Cryptocurrencies Transit to a Carbon Neutral Environment: From Fintech to Greentech Through Clean Energy and Eco-Efficiency Policies

Abstract

1. Introduction

2. Fintech and Clean Energy: The Driving Force Behind the Energy Transition

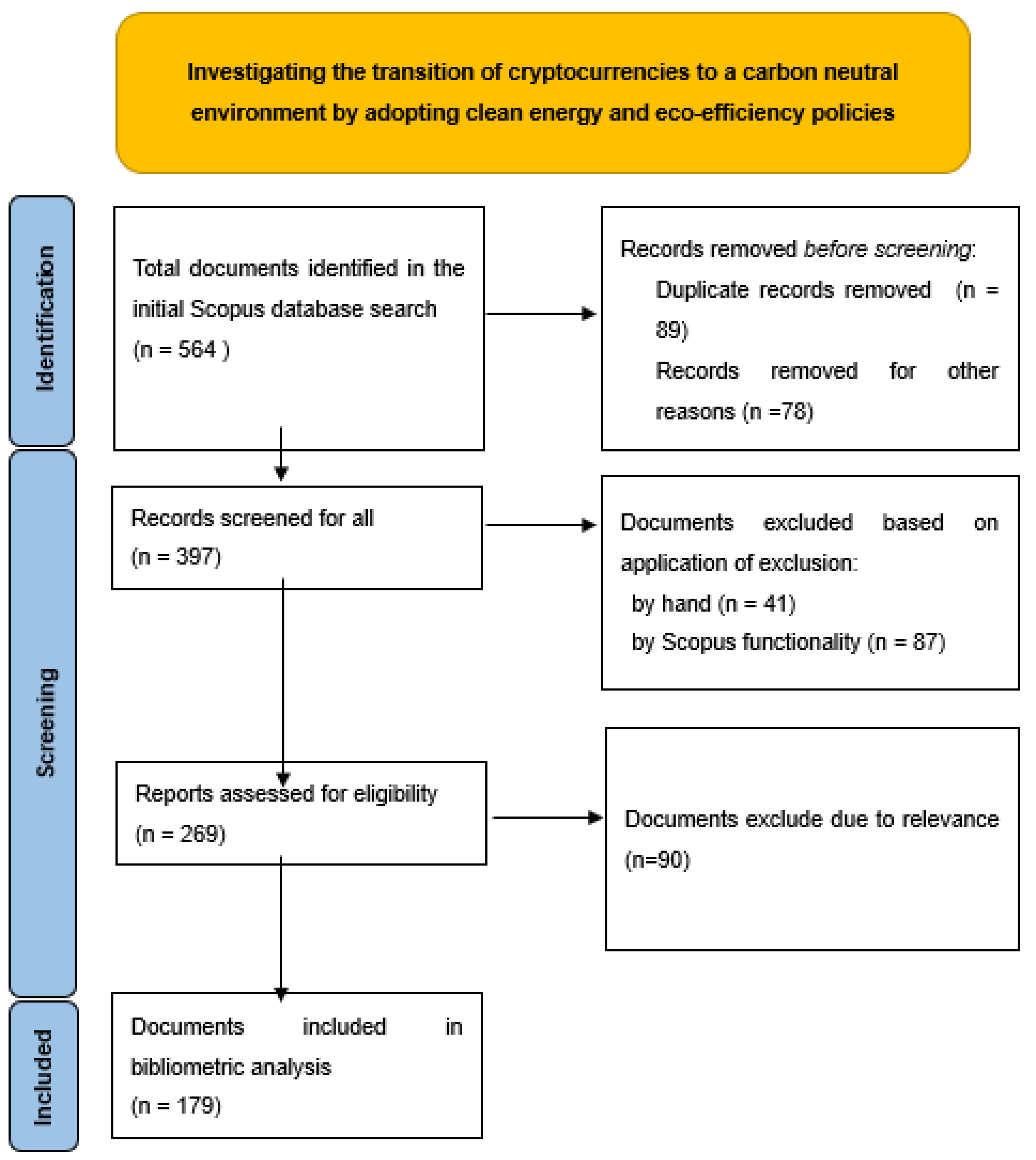

3. Materials and Methods

Data

4. Results

4.1. Descriptive Analysis

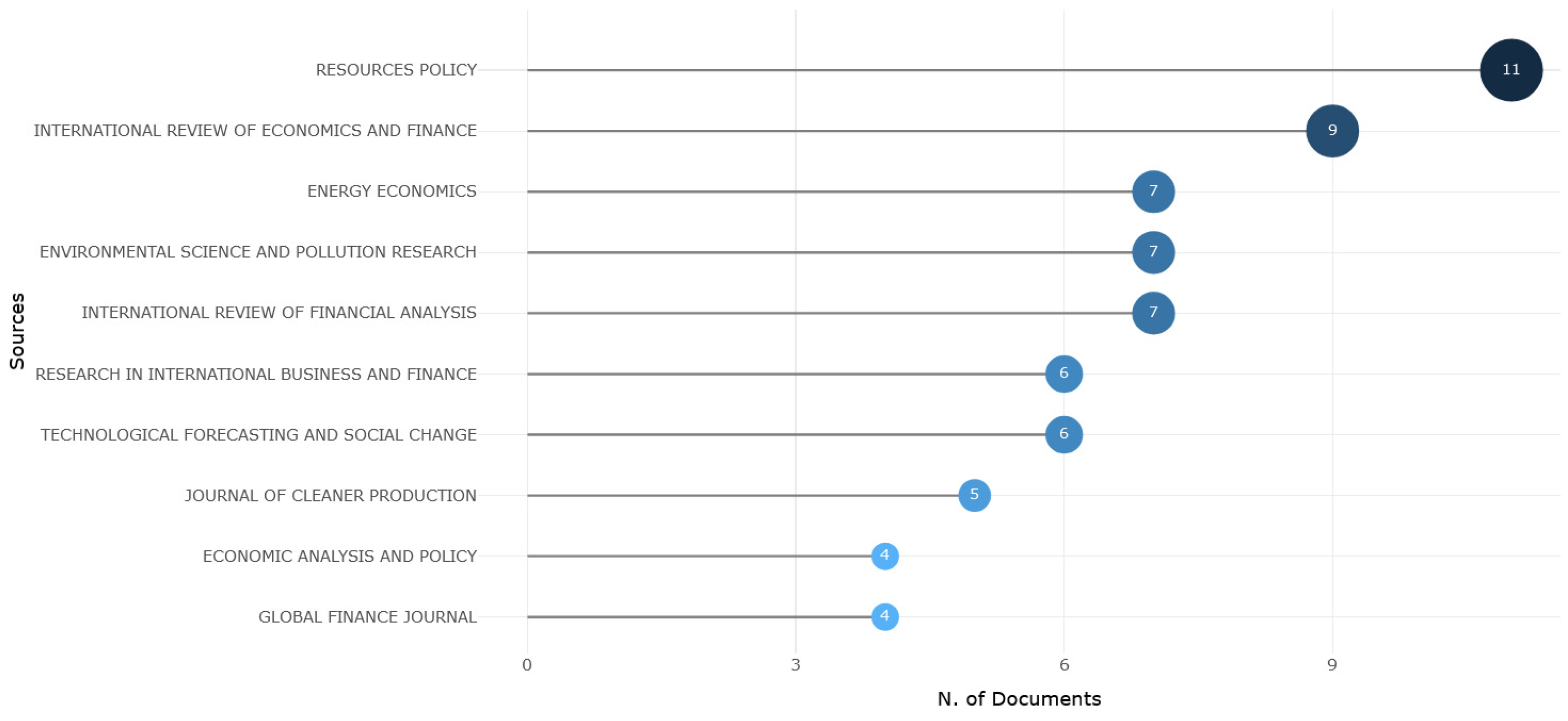

