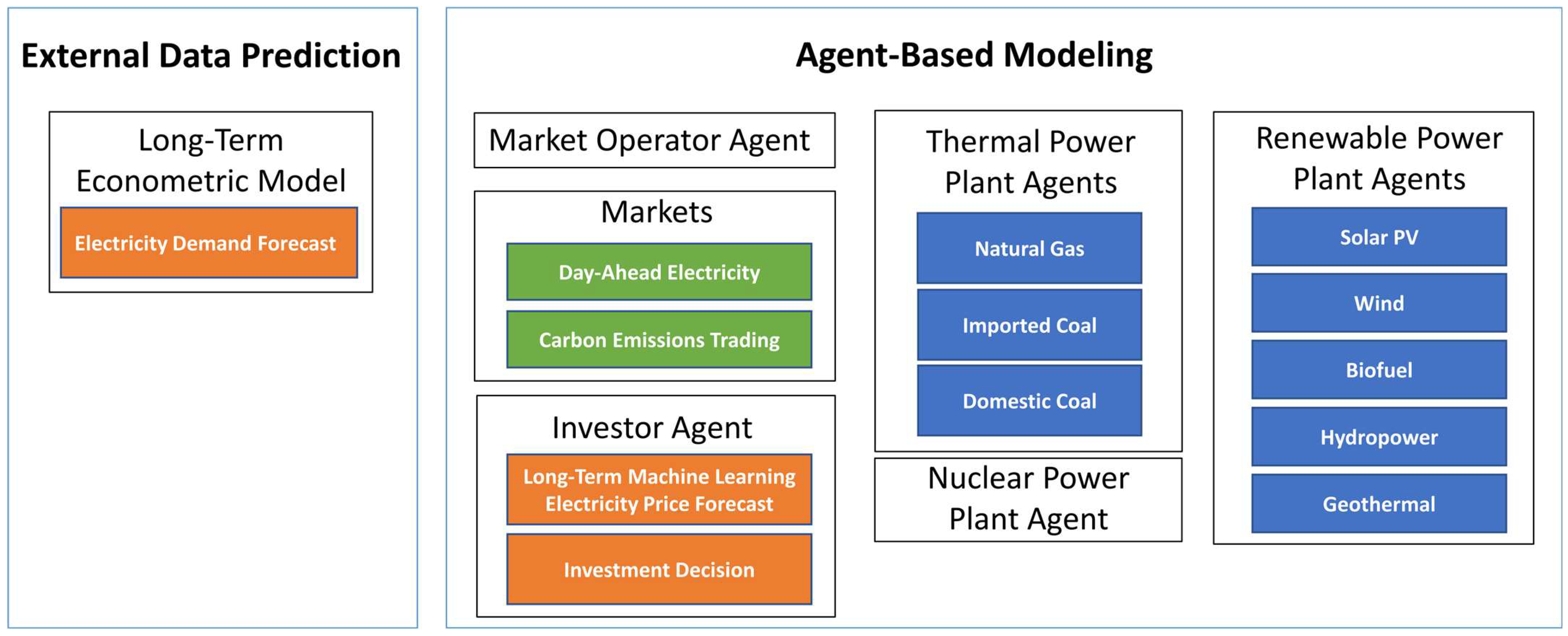

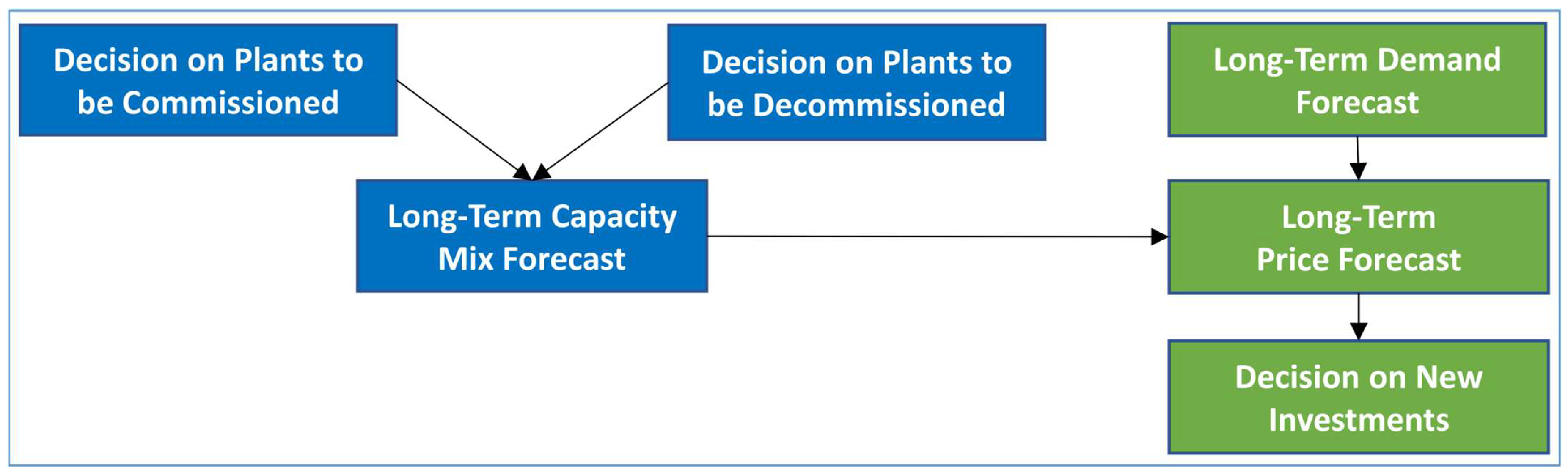

The Turkish energy market is modeled as a holistic system that encompasses the central electricity market, carbon emission trading scheme, generation units, investors, and the market operator. While the primary emphasis is on long-term projections, the model also incorporates short-term simulations for verification, thereby enhancing the reliability of long-term outcomes. Real market data are employed, and multiple supervised ML techniques, together with an econometric approach based on the seasonal autoregressive integrated moving average (SARIMA) method, are applied to forecast exogenous demand and price variables. The integration of econometric and ML methods represents a methodological innovation, strengthening the robustness of the long-term ABM framework. The main contributions of this study can be summarized as follows:

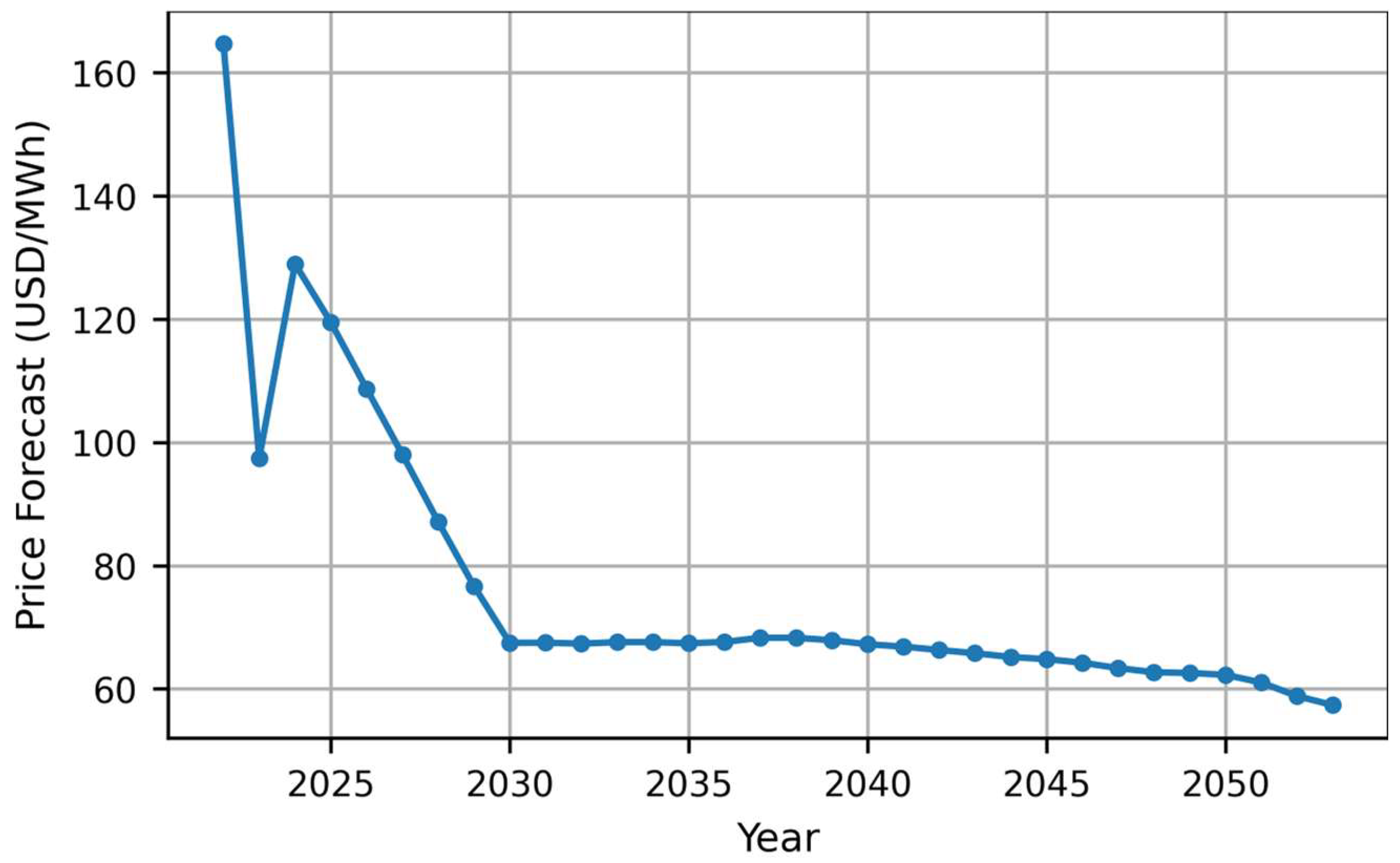

Developing a long-term ABM framework for Türkiye’s energy market that integrates econometric (SARIMA) demand forecasting with ML-based (CatBoost) day-ahead price (DAP) prediction;

Integrating ML for exogenous data prediction to enhance ABM accuracy and benchmarking multiple ML models to identify the best-performing approach;

Demonstrating the value of combining ABM, econometric forecasting, and ML methods for long-term policy and investment assessment;