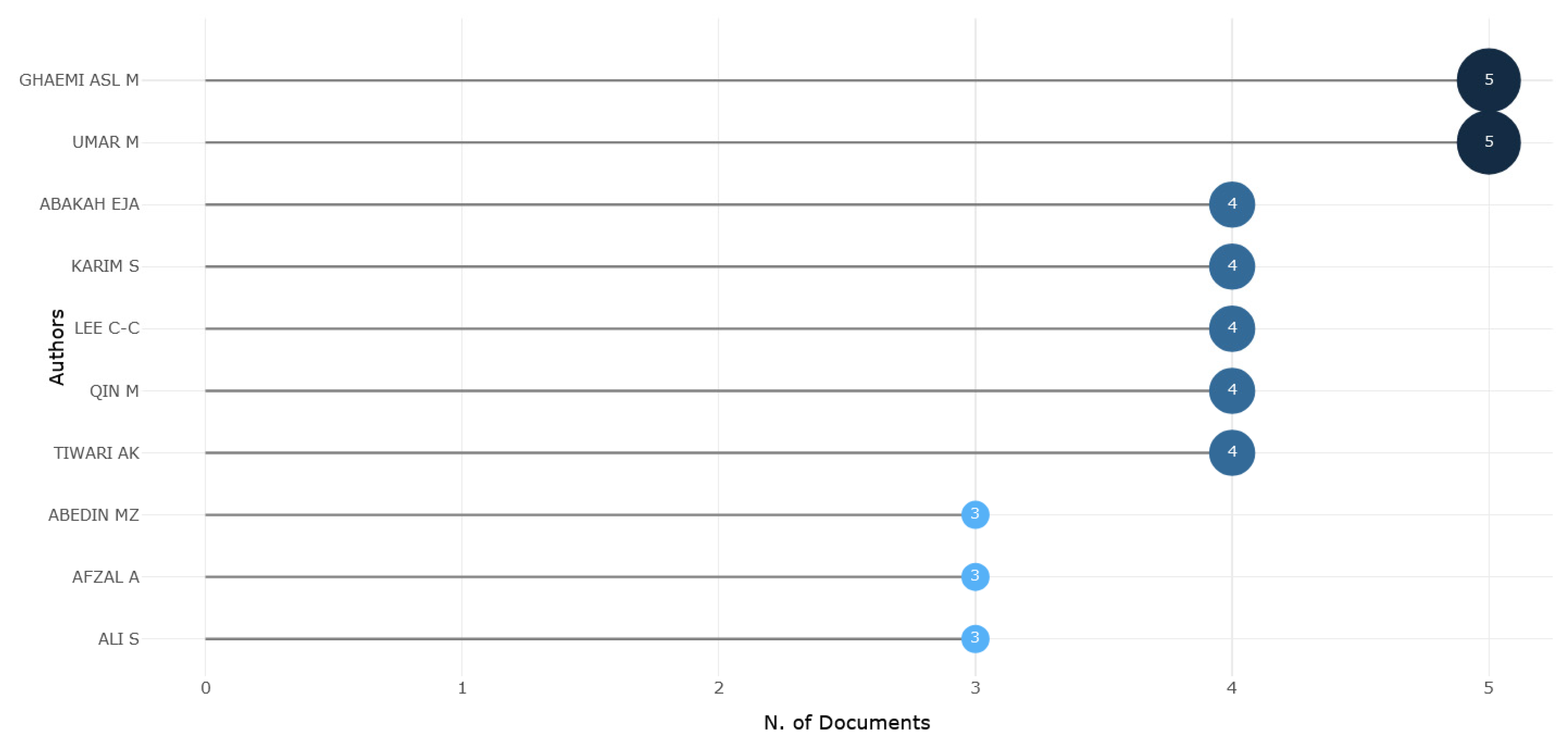

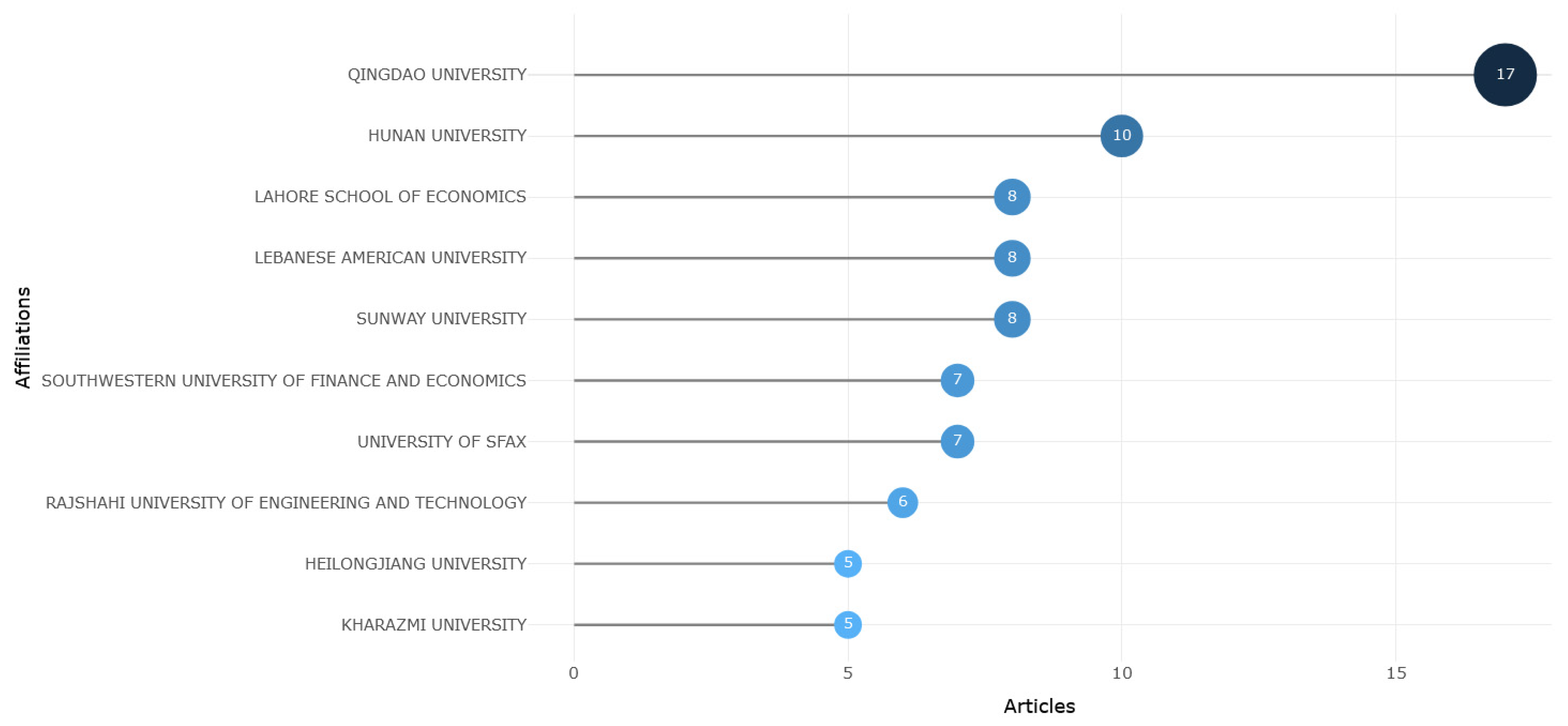

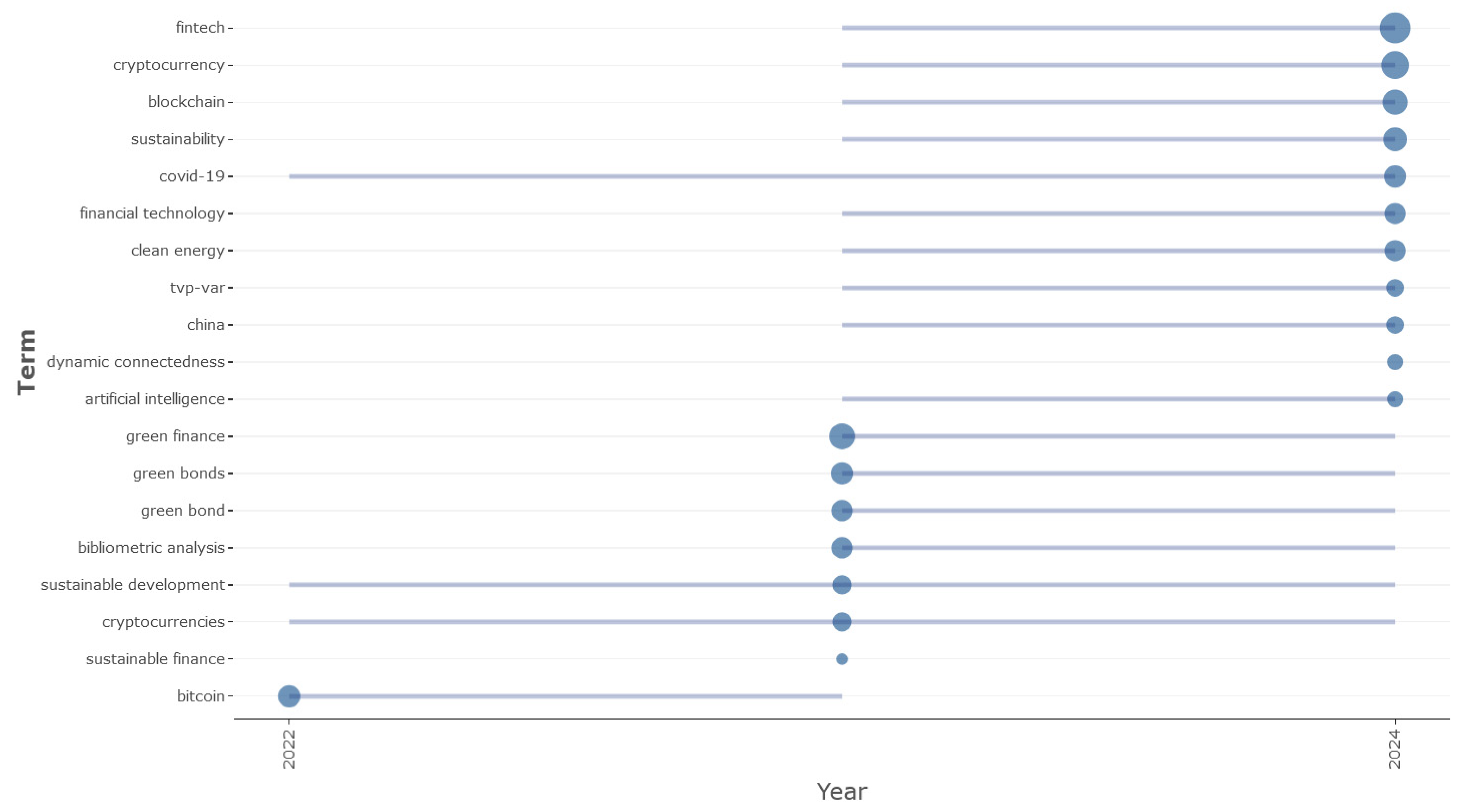

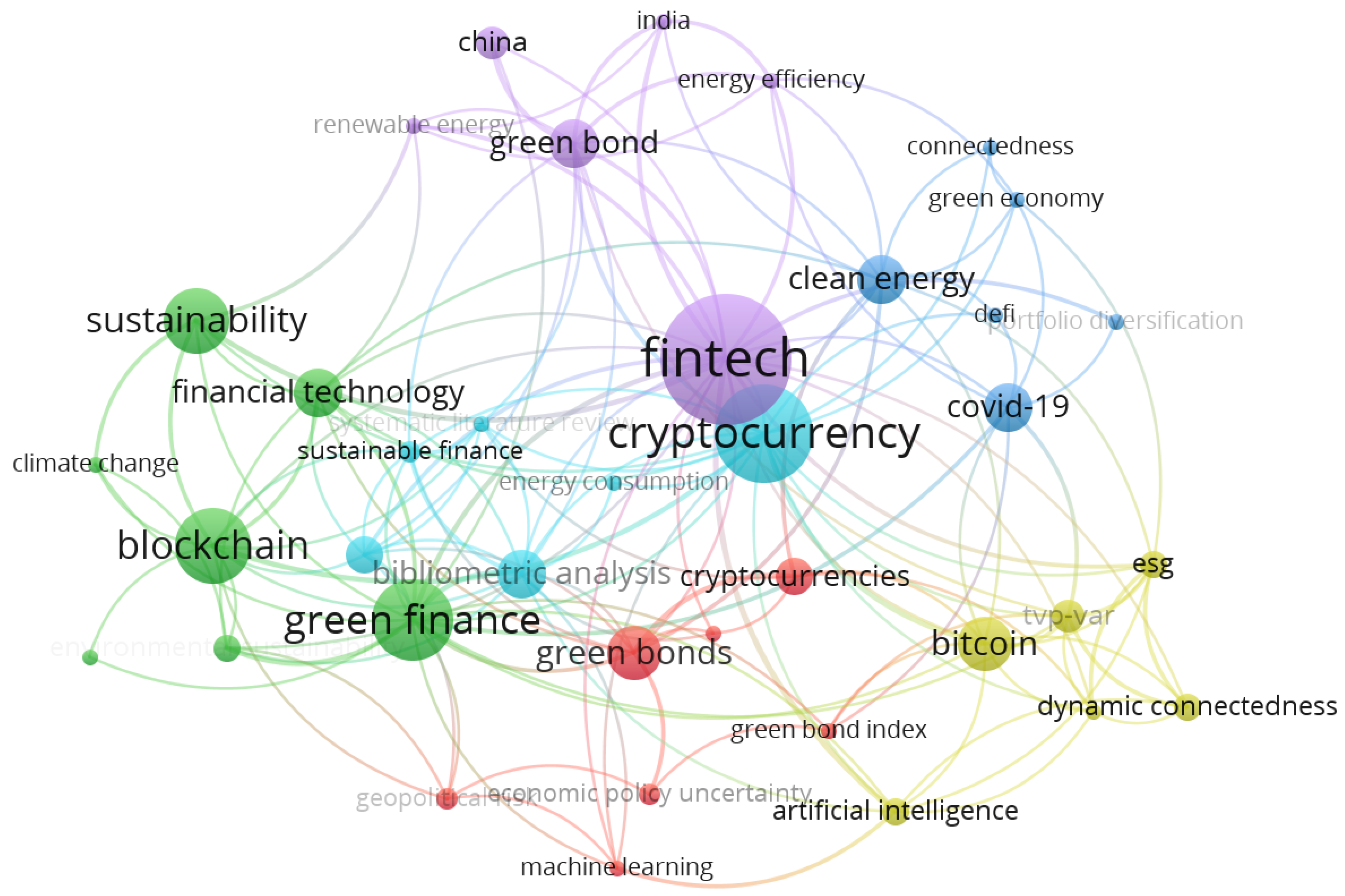

4.2. Bibliometric Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Cavallaro, M.; Mathieu, A. Beyond the veil: Mapping cryptocurrencies’ ecosystem. Int. Rev. Financ. Anal. 2024, 94, 103297. [Google Scholar] [CrossRef]

- Tan, S.K.; Chan, J.S.K.; Ng, K.H. On the speculative nature of cryptocurrencies: A study on Garman and Klass volatility measure. Financ. Res. Lett. 2020, 32, 101075. [Google Scholar] [CrossRef]

- Cong, L.W.; Landsman, W.; Maydew, E.; Rabetti, D. Tax-loss harvesting with cryptocurrencies. J. Account. Econ. 2023, 76, 101607. [Google Scholar] [CrossRef]

- Gallersdörfer, U.; Klaaßen, L.; Stoll, C. Energy Consumption of Cryptocurrencies Beyond Bitcoin. Joule 2020, 4, 1843–1846. [Google Scholar] [CrossRef]

- Köhler, S.; Pizzol, M. Life Cycle Assessment of Bitcoin Mining. Environ. Sci. Technol. 2019, 53, 13598–13606. [Google Scholar] [CrossRef] [PubMed]

- Kimani, D.; Adams, K.; Attah-Boakye, R.; Ullah, S.; Frecknall-Hughes, J.; Kim, J. Blockchain, business and the fourth industrial revolution: Whence, whither, wherefore and how? Technol. Forecast. Soc. Chang. 2020, 161, 120254. [Google Scholar] [CrossRef]

- Duan, K.; Zhao, Y.; Urquhart, A.; Huang, Y. Do clean and dirty cryptocurrencies connect with financial assets differently? The role of economic policy uncertainty. Energy Econ. 2023, 127, 107079. [Google Scholar] [CrossRef]

- Naeem, M.A.; Karim, S. Tail dependence between bitcoin and green financial assets. Econ. Lett. 2021, 208, 110068. [Google Scholar] [CrossRef]

- Silaev, V.I.; Klyuev, R.V.; Eremeev, D.V.; Martynova, T.A.; Danilchenko, Y.V. Analysis of the carbon footprint created by mining enterprises. Min. Inf. Anal. Bull. 2023, 11, 265–277. [Google Scholar] [CrossRef]

- Rasheed, M.Q.; Yuhuan, Z.; Haseeb, A.; Ahmed, Z.; Saud, S. Asymmetric relationship between competitive industrial performance, renewable energy, industrialization, and carbon footprint: Does artificial intelligence matter for environmental sustainability? Appl. Energy 2024, 367, 123346. [Google Scholar] [CrossRef]

- Putranti, I.R. Crypto Minning: Indonesia Carbon Tax Challenges and Safeguarding International Commitment on Human Security. Int. J. Bus. Econ. Soc. Dev. 2022, 3, 10–18. [Google Scholar] [CrossRef]

- Náñez Alonso, S.L.; Jorge-vázquez, J.; Echarte Fernández, M.Á.; Reier Forradellas, R.F. Cryptocurrency Mining from an Economic and Environmental Perspective. Analysis of the Most and Least Sustainable Countries. Energies 2021, 14, 4254. [Google Scholar] [CrossRef]

- Karagiannopoulou, S.; Sariannidis, N.; Ragazou, K.; Passas, I.; Garefalakis, A. Corporate Social Responsibility: A Business Strategy That Promotes Energy Environmental Transition and Combats Volatility in the Post-Pandemic World. Energies 2023, 16, 1102. [Google Scholar] [CrossRef]

- Liu, Q.; Ma, J.; Zhao, X.; Zhang, K.; Xiangli, K.; Meng, D.; Wang, J. Voltage fault diagnosis and misdiagnosis analysis of battery systems using the modified Shannon entropy in real-world electric vehicles. J. Energy Storage 2023, 73, 109287. [Google Scholar] [CrossRef]

- Dunbar, K.; Sarkis, J.; Treku, D.N. FinTech for environmental sustainability: Promises and pitfalls. One Earth 2024, 7, 23–30. [Google Scholar] [CrossRef]

- Li, X.; Ye, Y.; Liu, Z.; Tao, Y.; Jiang, J. FinTech and SME’ performance: Evidence from China. Econ. Anal. Policy 2024, 81, 670–682. [Google Scholar] [CrossRef]

- Su, F.; Xu, C. Curbing credit corruption in China: The role of FinTech. J. Innov. Knowl. 2023, 8, 100292. [Google Scholar] [CrossRef]

- Tang, P.; Ma, H.; Sun, Y.; Xu, X. Exploring the role of Fintech, Green Finance and Natural Resources towards Environmental Sustainability: A study on ASEAN economies. Resour. Policy 2024, 94, 105115. [Google Scholar] [CrossRef]

- Leng, J.; Ruan, G.; Jiang, P.; Xu, K.; Liu, Q.; Zhou, X.; Liu, C. Blockchain-empowered sustainable manufacturing and product lifecycle management in industry 4.0: A survey. Renew. Sustain. Energy Rev. 2020, 132, 110112. [Google Scholar] [CrossRef]