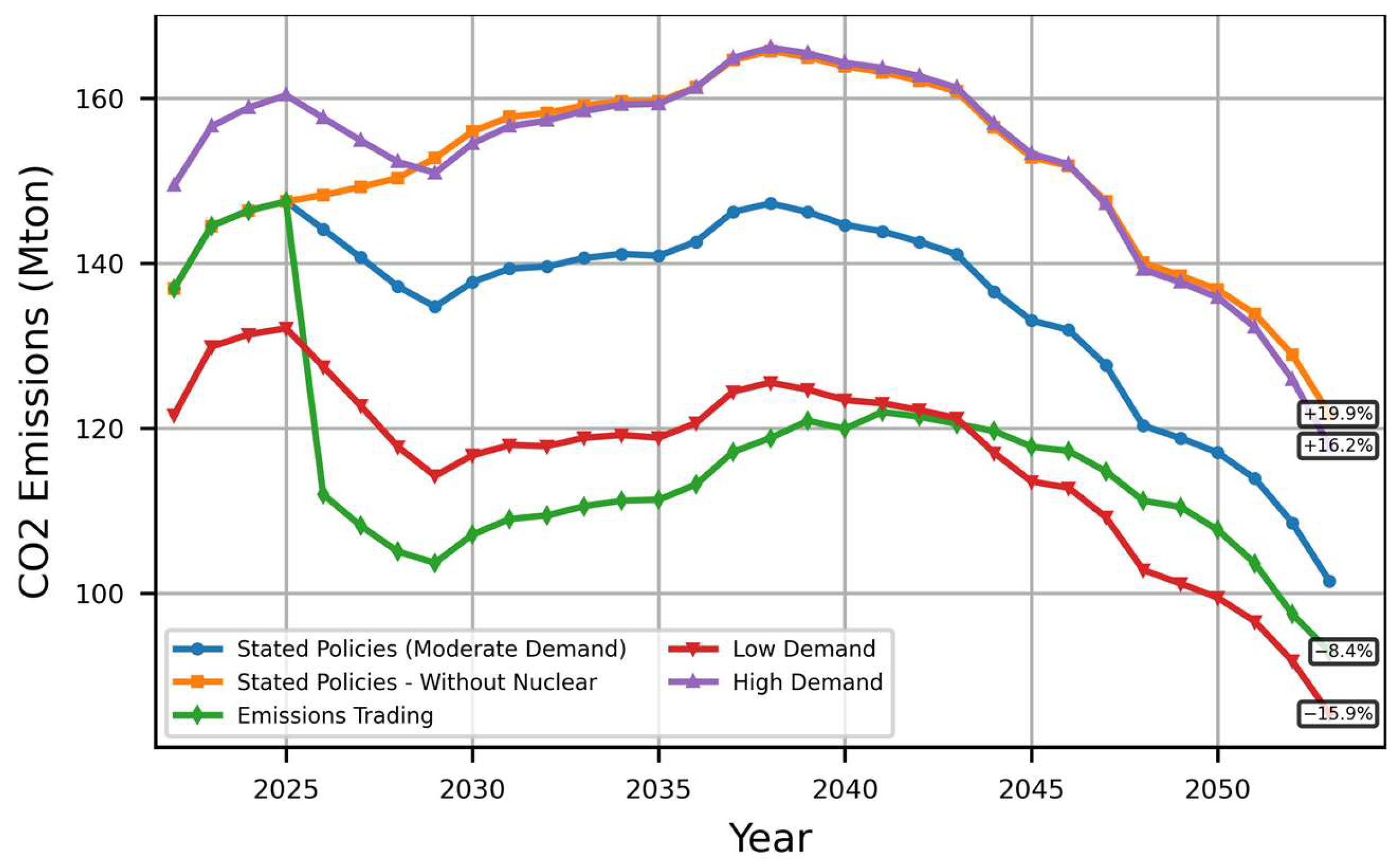

Quantifying the effects of nuclear commissioning, carbon pricing, and demand variations on electricity prices, generation mix, and emissions;

Introducing a short-term ABM component for model verification and validation, thereby increasing confidence in long-term outcomes;

Conducting hourly simulations through 2053 to capture market granularity and realistic operational dynamics;

Employing real-world, publicly available data to ensure transparency, reproducibility, and policy relevance.

The remainder of this paper is structured as follows.

Section 2 introduces the overall modeling framework, including materials and data, as well as the econometric and ML methods employed for electricity demand and price forecasting.

Section 3 presents the agent representation and the design of the day-ahead market (DAM), ETS, and investment modules.

Section 4 reports the results of long-term simulations, highlighting how alternative policy and demand scenarios shape electricity market prices, generation mix, and carbon emissions trajectories. It also provides a practical policy translation, connecting the simulation results to actionable recommendations for Türkiye’s energy transition. Finally,

Section 5 summarizes the conclusions and outlines directions for future research.

5. Conclusions

In this study, a long-term ABM simulation of the Turkish energy market was performed to analyze how policy, investment, and demand trajectories will shape the pathway to net-zero emissions by 2053. The framework includes power plants across diverse technologies—wind, hydropower, solar PV, geothermal, biofuel, coal, natural gas, and nuclear—and represents investors, the market operator, the DAM, and a potential ETS. By running hourly simulations from 2022 to 2053 under alternative policy and demand scenarios, the model offers a forward-looking perspective on how Türkiye’s energy sector can evolve during its low-carbon transition.