- Shahzad, U.; Ghaemi Asl, M.; Tedeschi, M. Is there any market state-dependent contribution from Blockchain-enabled solutions to ESG investments? Evidence from conventional and Islamic ESG stocks. Int. Rev. Econ. Financ. 2023, 86, 139–154. [Google Scholar] [CrossRef]

- Dicuonzo, G.; Palmaccio, M.; Shini, M. ESG, governance variables and Fintech: An empirical analysis. Res. Int. Bus. Financ. 2024, 69, 102205. [Google Scholar] [CrossRef]

- Cao, H.H.; Zhang, X.; Huang, Y.; Huang, Y.; Yeung, B. Fintech, financial inclusion, digital currency, and CBDC. J. Financ. Data Sci. 2023, 9, 100115. [Google Scholar] [CrossRef]

- Aladaileh, M.J.; Lahuerta-Otero, E.; Aladayleh, K.J. Mapping sustainable supply chain innovation: A comprehensive bibliometric analysis. Heliyon 2024, 10, e29157. [Google Scholar] [CrossRef] [PubMed]

- Torres-Salinas, D.; Orduña-Malea, E.; Delgado-Vázquez, Á.; Gorraiz, J.; Arroyo-Machado, W. Foundations of Narrative Bibliometrics. J. Informetr. 2024, 18, 101546. [Google Scholar] [CrossRef]

- Li, G.; Zhang, T.; Tsai, C.Y.; Yao, L.; Lu, Y.; Tang, J. Review of the metaheuristic algorithms in applications: Visual analysis based on bibliometrics. Expert Syst. Appl. 2024, 255, 124857. [Google Scholar] [CrossRef]

- Lim, W.M.; Kumar, S.; Donthu, N. How to combine and clean bibliometric data and use bibliometric tools synergistically: Guidelines using metaverse research. J. Bus. Res. 2024, 182, 114760. [Google Scholar] [CrossRef]

- Kiran, K.S.; Gupta, S.; Luthra, S.; Jagtap, S. Role of digitalized sustainable manufacturing in SME’S: A bibliometric analysis. In Materials Today: Proceedings; Springer: Berlin/Heidelberg, Germany, 2023. [Google Scholar] [CrossRef]

- Sapountzoglou, N. A bibliometric analysis of risk management methods in the space sector. J. Space Saf. Eng. 2023, 10, 13–21. [Google Scholar] [CrossRef]

- Ito, J.Y.; Silveira, F.F.; Munhoz, I.P.; Akkari, A.C.S. International publication trends in Lean Agile Management research: A bibliometric analysis. Procedia Comput. Sci. 2023, 219, 666–673. [Google Scholar] [CrossRef]

- Ghaemi Asl, M.; Ben Jabeur, S.; Ben Zaied, Y. Analyzing the interplay between eco-friendly and Islamic digital currencies and green investments. Technol. Forecast. Soc. Chang. 2024, 208, 123715. [Google Scholar] [CrossRef]

- Yang, Y.; Su, X.; Yao, S. Nexus between green finance, fintech, and high-quality economic development: Empirical evidence from China. Resour. Policy 2021, 74, 102445. [Google Scholar] [CrossRef]

- Bhutta, U.S.; Tariq, A.; Farrukh, M.; Raza, A.; Iqbal, M.K. Green bonds for sustainable development: Review of literature on development and impact of green bonds. Technol. Forecast. Soc. Chang. 2022, 175, 121378. [Google Scholar] [CrossRef]

- Javaid, M.; Haleem, A.; Singh, R.P.; Suman, R.; Khan, S. A review of Blockchain Technology applications for financial services. BenchCouncil Trans. Benchmarks Stand. Eval. 2022, 2, 100073. [Google Scholar] [CrossRef]

- Wang, M.; Li, X.; Wang, S. Discovering research trends and opportunities of green finance and energy policy: A data-driven scientometric analysis. Energy Policy 2021, 154, 112295. [Google Scholar] [CrossRef]

- Lisha, L.; Mousa, S.; Arnone, G.; Muda, I.; Huerta-Soto, R.; Shiming, Z. Natural resources, green innovation, fintech, and sustainability: A fresh insight from BRICS. Resour. Policy 2023, 80, 103119. [Google Scholar] [CrossRef]

- Awais, M.; Afzal, A.; Firdousi, S.; Hasnaoui, A. Is fintech the new path to sustainable resource utilisation and economic development? Resour. Policy 2023, 81, 103309. [Google Scholar] [CrossRef]

- Macchiavello, E.; Siri, M. Sustainable Finance and Fintech: Can Technology Contribute to Achieving Environmental Goals? A Preliminary Assessment of ‘Green FinTech’. SSRN Electron. J. 2020, 10. [Google Scholar] [CrossRef]

- Si Mohammed, K.; Serret, V.; Ben Jabeur, S.; Nobanee, H. The role of artificial intelligence and fintech in promoting eco-friendly investments and non-greenwashing practices in the US market. J. Environ. Manag. 2024, 359, 120977. [Google Scholar] [CrossRef]

- Arfaoui, N.; Naeem, M.A.; Boubaker, S.; Mirza, N.; Karim, S. Interdependence of clean energy and green markets with cryptocurrencies. Energy Econ. 2023, 120, 106584. [Google Scholar] [CrossRef]

- Kraus, S.; Kumar, S.; Lim, W.M.; Kaur, J.; Sharma, A.; Schiavone, F. From moon landing to metaverse: Tracing the evolution of Technological Forecasting and Social Change. Technol. Forecast. Soc. Chang. 2023, 189, 122381. [Google Scholar] [CrossRef]

- Zournatzidou, G.; Floros, C. Hurst Exponent Analysis: Evidence from Volatility Indices and the Volatility of Volatility Indices. J. Risk Financ. Manag. 2023, 16, 272. [Google Scholar] [CrossRef]

- Ragazou, K.; Sklavos, G. Circular economy as a footpath for regional development in European Union. In Proceedings of the International Virtual Conference on Social Sciences, Virtual, 28 May 2021. [Google Scholar] [CrossRef]

- Zournatzidou, G.; Sklavos, G.; Ragazou, K.; Sariannidis, N. Anti-Competition and Anti-Corruption Controversies in the European Financial Sector: Examining the Anti-ESG Factors with Entropy Weight and TOPSIS Methods. J. Risk Financ. Manag. 2024, 17, 492. [Google Scholar] [CrossRef]

- Giakoumelou, A.; Salvi, A.; Bekiros, S.; Onorato, G. ESG and FinTech funding in the EU. Res. Int. Bus. Financ. 2024, 69, 102233. [Google Scholar] [CrossRef]

- Ragazou, K.; Zournatzidou, G.; Sklavos, G.; Sariannidis, N. Integration of Circular Economy and Urban Metabolism for a Resilient Waste-Based Sustainable Urban Environment. Urban Sci. 2024, 8, 175. [Google Scholar] [CrossRef]

- Ghouse, G.; Iqbal, M. Resource extraction, FinTech, and social equal access: A quantitative analysis of resource-rich countries. Resour. Policy 2024, 99, 105416. [Google Scholar] [CrossRef]

- Su, X.; He, J. Quantile connectedness among fintech, carbon future, and energy markets: Implications for hedging and investment strategies. Energy Econ. 2024, 139, 107904. [Google Scholar] [CrossRef]

- Ahmad, M.; Pata, U.K.; Ahmed, Z.; Zhao, R. Fintech, natural resources management, green energy transition, and ecological footprint: Empirical insights from EU countries. Resour. Policy 2024, 92, 104972. [Google Scholar] [CrossRef]

- Pandey, D.K.; Hassan, M.K.; Kumari, V.; Zaied, Y.B.; Rai, V.K. Mapping the landscape of FinTech in banking and finance: A bibliometric review. Res. Int. Bus. Financ. 2024, 67, 102116. [Google Scholar] [CrossRef]

- Hoang, T.G.; Phan, T.N.T. The Emergence of Fintech Entrepreneurship: Empowering the Transition to the Digital Economy. In Reference Module in Social Sciences; Elsevier: Amsterdam, The Netherlands, 2024. [Google Scholar] [CrossRef]

- Hou, Y.; Li, X.; Wang, H.; Yunusova, R. Focusing on energy efficiency: The convergence of green financing, FinTech, financial inclusion, and natural resource rents for a greener Asia. Resour. Policy 2024, 93, 105052. [Google Scholar] [CrossRef]

- Tao, Z.; Chao, J. Investing in green, sustaining the planet: The role of fintech in promoting corporate green investment in the Chinese energy industry. J. Environ. Manag. 2024, 370, 122990. [Google Scholar] [CrossRef]

- Fan, M.; Zhou, Y.; Lu, Z.; Gao, S. Fintech’s impact on green productivity in China: Role of fossil fuel energy structure, environmental regulations, government expenditure, and R&D investment. Resour. Policy 2024, 91, 104857. [Google Scholar] [CrossRef]

- Tong, Y.; Lau, Y.W.; Binti Ngalim, S.M. Do pilot zones for green finance reform and innovation avoid ESG greenwashing? Evidence from China. Heliyon 2024, 10, e33710. [Google Scholar] [CrossRef]

- Chu, S. Are women greener? Board gender diversity and corporate green technology innovation in China. Int. Rev. Econ. Financ. 2024, 93, 1001–1020. [Google Scholar] [CrossRef]

- Xu, J.; Liu, Q.; Wider, W.; Zhang, S.; Fauzi, M.A.; Jiang, L.; Udang, L.N.; An, Z. Research landscape of energy transition and green finance: A bibliometric analysis. Heliyon 2024, 10, e24783. [Google Scholar] [CrossRef] [PubMed]

- Obobisa, E.S.; Ahakwa, I. Stimulating the adoption of green technology innovation, clean energy resources, green finance, and environmental taxes: The way to achieve net zero CO2 emissions in Europe? Technol. Forecast. Soc. Chang. 2024, 205, 123489. [Google Scholar] [CrossRef]

- Wang, W.; Huang, H.; Peng, X.; Wang, Z.; Zeng, Y. Utilizing support vector machines to foster sustainable development and innovation in the clean energy sector via green finance. J. Environ. Manag. 2024, 360, 121225. [Google Scholar] [CrossRef]

- Safi, A.; Kchouri, B.; Elgammal, W.; Nicolas, M.K.; Umar, M. Bridging the green gap: Do green finance and digital transformation influence sustainable development? Energy Econ. 2024, 134, 107566. [Google Scholar] [CrossRef]

- Huang, L. Green bonds and ESG investments: Catalysts for sustainable finance and green economic growth in resource-abundant economies. Resour. Policy 2024, 91, 104806. [Google Scholar] [CrossRef]

- Feng, J.; Yuan, Y. Green investors and corporate ESG performance: Evidence from China. Financ. Res. Lett. 2024, 60, 104892. [Google Scholar] [CrossRef]

- Zhang, H.; Wang, B. Impacts of government ESG policies on corporate green innovation. Int. Rev. Econ. Financ. 2024, 94, 103383. [Google Scholar] [CrossRef]

- Jin, X.; Qi, H.; Huang, X. Green financial regulation and corporate strategic ESG behavior: Evidence from China. Financ. Res. Lett. 2024, 65, 105581. [Google Scholar] [CrossRef]