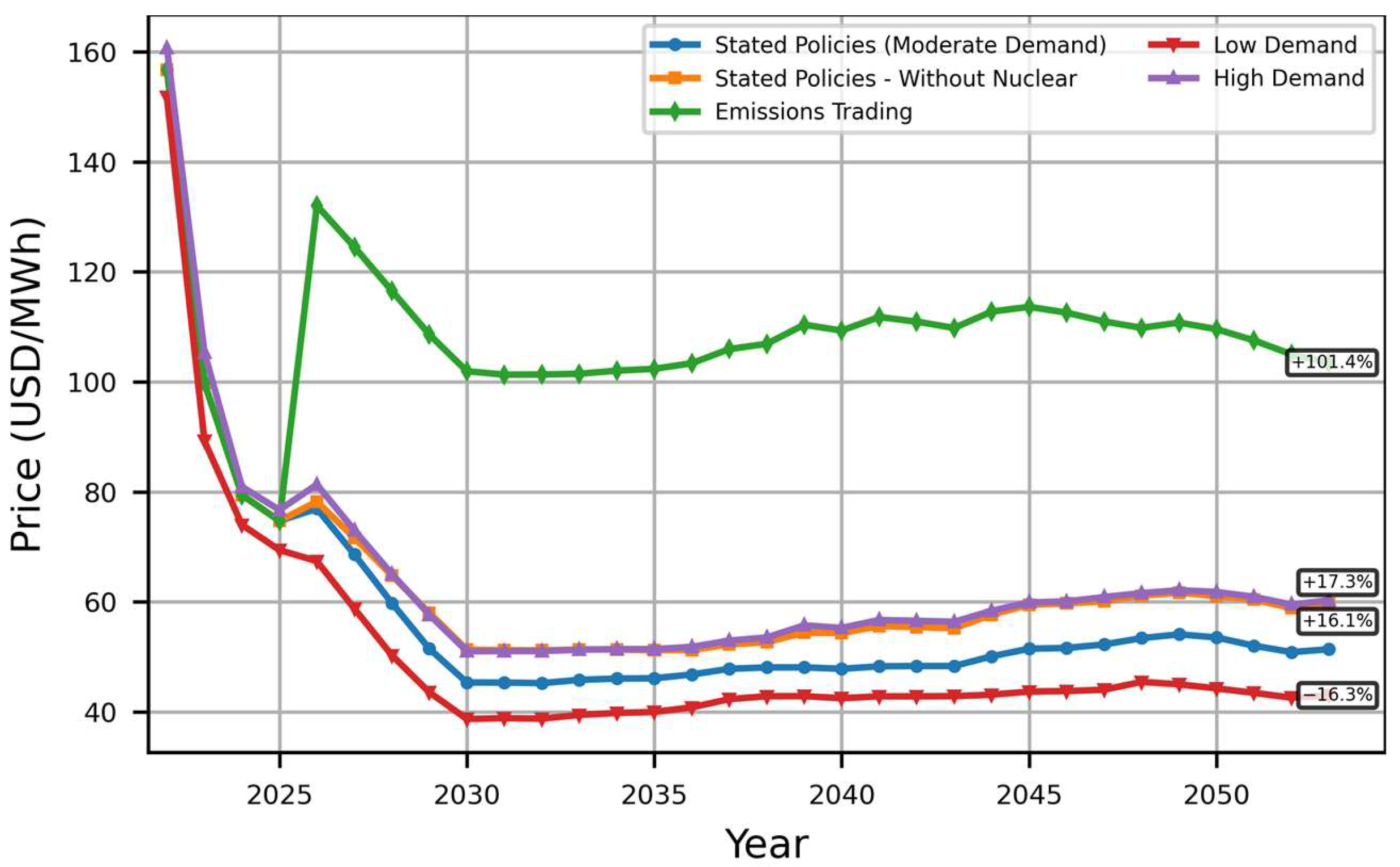

The ABM simulation results highlight three main insights. First, under the Stated Policies scenario, renewable generation steadily expands to reach 63.1% of total production by 2053, with onshore wind and solar PV jointly accounting for 35.8%, supported by declining technology costs and continued investment. This expansion drives a 45.0% reduction in imported coal plant generation. Natural gas plants, however, retain a 14.8% share in 2053 due to their role in balancing intermittent renewable output. Emissions peak at 147.2 Mt CO2 in 2038, before declining to 101.4 Mt CO2 in 2053, representing a 25.9% reduction from the initial level. Excluding nuclear power increases average wholesale electricity prices by 6.28 USD/MWh over the simulation period and raises 2053 emissions by 20.2 Mt CO2. Second, policy choices significantly influence both prices and emissions. Introducing an ETS results in much sharper price increases—averaging +57.91 USD/MWh—but reduces emissions by 8.54 Mt CO2 in 2053 relative to the baseline. Third, demand scenarios alter the generation mix and fuel reliance. In the High Demand case (+9.1%), additional supply is primarily met by natural gas, raising average prices by 6.46 USD/MWh and limiting the renewable share to 58.7% in 2053. In the Low Demand case (–10%), prices fall by 7.11 USD/MWh, natural gas generation drops substantially, and the renewable share increases to 68.0%. Even under high demand, emissions are reduced by 21.1% by 2053 compared to 2022, confirming that the net-zero pathway is preserved, although the pace and composition of decarbonization differ across scenarios.