- Liu, X.; Huang, N.; Su, W.; Zhou, H. Green innovation and corporate ESG performance: Evidence from Chinese listed companies. Int. Rev. Econ. Financ. 2024, 95, 103461. [Google Scholar] [CrossRef]

- Wang, M.; Wang, Y.; Wen, S. ESG performance and green innovation in new energy enterprises: Does institutional environment matter? Res. Int. Bus. Financ. 2024, 71, 102495. [Google Scholar] [CrossRef]

| Step | Keyword Search |

|---|---|

| 1 | ((“cryptocurrencies” AND “energy”)) |

| 2 | ((“cryptocurrencies”) AND (“FinTech”) AND (“energy”) AND (“carbon neutral”)) |

| 3 | ((“cryptocurrencies”) AND (“FinTech”) AND (“energy” OR “renewable energy”) AND (“carbon neutral”)) |

| 4 | ((“cryptocurrencies”) AND (“FinTech”) AND (“energy” OR “renewable energy” OR “clear energy”) AND (“carbon neutral”)) |

| 5 | ((“cryptocurrencies”) AND (“FinTech”) AND (“energy” OR “renewable energy” OR “clear energy”) AND (“carbon neutral” OR “sustainability”)) |

| 6 | ((“cryptocurrencies”) AND (“FinTech”) AND (“energy” OR “renewable energy” OR “clear energy”) AND (“carbon neutral” OR “sustainability” OR “sustainable development”)) |

| 7 | ((“cryptocurrencies”) AND (“FinTech” OR “financial technology”) AND (“energy” OR “renewable energy” OR “clear energy”) AND (“carbon neutral” OR “sustainability” OR “sustainable development”)) |

| 8 | ((“cryptocurrencies”) AND (“FinTech” OR “financial technology”) AND (“energy” OR “renewable energy” OR “clear energy”) AND (“carbon neutral” OR “sustainability” OR “sustainable development”)) |

| 9 | ((“cryptocurrencies” OR “crypto” OR “blochchain”) AND (“FinTech” OR “financial technology”) AND (“energy” OR “renewable energy” OR “clear energy”) AND (“carbon neutral” OR “sustainability” OR “sustainable development”)) |

| 10 | ((“cryptocurrencies” OR “crypto” OR “blochchain”) AND (“FinTech” OR “financial technology”) AND (“energy” OR “renewable energy” OR “clear energy”) AND (“carbon neutral” OR “sustainability” OR “sustainable development”)) AND (LIMIT-TO (DOCTYPE, “ar”)) AND (LIMIT-TO (PUBSTAGE, “final”) OR LIMIT-TO (PUBSTAGE, “aip”)) AND (LIMIT-TO (SRCTYPE, “j”)) |

| Paper | Total Citations | TC per Year | Normalized TC |

|---|---|---|---|

| Nexus between green finance, fintech, and high-quality economic development: Empirical evidence from China [31] | 265 | 66.25 | 2.26 |

| Green bonds for sustainable development: Review of literature on development and impact of green bonds [32] | 169 | 56.33 | 3.40 |

| A review of Blockchain Technology applications for financial services [33] | 123 | 41.00 | 2.47 |

| Discovering research trends and opportunities of green finance and energy policy: A data-driven scientometric analysis [34] | 112 | 28.00 | 0.95 |

| Natural resources, green innovation, fintech, and sustainability: A fresh insight from BRICS [35] | 96 | 48.00 | 3.98 |

| Is fintech the new path to sustainable resource utilisation and economic development? [36] | 77 | 38.50 | 3.19 |

| Sustainable Finance and Fintech: Can Technology Contribute to Achieving Environmental Goals? A Preliminary Assessment of ‘Green Fintech’ and ‘Sustainable Digital Finance’ [37] | 76 | 25.33 | 1.53 |

| The role of fintech in promoting green finance, and profitability: Evidence from the banking sector in the euro zone [38] | 70 | 35.00 | 2.90 |

| Interdependence of clean energy and green markets with cryptocurrencies [39] | 64 | 32.00 | 2.65 |

| From moon landing to metaverse: Tracing the evolution of Technological Forecasting and Social Change [40] | 61 | 30.50 | 2.53 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Koemtzopoulos, D.; Zournatzidou, G.; Ragazou, K.; Sariannidis, N. Cryptocurrencies Transit to a Carbon Neutral Environment: From Fintech to Greentech Through Clean Energy and Eco-Efficiency Policies. Energies 2025, 18, 291. https://doi.org/10.3390/en18020291

Koemtzopoulos D, Zournatzidou G, Ragazou K, Sariannidis N. Cryptocurrencies Transit to a Carbon Neutral Environment: From Fintech to Greentech Through Clean Energy and Eco-Efficiency Policies. Energies. 2025; 18(2):291. https://doi.org/10.3390/en18020291

Chicago/Turabian StyleKoemtzopoulos, Dimitrios, Georgia Zournatzidou, Konstantina Ragazou, and Nikolaos Sariannidis. 2025. "Cryptocurrencies Transit to a Carbon Neutral Environment: From Fintech to Greentech Through Clean Energy and Eco-Efficiency Policies" Energies 18, no. 2: 291. https://doi.org/10.3390/en18020291

APA StyleKoemtzopoulos, D., Zournatzidou, G., Ragazou, K., & Sariannidis, N. (2025). Cryptocurrencies Transit to a Carbon Neutral Environment: From Fintech to Greentech Through Clean Energy and Eco-Efficiency Policies. Energies, 18(2), 291. https://doi.org/10.3390/en18020291