These findings provide actionable insights for both policymakers and market participants. For regulators, the results underscore the pivotal role of nuclear capacity and carbon pricing in shaping future prices and emissions, offering a framework to help design ETS rules and broader market policies that balance decarbonization with affordability. For private investors, the scenarios illustrate how renewable deployment, demand evolution, and policy choices influence the generation mix, investment risks, and long-term profitability, thereby supporting more informed investment strategies.

The scenario-based findings can be directly translated into policy pathways for accelerating Türkiye’s transition toward its 2053 net-zero target. Under the Stated Policies framework, achieving deeper decarbonization requires expanding existing renewable support mechanisms (FITs and YEKA), maintaining affordable financing channels, modernizing the electricity grid with digitalized and storage-integrated infrastructure, and deepening regional energy-market integration with the EU. The nuclear policy track must ensure the timely completion of the Akkuyu NPP and initiate the planning of at least one additional plant to secure low-carbon baseload generation. In the Emissions Trading Scenario, early ETS implementation—ideally by 2026—should be combined with a predictable carbon-price corridor and technology mandates that improve thermal plant emissions efficiency. Finally, the Demand Scenarios highlight the need to couple renewable expansion with effective demand management. This entails enforcing the Energy Efficiency 2030 Strategy and 2nd NEEAP targets, promoting demand–response programs and distributed storage, and upgrading distribution networks into smart-grid systems. Collectively, these measures form an integrated policy package that aligns Türkiye’s energy market development with its long-term climate commitments while safeguarding security of supply and investment stability.

Methodologically, this study demonstrates a novel integration of ABM, SARIMA econometric demand forecasting, and CatBoost ML-based price prediction, each validated against historical data. The SARIMA model achieved a monthly MAPE of 3.5% and an annual deviation of 1.9% on realized demand from 2022. The CatBoost model achieved a 6.09% MAPE and −1.94% average error on actual prices from 2021, outperforming the other benchmarked ML models. The ABM reproduced market behavior from 2021 with a 0.49% average price error and 4.01% MAPE. Furthermore, the investment evaluation was refined through NPV analysis using a central real discount rate sensitivity testing. These enhancements collectively improve the transparency, robustness, and empirical credibility of the proposed framework.

Several limitations should be acknowledged. First, the model does not explicitly capture policy uncertainty or the transmission mechanisms between electricity, carbon, and fuel markets, which may influence investment and pricing outcomes. Second, the transition of investor behavior over time is not dynamically represented, as investment decisions are modeled through rational, economically driven assumptions. Third, the analysis assumes that Türkiye’s electricity transmission infrastructure will receive adequate investment to integrate the projected renewable capacity additions. Relaxing these assumptions in future work would allow for a more comprehensive representation of long-term market dynamics. Fourth, demand-side behavioral responses are not endogenously represented, as price elasticity was excluded to prevent double-counting with the SARIMA forecast. Incorporating explicit demand–response behavior in future work could further enhance the realism of short-term market dynamics. Fifth, because high-resolution historical data remain limited, both the calibration and validation of the ABM were performed using observations from 2021. This represents an in-sample validation demonstrating that the model reproduces observed market behavior under current conditions. Future work will extend the calibration–validation process by incorporating additional historical years as they become available, enabling out-of-sample validation and broader robustness testing across different market states.

Future work may extend the framework in several other directions. First, model granularity can be improved by including ancillary markets and BESS dynamics. Second, the ABM framework could be enhanced by incorporating risk-awareness across all agents to better capture their heterogeneity. Third, incorporating local energy markets and their interactions with the national system would allow for a more integrated analysis. Fourth, wholesale and spot natural gas markets could be modeled in greater detail. Finally, generative artificial intelligence could be employed to enrich scenario generation and improve forecasting accuracy.